0000850261

false

0000850261

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): August 1, 2023 (August 1, 2023)

SORRENTO THERAPEUTICS, INC.

(Exact Name of Registrant as Specified

in its Charter)

| Delaware |

|

001-36150 |

|

33-0344842 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

4955 Directors Place

San Diego, CA 92121

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number,

including area code: (858) 203-4100

N/A

(Former Name, or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

SRNEQ |

|

N/A |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

Cleansing Materials

During the months of

June and July, 2023, Sorrento Therapeutics, Inc. (the “Company”) entered into confidentiality agreements (collectively, the

“NDAs”) with certain counterparties with whom the Company shared certain confidential information for the purpose of assessing the businesses of Sorrento and

Scilex Holding Company. Pursuant to those NDAs, the Company agreed to

publicly disclose all material non-public information disclosed to such counterparties (collectively, the “Cleansing

Materials”). A copy of the Cleansing Materials is attached to this Current Report on Form 8-K as Exhibit 99.1.

The information under

this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be

deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Securities Act”), or

otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing

under the Securities Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference

in such a filing. This report will not be deemed an admission as to the materiality of any information required to be disclosed

solely to satisfy the requirements of Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| 99.1 | Cleansing Materials |

| 104 |

Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SORRENTO THERAPEUTICS, INC. |

| |

|

|

| Date: August 1, 2023 |

By: |

/s/ Henry Ji, Ph.D. |

| |

|

Name: Henry Ji, Ph.D. |

| |

|

Title: Chairman of the Board, President and Chief Executive Officer |

Exhibit 99.1

Project Stallion Business Plan Overview July 11, 2023

Disclaimer 2 This presentation contains selected information pertaining to the business and operations of Sorrento Therapeutics, Inc. (“ Sorrento ” or the “ Company ”). The purpose of this presentation is to assist interested parties in evaluating (i) a potential sale of all or a portion of the Company’s assets, (ii) a potential debt and/or equity financing transaction, and/or (iii) the terms of a potential chapter 11 plan (each, a “ Transaction ”). It does not provide the basis for any investment decision including a decision to purchase, invest in, or lend to the Company. In addition, this presentation is not an offer or invitation for the sale or purchase of securities or the extension of any debt and/or equity financing. No Representations and Warranties The Company provided the information in this presentation, and no advisor of the Company has assumed any responsibility for independently verifying such information. Neither Sorrento, nor any of their respective officers, directors, managers, employees, agents, advisors or representatives, (i) make any representations or warranties, express or implied, with respect to any of the information contained herein, including the accuracy or completeness of this presentation or any other written or oral information made available to any interested party or its advisor (and any liability therefore is expressly disclaimed), (ii) have any liability from the use of the information, including with respect to any forward - looking statements, or (iii) undertake to update any of the information contained herein or provide additional information as a result of new information or future events or developments. Forward - Looking Statements This presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions are intended to identify such forward - looking statements. The Company’s actual results or outcomes and the timing of certain events may differ significantly from those discussed in any forward - looking statements. These statements are based on various assumptions and on the current expectations of the Company’s management and are not predictions of actual performance. These forward - looking statements are subject to a number of risks and uncertainties, including risks associated with Sorrento’s ability to pursue and execute any potential Transaction; the unpredictability of trading markets and whether a market will be established for the Company’s common stock; general economic, political and business conditions; risks related to the COVID - 19 pandemic; the risk that the potential product candidates that Sorrento develops may not progress through clinical development or receive required regulatory approvals within expected timelines or at all; risks relating to uncertainty regarding the regulatory pathway for Sorrento's product candidates; the risk that Sorrento will be unable to successfully market or gain market acceptance of its product candidates; the risk that Sorrento's product candidates may not be beneficial to patients or successfully commercialized; the risk that Sorrento has overestimated the size of the target patient population, their willingness to try new therapies and the willingness of physicians to prescribe these therapies; risks that the results of the Phase 2 trial for SP - 103 or Phase 1 trials for SP - 104 may not be successful; risks that the prior results of the clinical trials of SP - 102 (SEMDEXA Œ ), SP - 103 or SP - 104 may not be replicated; regulatory and intellectual property risks; the potential adverse impact of the Company’s bankruptcy proceedings pursuant to Chapter 11 (the “Chapter 11 Cases”) on the Company’s liquidity and results of operations; changes in the Company’s ability to meet its financial obligations during the Chapter 11 process and to maintain contracts that are critical to its operations; the outcome and timing of the Chapter 11 process; the effect of the Chapter 11 Cases on the Company’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the Chapter 11 process; the timing or amount of any recovery, if any, to the Company’s stakeholders; any effects of the Chapter 11 Cases on any potential Transaction; the trading of the Company’s common stock on the Pink Open Market; and those factors discussed in the Company’s Annual Report on Form 10 - K for the year ended December 31, 2022 and any subsequent Quarterly Reports on Form 10 - Q filed with the Securities and Exchange Commission (the “SEC”), in each case under the heading “Risk Factors,” and other documents of the Company filed, or to be filed, with the SEC. The foregoing list of factors is not exhaustive. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any interested party as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

Disclaimer, cont. 3 Use of Forecasts This presentation contains financial forecasts or forecasts with respect to Sorrento’s forecasted financial results. Sorrento’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the forecasts for the purpose of their inclusion in this presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this presentation . These forecasts should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of future performance of Sorrento or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. All forecasts and estimates included in this presentation are approximations. Non - GAAP Financial Measures In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), this presentation includes certain non - GAAP financial measures. These financial measures include EBITDA. The Company believes that these non - GAAP measures are useful to interested parties as they provide a better understanding of our financial condition and results of operations on a comparable basis. Management does not use these non - GAAP financial measures for any purpose other than the reasons stated above. Confidentiality This presentation is being made available only to parties who signed and returned a confidentiality agreement, and such parties continue to be bound by the confidentiality agreement in respect of the information contained herein. Except as permitted in the confidentiality agreements, this presentation may not be copied, reproduced, or distributed without the prior written consent of the Company or for any purpose other than the evaluation of a potential Transaction by the person to whom this presentation has been delivered or as otherwise provided in the relevant confidentiality agreement. This presentation has been delivered for the sole purpose referred to above with the express understanding that interested parties will use it only for such purpose. Interested parties should conduct their own investigations and analyses of the Company and the information in this presentation and rely solely upon their own due diligence investigation. Only representations and warranties that may be made in a definitive written agreement when, as, and if executed and subject to such limitations and restrictions as may be specified therein, will have any legal effect. The presentation is not a binding agreement. The presentation does not purport to contain all the information that may be required to evaluate the Transaction and each recipient should conduct its own independent analysis of the proposed Transaction and the data contained or referred to herein. Sorrento reserves the right to negotiate with one or more parties and, without notice, to change the procedure for pursuing a Transaction and terminate negotiations at any time.

Introduction 4 (1) EBITDA Contribution is determined before unallocated G&A, Unallocated R&D and restructuring expense Introduction • This presentation contains management’s financial forecast (the “Business Plan”) for reorganized Sorrento (the “Company”) for the period from August 1 2023 through 2039 • The Business Plan has been constructed on a monthly basis through December 2024 and annually thereafter, bottom up, and incorporates input from program managers, executive management, finance and clinical heads • The Business Plan reflects the following key assumptions: • Emergence from Ch.11 on August 1, 2023 • All clinical development programs (excl. Ovydso China and RTX OAK) are paused until 2025, with no disruption of in - process clinical trials • Resumption of clinical programs and build out of infrastructure to support these programs and other pre - clinical activities beginning in 2025 • Ovydso revenue to commence July 2024 • Significant reduction in pre - clinical R&D activities, personnel headcount, and other overhead expenses through 2024 • No asset monetization transactions occur pre - or post - emergence (e.g. no sale of Scilex interests, Sorrento programs, or licensing/partnership deals) • Settlement of NANT litigation is completed prior to emergence • Sorrento maintains future flexibility to adjust future capital allocation priorities dependent on capital availability, project economics and strategic considerations Pro Forma Funding Req u i r emen t s • The Business Plan implies peak near - term funding requirements of $55MM in June 2024 • Successful realization of Ovydso revenues prior to Q3 2024 and/or other asset monetization transactions could reduce Sorrento’s near term financing requirements Key P e r fo r mance Metrics • Revenue is projected to grow to $2.1BB by 2030 (before probability adjustments) driven by $1.1BB in RTX revenue, $0.4BB in Fujovee revenues, and $0.6BB of revenue contribution from other platforms • EBITDA is projected to grow to $1.1BB by 2030 (before probability adjustments) driven by $774MM of EBITDA Contribution (1) from RTX, $144MM of EBITDA Contribution (1) from Fujovee, and $304MM of EBITDA Contribution (1) from other platforms

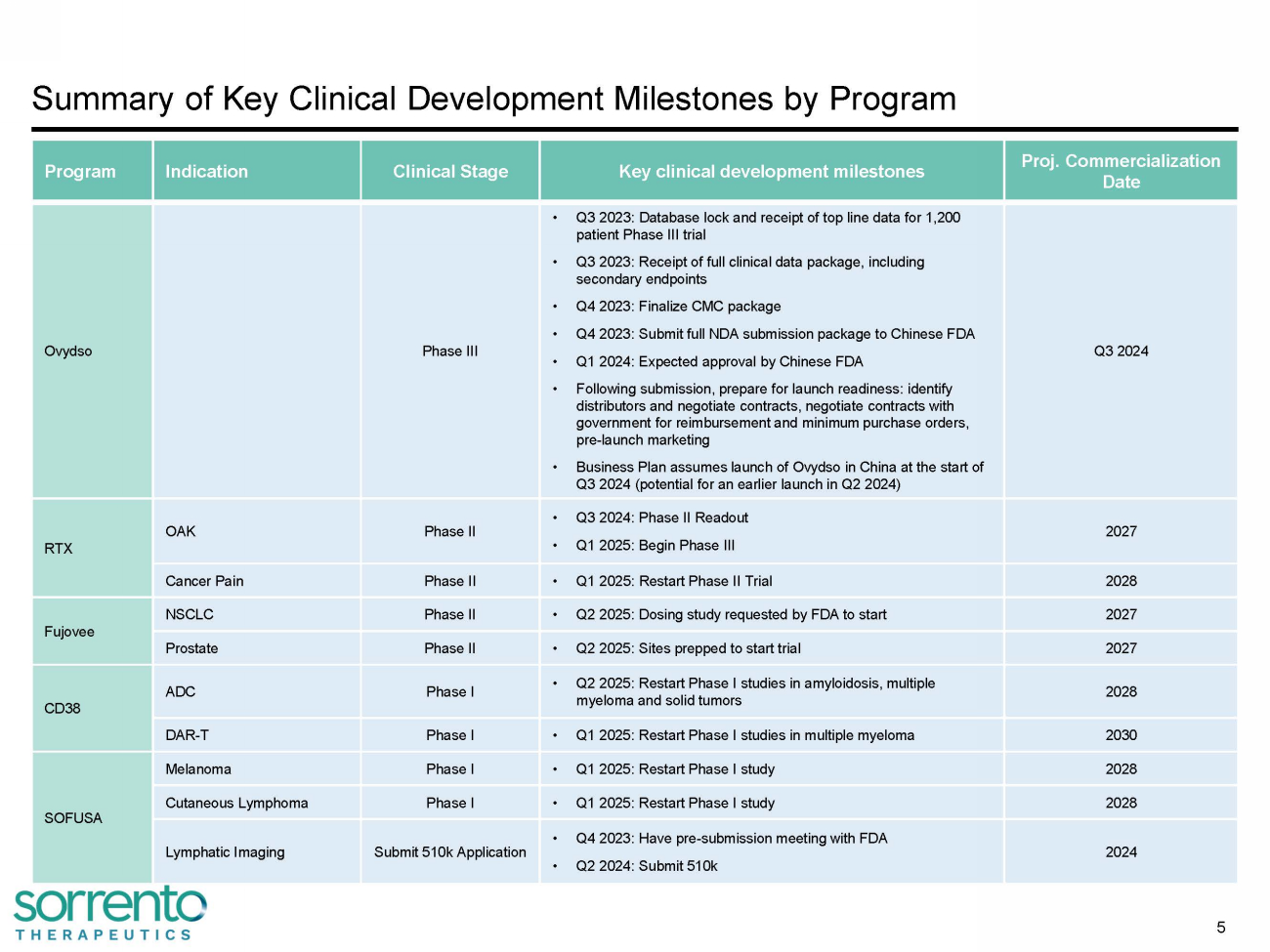

Summary of Key Clinical Development Milestones by Program 5 Program Indication Clinical Stage Key clinical development milestones Proj. Commercialization Date Ovydso Phase III • Q3 2023: Database lock and receipt of top line data for 1,200 patient Phase III trial • Q3 2023: Receipt of full clinical data package, including secondary endpoints • Q4 2023: Finalize CMC package • Q4 2023: Submit full NDA submission package to Chinese FDA • Q1 2024: Expected approval by Chinese FDA • Following submission, prepare for launch readiness: identify distributors and negotiate contracts, negotiate contracts with government for reimbursement and minimum purchase orders, pre - launch marketing • Business Plan assumes launch of Ovydso in China at the start of Q3 2024 (potential for an earlier launch in Q2 2024) Q3 2024 RTX OAK Phase II • Q3 2024: Phase II Readout • Q1 2025: Begin Phase III 2027 Cancer Pain Phase II • Q1 2025: Restart Phase II Trial 2028 Fujovee NSCLC Phase II • Q2 2025: Dosing study requested by FDA to start 2027 Prostate Phase II • Q2 2025: Sites prepped to start trial 2027 CD38 ADC Phase I • Q2 2025: Restart Phase I studies in amyloidosis, multiple myeloma and solid tumors 2028 DAR - T Phase I • Q1 2025: Restart Phase I studies in multiple myeloma 2030 SOFUSA Melanoma Phase I • Q1 2025: Restart Phase I study 2028 Cutaneous Lymphoma Phase I • Q1 2025: Restart Phase I study 2028 Lymphatic Imaging Submit 510k Application • Q4 2023: Have pre - submission meeting with FDA • Q2 2024: Submit 510k 2024

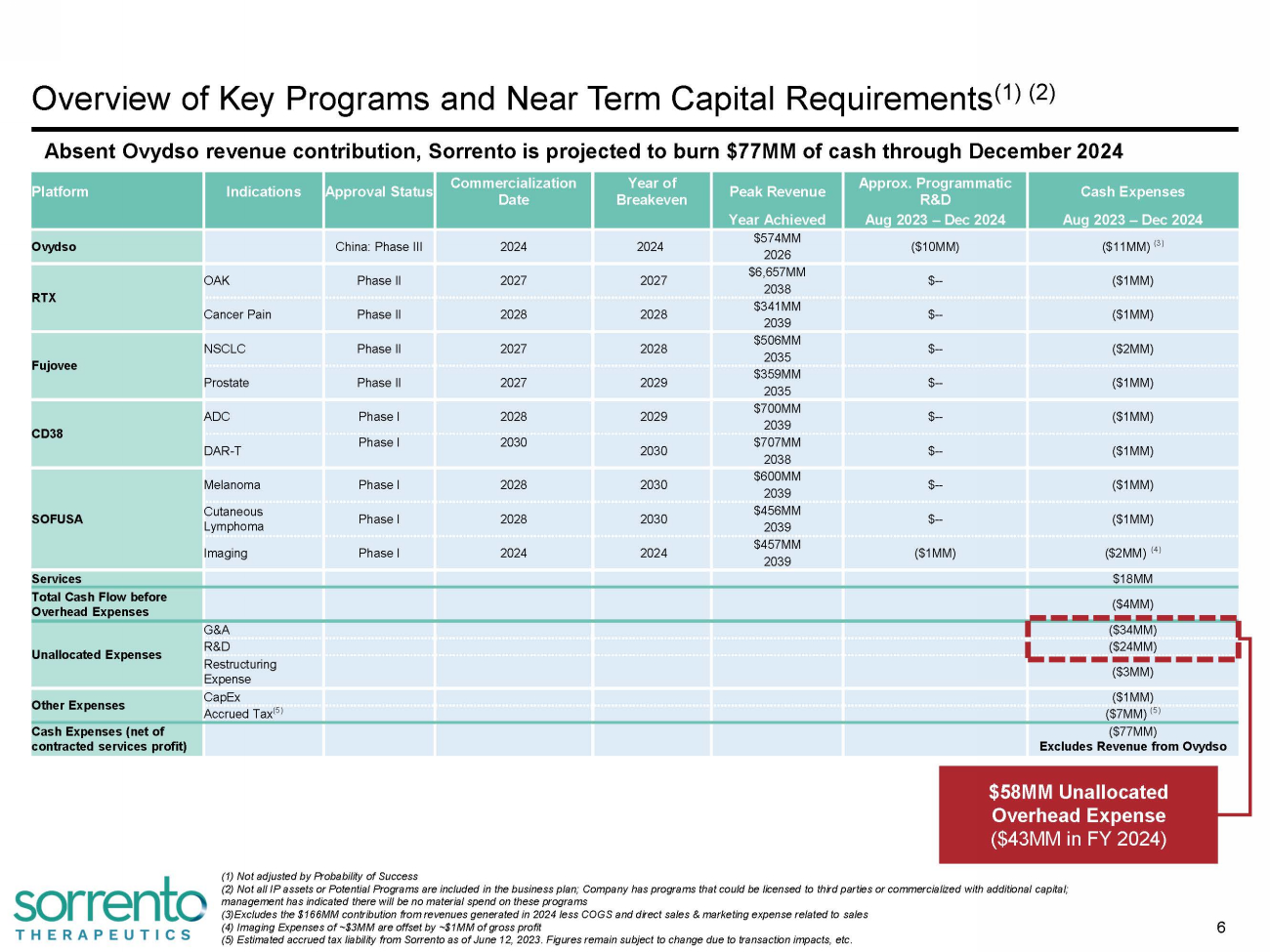

Overview of Key Programs and Near Term Capital Requirements (1) (2) 6 (1) Not adjusted by Probability of Success (2) Not all IP assets or Potential Programs are included in the business plan; Company has programs that could be licensed to third parties or commercialized with additional capital; management has indicated there will be no material spend on these programs (3) Excludes the $166MM contribution from revenues generated in 2024 less COGS and direct sales & marketing expense related to sales (4) Imaging Expenses of ~$3MM are offset by ~$1MM of gross profit Platform Indications Approval Status C omm e r c i a liz at ion Date Year of B r eakeve n Peak Revenue Approx. Programmatic R&D Cash Expenses Year Achieved Aug 2023 – Dec 2024 Aug 2023 – Dec 2024 Ovydso China: Phase III 2024 2024 $574MM ($10MM) ($11MM) (3) 2026 RTX OAK Phase II 2027 2027 $6,657MM $ -- ($1MM) 2038 Cancer Pain Phase II 2028 2028 $341MM $ -- ($1MM) 2039 Fujovee NSCLC Phase II 2027 2028 $506MM $ -- ($2MM) 2035 Prostate Phase II 2027 2029 $359MM $ -- ($1MM) 2035 CD38 ADC Phase I 2028 2029 $700MM $ -- ($1MM) 2039 DAR - T Phase I 2030 2030 $707MM $ -- ($1MM) 2038 SOFUSA Melanoma Phase I 2028 2030 $600MM $ -- ($1MM) 2039 Cutaneous L y m pho m a Phase I 2028 2030 $456MM $ -- ($1MM) 2039 Imaging Phase I 2024 2024 $457MM ($1MM) ($2MM) (4) 2039 Services $18MM Total Cash Flow before Overhead Expenses ($4MM) Unallocated Expenses G&A ($34MM) R&D ($24MM) Res tru ct ur ing Expense ($3MM) Other Expenses CapEx ($1MM) Accrued Tax (5) ($7MM) (5) Cash Expenses (net of contracted services profit) ($77MM) Excludes Revenue from Ovydso $58MM Unallocated (5) Estimated accrued tax liability from Sorrento as of June 12, 2023. Figures remain subject to change due to transaction impacts, etc. Overhead Expense ($43MM in FY 2024) Absent Ovydso revenue contribution, Sorrento is projected to burn $77MM of cash through December 2024

Summary Annual Forecast through FYE 2039 (1) (1) Not Adjusted by Probability of Success 7 Aug - Dec FY FY FY FY FY FY FY A v e r a ge ($ MM) 2023 2024 2025 2026 2027 2028 2029 2030 2031 - 203 9 @ Peak Peak Year Revenue Ovydso – $250 . 3 $500 . 8 $574 . 0 $505 . 2 $404 . 1 $282 . 9 $198 . 0 $49 . 3 $574 . 0 FY 202 6 RTX - OAK – – – – 354 . 0 662 . 4 843 . 8 1 , 063 . 1 4 , 072 . 3 6 , 657 . 3 FY 203 8 RTX - Cancer Pain – – – – – 6 . 9 34 . 8 50 . 6 197 . 5 341 . 4 FY 203 9 Fujovee - NSCLC – – – – 26 . 8 149 . 6 201 . 5 258 . 9 273 . 3 505 . 7 FY 203 5 Fujovee - Prostate – – – – 28 . 0 63 . 0 125 . 9 173 . 5 191 . 3 358 . 9 FY 203 5 CD38 - ADC – – – – – 28 . 2 83 . 9 147 . 1 483 . 0 700 . 4 FY 203 9 CD38 - DAR - T – – – – – – – 20 . 1 386 . 9 707 . 4 FY 203 8 SOFUSA - Melanoma – – – – – 18 . 1 38 . 8 55 . 9 299 . 0 600 . 4 FY 203 9 SOFUSA - Cutaneous Lymphoma – – – – – 17 . 4 34 . 9 53 . 9 262 . 5 455 . 7 FY 203 9 SOFUSA - Lymphatic Imaging – 1 . 5 9 . 3 18 . 8 34 . 4 61 . 4 80 . 6 106 . 5 310 . 6 457 . 0 FY 203 9 Services 7 . 9 23 . 1 25 . 3 27 . 5 32 . 3 37 . 3 42 . 4 46 . 9 70 . 7 95 . 4 FY 203 9 Total Revenues $7 . 9 $275 . 0 $535 . 4 $620 . 3 $980 . 6 $1 , 448 . 4 $1 , 769 . 4 $2 , 174 . 6 $6 , 596 . 4 $11 , 453 . 7 EBITDA ($22 . 8 ) $129.9 $179.2 $197.6 $349 . 7 $534.4 $709 . 7 $1,056.6 $4,706.4 $8,425.4 Cumulative EBITDA ($22 . 8 ) $107.1 $286.3 $483.9 $833 . 6 $1,368.0 $2 , 077 . 8 $3,134.3 Gross Profit Ovydso – $183 . 6 $367 . 3 $420 . 9 $370 . 4 $296 . 4 $207 . 5 $145 . 2 $36 . 1 $420 . 9 FY 202 6 RTX - OAK – – – – 318 . 6 596 . 2 759 . 4 956 . 8 3 , 665 . 0 5 , 991 . 6 FY 203 8 RTX - Cancer Pain – – – – – 6 . 3 31 . 3 45 . 5 177 . 7 307 . 2 FY 203 9 Fujovee - NSCLC – – – – 20 . 1 113 . 8 152 . 2 195 . 3 205 . 9 380 . 9 FY 203 5 Fujovee - Prostate – – – – 21 . 0 44 . 8 92 . 0 127 . 3 140 . 7 264 . 1 FY 203 5 CD38 - ADC – – – – – 22 . 6 67 . 2 117 . 7 386 . 4 560 . 3 FY 203 9 CD38 - DAR - T – – – – – – – 16 . 1 338 . 0 622 . 6 FY 203 8 SOFUSA - Melanoma – – – – – 9 . 5 20 . 8 44 . 5 235 . 3 477 . 9 FY 203 9 SOFUSA - Cutaneous Lymphoma – – – – – 8 . 8 17 . 8 42 . 9 206 . 1 362 . 7 FY 203 9 SOFUSA - Lymphatic Imaging – 1 . 3 8 . 0 17 . 5 31 . 9 57 . 2 76 . 3 101 . 0 300 . 3 443 . 5 FY 203 9 Services 4 . 5 13 . 5 15 . 0 16 . 4 19 . 4 22 . 5 25 . 6 28 . 3 42 . 9 58 . 0 FY 203 9 Total Gross Profit $4 . 5 $198 . 4 $390 . 2 $454 . 8 $781 . 5 $1 , 177 . 8 $1 , 450 . 0 $1 , 820 . 6 $5 , 734 . 5 $9 , 889 . 9 EBITDA Contribution Ovydso ($10 . 4 ) $165 . 1 $330 . 5 $379 . 3 $333.1 $265 . 4 $184 . 0 $127 . 1 $26 . 8 $379 . 3 FY 202 6 RTX - OAK (0 . 1 ) (0 . 3 ) (14 . 8 ) (14 . 9 ) 195.4 402 . 7 532 . 7 741 . 2 3 , 184 . 8 5 , 254 . 6 FY 203 8 RTX - Cancer Pain (0 . 1 ) (0 . 3 ) (2 . 3 ) (14 . 9 ) (15.0) 1 . 8 19 . 6 32 . 7 151 . 4 265 . 7 FY 203 9 Fujovee - NSCLC (0 . 3 ) (0 . 8 ) (5 . 8 ) (5 . 9 ) (18.2) 33 . 7 51 . 5 94 . 2 156 . 6 304 . 4 FY 203 5 Fujovee - Prostate (0 . 3 ) (0 . 8 ) (7 . 4 ) (14 . 7 ) (15.4) (1 . 6 ) 13 . 4 49 . 5 105 . 4 208 . 3 FY 203 5 CD38 - ADC (0 . 1 ) (0 . 3 ) (6 . 3 ) (7 . 4 ) (16.5) (27 . 5 ) 7 . 5 47 . 4 306 . 9 461 . 3 FY 203 9 CD38 - DAR - T (0 . 1 ) (0 . 3 ) (3 . 2 ) (4 . 3 ) (7.3) (7 . 7 ) (7 . 8 ) 0 . 4 276 . 3 527 . 4 FY 203 8 SOFUSA - Melanoma (0 . 1 ) (0 . 3 ) (3 . 7 ) (8 . 3 ) (5.5) (34 . 5 ) (15 . 6 ) 1 . 9 186 . 1 414 . 6 FY 203 9 SOFUSA - Cutaneous Lymphoma (0 . 1 ) (0 . 3 ) (2 . 4 ) (4 . 1 ) (3.4) (19 . 8 ) (11 . 0 ) 8 . 9 160 . 4 312 . 5 FY 203 9 SOFUSA - Lymphatic Imaging (0 . 1 ) (1 . 9 ) 3 . 8 11 . 6 25.1 48 . 6 66 . 6 89 . 9 278 . 7 414 . 2 FY 203 9 Services 4 . 5 13 . 5 15 . 0 16 . 4 19.4 22 . 5 25 . 6 28 . 3 42 . 9 58 . 0 FY 203 9 EBITDA Contribution ($7 . 5 ) $173 . 2 $303 . 2 $332 . 9 $491.8 $683 . 5 $866 . 4 $1 , 221 . 5 $4 , 876 . 3 $8 , 600 . 3 Unallocated G&A (8 . 8 ) (25 . 4 ) (58 . 4 ) (62 . 2 ) (65.5) (69 . 0 ) (72 . 6 ) (76 . 6 ) (78 . 9 ) (81 . 3 ) Unallocated R&D (6 . 5 ) (17 . 9 ) (65 . 6 ) (73 . 2 ) (76.6) (80 . 1 ) (84 . 1 ) (88 . 3 ) (90 . 9 ) (93 . 7 ) Unallocated Expenses ($15 . 3 ) ($43 . 3 ) ($124 . 0 ) ($135 . 3 ) ($142.1) ($149 . 1 ) ($156 . 7 ) ($164 . 9 ) ($169 . 8 ) ($174 . 9 ) Approximate Cash Flow EBITDA ($22 . 8 ) $129 . 9 $179 . 2 $197 . 6 $349 . 7 $534 . 4 $709 . 7 $1 , 056 . 6 $4 , 706 . 4 Less: Restructuring Expense (3 . 4 ) – – – – – – – – Less: Capex (0 . 3 ) (0 . 6 ) (2 . 0 ) (4 . 0 ) (4 . 0 ) (4 . 0 ) (4 . 0 ) (4 . 0 ) (4 . 0 ) Less: Accrued Tax Expense – (7 . 0 ) – – – – – – – Less: Income Taxes (23% paid quarterly) – (27 . 8 ) (37 . 8 ) (42 . 0 ) (77 . 0 ) (119 . 5 ) (159 . 8 ) (239 . 6 ) (1 , 074 . 0 ) Approximate Cash Flow ($26 . 5 ) $94 . 5 $139 . 5 $151 . 6 $268 . 7 $410 . 9 $545 . 9 $813 . 0 $3 , 628 . 4 Cumulative Approx. Cash Flow ($26 . 5 ) $68 . 0 $207 . 5 $359 . 1 $627 . 8 $1 , 038 . 7 $1 , 584 . 7 $2 , 397 . 7

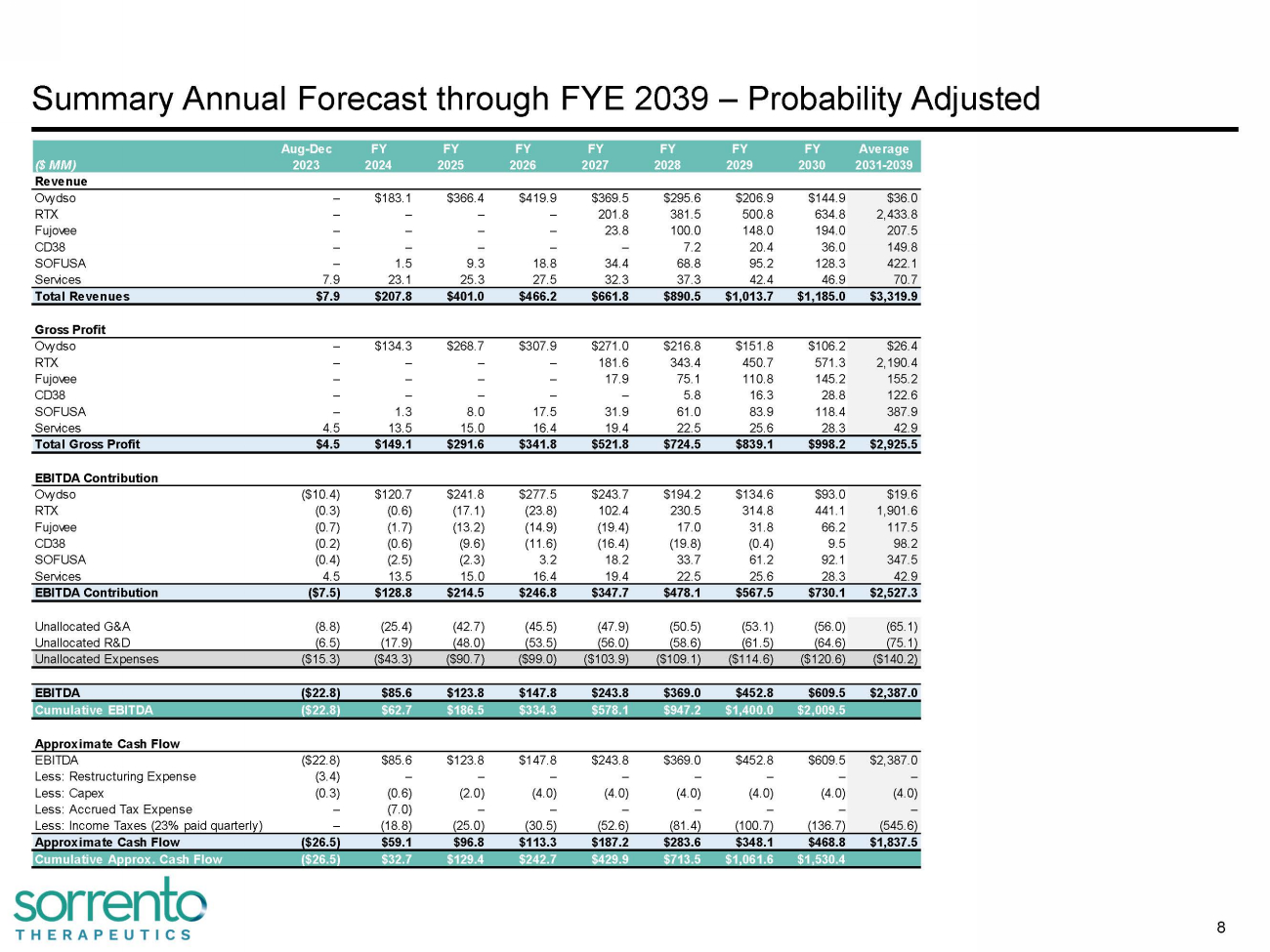

Summary Annual Forecast through FYE 2039 – Probability Adjusted A ug - D e c FY FY FY FY FY FY FY Average ($ MM) 2023 2024 2025 2026 2027 2028 2029 2030 2031 - 2 Revenue Ovydso – $183 . 1 $366 . 4 $419 . 9 $369 . 5 $295 . 6 $206 . 9 $144.9 RTX – – – – 201 . 8 381 . 5 500 . 8 634 Fujovee – – – – 23 . 8 100 . 0 148 . 0 CD38 – – – – – 7 . 2 20 . 4 SOFUSA – 1 . 5 9 . 3 18 . 8 34 . 4 68 . 8 95 . 2 Services 7 . 9 23 . 1 25 . 3 27 . 5 32 . 3 37 . 3 4 Total Revenues $7 . 9 $207 . 8 $401 . 0 $466 . 2 $661 . 8 $890 . 5 $ Gross Profit Ovydso – $134 . 3 $268 . 7 $307 . 9 $271 . 0 $ RTX – – – – 181 . 6 Fujovee – – – – 17 . 9 CD38 – – – – SOFUSA – 1 . 3 8 . 0 17 . 5 Services 4 . 5 13 . 5 15 . 0 16 . 4 Total Gross Profit $4 . 5 $149 . 1 $291 . 6 $341. EBITDA Contribution Ovydso ( $10 . 4 ) $120 . 7 $241 . 8 RTX ( 0 . 3 ) ( 0 . 6 ) (17 Fujovee ( 0 . 7 ) ( 1 . 7 ) CD38 ( 0 . 2 ) ( 0 . 6 ) SOFUSA ( 0 . 4 ) ( 2 . 5 S e r v i c e s 4 . 5 1 EBITDA Contribution ($7.5) Unallocated G&A Unallocated R&D Unallocated Expenses ( 8 . EBITDA Cumulative EBITDA Approximate Cash Flow EBITDA Less: Restructuring Less: Capex Less: Accrue Less: I nc A pp r o C 8

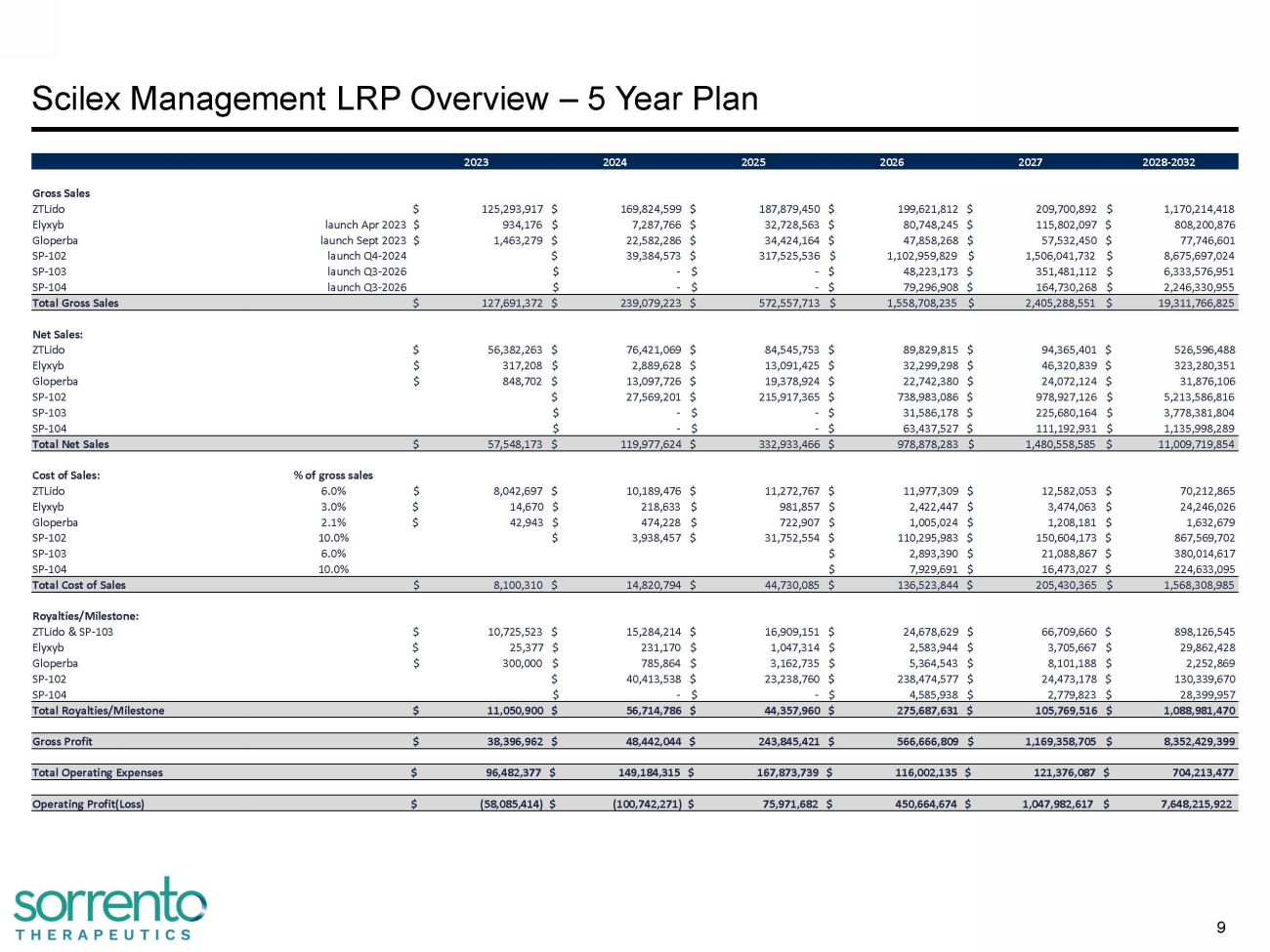

2023 2024 2025 2026 2027 2028 - 2032 Gross Sales ZTLido $ 125,293,917 $ 169,824,599 $ 187,879,450 $ 199,621,812 $ 209,700,892 $ 1,170,214,418 Elyxyb launch Apr 2023 $ 934,176 $ 7,287,766 $ 32,728,563 $ 80,748,245 $ 115,802,097 $ 808,200,876 Gloperba launch Sept 2023 $ 1,463,279 $ 22,582,286 $ 34,424,164 $ 47,858,268 $ 57,532,450 $ 77,746,601 SP - 102 launch Q4 - 2024 $ 39,384,573 $ 317,525,536 $ 1,102,959,829 $ 1,506,041,732 $ 8,675,697,024 SP - 103 launch Q3 - 2026 $ - $ - $ 48,223,173 $ 351,481,112 $ 6,333,576,951 SP - 104 launch Q3 - 2026 $ - $ - $ 79,296,908 $ 164,730,268 $ 2,246,330,955 Total Gross Sales $ 127,691,372 $ 239,079,223 $ 572,557,713 $ 1,558,708,235 $ 2,405,288,551 $ 19,311,766,825 Net Sales: ZTLido $ 56,382,263 $ 76,421,069 $ 84,545,753 $ 89,829,815 $ 94,365,401 $ 526,596,488 Elyxyb $ 317,208 $ 2,889,628 $ 13,091,425 $ 32,299,298 $ 46,320,839 $ 323,280,351 Gloperba $ 848,702 $ 13,097,726 $ 19,378,924 $ 22,742,380 $ 24,072,124 $ 31,876,106 SP - 102 $ 27,569,201 $ 215,917,365 $ 738,983,086 $ 978,927,126 $ 5,213,586,816 SP - 103 $ - $ - $ 31,586,178 $ 225,680,164 $ 3,778,381,804 SP - 104 $ - $ - $ 63,437,527 $ 111,192,931 $ 1,135,998,289 Total Net Sales $ 57,548,173 $ 119,977,624 $ 332,933,466 $ 978,878,283 $ 1,480,558,585 $ 11,009,719,854 Cost of Sales: % of gross sales ZTLido 6.0% $ 8,042,697 $ 10,189,476 $ 11,272,767 $ 11,977,309 $ 12,582,053 $ 70,212,865 Elyxyb 3.0% $ 14,670 $ 218,633 $ 981,857 $ 2,422,447 $ 3,474,063 $ 24,246,026 Gloperba 2.1% $ 42,943 $ 474,228 $ 722,907 $ 1,005,024 $ 1,208,181 $ 1,632,679 SP - 102 10.0% $ 3,938,457 $ 31,752,554 $ 110,295,983 $ 150,604,173 $ 867,569,702 SP - 103 6.0% $ 2,893,390 $ 21,088,867 $ 380,014,617 SP - 104 10.0% $ 7,929,691 $ 16,473,027 $ 224,633,095 Total Cost of Sales $ 8,100,310 $ 14,820,794 $ 44,730,085 $ 136,523,844 $ 205,430,365 $ 1,568,308,985 Royalties/Milestone: ZTLido & SP - 103 $ 10,725,523 $ 15,284,214 $ 16,909,151 $ 24,678,629 $ 66,709,660 $ 898,126,545 Elyxyb $ 25,377 $ 231,170 $ 1,047,314 $ 2,583,944 $ 3,705,667 $ 29,862,428 Gloperba $ 300,000 $ 785,864 $ 3,162,735 $ 5,364,543 $ 8,101,188 $ 2,252,869 SP - 102 $ 40,413,538 $ 23,238,760 $ 238,474,577 $ 24,473,178 $ 130,339,670 SP - 104 $ - $ - $ 4,585,938 $ 2,779,823 $ 28,399,957 Total Royalties/Milestone $ 11,050,900 $ 56,714,786 $ 44,357,960 $ 275,687,631 $ 105,769,516 $ 1,088,981,470 Gross Profit $ 38,396,962 $ 48,442,044 $ 243,845,421 $ 566,666,809 $ 1,169,358,705 $ 8,352,429,399 Total Operating Expenses $ 96,482,377 $ 149,184,315 $ 167,873,739 $ 116,002,135 $ 121,376,087 $ 704,213,477 Operating Profit(Loss) $ (58,085,414) $ (100,742,271) $ 75,971,682 $ 450,664,674 $ 1,047,982,617 $ 7,648,215,922 Scilex Management LRP Overview – 5 Year Plan 9

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Sorrento Therapeutics (NASDAQ:SRNE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Sorrento Therapeutics (NASDAQ:SRNE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024