UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 or

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-14946

Cemex, S.A.B. de C.V.

(Translation of Registrant’s name into English)

Avenida

Ricardo Margáin Zozaya #325, Colonia Valle del Campestre,

San Pedro Garza García, Nuevo León 66265,

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Contents

|

|

|

| 1. |

|

Press release dated February 8, 2024, announcing fourth quarter 2023 results for Cemex, S.A.B. de C.V. (NYSE: CX) (“Cemex”). |

|

|

| 2. |

|

Fourth quarter 2023 results for Cemex. |

|

|

| 3. |

|

Presentation regarding fourth quarter 2023 results for Cemex. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Cemex, S.A.B. de C.V. has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cemex, S.A.B. de C.V. |

|

|

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

| Date: |

|

February 8, 2024 |

|

|

|

By: |

|

/s/ Rafael Garza Lozano |

|

|

|

|

|

|

|

|

Name: Rafael Garza Lozano |

|

|

|

|

|

|

|

|

Title: Chief Comptroller |

3

EXHIBIT INDEX

|

|

|

EXHIBIT

NO. |

|

DESCRIPTION |

|

|

| 1. |

|

Press release dated February 8, 2024, announcing fourth quarter 2023 results for Cemex, S.A.B. de C.V. (NYSE: CX) (“Cemex”). |

|

|

| 2. |

|

Fourth quarter 2023 results for Cemex. |

|

|

| 3. |

|

Presentation regarding fourth quarter 2023 results for Cemex. |

4

Exhibit 1

Cemex announces record annual EBITDA

and proposal to initiate a dividend program

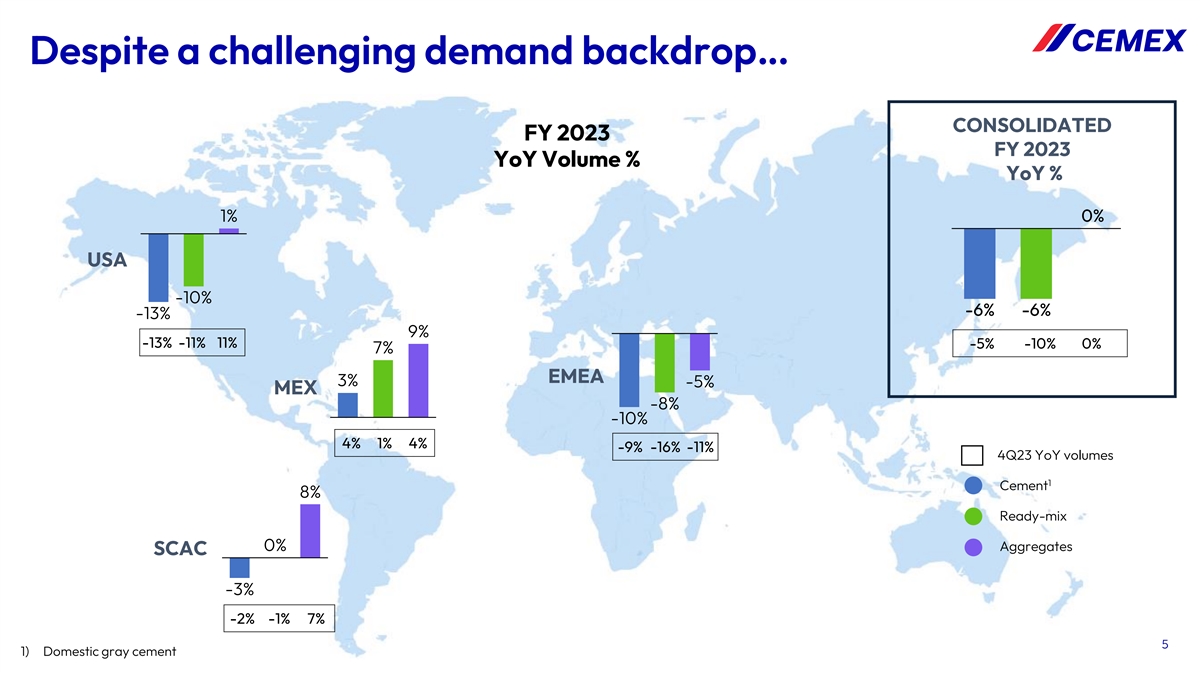

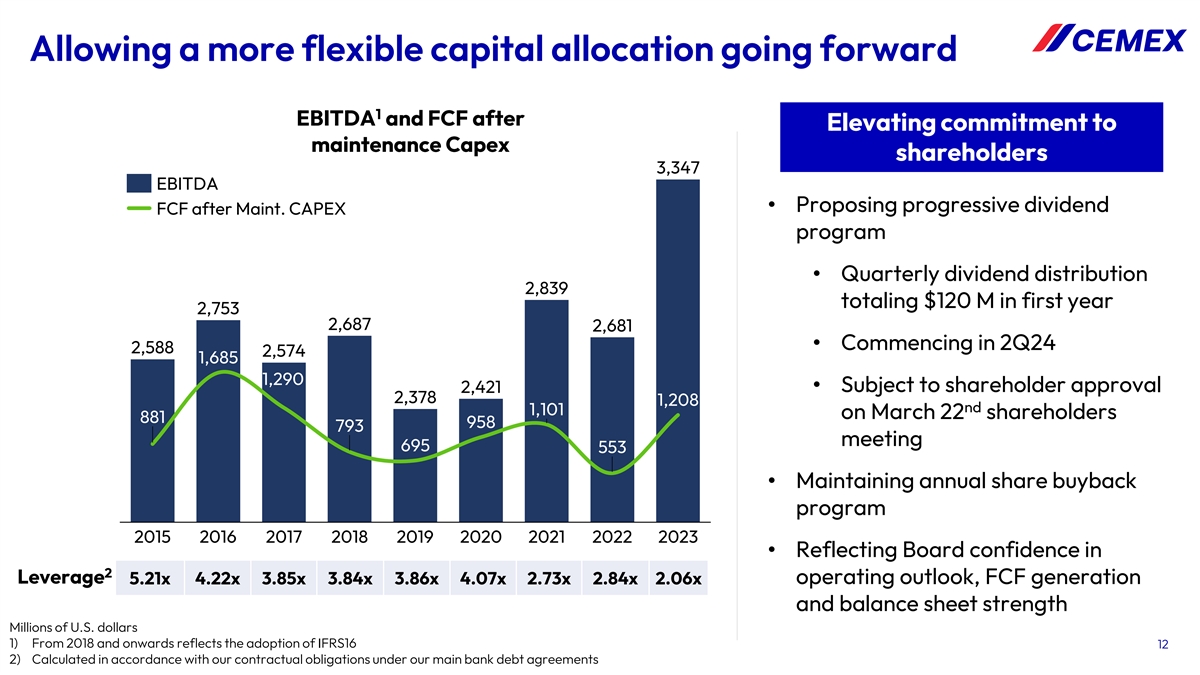

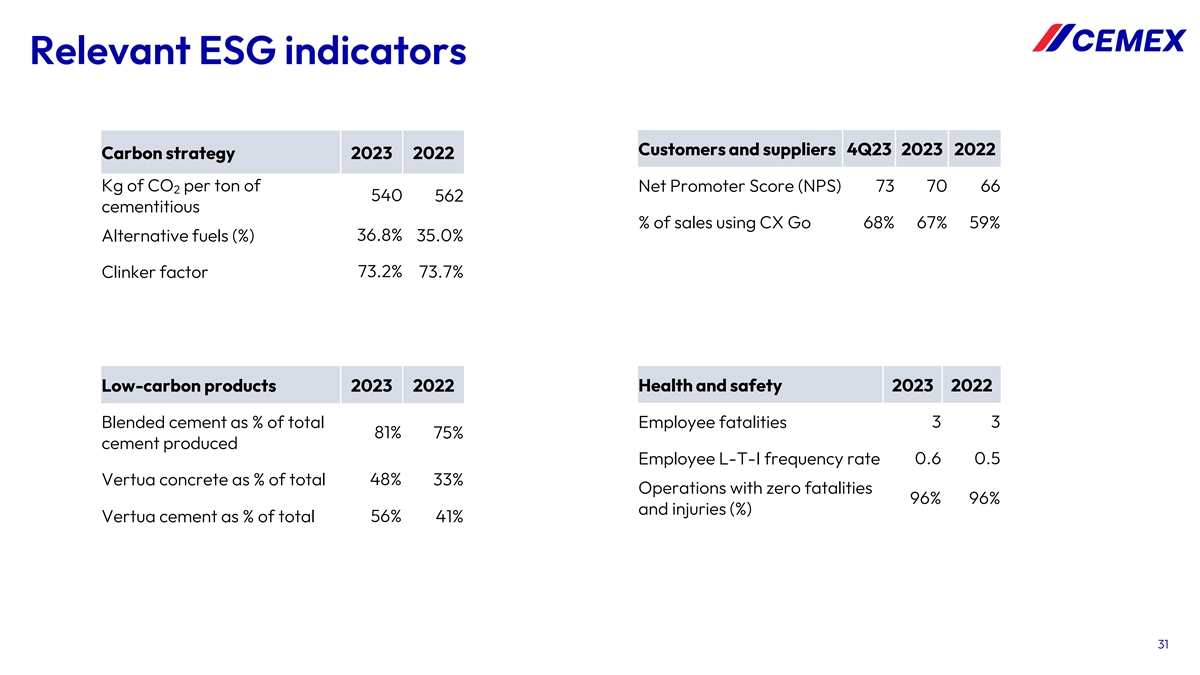

Monterrey, Mexico. February 8, 2024 – Cemex reported today exceptional 2023 results, with an 8% growth in Sales, 20% increase

in EBITDA, and a more than doubling of Free Cash Flow after maintenance capex to US$1.2 billion. This performance, coupled with the Board’s confidence in the medium-term outlook and strong free cash flow generation over the last few years,

allows Cemex to initiate a formal shareholder return program, subject to approval at the next Annual Shareholders’ Meeting.

Cemex reported an EBITDA

margin of 19.2%, an expansion of 2.0pp, achieving its stated goal of recovering 2021 margin. Record EBITDA of approximately US$3.35 billion, and a turnaround in working capital investment, significantly contributed to a 6-year high in Free Cash Flow after maintenance capex. Results were bolstered by strong pricing for its products across all markets, decelerating input cost inflation, and contributions from Cemex’s growth

investment strategy and Urbanization Solutions business. Cemex’s leverage ratio declined to 2.06x(1), within investment grade parameters.

“I am pleased to announce that 2023 is a record year for our company where we delivered not only great results and recovered from the extraordinary

inflationary pressures of the last few years, but also continued executing against our ambitious decarbonization commitments, reducing our CO2 emissions by 4% this year and by 13% since

2020,” said Fernando A. González, CEO of Cemex. “Despite the significant macro challenges of the last four years, we have proven not only the resiliency of our business model but also our ability to pivot and adjust rapidly to

changing global conditions. This foundation gives us additional flexibility in capital allocation, where we continue to accelerate investments in our bolt-on growth strategy, initiate a sustainable return

program for shareholders, and bolster our capital structure.”

Cemex proposes the initiation of a quarterly dividend program:

| |

• |

|

Subject to approval at Cemex’s Annual Shareholder Meeting to be scheduled on March 22nd. |

| |

• |

|

Equal quarterly dividend distribution totaling US$120 million in first year; first payment commencing in 2nd quarter of 2024 and final payment in 1st quarter of 2025. |

| |

• |

|

Subsequent dividend distributions under the program will be subject to shareholder approval.

|

Cemex’s Consolidated 2023 Full Year and 4th Quarter Financial and

Operational Highlights.

| |

• |

|

Net Sales increased 8%, to US$17,416 million in 2023, and 5% to US$4,243 million in the

4th quarter. |

| |

• |

|

EBITDA increased 20%, to US$3,347 million in 2023, and 13%, to US$743 million in the 4th quarter. |

| |

• |

|

EBITDA margin increased 2.0pp in 2023, to 19.2%, and by 1.2 pp, to 17.5% in the 4th quarter.

|

| |

• |

|

Free Cash Flow after Maintenance Capital Expenditures was US$1,208 million in 2023, and US$511 million

in 4th quarter. |

| |

• |

|

For the full year, EBITDA from Cemex’s Urbanization Solutions business increased by 27%.

|

| |

• |

|

Continued execution of Cemex’s decarbonization roadmap, with a 4% YoY CO2 reduction in 2023 and 13% since 2020. |

| |

• |

|

Controlling interest net income after adjusting for a previously disclosed adverse tax judgement in Spain of

US$613 million in 4th quarter, was US$63 million lower YoY for the full year, and was US$271 million higher YoY for the fourth quarter. |

1

Geographical Markets 2023 Full Year and 4th Quarter

Highlights.

| |

• |

|

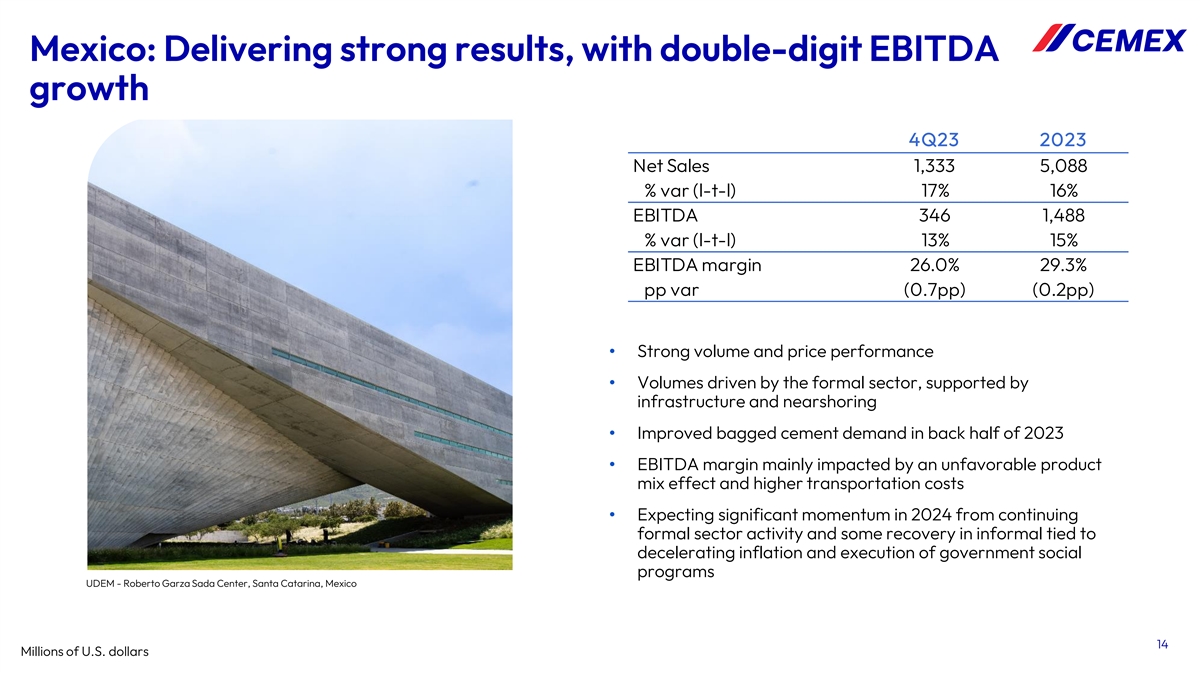

Net Sales in Mexico increased 16% in 2023, to US$5,088 million, and 17% in 4th quarter, to US$1,333 million. EBITDA increased 15% in 2023, to US$1,488 million, and increased 13% in 4th quarter, to

US$346 million. |

| |

• |

|

Cemex’s operations in the United States reported Net Sales of US$5,338 million in 2023, an increase of

6%, and US$1,269 million in 4th quarter, an increase of 4%. EBITDA increased 37% in 2023, to US$1,040 million, and increased 18% to US$239 million in the 4th quarter.

|

| |

• |

|

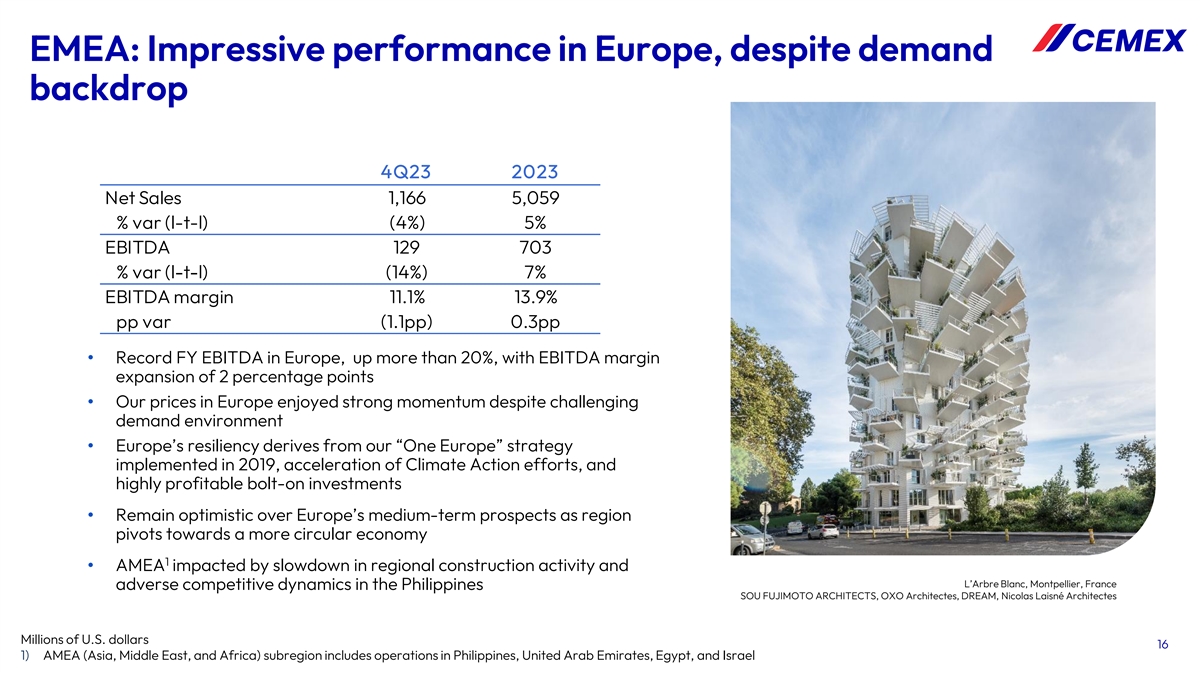

In the Europe, Middle East, Africa and Asia region, Net Sales increased by 5% in 2023, to US$5,059 million,

and decreased 4% in 4th quarter, to US$1,166 million. EBITDA was US$703 million in 2023, 7% higher, and US$129 million for 4th

quarter, a 14% decrease. |

| |

• |

|

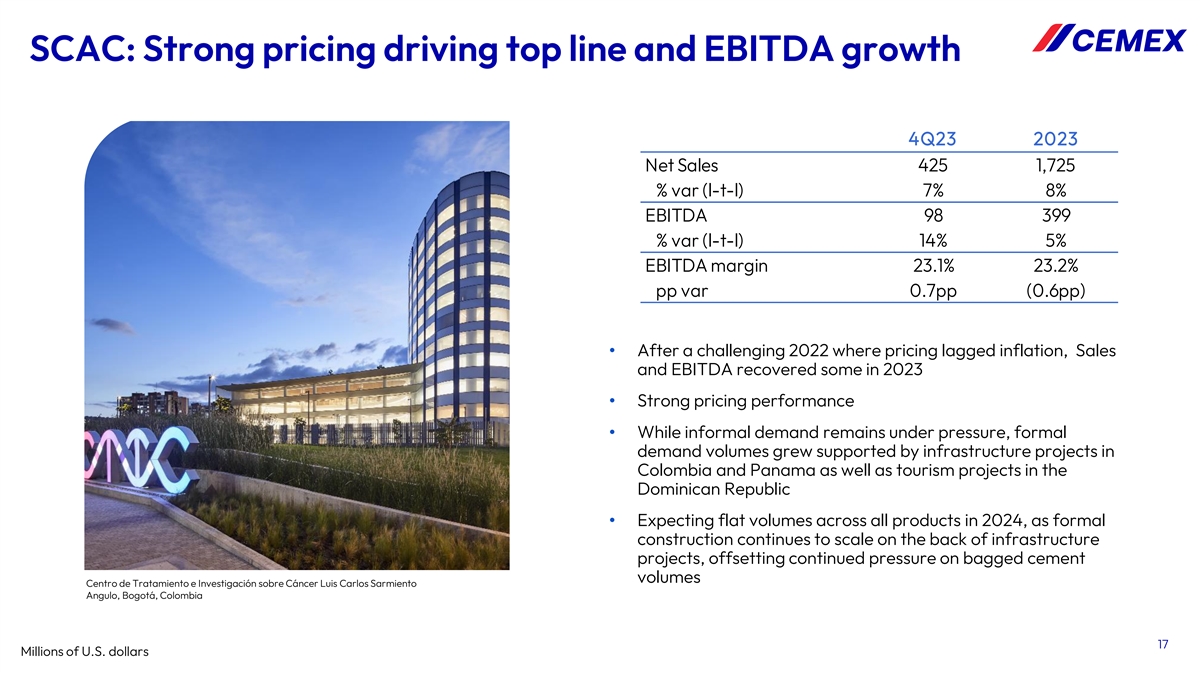

Cemex’s operations in the South, Central America, and the Caribbean region, reported Net Sales of

US$1,725 million in 2023, an increase of 8%, and US$425 million in 4th quarter, an increase of 7%. EBITDA increased 5% to US$399 million in 2023 and increased 14% to

US$98 million in the 4th quarter. |

Note: All percentage variations related to Net Sales and EBITDA are on a like-to-like basis for the ongoing operations and for foreign exchange fluctuations compared to the same period of last year. All references to EBITDA mean Operating EBITDA.

| (1) |

Calculated in accordance with Cemex’s bank debt agreements. |

About Cemex

Cemex is a global construction materials

company that is building a better future through sustainable products and solutions. Cemex is committed to achieving carbon neutrality through relentless innovation and industry-leading research and development. Cemex is at the forefront of the

circular economy in the construction value chain and is pioneering ways to increase the use of waste and residues as alternative raw materials and fuels in its operations with the help of new technologies. Cemex offers cement, ready-mix concrete, aggregates, and urbanization solutions in growing markets around the world, powered by a multinational workforce focused on providing a superior customer experience enabled by digital

technologies. For more information, please visit: www.cemex.com

Contact information

Analyst and Investor Relations - Monterrey

Fabián Orta

+52 (81) 8888-4327

ir@cemex.com

Analyst and Investor Relations - New York

Scott Pollak

+1 (212) 317-6011

ir@cemex.com

Media Relations

Jorge Pérez

+52 (81) 8259-6666

jorgeluis.perez@cemex.com

###

2

Except as the context otherwise may require, references in this press release to “Cemex,”

”we,” ”us,” ”our,” refer to Cemex, S.A.B. de C.V. and its consolidated subsidiaries. This press release contains forward-looking statements within the meaning of the U.S. federal securities laws. Cemex intends these

forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the U.S. federal securities laws. These forward-looking statements reflect Cemex’s current expectations and projections about future events

based on Cemex’s knowledge of present facts and circumstances and assumptions about future events, as well as Cemex’s current plans based on such facts and circumstances, unless otherwise indicated. These statements necessarily involve

risks, uncertainties, and assumptions that could cause actual results to differ materially from Cemex’s expectations, including, among others, risks, uncertainties, and assumptions discussed in Cemex’s most recent annual report and

detailed from time to time in Cemex’s other filings with the U.S. Securities and Exchange Commission and the Mexican Stock Exchange (Bolsa Mexicana de Valores), which factors are incorporated herein by reference, which if materialized could

ultimately lead to Cemex’s expectations and/or expected results not producing the expected benefits and/or results. Forward-looking statements should not be considered guarantees of future performance, nor the results or developments are

indicative of results or developments in subsequent periods. These factors may be revised or supplemented, and the information contained in this press release is subject to change without notice, but Cemex is not under, and expressly disclaims, any

obligation to update or correct this press release or revise any forward-looking statement contained herein, whether as a result of new information, future events or otherwise, or to reflect the occurrence of anticipated or unanticipated events or

circumstances. Any or all of Cemex’s forward-looking statements may turn out to be inaccurate. Accordingly, undue reliance on forward-looking statements should not be placed, as such forward-looking statements speak only as of the dates on

which they are made. The content of this press release is for informational purposes only, and you should not construe any such information or other material as legal, tax, investment, financial, or other advice. All references to prices in this

press release refer to Cemex’s prices for Cemex products and services. There is currently no single globally recognized or accepted, consistent, and comparable set of definitions or standards (legal, regulatory, or otherwise) of, nor widespread

cross-market consensus i) as to what constitutes, a ‘green’, ‘social,’ or ‘sustainable’ or having equivalent-labelled activity, product, or asset; or ii) as to what precise attributes are required for a particular

activity, product, or asset to be defined as ‘green’, ‘social,’ or ‘sustainable’ or such other equivalent label; or iii) as to climate and sustainable funding and financing activities and their classification and

reporting. Therefore, there is little certainty, and no assurance or representation is given that such activities and/or reporting of those activities will meet any present or future expectations or requirements for describing or classifying funding

and financing activities as ‘green’, ‘social’, or ‘sustainable’ or attributing similar labels. We expect policies, regulatory requirements, standards, and definitions to be developed and continuously evolve over time.

3

Exhibit 2

Fourth Quarter Results 2023

Oum Wellness Center,

San Pedro Garza García, Mexico

Built with Resilia and Pervia concrete, part of our Vertua family of sustainable products

Stock Listing Information

NYSE (ADS)

Ticker: CX

Mexican Stock Exchange (CPO)

Ticker: CEMEX.CPO

Ratio of CEMEXCPO to CX = 10:1

Investor Relations

In the United States:

+ 1 877 7CX NYSE

In Mexico:

+ 52 (81) 8888 4292

E-Mail: ir@cemex.com

|

|

|

| Operating and financial highlights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

January - December |

|

|

|

|

|

Fourth Quarter |

|

| |

|

|

|

|

|

|

|

|

|

|

l-t-l |

|

|

|

|

|

|

|

|

|

|

|

l-t-l |

|

| |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

% var |

|

|

2023 |

|

|

2022 |

|

|

% var |

|

|

% var |

|

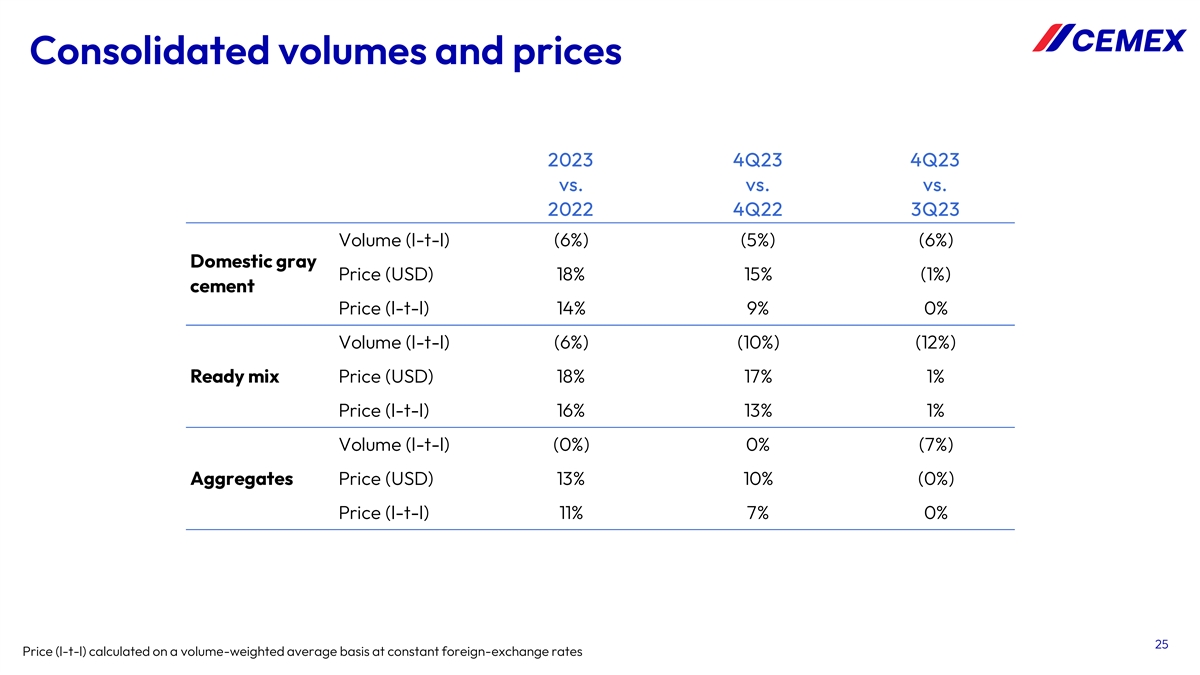

| Consolidated volumes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic gray cement |

|

|

51,665 |

|

|

|

55,134 |

|

|

|

(6 |

%) |

|

|

|

|

|

|

12,584 |

|

|

|

13,288 |

|

|

|

(5 |

%) |

|

|

|

|

| Ready-mix |

|

|

47,093 |

|

|

|

50,026 |

|

|

|

(6 |

%) |

|

|

|

|

|

|

10,803 |

|

|

|

12,043 |

|

|

|

(10 |

%) |

|

|

|

|

| Aggregates |

|

|

138,839 |

|

|

|

139,210 |

|

|

|

(0 |

%) |

|

|

|

|

|

|

33,699 |

|

|

|

33,654 |

|

|

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

|

17,416 |

|

|

|

15,577 |

|

|

|

12 |

% |

|

|

8 |

% |

|

|

4,243 |

|

|

|

3,869 |

|

|

|

10 |

% |

|

|

5 |

% |

| Gross profit |

|

|

5,861 |

|

|

|

4,822 |

|

|

|

22 |

% |

|

|

16 |

% |

|

|

1,432 |

|

|

|

1,208 |

|

|

|

19 |

% |

|

|

12 |

% |

| as % of net sales |

|

|

33.7 |

% |

|

|

31.0 |

% |

|

|

2.7pp |

|

|

|

|

|

|

|

33.7 |

% |

|

|

31.2 |

% |

|

|

2.5pp |

|

|

|

|

|

| Operating earnings before other income and expenses, net |

|

|

2,114 |

|

|

|

1,561 |

|

|

|

35 |

% |

|

|

29 |

% |

|

|

432 |

|

|

|

361 |

|

|

|

20 |

% |

|

|

14 |

% |

| as % of net sales |

|

|

12.1 |

% |

|

|

10.0 |

% |

|

|

2.1pp |

|

|

|

|

|

|

|

10.2 |

% |

|

|

9.3 |

% |

|

|

0.9pp |

|

|

|

|

|

| SG&A expenses as % of net sales |

|

|

9.1 |

% |

|

|

8.0 |

% |

|

|

1.1pp |

|

|

|

|

|

|

|

10.6 |

% |

|

|

8.5 |

% |

|

|

2.1pp |

|

|

|

|

|

| Controlling interest net income (loss) |

|

|

182 |

|

|

|

858 |

|

|

|

(79 |

%) |

|

|

|

|

|

|

(441 |

) |

|

|

(99 |

) |

|

|

(345 |

%) |

|

|

|

|

| Operating EBITDA |

|

|

3,347 |

|

|

|

2,681 |

|

|

|

25 |

% |

|

|

20 |

% |

|

|

743 |

|

|

|

630 |

|

|

|

18 |

% |

|

|

13 |

% |

| as % of net sales |

|

|

19.2 |

% |

|

|

17.2 |

% |

|

|

2.0pp |

|

|

|

|

|

|

|

17.5 |

% |

|

|

16.3 |

% |

|

|

1.2pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow after maintenance capital expenditures |

|

|

1,208 |

|

|

|

553 |

|

|

|

118 |

% |

|

|

|

|

|

|

511 |

|

|

|

391 |

|

|

|

31 |

% |

|

|

|

|

| Free cash flow |

|

|

788 |

|

|

|

78 |

|

|

|

909 |

% |

|

|

|

|

|

|

403 |

|

|

|

201 |

|

|

|

101 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total debt |

|

|

7,486 |

|

|

|

8,147 |

|

|

|

(8 |

%) |

|

|

|

|

|

|

7,486 |

|

|

|

8,147 |

|

|

|

(8 |

%) |

|

|

|

|

| Earnings (loss) of continuing operations per ADS |

|

|

0.12 |

|

|

|

0.36 |

|

|

|

(66 |

%) |

|

|

|

|

|

|

(0.30 |

) |

|

|

(0.12 |

) |

|

|

(160 |

%) |

|

|

|

|

| Fully diluted earnings (loss) of continuing operations per ADS |

|

|

0.12 |

|

|

|

0.36 |

|

|

|

(66 |

%) |

|

|

|

|

|

|

(0.30 |

) |

|

|

(0.12 |

) |

|

|

(160 |

%) |

|

|

|

|

| Average ADSs outstanding (1) |

|

|

1,471 |

|

|

|

1,478 |

|

|

|

(1 |

%) |

|

|

|

|

|

|

1,471 |

|

|

|

1,475 |

|

|

|

(0 |

%) |

|

|

|

|

| Employees |

|

|

46,063 |

|

|

|

43,535 |

|

|

|

6 |

% |

|

|

|

|

|

|

46,063 |

|

|

|

43,535 |

|

|

|

6 |

% |

|

|

|

|

| (1) |

For purposes of this report, Average ADSs outstanding equals the total number of Series A shares and Series B

shares outstanding as if they were all held in ADS form. Please see “Equity-related information” below in this report. The calculation of Average ADSs outstanding also includes the restricted CPOs allocated to eligible employees as

variable compensation. |

This information does not include discontinued operations. Please see page 14 of this report for

additional information. Cement and aggregates volumes in thousands of metric tons. Ready-mix volumes in thousands of cubic meters. In millions of U.S. dollars, except volumes, percentages, employees, and per-ADS amounts. Average ADSs outstanding are presented in millions. Please refer to page 13 for end-of quarter CPO-equivalent units

outstanding.

Consolidated net sales in 2023 reached US$17.4 billion, an increase of 8% on a like-to-like basis, while increasing 5% in fourth quarter, compared to the fourth quarter of 2022. Our higher prices in local currency terms in all regions drove our top line

growth.

Cost of sales, as a percentage of Net Sales, decreased by 2.7pp to 66.3% in 2023, and was 2.5pp lower in the fourth quarter versus the

same period last year, mainly driven by pricing of our products, easing cost headwinds, and operational efficiencies. This was the fifth consecutive quarter of year-over-year decrease in cost of sales as a percentage of Net Sales.

Operating expenses, as a percentage of Net Sales, increased by 0.6pp in 2023 to 21.5%, and was 1.7pp higher during the fourth quarter of 2023 compared

with the same period last year.

Operating EBITDA in 2023 grew 20% on a

like-to-like basis, reaching a record US$3.35 billion, with growth in all four regions, while increasing 13% in the fourth quarter. Operating EBITDA outperformance

reflects not only strong pricing of our products and decelerating input cost inflation, but also the success of our growth investment strategy, as well as continued growth in our Urbanization Solutions business.

Operating EBITDA margin increased by 2.0pp from 17.2% to 19.2% in 2023 and was 1.2pp higher in fourth

quarter. The expansion reflects the pricing strategy execution for our products, as well as easing cost inflation and operational efficiencies, with full year margin exceeding our goal of recovering 2021 levels, after adjusting for volume and

product mix.

Controlling interest net income (loss) resulted in an income of US$182 million in 2023 and a loss of US$441 million in the

fourth quarter. Despite better operating performance, net income for the year was lower due to a provision for a tax fine created in fourth quarter related to a tax matter in Spain. In addition, in 2022 we recorded a gain from the sale of our

operations in Costa Rica and El Salvador, and Neoris.

|

|

|

| 2023 Fourth Quarter Results |

|

Page 2 |

|

|

|

| Operating results |

|

|

Mexico

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

l-t-l

% var |

|

|

2023 |

|

|

2022 |

|

|

% var |

|

|

l-t-l

% var |

|

| Net sales |

|

|

5,088 |

|

|

|

3,842 |

|

|

|

32 |

% |

|

|

16 |

% |

|

|

1,333 |

|

|

|

1,016 |

|

|

|

31 |

% |

|

|

17 |

% |

| Operating EBITDA |

|

|

1,488 |

|

|

|

1,133 |

|

|

|

31 |

% |

|

|

15 |

% |

|

|

346 |

|

|

|

271 |

|

|

|

28 |

% |

|

|

13 |

% |

| Operating EBITDA margin |

|

|

29.3 |

% |

|

|

29.5 |

% |

|

|

(0.2pp |

) |

|

|

|

|

|

|

26.0 |

% |

|

|

26.7 |

% |

|

|

(0.7pp |

) |

|

|

|

|

In millions of U.S. dollars, except percentages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic gray cement |

|

|

Ready-mix |

|

|

Aggregates |

|

Year-over-year percentage

variation |

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

| Volume |

|

|

3 |

% |

|

|

4 |

% |

|

|

7 |

% |

|

|

1 |

% |

|

|

9 |

% |

|

|

4 |

% |

| Price (USD) |

|

|

27 |

% |

|

|

21 |

% |

|

|

42 |

% |

|

|

37 |

% |

|

|

41 |

% |

|

|

44 |

% |

| Price (local currency) |

|

|

11 |

% |

|

|

8 |

% |

|

|

25 |

% |

|

|

22 |

% |

|

|

23 |

% |

|

|

29 |

% |

Our Mexican operations delivered strong results in 2023, with both Sales and EBITDA growing in the mid

teen percentage area, supported by strong volumes and pricing of our products. Operating EBITDA margin slightly decreased in the year mainly due to an unfavorable product mix effect and higher transportation costs.

The recovery in cement volumes in 2023 was driven by the formal sector, with bulk cement more than offsetting the decline in bagged, while

ready mix and aggregate volumes grew high single-digit. Importantly, we have seen a pickup in bagged cement demand in the back half of the year which we believe bodes well for 2024.

United States

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

l-t-l

% var |

|

|

2023 |

|

|

2022 |

|

|

% var |

|

|

l-t-l

% var |

|

| Net sales |

|

|

5,338 |

|

|

|

5,038 |

|

|

|

6 |

% |

|

|

6 |

% |

|

|

1,269 |

|

|

|

1,221 |

|

|

|

4 |

% |

|

|

4 |

% |

| Operating EBITDA |

|

|

1,040 |

|

|

|

762 |

|

|

|

37 |

% |

|

|

37 |

% |

|

|

239 |

|

|

|

202 |

|

|

|

18 |

% |

|

|

18 |

% |

| Operating EBITDA margin |

|

|

19.5 |

% |

|

|

15.1 |

% |

|

|

4.4pp |

|

|

|

|

|

|

|

18.8 |

% |

|

|

16.5 |

% |

|

|

2.3pp |

|

|

|

|

|

In millions of U.S. dollars, except percentages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic gray cement |

|

|

Ready-mix |

|

|

Aggregates |

|

Year-over-year percentage

variation |

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

| Volume |

|

|

(13 |

%) |

|

|

(13 |

%) |

|

|

(10 |

%) |

|

|

(11 |

%) |

|

|

1 |

% |

|

|

11 |

% |

| Price (USD) |

|

|

14 |

% |

|

|

10 |

% |

|

|

19 |

% |

|

|

14 |

% |

|

|

12 |

% |

|

|

(0 |

%) |

| Price (local currency) |

|

|

14 |

% |

|

|

10 |

% |

|

|

19 |

% |

|

|

14 |

% |

|

|

12 |

% |

|

|

(0 |

%) |

The United States posted record full year Operating EBITDA of over US$1 billion in 2023, an

important milestone for the business. Operating EBITDA grew 37% year-over-year due to the pricing strategy for our products, growth investments, and decelerating costs. The material Operating EBITDA margin recovery of 4.4pp reflects our success in

recovering multi-year cost inflation through pricing as well as easing inflation headwinds.

Prices in 2023 for our three core products

rose between 12% and 19%.

Volume decline in the US in 2023 largely reflects bad weather, lower residential and commercial demand,

completion of some large industrial projects, as well as some market share loss due to our pricing strategy for our products. In response to the slowdown in demand, we were once again able to reduce our lower margin cement imports to support

profitability.

|

|

|

| 2023 Fourth Quarter Results |

|

Page 3 |

|

|

|

| Operating results |

|

|

Europe, Middle East, Africa and Asia

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

l-t-l

% var |

|

|

2023 |

|

|

2022 |

|

|

% var |

|

|

l-t-l

% var |

|

| Net sales |

|

|

5,059 |

|

|

|

4,930 |

|

|

|

3 |

% |

|

|

5 |

% |

|

|

1,166 |

|

|

|

1,199 |

|

|

|

(3 |

%) |

|

|

(4 |

%) |

| Operating EBITDA |

|

|

703 |

|

|

|

670 |

|

|

|

5 |

% |

|

|

7 |

% |

|

|

129 |

|

|

|

146 |

|

|

|

(11 |

%) |

|

|

(14 |

%) |

| Operating EBITDA margin |

|

|

13.9 |

% |

|

|

13.6 |

% |

|

|

0.3pp |

|

|

|

|

|

|

|

11.1 |

% |

|

|

12.2 |

% |

|

|

(1.1pp |

) |

|

|

|

|

In millions of U.S. dollars, except percentages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic gray cement |

|

|

Ready-mix |

|

|

Aggregates |

|

Year-over-year percentage

variation |

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

| Volume |

|

|

(10 |

%) |

|

|

(9 |

%) |

|

|

(8 |

%) |

|

|

(16 |

%) |

|

|

(5 |

%) |

|

|

(11 |

%) |

| Price (USD) |

|

|

15 |

% |

|

|

11 |

% |

|

|

10 |

% |

|

|

9 |

% |

|

|

8 |

% |

|

|

8 |

% |

| Price (local currency) (*) |

|

|

18 |

% |

|

|

9 |

% |

|

|

12 |

% |

|

|

7 |

% |

|

|

8 |

% |

|

|

5 |

% |

EMEA delivered solid full year results despite a challenging demand environment. The operating EBITDA growth and margin

expansion experienced in the first nine months of the year was interrupted in the fourth quarter, with a slowdown in construction activity in the region, as well as major maintenance in the Philippines. Despite the slowdown, full year EBITDA rose

7%, while EBITDA margin expanded by 0.3 percentage points.

Europe posted record full year Operating EBITDA, growing more than 20%, and margin

expansion of 2pp. These achievements are attributable to the success of our “One Europe” strategy implemented in 2019 which consolidated and integrated our footprint in the region, accelerated our Climate Action efforts, while

rationalizing costs and pursuing bolt-on growth investments in integrated urban micro markets.

In Asia, Middle

East and Africa, adverse competitive dynamics in the Philippines, as well as an overall slowdown of construction activity, negatively impacted the region throughout the year.

| (*) |

Calculated on a volume-weighted-average basis at constant foreign-exchange rates. |

South, Central America and the Caribbean

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

l-t-l

% var |

|

|

2023 |

|

|

2022 |

|

|

% var |

|

|

l-t-l

% var |

|

| Net sales |

|

|

1,725 |

|

|

|

1,605 |

|

|

|

7 |

% |

|

|

8 |

% |

|

|

425 |

|

|

|

377 |

|

|

|

13 |

% |

|

|

7 |

% |

| Operating EBITDA |

|

|

399 |

|

|

|

382 |

|

|

|

4 |

% |

|

|

5 |

% |

|

|

98 |

|

|

|

84 |

|

|

|

16 |

% |

|

|

14 |

% |

| Operating EBITDA margin |

|

|

23.2 |

% |

|

|

23.8 |

% |

|

|

(0.6pp |

) |

|

|

|

|

|

|

23.1 |

% |

|

|

22.4 |

% |

|

|

0.7pp |

|

|

|

|

|

In millions of U.S. dollars, except percentages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic gray cement |

|

|

Ready-mix |

|

|

Aggregates |

|

Year-over-year

percentage variation |

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

| Volume |

|

|

(3 |

%) |

|

|

(2 |

%) |

|

|

(0 |

%) |

|

|

(1 |

%) |

|

|

8 |

% |

|

|

7 |

% |

| Price (USD) |

|

|

8 |

% |

|

|

12 |

% |

|

|

21 |

% |

|

|

36 |

% |

|

|

14 |

% |

|

|

23 |

% |

| Price (local currency) (*) |

|

|

9 |

% |

|

|

7 |

% |

|

|

20 |

% |

|

|

19 |

% |

|

|

14 |

% |

|

|

7 |

% |

|

|

|

| 2023 Fourth Quarter Results |

|

Page 4 |

|

|

|

| Operating results |

|

|

In South, Central America and Caribbean, after a challenging 2022 where the pricing for our products

struggled to keep up with cost inflation, Sales and Operating EBITDA rebounded in 2023.

Pricing of our products drove top line growth, with cement prices

increasing 9%, but still not sufficient to cover input cost inflation. While bagged cement demand remains under pressure, bulk volumes continue to grow, supported by infrastructure projects such as the Bogotá Metro, the 4th Bridge over the Canal in Panamá and tourism related projects in the Dominican Republic.

| (*) |

Calculated on a volume-weighted-average basis at constant foreign-exchange rates. |

|

|

|

| 2023 Fourth Quarter Results |

|

Page 5 |

|

|

|

| Operating results |

|

|

Operating EBITDA and free cash flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

2023 |

|

|

2022 |

|

|

% var |

|

| Operating earnings before other income and expenses, net |

|

|

2,114 |

|

|

|

1,561 |

|

|

|

35 |

% |

|

|

432 |

|

|

|

361 |

|

|

|

20 |

% |

| + Depreciation and operating amortization |

|

|

1,233 |

|

|

|

1,120 |

|

|

|

|

|

|

|

311 |

|

|

|

270 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating EBITDA |

|

|

3,347 |

|

|

|

2,681 |

|

|

|

25 |

% |

|

|

743 |

|

|

|

630 |

|

|

|

18 |

% |

| - Net financial expense |

|

|

574 |

|

|

|

529 |

|

|

|

|

|

|

|

145 |

|

|

|

132 |

|

|

|

|

|

| - Maintenance capital expenditures |

|

|

996 |

|

|

|

888 |

|

|

|

|

|

|

|

399 |

|

|

|

301 |

|

|

|

|

|

| - Change in working capital |

|

|

1 |

|

|

|

515 |

|

|

|

|

|

|

|

(405 |

) |

|

|

(307 |

) |

|

|

|

|

| - Taxes paid |

|

|

550 |

|

|

|

197 |

|

|

|

|

|

|

|

56 |

|

|

|

41 |

|

|

|

|

|

| - Other cash items (net) |

|

|

17 |

|

|

|

6 |

|

|

|

|

|

|

|

36 |

|

|

|

74 |

|

|

|

|

|

| - Free cash flow discontinued operations |

|

|

— |

|

|

|

(6 |

) |

|

|

|

|

|

|

— |

|

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow after maintenance capital expenditures |

|

|

1,208 |

|

|

|

553 |

|

|

|

118 |

% |

|

|

511 |

|

|

|

391 |

|

|

|

31 |

% |

| - Strategic capital expenditures |

|

|

420 |

|

|

|

475 |

|

|

|

|

|

|

|

108 |

|

|

|

191 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

|

788 |

|

|

|

78 |

|

|

|

909 |

% |

|

|

403 |

|

|

|

201 |

|

|

|

101 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In millions of U.S. dollars, except percentages. |

Higher Operating EBITDA and a lower investment in working capital, partially offset by higher taxes, resulted

in free cash flow after maintenance capex of US$1,208 million in 2023, a 6-year high, and US$655 million higher than last year.

The increase in cash taxes is a consequence of stronger results, as well as the tax effect of foreign exchange on our U.S. dollar denominated

debt.

During 2023 we had no incremental investment in working capital despite higher sales and continued inflationary and supply chain

pressures. This is the consequence of a management initiative undertaken in 2nd quarter to optimize working capital. This focus on working capital to maximize free cash flow generation is expected

to continue into 2024.

During the year, the main uses of Free cash flow include the acquisition of the assets of Atlantic Minerals Limited

in Canada, the investment in a new Construction, Demolition, and Excavation Waste (CDEW) recycling center in EMEA, outflows from our derivative instruments primarily related to FX, coupons of our subordinated notes with no fixed maturity, and

repurchases of shares in CLH and CHP.

Information on debt

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

|

|

|

|

Third

Quarter |

|

|

|

|

Fourth Quarter |

|

| |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

2023 |

|

|

|

|

2023 |

|

|

2022 |

|

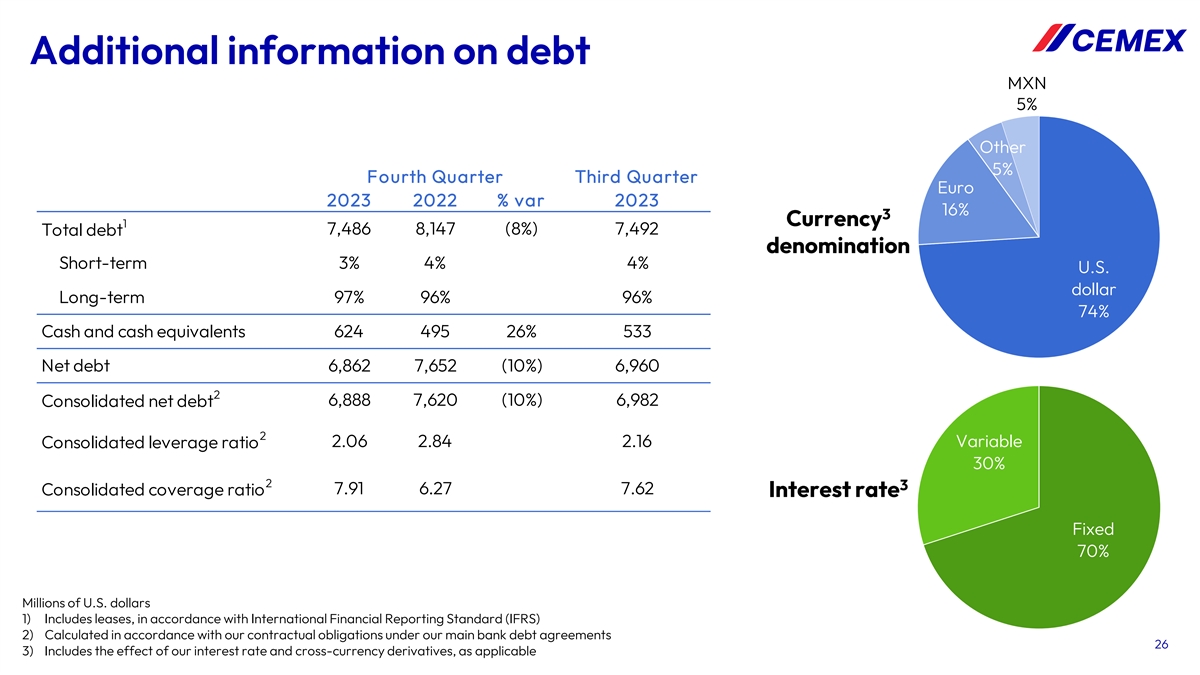

| Total debt (1) |

|

|

7,486 |

|

|

|

8,147 |

|

|

|

(8 |

%) |

|

|

7,492 |

|

|

Currency denomination |

|

|

|

|

|

|

|

|

| Short-term |

|

|

3 |

% |

|

|

4 |

% |

|

|

|

|

|

|

4 |

% |

|

U.S. dollar |

|

|

74 |

% |

|

|

78 |

% |

| Long-term |

|

|

97 |

% |

|

|

96 |

% |

|

|

|

|

|

|

96 |

% |

|

Euro |

|

|

16 |

% |

|

|

14 |

% |

| Cash and cash equivalents |

|

|

624 |

|

|

|

495 |

|

|

|

26 |

% |

|

|

533 |

|

|

Mexican peso |

|

|

5 |

% |

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net debt |

|

|

6,862 |

|

|

|

7,652 |

|

|

|

(10 |

%) |

|

|

6,960 |

|

|

Other |

|

|

5 |

% |

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net debt (2) |

|

|

6,888 |

|

|

|

7,620 |

|

|

|

|

|

|

|

6,982 |

|

|

Interest rate (3) |

|

|

|

|

|

|

|

|

| Consolidated leverage ratio (2) |

|

|

2.06 |

|

|

|

2.84 |

|

|

|

|

|

|

|

2.16 |

|

|

Fixed |

|

|

70 |

% |

|

|

71 |

% |

| Consolidated coverage ratio (2) |

|

|

7.91 |

|

|

|

6.27 |

|

|

|

|

|

|

|

7.62 |

|

|

Variable |

|

|

30 |

% |

|

|

29 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of U.S. dollars, except percentages and ratios.

| (1) |

Includes leases, in accordance with International Financial Reporting Standards (IFRS). |

| (2) |

Calculated in accordance with our contractual obligations under our main bank debt agreements.

|

| (3) |

Includes the effect of our interest rate derivatives, as applicable. |

On October 30th, 2023, we closed the refinancing of our sustainability-linked syndicated

bank facility, which consists of a US$1 billion term loan and US$2 billion committed revolving credit facility. Additionally, in early October we issued $6 billion pesos, the equivalent of approximately US$ 350 million, in

peso-denominated sustainability-linked long-term notes (certificados bursátiles de largo plazo) in Mexico. Finally, on December 6th, 2023, we closed the refinancing of our

sustainability-linked bilateral loan agreement for $6 billion pesos – the equivalent of approximately US$350 million.

|

|

|

| 2023 Fourth Quarter Results |

|

Page 6 |

|

|

|

| Operating results |

|

|

Consolidated Statement of Operations & Statement of Financial Position

Cemex, S.A.B. de C.V. and Subsidiaries

(Thousands of

U.S. dollars, except per ADS amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

|

|

|

|

|

|

|

|

|

like-to-like |

|

|

|

|

|

|

|

|

|

|

|

like-to-like |

|

| STATEMENT OF OPERATIONS |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

% var |

|

|

2023 |

|

|

2022 |

|

|

% var |

|

|

% var |

|

| Net sales |

|

|

17,415,624 |

|

|

|

15,576,819 |

|

|

|

12 |

% |

|

|

8 |

% |

|

|

4,243,201 |

|

|

|

3,868,517 |

|

|

|

10 |

% |

|

|

5 |

% |

| Cost of sales |

|

|

(11,554,540 |

) |

|

|

(10,754,908 |

) |

|

|

(7 |

%) |

|

|

|

|

|

|

(2,811,609 |

) |

|

|

(2,660,572 |

) |

|

|

(6 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

5,861,083 |

|

|

|

4,821,911 |

|

|

|

22 |

% |

|

|

16 |

% |

|

|

1,431,592 |

|

|

|

1,207,945 |

|

|

|

19 |

% |

|

|

12 |

% |

| Operating expenses |

|

|

(3,747,513 |

) |

|

|

(3,261,376 |

) |

|

|

(15 |

%) |

|

|

|

|

|

|

(999,519 |

) |

|

|

(847,045 |

) |

|

|

(18 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating earnings before other income and expenses, net |

|

|

2,113,570 |

|

|

|

1,560,535 |

|

|

|

35 |

% |

|

|

29 |

% |

|

|

432,073 |

|

|

|

360,901 |

|

|

|

20 |

% |

|

|

14 |

% |

| Other expenses, net |

|

|

(264,574 |

) |

|

|

(467,275 |

) |

|

|

43 |

% |

|

|

|

|

|

|

(138,722 |

) |

|

|

(460,997 |

) |

|

|

70 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating earnings |

|

|

1,848,996 |

|

|

|

1,093,260 |

|

|

|

69 |

% |

|

|

|

|

|

|

293,350 |

|

|

|

(100,097 |

) |

|

|

N/A |

|

|

|

|

|

| Financial expense |

|

|

(530,612 |

) |

|

|

(505,843 |

) |

|

|

(5 |

%) |

|

|

|

|

|

|

(131,583 |

) |

|

|

(128,195 |

) |

|

|

(3 |

%) |

|

|

|

|

| Other financial income (expense), net |

|

|

32,888 |

|

|

|

151,674 |

|

|

|

(78 |

%) |

|

|

|

|

|

|

57,806 |

|

|

|

107,733 |

|

|

|

(46 |

%) |

|

|

|

|

| Financial income |

|

|

40,171 |

|

|

|

26,697 |

|

|

|

50 |

% |

|

|

|

|

|

|

12,770 |

|

|

|

14,302 |

|

|

|

(11 |

%) |

|

|

|

|

| Results from financial instruments, net |

|

|

(58,337 |

) |

|

|

109,264 |

|

|

|

N/A |

|

|

|

|

|

|

|

(5,780 |

) |

|

|

(4,562 |

) |

|

|

(27 |

%) |

|

|

|

|

| Foreign exchange results |

|

|

143,991 |

|

|

|

72,899 |

|

|

|

98 |

% |

|

|

|

|

|

|

76,493 |

|

|

|

110,774 |

|

|

|

(31 |

%) |

|

|

|

|

| Effects of net present value on assets and liabilities and others, net |

|

|

(92,937 |

) |

|

|

(57,186 |

) |

|

|

(63 |

%) |

|

|

|

|

|

|

(25,678 |

) |

|

|

(12,782 |

) |

|

|

(101 |

%) |

|

|

|

|

| Equity in gain (loss) of associates |

|

|

97,629 |

|

|

|

30,900 |

|

|

|

216 |

% |

|

|

|

|

|

|

31,483 |

|

|

|

(15,432 |

) |

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income tax |

|

|

1,448,901 |

|

|

|

769,991 |

|

|

|

88 |

% |

|

|

|

|

|

|

251,056 |

|

|

|

(135,991 |

) |

|

|

N/A |

|

|

|

|

|

| Income tax |

|

|

(1,250,303 |

) |

|

|

(209,065 |

) |

|

|

(498 |

%) |

|

|

|

|

|

|

(693,305 |

) |

|

|

(37,992 |

) |

|

|

(1725 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (loss) of continuing operations |

|

|

198,598 |

|

|

|

560,926 |

|

|

|

(65 |

%) |

|

|

|

|

|

|

(442,249 |

) |

|

|

(173,983 |

) |

|

|

(154 |

%) |

|

|

|

|

| Discontinued operations |

|

|

— |

|

|

|

323,605 |

|

|

|

(100 |

%) |

|

|

|

|

|

|

— |

|

|

|

71,478 |

|

|

|

(100 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net income (loss) |

|

|

198,598 |

|

|

|

884,530 |

|

|

|

(78 |

%) |

|

|

|

|

|

|

(442,249 |

) |

|

|

(102,504 |

) |

|

|

(331 |

%) |

|

|

|

|

| Non-controlling interest net income (loss) |

|

|

16,435 |

|

|

|

26,173 |

|

|

|

(37 |

%) |

|

|

|

|

|

|

(1,249 |

) |

|

|

(3,364 |

) |

|

|

63 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Controlling interest net income (loss) |

|

|

182,163 |

|

|

|

858,357 |

|

|

|

(79 |

%) |

|

|

|

|

|

|

(441,000 |

) |

|

|

(99,140 |

) |

|

|

(345 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating EBITDA |

|

|

3,347,038 |

|

|

|

2,680,630 |

|

|

|

25 |

% |

|

|

20 |

% |

|

|

743,107 |

|

|

|

630,463 |

|

|

|

18 |

% |

|

|

13 |

% |

| Earnings (loss) of continued operations per ADS |

|

|

0.12 |

|

|

|

0.36 |

|

|

|

(66 |

%) |

|

|

|

|

|

|

(0.30 |

) |

|

|

(0.12 |

) |

|

|

(160 |

%) |

|

|

|

|

| Earnings (loss) of discontinued operations per ADS |

|

|

— |

|

|

|

0.22 |

|

|

|

(100 |

%) |

|

|

|

|

|

|

— |

|

|

|

0.05 |

|

|

|

(100 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31 |

|

| STATEMENT OF FINANCIAL POSITION |

|

2023 |

|

|

2022 |

|

|

% var |

|

| Total assets |

|

|

28,433,399 |

|

|

|

26,447,451 |

|

|

|

8 |

% |

| Cash and cash equivalents |

|

|

623,933 |

|

|

|

494,920 |

|

|

|

26 |

% |

| Trade receivables less allowance for doubtful accounts |

|

|

1,751,468 |

|

|

|

1,644,491 |

|

|

|

7 |

% |

| Other accounts receivable |

|

|

649,674 |

|

|

|

535,065 |

|

|

|

21 |

% |

| Inventories, net |

|

|

1,789,303 |

|

|

|

1,668,658 |

|

|

|

7 |

% |

| Assets held for sale |

|

|

48,825 |

|

|

|

68,926 |

|

|

|

(29 |

%) |

| Other current assets |

|

|

142,197 |

|

|

|

113,664 |

|

|

|

25 |

% |

| Current assets |

|

|

5,005,400 |

|

|

|

4,525,723 |

|

|

|

11 |

% |

| Property, machinery and equipment, net |

|

|

12,465,655 |

|

|

|

11,284,126 |

|

|

|

10 |

% |

| Other assets |

|

|

10,962,343 |

|

|

|

10,637,602 |

|

|

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

16,290,314 |

|

|

|

15,538,582 |

|

|

|

5 |

% |

| Current liabilities |

|

|

6,785,733 |

|

|

|

5,546,947 |

|

|

|

22 |

% |

| Long-term liabilities |

|

|

6,202,961 |

|

|

|

6,919,512 |

|

|

|

(10 |

%) |

| Other liabilities |

|

|

3,301,621 |

|

|

|

3,072,124 |

|

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholder’s equity |

|

|

12,143,084 |

|

|

|

10,908,869 |

|

|

|

11 |

% |

| Common stock and additional paid-in capital |

|

|

7,686,469 |

|

|

|

7,810,104 |

|

|

|

(2 |

%) |

| Other equity reserves |

|

|

(2,036,270 |

) |

|

|

(2,463,631 |

) |

|

|

17 |

% |

| Subordinated notes |

|

|

1,771,427 |

|

|

|

908,942 |

|

|

|

95 |

% |

| Retained earnings |

|

|

4,370,228 |

|

|

|

4,245,780 |

|

|

|

3 |

% |

| Non-controlling interest |

|

|

351,231 |

|

|

|

407,674 |

|

|

|

(14 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2023 Fourth Quarter Results |

|

Page 7 |

|

|

|

| Operating results |

|

|

Operating Summary per Country

In thousands of U.S. dollars

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

|

|

|

|

|

|

|

|

|

like-to-like |

|

|

|

|

|

|

|

|

|

|

|

like-to-like |

|

| NET SALES |

|

2023 |

|

|

2022 |

|

|

% var |

|

|

% var |

|

|

2023 |

|

|

2022 |

|

|

% var |

|

|

% var |

|

| Mexico |

|

|

5,088,356 |

|

|

|

3,842,407 |

|

|

|

32 |

% |

|

|

16 |

% |

|

|

1,333,267 |

|

|

|

1,016,496 |

|

|

|

31 |

% |

|

|

17 |

% |

| U.S.A. |

|

|

5,337,668 |

|

|

|

5,037,534 |

|

|

|

6 |

% |

|

|

6 |

% |

|

|

1,268,722 |

|

|

|

1,221,007 |

|

|

|

4 |

% |

|

|

4 |

% |

| Europe, Middle East, Asia and Africa |

|

|

5,059,473 |

|

|

|

4,929,607 |

|

|

|

3 |

% |

|

|

5 |

% |

|

|

1,165,643 |

|

|

|

1,198,768 |

|

|

|

(3 |

%) |

|

|

(4 |

%) |

| Europe |

|

|

3,653,975 |

|

|

|

3,389,313 |

|

|

|

8 |

% |

|

|

4 |

% |

|

|

848,724 |

|

|

|

819,660 |

|

|

|

4 |

% |

|

|

(3 |

%) |

| Asia, Middle East and Africa (1) |

|

|

1,405,497 |

|

|

|

1,540,294 |

|

|

|

(9 |

%) |

|

|

4 |

% |

|

|

316,919 |

|

|

|

379,108 |

|

|

|

(16 |

%) |

|

|

(9 |

%) |

| South, Central America and the Caribbean |

|

|

1,724,876 |

|

|

|

1,604,708 |

|

|

|

7 |

% |

|

|

8 |

% |

|

|

424,574 |

|

|

|

377,276 |

|

|

|

13 |

% |

|

|

7 |

% |

| Others and intercompany eliminations |

|

|

205,252 |

|

|

|

162,562 |

|

|

|

26 |

% |

|

|

26 |

% |

|

|

50,996 |

|

|

|

54,971 |

|

|

|

(7 |

%) |

|

|

(7 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

|

|

17,415,624 |

|

|

|

15,576,819 |

|

|

|

12 |

% |

|

|

8 |

% |

|

|

4,243,201 |

|

|

|

3,868,517 |

|

|

|

10 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mexico |

|

|

2,414,888 |

|

|

|

1,772,121 |

|

|

|

36 |

% |

|

|

20 |

% |

|

|

617,674 |

|

|

|

463,346 |

|

|

|

33 |

% |

|

|

19 |

% |

| U.S.A. |

|

|

1,556,661 |

|

|

|

1,284,903 |

|

|

|

21 |

% |

|

|

21 |

% |

|

|

377,856 |

|

|

|

355,822 |

|

|

|

6 |

% |

|

|

6 |

% |

| Europe, Middle East, Asia and Africa |

|

|

1,227,671 |

|

|

|

1,205,406 |

|

|

|

2 |

% |

|

|

3 |

% |

|

|

263,277 |

|

|

|

277,049 |

|

|

|

(5 |

%) |

|

|

(8 |

%) |

| Europe |

|

|

956,424 |

|

|

|

864,581 |

|

|

|

11 |

% |

|

|

7 |

% |

|

|

214,099 |

|

|

|

210,505 |

|

|

|

2 |

% |

|

|

(5 |

%) |

| Asia, Middle East and Africa |

|

|

271,246 |

|

|

|

340,825 |

|

|

|

(20 |

%) |

|

|

(7 |

%) |

|

|

49,178 |

|

|

|

66,544 |

|

|

|

(26 |

%) |

|

|

(18 |

%) |

| South, Central America and the Caribbean |

|

|

584,718 |

|

|

|

553,761 |

|

|

|

6 |

% |

|

|

6 |

% |

|

|

146,024 |

|

|

|

126,949 |

|

|

|

15 |

% |

|

|

11 |

% |

| Others and intercompany eliminations |

|

|

77,146 |

|

|

|

5,719 |

|

|

|

1249 |

% |

|

|

1249 |

% |

|

|

26,762 |

|

|

|

(15,220 |

) |

|

|

N/A |

|

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

|

|

5,861,083 |

|

|

|

4,821,911 |

|

|

|

22 |

% |

|

|

16 |

% |

|

|

1,431,592 |

|

|

|

1,207,945 |

|

|

|

19 |

% |

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS BEFORE OTHER EXPENSES, NET |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mexico |

|

|

1,267,027 |

|

|

|

960,589 |

|

|

|

32 |

% |

|

|

15 |

% |

|

|

288,904 |

|

|

|

224,840 |

|

|

|

28 |

% |

|

|

13 |

% |

| U.S.A. |

|

|

557,080 |

|

|

|

306,590 |

|

|

|

82 |

% |

|

|

82 |

% |

|

|

118,171 |

|

|

|

105,278 |

|

|

|

12 |