Exhibit 99.1

We are over 42,400 individuals – thinkers, innovators, problem solvers, planners, movers and makers. As a team, working together with our partners and customers, we help feed the world’s ever-growing demand for faster and more efficient microchips. We create impact by pushing technology to new limits, unlocking the potential of society and enabling people to tackle some of humanity’s biggest challenges. Together we create impact. Delivering for our customers Embracing change, driving innovation A sustainability mindset Making a difference Helping our teams thrive Working together, growing together Impact through collaboration See page 17 > See page 34 > See page 88 > See page 104 > See page 123 > See page 134 > See page 143 > ASML ANNUAL REPORT 2023 SMALL PATTERNS. BIG IMPACT. STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 2

Together we create impact Throughout this year's report we feature ASML colleagues and look at the impact they are having on ASML and society. 17 Delivering for our customers 34 Embracing change, driving innovation 88 A sustainability mindset 104 Making a difference 123 Helping our teams thrive 134 Working together, growing together 143 Impact through collaboration View our Highlights online > Our 2023 online report, highlights key information from this pdf with additional links to relevant information on our corporate website. 4 Message from the CEO 7 At a glance 10 Our unique offer 12 Our products and services 19 Q&A with the CTO 21 Innovation 23 Marketplace 29 Our business strategy 31 Our business model 39 Q&A with the CFO Financial performance 42 Performance KPIs 47 Long-term growth opportunities Risk 49 How we manage risk 54 Risk factors 67 Q&A with the CBO Environmental, social and governance 70 Our material ESG sustainability topics 73 Contributing to the UN Sustainable Development Goals Environmental 75 Energy efficiency and climate action 90 Circular economy 102 Water management Social 106 Attractive workplace for all 125 Responsible supply chain 136 Innovation ecosystem 145 Valued partner in our communities Governance 155 ESG Integrated governance 173 Transparent reporting Corporate Governance 179 Board of Management 181 Supervisory Board 184 Other Board-related matters 187 AGM and share capital 192 Financial reporting and audit 194 Compliance with Corporate Governance requirements Supervisory Board Report 195 Message from the Chair of the Supervisory Board 197 Supervisory Board focus in 2023 201 Meetings and attendance 205 Supervisory Board committees 215 Financial Statements and Profit Allocation Remuneration Report 216 Message from the Chair of the Remuneration Committee 218 Remuneration at a glance 220 Remuneration Committee 223 Board of Management remuneration 239 Supervisory Board remuneration 243 Directors’ Responsibility Statement Consolidated Financial Statements 246 Consolidated Statement of Profit or Loss 247 Consolidated Statement of Comprehensive Income 248 Consolidated Statement of Financial Position 249 Consolidated Statement of Changes in Equity 251 Consolidated Statement of Cash Flows 252 Notes to the Consolidated Financial Statements Company Financial Statements 307 Company Balance Sheet 308 Company Statement of Profit or Loss 309 Notes to the Company Financial Statements Other Information 315 Appropriation of profits 315 Adoption of Financial Statements 315 Voting rights 315 Branch offices 316 Independent auditor’s report Non-financial Statements 323 Assurance Report of the Independent Auditor 325 About the non-financial information 332 EU Taxonomy 337 Non-financial indicators 357 Other appendices 362 Definitions ASML ANNUAL REPORT 2023 CONTENTS STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 3 Contents STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS & NON FINANCIALS A definition or explanation of abbreviations, technical terms and other terms used throughout this Annual Report can be found in the Definitions section. In some cases, numbers have been rounded for readers’ convenience. This report comprises regulated information within the meaning of articles 1:1 and 5:25c of the Dutch Financial Markets Supervision Act (Wet op het Financieel Toezicht). The sections Strategic Report, Corporate Governance, Supervisory Board report, Directors’ Responsibility Statement and EU Taxonomy together form the Management Report within the meaning of Section 2:391 of the Dutch Civil Code (and related Decrees). In this report the name ‘ASML’ is sometimes used for convenience in contexts where reference is made to ASML Holding NV and/or any of its subsidiaries, as the context may require. This document is the PDF/printed version of the 2023 Annual Report of ASML Holding NV in the European single electronic reporting format (ESEF) and has been prepared for ease of use. The ESEF reporting package is available on the company's website at https:// www.asml.com. In any case of discrepancies between this PDF version and the ESEF reporting package, the latter prevails. References to our website and/or video presentations in this Annual Report are for reference only and none nor any portion thereof are incorporated by reference in this report. © 2024, ASML Holding NV All Rights Reserved.

Dear Stakeholder, In last year’s message, I wrote that I expected 2023 to yet again see us break records – and ASML's performance has fully justified that confidence. We have grown sales by 30% to €27.6 billion and lifted our gross margin to 51.3%. We returned €3.3 billion to shareholders through a combination of dividends and share buybacks. At the end of 2023, we finished with a backlog of €39.0 billion and we anticipate that with our sustained focus on technology innovation, we will continue to break new ground – not only in terms of technological development, but also in how we manage the environmental impact of our products and services. This stellar performance has been achieved against a backdrop of what turned out to be a real downturn in the semiconductor industry instead of the mild and short-term correction that many had forecast. In addition, we had to manage uncertainties created by geopolitical challenges including the US and Dutch governments' export control regulations, and global macro concerns around inflation, rising interest rates and lower GDP growth in certain economies. There have also been other uncertainties at play, driven by the ongoing war in Ukraine as well as the more recent conflict in the Middle East. These have inevitably dented confidence and reduced investment by our customers. In 2023, demand for our DUV systems continued to be strong, particularly in China. During the previous two years, our Chinese customers had received significantly fewer systems than they had ordered, due to global demand for our systems exceeding supply. However, the shifts in demand timing from other customers that we experienced in 2023 meant that we had the opportunity to backfill these orders for mature and mid- critical nodes to China, while of course complying with export regulations. Executing our business strategy Our strategic innovation roadmap has continued to guide us, and, as you can read in the Q&A with our Chief Technology Officer on page 19,we have made good progress on further enhancements to our EUV, DUV and metrology and inspection systems. Our holistic approach to lithography provides customers with support and solutions at every stage of the chipmaking process, from early design and development to high- volume production. To mention a highlight: In 2023, we shipped the first modules of the first High NA EUV EXE:5000 system. Two further elements of our strategic progress have been particularly pleasing. Firstly, we strengthened the resilience of our supply chain, which had been under immense pressure, with a significant number of suppliers experiencing challenges to meet our increasing expectations. During 2023, we reshaped our sourcing and procurement organization under the leadership of Wayne Allan, a new member of the Board of Management (BoM). This team is now working with suppliers to help optimize our partnerships, so they have the flexibility and capability to deliver the products and services we need. ASML ANNUAL REPORT 2023 MESSAGE FROM THE CEO STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 4 Managing the cycle, preparing for greater growth in years to come Despite macroeconomic and geopolitical challenges, ASML has again delivered strong performance. Now, as we see signs of the industry coming out of its cyclical downturn, we are laying plans for further significant growth. Our holistic approach to lithography provides customers with support and solutions at every stage of the chipmaking process.” Peter Wennink President, Chief Executive Officer and Chair of the Board of Management

The second area is around customer trust. Trust is the foundation for our customer relationships – it means always being reliable, working at the highest possible level of efficiency, being transparent about what we are doing and fairly sharing the risks and rewards. And while customer trust in general was at a high level in 2023, we – as always – recognize that we can do even better. So over the last 12 months we have developed plans for fundamental reorganization of our customer- facing roles and responsibilities to prepare for future growth, and this was implemented from January 2024. We expect that the reorganization will help us cement greater customer trust, which will be essential in ensuring that we and our customers reap the rewards of the upturn that we expect in 2025 and 2026. ESG sustainability at the heart of our company Developed in 2022, our ESG sustainability strategy took shape in 2023. It is now being executed across the business, and we have taken important steps in each of the E (Environmental), S (Social) and G (Governance) elements. The overarching aim of our ESG sustainability strategy is simple: As we grow our company, we want to increase our positive impact at the same time as minimizing our negative impacts on the environment and people, while doing business in a responsible way. The very nature of what we do means we are already making a contribution to overcoming the challenges that our world is facing. Without semiconductors, the changes that society needs to implement – whether to do with the energy transition, healthcare, electrification, AI or many other areas – will not happen. Our role is to make sure that our customers can continue to deliver the innovation that is already transforming the world, and with a reduced CO2 footprint per chip. In our own facilities, we are reducing energy consumption and increasingly using renewable energy. Together with our suppliers and other upstream value chain partners, we are working to jointly reduce our carbon footprint in our supply chain. In addition, we are taking steps to increase the energy efficiency of our systems at our customers’ sites – reducing waste intensity, increasing reuse and repair, supporting our people and their communities, and promoting transparency and accountability through good governance. There is work to do in all those areas – but we have made excellent progress and we are committed to playing our full part in creating a more responsible and sustainable society. You can read more details in the ESG sustainability sections of this report. Our stakeholder model ASML operates on a stakeholder model. With every decision we take, the Board of Management and I, as CEO, aim to balance the concerns and needs of our five different stakeholders: Customers, suppliers and partners, our people, our shareholders and wider society – for example, the communities where we operate. Over the last year, we have used a significant part of our operational cash flow to support our customers, extending payment terms to help them make investments despite their negative cash flows. This was crucial sustaining their businesses through difficult times while ensuring that they have the resources in place to meet future demand. Similarly, we encouraged our suppliers to maintain their investment ambitions through the downturn, using opportunities such as our Suppliers’ Day to explain how we expected our business to accelerate from 2025 onward. It is vital that we retain the trust of our suppliers. To retain the trust of our shareholders, our key focus is to be as transparent as possible with them about everything to do with ASML – on export controls, on industry cyclicality, on how we are going to use our operational cash flow, on how we are going to pay dividends and buy back shares, and on how we are going to help our customers and suppliers. As the stories highlighted in this report demonstrate, our employees – representing many different nationalities and bringing a broad range of backgrounds, perspectives and skills – are key to our success. One of the reasons why so many talented people choose ASML as an employer is because we give them the opportunity to work at the sharp end of technology and make a real difference, while also supporting their health and well-being. We put a lot of effort into this, providing our employees with opportunities and the best environments to develop their talent, to feel respected and to ASML ANNUAL REPORT 2023 MESSAGE FROM THE CEO CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 5 Managing the cycle, preparing for greater growth in years to come (continued) Our task in 2024 is to reflect on our organization and capabilities and prepare for the rapid growth that is sure to come.” Peter Wennink President, Chief Executive Officer and Chair of the Board of Management

thrive. We need our people to trust us, and the fact that our engagement score has improved again shows we are on the right track. Regarding society, we strive to respect a range of different and sometimes conflicting interests around our growth trajectory and the increasing impact of our products and services on society. We engage extensively with communities, institutions, special interest groups and governments at all levels across the world on topics that are relevant to our business and its role in society and that therefore require long-term vision and support, such as education, infrastructure, culture and environment. A year of transition Our expectation is that our net sales in 2024 will be broadly in line with our net sales in 2023. But above all, this will be a year of transition – a time to digest the fast growth we have experienced in recent years and to prepare for 2025 and 2026, which I believe will be strong years because of three major factors. Firstly, demand for semiconductors is increasingly generated by secular growth drivers in end markets, such as the energy transition, electrification and AI. As the application space expands, with lithography playing an ever-greater role in future technology nodes, demand grows for both advanced and mature semiconductors. Secondly, the semiconductor industry is currently working through the bottom of the cycle. Historically, the downturns of the last 30-40 years have been for two to three years, with the present downturn really beginning in the second half of 2022. Our customers are still not certain of the shape or slope of the recovery, but there are some positive signs in the indicators we have been monitoring. Industry end-market inventory levels continue to improve and litho tool utilization levels are beginning to show improvement. Our strong order intake in the fourth quarter clearly supports future demand. Lastly, we need to prepare for the significant number of new semiconductor fabs that are being built. These fabs are spread geographically across the globe – they’re strategically important for our customers and they’re scheduled to take our tools. It is essential that we keep our focus on the future and build capacity to be ready for this ramp. The semiconductor industry is expected to double somewhere in the next decade, as compared with today. Our task in 2024 is to reflect on our organization and capabilities and prepare for the rapid growth that is expected to come, while managing increased cost pressures. That means working on our processes – for example, ensuring that they are fit for purpose and have the flexibility to expand rapidly when and where needed. And it means taking care of our people, making sure that they feel fully engaged in our company. Many thousands of new employees have joined us in the last few years, and around 40% of all our colleagues have been with us for three years or less. Our values of challenge, collaborate and care have been instrumental in our success to date, and they will continue to guide us in the future. It is vital that all our people embrace these values. In 2024, we need to take the opportunity to create clarity about the many roles and responsibilities in our diverse, cross- functional teams, to maintain a safe environment where people feel connected, included and respected. Stakeholder support We are tremendously proud of what we’ve achieved to date and extremely excited for the years ahead. But none of this would be possible without the support of our stakeholders. ASML has succeeded and will continue to thrive because of the patience and success of our customers, the collaboration of our suppliers and partners, and the understanding of shareholders and governments. Most of all, we rely on our people – and I thank them for all their expertise and hard work over the last year. This is my final Annual Report message as ASML's CEO, following the Supervisory Board’s announcement that Christophe Fouquet will succeed me as President and Chief Executive Officer at the 2024 AGM. Christophe has been with ASML for 15 years, with a major focus on technology, products and customers, and I am delighted that we have been able to secure such a talented, experienced individual to guide the business through the coming years. Christophe and I share the ‘ASML DNA’ of collaboration and partnership, and we will work closely together to ensure that he has the best possible start in his new position. I wish Christophe and all our stakeholders – and particularly our fantastic people – every success as, together, you embark on the next phase of this great company’s journey. Peter Wennink President, Chief Executive Officer and Chair of the Board of Management ASML ANNUAL REPORT 2023 MESSAGE FROM THE CEO CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 6 Managing the cycle, preparing for greater growth in years to come (continued) Our values of challenge, collaborate and care have been instrumental in our success.” Peter Wennink President, Chief Executive Officer and Chair of the Board of Management

Key facts in 2023 €27.6bn 42,416 Total net sales Employees (FTE) €23.2bn Asia €3.2bn US €1.2bn EMEA 19,805 in Operations 15,604 in R&D 7,007 in Sales and Support Read more on page 42 > Read more on page 106 > €4.0bn 35.1 kt R&D investments (based on US GAAP) Scope 1 and 2 CO2e emissions We innovate across our entire product portfolio through strong investment in R&D (2025 target net zero) Read more on page 136 > Read more on page 75 > €15.5bn 80.3% Total sourcing spend1 Employee engagement score against benchmark (Netherlands: 40% | EMEA (excl. NL): 40% North America: 13% | Asia: 7%) 1. Reported for non-financial (GRI) reporting purposes (2025 target -2% vs. top 25% performing companies) Read more on page 125 > Read more on page 106 > What we do At ASML, we design and integrate lithography systems with computational tools, metrology and inspection systems, and process control software solutions. This holistic approach to lithography provides chipmakers with support and solutions at every stage of the chipmaking process, from early design and development to high-volume production. It enables chipmakers to optimize the lithography system setup and process window for high-volume manufacturing, helping them achieve their highest yields and best chip performance. Read more in Our unique offer page 10 > Our key products and services • Lithography systems • Metrology and inspection systems • Computational lithography • Supporting our customers • System and process control software • Managing our installed base systems • Refurbished systems Read more in Our products and services on page 12 > Where we operate – more than 60 locations across 3 continents Asia China Japan Malaysia Singapore South Korea Taiwan North America Arizona New Mexico California New York Colorado Oregon Connecticut Texas Idaho Utah Massachusetts Virginia EMEA Belgium France Germany Ireland Israel Italy Netherlands United Kingdom ASML ANNUAL REPORT 2023 AT A GLANCE STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 7 We are a global innovator As one of the leading innovators in the semiconductor industry, we’ve been helping chipmakers push technology to new limits and unlock the potential of society since 1984. Together, our hardware, software and services provide a holistic approach to mass producing the patterns of microchips. Berliner Glas (ASML Berlin GmbH) is reflected as part of our business throughout this report, with the exception of non-financial reporting. We are preparing to integrate this in 2024 in line with Corporate Sustainability Reporting Directive (CSRD) requirements.

Why we exist – our purpose Unlocking the potential of people and society by pushing technology to new limits. What we try to achieve – our vision We enable ground-breaking technology to solve some of humanity’s toughest challenges. What we uniquely do – our mission Together with our partners, we provide leading patterning solutions that drive the advancement of microchips. Read more in Our business model on page 31 > You can see the impact of our collaboration in the commercial results of ASML and our customers.” George Tao Director Customer Service Applications Read more on page 143 > Managing expansion in high- stress situations means focusing on your people and their well-being.” Mark Bergkotte Director Logistics Operations Read more on page 123 > The interaction among supply chain partners helps us all improve to support faster growth.” Manon Hendriks Senior Director Sourcing & Procurement Read more on page 134 > ASML ANNUAL REPORT 2023 AT A GLANCE CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 8 We work together to help society progress

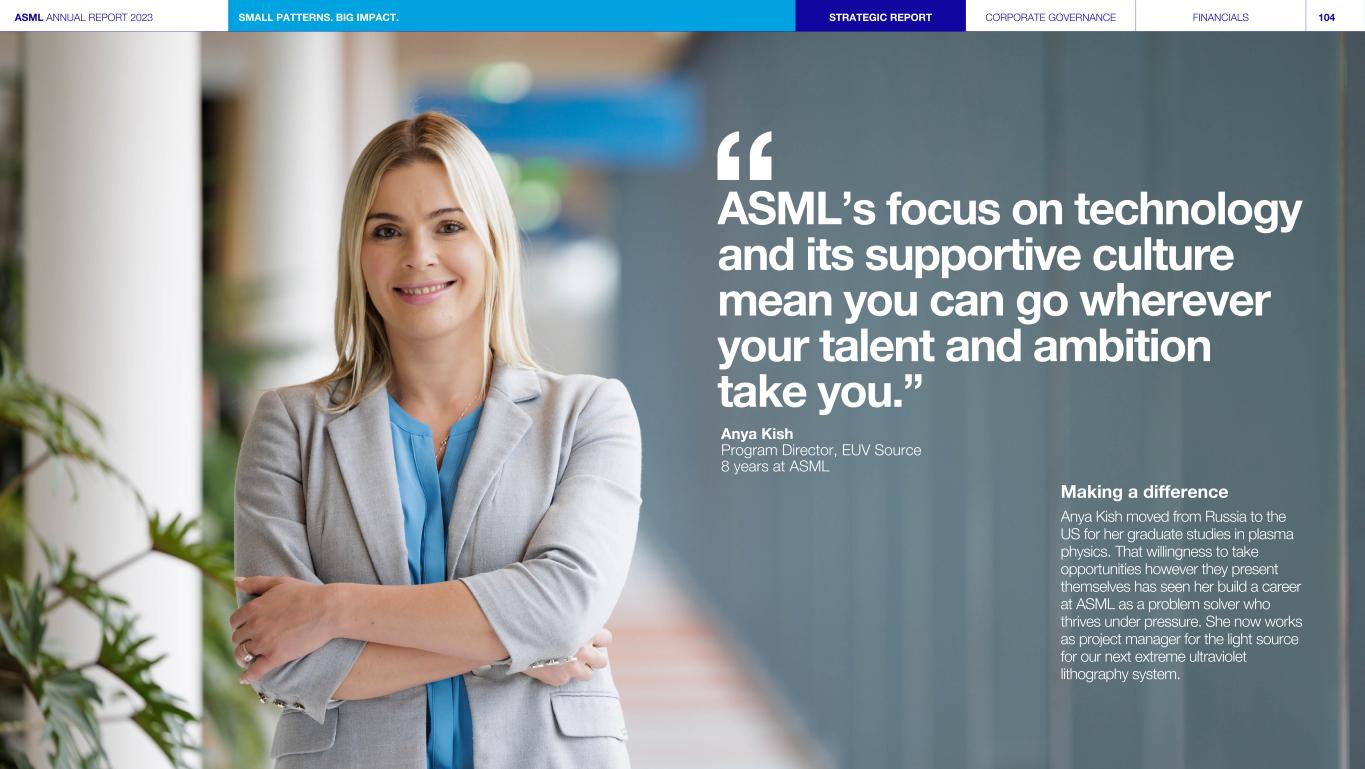

We challenge We challenge boundaries and question the status quo to keep pushing technology forward. We collaborate By tapping into the collective potential of our ecosystem of customers, partners and stakeholders, we can create better solutions. We care We act with integrity and respect, and provide a safe, inclusive and trusting environment where our people can learn and grow. Sustainability is a design challenge that must be solved in parallel with system cost and performance.” Ton van der Net Principal Architect D&E Read more on page 88 > ASML’s focus on technology and its supportive culture mean you can go wherever your talent and ambition take you.” Anya Kish Program Director EUV Source Read more on page 104 > My new role will help us safeguard our innovation power as we evolve to support future growth.” Ron Kool Head of Business Performance Improvement Read more on page 34 > Every few months, I have been given a new challenge to extend myself.” Manisha Devi Solution Test Architect Read more on page 17 > ASML ANNUAL REPORT 2023 AT A GLANCE CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 9 We live by our values to drive success

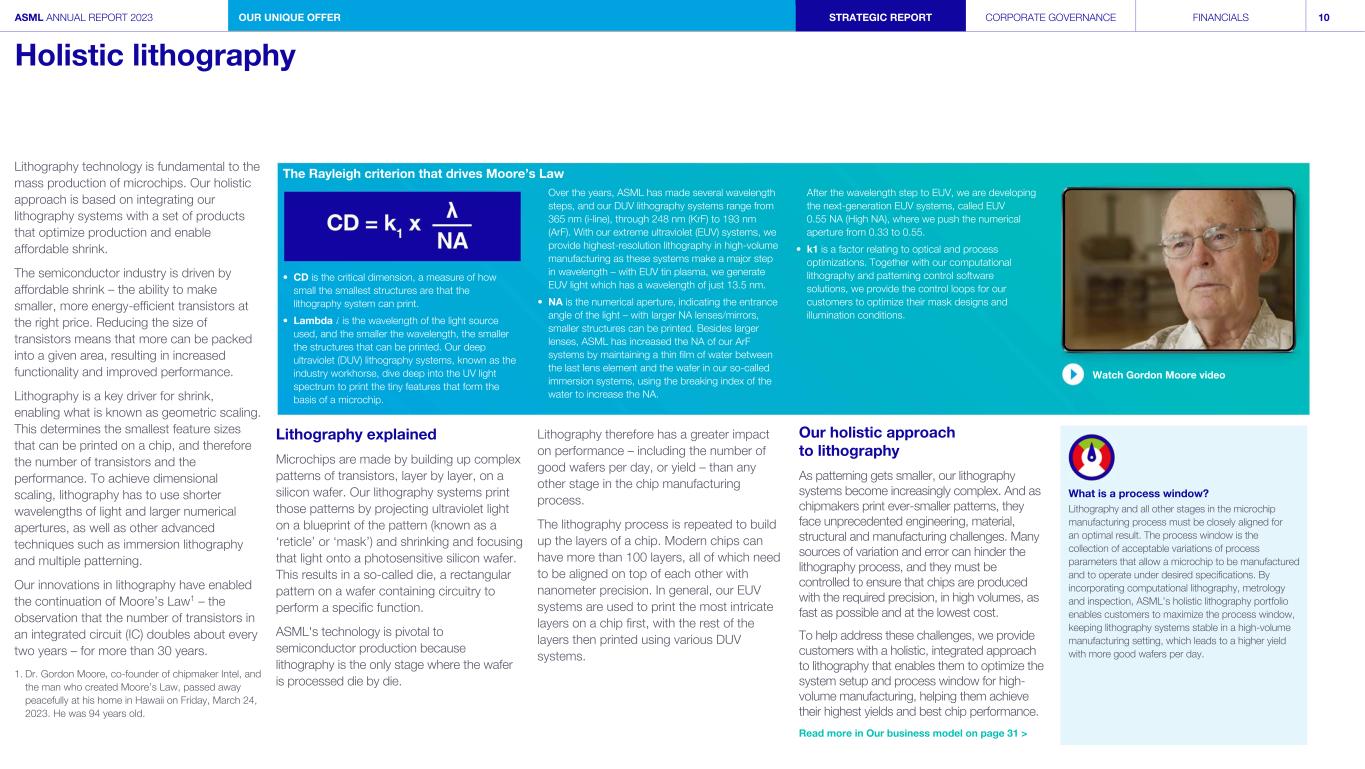

Lithography technology is fundamental to the mass production of microchips. Our holistic approach is based on integrating our lithography systems with a set of products that optimize production and enable affordable shrink. The semiconductor industry is driven by affordable shrink – the ability to make smaller, more energy-efficient transistors at the right price. Reducing the size of transistors means that more can be packed into a given area, resulting in increased functionality and improved performance. Lithography is a key driver for shrink, enabling what is known as geometric scaling. This determines the smallest feature sizes that can be printed on a chip, and therefore the number of transistors and the performance. To achieve dimensional scaling, lithography has to use shorter wavelengths of light and larger numerical apertures, as well as other advanced techniques such as immersion lithography and multiple patterning. Our innovations in lithography have enabled the continuation of Moore’s Law1 – the observation that the number of transistors in an integrated circuit (IC) doubles about every two years – for more than 30 years. 1. Dr. Gordon Moore, co-founder of chipmaker Intel, and the man who created Moore’s Law, passed away peacefully at his home in Hawaii on Friday, March 24, 2023. He was 94 years old. The Rayleigh criterion that drives Moore’s Law Over the years, ASML has made several wavelength steps, and our DUV lithography systems range from 365 nm (i-line), through 248 nm (KrF) to 193 nm (ArF). With our extreme ultraviolet (EUV) systems, we provide highest-resolution lithography in high-volume manufacturing as these systems make a major step in wavelength – with EUV tin plasma, we generate EUV light which has a wavelength of just 13.5 nm. • NA is the numerical aperture, indicating the entrance angle of the light – with larger NA lenses/mirrors, smaller structures can be printed. Besides larger lenses, ASML has increased the NA of our ArF systems by maintaining a thin film of water between the last lens element and the wafer in our so-called immersion systems, using the breaking index of the water to increase the NA. After the wavelength step to EUV, we are developing the next-generation EUV systems, called EUV 0.55 NA (High NA), where we push the numerical aperture from 0.33 to 0.55. • k1 is a factor relating to optical and process optimizations. Together with our computational lithography and patterning control software solutions, we provide the control loops for our customers to optimize their mask designs and illumination conditions. • CD is the critical dimension, a measure of how small the smallest structures are that the lithography system can print. • Lambda ⁁ is the wavelength of the light source used, and the smaller the wavelength, the smaller the structures that can be printed. Our deep ultraviolet (DUV) lithography systems, known as the industry workhorse, dive deep into the UV light spectrum to print the tiny features that form the basis of a microchip. Watch Gordon Moore video Lithography explained Microchips are made by building up complex patterns of transistors, layer by layer, on a silicon wafer. Our lithography systems print those patterns by projecting ultraviolet light on a blueprint of the pattern (known as a ‘reticle’ or ‘mask’) and shrinking and focusing that light onto a photosensitive silicon wafer. This results in a so-called die, a rectangular pattern on a wafer containing circuitry to perform a specific function. ASML's technology is pivotal to semiconductor production because lithography is the only stage where the wafer is processed die by die. Lithography therefore has a greater impact on performance – including the number of good wafers per day, or yield – than any other stage in the chip manufacturing process. The lithography process is repeated to build up the layers of a chip. Modern chips can have more than 100 layers, all of which need to be aligned on top of each other with nanometer precision. In general, our EUV systems are used to print the most intricate layers on a chip first, with the rest of the layers then printed using various DUV systems. Our holistic approach to lithography As patterning gets smaller, our lithography systems become increasingly complex. And as chipmakers print ever-smaller patterns, they face unprecedented engineering, material, structural and manufacturing challenges. Many sources of variation and error can hinder the lithography process, and they must be controlled to ensure that chips are produced with the required precision, in high volumes, as fast as possible and at the lowest cost. To help address these challenges, we provide customers with a holistic, integrated approach to lithography that enables them to optimize the system setup and process window for high- volume manufacturing, helping them achieve their highest yields and best chip performance. Read more in Our business model on page 31 > What is a process window? Lithography and all other stages in the microchip manufacturing process must be closely aligned for an optimal result. The process window is the collection of acceptable variations of process parameters that allow a microchip to be manufactured and to operate under desired specifications. By incorporating computational lithography, metrology and inspection, ASML’s holistic lithography portfolio enables customers to maximize the process window, keeping lithography systems stable in a high-volume manufacturing setting, which leads to a higher yield with more good wafers per day. ASML ANNUAL REPORT 2023 OUR UNIQUE OFFER STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 10 Holistic lithography

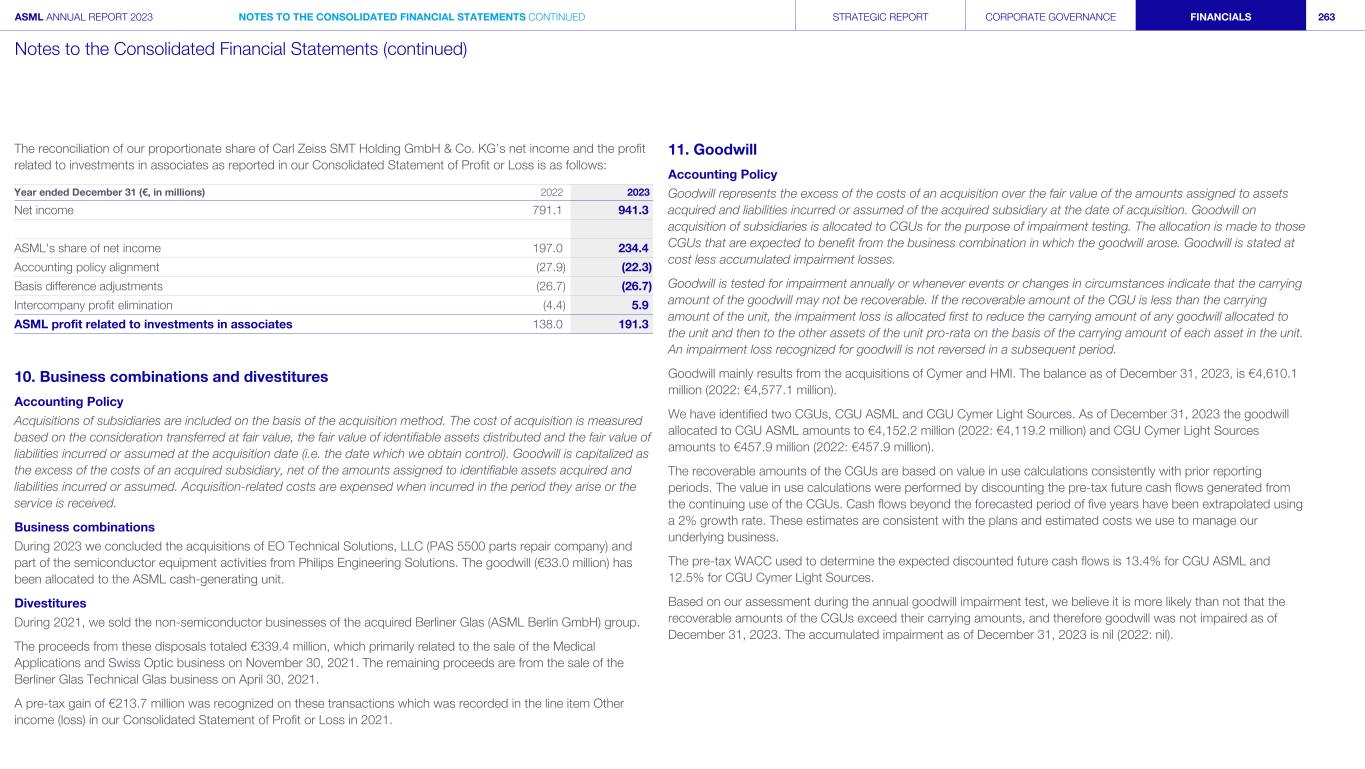

Our holistic approach integrates lithography systems with computational tools, metrology and inspection systems, and process control software solutions. This enables us to provide chipmakers with support and solutions at every stage of the chipmaking process, from early design and development to high-volume production. By bringing together the different elements of our holistic lithography portfolio, we help our customers understand and correct for potential issues that could cause variations or errors. Read more in Our business model on page 31 > This helps minimize any deviation between the intended and printed features of a microchip layout, thereby optimizing the lithography system’s performance, stability and yield – including maximizing the number of good wafers per day – and enabling ever- smaller chip features. What is edge placement error (EPE)? Creating a microchip involves the patterning of tiny features in precise locations. Edge placement error (EPE) is the difference between the intended and the printed features of the layout of a microchip. For example, a feature could be a line, which has right and left edges. On a microchip, this line and its edges must be precise and placed in exact locations. Any deviation, no matter how slight, can result in misalignment, or an EPE. If one or more EPE issues crop up in the microchip production flow, the device is subject to shorts or poor yields, which could cause the entire chip to fail. ASML plays an integral role in the microchip manufacturing process 1 Deposition – The first step is typically to deposit different materials – such as metals/conductors, insulation films and semiconductors – onto a silicon wafer. 2 Photoresist coating – The wafer is then coated with a light-sensitive layer called a photoresist. 3 Lithography – Light is projected onto the wafer through a reticle. Optics shrink and focus the reticle pattern. This pattern is then printed onto the wafer when the resist layer is exposed to light. 4 Baking, developing and etching – The wafer is then baked and developed to make the pattern permanent, with a pattern of open spaces. Reactive gases are used to etch away material from the open spaces, leaving a 3D version of the pattern. 5 Ion implantation – The wafer may be bombarded with positive or negative ions to tune the semiconductor properties. 6 Removing photoresist – After the layer is etched or ionized, the remainder of the photoresist coating that was protecting areas not to be etched is removed. The entire microchip manufacturing process – from start to tested and packaged device, ready for shipment – can take between 18 and 26 weeks, depending on the complexity of the microchip. ASML ANNUAL REPORT 2023 OUR UNIQUE OFFER CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 11 Holistic lithography (continued)

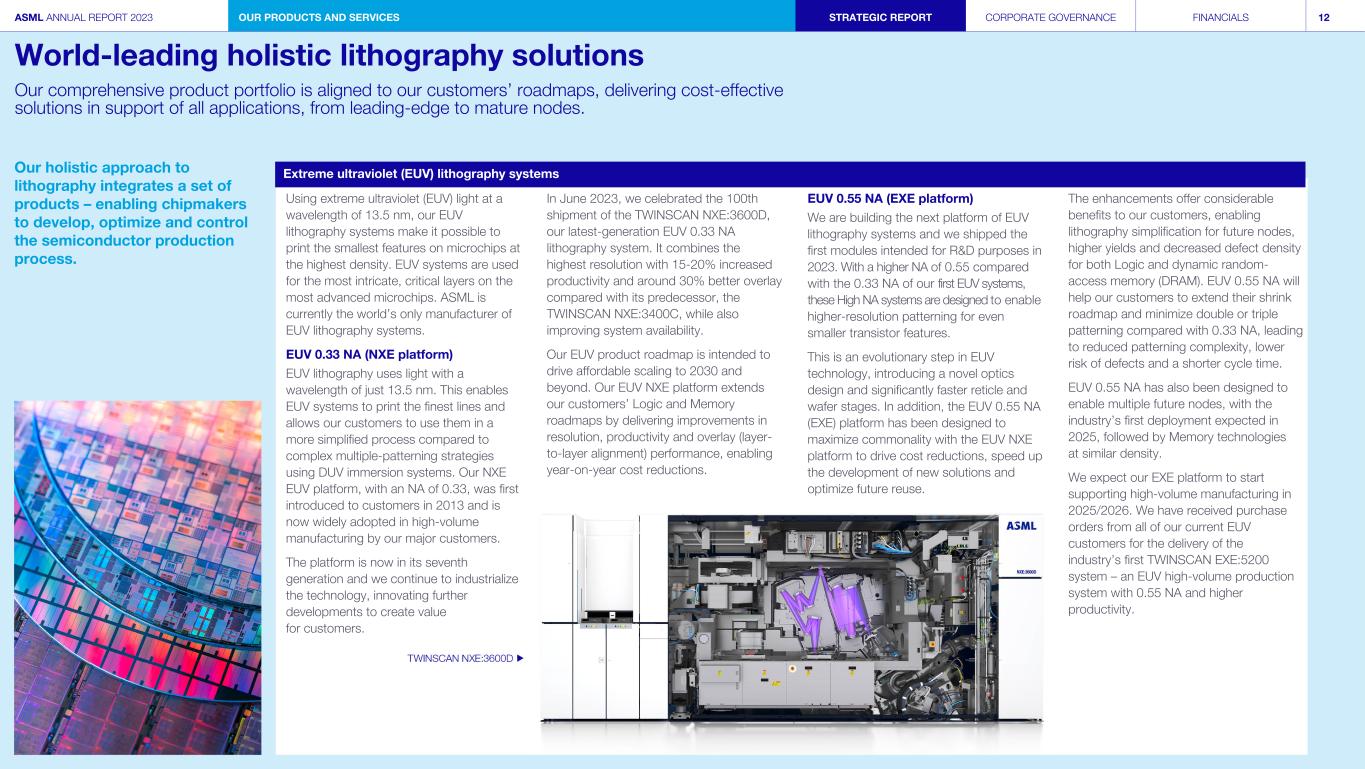

Our holistic approach to lithography integrates a set of products – enabling chipmakers to develop, optimize and control the semiconductor production process. Extreme ultraviolet (EUV) lithography systems Using extreme ultraviolet (EUV) light at a wavelength of 13.5 nm, our EUV lithography systems make it possible to print the smallest features on microchips at the highest density. EUV systems are used for the most intricate, critical layers on the most advanced microchips. ASML is currently the world’s only manufacturer of EUV lithography systems. EUV 0.33 NA (NXE platform) EUV lithography uses light with a wavelength of just 13.5 nm. This enables EUV systems to print the finest lines and allows our customers to use them in a more simplified process compared to complex multiple-patterning strategies using DUV immersion systems. Our NXE EUV platform, with an NA of 0.33, was first introduced to customers in 2013 and is now widely adopted in high-volume manufacturing by our major customers. The platform is now in its seventh generation and we continue to industrialize the technology, innovating further developments to create value for customers. In June 2023, we celebrated the 100th shipment of the TWINSCAN NXE:3600D, our latest-generation EUV 0.33 NA lithography system. It combines the highest resolution with 15-20% increased productivity and around 30% better overlay compared with its predecessor, the TWINSCAN NXE:3400C, while also improving system availability. Our EUV product roadmap is intended to drive affordable scaling to 2030 and beyond. Our EUV NXE platform extends our customers’ Logic and Memory roadmaps by delivering improvements in resolution, productivity and overlay (layer- to-layer alignment) performance, enabling year-on-year cost reductions. EUV 0.55 NA (EXE platform) We are building the next platform of EUV lithography systems and we shipped the first modules intended for R&D purposes in 2023. With a higher NA of 0.55 compared with the 0.33 NA of our first EUV systems, these High NA systems are designed to enable higher-resolution patterning for even smaller transistor features. This is an evolutionary step in EUV technology, introducing a novel optics design and significantly faster reticle and wafer stages. In addition, the EUV 0.55 NA (EXE) platform has been designed to maximize commonality with the EUV NXE platform to drive cost reductions, speed up the development of new solutions and optimize future reuse. The enhancements offer considerable benefits to our customers, enabling lithography simplification for future nodes, higher yields and decreased defect density for both Logic and dynamic random- access memory (DRAM). EUV 0.55 NA will help our customers to extend their shrink roadmap and minimize double or triple patterning compared with 0.33 NA, leading to reduced patterning complexity, lower risk of defects and a shorter cycle time. EUV 0.55 NA has also been designed to enable multiple future nodes, with the industry’s first deployment expected in 2025, followed by Memory technologies at similar density. We expect our EXE platform to start supporting high-volume manufacturing in 2025/2026. We have received purchase orders from all of our current EUV customers for the delivery of the industry’s first TWINSCAN EXE:5200 system – an EUV high-volume production system with 0.55 NA and higher productivity. ASML ANNUAL REPORT 2023 OUR PRODUCTS AND SERVICES STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 12 World-leading holistic lithography solutions Our comprehensive product portfolio is aligned to our customers’ roadmaps, delivering cost-effective solutions in support of all applications, from leading-edge to mature nodes.

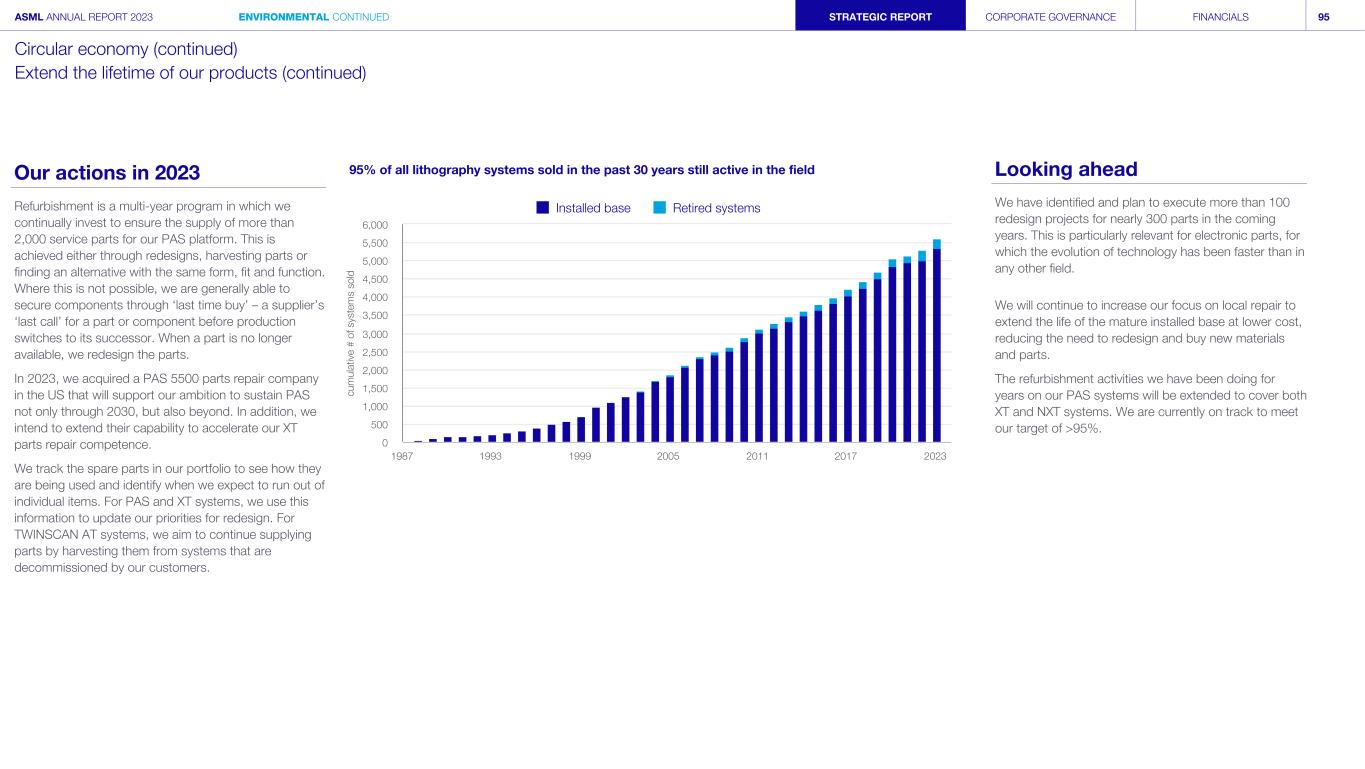

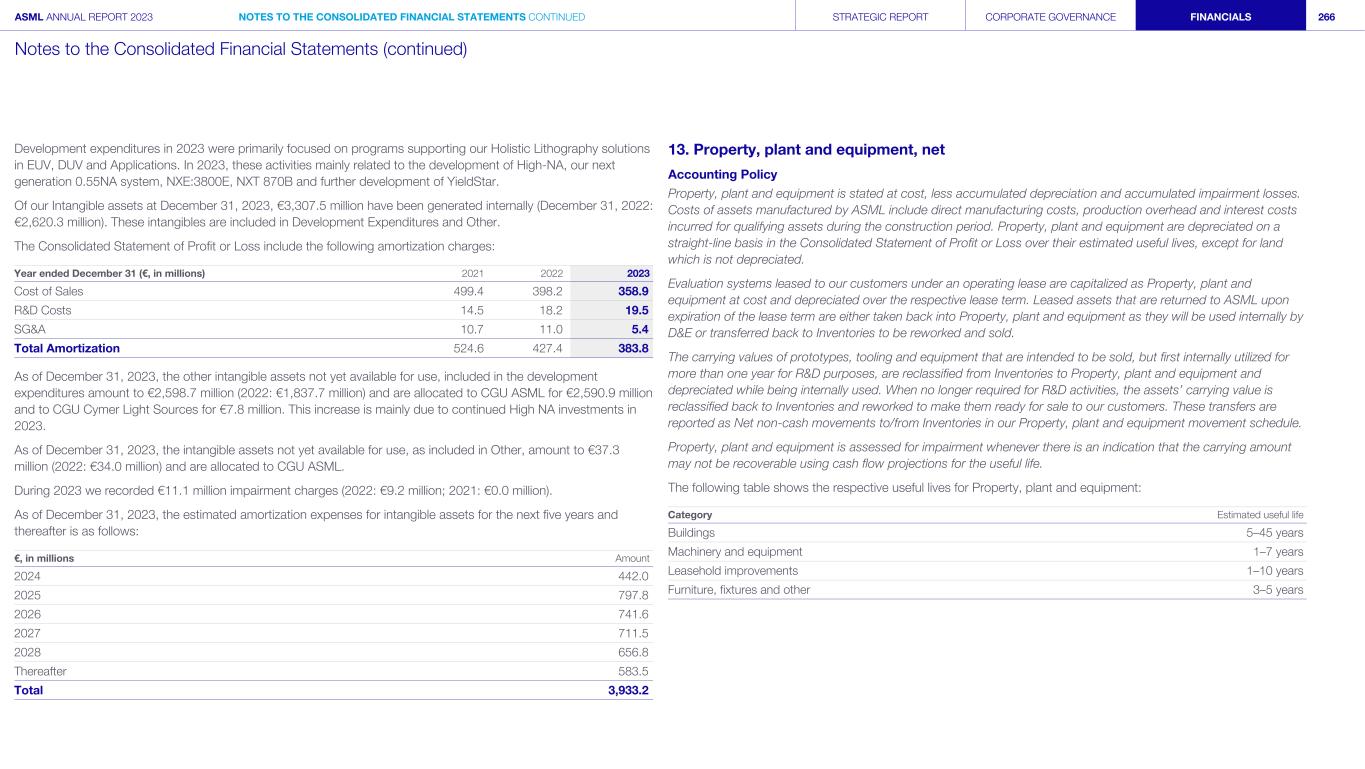

Deep ultraviolet (DUV) lithography systems Deep ultraviolet (DUV) lithography systems are the workhorses of the industry, producing the majority of layers in microchips. Supporting numerous market segments, we offer immersion as well as dry lithography systems, and a range of light sources to offer all wavelengths currently used in the semiconductor industry – argon fluoride (ArF) for 193 nm wavelength, krypton fluoride (KrF) for 248 nm and mercury gas discharge lamp (i-line) for 365 nm. Our systems lead the industry in productivity, imaging and overlay performance to help manufacture a broad range of semiconductor nodes and technologies, and support the industry’s cost- and energy-efficient scaling. Immersion systems (NXTi platform) ArF immersion lithography maintains a thin film of water between the lens and the wafer. Using the refractive index of water to increase NA improves resolution to support further shrink. Our immersion systems are suitable for both single-exposure and multiple-patterning lithography, and can be used in seamless combination with EUV systems to print different layers of the same chip. Our latest state-of-the-art immersion system is the TWINSCAN NXT:2100i, launched in the third quarter of 2022. Alongside intrinsic improvements to lens metrology, reticle conditioning and wafer table, as well as overall cross-matching improvements, the NXT:2100i features innovations such as the Alignment Optimizer 12 Color package. The system delivers 295-wafers-per-hour (wph) productivity combined with unprecedented overlay performance, providing the most cost-efficient solution to customers for critical immersion layers on the sub 3 nm nodes. Dry systems (NXT and XT platform) Not every layer on a chip has to be produced by the most innovative immersion lithography systems. While some more complicated layers do require more advanced lithography systems, others can often be printed using ‘older’ technology such as dry lithography systems. Our dry systems product portfolio offers our customers more cost-effective solutions for all types of wavelengths. Our TWINSCAN NXT:1470 dual-stage ArF system continues to be adopted by the majority of Logic and Memory customers and has been inserted in high-volume manufacturing processes. It is the first dry NXT system, building on the common immersion platform, with improvements in matched machine overlay (<4.0 nm), productivity (>300 wph) and footprint. The TWINSCAN NXT:870 248 nm step- and-scan system is a high-productivity, dual-stage KrF lithography tool designed for high-volume 300 mm wafer production at and above-110-nm resolution. The system increases productivity from the 260 wph capability of the XT:860N to 330 wph through the use of the NXT platform, a higher scan speed and reduced system overhead time. The TWINSCAN XT:400L is our latest i-line lithography system, which can print features down to a resolution of 220 nm for 200 mm and 300 mm wafer production. We are on track with a platform commonality roadmap in order to reduce the cost of ownership: The transition in ArF and KrF from the XT platform to the NXT platform is resulting in significant productivity gains (KrF 27% to 330 wph on NXT:870, ArF 46% to 300 wph on NXT:1470). We continue to innovate in productivity, cost of ownership and performance across our TWINSCAN XT product lines (ArF, KrF and i-line) for 200 mm and 300 mm wafer sizes. Refurbished systems Our refurbished products business refurbishes and upgrades our older lithography systems to extend their lives, and offers associated services and support. We currently offer refurbished PAS 5500 and first-generation AT, XT and NXT systems. ASML systems have a very long operational lifetime that often exceeds their role at the initial customer. Many customers are therefore able to generate value by selling off systems they no longer require. To support this sustainable product use and ensure used systems deliver the quality that ASML stands for, we are actively involved in the used- system market. Remarkably, 95% of the systems that we have sold in the last 30 years are still in use. Read more in Environmental – Circular economy ASML ANNUAL REPORT 2023 OUR PRODUCTS AND SERVICES CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 13 World-leading holistic lithography solutions (continued)

Metrology and inspections systems Our metrology and inspection systems allow chipmakers to measure the patterns that they print on the wafer to see how well they match the intended pattern. Our portfolio enables chipmakers to monitor most steps of bringing a chip to market, from R&D to mass production. The systems are a key element of our holistic approach to lithography. They produce data at the speed and accuracy needed during high-volume manufacturing to enable our process control software solutions to create automated feedback control loops. This optimizes the lithography system settings for each exposure to reduce EPE, enlarging the process window to achieve the highest yield and best performance in a fab environment. Optical metrology Our YieldStar optical metrology systems allow chipmakers to assess the quality of patterns on the wafer in volume production, through fast and accurate overlay measurements. We offer two categories of YieldStar systems for use before and after ‘etching’ (the stage when the material in any open spaces is removed to reveal the 3D version of the patterns on the wafer). Pre- etch metrology measures the overlay and focus of the lithography system and the pattern printed on the photoresist. Post- etch metrology measures the overlay and critical dimensions of the final patterns formed on the wafer. In 2023, we shipped the YieldStar 500, our latest optical overlay and focus metrology tool, designed to be the new benchmark for measurement accuracy, matching performance and measurement speed. It is a standalone optical wafer metrology system for measuring pre-etch overlay. Using diffraction-based measurements, the YieldStar 500 offers fast monitoring of overlay and focus performance directly on produced wafers with nanometer-level accuracy. E-beam metrology and inspection Our HMI electron beam (e-beam) solutions allow customers to locate and analyze individual chip defects amid millions of printed patterns, extending the scope for process control. While e-beam solutions were historically too slow to monitor volume production processes, we have increased the throughput to now uniquely offer e- beam solutions for use during high-volume production as well as the R&D phase. The R&D phase of chip manufacturing involves extensive testing, validation and fine-tuning to optimize the complete manufacturing process for reliable, high- yield mass production. We offer two types of solutions to support this stage: E-beam metrology and defect detection to monitor critical dimension and EPE data at resolutions necessary for the implementation of EUV lithography; and single-beam inspection to monitor voltage contrast and physical defects. Our ground-breaking multiple e-beam (multibeam) inspection systems operate at throughput speeds that enable them to be used inline during mass production to detect voltage contrast defects and physical defects. We continue to extend technology leadership in voltage contrast inspection and physical defect inspection with the widely adopted single-beam platform. The HMI eScan 600 is our latest highly flexible e-beam wafer inspection system that can operate in multiple modes, allowing chipmakers to capture the widest variety of defect types in a single system. Our high-resolution e-beam metrology system HMI eP5 offers world-class 1 nm resolution with large field-of-view capabilities. It produces critical dimension (CD) and EPE data in high volume with a quality level that customers need for monitoring and control. EPE is becoming more critical for device patterning and yield with shrinking design rules and the adoption of EUV lithography. We also released an EPE metrology application software product on eP5. It is capable of local and global EPE measurements on device, both intralayer and interlayer. In 2022, we released and shipped the eP5 XLE, which extends the high-resolution eP5 system with high landing energy up to 30 keV and fast back-scattered electron detection for inspection and metrology of 3D devices in Logic and Memory. It is capable of overlay measurement on device patterns, complementing our YieldStar product offering. We also released and shipped the first next-generation high- resolution e-beam metrology system, eP6, to succeed eP5. The projected eP6 performance is expected to be more than 10 times the speed of existing technologies. Building on the 2020 launch of our breakthrough multibeam inspection tool HMI eScan 1000, with a 3x3 image, in 2022 we also introduced the next-generation HMI eScan 1100. With a 5x5 image, it demonstrates successful multibeam operation, simultaneously scanning with 25 beams. The 5x5 system has higher sensitivity for detecting voltage contrast defects and physical defects, while substantially increasing inspection throughput. In 2022, the first eScan 1100 multibeam system was installed at a customer site to start customer evaluation. ASML ANNUAL REPORT 2023 OUR PRODUCTS AND SERVICES CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 14 World-leading holistic lithography solutions (continued)

System and process control software Taking advantage of the huge flexibility of our lithography systems, our system and process control software products enable automated control loops to maintain optimal operation of lithography processes and therefore maximize yield. Using powerful algorithms, they analyze metrology and inspection data and calculate necessary corrections for each individual exposure. This provides a feedback loop to the lithography system to minimize EPE in subsequent wafer lots. Our roadmap aims to apply more powerful algorithms with higher-order corrections to enable our customers to continue improving EPE performance. Read more on EPE at box-out on page 11 Our roadmap aims to apply more powerful algorithms with higher- order corrections to enable our customers to continue improving EPE performance. Computational lithography We use computational lithography to predict and enhance the process window of our lithography systems by calculating the optimal settings, depending on the specific application. This takes place in the R&D phase, during the development of new chips to optimize both the reticle patterns and the setup of the lithography system to ensure robust, manufacturable designs that deliver high yields. Our computational lithography solutions are based on models of the various physical and chemical processes that influence pattern quality. Advanced algorithms, driven by these models, predict how a designed pattern will appear when printed on a wafer. Based on those predictions, the reticle design and factors within the lithography system can be subtly adjusted to ensure that a chip pattern is printed exactly as intended. Increasingly, we are using machine-learning techniques to further speed up development of models and to reduce the computational time and cost. Managing our installed base system Our installed base continues to grow, comprising not only new systems but also refurbished systems with new owners in new markets and applications. To provide all our customers with the best possible value proposition, we offer an extensive installed base management (IBM) portfolio, including a wide range of service and upgrade options. We develop and sell product options and enhancements designed to improve throughput, patterning performance and overlay. Our field upgrade packages enable customers to optimize their cost of ownership over a system’s lifetime by upgrading older systems to improved models. ASML ANNUAL REPORT 2023 OUR PRODUCTS AND SERVICES CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 15 World-leading holistic lithography solutions (continued)

We are one of the world’s leading manufacturers of chipmaking equipment, while our customers are the world’s leading microchip manufacturers. We enable them to create the patterns that define the electronic circuits on a chip, and consequently our success is inextricably linked with theirs. That’s why we collaborate with our customers to understand how our technology best fits their needs and challenges. That means engaging with our customers at all levels: Building partnerships, sharing knowledge and risks, aligning our investments in innovation and increasingly focusing on the long-term challenges for the next five to ten years and beyond. We develop our solutions based on their input, help them achieve their technology and cost roadmaps, and work together, often literally in the same team, to make sure our solutions fit together perfectly. Engaging fully with customers is also an important part of working toward securing the full product portfolio that will sustain our company into the future. As our installed base continues to grow, we work very closely with our customers to develop and sell options and enhancements designed to improve throughput, patterning performance and overlay to optimize the cost of ownership over a system’s lifetime. Building on our customer relationships We market and sell our products directly to customers, without agencies or other intermediaries. Our account managers, field and application engineers, and service and technical support specialists are located close to our customers' operations throughout Asia, the US and Europe, the Middle East and Africa (EMEA). Customer trust is the foundation for our customer relationships. Our customers expect us to have the right means to meet their needs and expectations, consistently deliver upon the promises we make, be transparent about what we are doing and fairly share the risks and rewards with them. In 2023, we took the first steps toward a reorganization of our customer- facing roles and responsibilities, and we announced the intended appointment of a Chief Customer Officer in ASML's Board of Management, effective per the date of the 2024 AGM. This will help us to continue to scale customer relationships, excellent support and customer trust as the business grows. How we provide customer support We support our customers with a broad range of applications, services and technical support products to maintain and enhance our systems’ performance. Our customer support teams across the world ensure the systems in our customers’ fabs run at the highest levels of predictability and availability. We offer 24/7 support, next-day parts delivery and an easy- to-use, centralized customer portal. It is essential for us and our customers to have well-trained engineers in the regions where we operate. We offer specialized training to boost the capabilities of our local customer service teams and enhance local technical expertise. This helps us to increase the self-sufficiency of local field engineers. Read more in Engaging with our stakeholders – Customers ASML ANNUAL REPORT 2023 OUR PRODUCTS AND SERVICES CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 16 Supporting our customers We believe a true partnership with our customers based on mutual trust is vitally important, ensuring that we share the risks and rewards of what we do. We collaborate with our customers to understand how our technology best fits their needs and challenges.

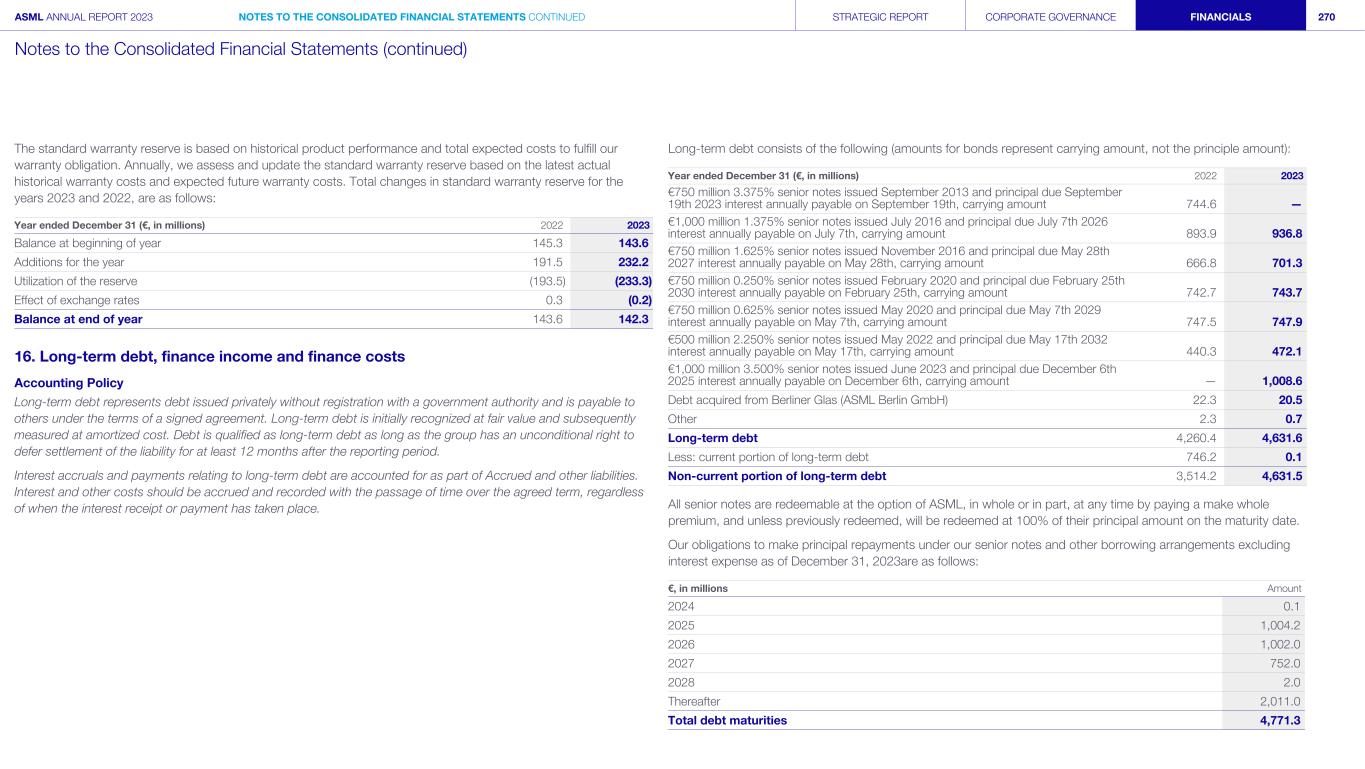

Every few months, I have been given a new challenge to extend myself.” Manisha Devi Solution Test Architect 4 years at ASML Delivering for our customers After joining ASML four years ago, Manisha Devi led a team of engineers in the roll-out of ASML’s digital platform to customers in 2023. Aware that any mishaps could lead to unplanned downtime that may cost customers millions in lost revenue, Manisha knew the stakes couldn’t be higher. ASML ANNUAL REPORT 2023 SMALL PATTERNS. BIG IMPACT. STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 17

Finding your passion I have always been inspired by the quote from Marie Curie: “I am among those who think that science has great beauty.” As a child in a small town in North India, I dreamed of a career in science and technology. And I took every opportunity to make that happen. I left the comfort of home to study at a premier science & technology institute before starting work in the telecoms technology domain, growing with each new role and responsibility. ASML then gave me the chance to test my skills in the semiconductor industry. I joined as a software tester and am now a solution test architect – determining test and integration strategies for new solutions. Unlocking the code There is a huge amount of software inside ASML’s systems, and we are continually developing more. That software is critical to the operation of the system and the economic success of our customers. Any unintended downtime can cost our customers millions in lost revenue. So, ASML isn’t just investing in development, it is also investing in quality – to ensure all that software works together seamlessly and doesn’t cause unplanned stoppages in production. Like most software-enabled systems, ASML’s products have a huge amount of legacy code. You can’t just reengineer that every time you want to make an update or add a feature – you need to develop new software in such a way as to ensure that it doesn’t break the legacy code. To streamline the process, ASML has recently switched to a platform development approach: Instead of delivering a single software package for the scanner, we deliver a series of options that all work together. Part of this transition is to update all installed systems in the field with an entire new software stack. I was asked to lead the team responsible for qualifying and integrating that new stack. As someone who loves a challenge, I jumped at the chance. Replacing all the system software is a daunting prospect, so quality was essential – we had to get it right first time. To make that possible, ASML has recently introduced a new methodology for software development. Of course, we make use of the standard approaches like Lean and Agile, but we take the parts that work best for us and our customers, then combine them with new ideas. For example, for the new stack, we used a ‘shift-left strategy’ where testing and quality evaluation starts much earlier. Having the development team involved in testing end-to-end helped us bring the software to the required quality level faster. A customer-first approach Throughout the development of the new software stack, we were guided by our customers’ needs. ASML is in constant contact with its customers, and regularly asks them for feedback. In this case, our customer representatives provided continuous feedback on the features customers will want in the next 9-12 months and customers’ specific use cases. This helped us better understand which software configurations do and don’t work. We started rolling out the new software stack to customers in 2023. The goal is to do this without downtime – this was the most nerve- wracking part of the process, certainly for our customers. There are always things that can go wrong when you go live with such complicated software, but we had done so much preparation, studying each customer’s use case, so we could be one step ahead. That’s not to say that issues didn’t crop up, but we were always ready with the solution when they did. Our customers may not have been smiling when we arrived, but they definitely were eight hours later when their system was running the new stack without problems. And now they can be confident about adding new options equally painlessly in the future. ASML ANNUAL REPORT 2023 SMALL PATTERNS. BIG IMPACT. CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 18

We expect High NA EUV high-volume manufacturing systems to be fully operational in customer factories by 2025.” Martin van den Brink President, Chief Technology Officer and Vice Chair of the Board of Management Q What were the highlights in technology development and innovation in 2023? Martin: Let me start by saying that in 2024 it will be 40 years since a small team of colleagues, including me, first came together in a leaky shed in Eindhoven, tasked with developing lithography systems for the growing semiconductor market. That was the start of ASML as we know it today. So, although 2023 was another dynamic year for innovation, this was not achieved overnight but as the result of all the hard work that preceded it. Having said that, it was undeniably a very proud moment for our innovation teams when we successfully shipped the first modules of our first High NA EUV system, EXE:5000, following extensive testing and integration throughout the year. Our EXE High NA EUV platform increases the numerical aperture from 0.33 to 0.55 and will enable geometric chip scaling well into the next decade. We expect High NA EUV high- volume manufacturing systems to be fully operational in customer factories by 2025. In DUV immersion, we rolled out a lens distortion manipulator to adjust the optics in operation and reduce overlay errors, which gives us an opportunity to improve our mix and match overlay between EUV and DUV immersion. It provides us with more flexibility following distortion of the wafer and is also applicable for 3D integration bonding. On the application side, we made progress with key technologies such as x-ray, working closely with our customers, with whom we are closely aligned. Regarding our metrology and inspection product portfolio, in 2023, we brought to market the YieldStar 500, our latest optical overlay and focus metrology tool, designed to be the new benchmark for measurement accuracy, matching performance and measurement speed. We are now also delivering our multibeam and single-beam high- voltage system. While there remains some work for our teams in maximizing reliability and maturing these systems to a point where customers can use them in production, this has been an important step forward, and one where AI has played a key role. Two years ago, we started to develop a strategy to arrive at a unified or common EUV platform in order to drive productivity. It was very exciting to see that strategy begin to bear fruit during 2023. We now have a clear, articulated roadmap to achieve a full EUV suite – a common platform with common manufacturing processes and a common supplier base. This will drive cost reductions and speed up the development of new solutions, which is important not only for ASML, but also for our customers. ASML ANNUAL REPORT 2023 Q&A WITH THE CTO STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 19 Driving Moore’s Law across four decades of innovation In conversation with our President, Chief Technology Officer and Vice Chair of the Board of Management Martin van den Brink On April 24, 2024, ASML President & CTO Martin van den Brink will retire from ASML upon completion of his current appointment term. “It has been a privilege to co-lead ASML with Peter Wennink and to have brought a strong focus on product, technology and engineering capabilities to the company and its suppliers. I am proud of the innovations that we have delivered together with our customers over the decades."

Q Is shrink still the most important driver of innovation? Martin: In line with Moore’s Law, shrink has long played a key role in innovation, and although this is inevitably becoming more and more challenging, it will continue because shrink is the only way to effectively reduce costs. However, it’s important to put this into context. What we are looking at today is whole-system integration shrink, not just of the chips themselves. For example, 3D system integration – vertically stacking different chips together into a single package – requires innovative lithography solutions to handle the increasingly dense interconnections. We have been working with both Logic and Memory customers on how to shrink these connections from chip to chip. As is always the case with innovation on this scale and in this industry, we are engaging with core solution providers, such as bonding suppliers, to find the answers. Cost is closely aligned with shrink. As shrink becomes more challenging over time, and as technology continues to demand more energy-efficient transistors per chip, the industry will need to produce more silicon but at lower cost. The cost-productivity ratio is now a key aspect of our roadmap because we understand the cost pressures that our customers and suppliers are facing. Moving forward, we have clear parameters for R&D to work within so that future innovations take account of the technology limits of our supplier base and, where possible, reduce any risks of suppliers making unnecessary investments in new capabilities. Q How have your ecosystem partners driven innovation in 2023? Martin: It is impossible to overstate the importance of our partners. A significant number of them are integral to our innovation activities and several have worked with us for many years. Our requirements are frequently unique and very demanding – so we work hard to help suppliers engage with our objectives in a spirit of mutual trust and respect. The importance of these relationships has been further recognized at ASML Board level through the recent appointment of Wayne Allan as Executive Vice President (EVP) and Chief Strategic Sourcing & Procurement Officer (CSPO), heading up the supply improvement program which aims to radically step up our ability to work with suppliers and deliver what our customers demand. We saw a number of developments in our supplier relationships in 2023. Having partnered with imec (Interuniversitair Micro- Elektronica Centrum) – a leading research and innovation hub in nanoelectronics and digital technologies – since the late 1980s, in 2023 we signed a new Memorandum of Understanding (MoU) to intensify our collaboration around High NA. The MoU includes the installation and service of our full suite of advanced equipment in the imec pilot line in Leuven, Belgium. This facility will enable us to work alongside imec to develop a new process that will take us to the next semiconductor process node. Q How do you safeguard ASML’s ability to continually improve? Martin: We aim for R&D spend to be in the 10-15% range of revenue. As our revenue increases rapidly, so too does our financial commitment to supporting innovation – in 2023, we invested €4.0 billion (based on US GAAP) in R&D. Of that amount, we spend around 10% on pure explorative research that aims to fill the innovation pipeline. We continue to work with our partners, for example by investing in a high- transmissive illuminator with ZEISS. Q Can you update us on future developments such as Hyper NA? Martin: Hyper NA with an NA higher than 0.7 is certainly an opportunity that will become more visible from around 2030. It is likely to be most relevant for Logic – and it will need to be more affordable than double patterning – but it may also be an opportunity for DRAM. For us, the key thing is that Hyper NA is driving our overall EUV capability platform to improve both cost and lead time. Regarding the industry in general, digitalization will continue to enable many of the solutions that are transforming our planet. Although systems such as our EUV platform require a great deal of energy, I think that we make a positive contribution to reducing GHG emissions by enabling the development of technologies such as smart grids and electric vehicles. More such technologies will follow – so at ASML we can feel good that our customers and their customers are engaging with society in a positive way when it comes to the environment. Digitalization will continue to enable many of the solutions that are transforming our planet.” Martin van den Brink President, Chief Technology Officer and Vice Chair of the Board of Management Q How do you envisage ASML on its 50th anniversary? Martin: It is fair to say that our innovations are likely to be restricted by more boundaries, whether in terms of cost, cycle time or technology limits. Our challenge is to make efficiency gains in all these areas over the next 10 years – to make sure not only that we invent new solutions and ways of working but that these can be put into cost- effective and timely practice for our customers. It’s all about doing everything we can to turn theory into practical reality, giving our customers the most efficient possible operation in every regard: cost, sustainability and productivity. ASML ANNUAL REPORT 2023 Q&A WITH THE CTO CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 20 Driving Moore’s Law across four decades of innovation (continued) In conversation with our President, Chief Technology Officer and Vice Chair of the Board of Management Martin van den Brink

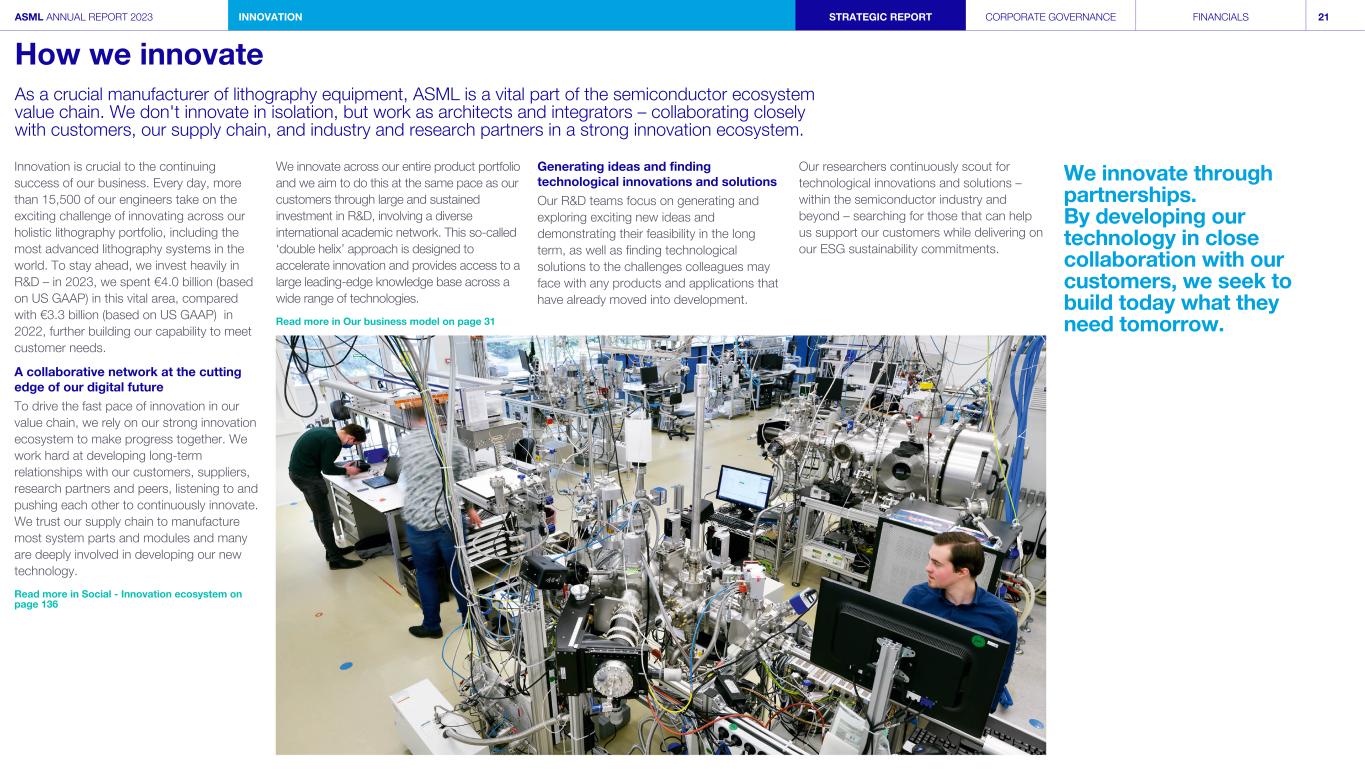

Innovation is crucial to the continuing success of our business. Every day, more than 15,500 of our engineers take on the exciting challenge of innovating across our holistic lithography portfolio, including the most advanced lithography systems in the world. To stay ahead, we invest heavily in R&D – in 2023, we spent €4.0 billion (based on US GAAP) in this vital area, compared with €3.3 billion (based on US GAAP) in 2022, further building our capability to meet customer needs. A collaborative network at the cutting edge of our digital future To drive the fast pace of innovation in our value chain, we rely on our strong innovation ecosystem to make progress together. We work hard at developing long-term relationships with our customers, suppliers, research partners and peers, listening to and pushing each other to continuously innovate. We trust our supply chain to manufacture most system parts and modules and many are deeply involved in developing our new technology. Read more in Social - Innovation ecosystem on page 136 We innovate across our entire product portfolio and we aim to do this at the same pace as our customers through large and sustained investment in R&D, involving a diverse international academic network. This so-called ‘double helix’ approach is designed to accelerate innovation and provides access to a large leading-edge knowledge base across a wide range of technologies. Read more in Our business model on page 31 Generating ideas and finding technological innovations and solutions Our R&D teams focus on generating and exploring exciting new ideas and demonstrating their feasibility in the long term, as well as finding technological solutions to the challenges colleagues may face with any products and applications that have already moved into development. Our researchers continuously scout for technological innovations and solutions – within the semiconductor industry and beyond – searching for those that can help us support our customers while delivering on our ESG sustainability commitments. We innovate through partnerships. By developing our technology in close collaboration with our customers, we seek to build today what they need tomorrow. ASML ANNUAL REPORT 2023 INNOVATION STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 21 How we innovate As a crucial manufacturer of lithography equipment, ASML is a vital part of the semiconductor ecosystem value chain. We don't innovate in isolation, but work as architects and integrators – collaborating closely with customers, our supply chain, and industry and research partners in a strong innovation ecosystem.

Filling the innovation funnel We encourage our experts to build wide networks in the broader technology space. This supports the constant stream of new ideas into the technology pipeline that flows through what we call our ‘innovation funnel’ (see diagram). Based on our fundamental understanding of our markets and the needs of chipmakers, we select new ideas that have the potential to advance our products and their customer application. Ideas that pass the ideation and selection stages are assessed in the research stage for their feasibility to go into our product generation process (PGP), a decision-based process for product development that includes an ESG assessment as well as the building and testing of system prototypes in the relevant environments. Prototypes that pass these tests may eventually lead to new product releases. ASML Fellowship Program At ASML, we recognize and honor our technical experts because we know that our company’s success is built on technology leadership. One of the ways we do this is through the ASML Fellowship Program. Innovation achievements in 2023 Our goal is to give customers the products and capabilities they need to deliver on technology’s potential to make a positive contribution to society. As well as creating some of the most advanced machines in the world, this includes an increased focus on sustainability through parts commonality and reuse, and improvements in the performance and energy efficiency of our products to reduce costs and waste. Innovation achievements of the last 12 months include: • Soft x-ray (SXR) scatterometry. Using 10-20 nm wavelength light, this is a revolutionary next-generation metrology for 3D metrology suitable for measuring 3D profiles of advanced devices such as Gate All Around (GAA) transistors. • Generation of smooth mirror surfaces. This innovation is used on the EXE:5200 mirror block. The mirror block carries the wafer table, with its mirrors used to position the wafer in three dimensions. The smooth mirror surface has greater stiffness compared to other glass materials, enabling it to better cope with the extreme stage accelerations in our next-generation NXE and EXE systems. In 2023, three new ASML Fellows were appointed, and two of our current Fellows were promoted to the titles of Senior and Corporate Fellow, respectively, for their personal outstanding technical contributions. ASML ANNUAL REPORT 2023 INNOVATION CONTINUED STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 22 How we innovate (continued)

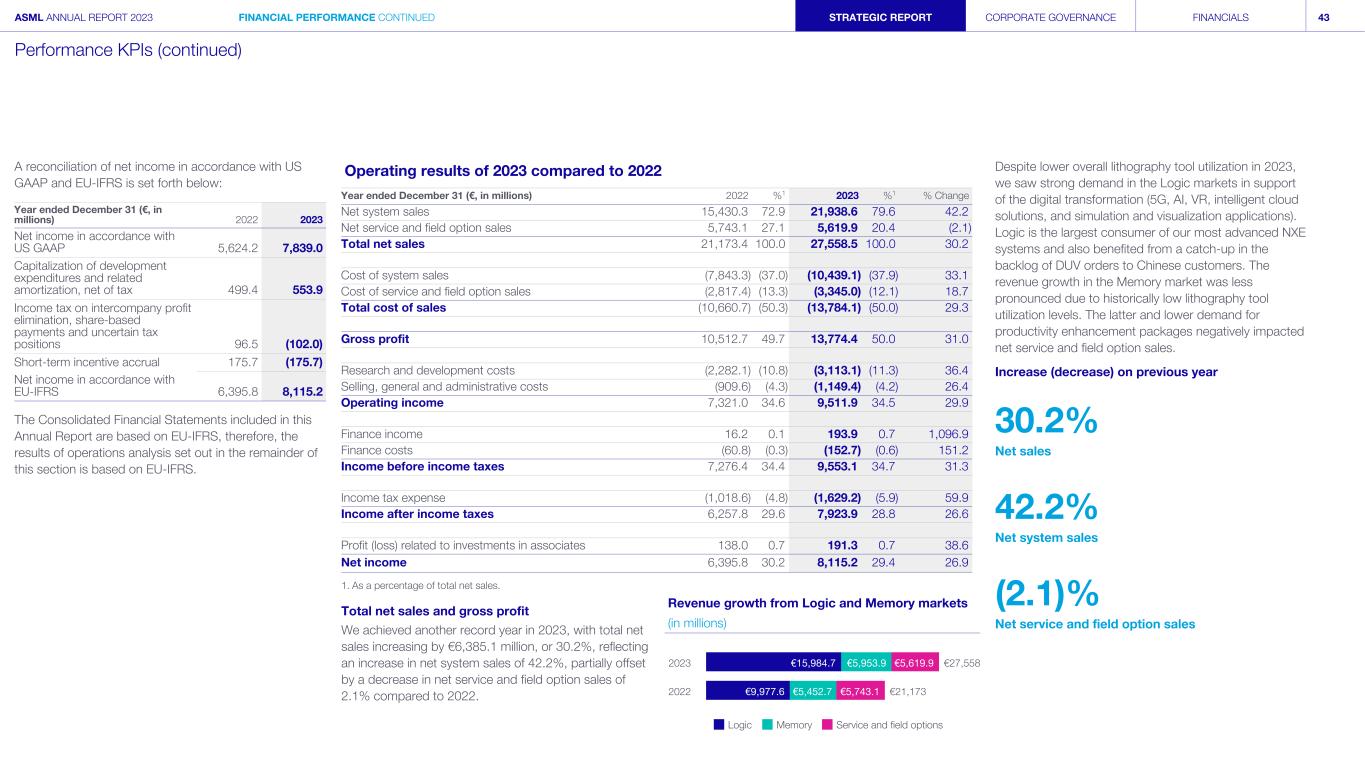

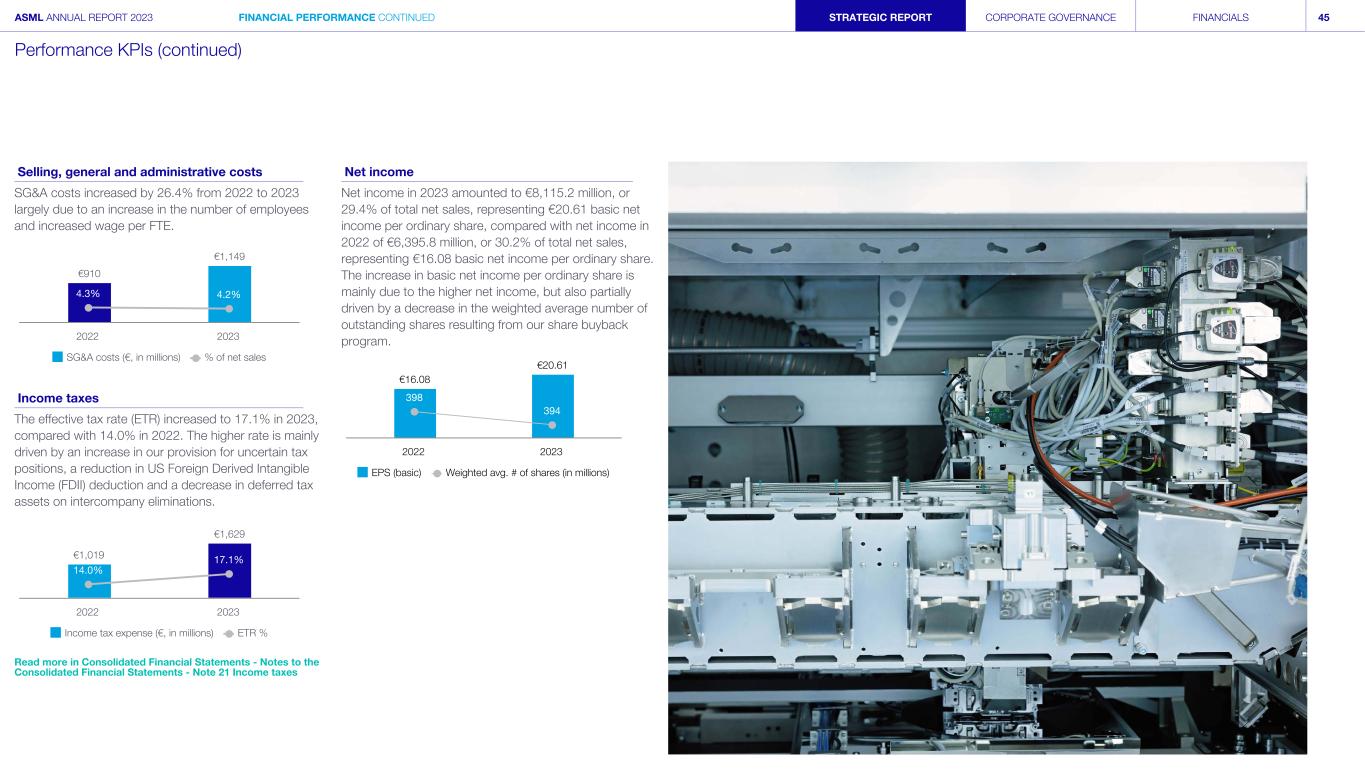

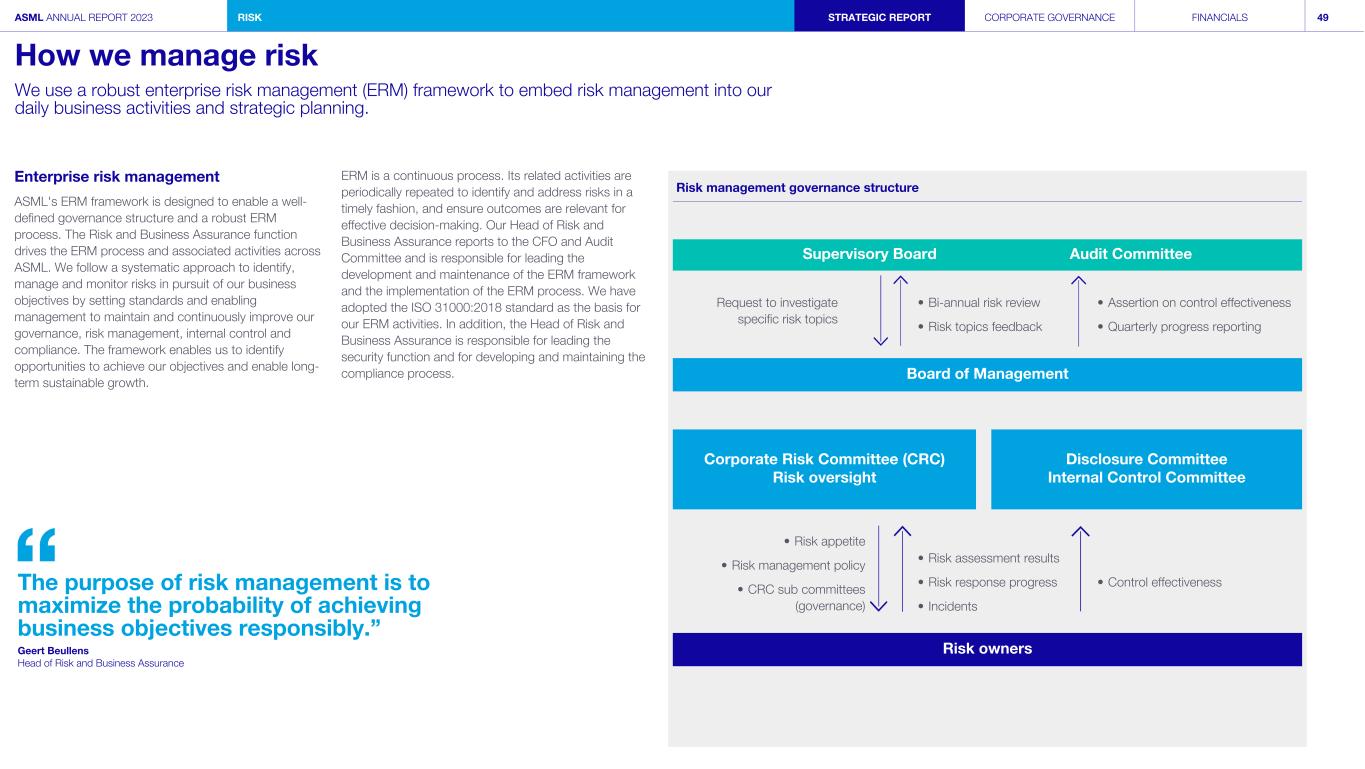

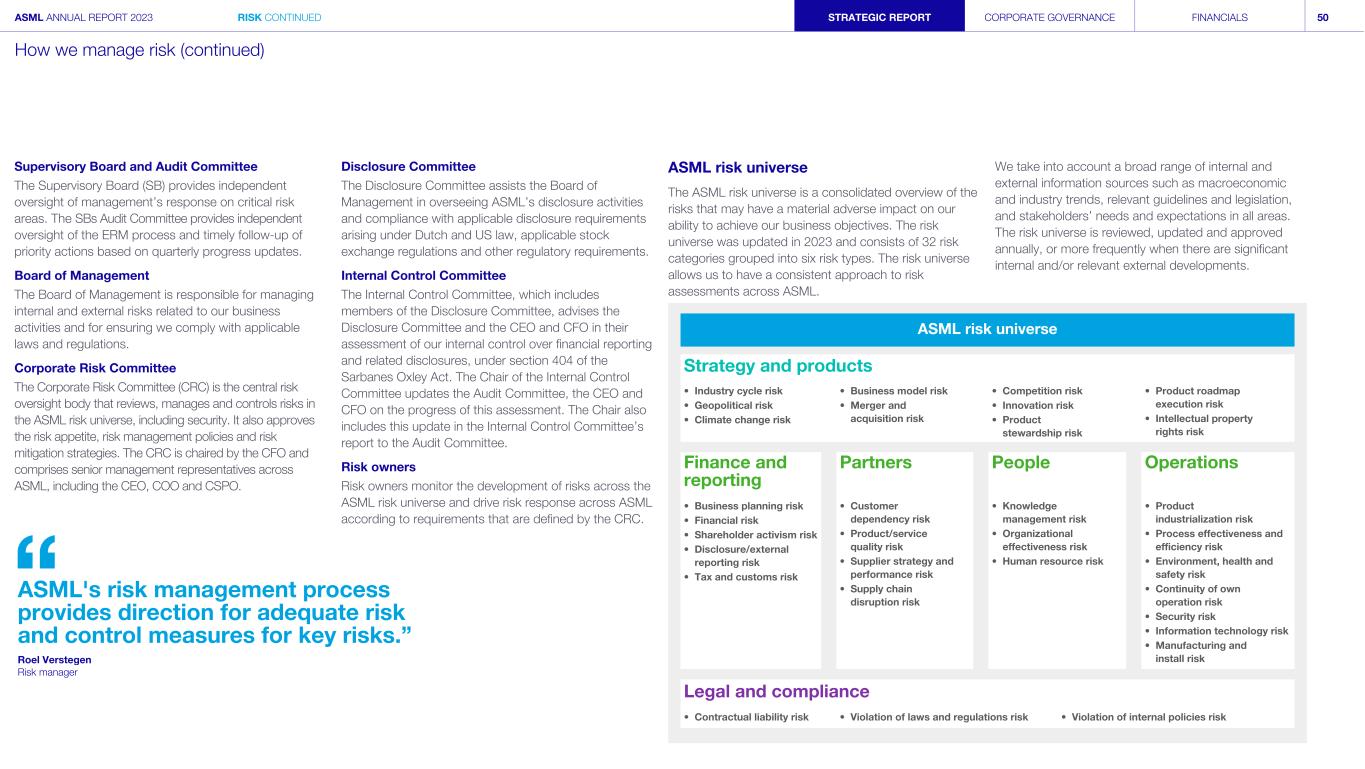

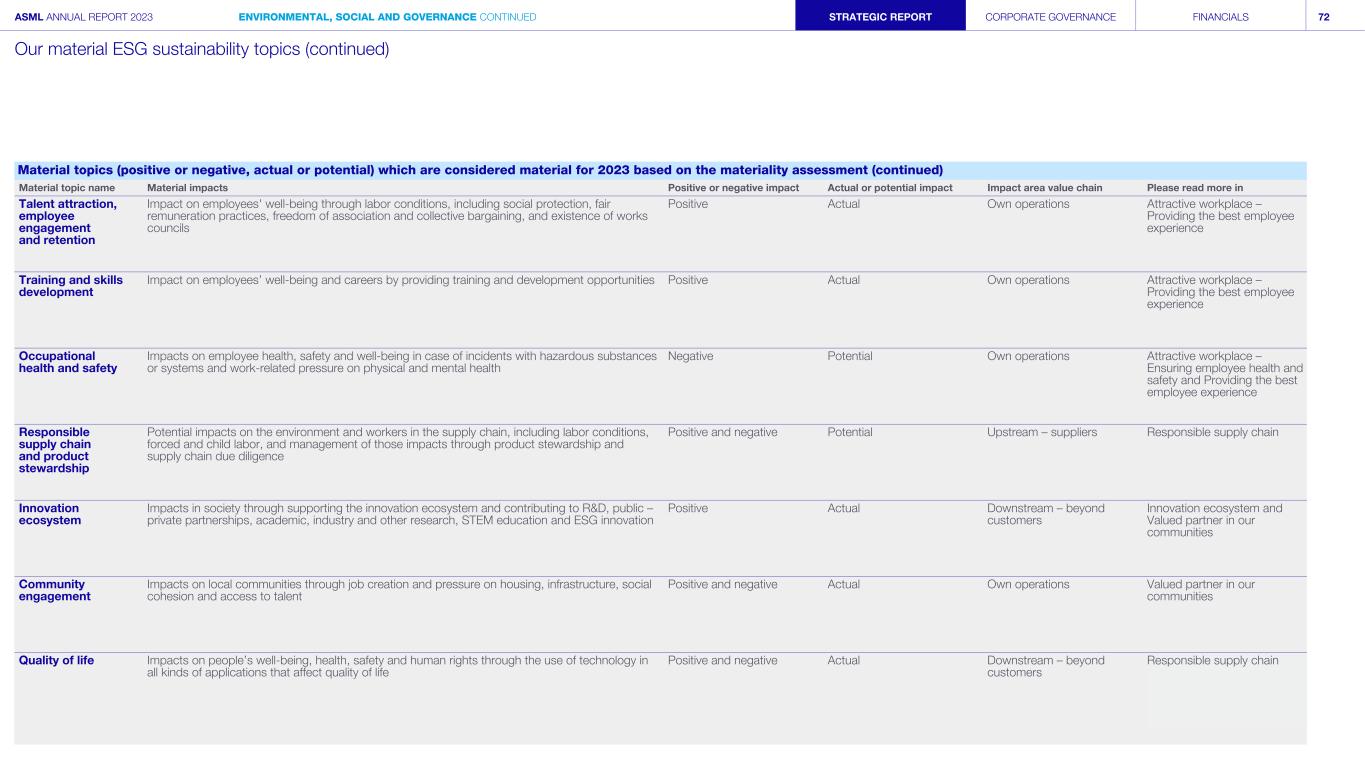

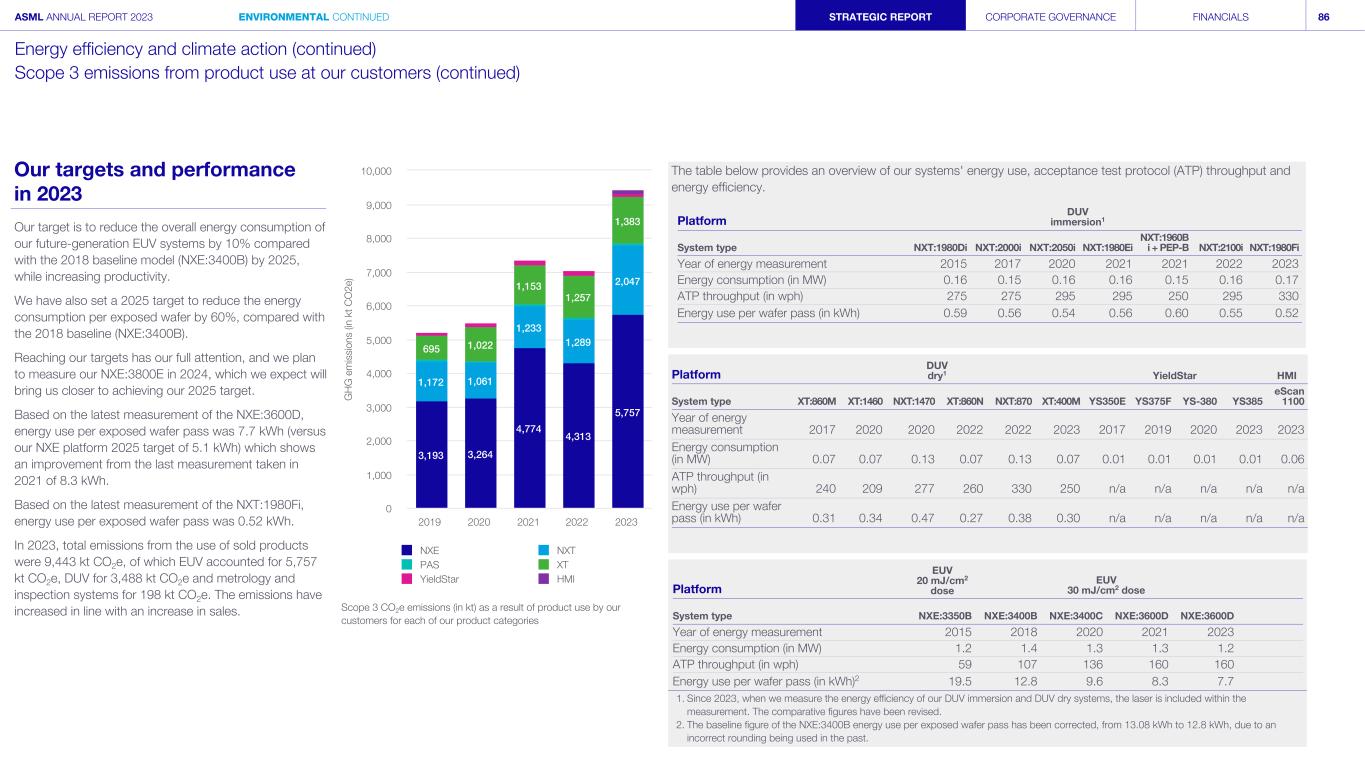

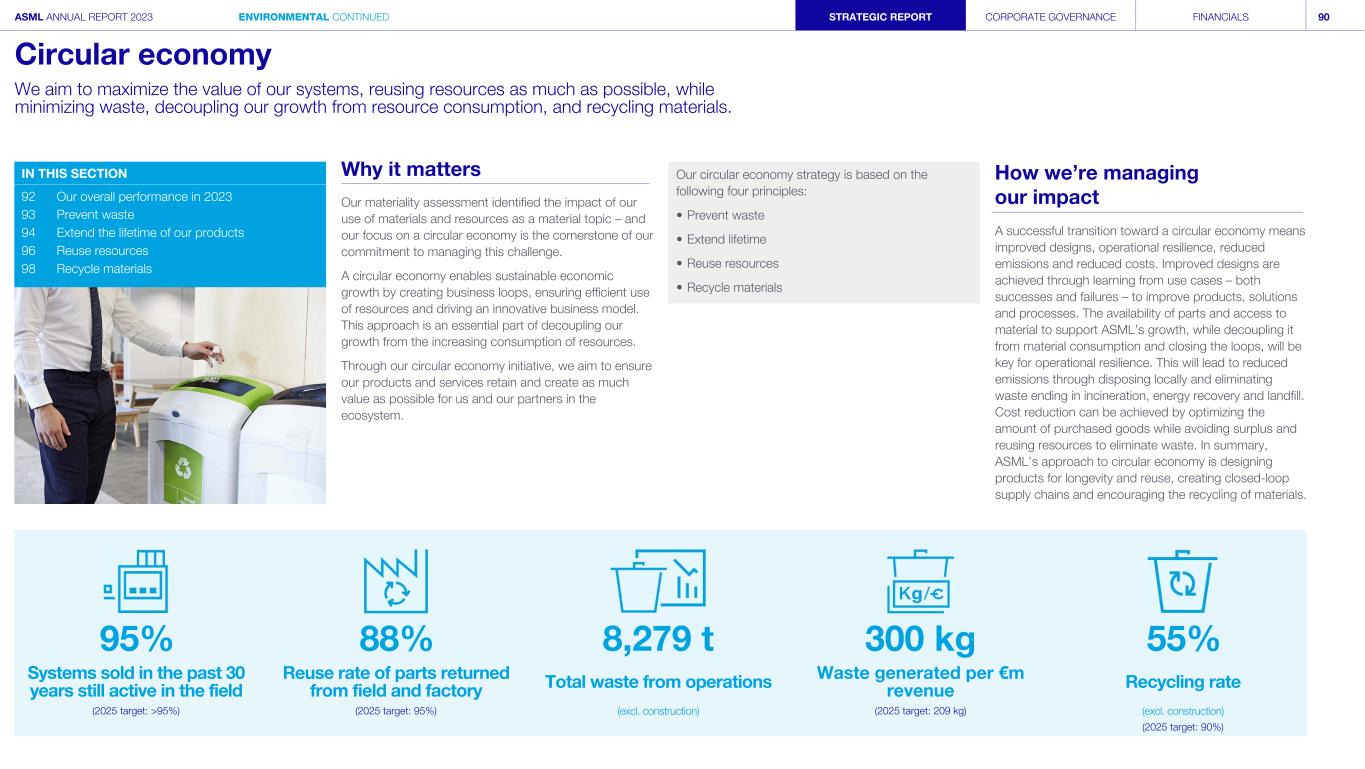

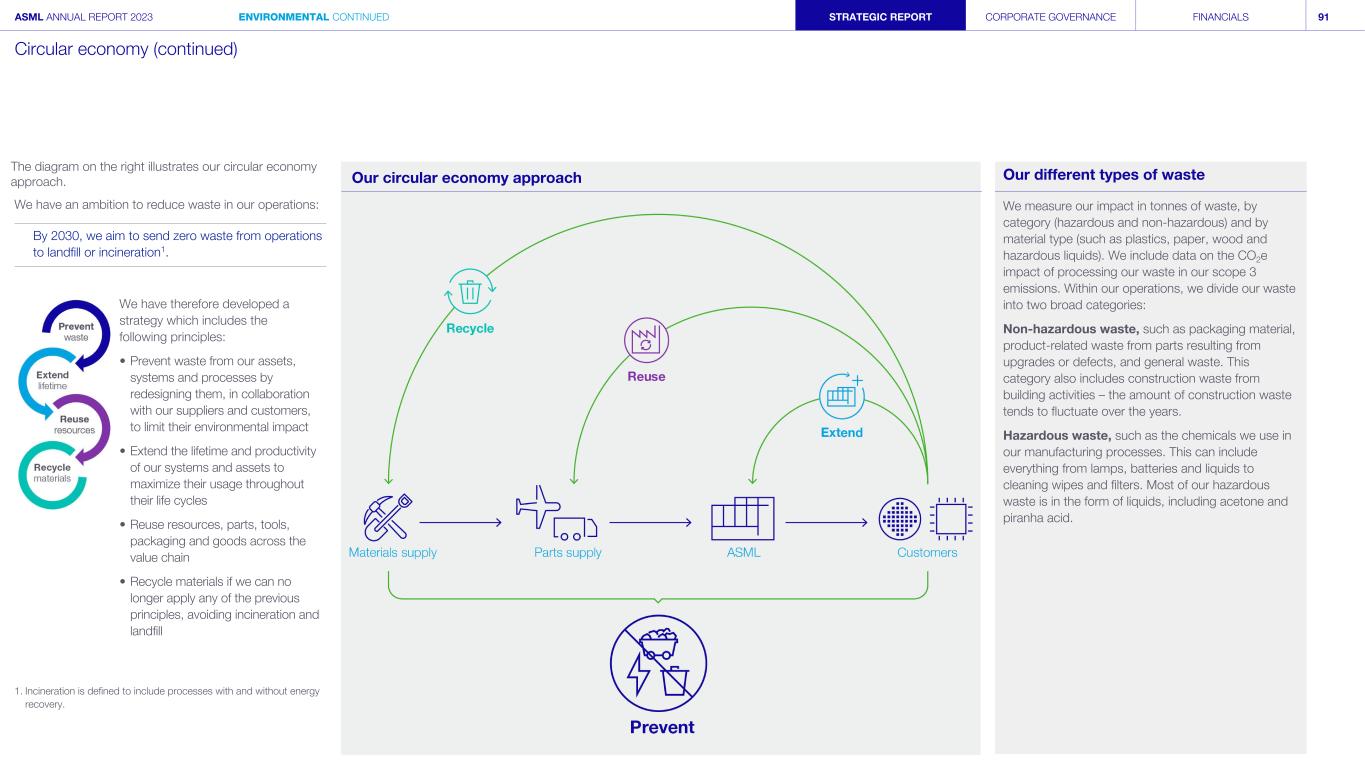

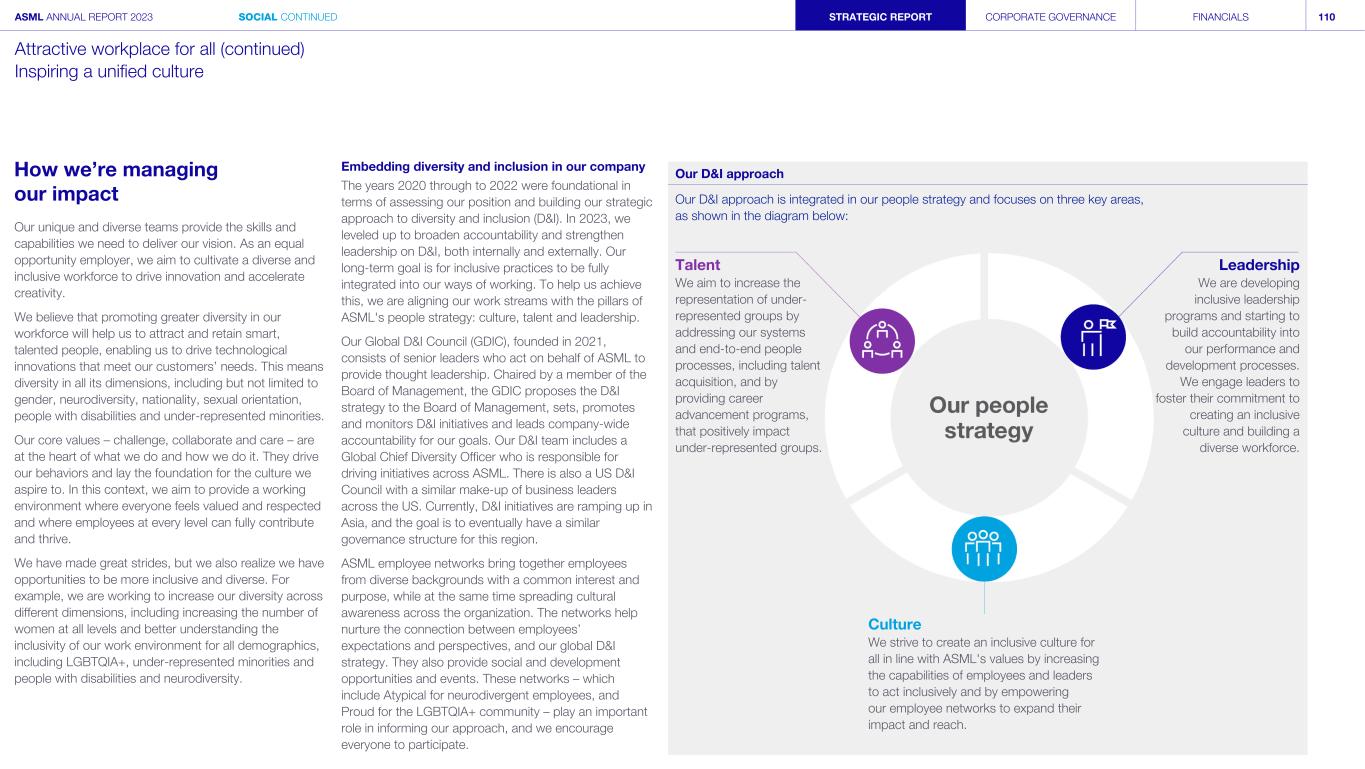

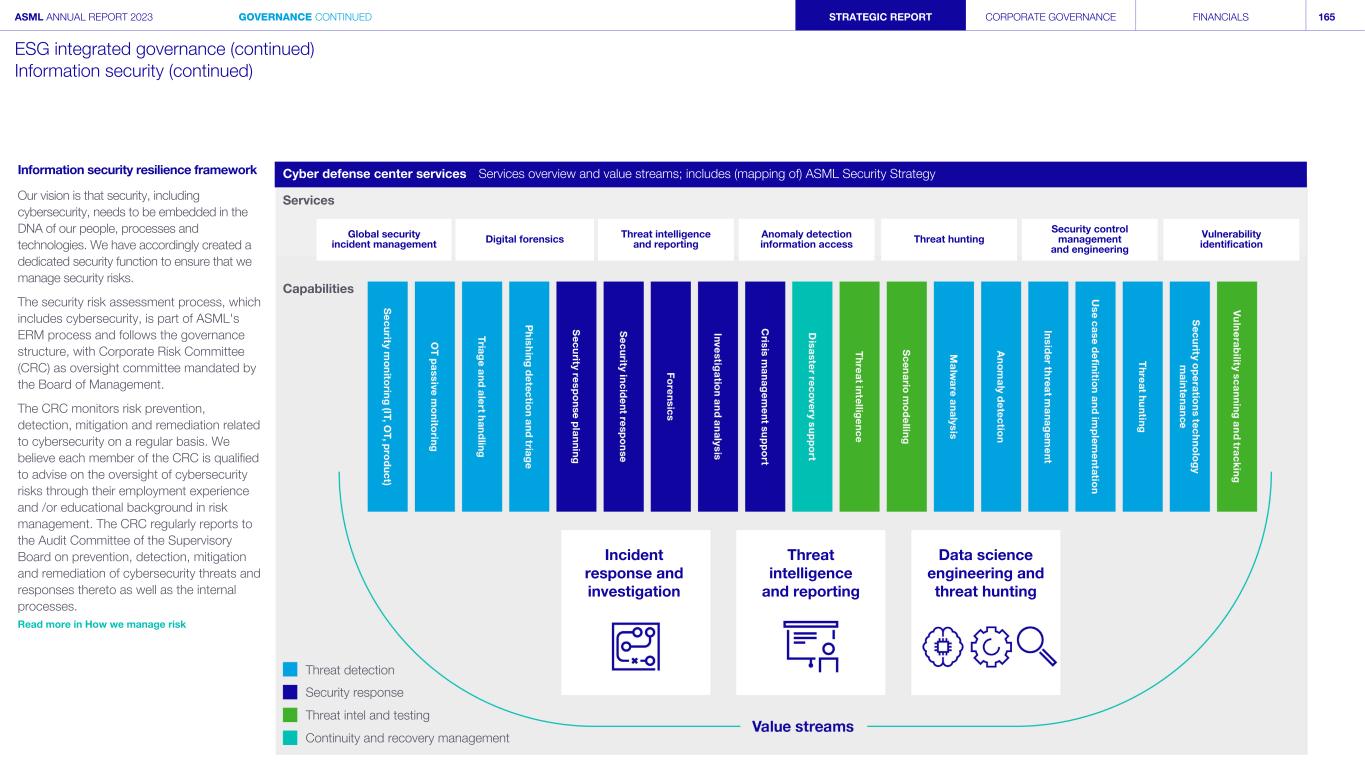

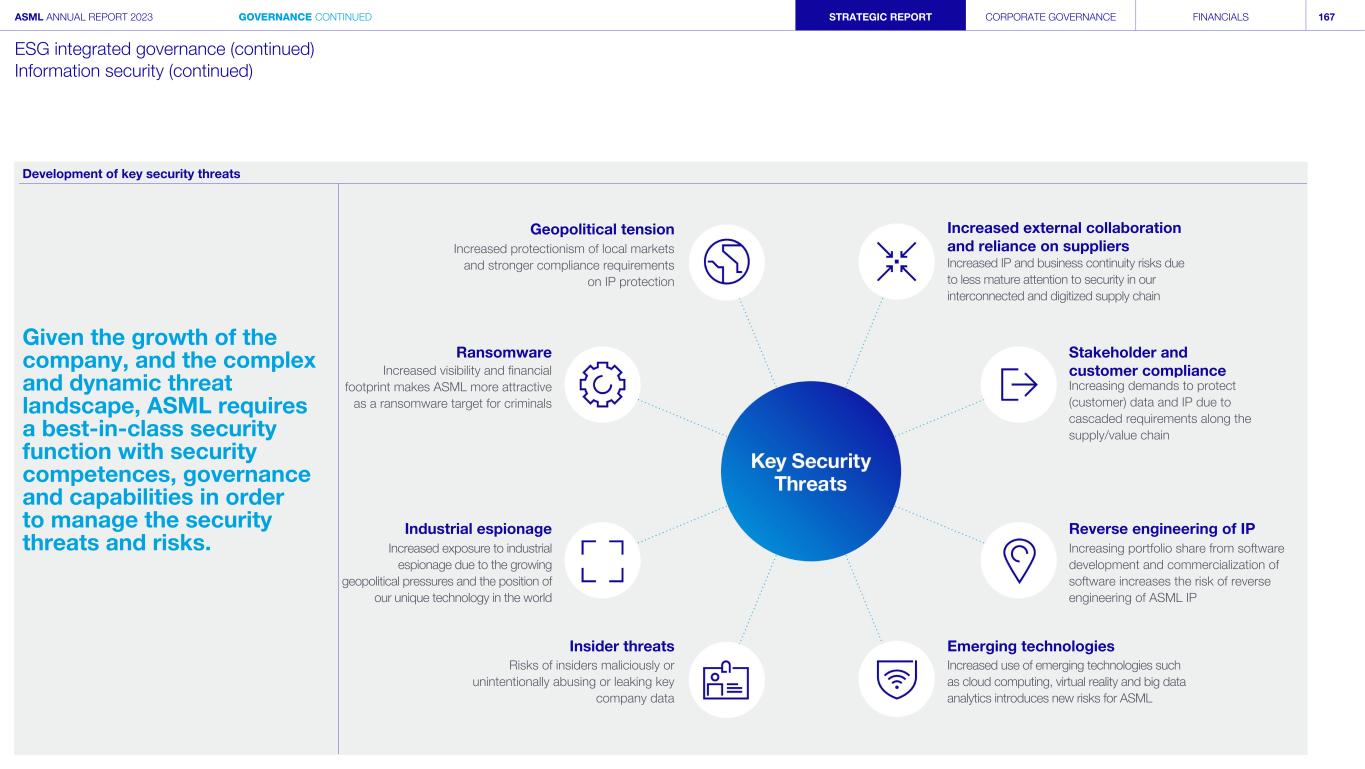

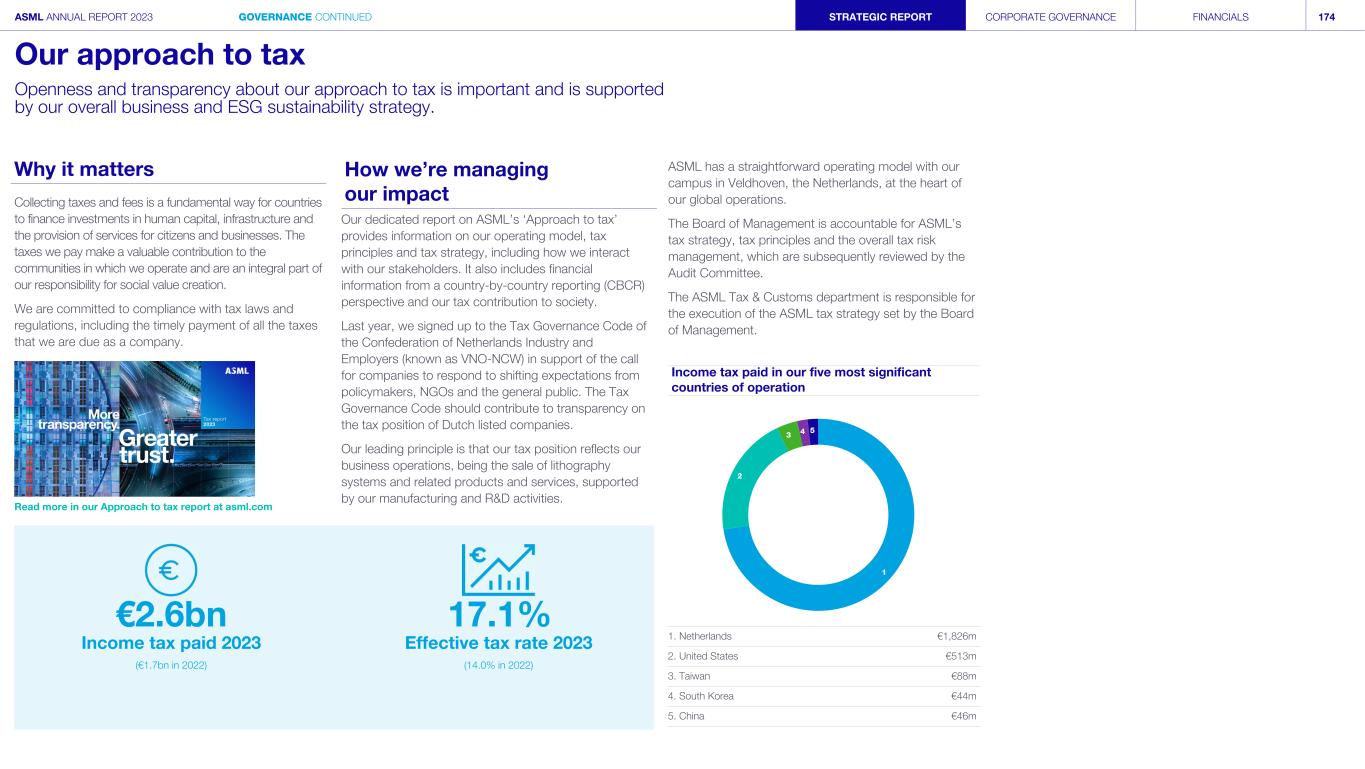

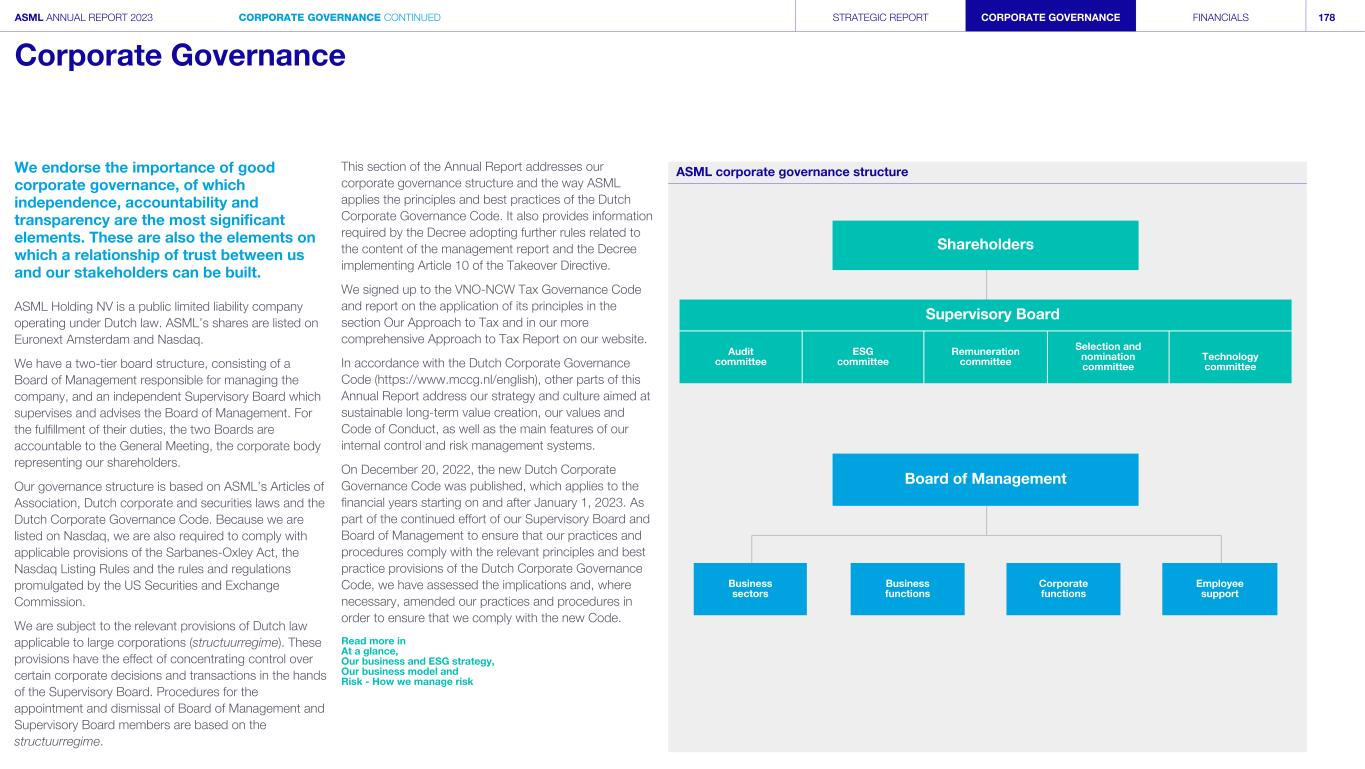

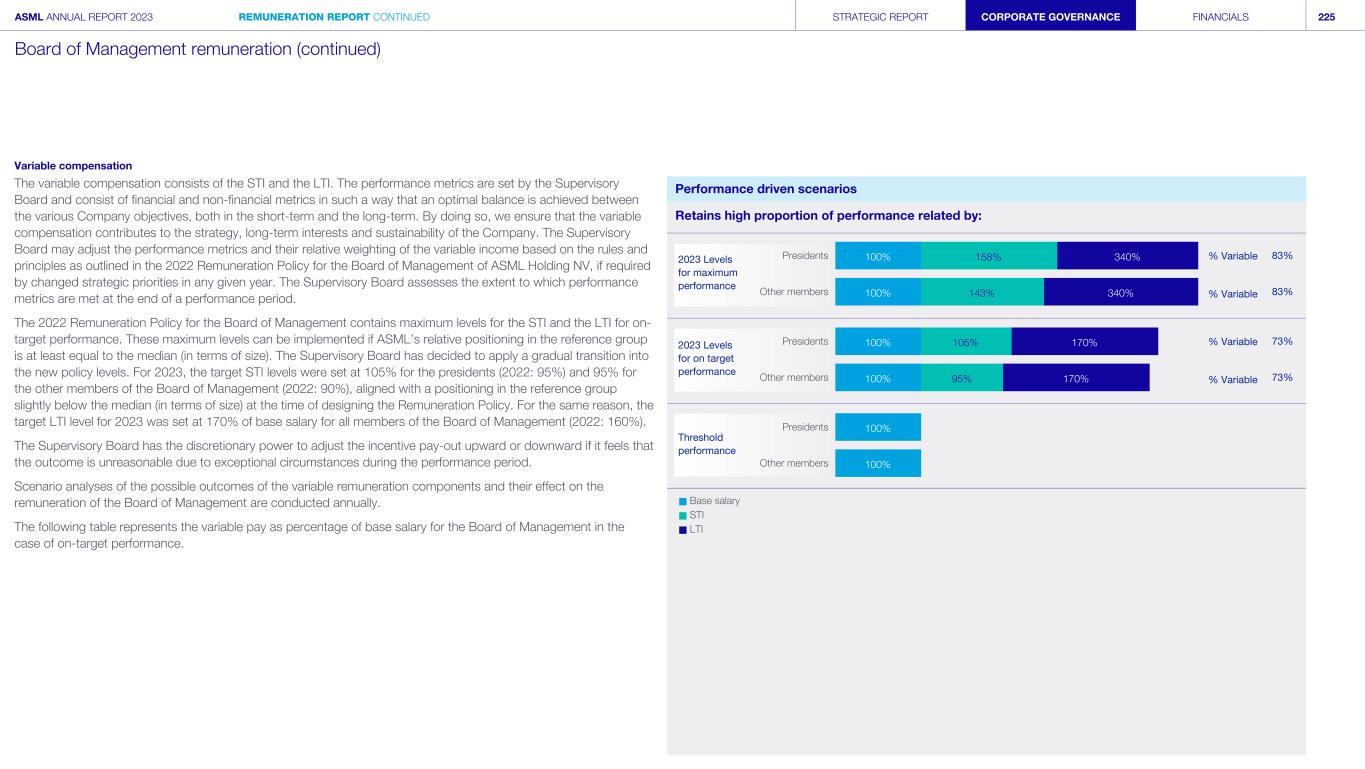

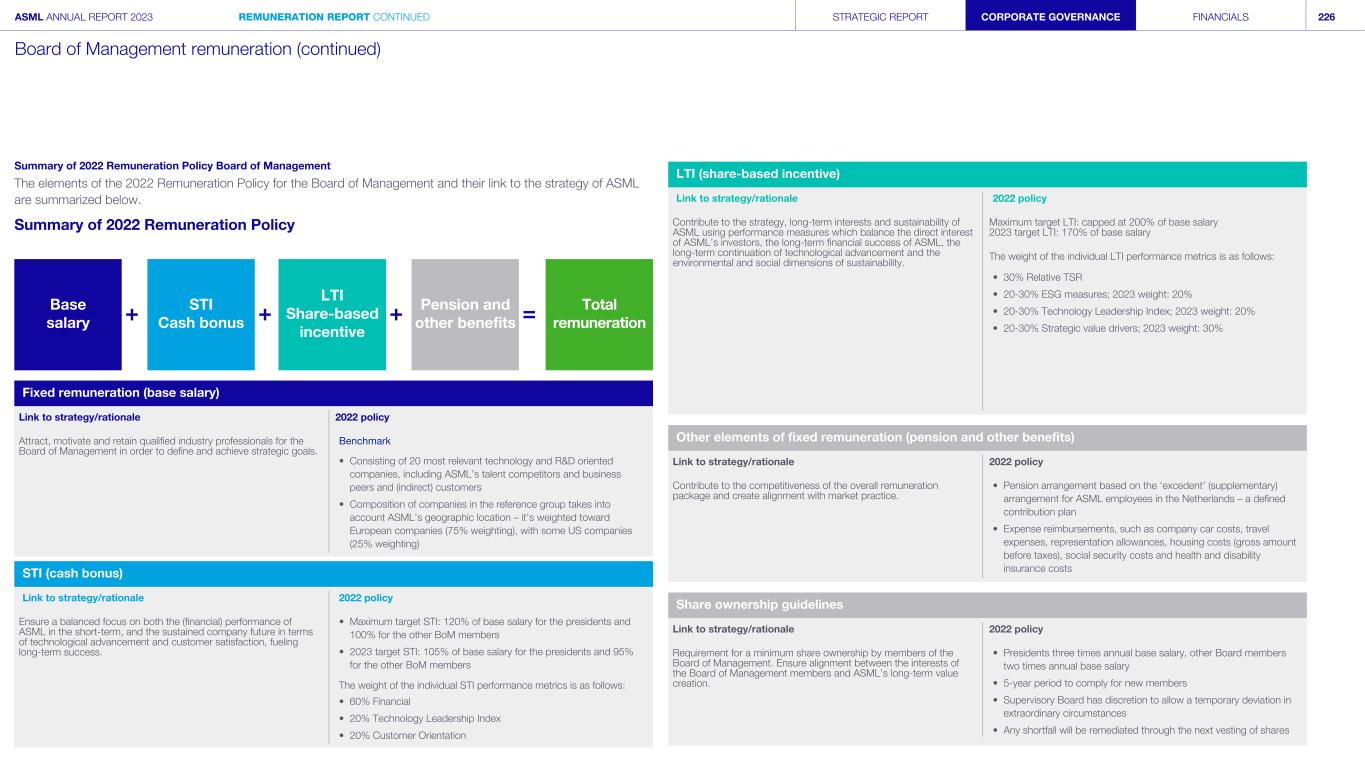

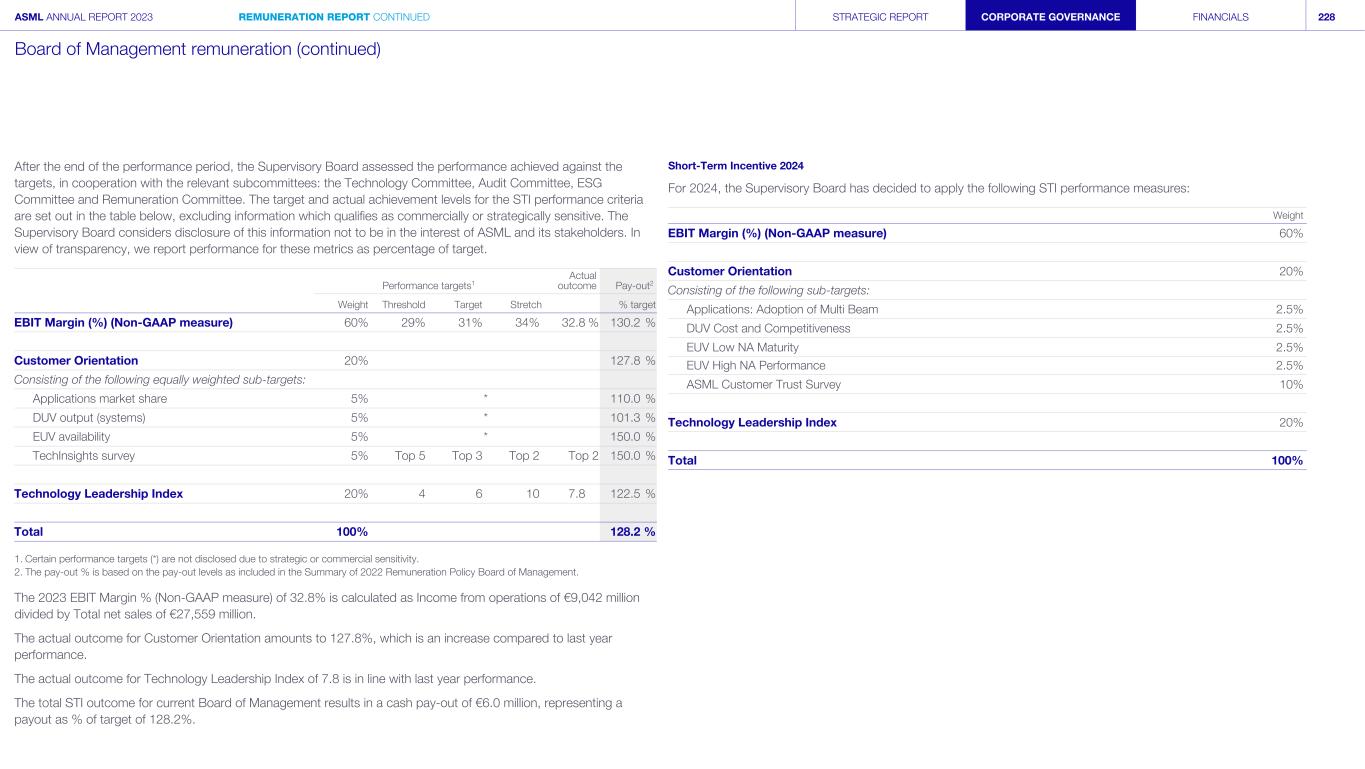

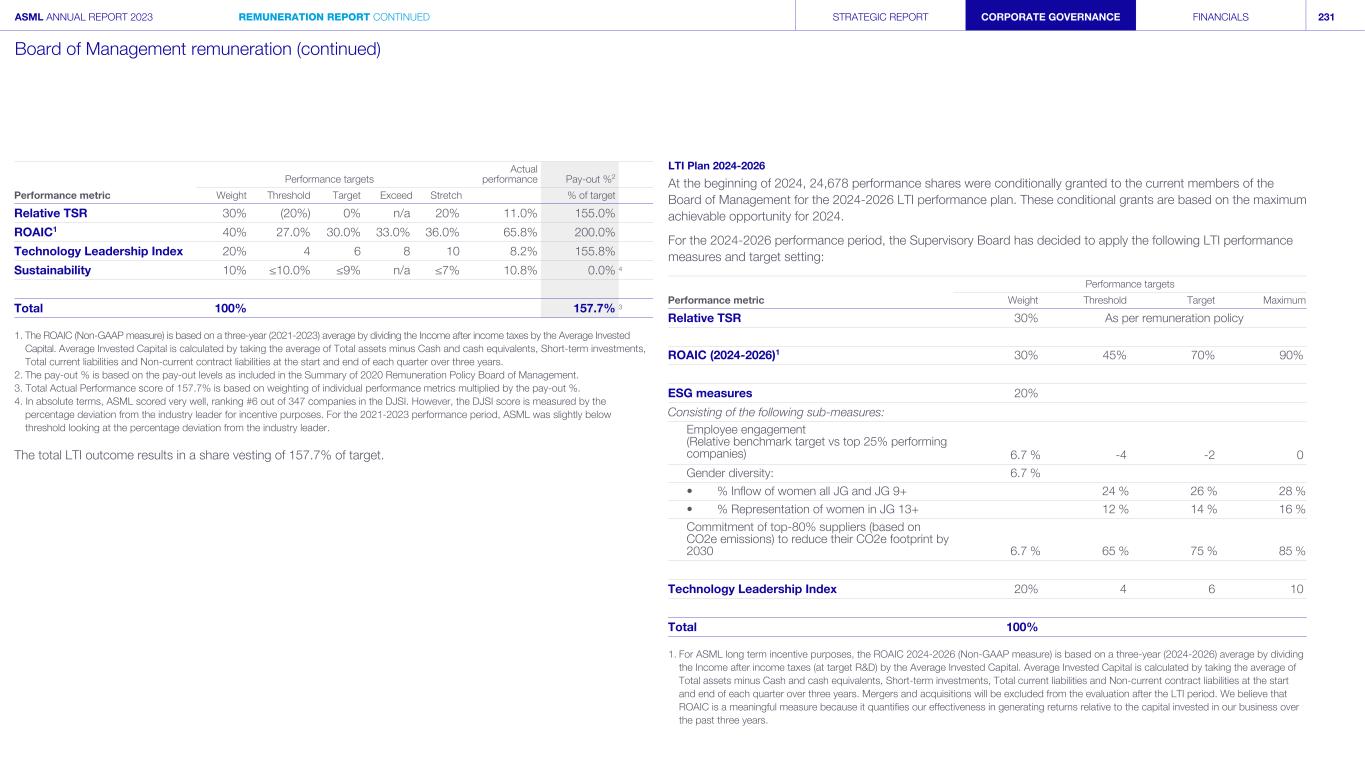

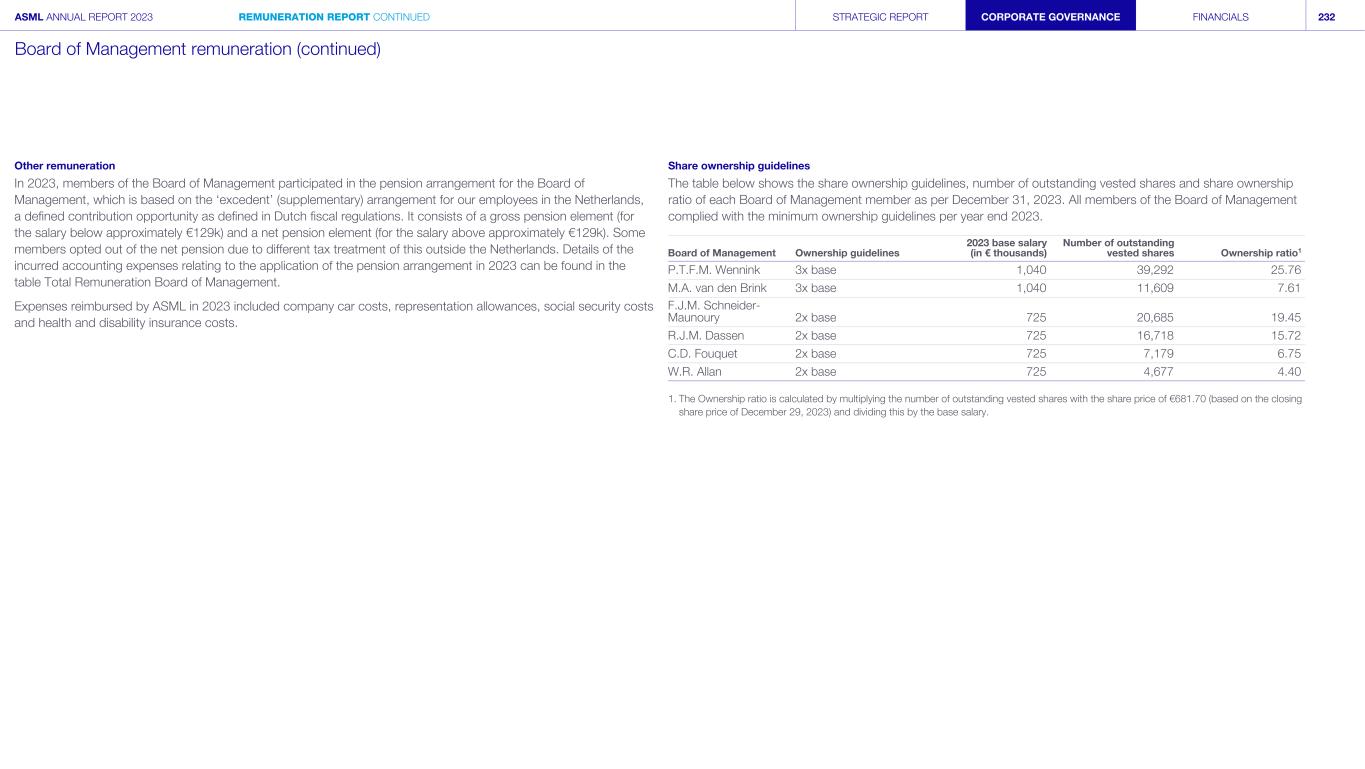

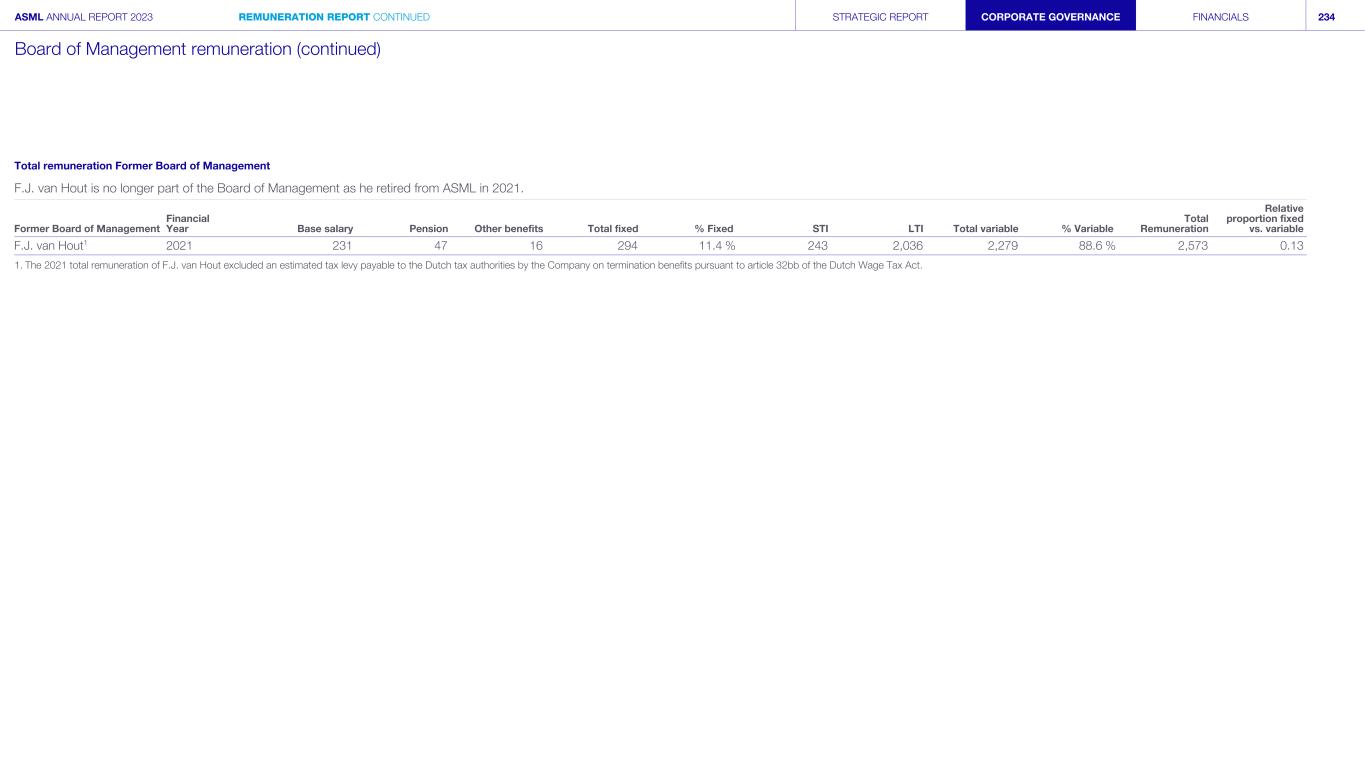

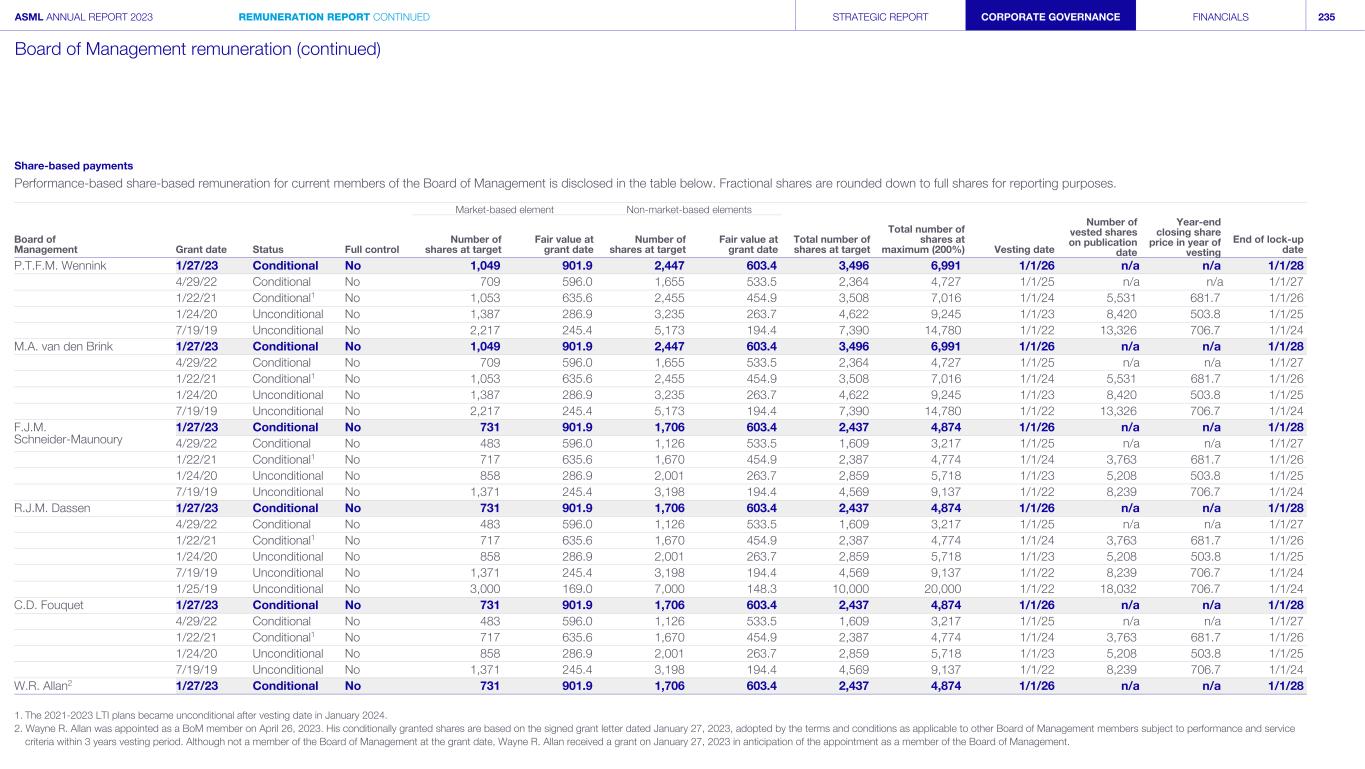

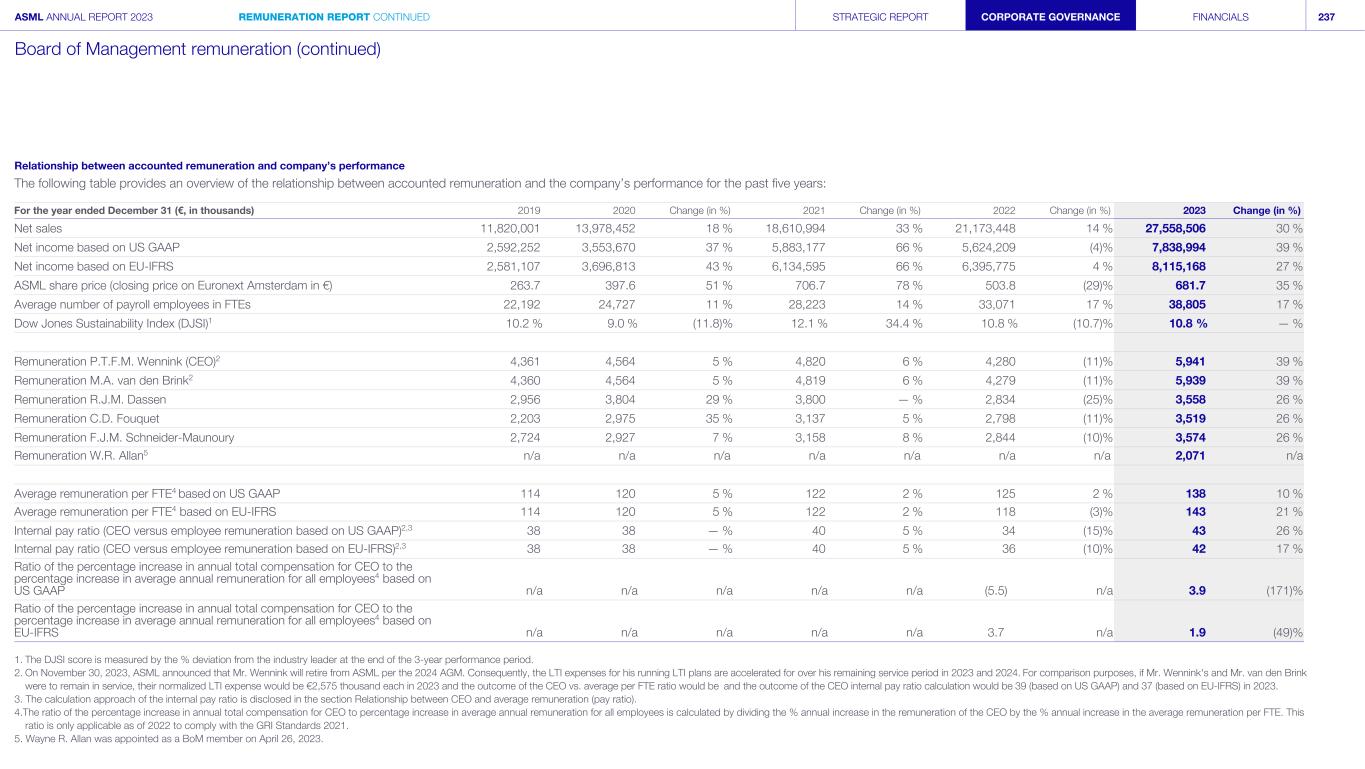

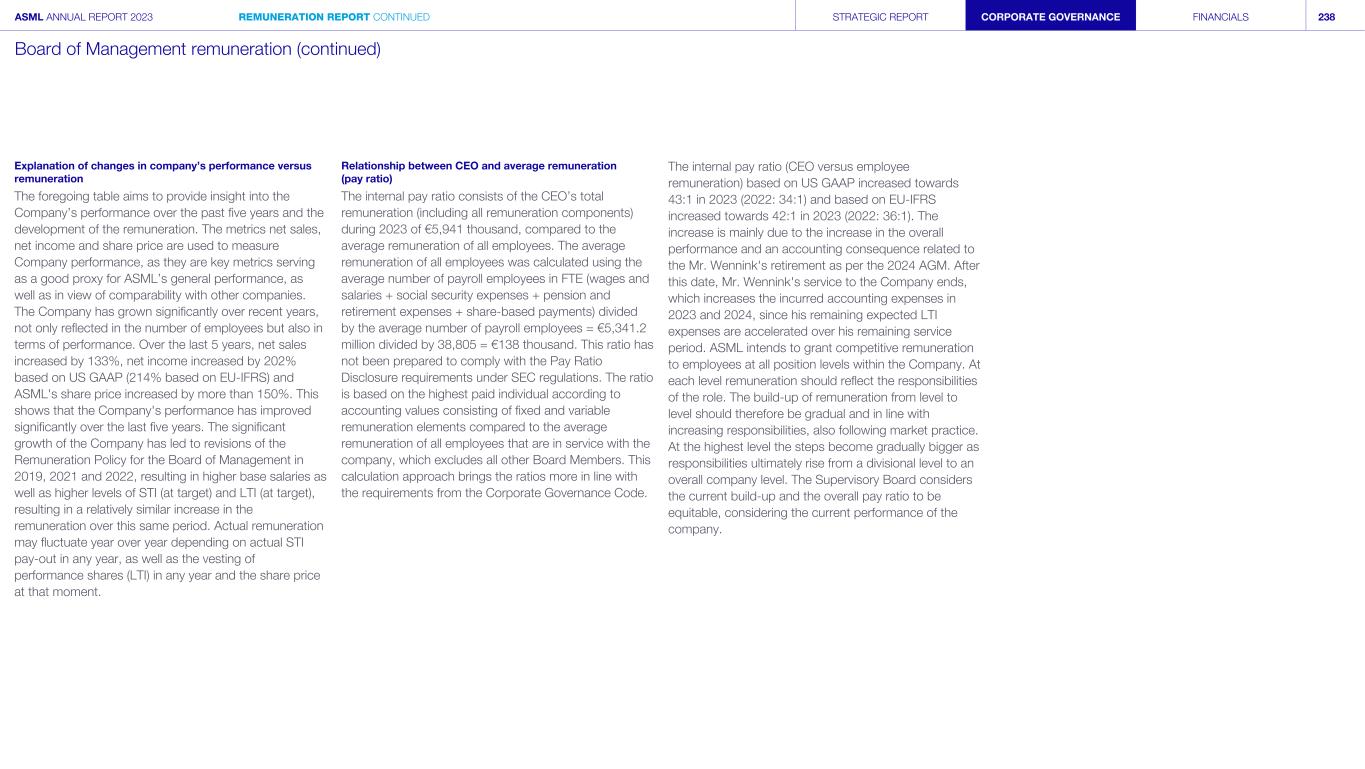

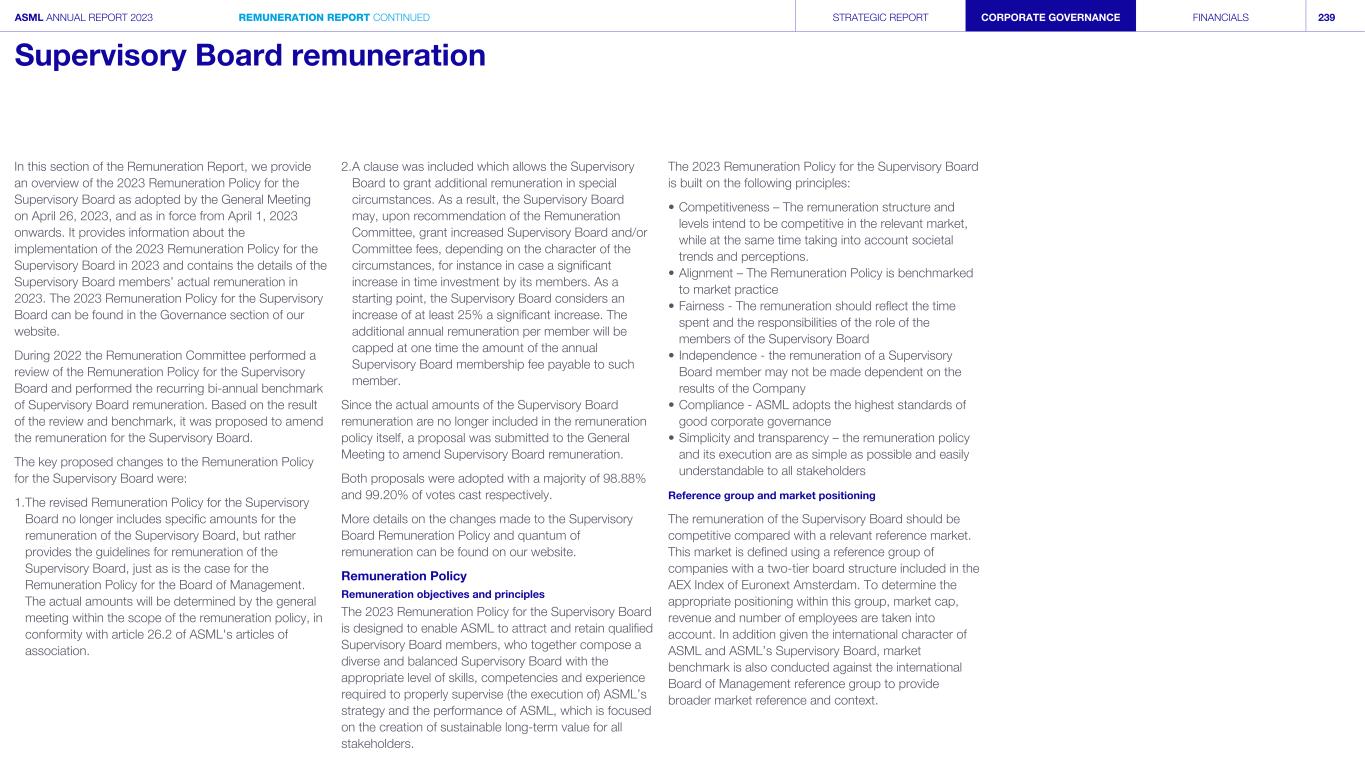

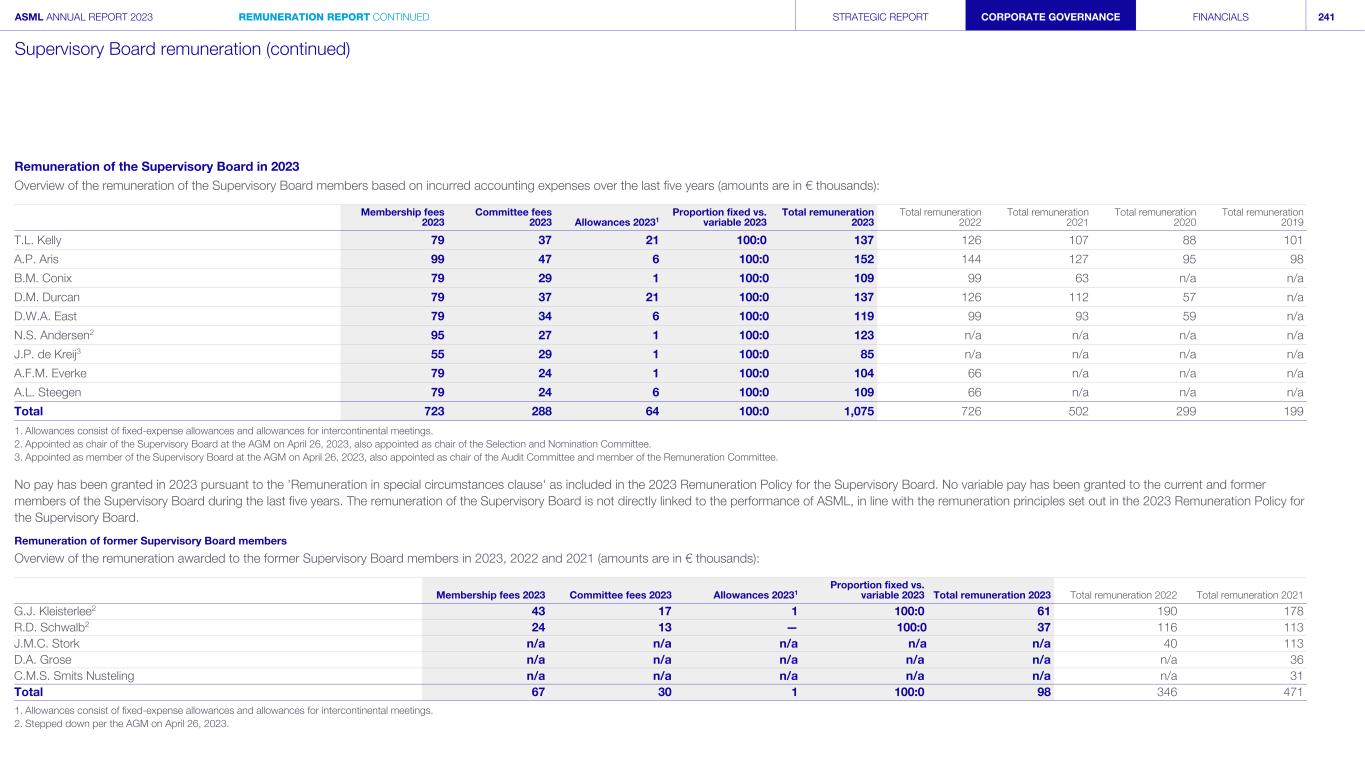

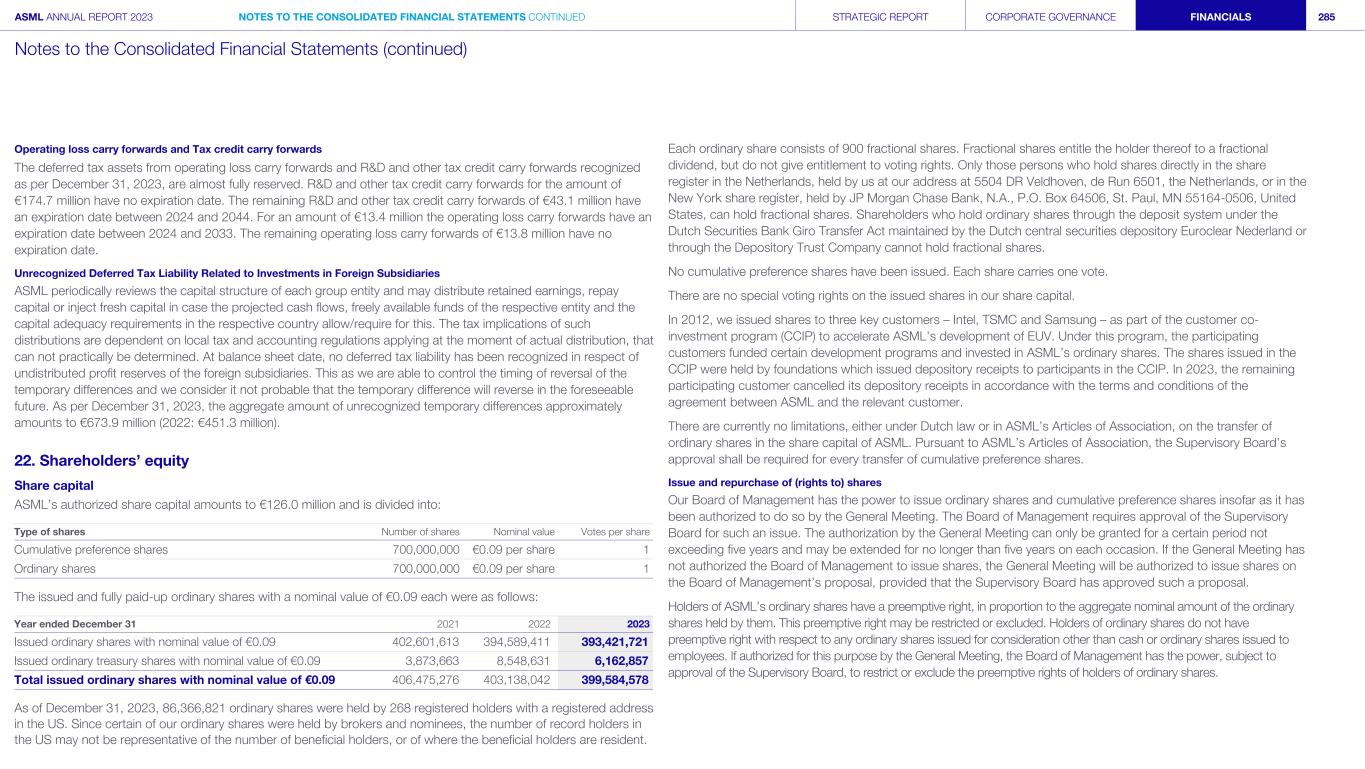

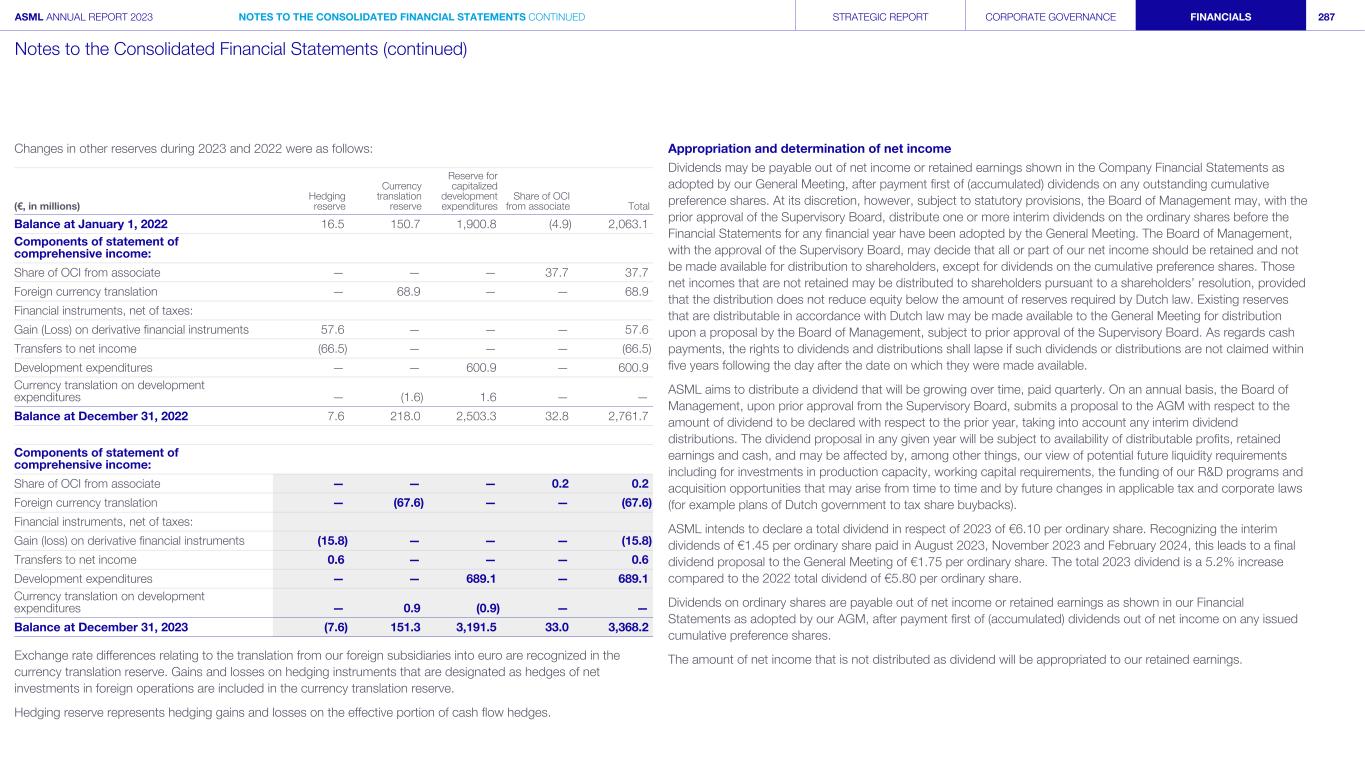

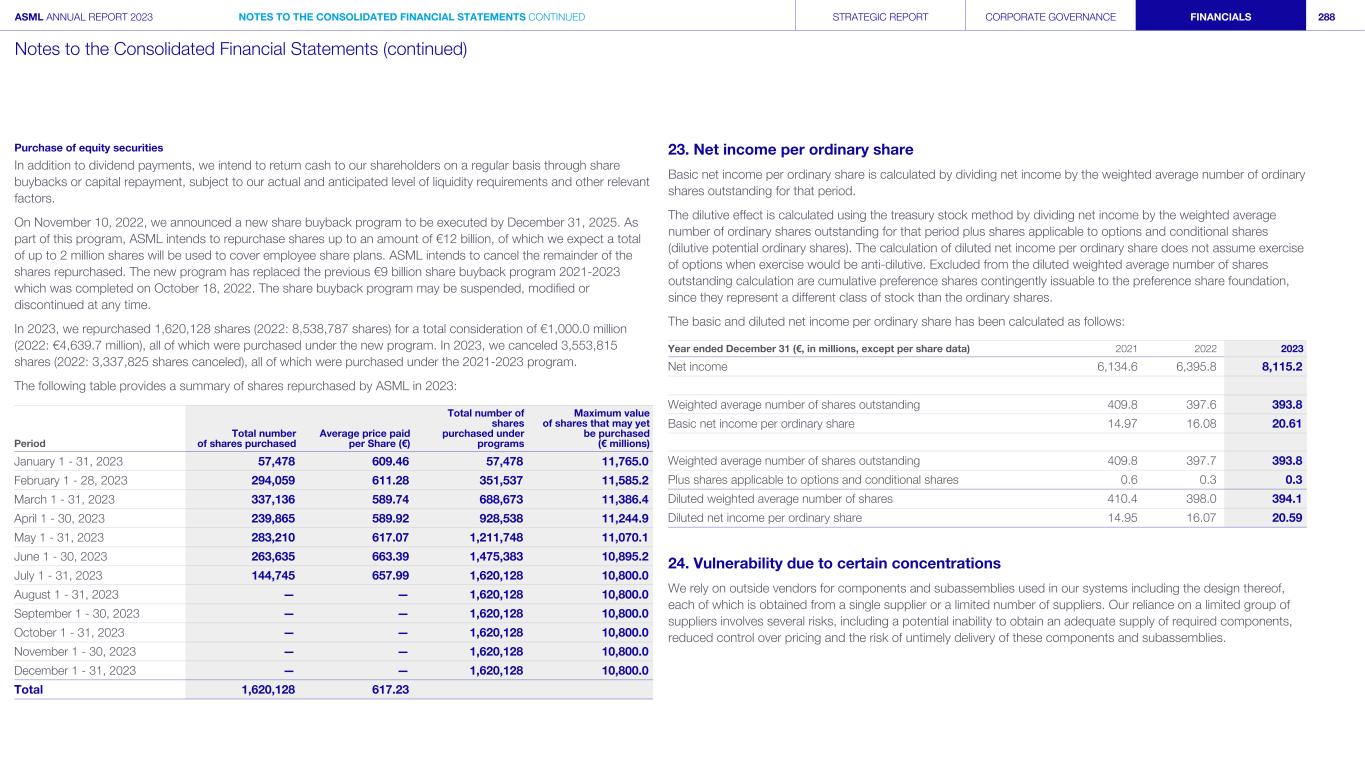

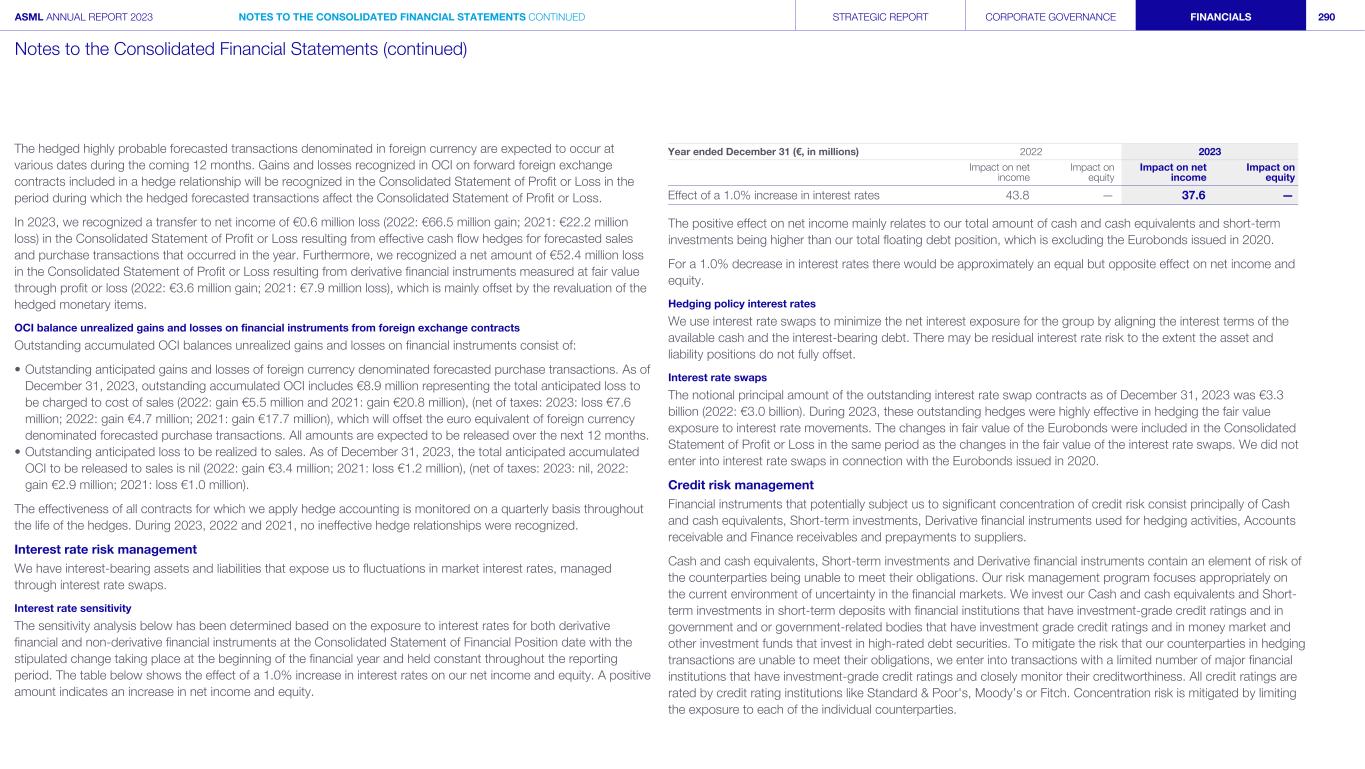

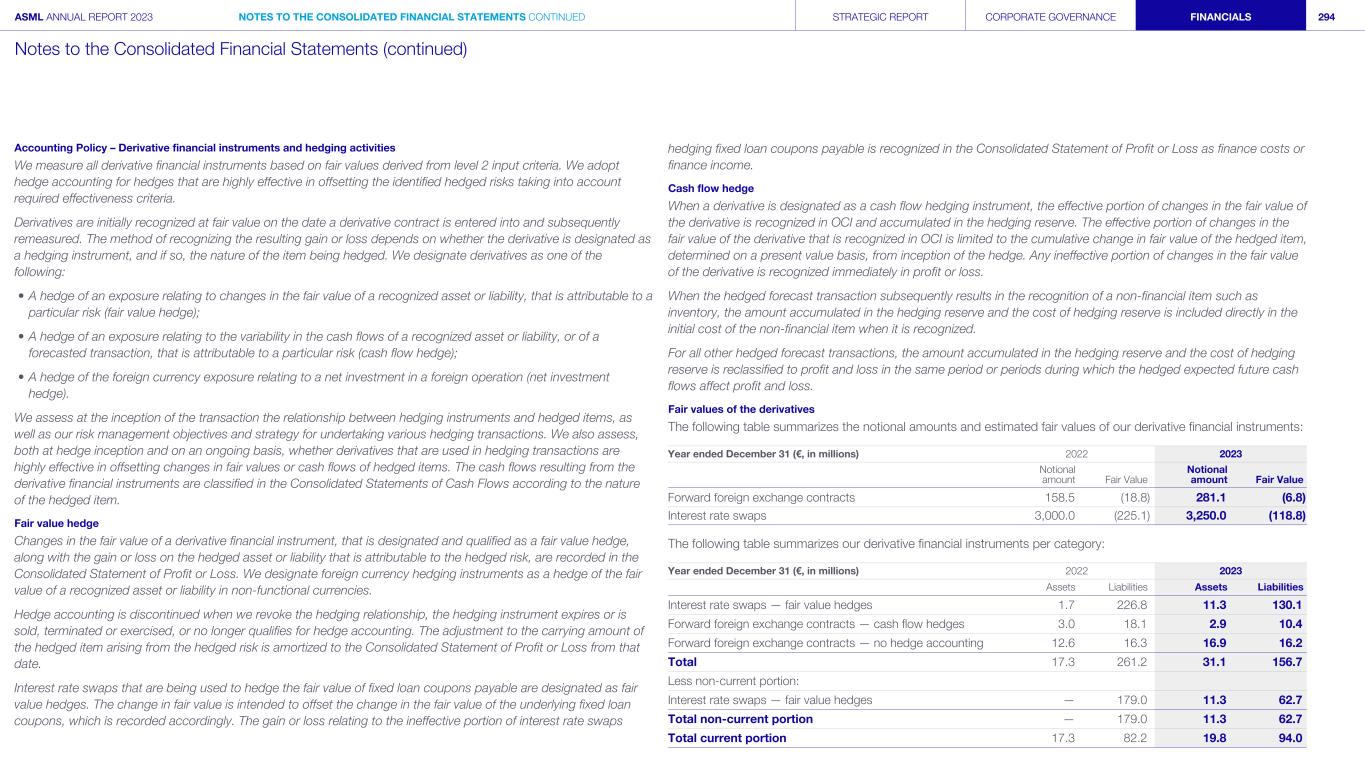

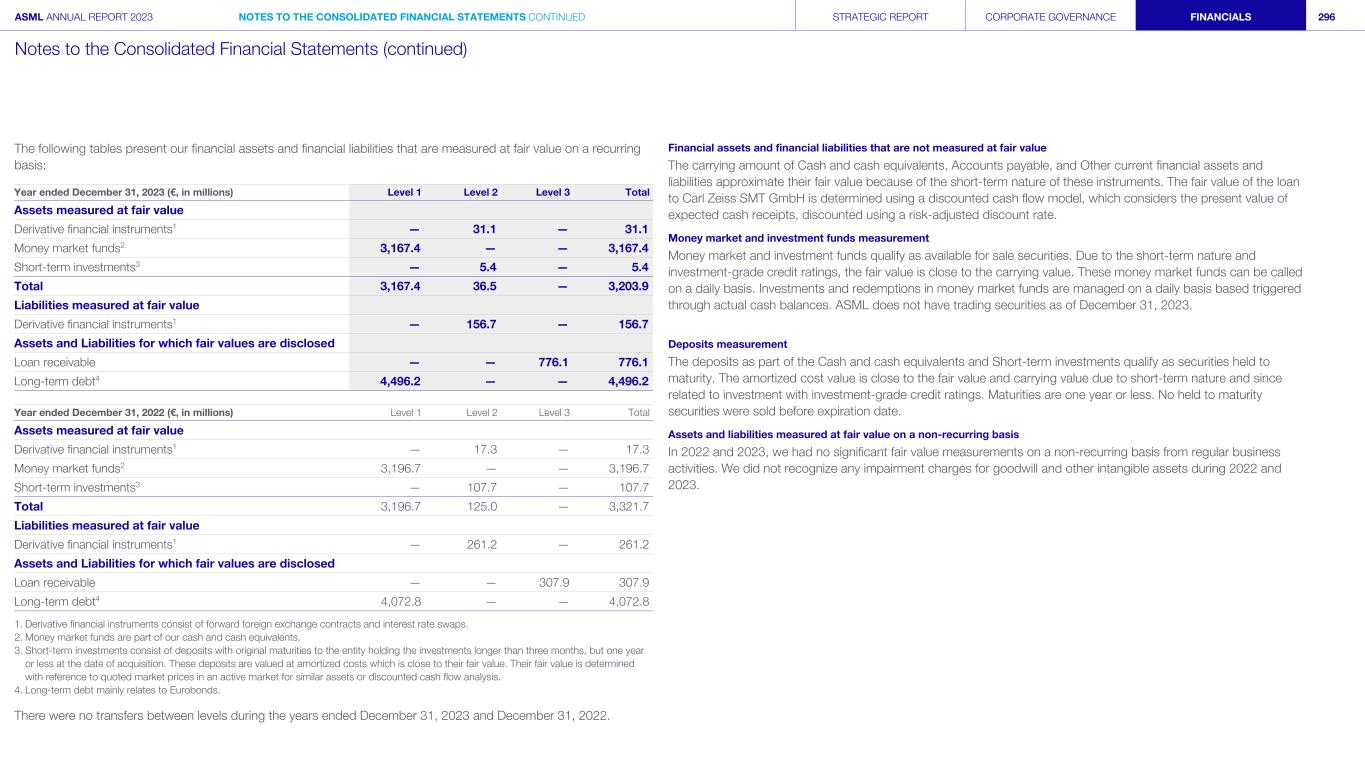

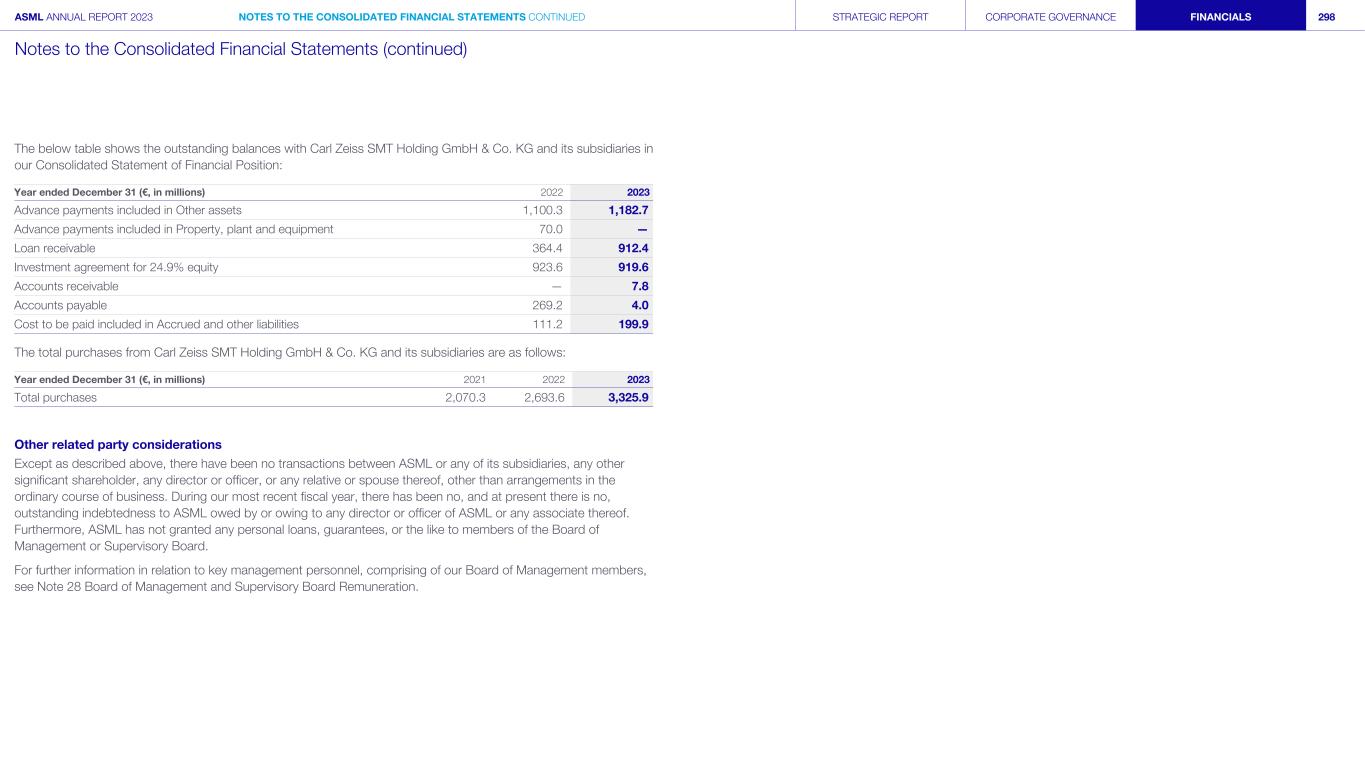

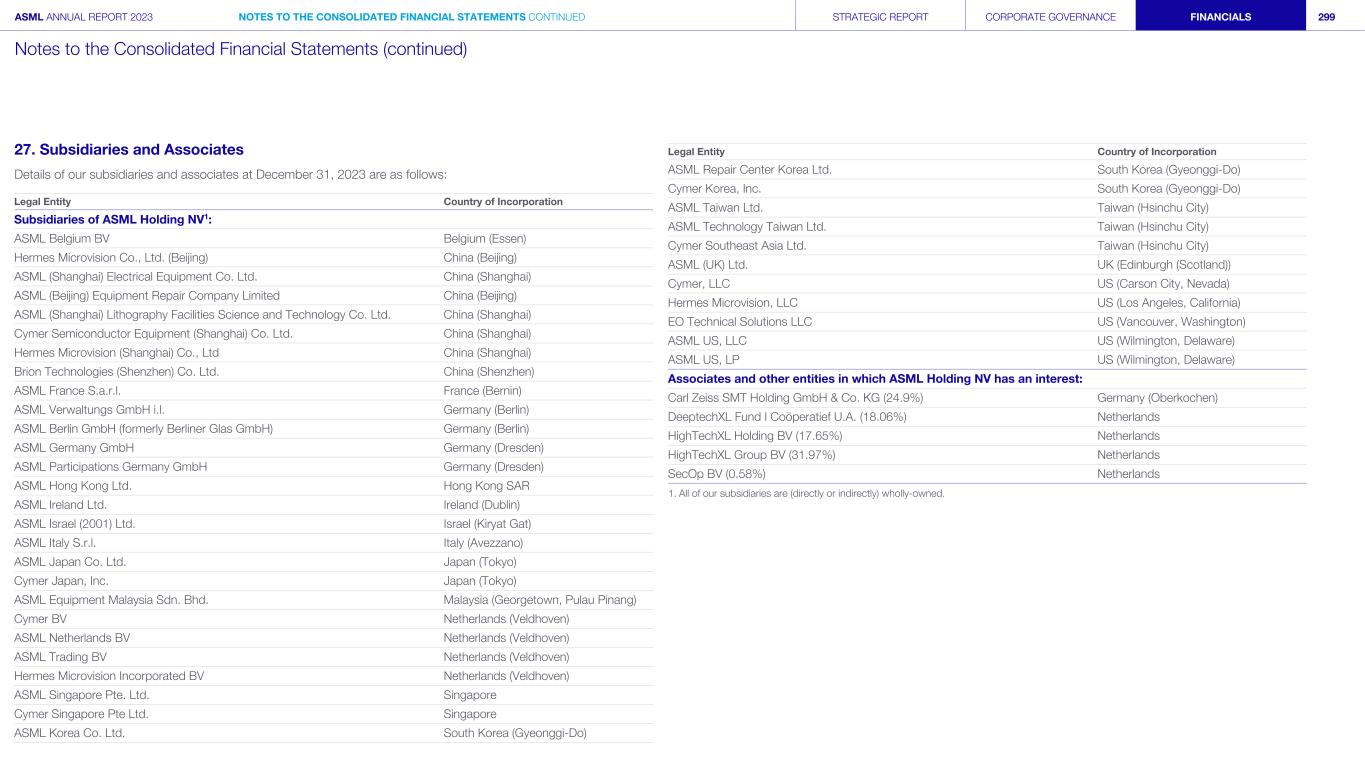

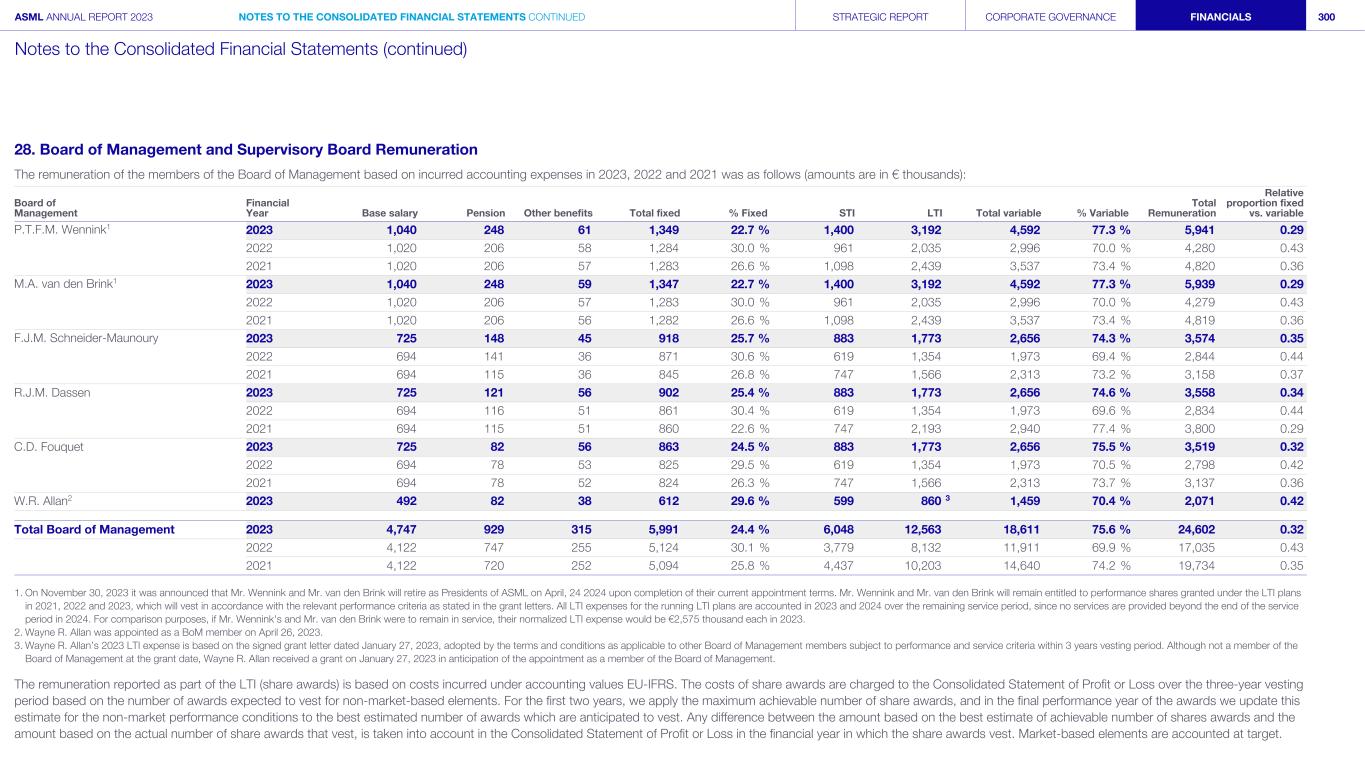

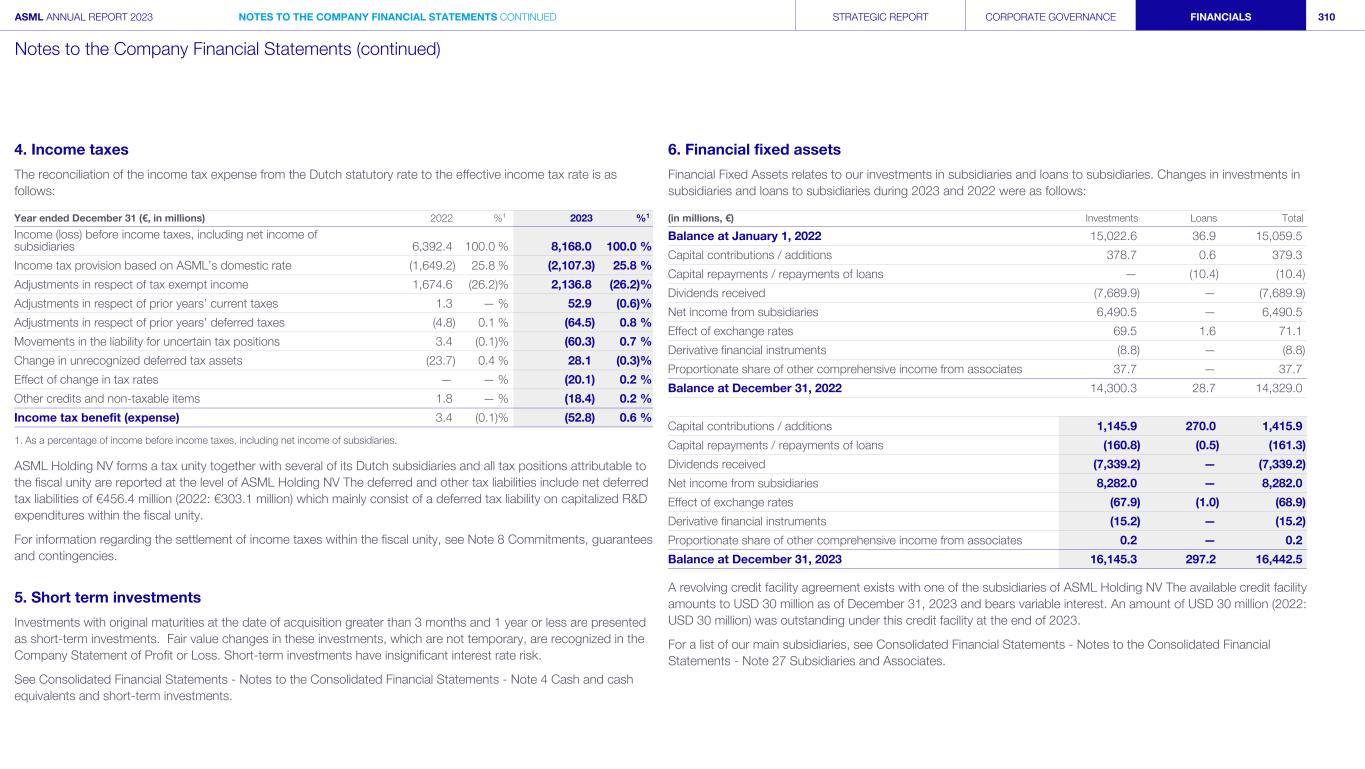

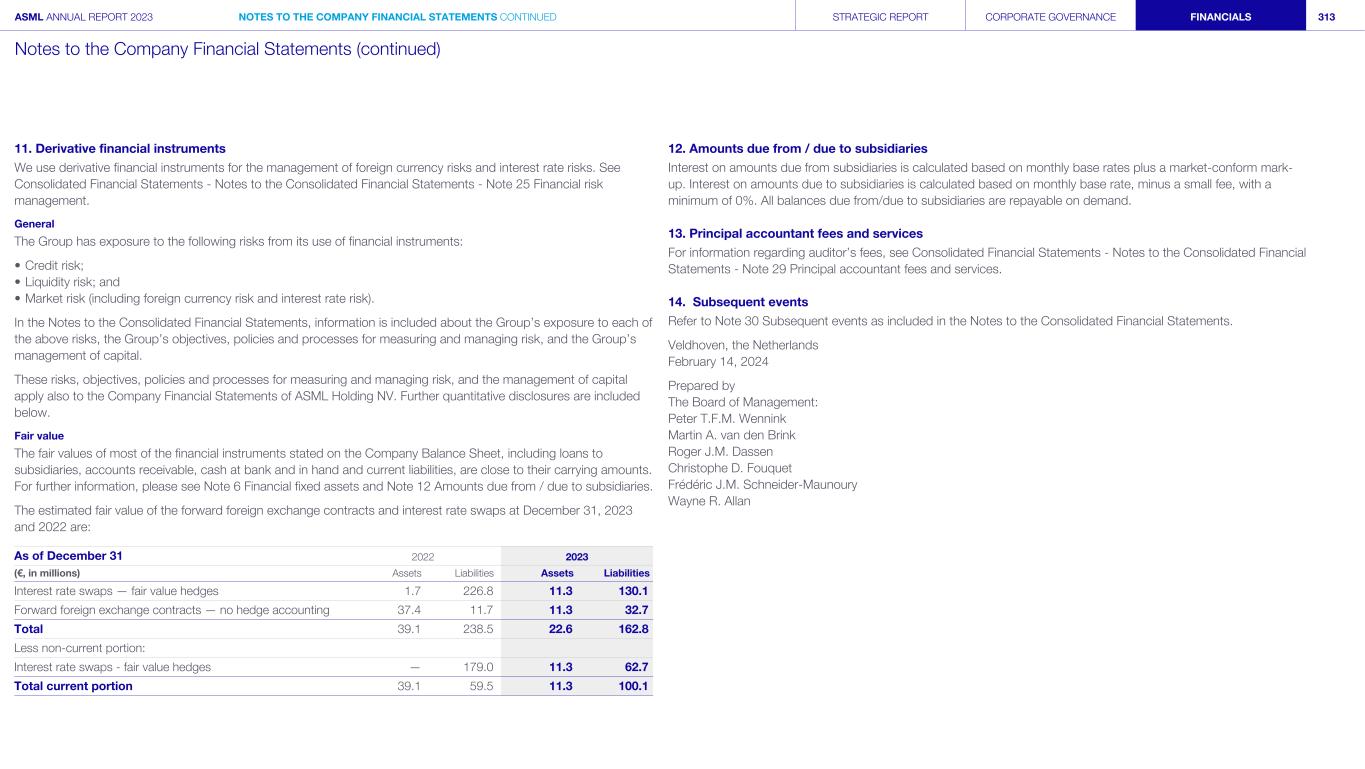

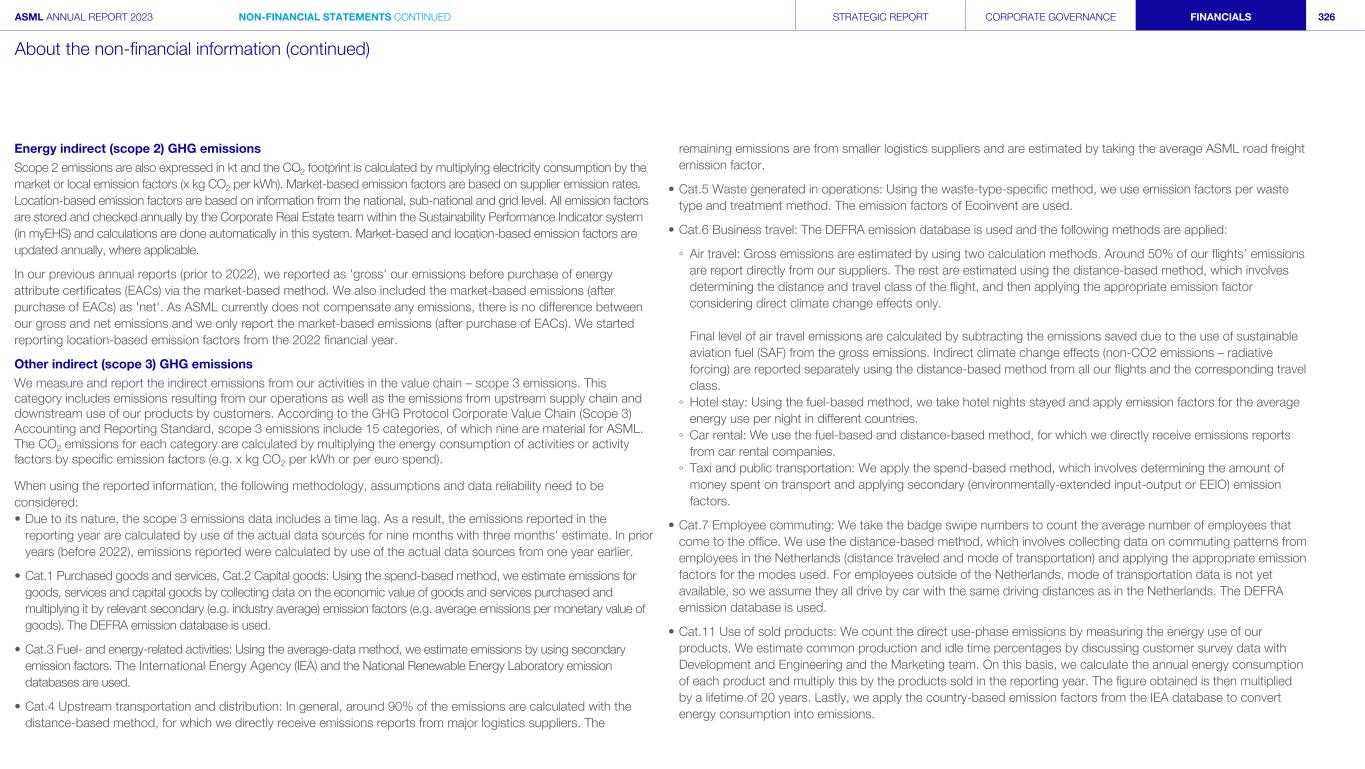

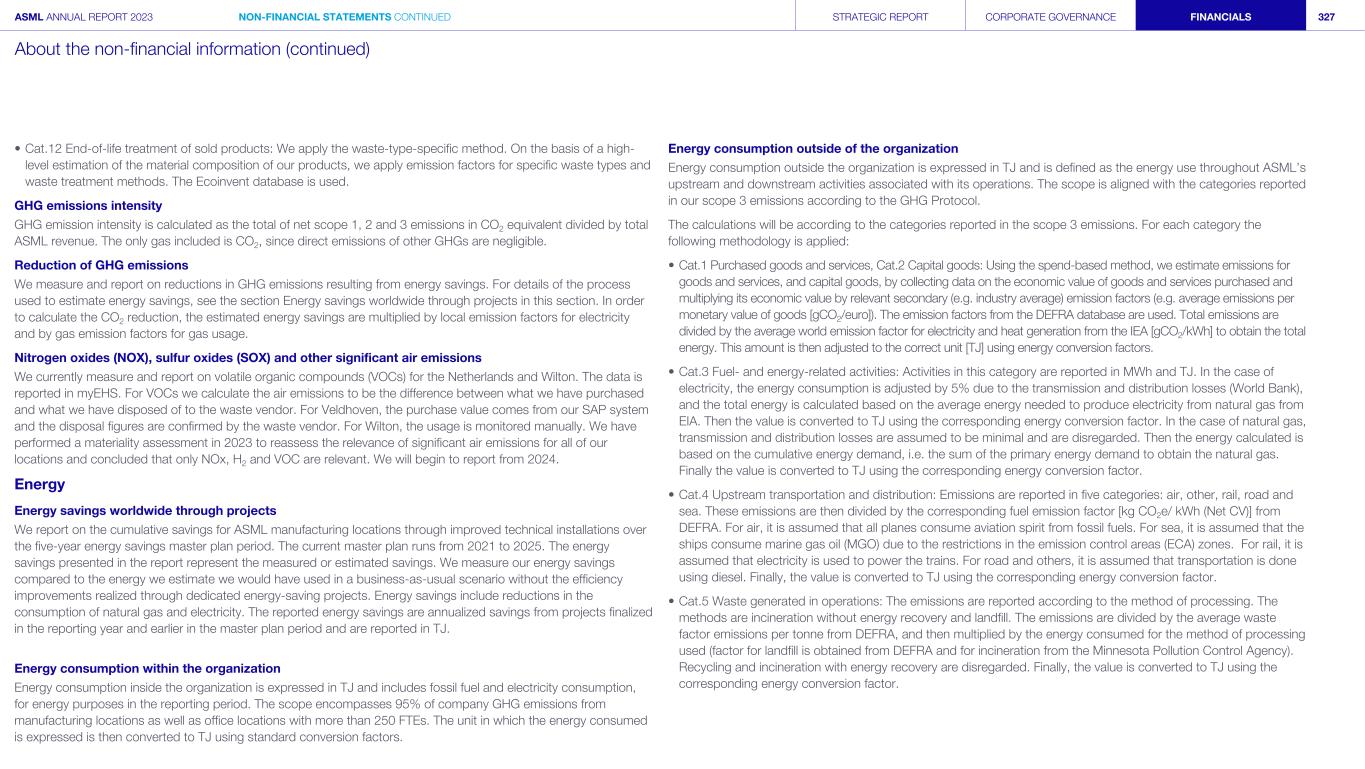

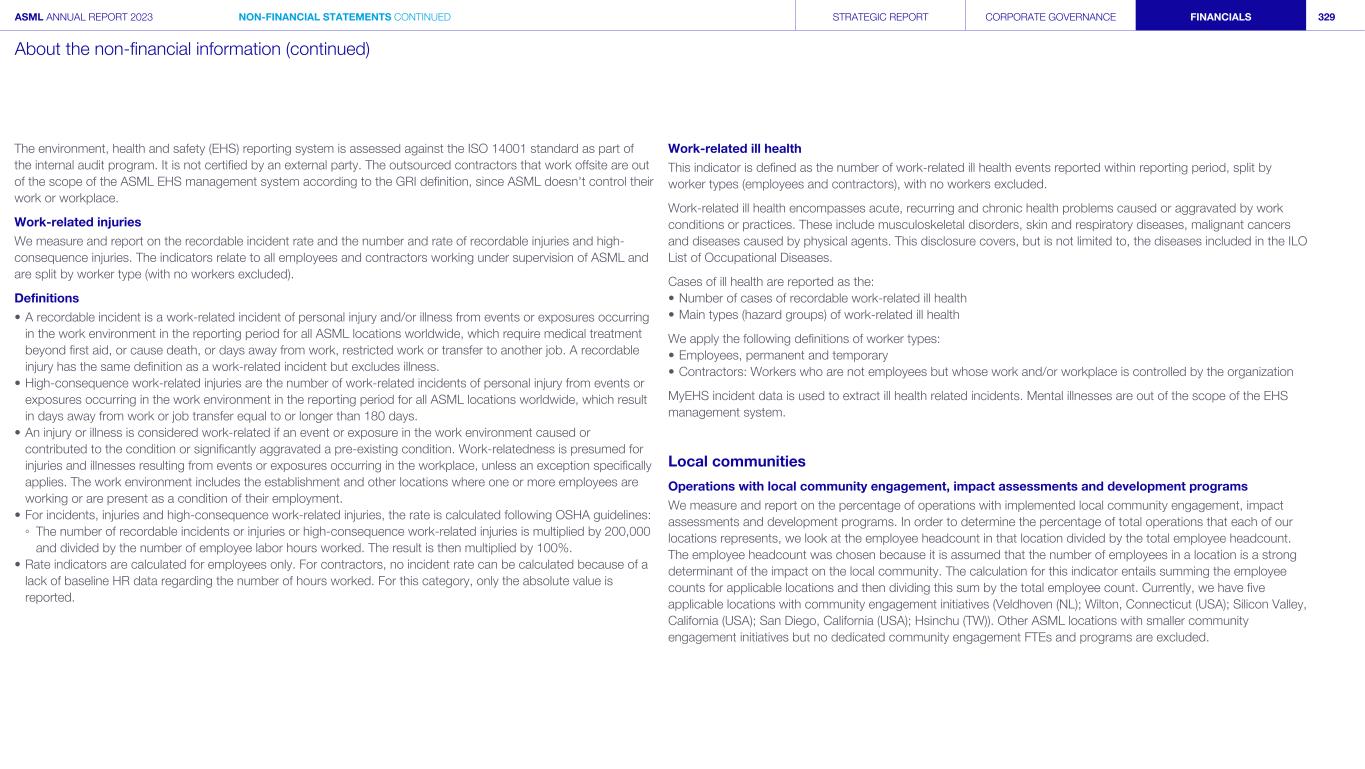

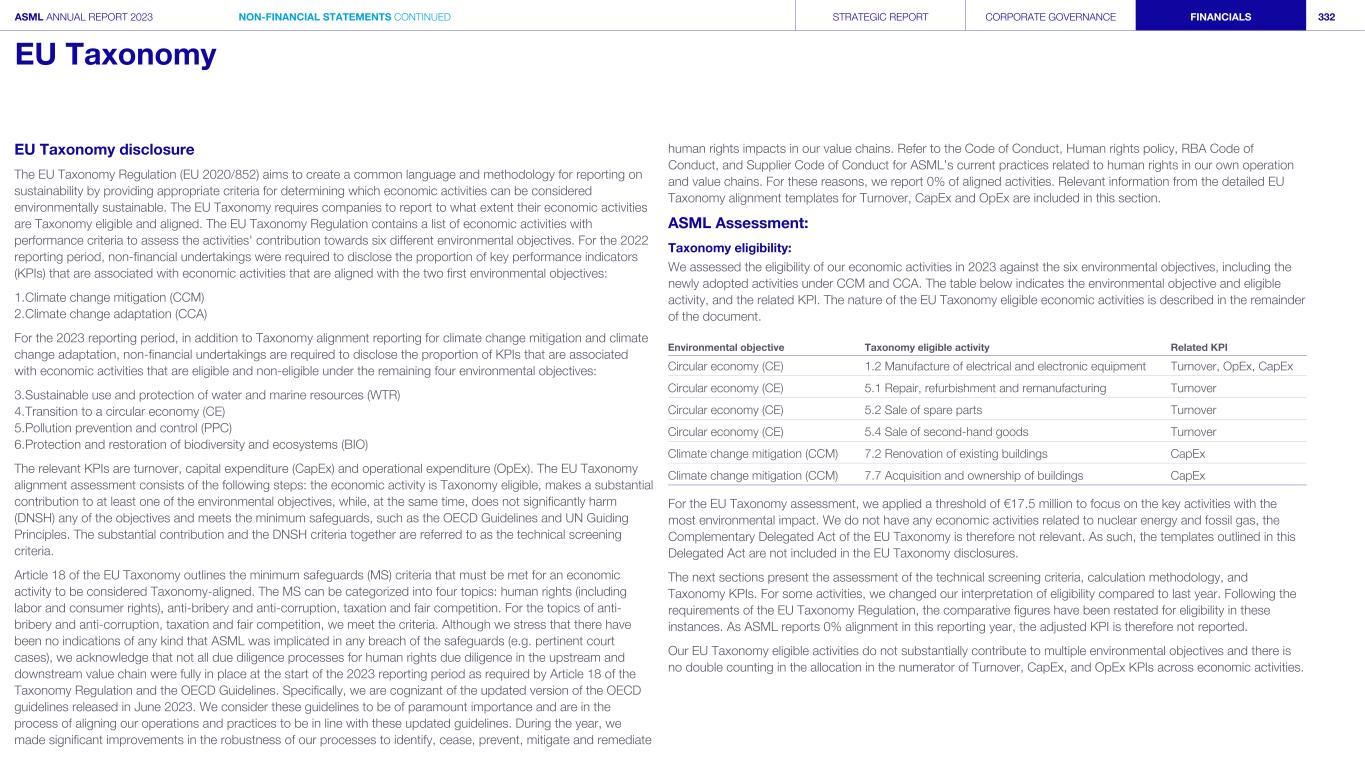

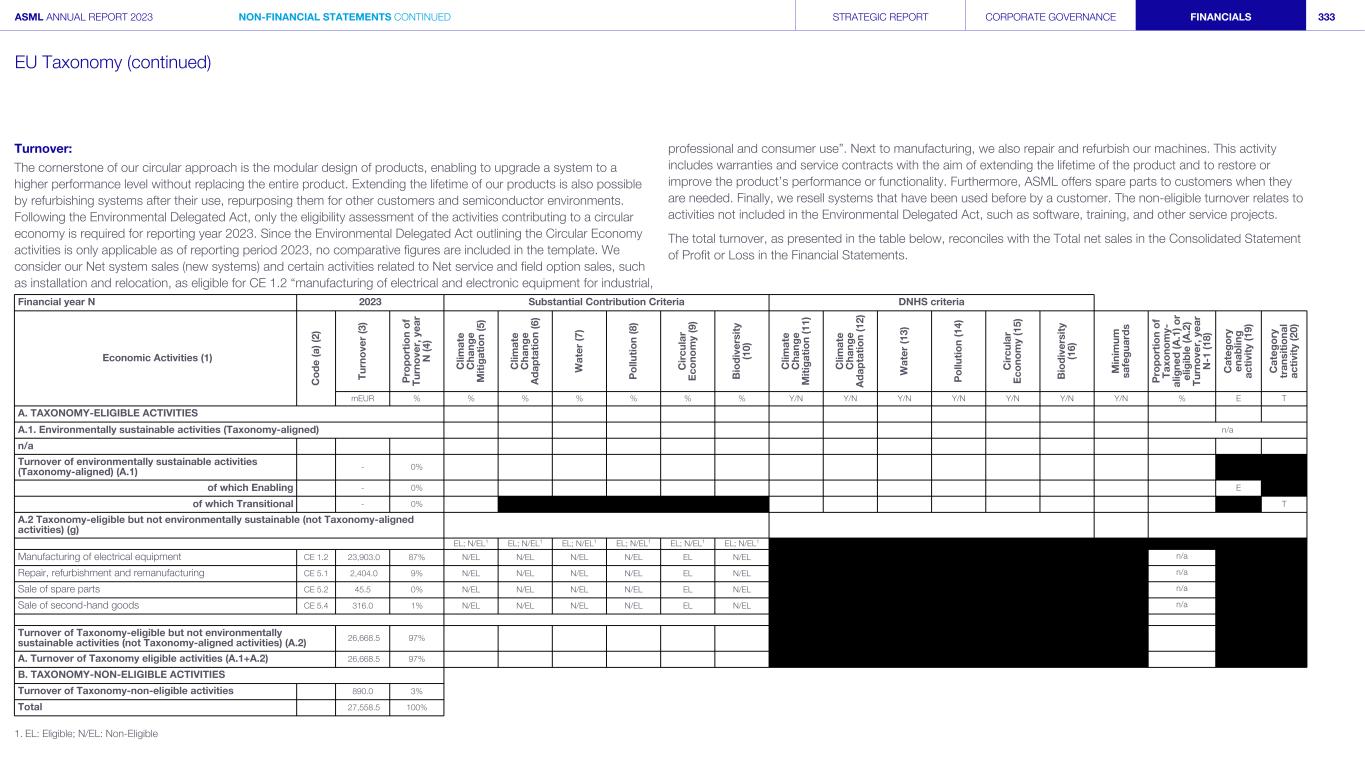

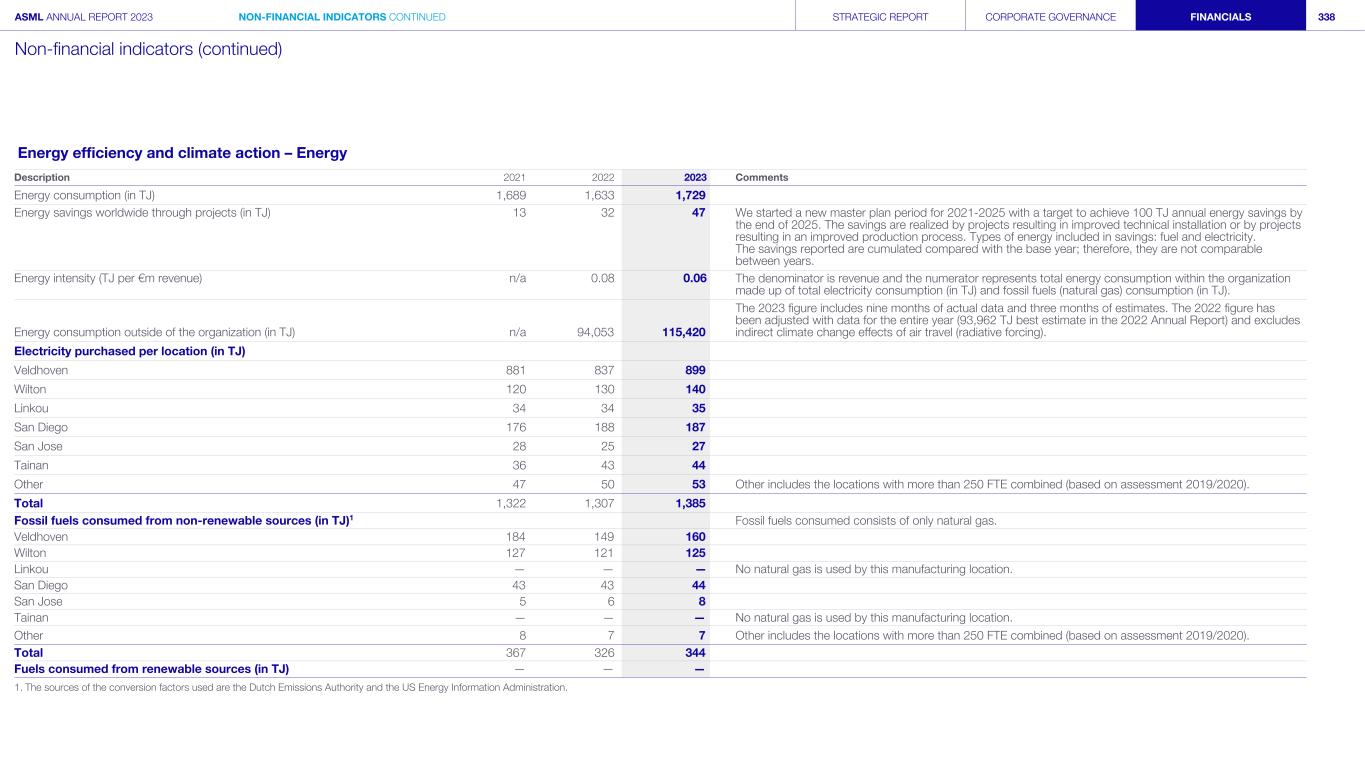

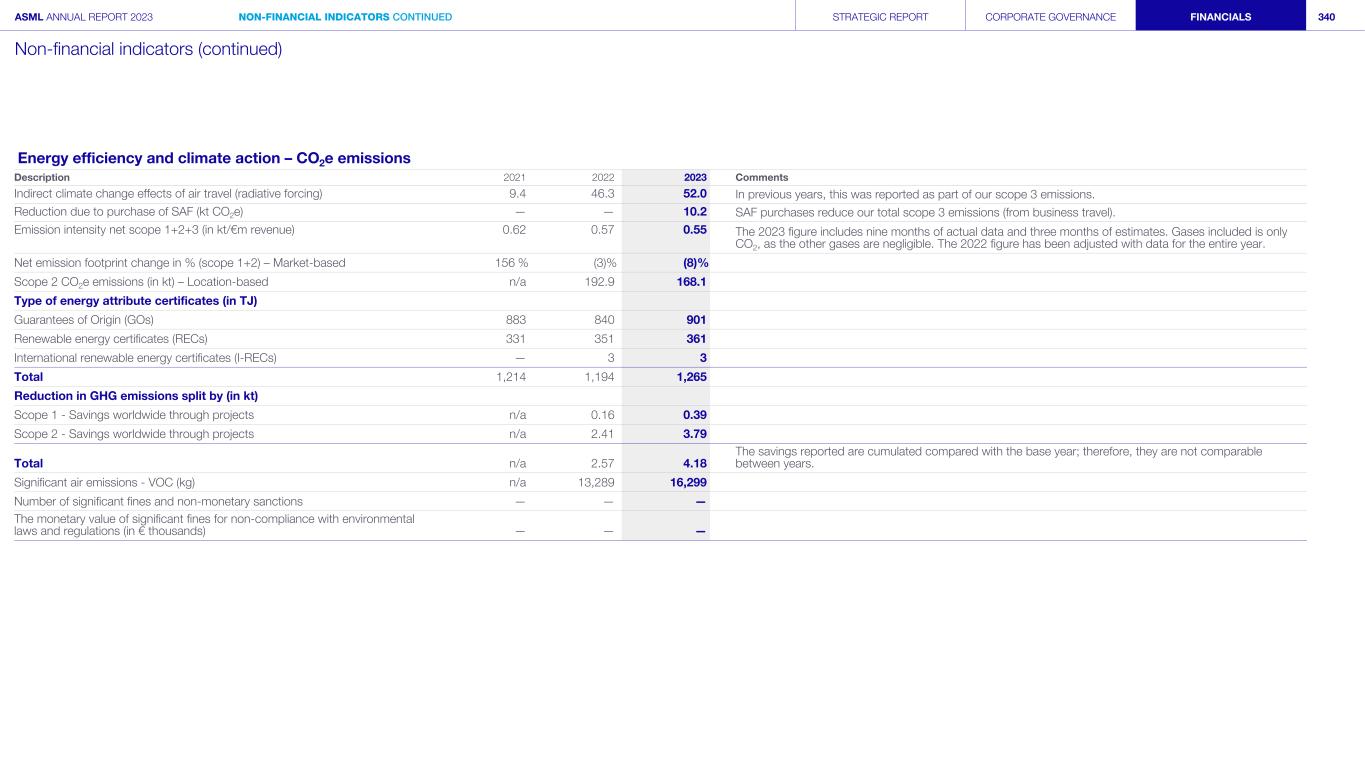

ASML ANNUAL REPORT 2023 MARKETPLACE STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIALS 23 The world around us The macroeconomic situation remains volatile and we continue to see macro trends such as high interest rates, inflation, fear of recession and geopolitical tensions increasing in some parts of the world. The semiconductor industry is trying to manage its inventory levels in some end-market segments to balance supply and demand. The semiconductor market was still in the aftermath of the COVID-19 crisis in 2023, during which large stimulus packages accelerated economic growth. This created shortages in supply in the electronics industry as companies built safety stocks to increase future resilience. End demand for electronics slowed as we reached the end of the pandemic, while the supply chain was still building safety buffers. This resulted in a supply chain correction in 2023 which impacted our industry. In the context of demand for lithography, some customers delayed the timing of their demand for specific systems, as some of their facilities were not ready to receive the systems as well as a result of their end demand. This provided an opportunity to allocate these systems to customers whose demand profile we could not initially meet. Despite these delays, for certain system types the supply is still the main constraint, with demand being higher than supply, albeit at a reduced level than was experienced at the start of the year. All in all, global trends – such as generative AI, the energy transition, the electrification of mobility and the industrial Internet of Things (IoT) – continue to fuel semiconductor growth in the longer term. Our highest-priority objective is to optimize supply so that we can deliver and live up to our customers’ expectations. We have strong confidence that the semiconductor ecosystem will continue to innovate and grow at a high single-digit compound annual growth rate. Factors that may impact our business are explained in more detail over the next few pages, including: 1. Macroeconomic and geopolitical trends 2. Semiconductor market trends 3. Semiconductor application areas 4. Semiconductor industry market 1. Macroeconomic and geopolitical trends Economic outlook Middle East conflict Russia-Ukraine war Description The macroeconomic situation did not improve in 2023; inflation rates and interest rates stayed relatively high and the fear of recession, amid the geopolitical conflicts, remained. The continued macroeconomic uncertainty means our customers in different market segments have remained cautious. A later recovery of markets is expected, and the timing and shape of the recovery slope remains unclear. What it means for ASML Our EUV business saw a slight shift in demand timing, predominantly driven by a lack of readiness of fabs. This was due to the market environment and a shortage of people who have the capability to build advanced fabs. With DUV demand higher than we can deliver, particularly in China, we are working closely with our customers and suppliers to ride out the uncertainty and manage the risks. Description The military action in the Middle East is an additional factor in the current uncertainty in the macroeconomic environment. What it means for ASML Both ASML and our customers have operations in the Middle East. Additional military action in the region has and could further adversely affect the global economy, financial markets and the supply chain. This may impact our people and operations and our customers' operations, customer demand, delivery of products and services to customers, and the ability to obtain parts and components due to supply chain disruption. The safety and well-being of our employees and their families are a priority for us. Description The military action in Ukraine is an element of the current uncertainty in the macroeconomic environment. What it means for ASML While we do not have operations in Russia or Ukraine, sanctions and other measures taken in response to the military action have adversely affected – and could further affect – the global economy, financial markets and the supply chain. This may impact our customer demand, delivery of products and services to customers, and the ability of us and our suppliers to obtain parts, components and gas supply due to supply chain disruption. Read more in Our business strategy Read more in Risk - How we manage risk