Form S-8 - Securities to be offered to employees in employee benefit plans

09 Fevereiro 2024 - 6:10PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on February 9, 2024

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Stronghold Digital Mining, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

86-2759890

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

|

|

595 Madison Avenue, 29th Floor

New York, New York

|

|

10022

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

STRONGHOLD DIGITAL MINING, INC. OMNIBUS INCENTIVE PLAN

(Full title of the plan)

Gregory A. Beard

Chief Executive Officer

595 Madison Avenue, 29th Floor

New York, New York 10022

(Name and address of agent for service)

(212) 967-5294

(Telephone number, including area code, of agent for service)

Copies to:

Daniel M. LeBey

Shelley A. Barber

Lucy Liu

Vinson & Elkins L.L.P.

1114 Avenue of the Americas, 32nd Floor

New York, New York 10036

(804) 327-6300

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| |

|

|

|

Large accelerated filer

|

☐

|

Accelerated filer ☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company ☒

|

| |

|

Emerging growth company ☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”). ☐

This Registration Statement on Form S-8 (this “Registration Statement”) is being filed for the purpose of registering the offer and sale of an additional 487,250 shares of Class A common stock,

$0.0001 par value per share (the “Common Stock”) of Stronghold Digital Mining, Inc., a Delaware corporation (the “Registrant”), that may be issued pursuant to the Stronghold Digital Mining, Inc. Omnibus Incentive Plan (as amended from time to time,

the “Plan”). These additional shares of Common Stock have become reserved for issuance as a result of the operation of the “evergreen” provisions in the Plan, which provides that the total number of shares subject

to the Plan will be increased each year pursuant to a specified formula. The additional shares reflect the 1-for-10 reverse stock split the Registrant effected on May 15, 2023 of its Common Stock and Class V common stock. Except as

otherwise set forth below, the contents of the registration statements on Form S-8 previously filed with the Securities and Exchange Commission (the “Commission”) on March 29, 2023 (File No. 333-270966) and October 26, 2021 (File No. 333-260497) are

incorporated herein by reference and made a part of this Registration Statement as permitted by General Instruction E to Form S-8.

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

|

|

| |

|

|

|

Second Amended and Restated Certificate of Incorporation of Stronghold Digital Mining, Inc. (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K (File No. 001-40931) filed

on October 25, 2021).

|

| |

|

4.2

|

Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation of Stronghold Digital Mining, Inc. (incorporated by reference to Exhibit

3.1 to the Registrant’s Current Report on Form 8-K (File No. 001-40931) filed on May 19, 2023).

|

| |

|

|

|

Amended and Restated Bylaws of Stronghold Digital Mining, Inc. (incorporated by reference to Exhibit 3.2 to the Registrant’s Current Report on Form 8-K (File No. 001-40931) filed on October 25, 2021).

|

| |

|

|

|

Stronghold Digital Mining, Inc. Omnibus Incentive Plan (incorporated by reference to Exhibit 10.2 to the Registrant’s Current Report on Form 8-K (File No. 001-40931 filed on October 25, 2021).

|

| |

|

|

|

First Amendment to the Stronghold Digital Mining, Inc. Omnibus Incentive Plan.

|

| |

|

|

|

Opinion of Vinson & Elkins L.L.P.

|

| |

|

|

|

Consent of Urish Popeck & Co., LLC.

|

| |

|

|

|

Consent of Vinson & Elkins L.L.P. (included in Exhibit 5.1 to this Registration Statement).

|

| |

|

|

|

Power of Attorney (included in the signature page of this Registration Statement).

|

| |

|

|

|

Calculation of Filing Fee Table.

|

* Filed herewith

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly

caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, New York on February 9, 2024.

| |

Stronghold Digital Mining, Inc.

|

| |

|

| |

By:

|

/s/ Gregory A. Beard

|

| |

Name:

|

Gregory A. Beard

|

| |

Title:

|

Chief Executive Officer and Chairman

|

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Gregory

A. Beard as his or her attorney-in-fact, with full

power of substitution for him or her in any and all capacities, to sign any amendments to this Registration Statement, including any and all pre-effective and post-effective amendments and to file such amendments thereto, with exhibits thereto and

other documents in connection therewith, with the Commission, hereby ratifying and confirming all that said attorney-in-fact, or each of his or her substitute or substitutes, may do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities indicated on February 9, 2024.

| |

|

|

|

| |

|

|

|

| |

|

|

Chief Executive Officer and

Chairman

|

| |

|

|

(Principal Executive Officer)

|

| |

|

|

|

| |

|

|

Chief Financial Officer and Director

|

| |

|

|

(Principal Financial Officer and Principal Accounting Officer)

|

| |

|

|

|

| |

/s/ Sarah P. James

|

|

Director

|

| |

|

|

|

| |

|

|

|

| |

/s/ Thomas J. Pacchia

|

|

Director

|

| |

|

|

|

| |

|

|

|

| |

/s/ Thomas R. Trowbridge, IV

|

|

Director

|

| |

|

|

|

| |

|

|

|

| |

/s/ Indira Agarwal

|

|

Director

|

| |

Indira Agarwal

|

|

|

| |

|

|

|

| |

/s/ Thomas Doherty

|

|

Director

|

| |

Thomas Doherty

|

|

|

FIRST AMENDMENT TO THE

STRONGHOLD DIGITAL MINING, INC.

OMNIBUS INCENTIVE PLAN

THIS FIRST AMENDMENT (the “First Amendment”) to the Stronghold Digital Mining, Inc. Omnibus Incentive Plan, as may be amended from time to

time (the “Plan”), has been adopted by Stronghold Digital Mining, Inc., a Delaware corporation (the “Company”). Capitalized terms

used but not defined herein shall have the meanings assigned to them in the Plan.

W I T N E S S E T H:

WHEREAS, the Company previously adopted the Plan;

WHEREAS, Section 9(p) of the Plan provides that the board of directors of the Company (the “Board”) or the Compensation Committee of the Board may amend the Plan from time to time without the consent of any stockholders or Participants, except that any amendment or alteration to the

Plan, that any amendment or alteration to the Plan, including any increase in any share limitation, shall be subject to the approval of the Company’s stockholders not later than the annual meeting next following such Committee action if such

stockholder approval is required by any federal or state law or regulation or the rules of any stock exchange or automated quotation system on which the Stock may then be listed or quoted;

WHEREAS, the Board desires to amend the Plan to increase the number of shares of Stock

available for delivery with respect to Awards; and

WHEREAS, the Board has determined that the First Amendment shall be made effective as of date

the First Amendment is approved by the stockholders of the Company (such date, the “Amendment Effective Date”).

NOW, THEREFORE, the Plan shall be amended as of the Amendment Effective Date, as set forth

below:

1. Section 4(a) of the Plan is hereby deleted and replaced in its entirety with the following:

“Number of Shares Available for Delivery. Subject to adjustment in a manner consistent with Section 8,

1,106,951 shares of Stock are reserved and available for delivery with respect to Awards.1 Such total shall be available for the issuance of shares upon the exercise of ISOs; provided, that, on January 1 of each calendar year occurring

after the Effective Date and prior to the tenth anniversary of the Effective Date, the total number of shares of Stock reserved and available for delivery with respect to Awards under the Plan shall increase by a number of shares of Stock equal to

the lesser of (i) 3% of the total number of shares of Stock outstanding as of December 31 of the immediately preceding calendar year and (ii) such smaller number of shares of Stock as is determined by the Board.”

1 The shares reserved and available for delivery reflect the 1-for-10 reverse stock split the Company effected on May 15, 2023 of its Stock and Class V common stock.

RESOLVED FURTHER, that except as amended hereby, the Plan is specifically ratified and reaffirmed.

[Remainder of Page Intentionally Left Blank.]

February 9, 2024

Stronghold Digital Mining, Inc.

595 Madison Avenue, 29th Floor

New York, New York 10022

Ladies and Gentlemen:

We have acted as counsel for Stronghold Digital Mining, Inc., a Delaware corporation (the “Company”), in connection with the Company’s registration under the Securities Act of 1933, as amended (the

“Act”), of the offer and sale of an additional 487,250 shares of the Company’s Class A common stock, par value $0.0001 per share (the “Shares”), pursuant to the Company’s registration statement on Form S-8 (the “Registration Statement”) to be filed

with the Securities and Exchange Commission on February 9, 2024, which Shares may be issued from time to time in accordance with the terms of the Stronghold Digital Mining, Inc. Omnibus Incentive Plan (as amended from time to time, the “Plan”).

In reaching the opinions set forth herein, we have examined and are familiar with originals or copies, certified or otherwise identified to our satisfaction, of such documents and records of the

Company and such statutes, regulations and other instruments as we deemed necessary or advisable for purposes of this opinion, including (i) the Registration Statement, (ii) certain resolutions adopted by the board of directors of the Company, (iii)

the Plan, and (iv) such other certificates, instruments, and documents as we have considered necessary for purposes of this opinion. As to any facts material to our opinions, we have made no independent investigation or verification of such facts

and have relied, to the extent that we deem such reliance proper, upon certificates of public officials and officers or other representatives of the Company.

We have assumed (i) the legal capacity of all natural persons, (ii) the genuineness of all signatures, (iii) the authority of all persons signing all documents submitted to us on behalf of the

parties to such documents, (iv) the authenticity of all documents submitted to us as originals, (v) the conformity to authentic original documents of all documents submitted to us as copies, (vi) that all information contained in all documents

reviewed by us is true, correct and complete, and (vii) that the Shares will be issued in accordance with the terms of the Plan.

Based on the foregoing and subject to the limitations set forth herein, and having due regard for the legal considerations we deem relevant, we are of the opinion that the Shares have been duly

authorized and, when the Shares are issued by the Company in accordance with the terms of the Plan and the instruments executed pursuant to the Plan, as applicable, the Shares will be validly issued, fully paid and non-assessable.

This opinion is limited in all respects to the General Corporation Law of the State of Delaware. We express no opinion as to any other law or any matter other than as expressly set forth above, and

no opinion as to any other law or matter may be inferred or implied herefrom. The opinions expressed herein are rendered as of the date hereof and we expressly disclaim any obligation to update this letter or advise you of any change in any matter

after the date hereof.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not thereby admit that we come within the category of persons whose consent

is required under Section 7 of the Act.

| |

Very truly yours,

|

| |

|

| |

/s/ Vinson & Elkins L.L.P.

|

| |

Vinson & Elkins L.L.P.

|

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated March 31, 2023, relating to the consolidated financial statements of Stronghold Digital Mining, Inc.

and subsidiaries (the Company) appearing in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

/s/ Urish Popeck & Co., LLC

Pittsburgh, PA

February 9, 2024

Exhibit 107.1

Calculation of Filing Fee Tables

Form S-8

Registration Statement Under

The Securities Act Of 1933

(Form Type)

Stronghold Digital Mining, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1 – Newly Registered Securities

|

|

|

|

|

|

Proposed Maximum Offering Price Per Unit (3)

|

Maximum

Aggregate Offering

Price (3)

|

|

Amount of Registration

Fee

|

|

Equity

|

Class A common stock, $0.0001 par value per share

|

Rule 457(c) and Rule 457(h)

|

487,250

|

$4.39

|

$2,139,028

|

$147.60 per $1,000,000

|

$315.73

|

|

Total Offering Amounts

|

|

$2,139,028

|

|

$315.73

|

|

Total Fee Offsets

|

|

|

|

—

|

|

Net Fee Due

|

|

|

|

$315.73

|

| (1) |

The Form S-8 registration statement to which this Exhibit 107.1 is attached (the “Registration Statement”) registers 487,250 shares of Class A common stock, $0.0001 par value per share (the “Common Stock”), of Stronghold Digital Mining,

Inc., a Delaware corporation, that may be delivered with respect to awards under the Stronghold Digital Mining, Inc. Omnibus Incentive Plan (as amended from time to time, the “Plan”), which shares consist of shares of Common Stock reserved

and available for delivery with respect to awards under the Plan.

|

| (2) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), the Registration Statement shall be deemed to cover an indeterminate number of additional shares of Common Stock that may become issuable as a

result of stock splits, stock dividends or similar transactions pursuant to the adjustment or anti-dilution provisions of the Plan.

|

| (3) |

The proposed maximum offering price per share and proposed maximum aggregate offering price for the shares of Common Stock covered by this Registration Statement have been estimated solely for purposes of calculating the registration fee

pursuant to Rules 457(c) and 457(h) under the Securities Act based upon the average of the high and low prices of a share of Common Stock as reported on The Nasdaq Global Market on February 6, 2024 (a date within five business days prior to

the date of filing the Registration Statement), which was equal to $4.39.

|

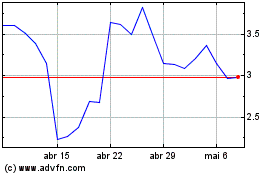

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024