As

filed with the Securities and Exchange Commission on January 22, 2024

Registration

Statement No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

| BRIACELL

THERAPEUTICS CORP. |

| (Exact

name of registrant as specified in its charter) |

| British

Columbia |

|

47-1099599 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

Suite

300, 235 15th Street

West

Vancouver, BC V7T 2X1

(604)

921-1810

(Address,

including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Dr.

William V. Williams

Suite

300, 235 15th Street

West

Vancouver, BC V7T 2X1

(604)

921-1810

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

to:

Gregory

Sichenzia, Esq.

Avital

Perlman, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

Telephone:

(212) 930-9700

From

time to time after this Registration Statement becomes effective.

(Approximate

date of commencement of proposed sale to the public)

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting

company” in Rule 12b-2 of the Securities Exchange Act of 1934:

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

Growth Company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities nor does it

seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JANUARY 22, 2024

PROSPECTUS

BriaCell

Therapeutics Corp.

$200,000,000

Common

Shares

Warrants

Rights

Units

From

time to time, we may offer and sell up to $200,000,000 in aggregate of the securities described in this prospectus separately or together

in any combination, in one or more classes or series, in amounts, at prices and on terms that we will determine at the time of the offering.

This

prospectus provides a general description of the securities we may offer. We may provide specific terms of securities to be offered in

one or more supplements to this prospectus. We may also provide a specific plan of distribution for any securities to be offered in a

prospectus supplement. Prospectus supplements may also add, update or change information in this prospectus. You should carefully read

this prospectus and the applicable prospectus supplement, together with any documents incorporated by reference herein, before you invest

in our securities.

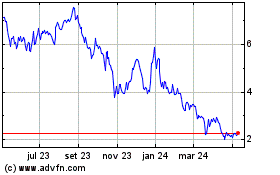

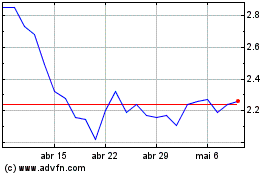

Our

common shares and public warrants are listed on the Nasdaq Capital Market under the symbols “BCTX” and “BCTXW,”

respectively. The last reported sale prices of our common shares and public warrants on the Nasdaq Capital Market on January 19, 2024,

were $4.15 per share and $2.03 per public warrant, respectively.

Investing

in any of our securities involves a high degree of risk. Please read carefully the section entitled “Risk Factors”

on page 4 of this prospectus, the “Risk Factors” section contained in the applicable prospectus supplement and the information

included and incorporated by reference in this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration or continuous offering process. Under this shelf registration process, we may, from time to time,

sell any combination of the securities described in this prospectus in one or more offerings up to a total aggregate offering price of

$200,000,000.

This

prospectus provides a general description of the securities we may offer. We may provide specific terms of securities to be offered in

one or more supplements to this prospectus. We may also provide a specific plan of distribution for any securities to be offered in a

prospectus supplement. Prospectus supplements may also add, update or change information in this prospectus. If the information varies

between this prospectus and the accompanying prospectus supplement, you should rely on the information in the accompanying prospectus

supplement.

Before

purchasing any securities, you should carefully read both this prospectus and any prospectus supplement, together with the additional

information described under the heading “Information We Incorporate by Reference.” You should rely only on the information

contained or incorporated by reference in this prospectus, any prospectus supplement and any free writing prospectus prepared by or on

behalf of us or to which we have referred you. Neither we nor any underwriters have authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the

information contained in this prospectus, any prospectus supplement or any free writing prospectus is accurate only as of the date on

its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated

by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since

those dates. This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference

is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to

the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under

the heading “Where You Can Find More Information.”

This

prospectus and any applicable prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the registered securities to which they relate. We are not making offers to sell common shares or any other securities described

in this prospectus in any jurisdiction in which an offer or solicitation is not authorized or in which we are not qualified to do so

or to anyone to whom it is unlawful to make an offer or solicitation.

Unless

otherwise expressly indicated or the context otherwise requires, we use the terms “BriaCell,” the “Company,”

“we,” “us,” “our” or similar references to refer to BriaCell Therapeutics Corp. and its subsidiaries.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed our registration statement on Form S-3 with the SEC under the Securities Act of 1933, as amended, or the Securities Act. We

also file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document

that we file with the SEC, including the registration statement and the exhibits to the registration statement, at the SEC’s Public

Reference Room located at 100 F Street, N.E., Washington D.C. 20549. Our SEC filings are also available to the public at the SEC’s

web site at www.sec.gov. These documents may also be accessed on our web site at www.briacell.com. Information contained on our web site

is not incorporated by reference into this prospectus and you should not consider information contained on our web site to be part of

this prospectus.

This

prospectus and any prospectus supplement are part of a registration statement filed with the SEC and do not contain all of the information

in the registration statement. The full registration statement may be obtained from the SEC or us as indicated above. Other documents

establishing the terms of the offered securities are filed as exhibits to the registration statement or will be filed through an amendment

to our registration statement on Form S-3 or under cover of a Current Report on Form 8-K and incorporated into this prospectus by reference.

INFORMATION

WE INCORPORATE BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be part of this prospectus. Any statement contained herein or in a document incorporated or deemed to be incorporated by reference into

this document will be deemed to be modified or superseded for purposes of the document to the extent that a statement contained in this

document or any other subsequently filed document that is deemed to be incorporated by reference into this document modifies or supersedes

the statement. We incorporate by reference in this prospectus the following information (other than, in each case, documents or information

deemed to have been furnished and not filed in accordance with SEC rules):

| ● |

our

Annual Report on Form 10-K for the fiscal year ended July 31, 2023, filed with the SEC on October 25, 2023; |

| |

|

| ● |

our Quarterly Report on Form 10-Q for the quarter ending

October 31, 2023, filed with the SEC on December 14, 2023; |

| |

|

| ● |

our

Current Reports on Form 8-K filed with the SEC on August

21, 2023; August

25, 2023; August

31, 2023; August

31, 2023; September

7, 2023; and December 20, 2023; |

| |

|

| ● |

our Definitive Proxy Statement for our Annual General

Meeting of Shareholders on Form DEF 14A, filed with the SEC on January 9, 2024; and |

| |

|

| ● |

our

Form 8-A12B, filed with the SEC on February 23, 2021. |

We

also incorporate by reference each of the documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities

Exchange Act of 1934, as amended, or the Exchange Act, (i) after the date of this prospectus and prior to effectiveness of this registration

statement on Form S-3 and (ii) on or after the date of this prospectus and prior to the termination of the offerings under this prospectus

and any prospectus supplement. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K, as well as proxy statements. We will not, however, incorporate by reference in this prospectus

any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant

to Item 2.02 or Item 7.01 of our Current Reports on Form 8-K after the date of this prospectus unless, and except to the extent, specified

in such Current Reports.

We

will provide to each person, including any beneficial owner, to whom a prospectus (or a notice of registration in lieu thereof) is delivered

a copy of any of these filings (other than an exhibit to these filings, unless the exhibit is specifically incorporated by reference

as an exhibit to this prospectus) at no cost, upon a request to us by writing or telephoning us at the following address and telephone

number:

BriaCell

Therapeutics Corp.

235

15th Street, Suite 300

West

Vancouver, BC, V7T 2X1

604-921-1810

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

information set forth in this prospectus may contain forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe

harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and describe our future plans,

strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,”

“may,” “will,” “should,” “could,” “would,” “seek,” “intend,”

“plan,” “goal,” “project,” “estimate,” “anticipate” “strategy,”

“future,” “likely” or other comparable terms and references to future periods. All statements other than statements

of historical facts included in this prospectus regarding our strategies, prospects, financial condition, operations, costs, plans and

objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding:

possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies;

future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash

needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

Forward-looking

statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, known

and unknown risks, changes in circumstances and other factors that are difficult to predict and many of which are outside of our control.

Our actual results, performance, achievements and financial condition may differ materially from those expressed or implied in such forward-looking

statements. Therefore, you should not place undue reliance on any of these forward-looking statements. The forward looking statements

contained herein and in the documents incorporated hereto by reference are presented for the purposes of assisting readers in understanding

BriaCell’s expected financial and operating performance and BriaCell’s plans and objectives, and may not be appropriate for

any other purpose.

Any

forward-looking statement made by us in this prospectus is based only on information currently available to us and speaks only as of

the date on which it is made.

We

undertake no obligation to publicly update any forward-looking statement, whether written or oral that may be made from time to time,

whether as a result of new information, future developments or otherwise, except as may be required under applicable law. We anticipate

that subsequent events and developments will cause our views to change. You should read this prospectus and the documents filed as exhibits

to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results

may be materially different from what we expect. Our forward-looking statements do not reflect the potential impact of any future acquisitions,

merger, dispositions, joint ventures, spinouts or investments we may undertake. We qualify all of our forward-looking statements by these

cautionary statements.

BriaCell

Therapeutics Corp.

BriaCell

Therapeutics Corp. (the “Company”), is a clinical-stage biotechnology company that is developing novel immunotherapies to

transform cancer care. Immunotherapies have come to the forefront in the fight against cancer as they harness the body’s own immune

system to recognize and destroy cancer cells. The Company is currently advancing its Bria-IMT™ targeted immunotherapy in combination

with an immune check point inhibitor in a pivotal Phase 3 study in advanced metastatic breast cancer. BriaCell recently reported benchmark-beating

patient survival and clinical benefit in advanced metastatic breast with median overall survival of 13.5 months in BriaCell’s advanced

metastatic breast cancer patients vs. 6.7-9.8 months for similar patients reported in the literature. A completed Bria-IMT™ Phase

1 combination study with retifanlimab (an anti-PD1 antibody manufactured by Incyte) confirmed tolerability and early-stage efficacy.

BriaCell is also developing a personalized off-the-shelf immunotherapy, Bria-OTS™, which provides a platform technology to develop

personalized off-the-shelf immunotherapies for numerous types of cancer, and a soluble CD80 protein therapeutic which acts both as a

stimulator of the immune system as well as an immune checkpoint inhibitor.

RISK

FACTORS

Investing

in our securities involves a high degree of risk, and there are various risk factors that could cause the Company’s future results

to differ materially from those described in this prospectus. Before making an investment decision, you should carefully consider any

risk factors set forth in the applicable prospectus supplement and the documents incorporated by reference in this prospectus, including

the factors discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and each subsequently

filed Quarterly Report on Form 10-Q and any risk factors set forth in our other filings with the SEC pursuant to Sections 13(a), 13(c),

14 or 15(d) of the Securities Exchange. See “Where You Can Find More Information” and “Information We Incorporate By

Reference.”. Each of the risks described in these documents could materially and adversely affect our business, financial condition,

results of operations and prospects, and could result in a partial or complete loss of your investment. If any of the risks described

in these documents, or any other risks and uncertainties that we have not yet identified or that we currently consider not to be material,

actually occur or become material risks, our business, financial condition, results of operations and cash flows, and consequently the

price of the common shares, could be materially and adversely affected. The risks discussed in these documents also include forward-looking

statements and our actual results may differ substantially from those discussed in these forward-looking statements. In addition, past

financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results

or trends in future periods.

Prospects

for companies in the life sciences industry generally may be regarded as uncertain, given the research and development nature of the

industry and uncertainty regarding the prospects of successfully commercializing product candidates. In particular, as the Company continues

to progress with conducting clinical trials of its product candidates, including Bria-IMTTM or Bria-OTSTM, additional

risk factors will arise and will be outlined in prospectus supplements as applicable.

USE

OF PROCEEDS

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Unless otherwise specified

in any prospectus supplement, we currently intend to use the net proceeds from the sale of our securities offered under this prospectus

for working capital and general corporate purposes including, but not limited to, research and development studies and the patent and

legal costs associated therewith, potential repurchase of certain of our issued shares and warrants and for general working capital purposes.

Pending any specific application, we may initially invest funds in short-term marketable securities or apply them to the reduction of

indebtedness.

DESCRIPTION

OF CAPITAL STOCK

The

following information describes the authorized share capital of the Company, as well as certain provisions of our articles, as amended

(the “Articles”). This description is only a summary. You should also refer to our Articles, which have been filed with the

SEC as exhibits to the registration statement of which this prospectus forms a part.

Description

of Common Shares

As

of January 22, 2024, our authorized share capital, as described in our Notice of Articles, consists of an unlimited number of

common shares, without par value, of which approximately 15,981,726 common shares are issued and outstanding. All of our outstanding

common shares are validly issued, fully paid and non-assessable.

Our

common shares are the only securities with respect to which a voting right may be exercised at a meeting of the shareholders of the Company.

Dividends.

Our shareholders are entitled to receive dividends, as may be declared from time to time and in the sole discretion of the Board.

Dividends shall be paid according to the number of Common Shares owned. Dividends may take the form of specific assets or of fully paid

shares or of bonds, debentures or other securities of the Company, or in any one or more of those ways. Shareholders are not entitled

to notice of any dividend. We have never paid cash dividends on our capital stock and we do not anticipate paying any dividends in the

foreseeable future.

Voting

Rights. Each common share is entitled to one vote at a meeting of shareholders of the Company.

Listing.

Our common shares are traded on the Nasdaq Capital Market under the symbol “BCTX” and on the Toronto Stock Exchange under

the symbol “BCT”. The transfer agent and registrar for our common shares is Computershare Investor Services Inc., 3rd Floor,

510 Burrard Street, Vancouver, British Columbia V6C 3B9, telephone: (604) 661-9474, facsimile: (604) 661-9401.

Description

of Warrants

General

The

following description, together with the additional information we include in any applicable prospectus supplement, summarizes the material

terms and provisions of the warrants that we may offer under this prospectus, which consist of warrants to purchase common shares. Warrants

may be offered independently or together with common shares by any prospectus supplement and may be attached to or separate from those

securities.

While

the terms we have summarized below will generally apply to any future warrants we may offer under this prospectus, we will describe the

particular terms of any warrants that we may offer in more detail in the applicable prospectus supplement. The specific terms of any

warrants may differ from the description provided below as a result of negotiations with third parties in connection with the issuance

of those warrants, as well as for other reasons. Because the terms of any warrants we offer under a prospectus supplement may differ

from the terms we describe below, you should rely solely on information in the applicable prospectus supplement if that summary is different

from the summary in this prospectus.

We

will issue the warrants under a warrant agreement, which we will enter into with a warrant agent to be selected by us. We use the term

“warrant agreement” to refer to any of these warrant agreements. We use the term “warrant agent” to refer to

the warrant agent under any of these warrant agreements. The warrant agent will act solely as an agent of ours in connection with the

warrants and will not act as an agent for the holders or beneficial owners of the warrants.

We

will incorporate by reference into the registration statement, of which this prospectus is a part, the form of warrant agreement, including

a form of warrant certificate, which describes the terms of the series of warrants we are offering before the issuance of the related

series of warrants. The following summaries of material provisions of the warrants and the warrant agreements are subject to, and qualified

in their entirety by reference to, all the provisions of the warrant agreement applicable to a particular series of warrants. We urge

you to read any applicable prospectus supplement related to the warrants that we sell under this prospectus, as well as the complete

warrant agreement that contain the terms of the warrants and defines your rights as a warrant holder.

We

will describe in the applicable prospectus supplement the terms relating to a series of warrants. If warrants for the purchase of common

shares are offered, the prospectus supplement will describe the following terms, to the extent applicable:

| ● |

the

offering price and the aggregate number of warrants offered; |

| ● |

the

total number of shares that can be purchased if a holder of the warrants exercises them; |

| |

|

| ● |

the

number of warrants being offered with each common share; |

| |

|

| ● |

the

date on and after which the holder of the warrants can transfer them separately from the related common shares; |

| |

|

| ● |

the

number of common shares that can be purchased if a holder exercises the warrant and the price at which those shares may be purchased

upon exercise, including, if applicable, any provisions for changes to or adjustments in the exercise price and in the securities

or other property receivable upon exercise; |

| |

|

| ● |

the

terms of any rights to redeem or call, or accelerate the expiration of, the warrants; |

| |

|

| ● |

the

date on which the right to exercise the warrants begins and the date on which that right expires; |

| |

|

| ● |

federal

income tax consequences of holding or exercising the warrants; and |

| |

|

| ● |

any

other specific terms, preferences, rights or limitations of, or restrictions on, the warrants. |

Warrants

for the purchase of common shares will be in registered form only.

A

holder of warrant certificates may exchange them for new certificates of different denominations, present them for registration of transfer

and exercise them at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement.

Until any warrants to purchase common shares are exercised, holders of the warrants will not have any rights of holders of the underlying

common shares, including any rights to receive dividends or to exercise any voting rights, except to the extent set forth under “Warrant

Adjustments” below.

Exercise

of Warrants

Each

holder of a warrant is entitled to purchase the number of common shares, as the case may be, at the exercise price described in the applicable

prospectus supplement. After the close of business on the day when the right to exercise terminates (or a later date if we extend the

time for exercise), unexercised warrants will become void.

A

holder of warrants may exercise them by following the general procedure outlined below:

| ● |

deliver

to the warrant agent the payment required by the applicable prospectus supplement to purchase the underlying security; |

| |

|

| ● |

properly

complete and sign the reverse side of the warrant certificate representing the warrants; and |

| |

|

| ● |

deliver

the warrant certificate representing the warrants to the warrant agent within five business days of the warrant agent receiving payment

of the exercise price. |

If

you comply with the procedures described above, your warrants will be considered to have been exercised when the warrant agent receives

payment of the exercise price, subject to the transfer books for the securities issuable upon exercise of the warrant not being closed

on such date. After you have completed those procedures and subject to the foregoing, we will, as soon as practicable, issue and deliver

to you the common shares that you purchased upon exercise. If you exercise fewer than all of the warrants represented by a warrant certificate,

a new warrant certificate will be issued to you for the unexercised amount of warrants. Holders of warrants will be required to pay any

tax or governmental charge that may be imposed in connection with transferring the underlying securities in connection with the exercise

of the warrants.

Amendments

and Supplements to the Warrant Agreements

We

may amend or supplement a warrant agreement without the consent of the holders of the applicable warrants to cure ambiguities in the

warrant agreement, to cure or correct a defective provision in the warrant agreement, or to provide for other matters under the warrant

agreement that we and the warrant agent deem necessary or desirable, so long as, in each case, such amendments or supplements do not

materially adversely affect the interests of the holders of the warrants.

Warrant

Adjustments

Unless

the applicable prospectus supplement states otherwise, the exercise price of, and the number of securities covered by, a warrant for

common shares will be adjusted proportionately if we subdivide or combine our common shares, as applicable. In addition, unless the prospectus

supplement states otherwise, if we, without payment:

| ● |

pay

any cash to all or substantially all holders of our common shares, other than a cash dividend paid out of our current or retained

earnings; |

| |

|

| ● |

issue

any evidence of our indebtedness or rights to subscribe for or purchase our indebtedness to all or substantially all holders of our

common shares; or |

| |

|

| ● |

issue

common shares or additional shares or other securities or property to all or substantially all holders of our common shares by way

of spinoff, split-up, reclassification, combination of shares or similar corporate rearrangement; |

then

the holders of common share warrants will be entitled to receive upon exercise of the warrants, in addition to the securities otherwise

receivable upon exercise of the warrants and without paying any additional consideration, the amount of shares and other securities and

property such holders would have been entitled to receive had they held the common shares issuable under the warrants on the dates on

which holders of those securities received or became entitled to receive such additional shares and other securities and property.

Except

as stated above, the exercise price and number of securities covered by a warrant for common shares, and the amounts of other securities

or property to be received, if any, upon exercise of those warrants, will not be adjusted or provided for if we issue those securities

or any securities convertible into or exchangeable for those securities, or securities carrying the right to purchase those securities

or securities convertible into or exchangeable for those securities.

Holders

of common share warrants may have additional rights under the following circumstances:

| ● |

certain

reclassifications, capital reorganizations or changes of the common shares; |

| |

|

| ● |

certain

share exchanges, mergers, or similar transactions involving us that result in changes of the common shares; or |

| |

|

| ● |

certain

sales or dispositions to another entity of all or substantially all of our property and assets. |

If

one of the above transactions occurs and holders of our common shares are entitled to receive shares, securities or other property with

respect to or in exchange for their securities, the holders of the common share warrants then-outstanding, as applicable, will be entitled

to receive upon exercise of their warrants the kind and amount of shares and other securities or property that they would have received

upon the applicable transaction if they had exercised their warrants immediately before the transaction.

Description

of Rights

The

following description, together with the additional information we include in any applicable prospectus supplement, summarizes the general

features of the rights that we may offer under this prospectus. We may issue rights to our shareholders to purchase our common shares

and/or any of the other securities offered hereby. Each series of rights will be issued under a separate rights agreement to be entered

into between us and a bank or trust company, as rights agent. When we issue rights, we will provide the specific terms of the rights

and the applicable rights agreement in a prospectus supplement. Because the terms of any rights we offer under a prospectus supplement

may differ from the terms we describe below, you should rely solely on information in the applicable prospectus supplement if that summary

is different from the summary in this prospectus. We will incorporate by reference into the registration statement of which this prospectus

is a part, the form of rights agreement that describes the terms of the series of rights we are offering before the issuance of the related

series of rights. The applicable prospectus supplement relating to any rights will describe the terms of the offered rights, including,

where applicable, the following:

| ● |

the

date for determining the persons entitled to participate in the rights distribution; |

| |

|

| ● |

the

exercise price for the rights; |

| |

|

| ● |

the

aggregate number or amount of underlying securities purchasable upon exercise of the rights; |

| |

|

| ● |

the

number of rights issued to each stockholder and the number of rights outstanding, if any; |

| |

|

| ● |

the

extent to which the rights are transferable; |

| |

|

| ● |

the

date on which the right to exercise the rights will commence and the date on which the right will expire; |

| |

|

| ● |

the

extent to which the rights include an over-subscription privilege with respect to unsubscribed securities; |

| |

|

| ● |

anti-dilution

provisions of the rights, if any; and |

| |

|

| ● |

any

other terms of the rights, including terms, procedures and limitations relating to the distribution, exchange and exercise of the

rights. |

Holders

may exercise rights as described in the applicable prospectus supplement. Upon receipt of payment and the rights certificate properly

completed and duly executed at the corporate trust office of the rights agent or any other office indicated in the prospectus supplement,

we will, as soon as practicable, forward the securities purchasable upon exercise of the rights. If less than all of the rights issued

in any rights offering are exercised, we may offer any unsubscribed securities directly to persons other than shareholders, to or through

agents, underwriters or dealers or through a combination of such methods, including pursuant to standby underwriting arrangements, as

described in the applicable prospectus supplement.

Description

of Units

We

may issue units comprising two or more securities described in this prospectus in any combination. For example, we might issue units

consisting of a combination of common shares and warrants to purchase common shares. The following description sets forth certain general

terms and provisions of the units that we may offer pursuant to this prospectus. The particular terms of the units and the extent, if

any, to which the general terms and provisions may apply to the units so offered will be described in the applicable prospectus supplement.

Each

unit will be issued so that the holder of the unit also is the holder of each security included in the unit. Thus, the unit will have

the rights and obligations of a holder of each included security. Units will be issued pursuant to the terms of a unit agreement, which

may provide that the securities included in the unit may not be held or transferred separately at any time or at any time before a specified

date. A copy of the forms of the unit agreement and the unit certificate relating to any particular issue of units will be filed with

the SEC each time we issue units, and you should read those documents for provisions that may be important to you. For more information

on how you can obtain copies of the forms of the unit agreement and the related unit certificate, see “Where You Can Find More

Information.”

The

prospectus supplement relating to any particular issuance of units will describe the terms of those units, including, to the extent applicable,

the following:

| ● |

the

designation and terms of the units and the securities comprising the units, including whether and under what circumstances those

securities may be held or transferred separately; |

| |

|

| ● |

any

provision for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units; and |

| |

|

| ● |

whether

the units will be issued in fully registered or global form. |

Certain

Important Provisions of our Articles and the BCBCA

The

following is a summary of certain important provisions of our Articles and certain related sections of the Business Corporations Act

(British Columbia) (“BCBCA”). Please note that this is only a summary and is not intended to be exhaustive. This summary

is subject to, and is qualified in its entirety by reference to, the provisions of our Articles and the BCBCA.

Directors

Power

to vote on matters in which a director is materially interested. Under the BCBCA a director who has a material interest in a contract

or transaction or who is a director or senior officer of, or has a material interest in, a person who has a material interest in the

contract or transaction, whether made or proposed, if that contract or transaction is material to us, must disclose such interest to

us. A director does not hold a disclosable interest in a contract or transaction if the contract or transaction: (i) is an arrangement

by way of security granted by us for money loaned to, or obligations undertaken by, the director for our benefit or for one of our affiliates’

benefit; (ii) relates to an indemnity or insurance permitted under the BCBCA; (iii) relates to the remuneration of the director in his

or her capacity as director, officer, employee or agent of our company or of one of our affiliates; (iv) relates to a loan to our Company

while the director, or a person in whom the director has a material interest, is the guarantor of some or all of the loan; or (v) has

been or will be made with or for the benefit of a corporation that is affiliated with us and the director is also a director or senior

officer of that corporation or an affiliate of that corporation.

A

director who holds a disclosable interest in a contract or transaction into which the Company has entered or proposes to enter is not

entitled to vote on any directors’ resolution to approve that contract or transaction, unless all the directors have a disclosable

interest in that contract or transaction, in which case any or all of those directors may vote on such resolution. A director who holds

a disclosable interest in a contract or transaction into which the Company has entered or proposes to enter and who is present at the

meeting of directors at which the contract or transaction is considered for approval may be counted in the quorum at the meeting whether

or not the director votes on any or all of the resolutions considered at the meeting.

A

director or senior officer who holds any office or possesses any property, right or interest that could result, directly or indirectly,

in the creation of a duty or interest that materially conflicts with that individual’s duty or interest as a director or senior

officer, must disclose the nature and extent of the conflict as required by the BCBCA.

.

Directors are also required to comply with certain other relevant provisions of the BCBCA regarding conflicts of interest.

Directors’

power to determine the remuneration of directors. The remuneration of our directors is determined by our directors subject to our

Articles. If the directors so decide, the remuneration of the directors, if any, will be determined by the shareholders. The remuneration

may be in addition to any salary or other remuneration paid to any of our employees (including executive officers) who are also directors.

Number

of shares required for director’s qualification. Directors do not need to own shares of the Company to qualify to be a director.

Shareholder

Meetings

Subject

to applicable stock exchange requirements, we must hold a general meeting of our shareholders at least once every calendar year and not

more than 15 months after the date of the annual general meeting for the preceding calendar year. A meeting of our shareholders may be

held anywhere in or outside British Columbia at a time and place determined by our board of directors.

A

notice to convene a meeting, specifying the date, time and location of the meeting, and, where a meeting is to consider special business,

the general nature of the special business must be sent to each shareholder entitled to attend the meeting and to each director not less

than 21 days and no more than two months prior to the meeting, although, as a result of applicable securities laws, the minimum time

for notice is effectively longer in most circumstances. Under the BCBCA, shareholders entitled to notice of a meeting may waive or reduce

the period of notice for that meeting, provided applicable securities laws are met. The accidental omission to send notice of any meeting

of shareholders to, or the non-receipt of any notice by, any person entitled to notice does not invalidate any proceedings at that meeting.

Our

Articles provide that a quorum for the transaction of business at a meeting of our shareholders is met where there are two persons who

are, or who represent by proxy, shareholders who, in the aggregate, hold at least 33.33% of the issued shares entitled to vote.

If

a quorum is not present at the opening of any meeting of shareholders, the meeting stands adjourned to the same day in the next week

at the same time and place, unless the meeting is requisitioned by shareholders, in which case the meeting is dissolved. At such adjourned

meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting

as originally notified.

When

a quorum is present or represented at any meeting, the vote of the holders of a majority of the shares having voting power present in

person or represented by proxy shall be sufficient to elect directors or to decide any question brought before such meeting, unless the

question is one upon which by express provision of the BCBCA or of the Articles, a different vote is required in which case such express

provision shall govern and control the decision of such question.

Each

shareholder of record of the Company shall be entitled at each meeting of shareholders to one vote for each common share held. Upon the

demand of any shareholder, the vote for directors and the vote upon any question before the meeting shall be conducted by ballot.

At

any meeting of the shareholders any shareholder may be represented and vote by a proxy or proxies appointed by an instrument in writing.

In the event that any such instrument in writing shall designate two or more persons to act as proxies, a majority of such persons present

at the meeting, or, if only one shall be present, then that one shall have and may exercise all of the powers conferred by such written

instrument upon all of the persons so designated unless the instrument shall otherwise provide. No proxy or power of attorney to vote

shall be used to vote at a meeting of the shareholders unless it shall have been validly deposited with the Company in accordance with

the Articles, the BCBCA and applicable securities laws. All questions regarding the qualification of voters, the validity of proxies

and the acceptance or rejection of votes shall be decided by the inspectors of election who shall be appointed in accordance with the

Articles, the BCBCA and applicable securities laws.

Any

action which may be taken by the vote of the shareholders at a meeting may be taken without a meeting if authorized by the written consent

of shareholders holding at least a majority of the voting power, unless the provisions of the BCBCA or of the Articles require a greater

proportion of voting power to authorize such action in which case such greater proportion of written consents shall be required.

Shareholder

Proposals

Under

the BCBCA, qualified shareholders holding at least one percent (1%) of our issued voting shares may make proposals for matters to be

considered at the annual general meeting of shareholders. Such proposals must be sent to us in advance of any proposed meeting by delivering

a timely written notice in proper form to our registered office in accordance with the requirements of the BCBCA and be accompanied by

one written statement in support of the proposal. The notice must include information on the business the shareholder intends to bring

before the meeting.

Forum

Selection

We

have not included a forum selection provision in our Articles.

Ownership

Limitation and Transfer of Shares

Our

common shares are not subject to transfer restrictions under our Articles, but may be subject to restrictions on transfer or prohibited

by another instrument, applicable law or the rules of a stock exchange on which the shares are listed for trade. The ownership or voting

of our common shares by non-residents of Canada is not restricted by our Articles.

Share

Transfers

Pursuant

to our Articles, a transfer of a share must not be registered unless:

| |

(a) |

Except

as exempted by the BCBCA, a duly signed proper instrument of transfer in respect of the share has been received by the Company; |

| |

(b) |

If

a share certificate has been issued by the Company in respect of the share to be transferred, that share certificate has been surrendered

to the Company; and |

| |

(c) |

if

a non-transferable written acknowledgment of the shareholder’s right to obtain a share certificate has been issued by the Company

in respect of the share to be transferred, that acknowledgment has been surrendered to the Company. |

Change

in Control

Our

Articles do not contain restrictions on change in control.

Election

of Directors

Our

common shares do not have cumulative voting rights for the election of directors. As a result, the holders of a majority of the voting

power represented at a shareholders meeting have the power to elect all of our directors.

The

directors shall be elected at the annual meeting of the shareholders by a simple majority vote of holders of our voting shares, participating

and voting at such meeting, and each director elected shall hold office until his successor is elected and qualified. However, in the

event of any vacancy in the Board, including those caused by an increase in the number of Directors, such vacancy may be filled by a

majority of the remaining directors, though less than a quorum, or by a sole remaining director, and each director so elected shall hold

office until his successor is elected at an annual or a special meeting of the shareholders. The holders of a two-thirds of the outstanding

shares of stock entitled to vote may at any time peremptorily terminate the term of office of all or any of the directors by vote at

a meeting called for such purpose or by a written statement filed with the secretary or, in his absence, with any other officer. Such

removal shall be effective immediately, even if successors are not elected simultaneously and the vacancies on the Board of Directors

resulting therefrom shall be filled only by the shareholders.

A

vacancy or vacancies in the Board of Directors shall be deemed to exist in case of the death, resignation or removal of any directors,

or if the authorized number of directors be increased in accordance with the Articles and the BCBCA, or if the shareholders fail at any

annual or special meeting of shareholders at which any director or directors are elected to elect the full authorized number of directors

to be voted for at that meeting.

The

shareholders may elect a director or directors at any time to fill any vacancy or vacancies not filled by the directors. If the Board

of Directors accepts the resignation of a director tendered to take effect at a future time, the Board or the shareholders shall have

power to elect a successor to take office when the resignation is to become effective.

No

reduction of the authorized number of directors shall have the effect of removing any director prior to the expiration of his term of

office.

Anti-Takeover

Measures

Our

Articles do not provide for any anti-takeover measures.

Changes

in Capital

Our

Articles enable us to increase or reduce our share capital. Any such changes are subject to the provisions of the BCBCA.

We

have had no change in share capital in the prior three years other than increasing the number of issued and outstanding common shares

as described elsewhere in this prospectus.

Exchange

Controls

The

BCBCA and our Articles do not provide for any restriction in connection with the following:

| |

(1) |

the

import or export of capital, including the availability of cash and cash equivalents for use by the company’s group; and |

| |

|

|

| |

(2) |

the

remittance of dividends, interest or other payments to nonresident holders of the company’s securities. |

PLAN

OF DISTRIBUTION

We

may sell the securities from time to time, by a variety of methods, including the following:

| ● |

on

any national securities exchange or quotation service on which our securities may be listed at the time of sale, including the Nasdaq

Capital Market; |

| |

|

| ● |

in

the over-the-counter market; |

| |

|

| ● |

in

transactions otherwise than on such exchange or in the over-the-counter market, which may include privately negotiated transactions

and sales directly to one or more purchasers; |

| |

|

| ● |

through

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

| ● |

through

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

| ● |

through

underwriters, broker-dealers, agents, in privately negotiated transactions, or any combination of these methods; |

| |

|

| ● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

| ● |

a

combination of any of these methods; or |

| |

|

| ● |

by

any other method permitted pursuant to applicable law. |

The

securities may be distributed from time to time in one or more transactions:

| ● |

at

a fixed price or prices, which may be changed; |

| |

|

| ● |

at

market prices prevailing at the time of sale; |

| |

|

| ● |

at

prices related to such prevailing market prices; or |

| |

|

| ● |

at

negotiated prices. |

Offers

to purchase the securities being offered by this prospectus may be solicited directly. Agents may also be designated to solicit offers

to purchase the securities from time to time. Any agent involved in the offer or sale of our securities will be identified in a prospectus

supplement.

If

a dealer is utilized in the sale of the securities being offered by this prospectus, the securities will be sold to the dealer, as principal.

The dealer may then resell the securities to the public at varying prices to be determined by the dealer at the time of resale.

If

an underwriter is utilized in the sale of the securities being offered by this prospectus, an underwriting agreement will be executed

with the underwriter at the time of sale and the name of any underwriter will be provided in the prospectus supplement that the underwriter

will use to make resales of the securities to the public. In connection with the sale of the securities, we, or the purchasers of securities

for whom the underwriter may act as agent, may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter

may sell the securities to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or commissions

from the underwriters and/or commissions from the purchasers for which they may act as agent. Unless otherwise indicated in a prospectus

supplement, an agent will be acting on a best efforts basis and a dealer will purchase securities as a principal, and may then resell

the securities at varying prices to be determined by the dealer.

Any

compensation paid to underwriters, dealers or agents in connection with the offering of the securities, and any discounts, concessions

or commissions allowed by underwriters to participating dealers will be provided in the applicable prospectus supplement. Underwriters,

dealers and agents participating in the distribution of the securities may be deemed to be underwriters within the meaning of the Securities

Act, and any discounts and commissions received by them and any profit realized by them on resale of the securities may be deemed to

be underwriting discounts and commissions. In compliance with the guidelines of the Financial Industry Regulatory Authority, Inc., or

FINRA, the maximum amount of underwriting compensation, including underwriting discounts and commissions, to be paid in connection with

any offering of securities pursuant to this prospectus may not exceed 8% of the aggregate principal amount of securities offered. We

may enter into agreements to indemnify underwriters, dealers and agents against civil liabilities, including liabilities under the Securities

Act, or to contribute to payments they may be required to make in respect thereof and to reimburse those persons for certain expenses.

The securities may or may not be listed on a national securities exchange. To facilitate the offering of securities, certain persons

participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of the securities. This

may include over-allotments or short sales of the securities, which involve the sale by persons participating in the offering of more

securities than were sold to them. In these circumstances, these persons would cover such over-allotments or short positions by making

purchases in the open market or by exercising their over-allotment option, if any. In addition, these persons may stabilize or maintain

the price of the securities by bidding for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions

allowed to dealers participating in the offering may be reclaimed if securities sold by them are repurchased in connection with stabilization

transactions. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that

which might otherwise prevail in the open market. These transactions may be discontinued at any time.

If

indicated in the applicable prospectus supplement, underwriters or other persons acting as agents may be authorized to solicit offers

by institutions or other suitable purchasers to purchase the securities at the public offering price set forth in the prospectus supplement,

pursuant to delayed delivery contracts providing for payment and delivery on the date or dates stated in the prospectus supplement. These

purchasers may include, among others, commercial and savings banks, insurance companies, pension funds, investment companies and educational

and charitable institutions. Delayed delivery contracts will be subject to the condition that the purchase of the securities covered

by the delayed delivery contracts will not at the time of delivery be prohibited under the laws of any jurisdiction in the United States

to which the purchaser is subject. The underwriters and agents will not have any responsibility with respect to the validity or performance

of these contracts.

We

may engage in at-the-market offerings into an existing trading market in accordance with rule 415(a)(4) under the Securities Act. In

addition, we may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties

in privately negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the

third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions.

If so, the third party may use securities pledged by us, or borrowed from us or others to settle those sales or to close out any related

open borrowings of common shares, and may use securities received from us in settlement of those derivatives to close out any related

open borrowings of our common shares. In addition, we may loan or pledge securities to a financial institution or other third party that

in turn may sell the securities using this prospectus and an applicable prospectus supplement. Such financial institution or other third

party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

The

underwriters, dealers and agents may engage in transactions with us, or perform services for us, in the ordinary course of business for

which they receive compensation.

LEGAL

MATTERS

Unless

otherwise indicated in the applicable prospectus supplement, certain legal matters in connection with the offering and the validity of

the securities offered by this prospectus, and any supplement thereto, will be passed upon by Sichenzia Ross Ference Carmel LLP with

respect to U.S. legal matters and by Bennett Jones LLP, Toronto, Canada with respect to Canadian legal matters.

EXPERTS

The

audited consolidated financial statements of the Company and its subsidiaries, as of and for the years ended July 31, 2023, and 2022,

included in this prospectus have been so included in reliance upon the report of MNP LLP, independent registered public accountants,

upon the authority of said firm as experts in accounting and auditing.

BriaCell

Therapeutics Corp.

$200,000,000

Common

Shares

Warrants

Rights

Units

PART

II

INFORMATION

NOT REQUIRED IN THE PROSPECTUS

ITEM

14. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The

following table sets forth the costs and expenses payable by us in connection with this offering, other than underwriting commissions

and discounts, all of which are estimated except for the SEC registration fee.

| SEC registration fee | |

$ | [29,520.00] | |

| Printing | |

$ | * | |

| Legal fees and expenses | |

$ | * | |

| Accounting fees and expenses | |

$ | * | |

| Warrant Agent Fees and Expenses | |

$ | * | |

| Miscellaneous | |

$ | * | |

| Total | |

$ | * | |

| * |

These

fees are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time.

The applicable prospectus supplement will set forth the estimated amount of expenses of any offering of securities. |

ITEM

15. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Indemnification

of Directors and Officers

Under

the BCBCA, subject to certain limitations set forth in section 163 of the BCBCA, a company may (a) indemnify: an eligible party against

all eligible penalties to which the eligible party is or may be liable, and (b) after the final disposition of an eligible proceeding,

pay the expenses actually and reasonably incurred by an eligible party in respect of that proceeding.

For

the purposes of this section:

“eligible

party” means (i) a current or former director or officer of that company; (ii) a current or former director or officer of another

corporation if, at the time such individual held such office, the corporation was an affiliate of the company, or if such individual

held such office at the company’s request; or (iii) an individual who, at the request of the company, held, or holds, an equivalent

position to that of, a director or officer of a partnership, trust, joint venture or other unincorporated entity;

“eligible

penalty” means a judgment, penalty or fine awarded or imposed in, or an amount paid in settlement of, an eligible proceeding;

and

“eligible

proceeding” means a proceeding in which an eligible party or any of the heirs and personal or other legal representatives of

the eligible party, by reason of the eligible party being or having been a director or officer of, or holding or having held a position

equivalent to that of a director or officer of, the company or an associated corporation (A) is or may be joined as a party, or (B) is

or may be liable for or in respect of a judgment, penalty or fine in, or expenses related to, the proceeding.

A

company must not indemnify or pay the expense of an eligible party if: (i) in relation to the subject matter of the eligible proceeding,

the eligible party did not act honestly and in good faith with a view to the best interests of such company or the other entity, as the

case may be; or (ii) in the case of an eligible proceeding other than a civil proceeding, the eligible party did not have reasonable

grounds for believing that the eligible party’s conduct was lawful. A company cannot indemnify an eligible party if it is prohibited

from doing so under its Articles, by the BCBCA or by other applicable law.

A

company may pay, as they are incurred in advance of the final disposition of an eligible proceeding, the expenses actually and reasonably

incurred by an eligible party in respect of that proceeding only if the eligible party has provided the company with an undertaking that,

if it is ultimately determined that the payment of expenses was prohibited by the BCBCA, the eligible party will repay any amounts advanced.

Subject to the aforementioned prohibitions on indemnification, a company must, after the final disposition of an eligible proceeding,

pay the expenses actually and reasonably incurred by an eligible party in respect of that proceeding if the eligible party has not been

reimbursed for such expenses, and was wholly successful, on the merits or otherwise, in the outcome of such proceeding or was substantially

successful on the merits in the outcome of such proceeding.

On

application from an eligible party, a court may make any order the court considers appropriate in respect of an eligible proceeding,

including the indemnification of an eligible party against any liability incurred by the eligible party in respect of an eligible proceeding,

the payment of some or all of the expenses incurred by an eligible party in respect of an eligible proceeding and the enforcement of

an indemnification agreement. As permitted by the BCBCA, under Section 21 of the Articles, we are required to indemnify our directors

and former directors (and such individual’s respective heirs and legal representatives) and we will indemnify any such person to

the extent permitted by the BCBCA.

We

maintain insurance policies relating to certain liabilities that our directors and officers may incur in such capacity.

Disclosure

of Commission Position on Indemnification for Securities Act Liabilities

Insofar

as indemnification for liabilities under the Securities Act may be permitted to officers, directors or persons controlling the Company

pursuant to the foregoing provisions, the Company has been informed that is it is the opinion of the SEC that such indemnification is

against public policy as expressed in such Securities Act and is, therefore, unenforceable.

ITEM

16. EXHIBITS

A

list of exhibits included as part of this registration statement is set forth in the Exhibit Index and is incorporated herein by reference.

ITEM

17. UNDERTAKINGS

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

provided,

however, Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-3

or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed

with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934

that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b)

that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required

by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier

of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the

offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date

an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the

registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in

any such document immediately prior to such effective date; or

(5)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

The registrant hereby undertakes that for purposes of determining any liability under the Securities Act of 1933, each filing of the

registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

(d)

The registrant hereby undertakes that:

(1)

For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part

of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule