As filed with the Securities and Exchange Commission

on February 6, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INPIXON

(Exact name of registrant as specified in its charter)

| Nevada |

|

88-0434915 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

405 Waverley St.

Palo Alto, CA 94301

(408) 702-2167

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Nadir Ali

Chief Executive Officer

Inpixon

405 Waverley St.

Palo Alto, CA 94301

(408) 702-2167

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Nimish Patel, Esq.

Blake Baron, Esq.

Mitchell Silberberg & Knupp LLP

437 Madison Ave., 25th Floor

New York, NY 10022

Tel: (212) 509-3900

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this registration statement is declared effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in this

preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with

the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED FEBRUARY 6, 2024

PRELIMINARY

PROSPECTUS

Warrants

to Purchase up to 49,131,148 Shares of Common Stock

49,131,148

Shares of Common Stock Issuable Upon Exercise of Warrants

This

prospectus relates to the offer and resale from time to time by the selling stockholders named herein (the “Selling Stockholders”),

including their respective transferees, pledgees or donees, or their respective successors, of (i) warrants to purchase up to 49,131,148

shares of our common stock (the “Warrants”) and (ii) up to an aggregate of 49,131,148 shares of our common stock (the “Warrant

Shares”), par value $0.001 per share, issuable upon the exercise of the Warrants. For information about the Selling Stockholders,

see “Selling Stockholders”.

The

Warrants were issued pursuant to warrant inducement letter agreements, each dated as of December 15, 2023 (the “Inducement Agreements”),

by and between us and each Selling Stockholder. We are registering the offer and resale of the Warrant Shares to satisfy a covenant set

forth in the Inducement Agreements, pursuant to which we agreed to register the resale of the Warrant Shares within a limited period of

time following the date of the Inducement Agreements. See “Warrant Exercise Inducement and Private Placement.”

We

will not receive any proceeds from the sale of the Warrants or the Warrant Shares covered by this prospectus by the Selling Stockholders,

except for funds received from the exercise of the Warrants held by the Selling Stockholders, if and when exercised for cash. All net

proceeds from the sale of the Warrants or the Warrant Shares covered by this prospectus will go to the Selling Stockholders. See “Use

of Proceeds.”

The Selling Stockholders may sell any, all or none of the securities

and we do not know when or in what amount the Selling Stockholders may sell their securities hereunder following the date of this prospectus.

The Selling Stockholders may sell the securities described in this prospectus in a number of different ways and at varying prices. We

provide more information about how the Selling Securityholders may sell their securities in the section titled “Plan of Distribution”

appearing elsewhere in this prospectus.

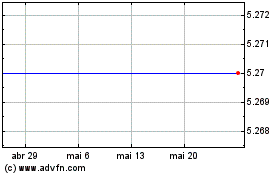

Our

common stock is listed on the Nasdaq Capital Market under the symbol “INPX.” On February 5, 2024, the last reported sale price

of our common stock on the Nasdaq Capital Market was $0.05.

Investing

in our securities involves a high degree of risk. Before buying any securities, you should review carefully the risks and uncertainties

described under the heading “Risk Factors” section beginning on page 14 of this prospectus and in

the documents incorporated by reference into this prospectus.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you make your investment decision.

Neither

the Securities and Exchange Commission (“SEC”) nor any other regulatory body has approved or disapproved of

these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus

is , 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form S-3 that we filed with the SEC using the “shelf” registration process. Under this shelf registration

process, the Selling Stockholders may, from time to time, sell the securities offered by them described in this prospectus. We will not

receive any proceeds from the sale by the Selling Stockholders of the securities offered by them described in this prospectus.

You should rely only on the

information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable

prospectus supplement. Neither we nor the Selling Stockholders have authorized anyone to provide you with any information or to make

any representations other than those contained in this prospectus, or any applicable prospectus supplement or any free writing prospectuses

prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Stockholders take responsibility for,

and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling

Stockholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Neither we nor

the Selling Stockholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should

not assume that the information in this prospectus, any applicable prospectus supplement or any documents incorporated by reference is

accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus and the documents

incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed.

We may also provide a prospectus

supplement or post-effective amendment to the registration statement to add information to, or update or change information contained

in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the

registration statement together with the additional information to which we refer you in the section of this prospectus entitled “Where

You Can Find More Information.”

This prospectus contains forward-looking

statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See the sections titled “Risk

Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

Unless the context otherwise

requires, references in this prospectus to the “Company,” “we,” “us” and “our” refer to

Inpixon and its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Some of the statements in this

prospectus and the documents incorporated by reference constitute forward-looking statements. These statements involve known and unknown

risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance, or

achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied

by such forward-looking statements. These factors include, among others, those incorporated by reference under “Risk Factors”

below.

In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,” “should,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“potential,” “continue” or similar terms. Factors that could cause actual results to differ from those discussed

in the forward-looking statements include, but are not limited to:

| |

● |

our ability to achieve profitability; |

| |

● |

our limited operating history with recent acquisitions; |

| |

● |

the possibility that anticipated tax treatment and benefits of the spin-off of our enterprise apps business or any other strategic transaction that we undertake may not be achieved; |

| |

● |

risks related to the spin-off of our enterprise apps business that recently closed or any other strategic transactions that we may undertake, including the proposed transactions with XTI Aircraft Company and Damon Motors, Inc.; |

| |

● |

our ability to successfully integrate companies or technologies we acquire; |

| |

● |

emerging competition and rapidly advancing technology in our industry that may outpace our technology; |

| |

● |

customer demand for the products and services we develop; |

| |

● |

the impact of competitive or alternative products, technologies and pricing; |

| |

● |

our ability to manufacture or deliver any products we develop; |

| |

● |

general economic conditions and events and the impact they may have on us and our potential customers, including, but not limited to increases in inflation rates and rates of interest, supply chain challenges, increased costs for materials and labor, cybersecurity attacks, other lingering impacts resulting from COVID-19, and the Russia/Ukraine and Israel/Hamas conflicts; |

| |

● |

our ability to obtain adequate financing in the future as needed; |

| |

● |

our ability to consummate strategic transactions which may include acquisitions, mergers, dispositions involving us and any of our business units or other strategic investments; |

| |

● |

our ability to attract, retain and manage existing customers; |

| |

● |

our ability to maintain compliance with the continued listing requirements of the Nasdaq Capital Market; |

| |

● |

lawsuits and other claims by third parties or investigations by various regulatory agencies that we may be subjected to and are required to report, including but not limited to, the U.S. Securities and Exchange Commission; |

| |

● |

our success at managing the risks involved in the foregoing items; and |

| |

● |

impact of any changes in existing or future tax regimes. |

Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance,

or achievements. Our actual results could differ materially from those expressed or implied by these forward-looking statements as a result

of various factors, including the risk factors under the section titled “Risk Factors” and a variety of other factors, including,

without limitation, statements about our future business operations and results, the market for our technology, our strategy and competition.

Moreover, neither we nor any

other person assumes responsibility for the accuracy and completeness of these statements. We undertake no obligation to update or revise

any of the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In light of these risks, uncertainties and assumptions, the forward-looking events discussed or incorporated by reference in this prospectus

supplement and the accompanying prospectus may not occur.

PROSPECTUS SUMMARY

This summary highlights

selected information appearing elsewhere in this prospectus, or the documents incorporated by reference herein. Because it is a summary,

it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire

prospectus, the registration statement of which this prospectus is a part and the documents incorporated by reference herein carefully,

including the information set forth under the heading “Risk Factors” and our financial statements.

Overview

Inpixon is the Indoor Intelligence™

company. Our solutions and technologies help organizations create and redefine exceptional experiences that enable smarter, safer and

more secure environments. Inpixon customers can leverage our real-time positioning and analytics technologies to achieve higher levels

of productivity and performance, increase safety and security, and drive a more connected work environment.

Inpixon specializes in providing

real-time location systems (RTLS) for the industrial sector. As the manufacturing industry has evolved, RTLS technology has become

a crucial aspect of Industry 4.0. Our RTLS solution leverages cutting-edge technologies such as IoT, AI, and big data analytics to

provide real-time tracking and monitoring of assets, machines, and people within industrial environments. With our RTLS, businesses

can achieve improved operational efficiency, enhanced safety and reduced costs. By having real-time visibility into operations, industrial

organizations can make informed, data-driven decisions, minimize downtime, and ensure compliance with industry regulations. With

our RTLS, industrial businesses can transform their operations and stay ahead of the curve in the digital age.

Inpixon’s full-stack industrial

IoT solution provides end-to-end visibility and control over a wide range of assets and devices. It’s designed to help organizations

optimize their operations and gain a competitive edge in today’s data-driven world. The turn-key platform integrates a

range of technologies, including RTLS, sensor networks, edge computing, and big data analytics, to provide a comprehensive view of an

organization’s operations. We help organizations to track the location and status of assets in real-time, identify inefficiencies,

and make decisions that drive business growth. Our IoT stack covers all the technology layers, from the edge devices to the cloud. It

includes hardware components such as sensors and gateways, a robust software platforms for data management and analysis, and a user-friendly dashboard

for real-time monitoring and control. Our solutions also offer robust security features, to help ensure the protection of sensitive

data. Additionally, our RTLS provides scalability and flexibility, allowing organizations to easily integrate it with their existing systems

and add new capabilities as their needs evolve.

In addition to our Indoor Intelligence

technologies and solutions, we also offer:

| |

● |

Digital solutions (eTearsheets; eInvoice, adDelivery) or cloudbased applications and analytics for the advertising, media and publishing industries through our advertising management platform referred to as Shoom by Inpixon; and |

| |

● |

A comprehensive set of data analytics and statistical visualization solutions for engineers and scientists referred to as SAVES by Inpixon. |

We report financial results

for three segments: Indoor Intelligence, Shoom and SAVES. For Indoor Intelligence, we generate revenue from sales of hardware, software

licenses and professional services. For Shoom and SAVES we generate revenue from the sale of software licenses.

XTI Merger Agreement

On July 24, 2023, the Company

entered into an Agreement and Plan of Merger (as it may be amended from time to time, the “XTI Merger Agreement”) by and among

Inpixon, Superfly Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of Inpixon (“Merger Sub”), and XTI

Aircraft Company, a Delaware corporation (“XTI”). The XTI Merger Agreement was unanimously approved by Inpixon’s and

XTI’s board of directors. If the XTI Merger Agreement is approved by Inpixon’s and XTI’s stockholders (and the other

closing conditions are satisfied or waived in accordance with the Merger Agreement), and the transactions contemplated by the XTI Merger

Agreement are consummated, Merger Sub will merge with and into XTI, with XTI surviving the merger as a wholly-owned subsidiary of Inpixon

(collectively, the “XTI Proposed Transaction”). In addition, upon the consummation of the XTI Proposed Transaction (the “Closing,”

and the date of the Closing, the “Closing Date”), Inpixon will be renamed “XTI Aerospace, Inc.” (the “Name

Change”). Inpixon upon the Closing is referred to herein as the “combined company.”

About

XTI

XTI

is an aircraft development and manufacturing company. Headquartered in Englewood, Colorado, XTI is developing a vertical takeoff and landing

(“VTOL”) aircraft that takes off and lands like a helicopter and cruises like a fixed-wing business aircraft. XTI’s

initial model, the TriFan 600, is a six-seat aircraft with a mission to provide point-to-point air travel over distances of up to 700

miles, fly at twice the speed of a helicopter and cruise at altitudes up to 25,000 feet.

The

TriFan 600 is anticipated to be one of the first VTOL aircrafts that offers the speed and comfort of a business aircraft and the range

and versatility of VTOL for a wide range of customer applications, including private aviation for business and high net worth individuals,

emergency medical services, and commuter and regional air travel.

XTI

was incorporated in October 2009, and operations began in the fourth quarter of 2012. Since then, XTI has been engaged primarily

in developing the design and engineering concepts for the TriFan 600, building and testing a two-thirds scale unmanned version of the

TriFan 600, generating pre-orders for the TriFan 600, and seeking funds from investors to enable it to build full-scale piloted prototypes

of the TriFan 600, and to eventually engage in commercial development of the TriFan 600.

TriFan

600

The

TriFan 600 design is expected to provide unique advantages over existing helicopters, turboprop and light jet aircraft. Since the aircraft

will take off and land vertically, it is anticipated that the TriFan 600 will generate significant time savings on a typical 500-mile

trip by traveling point-to-point or utilizing more convenient existing ground and airspace infrastructure (such as helipads) to avoid

or reduce the time traveling on the ground to and from an airport. The TriFan 600 will also have the capability to take off and land

conventionally if a runway is available. This added ability can increase range and payload and expand utility.

Corporate Strategy

In order to continue to respond to rapid changes and required technological

advancements, as well as increase our shareholder value, we are exploring strategic transactions and opportunities that we believe will

enhance shareholder value. Our board of directors has authorized a review of strategic alternatives, including a possible asset sale,

merger with another company or spin-off of one or more of our business units. We will also be opportunistic and may consider other strategic

and/or attractive transactions, which may include, but not be limited to other alternative investment opportunities, such as minority

investments, joint ventures or special purpose acquisition companies. If we make any acquisitions in the future, we expect that we may

pay for such acquisitions with cash, equity securities and/or debt in combinations appropriate for each acquisition. In September of 2022,

we entered into an Agreement and Plan of Merger in connection with the spin-off and sale of our enterprise apps business which was consummated

on March 14, 2023. (See “Recent Events” below for more details). Additionally, on July 24, 2023, we entered into an Agreement

and Plan of Merger with XTI Aircraft Company (the “XTI Business Combination”) (see “Recent Events” below for more

details). In addition, on or prior to the effective time of the merger with XTI we intend to effect a transaction for the divestiture

of our Shoom, SAVES and Game Your Game lines of business and investment securities, as applicable, by any lawful means, which may include

a sale to one or more third parties, spin off, plan of arrangement, merger, reorganization, or any combination of these. On October 23,

2023, we entered into a Separation and Distribution Agreement (the “Separation Agreement”) with Grafiti Holding Inc., a British

Columbia corporation and newly formed wholly-owned subsidiary of Inpixon (“Grafiti”), pursuant to which we plan to transfer

to Grafiti all of the outstanding shares of Inpixon Ltd., a United Kingdom (the “UK”) limited company that operates our SAVES

line of business in the UK (“Inpixon UK”), such that Inpixon UK will become a wholly-owned subsidiary of Grafiti (the “Reorganization”).

Following the Reorganization and subject to conditions in the Separation Agreement, we will spin off Grafiti (the “Spin-off”)

by distributing to our stockholders and certain securities holders as of a record date to be determined (the “Participating Security

holders”) on a pro rata basis all of the outstanding common shares of Grafiti (the “Grafiti Common Shares”) owned by

us (the “Distribution”), subject to certain lock-up restrictions and subject to registration of the Grafiti Common Shares

pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or the Securities Act of 1933, as amended

(the “Securities Act”), as further described below. On October 23, 2023, we also entered into a Business Combination Agreement

(the “Business Combination Agreement”), by and among us, Damon Motors Inc., a British Columbia corporation (“Damon”),

Grafiti, and 1444842 B.C. Ltd., a British Columbia corporation and a newly formed wholly-owned subsidiary of Grafiti (“Amalco Sub”),

pursuant to which it is proposed that Amalco Sub and Damon amalgamate under the laws of British Columbia, Canada with the amalgamated

company (the “Damon Surviving Corporation”) continuing as a wholly-owned subsidiary of Grafiti (the “Business Combination”).

Recent Events

Compliance with Nasdaq Continued Listing

Requirements

On April 14, 2023, the Company

received a letter from the Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based upon

the closing bid price of our common stock for the last 30 consecutive business days beginning on March 2, 2023, and ending on April 13,

2023, the Company no longer meets the requirement to maintain a minimum bid price of $1 per share, as set forth in Nasdaq Listing Rule

5550(a)(2). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company was provided a period of 180 calendar days, or until October

11, 2023, in which to regain compliance. In order to regain compliance with the minimum bid price requirement, the closing bid price of

our common stock must be at least $1 per share for a minimum of ten consecutive business days during this 180-day period. The Company

was not able to regain compliance within this 180-day period; however, on October 12, 2023,the Company received notice from Nasdaq that

it was granted an additional 180 calendar days, or until April 8, 2024 to regain compliance with the minimum bid price requirement.

On November 9, 2023, the Company

received notice (the “November 9 Letter”) from Nasdaq that Nasdaq had determined that as of November 8, 2023, the Company’s

securities had a closing bid price of $0.10 or less for ten consecutive trading days triggering application of Listing Rule 5810(c)(3)(A)(iii)

which states in part: if during any compliance period specified in Rule 5810(c)(3)(A), a company’s security has a closing bid price

of $0.10 or less for ten consecutive trading days, the Listing Qualifications Department shall issue a Staff Delisting Determination under

Rule 5810 with respect to that security (the “Low Priced Stocks Rule”). As a result, the Staff has issued a letter notifying

the Company of its determination to delist the Company’s securities from Nasdaq effective as of the opening of business on November

20, 2023, unless the Company requests an appeal of the Staff’s determination on or prior to November 16, 2023, pursuant to the procedures

set forth in the Nasdaq Listing Rule 5800 Series.

The Company requested a hearing

before the Nasdaq Hearings Panel (the “Panel”) to appeal the determination described in the November 9 Letter and to address

compliance with the Low-Priced Stocks Rule and a hearing has been scheduled for February 6, 2024. The Company may cure the bid price deficiency

to regain compliance with the Low Priced Stock Rule by effecting a reverse stock split to increase the price per share of its common stock.

A reverse stock split also would be expected to allow the Company to regain compliance with the minimum bid price requirement. At a special

meeting of stockholders held on September 29, 2023, the Company obtained the necessary stockholder approval of an amendment to the Company’s

articles of incorporation to effect a reverse stock split of the Company’s outstanding common stock, at a ratio between 1-for-2

and 1-for-50 (the “Reverse Split Ratio”), to be determined at the discretion of the Company’s board of directors. At

a special in lieu of annual meeting held on December 8, 2023, the Company’s stockholders approved an increase in the maximum range

of the Reverse Split Ratio to 1-for-200. The Company also intends to seek an increase in the Reverse Split Ratio for the purpose of satisfying

the bid price requirements applicable for initial listing applications in connection with the closing of the XTI transaction. The

proposed transaction between the Company and XTI is anticipated to close prior to the end of this year and as a result, the Company expects

that it will be able to cure the bid price deficiencies in connection with the closing of the XTI transaction.

The November 9 Letter has no

immediate effect on the listing of the Company’s common stock and its common stock will continue to be listed on the Nasdaq Capital

Market under the symbol “INPX”. While the appeal process is pending, the suspension of trading of the Company’s common

stock would be stayed and the Company’s common stock would continue to trade on the Nasdaq Capital Market until the hearing process

concludes and the Panel issues a written decision.

XTI Transaction

Merger Agreement

Subject to the terms and conditions

of the XTI Merger Agreement, at the effective time of the merger (the “Effective Time”):

| |

(i) |

Each share of XTI common stock outstanding immediately prior to the Effective Time (excluding any shares to be canceled pursuant to the Merger Agreement and shares held by holders of XTI common stock who have exercised and perfected appraisal rights) will automatically be converted into the right to receive a number of shares of Inpixon common stock equal to the Exchange Ratio (as described below). Prior to the Effective Time, subject to obtaining the consent of requisite note holders, all outstanding XTI convertible notes will be converted into XTI common stock and will participate in the merger on the same basis as the other shares of XTI common stock, except for (1) a promissory note dated April 1, 2023, in the initial principal amount of $1,817,980, which will be amended to extend the maturity date thereof until no sooner than December 31, 2026 and be assumed by the combined company at the Closing to become convertible into the shares of common stock of the combined company, and (2) a promissory note dated December 31, 2021, in the initial principal amount of $1,007,323, which will provide for, at Closing, payment in cash of $507,323 of the principal plus interest accrued to the date of payment, and the conversion of the remaining $500,000 of outstanding principal into shares of common stock of the combined company (collectively, the “Note Amendments”). |

| |

(ii) |

Each option to purchase shares of XTI common stock outstanding and unexercised immediately prior to the Effective Time will be assumed by Inpixon and will become an option, subject to any applicable vesting conditions, to purchase shares of Inpixon common stock with the number of shares of Inpixon common stock underlying the unexercised portions of such options and the exercise prices for such options to be adjusted to reflect the Exchange Ratio. |

| |

(iii) |

Each warrant to purchase shares of XTI common stock outstanding and unexercised immediately prior to the Effective Time will be assumed by Inpixon and will become a warrant to purchase shares of Inpixon common stock with the number of shares of Inpixon common stock underlying such warrants and the exercise prices for such warrants will be adjusted to reflect the Exchange Ratio. |

Subject to adjustment pursuant

to the formula for the Exchange Ratio set forth in Exhibit A of the Merger Agreement, the Exchange Ratio will be determined based on (a)

the fully diluted capitalization of each of Inpixon and XTI immediately prior to the Effective Time, provided, however, that for this

purpose the calculation of Inpixon’s fully diluted capitalization will not take into account any shares of Inpixon common stock

issuable after Closing for cash consideration upon conversion, exercise or exchange of derivative securities that are issued by Inpixon

in Inpixon Permitted Issuances. “Inpixon Permitted Issuances” are any issuances of common stock or derivative securities by

Inpixon for financing or debt cancellation purposes that are permitted under the Merger Agreement and occur after the date of the Merger

Agreement but before the Closing.

The Exchange Ratio will be

subject to certain adjustments to the extent that Inpixon’s Net Cash (as such term is defined on Exhibit A of the Merger Agreement)

is greater than or less than $21.5 million and/or any principal and accrued or unpaid interest remains outstanding under those certain

promissory notes issued by Inpixon to Streeterville Capital, LLC on July 22, 2022 and December 30, 2022.

It is expected that Inpixon’s

Chief Executive Officer, Nadir Ali, and Chief Financial Officer, Wendy Loundermon, will resign upon the Closing, effective as of the Closing

Date.

In addition, pursuant to a

Financial Advisory and Investment Banking Services Agreement dated May 16, 2023, between Inpixon and Maxim Group LLC (“Maxim”)

(the “Maxim Agreement”), as part of compensation for Maxim’s services in connection with the transaction, Inpixon has

agreed to, upon Closing, pay Maxim a cash fee equal to $800,000 (the “Cash Fee”), and to issue Maxim (or its designees) 6,565,988

shares of common stock of Inpixon, with such number determined by dividing $1,000,000 by the closing price of Inpixon common stock as

reported by Nasdaq on the date immediately preceding the announcement of the closing of the XTI Proposed Transaction. These shares will

be issued in reliance on an exemption from registration under Section 4(a)(2) of the Securities Act, if they are not registered.

The foregoing description

of the XTI Merger Agreement and the XTI Proposed Transaction does not purport to be complete and is qualified in its entirety by the terms

and conditions of the Merger Agreement, a copy of which is attached as Exhibit 2.25 to the registration statement of which this prospectus

is a part of and incorporated herein by reference.

XTI Promissory Note & Security Agreement

Pursuant to the Merger Agreement,

on the first calendar day of the month following the date of the Merger Agreement and on the first calendar day of each month thereafter

until the earlier of (i) four months following the date of the Merger Agreement and (ii) the Closing Date, Inpixon shall provide loans

to XTI on a senior secured basis (each, a “Future Loan”), in such amounts requested by XTI in writing prior to the first calendar

day of each such month. Each Future Loan will be in the principal amount of up to $500,000, and the aggregate amount of the Future Loans

will be up to $1,775,000 (or such greater amount as Inpixon shall otherwise agree in its sole and absolute discretion). These Future Loans

and security will be evidenced by a Senior Secured Promissory Note (the “XTI Promissory Note”) and a Security and Pledge Agreement

(the “Security Agreement”).

The XTI Promissory Note provides

an aggregate principal amount up to $2,313,407, which amount includes the principal sum of $525,000 which Inpixon previously advanced

to XTI (the “Existing Loans”, collectively with the Future Loans, the “Inpixon Loans to XTI”) plus accrued interest

on such amount, and the aggregate principal amount of the Future Loans. The XTI Promissory Note will bear interest at 10% per annum, compounded

annually, and for each Future Loan, beginning on the date the Future Loan is advanced to XTI. The XTI Promissory Note is included in the

Company’s condensed consolidated balance sheet as of September 30, 2023 in Notes Receivable. On November 14, 2023, the principal

amount under the XTI Promissory Note was increased to approximately $3.1 million and further increased to $4 million effective as of January

30,, 2024. As of the date of this filing, the principal balance on the loan to XTI is approximately $3.6 million.

The outstanding principal amount

under the XTI Promissory Note, together with all accrued and unpaid interest, shall be due and payable upon the earlier of (a) March 31,

2024, (b) when declared due and payable by Inpixon upon the occurrence of an event of default, or (c) within three business days following

termination of the XTI Merger Agreement (i) by XTI because the XTI Board adopts a superior proposal prior to delivering the XTI Stockholder

Consent, or (ii) by Inpixon because the XTI Board has made a change in recommendation, or XTI has breached or failed to perform in any

material respect any of its covenants and agreements regarding obtaining its required stockholder approval or non-solicitation. The XTI

Promissory Note will be forgiven and of no further force if the XTI Merger Agreement is terminated by the Inpixon Board because it adopts

a superior proposal prior to obtaining the required Inpixon stockholder approval, subject to Inpixon’s rights and remedies under

the Promissory Note, the Security Agreement, and the Merger Agreement. If the XTI Merger Agreement is terminated by XTI because the Inpixon

Board makes a change in recommendation or Inpixon is in material breach of its covenants and agreements regarding obtaining its required

stockholder approval or non-solicitation, the maturity date of the XTI Promissory Note will be extended to December 31, 2024.

The Security Agreement grants

Inpixon a first priority security interest in and lien upon all of XTI’s property to secure the repayment of the XTI Promissory

Note.

Xeriant Complaint related to XTI

On December 6, 2023, Xeriant, Inc. (“Xeriant”)

filed a complaint against XTI, along with two unnamed companies and five unnamed persons, in the United States District Court for the

Southern District of New York. The complaint was amended on January 31, 2024 to add claims against us (the “Xeriant

Matter”). The Xeriant Matter alleges that XTI induced Xeriant to enter a May 31, 2021 joint venture agreement pertaining to the

development of the TriFan 600 aircraft and to invest more than $5 million in the joint venture based on purported misrepresentations regarding

the stage of development, estimated cost of completion for the project, amount of committed preorders for the aircraft, XTI’s future

merger plans, and other issues. Xeriant further alleges that it owns a 50% interest in the TriFan 600 technology, that XTI is obligated

pursuant to a May 17, 2022 letter agreement to issue stock to Xeriant and incur other obligations if XTI consummates a transaction with

us within a year, and that XTI made misrepresentations to Xeriant regarding the status of merger discussions and is liable under the letter

agreement and for alleged misrepresentations. The suit appears to allege that we are jointly liable with XTI and asserts claims

for breach of contract, intentional fraud, fraudulent concealment, quantum meruit, unjust enrichment, unfair competition/deceptive business

practices, misappropriation of confidential information, misappropriation of ideas, misappropriation of skill, and seeks damages purportedly

in excess of $500 million, injunctive relief to stay or unwind the XTI Proposed Transaction and prevent further transfer or alleged misuse

of the intellectual property at issue, the imposition of a royalty obligation, and such other relief as deemed appropriate by the court.

The case is in its early stages, no discovery with respect to Inpixon has occurred, and we are unable to estimate the likelihood

or magnitude of a potential adverse judgment.

Transaction Bonus Plan

in connection with Completed Transaction

On March 14, 2023, Inpixon

completed a reorganization involving the transfer of Inpixon’s CXApp and enterprise app business lines to a subsidiary of Inpixon,

followed by a distribution of shares of such subsidiary to Inpixon’s equityholders. The reorganization was followed by a subsequent

business combination transaction between such former subsidiary and KINS Technology Group Inc., a special purpose acquisition company

which was renamed CXApp, Inc. upon the consummation of the business combination (collectively, the “Completed Transaction”).

On July 24, 2023, the compensation

committee of the Inpixon Board (the “Committee”) adopted a Transaction Bonus Plan (the “Completed Transaction Bonus

Plan”), which is intended to compensate certain current and former employees and service providers for the successful consummation

of the Completed Transaction. The Completed Transaction Bonus Plan will be administered by the Committee. It will terminate upon the completion

of all payments under the terms of the Completed Transaction Bonus Plan, provided, that the Board may terminate the plan as to any participant

prior to the completion of all payment to under participant under the plan.

Pursuant to the Completed Transaction

Bonus Plan, in connection with the Completed Transaction,

| |

● |

Participants listed on Schedule 1 of the Completed Transaction Bonus Plan will be eligible for a cash bonus equal to 100% of their aggregate annual base salary in effect as of the end of the year ended December 31, 2022, provided that the participants must execute a customary release of claims and confidentiality agreement. |

| |

● |

Participants listed on Schedule 2 of the Completed Transaction Bonus Plan including Inpixon’s named executive officers Nadir Ali and Wendy Loundermon will be eligible for a cash bonus in an aggregate amount of 4% of the $70,350,000 transaction value of the Completed Transaction, with Mr. Ali and Ms. Loundermon being entitled to 3.5% and 0.5% of such transaction value, respectively. |

The Company paid approximately

$3.5 million to the company management and former management under the Transaction Bonus Plan which settled the amount in full and no

additional amounts are owed under the Completed Transaction Bonus Plan as of the date hereof.

In addition, if a participant

becomes entitled to any payments or benefits from the Completed Transaction Bonus Plan or any other amounts (collectively, the “Company

Payments Relating to the Completed Transaction Plan”) that are subject to the tax imposed by Section 4999 of the Internal Revenue

Code of 1986, as amended (the “Excise Tax”), the company will pay the participant the greater of the following amounts: (i)

the Company Payments Relating to the Completed Transaction Plan, or (ii) one dollar less than the amount of the Company Payments Relating

to the Completed Transaction Plan that would subject the participant to the Excise Tax, as mutually agreed between the company and the

participant.

The foregoing description

of the Completed Transaction Bonus Plan does not purport to be complete and is qualified in its entirety by the terms and conditions of

the Completed Transaction Bonus Plan, a copy of which is attached as Exhibit 10.61 to the registration statement of which this prospectus

is a part of and incorporated herein by reference.

Transaction Bonus Plan in connection with Future Strategic Transactions

On July 24, 2023, the Committee

adopted a Transaction Bonus Plan (the “Plan”), which is intended to provide incentives to certain employees and other service

providers to remain with Inpixon through the consummation of a Contemplated Transaction or Qualifying Transaction (each as defined below)

and to maximize the value of the company with respect to such transaction for the benefit of its stockholders. The Plan will be administered

by the Committee. It will automatically terminate upon the earlier of (i) the one-year anniversary of the adoption date, (ii) the completion

of all payments under the terms of the Plan, or (iii) at any time by the Committee, provided, however, that the Plan may not be amended

or terminated following the consummation of a Contemplated Transaction or Qualifying Transaction without the consent of each participant

being affected, except as required by any applicable law.

A “Contemplated Transaction”

refers to a strategic alternative transaction including an asset sale, merger, reorganization, spin-off or similar transaction (a “Strategic

Transaction”) that results in a change of control as defined in the Plan. A Qualifying Transaction refers to a Strategic Transaction

that does not result in a change of control for which bonuses may be paid pursuant to the Plan as approved by the Committee. The XTI Proposed

Transaction is expected to qualify as a Contemplated Transaction.

Pursuant to the Plan, in connection

with the closing of a Contemplated Transaction or a Qualifying Transaction, the participants will be eligible to receive bonuses as described

below.

| |

● |

Participants listed on Schedule 1 of the Plan including Inpixon’s named executive officers Nadir Ali, Wendy Loundermon and Soumya Das, will be eligible for a cash bonus equal to 100% of their aggregate annual base salary and target bonus amount at the closing of a Contemplated Transaction and any applicable Qualifying Transaction, provided that the participants must execute a customary release of claims and confidentiality agreement. These bonus amounts will be paid at the closing of each applicable transaction. |

| |

● |

Participants listed on Schedule 2 of the Plan including Inpixon’s named executive officers Nadir Ali and Wendy Loundermon will be eligible for a cash bonus in an aggregate amount of 4% of the applicable Transaction Value (as defined below), with Mr. Ali and Ms. Loundermon being entitled to 3.5% and 0.5% of such Transaction Value, respectively. These bonus amounts will be paid at the closing of each applicable transaction but the pro rata portion attributable to any deferred payments will be paid when those deferred payments become due, within a maximum period of five years from the closing date. “Transaction Value” means the sum of any cash and the fair market value of any securities or other assets or property received by Inpixon or available for distribution to the holders of Inpixon’s equity securities in connection with the applicable transaction as provided for in the definitive agreement governing the applicable transaction, or such value as shall be designated by the Committee. |

| |

● |

Participants listed on Schedule 3 of the Plan including Inpixon’s named executive officers Nadir Ali, Wendy Loundermon and Soumya Das, will be eligible for equity-based grants, such as options or restricted stock, on such terms and upon such date as the Committee may determine. |

| |

● |

In the sole discretion of the Committee, receipt or eligibility for receipt by a participant of a transaction bonus in respect of a Contemplated Transaction shall not preclude such participant from receiving or being eligible to receive an additional transaction bonus in respect of a Qualifying Transaction. |

If a participant becomes entitled

to any payments or benefits from the Plan or any other amounts (the “Company Payments Relating to the Plan”) that are subject

to the Excise Tax, the company will pay the participant the greater of the following amounts: (i) the Company Payments Relating to the

Plan, or (ii) one dollar less than the amount of the Company Payments Relating to the Plan that would subject the participant to the Excise

Tax, as mutually agreed between the company and the participant.

The foregoing description

of the Plan does not purport to be complete and is qualified in its entirety by the terms and conditions of the Plan, a copy of which

is attached as Exhibit 10.62 to the registration statement of which this prospectus is a part of and incorporated herein by reference.

The Company has not paid or accrued

any bonuses under the Plan in connection with future strategic transactions.

Spin-off - Grafiti Holding, Inc.

On October 23, 2023, Inpixon entered into a Separation and Distribution

Agreement (the “Separation Agreement”) with Grafiti Holding Inc., a British Columbia corporation and newly formed wholly-owned

subsidiary of Inpixon (“Grafiti”), pursuant to which Inpixon transferred all of the outstanding shares of Inpixon Ltd., a

United Kingdom (the “UK”) limited company that operates Inpixon’s SAVES line of business in the UK (“Inpixon UK”),

to Grafiti such that Inpixon UK became a wholly-owned subsidiary of Grafiti (the “Reorganization”). The terms of the Separation

Agreement, provide that Inpixon will spin off Grafiti (the “Grafiti Spin-off”) by distributing to Inpixon stockholders and

certain securities holders as of a record date to be determined (the “Participating Securityholders”) on a pro rata basis

all of the outstanding common shares of Grafiti (the “Grafiti Common Shares”) owned by Inpixon (the “Distribution”),

subject to certain lock-up restrictions and subject to registration of the Grafiti Common Shares pursuant to the Exchange Act or the Securities

Act.

On December 14, 2023, we announced

that our board of directors set December 27, 2023 as the record date for determining the holders of our outstanding capital stock and

certain other securities entitled to the distribution of all the outstanding common shares of Grafiti owned by Inpixon in connection with

the Grafiti Spin-off.

On

December 27, 2023, we entered into a Liquidating Trust Agreement (the “Trust Agreement”) by and among the Company, Grafiti

and the sole original trustee named therein (collectively with any additional trustees duly appointed under the Liquidating Trust Agreement

from time to time, the “Trustees”). The Trust Agreement provided for the distribution by the Company of its Grafiti Common

Shares to a liquidating trust, titled the Grafiti Holding Inc. Liquidating Trust (the “Trust”), which will hold the Grafiti

Common Shares for the benefit of the Participating Securityholders until a registration statement covering the distribution of the Grafiti

Common Shares to Participating Securityholders is declared effective by the SEC. Promptly following the effective time of the registration

statement, the Trust will deliver the Grafiti Common Shares to the Participating Securityholders, as beneficiaries of the Trust, pro rata

in accordance with their ownership of shares or underlying shares of Common Stock as of the Record Date. The Trustees will be empowered

to liquidate the Grafiti Common Shares and distribute the proceeds thereof to the Participating Securityholders if the registration statement

is not declared effective prior to the second anniversary of the date of the Liquidating Trust Agreement.

The Liquidating

Trust Agreement provides that the Trust will terminate upon the earlier of (i) a termination required by the applicable laws of the State

of Nevada, (ii) the delivery of the Grafiti Common Shares owned by the Company to the Participating Securityholders, or (iii) the expiration

of a period of three years from December 27, 2023; provided that the Trust shall not terminate pursuant to foregoing clause (iii) prior

to the date the Trustees are permitted to make a final distribution of trust assets in accordance with the Liquidating Trust Agreement.

The Company

and Grafiti will indemnify each Trustee and each agent of the Trust and will advance expenses, defend and hold harmless from time to time

against any and all losses, claims, costs, expenses and liabilities to which such indemnified parties may be subject by reason of such

indemnified party’s performance of its duties pursuant to the discretion, power and authority conferred on such person by the Liquidating

Trust Agreement.

Damon Business Combination

On October 23, 2023, Inpixon

also entered into a Business Combination Agreement (the “Business Combination Agreement”), by and among Inpixon, Damon Motors

Inc., a British Columbia corporation (“Damon”), Grafiti, and 1444842 B.C. Ltd., a British Columbia corporation and a newly

formed wholly-owned subsidiary of Grafiti (“Amalco Sub”), pursuant to which it is proposed that Amalco Sub and Damon amalgamate

under the laws of British Columbia, Canada with the amalgamated company (the “Damon Surviving Corporation”) continuing as

a wholly-owned subsidiary of Grafiti (the “Damon Business Combination”). The Damon Business Combination is subject to material

conditions, including approval of the Damon Business Combination by securities holders of Damon, approval of the issuance of Grafiti Common

Shares to Damon securities holders pursuant to the Damon Business Combination Agreement by a British Columbia court after a hearing upon

the fairness of the terms and conditions of the Business Combination Agreement as required by the exemption from registration provided

by Section 3(a)(10) under the Securities Act, and approval of the listing of the Grafiti Common Shares on the Nasdaq Stock Market (“Nasdaq”)

after giving effect to the Damon Business Combination. Upon the consummation of the Damon Business Combination (the “Closing”),

both Inpixon UK and the Damon Surviving Corporation will be wholly-owned subsidiaries of Grafiti, which will adopt a new name as determined

by Damon. Grafiti, after the Closing, is referred to herein as the “combined company.” Pursuant to the Business Combination

Agreement, the parties will take all necessary action so that at the Closing, the board of directors of the combined company will consist

of such directors as Damon may determine, subject to the independent requirements under the Nasdaq rules, and provided that at least one

director will be nominated by Grafiti.

Holders of Grafiti Common Shares,

including Participating Security holders and management that hold Grafiti Common Shares immediately prior to the closing of the Damon

Business Combination, are anticipated to retain approximately 18.75% of the outstanding capital stock of the combined company determined

on a fully diluted basis, which includes up to 5% in equity incentives which may be issued to Inpixon management.

On October 23, 2023, Inpixon

purchased a convertible note from Damon in an aggregate principal amount of $3.0 million (the “Bridge Note”) together with

the Bridge Note Warrant (as defined below) pursuant to a private placement, for a purchase price of $3.0 million. The Bridge Note has

a 12% annual interest rate, payable on the maturity date, which is twelve months from June 16, 2023. The full principal balance and interest

on the Bridge Note will automatically convert into common shares of Damon upon the public listing of Damon or a successor issuer thereof

on a national securities exchange (a “Public Company Event”). The number of shares issued upon conversion due to a Public

Company Event will equal the quotient obtained by dividing (x) the outstanding principal and unpaid accrued interest on the date of a

Public Company Event (or within ten trading days of a direct listing), if any, by (y) the lesser of the then applicable Conversion Price

or Public Company Event Conversion Price, each as defined in the Bridge Note. The Bridge Note will contain customary covenants relating

to Damon’s financials and operations. Inpixon will receive a five-year warrant to purchase 1,096,321 Damon Common Shares in connection

with the Bridge Note (“Bridge Note Warrant”) at an exercise price as defined in the Bridge Note Warrant, in each case subject

to adjustments for dividends, splits and subsequent equity sales by Damon. The Bridge Note Warrant contains a cashless exercise option

if the warrant shares are not covered by an effective registration statement within 180 days following the consummation of the Public

Company Event, and also a full ratchet price protection feature. If the Damon Business Combination is consummated, the Bridge Note will

be converted into Grafiti Common Shares and the Bridge Note Warrant will become exercisable for Grafiti Common Shares.

At-the-Market Offering Extension

On

December 29, 2023, we entered into Amendment No. 2 to the Equity Distribution Agreement (“Amendment 2”) with Maxim, amending

the Equity Distribution Agreement, dated as of July 22, 2022, between the Company and Maxim (the “Original Agreement”), as

amended by Amendment No. 1 to the Original Agreement, dated as of June 13, 2023, between the Company and Maxim (“Amendment 1”

and, together with the Original Agreement and Amendment 2, the “Equity Distribution Agreement”), pursuant to which the parties

extended the term of the Equity Distribution Agreement until the earliest of (i) December 31, 2024, (ii) the sale of shares of the Company’s

common stock having an aggregate offering price equal to the Offering Size (as defined in the Equity Distribution Agreement), and (iii)

the termination by either Maxim or the Company upon the provision of 15 days written notice or otherwise pursuant to the terms of the

Equity Distribution Agreement.

Corporate History

We were originally formed in

the State of Nevada in April 1999. Prior to the spin-off in August 2018 of our wholly-owned subsidiary, Sysorex, Inc.

(“Sysorex”), our business was primarily focused on providing information technology and telecommunications solutions and services

to commercial and government customers primarily in the United States. The product and service offerings included enterprise infrastructure

solutions for business operations, continuity, data protection, software development, collaboration, IT security, and physical security

needs, including, third party hardware, software and related maintenance and warranty products and services resold from well-known brands

and information technology development and implementation professional services.

On August 31, 2018, we

completed the spin-off of Sysorex to separate our legacy enterprise infrastructure solution business from our indoor intelligence

business.

On

May 21, 2019, we completed the acquisition of 100% of the outstanding capital stock of Locality Systems, Inc. (“Locality”),

including its wireless device positioning and RF augmentation of video surveillance systems through our subsidiary, Inpixon Canada. The

video management system (“VMS”) integration, which is currently available for a number of VMS vendors, can assist security

personnel in identifying potential suspects and tracking their movements cross-camera and from one facility to another. The solution

is designed to enhance traditional security video feeds by correlating RF signals with video images.

On

June 27, 2019, we acquired a portfolio of GPS technologies and IP, including, but not limited to (a) an IP portfolio that includes

a registered patent, along with more than 20 pending patent applications or licenses to registered patents or pending applications relating

to GPS technologies; (b) a smart school safety network solution that consists of a combination of wristbands, gateways and proprietary

backend software, which rely on the Bluetooth Low-Energy protocol and a low-power enterprise wireless 2.4Ghz platform, to help

school administrators identify the geographic location of students or other people or things (e.g., equipment, vehicles, tools, etc.)

in order to, among other things, ensure the safety and security of students while at school; (c) a personnel equipment tracking system

and ground personnel safety system, which includes a combination of hardware and software components, for a GPS and RF based personnel,

vehicle and asset-tracking solution designed to provide ground situational awareness and near real-time surveillance of personnel

and equipment traveling within a designated area for, among other things, government and military applications and (d) a right to

30% of royalty payments that may be received by GTX in connection with its ownership interest in Inventergy LBS, LLC, which is the owner

of certain patents related to methods and systems for communicating with a tracking device.

On

August 15, 2019, we acquired our Inpixon Mapping product in connection with the acquisition of Jibestream, Inc. (“Jibestream”)

which was amalgamated into Inpixon Canada on January 1, 2020.

On

October 31, 2019, we received stockholder approval for, and subsequently effected, a reverse split of our outstanding common stock

at a ratio of 1-for-45, effective as of January 7, 2020 for the purpose of complying with Nasdaq Listing Rule 5550(a)(2).

On

June 19, 2020, we acquired an exclusive license to use, market, distribute, and develop the SYSTAT and SigmaPlot software suite of

products (referred to as “SAVES”) pursuant to an Exclusive Software License and Distribution Agreement, by and among the Company,

Cranes Software International Ltd. (“Cranes”) and Systat Software, Inc. (“Systat” and, together with Cranes, the

“Systat Parties”), as amended on June 30, 2020 and February 22, 2021 (as amended, the “License Agreement”).

In connection with the License Agreement, we received an exclusive, worldwide license to use, modify, develop, market, sublicense and

distribute the SAVES software, software source, user documentation and related Systat Intellectual Property (as defined in License Agreement)

(the “License”); and an option to acquire the assets underlying the License (the “Purchase Option”). On February 22,

2021, we exercised the Purchase Option for a portion of the assets including certain of the SAVES software, trademarks, solutions, domain

names and websites.

On

August 19, 2020, we entered into an agreement with Ten Degrees Inc. (“TDI”), Ten Degrees International Limited (“TDIL”),

mCube International Limited (“MCI”), and the holder of a majority of the outstanding capital of TDIL and mCube, Inc., and

the sole shareholder of 100% of the outstanding capital stock of MCI (“mCube,” together with TDI, TDIL, and MCI collectively,

the “Transferors”) to acquire a suite of on-device “blue-dot” indoor location and motion technologies, including

patents, trademarks, software and related intellectual property from the Transferors.

On October 6,

2020, we acquired all of the outstanding shares of Nanotron (“Nanotron Shares”) through our wholly-owned subsidiary Inpixon

GmbH (which has since changed its name to Grafiti GmbH), pursuant to a Share Sale and Purchase Agreement with Nanotron Technologies GmbH,

a limited liability company incorporated under the laws of Germany (which has since changed its name to Inpixon GmbH) (“Nanotron”),

and Sensera Limited (“Sensera”), the sole shareholder of Nanotron. As a result of the acquisition, our asset tracking and

RTLS business expanded to include offering wireless location awareness technology for consumers, for solutions such as locating and tracking

a pet, livestock, child, or property, while transmitting the data into a useable format.

On

March 25, 2021, we entered into a Stock Purchase Agreement (the “GYG Purchase Agreement”) with Game Your Game, Inc.,

a Delaware corporation (“GYG”), and certain selling shareholders (the “Selling Shareholders”), pursuant to which

we acquired an aggregate of 522,000 shares of common stock of GYG (the “GYG Shares”), representing 55.4% of the outstanding

shares of common stock of GYG. GYG’s business consists of developing and providing solutions using sports data and analytics.

On

April 23, 2021 we entered into an asset purchase agreement (the “Asset Purchase Agreement”) with Visualix GmbH i.L. (the

“Visualix”), its founders (each, a “Founder,” and collectively, the “Founders”), and Future Energy

Ventures Management GmbH (“FEVM”) pursuant to which we acquired substantially all of the Visualix assets including certain

computer vision, robust localization, large-scale navigation, mapping, and 3D reconstruction technologies (collectively, the “AR

Technology”), the intellectual property and patent applications underlying the AR Technology.

On

April 30, 2021, we acquired over 99.9% of the outstanding capital stock of Design Reactor, Inc., a California corporation (“The

CXApp”), the provider of a leading SaaS app platform that enables corporate enterprise organizations to provide a custom-branded,

location-aware employee app focused on enhancing the workplace experience and hosting virtual and hybrid events pursuant to the terms

of a Stock Purchase Agreement. On May 10, 2021, we acquired the remaining interest of The CXApp.

On

December 9, 2021, through our wholly-owned subsidiary, Nanotron Technologies GmbH, a limited liability company incorporated

under the laws of Germany, we entered into a Share Sale and Purchase Agreement (the “Purchase Agreement”) with the shareholders

of IntraNav GmbH, a limited liability company incorporated under the laws of Germany (“IntraNav”), pursuant to which we acquired

100% of the outstanding capital stock (the “IntraNav Shares”) of IntraNav, a leading industrial IoT (“IIoT”),

real-time location system (“RTLS”), and sensor data services provider.

On

September 25, 2022, we entered into an Agreement and Plan of Merger (the “KINS Merger Agreement”) by and among Inpixon,

KINS Technology Group Inc., a Delaware corporation (renamed CXApp Inc., “KINS” or “New CXApp”), CXApp Holding

Corp., a Delaware corporation and wholly-owned subsidiary of New CXApp (formerly a wholly-owned subsidiary of Inpixon, “CXApp”),

and KINS Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of KINS (“KINS Merger Sub”), pursuant

to which KINS would acquire Inpixon’s enterprise apps business (including its workplace experience technologies, indoor mapping,

events platform, augmented reality and related business solutions) (the “Enterprise Apps Business”) through the merger of

KINS Merger Sub with and into CXApp (the “KINS Merger”), with CXApp continuing as the surviving company and as a wholly-owned subsidiary

of KINS, in exchange for the issuance of shares of KINS capital stock valued at $69 million (the “KINS Business Combination”).

Immediately prior to the KINS Merger and pursuant to a Separation and Distribution Agreement, dated as of September 25, 2022, among

KINS, Inpixon, Design Reactor, Inc., a California corporation (“Design Reactor”) and CXApp (the “KINS Separation Agreement”),

and other ancillary conveyance documents, Inpixon would, among other things and on the terms and subject to the conditions of the KINS

Separation Agreement, transfer the Enterprise Apps Business, including certain related subsidiaries of Inpixon, including Design Reactor,

to CXApp (the “KINS Reorganization”). Following the KINS Reorganization, Inpixon would distribute 100% of the common stock

of CXApp, par value $0.00001, to certain holders of Inpixon securities as of the record date of March 6, 2023 (the “Enterprise

Apps Spin-Off”).

On

March 14, 2023, we completed the Enterprise Apps Spin-off and subsequent KINS Business Combination (the “KINS Closing”)

In connection with the KINS Closing, KINS was renamed CXApp Inc. (“New CXApp”). Pursuant to the KINS Transaction Agreements,

Inpixon contributed to CXApp cash and certain assets and liabilities constituting the Enterprise Apps Business, including certain related

subsidiaries of Inpixon, to CXApp (the “CXApp Contribution”). In consideration for the CXApp Contribution, CXApp issued to

Inpixon additional shares of CXApp common stock such that the number of shares of CXApp common stock then outstanding equaled the number

of shares of CXApp common stock necessary to effect the KINS Distribution. Pursuant to the KINS Distribution, Inpixon shareholders as

of the KINS Record Date received one share of CXApp common stock for each share of Inpixon common stock held as of such date. Pursuant

to the KINS Merger Agreement, each share of Legacy CXApp common stock was thereafter exchanged for the right to receive 0.09752221612415190

of a share of New CXApp Class A common stock (with fractional shares rounded down to the nearest whole share) and 0.3457605844401750

of a share of New CXApp Class C common stock (with fractional shares rounded down to the nearest whole share). New CXApp Class A

common stock and New CXApp Class C common stock are identical in all respects, except that New CXApp Class C common stock is

not listed and will automatically convert into New CXApp Class A common stock on the earlier to occur of (i) the 180th day

following the closing of the KINS Merger and (ii) the day that the last reported sale price of New CXApp Class A common

stock equals or exceeds $12.00 per share for any 20 trading days within any 30-trading day period following the closing of the

Merger. Upon the closing of the KINS Business Combination, Inpixon’s existing securityholders held approximately 50.0% of the shares

of New CXApp common stock outstanding. The Enterprise Apps Spin-off was expected to be tax-free to Inpixon and its stockholders

for U.S. federal income tax purposes. If the Business Combination with XTI is completed, the Enterprise Apps Spin-off would

become taxable to Inpixon.

On

March 15, 2023, New CXApp began regular-way trading on NASDAQ under the ticker symbol “CXAI.” Inpixon continues

to trade under the ticker symbol “INPX.”

Effective

as of October 7, 2022, we effected a reverse stock split of our authorized and issued and outstanding common stock at a ratio of

1-for-75, for the purpose of complying with Nasdaq Listing Rule 5550(a)(2).

On December 21, 2023, in connection

an internal reorganization, and pursuant to the terms of a contribution agreement, we agreed to contribute and assign to Grafiti LLC,

a newly formed wholly-owned subsidiary of the Company, the assets and liabilities primarily relating to our Saves, Shoom and Game Your

Game business, including but not limited to 100% of the equity interests of Inpixon India, Grafiti GmbH (previously Inpixon Gmbh) and

Game Your Game, Inc., and excluding Inpixon Limited, in exchange for 100% of the equity interests of Grafiti LLC.

On December 27, 2023, we transferred

all of the outstanding common shares of Grafiti Holding, Inc. to the Trust in connection with the Grafiti Spin-off.

Corporate Information

We

currently have two direct operating subsidiaries: (i) Grafiti LLC (100% ownership) based in Palo Alto, California; and (ii) Inpixon GmbH,

previously Nanotron Technologies GmbH, (100% ownership) based in Berlin, Germany. In addition, Grafiti GmbH, previously Inpixon GmbH based

in Ratigen, Germany (100% ownership), Inpixon India based in Hyderbad, India (82.5% ownership), and Game Your Game, Inc., based in Palo

Alto, CA (75% ownership) are indirect subsidiaries of the Company and subsidiaries of Grafiti LLC. Active Mind Technology Ltd. and Active

Mind Technology R&D, both based in Galway, Ireland, are indirect subsidiaries of the Company and the wholly-owned subsidiaries

of Game Your Game Inc. IntraNav GmbH, based in Eschborn, Germany (“IntraNav”) is an indirect subsidiary of the Company and

the wholly-owned subsidiary of Inpixon GmbH (previously Nanotron Technologies GmbH).

Our principal executive offices

are located at 405 Waverley St., Palo Alto, CA 94301, and our telephone number is (408) 702-2167. Our subsidiaries maintain

offices in Hyderabad, India, Berlin Germany, Ratingen, Germany and Eschborn, Germany. Our Internet website is www.inpixon.com.

The information on, or that can be accessed through, our website is not part of this report, and you should not rely on any such information

in making any investment decision relating to our common stock.

The Offering

| Securities offered by the Selling Stockholders |

|

Warrants to purchase up to 49,131,148 shares of common stock and 49,131,148

Warrant Shares issuable upon exercise of the Warrants. |

| |

|

|

| Shares of common stock outstanding immediately prior to this offering |

|

194,298,358 shares. |

| |

|

|

| Terms of this offering |

|

The Selling Stockholders will determine when and how to sell the securities

offered in this prospectus, as described in “Plan of Distribution.” |

| |

|

|

| Use of proceeds |

|

We will not receive any proceeds from the sale of the Warrants or the

Warrant Shares in this offering. However, we will receive proceeds from the exercise of the Warrants by the Selling Stockholders to the

extent they are exercised for cash. In the event we receive proceeds from the cash exercise of the Warrants, we intend to use the aggregate

net proceeds from the exercise of the Warrants for general corporate purposes, including working capital. See the sections titled “Use

of Proceeds” and “Selling Stockholders” for additional information. |

| |

|

|

| Nasdaq Capital Market symbol |

|

INPX |

| |

|

|

| Reverse stock split |

|

Our Board of Directors and stockholders have approved a resolution authorizing our Board of Directors to effect a reverse split of our common stock at an exchange ratio between one-for-two and one-for two-hundred with our Board of Directors retaining the discretion as to whether to implement the reverse split and the exact exchange ratio to implement. We anticipate that following the effectiveness of the registration statement of which this prospectus forms a part, and in connection with the closing of the transaction contemplated by the XTI Merger Agreement, our Board of Directors will determine the reverse stock split ratio (“Inpixon Reverse Split”). Except where specifically noted, all information in this prospectus does not give effect to any Inpixon Reverse Split. |

| |

|

|

| Risk factors |

|

Investment in our securities involves a high degree of risk and could

result in a loss of your entire investment. See the section entitled “Risk Factors” of this prospectus and the section entitled

“Risk Factors” in the documents incorporated by reference herein for a discussion of factors you should carefully consider

before investing in our securities. |

Unless otherwise indicated,

the number of shares of our common stock outstanding prior to this offering is based on 194,298,358 shares of common stock outstanding

as of January 30, 2024, and excludes as of such date:

| |

● |

9 shares of common stock issuable upon the exercise of outstanding stock options under our 2011 Employee Stock Incentive Plan, having a weighted average exercise price of $83,037,950.50 per share; |

| |

● |

105,384 shares of common stock issuable upon the exercise of outstanding stock options under the Company’s 2018 Employee Stock Incentive Plan, having a weighted average exercise price of $63.97 per share; |

| |

● |

62,015,945 shares of common stock available for future issuance under our 2018 Employee Stock Incentive Plan and any other additional shares of our common stock that may become available under our 2018 Employee Stock Incentive Plan; |

| |

● |

34 shares of common stock issuable upon the exercise of warrants originally issued in January of 2019 at an exercise price of $11,238.75 per share; |

| |

● |

73 shares of common stock issuable upon the exercise of Series A warrants originally issued in August of 2019 at an exercise price of $936.56 per share; |

| |

● |

3,846,153 shares of common stock issuable upon the exercise of warrants at an exercise price of $5.85 per share; |

| |

● |