Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

07 Novembro 2023 - 6:45PM

Edgar (US Regulatory)

SCHEDULE OF INVESTMENTS

Eagle Capital Growth Fund, Inc.

Portfolio of Investments (as of September 30, 2023) (unaudited)

| Common Stock (89.0% of total investments) | |

| |

| |

| |

|

| Industry | |

| |

| |

LEVEL ONE | |

|

| Advertising | |

Shares | |

Cost | |

Market Value | |

% Total Inv. |

| Alphabet, Inc. A* | |

| 17,000 | | |

| 1,376,922 | | |

| 2,224,620 | | |

| | |

| MediaAlpha, Inc.* | |

| 9,876 | | |

| 166,690 | | |

| 81,576 | | |

| | |

| | |

| | | |

| | | |

$ | 2,306,196 | | |

| (6.3 | %) |

| Bank | |

| | | |

| | | |

| | | |

| | |

| JPMorgan Chase & Co | |

| 3,000 | | |

| 390,311 | | |

| 435,060 | | |

| | |

| US Bancorp. | |

| 24,000 | | |

| 941,508 | | |

| 793,440 | | |

| | |

| Wells Fargo & Co. | |

| 10,000 | | |

| 403,661 | | |

| 408,600 | | |

| | |

| | |

| | | |

| | | |

$ | 1,637,100 | | |

| (4.0 | %) |

| Brokerage | |

| | | |

| | | |

| | | |

| | |

| Charles Schwab Corp. | |

| 34,000 | | |

| 1,760,697 | | |

| 1,866,600 | | |

| | |

| | |

| | | |

| | | |

$ | 1,866,600 | | |

| (5.1 | %) |

| Conglomerate | |

| | | |

| | | |

| | | |

| | |

| Berkshire Hathaway Inc. B* | |

| 21,000 | | |

| 3,205,343 | | |

| 7,356,300 | | |

| | |

| | |

| | | |

| | | |

$ | 7,356,300 | | |

| (19.9 | %) |

| Consumer | |

| | | |

| | | |

| | | |

| | |

| Colgate-Palmolive Company | |

| 21,000 | | |

| 626,458 | | |

| 1,493,310 | | |

| | |

| Procter & Gamble Company | |

| 2,000 | | |

| 145,879 | | |

| 291,720 | | |

| | |

| | |

| | | |

| | | |

$ | 1,785,030 | | |

| (4.3 | %) |

| Credit Card | |

| | | |

| | | |

| | | |

| | |

| Mastercard Inc | |

| 1000 | | |

| 219636.1 | | |

| 395910 | | |

| | |

| Visa Inc. | |

| 1500 | | |

| 225957.45 | | |

| 345015 | | |

| | |

| | |

| | | |

| | | |

$ | 740,925 | | |

| (1.8 | %) |

| Data Processing | |

| | | |

| | | |

| | | |

| | |

| Automatic Data Processing, Inc. | |

| 3000 | | |

| 82774.56 | | |

| 721740 | | |

| | |

| Paychex, Inc. | |

| 6000 | | |

| 140074.91 | | |

| 691980 | | |

| | |

| | |

| | | |

| | | |

$ | 1,413,720 | | |

| (3.8 | %) |

| Drug/Medical Device | |

| | | |

| | | |

| | | |

| | |

| Johnson & Johnson | |

| 3071 | | |

| 34932.62 | | |

| 478308.25 | | |

| | |

| Stryker Corp. | |

| 4500 | | |

| 19054.69 | | |

| 1229715 | | |

| | |

| | |

| | | |

| | | |

$ | 1,708,023 | | |

| (4.6 | %) |

| Food | |

| | | |

| | | |

| | | |

| | |

| Kraft Heinz Company | |

| 29,000 | | |

| 772,000 | | |

| 975,560 | | |

| | |

| PepsiCo, Inc. | |

| 10,000 | | |

| 168,296 | | |

| 1,694,400 | | |

| | |

| | |

| | | |

| | | |

$ | 2,669,960 | | |

| (6.4 | %) |

| Industrial | |

| | | |

| | | |

| | | |

| | |

| Danaher Corporation | |

| 1,000 | | |

| 254,997 | | |

| 248,100 | | |

| | |

| Illinois Tool Works Inc. | |

| 7,000 | | |

| 295,051 | | |

| 1,612,170 | | |

| | |

| Waters Corp.* | |

| 2,000 | | |

| 100,780 | | |

| 548,420 | | |

| | |

| | |

| | | |

| | | |

$ | 2,408,690 | | |

| (5.8 | %) |

| Insurance | |

| | | |

| | | |

| | | |

| | |

| Markel Corp.* | |

| 1,670 | | |

| 1,296,670 | | |

| 2,459,058 | | |

| | |

| | |

| | | |

| | | |

$ | 2,459,058 | | |

| (5.9 | %) |

| Mutaul Fund Management | |

| | | |

| | | |

| | | |

| | |

| Diamond Hill Investment Group, Inc. | |

| 9,576 | | |

| 1,338,331 | | |

| 1,614,226 | | |

| | |

| Franklin Resources, Inc. | |

| 70,000 | | |

| 1,794,630 | | |

| 1,720,600 | | |

| | |

| T. Rowe Price Group Inc. | |

| 18,400 | | |

| 2,399,683 | | |

| 1,929,608 | | |

| | |

| | |

| | | |

| | | |

$ | 5,264,434 | | |

| (12.7 | %) |

| Restaurant | |

| | | |

| | | |

| | | |

| | |

| Starbucks Corp. | |

| 12,000 | | |

| 588,432 | | |

| 1,095,240 | | |

| | |

| | |

| | | |

| | | |

$ | 1,095,240 | | |

| (2.6 | %) |

| Retail | |

| | | |

| | | |

| | | |

| | |

| AutoZone Inc.* | |

| 600 | | |

| 319,026 | | |

| 1,523,994 | | |

| | |

| eBay Inc. | |

| 3,000 | | |

| 68,886 | | |

| 132,270 | | |

| | |

| O'Reilly Automotive Inc.* | |

| 1,500 | | |

| 305,534 | | |

| 1,363,290 | | |

| | |

| | |

| | | |

| | | |

$ | 3,019,554 | | |

| (8.2 | %) |

| Technology Services | |

| | | |

| | | |

| | | |

| | |

| Amazon.com Inc. | |

| 9,000 | | |

| 915,707 | | |

| 1,144,080 | | |

| | |

| | |

| | | |

| | | |

$ | 1,144,080 | | |

| (3.1 | %) |

| | |

| | | |

| | | |

| | | |

| | |

| Total common stock investments | |

| | | |

| | | |

$ | 36,874,910 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Money Market Funds (11.0% of total investments) | |

| | | |

| | | |

| LEVEL ONE | | |

| | |

| Morgan Stanley Inst. Liquidity Fund, Treasury, 5.34% | |

| | | |

| | | |

| 4,539,439 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Total investments | |

| | | |

| | | |

$ | 41,414,349 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| All other assets less liabilities | |

| | | |

| | | |

| 39,765 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Total net assets | |

| | | |

| | | |

$ | 41,454,113 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| *Non-dividend paying security | |

| | | |

| | | |

| | | |

| | |

Footnote:

The following information is based upon federal income tax

costs of portfolio investments, excluding money market investments, as of September 30, 2023:

| Gross unrealized appreciation: | |

$ | 17,675,922 | |

| Gross unrealized depreciation: | |

| 1,083,995 | |

| Net unrealized appreciation: | |

$ | 16,591,928 | |

Federal income tax basis: $20,357,923

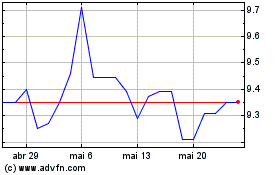

Eagle Capital Growth (AMEX:GRF)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Eagle Capital Growth (AMEX:GRF)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024