UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13

or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended September 30,

2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from ____________ to

____________

Commission File Number 001-34260

CHINA GREEN AGRICULTURE, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 36-3526027 |

| (State or other jurisdiction of | | (IRS Employer |

| incorporation or organization) | | Identification No.) |

3rd floor, Borough A, Block A. No. 181, South Taibai

Road, Xi’an, Shaanxi province, PRC 710065

(Address of principal executive offices) (Zip Code)

+86-29-88266368

(Issuer’s telephone number, including area

code)

Indicate by check mark whether

the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether

the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| | Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☐ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | CGA | | NYSE |

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares

outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 13,380,914 shares of common stock,

$0.001 par value, as of November 20, 2023.

TABLE OF CONTENTS

INFORMATION RELATING TO FORWARD-LOOKING STATEMENTS

In addition to historical information, this report

contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. You can

identify such forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “would” and similar expressions intended to identify forward-looking statements.

Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and

uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking

statements may include, among other things, statements relating to:

| |

● |

our expectations regarding the market for our products and services; |

| |

● |

our expectations regarding the continued growth of our industry; |

| |

● |

our beliefs regarding the competitiveness of our products; |

| |

● |

our expectations regarding the expansion of our manufacturing capacity; |

| |

● |

our expectations with respect to increased revenue growth and our ability to maintain profitability resulting from increases in our production volumes; |

| |

● |

our future business development, results of operations and financial condition; |

| |

● |

competition from other fertilizer and plant producers; |

| |

● |

the loss of any member of our management team; |

| |

● |

our ability to integrate acquired subsidiaries and operations into existing operations; |

| |

● |

market conditions affecting our equity capital; |

| |

● |

our ability to successfully implement our selective acquisition strategy; |

| |

● |

changes in general economic conditions; |

| |

● |

changes in accounting rules or the application of such rules; |

| |

● |

any failure to comply with the periodic filing and other requirements of The New York Stock Exchange, or NYSE, for continued listing, |

| |

● |

any failure to identify and remediate the material weaknesses or other deficiencies in our internal control and disclosure control over financial reporting; |

Also, forward-looking statements represent our

estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this

report, or that we filed as exhibits to this report, in their entirety and with the understanding that our actual future results may be

materially different from what we expect.

Except as required by law, we assume no obligation

to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated

in any forward-looking statements, even if new information becomes available in the future.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

September 30,

2023 | | |

June 30,

2023 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 67,285,823 | | |

$ | 71,142,188 | |

| Digital assets | |

| 41,564 | | |

| 210,342 | |

| Accounts receivable, net | |

| 19,908,132 | | |

| 16,455,734 | |

| Inventories, net | |

| 42,595,553 | | |

| 46,455,131 | |

| Prepaid expenses and other current assets | |

| 2,668,186 | | |

| 2,603,489 | |

| Amount due from related parties | |

| - | | |

| 27,560 | |

| Advances to suppliers, net | |

| 14,685,085 | | |

| 14,332,715 | |

| Total Current Assets | |

| 147,184,343 | | |

| 151,227,159 | |

| | |

| | | |

| | |

| Plant, property and equipment, net | |

| 17,519,818 | | |

| 16,690,245 | |

| Other assets | |

| 9,734 | | |

| 9,784 | |

| Other non-current assets | |

| 4,605,489 | | |

| 5,092,721 | |

| Intangible assets, net | |

| 13,439,658 | | |

| 13,563,635 | |

| Deferred Tax Asset | |

| 102,233 | | |

| 97,820 | |

| Total Assets | |

$ | 182,861,275 | | |

$ | 186,681,364 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,979,494 | | |

$ | 2,100,449 | |

| Customer deposits | |

| 5,669,071 | | |

| 5,489,781 | |

| Accrued expenses and other payables | |

| 15,117,943 | | |

| 14,929,427 | |

| Amount due to related parties | |

| 5,625,161 | | |

| 5,439,209 | |

| Taxes payable | |

| 27,033,499 | | |

| 27,070,961 | |

| Short term loans | |

| 3,756,540 | | |

| 5,346,640 | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 59,181,708 | | |

| 60,376,467 | |

| | |

| | | |

| | |

| Long-term Liabilities | |

| | | |

| | |

| Long-term loans | |

| 932,280 | | |

| 937,040 | |

| Total Liabilities | |

$ | 60,113,988 | | |

| 61,313,507 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Preferred Stock, $.001 par value, 20,000,000 shares authorized, 0 shares issued and outstanding as of September 30, 2023 and June 30, 2023, respectively | |

| - | | |

| - | |

| Common stock, $.001 par value, 115,197,165 shares authorized, 13,380,914 and 13,380,914 shares issued and outstanding as of September 30, 2023 and June 30, 2023, respectively | |

| 13,381 | | |

| 13,381 | |

| Additional paid-in capital | |

| 242,090,576 | | |

| 242,090,576 | |

| Statutory reserve | |

| 26,732,603 | | |

| 26,728,079 | |

| Retained earnings | |

| (118,302,403 | ) | |

| (116,513,686 | ) |

| Accumulated other comprehensive loss | |

| (27,786,870 | ) | |

| (26,950,493 | ) |

| Total Stockholders’ Equity | |

| 122,747,287 | | |

| 125,367,857 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Equity | |

$ | 182,861,275 | | |

$ | 186,681,364 | |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS AND

COMPREHENSIVE LOSS

(UNAUDITED)

| | |

Three Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Sales | |

| | |

| |

| Jinong | |

$ | 9,288,758 | | |

$ | 12,148,002 | |

| Gufeng | |

| 10,421,274 | | |

| 12,578,822 | |

| Yuxing | |

| 2,342,716 | | |

| 2,870,501 | |

| Antaeus | |

| 345,114 | | |

| - | |

| Net sales | |

| 22,397,862 | | |

| 27,597,325 | |

| Cost of goods sold | |

| | | |

| | |

| Jinong | |

| 6,606,614 | | |

| 8,760,170 | |

| Gufeng | |

| 8,995,321 | | |

| 11,254,877 | |

| Yuxing | |

| 1,877,527 | | |

| 2,397,469 | |

| Antaeus | |

| 268,546 | | |

| - | |

| Cost of goods sold | |

| 17,748,008 | | |

| 22,412,516 | |

| Gross profit | |

| 4,649,854 | | |

| 5,184,809 | |

| Operating expenses | |

| | | |

| | |

| Selling expenses | |

| 1,879,155 | | |

| 2,437,354 | |

| General and administrative expenses | |

| 4,556,606 | | |

| 3,285,115 | |

| Total operating expenses | |

| 6,435,761 | | |

| 5,722,469 | |

| Loss from operations | |

| (1,785,907 | ) | |

| (537,660 | ) |

| Other income (expense) | |

| | | |

| | |

| Other (expense) | |

| 9,783 | | |

| 27,790 | |

| Interest income | |

| 55,072 | | |

| 64,000 | |

| Interest expense | |

| (67,554 | ) | |

| (82,244 | ) |

| Total other (expense) | |

| (2,699 | ) | |

| 9,546 | |

| Loss before income taxes | |

| (1,788,606 | ) | |

| (528,114 | ) |

| Provision for income taxes | |

| (4,413 | ) | |

| - | |

| Net loss | |

$ | (1,784,193 | ) | |

| (528,114 | ) |

| | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | |

| Foreign currency translation loss | |

| (836,377 | ) | |

| (10,920,158 | ) |

| Comprehensive loss | |

$ | (2,620,570 | ) | |

$ | (11,448,272 | ) |

| | |

| | | |

| | |

| Basic weighted average shares outstanding | |

| 13,380,914 | | |

| 12,930,752 | |

| Basic net loss per share | |

$ | (0.13 | ) | |

$ | (0.04 | ) |

| | |

| | | |

| | |

| Diluted weighted average shares outstanding | |

| 13,380,914 | | |

| 12,930,752 | |

| Diluted net loss per share | |

$ | (0.13 | ) | |

$ | (0.04 | ) |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF STOCKHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2023

AND 2022

(UNAUDITED)

| | |

Number Of | | |

Common | | |

Additional

Paid In | | |

Statutory | | |

Retained | | |

Accumulated

Other

Comprehensive | | |

Total

Stockholders’ | |

| | |

Shares | | |

Stock | | |

Capital | | |

Reserve | | |

Earnings | | |

Loss | | |

Equity | |

| BALANCE, JUNE 30, 2023 | |

| 13,380,914 | | |

$ | 13,381 | | |

$ | 242,090,576 | | |

$ | 26,728,079 | | |

$ | (116,513,686 | ) | |

$ | (26,950,493 | ) | |

$ | 125,367,857 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| | | |

| | | |

| | | |

| | | |

| (1,784,193 | ) | |

| | | |

| (1,784,193 | ) |

| Issuance of stock | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Transfer to statutory reserve | |

| | | |

| | | |

| | | |

| 4,524 | | |

| (4,524 | ) | |

| | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (836,377 | ) | |

| (836,377 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE, SEPTEMBER 30, 2023 | |

| 13,380,914 | | |

$ | 13,381 | | |

$ | 242,090,576 | | |

$ | 26,732,603 | | |

$ | (118,302,403 | ) | |

$ | (27,786,870 | ) | |

$ | 122,747,287 | |

| | |

Number Of | | |

Common | | |

Additional

Paid In | | |

Statutory | | |

Retained | | |

Accumulated

Other

Comprehensive | | |

Total

Stockholders’ | |

| | |

Shares | | |

Stock | | |

Capital | | |

Reserve | | |

Earnings | | |

Loss | | |

Equity | |

| BALANCE, JUNE 30, 2022 | |

| 12,141,467 | | |

$ | 12,141 | | |

$ | 224,676,686 | | |

$ | 26,870,968 | | |

$ | (103,374,589 | ) | |

$ | (13,414,442 | ) | |

$ | 134,770,764 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| | | |

| | | |

| | | |

| | | |

| (528,114 | ) | |

| | | |

| (528,114 | ) |

| Issuance of stock | |

| 1,117,142 | | |

| 1,117 | | |

| 16,756,013 | | |

| | | |

| | | |

| | | |

| 16,757,130 | |

| Transfer to statutory reserve | |

| | | |

| | | |

| | | |

| 119.594 | | |

| (119,594 | ) | |

| | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (10,920,158 | ) | |

| (10,920,158 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE, SEPTEMBER 30, 2022 | |

| 13,258,609 | | |

$ | 13,259 | | |

$ | 241,432,699 | | |

$ | 26,990,562 | | |

$ | (104,022,298 | ) | |

$ | (24,334,600 | ) | |

$ | 140,079,622 | |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(UNAUDITED)

| | |

Three Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash flows from operating activities | |

| | |

| |

| Net loss | |

$ | (1,784,193 | ) | |

$ | (528,114 | ) |

| Adjustments to reconcile Net loss to net cash provided by (used in) operating activities | |

| | | |

| | |

| Depreciation and amortization | |

| 656,959 | | |

| 662,177 | |

| Provision for losses on accounts receivable | |

| (538,416 | ) | |

| - | |

| Inventories impairment | |

| 2,379,234 | | |

| 1,735,860 | |

| Changes in operating assets | |

| | | |

| | |

| Digital assets | |

| 168,777 | | |

| - | |

| Accounts receivable | |

| (3,024,768 | ) | |

| (347,169 | ) |

| Amount due from related parties | |

| 27,631 | | |

| (5,167 | ) |

| Other current assets | |

| (77,657 | ) | |

| (8,349,885 | ) |

| Inventories | |

| 1,272,227 | | |

| (7,691,110 | ) |

| Advances to suppliers | |

| (426,393 | ) | |

| 12,793,200 | |

| Other assets | |

| 464,911 | | |

| 491,281 | |

| Deferred tax assets | |

| (4,413 | ) | |

| - | |

| Changes in operating liabilities | |

| | | |

| | |

| Accounts payable | |

| (112,632 | ) | |

| 71,479 | |

| Customer deposits | |

| 208,770 | | |

| (1,510,592 | ) |

| Amount due to related parties | |

| - | | |

| (11,177 | ) |

| Tax payables | |

| (47,678 | ) | |

| 61,229 | |

| Accrued expenses and other payables | |

| 211,131 | | |

| 381,397 | |

| Interest payable | |

| - | | |

| (748,919 | ) |

| Net cash used in operating activities | |

| (626,510 | ) | |

| (2,995,510 | ) |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of plant, property, and equipment | |

| (1,507,026 | ) | |

| (228,541 | ) |

| Sales of discontinued operations | |

| - | | |

| 912,425 | |

| Net cash (used in) provided by investing activities | |

| (1,507,026 | ) | |

| 683,884 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from the sale of common stock | |

| - | | |

| 16,757,130 | |

| Proceeds from loans | |

| - | | |

| 1,167,904 | |

| Repayment of loans | |

| (1,574,960 | ) | |

| - | |

| Advance from related party | |

| 191,000 | | |

| 100,000 | |

| Net cash (used in) provided by financing activities | |

| (1,383,960 | ) | |

| 18,025,034 | |

| | |

| | | |

| | |

| Effect of exchange rate change on cash and cash equivalents | |

| (338,869 | ) | |

| (3,651,176 | ) |

| Net (decrease) increase in cash and cash equivalents | |

| (3,856,365 | ) | |

| 12,062,232 | |

| | |

| | | |

| | |

| Cash and cash equivalents, beginning balance | |

| 71,142,188 | | |

| 57,770,303 | |

| Cash and cash equivalents, ending balance | |

$ | 67,285,823 | | |

$ | 69,832,535 | |

| | |

| | | |

| | |

| Supplement disclosure of cash flow information | |

| | | |

| | |

| Interest expense paid | |

$ | 67,554 | | |

$ | 82,244 | |

| Income taxes paid | |

$ | 60,650 | | |

$ | 84,622 | |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

CHINA GREEN AGRICULTURE, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

China Green Agriculture, Inc. (the “Company”,

“Parent Company” or “Green Nevada”), through its subsidiaries, is engaged in the research, development, production,

distribution and sale of humic acid-based compound fertilizer, compound fertilizer, blended fertilizer, organic compound fertilizer, slow-release

fertilizers, highly concentrated water-soluble fertilizers and mixed organic-inorganic compound fertilizer and the development, production,

and distribution of agricultural products.

Unless the context indicates otherwise, as used

in this Report, the following are the references herein of all the subsidiaries of the Company (i) Green Agriculture Holding Corporation

(“Green New Jersey”), a wholly-owned subsidiary of Green Nevada, incorporated in the State of New Jersey; (ii) Shaanxi TechTeam

Jinong Humic Acid Product Co., Ltd. (“Jinong”), a wholly-owned subsidiary of Green New Jersey organized under the laws of

the PRC; (iii) Xi’an Hu County Yuxing Agriculture Technology Development Co., Ltd. (“Yuxing”), a Variable Interest

Entity (“VIE”) in the in the PRC controlled by Jinong through a series of contractual agreements; (iv) Beijing Gufeng Chemical

Products Co., Ltd., a wholly-owned subsidiary of Jinong in the PRC (“Gufeng”), (v) Beijing Tianjuyuan Fertilizer Co., Ltd.,

Gufeng’s wholly-owned subsidiary in the PRC (“Tianjuyuan”), and (vi)Antaeus Tech, Inc. (“Antaeus”),

a wholly-owned subsidiary of Green Nevada incorporated in the State of Delaware.

On June 30, 2016 the Company, through its wholly-owned

subsidiary Jinong, entered into strategic acquisition agreements and a series of contractual agreements with the shareholders of the following

six companies that are organized under the laws of the PRC and would be deemed VIEs: Shaanxi Lishijie Agrochemical Co., Ltd. (“Lishijie”),

Songyuan Jinyangguang Sannong Service Co., Ltd. (“Jinyangguang”), Shenqiu County Zhenbai Agriculture Co., Ltd. (“Zhenbai”),

Weinan City Linwei District Wangtian Agricultural Materials Co., Ltd. (“Wangtian”), Aksu Xindeguo Agricultural Materials Co.,

Ltd. (“Xindeguo”), and Xinjiang Xinyulei Eco-agriculture Science and Technology co., Ltd. (“Xinyulei”). On January

1, 2017, the Company, through its wholly owned subsidiary Jinong, entered into strategic acquisition agreements and a series of contractual

agreements with the shareholders of the following two companies that are organized under the laws of the PRC and would be deemed VIEs,

Sunwu County Xiangrong Agricultural Materials Co., Ltd. (“Xiangrong”), and Anhui Fengnong Seed Co., Ltd. (“Fengnong”).

On November 30, 2017, the Company, through its

wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Zhenbai.

On June 2, 2021, the Company, through its wholly

owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Xindeguo, Xinyulei and Xiangrong.

On December 1, 2021, the Company, through its

wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Lishijie.

On December 31, 2021, the Company, through its

wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Fengnong.

On March 31, 2022, the Company, through its wholly

owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Jinyangguang and Wangtian.

On March 13, 2023, the Company established Antaeus

Tech Inc. (“Antaeus”) in the State of Delaware. In April 2023, Antaeus started to purchase digital assets mining machines

and to mine Bitcoin in West Texas.

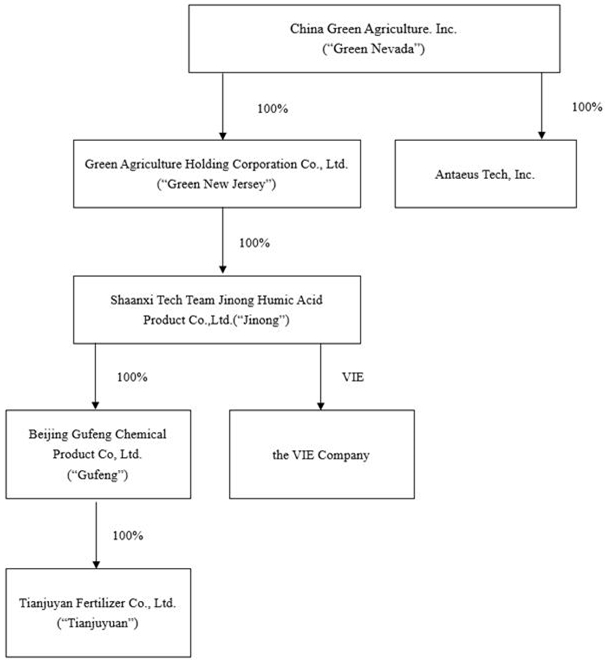

Our current corporate structure is set forth in the following diagram:

Yuxing may also collectively be referred to

as “the VIE Company”.

NOTE 2 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Principle of consolidation

The accompanying consolidated financial statements

include the accounts of the Company and its wholly owned subsidiaries, Green New Jersey, Jinong, Gufeng, Tianjuyuan, Yuxing and Antaeus.

All significant inter-company accounts and transactions have been eliminated in consolidation.

For purposes of comparability, certain prior period

amounts have been reclassified to conform to the current year presentation in accordance with accounting principles generally accepted

in the United States of America (“GAAP”).

Effective June 16, 2013, Yuxing was converted

from being a wholly owned foreign enterprise 100% owned by Jinong to a domestic enterprise 100% owned one natural person, who is not affiliated

to the Company (“Yuxing’s Owner”). Effective the same day, Yuxing’s Owner entered into a series of contractual

agreements with Jinong pursuant to which Yuxing became the VIE of Jinong.

VIE assessment

A VIE is an entity (1) that has total equity at

risk that is not sufficient to finance its activities without additional subordinated financial support from other entities, (2) where

the group of equity holders does not have the power to direct the activities of the entity that most significantly impact the entity’s

economic performance, or the obligation to absorb the entity’s expected losses or the right to receive the entity’s expected

residual returns, or both, or (3) where the voting rights of some investors are not proportional to their obligations to absorb the expected

losses of the entity, their rights to receive the expected residual returns of the entity, or both, and substantially all of the entity’s

activities either involve or are conducted on behalf of an investor that has disproportionately few voting rights. In order to determine

if an entity is considered a VIE, the Company first performs a qualitative analysis, which requires certain subjective decisions regarding

its assessments, including, but not limited to, the design of the entity, the variability that the entity was designed to create and pass

along to its interest holders, the rights of the parties, and the purpose of the arrangement. If the Company cannot conclude after a qualitative

analysis whether an entity is a VIE, it performs a quantitative analysis. The qualitative analysis considered the design of the entity,

the risks that cause variability, the purpose for which the entity was created, and the variability that the entity was designed to pass

along to its variable interest holders. When the primary beneficiary could not be identified through a qualitative analysis, we used internal

cash flow models to compute and allocate expected losses or expected residual returns to each variable interest holder based upon the

relative contractual rights and preferences of each interest holder in the VIE’s capital structure.

Use of estimates

The preparation of consolidated financial statements

in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date

of the consolidated financial statements and the amount of revenues and expenses during the reporting periods. Management makes these

estimates using the best information available at the time the estimates are made. However, actual results and outcomes may differ from

management’s estimates and assumptions due to risks and uncertainties.

Leases

The Company determines if an arrangement is a

lease or contains a lease at inception. Operating lease right-of-use assets and lease liabilities are recognized at commencement based

on the present value of lease payments over the lease term. As the implicit rate is typically not readily determinable in the Company’s

lease agreements, the Company uses its incremental borrowing rate as of the lease commencement date to determine the present value of

the lease payments. The incremental borrowing rate is based on the Company’s specific rate of interest to borrow on a collateralized

basis, over a similar term and in a similar economic environment as the lease. Lease expense is recognized on a straight-line basis over

the lease term. Leases with an initial term of 12 months or less are not recognized on the balance sheet; the Company recognizes lease

expense for these leases on a straight-line basis over the lease term. Additionally, the Company accounts for lease and non-lease components

as a single lease component for its identified asset classes. As of September 30, 2023, the Company does not have any material leases

for the implementation of ASC 842.

Cash and cash equivalents and concentration of cash

For statement of cash flows purposes, the Company

considers all cash on hand and in banks, certificates of deposit with state owned banks in the PRC and banks in the United States, and

other highly-liquid investments with maturities of three months or less, when purchased, to be cash and cash equivalents. The Company

maintains large sums of cash in three major banks in China. The aggregate cash in such accounts and on hand as of September 30, 2023 and

June 30, 2023 were $67,166,687 and $69,091,838, respectively. There is no insurance securing these deposits in China. In addition,

the Company also had $119,136 and $2,050,350 in cash in three banks in the United States as of September 30, 2023 and June 30, 2023, respectively.

Cash overdraft as of balance sheet date will be reflected as liabilities in the balance sheet. The Company has not experienced any losses

in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Digital Assets

Digital assets are included

in current assets in the condensed consolidated balance sheets. Digital assets are accounted for as indefinite-lived intangible assets,

and are initially measured in accordance with FASB Accounting Standards Codification (“ASC”) Topic 350 – Intangibles-Goodwill

and Other. The Company measures gains or losses on the disposition of digital assets in accordance with the first-in-first-out (“FIFO”)

method of accounting.

Digital assets are not

amortized, but are assessed for impairment annually, or more frequently, when events or changes in circumstances occur indicating that

it is more likely than not that the indefinite-lived intangible asset is impaired. Whenever the exchange-traded price of digital assets

declines below its carrying value, the Company has determined that an impairment exists and records an impairment equal to the amount

by which the carrying value exceeds the fair value.

As of September

30, 2023, the Company held Bitcoin as digital assets with amount of $41,564. Bitcoin is classified on our balance sheet as a current asset

due to the Company’s ability to sell it in a highly liquid marketplace and its intent to liquidate its Bitcoin to support operations

when needed. As of September 30, 2023, the Company determined that there were no impairments of its digital assets.

Accounts receivable

Management regularly reviews the composition of

accounts receivable and analyzes customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate

the adequacy of these reserves at each year-end. Accounts considered uncollectible are provisioned for /written off based upon management’s

assessment. As of September 30, 2023, and June 30, 2023, the Company had accounts receivable of $19,908,132 and $16,455,734, net of allowance

for doubtful accounts of $50,913,569 and $54,708,486, respectively. The impact of COVID-19 caused the difficulty of accounts receivable

collection from 2020 as numerous distributors encountered significant difficulties and/or hardships in their businesses amid the pandemic.

The company recorded bad debt expense in the amount of $(538,416) and $0 for the three months ended September 30, 2023 and 2022, respectively.

The Company adopts no policy to accept product returns after the sales delivery.

Inventories

Inventory is valued at the lower of cost (determined

on a weighted average basis) or market. Inventories consist of raw materials, work in process, finished goods and packaging materials.

The Company reviews its inventories regularly for possible obsolete goods and establishes reserves when determined necessary. As of September

30, 2023, and 2022, the Company had no reserve for obsolete goods. The company confirmed the loss of $2.4 million and $1.7 million of

inventories for the three months ended September 30, 2023 and 2022, respectively.

Intangible Assets

The Company records intangible assets acquired

individually or as part of a group at fair value. Intangible assets with definitive lives are amortized over the useful life of the intangible

asset, which is the period over which the asset is expected to contribute directly or indirectly to the entity’s future cash flows.

The Company evaluates intangible assets for impairment at least annually and more often whenever events or changes in circumstances indicate

that the carrying value may not be recoverable. Whenever any such impairment exists, an impairment loss will be recognized for the amount

by which the carrying value exceeds the fair value. The Company has not recorded impairment of intangible assets as of September 30,

2023 and 2022, respectively.

Customer deposits

Payments received before all the relevant criteria

for revenue recognition are satisfied are recorded as customer deposits. When all revenue recognition criteria are met, the customer deposits

are recognized as revenue. As of September 30, 2023, and June 30, 2023, the Company had customer deposits of $5,669,071 and $5,489,781,

respectively.

Earnings per share

Basic earnings per share is computed based on

the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share is computed based on

the weighted average number of shares of common stock plus the effect of dilutive potential common shares outstanding during the period

using the treasury stock method. Dilutive potential common shares include outstanding stock options and stock awards.

The components of basic and diluted earnings per share consist of the

following:

| | |

Three Months Ended | |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| Net loss for Basic Earnings Per Share | |

$ | (1,784,193 | ) | |

$ | (528,114 | ) |

| Basic Weighted Average Number of Shares | |

| 13,380,914 | | |

| 12,930,752 | |

| Net loss Per Share – Basic | |

$ | (0.13 | ) | |

$ | (0.04 | ) |

| Net loss for Diluted Earnings Per Share | |

$ | (1,784,193 | ) | |

$ | (528,114 | ) |

| Diluted Weighted Average Number of Shares | |

| 13,380,914 | | |

| 12,930,752 | |

| Net loss Per Share – Diluted | |

$ | (0.13 | ) | |

$ | (0.04 | ) |

Recent accounting pronouncements

The Company has evaluated all recently issued accounting pronouncements

and does not believe any such pronouncements currently have, and does not expect such pronouncements to have, a material impact on the

Condensed Consolidated Financial Statements on a prospective basis.

NOTE 3 – GOING CERCERN

The Company’s financial statements are prepared

assuming that the Company will continue as a going concern. The Company has incurred operating losses and had negative operating cash

flows during the reporting period from July 1, 2023 through September 30, 2023 and may continue to incur operating losses and generate

negative cash flows as the Company implements its future business plan. If the situation exists, there could be substantial doubt about

the Company’s ability to continue as going concern.

To meet its working capital needs through the

next twelve months and to fund the growth of the Company, the Company may consider plans to raise additional funds through the issuance

of equity or borrow loan from local bank. The ability of the Company to continue as a going concern is dependent upon its ability to successfully

execute its new business strategy and eventually attain profitable operations.

The accompanying financial statements do not include

any adjustments to reflect the recoverability and classification of recorded asset amounts and classification of liabilities that might

be necessary should the Company be unable to continue as going concern.

NOTE 4 – INVENTORIES

Inventories consisted of the following:

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Raw materials | |

$ | 7,377,961 | | |

$ | 11,617,989 | |

| Supplies and packing materials | |

$ | 407,456 | | |

$ | 410,904 | |

| Work in progress | |

$ | 170,203 | | |

$ | 172,248 | |

| Finished goods | |

$ | 34,639,933 | | |

$ | 34,253,990 | |

| Total | |

$ | 42,595,553 | | |

$ | 46,455,131 | |

The company confirmed the loss of $2.4 million

and $1.7 million of inventories for the three months ended September 30, 2023 and 2022, respectively.

NOTE 5 – PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following:

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Building and improvements | |

$ | 36,877,178 | | |

$ | 37,065,465 | |

| Auto | |

| 2,703,358 | | |

| 2,716,931 | |

| Machinery and equipment | |

| 18,522,972 | | |

| 18,608,254 | |

| Others | |

| 1,502,600 | | |

| - | |

| Total property, plant and equipment | |

| 59,606,108 | | |

| 58,390,650 | |

| Less: accumulated depreciation | |

| (42,086,290 | ) | |

| (41,700,404 | ) |

| Total | |

$ | 17,519,818 | | |

$ | 16,690,246 | |

For the three months ended September 30, 2023,

total depreciation expense was $601,458, decreased $2,072, or 0.3%, from $603,530 for the three months ended September 30, 2022.

NOTE 6 – INTANGIBLE ASSETS AND DIGITAL ASSETS

Intangible assets consisted of the following:

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Land use rights, net | |

$ | 7,767,607 | | |

$ | 7,862,624 | |

| Technology patent, net | |

| - | | |

| - | |

| Customer relationships, net | |

| - | | |

| - | |

| Non-compete agreement | |

| - | | |

| - | |

| Trademarks | |

| 5,672,051 | | |

| 5,701,011 | |

| Total | |

$ | 13,439,658 | | |

$ | 13,563,635 | |

LAND USE RIGHT

On September 25, 2009, Yuxing was granted a land

use right for approximately 88 acres (353,000 square meters or 3.8 million square feet) by the People’s Government and Land &

Resources Bureau of Hu County, Xi’an, Shaanxi Province. The fair value of the related intangible asset was determined to be the

respective cost of RMB73,184,895 (or $10,033,649). The intangible asset is being amortized over the grant period of 50 years using the

straight-line method.

On August 13, 2003, Tianjuyuan was granted a certificate

of Land Use Right for a parcel of land of approximately 11 acres (42,726 square meters or 459,898 square feet) at Ping Gu District, Beijing.

The purchase cost was recorded at RMB1,045,950 (or $143,400). The intangible asset is being amortized over the grant period of 50 years.

On August 16, 2001, Jinong received a land use

right as a contribution from a shareholder, which was granted by the People’s Government and Land & Resources Bureau of Yangling

District, Shaanxi Province. The fair value of the related intangible asset at the time of the contribution was determined to be RMB7,285,099

(or $998,787). The intangible asset is being amortized over the grant period of 50 years.

The Land Use Rights consisted of the following:

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Land use rights | |

$ | 11,032,436 | | |

| 11,088,765 | |

| Less: accumulated amortization | |

| (3,264,829 | ) | |

| (3,226,141 | ) |

| Total land use rights, net | |

$ | 7,767,607 | | |

| 7,862,624 | |

TECHNOLOGY PATENT

On August 16, 2001, Jinong was issued a technology

patent related to a proprietary formula used in the production of humic acid. The fair value of the related intangible asset was determined

to be the respective cost of RMB 5,875,068 (or $805,472) and is being amortized over the patent period of 10 years using the straight-line

method. This technology patent has been fully amortized.

On July 2, 2010, the Company acquired Gufeng and

its wholly-owned subsidiary Tianjuyuan. The fair value of the acquired technology patent was estimated to be RMB9,200,000 (or $1,261,320)

and is amortized over the remaining useful life of six years using the straight-line method. As of September 30, 2023, this technology

patent is fully amortized.

The technology know-how consisted of the following:

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Technology know-how | |

$ | 2,066,792 | | |

$ | 2,077,344 | |

| Less: accumulated amortization | |

| (2,066,792 | ) | |

| (2,077,344 | ) |

| Total technology know-how, net | |

$ | - | | |

$ | - | |

CUSTOMER RELATIONSHIPS

On July 2, 2010, the Company acquired Gufeng and

its wholly-owned subsidiary Tianjuyuan. The fair value of the acquired customer relationships was estimated to be RMB65,000,000 (or $8,911,500)

and is amortized over the remaining useful life of ten years.

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Customer relationships | |

$ | 8,911,500 | | |

$ | 8,957,000 | |

| Less: accumulated amortization | |

| (8,911,500 | ) | |

| (8,957,000 | ) |

| Total customer relationships, net | |

$ | - | | |

$ | - | |

NON-COMPETE AGREEMENT

On July 2, 2010, the Company acquired Gufeng and

its wholly-owned subsidiary Tianjuyuan. The fair value of the acquired non-compete agreement was estimated to be RMB1,320,000 (or $180,972)

and is amortized over the remaining useful life of five years using the straight-line method.

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Non-compete agreement | |

$ | 180,972 | | |

$ | 181,896 | |

| Less: accumulated amortization | |

| (180,972 | ) | |

| (181,896 | ) |

| Total non-compete agreement, net | |

$ | - | | |

$ | - | |

TRADEMARKS

On July 2, 2010, the Company acquired Gufeng and

its wholly-owned subsidiary Tianjuyuan. The preliminary fair value of the acquired trademarks was estimated to be RMB41, 371,630 (or $5,672,051)

and is subject to an annual impairment test.

AMORTIZATION EXPENSE

Estimated amortization expenses of intangible

assets for the next five twelve months periods ended September 30, are as follows:

| Twelve Months Ended on September 30, | |

Expense

($) | |

| 2024 | |

| 286,798 | |

| 2025 | |

| 247,300 | |

| 2026 | |

| 228,983 | |

| 2027 | |

| 220,306 | |

| 2028 | |

| 220,306 | |

DIGITAL ASSETS

On March 13, 2023, the Company established Antaeus

Tech Inc. (“Antaeus”) in the State of Delaware. In April 2023, Antaeus started to purchase digital assets mining machines

and to mine Bitcoin in West Texas. As of September 30, 2023, the company held digital assets with amount of $41,564.

NOTE 7 – OTHER NON-CURRENT ASSETS

Other non-current assets mainly include advance

payments related to leasing land for use by the Company. As of September 30, 2023, the balance of other non-current assets was $4,605,489,

which was the lease fee advances for agriculture lands that the Company engaged in Shiquan County from 2025 to 2027.

In March 2017, Jinong entered into a lease agreement

for approximately 3,400 mu, and 2600-hectare agriculture lands in Shiquan County, Shaanxi Province. The lease was from April 2017 and

was renewable for every ten-year period up to 2066. The aggregate leasing fee was approximately RMB 13 million per annum, The Company

had made 10-year advances of leasing fee per lease terms. The Company has amortized $0.5 million and $0.5 million as expenses for the

three months ended September 30, 2023 and 2022, respectively.

Estimated amortization expenses of the lease advance

payments for the next four twelve-month periods ended September 30 and thereafter are as follows:

| Twelve months ending September 30, | |

| |

| 2024 | |

$ | 1,840,568 | |

| 2025 | |

$ | 1,840,568 | |

| 2026 | |

$ | 1,840,568 | |

| 2027 | |

$ | 924,354 | |

NOTE 8 – ACCRUED EXPENSES AND OTHER PAYABLES

Accrued expenses and other payables consisted of the following:

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Payroll and welfare payable | |

$ | 165,186 | | |

$ | 188,222 | |

| Accrued expenses | |

| 10,135,859 | | |

| 9,805,444 | |

| Other payables | |

| 4,701,917 | | |

| 4,820,193 | |

| Other levy payable | |

| 114,981 | | |

| 115,568 | |

| Total | |

$ | 15,117,943 | | |

$ | 14,929,427 | |

NOTE 9 – AMOUNT DUE TO RELATED PARTIES

At the end of December 2015, Yuxing entered into

a sales agreement with the Company’s affiliate, 900LH.com Food Co., Ltd. (“900LH.com”, previously announced as Xi’an

Gem Grain Co., Ltd) pursuant to which Yuxing is to supply various vegetables to 900LH.com for its incoming seasonal sales at the holidays

and year ends (the “Sales Agreement”). The contingent contracted value of the Sales Agreement is RMB 25,500,000 (approximately

$3,496,050). For the three months ended September 30, 2023 and 2022, Yuxing hadn’t sold any products to 900LH.com.

The amount due from 900LH.com to Yuxing was $0

and $27,560 as of September 30, 2023 and June 30, 2023, respectively.

As of September 30, 2023, and June 30, 2023, the

amount due to related parties was $5,625,161 and $5,439,209, respectively. As of September 30, 2023, and June 30, 2023, $959,700

and $964,600, respectively were amounts that Gufeng borrowed from a related party, Xi’an Techteam Science& Technology Industry

(Group) Co. Ltd., a company controlled by Mr. Zhuoyu Li, Chairman and CEO of the Company, representing unsecured, non-interest-bearing

loans that are due on demand. These loans are not subject to written agreements. As of September 30, 2023, and June 30, 2023,

$2,336,693 and $2,261,693, respectively were advances from Mr. Zhuoyu Li, Chairman and CEO of the Company. The advances were unsecured

and non-interest-bearing. As of September 30, 2023, and June 30, 2023, $116,000 and $0, respectively were advances from Mr. Zhibiao Pan,

Co-CEO of the Company. The advances were unsecured and non-interest-bearing.

As of September 30, 2023, and June 30, 2023, the

Company’s subsidiary, Jinong, owed 900LH.com $990 and $995, respectively.

On July 1, 2022, Jinong signed an office lease

with Kingtone Information Technology Co., Ltd. (“Kingtone Information”), of which Mr. Zhuoyu Li, Chairman and CEO of the Company,

served as Chairman. Pursuant to the lease, Jinong rented 612 square meters (approximately 6,588 square feet) of office space from Kingtone

Information. The lease provides for a two-year term effective as of July 1, 2022 with monthly rent of RMB28,000 (approximately $3,839).

NOTE 10 – LOAN PAYABLES

As of September 30, 2023, the short-term and long-term

loan payables consisted of four loans which mature on dates ranging from June 5, 2024 through August 18, 2024 with interest rates ranging

from 3.65% to 5.00%. The first three loans are collateralized by Tianjuyuan’s land use right and building ownership right.

| No. | |

Payee | |

Loan period per agreement | |

Interest

Rate | | |

September 30,

2023 | |

| 1 | |

Beijing Bank -Pinggu Branch | |

June 5, 2023-June 5, 2024 | |

| 4.15 | % | |

| 1,371,000 | |

| 2 | |

Huaxia Bank -HuaiRou Branch | |

June 28, 2023-June 28, 2024 | |

| 3.65 | % | |

| 1,371,000 | |

| 3 | |

Pinggu New Village Bank | |

June 29, 2023-June 28, 2024 | |

| 5.00 | % | |

| 959,700 | |

| 4 | |

Industrial Bank Co. Ltd | |

August 19, 2022-August 18, 2024 | |

| 3.98 | % | |

| 987,120 | |

| | |

Total | |

| |

| | | |

$ | 4,688,820 | |

The interest expense from loans was $67,554 and

$82,244 for the three months ended September 30, 2023 and 2022, respectively.

NOTE 11 – TAXES PAYABLE

Enterprise Income Tax

Effective January 1, 2008, the Enterprise Income

Tax (“EIT”) law of the PRC replaced the tax laws for Domestic Enterprises (“DEs”) and Foreign Invested Enterprises

(“FIEs”). The EIT rate of 25% replaced the 33% rate that was applicable to both DEs and FIEs. The two-year tax exemption and

three-year 50% tax reduction tax holiday for production-oriented FIEs was eliminated. Since January 1, 2008, Jinong became subject to

income tax in China at a rate of 15% as a high-tech company, because of the expiration of its tax exemption on December 31, 2007. Accordingly,

it made no provision for income taxes for the three-month period ended September 30, 2023 and 2022.

Value-Added Tax

All the Company’s fertilizer products that

are produced and sold in the PRC were subject to a Chinese Value-Added Tax (VAT) of 13% of the gross sales price. On April 29, 2008, the

PRC State of Administration of Taxation (SAT) released Notice #56, “Exemption of VAT for Organic Fertilizer Products”,

which allows certain fertilizer products to be exempt from VAT beginning June 1, 2008. The Company submitted the application for exemption

in May 2009, which was granted effective September 1, 2009, continuing through December 31, 2015. On August 10, 2015 and August 28, 2015,

the SAT released Notice #90. “Reinstatement of VAT for Fertilizer Products”, and Notice #97, “Supplementary

Reinstatement of VAT for Fertilizer Products”, which restore the VAT of 13% of the gross sales price on certain fertilizer products

includes non-organic fertilizer products starting from September 1, 2015, but granted taxpayers a reduced rate of 3% from September 1,

2015 through June 30, 2016.

On April 28, 2017, the PRC State of Administration

of Taxation (SAT) released Notice 2017 #37, “Notice on Policy of Reduced Value Added Tax Rate,” under which, effective

July 1, 2017, all the Company’s fertilizer products that are produced and sold in the PRC are subject to a Chinese Value-Added Tax

(VAT) of 11% of the gross sales price. The tax rate was reduced 2% from 13%.

On April 4, 2018, the PRC State of Administration

of Taxation (SAT) released Notice 2018 #32, “Notice on Adjustment of VAT Tax Rate,” under which, effective May 1, 2018,

all the Company’s fertilizer products that are produced and sold in the PRC are subject to a Chinese Value-Added Tax (VAT) of 10%

of the gross sales price. The tax rate was reduced 1% from 11%.

On March 20, 2019, the PRC State of Administration

of Taxation (SAT) released Notice 2019 #39, “Announcement on Policies Concerning Deepening the Reform of Value Added Tax,”

under which, effective April 1, 2019, all the Company’s fertilizer products that are produced and sold in the PRC are subject to

a Chinese Value-Added Tax (VAT) of 9% of the gross sales price. The tax rate was reduced 1% from 10%.

Income Taxes and Related Payables

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| VAT provision | |

$ | (456,256 | ) | |

$ | (398,499 | ) |

| Income tax payable | |

| (2,121,569 | ) | |

| (2,132,400 | ) |

| Other levies | |

| 600,789 | | |

| 591,325 | |

| Repatriation tax | |

| 29,010,535 | | |

| 29,010,535 | |

| Total | |

$ | 27,033,499 | | |

$ | 27,070,961 | |

The provision for income taxes consists of the following:

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | |

| Current tax - foreign | |

$ | (4,413 | ) | |

$ | - | |

| Deferred tax | |

| - | | |

| - | |

| Total | |

$ | (4,413 | ) | |

$ | - | |

Significant components of deferred tax assets were as follows:

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Deferred tax assets | |

| | |

| |

| Deferred Tax Benefit | |

| 32,304,001 | | |

| 32,464,001 | |

| Valuation allowance | |

| (32,201,767 | ) | |

| (32,366,181 | ) |

| Total deferred tax assets | |

$ | 102,233 | | |

| 97,820 | |

Tax Rate Reconciliation

Our effective tax rates were approximately 0.2%

and 0% for the three months ended September 30, 2023 and 2022, respectively. Substantially all the Company’s income before income

taxes and related tax expense are from PRC sources. Actual income tax benefit reported in the consolidated statements of operations and

comprehensive income (loss) differ from the amounts computed by applying the US statutory income tax rate of 21.0% to income before income

taxes for the Three months Ended September 30, 2023 and 2022 for the following reasons:

September 30, 2023

| | |

China

15% - 25% | | |

| | |

United

States 21% | | |

| | |

Total | | |

| |

| Pretax loss | |

$ | (1,243,531 | ) | |

| | | |

| (545,075 | ) | |

| | | |

$ | (1,788,606 | ) | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Expected income tax expense (benefit) | |

| (310,883 | ) | |

| 25.0 | % | |

| (114,466 | ) | |

| 21.0 | % | |

| (425,349 | ) | |

| | |

| High-tech income benefits on Jinong | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | |

| Losses from subsidiaries in which no benefit is recognized | |

| 306,469 | | |

| -24.6 | % | |

| - | | |

| - | | |

| 306,469 | | |

| | |

| Change in valuation allowance on deferred tax asset from US tax benefit | |

| - | | |

| - | | |

| 114,466 | | |

| (21.0 | )% | |

| 114,466 | | |

| | |

| Actual tax expense | |

$ | (4,413 | ) | |

| 0.4 | % | |

$ | - | | |

| - | | |

$ | (4,413 | ) | |

| 0.2 | % |

September 30, 2022

| | |

China

15% - 25% | | |

| | |

United

States 21% | | |

| | |

Total | | |

| |

| Pretax loss | |

$ | 449,437 | | |

| | | |

| (977,551 | ) | |

| | | |

$ | (528,114 | ) | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Expected income tax expense (benefit) | |

| 112,359 | | |

| 25.0 | % | |

| (205,286 | ) | |

| 21.0 | % | |

| (92,927 | ) | |

| | |

| High-tech income benefits on Jinong | |

| (246,088 | ) | |

| (54.8 | )% | |

| - | | |

| - | | |

| (246,088 | ) | |

| | |

| Losses from subsidiaries in which no benefit is recognized | |

| 133,728 | | |

| 29.8 | % | |

| - | | |

| - | | |

| 133,728 | | |

| | |

| Change in valuation allowance on deferred tax asset from US tax benefit | |

| - | | |

| - | | |

| 205,286 | | |

| (21.0 | )% | |

| 205,286 | | |

| | |

| Actual tax expense | |

$ | - | | |

| - | | |

$ | - | | |

| - | | |

$ | - | | |

| 0 | % |

NOTE 12 – STOCKHOLDERS’ EQUITY

Common Stock

There were no shares of common stock issued during

the quarter ended September 30, 2023.

On August 2, 2022, the Company completed the issuance

of 1,117,142 shares of its Common Stock for $16,757,130 to P Kevin HODL Ltd, an entity owned and controlled by Mr. Zhibiao Pan, who was

subsequently appointed as the Company’s co-Chief Executive Officer on August 25, 2022. This sale was made pursuant to the Share

Purchase Agreement dated November 23, 2021 in transactions exempt from registration under the Securities Act of 1933, as amended, in reliance

on an exemption provided by Rule 903 of Regulation S and/or Section 4(a)(2) of the Securities Act.

As of September 30, 2023, and June 30, 2023, there

were 13,380,914 and 13,380,914 shares of common stock issued and outstanding, respectively.

Preferred Stock

Under the Company’s Articles of Incorporation,

the Board has the authority, without further action by stockholders, to designate up to 20,000,000 shares of preferred stock in one or

more series and to fix the rights, preferences, privileges, qualifications and restrictions granted to or imposed upon the preferred stock,

including dividend rights, conversion rights, voting rights, rights and terms of redemption, liquidation preference and sinking fund terms,

any or all of which may be greater than the rights of the common stock. If the Company sells preferred stock under its registration statement

on Form S-3, it will fix the rights, preferences, privileges, qualifications and restrictions of the preferred stock of each series in

the certificate of designation relating to that series and will file the certificate of designation that describes the terms of the series

of preferred stock the Company offers before the issuance of the related series of preferred stock.

As of September 30, 2023, the Company has 20,000,000

shares of preferred stock authorized, with a par value of $.001 per share, of which no shares are issued or outstanding.

NOTE 13 – CONCENTRATIONS AND LITIGATION

Market Concentration

The majority of the Company’s revenue-generating

operations are conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced

by the political, economic and legal environments in the PRC, and by the general state of the PRC’s economy.

The Company’s operations in the PRC are

subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe.

These include risks associated with, among other things, the political, economic and legal environment and foreign currency exchange.

The Company’s results may be adversely affected by, among other things, changes in governmental policies with respect to laws and

regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation.

Vendor and Customer Concentration

There are three vendors that the Company purchased over 10% of its

raw materials with an aggregate amount of $6,878,429, or 10.7%, 10.5%, and 10.1%, respectively, for fertilizer manufacturing during the

three months ended September 30, 2023.

None of the vendors accounted over 10% of the Company’s purchase

of raw materials and supplies for the three months ended September 30, 2022.

No customer accounted for over 10% of the Company’s sales for

the three months ended September 30, 2023 and 2022.

Litigation

On June 5, 2020, an individual filed suit pro

se (as in, representing oneself without an attorney) in the Southern District of Florida federal court alleging violations of the Securities

Exchange Act. The Company believes the action is without merit and vigorously opposed it. The company moved to dismiss the litigation

and for attorney’s fees from the plaintiff. On November 2, 2020, the case was transferred to the United States District Court for

The Southern District Of New York. On September 30, 2021, the Southern District of New York federal court presiding over the case dismissed

all claims against the company, its executives, and its independent directors. The dismissal was without prejudice and the plaintiff

can appeal or amend within 30 days, or by October 29, 2021. The plaintiff amended the complaint on Oct 30, 2021. On August 30, 2022, the

Southern District of New York federal court presiding over the case issued an order granting motions to dismiss all claims in the amended

complaint against the Company, its executives, and its independent directors. On September 6, 2022, the plaintiff filed a notice of civil

appeal to the U.S. Court of Appeals, Second Circuit. The appeal has now been fully briefed and the Company expects a decision to issue

sometime in the coming year.

There are no other actions, suits, proceedings,

inquiries or investigations before or by any court, public board, government agency, self-regulatory organization or body pending or,

to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our

common stock, any of our subsidiaries or of our companies or our subsidiaries’ officers or directors in their capacities as such,

in which an adverse decision could have a material adverse effect.

NOTE 14 – SEGMENT REPORTING

As of September 30, 2023, the Company was organized

into four main business segments based on location and product: Jinong (fertilizer production), Gufeng (fertilizer production), Yuxing

(agricultural products production) and Antaeus (Bitcoin). Each of the four operating segments referenced above has separate and distinct

general ledgers. The chief operating decision maker (“CODM”) receives financial information, including revenue, gross margin,

operating income and net income produced from the various general ledger systems to make decisions about allocating resources and assessing

performance; however, the principal measure of segment profitability or loss used by the CODM is net income by segment.

| | |

Three Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Revenues from unaffiliated customers: | |

| | |

| |

| Jinong | |

$ | 9,288,758 | | |

$ | 12,148,002 | |

| Gufeng | |

| 10,421,274 | | |

| 12,578,822 | |

| Yuxing | |

| 2,342,716 | | |

| 2,870,501 | |

| Antaeus | |

| 345,114 | | |

| - | |

| Consolidated | |

$ | 22,397,862 | | |

| 27,597,325 | |

| | |

| | | |

| | |

| Operating income (expense): | |

| | | |

| | |

| Jinong | |

$ | (145,123 | ) | |

$ | 919,643 | |

| Gufeng | |

| (1,219,882 | ) | |

| (663,730 | ) |

| Yuxing | |

| 154,682 | | |

| 183,994 | |

| Antaeus | |

| (30,496 | ) | |

| - | |

| Reconciling item (1) | |

| - | | |

| - | |

| Reconciling item (2) | |

| (545,088 | ) | |

| (977,567 | ) |

| Consolidated | |

$ | (1,785,907 | ) | |

$ | (537,660 | ) |

| | |

| | | |

| | |

| Net income (loss): | |

| | | |

| | |

| Jinong | |

$ | (114,362 | ) | |

$ | 984,350 | |

| Gufeng | |

| (1,262,423 | ) | |

| (746,500 | ) |

| Yuxing | |

| 154,271 | | |

| 211,586 | |

| Antaeus | |

| (16,603 | ) | |

| - | |

| Reconciling item (1) | |

| 12 | | |

| 16 | |

| Reconciling item (2) | |

| (545,088 | ) | |

| (977,566 | ) |

| Consolidated | |

$ | (1,784,193 | ) | |

$ | (528,114 | ) |

| | |

| | | |

| | |

| Depreciation and Amortization: | |

| | | |

| | |

| Jinong | |

$ | 189,307 | | |

$ | 198,245 | |

| Gufeng | |

| 182,340 | | |

| 193,653 | |

| Yuxing | |

| 185,225 | | |

| 270,280 | |

| Antaeus | |

| 100,087 | | |

| - | |

| Consolidated | |

$ | 656,959 | | |

$ | 662,177 | |

| | |

| | | |

| | |

| Interest expense: | |

| | | |

| | |

| Jinong | |

| 25,128 | | |

| - | |

| Gufeng | |

| 42,426 | | |

| 82,244 | |

| Yuxing | |

| - | | |

| - | |

| Antaeus | |

| - | | |

| - | |

| Consolidated | |

$ | 67,554 | | |

$ | 82,244 | |

| | |

| | | |

| | |

| Capital Expenditure: | |

| | | |

| | |

| Jinong | |

$ | 743 | | |

$ | 3,762 | |

| Gufeng | |

| - | | |

| 219,870 | |

| Yuxing | |

| 3,684 | | |

| 4,909 | |

| Antaeus | |

| 1,502,600 | | |

| - | |

| Consolidated | |

$ | 1,507,027 | | |

$ | 228,541 | |

| | |

As of | |

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| Identifiable assets: | |

| | |

| |

| Jinong | |

$ | 86,188,315 | | |

$ | 87,862,836 | |

| Gufeng | |

| 47,935,231 | | |

| 49,749,041 | |

| Yuxing | |

| 38,355,326 | | |

| 38,223,482 | |

| Antaeus | |

| 2,839,333 | | |

| 3,292,247 | |

| Reconciling item (1) | |

| 7,376,949 | | |

| 7,387,637 | |

| Reconciling item (2) | |

| 166,121 | | |

| 166,121 | |

| Consolidated | |

$ | 182,861,275 | | |

$ | 186,681,364 | |

NOTE 15 – COMMITMENTS AND CONTINGENCIES

We are subject to various claims and contingencies

related to lawsuits, certain taxes and environmental matters, as wells commitments under contractual and other commercial obligations.

We recognize liabilities for commitments and contingencies when a loss is probable and estimable.

On July 1, 2022, Jinong signed an office lease

with Kingtone Information Technology Co., Ltd. (“Kingtone Information”), of which Mr. Zhuoyu Li, Chairman and CEO of the Company,

served as Chairman. Pursuant to the lease, Jinong rented 612 square meters (approximately 6,588 square feet) of office space from Kingtone

Information. The lease provides for a two-year term effective as of July 1, 2022 with monthly rent of RMB28,000 (approximately $3,839).

In February 2004, Tianjuyuan signed a fifty-year

rental agreement with the village committee of Dong Gao Village and Zhen Nan Zhang Dai Village in the Beijing Ping Gu District.

On April 2, 2023, Antaeus signed a one-year rental

agreement for an office in Austin, Texas for approximately 404 square meters (4,348 square feet) space.

Accordingly, the Company recorded an aggregate

of $13,783 and $13,021 as rent expenses from these committed property leases for the three-month periods ended September 30, 2023 and

2022, respectively. The contingent rent expenses herein for the next five twelve-month periods ended September 30, are as follows:

| Years ending September 30, | |

| |

| 2024 | |

$ | 55,132 | |

| 2025 | |

| 55,132 | |

| 2026 | |

| 55,132 | |

| 2027 | |

| 55,132 | |

| 2028 | |

| 55,132 | |

NOTE 16 – VARIABLE INTEREST ENTITIES

In accordance with accounting standards regarding

consolidation of variable interest entities, VIEs are generally entities that lack sufficient equity to finance their activities without

additional financial support from other parties or whose equity holders lack adequate decision-making ability. All VIEs with which a company

is involved must be evaluated to determine the primary beneficiary of the risks and rewards of the VIE. The primary beneficiary is required

to consolidate the VIE for financial reporting purposes.

Green Nevada through one of its subsidiaries,

Jinong, entered into a series of agreements (the “VIE Agreements”) with Yuxing for it to qualify as a VIE, effective June

16, 2013.

The Company has concluded, based on the contractual

arrangements, that Yuxing is a VIE and that the Company’s wholly owned subsidiary, Jinong, absorbs most of the risk of loss from

the activities of Yuxing, thereby enabling the Company, through Jinong, to receive a majority of Yuxing expected residual returns.

On June 30, 2016 and January 1, 2017, the Company,

through its wholly owned subsidiary Jinong, entered into strategic acquisition agreements and into a series of contractual agreements

to qualify as VIEs with the shareholders of the sales VIE Companies.

Jinong, the sales VIE Companies, and the shareholders

of the sales VIE Companies also entered into a series of contractual agreements for the sales VIE Companies to qualify as VIEs (the “VIE

Agreements”).

On November 30, 2017, the Company, through its

wholly owned subsidiary Jinong, exited the VIE agreements with the shareholders of Zhenbai.

On June 2, 2021, the Company, through its wholly

owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Xindeguo, Xinyulei and Xiangrong.

On December 1, 2021, the Company, through its

wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Lishijie.

On December 31, 2021, the Company, through its

wholly owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Fengnong.

On March 31, 2022, the Company, through its wholly

owned subsidiary Jinong, discontinued the strategic acquisition agreements and the series of contractual agreements with the shareholders

of Jinyangguang and Wangtian.

As a result of these contractual arrangements,

with Yuxing and the sales VIE Companies the Company is entitled to substantially all the economic benefits of Yuxing and the VIE Companies.

The following financial statement amounts and balances of the VIE (Yuxing) was included in the accompanying consolidated financial statements

as of September 30, 2023 and June 30, 2023:

| | |

September 30, | | |

June 30, | |

| | |

2023 | | |

2023 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 278,236 | | |

$ | 323,854 | |

| Accounts receivable, net | |

| 622,237 | | |

| 283,221 | |

| Inventories | |

| 24,388,477 | | |

| 24,288,379 | |

| Other current assets | |

| 121,753 | | |

| 108,677 | |

| Related party receivable | |

| - | | |

| 27,560 | |

| | |

| | | |

| | |

| Total Current Assets | |

| 25,410,703 | | |

| 25,031,691 | |

| | |

| | | |

| | |

| Plant, Property and Equipment, Net | |

| 5,727,384 | | |

| 5,887,278 | |

| Other assets | |

| 9,734 | | |

| 9,784 | |

| Intangible Assets, Net | |

| 7,207,505 | | |

| 7,294,729 | |

| Total Assets | |

$ | 38,355,326 | | |

$ | 38,223,482 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 58,898 | | |

$ | 12,512 | |

| Customer deposits | |

| 18,126 | | |

| 62,134 | |

| Accrued expenses and other payables | |

| 281,690 | | |

| 282,968 | |

| Amount due to related parties | |

| 39,316,184 | | |

| 39,346,051 | |

| Total Current Liabilities | |

| 39,674,898 | | |

| 39,703,665 | |

| Total Liabilities | |

$ | 39,674,898 | | |

| 39,703,665 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| (1,319,572 | ) | |

| (1,480,183 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Equity | |

$ | 38,355,326 | | |

$ | 38,223,482 | |

| | |

Three Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Revenue | |

$ | 2,342,717 | | |

$ | 2,870,501 | |

| Expenses | |

| 2,188,446 | | |

| 2,658,915 | |

| Net income | |

$ | 154,271 | | |

$ | 211,586 | |

NOTE 17 – SUBSEQUENT EVENTS

In accordance with ASC 855-10, the Company has

analyzed its operations after September 30, 2023 to the date these unaudited condensed consolidated financial statements were available

to be issued and has determined that there were no significant subsequent events or transactions that would require recognition or disclosure

in the unaudited condensed consolidated financial statements.

Item 2. Management’s Discussion and Analysis

of Financial Condition and Results of Operations

The following discussion and analysis of our

financial condition and results of operations should be read in conjunction with our consolidated financial statements and the notes to

those financial statements appearing elsewhere in this report. This discussion and analysis contain forward-looking statements that involve

significant risks and uncertainties. As a result of many factors, such as the slow-down of the macro-economic environment in China and

its impact on economic growth in general, the competition in the fertilizer industry and the impact of such competition on pricing, revenues

and margins, the weather conditions in the areas where our customers are based, the cost of attracting and retaining highly skilled personnel,

the prospects for future acquisitions, and the factors set forth elsewhere in this report, our actual results may differ materially from

those anticipated in these forward-looking statements. With these risks and uncertainties, there can be no assurance that the forward-looking

statements contained in this report will in fact occur. You should not place undue reliance on the forward-looking statements contained

in this report.

The forward-looking statements speak only as

of the date on which they are made, and, except to the extent required by U.S. federal securities laws, we undertake no obligation to

update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the

occurrence of unanticipated events. Further, the information about our intentions contained in this report is a statement of our

intention as of the date of this report and is based upon, among other things, the existing regulatory environment, industry conditions,

market conditions and prices, and our assumptions as of such date. We may change our intentions, at any time and without notice,

based upon any changes in such factors, in our assumptions or otherwise.