false0000805676--12-3100008056762024-01-182024-01-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 | | | | | |

| Date of Report (Date of earliest event reported) | January 18, 2024 |

| | |

| PARK NATIONAL CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Ohio | 1-13006 | 31-1179518 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | | | | | | | |

| 50 North Third Street, | P.O. Box 3500, | Newark, | Ohio | 43058-3500 |

| (Address of principal executive offices) (Zip Code) |

| | | | | |

| (740) | 349-8451 |

| (Registrant’s telephone number, including area code) |

| | |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

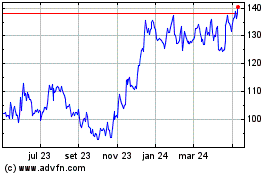

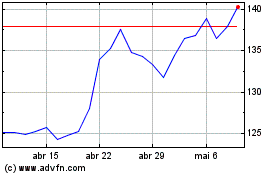

| Common shares, without par value | PRK | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition

On January 22, 2024, Park National Corporation (“Park”) issued a news release (the “Financial Results News Release”) announcing financial results for the three months and the twelve months ended December 31, 2023. A copy of the Financial Results News Release is included as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Non-U.S. GAAP Financial Measures

Item 7.01 of this Current Report on Form 8-K as well as the Financial Results News Release contain non-U.S. GAAP (generally accepted accounting principles in the United States or "U.S. GAAP") financial measures where management believes them to be helpful in understanding Park’s results of operations or financial position. Where non-U.S. GAAP financial measures are used, the comparable U.S. GAAP financial measures, as well as the reconciliation from the comparable U.S. GAAP financial measures, can be found in the Financial Results News Release.

Items Impacting Comparability of Period Results

From time to time, revenue, expenses and/or taxes are impacted by items judged by management of Park to be outside of ordinary banking activities and/or by items that, while they may be associated with ordinary banking activities, are so unusually large that their impact is believed by management of Park at that time to be infrequent or short-term in nature. Most often, these items impacting comparability of period results are due to merger and acquisition activities and revenue and expenses related to former Vision Bank loan relationships. In other cases, they may result from management's decisions associated with significant corporate actions outside of the ordinary course of business.

Even though certain revenue and expense items are naturally subject to more volatility than others due to changes in market and economic environment conditions, as a general rule volatility alone does not result in the inclusion of an item as one impacting comparability of period results. For example, changes in the provision for (recovery of) credit losses (aside from those related to former Vision Bank loan relationships), gains (losses) on equity securities, net, and asset valuation adjustments, reflect ordinary banking activities and are, therefore, typically excluded from consideration as items impacting comparability of period results.

Management believes the disclosure of items impacting comparability of period results provides a better understanding of Park's performance and trends and allows management to ascertain which of such items, if any, to include or exclude from an analysis of Park's performance; i.e., within the context of determining how that performance differed from expectations, as well as how, if at all, to adjust estimates of future performance taking such items into account.

Items impacting comparability of the results of particular periods are not intended to be a complete list of items that may materially impact current or future period performance.

Non-U.S. GAAP Financial Measures

Park's management uses certain non-U.S. GAAP financial measures to evaluate Park's performance. Specifically, management reviews the return on average tangible equity, the return on average tangible assets, the tangible equity to tangible assets ratio, tangible book value per common share and pre-tax, pre-provision net income.

Management has included in the Financial Results News Release information relating to the annualized return on average tangible equity, the annualized return on average tangible assets, the tangible equity to tangible assets ratio, tangible book value per common share and pre-tax, pre-provision net income for the three months ended and at December 31, 2023, September 30, 2023, and December 31, 2022 and for the twelve months ended and at December 31, 2023 and December 31, 2022. For the purpose of calculating the annualized return on average tangible equity, a non-U.S. GAAP financial measure, net income for each period is divided by average tangible equity during the period. Average tangible equity equals average shareholders' equity during the applicable period less average goodwill and other intangible assets during the applicable period. For the purpose of calculating the annualized return on average tangible assets, a non-U.S. GAAP financial measure, net income for each period is divided by average tangible assets during the period. Average tangible assets equals average assets during the applicable period less average goodwill and other intangible assets during the applicable period. For the purpose of calculating the tangible equity to tangible assets ratio, a non-U.S. GAAP financial measure, tangible equity is divided by tangible assets. Tangible equity equals total shareholders' equity less goodwill and other intangible assets, in each case at period end. Tangible assets equal total assets less goodwill and other intangible assets, in each case at period end. For the purpose of calculating tangible book value per common share, a non-U.S. GAAP financial measure, tangible equity is divided by the number of common shares outstanding, in each case at period end. For the purpose of calculating pre-tax, pre-provision net income, a non-U.S. GAAP financial measure, income taxes and the provision for (recovery of) credit losses are added back to net income, in each case during the applicable period.

Management believes that the disclosure of the annualized return on average tangible equity, the annualized return on average tangible assets, the tangible equity to tangible assets ratio, tangible book value per common share and pre-tax, pre-provision net income presents additional information to the reader of the consolidated financial statements, which, when read in conjunction with the consolidated financial statements prepared in accordance with U.S. GAAP, assists in analyzing Park's operating performance, ensures comparability of operating performance from period to period, and facilitates comparisons with the performance of Park's peer financial holding companies and bank holding companies, while eliminating certain non-operational effects of acquisitions. In the Financial Results News Release, Park has provided a reconciliation of average tangible equity from average shareholders' equity, average tangible assets from average assets, tangible equity from total shareholders' equity, tangible assets from total assets, and pre-tax, pre-provision net income from net income solely for the purpose of complying with SEC Regulation G and not as an indication that the annualized return on average tangible equity, the annualized return on average tangible assets, the tangible equity to tangible assets ratio, tangible book value per common share and pre-tax, pre-provision net income are substitutes for the annualized return on average equity, the annualized return on average assets, the total shareholders' equity to total assets ratio, book value per common share and net income, respectively, as determined in accordance with U.S. GAAP.

FTE (fully taxable equivalent) Financial Measures

Interest income, yields, and ratios on a FTE basis are considered non-U.S. GAAP financial measures. Management believes net interest income on a FTE basis provides an insightful picture of the interest margin for comparison purposes. The FTE basis also allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The FTE basis assumes a corporate federal statutory tax rate of 21 percent. In the Financial Results News Release, Park has provided a reconciliation of FTE interest income solely for the purpose of complying with SEC Regulation G and not as an indication that FTE interest income, yields and ratios are substitutes for interest income, yields and ratios, as determined in accordance with U.S. GAAP.

Paycheck Protection Program ("PPP") Loans

Park originated an aggregate of $764.7 million in loans as part of the PPP. For its assistance in making and retaining these loans, Park received an aggregate of $33.1 million in fees from the Small Business Administration ("SBA"). These loans are not typical of Park's loan portfolio in that they are part of a specific government program to support businesses during the COVID-19 pandemic and are 100% guaranteed by the SBA. As such, management considers the total allowance for credit losses to total loans ratio (excluding PPP loans) and general reserve on collectively evaluated loans as a percentage of total collectively evaluated loans (excluding PPP loans) in addition to the related U.S. GAAP metrics which are not adjusted for PPP loans.

Item 5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

| | | | | |

| (a) | Not applicable |

| (b) | Not applicable |

| (c) | Not applicable |

| (d) | Not applicable |

| (e) | The Compensation Committee of the Board of Directors (the "Compensation Committee") of Park met on January 18, 2024 to determine the 2024 base salaries (the “2024 Base Salaries”) for Park’s executive officers, the discretionary annual incentive compensation award for the twelve-month period ended December 31, 2023 (the "2023 Incentive Compensation") earned by each of Park’s executive officers and the equity-based award granted to each of Park's executive officers.

|

| In determining the 2024 Base Salaries, the 2023 Incentive Compensation and the equity-based awards, the Compensation Committee considered, as one of the relevant factors, Park’s compensation (for each of Park's executive officers) relative to Park's peer bank holding companies (the financial services holding companies included in the Regional Compensation Peer Group ("Regional Peers")) compensation for executive officers holding comparable positions. In determining the 2023 Incentive Compensation awards, the Compensation Committee considered Park's 2023 performance versus both budgeted results for the twelve-month period ended December 31, 2023 and results for the twelve-month period ended December 31, 2022. The Compensation Committee also considered Park's performance measured by the return on average equity ("ROAE") and the return on average assets ("ROAA") for the twelve-month period ended December 31, 2023, as well as total shareholder return for the twelve-month period ended December 31, 2023, in each case compared to the Regional Peers (note, ROAA and ROAE information for the Regional Peers was available for the nine-month period ended September 30, 2023 and used for comparison purposes). |

| The 2024 Base Salaries are effective as of January 1, 2024 and the 2023 Incentive Compensation is expected to be paid in March 2024. |

| The following table shows the 2024 Base Salaries and the 2023 Incentive Compensation award for each of Park's executive officers: |

| | | | | | | | |

| Name | 2024 Base Salaries | 2023 Incentive Compensation |

David L. Trautman1 | $750,000 | $364,000 |

Matthew R. Miller2 | $550,000 | $223,000 |

Brady T. Burt3 | $400,000 | $162,000 |

______________________________________

1 Mr. Trautman serves as Chairman of the Board and Chief Executive Officer of each of Park and Park's national bank subsidiary, The Park National Bank ("PNB").

2 Mr. Miller serves as President of each of Park and PNB.

3 Mr. Burt serves as Chief Financial Officer, Secretary and Treasurer of Park and as Senior Vice President and Chief Financial Officer of PNB.

Park National Corporation 2017 Long-Term Incentive Plan for Employees - Performance-Based Restricted Stock Unit Awards

On January 18, 2024, the Compensation Committee determined the dollar value of equity-based awards (the “2024 PBRSU Awards”) of performance-based restricted stock units (“PBRSUs”) to be granted to each of Messrs. Trautman, Miller and Burt based on Park's closing share price on January 25, 2024, which 2024 PBRSU Awards are subject to the terms and conditions of Park’s 2017 Long-Term Incentive Plan for Employees (the “2017 Employees LTIP”) and the award agreements evidencing the 2024 PBRSU Awards.

The following table shows the minimum/target dollar value of PBRSUs which may be earned (the “Target Award”) and the maximum dollar value of PBRSUs which may be earned (the “Maximum Award”) in respect of the 2024 PBRSU Award to be granted to each of Messrs. Trautman, Miller and Burt. The actual number of PBRSUs awarded will be based on the dollar value approved and Park's closing share price on January 25, 2024.

| | | | | | | | |

| Name and Position | Target Award | Maximum Award |

David L. Trautman

Chairman of the Board and Chief Executive Officer of each Park and PNB | $575,000 | $862,500 |

| | |

Matthew R. Miller

President of each Park and PNB | $385,000 | $577,500 |

| | |

Brady T. Burt

Chief Financial Officer, Secretary and Treasurer of Park; Senior Vice President and Chief Financial Officer of PNB | $250,000 | $375,000 |

The number of PBRSUs earned and settled or, in the alternative, forfeited will be based upon Park’s performance, measured by Park’s cumulative return on average assets (“Cumulative ROA”) for the three-year performance period beginning January 1, 2024 and ending December 31, 2026 (the “Performance Period”), relative to the Cumulative ROA results for the Performance Period for the Industry Index of financial services holding companies (excluding corporations classified for federal income tax purposes as "S" corporations) in the United States with total consolidated assets of $5 billion to $15 billion (the "$5B to $15B Industry Index"). However, no PBRSUs will be earned by Messrs. Trautman, Miller and Burt if Park’s consolidated net income for each fiscal year during the Performance Period has not equaled or exceeded an amount equal to 110% of all cash dividends declared and paid by Park during such fiscal year.

Park’s performance at the 50th percentile and the 80th percentile of the performance of the $5B to $15B Industry Index will result in Messrs. Trautman, Miller and Burt earning PBRSUs representing the Target Award and the Maximum Award, respectively (interpolated on a straight line basis for performance at percentiles between these specified percentiles), covered by their respective grants.

Any PBRSUs earned based on Park’s performance relative to the performance of the $5B to $15B Industry Index will also be subject to a service-based vesting requirement. One-half of the PBRSUs earned in respect of the Performance Period will vest and be settled in Park common shares (on a one-for-one basis) on the date the Compensation Committee determines and certifies the number of PBRSUs earned in respect of the Performance Period (the “Certification Date”) if the executive officer earning such PBRSUs is still employed by Park or one of Park's subsidiaries on the Certification Date. On the first anniversary of the Certification Date, the other half of the PBRSUs earned in respect of the Performance Period will vest and be settled in Park common shares (on a one-for-one basis) if the executive officer earning such PBRSUs is still employed by Park or one of Park's subsidiaries on the first anniversary of the Certification Date. Subject to the terms of the award agreement evidencing each 2024 PBRSU Award, none of the Park common shares received by each of Messrs. Trautman, Miller and Burt upon settlement of earned and vested PBRSUs may be sold, transferred, assigned or otherwise similarly disposed of by him for a period of five years after the date of settlement.

Each award agreement evidencing a 2024 PBRSU Award also addresses the effect of termination of employment of the executive officer to whom the 2024 PBRSU Award is granted, the effect of a defined “Change in Control” for purposes of the 2017 Employees LTIP and events the occurrence of which will result in the forfeiture of the PBRSUs and any common shares delivered pursuant to the award agreement.

Item 5.03 - Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

On January 22, 2024, the Board of Directors (the “Park Board”) of Park approved certain amendments to Park’s Code of Business Conduct and Ethics (the “Code”). The Code sets forth Park’s ethical business and personal conduct expectations for all officers, directors, employees, and agents of Park and its subsidiaries. The amendments to the Code were approved and adopted by the Park Board as part of its ordinary course recurrent review of Park’s codes and policies.

The amended Code is effective January 22, 2024, and does not result in any waiver with respect to any officer, director, employee or agent of Park from any provision of the Code as in effect prior to Park Board’s action to amend the Code.

The Code was amended to, among other things, improve its readability, remove unnecessary duplication, and to incorporate current governance best practices, including those related to hiring.

The description of the amendments to the Code contained in this Current Report on Form 8-K is not intended to be exhaustive and is qualified in its entirety by reference to the full text of the Code, as amended, which is attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 7.01 - Regulation FD Disclosure

Liquidity and Capital

Park continues to maintain strong capital and liquidity. Funds are available from a number of sources, including the capital markets, the investment securities portfolio, the core deposit base, FHLB borrowings and the capability to securitize or package loans for sale. The most easily accessible forms of liquidity, Fed Funds Sold, unpledged investment securities and available FHLB borrowing capacity, totaled $1.95 billion at December 31, 2023. Park's debt securities portfolio is classified as available-for-sale ("AFS") and these debt securities are available to be sold in the future in response to Park's liquidity needs, changes in market interest rates, and asset-liability management strategies, among other reasons. Net unrealized losses on debt securities AFS were $85.9 million at December 31, 2023 compared to $121.2 million at December 31, 2022.

Deposits

Park's deposits grew during the COVID pandemic and have declined toward pre-pandemic levels throughout 2022 and 2023. In order to manage the impact of this growth on its balance sheet, Park has utilized a program where certain deposit balances are transferred off balance sheet while maintaining the customer relationship. Park is able to increase or decrease the amount of deposit balances transferred off balance sheet based on its balance sheet management strategies and liquidity needs. The balance of deposits transferred off balance sheet has declined as deposit balances have returned to pre-pandemic levels. The table below breaks out the change in deposit balances, by deposit type, for Park.

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2023 | December 31, 2022 | December 31, 2021 | December 31, 2020 | December 31, 2019 |

| Retail deposits | $ | 4,080,372 | | $ | 4,388,394 | | $ | 4,416,228 | | $ | 4,025,852 | | $ | 3,748,039 | |

| Commercial deposits | 3,962,194 | | 3,846,321 | | 3,488,300 | | 3,546,506 | | 3,304,573 | |

| Total deposits | $ | 8,042,566 | | $ | 8,234,715 | | $ | 7,904,528 | | $ | 7,572,358 | | $ | 7,052,612 | |

| Off balance sheet deposits | 1,185 | | 195,937 | | 983,053 | | 710,101 | | — | |

| Total deposits including off balance sheet deposits | $ | 8,043,751 | | $ | 8,430,652 | | $ | 8,887,581 | | $ | 8,282,459 | | $ | 7,052,612 | |

| $ change from prior period end | $ | (386,901) | | $ | (456,929) | | $ | 605,122 | | $ | 1,229,847 | | |

| % change from prior period end | (4.6) | % | (5.1) | % | 7.3 | % | 17.4 | % | |

During the year ended December 31, 2023, total deposits including off balance sheet deposits decreased by $386.9 million, or 4.6%. This decrease consisted of a $308.0 million decrease in total retail deposits and a $194.8 million decrease in off balance sheet deposits, partially offset by a $115.9 million increase in total commercial deposits. The majority of off balance sheet deposits are commercial and thus impact the increase in commercial deposits as the deposits are moved back onto the balance sheet.

Included in the total commercial deposits and off balance sheet deposits shown in the previous table are public fund deposits. These balances fluctuate based on seasonality and the cycle of collection and remittance of tax funds. The following table

details the change in public fund deposits.

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2023 | December 31, 2022 | December 31, 2021 | December 31, 2020 | December 31, 2019 |

| Total public fund deposits | $ | 1,213,418 | | $ | 1,335,400 | | $ | 1,548,217 | | $ | 1,406,101 | | $ | 1,293,090 | |

| $ change from prior period end | $ | (121,982) | | $ | (212,817) | | $ | 142,116 | | $ | 113,011 | | |

| % change from prior period end | (9.1) | % | (13.7) | % | 10.1 | % | 8.7 | % | |

As of December 31, 2023, Park had approximately $1.3 billion of uninsured deposits, which was 16.2% of total deposits. Uninsured deposits of $1.3 billion included $288.2 million of deposits which were over $250,000 but were fully collateralized by Park's investment securities portfolio.

Financial Results

Net income for the three months ended December 31, 2023 of $24.5 million represented an $8.6 million, or 25.9%, decrease compared to $33.1 million for the three months ended December 31, 2022. Net income for the year ended December 31, 2023 of $126.7 million represented a $21.6 million, or 14.6%, decrease compared to $148.4 million for the year ended December 31, 2022.

Pre-tax, pre-provision net income for the three months ended December 31, 2023 of $31.6 million represented a $11.8 million, or 27.2%, decrease compared to $43.3 million for the three months ended December 31, 2022. Pre-tax, pre-provision net income for the year ended December 31, 2023 of $156.5 million represented a $28.5 million, or 15.4%, decrease compared to $185.0 million for the year ended December 31, 2022.

Highlights from the three-month and twelve-month periods ended December 31, 2023 and 2022 included:

•Park completed a series of debt security sale trades in November 2023, selling an aggregate of $291.0 million in AFS debt securities with a net pre-tax loss of $7.9 million for the three months and year ended December 31, 2023. Among the various objectives of the trade, the liquidity generated from the sale was used to reduce borrowing needs. No gain or loss on the sale of debt securities was recorded in the year ended December 31, 2022.

•Net interest income for the three months ended December 31, 2023 of $95.1 million represented a $468,000, or 0.5%, increase compared to $94.6 million for the three months ended December 31, 2022. Net interest income for the year ended December 31, 2023 of $373.1 million represented a $26.1 million, or 7.5%, increase compared to $347.1 million for the year ended December 31, 2022.

•During the three months ended December 31, 2023, Park recorded interest income of $12,000 related to PPP loans, compared to $78,000 for the three months ended December 31, 2022. During the year ended December 31, 2023, Park recorded interest income of $69,000 related to PPP loans, compared to $3.1 million for the year ended December 31, 2022.

•Park recognized a $5.6 million gain on the sale of OREO, net, during the year ended December 31, 2022 related to former Vision Bank relationships. There was no gain on the sale of OREO, net, related to former Vision Bank relationships during the three months or the year ended December 31, 2023, or the three months ended December 31, 2022.

•Park recognized a $12.0 million OREO valuation markup during the year ended December 31, 2022 related to the foreclosure and subsequent sale of a property collateralizing a former Vision Bank relationship. There was no OREO valuation markup related to former Vision Bank relationships during the three months or the year ended December 31, 2023, or the three months ended December 31, 2022.

•During the three months and the year ended December 31, 2022, Park incurred expenses of $100,000 and $1.8 million, respectively, in direct expenses related to the collection of payments on former Vision Bank loan relationships, compared $100,000 for the year ended December 31, 2023. There were no direct expenses related to the collection of payments on former Vision Bank loan relationships for the three months ended December 31, 2023.

•During the three months ended and the year ended December 2023, Park contributed $1.0 million to its charitable foundation. During the year ended December 31, 2022, Park contributed $4.0 million to its charitable foundation. There was no contribution made by Park to its charitable foundation during the three months ended December 31, 2022.

•Park's loans outstanding at December 31, 2023 increased 4.7%, compared to December 31, 2022.

•Park's loan portfolio had annualized net loan charge-offs as a percentage of average loans of 0.14% for the three months ended December 31, 2023, compared to 0.09% for the three months ended December 31, 2022. Park's loan

portfolio had net loan charge-offs as a percentage of average loans of 0.07% for the year ended December 31, 2023, compared to 0.03% for the year ended December 31, 2022.

Net income for each of the three months ended December 31, 2023, September 30, 2023 and December 31, 2022 and for each of the twelve months ended December 31, 2023 and December 31, 2022, included several items of income and expense that impacted comparability of period results. These items are detailed in the "Financial Reconciliations" section within the Financial Results News Release.

The following discussion provides additional information regarding Park.

Park National Corporation (Park)

The table below reflects the net income for each quarter of 2023, and for the years ended December 31, 2023, 2022 and 2021.

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Q4 2023 | Q3 2023 | Q2 2023 | Q1 2023 | 2023 | 2022 | 2021 |

| Net interest income | $ | 95,074 | | $ | 94,269 | | $ | 91,572 | | $ | 92,198 | | $ | 373,113 | | $ | 347,059 | | $ | 329,893 | |

| Provision for (recovery of) credit losses | 1,809 | | (1,580) | | 2,492 | | 183 | | 2,904 | | 4,557 | | (11,916) | |

| Other income | 15,519 | | 27,713 | | 25,015 | | 24,387 | | 92,634 | | 135,935 | | 129,944 | |

| Other expense | 79,043 | | 77,808 | | 75,885 | | 76,503 | | 309,239 | | 297,978 | | 283,518 | |

| Income before income taxes | $ | 29,741 | | $ | 45,754 | | $ | 38,210 | | $ | 39,899 | | $ | 153,604 | | $ | 180,459 | | $ | 188,235 | |

| Income tax expense | 5,241 | | 8,837 | | 6,626 | | 6,166 | | 26,870 | | 32,108 | | 34,290 | |

| Net income | $ | 24,500 | | $ | 36,917 | | $ | 31,584 | | $ | 33,733 | | $ | 126,734 | | $ | 148,351 | | $ | 153,945 | |

Net interest income of $373.1 million for the year ended December 31, 2023 represented a $26.1 million, or 7.5%, increase compared to $347.1 million for the year ended December 31, 2022. The increase was a result of a $93.4 million increase in interest income, partially offset by a $67.4 million increase in interest expense.

The $93.4 million increase in interest income was due to a $76.7 million increase in interest income on loans and a $16.7 million increase in investment income. The $76.7 million increase in interest income on loans was primarily the result of a $266.8 million (or 3.84%) increase in average loans, from $6.96 billion for the year ended December 31, 2022 to $7.22 billion for the year ended December 31, 2023, as well as an increase in the yield on loans, which increased 90 basis points to 5.55% for the year ended December 31, 2023, compared to 4.65% for the year ended December 31, 2022. The $16.7 million increase in investment income was primarily the result of an increase in the yield on investments, including money market investments, which increased 128 basis points to 3.84% for the year ended December 31, 2023, compared to 2.56% for the year ended December 31, 2022. The increase in the yield on investments was partially offset by a decrease in average investments, including money market investments, from $2.27 billion for the year ended December 31, 2022 to $1.95 billion for the year ended December 31, 2023.

The $67.4 million increase in interest expense was due to a $63.5 million increase in interest expense on deposits, as well as a $3.9 million increase in interest expense on borrowings. The increase in interest expense on deposits was the result of a $189.2 million (or 3.53%) increase in average on-balance sheet interest bearing deposits from $5.36 billion for the year ended December 31, 2022, to $5.55 billion for the year ended December 31, 2023, as well as an increase in the cost of deposits of 113 basis points, from 0.39% for the year ended December 31, 2022 to 1.52% for the year ended December 31, 2023. The increase in on-balance sheet interest bearing deposits was due to an increase in transaction accounts and brokered deposits, which was partially offset by decreases in savings accounts and time deposits. During the years ended December 31, 2023 and 2022, Park decided to continue its participation in a program to transfer deposits off-balance sheet in order to manage growth of the balance sheet.

The provision for credit losses of $2.9 million for the year ended December 31, 2023 represented a decline of $1.7 million, compared to $4.6 million for the year ended December 31, 2022. Refer to the “Credit Metrics and Provision for (Recovery of) Credit Losses” section for additional details regarding the level of the provision for (recovery of) credit losses recognized in each period presented above.

The table below reflects Park's total other income for the year ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | |

| (Dollars in thousands) | 2023 | 2022 | $ change | % change |

| Other income: | | | | |

| Income from fiduciary activities | $ | 35,474 | | $ | 34,091 | | $ | 1,383 | | 4.1 | % |

| Service charges on deposit accounts | 8,445 | | 10,091 | | (1,646) | | (16.3) | % |

| Other service income | 10,300 | | 15,295 | | (4,995) | | (32.7) | % |

| Debit card fee income | 26,522 | | 26,046 | | 476 | | 1.8 | % |

| Bank owned life insurance income | 5,338 | | 6,100 | | (762) | | (12.5) | % |

| ATM fees | 2,178 | | 2,273 | | (95) | | (4.2) | % |

| (Loss) gain on the sale of OREO, net | (3) | | 5,611 | | (5,614) | | N.M. |

| OREO valuation markup | 60 | | 12,039 | | (11,979) | | N.M. |

| Loss on sale of debt securities, net | (7,875) | | — | | (7,875) | | N.M. |

| Gain on equity securities, net | 971 | | 2,955 | | (1,984) | | (67.1) | % |

| Other components of net periodic benefit income | 7,572 | | 12,108 | | (4,536) | | (37.5) | % |

| Miscellaneous | 3,652 | | 9,326 | | (5,674) | | (60.8) | % |

| Total other income | $ | 92,634 | | $ | 135,935 | | $ | (43,301) | | (31.9) | % |

Other income of $92.6 million for the year ended December 31, 2023 represented a decrease of $43.3 million, or 31.9%, compared to $135.9 million for the year ended December 31, 2022. The $1.4 million increase in income from fiduciary activity was due to an increase in the market value of assets under management. The $1.6 million decrease in service charges on deposits income was primarily related to a decrease in overdraft fee income. The $5.0 million decrease in other service income was primarily due to declines in fee income from mortgage loan originations and mortgage servicing rights, partially offset by increases in investor rate locks and mortgage loans held for sale. The decrease in (loss) gain on the sale of OREO, net was due to a $5.6 million gain on the sale of OREO, net, during the year ended December 31, 2022 related to former Vision Bank relationships, compared to no gain on the sale of OREO, net, related to former Vision Bank relationships during the year ended December 31, 2023. The decrease in OREO valuation mark up was due to a $12.0 million OREO valuation markup related to the foreclosure and subsequent sale of a property collateralizing a former Vision Bank relationship, which was recognized during the year ended December 31, 2022 with no OREO valuation markup related to former Vision Bank relationships recognized during the year ended December 31, 2023. The change in loss on sale of debt securities, net was due to loss on sale of debt securities, net, of $7.9 million recorded during the year ended December 31, 2023. No loss on sale of debt securities, net was recorded during the year ended December 31, 2022. The $2.0 million decrease in gain on equity securities, net, was due to fair value adjustments on equity securities. The $4.5 million decrease in other components of net periodic benefit income was largely due to a decrease in the expected return on plan assets and an increase in interest cost. The $5.6 million decrease in other miscellaneous income, was primarily due to (i) a $1.2 million decrease in the net gain (loss) on the sale of loans and other assets; (ii) a $1.0 million decrease due to write downs on strategic initiatives, which are considered items impacting comparability and are detailed in the "Financial Reconciliation" section within the Financial Results News Release; and (iii) a $1.6 million decrease in other fee income related to one way sells on deposits.

A summary of mortgage loan originations for the years ended December 31, 2023, 2022 and 2021 follows.

| | | | | | | | | | | |

| (In thousands) | 2023 | 2022 | 2021 |

| Mortgage Loan Origination Volume | | | |

| Sold | $ | 59,386 | $ | 159,142 | $ | 555,278 |

| Portfolio | 249,151 | 263,287 | 284,686 |

| Construction | 92,612 | 120,794 | 119,555 |

| Service released | 5,825 | 14,738 | 13,802 |

| Total mortgage loan originations | $ | 406,974 | $ | 557,961 | $ | 973,321 |

| | | |

| Refinances as a % of Total Mortgage Loan Originations | 17.4 | % | 29.4 | % | 54.2 | % |

Total mortgage loan originations decreased $151.0 million, or 27.1%, to $407.0 million for the year ended December 31, 2023 compared to $558.0 million for the year ended December 31, 2022.

The table below reflects Park's total other expense for the year ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | |

| (Dollars in thousands) | 2023 | 2022 | $ change | % change |

| Other expense: | | | | |

| Salaries | $ | 139,237 | | $ | 133,299 | | $ | 5,938 | | 4.5 | % |

| Employee benefits | 42,264 | | 40,490 | | 1,774 | | 4.4 | % |

| Occupancy expense | 13,114 | | 13,866 | | (752) | | (5.4) | % |

| Furniture and equipment expense | 12,233 | | 11,901 | | 332 | | 2.8 | % |

| Data processing fees | 37,637 | | 32,627 | | 5,010 | | 15.4 | % |

| Professional fees and services | 29,173 | | 30,837 | | (1,664) | | (5.4) | % |

| Marketing | 5,471 | | 5,335 | | 136 | | 2.5 | % |

| Insurance | 7,640 | | 5,413 | | 2,227 | | 41.1 | % |

| Communication | 4,210 | | 3,891 | | 319 | | 8.2 | % |

| State tax expense | 4,657 | | 4,585 | | 72 | | 1.6 | % |

| Amortization of intangible assets | 1,323 | | 1,487 | | (164) | | (11.0) | % |

| Foundation contribution | 1,000 | | 4,000 | | (3,000) | | (75.0) | % |

| Miscellaneous | 11,280 | | 10,247 | | 1,033 | | 10.1 | % |

| Total other expense | $ | 309,239 | | $ | 297,978 | | $ | 11,261 | | 3.8 | % |

Total other expense of $309.2 million for the year ended December 31, 2023 represented an increase of $11.3 million, or 3.8%, compared to $298.0 million for the year ended December 31, 2022. The increase in salaries expense was primarily related to increases in base salary expense and share-based compensation expense, partially offset by decreases in additional compensation expense and officer incentive compensation expense. The increase in employee benefits expense was primarily related to increases in group insurance expense and payroll tax expense, partially offset by a decrease in retirement benefit expense. The decrease in occupancy expense was primarily related to a decrease in lease expense. The increase in data processing fees was primarily related to increases in software data processing expense and debit card processing expense. The decrease in professional fees and services expense was primarily due to decreases in consulting and recruiting expenses, partially offset by increases in IntraFi insured deposit fees and temporary wages. The increase in insurance expense was due to an increase in FDIC insurance assessment expense. The increase in miscellaneous expense was due to increased training and travel-related expenses, increased expense related to losses as a result of fraud and other non loan related losses and other miscellaneous expense, which were partially offset by a decrease in operating lease depreciation expense and a decrease in expense for the allowance for unfunded lines of credit.

The table below provides certain balance sheet information and financial ratios for Park as of or for the year ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2023 | December 31, 2022 | | % change from 12/31/22 |

| Loans | 7,476,221 | | 7,141,891 | | | 4.68 | % |

| Allowance for credit losses | 83,745 | | 85,379 | | | (1.91) | % |

| Net loans | 7,392,476 | | 7,056,512 | | | 4.76 | % |

| Investment securities | 1,429,144 | | 1,820,787 | | | (21.51) | % |

| Total assets | 9,836,453 | | 9,854,993 | | | (0.19) | % |

| Total deposits | 8,042,566 | | 8,234,715 | | | (2.33) | % |

Average assets (1) | 9,957,554 | | 10,044,208 | | | (0.86) | % |

Efficiency ratio (2) | 65.87 | % | 61.24 | % | | 7.56 | % |

| Return on average assets | 1.27 | % | 1.48 | % | | (14.19) | % |

(1) Average assets for each of the years ended December 31, 2023 and 2022.

(2) Efficiency ratio is calculated by dividing total other expense by the sum of fully taxable equivalent net interest income and other income. Fully taxable equivalent net interest income includes the effects of taxable equivalent adjustments using a 21% federal corporate income tax rate. The taxable equivalent adjustments were $3.7 million for the year ended December 31, 2023 and $3.5 million for the year ended December 31 2022.

Loans outstanding at December 31, 2023 were $7.48 billion, compared to $7.14 billion at December 31, 2022, an increase of $334.3 million. The table below breaks out the change in loans outstanding, by loan type.

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2023 | December 31, 2022 | | $ change from 12/31/22 | % change from 12/31/22 | |

| Home equity | $ | 174,621 | | $ | 167,232 | | | $ | 7,389 | | 4.4 | % | |

| Installment | 1,950,304 | | 1,921,333 | | | 28,971 | | 1.5 | % | |

| Real estate | 1,340,169 | | 1,195,037 | | | 145,132 | | 12.1 | % | |

| Commercial | 4,007,941 | | 3,854,939 | | | 153,002 | | 4.0 | % | |

| Other | 3,186 | | 3,350 | | | (164) | | (4.9) | % | |

Total loans | $ | 7,476,221 | | $ | 7,141,891 | | | $ | 334,330 | | 4.7 | % | |

Park's allowance for credit losses was $83.7 million at December 31, 2023, compared to $85.4 million at December 31, 2022, a decrease of $1.6 million, or 1.9%. Refer to the “Credit Metrics and Provision for (Recovery of) Credit Losses” section for additional information regarding Park's loan portfolio and the level of provision for (recovery of) credit losses recognized in each period presented.

Total deposits at December 31, 2023 were $8.04 billion, compared to $8.23 billion at December 31, 2022, a decrease of $192.1 million. During the years ended December 31, 2023 and 2022, Park decided to continue participation in a program to transfer deposits off-balance sheet in order to manage growth of the balance sheet, as deposits increased significantly throughout the COVID-19 pandemic. At December 31, 2023 and December 31, 2022, Park had $1.2 million and $195.9 million, respectively,

in deposits which were off-balance sheet. Total deposits would have decreased $386.9 million, or 4.6%, compared to December 31, 2022 had the $1.2 million and $195.9 million in deposits remained on the balance sheet at the respective dates.

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2023 | December 31, 2022 | | $ change from 12/31/22 | % change from 12/31/22 | |

| Non-interest bearing deposits | $ | 2,628,234 | | $ | 3,074,276 | | | $ | (446,042) | | (14.5) | % | |

| Transaction accounts | 2,064,512 | | 1,988,106 | | | 76,406 | | 3.8 | % | |

| Savings | 2,543,220 | | 2,617,888 | | | (74,668) | | (2.9) | % | |

| Certificates of deposit | 641,615 | | 554,445 | | | 87,170 | | 15.7 | % | |

| Brokered deposits | 164,985 | | — | | | 164,985 | | N.M. | |

| Total deposits | $ | 8,042,566 | | $ | 8,234,715 | | | $ | (192,149) | | (2.3) | % | |

| Off balance sheet deposits | 1,185 | | 195,937 | | | (194,752) | | N.M. | |

| Total deposits including off balance sheet deposits | $ | 8,043,751 | | $ | 8,430,652 | | | $ | (386,901) | | (4.6) | % | |

Credit Metrics and Provision for (Recovery of) Credit Losses

Park reported a provision for credit losses for the year ended December 31, 2023 of $2.9 million, compared to $4.6 million for the year ended December 31, 2022. Net charge-offs were $4.9 million, or 0.07% of total average loans, for the year ended December 31, 2023 and were $2.4 million, or 0.03% of total average loans, for the year ended December 31, 2022.

The table below provides additional information related to Park's allowance for credit losses as of December 31, 2023, September 30, 2023 and December 31, 2022.

| | | | | | | | | | | |

| (Dollars in thousands) | 12/31/2023 | 9/30/2023 | 12/31/2022 |

| Total allowance for credit losses | $ | 83,745 | | $ | 84,602 | | $ | 85,379 | |

| Allowance on accruing purchased credit deteriorated ("PCD") loans | — | | — | | — | |

| Specific reserves on individually evaluated loans | 4,983 | | 3,422 | | 3,566 | |

| General reserves on collectively evaluated loans | $ | 78,762 | | $ | 81,180 | | $ | 81,813 | |

| | | |

| Total loans | $ | 7,476,221 | | $ | 7,349,745 | | $ | 7,141,891 | |

| Accruing PCD loans | 2,835 | | 3,807 | | 4,653 | |

| Individually evaluated loans | 45,215 | | 40,839 | | 78,341 | |

| Collectively evaluated loans | $ | 7,428,171 | | $ | 7,305,099 | | $ | 7,058,897 | |

| | | |

| Total allowance for credit losses as a % of total loans | 1.12 | % | 1.15 | % | 1.20 | % |

| | | |

| General reserve as a % of collectively evaluated loans | 1.06 | % | 1.11 | % | 1.16 | % |

The total allowance for credit losses of $83.7 million at December 31, 2023 represented a $857,000, or 1.0%, decrease compared to $84.6 million at September 30, 2023. The decrease was due to a $2.4 million decrease in general reserves, partially offset by a $1.6 million increase in specific reserves.

The total allowance for credit losses of $83.7 million at December 31, 2023 represented a $1.6 million, or 1.9%, decrease compared to $85.4 million at December 31, 2022. The decrease was due to a $3.1 million decrease in general reserves partially offset by a $1.4 million increase in specific reserves.

As part of its quarterly allowance process, Park evaluates certain industries which are more likely to be under economic stress in the current environment. The office sector continues to face challenges as it adjusts to the new normal of work from home brought on by the pandemic. Nationally, office properties in downtown and urban business districts are seeing the most stress. As of December 31, 2023, Park had $220.8 million of loans which were fully or partially secured by non-owner-occupied office space. Of the $220.8 million in loans collateralized by non-owner-occupied office space, $219.2 million were accruing. This portfolio is not currently exhibiting signs of stress, but Park continues to monitor this portfolio, and others, for signs of deterioration.

Effective January 1, 2023, Park adopted Accounting Standards Update ("ASU") 2022-02. Among other things, this ASU eliminated the concept of troubled debt restructurings ("TDRs"). As a result of the adoption of this ASU and elimination of the concept of TDRs, total nonperforming loans ("NPLs") and total nonperforming assets ("NPAs") each decreased by $20.1 million effective January 1, 2023. Additionally, as a result of the adoption of this ASU, individually evaluated loans decreased by $11.5 million effective January 1, 2023.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Park cautions that any forward-looking statements contained in this Current Report on Form 8-K or made by management of Park are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements.

Risks and uncertainties that could cause actual results to differ materially include, without limitation:

•Park's ability to execute our business plan successfully and within the expected timeframe as well as our ability to manage strategic initiatives;

•current and future economic and financial market conditions, either nationally or in the states in which Park and our subsidiaries do business, that may reflect deterioration in business and economic conditions, including the effects of higher unemployment rates or labor shortages, the impact of persistent inflation, the impact of continued elevated interest rates, changes in the economy or global supply chain, supply-demand imbalances affecting local real estate prices, U.S. fiscal debt, budget and tax matters, geopolitical matters (including the impact of the Russia-Ukraine conflict and associated sanctions and export controls as well as the Israel-Hamas conflict), and any slowdown in global economic growth, any of which may result in adverse impacts on the demand for loan, deposit and other financial services, delinquencies, defaults and counterparties' inability to meet credit and other obligations and the possible impairment of collectability of loans;

•factors that can impact the performance of our loan portfolio, including changes in real estate values and liquidity in our primary market areas, the financial health of our commercial borrowers and the success of construction projects that we finance;

•the effect of monetary and other fiscal policies (including the impact of money supply, ongoing increasing market interest rate policies and policies impacting inflation, of the Federal Reserve Board, the U.S. Treasury and other governmental agencies) as well as disruption in the liquidity and functioning of U.S. financial markets, may adversely impact prepayment penalty income, mortgage banking income, income from fiduciary activities, the value of securities, deposits and other financial instruments, in addition to the loan demand and the performance of our loan portfolio, and the interest rate sensitivity of our consolidated balance sheet as well as reduce net interest margins;

•changes in the federal, state, or local tax laws may adversely affect the fair values of net deferred tax assets and obligations of state and political subdivisions held in Park's investment securities portfolio and otherwise negatively impact our financial performance;

•the impact of the changes in federal, state and local governmental policy, including the regulatory landscape, capital markets, elevated government debt, potential changes in tax legislation that may increase tax rates, government shutdown, infrastructure spending and social programs;

•changes in laws or requirements imposed by Park's regulators impacting Park's capital actions, including dividend payments and stock repurchases;

•changes in consumer spending, borrowing and saving habits, whether due to changes in retail distribution strategies, consumer preferences and behaviors, changes in business and economic conditions, legislative and regulatory initiatives, or other factors may be different than anticipated;

•changes in customers', suppliers', and other counterparties' performance and creditworthiness, and Park's expectations regarding future credit losses and our allowance for credit losses, may be different than anticipated due to the continuing impact of and the various responses to inflationary pressures and continued elevated interest rates;

•Park may have more credit risk and higher credit losses to the extent there are loan concentrations by location or industry of borrowers or collateral;

•the volatility from quarter to quarter of mortgage banking income, whether due to interest rates, demand, the fair value of mortgage loans, or other factors;

•the adequacy of our internal controls and risk management program in the event of changes in the market, economic, operational (including those which may result from our associates working remotely), asset/liability repricing, legal, compliance, strategic, cybersecurity, liquidity, credit and interest rate risks associated with Park's business;

•competitive pressures among financial services organizations could increase significantly, including product and pricing pressures (which could in turn impact our credit spreads), changes to third-party relationships and revenues, changes in the manner of providing services, customer acquisition and retention pressures, and Park's ability to attract, develop and retain qualified banking professionals;

•uncertainty regarding the nature, timing, cost and effect of changes in banking regulations or other regulatory or legislative requirements affecting the respective businesses of Park and our subsidiaries, including major reform of the regulatory oversight structure of the financial services industry and changes in laws and regulations concerning taxes, FDIC insurance premium levels, pensions, bankruptcy, consumer protection, rent regulation and housing, financial accounting and reporting, environmental protection, insurance, bank products and services, bank and bank holding company capital and liquidity standards, fiduciary standards, securities and other aspects of the financial services industry;

•Park's ability to meet heightened supervisory requirements and expectations;

•the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board, the SEC, the Public Company Accounting Oversight Board and other regulatory agencies, may adversely affect Park's reported financial condition or results of operations;

•Park's assumptions and estimates used in applying critical accounting policies and modeling which may prove unreliable, inaccurate or not predictive of actual results;

•the possibility that future credit losses may be higher than currently expected due to changes in economic assumptions;

•Park's ability to anticipate and respond to technological changes and Park's reliance on, and the potential failure of, a number of third-party vendors to perform as expected, including Park's primary core banking system provider, which can impact Park's ability to respond to customer needs and meet competitive demands;

•operational issues stemming from and/or capital spending necessitated by the potential need to adapt to industry changes in information technology systems on which Park and our subsidiaries are highly dependent;

•Park's ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks, including those of Park's third-party vendors and other service providers, which may prove inadequate, and could adversely affect customer confidence in Park and/or result in Park incurring a financial loss;

•a failure in or breach of Park's operational or security systems or infrastructure, or those of our third-party vendors and other service providers, resulting in failures or disruptions in customer account management, general ledger, deposit, loan, or other systems, including as a result of cyber attacks;

•the impact on Park's business and operating results of any costs associated with obtaining rights in intellectual property claimed by others and of the adequacy of Park's intellectual property protection in general;

•the existence or exacerbation of general geopolitical instability and uncertainty as well as the effect of trade policies (including the impact of potential or imposed tariffs, a U.S. withdrawal from or significant renegotiation of trade agreements, trade wars and other changes in trade regulations, closing of border crossings and changes in the relationship of the U.S. and its global trading partners);

•the impact on financial markets and the economy of any changes in the credit ratings of the U.S. Treasury obligations and other U.S. government-backed debt, as well as issues surrounding the levels of U.S., European and Asian government debt and concerns regarding the growth rates and financial stability of certain sovereign governments, supranationals and financial institutions in Europe and Asia and the risk they may face difficulties servicing their sovereign debt;

•the effect of a fall in stock market prices on Park's asset and wealth management businesses;

•our litigation and regulatory compliance exposure, including the costs and effects of any adverse developments in legal proceedings or other claims, the costs and effects of unfavorable resolution of regulatory and other governmental examinations or other inquiries, and liabilities and business restrictions resulting from litigation and regulatory investigations;

•continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends;

•the impact on Park's business, personnel, facilities or systems of losses related to acts of fraud, scams and schemes of third parties;

•the impact of widespread natural and other disasters, pandemics (including the COVID-19 pandemic), dislocations, regional or national protests and civil unrest (including any resulting branch closures or damages), military or terrorist activities or international hostilities (especially in light of the Russia-Ukraine conflict and the Israel-Hamas conflict) on the economy and financial markets generally and on us or our counterparties specifically;

•the potential further deterioration of the U.S. economy due to financial, political, or other shocks;

•the effect of healthcare laws in the U.S. and potential changes for such laws which may increase our healthcare and other costs and negatively impact our operations and financial results;

•the impact of larger or similar-sized financial institutions encountering problems, such as the recent closures of Silicon Valley Bank in California, Signature Bank in New York, First Republic Bank in California, and Heartland Tri-State Bank in Kansas, which may adversely affect the banking industry and/or Park's business generation and retention, funding and liquidity, including potential increased regulatory requirements and increased reputational risk and potential impacts to macroeconomic conditions;

•Park's continued ability to grow deposits or maintain adequate deposit levels in light of the recent bank failures;

•unexpected outflows of deposits which may require Park to sell investment securities at a loss;

•and other risk factors relating to the financial services industry as detailed from time to time in Park's reports filed with the SEC including those described in "Item 1A. Risk Factors" of Part I of Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, in "Item 1A. Risk Factors" of Part II of Park's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023, in "Item 1A. Risk Factors" of Part II of Park's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023 and in "Item 1A. Risk Factors" of Part II of Park's Quarterly Report on Form 10-Q for the quarterly period ended September, 30, 2023.

Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Item 8.01 - Other Events

Declaration of Cash Dividend

As reported in the Financial Results News Release, on January 22, 2024, the Park Board declared a $1.06 per common share quarterly cash dividend in respect of Park's common shares. The cash dividend is payable on March 8, 2024 to common shareholders of record as of the close of business on February 16, 2024. A copy of the Financial Results News Release is included as Exhibit 99.1 and the portion thereof addressing the declaration of the quarterly cash dividend by the Park Board is incorporated by reference herein.

Item 9.01 - Financial Statements and Exhibits.

(a)Not applicable

(b)Not applicable

(c)Not applicable

(d)Exhibits. The following exhibits are included with this Current Report on Form 8-K:

Exhibit No. Description

99.1 News Release issued by Park National Corporation on January 22, 2024 addressing financial results for the three months and the twelve months ended December 31, 2023 and declaration of quarterly cash dividend

99.2 Revised Park National Corporation Code of Business Conduct and Ethics

104 Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PARK NATIONAL CORPORATION |

| | | |

| Dated: January 22, 2024 | By: | /s/ Brady T. Burt |

| | | Brady T. Burt |

| | | Chief Financial Officer, Secretary and Treasurer |

| | | |

January 22, 2024 Exhibit 99.1

Park National Corporation reports 2023 results

NEWARK, Ohio ‒ Park National Corporation (Park) (NYSE American: PRK) today reported financial results for the fourth quarter and the full year of 2023. Park's board of directors declared a quarterly cash dividend of $1.06 per common share, payable on March 8, 2024, to common shareholders of record as of February 16, 2024.

“We are pleased to end the year with solid loan growth for the third consecutive quarter and enter 2024 with strong asset quality,” Park Chairman and Chief Executive Officer David Trautman said. “Park bankers remain committed to providing robust financial solutions in all market conditions.”

Park’s net income for the fourth quarter of 2023 was $24.5 million, a 25.9 percent decrease from $33.1 million for the fourth quarter of 2022. Fourth quarter 2023 net income per diluted common share was $1.51, compared to $2.02 for the fourth quarter of 2022. Park’s net income for the full year of 2023 was $126.7 million, a 14.6 percent decrease from $148.4 million for the full year of 2022. Net income per diluted common share was $7.80 for the full year of 2023, compared to $9.06 for the full year of 2022.

Net income for the fourth quarter of 2023 and 2022 and the full year 2023 and 2022 included several items of income and expense that impacted comparability of prior results. These items are detailed in the "Financial Reconciliation" section of this report. Considering these items impacting comparability of prior results, Park's adjusted (non-gaap) net income for the fourth quarter of 2023 was $32.4 million, a 1.9 percent increase from adjusted (non-gaap) net income of $31.8 million for the fourth quarter of 2022. Park’s adjusted (non-gaap) net income for the full year of 2023 was $133.9 million, a 0.2 percent decrease from adjusted (non-gaap) net income of $134.2 million for the full year of 2022.

Park’s total loans increased 4.7 percent during 2023.

“The personal relationships our bankers build with customers and a substantial core deposit base are pivotal factors impacting our stable net interest margin and overall financial results,” said Park President Matthew Miller. “Our unwavering attention to these factors serves as a testament to our customers that we are a reliable and trustworthy financial partner.”

Headquartered in Newark, Ohio, Park National Corporation has $9.8 billion in total assets (as of December 31, 2023). Park's banking operations are conducted through its subsidiary The Park National Bank. Other Park subsidiaries are Scope Leasing, Inc. (d.b.a. Scope Aircraft Finance), Guardian Financial Services Company (d.b.a. Guardian Finance Company) and SE Property Holdings, LLC.

Complete financial tables are listed below.

Category: Earnings

Media contact: Michelle Hamilton, 740.349.6014, media@parknationalbank.com

Investor contact: Brady Burt, 740.322.6844, investor@parknationalbank.com

Park National Corporation, 50 N. Third Street, Newark, Ohio 43055

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Park cautions that any forward-looking statements contained in this news release or made by management of Park are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements.

Risks and uncertainties that could cause actual results to differ materially include, without limitation:

•Park's ability to execute our business plan successfully and within the expected timeframe as well as our ability to manage strategic initiatives;

•current and future economic and financial market conditions, either nationally or in the states in which Park and our subsidiaries do business, that may reflect deterioration in business and economic conditions, including the effects of higher unemployment rates or labor shortages, the impact of persistent inflation, the impact of continued elevated interest rates, changes in the economy or global supply chain, supply-demand imbalances affecting local real estate prices, U.S. fiscal debt, budget and tax matters, geopolitical matters (including the impact of the Russia-Ukraine conflict and associated sanctions and export controls as well as the Israel-Hamas conflict), and any slowdown in global economic growth, any of which may result in adverse impacts on the demand for loan, deposit and other financial services, delinquencies, defaults and counterparties' inability to meet credit and other obligations and the possible impairment of collectability of loans;

•factors that can impact the performance of our loan portfolio, including changes in real estate values and liquidity in our primary market areas, the financial health of our commercial borrowers and the success of construction projects that we finance;

•the effect of monetary and other fiscal policies (including the impact of money supply, ongoing increasing market interest rate policies and policies impacting inflation, of the Federal Reserve Board, the U.S. Treasury and other governmental agencies) as well as disruption in the liquidity and functioning of U.S. financial markets, may adversely impact prepayment penalty income, mortgage banking income, income from fiduciary activities, the value of securities, deposits and other financial instruments, in addition to the loan demand and the performance of our loan portfolio, and the interest rate sensitivity of our consolidated balance sheet as well as reduce net interest margins;

•changes in the federal, state, or local tax laws may adversely affect the fair values of net deferred tax assets and obligations of state and political subdivisions held in Park's investment securities portfolio and otherwise negatively impact our financial performance;

•the impact of the changes in federal, state and local governmental policy, including the regulatory landscape, capital markets, elevated government debt, potential changes in tax legislation that may increase tax rates, government shutdown, infrastructure spending and social programs;

•changes in laws or requirements imposed by Park's regulators impacting Park's capital actions, including dividend payments and stock repurchases;

•changes in consumer spending, borrowing and saving habits, whether due to changes in retail distribution strategies, consumer preferences and behaviors, changes in business and economic conditions, legislative and regulatory initiatives, or other factors may be different than anticipated;

•changes in customers', suppliers', and other counterparties' performance and creditworthiness, and Park's expectations regarding future credit losses and our allowance for credit losses, may be different than anticipated due to the continuing impact of and the various responses to inflationary pressures and continued elevated interest rates;

•Park may have more credit risk and higher credit losses to the extent there are loan concentrations by location or industry of borrowers or collateral;

•the volatility from quarter to quarter of mortgage banking income, whether due to interest rates, demand, the fair value of mortgage loans, or other factors;

•the adequacy of our internal controls and risk management program in the event of changes in the market, economic, operational (including those which may result from our associates working remotely), asset/liability repricing, legal, compliance, strategic, cybersecurity, liquidity, credit and interest rate risks associated with Park's business;

•competitive pressures among financial services organizations could increase significantly, including product and pricing pressures (which could in turn impact our credit spreads), changes to third-party relationships and revenues, changes in the manner of providing services, customer acquisition and retention pressures, and Park's ability to attract, develop and retain qualified banking professionals;

•uncertainty regarding the nature, timing, cost and effect of changes in banking regulations or other regulatory or legislative requirements affecting the respective businesses of Park and our subsidiaries, including major reform of the regulatory oversight structure of the financial services industry and changes in laws and regulations concerning taxes, FDIC insurance premium levels, pensions, bankruptcy, consumer protection, rent regulation and housing, financial accounting and reporting, environmental protection, insurance, bank products and services, bank and bank holding company capital and liquidity standards, fiduciary standards, securities and other aspects of the financial services industry;

•Park's ability to meet heightened supervisory requirements and expectations;

•the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board, the SEC, the Public Company Accounting Oversight Board and other regulatory agencies, may adversely affect Park's reported financial condition or results of operations;

•Park's assumptions and estimates used in applying critical accounting policies and modeling which may prove unreliable, inaccurate or not predictive of actual results;

•the possibility that future credit losses may be higher than currently expected due to changes in economic assumptions;

•Park's ability to anticipate and respond to technological changes and Park's reliance on, and the potential failure of, a number of third-party vendors to perform as expected, including Park's primary core banking system provider, which can impact Park's ability to respond to customer needs and meet competitive demands;

•operational issues stemming from and/or capital spending necessitated by the potential need to adapt to industry changes in information technology systems on which Park and our subsidiaries are highly dependent;

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

•Park's ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks, including those of Park's third-party vendors and other service providers, which may prove inadequate, and could adversely affect customer confidence in Park and/or result in Park incurring a financial loss;

•a failure in or breach of Park's operational or security systems or infrastructure, or those of our third-party vendors and other service providers, resulting in failures or disruptions in customer account management, general ledger, deposit, loan, or other systems, including as a result of cyber attacks;

•the impact on Park's business and operating results of any costs associated with obtaining rights in intellectual property claimed by others and of the adequacy of Park's intellectual property protection in general;

•the existence or exacerbation of general geopolitical instability and uncertainty as well as the effect of trade policies (including the impact of potential or imposed tariffs, a U.S. withdrawal from or significant renegotiation of trade agreements, trade wars and other changes in trade regulations, closing of border crossings and changes in the relationship of the U.S. and its global trading partners);

•the impact on financial markets and the economy of any changes in the credit ratings of the U.S. Treasury obligations and other U.S. government-backed debt, as well as issues surrounding the levels of U.S., European and Asian government debt and concerns regarding the growth rates and financial stability of certain sovereign governments, supranationals and financial institutions in Europe and Asia and the risk they may face difficulties servicing their sovereign debt;

•the effect of a fall in stock market prices on Park's asset and wealth management businesses;

•our litigation and regulatory compliance exposure, including the costs and effects of any adverse developments in legal proceedings or other claims, the costs and effects of unfavorable resolution of regulatory and other governmental examinations or other inquiries, and liabilities and business restrictions resulting from litigation and regulatory investigations;

•continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends;

•the impact on Park's business, personnel, facilities or systems of losses related to acts of fraud, scams and schemes of third parties;

•the impact of widespread natural and other disasters, pandemics (including the COVID-19 pandemic), dislocations, regional or national protests and civil unrest (including any resulting branch closures or damages), military or terrorist activities or international hostilities (especially in light of the Russia-Ukraine conflict and the Israel-Hamas conflict) on the economy and financial markets generally and on us or our counterparties specifically;

•the potential further deterioration of the U.S. economy due to financial, political, or other shocks;

•the effect of healthcare laws in the U.S. and potential changes for such laws which may increase our healthcare and other costs and negatively impact our operations and financial results;

•the impact of larger or similar-sized financial institutions encountering problems, such as the recent closures of Silicon Valley Bank in California, Signature Bank in New York, First Republic Bank in California, and Heartland Tri-State Bank in Kansas, which may adversely affect the banking industry and/or Park's business generation and retention, funding and liquidity, including potential increased regulatory requirements and increased reputational risk and potential impacts to macroeconomic conditions;

•Park's continued ability to grow deposits or maintain adequate deposit levels in light of the recent bank failures;

•unexpected outflows of deposits which may require Park to sell investment securities at a loss;

•and other risk factors relating to the financial services industry as detailed from time to time in Park's reports filed with the SEC including those described in "Item 1A. Risk Factors" of Part I of Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, in "Item 1A. Risk Factors" of Part II of Park's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023, in "Item 1A. Risk Factors" of Part II of Park's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023 and in "Item 1A. Risk Factors" of Part II of Park's Quarterly Report on Form 10-Q for the quarterly period ended September, 30, 2023.

Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

| | | | | | | | | | | | | | | | | | | | |

| PARK NATIONAL CORPORATION |

| Financial Highlights |

| As of or for the three months ended December 31, 2023, September 30, 2023 and December 31, 2022 | | | | | |

| | | | | | | |

| | 2023 | 2023 | 2022 | | Percent change vs. |

| (in thousands, except common share and per common share data and ratios) | 4th QTR | 3rd QTR | 4th QTR | | 3Q '23 | 4Q '22 |

| INCOME STATEMENT: | | | | | | |

| Net interest income | $ | 95,074 | | $ | 94,269 | | $ | 94,606 | | | 0.9 | % | 0.5 | % |

| Provision for (recovery of) credit losses | 1,809 | | (1,580) | | 2,981 | | | N.M. | N.M. |

| Other income | 15,519 | | 27,713 | | 26,392 | | | (44.0) | % | (41.2) | % |

| Other expense | 79,043 | | 77,808 | | 77,654 | | | 1.6 | % | 1.8 | % |

| Income before income taxes | $ | 29,741 | | $ | 45,754 | | $ | 40,363 | | | (35.0) | % | (26.3) | % |

| Income taxes | 5,241 | | 8,837 | | 7,279 | | | (40.7) | % | (28.0) | % |

| Net income | $ | 24,500 | | $ | 36,917 | | $ | 33,084 | | | (33.6) | % | (25.9) | % |

| | | | | | | |

| MARKET DATA: | | | | | | |

| Earnings per common share - basic (a) | $ | 1.52 | | $ | 2.29 | | $ | 2.03 | | | (33.6) | % | (25.1) | % |

| Earnings per common share - diluted (a) | 1.51 | | 2.28 | | 2.02 | | | (33.8) | % | (25.2) | % |

| Quarterly cash dividend declared per common share | 1.05 | | 1.05 | | 1.04 | | | — | % | 1.0 | % |

| Special cash dividend declared per common share | — | | — | | 0.50 | | | N.M. | N.M. |