0001642375

false

0001642375

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

GUARDION

HEALTH SCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38861 |

|

47-4428421 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

2925

Richmond Avenue, Suite 1200

Houston,

Texas 77098

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (800) 873-5141

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

GHSI |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition.

On

August 14, 2023, Guardion Health Sciences, Inc. (the “Company”) issued a press release announcing financial results for the

three months and six months ended June 30, 2023. The text of the press release is furnished as Exhibit 99.1 to this current report.

The

information in this Item 2.02 and Exhibit 99.1 hereto shall not be deemed “filed” for the purposes of or otherwise subject

to the liabilities under Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unless expressly

incorporated into a filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, the information contained

in this Item 2.02 and Exhibit 99.1 hereto shall not be incorporated by reference into any Company filing, whether made before or after

the date hereof, regardless of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

GUARDION

HEALTH SCIENCES, INC. |

| Date:

August 14, 2023 |

|

|

| |

By: |

/s/

Jan Hall |

| |

Name: |

Jan

Hall |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Guardion

Health Sciences Announces Financial Results for the Three Months and Six Months Ended June 30, 2023

Viactiv®

Product Line Total Revenue Increased Approximately 6% for the Six Months Ended June 30, 2023, as Compared to the Six Months Ended

June 30, 2022; Robust Growth in Amazon Sales Channel Demonstrates Positive Results of Company’s Focus on eCommerce Initiatives

HOUSTON,

TEXAS – August 14, 2023 (GLOBE NEWSWIRE) – Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the “Company”),

a clinical nutrition company that offers a portfolio of science-based, clinically-supported products designed to support the health needs

of consumers, healthcare professionals and providers and their patients, announced its financial results for the three months and six

months ended June 30, 2023. The Company also provided a corporate update to stockholders.

Financial

highlights for the three months and six months ended June 30, 2023 include the following (all common share and per share amounts shown

below have been adjusted to reflect the 1-for-50 reverse stock split effective January 6, 2023):

| |

● |

Total

revenue was $2,789,817 for the three months ended June 30, 2023, as compared to $3,275,213 for the three months ended June 30, 2022,

a decrease of $485,396 or 14.8%.The decrease in total revenue was driven by reduced sales of the Viactiv®

product line, which accounted for approximately 97% and 97% of the Company’s total revenue for the three months

ended June 30, 2023 and 2022, respectively.Shipments of Viactiv® to retail customers were

delayed in the month of June 2023 due to the short-term impact of a third-party warehouse expansion, which was fully resolved in

July 2023. eCommerce logistics were unaffected by this issue. Amazon net sales for the three months ended June 30, 2023,

increased by approximately 334.3% as compared to the three months ended June 30, 2022 and by approximately 124.3% as compared to

the three months ended March 31, 2023. |

| |

|

|

| |

● |

Gross

profit was $1,249,268 for the three months ended June 30, 2023, as compared to $1,399,544 for the three months ended June 30, 2022,

a decrease of $150,276 or 10.7%.The reduction in gross profit was primarily attributable to the decrease in sales from

the Viactiv® product line. |

| |

|

|

| |

● |

Gross

margin for the three months ended June 30, 2023 was 44.8%, as compared to 42.7% for the three months ended June 30, 2022, an increase

of 4.9%, which was driven primarily by an inventory reserve recorded in 2022. |

| |

|

|

| |

● |

Total

operating expenses for the three months ended June 30, 2023 were $2,261,914, as compared to $3,111,122 for the three months ended

June 30, 2022, a decrease of $849,208 or 27.3%.The variance was attributable to a combination of factors, including the

amortization of intangible assets in 2022 that was no longer occurring in 2023 and reduced payroll expense and lower executive stock

compensation expense. |

| |

● |

Loss

from operations for the three months ended June 30, 2023 decreased to $(1,012,646), as compared to $(1,711,578) for the three months

ended June 30, 2022, a reduction of $698,932 or 40.8%. |

| |

|

|

| |

● |

As

a result of the aforementioned factors, and also including the non-cash gain (loss) from the change in fair value of the warrant

derivative liability of $(255,300) and $5,357,600 for the three months ended June 30, 2023 and 2022, respectively, net loss was $(1,172,411)

for the three months ended June 30, 2023, as compared to net income of $3,655,637 for the three months ended June 30, 2022. |

| |

|

|

| |

● |

Basic

and diluted net loss for the three months ended June 30, 2023 was $(0.93) per share, as compared to basic and diluted net income

of $2.97 per share for the three months ended June 30, 2022, based on 1,267,340 weighted average common shares outstanding in 2023

and 1,231,063 weighted average common shares outstanding in 2022. |

Financial

highlights for the six months ended June 30, 2023 include the following:

| |

● |

Total

revenue was $5,975,506 for the six months ended June 30, 2023, as compared to $5,659,832 for the six months ended June 30, 2022,

an increase of $315,674 or 5.6%.The increase in total revenue was driven by increased sales of the Viactiv®

product line, which accounted for approximately 97% and 96% of the Company’s total revenue for the six months

ended June 30, 2023 and 2022, respectively. Shipments of Viactiv® to retail customers were delayed in

the month of June 2023 due to the short-term impact of a third-party warehouse expansion, which was fully resolved in July 2023.

eCommerce logistics were unaffected by this issue. Amazon net sales for the six months ended June 30, 2023 increased by

approximately 647.8% as compared to the six months ended June 30, 2022. |

| |

|

|

| |

● |

Gross

profit was $2,584,570 for the six months ended June 30, 2023, as compared to $2,496,001 for the six months ended June 30, 2022, an

increase of $88,569 or 3.5%.The increase in gross profit was primarily attributable to the increase in sales from the

Viactiv® product line. |

| |

|

|

| |

● |

Gross

margin for the six months ended June 30, 2023 was 43.3%, as compared to 44.1% for the six months ended June 30, 2022, a decrease

of 0.8%, which was driven primarily by higher short-term fulfillment costs to accelerate initial product setup on Amazon in the three

months ended March 31, 2023. Amazon fulfillment costs were lower for the three months ended June 30, 2023, as compared

to the three months ended March 31, 2023. |

| |

|

|

| |

● |

Total

operating expenses for the six months ended June 30, 2023 were $5,061,223, as compared to $6,827,627 for the six months ended June

30, 2022, a decrease of $1,766,404 or 25.9%. The variance was attributable to a combination of factors, including the

amortization of intangible assets in 2022, reduced payroll expense, insurance, and professional fees and consulting fees. |

| |

● |

Loss

from operations for the six months ended June 30, 2023 decreased to $(2,476,653), as compared to $(4,331,626) for the six months

ended June 30, 2022, a reduction of $1,854,973 or 42.8%. |

| |

|

|

| |

● |

Basic

and diluted net loss for the six months ended June 30, 2023 was $(0.50) per share, as compared to basic and diluted net loss of $(1.63)

per share for the six months ended June 30, 2022, based on 1,267,340 weighted average common shares outstanding in 2023 and 1,009,243

weighted average common shares outstanding in 2022. |

| |

|

|

| |

● |

Cash

used in operations for the six months ended June 30, 2023 was $2,285,712, as compared to $4,800,765 for the six months ended June

30, 2022. |

| |

|

|

| |

● |

As

of June 30, 2023, the Company had unrestricted cash and cash equivalents of $8,365,987 and net working capital (excluding the current

portion of the warrant derivative liability) of $11,993,202. |

Additional

significant events that occurred during the three months and six months ended June 30, 2023 and subsequently included the following:

| |

● |

Alantra

LLC was retained as the Company’s exclusive financial advisor to implement a strategic review to solicit and evaluate alternatives

to maximize stockholder value in the near-term, which review is on-going. |

| |

|

|

| |

● |

Jan

Hall was appointed President and CEO, effective June 19, 2023, replacing Bret Scholtes. |

| |

|

|

| |

● |

Katie

Cox was appointed as Chief Accounting Officer, effective July 25, 2023, replacing Jeffrey Benjamin. |

Jan

Hall, Guardion’s recently-appointed President and Chief Executive Officer, commented, “I am truly excited to be able to join

the Guardion team as its President and Chief Executive Officer. Based on my initial review, I believe that the Viactiv business has the

potential to grow by focusing on powerful brand messaging with science-based claims that rank highest for shoppers’ purchase intent.

We believe that we can deliver this messaging with an emotional hook that connects with the values, needs and aspirations of our target

consumers. We recently implemented a Bold Age advertising campaign for the Viactiv calcium chews that has already seen positive results,

as compared with industry metrics and prior Viactiv campaigns. As we learn more from in-market performance, we will continue to refine

and optimize the creative aspects of our marketing campaigns. Effective advertising, combined with targeted marketing initiatives, product

innovations in existing and new product segments, plus expanded retail and online distribution, will be the engine of future growth to

make Viactiv a broad-based destination health and wellness brand with a foundation in clinically supported efficacy.”

“We

have seen the initial results of management’s continuing efforts to improve operating performance during the first half of 2023,

reflected in improved operating margins in the second quarter of 2023 and a reduced cash burn. The focus on efficiency will be ongoing

in the second half of the year.”

“We

continue to believe that the Company remains undervalued in the public market, specifically with regard to the clinical nutrition platform

and the brand that we are building. Our work with Alantra, LLC (“Alantra”), our exclusive financial advisor, is underway

as we conduct our strategic review to solicit and evaluate alternatives to maximize stockholder value in the near-term, which could range

from a sale of the Company, sale of the Viactiv brand, merger, asset acquisition, reverse acquisition, or other potential strategic transaction.

As this process evolves, we anticipate providing updates to our stockholders as developments warrant.”

“In

the meantime, we believe our market position and the extendability of the Viactiv brand, combined with our current operating business

strategy, provide us with a viable platform from which to leverage our resources to continue our efforts to grow operations, improve

financial performance and maximize stockholder value,” concluded Ms. Hall.

Financial

Results

Additional

information with respect to the Company’s business, operations and financial condition as of and for the three months and six months

ended June 30, 2023 is contained in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, which

has been filed with the U.S. Securities and Exchange Commission (the “SEC”) at www.sec.gov.

About

Guardion Health Sciences, Inc.

Guardion

Health Sciences, Inc. (Nasdaq: GHSI), is a clinical nutrition company that offers a portfolio of science-based, clinically supported

products designed to support the health needs of consumers, healthcare professionals and providers and their patients. Information and

risk factors with respect to Guardion and its business may be obtained in the Company’s filings with the SEC at www.sec.gov.

Forward-Looking

Statement Disclaimer

With

the exception of the historical information contained in this news release, the matters described herein may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. These forward-looking statements contain information about our expectations, beliefs, plans or intentions regarding

our product development and commercialization efforts, research and development efforts, business, financial condition, results of operations,

strategies or prospects, and other similar matters. Statements preceded by, followed by or that otherwise include the words “believes,”

“expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,”

“hopes” and similar expressions or future or conditional verbs such as “will,” “should,” “would,”

“may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking

statements include the foregoing.

These

statements are based on management’s current expectations and assumptions about future events, which are inherently subject to

uncertainties, risks and changes in circumstances that are difficult to predict, and involve unknown risks and uncertainties that may

individually or materially impact the matters discussed herein for a variety of reasons that are outside the control of the Company,

including, but not limited to, the Company’s ability to raise sufficient financing to fund its business plan, the impact of the

Company’s exploration of strategic alternatives, any replacement and integration of new management team members, the implementation

of new financial, management, accounting and business software systems, the identification and integration of possible acquisition targets

and suitors, the impact of the Covid-19 pandemic, supply chain disruptions, inflation and a potential recession on the Company’s

business, operations and the economy in general, the Company’s ability to successfully develop and commercialize its proprietary

products and technologies, and the Company’s ability to maintain compliance with Nasdaq’s continued listing requirements.

Readers

are cautioned not to place undue reliance on these forward-looking statements, as actual results could differ materially from those described

in the forward-looking statements contained herein. Readers are urged to read the risk factors set forth in the Company’s filings

with the SEC, which are available at the SEC’s website (www.sec.gov). The Company disclaims any intention or obligation to update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investor

Relations Contact:

CORE

IR

Scott

Arnold

516-222-2560

scotta@coreir.com

Media

Relations Contact:

Jules

Abraham

Director

of Public Relations

CORE

IR

917-885-7378

julesa@coreir.com

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-38861

|

| Entity Registrant Name |

GUARDION

HEALTH SCIENCES, INC.

|

| Entity Central Index Key |

0001642375

|

| Entity Tax Identification Number |

47-4428421

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2925

Richmond Avenue

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77098

|

| City Area Code |

(800)

|

| Local Phone Number |

873-5141

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per

|

| Trading Symbol |

GHSI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

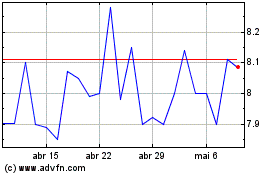

Guardion Health Sciences (NASDAQ:GHSI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

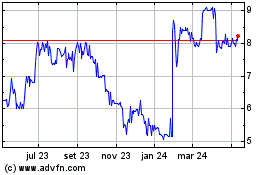

Guardion Health Sciences (NASDAQ:GHSI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024