UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 4 to

SCHEDULE 13G

[Rule 13d-102]

Under the Securities Exchange Act of 1934

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO

SECTION 240.13d-1(b), (c), and (d) AND AMENDMENTS THERETO FILED

PURSUANT TO SECTION 240.13d-2

Heritage

Insurance Holdings, Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

42727J102

(CUSIP Number)

December

31, 2023

(Date of Event Which Requires Filing of This Statement)

Check the appropriate box to designate the rule pursuant to which this

Schedule is filed:

CUSIP No. 42727J102

| 1. |

Names of Reporting Persons.

Raymond T. Hyer

|

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

|

(a) ☒

(b) ☐

|

| 3. |

SEC Use Only

|

|

| 4. |

Citizenship or Place of Organization

U.S.

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

5. |

Sole Voting Power

2,959,263

|

|

| 6. |

Shared Voting Power

580,000

|

|

7.

|

Sole Dispositive Power

2,959,263

|

|

8.

|

Shared Dispositive Power

580,000

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,711,263

|

|

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions)

|

☐ |

11.

|

Percent of Class Represented by Amount in Row (9)

13.75%(1)

|

|

| 12. |

Type of Reporting Person (See Instructions)

IN

|

|

(1) Based on an aggregate of 27,000,125 shares of common stock

outstanding as of December 19, 2023.

CUSIP No. 42727J102

| 1. |

Names of Reporting Persons.

The Kathleen Hays Hyer Revocable Trust UA 06/03/2013, a/k/a Kathleen A.

Hyer

|

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

|

(a) ☒

(b) ☐

|

| 3. |

SEC Use Only

|

|

| 4. |

Citizenship or Place of Organization

U.S.

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

5. |

Sole Voting Power

100,000

|

|

| 6. |

Shared Voting Power

0

|

|

7.

|

Sole Dispositive Power

100,000

|

|

8.

|

Shared Dispositive Power

0

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,711,263

|

|

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions)

|

☐ |

11.

|

Percent of Class Represented by Amount in Row (9)

13.75%(1)

|

|

| 12. |

Type of Reporting Person (See Instructions)

IN |

|

(1) Based on an aggregate of 27,000,125 shares of common stock

outstanding as of December 19, 2023.

CUSIP No. 42727J102

| 1. |

Names of Reporting Persons.

Tara Tira

|

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

|

(a) ☒

(b) ☐

|

| 3. |

SEC Use Only

|

|

| 4. |

Citizenship or Place of Organization

U.S.

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

5. |

Sole Voting Power

50,000

|

|

| 6. |

Shared Voting Power

0

|

|

7.

|

Sole Dispositive Power

50,000

|

|

8.

|

Shared Dispositive Power

0

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,711,263

|

|

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions)

|

☐ |

11.

|

Percent of Class Represented by Amount in Row (9)

13.75%(1)

|

|

| 12. |

Type of Reporting Person (See Instructions)

IN |

|

(1) Based on an aggregate of 27,000,125 shares of common stock outstanding

as of December 19, 2023.

CUSIP No. 42727J102

| 1. |

Names of Reporting Persons.

Sean W. Poole

|

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

|

(a) ☒

(b) ☐

|

| 3. |

SEC Use Only

|

|

| 4. |

Citizenship or Place of Organization

U.S.

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

5. |

Sole Voting Power

22,000

|

|

| 6. |

Shared Voting Power

120,000

|

|

7.

|

Sole Dispositive Power

22,000

|

|

8.

|

Shared Dispositive Power

120,000

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,711,263

|

|

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions)

|

☐ |

11.

|

Percent of Class Represented by Amount in Row (9)

13.75%(1)

|

|

| 12. |

Type of Reporting Person (See Instructions)

IN |

|

(1) Based on an aggregate of 27,000,125 shares of common stock outstanding

as of December 19, 2023.

CUSIP No. 42727J102

| 1. |

Names of Reporting Persons.

Futura Circuits Corp.

|

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

|

(a) ☒

(b) ☐

|

| 3. |

SEC Use Only

|

|

| 4. |

Citizenship or Place of Organization

Florida

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

5. |

Sole Voting Power

0 |

|

| 6. |

Shared Voting Power

460,000

|

|

7.

|

Sole Dispositive Power

0 |

|

8.

|

Shared Dispositive Power

460,000

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,711,263

|

|

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions)

|

☐ |

11.

|

Percent of Class Represented by Amount in Row (9)

13.75%(1)

|

|

| 12. |

Type of Reporting Person (See Instructions)

CO |

|

(1) Based on an aggregate of 27,000,125 shares of common stock outstanding

as of December 19, 2023.

CUSIP No. 42727J102

| 1. |

Names of Reporting Persons.

Hyer Family Partnership, LLC

|

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

|

(a) ☒

(b) ☐

|

| 3. |

SEC Use Only

|

|

| 4. |

Citizenship or Place of Organization

Florida

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

5. |

Sole Voting Power

0 |

|

| 6. |

Shared Voting Power

120,000

|

|

7.

|

Sole Dispositive Power

0 |

|

8.

|

Shared Dispositive Power

120,000

|

|

9.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,711,263

|

|

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions)

|

☐ |

11.

|

Percent of Class Represented by Amount in Row (9)

13.75%(1)

|

|

| 12. |

Type of Reporting Person (See Instructions)

OO |

|

(1) Based on an aggregate of 27,000,125 shares of common stock outstanding

as of December 19, 2023.

| ITEM 1. | (a) Name of Issuer: Heritage Insurance Holdings, Inc. (the “Issuer”) |

(b) Address of

Issuer’s Principal Executive Offices:

1401 N. Westshore Blvd.

Tampa, Florida 33607

| ITEM 2. | (a) Name of Person Filing: |

This Schedule 13G/A is being jointly filed by and

on behalf of (i) Raymond T. Hyer, a citizen of the United States (“RTH”), (ii) The Kathleen Hays Hyer Revocable

Trust UA 06/03/2013, a/k/a Kathleen A. Hyer, formerly a citizen of the United States and the spouse of RTH, (iii) Tara Tira, a citizen of the

United States and the daughter of RTH, (iv) Sean W. Poole, a citizen of the United States, (v) Futura Circuits Corp., a Florida

corporation that is 100% owned by RTH, and (vi) Hyer Family Partnership, LLC, a Florida limited liability company of which RTH has

the largest ownership percentage and of which Sean W. Poole serves as the Manager (the “Reporting Persons”).

The Reporting Persons have entered into a Joint Filing

Agreement, a copy of which has been filed with a prior Schedule 13G, pursuant to which the Reporting Persons have agreed to file this

Schedule 13G/A jointly in accordance with the provisions of Rule 13d-1(k) of the Securities Exchange Act of 1934, as amended.

| (b) | Address of Principal Business Office, or if None, Residence: |

The address of each of the Reporting Persons is 3919

E. 7th Ave, Tampa, Florida 33605.

| (c) | Citizenship or Place of Organization: |

Each

of Raymond T. Hyer, Kathleen A. Hyer, Tara Tira and Sean W. Poole is, or was, a citizen of the United States. The place of organization

of Futura Circuits Corp. and Hyer Family Partnership, LLC is Florida.

| (d) | Title of Class of Securities: |

This Schedule 13G/A relates to the Issuer’s

Common Stock, par value $0.001 per share.

| (e) | CUSIP Number:

42727J102 |

ITEM 3. IF THIS

STATEMENT IS FILED PURSUANT TO SS.240.13D-1(B) OR 240.13D-2(B) OR (C), CHECK WHETHER THE PERSON FILING IS A:

Not Applicable.

ITEM 4. OWNERSHIP.

The information required by Item 4 is set forth in Rows

5 – 11 of the cover pages hereto and incorporated by reference herein.

ITEM 5. OWNERSHIP OF FIVE PERCENT

OR LESS OF A CLASS.

Not Applicable.

ITEM 6. OWNERSHIP OF MORE THAN

FIVE PERCENT ON BEHALF OF ANOTHER PERSON.

Not Applicable.

ITEM 7. IDENTIFICATION AND

CLASSIFICATION OF THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING REPORTED ON BY THE PARENT HOLDING COMPANY.

Not Applicable.

ITEM 8. IDENTIFICATION AND CLASSIFICATION OF MEMBERS OF THE GROUP.

See Exhibit 2.

ITEM 9. NOTICE OF DISSOLUTION OF GROUP.

Not Applicable.

ITEM 10. CERTIFICATIONS.

By signing below I certify that, to the best of my

knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing

or influencing the control of the issuer of the securities and were not acquired and are not held in connection with or as a participant

in any transaction having that purpose or effect, other than activities solely in connection with a nomination under Section 240.14a-11.

SIGNATURES

After reasonable inquiry and to the

best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 20, 2024

| |

/s/ Raymond T. Hyer

Raymond T. Hyer

THE KATHLEEN HAYS HYER REVOCABLE TRUST UA 06/03/2013, A/K/A

KATHLEEN A. HYER

By: /s/ Raymond T. Hyer

Name: Raymond T. Hyer

Title: Co-Trustee

/s/ Tara Tira

Tara Tira

/s/ Sean W. Poole

Sean W. Poole

FUTURA CIRCUITS CORP.

a Florida corporation

By: /s/ Raymond T. Hyer

Name: Raymond T. Hyer

Title: President

HYER FAMILY PARTNERSHIP, LLC

a Florida corporation

By: /s/ Sean Poole

Name: Sean W. Poole

Title: Manager

|

Page

10 of 10

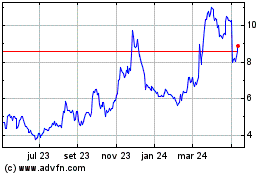

Heritage Insurance (NYSE:HRTG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

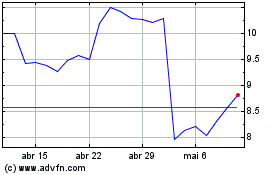

Heritage Insurance (NYSE:HRTG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024