SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-163

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of January 2024

Alterity

Therapeutics Limited

(Name

of Registrant)

Level 14, 350 Collins Street,

Melbourne, Victoria 3000 Australia

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

This

Form 6-K is being incorporated by reference into our Registration Statement on Form S-8 (Files No. 333-251073, 333-248980

and 333-228671) and our

Registration Statements on Form F-3 (Files No. 333-274816, 333-251647, 333-231417

and 333-250076)

ALTERITY

THERAPEUTICS LIMITED

(a

development stage enterprise)

The

following exhibits are submitted:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Alterity Therapeutics Limited |

| |

|

| |

By: |

/s/ Geoffrey P. Kempler |

| |

|

Geoffrey P. Kempler |

| |

|

Chairman |

Date:

January 31, 2024

2

Exhibit 99.1

Appendix 4C – Q2 FY24

Quarterly Cash Flow Report

Highlights

| ● | Completed

enrollment in for ATH434-201 Phase 2 study |

| ● | Delivered

promising data on ATH434 in Parkinson’s disease and on its novel mechanism of action |

| ● | Strengthened

the balance sheet with successful A$4.8M financing |

| ● | Closed

Securities Purchase Plan (SPP) on 25 January |

| ● | Cash

balance on 31 December 2023 of A$12.3M |

MELBOURNE, AUSTRALIA AND SAN

FRANCISCO, USA – 31 January 2024, Alterity Therapeutics Limited (ASX: ATH, NASDAQ: ATHE) (“Alterity” or “the

Company”), a biotechnology company dedicated to developing disease modifying treatments for neurodegenerative diseases, releases

its Appendix 4C Quarterly Cash Flow Report and update on company activities for the quarter ending 31 December 2023 (Q2 FY24).

“The second quarter of our

fiscal year was extremely productive and provided great momentum to carry us into the 2024 calendar year,” said David Stamler, M.D.,

Chief Executive Officer of Alterity. “Completing enrolment in our ATH434-201 clinical trial in early-stage multiple system atrophy

(MSA) was a major milestone as we look to change the treatment paradigm for individuals living with this rare and devastating disease.

We expect to complete the 201 trial in November 2024 and report topline results in January 2025. For our ATH434-202 trial in more advanced

MSA, we plan to report preliminary six-month data in the first half of 2024.”

Dr. Stamler, continued, “During

the quarter, we also had several important data presentations related to ATH434 that validate the treatment approach in our ongoing clinical

trials. Most notably, for the first time we demonstrated the efficacy of ATH434 in a primate model of Parkinson’s disease. ATH434

treatment improved both motor performance and general function in this higher order animal, and these benefits were associated with reductions

in iron in affected brain regions. In a separate investigation, a new mechanism was described for ATH434 – direct antioxidant activity.

By protecting vital mitochondrial function, we believe ATH434 has increased potential to slow disease progression.”

“During 2024, we will continue

to reap benefits from our bioMUSE natural history study as we deepen our understanding of the biomarker evaluation of MSA. We are excited

about the progress of all of our studies to date and look forward to the data readouts coming over the next year,” concluded Dr.

Stamler.

Alterity’s cash position

on 31 December 2023 was A$12.3M with operating cash outflows for the quarter of A$4.9M. The company strengthened its balance sheet through

a Two Tranche placement raising approximately A$1.3M during the quarter from qualified institutional investors in Tranche One, with the

balance of approximately A$3.5M from Tranche Two of the Placement raised in January 2024. In conjunction with this offering, a Security

Purchase Plan (SPP) was approved by shareholders at the Extraordinary General Meeting held on 29 December 2023. The SPP results will be

released this week and the Company is pleased to report that there was significant interest from current shareholders.

In accordance with ASX Listing Rule 4.7C, payments

made to related parties and their associates included in item 6.1 of the Appendix 4C incorporates directors’ fees, consulting fees,

remuneration and superannuation at commercial rates.

Operational Activities

ATH434–201: Randomized, Double-Blind Phase 2 Clinical

Trial in Early-State MSA

On 8 November 2023, Alterity announced

that enrollment was successfully completed in the ATH434-201 Phase 2 clinical trial. This randomized, double-blind, placebo-controlled

study enrolled participants with early-stage multiple system atrophy (MSA) across the U.S., Europe, Australia and New Zealand. The ATH434-201

study is treating participants for 12 months and, therefore, the study will complete in November 2024. Once complete, the data from the

trial will be analyzed and the Company expects to report topline results by January 2025.

ATH434–202: Open-label, Biomarker Phase 2 Clinical

Trial in More Advanced MSA

The ATH434-202 trial continues

to enroll participants with more advanced MSA than in the 201 trial. A key aim of the 202 study is to assess the efficacy of ATH434 treatment

on neuroimaging and protein biomarkers to evaluate target engagement, in addition to clinical measures, safety, and pharmacokinetics.

While the 202 trial is also treating participants for 12-months, it has an open label design that will allow Alterity to perform interim

analyses of biomarker and clinical data while the study is ongoing, providing a potential early indication of efficacy. The Company expects

to report preliminary six-month data from the initial patients enrolled in the ATH434-202 trial in the first half of 2024.

ATH434 for the Treatment of Parkinson’s Disease

On 4 December 2023, Alterity

announced that promising new data on the effect of ATH434 in a Parkinson’s disease primate model was presented at the Future of

Parkinson’s Disease Conference. The poster, entitled, “Effects of ATH434, a Clinical-Phase Small Molecule with Moderate Affinity

for Iron, in Hemiparkinsonian Macaques” demonstrated that ATH434 treatment improved motor performance and general function in monkeys

with experimentally induced Parkinson’s disease. Importantly, the improvements in motor skills and general functioning in this higher

order animal - the monkey - parallel human parkinsonism and were associated with reductions in iron in affected brain regions.

Novel Mechanisms for ATH434 as a Treatment for Neurodegenerative

Diseases

On 16 November 2023, Alterity

announced that promising new data related to ATH434 was presented at the Society for Neuroscience. The poster entitled, “Potent

Antioxidant and Mitochondrial- protectant Effects of ATH434, a Novel Inhibitor of α-Synuclein Aggregation with Moderate Iron- binding

Affinity,” demonstrated new data indicating that ATH434 can preserve mitochondrial function after oxidative injury and exert direct

anti-oxidant activity independent of its iron binding properties. These features were not observed with another iron binding agent approved

for treating iron overload that was also investigated. The demonstrated mitochondrial protection may reveal additional mechanisms that

augment the ability of ATH434 to slow disease progression and underscores the potential of ATH434 as a treatment for neurodegenerative

diseases.

bioMUSE Natural History Study

The bioMUSE study continues to generate

invaluable data related to the understanding of MSA and its early presentation and demonstrates that Alterity is leading the way in

biomarker evaluation of this rare disease. On 27 November 2023, a data presentation entitled, “Relationship between

N-acetylaspartate and neurofilament light chain in multiple system atrophy” was presented at the recent 34th International

Symposium on the Autonomic Nervous System (AAS). In the study, the data provided evidence that N-acetylaspartate (NAA) correlates

with levels of neurofilament light chain (NfL) in patients with early MSA. NfL is a widely used biomarker that is a measure of

neuronal damage. The findings suggest that the NAA metabolite may be a useful biomarker for assessing disease severity and treatment

response in MSA.

About Alterity Therapeutics Limited

Alterity Therapeutics is a clinical

stage biotechnology company dedicated to creating an alternate future for people living with neurodegenerative diseases. The Company’s

lead asset, ATH434, has the potential to treat various Parkinsonian disorders. Alterity also has a broad drug discovery platform generating

patentable chemical compounds to intercede in disease processes. The Company is based in Melbourne, Australia, and San Francisco, California,

USA. For further information please visit the Company’s web site at www.alteritytherapeutics.com.

END

Authorisation & Additional information

This announcement was authorised by David Stamler, CEO of

Alterity Therapeutics Limited.

Investor and Media Contacts:

Australia

Hannah Howlett

we-aualteritytherapeutics@we-worldwide.com

+61 4 5064 8064

U.S.

Remy Bernarda

remy.bernarda@iradvisory.com

+1 (415) 203-6386

Forward Looking Statements

This press release contains “forward-looking

statements” within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934.

The Company has tried to identify such forward-looking statements by use of such words as “expects,” “intends,” “hopes,”

“anticipates,” “believes,” “could,” “may,” “evidences” and “estimates,” and

other similar expressions, but these words are not the exclusive means of identifying such statements.

Important factors that could cause actual results

to differ materially from those indicated by such forward- looking statements are described in the sections titled “Risk Factors”

in the Company’s filings with the SEC, including its most recent Annual Report on Form 20-F as well as reports on Form 6-K, including,

but not limited to the following: statements relating to the Company’s drug development program, including, but not limited to the initiation,

progress and outcomes of clinical trials of the Company’s drug development program, including, but not limited to, ATH434, and any other

statements that are not historical facts. Such statements involve risks and uncertainties, including, but not limited to, those risks

and uncertainties relating to the difficulties or delays in financing, development, testing, regulatory approval, production and marketing

of the Company’s drug components, including, but not limited to, ATH434, the ability of the Company to procure additional future

sources of financing, unexpected adverse side effects or inadequate therapeutic efficacy of the Company’s drug compounds, including,

but not limited to, ATH434, that could slow or prevent products coming to market, the uncertainty of obtaining patent protection for

the Company’s intellectual property or trade secrets, the uncertainty of successfully enforcing the Company’s patent rights and

the uncertainty of the Company freedom to operate.

Any forward-looking statement

made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is

made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time

to time, whether as a result of new information, future developments or otherwise.

Rule 4.7B

Appendix 4C

Quarterly cash flow report for

entities

subject to Listing Rule 4.7B

| Name of entity |

|

|

| Alterity Therapeutics Limited |

|

|

| ABN |

|

Quarter ended (“current quarter”) |

| 37 080 699 065 |

|

31 December 2023 |

| Consolidated statement of cash flows |

Current

quarter

$A’000 |

Year to date

(6 months)

$A’000 |

| 1. |

Cash flows from operating activities |

|

|

| 1.1 |

Receipts from customers |

- |

- |

| 1.2 |

Payments for |

|

|

| |

(a) research and development |

(3,471) |

(6,422) |

| |

(b) product manufacturing and operating costs |

- |

- |

| |

(c) advertising and marketing |

(69) |

(114) |

| |

(d) leased assets |

- |

- |

| |

(e) staff costs |

(922) |

(1,752) |

| |

(f) administration and corporate costs |

(417) |

(787) |

| 1.3 |

Dividends received (see note 3) |

- |

- |

| 1.4 |

Interest received |

17 |

99 |

| 1.5 |

Interest and other costs of finance paid |

- |

- |

| 1.6 |

Income taxes paid |

- |

- |

| 1.7 |

Government grants and tax incentives |

- |

4,679 |

| 1.8 |

Other (provide details if material) |

- |

(17) |

| 1.9 |

Net cash from / (used in) operating activities |

(4,862) |

(4,314) |

| |

| 2. |

Cash flows from investing activities |

|

|

| 2.1 |

Payments to acquire or for: |

|

|

| |

(a) entities |

- |

- |

| |

(b) businesses |

- |

- |

| |

(c) property, plant and equipment |

(2) |

(6) |

| |

(d) investments |

- |

- |

| |

(e) intellectual property |

- |

- |

| |

(f) other non-current assets |

- |

- |

| ASX Listing Rules Appendix 4C (17/07/20) | Page 1 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

Appendix 4C

Quarterly cash flow

report for entities subject to Listing Rule 4.7B

| |

|

|

| Consolidated statement of cash flows |

Current

quarter $A’000 |

Year to date

(6 months) $A’000 |

| 2.2 |

Proceeds from disposal of: |

|

|

| |

(a) entities |

- |

- |

| |

(b) businesses |

- |

- |

| |

(c) property, plant and equipment |

1 |

1 |

| |

(d) investments |

- |

- |

| |

(e) intellectual property |

- |

- |

| |

(f) other non-current assets |

- |

- |

| 2.3 |

Cash flows from loans to other entities |

- |

- |

| 2.4 |

Dividends received (see note 3) |

- |

- |

| 2.5 |

Other (provide details if material) |

- |

- |

| 2.6 |

Net cash from / (used in) investing activities |

(1) |

(5) |

| |

| 3. |

Cash flows from financing activities |

|

|

| 3.1 |

Proceeds from issues of equity securities (excluding convertible debt securities) |

1,126 |

1,126 |

| 3.2 |

Proceeds from issue of convertible debt securities |

- |

- |

| 3.3 |

Proceeds from exercise of options |

- |

- |

| 3.4 |

Transaction costs related to issues of equity securities or convertible debt securities |

(238) |

(237) |

| 3.5 |

Proceeds from borrowings |

- |

- |

| 3.6 |

Repayment of borrowings |

- |

- |

| 3.7 |

Transaction costs related to loans and borrowings |

- |

- |

| 3.8 |

Dividends paid |

- |

- |

| 3.9 |

Other (provide details if material) |

82 |

63 |

| 3.10 |

Net cash from / (used in) financing activities |

(970) |

(952) |

| |

| 4. |

Net increase / (decrease) in cash and cash equivalents for the period |

|

|

| 4.1 |

Cash and cash equivalents at beginning of period |

16,709 |

15,773 |

| 4.2 |

Net cash from / (used in) operating activities (item 1.9 above) |

(4,862) |

(4,314) |

| 4.3 |

Net cash from / (used in) investing activities (item 2.6 above) |

(1) |

(5) |

| ASX Listing Rules Appendix 4C (17/07/20) | Page 2 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

Appendix 4C

Quarterly cash flow

report for entities subject to Listing Rule 4.7B

| |

|

|

| Consolidated statement of cash flows |

Current

quarter $A’000 |

Year to date

(6 months) $A’000 |

| 4.4 |

Net cash from / (used in) financing activities (item 3.10 above) |

969 |

952 |

| 4.5 |

Effect of movement in exchange rates on cash held |

(495) |

(86) |

| 4.6 |

Cash and cash equivalents at end of period |

12,320 |

12,320 |

| 5. |

Reconciliation of cash and cash equivalents

at the end of the quarter (as shown in the consolidated

statement of cash flows) to the related items in the accounts |

Current

quarter $A’000 |

Previous

quarter $A’000 |

| 5.1 |

Bank balances |

12,320 |

16,709 |

| 5.2 |

Call deposits |

- |

- |

| 5.3 |

Bank overdrafts |

- |

- |

| 5.4 |

Other (provide details) |

- |

- |

| 5.5 |

Cash and cash equivalents at end of quarter (should equal item 4.6 above) |

12,320 |

16,709 |

| 6. |

Payments to related parties of the entity and their associates |

Current

quarter

$A’000 |

| 6.1 |

Aggregate amount of payments to related parties and their associates included in item 1 |

131 |

| 6.2 |

Aggregate amount of payments to related parties and their associates included in item 2 |

- |

| Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. |

The amount at 6.1 includes payment of director’s

fees and salaries and consulting fees, excluding GST where applicable.

| ASX Listing Rules Appendix 4C (17/07/20) | Page 3 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

Appendix 4C

Quarterly cash flow

report for entities subject to Listing Rule 4.7B

| |

|

|

|

| 7. |

Financing facilities

Note: the term “facility’ includes all forms

of financing arrangements available to the entity.

Add notes as necessary for an understanding of the sources

of finance available to the entity. |

Total facility

amount at

quarter end

$A’000 |

Amount

drawn at

quarter end

$A’000 |

| 7.1 |

Loan facilities |

- |

- |

| 7.2 |

Credit standby arrangements |

- |

- |

| 7.3 |

Other (please specify) |

- |

- |

| 7.4 |

Total financing facilities |

- |

- |

| |

| 7.5 |

Unused financing facilities available at quarter end |

- |

| 7.6 |

Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. |

| |

|

| 8. |

Estimated cash available for future operating activities |

$A’000 |

| 8.1 |

Net cash from / (used in) operating activities (item 1.9) |

(4,862) |

| 8.2 |

Cash and cash equivalents at quarter end (item 4.6) |

12,320 |

| 8.3 |

Unused finance facilities available at quarter end (item 7.5) |

- |

| 8.4 |

Total available funding (item 8.2 + item 8.3) |

12,320 |

| |

| 8.5 |

Estimated quarters of funding available (item 8.4 divided by item 8.1) |

2.5 |

| Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.5. |

| |

| 8.6 |

If item 8.5 is less than 2 quarters, please provide answers to the following questions: |

| |

|

| |

8.6.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? |

| |

|

| |

Answer: N/A |

|

| |

|

| |

8.6.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? |

| |

|

| |

Answer: N/A |

|

| |

|

| |

8.6.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? |

| |

|

| |

Answer: N/A |

| Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered. |

| ASX Listing Rules Appendix 4C (17/07/20) | Page 4 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

Appendix 4C

Quarterly cash flow report for entities

subject to Listing Rule 4.7B

Compliance statement

| 1 | This statement has been prepared in accordance with accounting standards and policies which comply

with Listing Rule 19.11A. |

| 2 | This statement gives a true and fair view of the matters disclosed. |

| Date: | 31 January 2024 |

| | | |

| | |  |

| Authorised

by: | Phillip Hains – Company Secretary |

(Name of body or officer authorising release – see note 4)

Notes

| 1. | This quarterly cash flow report and the accompanying activity report provide a

basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this

has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing

Rules is encouraged to do so. |

| 2. | If this quarterly cash flow report has been prepared in accordance with Australian

Accounting Standards, the definitions in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly

cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding

equivalent standard applies to this report. |

| 3. | Dividends received may be classified either as cash flows from operating activities

or cash flows from investing activities, depending on the accounting policy of the entity. |

| 4. | If this report has been authorised for release to the market by your board of

directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your

board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”.

If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”. |

| 5. | If this report has been authorised for release to the market by your board of

directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate

Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion,

the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards

and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system

of risk management and internal control which is operating effectively. |

| ASX Listing Rules Appendix 4C (17/07/20) | Page 5 |

| + See chapter 19 of the ASX Listing Rules for defined terms. | |

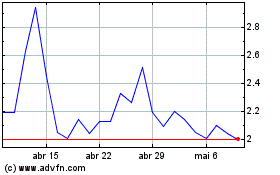

Alterity Therapeutics (NASDAQ:ATHE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Alterity Therapeutics (NASDAQ:ATHE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024