Filed by Lotus Technology Inc.

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-6

under the Securities Exchange Act of 1934, as amended

Subject Company: L Catterton Asia Acquisition

Corp

Commission File No.: 001-40196

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2024

L Catterton Asia Acquisition Corp

(Exact

name of registrant as specified in its charter)

| Cayman Islands |

001-40196 |

98-1577355 |

| (State or other jurisdiction of |

(Commission |

(I.R.S. Employer |

| incorporation or organization) |

File Number) |

Identification Number) |

| 8 Marina View, Asia Square Tower 1 |

|

|

| #41-03, Singapore |

|

018960 |

| (Address of principal executive offices) |

|

(Zip Code) |

+65 6672 7600

Registrant’s

telephone number, including area code

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

Trading |

|

Name of each exchange on |

| Title of each class |

|

Symbol(s) |

|

which registered |

| Units,

each consisting of one Class A Ordinary Share, $0.0001 par value, and one-third of one redeemable warrant |

|

LCAAU |

|

The

Nasdaq Stock Market LLC |

| Class A

Ordinary Shares included as part of the units |

|

LCAA |

|

The

Nasdaq Stock Market LLC |

| Redeemable

warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of

$11.50 |

|

LCAAW |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure |

On February 20,

2024, L Catterton Asia Acquisition Corp, an exempted company limited by shares incorporated under the laws of the Cayman

Islands (“SPAC” or “LCAA”) issued a press release announcing

that the previously proposed Business Combination (as defined below) is expected to be completed on February 22, 2024. The press

release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

The foregoing

(including Exhibits 99.1) is being furnished pursuant to Item 7.01 and shall not be deemed to be filed for purposes of Section 18

of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities

of that section, nor shall it be deemed to be incorporated by reference into any filing of LCAA under the Securities Act or the Exchange

Act, regardless of any general incorporation language in such filings. This Current Report will not be deemed an admission as to the materiality

of any of the information in this Item 7.01, including Exhibits 99.1.

As previously announced, on January 31,

2023, LCAA, Lotus Technology Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands (the “Company”

or “Lotus Tech”), Lotus Temp Limited, an exempted company limited by shares incorporated under the laws of the Cayman

Islands and a wholly-owned subsidiary of Lotus Tech (“Merger Sub 1”), and Lotus EV Limited, an exempted company limited

by shares incorporated under the laws of the Cayman Islands and a wholly-owned subsidiary of Lotus Tech (“Merger Sub 2”)

entered into the Agreement and Plan of Merger (as amended and restated by the First Amended and Restated Agreement and Plan of Merger,

dated as of October 11, 2023 and as may be further amended, supplemented or otherwise modified from time to time, the “Merger

Agreement”), pursuant to which, among other things, (i) Merger Sub 1 will merge with and into LCAA (the “First

Merger”), with LCAA surviving the First Merger as a wholly owned subsidiary of Lotus Tech (the surviving entity of the First

Merger, “Surviving Entity 1”), and (ii) immediately following the consummation of the First Merger, Surviving

Entity 1 will merge with and into Merger Sub 2 (the “Second Merger”, and together with the First Merger, collectively,

the “Mergers”), with Merger Sub 2 surviving the Second Merger as a wholly owned subsidiary of Lotus Tech (the transactions

contemplated by the Merger Agreement, including the Mergers, collectively, the “Business Combination”).

Filing with CSRC

As described in the definitive proxy statement/prospectus

filed with the SEC by LCAA and Lotus Tech on January 12, 2024, in connection with the Business Combination and Lotus Tech’s

listing, Lotus Tech is required to make a filing with the China Securities Regulatory Commission (the “CSRC”) and to

comply with the other requirements pursuant to the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic

Companies promulgated by the CSRC on February 17, 2023.

On February 8, 2024, the CSRC has concluded

the filing procedures and published the filing results on the CSRC website.

Subscription Agreements

On February 15,

2024, Lotus Tech entered into a subscription agreement with a third-party investor pursuant to which such investor agreed to subscribe

for and purchase 1,500,000 ordinary shares of Lotus Tech for US$10.00 per share on terms and conditions substantially similar to those

contained in the other subscription agreements previously entered into by Lotus Tech and the PIPE investors.

Separately, a PIPE investor

which previously committed to subscribing for and purchasing certain ordinary shares of Lotus Tech for a total investment amount of approximately

US$3,000,000 has elected to terminate such investment commitment.

Forward-Looking Statements

This current report (the “Current

Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions

and on information currently available to LCAA and Lotus Tech.

All statements other than statements

of historical fact contained in this Current Report are forward-looking statements. In some cases, you can identify forward-looking statements

by the following words: “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing,” “target,” “seek”

or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although

not all forward-looking statements contain these words. These statements are based upon estimates and forecasts and reflect the views,

assumptions, expectations, and opinions of LCAA and Lotus Tech, which involve risks, uncertainties and other factors that may cause actual

results, levels of activity, performance or achievements to be materially different from those expressed or implied by these forward-looking

statements. Any such estimates, assumptions, expectations, forecasts, views or opinions, whether or not identified in this Current Report,

should be regarded as preliminary and for illustrative purposes only and should not be relied upon as being necessarily indicative of

future results. Although each of LCAA and Lotus Tech believes that it has a reasonable basis for each forward-looking statement contained

in this Current Report, each of LCAA and Lotus Tech caution you that these statements are based on a combination of facts and factors

currently known and projections of the future, which are inherently uncertain. In addition, there are risks and uncertainties described

in the definitive proxy statement/prospectus in the registration statement on Form F-4 relating to the proposed transaction filed

by Lotus Tech with the SEC and other documents filed by LCAA or Lotus Tech from time to time with the SEC. These filings may identify

and address other important risks and uncertainties that could cause actual events and results to differ materially from those expressed

or implied in the forward-looking statements. Neither LCAA nor Lotus Tech can assure you that the forward-looking statements in this Current

Report will prove to be accurate. These forward-looking statements are subject to a number of risks and uncertainties, including the ability

to complete the business combination due to the failure to obtain approval from LCAA shareholders or satisfy other closing conditions

in the Merger agreement, the occurrence of any event that could give rise to the termination of the Merger agreement, the ability to recognize

the anticipated benefits of the business combination, the amount of redemption requests made by LCAA public shareholders, costs related

to the transaction, the risk that the transaction disrupts current plans and operations as a result of the announcement and consummation

of the transaction, the outcome of any potential litigation, government or regulatory proceedings and other risks and uncertainties, including

those included under the heading “Risk Factors” in the registration statement on Form F-4 filed by Lotus Tech with the

SEC and those included under the heading “Risk Factors” in the annual report on Form 10-K of LCAA and in its subsequent

quarterly reports on Form 10-Q and other filings with the SEC. In light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a representation or warranty by LCAA or Lotus Tech, their respective directors,

officers or employees or any other person that LCAA or Lotus Tech will achieve their objectives and plans in any specified time frame,

or at all. The forward-looking statements in this Current Report represent the views of LCAA and Lotus Tech as of the date of this Current

Report. Subsequent events and developments may cause those views to change. However, while LCAA and Lotus Tech may update these forward-looking

statements in the future, LCAA and Lotus Tech specifically disclaim any obligation to do so, except to the extent required by applicable

law. You should, therefore, not rely on these forward-looking statements as representing the views of LCAA and Lotus Tech as of any date

subsequent to the date of this Current Report. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed transaction, Lotus

Tech has filed a registration statement on Form F-4 with the SEC that includes a prospectus with respect to Lotus Tech’s securities

to be issued in connection with the proposed transaction and a proxy statement with respect to the shareholder meeting of LCAA to vote

on the proposed transaction, which was declared effective on January 12, 2024. Shareholders of LCAA and other interested persons

are encouraged to read the definitive proxy statement/prospectus as well as other documents to be filed with the SEC because these documents

contain important information about LCAA and Lotus Tech and the proposed transaction. Shareholders of LCAA are also able to obtain a copy

of the Form F-4, including the definitive proxy statement/prospectus, and other documents filed with the SEC without charge, by directing

a request to: L Catterton Asia Acquisition Corp, 8 Marina View, Asia Square Tower 1, #41-03, Singapore or, without charge, at the

SEC’s website (www.sec.gov).

Participants in the Solicitation

LCAA and Lotus Tech and their respective directors

and executive officers may be considered participants in the solicitation of proxies with respect to the potential transaction described

in this Current Report under the rules of the SEC. Information about the directors and executive officers of LCAA and their ownership

is set forth in LCAA’s filings with the SEC. Additional information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of LCAA’s shareholders in connection with the potential transaction is set forth in the

registration statement containing the definitive proxy statement/prospectus filed with the SEC. These documents are available free of

charge at the SEC’s website at www.sec.gov or by directing a request to L Catterton Asia Acquisition Corp, 8 Marina View,

Asia Square Tower 1, #41-03, Singapore.

No Offer and Non-Solicitation

This Current

Report is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect

of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of LCAA or

Lotus Tech, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale

would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: February 20, 2024

| |

L CATTERTON ASIA ACQUISITION CORP |

| |

|

|

| |

By: |

/s/ Chinta Bhagat |

| |

Name: |

Chinta Bhagat |

| |

Title: |

Co-Chief Executive Officer and Chairman |

Exhibit 99.1

Lotus Tech and L Catterton Asia Acquisition

Corp Announce Closing of Business Combination

Lotus Tech’s American Depositary Shares to

Begin Trading on the Nasdaq on February 23, 2024 under Ticker Symbol “LOT”

New York and Singapore - February 20, 2024

– Lotus Technology Inc. (“Lotus Tech” or the “Company”), a leading global luxury electric vehicle maker,

and L Catterton Asia Acquisition Corp (“LCAA”) (NASDAQ: LCAA), a special purpose acquisition company formed

by affiliates of L Catterton, a leading global consumer-focused investment firm, announced today that their previously proposed

business combination is expected to be completed on February 22, 2024. The combined company will retain Lotus Tech's name as “Lotus

Technology Inc.” and its American Depositary Shares (ADS) will commence trading on the Nasdaq under the ticker symbol “LOT”

on February 23, 2024. The business combination was approved by LCAA shareholders at an extraordinary general meeting held

on February 2, 2024.

Integrating Lotus’s sports car DNA with a new generation of premium

lifestyle vehicles, Lotus Tech is committed to transforming the brand into an advanced, fully electric, intelligent, and sustainable luxury

mobility provider before its 80th anniversary in 2028. The Company has already set this ambitious plan in motion by launching

a leading product portfolio of high-performing battery electric vehicles (“BEVs”) ahead of other global luxury automakers.

These BEVs include Eletre, a new breed of all-electric hyper-SUV powered by Lotus’s proprietary 800-volt EPA, and Emeya, an all-electric

hyper-GT among the most advanced vehicles of its kind in the world. With both BEVs already on the roads and two more fully electric models

planned for launch over the next two years, Lotus Tech is on track to become the first traditional luxury automotive brand to achieve

a 100% electric product portfolio by 2027.

Since the transaction was announced, the Company has raised more than

US$880 million in pre-closing and private investment in public equity (“PIPE”) financing commitments from global investors,

existing shareholders, and strategic partners, representing one of the largest amounts of additional financings raised in connection with

a de-SPAC transaction since 2023.

“We are thrilled to announce our upcoming debut on the Nasdaq

as we complete our business combination with LCAA,” said Mr. Qingfeng Feng, Chief Executive Officer of Lotus Tech. “This

is a pivotal moment in our journey. We look forward to accelerating our growth as a listed company, leading the electric transformation

of the global luxury BEV market together with L Catterton."

“Our partnership with Lotus Tech has gotten stronger over time

and our respect for the mission it is on has only increased,” said Chinta Bhagat, Co-Chief Executive Officer of LCAA. “We

are excited about the road ahead as we continue building the definitive luxury electric vehicle brand together, leveraging our global

consumer insights and our strategic relationship with LVMH. Lotus Tech’s upcoming debut on the Nasdaq will be a key milestone in

its journey and we believe that the Company will have many more achievements to celebrate over the coming years.”

Lotus Tech will ring the Nasdaq opening bell in New York City on February 23,

2024 to commemorate the Company's public listing. A live stream of the event can be viewed at https://www.nasdaq.com/marketsite/bell-ringing-ceremony.

– END –

Advisors

Deutsche Bank acted as financial advisor, capital markets advisor and

PIPE placement agent, Skadden, Arps, Slate, Meagher & Flom as international legal counsel, and Han Kun Law Offices as PRC counsel

to Lotus Tech. Santander US Capital Markets LLC acted as equity capital markets advisor and financial advisor, Kirkland & Ellis

as international legal counsel and Fangda Partners as PRC counsel to LCAA. Shearman & Sterling LLP acted as international legal

counsel to Deutsche Bank and Santander US Capital Markets LLC.

About Lotus Technology

Lotus Technology Inc. has operations across China, the UK, and the

EU. The Company is dedicated to delivering luxury lifestyle battery electric vehicles, with a focus on world-class R&D in next-generation

automobility technologies such as electrification, digitalisation and more. For more information about Lotus Technology Inc., please

visit www.group-lotus.com.

About L Catterton Asia

Acquisition Corp

L Catterton Asia Acquisition Corp (NASDAQ: LCAA) is a

blank check company incorporated for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization

or similar business combination with one or more businesses or entities. While it may pursue an initial target business in any industry

or sector, it has focused its search on high-growth, consumer technology sectors across Asia. For more information about L Catterton

Asia Acquisition Corp, please visit www.lcaac.com.

About L Catterton

L Catterton is a market-leading consumer-focused

investment firm, managing approximately $35 billion of equity capital across three multi-product platforms: private equity, credit and

real estate. Leveraging deep category insight, operational excellence, and a broad network of strategic relationships, L Catterton's

team of more than 200 investment and operating professionals across 17 offices partners with management teams to drive differentiated

value creation across its portfolio. Founded in 1989, the firm has made over 275 investments in some of the world's most iconic consumer

brands. For more information about L Catterton, please visit www.lcatterton.com.

Forward-Looking Statements

This press release (the “Press Release”) contains forward-looking

statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the U.S. Securities Exchange Act of 1934, that are based on beliefs and assumptions and on information currently available

to Lotus Tech and LCAA. All statements other than statements of historical fact contained in this Press Release are forward-looking

statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”,

“expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”,

“predict”, “potential”, “forecast”, “plan”, “seek”, “future”,

“propose” or “continue”, or the negatives of these terms or variations of them or similar terminology although

not all forward-looking statements contain such terminology. Such forward-looking statements are subject to risks, uncertainties, and

other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements.

These forward-looking statements are based upon estimates and assumptions

that, while considered reasonable by LCAA and its management, and Lotus Tech and its management, as the case may be, are inherently

uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) the

occurrence of any event, change or other circumstances that could give rise to the termination of definitive agreements with respect to

the proposed Business Combination between LCAA, Lotus Tech and the other parties thereto (the “Business Combination”);

(2) the outcome of any legal proceedings that may be instituted against LCAA, the Combined Company or others following the

announcement of the Business Combination and any definitive agreements with respect thereto; (3) the amount of redemption requests

made by LCAA public shareholders and the inability to complete the Business Combination due to the failure to obtain approval of

the shareholders of LCAA, to obtain financing to complete the Business Combination or to satisfy other conditions to closing and;

(4) changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws

or regulations or as a condition to obtaining regulatory approval of the Business Combination; (5) the ability to meet stock exchange

listing standards following the consummation of the Business Combination; (6) the risk that the Business Combination disrupts current

plans and operations of the Company as a result of the announcement and consummation of the Business Combination; (7) the ability

to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability

of the Combined Company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management

and key employees; (8) costs related to the Business Combination; (9) risks associated with changes in applicable laws or regulations

and Lotus Tech’s international operations; (10) the possibility that Lotus Tech or the Combined Company may be adversely affected

by other economic, business, and/or competitive factors; (11) Lotus Tech’s estimates of expenses and profitability; (12) Lotus

Tech’s ability to maintain agreements or partnerships with its strategic partner Geely Holding and to develop new agreements or

partnerships; (13) Lotus Tech’s ability to maintain relationships with its existing suppliers and strategic partners, and source

new suppliers for its critical components, and to complete building out its supply chain, while effectively managing the risks due to

such relationships; (14) Lotus Tech’s reliance on its partnerships with vehicle charging networks to provide charging solutions

for its vehicles and its strategic partners for servicing its vehicles and their integrated software; (15) Lotus Tech’s ability

to establish its brand and capture additional market share, and the risks associated with negative press or reputational harm, including

from lithium-ion battery cells catching fire or venting smoke; (16) delays in the design, manufacture, launch and financing

of Lotus Tech’s vehicles and Lotus Tech’s reliance on a limited number of vehicle models to generate revenues; (17) Lotus

Tech’s ability to continuously and rapidly innovate, develop and market new products; (18) risks related to future market adoption

of Lotus Tech’s offerings; (19) increases in costs, disruption of supply or shortage of materials, in particular for lithium-ion cells

or semiconductors; (20) Lotus Tech’s reliance on its partners to manufacture vehicles at a high volume, some of which have

limited experience in producing electric vehicles, and on the allocation of sufficient production capacity to Lotus Tech by its partners

in order for Lotus Tech to be able to increase its vehicle production capacities; (21) risks related to Lotus Tech’s distribution

model; (22) the effects of competition and the high barriers to entry in the automotive industry, and the pace and depth of electric

vehicle adoption generally on Lotus Tech’s future business; (23) changes in regulatory requirements, governmental incentives

and fuel and energy prices; (24) the impact of the global COVID-19 pandemic on LCAA, Lotus Tech, Lotus Tech’s

post business combination’s projected results of operations, financial performance or other financial metrics, or on any of the

foregoing risks; and (25) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary

Note Regarding Forward-Looking Statements” in LCAA’s final prospectus relating to its initial public offering (File No. 333-253334) declared

effective by the SEC on March 10, 2021, and other documents filed, or to be filed, with the U.S. Securities and Exchange Commission

(the “SEC”) by LCAA or Lotus Tech, including the Registration/Proxy Statement (as defined below). There may be additional

risks that neither LCAA nor Lotus Tech presently know or that LCAA or Lotus Tech currently believe are immaterial that could

also cause actual results to differ from those contained in the forward-looking statements.

Nothing in this Press Release should be regarded as a representation

by any person that the forward-looking statements set forth herein will be achieved in any specified time frame, or at all, or that any

of the contemplated results of such forward-looking statements will be achieved in any specified time frame, or at all. The forward-looking

statements in this Press Release represent the views of LCAA and Lotus Tech as of the date they are made. While LCAA and

Lotus Tech may update these forward-looking statements in the future, LCAA and Lotus Tech specifically disclaim any obligation

to do so, except to the extent required by applicable law. You should not place undue reliance on forward-looking statements.

Additional Information

In connection with the proposed Business Combination,

(i) Lotus Tech has filed with the SEC a registration statement on Form F-4 (File No. 333-275001) containing a preliminary

proxy statement of LCAA and a preliminary prospectus (the “Registration/Proxy Statement”), and (ii) LCAA

will file a definitive proxy statement relating to the proposed Business Combination (the “Definitive Proxy Statement”) and

will mail the Definitive Proxy Statement and other relevant materials to its shareholders after the Registration/Proxy Statement is declared

effective. The Registration/Proxy Statement contains important information about the proposed Business Combination and the other matters

to be voted upon at a meeting of LCAA shareholders to be held to approve the proposed Business Combination. This Press Release

does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form

the basis of any investment decision or any other decision in respect of the Business Combination.

Before making any voting or other investment

decisions, securityholders of LCAA and other interested persons are advised to read, when available, the Registration/Proxy Statement

and the amendments thereto and the Definitive Proxy Statement and other documents filed in connection with the proposed Business Combination,

as these materials will contain important information about LCAA, Lotus Tech and the Business Combination. When available,

the Definitive Proxy Statement and other relevant materials for the proposed Business Combination will be mailed to shareholders of LCAA

as of a record date to be established for voting on the proposed Business Combination. Shareholders will also be able to obtain copies

of the Registration/Proxy Statement, the Definitive Proxy Statement and other documents filed with the SEC, without charge, once available,

at the SEC’s website at www.sec.gov, or by directing a request to: LCAA, 8 Marina View, Asia Square Tower 1, #41-03, Singapore

018960, attention: Katie Matarazzo.

INVESTMENT IN ANY SECURITIES DESCRIBED

HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED

THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

Participants in the Solicitation

LCAA and Lotus Tech, and certain of

their directors and executive officers, may be deemed participants in the solicitation of proxies from LCAA’s shareholders

with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of

their interests in LCAA is set forth in LCAA’s filings with the SEC (including LCAA’s final prospectus

related to its initial public offering (File No. 333-253334) declared effective by the SEC on March 10, 2021), and

are available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to LCAA, 8 Marina View, Asia

Square Tower 1, #41-03, Singapore 018960, attention: Katie Matarazzo. Additional information regarding the interests of such participants

and other persons who may, under the rules of the SEC, be deemed participants in the solicitation of the shareholders in connection

with the proposed Business Combination will be contained in the Registration/Proxy Statement for the proposed Business Combination when

available.

No Offer and Non-Solicitation

This Press Release is not a proxy statement

or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and shall

not constitute an offer to sell or a solicitation of an offer to buy the securities of LCAA or Lotus Tech, nor shall there be any

sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act.

Contact Information

For inquiries regarding Lotus Tech

Demi Zhang

ir@group-lotus.com

Brunswick Group

Lotustechmedia@brunswickgroup.com

For inquiries regarding LCAA and/or

L Catterton

Julie Hamilton (U.S.)

media@lcatterton.com

+1 203 742 5185

Bob Ong / Bonnie Gan (Asia)

bob.ong@lcatterton.com / bonnie.gan@lcatterton.com

+65 6672 7619 / +86 10 8555 1807

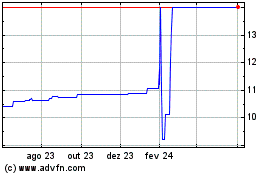

L Catterton Asia Acquisi... (NASDAQ:LCAAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

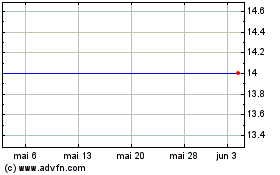

L Catterton Asia Acquisi... (NASDAQ:LCAAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024