0001883788

false

--12-31

0001883788

2023-07-27

2023-07-27

0001883788

ATAKU:UnitsEachConsistingOfOneClassOrdinaryShareParValue0.0001PerShareOneRedeemableWarrantToAcquireOnehalfOfOneClassOrdinaryShareAndOneRightToAcquireOnetenthOfOneClassOrdinaryShareMember

2023-07-27

2023-07-27

0001883788

ATAKU:ClassOrdinarySharesMember

2023-07-27

2023-07-27

0001883788

ATAKU:RedeemableWarrantsEachTwoWarrantsExercisableForOneClassOrdinaryShareAt11.50PerShareMember

2023-07-27

2023-07-27

0001883788

ATAKU:RightsEach10RightsEntitlingHolderThereofToOneClassOrdinaryShareMember

2023-07-27

2023-07-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

July

27, 2023

AURORA

TECHNOLOGY ACQUISITION CORP.

(Exact

Name of Registrant as Specified in its Charter)

| Cayman

Islands |

|

001-41250 |

|

98-1624542 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification

No.) |

4

Embarcadero Center, Suite 1449

San

Francisco, California |

|

94105 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (650) 550-0458

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units,

each consisting of one Class A Ordinary Share, par value, $0.0001 per share, one Redeemable Warrant to acquire one-half of one Class

A Ordinary Share, and one Right to acquire one-tenth of one Class A Ordinary Share |

|

ATAKU |

|

The

Nasdaq Stock Market LLC |

| Class

A Ordinary Shares |

|

ATAK |

|

The

Nasdaq Stock Market LLC |

| Redeemable

Warrants, each two warrants exercisable for one Class A ordinary share at $11.50 per share |

|

ATAKW |

|

The

Nasdaq Stock Market LLC |

| Rights,

each 10 rights entitling the holder thereof to one Class A ordinary share |

|

ATAKR |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

1.01 |

Entry

into a Material Definitive Agreement |

On

July 27, 2023, in connection with its Extraordinary General Meeting held on July 27, 2023 (the “Extraordinary General Meeting”),

Aurora Technology Acquisition Corp. (the “Company”) and Continental Stock Transfer & Trust Company (the “Trustee”)

entered into Amendment No. 2 to the Investment Management Trust Agreement dated February 7, 2022 to change the date on which the Trustee

must commence liquidation of the trust account established in connection with the Company’s initial public offering (the “Trust

Account”) to the earliest of (i) the Company’s completion of an initial business combination (a “Business Combination”)

and (ii) February 9, 2024, provided that the Company deposit into the Trust Account for each one-month extension the lesser of:

(x) $135,000 or (y) $0.045 per share multiplied by the number of public shares then outstanding (the “Trust Amendment”).

A copy of the Trust Amendment is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated herein by reference.

| Item

5.03 |

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

At

the Extraordinary General Meeting, the shareholders approved an amendment to the Company’s amended and restated Articles of Association

(the “Articles”):

(i)

to extend the date by which the Company has to consummate an initial Business Combination (the “Termination Date”) from August

9, 2023 to September 9, 2023 and to allow the Company, without another shareholder vote, to elect to further extend the Termination Date

on a monthly basis for up to five times by an additional one month each time from September 9, 2023 until February 7, 2024 (the “Extension

Amendment”);

(ii)

to eliminate from the Articles the limitation that the Company shall not redeem Class A ordinary shares included as part of the units

sold in the Company’s initial public offering to the extent such redemption would cause the Company’s net tangible assets

to be less than $5,000,001 (the “Redemption Limitation Amendment”); and

(iii)

to provide that the Class B ordinary shares may be converted either at the time of the consummation of the Company’s initial business

combination or at any earlier date at the option of the holders of the Class B ordinary shares (the “Founder Conversion Amendment”).

A

copy of the amendment to the Articles is attached to this Current Report on Form 8-K as Exhibit 3.1 and incorporated herein by reference.

| Item

5.07 |

Submission

of Matters to a Vote of Security Holders |

At

the Extraordinary General Meeting, holders of 9,056,731 of the Company’s ordinary shares, which represents approximately 82.16%

of the ordinary shares outstanding and entitled to vote as of the record date of June 14, 2023, were represented in person or by proxy.

At

the Extraordinary General Meeting, the shareholders approved the following proposals (the “Proposals”): (i) the proposal

to approve the Extension Amendment, (ii) the proposal to approve the Redemption Limitation Amendment, (iii) the proposal to approve the

Founder Conversion Amendment and (iv) the proposal to approve the Trust Amendment.

Approval

of Extension Amendment

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 9,056,731 |

|

0 |

|

0 |

Approval

of Redemption Limitation Amendment

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 9,056,731 |

|

0 |

|

0 |

Approval

of Founder Conversion Amendment

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 9,056,731 |

|

0 |

|

0 |

Approval

of Trust Amendment

| Votes

For |

|

Votes

Against |

|

Abstentions |

| 9,056,731 |

|

0 |

|

0 |

In

connection with the vote to approve the Extension Amendment, the holders of 362,831 Class A ordinary shares elected to redeem their shares

for cash at a redemption price of approximately $10.68 per share, for an aggregate redemption amount of approximately $3.9 million, leaving

approximately $56.7 million in the trust account.

The

information included in Items 1.01 and 5.03 are incorporated by reference in this item to the extent required herein.

The

proposal to adjourn the Extraordinary General Meeting to a later date or dates, if necessary, to permit further solicitation and vote

of proxies in the event that there were insufficient votes for, or otherwise in connection with, the Proposals, was not presented at

the Extraordinary General Meeting, as each of the Proposals received a sufficient number of votes required for approval.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

Date:

July 28, 2023

| Aurora

Technology Acquisition Corp. |

|

| |

|

|

| By: |

/s/

Zachary Wang |

|

| Name: |

Zachary

Wang |

|

| Title: |

Chief

Executive Officer and Chairman |

|

Exhibit

3.1

SECOND

AMENDMENT

TO

THE

AMENDED

AND RESTATED

ARTICLES

OF ASSOCIATION

OF

AURORA

TECHNOLOGY ACQUISITION CORP.

(the

“Company”)

July

27, 2023

RESOLUTIONS

OF THE SHAREHOLDERS OF THE COMPANY

FIRST,

RESOLVED, as a special resolution that, effective immediately, the Amended and Restated Memorandum and Articles of Association of the

Company be amended by:

Article

37.2 of the Company’s Amended and Restated Articles of Association be deleted in its entirety and replaced with

the following new Article 37.2:

“The

Company has until 19 months from the closing of the IPO to consummate a Business Combination, provided however that if the board of directors

anticipates that the Company may not be able to consummate a Business Combination within 19 months of the closing of the IPO, the Company

may, by resolution of directors if requested by the Sponsor, extend the period of time to consummate a Business Combination up to five

times, each by an additional one month (for a total of up to 24 months to complete a Business Combination), subject to the Sponsor depositing

additional funds into the Trust Account in accordance with terms as set out in the trust agreement governing the Trust Account and referred

to in the Registration Statement, as may be amended from time to time. In the event that the Company does not consummate a Business Combination

within 19 months from the closing of the IPO or within up to 24 months from the closing of the IPO (subject in the latter case to valid

one-month extensions having been made in each case (such date falling 19 months or up to 24 months, as applicable, after the closing

of the IPO being referred to as the Termination Date)), such failure shall trigger an automatic redemption of the Public Shares (an Automatic

Redemption Event) and the directors of the Company shall take all such action necessary to (i) cease all operations except for the purpose

of winding up (ii) as promptly as reasonably possible but no more than ten (10) Business Days thereafter to redeem the Public Shares

to the holders of Public Shares, on a pro rata basis, in cash at a per-share amount equal to the applicable Per-Share Redemption Price;

and (iii) as promptly as reasonably possible following such Automatic Redemption Event, subject to the approval of our remaining Members

and our directors, liquidate and dissolve the Company, subject to the Company’s obligations under the Act to provide for claims

of creditors and the requirements of other applicable law. In the event of an Automatic Redemption Event, only the holders of Public

Shares shall be entitled to receive pro rata redeeming distributions from the Trust Account with respect to their Public Shares.”

SECOND,

RESOLVED, as a special resolution that, effective immediately, the Amended and Restated Memorandum and Articles of Association of the

Company be amended by:

Article

37.5 of the Company’s Amended and Restated Articles of Association be deleted in its entirety and replaced with

the following new Article 37.5:

“(a)

In the event that a Business Combination is consummated by the Company other than in connection with a shareholder vote under Article

37.4, the Company will, subject to as provided below, offer to redeem the Public Shares for cash in accordance with Rule 13e-4 and Regulation

14E of the Exchange Act and subject to any limitations (including but not limited to cash requirements) set forth in the definitive transaction

agreements related to the initial Business Combination (the Tender Redemption Offer), provided however that the Company shall not redeem

those Shares held by the Initial Shareholders or their affiliates or the directors or officers of the Company pursuant to such Tender

Redemption Offer, whether or not such holders accept such Tender Redemption Offer. The Company will file tender offer documents with

the SEC prior to consummating the Business Combination which contain substantially the same financial and other information about the

Business Combination and the redemption rights as would be required in a proxy solicitation pursuant to Regulation 14A of the Exchange

Act. In accordance with the Exchange Act, the Tender Redemption Offer will remain open for a minimum of 20 Business Days and the Company

will not be permitted to consummate its Business Combination until the expiry of such period. If in the event a Member holding Public

Shares accepts the Tender Redemption Offer and the Company has not otherwise withdrawn the tender offer, the Company shall, promptly

after the consummation of the Business Combination, pay such redeeming Member, on a pro rata basis, cash equal to the applicable Per-Share

Redemption Price.

(b)

In the event that a Business Combination is consummated by the Company in connection with a shareholder vote held pursuant to Article

37.4 in accordance with a proxy solicitation pursuant to Regulation 14A of the Exchange Act (the Redemption Offer), the Company will,

subject as provided below, offer to redeem the Public Shares, other than those Shares held by the Initial Shareholders or their affiliates

or the directors or officers of the Company, regardless of whether such shares are voted for or against the Business Combination, for

cash, on a pro rata basis, at a per-share amount equal to the applicable Per-Share Redemption Price, provided however that: (i) the Company

shall not redeem those Shares held by the Initial Shareholders or their affiliates or the directors or officers of the Company pursuant

to such Redemption Offer, whether or not such holders accept such Redemption Offer; and (ii) any other redeeming Member who either individually

or together with any affiliate of his or any other person with whom he is acting in concert or as a “group” (as such term

is defined under Section 13 of the Exchange Act) shall not be permitted to redeem, without the consent of the directors, more than fifteen

percent (15%) of the total Public Shares sold in the IPO.”

THIRD,

RESOLVED, as a special resolution that, effective immediately, the Amended and Restated Memorandum and Articles of Association of the

Company be amended by:

(a)

Article 36.2 of the Company’s Amended and Restated Articles of Association be deleted in its entirety and replaced

with the following new Article 36.2:

“Class

B Shares shall automatically convert into Class A Shares in such a ratio so as to give effect to the Class B Share Entitlement (the Conversion

Ratio): (a) at any time and from time to time at the option of the holders of the Class B Shares, including (for the avoidance of doubt)

at any time prior to the consummation of a Business Combination; or (b) automatically on the day of the consummation of a Business Combination.”

(b)

Article 2.2 of the Company’s Amended and Restated Articles of Association be deleted in its entirety and replaced

with the following new Article 2.2”

“Without

limitation to the preceding Article, the directors may so deal with the unissued Shares of the Company:

(a)

either at a premium or at par;

(b)

with or without preferred, deferred or other special rights or restrictions whether in regard to dividend, voting, return of capital

or otherwise.

Notwithstanding

the above, following an IPO and prior to a Business Combination, the Company may not issue additional Shares that would entitle the holders

thereof to (i) receive funds from the Trust Account or (ii) vote on any Business Combination, other than in connection with the Class

A Shares converted into Class A Shares pursuant to Article 36.2 where the holders of such Shares have waived any right to receive funds

from the Trust Account.”

Exhibit

10.1

AMENDMENT

NO. 2 TO INVESTMENT MANAGEMENT

TRUST

AGREEMENT

THIS

AMENDMENT NO. 2 TO THE INVESTMENT MANAGEMENT TRUST AGREEMENT (this “Amendment”) is made as of July 27, 2023, by and between

Aurora Technology Acquisition Corp., a Cayman Islands exempted company (the “Company”), and Continental Stock Transfer &

Trust Company, a New York corporation (the “Trustee”). Capitalized terms contained in this Amendment, but not specifically

defined in this Amendment, shall have the meanings ascribed to such terms in the Original Agreement (as defined below).

WHEREAS,

on February 9, 2022, the Company consummated an initial public offering (the “Offering”) of units of the Company, each of

which is composed of one of the Company’s Class A ordinary shares, par value $0.0001 per share (“Ordinary Shares”),

one warrant and one right;

WHEREAS,

$ 204,020,000 of the gross proceeds of the Offering and sale of the Private Placement Warrants (as defined in the Underwriting Agreement)

were delivered to the Trustee to be deposited and held in the segregated Trust Account located in the United States for the benefit of

the Company and the holders of Ordinary Shares included in the Units issued in the Offering pursuant to the investment management trust

agreement made effective as of February 7, 2022, by and between the Company and the Trustee (the “Original Agreement”);

WHEREAS,

on February 3, 2023, the Company and the Trustee entered into an Amendment No. 1 to the Original Agreement whereby the Original Agreement

was amended to require the Company to deposit into the Trust Account funds equal to the lesser of (A) $135,000, or (B) $0.045 per share

multiplied by the number of outstanding public Ordinary Shares for each one-month extension from February 9, 2023 (the “Amended

Agreement”);

WHEREAS,

the Company has sought the approval of the holders of its Ordinary Shares and holders of its Class B ordinary shares, par value $0.0001

per share (the “Class B Ordinary Shares”), at an extraordinary general meeting to: (i) to extend the date by which the Company

has to consummate a Business Combination (the “Termination Date”) from August 9, 2023 to September 9, 2023 and to allow the

Company, without another shareholder vote, to elect to further extend the Termination Date to consummate a Business Combination on a

monthly basis for up to five times by an additional one month each time until February 7, 2024 (the “Extension Amendment”),

and (ii) a proposal to amend the Trust Agreement requiring the Company to deposit $135,000 into the Trust Account for each one-month

extension from August 9, 2023 (the “Trust Amendment”);

WHEREAS,

holders of at least fifty percent (50%) of the then issued and outstanding Class A Ordinary Shares and Class B Ordinary Shares,

voting together as a single class, approved the Extension Amendment and the Trust Amendment; and

WHEREAS,

the parties desire to amend the Original Agreement to, among other things, reflect amendments to the Original Agreement contemplated

by the Trust Amendment.

NOW,

THEREFORE, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto agree as follows:

1.

Amendment to Trust Agreement. Section 1(i) of the Original Agreement is hereby amended and restated in its entirety as follows:

“(i)

Commence liquidation of the Trust Account only after and promptly after (x) receipt of, and only in accordance with, the terms of a letter

from the Company (“Termination Letter”) in a form substantially similar to that attached hereto as either Exhibit

A or Exhibit B signed on behalf of the Company by the Chief Executive Officer or Chief Financial Officer of the Company or by the Executive

Chairman of the Board of Directors of the Company (the “Board”) or other authorized officer of the Company, and, in the case

of a Termination Letter in a form substantially similar to the attached hereto as Exhibit A, acknowledged and agreed to by the

Representatives, and complete the liquidation of the Trust Account and distribute the Property in the Trust Account, including interest

(less up to $50,000 of interest that may be released to the Company to pay dissolution expenses in the case of a Termination Letter in

the form of Exhibit B hereto and which interest shall be net of any taxes payable), only as directed in the Termination Letter and the

other documents referred to therein, or (y) the date which is the later of (i) 19 months after the closing of the IPO, provided that

the Company may, but is not obligated to, extend the period of time to consummate its initial Business Combination five (5) times by

an additional one month each time (for a total of up to 24 months to complete its initial Business Combination); further provided that

upon each one-month extension of the period of time to consummate an initial Business Combination, the Sponsor (or its designees) must

deposit into the Trust Account funds equal to the lesser of (A) $135,000, or (B) $0.045 per share multiplied by the number of outstanding

public ordinary shares that have not been redeemed in accordance with Section 37.2 of the Company’s Articles (as defined below),

in exchange for a non-interest bearing, unsecured promissory note, and (ii) such later date as may be approved by the Company’s

stockholders in accordance with the Company’s Amended and Restated Articles of Association, as amended (the “Articles”)

if a Termination Letter has not been received by the Trustee prior to such date, in which case the Trust Account shall be liquidated

in accordance with the procedures set forth in the Termination Letter attached as Exhibit B and the Property in the Trust Account, including

interest earned on the funds held in the Trust Account and not previously released to the Company to pay its taxes (less up to $50,000

of interest to pay dissolution expenses), shall be distributed to the Public Shareholders of record as of such date;”

2.

Miscellaneous Provisions.

2.1.

Successors. All the covenants and provisions of this Amendment by or for the benefit of the Company or the Trustee shall bind

and inure to the benefit of their permitted respective successors and assigns.

2.2.

Severability. This Amendment shall be deemed severable, and the invalidity or unenforceability of any term or provision hereof

shall not affect the validity or enforceability of this Amendment or of any other term or provision hereof. Furthermore, in lieu of any

such invalid or unenforceable term or provision, the parties hereto intend that there shall be added as a part of this Amendment a provision

as similar in terms to such invalid or unenforceable provision as may be possible and be valid and enforceable.

2.3.

Applicable Law. This Amendment shall be governed by and construed and enforced in accordance with the laws of the State of New

York.

2.4.

Counterparts. This Amendment may be executed in several original or facsimile counterparts, each of which shall constitute an

original, and together shall constitute but one instrument.

2.5.

Effect of Headings. The section headings herein are for convenience only and are not part of this Amendment and shall not affect

the interpretation thereof.

2.6.

Entire Agreement. The Original Agreement, as modified by this Amendment, constitutes the entire understanding of the parties and

supersedes all prior agreements, understandings, arrangements, promises and commitments, whether written or oral, express or implied,

relating to the subject matter hereof, and all such prior agreements, understandings, arrangements, promises and commitments are hereby

canceled and terminated.

[Signature

page follows]

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first above written.

| Continental

Stock Transfer & Trust Company, as Trustee |

|

| |

|

|

| By: |

/s/

Francis Wolf |

|

| Name: |

Francis

Wolf |

|

| Title: |

Vice

President |

|

| |

|

|

| Aurora

Technology Acquisition Corp. |

|

| |

|

|

| By: |

/s/

Zachary Wang |

|

| Name: |

Zachary

Wang |

|

| Title: |

Chief

Executive Officer and Chairman |

|

[Signature

Page to Amendment to Investment Management Trust Agreement]

v3.23.2

Cover

|

Jul. 27, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 27, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-41250

|

| Entity Registrant Name |

AURORA

TECHNOLOGY ACQUISITION CORP.

|

| Entity Central Index Key |

0001883788

|

| Entity Tax Identification Number |

98-1624542

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

4

Embarcadero Center

|

| Entity Address, Address Line Two |

Suite 1449

|

| Entity Address, City or Town |

San

Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94105

|

| City Area Code |

(650)

|

| Local Phone Number |

550-0458

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share, par value, $0.0001 per share, one Redeemable Warrant to acquire one-half of one Class A Ordinary Share, and one Right to acquire one-tenth of one Class A Ordinary Share |

|

| Title of 12(b) Security |

Units,

each consisting of one Class A Ordinary Share

|

| Trading Symbol |

ATAKU

|

| Security Exchange Name |

NASDAQ

|

| Class A Ordinary Shares |

|

| Title of 12(b) Security |

Class

A Ordinary Shares

|

| Trading Symbol |

ATAK

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each two warrants exercisable for one Class A ordinary share at $11.50 per share |

|

| Title of 12(b) Security |

Redeemable

Warrants, each two warrants exercisable for one Class A ordinary share at $11.50 per share

|

| Trading Symbol |

ATAKW

|

| Security Exchange Name |

NASDAQ

|

| Rights, each 10 rights entitling the holder thereof to one Class A ordinary share |

|

| Title of 12(b) Security |

Rights,

each 10 rights entitling the holder thereof to one Class A ordinary share

|

| Trading Symbol |

ATAKR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATAKU_UnitsEachConsistingOfOneClassOrdinaryShareParValue0.0001PerShareOneRedeemableWarrantToAcquireOnehalfOfOneClassOrdinaryShareAndOneRightToAcquireOnetenthOfOneClassOrdinaryShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATAKU_ClassOrdinarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATAKU_RedeemableWarrantsEachTwoWarrantsExercisableForOneClassOrdinaryShareAt11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATAKU_RightsEach10RightsEntitlingHolderThereofToOneClassOrdinaryShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

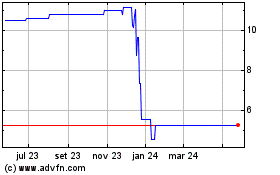

Aurora Technology Acquis... (NASDAQ:ATAKU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Aurora Technology Acquis... (NASDAQ:ATAKU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025