Traders May Make Another Attempt At Bargain Hunting

18 Abril 2024 - 10:14AM

IH Market News

The major U.S. index futures are currently pointing to a

modestly higher open on Thursday, with stocks likely to move back

to the upside after ending yesterday’s volatile session mostly

lower.

The upward momentum on Wall Street comes on the heels of

four-day losing streaks for the Nasdaq and S&P 500, which have

fallen to their lowest levels in almost two months.

Traders may once again look to pick up stocks at relatively

reduced levels following the recent weakness, although recent

bargain hunting efforts have been thwarted by ongoing concerns the

Federal Reserve will hold off on cutting interest rates until later

in the year.

Stocks fluctuated over the course of the trading session on

Wednesday before eventually ending the day mostly lower. The Nasdaq

and the S&P 500 extended their losing streaks to four days,

falling to their lowest closing levels in nearly two months.

The major averages all finished the day red, although the Dow

posted a relatively modest loss, edging down 45.66 points or 0.1

percent to 37,753.31. The S&P 500 slid 29.20 points or 0.6

percent to 5,022.21 and the Nasdaq tumbled 181.88 points or 1.2

percent to 15,683.37.

Weakness among technology stocks weighed on the markets, as

reflected by the notable slump by the tech-heavy Nasdaq.

Shares of Nvidia (NASDAQ:NVDA) came under pressure as the day

progressed, with the AI darling plunging by 3.9 percent to its

lowest closing level in well a month.

The drop by Nvidia came as semiconductor stocks broadly came

under pressure following disappointing first quarter sales by Dutch

chip equipment maker ASML (NASDAQ:ASML).

Reflecting the weakness in the sector, the Philadelphia

Semiconductor Index dove by 3.3 percent to a nearly two-month

closing low.

The lower close on Wall Street also came amid ongoing concerns

about the outlook for interest rates following Tuesday’s remarks by

Federal Reserve Chair Jerome Powell.

During a moderated discussion with Bank of Canada Governor Tiff

Macklem, Powell suggested rates are likely to remain higher for

longer amid a “lack of progress” toward reaching the central bank’s

inflation goal.

The Fed chief’s remarks came as recent data showing sticky

inflation along with continued economic strength have led to

reduced expectations of a rate cut in June.

According to CME Group’s FedWatch Tool, the chances of a 25

basis point rate cut in June have tumbled to 16.4 percent compared

to 55.2 percent just a week ago.

Airline stocks bucked the downtrend, however, with the NYSE Arca

Airline Index soaring by 3.8 percent after ending Tuesday’s session

at a two-month closing low.

United Airlines (NASDAQ:UAL) led the sector higher, skyrocketing

by 17.5 percent reporting a much narrower than expected first

quarter loss.

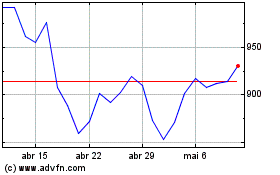

ASML Holding NV (NASDAQ:ASML)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

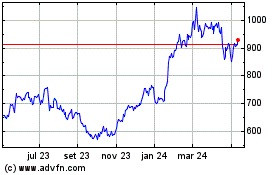

ASML Holding NV (NASDAQ:ASML)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024