0001579157false00015791572024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 08, 2024 |

Vince Holding Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36212 |

75-3264870 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

500 5th Avenue 20th Floor |

|

New York, New York |

|

10110 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 323 421-5980 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value per share |

|

VNCE |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Vince Holding Corp. (the "Company") intends to use the Investor Presentation, attached hereto as Exhibit 99.1, in whole or in part, in one or more meetings with existing and/or potential investors.

The information, including Exhibit 99.1 hereto, which the registrant furnished in this report is not deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Registration statements or other documents filed with te Securities Exchange Commission shall not incorporate this information by reference, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VINCE HOLDING CORP. |

|

|

|

|

Date: |

January 8, 2024 |

By: |

/s/ Jonathan Schwefel |

|

|

|

Jonathan Schwefel

Chief Executive Officer |

ICR - JANUARY 2024 99.2 EXHIBIT 99.1

This Management Presentation (this “Presentation”) is the property of Vince Holding Corp. and its subsidiaries (collectively, “Vince” or the “Company”). By accepting this Presentation, the recipient acknowledges that it has read, understood and accepted the terms of this disclaimer. This Presentation is not a formal offer to sell or solicitation of an offer to buy the Company’s securities. Information contained in this Presentation should not be relied upon as advice to buy or sell or hold such securities or as an offer to sell such securities. No representation or warranty, express or implied, is or will be given by the Company or its affiliates, directors, officers, partners, employees, agents or advisers or any other person as to the accuracy, completeness, reasonableness or fairness of any information contained in this Presentation and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements relating thereto. By acceptance of this Presentation, each recipient agrees not to copy, reproduce or distribute to others the Presentation, in whole or in part, without the prior written consent of the Company, and will promptly return this Presentation to the Company upon request. This Presentation may contain forward-looking statements under the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact or relating to present facts or current conditions included in this presentation are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “target,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. These forward-looking statements are not guarantees of actual results, and our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including those as set forth from time to time in our Securities and Exchange Commission (the “SEC”) filings, including those described in our Annual Report on Form 10-K under “Item 1A – Risk Factors” filed with the SEC on April 28, 2023. Any forward-looking statement made by the Company in this Presentation speaks only as of the date on which it is made. Except as may be required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Market data and industry information used in this presentation are based on independent industry surveys and publications and other publicly available information prepared by third party sources. Although the Company believes that these sources are reliable as of their respective dates, it has not verified the accuracy or completeness of this information from independent sources. Disclaimer

TOTAL SOCIAL FOLLOWING 1.1M+ 412K FOLLOWERS 17.8K FOLLOWERS [d] 0 248K FOLLOWERS @ t§t 422K SUBSCRIBERS AGE BREAKDOWN TOP AUDIENCE: Female 30-45 3% -8% 13% 13-17 18-20 21-24 25-29 30-34 35-44 45+ -8% Social Stats 20% 26% 22% GENDER BREAKDOWN 80% 20% MALE FOLLOWING BY REGION TOP COUNTRY: USA US/CAN: 51% UK: 4% CHN/AUS: 4%

GLOBAL WHOLESALE BREAKOUT

Our stores are located in major cities coast to coast, in distinguished neighborhoods and prominent shopping malls. UNITED STATES: 49 Full Price 17 Outlet UNITED KINGDOM: 1 Full Price CHINA: 2 Full Price SALES AND DISTRIBUTION .A. FULL PRICE OUTLET

NET SALES BY SEGMENT ($ in millions) $170.1 $166.1 $159.6 $166.8 $105.7 $147.8 $169.4 $98.1 $106.5 $119.3 $133.4 $86.3 $135.7 $149.8 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $450.0 $400.0 $350.0 2016 2017 2018 2019 2020 2021 2022 Wholesale Direct-to-consumer $268.2 $272.6 $279.0 $300.2 $192.1 $283.5 $319.1 Annual Vince Brand Net Sales

Q3 FY22 Q3 FY23 Q3 NET SALES ($ in millions) $55.0 $49.9 $34.7 $34.2 Q3 FY23 Q3 FY22 Wholesale Direct-to-Consumer $15.0 $15.1 $89.7 $84.1 Q3 OPERATING INCOME ($ in millions) Q3 Vince Total Net Sales Declined 6.2% vs. LY Driven By: Strategic Decision to Pullback Off-price Wholesale Business Given Improved Inventory Position Ongoing challenging macro environment Q3 Vince Income from Operations Approx. Flat vs. LY Despite Lower Sales and Approx. $4M Royalty Expenses Not Incurred in Prior Year Q3 Vince Income from Operations Margin Expanded 120 Bps vs. LY Driven by: Lower Freight Expenses Lower Promotional Activity Partially Offset by Royalty Expenses Remain on track to achieve full year fiscal 2023 objectives Q3 Fiscal 2023 Vince Brand Results

Net Funded Debt (USD M's) FY 2022 YTD Q3-23 28-Jan-23 28-Oct-23 TERM LOAN 32.9 - REVOLVER 58.5 29.4 THIRD LIEN FACILITY1 26.0 28.8 TOTAL DEBT 117.3 58.2 CASH 1.1 1.2 NET FUNDED DEBT 116.3 57.0 NET FUNDED DEBT (EXCL 3RD LIEN) 90.3 28.2 During Fiscal 2023 the Company took actions to strengthen its balance sheet: With the proceeds from the Authentic transaction, the Company repaid in full the outstanding balance under its Term Loan Credit Facility as well as a portion of the outstanding borrowings under its Revolving Credit Facility. Following the transaction, on June 26, 2023, the Company announced that it entered into a new five-year credit agreement for an $85 million senior secured asset-based revolving credit facility (“ABL Credit Facility”) expected to mature in June 2028. At the end of Q3 FY2023, total borrowings under the Company's debt agreements totaled $58.2 million compared to $117.3 million at the end of FY2022. 1 PIK Interest Balance Sheet

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

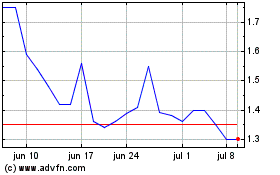

Vince (NYSE:VNCE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Vince (NYSE:VNCE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024