WOLVERINE WORLD WIDE INC /DE/2/21/20240000110471falseFebruary 21, 202400001104712024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 21, 2024

________________________________________________

| | |

WOLVERINE WORLD WIDE, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-06024 | | 38-1185150 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| 9341 Courtland Drive N.E. | , | Rockford | , | Michigan | | 49351 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (616) 866-5500

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading symbol | Name of each exchange on which registered |

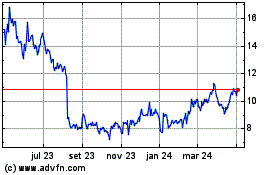

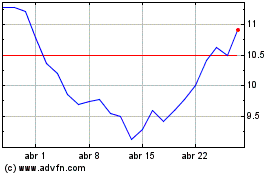

| Common Stock, $1 Par Value | WWW | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 21, 2024, Wolverine World Wide, Inc. (the “Company”) issued a press release and posted an investor presentation to its website, www.wolverineworldwide.com, announcing its financial results for the Company’s fourth quarter of 2023 and its 2023 fiscal year ended December 30, 2023. The press release and investor presentation are furnished and attached as Exhibits 99.1 and 99.2 hereto and are hereby incorporated into this Item 2.02 by reference.

The Company plans to use its website to disseminate future investor and corporate presentations and does not intend to file or furnish a Form 8-K alerting investors each time a presentation is disseminated or updated. By filing this Current Report on Form 8-K, the Company makes no admission as to the materiality of the information in this report or the investor presentation available on the Company’s website.

The information furnished shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such a filing.

The Company undertakes no duty or obligation to publicly update or revise the information contained in this Current Report on Form 8-K, although it may do so from time to time as its management believes is appropriate or as required by applicable law. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases, by updating its website or through other public disclosure.

| | | | | | | | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | |

| (d) | Exhibits: |

| | | |

| | 99.1 | |

| | | |

| | 99.2 | |

| | | |

| | 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Dated: February 21, 2024 | WOLVERINE WORLD WIDE, INC. (Registrant) |

| | |

| | |

| | /s/ Michael D. Stornant |

| | Michael D. Stornant |

| | Executive Vice President, Chief Financial Officer and Treasurer |

| | | | | |

| 9341 Courtland Drive NE, Rockford, MI 49351 Phone (616) 866-5500 |

FOR IMMEDIATE RELEASE

CONTACT: Alex Wiseman

(616) 863-3974

WOLVERINE WORLDWIDE REPORTS FOURTH QUARTER AND

FULL YEAR 2023 RESULTS IN-LINE WITH GUIDANCE

AND PROVIDES OUTLOOK FOR 2024

Company Significantly Strengthens its Balance Sheet and Improves Cost Structure, Enabling

an Acceleration of its Transformation to Become Great Global Brand Builders

ROCKFORD, Mich., February 21, 2024 – Wolverine World Wide, Inc. (NYSE: WWW) today reported financial results for the fourth-quarter and full-year 2023 ended December 30, 2023.

“We are effectively executing our transformation plan with great pace – having largely completed the stabilization phase of our turnaround,” said Chris Hufnagel, President and Chief Executive Officer of Wolverine Worldwide. “We finished the year with revenue and earnings in-line with guidance, and inventory and debt levels better than expected. Most importantly, Wolverine Worldwide is a much different company than it was just six months ago, with a healthier balance sheet, enhanced efficiency to deliver higher profit and investment, and a redesigned organizational structure to strengthen our brand-building capabilities. Our focused portfolio of authentic brands – supported by powerful central platforms – is focused on helping consumers live better lives through performance-led product innovation and design. Going forward, we are accelerating our transformation of the business to ultimately drive an inflection to growth. Our team is energized by our new vision to become global brand builders, and we are confident in our ability to drive meaningful and sustained shareholder value.”

FINANCIAL HIGHLIGHTS

Financial results for 2023, and comparable results from 2022, in each case, for our ongoing business exclude the impact of Keds, which was sold in February 2023, the U.S. Wolverine Leathers business, which was sold in August 2023, the non-U.S. Wolverine Leathers business, which was sold in December 2023, and reflect an adjustment for the transition of our Hush Puppies North America business to a licensing model in the second half of 2023. Tables have been provided in the back of this release showing the impact of these adjustments on financial results for 2023 and 2022. For visibility regarding this impact on our 2023 operating results, the Company has reported actual results reflecting its ongoing businesses and separately reported results for Keds, which will be limited to the period through February 3, 2023, and Wolverine Leathers to the extent it owned and operated the business.

Prior to the fourth quarter of 2023, Sperry®, Keds®, and Hush Puppies® financial results were reported in the Lifestyle Group. The Lifestyle Group is no longer a reportable segment and the financial results for Sperry®, Keds®, and Hush Puppies® are included in Other. Prior period disclosures have been adjusted.

FOURTH-QUARTER 2023 FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | December 30, 2023 | | December 31, 2022 | Y/Y Change | Constant Currency Change |

| Reported Segment Revenue Results: | | | | | |

| Active Group | | $341.3 | | $397.6 | (14.2)% | (15.2)% |

| Work Group | | $125.3 | | $154.5 | (18.9)% | (19.7)% |

| Other | | $60.1 | | $112.9 | (46.8)% | (44.8)% |

| Total Revenue | $526.7 | | $665.0 | (20.8)% | (21.3)% |

| Ongoing Total Revenue | $521.2 | | $634.6 | (17.9)% | (18.4)% |

| Supplemental Brand Revenue Information | | | | |

| Merrell | | $161.8 | | $193.9 | (16.6)% | (17.0)% |

| Saucony | | $105.1 | | $121.3 | (13.4)% | (13.7)% |

| Wolverine | | $51.8 | | $71.8 | (27.9)% | (27.9)% |

| Sweaty Betty | | $67.3 | | $72.8 | (7.6)% | (11.8)% |

| | | | | |

| Reported: | | | | | | |

| Gross Margin | 36.6% | | 33.7% | 290 bps | |

| Operating Margin | (35.5)% | | (68.4)% | 3,290 bps | |

| Diluted Earnings Per Share | ($1.15) | | ($4.59) | 74.9% | |

| Non-GAAP and Ongoing business: | | | | | |

| Adjusted Gross Margin | 36.9% | | 34.2% | 270 bps | |

| Adjusted Operating Margin | (3.5)% | | (1.8)% | (170) bps | |

| Adjusted Diluted Earnings Per Share | $(0.30) | | $(0.13) | 130.8% | |

| Constant Currency Earnings Per Share | $(0.29) | | $(0.13) | 123.1% | |

Revenue of $526.7 million declined 20.8% versus the prior year and declined 21.3% on a constant currency basis. Revenue from the ongoing business was $521.2 million and declined 18.4% on a constant currency basis.

The Company's international revenue of $267.2 million was down 5.1% compared to the prior year and down 6.2% on a constant currency basis. International revenue from the ongoing business of $261.7 million was down 3.4% compared to the prior year and down 4.6% on a constant currency basis. Direct-to-Consumer revenue of $186.9 million was down 17.6% compared to the prior year and down 15.5% for the ongoing business compared to the prior year.

Gross margin was 36.6% compared to 33.7% in the prior year and improved due to less promotional eCommerce sales and inventory markdown provisions as a result of much healthier inventory levels. Benefits from profit improvement initiatives were offset by the sale of the last tranche of higher-cost inventory containing transitory supply chain costs from 2022.

Selling, General & Administrative expenses were $379.9 million, or 72.1% of revenue. Adjusted SG&A expenses of $210.5 million or 40.4% of adjusted revenue, were 450 basis points higher than the prior year. Refer to table in the back of the release for reconciliation of reported SG&A expenses to adjusted SG&A expenses.

Inventory at the end of the quarter was $373.6 million and was down $371.6 million or approximately 50% compared to the prior year. The Sperry business and China joint venture entities are considered held for sale and not included in the Company's 2023 total inventory balance.

Net Debt at the end of the quarter was $740 million, down $285 million from the prior year. The Company's bank-defined leverage ratio was 2.9x.

FULL-YEAR 2023 FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | December 30, 2023 | | December 31, 2022 | Y/Y Change | Constant Currency Change |

| Segment Revenue Results: | | | | | |

| Active Group | | $1,439.1 | | $1,570.2 | (8.3)% | (8.1)% |

| Work Group | | $480.6 | | $590.5 | (18.6)% | (19.0)% |

| Other | | $323.2 | | $524.1 | (38.3)% | (37.9)% |

| Total Revenue | $2,242.9 | | $2,684.8 | (16.5)% | (16.3)% |

| Ongoing Total Revenue | $2,199.3 | | $2,532.1 | (13.1)% | (13.0)% |

| Supplemental Brand Information | | | | |

| Merrell | | $675.8 | | $764.2 | (11.6)% | (11.3)% |

| Saucony | | $495.8 | | $505.3 | (1.9)% | (1.2)% |

| Wolverine | | $201.2 | | $247.5 | (18.7)% | (18.7)% |

| Sweaty Betty | | $203.8 | | $211.5 | (3.6)% | (4.5)% |

| | | | | |

| Reported: | | | | | | |

| Gross Margin | 38.9% | | 39.9% | (100) bps | |

| Operating Margin | (3.0)% | | (7.8)% | 480 bps | |

| Diluted Earnings Per Share | $(0.51) | | $(2.37) | 78.5% | |

| Non-GAAP: | | | | | |

| Adjusted Gross Margin | 39.3% | | 40.7% | (140) bps | |

| Adjusted Operating Margin | 3.1% | | 6.8% | (370) bps | |

| Adjusted Diluted Earnings Per Share | $0.05 | | $1.37 | (96.4)% | |

| Constant Currency Earnings Per Share | $0.15 | | $1.37 | (89.1)% | |

Revenue of $2,242.9 million represents a decline of 16.5% versus the prior year and a decline of 16.3% on a constant currency basis.

Gross margin was 38.9% versus 39.9% in the prior year and reflects sales of higher-cost inventory due to transitory costs from 2022 and acceleration of end-of-life inventory liquidations.

Selling, General & Administrative expenses were $940.7 million, or 41.9% of revenue. Adjusted SG&A expenses of $797.7 million or 36.3% of adjusted revenue, were 250 basis points higher than the prior year.

FULL-YEAR 2024 OUTLOOK

The outlook for 2024, and comparable results from 2023, in each case, for our ongoing business now also exclude the impact of Sperry, which was sold in January 2024.

“Our expectation of improved Fiscal 2024 profitability reflects the comprehensive stabilization work completed over the last six months,” said Mike Stornant, Executive Vice President and Chief Financial Officer. “We expect to deliver incremental cost benefits of $140 million from recent profit improvement initiatives, allowing reinvestment into demand creation, enhanced technology, among other new capabilities needed to drive sustained growth. Solid inventory reductions already executed will benefit gross margin and allow for an increased flow of new and innovative product offerings. Successful efforts to lower debt are expected to reduce interest expense by approximately $20 million. While we expect the macro environment to remain challenging, especially in the first half of the year, we believe firmly that the business is on much stronger footing and poised to drive improved profit, cash flow and growth into the future."

Full year 2024 outlook is as follows:

•Revenue from our ongoing business is expected to be approximately $1.70 billion to $1.75 billion, representing a decline compared to 2023 of approximately 14.7% to 12.2% and constant currency decline of approximately 14.3% and 11.8%.

•Gross margin is expected to be approximately 44.5% up 460 basis points compared to 2023.

•Operating margin is expected to be approximately 5.7%, and adjusted operating margin is expected to be approximately 7.0%, up 310 basis points compared to 2023.

•The effective tax rate is expected to be approximately 18%.

•Diluted earnings per share are expected to be between $0.43 and $0.63, and adjusted diluted earnings per share are expected to be between $0.65 and $0.85. These full-year EPS projections include an approximate $0.10 negative impact from foreign currency exchange rate fluctuations.

•Diluted weighted average shares are expected to be approximately 80 million.

•Inventory is expected to decline by at least $70 million by year-end.

•Net Debt at year-end is expected to be approximately $575 million.

NON-GAAP FINANCIAL MEASURES

Measures referred to in this release as “adjusted” financial results and the financial results of the "ongoing business" are non-GAAP measures. Adjusted financial results exclude environmental and other related costs net of recoveries, non-cash impairment of long-lived assets, reorganization costs, debt modification costs, gain on the sale of businesses, trademarks and long-lived assets, costs associated with divestitures, SERP curtailment gain, receivables securitization transaction costs, and costs associated with Sweaty Betty® integration. The financial results of the ongoing business exclude financial results from the Keds business, Wolverine Leathers business and reflect an adjustment for the transition of our Hush Puppies North America business to a licensing model in the second half of 2023. The outlook for 2024, and comparable results from 2023, in each case, for our ongoing business now also exclude the impact of Sperry, which was sold in January 2024. The Company also presents constant currency information, which is a non-GAAP measure that excludes the impact of fluctuations in foreign currency exchange rates. The Company calculates constant currency basis by converting the current-period local currency financial results using the prior period exchange rates and comparing these adjusted amounts to the Company's current period reported results. The Company believes providing each of these non- GAAP measures provides valuable supplemental information regarding its results of operations, consistent with how the Company evaluates performance.

The Company has provided a reconciliation of each of the above non-GAAP financial measures to the most directly comparable GAAP financial measure. The Company believes these non-GAAP measures provide useful information to both management and investors because they increase the comparability of current period results to prior period results by adjusting for certain items that may not be indicative of core operating results and enable better identification of trends in our business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company on a comparable basis. Management does not, nor should investors, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP.

EARNINGS CALL INFORMATION

The Company will host a conference call today at 8:30 a.m. EST to discuss these results and current business trends. The conference call will be broadcast live and accessible under the “Investor Relations” tab at www.wolverineworldwide.com. A replay of the conference call will be available on the Company’s website for a period of approximately 30 days.

ABOUT WOLVERINE WORLDWIDE

Founded in 1883, Wolverine World Wide, Inc. (NYSE:WWW) is one of the world’s leading marketers and licensors of branded casual, active lifestyle, work, outdoor sport, athletic, children's and uniform footwear and apparel. The Company's diverse portfolio of highly recognized brands includes Merrell®, Saucony®, Sweaty Betty®, Hush Puppies®, Wolverine®, Chaco®, Bates®, HYTEST®, and Stride Rite®. Wolverine Worldwide is also the global footwear licensee of the popular brands Cat® and Harley-Davidson®. Based in Rockford, Michigan, for more than 140 years, the Company's products are carried by leading retailers in the U.S. and globally in approximately 170 countries and territories. For additional information, please visit our website, www.wolverineworldwide.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements, including statements regarding the Company’s outlook for 2024 including, among others: reported, adjusted and constant currency revenue; reported and adjusted gross margin; reported and adjusted operating margin; effective tax rate; reported and adjusted diluted earnings per share; diluted weighted average shares; and net debt; as well as statements regarding the Company's brand performance, strategic investment and improved profitability in 2024, the Company’s expectations regarding the macro environment in 2024, and the Company's ability to drive sustainable, long-term growth and shareholder returns.. In addition, words such as “estimates,” “anticipates,” “believes,” “forecasts,” “step,” “plans,” “predicts,” “focused,” “projects,” “outlook,” “is likely,” “expects,” “intends,” “should,” “will,” “confident,” variations of such words, and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions (“Risk Factors”) that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence. Risk Factors include, among others: changes in general economic conditions, employment rates, business conditions, interest rates, tax policies, inflationary pressures and other factors affecting consumer spending in the markets and regions in which the Company’s products are sold; the inability for any reason to effectively compete in global footwear, apparel and consumer-direct markets; the inability to maintain positive brand images and anticipate, understand and respond to changing footwear and apparel trends and consumer preferences; the inability to effectively manage inventory levels; changes in duties, tariffs, quotas or applicable assessments in countries of import and export; foreign currency exchange rate fluctuations; currency restrictions; supply chain or other capacity constraints, production disruptions, quality issues, price increases or other risks associated with foreign sourcing; the cost, including the effect of inflationary pressures, and availability of raw materials, inventories, services and labor for contract manufacturers; labor disruptions; changes in relationships with, including the loss of, significant wholesale customers; risks related to the significant investment in, and performance of, the Company’s consumer-direct operations; risks related to expansion into new markets and complementary product categories; the impact of seasonality and unpredictable weather conditions; the impact of changes in general economic conditions and/or the credit markets on the Company’s manufacturers, distributors, suppliers, joint venture partners and wholesale customers; changes in the Company’s effective tax rates; failure of licensees or distributors to meet planned annual sales goals or to make timely payments to the Company; the risks of doing business in developing countries, and politically or economically volatile areas; the ability to secure and protect owned intellectual property or use licensed intellectual property; the impact of regulation, regulatory and legal proceedings and legal compliance risks, including compliance with federal, state and local laws and regulations relating to the protection of the environment, environmental remediation and other related costs, and litigation or other legal proceedings relating to the protection of the environment or environmental effects on human health; risks of breach of the Company’s databases or other systems, or those of its vendors, which contain certain personal information, payment card data or proprietary information, due to cyberattack or other similar events; problems affecting the Company’s supply chain and distribution system, including service disruptions at shipping and receiving ports; strategic actions, including new initiatives and ventures, acquisitions and dispositions, and the Company’s success in integrating acquired businesses, and implementing new initiatives and ventures; risks relating to stockholder activism; the potential effects of outbreaks of COVID-19 or future health crises on the Company’s business, operations, financial results and liquidity; the risk of impairment to goodwill and other intangibles; changes in future pension funding requirements and pension expenses; and additional factors discussed in the Company’s reports filed with the Securities and Exchange Commission and exhibits thereto. The foregoing Risk Factors, as well as other existing Risk Factors and new Risk Factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these or other risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Furthermore, the Company undertakes no obligation to update, amend, or clarify forward-looking statements.

# # #

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

(In millions, except earnings per share)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Fiscal Year Ended |

| December 30,

2023 | | December 31,

2022 | | December 30,

2023 | | December 31,

2022 |

Revenue | $ | 526.7 | | | $ | 665.0 | | | $ | 2,242.9 | | | $ | 2,684.8 | |

Cost of goods sold | 333.7 | | | 440.8 | | | 1,370.4 | | | 1,614.4 | |

| | | | | | | |

Gross profit | 193.0 | | | 224.2 | | | 872.5 | | | 1,070.4 | |

Gross margin | 36.6 | % | | 33.7 | % | | 38.9 | % | | 39.9 | % |

| | | | | | | |

Selling, general and administrative expenses | 245.4 | | | 249.1 | | | 856.2 | | | 906.4 | |

| Gain on sale of business, trademarks and long-lived assets | (12.6) | | | — | | | (90.4) | | | (90.0) | |

| Impairment of long-lived assets | 129.5 | | | 428.7 | | | 185.3 | | | 428.7 | |

| Environmental and other related costs (income), net of recoveries | 17.6 | | | 1.1 | | | (10.4) | | | 33.7 | |

Operating expenses | 379.9 | | | 678.9 | | | 940.7 | | | 1,278.8 | |

Operating expenses as a % of revenue | 72.1 | % | | 102.1 | % | | 41.9 | % | | 47.6 | % |

| | | | | | | |

| Operating loss | (186.9) | | | (454.7) | | | (68.2) | | | (208.4) | |

Operating margin | (35.5) | % | | (68.4) | % | | (3.0) | % | | (7.8) | % |

| | | | | | | |

Interest expense, net | 16.1 | | | 16.0 | | | 63.5 | | | 47.3 | |

| | | | | | | |

| Other expense (income), net | (0.7) | | | (5.0) | | | 2.5 | | | (2.8) | |

Total other expenses | 15.4 | | | 11.0 | | | 66.0 | | | 44.5 | |

| Loss before income taxes | (202.3) | | | (465.7) | | | (134.2) | | | (252.9) | |

| | | | | | | |

| Income tax benefit | (111.7) | | | (104.9) | | | (95.0) | | | (63.8) | |

Effective tax rate | 55.2 | % | | 22.5 | % | | 70.7 | % | | 25.2 | % |

| | | | | | | |

| Net loss | (90.6) | | | (360.8) | | | (39.2) | | | (189.1) | |

| | | | | | | |

| Less: net earnings (loss) attributable to noncontrolling interests | 0.6 | | | 0.8 | | | 0.4 | | | (0.8) | |

| Net loss attributable to Wolverine World Wide, Inc. | $ | (91.2) | | | $ | (361.6) | | | $ | (39.6) | | | $ | (188.3) | |

| Diluted loss per share | $ | (1.15) | | | $ | (4.59) | | | $ | (0.51) | | | $ | (2.37) | |

| | | | | | | |

Supplemental information: | | | | | | | |

| Net loss used to calculate diluted loss per share | $ | (91.4) | | | $ | (361.8) | | | $ | (40.3) | | | $ | (188.9) | |

| Shares used to calculate diluted loss per share | 79.5 | | | 78.8 | | | 79.4 | | | 79.7 | |

| | | | | | | |

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED BALANCE SHEETS

(Unaudited)

(In millions)

| | | | | | | | | | | | | |

| December 30,

2023 | | December 31,

2022 | | |

ASSETS | | | | | |

Cash and cash equivalents | $ | 179.0 | | | $ | 131.5 | | | |

Accounts receivables, net | 230.8 | | | 241.7 | | | |

Inventories, net | 373.6 | | | 745.2 | | | |

| Current assets held for sale | 160.6 | | | 67.9 | | | |

Other current assets | 81.1 | | | 79.0 | | | |

Total current assets | 1,025.1 | | | 1,265.3 | | | |

Property, plant and equipment, net | 96.3 | | | 136.2 | | | |

Lease right-of-use assets | 118.2 | | | 174.7 | | | |

Goodwill and other indefinite-lived intangibles | 601.2 | | | 759.0 | | | |

Other noncurrent assets | 222.0 | | | 157.5 | | | |

Total assets | $ | 2,062.8 | | | $ | 2,492.7 | | | |

| | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

Accounts payable and other accrued liabilities | $ | 519.7 | | | $ | 636.2 | | | |

Lease liabilities | 34.7 | | | 39.1 | | | |

Current maturities of long-term debt | 10.0 | | | 10.0 | | | |

| Borrowings under revolving credit agreements | 305.0 | | | 425.0 | | | |

Total current liabilities | 869.4 | | | 1,110.3 | | | |

Long-term debt | 605.8 | | | 723.0 | | | |

Lease liabilities, noncurrent | 132.4 | | | 153.6 | | | |

Other noncurrent liabilities | 155.2 | | | 166.8 | | | |

Stockholders' equity | 300.0 | | | 339.0 | | | |

Total liabilities and stockholders' equity | $ | 2,062.8 | | | $ | 2,492.7 | | | |

WOLVERINE WORLD WIDE, INC.

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

(In millions)

| | | | | | | | | | | |

| Fiscal Year Ended |

| December 30,

2023 | | December 31,

2022 |

| OPERATING ACTIVITIES: | | | |

| Net loss | $ | (39.2) | | | $ | (189.1) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 35.1 | | | 34.6 | |

| Deferred income taxes | (95.8) | | | (105.7) | |

| Stock-based compensation expense | 15.2 | | | 33.4 | |

| | | |

| Pension and SERP expense | 0.7 | | | 9.3 | |

| | | |

| | | |

| Impairment of long-lived assets | 185.3 | | | 428.7 | |

| Environmental and other related costs | (55.1) | | | (23.0) | |

| Gain on sale of business, trademarks and long-lived assets | (90.4) | | | (90.0) | |

| Other | (2.0) | | | (2.7) | |

| Changes in operating assets and liabilities | 168.0 | | | (274.4) | |

| Net cash provided by (used in) operating activities | 121.8 | | | (178.9) | |

| | | |

| INVESTING ACTIVITIES: | | | |

| | | |

| Additions to property, plant and equipment | (14.6) | | | (36.5) | |

| Proceeds from sale of business, trademarks and long-lived assets | 188.9 | | | 90.0 | |

| Investment in joint ventures | — | | | (2.8) | |

| | | |

| Other | (2.7) | | | 3.9 | |

| Net cash provided by investing activities | 171.6 | | | 54.6 | |

| | | |

| FINANCING ACTIVITIES: | | | |

| Payments under revolving credit agreements | (743.0) | | | (740.0) | |

| Borrowings under revolving credit agreements | 623.0 | | | 940.0 | |

| Proceeds from company-owned insurance policies | — | | | 30.5 | |

| | | |

| Payments on long-term debt | (118.3) | | | (10.0) | |

| Payments of debt issuance costs | (0.9) | | | — | |

| | | |

| Cash dividends paid | (32.6) | | | (32.8) | |

| Purchase of common stock for treasury | — | | | (81.3) | |

Employee taxes paid under stock-based compensation plans | (5.8) | | | (7.7) | |

| Proceeds from the exercise of stock options | 0.1 | | | 1.4 | |

| Contributions from noncontrolling interests | 31.2 | | | 7.0 | |

| | | |

| Net cash provided by (used in) financing activities | (246.3) | | | 107.1 | |

| | | |

| Effect of foreign exchange rate changes | 2.0 | | | (9.0) | |

| Increase (decrease) in cash and cash equivalents | 49.1 | | | (26.2) | |

| | | |

| Cash and cash equivalents at beginning of the year | 135.5 | | | 161.7 | |

| Cash and cash equivalents at end of the year | $ | 184.6 | | | $ | 135.5 | |

The following tables contain information regarding the non-GAAP financial measures used by the Company in the presentation of its financial results:

WOLVERINE WORLD WIDE, INC.

Q4 2023 RECONCILIATION TABLES

RECONCILIATION OF REPORTED REVENUE TO ADJUSTED

REVENUE ON A CONSTANT CURRENCY BASIS*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis 2023-Q4 | | Foreign Exchange Impact | | Constant Currency Basis 2023-Q4 | | GAAP Basis 2022-Q4 | | Reported Change | | Constant Currency Change |

| REVENUE | | | | | | | | | | | |

| Active Group | $ | 341.3 | | | $ | (4.3) | | | $ | 337.0 | | | $ | 397.6 | | | (14.2) | % | | (15.2) | % |

| Work Group | 125.3 | | | (1.2) | | | 124.1 | | | 154.5 | | | (18.9) | % | | (19.7) | % |

| Other | 60.1 | | | 2.2 | | | 62.3 | | | 112.9 | | | (46.8) | % | | (44.8) | % |

| Total | $ | 526.7 | | | $ | (3.3) | | | $ | 523.4 | | | $ | 665.0 | | | (20.8) | % | | (21.3) | % |

RECONCILIATION OF REPORTED REVENUE

TO ADJUSTED REVENUE*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Divestiture (1) | | | | | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2023 Q4 | $ | 526.7 | | | $ | 5.5 | | | | | | | $ | 521.2 | | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2022 Q4 | $ | 665.0 | | | $ | 30.4 | | | | | | | $ | 634.6 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Q4 2023 adjustments reflect the Wolverine Leathers business results included in the consolidated condensed statement of operations. Q4 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED GROSS MARGIN

TO ADJUSTED GROSS MARGIN *

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | Divestiture (2) | | As Adjusted | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Gross Profit - Fiscal 2023 Q4 | $ | 193.0 | | | $ | — | | | | | $ | (0.6) | | | $ | 192.4 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Gross margin | 36.6 | % | | | | | | | | 36.9 | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Gross Profit - Fiscal 2022 Q4 | $ | 224.2 | | | $ | 1.0 | | | | | $ | (8.3) | | | $ | 216.9 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Gross margin | 33.7 | % | | | | | | | | 34.2 | % | | | | | | | | | | |

(1)Q4 2022 adjustment reflects $1.0 million of costs associated with Sweaty Betty® integration. | | | | |

(2)Q4 2023 adjustments reflect the Wolverine Leathers business results included in the consolidated condensed statement of operations. Q4 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

TO ADJUSTED SELLING, GENERAL AND ADMINISTRATIVE EXPENSES*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustment (1) | | | | Divestiture (2) | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

Selling, general and administrative expenses - Fiscal 2023 Q4 | $ | 379.9 | | | $ | (168.8) | | | | | $ | (0.6) | | | $ | 210.5 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Selling, general and administrative expenses - Fiscal 2022 Q4 | $ | 678.9 | | | $ | (440.6) | | | | | $ | (10.2) | | | $ | 228.1 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

|

(1)Q4 2023 adjustments reflect $129.4 million for non-cash impairments of long-lived assets, $31.3 million of reorganization costs, $17.6 million of environmental and other related costs net of recoveries, $3.1 million of costs associated with divestitures, partially offset by $12.6 million gain on the sale of businesses, trademarks and long-lived assets. Q4 2022 adjustments reflect $428.7 million for a non-cash impairment of the Sperry® trade name and the Sweaty Betty® trade name and goodwill, $9.1 million for reorganization costs, $1.1 million of environmental and other related costs net of recoveries, $0.9 million of costs associated with Sweaty Betty® integration and $0.8 of receivables securitization transaction costs. | | | | |

(2)Q4 2023 adjustments reflect the Wolverine Leathers business results included in the consolidated condensed statement of operations. Q4 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. |

RECONCILIATION OF REPORTED OPERATING MARGIN

TO ADJUSTED OPERATING MARGIN

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | Divestiture (2) | | As Adjusted | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Operating Profit - Fiscal 2023 Q4 | $ | (186.9) | | | $ | 168.8 | | | | | $ | — | | | $ | (18.1) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Operating margin | (35.5) | % | | | | | | | | (3.5) | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Operating Profit - Fiscal 2022 Q4 | $ | (454.7) | | | $ | 441.6 | | | | | $ | 1.9 | | | $ | (11.2) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Operating margin | (68.4) | % | | | | | | | | (1.8) | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

|

(1)Q4 2023 adjustments reflect $129.4 million for non-cash impairments of long-lived assets, $31.3 million of reorganization costs, $17.6 million of environmental and other related costs net of recoveries, $3.1 million of costs associated with divestitures, partially offset by $12.6 million gain on the sale of businesses, trademarks and long-lived assets. Q4 2022 adjustments reflect $428.7 million for a non-cash impairment of the Sperry® trade name and the Sweaty Betty® trade name and goodwill, $9.1 million for reorganization costs, $1.1 million of environmental and other related costs net of recoveries, $1.9 million of costs associated with Sweaty Betty® integration and $0.8 of receivables securitization transaction costs. | | | | |

(2)Q4 2023 adjustments reflect the Wolverine Leathers business results included in the consolidated condensed statement of operations. Q4 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED DILUTED EPS TO ADJUSTED

DILUTED EPS ON A CONSTANT CURRENCY BASIS*

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | Divestiture (2) | | As Adjusted | | Foreign Exchange Impact | | As Adjusted

EPS On a Constant Currency Basis | | | | | | |

| | | | | | | | | | | | | | | | | |

EPS - Fiscal 2023 Q4 | $ | (1.15) | | | $ | 0.85 | | | $ | — | | | $ | (0.30) | | | $ | 0.01 | | | $ | (0.29) | | | | | | | |

| | | | | | | | | | | | | | | | | |

EPS - Fiscal 2022 Q4 | $ | (4.59) | | | $ | 4.44 | | | $ | 0.02 | | | $ | (0.13) | | | | | | | | | | | |

(1)Q4 2023 adjustments reflect non-cash impairments of long-lived assets, reorganization costs, environmental and other related costs net of recoveries, costs associated with divestitures, partially offset by gain on the sale of businesses, trademarks and long-lived assets and SERP curtailment gain. Q4 2022 adjustment reflects non-cash impairment of the Sperry® trade name and the Sweaty Betty® trade name and goodwill, reorganization costs, environmental and other related costs net of recoveries, costs associated with Sweaty Betty® integration and receivables securitization transaction costs | | | | | | |

(2)Q4 2023 adjustments reflect the Wolverine Leathers business results included in the consolidated condensed statement of operations. Q4 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. | | |

RECONCILIATION OF REPORTED INVENTORY

TO ADJUSTED INVENTORY*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Divestiture (1) | | | | | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

Inventory - 2023 Q4 | $ | 373.6 | | | $ | — | | | | | | | $ | 373.6 | | | | | | | |

| | | | | | | | | | | | | | | |

Inventory - 2023 Q3 | $ | 563.8 | | | $ | 100.6 | | | | | | | $ | 463.2 | | | | | | | |

| | | | | | | | | | | | | | | |

Inventory - 2023 Q2 | $ | 647.9 | | | $ | 113.3 | | | | | | | $ | 534.6 | | | | | | | |

| | | | | | | | | | | | | | | |

Inventory - 2023 Q1 | $ | 725.9 | | | $ | 120.5 | | | | | | | $ | 605.4 | | | | | | | |

| | | | | | | | | | | | | | | |

Inventory - 2022 Q4 | $ | 745.2 | | | $ | 132.0 | | | | | | | $ | 613.2 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Adjustments reflect the Sperry business and consolidated China joint ventures inventory included in the consolidated condensed balance sheet. | | | | |

2023 FULL-YEAR RECONCILIATION TABLES

RECONCILIATION OF REPORTED REVENUE TO ADJUSTED

REVENUE ON A CONSTANT CURRENCY BASIS*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis 2023 | | Foreign Exchange Impact | | Constant Currency Basis 2023 | | GAAP Basis 2022 | | Reported Change | | Constant Currency Change |

| REVENUE | | | | | | | | | | | |

| Active Group | $ | 1,439.1 | | | 3.5 | | | $ | 1,442.6 | | | $ | 1,570.2 | | | (8.3) | % | | (8.1) | % |

| Work Group | 480.6 | | | (2.4) | | | 478.2 | | | 590.5 | | | (18.6) | % | | (19.0) | % |

| Other | 323.2 | | | 2.3 | | | 325.5 | | | 524.1 | | | (38.3) | % | | (37.9) | % |

| Total | $ | 2,242.9 | | | $ | 3.4 | | | $ | 2,246.3 | | | $ | 2,684.8 | | | (16.5) | % | | (16.3) | % |

RECONCILIATION OF REPORTED REVENUE

TO ADJUSTED REVENUE*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Divestiture (1) | | | | | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2023 | $ | 2,242.9 | | | $ | 43.6 | | | | | | | $ | 2,199.3 | | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2022 | $ | 2,684.8 | | | $ | 152.7 | | | | | | | $ | 2,532.1 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)2023 adjustments reflect the Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED GROSS MARGIN

TO ADJUSTED GROSS MARGIN*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | Divestiture (2) | | As Adjusted | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gross Profit - Fiscal 2023 | $ | 872.5 | | | $ | 0.4 | | | | | $ | (7.7) | | | $ | 865.2 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gross margin | 38.9 | % | | | | | | | | 39.3 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gross Profit - Fiscal 2022 | $ | 1,070.4 | | | $ | 1.7 | | | | | $ | (42.1) | | | $ | 1,030.0 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gross margin | 39.9 | % | | | | | | | | 40.7 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1)2023 adjustment reflects $0.4 million of costs associated with divestitures. 2022 adjustment reflects $1.7 million of costs associated with Sweaty Betty® integration. | | | | |

(2)2023 adjustments reflect the Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

TO ADJUSTED SELLING, GENERAL AND ADMINISTRATIVE EXPENSES*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustment (1) | | | | Divestiture (2) | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

| Selling, general and administrative expenses - Fiscal 2023 | $ | 940.7 | | | $ | (136.7) | | | | | $ | (6.3) | | | $ | 797.7 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Selling, general and administrative expenses - Fiscal 2022 | $ | 1,278.8 | | | $ | (384.3) | | | | | $ | (37.9) | | | $ | 856.6 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

|

(1)2023 adjustments reflect $185.3 million for non-cash impairments of long-lived assets, $47.1 million of reorganization costs, $5.1 million of costs associated with divestitures, partially offset by $90.4 million gain on the sale of businesses, trademarks and long-lived assets and $10.4 million of environmental and other related costs net of recoveries. 2022 adjustments reflect $428.7 million for a non-cash impairment of the Sperry® trade name and the Sweaty Betty® trade name and goodwill, $9.1 million for reorganization costs, $33.7 million of environmental and other related costs net of recoveries, $2.0 million of costs associated with Sweaty Betty® integration and $0.8 million of receivables securitization transaction costs, partially offset by $90.0 gain on the sale of the Champion trademarks. | | | | |

(2)2023 adjustments reflect the Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. | | |

RECONCILIATION OF REPORTED OPERATING MARGIN

TO ADJUSTED OPERATING MARGIN*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | Divestiture (2) | | As Adjusted | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) - Fiscal 2023 | $ | (68.2) | | | $ | 137.1 | | | | | $ | (1.4) | | | $ | 67.5 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating margin | (3.0) | % | | | | | | | | 3.1 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) - Fiscal 2022 | $ | (208.4) | | | $ | 386.0 | | | | | $ | (4.2) | | | $ | 173.4 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating margin | (7.8) | % | | | | | | | | 6.8 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1)2023 adjustments reflect $185.3 million for non-cash impairments of long-lived assets, $47.1 million of reorganization costs, $5.5 million of costs associated with divestitures, partially offset by $90.4 million gain on the sale of businesses, trademarks and long-lived assets and $10.4 million of environmental and other related costs net of recoveries. 2022 adjustments reflect $428.7 million for a non-cash impairment of the Sperry® trade name and the Sweaty Betty® trade name and goodwill, $9.1 million for reorganization costs, $33.7 million of environmental and other related costs net of recoveries, $3.7 million of costs associated with Sweaty Betty® integration and $0.8 million of receivables securitization transaction costs, partially offset by $90.0 gain on the sale of the Champion trademarks. | | | | |

(2)2023 adjustments reflect the Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED DILUTED EPS TO ADJUSTED

DILUTED EPS ON A CONSTANT CURRENCY BASIS*

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | Divestiture (2) | | As Adjusted | | Foreign Exchange Impact | | As Adjusted

EPS On a Constant Currency Basis |

| | | | | | | | | | | |

| EPS - Fiscal 2023 | $ | (0.51) | | | $ | 0.57 | | | $ | (0.01) | | | $ | 0.05 | | | $ | 0.10 | | | $ | 0.15 | |

| | | | | | | | | | | |

| EPS - Fiscal 2022 | $ | (2.37) | | | $ | 3.78 | | | $ | (0.04) | | | $ | 1.37 | | | | | |

(1)2023 adjustments reflect non-cash impairments of long-lived assets, reorganization costs, costs associated with divestitures, debt modification costs, partially offset by gain on the sale of businesses, trademarks and long-lived assets, environmental and other related costs net of recoveries, and SERP curtailment gain. 2022 adjustment reflects non-cash impairment of the Sperry® trade name and the Sweaty Betty® trade name and goodwill, reorganization costs, environmental and other related costs net of recoveries, costs associated with Sweaty Betty® integration and receivables securitization transaction costs, partially offset by gain on the sale of the Champion trademark. |

(2)2023 adjustments reflect the Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. 2022 adjustments reflect results for the Keds business, Wolverine Leathers business and Hush Puppies prior to the license model change included in the consolidated condensed statement of operations. |

DIVESTITURE

FINANCIAL SUMMARY

(Unaudited)

(In millions, except per share amounts)

In order to provide visibility regarding the financial impact of completed divestitures, and the impact of the transition of Hush Puppies® from a wholesale model to a license model on July 1, 2023, the Company has provided additional information within the supplemental table below. The items included in the tables represent amounts that are reflected in the reported fiscal 2023 and 2022 results that are related to businesses the Company has sold or announced that the Company does not intend to include the business in the Company's long-term plans. The Company believes providing the following information is helpful to better understand the impact of the divestitures and transition to a license model on the Company's ongoing business.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 | | Q2 | | Q3 | | Q4 | | 2023

Full-Year |

Revenue - Impact |

Keds business (1) | $ | 6.5 | | | $ | — | | | $ | — | | | $ | — | | | $ | 6.5 |

Wolverine Leathers business (2) | 12.5 | | | 10.9 | | | 8.2 | | | 5.5 | | | 37.1 | |

Total Revenue - Impact | $ | 19.0 | | | $ | 10.9 | | | $ | 8.2 | | | $ | 5.5 | | | $ | 43.6 | |

| | | | | | | | | |

Operating profit - Impact | | | | | | | | | |

Keds business (1) | $ | (1.9) | | | $ | — | | | $ | — | | | $ | — | | | $ | (1.9) | |

Wolverine Leathers business (2) | 1.4 | | | 0.8 | | | 1.1 | | | — | | | 3.3 | |

Total Operating profit - Impact | $ | (0.5) | | | $ | 0.8 | | | $ | 1.1 | | | $ | — | | | $ | 1.4 | |

| | | | | | | | | |

Net earnings per share - Impact | $ | (0.01) | | $ | 0.01 | | $ | 0.01 | | $ | — | | $ | 0.01 |

| | | | | | | | | |

| Q1 | | Q2 | | Q3 | | Q4 | | 2022

Full-Year |

Revenue - Impact |

Keds business (1) | $ | 20.4 | | | $ | 24.0 | | | $ | 21.3 | | | $ | 17.1 | | | $ | 82.8 |

Wolverine Leathers business (2) | 18.5 | | | 17.7 | | | 14.0 | | | 8.4 | | | 58.6 | |

Hush Puppies (3) | — | | — | | 6.4 | | | 4.9 | | | 11.3 | |

Total Revenue - Impact | $ | 38.9 | | | $ | 41.7 | | | $ | 41.7 | | | $ | 30.4 | | | $ | 152.7 | |

| | | | | | | | | |

Operating profit - Impact | | | | | | | | | |

Keds business (1) | $ | 1.5 | | | $ | 0.5 | | | $ | 0.4 | | | $ | (0.9) | | | $ | 1.5 |

Wolverine Leathers business (2) | 1.4 | | | 1.7 | | | 0.9 | | | 0.4 | | | 4.4 | |

Hush Puppies (3) | — | | — | | (0.3) | | | (1.4) | | | (1.7) | |

Total Operating profit - Impact | $ | 2.9 | | | $ | 2.2 | | | $ | 1.0 | | | $ | (1.9) | | | $ | 4.2 | |

| | | | | | | | | |

Net earnings per share - Impact | $ | 0.03 | | $ | 0.02 | | $ | 0.01 | | $ | (0.02) | | $ | 0.04 |

(1) The Keds® business line item reflects the revenue and operating profit from sale of Keds® products that will not reoccur after the Company's first period in fiscal 2023 as a result of the sale of the global Keds® business effective February 4, 2023.

(2) The Wolverine Leathers business line item reflects revenue and operating profit from the Wolverine Leathers business that will not reoccur after the Wolverine Leathers business is sold. The Company divested the U.S. Wolverine Leathers business in August 2023 and divested the non-U.S. Wolverine Leathers business in December 2023.

(3) The Hush Puppies® line item represents financial results associated with the Hush Puppies® United States and Canada operations prior to the transition from a wholesale model to a license model on July 1, 2023, net of estimated license revenue.

2024 GUIDANCE

SPERRY DIVESTITURE AND

2024 GUIDANCE COMPARISON

RECONCILIATIONS

(Unaudited)

(In millions, except per share amounts)

In order to provide visibility regarding the financial impact of the Sperry® business divestiture, the Company has provided additional information within the supplemental table below. The items included in the table represent amounts related to the Sperry® business that are reflected in the Company’s reported fiscal year 2023 results. The Sperry® business financial results are excluded for purposes of comparison of the 2024 guidance to the adjusted 2023 results. Reconciliation tables are provided below for 2023 GAAP results to the 2023 as adjusted results included in any 2024 guidance comparisons to 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 | | Q2 | | Q3 | | Q4 | | 2023

YTD |

Sperry business (1) |

Revenue | $ | 62.9 | | | $ | 57.4 | | | $ | 46.2 | | | $ | 40.7 | | | $ | 207.2 |

| | | | | | | | | |

Operating profit | $ | (2.3) | | | $ | 0.2 | | | $ | (4.0) | | | $ | (4.2) | | | $ | (10.3) |

| | | | | | | | | |

| Net Earnings per share | $ | (0.02) | | | $ | — | | | $ | (0.04) | | | $ | (0.04) | | | $ | (0.10) |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Operating profit adjusted (2) | $ | 2.5 | | | $ | 4.6 | | | $ | (0.5) | | | $ | (1.1) | | | $ | 5.5 |

(1) The Sperry® business reflects the revenue and operating profit from sale of Sperry® products that will not reoccur after the Company's first period in fiscal 2024 as a result of the sale of the global Sperry® business effective January 10, 2024.

(2) Operating profit adjusted represents operating profit of the Sperry® business before cost allocations for Company resources shared by all Company brands, resources which were not sold as part of the Sperry® divestiture and the costs for which the Company will continue to bear.

The Company believes operating profit before internal cost allocations for shared resources provides useful information to both management and investors because it provides insights into the Sperry brand contribution to the Company’s consolidated results of operations, which contributions will not reoccur following the divestiture of the Sperry brand. Management does not, nor should investors, consider this financial measure in isolation from, or as a substitute for financial information prepared in accordance with GAAP.

RECONCILIATION OF 2023 REPORTED REVENUE

TO ADJUSTED REVENUE FOR COMPARISON

TO 2024 GUIDANCE*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Keds and Leathers Divestiture (1) | | Sperry Divestiture (2) | | | | As Adjusted | | | | | | |

| | | | | | | | | | | | | | | |

Revenue - Fiscal 2023 | $ | 2,242.9 | | | $ | 43.6 | | | $ | 207.2 | | | | | $ | 1,992.1 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Adjustments reflect the Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. | | | | |

(2)Adjustments reflect the Sperry business results included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED 2023 OPERATING MARGIN

TO ADJUSTED OPERATING MARGIN FOR COMPARISON

TO 2024 GUIDANCE*

(Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | | | Keds and Leathers Divestiture (2) | | Sperry Divestiture (3) | | As Adjusted | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) - Fiscal 2023 | $ | (68.2) | | | $ | 137.1 | | | | | $ | (1.4) | | | $ | 10.3 | | | $ | 77.8 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Operating margin | (3.0) | % | | | | | | | | | | 3.9 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1)Adjustments reflect $185.3 million for a non-cash impairment of long-lived assets, $47.1 million of reorganization costs, $5.5 million of costs associated with divestitures, partially offset by $90.4 million gain on the sale of businesses, trademarks and long-lived assets and $10.4 million of environmental and other related costs net of recoveries. | | | | |

(2)Adjustments reflect the Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. | | | | |

(3)Adjustments reflect the Sperry business results included in the consolidated condensed statement of operations. | | | | |

RECONCILIATION OF REPORTED 2023 DILUTED EPS TO ADJUSTED

DILUTED EPS FOR COMPARISON

TO 2024 GUIDANCE*

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Adjustments (1) | | Keds and Leathers Divestiture (2) | | Sperry Divestiture (3) | | As Adjusted | | |

| | | | | | | | | | | |

| EPS - Fiscal 2023 | $ | (0.51) | | | $ | 0.57 | | | $ | (0.01) | | | $ | 0.10 | | | $ | 0.15 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1)Adjustments reflect non-cash impairment of long-lived assets, reorganization costs, costs associated with divestitures, debt modification costs, partially offset by gain on the sale of businesses, trademarks and long-lived assets, environmental and other related costs net of recoveries, and SERP curtailment gain. |

(2)Adjustments reflect the Keds business and Wolverine Leathers business results included in the consolidated condensed statement of operations. |

(3)Adjustments reflect the Sperry business results included in the consolidated condensed statement of operations. |

2024 GUIDANCE RECONCILIATION TABLES

RECONCILIATION OF REPORTED GUIDANCE TO ADJUSTED GUIDANCE,

REPORTED DILUTED EPS GUIDANCE TO ADJUSTED DILUTED EPS

GUIDANCE AND SUPPLEMENTAL INFORMATION*

(Unaudited)

(In millions, except earnings per share)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP Basis | | Divestiture Adjustments (1) | | Other Adjustments (2) | | As Adjusted | | | | |

| | | | | | | | | | | |

| Revenue - Fiscal 2024 Full Year | $1,704 - $1,754 | | $(4) | | | | $1,700 - $1,750 | | | | |

| | | | | | | | | | | |

| Gross Margin - Fiscal 2024 Full Year | 44.5 | % | | –% | | | | 44.5 | % | | | | |

| | | | | | | | | | | |

| Operating Margin - Fiscal 2024 Full Year | 5.7 | % | | 0.3 | % | | 1.0 | % | | 7.0 | % | | | | |

| | | | | | | | | | | |

| Dilutive EPS - Fiscal 2024 Full Year | $0.43 -$0.63 | | $0.05 | | $0.17 | | $0.65 - $0.85 | | | | |

| | | | | | | | | | | |

| Fiscal 2024 Full Year Supplemental information: | | | | | | | | | | | |

| | | | | | | | | | | |

| Net Earnings | $35 -$51 | | $4 | | $14 | | $53 - $69 | | | | |

| | | | | | | | | | | |

| Net Earnings used to calculate diluted earnings per share | $34 - $50 | | $4 | | $14 | | $52 - $68 | | | | |

| | | | | | | | | | | |

| Shares used to calculate diluted earnings per share | 79.9 | | | | | | 79.9 | | | | |

| | | | | | | | | | | |

(1)2024 adjustments reflect financial results for the Sperry® business and Sperry® stores not divested which the Company is closing in 2024. |

(2)2024 adjustments reflect estimated environmental and other related costs net of recoveries and reorganization costs. |

*To supplement the consolidated condensed financial statements presented in accordance with Generally Accepted Accounting Principles ("GAAP"), the Company describes what certain financial measures would have been if environmental and other related costs net of recoveries, non-cash impairment of long-lived assets, reorganization costs, debt modification costs, gain on the sale of businesses, trademarks and long-lived assets, costs associated with divestitures, SERP curtailment gain and costs associated with Sweaty Betty® integration were excluded. The financial results of the ongoing business exclude financial results from the Keds business, Wolverine Leathers business and reflect an adjustment for the transition of our Hush Puppies North America business to a licensing model in the second half of 2023. The outlook for 2024, and comparable results from 2023, in each case, for our ongoing business now also exclude the impact of Sperry, which was sold in January 2024. The Company believes these non-GAAP measures provide useful information to both management and investors by increasing comparability to the prior period by adjusting for certain items that may not be indicative of the Company's core ongoing operating business results and to better identify trends in the Company's ongoing business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company on a comparable basis.

The constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates. The Company believes providing constant currency information provides valuable supplemental information regarding results of operations, consistent with how the Company evaluates performance. The Company calculates constant currency by converting the current-period local currency financial results using the prior period exchange rates and comparing these adjusted amounts to the Company's current period reported results.

Management does not, nor should investors, consider such non-GAAP financial measures in isolation from, or as a substitution for, financial information prepared in accordance with GAAP. A reconciliation of all non-GAAP measures included in this press release, to the most directly comparable GAAP measures are found in the financial tables above.

Wolverine Worldwide Investor Presentation | Fourth Quarter 2023 Ending December 30th, 2023

Forward-Looking Statements + Investor Presentation | 4Q23 2 This presentation contains forward-looking statements, including statements regarding: anticipated benefits of the Company’s global platforms and strategic transformation, including profitable growth and improved operating cash flow, opportunity to drive improvement in inventory, annual run rate savings and fiscal 2024 operating margin, lower fiscal 2024 supply chain costs, investments in brand-building; the expected results of the Company’s three-year value creation model, including total shareholder return, revenue growth, cash flow from operations, EPS growth, capital allocation and dividend expectations; and projected fiscal year 2024 and Q1 2024 brand performance.. In addition, words such as "estimates," "anticipates," "believes," "forecasts," "step," "plans," "predicts," "focused," "projects," "outlook," "is likely," "expects," "intends," "should," "will," "confident," variations of such words, and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions ("Risk Factors") that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence. Risk Factors include, among others: changes in general economic conditions, employment rates, business conditions, interest rates, tax policies, inflationary pressures and other factors affecting consumer spending in the markets and regions in which the Company’s products are sold; the inability for any reason to effectively compete in global footwear, apparel and consumer-direct markets; the inability to maintain positive brand images and anticipate, understand and respond to changing footwear and apparel trends and consumer preferences; the inability to effectively manage inventory levels; increases or changes in duties, tariffs, quotas or applicable assessments in countries of import and export; foreign currency exchange rate fluctuations; currency restrictions; supply chain or other capacity constraints, production disruptions, including reduction in operating hours, labor shortages, and facility closures resulting in production delays at the Company’s manufactures, quality issues, price increases or other risks associated with foreign sourcing; the cost, including the effect of inflationary pressures, and availability of raw materials, inventories, services and labor for contract manufacturers; labor disruptions; changes in relationships with, including the loss of, significant wholesale customers; risks related to the significant investment in, and performance of, the Company’s consumer- direct operations; risks related to expansion into new markets and complementary product categories as well as consumer direct operations; the impact of seasonality and unpredictable weather conditions; the impact of changes in general economic conditions and/or the credit markets on the Company’s manufacturers, distributors, suppliers, joint venture partners and wholesale customers; changes in the Company’s effective tax rates; failure of licensees or distributors to meet planned annual sales goals or to make timely payments to the Company; the risks of doing business in developing countries, and politically or economically volatile areas; the ability to secure and protect owned intellectual property or use licensed intellectual property; the impact of regulation, regulatory and legal proceedings and legal compliance risks, including compliance with federal, state and local laws and regulations relating to the protection of the environment, environmental remediation and other related costs, and litigation or other legal proceedings relating to the protection of the environment or environmental effects on human health; the risks of breach of the Company’s databases or other systems, or those of its vendors, which contain certain personal information, payment card data or proprietary information, due to cyberattack or other similar events; problems affecting the Company’s supply chain or distribution system, including service interruptions at shipping and receiving ports; strategic actions, including new initiatives and ventures, acquisitions and dispositions, and the new operating model for Merrell and Saucony businesses in China, and the Company’s success in integrating acquired businesses, and implementing new initiatives and ventures; risks related to stockholder activism; the potential effects of outbreaks of COVID-19 or future health crises on the Company’s business, operations, financial results and liquidity; the risk of impairment to goodwill and other intangibles; changes in future pension funding requirements and pension expenses; and additional factors discussed in the Company’s reports filed with the Securities and Exchange Commission and exhibits thereto. The foregoing Risk Factors, as well as other existing Risk Factors and new Risk Factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these or other risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Furthermore, the Company undertakes no obligation to update, amend, or clarify forward-looking statements. Non-GAAP Information Measures referred to in this presentation as “adjusted” financial results and the financial results of the "ongoing business" are non-GAAP measures. Adjusted financial results exclude environmental and other related costs net of recoveries, non-cash impairment of long-lived assets, reorganization costs, debt modification costs, gain on the sale of businesses, trademarks and long-lived assets, costs associated with divestitures, SERP curtailment gain, receivables securitization transaction costs, and costs associated with Sweaty Betty® integration. The financial results of the ongoing business exclude financial results from the Keds business, Wolverine Leathers business and reflect an adjustment for the transition of our Hush Puppies North America business to a licensing model in the second half of 2023. The Company also presents constant currency information, which is a non-GAAP measure that excludes the impact of fluctuations in foreign currency exchange rates. The Company calculates constant currency basis by converting the current-period local currency financial results using the prior period exchange rates and comparing these adjusted amounts to the Company's current period reported results. The Company believes these non-GAAP measures provide useful information to both management and investors because they increase the comparability of current period results to prior period results by adjusting for certain items that may not be indicative of core operating results and enable better identification of trends in our business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company on a comparable basis. Management does not, nor should investors, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. The Company has provided a reconciliation of the non-GAAP revenue financial measure to the directly comparable GAAP financial measure at the end of this presentation.

Vision: Consumer-Obsessed, Global Brand Builders + Investor Presentation | 4Q23 3 Portfolio of Authentic & Innovative Brands Focused on helping our consumers live healthier and more productive lives through product innovation and design Global Distribution Network & Powerful Platforms Enabling our brands to focus on consumers, products, and marketing and creating competitive advantages for key strategic capabilities Regions FY23 Revenue¹ (Outer) | FY23 Pairs¹ (Inner) Channels FY23 Revenue¹ 1. Ongoing business which excludes Keds, which was sold in February 2023, the U.S. Wolverine Leathers business, which was sold in August 2023, the non-U.S. Wolverine Leathers business, which was sold in December 2023. US EMEA Asia Pacific Latin America Canada Wholesale & 3P Distributors DTC eCom DTC Stores +

Authentic & Innovative Brands + Investor Presentation | 4Q23 Additional Brands: 1. US category share data for full year 2023 Global outdoor performance and lifestyle brand Est. 1983 Category-leading running innovation Est. 1898 Premium women’s activewear Est. 1998 Trusted work comfort technology Est. 1883 4 #1 Hike #1 Work Boots Agility Peak 5 ISPO Award Winner Torque DuraShocks® Flex Tech + Cushioning Foam Power Icon Bra Collection Personalized Fit + Air-light Guide 17 Max PWRRUN Cushioning Top 10 Run

Global Platforms Enabling Consumer Focus + Investor Presentation | 4Q23 5 International DT&E Licensing Global EMEA APAC LTAM Apparel Accessories Brands Systems& Platforms Data CX Sourcing Distribution Integrated Supply Chain Planning In-market knowledge & partnerships to build brands globally Model & category expertise to capture new, efficient business opportunities Strengthened processes to deliver the right product at the right place & time The technology and data to enable teams to drive the business Corporate Functions Legal Finance Human Resources Brands Commercial Drivers Competitive Advantage Enabler Lean Corporate Functions The Collective Insights & Innovation In-house Studio Creative & PR Insights & creative expertise to fuel innovation & storytelling Support to enable brands to focus on consumers & brand building

// 1. Stabilization // 2. Transformation // 3. Inflection to Growth Simplified and focused the business Portfolio focused on performance brands after significant rationalization, which generated approximately $380 million of proceeds 1Q23-1Q24, including the divestiture of the Sperry and Keds brands Redesigning the organization A more efficient organization focused on becoming a consumer-obsessed, global brand-building company Investment in brand building Committed to expanding gross margins and increasing marketing supporting our biggest growth opportunities Paid down debt Net debt $280 million lower at year-end compared to last year – resulting in bank- defined debt leverage of 2.9x Expanding profitability Line of sight to approximately $215 million of annual run rate savings and 7.0% operating margin in FY24, an increase of 310 basis points compared to FY23, resulting from comprehensive profit improvement initiatives Awesome product design & innovation On-trend, innovative product that addresses consumers’ biggest needs and style preferences Reduced inventory¹ Nearly 40% less inventory year-over-year, with an opportunity to drive further improvement through new integrated planning processes and SKU optimization Strengthening key capabilities New talent in many of the key brand leadership roles, establishment of the Collective (consumer insights, innovation, etc.), and investment in key platforms Amazing brand & product storytelling Differentiated stories told through modern demand creation channels that excite consumers about our brands and products Strategic Turnaround Unleashing Profitable Growth + Investor Presentation | 4Q23 6 The Company is executing its turnaround with great pace and urgency in three chapters: 1. Adjusted to reflect the exclusion of the Sperry business, consolidated China joint ventures, Keds business and Wolverine Leathers business. For more information for the ongoing business, see pages 19 – 25 for reconciliations to the most comparable GAAP measures

Stabilization + Investor Presentation | 4Q23 Simplified & Focused the Business Paid Down Debt Reduced Inventory $380 million in proceeds generated since the start of 2023 through January 2024 from the following transactions: —Sperry brand divestiture —Keds brand divestiture —Hush Puppies IP sale in Greater China —US & Asia Leathers business divestiture —Merrell & Saucony new operating model in China —Louisville distribution facility sale Net debt $280 million lower at year-end 2023 compared to year-end 2022 Inventory ended FY23 approximately $240 million lower than FY22 $360M $1,340M $1,020M $740M 1.5x 3.4x 2.7x 2.9x 0 1 2 3 4 5 6 0 250 500 750 1,000 1,250 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 Net Debt Bank-defined Leverage¹ $613M $605M $535M $463M $374M 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 -$240M Inventory² Inventory Reduction 7 1. Bank-defined leverage as calculated in accordance with our credit agreement 2. Adjusted to reflect the exclusion of the Sperry business, consolidated China joint ventures, Keds business and Wolverine Leathers business. For more information for the ongoing business, see pages 19 – 25 for reconciliations to the most comparable GAAP measures