UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

|

AvePoint, Inc. |

| (Name of Issuer) |

| |

|

|

| Common Stock |

| (Title of Class of Securities) |

| |

|

|

| 053604104 |

| (CUSIP Number) |

| |

|

|

|

Joshua Peck

c/o Sixth Street Partners,

LLC

2100 McKinney Avenue

Suite 1500

Dallas, TX 75201

469-621-3001 |

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

|

September 15, 2023 |

| (Date of Event Which Requires Filing of this Statement) |

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in

paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties

to whom copies are to be sent.

* The remainder of this cover

page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

CUSIP No. 053604104

Page 2 of 6 Pages

| 1 |

NAMES OF REPORTING PERSONS |

|

|

| SIXTH STREET PARTNERS MANAGEMENT COMPANY, L.P. |

|

|

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) |

☐ |

| |

(b) |

☐ |

| |

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

|

| AF |

|

|

| |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E) |

|

☐ |

| |

|

|

| |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| Delaware |

|

|

| |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER |

|

|

| 0 |

|

|

| |

|

| 8 |

SHARED VOTING POWER |

|

|

| 7,333,992 |

|

|

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

|

| 0 |

|

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

|

| 7,333,992 |

|

|

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| 7,333,992 |

|

|

| |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

|

☐ |

| |

|

|

| |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| 3.96% (1) |

|

|

| |

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

|

|

| PN |

|

|

| |

|

| |

|

|

|

|

|

(1) See response to Item 5(a, b) herein.

CUSIP No. 053604104

Page 3 of 6 Pages

| 1 |

NAMES OF REPORTING PERSONS |

|

|

| ALAN WAXMAN |

|

|

| |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) |

☐ |

| |

(b) |

☐ |

| |

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

|

| AF |

|

|

| |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E) |

|

☐ |

| |

|

|

| |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

|

| United States of America |

|

|

| |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER |

|

|

| 0 |

|

|

| |

|

| 8 |

SHARED VOTING POWER |

|

|

| 7,333,992 |

|

|

| |

|

| 9 |

SOLE DISPOSITIVE POWER |

|

|

| 0 |

|

|

| |

|

| 10 |

SHARED DISPOSITIVE POWER |

|

|

| 7,333,992 |

|

|

| |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

|

| 7,333,992 |

|

|

| |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

|

☐ |

| |

|

|

| |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

|

| 3.96% (1) |

|

|

| |

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

|

|

| IN, HC |

|

|

| |

|

| |

|

|

|

|

|

(1) See response to Item 5(a, b) herein.

CUSIP No. 053604104

Page 4 of 6 Pages

| Item 1. |

Security and Issuer |

Item

1 of the Schedule 13D is hereby amended and supplemented as follows:

This

Amendment No. 2 to Schedule 13D (“Amendment No. 2”) amends and supplements the information set forth in the Schedule 13D filed

by the Reporting Persons with the U.S. Securities and Exchange Commission (the “SEC”) on July 21, 2021, as amended

and supplemented by Amendment No. 1 filed on June 15, 2023 (as so amended, the “Original

Schedule 13D” and, as amended and supplemented by this Amendment No. 2, the “Schedule 13D”), with respect to

the Common Stock of the Issuer. Capitalized terms used in this Amendment and not otherwise defined shall have the same meanings ascribed

to them in the Original Schedule 13D. The filing of this Amendment No. 2 represents the final amendment to this Schedule 13D and constitutes

an exit filing for the Reporting Persons.

| Item 2. |

Identity and Background |

The second paragraph of Item

2(c) of the Schedule 13D is hereby amended and restated in its entirety as follows:

Management Company ultimately indirectly

controls (i) Sixth Street Growth GenPar, L.P. (formerly known as TSSP Capital Solutions GenPar, L.P.), a Delaware limited partnership,

which is the managing member of (a) TCS Finance (A), LLC, a Delaware limited liability company, which is the managing member of Avatar

Investment Solutions (A), LLC, a Delaware limited liability company (“Avatar (A)”), which directly holds 2,193,228 shares

of Common Stock and (b) TCS Finance 1, LLC, a Delaware limited liability company, which is the managing member of Avatar Investment Solutions

1, LLC, a Delaware limited liability company (“Avatar 1”), which directly holds 1,718,235 shares of Common Stock and (ii)

Sixth Street Opportunities GenPar IV, L.P. (formerly known as TSSP Opportunities GenPar IV, L.P.), a Delaware limited partnership, which

is the managing member of Redwood IV Finance 1, LLC, a Delaware limited liability company, which is the managing member of Avatar Investment

Opportunities, LLC, a Delaware limited liability company (“AIO”), which directly holds 3,422,529 shares of Common Stock (together

with the shares directly held by Avatar (A) and Avatar 1, the “Shares”). Because of Management Company’s relationship

Avatar (A), Avatar 1 and AIO, Management Company may be deemed to beneficially own the Shares. Management Company is managed by its general

partner, whose managing member is Alan Waxman. Each of Management Company and Mr. Waxman disclaim beneficial ownership of the Shares except

to the extent of their pecuniary interest therein.

| Item 4. |

Purpose of Transaction |

Item 4 of

the Schedule 13D is hereby amended and supplemented to add the following:

On September 15, 2023, Avatar (A), Avatar 1, and AIO entered into a securities

purchase agreement pursuant to which the Reporting Persons sold an aggregate of 16,666,600 shares of Common Stock at a price of $6.00

per share (the “Transaction”). The Transaction is expected to close on or around September 20, 2023.

| Item 5. |

Interest in Securities of the Issuer |

Item

5 of the Schedule 13D is hereby amended and supplemented as follows:

(a, b)

As of the date hereof, the Reporting Persons may be deemed to beneficially own 7,333,992 shares of Common Stock, representing approximately

3.96% of the shares of Common Stock outstanding. This amount consists of: (i) 2,193,228 shares of Common Stock held directly by Avatar

(A); (ii) 1,718,235 shares of Common Stock held directly by Avatar 1; and (iii) 3,422,529 shares of Common Stock held directly by AIO.

This amount excludes the 715,249 shares of Common Stock representing the Reporting Persons’ maximum Contingent Consideration, because

the Reporting Persons do not have the right to acquire such shares of Common Stock at this time. The foregoing percentage is based

on 185,397,977 shares of Common Stock as of August 9, 2023, as set forth in the supplement Form S-1 filed by the Issuer on August 10,

2023.

CUSIP No. 053604104

Page 5 of 6 Pages

(c) On

September 15, 2023, the Reporting Persons sold an aggregate 16,666,600 shares of Common Stock at a price per share of $6.00. This amount

includes 4,984,140 shares of Common Stock sold by Avatar (A); (ii) 3,904,714 shares of Common Stock sold by Avatar 1; and (iii) 7,777,746

shares of Common Stock sold by AIO. Other than as set forth herein, no transactions in the Issuer’s securities have been effected

by the Reporting Persons during the past 60 days.

(e) As of September 15, 2023 the Reporting Persons ceased to be beneficial owners of more than 5% of the Issuer's Common Stock.

| Item 7. |

Material to be Filed as an Exhibits |

| |

|

CUSIP No. 053604104

Page 6 of 6 Pages

SIGNATURES

After reasonable inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: September 18, 2023

| |

Sixth Street Partners Management Company, L.P. |

| |

|

|

| |

By: |

/s/ David Stiepleman (2) |

| |

|

Name: David Stiepleman |

| |

|

Title: Authorized Signatory of the GP of Sixth Street Partners Management Company, L.P. |

| |

|

|

| |

Alan Waxman |

| |

|

|

| |

By: |

/s/ Joshua Peck (2) |

| |

|

Name: Joshua Peck |

| |

|

Title: Joshua Peck, on behalf of Alan Waxman

|

(2) Sixth Street Partners Management Company, L.P. and Alan Waxman are

jointly filing this Schedule 13D pursuant to the Joint Filing Agreement dated July 21, 2021, which was previously filed with the Commission.

Sixth Street Partners Management Company, L.P. SC 13D/A

Exhibit 1

PURCHASE

AGREEMENT

PURCHASE

AGREEMENT, dated as of September 15, 2023 (this “Agreement”), by and between Anchor IV Pte. Ltd., a company organized

under the laws of Singapore (the “Purchaser”), and Avatar Investment Solutions (A), LLC, a limited liability company

organized under the laws of the State of Delaware, Avatar Investment Solutions 1, LLC, a limited liability company organized under the

laws of the State of Delaware, and Avatar Investment Opportunities, LLC, a limited liability company organized under the laws of the

State of Delaware (each, a “Seller” and, collectively, the “Sellers”).

WHEREAS,

the Sellers own shares of common stock, par value US$0.0001 per share (the “Common Stock”), of AvePoint, Inc., a corporation

organized under the laws of the State of Delaware (the “Issuer”); and

WHEREAS,

each Seller desires to sell the number of shares of Common Stock set forth opposite such Seller’s name on Schedule I hereto, in

the aggregate 16,666,600 shares of Common Stock (the “Shares”), to the Purchaser, and the Purchaser desires to purchase

such Shares from the Sellers in accordance with the terms hereof (the “Transaction”).

NOW,

THEREFORE, in consideration of the foregoing and the covenants, agreements and warranties contained herein, the sufficiency of which

consideration is hereby acknowledged, the parties agree as follows:

1. Definitions. When used herein, the following terms shall have the following meanings:

“Closing

Date” means: (a) the third Trading Day following the Signing Date; provided, however, that, if the Closing Date

does not occur on the third Trading Day following the Signing Date, it shall be automatically extended one time for a period of an additional

ten Trading Days; or (b) such other date as the Purchaser and the Sellers may otherwise mutually agree upon in writing.

“Encumbrance”

means any pledge, hypothecation, assignment, lien, restriction (other than a Transfer Restriction), charge, claim, security interest,

mortgage, option, preference, priority or other similar arrangement of any kind or nature whatsoever, other than any such encumbrance

that will be released in connection with the Transaction.

“Exchange

Act” means the Securities Exchange Act of 1934, as amended.

“Purchase

Price” shall have the meaning set forth in Section 2 hereof.

“Securities

Act” means the Securities Act of 1933, as amended.

“Signing

Date” means the date of this Agreement.

“Trading

Day” means any day that is a trading day on the primary securities exchange or market for the Common Stock.

“Transfer

Restriction” means, with respect to any security, any condition to or restriction on the ability of the holder thereof to sell,

assign or otherwise transfer such security or to enforce the provisions thereof or of any document related thereto, whether set forth

in such security itself or in any document related thereto or arising by operation of law, including, without limitation, such conditions

or restrictions arising under federal, state or foreign securities laws.

2. Sale and Purchase. Subject to the terms of this Agreement, each of the Sellers and the Purchaser agree on the Signing Date

that such Sellers shall sell to the Purchaser, and the Purchaser shall purchase from such Sellers, on the Closing Date, the Shares free

from all Encumbrances and Transfer Restrictions for a purchase price of US$6.00 per Share (such aggregate amount, the “Purchase

Price”). Each of the Sellers and the Purchaser has executed this Agreement on the Signing Date, shall submit trade instructions

to effect the Transaction promptly following the execution of this Agreement on the Signing Date and shall consummate the Transaction

on the Closing Date.

3. Seller’s Representations, Warranties and Agreements. Each Seller hereby represents, warrants and agrees on the Signing

Date and the Closing Date that:

(a) (1) Such Seller is duly organized and validly existing under the laws of the jurisdiction of such Seller’s organization or

incorporation and, if relevant under such laws, in good standing. Such Seller has the power to execute and deliver this Agreement and

to perform such Seller’s obligations under this Agreement and has taken all necessary action to authorize such execution, delivery

and performance;

(2) Such execution, delivery and performance of this Agreement, the sale and delivery of the Shares and the consummation of the Transaction

do not violate or conflict with any law applicable to such Seller, any provision of such Seller’s constitutional documents or any

order or judgment of any court or other agency of government applicable to such Seller or the Shares or any agreement or instrument to

which such Seller is a party or by which such Seller is bound;

(3) No consent, approval, authorization or other order of, or filing with, any governmental authority or other person, is required for the

execution, delivery and performance by such Seller of this Agreement or the consummation by such Seller of the Transaction, except for

such filings that may be required to be made by such Seller with the Securities and Exchange Commission under the Exchange Act; and

(4) This Agreement has been duly executed and delivered by such Seller. Such Seller’s obligations under this Agreement constitute the

legal, valid and binding obligations of such Seller, enforceable in accordance with their respective terms (subject to applicable bankruptcy,

reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability,

to equitable principles of general application (regardless of whether enforcement is sought in a proceeding in equity or at law)).

(b) Neither such Seller nor any person acting on behalf of such Seller has retained any broker in connection with the transactions contemplated

by this Agreement. Such Seller agrees that neither the Purchaser nor any affiliate, employee, agent or representative of the Purchaser

shall have any liability to such Seller or any other person with respect to any brokerage or finder’s fee or other commission in

connection with the Transaction; it being understood that no representation or warranty is given by such Seller in respect of any fees

or commission payable by Purchaser to its brokers, agents or other representatives.

(c) (i) Such Seller has good and valid title to such Seller’s Shares and owns such Shares free and clear of any Encumbrances; (ii)

such Shares are not and will not be as of the Closing Date subject to any Transfer Restriction; and (iii) upon the transfer of such Shares

to the Purchaser and payment therefor pursuant to Section 7 of this Agreement, the Purchaser will have good and valid title to such Shares,

free and clear of any Encumbrances or Transfer Restrictions.

(d) Such Seller is an “accredited investor” (as defined in Rule 501(a) promulgated under the Securities Act) and is knowledgeable

and experienced in finance, securities and investments and has had sufficient experience analyzing, investing in and selling securities

similar to the Shares so as to be capable of evaluating the merits and risks of the transactions contemplated by this Agreement.

(e) Such Seller is not in possession of any material nonpublic information concerning the Issuer. “Material” information for

these purposes is any information to which an investor would reasonably attach importance in reaching a decision to buy, sell or hold

securities of the Issuer.

(f) Such Seller has made available to the Purchaser, including through public filings made by the Issuer with the Securities and Exchange

Commission, the relevant documents concerning such Seller’s acquisition of its Shares and any Transfer Restrictions or Encumbrances

applicable to its Shares.

(g) If any opinion of counsel is required to be delivered to the Issuer pursuant to any Transfer Restriction or otherwise in connection with

the transfer of a Seller’s Shares hereunder, such Seller shall use reasonable best efforts to cause such opinion to be provided

at such Seller’s own expense and shall provide the Purchaser a reasonable opportunity to review and comment upon such opinion prior

to its delivery to the Issuer.

4. Purchaser’s Representations, Warranties and Agreements. The Purchaser hereby represents, warrants and agrees on the

Signing Date and the Closing Date that:

(a) (1) The Purchaser is duly organized and validly existing under the laws of the jurisdiction of the Purchaser’s organization or

incorporation and, if relevant under such laws, in good standing. The Purchaser has the power to execute and deliver this Agreement and

to perform the Purchaser’s obligations under this Agreement and has taken all necessary action to authorize such execution, delivery

and performance;

(2) Such execution, delivery and performance of this Agreement and the consummation of the Transaction do not violate or conflict with any

law applicable to the Purchaser, any provision of the Purchaser’s constitutional documents or any order or judgment of any court

or other agency of government applicable to the Purchaser or any agreement or instrument to which the Purchaser is a party or by which

the Purchaser is bound;

(3) No consent, approval, authorization or other order of, or filing with, any governmental authority or other person, is required for the

execution, delivery and performance by the Purchaser of this Agreement or the consummation by the Purchaser of the Transaction, except

for such filings that may be required to be made by the Purchaser with the Securities and Exchange Commission under the Exchange Act;

and

(4) This Agreement has been duly executed and delivered by the Purchaser. The Purchaser’s obligations under this Agreement constitute

the legal, valid and binding obligations of the Purchaser, enforceable in accordance with their respective terms (subject to applicable

bankruptcy, reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability,

to equitable principles of general application (regardless of whether enforcement is sought in a proceeding in equity or at law)).

(b) The Purchaser is an “accredited investor” (as defined in Rule 501(a) promulgated under the Securities Act) and is knowledgeable

and experienced in finance, securities and investments and has had sufficient experience analyzing, investing in and purchasing securities

similar to the Shares so as to be capable of evaluating the merits and risks of the transactions contemplated by this Agreement.

(c) Purchaser has delivered to the Sellers a true, correct and complete copy of an executed financing commitment letter, dated as of the

date hereof (the “Financing Commitment Letter”). The Financing Commitment Letter has been duly executed and delivered

by, and is a legal, valid and binding obligation of, each party thereto. The Financing Commitment Letter and the commitments thereunder

are in full force and effect and have not been and will not be withdrawn, rescinded, terminated or otherwise amended or modified.

5. Condition Precedent to Obligations of the Purchaser. The obligations of the Purchaser hereunder to consummate the Transaction

are subject solely to the satisfaction or waiver (by the Purchaser) of the following condition precedent:

(a) The representations and warranties of each Seller contained herein shall be true and correct as of the Closing Date.

6. Condition Precedent to Obligations of the Sellers. The obligations of the Sellers hereunder to consummate the Transaction

are subject solely to the satisfaction or waiver (by the Sellers) of the following condition precedent:

(a) The representations and warranties of the Purchaser contained herein shall be true and correct as of the Closing Date.

7. Settlement. (a) On the Closing Date, subject to Sections 5 and 6 of this Agreement, the Sellers shall deliver the Shares,

for credit on the records of The Depository Trust Company, to a security account in the name of the Purchaser against payment by the

Purchaser of the Purchase Price.

(b) All Shares delivered to the Purchaser pursuant to this Agreement shall be free and clear of all Encumbrances and Transfer Restrictions.

(c) The Purchase Price shall be paid on the Closing Date by the Purchaser to the account of the Sellers designated in writing to the Purchaser.

(d) Each of the Purchaser and the Sellers shall, upon the reasonable request of the other, execute and deliver all other documents and instruments

reasonably deemed necessary or desirable by the other party to fully effect the purchase and sale contemplated by this Agreement.

8. Acknowledgements. The Sellers acknowledge and agree that the Purchaser shall be conducting its own due diligence investigation

(including with the assistance and participation of the Issuer) with respect to the Issuer and its business, operations and financial

condition and that, as a result of such due diligence investigation, the Purchaser may be in possession of information (including material

non-public information) relating to the Issuer and its business, operations and financial condition that the Sellers are not in possession

of or aware of or is otherwise not publicly available and the Sellers wish to proceed with the transactions contemplated by this Agreement

notwithstanding such potential information asymmetry. Each of the Sellers and the Purchaser agrees that it shall release the other party

from any claims or allegations with respect to the foregoing and shall not seek any recourse against the other party or make any claim

or dispute against the other party as a result of the foregoing.

9. Notices. Any notice, request, instruction or other document to be given hereunder by a party hereto shall be in writing and

shall be deemed to have been given upon receipt at the address provided on the signature page hereto or to such other address as a party

may designate by notice given as herein provided.

10. Expenses. Except as otherwise expressly provided herein, each party hereto shall bear such party’s own expenses in connection

with the purchase and sale of the Shares contemplated hereby, except that the Sellers shall bear all transfer and issuance taxes, if

any, imposed on such purchase and sale.

11. Miscellaneous.

(a) This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together

shall constitute one and the same instrument. Delivery of an executed counterpart of a signature page to this Agreement by electronic

transmission (e.g., a “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart thereof.

The words “execution,” “signed,” “signature,” “delivery,” and words of like import in

or relating to this Agreement or any document to be signed in connection with this Agreement shall be deemed to include electronic signatures,

deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability

as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, and

the parties hereto consent to conduct the transactions contemplated hereunder by electronic means. This Agreement constitutes the entire

agreement between the parties hereto with respect to the subject matter hereof and supersedes all oral communication and prior writings

with respect thereto. If any provision of this Agreement shall be held invalid, illegal or unenforceable, the validity, legality and

enforceability of the other provisions hereof shall not be affected thereby. The headings used in this Agreement are for convenience

of reference only and are not to affect the construction of or be taken into consideration in interpreting this Agreement. No amendment,

modification or waiver in respect of this Agreement shall be effective unless in writing (including a writing evidenced by electronic

means) and executed by each of the parties. The parties acknowledge that money damages will not be a sufficient remedy for breach of

this Agreement and that the parties hereto may obtain specific performance or other injunctive relief, without the necessity of posting

a bond or security therefor.

(b) THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK (without

reference to choice OF law doctrine). THE PARTIES HEREBY KNOWINGLY AND VOLUNTARILY WAIVE ANY RIGHT THEY MAY HAVE TO A TRIAL BY JURY IN

RESPECT OF ANY LITIGATION BASED HEREON.

(c) Any legal suit, action or proceeding arising out of or based upon this Agreement or the transactions contemplated hereby shall be

instituted in (i) the federal courts of the United States of America located in the City and County of New York, Borough of Manhattan

or (ii) the courts of the State of New York located in the City and County of New York, Borough of Manhattan (collectively, the

“Specified Courts”), and each party irrevocably submits to the exclusive jurisdiction (except for proceedings instituted

in regard to the enforcement of a judgment of any such court, as to which such jurisdiction is non-exclusive) of such courts in any such

suit, action or proceeding. Service of any process, summons, notice or document by mail to such party’s address set forth on the

signature page hereto shall be effective service of process for any suit, action or other proceeding brought in any such court. The parties

irrevocably and unconditionally waive any objection to the laying of venue of any suit, action or other proceeding in the Specified Courts

and irrevocably and unconditionally waive and agree not to plead or claim in any such court that any such suit, action or other proceeding

brought in any such court has been brought in an inconvenient forum.

(d) Each party acknowledges that (i) money damages would be an insufficient remedy for any actual or threatened breach of this Agreement

by either party, (ii) any such breach would cause the other party irreparable harm, and (iii) in addition to any other remedies available

at law or in equity, including monetary damages, the other party will be entitled to equitable relief by way of injunction, specific

performance, or otherwise, without posting any bond or other undertaking, for any actual or threatened breach of or any failure to perform

under this Agreement by a party or to enforce and observe performance of the terms and conditions of this Agreement, including that Sellers

shall be entitled to specific performance or other equitable remedy to enforce the obligations under the Financing Commitment Letter

to fund the equity financing contemplated therein and to cause Purchaser to consummate the closing of the Transaction. No party will

contest the appropriateness of any injunction or specific performance as a remedy for a breach or threatened breach of, or other failure

to perform under, this Agreement.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed and delivered as of the date first above written.

Avatar

Investment Solutions (A), LLC

Avatar

Investment Solutions 1, LLC

Avatar

Investment Opportunities, LLC |

|

ANCHOR

IV PTE. LTD. |

|

| |

|

|

|

| By: |

|

|

By: |

|

|

| |

Name:

|

|

|

Name: |

|

| |

Title:

|

|

|

Title: |

|

| |

|

|

|

| |

|

|

|

[Signature Page to Purchase Agreement]

Schedule

I

| Name

of Seller |

Number

of Shares |

| Avatar

Investment Solutions (A), LLC |

4,984,140 |

| Avatar

Investment Solutions 1, LLC |

3,904,714 |

| Avatar

Investment Opportunities, LLC |

7,777,746 |

| Total |

16,666,600 |

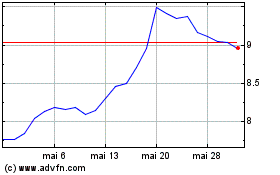

AvePoint (NASDAQ:AVPT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

AvePoint (NASDAQ:AVPT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025