false

0000043196

0000043196

2024-02-20

2024-02-20

0000043196

gtn:ClassACommonStockNoParValueCustomMember

2024-02-20

2024-02-20

0000043196

gtn:CommonStockNoParValueCustomMember

2024-02-20

2024-02-20

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2024 (February 20, 2024)

Gray Television, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Georgia

|

001-13796

|

58-0285030

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

4370 Peachtree Road, NE, Atlanta, Georgia

|

30319

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

404-504-9828

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each Class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Class A common stock (no par value) |

GTN.A |

New York Stock Exchange |

| common stock (no par value) |

GTN |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On February 20, 2024, Gray Television, Inc. (the “Company”) announced that James C. Ryan, who has served as Chief Financial Officer (“CFO”) of Gray Television, Inc. (the “Company”) for approximately 25 years, informed the Company of his voluntary decision to transition into retirement after 2025. As part of the transition plan that Mr. Ryan and the Company developed, Mr. Ryan will continue to serve as Executive Vice President and Chief Financial Officer of the Company through June 30, 2024, at which time he will retire from that executive officer position. Mr. Ryan has agreed that he will continue as an employee of the Company through December 31, 2025 (the “Retirement Date”) in the role of Senior Advisor and work closely with his successor and the Company’s entire executive team to assist with a seamless transition of his duties.

(c) On February 20, 2024, the Company also announced that Jeff Gignac, who currently serves as a Managing Director and Head of Media & Telecom Investment Banking at Wells Fargo Securities (including its predecessors, “Wells Fargo”), will join the Company to succeed Mr. Ryan as Chief Financial Officer. Mr. Gignac will join the Company, initially as Executive Vice President, Finance, on April 1, 2024, and will succeed Mr. Ryan as Executive Vice President and Chief Financial Officer on July 1, 2024. Mr. Gignac, age 48, joined Wells Fargo in September 2004, where he has served in a variety of roles in leveraged finance and media investment banking, and was named a Managing Director in February 2014, and as Head of Media & Telecom Investment Banking in September 2022. From 2002 to 2004, Mr. Gignac served as Vice President at Ernst & Young Corporate Finance, focusing on restructuring advisory, mergers and acquisitions, and capital raising, and prior thereto was a Senior Accountant at Arthur Andersen. Mr. Gignac received a B.A. in Accounting from Michigan State University in 1997 and is a licensed CPA in the State of Georgia.

Mr. Gignac will receive an annual base salary of $850,000, and, in accordance with the terms of the Company’s annual compensation programs for its executive officers, will be eligible to receive: (i) a target annual cash incentive opportunity for fiscal year 2024 under the Company’s 2024 Short Term Incentive Plan equal to 100% of his annual base salary, and (ii) an annual equity award for fiscal year 2024 under the Gray Television, Inc. 2024 Annual Long Term Equity Award with a target grant date fair value equal to 225% of his annual base salary, pro rated from his start date, with (x) 50% of such award to be granted in restricted shares of the Company’s common stock which vest ratably over a three-year period and (y) 50% of such award granted in performance based shares of the Company’s common stock which can be earned in a range of 0% to 200% of the initial shares awarded, at the end of the three-year period commencing when he joins the Company, determined by the average percent of target payout earned based on Company performance under the annual non-equity incentive program in 2024, 2025 and 2026. In addition, on the date he commences employment with the Company, Mr. Gignac will receive (i) a sign-on bonus of $250,000 in cash, one-half of which is payable on his start date and one-half on the six month anniversary thereof, and (ii) a make-whole award intended to compensate Mr. Gignac for his forfeiture of equity awards issued by Wells Fargo representing previously-earned deferred compensation otherwise payable by Wells Fargo, which make-whole award will consist of (x) a cash payment of $750,000, payable in three annual installments, commencing on the first anniversary of his joining the Company and (y) an award granted in restricted shares of the Company’s common stock with a grant date fair value equal to $1,500,000, also vesting over a three-year period. Both the cash and the stock portion of the make-whole award will vest at the rate of 50% on the first anniversary of his start of employment, and 25% on each of the second and third anniversaries thereof. The number of shares issuable will be based upon the average closing price of the Company’s common stock over the 30 trading days prior to the date he joins the Company.

Mr. Gignac will also be eligible for the Company’s compensation and benefits programs that are offered to similarly situated employees and will be a participant in the Company’s Executive and Key Employee Change in Control Severance Plan (the “CIC Plan”), subject to such modifications to the timing of payments thereunder as the Company may determine necessary to comply with Section 409A of the Internal Revenue Code. The CIC Plan is described under the heading “Potential Payments upon Termination or Change in Control” in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (the “SEC”) on March 23, 2023.

(e) During the period through June 30, 2024 while Mr. Ryan continues to serve as Chief Financial Officer, Mr. Ryan will continue to be entitled to his base salary, bonus and other benefits as determined by the Compensation Committee that are offered to similarly situated employees for 2024. Upon his retirement as Chief Financial Officer, the amounts that Mr. Ryan is eligible to receive under the Company’s 2024 Short Term Incentive Plan and the equity awards granted under the 2024 Long Term Incentive Plan will be prorated to reflect his retirement as an executive officer as of June 30, 2024, with the vesting schedule unchanged. Beginning July 1, 2024 through the Retirement Date, the period in which Mr. Ryan will no longer be CFO but will serve as Senior Advisor, Mr. Ryan will be entitled to a base salary of $1.5 million per annum. No bonus or new stock grants will be issued to Mr. Ryan after June 30, 2024, but all other benefits consistent with those offered to similarly situated employees will also be offered to Mr. Ryan.

Item 8.01. Other Events.

On February 20, 2024, the Company issued a press release announcing Mr. Ryan’s retirement, the appointment of Mr. Gignac and the related transition plan.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Gray Television, Inc.

|

|

| |

|

|

|

February 20, 2024

|

By:

|

/s/ James C. Ryan

|

|

| |

|

Name:

|

James C. Ryan

|

|

| |

|

Title:

|

Executive Vice President and

Chief Financial Officer

|

|

Exhibit 99.1

NEWS RELEASE

Gray Television Announces CFO Jim Ryan’s Upcoming Retirement

and Appointment of Jeff Gignac to Succeed Him

Atlanta, Georgia – February 20, 2024. . . Gray Television Inc. (“Gray,” the “Company,” “we,” “us,” or “our”) (NYSE: GTN) announced today that Chief Financial Officer Jim Ryan has notified the Company of his voluntary decision to transition into retirement after 2025. Gray and Jim have agreed that he will remain with Gray as a Senior Advisor through his retirement to assist with a seamless transition of his duties.

To succeed Jim as CFO, Gray announced the hiring of Jeff Gignac, who currently serves as a Managing Director and Head of Media & Telecom Investment Banking at Wells Fargo Securities. Jeff has worked closely with Jim and the Company as one of its lead bankers for the past several years. Mr. Gignac will join Gray, initially as Executive Vice President, Finance, on April 1, 2024, and he will step into Mr. Ryan’s role as Executive Vice President, Chief Financial Officer on July 1, 2024. Mr. Ryan will work closely with Mr. Gignac and the entire Gray executive team until he retires from the Company at the end of 2025.

Jim joined Gray as its CFO in 1998 upon our acquisition of Busse Broadcasting, where Jim had also served as CFO. In the ensuing 25 years, Jim’s role remained the same but the position became ever more complicated as Gray grew from a small regional media company to the nation’s second largest broadcast company. During his tenure, Gray entirely divested its newspapers, paging, satellite uplink and other businesses, while acquiring scores of television stations through multiple transactions including those involving Bostick Broadcasting (1999), Benedek Broadcasting (2002), the University of Notre Dame (2006), Yellowstone Television (2013), Hoak Media (2014), SJL Holdings (2014), Schurz Communications (2016), Raycom Media (2019), Quincy Media (2021), Meredith Corporation (2021), and many others.

“Jim has made tremendous contributions to Gray Television during his 25 year tenure,” said Gray’s Executive Chairman and CEO Hilton Howell. “He has helped guide the Company through a period of tremendous growth, innovation, and transformation that has made Gray the industry leader that we are today. His steady leadership will be missed but will not be forgotten.”

Jeff Gignac will join Gray after a nearly 20-year career with Wells Fargo Prior to his current leadership position, Jeff spent 18 years in leveraged finance, focused on the telecom, media and technology (TMT) industries. Prior to Wells Fargo, Jeff worked at Ernst & Young and Arthur Andersen. He holds a BA in Accounting from Michigan State University and is a licensed CPA in the State of Georgia.

“We are fortunate that Jeff Gignac will join Gray’s senior leadership team as our next CFO,” said Hilton Howell. “Over the past several years, Jeff has led our debt financing efforts for the Raycom and Meredith transactions and the AR securitization facility. Importantly, Jeff helped to ensure that we raised capital on advantageous terms to facilitate our transformation into a leading multimedia company. With Gray’s current focus on deleveraging and prudent balance sheet management, Jeff is the perfect candidate to lead our finance functions for the next chapter of our corporate history.”

About Gray:

Gray Television, Inc. is a multimedia company headquartered in Atlanta, Georgia. Gray is the nation’s largest owner of top-rated local television stations and digital assets in the United States. Its television stations serve 113 television markets that collectively reach approximately 36 percent of US television households. This portfolio includes 80 markets with the top-rated television station and 102 markets with the first and/or second highest rated television station. Gray also owns video program companies Raycom Sports, Tupelo Media Group, and PowerNation Studios, as well as the studio production facilities Assembly Atlanta and Third Rail Studios. Gray owns a majority interest in Swirl Films. For more information, please visit www.gray.tv.

Cautionary Statements for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act

This press release contains certain forward-looking statements that are based largely on Gray’s current expectations and reflect various estimates and assumptions by Gray. These statements are statements other than those of historical fact, and may be identified by words such as “estimates,” “expect,” “anticipate,” “will,” “implied,” “assume” and similar expressions. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward-looking statements. Such risks, trends and uncertainties, which in some instances are beyond Gray’s control. Gray is subject to additional risks and uncertainties described in Gray’s quarterly and annual reports filed with the Securities and Exchange Commission from time to time, including in the “Risk Factors,” and management’s discussion and analysis of financial condition and results of operations sections contained therein, which reports are made publicly available via its website, www.gray.tv. Any forward-looking statements in this communication should be evaluated in light of these important risk factors. This press release reflects management’s views as of the date hereof. Except to the extent required by applicable law, Gray undertakes no obligation to update or revise any information contained in this communication beyond the date hereof, whether as a result of new information, future events or otherwise.

Gray Contacts:

Hilton H. Howell, Jr., Executive Chairman and Chief Executive Officer, 404-266-5513

Kevin P. Latek, Executive Vice President, Chief Legal and Development Officer, 404-266-8333

v3.24.0.1

Document And Entity Information

|

Feb. 20, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Gray Television, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 20, 2024

|

| Entity, Incorporation, State or Country Code |

GA

|

| Entity, File Number |

001-13796

|

| Entity, Tax Identification Number |

58-0285030

|

| Entity, Address, Address Line One |

4370 Peachtree Road, NE

|

| Entity, Address, City or Town |

Atlanta

|

| Entity, Address, State or Province |

GA

|

| Entity, Address, Postal Zip Code |

30319

|

| City Area Code |

404

|

| Local Phone Number |

504-9828

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000043196

|

| ClassACommonStockNoParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock (no par value)

|

| Trading Symbol |

GTN.A

|

| Security Exchange Name |

NYSE

|

| CommonStockNoParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

common stock (no par value)

|

| Trading Symbol |

GTN

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gtn_ClassACommonStockNoParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gtn_CommonStockNoParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

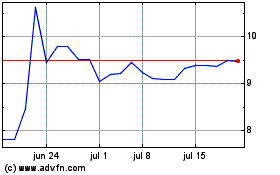

Gray Television (NYSE:GTN.A)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Gray Television (NYSE:GTN.A)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024