As filed with the Securities and Exchange Commission

on January 23, 2024

Registration

No. 333-275235

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT NO. 1 TO

FORM

F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ARB

IOT GROUP LIMITED

(Exact

name of Registrant as specified in its charter)

Not

Applicable

(Translation

of Registrant’s Name into English)

| Cayman

Islands |

|

7373 |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification No.) |

2F-09,

Pusat Perdagangan IOI

No.

1 Persiaran Puchong Jaya Selatan,

Bandar

Puchong Jaya, 47100 Puchong, Selangor, Malaysia

Tel:

+6010-947 5998

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency

Global Inc.

122

East 42nd Street, 18th Floor

New

York, NY 10168

(800)

221-0102

(Names,

address, including zip code, and telephone number, including area code, of agent for service)

| Copies

to: |

Kevin

(Qixiang) Sun, Esq.

Bevilacqua

PLLC

1050

Connecticut Avenue, NW, Suite 500

Washington,

DC 20036

(202)

869-0888 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † |

The

term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a),

may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JANUARY 23, 2024

PRELIMINARY

PROSPECTUS

ARB

IOT GROUP LIMITED

Up

to 20,124,963 Ordinary Shares

This prospectus relates to the distribution

of up to 20,124,963 ordinary shares, par value $0.0001 per share, of ARB IOT Group Limited, a Cayman Islands exempted company with limited

liability (“we,” “us, “our” or “our company”), by our parent company, ARB Berhad, a Malaysian

company. ARB Berhad will distribute up to 20,124,963 of these shares to its shareholders.

We

will not receive any proceeds from the distribution of our ordinary shares to the shareholders of ARB Berhad.

Our

ordinary shares are traded on the Nasdaq Stock Market under the symbol “ARBB.”

On January 22, 2024, the last reported sale price for our ordinary shares was $1.16 per share.

Our

company is currently a 94.56% owned subsidiary of ARB Berhad. ARB Berhad is a public company listed on the Main Market of Bursa

Malaysia Securities Berhad. Its stock name on such exchange is “ARBB.”

This

prospectus is being furnished in connection with the distribution of our ordinary shares by ARB Berhad to its shareholders, which will

occur as soon as practicable after the registration statement of which this prospectus forms a part has been declared effective by the

Securities and Exchange Commission (the “SEC”). Following the distribution, our company will no longer be a majority-owned

subsidiary of ARB Berhad.

ARB

Berhad is effectuating the distribution pursuant to the terms of the resolutions adopted by its board of directors on October 17, 2023.

As of the date of this prospectus, we had 26,437,500 ordinary shares issued and outstanding, 25,000,000 of which were held by ARB Berhad.

ARB Berhad intends to distribute up to 20,124,963 of these shares to its shareholders, as all of its irredeemable convertible preference

shares (ICPS) had been converted into its ordinary shares as of the record date. The board of directors of ARB Berhad set the record

date for this distribution as January 22, 2024. As of the record date, ARB Berhad had 1,249,801,166 ordinary shares issued and outstanding.

ARB Berhad’s shareholders at the close of business

on the record date are entitled to receive the shares distributed on a pro rata basis. Consequently, ARB Berhad’s shareholders

will receive our ordinary shares at a ratio of 14 of our ordinary shares for every 1,000 ordinary shares of ARB Berhad that they held

on the record date. Our ordinary shares being distributed to the shareholders of ARB Berhad will be registered in book entry form and

no share certificates representing those shares will be delivered to any shareholders of ARB Berhad.

We

are furnishing this prospectus to provide information to the shareholders of ARB Berhad who will receive our ordinary shares in the distribution.

It is not, and is not to be construed as, an inducement or encouragement to buy or sell any of our securities or those of ARB Berhad.

No

approval by the shareholders of our company is required for distribution, and none is being sought. Nor is our company asking

you for a proxy.

We

are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, and as such, have

elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing

in our ordinary shares is highly speculative and involves a significant degree of risk. You are urged to carefully consider the risk

factors beginning on page 8 of this prospectus, in any accompanying prospectus supplement and in the documents incorporated by reference

into this prospectus before making any decision to invest in the securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is [ ], 2024

TABLE

OF CONTENTS

We

have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus

and we take no responsibility for any other information others may give you. The information contained in this prospectus is accurate

only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of our ordinary

shares.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere, or incorporated by reference, in this prospectus. This summary is not complete

and does not contain all of the information that you should consider before deciding whether to invest in our ordinary shares. You should

carefully read the entire prospectus, including the matters set forth under the section of this prospectus captioned “Risk Factors”

and the financial statements and related notes and other information that we incorporate by reference herein, including, but not limited

to, the 2023 Annual Report on Form 20-F and our other SEC reports.

Our

Company

Overview

We

are a provider of complete solutions to our clients for the integration of Internet of Things (“IoT”) systems and devices

from designing to project deployment. We offer a wide range of IoT systems as well as a substantial range of services such as system

integration and system support services. We deliver holistic solutions with full turnkey deployment from designing, installation, testing,

pre-commissioning, and commissioning of various IoT systems and devices as well as integration of automated systems, including installation

of wire and wireless and mechatronic works.

Recent

new technology trends such as artificial intelligence (“AI”), cloud computing, 5G, robotic process automation, IoT and hyper-connectivity

continue to transform businesses and drive companies to seek digital changes to meet evolving demands of customers. We have built up

an IoT development ecosystem to help our customers address the challenges and opportunities brought by new digital technologies, offering

an array of design and development system software, application software and other software in providing digital solutions for various

processes, sub-processes, transactions and activities.

Currently,

we have organized our operations into four business lines:

| |

● |

IoT

Smart Home & Building. Design and implement smart home & building solutions which can integrate a range of electrical

appliances, centralized control and remote monitoring, accessible via mobile devices and Windows operating systems. |

| |

● |

IoT

Smart Agriculture. Carry out services of supply, installation, commissioning and testing of smart hydroponic and farming

systems which include IoT concept and functionality to the existing systems. |

| |

● |

IoT

System Development. Provide industrial building management systems on construction projects to improve the efficiency and

accuracy of construction projects. We are also expanding into warehouse management system, point-of-sale system as well as drone

services for farms and plantations. |

| |

● |

IoT

Gadget Distribution. Support the marketing and sales of mobile gadget accessories by resellers, distributors and retailers,

who are responsible for distribution to end users in Malaysia. |

We

have benefited from ARB Berhad’s experience, reputation and network in the IT industry. Prior to the completion of our initial

public offering on April 10, 2023, we operated as an operating segment of ARB Berhad. As an operating segment of a seasoned public company,

we have gained from established business processes and a veteran leadership team, allowing us to focus our attention on growing and developing

our IoT business. While our history with ARB Berhad has provided us with certain competitive advantages, we believe that the separation

and our initial public offering and listing on the Nasdaq help promote clearer segregation of business responsibilities and operations

for the IoT segment, thereby enabling efficient allocation of resources to accelerate the growth of our IoT business, and allow us to

have direct access to a globally recognized stock exchange, which may increase our financial flexibility to explore expansion and growth

prospects and enhance our corporate reputation and recognition.

Following

this distribution, no single individual, entity or group will hold more than 50% of our voting power for the election of directors. As

such, we will no longer be deemed to be a controlled company under the Nasdaq Rules. In addition, following this distribution, we will

no longer be included in ARB Berhad’s consolidated group for Malaysian income tax, accounting or public company reporting purposes.

Our

revenue increased from approximately $10.8 million for the fiscal year ended June 30, 2021 to approximately $94.9 million for the fiscal

year ended June 30, 2022, an increase of $84.1 million, or 780.7%. Revenue decreased from approximately $94.9 million for the fiscal

year ended June 30, 2022 to approximately $51.9 million for the fiscal year ended June 30, 2023, a decrease of $43.0 million or 45.3%.

Our profit increased from approximately $4.0 million for the fiscal year ended June 30, 2021 to approximately $15.7 million for the fiscal

year ended June 30, 2022, an increase of $11.7 million or 288.4%. Profit decreased from approximately $15.7 million for the fiscal year

ended June 30, 2022 to approximately $5.9 million for the fiscal year ended June 30, 2023, a decrease of $9.8 million or 62.4%.

Our

Corporate History and Structure

In

October 1997, ARB Berhad, our controlling shareholder, was incorporated in Malaysia. Since February 2004, it has been listed on the Main

Market of Bursa Malaysia Securities Berhad. ARB Berhad commenced IoT business in 2019, starting with offering smart home and building

solutions.

On

March 1, 2022, ARB IOT Group Limited was incorporated under the laws of Cayman Islands as an indirect wholly owned subsidiary of ARB

Berhad. Following the completion of a restructuring in March 2022, ARB IOT Group Limited became an indirect holding company of our operating

subsidiaries which conduct IoT Smart Home & Building, IoT Smart Agriculture, IoT System Development and IoT Gadget Distribution businesses

in Malaysia.

On

June 9, 2022, we subdivided all of our 50,000 authorized shares of par value $1.00 each into 500,000,000 shares, par value $0.0001 each,

resulting in our direct shareholder then, ARB IOT Limited, holding 10,000 ordinary shares of par value $0.0001. On June 9, 2022, an additional

9,990,000 ordinary shares were issued to ARB IOT Limited for a purchase price of $0.0001 per share. On September 19, 2022, ARB IOT Limited

subscribed for another 15,000,000 ordinary shares, at a purchase price of $0.0001 per share.

On

April 10, 2023, we closed our initial public offering of 1,250,000 ordinary shares, at an offering price of $4.00 per ordinary share,

for gross proceeds of approximately $5.0 million. Our ordinary shares began trading on the Nasdaq Capital Market on April 5, 2023, under

the symbol “ARBB.” On April 25, 2023, we completed the sale of an additional 187,500 ordinary shares at the public offering

price of $4.00 per share, pursuant to the exercise by the underwriter of the over-allotment option, in full, granted to it in connection

with our initial public offering.

On

September 29, 2023, ARB IOT Limited who then directly held 25,000,000 ordinary shares of the Company, declared a dividend in specie of

these 25,000,000 shares to be paid to ARB Holdings Sdn. Bhd., the sole shareholder of ARB IOT Limited. On October 2, 2023, ARB Holdings

Sdn. Bhd. Declared a dividend in specie of the 25,000,000 shares to be paid to ARB Berhad, the sole shareholder of ARB Holdings Sdn.

Bhd. As a result, ARB Berhad directly holds 25,000,000, or 94.56%, of our issued and outstanding ordinary shares as of the date of this

prospectus.

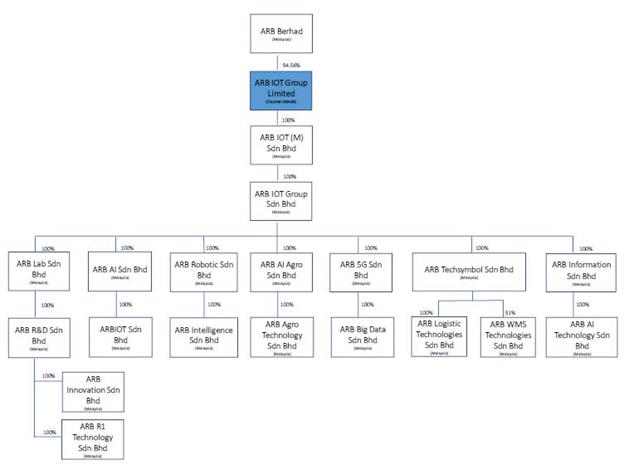

We operate our business through our indirect

subsidiaries in Malaysia. The following diagram illustrates our corporate structure as of the date of this prospectus.

Our

Risks and Challenges

An

investment in our ordinary shares involves a high degree of risk. You should carefully consider the risks summarized below. These risks

are discussed more fully in the “Risk Factors” section immediately following this Prospectus Summary. These risks

include, but are not limited to, the following:

| |

● |

We

have a limited operating history and experience in the Malaysian IoT industry, which may make it difficult to evaluate our business

and prospects and may not be indicative of our future growth or financial results. |

| |

● |

We

are subject to credit risks associated with a significant amount of accounts receivable, and if we are unable to collect accounts

receivable from our customers, our results of operations and cash flows could be materially adversely affected. |

| |

● |

We

are a holding company, and we are accordingly dependent upon distributions from our subsidiaries to service our debt and pay dividends,

if any, taxes and other expenses. |

| |

● |

If

our customers fail to pay us in accordance with the terms of their agreements, we may have to bring actions to compel payment. |

| |

● |

All

of our projects have agreed milestones and specific completion dates. If we fail to meet these contractual commitments, we could

be subject to financial penalties or claims for liquidated damages, which could adversely affect our business, operating results,

financial condition and prospects. |

| |

● |

A

major safety incident relating to our business could be costly in terms of potential liabilities and reputational damage. |

| |

● |

We

have engaged in and plan to conduct additional strategic transactions, which could divert our management’s attention, result

in additional dilution to our shareholders, disrupt our operations and adversely affect our operating results. We may not be able

to successfully integrate acquired businesses and technologies or achieve the anticipated benefits of such acquisitions. |

| |

● |

Our

planned expansions outside Malaysia and in the ASEAN region subject us to risks inherent in international operations that can harm

our business, results of operations, and financial condition. |

| |

● |

As

a IoT solution service provider, our success depends on our ability to recruit, deploy and manage employees. |

| |

● |

A

failure or breach of our security systems or infrastructure as a result of cyber-attacks could disrupt our business, result in the

disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses. |

| |

● |

We

are dependent on the continued services and performance of our senior management and other key employees, the loss of any of whom

could adversely affect our business, operating results and financial condition. |

| |

● |

The

market we compete is competitive. |

| |

● |

If

we fail to adopt new technologies to address evolving customer needs or emerging industry standards, our business may be materially

and adversely affected. |

| |

● |

We

are subject to general business regulations and laws, as well as regulations and laws specifically governing the Internet, physical

and e-commerce retail, digital content, web services, electronic devices, advertising, and other products and services that we offer

or sell. Unfavorable changes could harm our business. |

| |

● |

Our

operations are subject to various laws and regulations in Malaysia. |

| |

● |

Fluctuations

in exchange rates could adversely affect our business and the value of our securities. |

| |

● |

Because

our principal assets are located outside of the United States and all of our directors and officers reside outside of the United

States, it may be difficult for you to enforce your rights based on U.S. federal securities laws against us or our officers and directors

or to enforce a judgment of a United States court against us or our officers and directors in Malaysia. |

| |

● |

Some

of our directors and executive officers own shares of ARB Berhad or other securities or rights to acquire ARB Berhad’s shares

and hold positions with ARB Berhad, which could cause conflicts of interest, or the appearance of conflicts of interest. |

| |

● |

We

will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not

emerging growth companies, and our shareholders could receive less information than they might expect to receive from more mature

public companies. |

| |

● |

As

a foreign private issuer, we are permitted to rely on exemptions from certain Nasdaq corporate governance standards applicable to

domestic U.S. issuers. This may afford less protection to holders of our shares. |

Implications

of Being an Emerging Growth Company

We

had less than $1.235 billion in annual gross revenue during our last fiscal year. As a result, we qualify as an “emerging growth

company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and may take advantage of reduced

public reporting requirements. These provisions include, but are not limited to:

| |

● |

being

permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and

Analysis of Financial Condition and Results of Operations; |

| |

● |

not

being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

| |

● |

reduced

disclosure regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| |

● |

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute

payments not previously approved. |

We

may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first

sale of our initial public offering. However, if certain events occur before the end of such five-year period, including if we become

a “large accelerated filer,” if our annual gross revenues exceed $1.235 billion or if we issue more than $1.0 billion of

non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

Section

107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section

7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting

standards.

Implications

of Being a Foreign Private Issuer

We

report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with “foreign

private issuer” status. Even after we no longer qualify as an emerging growth company, so long as we qualify as a foreign private

issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act and the rules thereunder that are applicable

to U.S. domestic public companies, including:

| |

● |

the

rules under the Exchange Act that require U.S. domestic public companies to issue financial statements prepared under U.S. GAAP; |

| |

● |

sections

of the Exchange Act that regulate the solicitation of proxies, consents or authorizations in respect of any securities registered

under the Exchange Act; |

| |

● |

sections

of the Exchange Act that require insiders to file public reports of their share ownership and trading activities and that impose

liability on insiders who profit from trades made in a short period of time; and |

| |

● |

the

rules under the Exchange Act that require the filing with the SEC of quarterly reports on Form 10-Q, containing unaudited

financial and other specified information, and current reports on Form 8-K, upon the occurrence of specified significant

events. |

We

are required to file with the SEC, within four months after the end of each fiscal year (or such other reports required by the SEC),

an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We

may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private

issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents, and any of the following three

circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than

50% of our assets are located in the United States or (iii) our business is administered principally in the United States.

Both

foreign private issuers and emerging growth companies are also exempt from certain of the more extensive SEC executive compensation disclosure

rules. Therefore, if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt

from such rules and will continue to be permitted to follow our home country practice as to the disclosure of such matters.

Corporate

Information

Our

principal executive offices are located at 2F-09, Pusat Perdagangan IOI, No. 1 Persiaran Puchong Jaya Selatan, Bandar Puchong Jaya, 47100

Puchong, Selangor, Malaysia. The telephone number at our executive offices is +6010-947 5998.

ARB

IOT Group’s registered office is currently located at the offices of Conyers Trust Company (Cayman) Limited, Cricket Square, Hutchins

Drive, PO Box 2681, Grand Cayman, KY1-1111, Cayman Islands, which may be changed from time to time at the discretion of directors.

ARB

IOT Group’s agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street,

18th Floor, New York, NY 10168.

Our

website can be found at www.arbiotgroup.com. The information contained on our website is not a part of this prospectus, nor is such content

incorporated by reference herein, and should not be relied upon in determining whether to make an investment in our ordinary shares.

The

Offering

| Shares

outstanding:(1) |

|

26,437,500

shares. |

| Shares

to be distributed: |

|

Up

to 20,124,963 shares. |

| Use

of proceeds: |

|

We

will not receive any proceeds from the distribution of our shares by ARB Berhad. |

| The

distribution: |

|

ARB

Berhad will distribute up to 20,124,963 of our ordinary shares to its shareholders, representing

76.12% of our issued and outstanding ordinary shares. ARB Berhad will own 4,875,037, or 18.44%,

of our ordinary shares immediately following the distribution, if 20,124,963 of our ordinary

shares are distributed.

Of up to 20,124,963 ordinary shares to be

distributed, it is estimated that a total of 7,142,360 shares, or 27.02% of our issued and outstanding ordinary shares, will be beneficially

owned by our Chairman and Chief Executive Officer, Dato’ Sri Liew Kok Leong, by virtue of his direct and indirect ownership of

shares of ARB Berhad. See “Principal Shareholders” for additional information.

|

| Record

date: |

|

The record

date for the distribution is January 22, 2024. |

| Distribution

date: |

|

We

currently anticipate that the distribution will occur as soon as practicable after the date that the registration statement of which

this prospectus forms a part is declared effective by the SEC. |

| Distribution

ratio: |

|

If

you were a shareholder of ARB Berhad on the record date, you will receive 14 of our ordinary shares for every 1,000 shares of ARB

Berhad that you held on the record date. |

| Distribution

agent: |

|

VStock

Transfer, LLC, which serves as the transfer agent for our ordinary shares, will serve as distribution agent to distribute the shares.

|

| Distribution

of shares: |

|

On

the distribution date, the distribution agent will distribute up to 20,124,963 of our ordinary shares to the shareholders of ARB

Berhad on the record date. The shareholders of ARB Berhad will not be required to make any payment or take any other action to receive

our ordinary shares. |

| Lock-up

Agreement: |

|

Our

ordinary shares being distributed to the shareholders of ARB Berhad will be registered in

book entry form and no share certificates representing those shares will be delivered to

any shareholders of ARB Berhad.

The

shares you receive in the distribution will become freely tradeable unless you are an affiliate of our company.

|

| Certain

U.S. Federal income tax consequences: |

|

The

distribution may be taxable to the recipient, as with any dividend. |

| Appraisal

rights: |

|

The

shareholders of our company do not have any appraisal rights in connection with the distribution. |

| Nasdaq

trading symbol: |

|

ARBB |

| (1) | The

number of ordinary shares outstanding is based on 26,437,500 shares outstanding as of January

22, 2024 and excludes: |

| ● | 71,875

ordinary shares issuable upon exercise of outstanding warrants at an exercise price of $4.40

per share. |

Questions

And Answers Concerning The Distribution

Will

every shareholder of ARB Berhad share in proportion to their holdings in ARB Berhad?

Yes,

each shareholder of ARB Berhad will receive our ordinary shares at a ratio of 14 ordinary shares of our company for every 1,000 shares

of ARB Berhad that they held on the record date. Fractional shares will be disregarded and dealt with in such manner as ARB Berhad’s

board of directors shall in its discretion deem fair and in the best interests of ARB Berhad.

The

actual number of our ordinary shares that ARB Berhad’s shareholders will receive is illustrated as follows:

| Number of shares of ARB Berhad held on the record date | |

Number of our

ordinary shares to be received in the distribution | |

| 100 | |

| 1 | |

| 300 | |

| 4 | |

| 1,000 | |

| 14 | |

What

is the connection between ARB Berhad and our company?

We

are presently a 94.56% owned subsidiary of ARB Berhad. ARB Berhad is a public company listed on the Main Market of Bursa Malaysia Securities

Berhad. Its stock name on such exchange is “ARBB.”

Following the distribution, we will no longer

be a majority-owned subsidiary of ARB Berhad, and ARB Berhad will own approximately 18.44% of our issued and outstanding ordinary shares

immediately following the distribution.

Why

are we engaging in the distribution?

We

are engaging in the distribution principally because management of both our company and ARB Berhad believe that the distribution will

benefit the shareholders of ARB Berhad since distributing our ordinary shares will enable the shareholders of ARB Berhad to increase

or decrease their level of participation in our business by varying their level of investment in us separate from ARB Berhad, and will

benefit our shareholders by increasing the number of holders of our ordinary shares, which our management believes could enhance the

liquidity of our shares.

The

distribution will allow management of each company to focus solely on the business of that business. ARB Berhad focuses on the provision

of enterprise resource planning (ERP) solutions. Our company is engaged in providing IoT related solutions and systems. The distribution

will allow us to pursue our business plan independently. It also allows ARB Berhad to focus on its ERP business and other potential businesses.

The distribution will provide investors with greater choice and flexibility in their investment decisions. It may also enhance access

to financing by allowing the financial community to focus separately on each company.

Can

I sell my shares?

Our

ordinary shares being distributed to the shareholders of ARB Berhad will be registered in book entry form and no share certificates representing

those shares will be delivered to any shareholders of ARB Berhad.

Upon

distribution, our ordinary shares being distributed to shareholders of ARB Berhad will be freely transferable without restriction or

further registration under the Securities Act, except for shares received by persons who may be deemed to be our “affiliates,”

as such term is defined under the Securities Act. Persons who may be deemed to be our affiliates after the distribution include individuals

or entities that control, are controlled by or under common control with our company, and include our directors and executive officers,

as well as any shareholder owning 10% or more of our issued and outstanding ordinary shares. Ordinary shares of our company held by affiliates

may not be sold unless they are registered under the Securities Act or are sold pursuant to an exemption from registration, including

an exemption contained in Rule 144 under the Securities Act. See “Shares Eligible for Future Sale” for additional

information.

Where

will our ordinary shares trade?

Our

ordinary shares are traded on the Nasdaq Stock Market under the symbol “ARBB.”

What

are shares of our company worth?

The

value of our shares will be determined by their trading price after the distribution is effected. We do not know what the trading price

will be and we can provide no assurances as to the value of such shares, if any.

What

are the tax consequences to me of the distribution?

ARB

Berhad has not requested, nor does it intend to request, a ruling from the Internal Revenue Service or an opinion of tax counsel as to

the federal income tax consequences of the distribution. However, based on the facts of the proposed transaction, it is the opinion of

the management of ARB Berhad that the distribution of our ordinary shares will be treated as a taxable dividend distribution of property

to its shareholders. The amount of the distribution for purposes of Section 301 of the Internal Revenue Code of 1986, as amended (the

“Code”) will be equal to the fair market value of our shares on the date of the distribution. However, each shareholder’s

individual circumstances may affect the tax consequences of the distribution to such shareholder. We strongly urge all shareholders of

ARB Berhad to consult with their own tax, financial, or investment advisor or legal counsel experienced in these matters. See “Material

U.S. Federal Tax Consequences of the Distribution” for more information.

RISK

FACTORS

An

investment in our ordinary shares involves a high degree of risk. You should carefully consider the following risk factors, together

with the other information contained, or incorporated by reference, in this prospectus, before purchasing our ordinary shares. We have

listed below (not necessarily in order of importance or probability of occurrence) what we believe to be the most significant risk factors

applicable to us, but they do not constitute all of the risks that may be applicable to us. Any of the following factors could harm our

business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment.

Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please

refer to the section titled “Cautionary Statement Regarding Forward-Looking Statements”.

Risks

Related to Our Business

We

have a limited operating history and experience in the Malaysian IoT industry, which may make it difficult to evaluate our business and

prospects and may not be indicative of our future growth or financial results.

We

began operations in 2019, starting with offering smart home and building solutions, and since then, have expanded our product and service

offerings to provide IoT solutions for agriculture, construction, consumer electronics, retail and other industries. Following the business

expansion, our revenue increased from approximately RM50.3 million ($10.8 million) for the fiscal year ended June 30, 2021 to approximately

RM443.0 million ($94.9 million) for the fiscal year ended June 30, 2022, an increase of RM392.7 million ($84.1 million), or 780.7%. Our

profit increased from approximately RM18.9 million ($4.0 million) for the fiscal year ended June 30, 2021 to approximately RM73.4 million

($15.7 million) for the fiscal year ended June 30, 2022, an increase of 287.8%. In the fiscal year ended June 30, 2023, we focused on

providing IoT solutions such as point-of-sale system, inventory management system and other IoT machines to the retail industry, in order

to offset reduced revenues from system development for the construction and property development industries. While pivoting our business

strategy, our revenue decreased from approximately RM443.0 million ($94.9 million) for the fiscal year ended June 30, 2022 to approximately

RM242.1 million ($51.9 million) for the fiscal year ended June 30, 2023, a decrease of RM200.9 million ($43.0 million) or 45.3%. Profit

decreased from approximately RM73.4 million ($15.7 million) for the fiscal year ended June 30, 2022 to approximately RM27.5 million ($5.9

million) for the fiscal year ended June 30, 2023, a decrease of RM45.8 million ($9.8 million) or 62.4%. We have a limited operating history

in the Malaysian IoT industry, which makes it difficult to evaluate our business and prospects. Our growth prospects should be considered

in light of the risks and uncertainties that companies with a limited operating history and experience in our industry may encounter,

including, among others, risks and uncertainties regarding our ability to:

| |

● |

introduce

new products and services; |

| |

● |

improve

our existing products and services; |

| |

● |

retain

existing clients and attract new clients; |

| |

● |

identify

business synergies and enhance connectivity for our clients; |

| |

● |

adjust

and optimize our business model; |

| |

● |

successfully

compete with other companies that are currently in, or may in the future enter, our industry or similar industries; and |

| |

● |

observe

and strategize on the latest market trends. |

All

these endeavors involve risks and will require significant allocation of management and employee resources. We cannot assure you that

we will be able to effectively manage our growth or implement our business strategies effectively. If the market for our services does

not develop as we expect or if we fail to address the needs of this dynamic market, our business, results of operations, and financial

condition will be materially and adversely affected.

Our

expansion into new products, services, technologies, market segments and geographic regions subjects us to additional risks.

In

2021, we ventured into a number of new market segments, products and services, including IoT Smart Agriculture, industrial building management,

drone services and warehouse management. We have limited or no experience in our newer market segments, and our customers may not adopt

our product or service offerings. These offerings, which can present new and difficult technology challenges, may subject us to claims

if customers of these offerings experience service disruptions or failures or other quality issues. In addition, profitability, if any,

in our newer activities may not meet our expectations, and we may not be successful enough in these newer activities to recoup our investments

in them. In response to new regulatory requirements or industry standards, or in connection with the introduction of new products, we

may need to impose more rigorous risk management systems and policies, which may negatively affect the growth of our business. Any significant

change to our business model may not achieve expected results and may materially and adversely affect our financial condition and results

of operations. Failure to realize the benefits of amounts we invest in new technologies, products, or services could also result in the

value of those investments being written down or written off.

We

are subject to credit risks associated with a significant amount of accounts receivable, and if we are unable to collect accounts receivable

from our customers, our results of operations and cash flows could be materially adversely affected.

Our

normal trade credit terms range between 30 to 210 days. As of June 30, 2023, 2022 and 2021, we had approximately RM38.4 million ($8.2

million), RM101.2 million ($21.7 million) and RM23.7 million ($5.1 million) in trade receivables. We provide a long credit period from

210 days to 365 days to some large customers to secure contracts from them. However, our customers sometimes still require additional

time for payment, depending on their cash flow. Due to uncertainty of the timing of collection, we establish allowance for doubtful account

based on individual account analysis and historical collection trends. We establish a provision for doubtful receivables when there is

objective evidence that we may not be able to collect amounts due. The allowance is based on management’s best estimates of specific

losses on individual exposures, as well as on past trends of collections. Considering customers’ credit and ongoing relationship,

management makes conclusions whether any balances outstanding at the end of the period will be deemed uncollectible on an individual

basis and on aging analysis basis. The provision is recorded against account receivable balance, with a corresponding charge recorded

in the consolidated statements of operations and other comprehensive income. Delinquent account balances are written-off against the

allowance for doubtful accounts after management has determined that the likelihood of collection is not probable. We did not have any

bad debt write-off during the years ended June 30, 2023, 2022 and 2021.

Although

we manage credit risk related to our customers by performing periodic evaluations of credit worthiness and applying other credit risk

monitoring procedures, if there is an occurrence of circumstances that affect our customers’ ability to pay us such as deteriorating

conditions in, bankruptcies, or financial difficulties of a customer or within their industries generally, our operating cash flow will

be under tremendous pressure, and we could experience payment delays or default in payment to our suppliers or other creditors, which

may result in material and adverse impact on our business, results of operations and financial condition.

We

are a holding company, and we are accordingly dependent upon distributions from our subsidiaries to service our debt and pay dividends,

if any, taxes and other expenses.

We

are a Cayman Islands holding company and have no material assets other than ownership of equity interests in our subsidiaries. We have

no independent means of generating revenue. We intend to cause our subsidiaries to make distributions to their shareholders in an amount

sufficient to cover all applicable taxes payable and dividends, if any, declared by us. Our ability to service our debt, if any, depends

on the results of operations of our subsidiaries and upon the ability of such subsidiaries to provide us with cash, whether in the form

of dividends, loans or other distributions, to pay amounts due on our obligations. Future financing arrangements may contain negative

covenants that limit the ability of our subsidiaries to declare or pay dividends or make distributions. Our subsidiaries are separate

and distinct legal entities; to the extent that we need funds, and our subsidiaries are restricted from declaring or paying such dividends

or making such distributions under applicable law or regulations or are otherwise unable to provide such funds (for example, due to restrictions

in future financing arrangements that limit the ability of our operating subsidiaries to distribute funds), our liquidity and financial

condition could be materially harmed.

We

have engaged in transactions with related parties, and such transactions present possible conflicts of interest that could have an adverse

effect on our business and results of operations.

We

have entered into a number of transactions with ARB Berhad, our controlling shareholder, and its affiliated companies. We believe the

terms obtained or consideration that we paid or received, as applicable, in connection with these transactions were comparable to terms

available or the amounts that would be paid or received, as applicable, in arm’s-length transactions.

We

may in the future enter into additional transactions with entities controlled by ARB Berhad or in which any of our directors, officers

or principal shareholders (including ARB Berhad), or any members of their immediate family, have a direct or indirect material interest.

Such transactions present potential for conflicts of interest, as the interests of these entities and their shareholders may not align

with the interests of the Company and our unaffiliated shareholders with respect to the negotiation of, and certain other matters related

to, our purchases from and other transactions with such entities. Conflicts of interest may also arise in connection with the exercise

of contractual remedies under these transactions, such as for events of default.

Our

Audit Committee is responsible for reviewing and approving all material related party transactions. We rely on the laws of the Cayman

Islands, which provide that the directors owe a duty of care and a duty of loyalty to our company. Under Cayman Islands law, our directors

have a duty to act honestly, in good faith, and view our best interests. Our directors also have a duty to exercise the care, diligence,

and skills that a reasonably prudent person would exercise in comparable circumstances. Nevertheless, we may have achieved more favorable

terms if such transactions had not been entered into with related parties. These transactions, individually or in aggregate, may have

an adverse effect on our business and results of operations or may result in litigation or enforcement actions by the SEC or other agencies.

There

is no assurance that our IoT agriculture projects will operate as intended.

During the year ended June 30, 2023, we completed

construction and deployment of a newly developed IoT smart farming system on approximately 35 acres of lands in Kampung Tok Dor, Terengganu,

Malaysia. In the year ended June 30, 2022, we completed construction and deployment of our initial hydroponics IoT project on approximately

30 acres of land in Cameron Highlands, Pahang, Malaysia. However, as these projects were recently completed and have not been in operation

for long, they are subject to certain risks, including that they may not be able to achieve or maintain the intended benefits, such as

high production yields, lower crop losses and reduced operation costs.

If

our customers fail to pay us in accordance with the terms of their agreements, we may have to bring actions to compel payment.

We

typically enter into multiple year arrangements with our customers. If customers fail to pay us under the terms of our agreements, we

may be adversely affected both from the inability to collect amounts due and the cost of enforcing the terms of our contracts, including

litigation. The risk of such negative effects increases with the term length of our customer arrangements. Furthermore, some of our customers

may seek bankruptcy protection or other similar relief, including as a result of the impacts and disruptions caused by events beyond

their control such as the COVID-19 pandemic, and fail to pay amounts due to us, or pay those amounts more slowly, either of which could

adversely affect our business, results of operations and financial condition.

Our

product supply and service agreements generally give our customers flexibility to terminate engagements without cause by giving notice

in advance, and as such, subjects our revenue to uncertainty to some degree.

Our

product supply and service agreements, such as our drones agreements, typically allow our clients to terminate our master agreements

and work orders with or without cause, and, in the case of termination without cause, subject to 30 days’ prior notice.

Our

clients may terminate or reduce their use of our services for a number of reasons, including that they are not satisfied with our services

or our ability to meet their needs and expectations. Even if we successfully deliver on contracted services and maintain close relationships

with our clients, factors beyond our control could cause the loss of or reduction in business or revenue from our existing clients. These

factors include without limitation:

| |

● |

the

business or financial condition of that client or the economy generally; |

| |

● |

a

change in strategic priorities by our clients, resulting in a reduced level of spending on technology services; |

| |

● |

changes

in the personnel at our clients who are responsible for procurement of information technology, services or with whom we primarily

interact; |

| |

● |

a

demand for price reductions by our clients; and |

| |

● |

a

decision by that client to move work in-house or to one or several of our competitors. |

The

ability of our clients to terminate their engagement with us at will makes our future sales amounts uncertain. We may not be able to

replace any client that chooses to terminate or not renew its contract with us, which could materially adversely affect our revenue and

thus our results of operations. Furthermore, terminations in engagements may make it difficult to plan our project resource requirements.

If

a significant number of clients cease using or reduce their usage of our services, we may be required to spend significantly more on

sales and marketing than we currently plan to spend in order to maintain or increase revenue from clients or lay off our IT professionals.

Such changes could adversely affect our business, results of operations and financial condition.

We

depend on a limited number of customers for a large portion of our revenues.

We

consider our major customers in each period to be those customers that accounted for more than 10% of overall revenues in such period.

For the year ended June 30, 2023, the major customers of the Company were PSSBJAYA Holdings Sdn. Bhd., accounting for 31% of the total

revenue, and Annum Industries Sdn. Bhd, accounting for 15% of the total revenue. Both customers were unrelated third parties. For the

year ended June 30, 2022, one major customer, Ageson Industrial Sdn. Bhd. (formerly known as AB5 Sdn. Bhd.), accounted for 59.5% of the

revenues from the IoT System Development line of business and 34.8% of the total revenues. Ageson Industrial Sdn. Bhd. is a related party.

For the year ended June 30, 2022, another major customer, who is an unrelated third party, accounted for 30.9% of the revenues from the

IoT System Development line of business and 18.1% of the total revenues. For the year ended June 30, 2021, one (1) major customer, who

is an unrelated third party, accounted for 95.1% of the revenues from the IoT Smart Home & Building line of business and 56.2% of

the total revenues. For the year ended June 30, 2021, another major customer, ARB Cloud Sdn. Bhd., accounted for 100% of the revenues

from the IoT System Development line of business and 11.9% of the total revenues. ARB Cloud Sdn. Bhd. is a related party. The loss of,

or a substantial decrease in the volume of, revenues by any of our top customers could harm our revenues and profitability. In addition,

an adverse change in the terms of our dealings with, or in the financial wherewithal or viability of, one or more of our significant

customers could harm our business, financial condition and results of operations.

We

expect that a significant portion of our revenues will continue to be derived from a small number of customers and that the percentage

of revenues represented by these customers may increase. As a result, changes in the strategies of our largest customers or in their

operating environments may reduce our revenues, as a result of customers modifying their sales, pricing, or spending practices. The loss

of such sales could have an adverse effect on our business, financial condition and results of operations.

All

of our projects have agreed milestones and specific completion dates. If we fail to meet these contractual commitments, we could be subject

to financial penalties or claims for liquidated damages, which could adversely affect our business, operating results, financial condition

and prospects.

All

of our projects have agreed milestones and specific completion dates. There is a risk that we may encounter delays in completing our

projects or meeting agreed milestones. Failure to complete our projects on time or meet agreed milestones may subject us to financial

penalties and claims arising for liquidated damages by our customers. Any extended service delays could adversely affect our reputation,

ability to attract new customers and retain existing customers, revenue, and operating results.

We

depend on third-party providers and suppliers for components of our IoT smart agriculture, smart home and building, and industrial building

management systems and projects, third-party software licenses for our products and services, and third-party providers to transmit signals

to our monitoring facilities and provide other services to our customers. Any failure or interruption in products or services provided

by these third parties could harm our ability to operate our business.

We

source a variety of hardware and software from third party suppliers for our IoT smart agriculture, smart home and building, industrial

building management systems and projects. As a result, our ability to implement IoT solutions for customers depends on third parties

providing us with timely and reliable products and services at acceptable prices. In developing and operating our projects, we rely on

products supplied by third parties meeting our design and other specifications and on components manufactured and delivered from third

parties, and on certain services performed by third parties. We also rely on contractors to perform substantially all of the construction

and installation work related to our projects, and we may need to engage subcontractors with whom we have no experience. Any delays,

malfunctions, inefficiencies or interruptions in these products or services could adversely affect the quality and performance of our

projects and require considerable expense to maintain and repair our projects, which could harm our brand, reputation or growth. In addition,

if we are unable to avail ourselves of warranties and other contractual protections with providers of products and services, we may incur

additional costs related to the affected products and services, which could adversely affect our business, operating results, or financial

condition.

We

rely on third-party software for key automation features in certain of our offerings and on the interoperation of that software with

our own, such as our mobile applications and related platform. We could experience service disruptions if customer usage patterns for

such offerings exceed, or are otherwise outside of, design parameters for the system and the ability for us or our third-party provider

to make corrections. Such interruptions in the provision of services could result in our inability to meet customer demand, damage our

reputation and customer relationships, and materially and adversely affect our business. We also rely on certain software technology

that we license from third parties and use in our products and services to perform key functions and provide critical functionality.

For example, we license the software platform for our monitoring operations from third parties. Because a number of our products and

services incorporate technology developed and maintained by third parties, we are, to a certain extent, dependent upon such third parties’

ability to update, maintain, or enhance their current products and services; to ensure that their products are free of defects or security

vulnerabilities; to develop new products and services on a timely and cost-effective basis; and to respond to emerging industry standards,

customer preferences, and other technological changes. Further, these third-party technology licenses may not always be available to

us on commercially reasonable terms, or at all. If our agreements with third-party vendors are not renewed or the third-party software

becomes obsolete, is incompatible with future versions of our products or services, or otherwise fails to address our needs, we cannot

provide assurance that we would be able to replace the functionality provided by the third-party software with technology from alternative

providers. Furthermore, even if we obtain licenses to alternative software products or services that provide the functionality we need,

we may be required to replace hardware installed at our monitoring centers and at our customers’ sites, including security system

control panels and peripherals, in order to execute our integration of or migration to alternative software products. Any of these factors

could materially adversely affect our business, financial condition, results of operations, and cash flows.

We

will rely on various third-party telecommunications providers (if any) and signal processing centers (if any) to transmit and communicate

signals to our monitoring facility in a timely and consistent manner. These telecommunications providers and signal processing centers

could deprioritize or fail to transmit or communicate these signals to the monitoring facility for many reasons, including disruptions

from fire, natural disasters, pandemics, weather and the effects of climate change (such as flooding, wildfires, and increased storm

severity), transmission interruption, malicious acts, provider preference, government action, or terrorism. The failure of one or more

of these telecommunications providers or signal processing centers to transmit and communicate signals to the monitoring facility in

a timely manner could affect our ability to provide alarm monitoring, automation, and interactive services to our customers. We also

rely on third-party technology companies to provide automation and interactive services to our customers. These technology companies

could fail to provide these services consistently, or at all, which could result in our inability to meet customer demand and damage

our reputation. There can be no assurance that third-party telecommunications providers, signal processing centers, and other technology

companies will continue to transmit and communicate signals to the monitoring facility or provide automation and interactive services

to customers without disruption. Any such failure or disruption, particularly one of a prolonged duration, could have a material adverse

effect on our business, financial condition, results of operations, and cash flows.

We

source software and hardware from various local suppliers and any disruption in global supply chain may affect our business, operating

results, and financial condition.

We

source hardware and software from local suppliers. While we are not dependent on any single supplier, any serious and prolonged global

shortage of hardware and software required to implement our projects may lead to delay in delivery to customers which may affect our

reputation, our business relationship with our customers, or expose us to late delivery penalties. This in turn could potentially result

in loss of business opportunities or loss of revenue that may adversely affect our profitability and growth.

Our

success in the IoT gadgets distribution business depends on our relationships with third party gadget suppliers and their continued performance.

We

source IoT gadgets primarily from a third party supplier on an order-by-order basis and sell them through a large number of resellers,

distributors and retailers. We provide sales services to these resellers, distributors and retailers to support their distribution to

end users. If the products of the third party supplier have real or perceived quality or safety issues, we may experience negative effects

to our reputation as a result of our procurement of products from them. In addition, such supplier may develop relationships with our

competitors and such relationships may result in them terminating collaboration with us. If we fail to effectively manage our relationships

with, or lose such supplier, we may not be able to substitute them with suitable alternative business partners in a timely manner on

commercially acceptable terms or at all, which may negatively impact our revenues, financial condition, operations and prospects.

Indemnity

provisions in various agreements potentially expose us to substantial liability for intellectual property infringement and other losses.

Our

agreements with customers and other third parties generally include indemnification provisions under which we agree to indemnify them

for losses suffered or incurred as a result of claims of intellectual property infringement, or other liabilities relating to or arising

from our software, services or other contractual obligations. Large indemnity payments could harm our business, results of operations,

and financial condition. Although we normally contractually limit our liability with respect to such indemnity obligations, those limitations

may not be fully enforceable in all situations, and we may still incur substantial liability under those agreements. Any dispute with

a customer with respect to such obligations could have adverse effects on our relationship with that customer and other existing customers

and new customers and harm our business and results of operations.

Our

ability to manage approximately 1,100 resellers, distributors and retailers for the distribution of IoT gadgets is subject to a number

of risks.

We have a total of

approximately 1,100 resellers, distributors and retailers for the distribution of mobile gadget accessories. This business line is primarily

based on individual purchase orders placed by these resellers, distributors and retailers. If they fail to successfully market and sell

gadget products to end users, or fail to obtain sufficient capital or effectively manage their business operations, consumer relationships,

labor relationships or credit risks, it could adversely affect our revenues, as a result of reduced sales of gadget products to them.

A

major safety incident relating to our business could be costly in terms of potential liabilities and reputational damage.

Construction

sites are inherently dangerous, and provision of services to the construction, homebuilding and land development industries poses certain

inherent health and safety risks. Due to health and safety regulatory requirements and the projects we work on, health and safety performance

is critical to the success of our solutions in these fields.

Any

failure in health and safety performance may result in penalties for non-compliance with relevant regulatory requirements or litigation,

and a failure that results in a major or significant health and safety incident is likely to be costly in terms of potential liabilities

incurred as a result. Such a failure could generate significant negative publicity and have a corresponding impact on our reputation

and our relationships with relevant regulatory agencies, governmental authorities and local communities, which in turn could have a material

adverse effect on our business, prospects, liquidity, financial condition and results of operations.

We

have engaged in and plan to conduct additional strategic transactions, which could divert our management’s attention, result in

additional dilution to our shareholders, disrupt our operations and adversely affect our operating results. We may not be able to successfully

integrate acquired businesses and technologies or achieve the anticipated benefits of such acquisitions.

In

pursuing our business strategy, we have in the past acquired and plan to seek to acquire or invest in businesses, products, technologies,

or talent that we believe could complement or expand our business, augment our service and solution offerings, enhance our technical

capabilities or otherwise offer growth opportunities. We may compete with others for the same opportunities. The pursuit of any of these

strategic transactions may divert the attention of management and cause us to incur various expenses in identifying, investigating, and

pursuing suitable transactions, whether or not they are consummated.

Any

strategic transaction may result in unforeseen operating difficulties and expenditures. If we acquire additional businesses or enter

into other strategic transactions, we may not be able to integrate the acquired personnel, operations, and technologies successfully,

or effectively manage the combined business following the strategic transactions. In addition, we have limited experience in consummating

strategic transactions. We also may not achieve the anticipated benefits from the strategic transactions due to a number of factors,

including:

| |

● |

failure

to evaluate, integrate, utilize or benefit from or accurately anticipate the adoption rates of acquired technologies or services; |

| |

● |

product

synergies, cost reductions, increases in revenue and economies of scale may not materialize as expected; |

| |

● |

difficulty

in retaining, motivating and integrating key management and other employees of the acquired business; |

| |

● |

the

business culture of the acquired entity may not match well with our culture; |

| |

● |

unforeseen

delays, unanticipated costs and liabilities may arise when integrating operations, processes and systems in geographies where we

have not conducted business; |

| |

● |

unanticipated

costs or liabilities associated with the strategic transactions; |

| |

● |

incurrence

of transaction-related costs; |

| |

● |

assumption

of the existing obligations or unforeseen liabilities of the acquired business that we were not able to mitigate through due diligence

or other means; |

| |

● |

difficulty

integrating the accounting systems, security infrastructure, operations, and personnel of the acquired business; |

| |

● |

difficulties

and additional expenses associated with supporting legacy products and hosting infrastructure of the acquired business; |

| |

● |

difficulty

converting the current and prospective customers of the acquired business onto our platform and contract terms, including

disparities in the revenue, licensing, support, or professional services model of the acquired company; |

| |

● |

diversion

of management’s attention from other business concerns; |

| |

● |

adverse

effects to our existing business relationships with business partners and customers as a result of the strategic transactions; |

| |

● |

unexpected

costs may arise due to unforeseen changes in tax, payroll, pension, labor, trade, environmental and safety policies in new jurisdictions

where the acquired entity operates; |

| |

● |

use

of resources that are needed in other parts of our business; and |

| |

● |

use

of substantial portions of our available cash to consummate the strategic transaction. |

In

addition, a significant portion of the purchase price of companies we acquire may be allocated to acquired goodwill and other intangible

assets, which must be assessed for impairment at least annually. In the future, if our acquisitions do not yield expected returns, we

may be required to take charges to our operating results based on this impairment assessment process, which could adversely affect our

results of operations.

Strategic

transactions could also result in dilutive issuances of equity securities or the incurrence of debt, which could adversely affect our

operating results, increase our financial risk, restrict our ability to take certain actions and cause the market price of our ordinary

shares to decline. In addition, if a strategic transaction fails to meet our expectations, our operating results, business, and financial

position may suffer.

We

may be required to record impairment charges against the carrying value of our goodwill and other intangible assets in the future.

As

of June 30, 2023, 2022 and 2021, we had recorded goodwill and intangible assets with a net book value of RM116.6 million ($25.0 million),

RM139.1 million ($29.8 million) and RM68.7 million ($14.7 million), respectively. Besides amortizing intangible assets over 5 to

10 years, we are required to test for impairment at least annually and whenever evidence of impairment exists. During the year ended

June 30, 2023, 2022 and 2021, amortization of intangible assets of approximately RM22.4 million ($4.8 million), RM15.4 million ($3.3

million) and RM1.5 million ($0.3 million) were recorded in our statements of profit or loss, respectively. Other than that, we have not

recorded any impairment charges against the carrying value of our goodwill and intangible assets in the past. The carrying value of our

goodwill and intangible asset values are measured using a variety of factors, including values of comparable companies, overall stock

market and economic data and our own projections of future financial performance. We may be required in the future to record impairment

charges that could have a material adverse effect on our reported results.

We

will likely need to increase the size and capabilities of our organization, and we may experience difficulties in managing our growth.

In

order to execute our business plans, we expect that we will need to increase the number of our employees and the scope of our operations.

Our future financial performance and our ability to deliver solutions and services that meet customers’ expectations and to compete

effectively will depend, in part, on our ability to manage any future growth effectively. To manage our anticipated future growth, we

will need to continue to implement and improve our managerial, operational and financial systems, expand our facilities and continue

to recruit and train additional qualified personnel. In addition, the expansion of our systems and infrastructure may require us to commit

financial, operational and managerial resources before our revenues increase and without assurances that our revenues will increase.

Moreover, continued growth could strain our ability to maintain reliable service levels for our customers. If we fail to achieve the

necessary level of efficiency as we grow, our growth rate may decline and investors’ perceptions of our business and our prospects

may be adversely affected, and the market price of our securities could decline.

Our

lack of business insurance could expose us to significant costs and business disruption.

The

IoT industry in Malaysia is an emerging sector. We currently do not have any product liability or disruption insurance to cover our operations

in Malaysia, which, based on public information available to us relating to Malaysia-based IoT companies, is consistent with customary

industry practice in Malaysia. We have determined that the costs of insuring for these risks and the difficulties associated with acquiring

such insurance on commercially reasonable terms make it impractical for us to have such insurance. If we suffer any losses, damages or

liabilities in the course of our business operations, we would not have insurance coverage to provide funds to cover any such losses,

damages or product claim liabilities. Therefore, there may be instances when we will sustain losses, damages and liabilities because

of our lack of insurance coverage, which may in turn materially and adversely affect our financial condition and results of operations.

Our

planned expansions outside Malaysia and in the ASEAN region subject us to risks inherent in international operations that can harm our

business, results of operations, and financial condition.

A

key element of our strategy is to operate and sell our solutions to customers across the ASEAN region. Operating internationally requires

significant resources and management attention. We cannot be certain that the investment and additional resources required to operate

internationally will produce desired levels of revenue or profitability. Further, operating internationally subjects us to various risks,

including:

| ● | increased

management, travel, infrastructure and legal compliance costs associated with having

operations in many countries; |

| ● | increased

financial accounting and reporting burdens and complexities; |

| ● | variations

in adoption and acceptance of our solutions and services in different countries, requirements

or preferences for domestic products, and difficulties in replacing products offered by more

established or known regional competitors; |

| ● | new

and different sources of competition; |

| ● | laws

and business practices favoring local competitors; |

| ● | differing

technical standards, existing or future regulatory and certification requirements and required

features and functionality; |

| ● | communication

and integration problems related to entering and serving new markets with different languages,

cultures, and political systems; |

| ● | compliance

with foreign privacy and security laws and regulations, including data privacy laws that

require customer data to be stored and processed in a designated territory, and the risks

and costs of non-compliance; |

| ● | customer

preference for data to be stored in a specific geography, location, or region based on unique

customer requirements even if not required by applicable privacy and security laws and regulations; |

| ● | compliance

with laws and regulations for foreign operations, including anti-bribery laws (such as the