UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number 001-39564

Mingzhu Logistics Holdings Limited

(Translation of registrant’s name into English)

27F, Yantian Modern Industry Service Center

No. 3018 Shayan Road, Yantian District

Shenzhen, Guangdong, China 518081

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark whether by furnishing the

information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

MINGZHU LOGISTICS HOLDINGS LIMITED |

| Date: December 27, 2023 |

|

|

| |

By: |

/s/ Jinlong Yang |

| |

|

Name: |

Jinlong Yang |

| |

|

Title: |

Chief Executive Officer |

EXHIBIT INDEX

2

Exhibit 99.1

Mingzhu Announces Unaudited Financial Results

for the Six Months Ended June 30, 2023

SHENZHEN, China, December 27, 2023 –

MingZhu Logistics Holdings Limited (“MingZhu” or the “Company”) (NASDAQ: YGMZ), an elite provider of logistics

and transportation services to businesses, today announced its unaudited financial results for the six months ended June 30, 2023.

Mr. Jinlong Yang, CEO of MingZhu, commented, “While

the broader economic environment remained challenged, with customers adjusting to demand fluctuations, our team was focused and worked

to minimize the impact of the volatility where we could. Through our efforts, we were able to reduce operating expenses in the first six

months of 2023, compared to the year ago period, enabling us to maintain a healthy balance sheet. Our longer-term business diversification

strategy remains in place but has been slowed by a sluggish acquisition environment given higher interest rates and costs, including an

83% increase in our transportation costs, which served to depress our net income. We believe there are meaningful opportunities for further

cost reductions in our operations and have made this a priority moving forward as we continue to adjust our business to the evolving market.”

Operating Results for the Six Months Ended June 30, 2023

Revenue for the six months ended June 30, 2023,

decreased by $4,239,764, or 7.0%, to $56.1 million from $60.3 million for the same period of last year.

Total operating expenses decreased by $1,430,036,

or 2.4%, to $57.0 million for the six months ended June 30, 2023, from $58.4 million for the same period of last year.

Net loss for the six months ended June 30, 2023

was $805,636 compared to net income of $1,645,083 in the year ago period. The decrease in net income was primarily due to the lower revenue.

Balance Sheet and Cash Flow

As of June 30, 2023, the Company had a $4.3 million

balance of cash, and an accounts receivable balance of $15.5 million. The balance of prepayment to suppliers totaled $10.7 million as

of June 30, 2023, compared to $7.3 million as of December 31, 2022, as the Company retrieved partial payments back from suppliers or received

services and products.

About MingZhu Logistics Holdings Limited (NASDAQ:

YGMZ)

Established in 2002 and headquartered in Shenzhen,

China, MingZhu Logistics Holdings Limited is a 4A-rated professional trucking service provider. Based on the Company’s regional

logistics terminals in Guangdong Province and Xinjiang Autonomous Region, MingZhu Logistics Holdings offers tailored solutions to our

clients to deliver their goods through our network density and broad geographic coverage across the country by a combination of self-owned

fleets tractors and trailers and subcontractors’ fleets. For more information, please visit ir.szygmz.com.

Forward-Looking Statements

The statements in this press release regarding

the Company’s future expectations, plans and prospects constitute forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include statements regarding plans, goals, objectives, strategies, future events,

expected performance, assumptions and any other statements of fact that have not occurred. Any statements that contain the words “may”,

“will”, “want”, “should”, “believe”, “expect”, “anticipate”, “estimate”,

“calculate” or similar statements that are not factual in nature are to be considered forward-looking statements. Actual results

may differ materially from historical results or from those expressed in these forward-looking statements as a result of a variety of

factors. These factors include, but are not limited to, the Company’s strategic objectives, the Company’s future plans, market

demand and user acceptance of the Company’s products or services, technological advances, economic trends, the growth of the trucking

services market in China, the Company’s reputation and brand, the impact of industry competition and bidding, relevant policies

and regulations, fluctuations in China’s macroeconomic conditions, and the risks and assumptions disclosed in the Company’s

reports provided to the CSRC (China Security Regulatory Commission). For these and other related reasons, we advise investors not to place

any reliance on these forward-looking statements, and we urge investors to review the Company’s relevant SEC filings for additional

factors that may affect the Company’s future results of operations. The Company undertakes no obligation to publicly revise these

forward-looking statements subsequent to the filing of these documents as a result of changes in particular events or circumstances.

For further information, please contact:

MingZhu Logistics Holdings Limited

Jingwei Zhang

Email: company@szygmz.com

Phone: +86 186-5937-1270

Investor Relations

David Pasquale

Global IR Partners

Email: YGMZ@globalirpartners.com

Phone: +1-914-337-8801

MINGZHU LOGISTICS HOLDINGS LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | |

As of | | |

As of | |

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

USD | | |

USD | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash | |

$ | 4,307,362 | | |

$ | 5,687,311 | |

| Accounts receivable, net | |

| 15,496,761 | | |

| 19,127,321 | |

| Prepayments | |

| 10,666,774 | | |

| 7,339,861 | |

| Other receivables | |

| 3,462,794 | | |

| 2,795,843 | |

| Loans receivable* | |

| 31,085,776 | | |

| 28,622,704 | |

| Amount due from related parties | |

| 5,406,484 | | |

| 2,677,345 | |

| Total current assets | |

| 70,425,951 | | |

| 66,250,385 | |

| | |

| | | |

| | |

| NON-CURRENT ASSET | |

| | | |

| | |

| Property and equipment, net | |

| 7,338,773 | | |

| 9,073,698 | |

| Deferred tax assets | |

| 241,381 | | |

| 238,237 | |

| Deposits | |

| 3,059,220 | | |

| 2,657,126 | |

| Goodwill | |

| 33,237,409 | | |

| 33,237,409 | |

| Total non-current asset | |

| 43,876,783 | | |

| 45,206,470 | |

| Total assets | |

$ | 114,302,734 | | |

$ | 111,456,855 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Short-term bank borrowings | |

$ | 13,842,541 | | |

$ | 10,022,335 | |

| Accounts payable | |

| 7,147,277 | | |

| 10,134,535 | |

| Other payables and accrued liabilities | |

| 33,376,960 | | |

| 29,054,674 | |

| Amount due to related parties | |

| 6,933,731 | | |

| 6,108,866 | |

| Tax payable | |

| 4,754,198 | | |

| 5,278,436 | |

| Current maturities of long-term bank borrowings | |

| 206,209 | | |

| 586,935 | |

| Current portion of capital lease and financing obligations | |

| 714,621 | | |

| 757,088 | |

| Total current liabilities | |

| 66,975,537 | | |

| 61,942,869 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES | |

| | | |

| | |

| Long-term bank borrowings | |

| 274,485 | | |

| 253,352 | |

| Long-term portion of capital lease and financing obligations | |

| 687,901 | | |

| 1,158,642 | |

| Total non-current liabilities | |

| 962,386 | | |

| 1,411,994 | |

| Total liabilities | |

| 67,937,923 | | |

| 63,354,863 | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Ordinary shares: $0.001 par value, 50,000,000 shares authorized,

22,960,277 and 22,960,277 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively** | |

| 22,960 | | |

| 22,960 | |

| Share subscription receivables | |

| (848,414 | ) | |

| (847,086 | ) |

| Additional paid-in capital | |

| 41,583,382 | | |

| 41,734,546 | |

| Statutory reserves | |

| 1,046,249 | | |

| 1,036,841 | |

| Retained earnings | |

| 5,825,256 | | |

| 7,704,538 | |

| Accumulated other comprehensive Loss | |

| (1,264,622 | ) | |

| (1,549,807 | ) |

| Total shareholders’ equity | |

| 46,364,811 | | |

| 48,101,992 | |

| Total liabilities and shareholders’ equity | |

$ | 114,302,734 | | |

$ | 111,456,855 | |

| * | Loans

receivable mainly comprise of interest-free advances to third parties as a result of strategic business cooperation. |

| ** | Giving

retroactive effect to the re-denomination and nominal issuance of shares effected on February 12, 2020, and the surrender and cancellation

of shares effected on May 21, 2020. |

MINGZHU LOGISTICS HOLDINGS LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE

INCOME

(Unaudited)

| | |

For the Six Months Ended

June

30, | |

| | |

2023 | | |

2022 | |

| | |

USD | | |

USD | |

| REVENUES | |

$ | 56,090,997 | | |

$ | 60,330,761 | |

| | |

| | | |

| | |

| COSTS AND EXPENSES | |

| | | |

| | |

| Transportation costs | |

| 32,840,752 | | |

| 17,953,860 | |

| Costs of rental services | |

| 13,020,751 | | |

| 24,962,970 | |

| Costs of insurance services | |

| 8,576,401 | | |

| 12,740,606 | |

| General and administrative expenses | |

| 2,112,502 | | |

| 2,471,467 | |

| Sales and marketing expenses | |

| 442,500 | | |

| 294,039 | |

| Total costs and expenses | |

| 56,992,906 | | |

| 58,422,942 | |

| | |

| | | |

| | |

| (LOSS) INCOME FROM OPERATIONS | |

| (901,909 | ) | |

| 1,907,819 | |

| | |

| | | |

| | |

| OTHER (EXPENSES) INCOME | |

| | | |

| | |

| Interest expenses | |

| (413,618 | ) | |

| (652,372 | ) |

| Other expenses | |

| (12,815 | ) | |

| (358,267 | ) |

| Other income | |

| 482,540 | | |

| 1,237,049 | |

| Total other income, net | |

| 56,107 | | |

| 226,410 | |

| | |

| | | |

| | |

| (LOSS) INCOME BEFORE INCOME TAXES | |

| (845,802 | ) | |

| 2,134,229 | |

| | |

| | | |

| | |

| (BENEFIT) PROVISION FOR INCOME TAXES | |

| (40,166 | ) | |

| 489,147 | |

| | |

| | | |

| | |

| NET LOSS | |

| (805,636 | ) | |

| 1,645,082 | |

| | |

| | | |

| | |

| OTHER COMPREHENSIVE (LOSS) INCOME | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 285,185 | | |

| (229,321 | ) |

| COMPREHENSIVE (LOSS) INCOME | |

$ | (520,451 | ) | |

$ | 1,415,761 | |

| | |

| | | |

| | |

| Weighted average shares used in computation: | |

| | | |

| | |

| Basic* | |

| 21,429,877 | | |

| 21,429,877 | |

| Diluted* | |

| 20,885,442 | | |

| 20,885,442 | |

| | |

| | | |

| | |

| (LOSS) EARNINGS PER SHARE - BASIC* | |

$ | (0.04 | ) | |

$ | 0.07 | |

| (LOSS) EARNINGS PER SHARE - DILUTED* | |

$ | (0.04 | ) | |

$ | 0.07 | |

| * | Giving

retroactive effect to the re-denomination and nominal issuance of shares effected on February 12, 2020, and the surrender and cancellation

of shares effected on May 21, 2020. |

MINGZHU LOGISTICS HOLDINGS LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’

EQUITY

(Unaudited)

| | |

| | |

| | |

Share | | |

Additional | | |

| | |

| | |

Accumulated Other Comprehensive | | |

| |

| | |

| | |

| | |

Subscription | | |

Paid-in | | |

Statutory | | |

Retained | | |

Income | | |

| |

| | |

Shares* | | |

Amount | | |

Receivables | | |

Capital | | |

Reserve | | |

Earnings | | |

(Loss) | | |

Total | |

| | |

| | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | |

| BALANCE, December 31, 2022 | |

| 22,960,277 | | |

$ | 22,960 | | |

$ | (847,086 | ) | |

$ | 41,734,546 | | |

$ | 1,036,841 | | |

$ | 7,704,538 | | |

$ | (1,549,807 | ) | |

$ | 48,101,992 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (805,636 | ) | |

| - | | |

| (805,636 | ) |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| (1,328 | ) | |

| (151,164 | ) | |

| - | | |

| (1,064,238 | ) | |

| 285,185 | | |

| (931,545 | ) |

| Appropriation to statutory reserve | |

| - | | |

| - | | |

| - | | |

| - | | |

| 9,408 | | |

| (9,408 | ) | |

| - | | |

| - | |

| BALANCE, June 30, 2023 | |

| 22,960,277 | | |

$ | 22,960 | | |

$ | (848,414 | ) | |

$ | 41,583,382 | | |

$ | 1,046,249 | | |

$ | 5,825,256 | | |

$ | (1,264,622 | ) | |

$ | 46,364,811 | |

MINGZHU LOGISTICS HOLDINGS LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

For the Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | |

| | |

USD | | |

USD | |

| Cash flows from operating activities: | |

| | |

| |

| Net (loss) income | |

$ | (805,636 | ) | |

$ | 1,645,083 | |

| Adjustments to reconcile net income to net cash provided (used in by operating activities: | |

| | | |

| | |

| Amortization of deferred financing fees | |

| - | | |

| 26,607 | |

| Provision for doubtful accounts | |

| 19,413 | | |

| - | |

| Depreciation for property and equipment | |

| 851,324 | | |

| 3,441,564 | |

| Deferred income tax benefit | |

| (12,532 | ) | |

| (24,798 | ) |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| 3,015,034 | | |

| (19,659,925 | ) |

| Prepayments | |

| (3,845,327 | ) | |

| 1,080,484 | |

| Other receivables | |

| (2,629,641 | ) | |

| 702,011 | |

| Loans receivable | |

| (1,992,268 | ) | |

| (12,301,292 | ) |

| Deposits | |

| (822,745 | ) | |

| - | |

| Accounts payable | |

| (2,821,222 | ) | |

| 9,226,616 | |

| Other payables and accrued liabilities | |

| 5,356,422 | | |

| 9,259,017 | |

| Tax payables | |

| (278,606 | ) | |

| 2,572,424 | |

| Net cash used in operating activities | |

| (3,965,784 | ) | |

| (4,032,209 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of equipment | |

| - | | |

| (1,343,653 | ) |

| Disposal of equipment | |

| 31,102 | | |

| - | |

| Cash from acquisition of subsidiary | |

| - | | |

| 410,863 | |

| Net cash provided by (used in) investing activities | |

| 31,102 | | |

| (932,790 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from short-term bank borrowings | |

| 4,876,613 | | |

| 2,988,620 | |

| Repayment of short-term bank borrowings | |

| (354,778 | ) | |

| (1,122,278 | ) |

| Repayment of long-term bank borrowings | |

| - | | |

| (149,756 | ) |

| Repayments of loans from other financial institutions | |

| (784,097 | ) | |

| (144,126 | ) |

| Repayments of obligations under capital leases | |

| - | | |

| (1,864,325 | ) |

| Amounts advanced from related parties | |

| 3,222,649 | | |

| 3,128,231 | |

| Repayments to related parties | |

| (4,257,112 | ) | |

| - | |

| Net cash provided by financing activities | |

| 2,703,275 | | |

| 2,836,366 | |

| | |

| | | |

| | |

| Effect of exchange rate change on cash | |

| (148,542 | ) | |

| 86,862 | |

| | |

| | | |

| | |

| Net decrease in cash | |

| (1,379,949 | ) | |

| (2,041,771 | ) |

| Cash at beginning of the period | |

| 5,687,311 | | |

| 5,752,117 | |

| Cash at end of the period | |

$ | 4,307,362 | | |

$ | 3,710,346 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Interest paid | |

$ | 504,655 | | |

$ | 242,386 | |

| Income tax paid | |

$ | 10,620 | | |

$ | 769,924 | |

| | |

| | | |

| | |

| Supplemental non-cash investing and financing information: | |

| | | |

| | |

| Non-cash capital leases to acquire revenue equipment | |

$ | - | | |

$ | - | |

| Uncollected receivable from disposal of revenue equipment | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Reconciliation to amounts on consolidated balance sheets: | |

| | | |

| | |

| Cash | |

$ | 4,307,362 | | |

$ | 3,710,346 | |

| Restricted cash | |

| - | | |

| - | |

| Total cash and restricted cash | |

$ | 4,307,362 | | |

$ | 3,710,346 | |

6

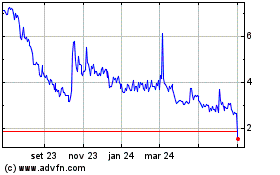

MingZhu Logistics (NASDAQ:YGMZ)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

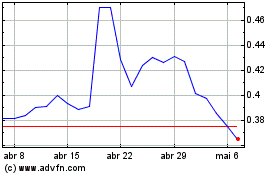

MingZhu Logistics (NASDAQ:YGMZ)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024