Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

14 Agosto 2023 - 5:38PM

Edgar (US Regulatory)

| |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549 |

SEC

FILE NUMBER

000-26372 |

| |

|

|

| |

FORM

12b –25

NOTIFICATION

OF LATE FILING |

CUSIP

NUMBER

00547W208 |

Check

One:

☐

Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐

Form 10-D ☐ Form N-CEN ☐ Form N-CSR

For

Period Ended: June 30, 2023

☐ Transition

Report on Form 10-K

☐ Transition

Report on Form 20-F

☐ Transition

Report on Form 11-K

☐ Transition

Report on Form 10-Q

☐ Transition

Report on Form N-SAR

For

the Transition Period Ended: __________________________

Nothing

in this form shall be construed to imply that the Commission has verified any information contained herein.

If

the notification relates to a portion of the filing check above, identify the Item(s) to which the notification relates:

PART

I -- REGISTRANT INFORMATION

Adamis

Pharmaceuticals Corporation

Full

Name of Registrant

Former

Name if Applicable

11622

El Camino Real, Suite 100

Address

of Principal Executive Office (Street and Number)

San

Diego, CA 92130

City,

State and Zip Code

PART

II -- RULES 12b - 25(b) and (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b - 25(b),

the following should be completed. (Check box if appropriate.)

| |

|

(a) |

The

reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort expense; |

| |

|

|

|

| |

☒ |

(b) |

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or a portion

thereof will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report

or transition report on Form 10-Q, or subject distribution report on Form 10-D, or a portion thereof, will be filed on or before

the fifth calendar day following the prescribed due date; and |

| |

|

|

|

| |

|

(c) |

The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART

III – NARRATIVE

State

below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof,

could not be filed within the prescribed time period. (Attach extra sheets if needed.)

Adamis

Pharmaceuticals Corporation (the “Registrant” or the “Company”) is filing this Notification of Late Filing on

Form 12b-25 with respect to its Quarterly Report on Form 10-Q for the three- and six-month periods ended June 30, 2023 (the “Form

10-Q”). For the reasons described below, which cannot be eliminated by the Company without unreasonable effort or expense, the

Company has determined that it is unable to file the Form 10-Q with the Securities and Exchange Commission (“SEC”) within

the prescribed time period because it requires additional time to compile and evaluate certain information and complete its review of

its financial statements and other disclosures in the Form 10-Q, including regarding the matters described below, which could not be

completed by the date required without incurring unreasonable effort and expense. The Company anticipates that it will file its Form

10-Q within the 5-day grace period provided by Rule 12b-25 of the Securities Exchange Act of 1934, as amended.

As

previously reported in a Current Report on Form 8-K filed with the SEC on May 26, 2023, on May 25, 2023, the Company completed its merger

transaction (the “Merger”) with DMK Pharmaceuticals Corporation (“DMK”). The Company requires additional time

to gather information, and prepare, analyze and review certain information and complete its review of its financial statements and other

disclosures in the Form 10-Q, including relating to the presentation of financial information during the period covered by the Form 10-Q

and other disclosures in the Form 10-Q, which could not be completed by the date required without incurring unreasonable effort and expense,

including without limitation concerning matters relating to accounting for the Merger transaction with DMK including the purchase price,

valuation of the assets acquired in the Merger, and allocation of the purchase price among the assets acquired in the Merger.

Forward-Looking

Statements

This

filing contains a number of forward-looking statements. Words such as “expects,” “will,” “anticipates,”

and variations of such words and similar future or conditional expressions are intended to identify forward-looking statements. These

forward-looking statements include, but are not limited to, statements regarding our beliefs and expectations relating to the timing

of our filing of the Form 10-Q and the completion of matters necessary to permit the filing of the Form 10-Q. These forward-looking statements

are not guarantees of future results and are subject to a number of risks and uncertainties, many of which are difficult to predict and

beyond our control. Important factors that may cause actual results to differ materially from those in the forward-looking statements

include, but are not limited to, a delay in the completion of matters necessary to permit the filing of the Form 10-Q and the possibility

that the Company will not be able to file its Form 10-Q within the five-day extension permitted by the rules of the SEC. There can be

no assurance that these forward-looking statements will be achieved, and actual results could differ materially from those suggested

by such forward-looking statements. We disclaim and do not undertake any obligation to update or revise any forward-looking statement

in this report, except as required by applicable law or regulation.

PART

IV – OTHER INFORMATION

| (1) |

Name

and telephone number of person to contact in regard to this notification. |

| |

David

J. Marguglio |

(858)

997-2400 |

| |

(Name) |

(Area

Code and Telephone Number) |

| |

(2) |

Have

all other periodic reports required under section 13 or 15(d) of the Securities Exchange Act of 1934 or section 30 of the Investment

Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s)

been filed? If the answer is no, identify report(s). |

☒ Yes ☐

No

| |

(3) |

Is

it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be

reflected by the earnings statements to be included in the subject report or portion thereof? |

☒

Yes ☐ No

If

so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why

a reasonable estimate of the results cannot be made.

The Company currently anticipates that the Form 10-Q will reflect

a decrease in revenue for the three months ended June 30, 2023 compared to the comparable period of 2022 and an increase in revenue for

the six months ended June 30, 2023 compared to the comparable period of 2022; a decrease in gross loss for the three and six month periods

ended June 30, 2023 compared to the comparable period of 2022; an increase in change in fair value of warrants for the three and six

month periods ended June 30, 2023 compared to the comparable period of 2022; an increase in loss from operations for the three and six

month periods ended June 30, 2023 compared to the comparable period of 2022; a decrease in net loss from continuing operations for the

three and six month periods ended June 30, 2023 compared to the comparable period of 2022; and an increase in net loss applicable to

common stock for the three months ended June 30, 2023 compared to the comparable period of 2022 and a decrease in net loss applicable

to common stock for the six months ended June 30, 2023. However, the Company is unable to determine whether the matters described in

Part III above will have an impact on the Company’s results of operations and financial information relating to the periods included

in the Form 10-Q. As a result, the Company is unable to provide an accurate quantitative estimate of its results of operations for the

three and six month periods ended June 30, 2023.

Adamis

Pharmaceuticals Corporation

(Name

of Registrant as specified in its charter)

has

caused this notification to be signed on its behalf by the undersigned thereunto duly authorized.

| |

By: |

/s/ David J. Marguglio |

| |

|

David

J. Marguglio |

| |

|

Chief

Financial Officer |

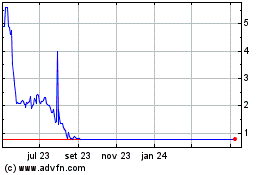

Adamis Pharmaceuticals (NASDAQ:ADMP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Adamis Pharmaceuticals (NASDAQ:ADMP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024