0001788882FALSE00017888822024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________

FORM 8-K

__________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 21, 2024

__________

ROOT, INC.

(Exact name of Registrant as Specified in Its Charter)

__________

| | | | | | | | |

| Delaware | 001-39658 | 84-2717903 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

80 E. Rich Street, Suite 500 Columbus, Ohio | | 43215 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(866) 980-9431

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

__________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | | ROOT | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 21, 2024, Root, Inc. (the "Company") announced its financial results for the fourth quarter and the full fiscal year ended December 31, 2023 by issuing a letter to Shareholders (the "Letter"). A copy of the Letter is furnished as Exhibit 99.1 to this Current Report and incorporated by reference herein.

The information contained in Item 2.02 of this Form 8-K (including Exhibit 99.1 attached hereto) shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly provided by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit relating to Item 2.02 shall be deemed to be furnished:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ROOT, INC. |

| | |

| Dated: February 21, 2024 | | |

| By: | /s/ Alexander Timm |

| | Alexander Timm |

| | Chief Executive Officer and Director |

Q4 2023

Shareholder

Letter

Dear Root Shareholders

2023 was a transformative year for Root.

•We were one of the fastest growing auto insurance companies in the country

•We recorded an exceptional loss ratio as we benefited from our technology platform’s ability to drive pricing and underwriting improvements

•We ended 2023 firmly on the path to drive sustainable and profitable growth

Our Q4 2023 performance accelerated our momentum, as we reached record revenue and our best bottom-line quarterly results in the company’s history. In Q4 2023, we:

•Delivered strong and accelerated growth with 74% improvement in our operating loss of $12 million, compared to $48 million in Q4 2022

•Improved net combined ratio by 68 points to 112% in Q4 2023

•Grew total new writings almost five-fold and policies-in-force 55% compared to Q4 2022

•Produced an unencumbered cash increase of $5 million, compared to a decrease of $70 million in Q4 2022

These results were driven by the disciplined execution of our strategy. We have significantly bolstered our pricing and underwriting technology while optimizing our expense structure, putting us in an increasingly strong position throughout 2023.

Importantly, we believe we have now achieved scale in the business. This provides us the ability to make decisions for the long-term success of Root. Specifically, we believe we are positioned to identify opportunities to profitably gain market share, or if we determine that growth may not achieve our target returns, quickly shift our focus to drive near-term profitability.

We are still in the early chapters of disrupting the auto insurance industry. Our conviction remains unwavering that over the long-term, our ongoing investments in data science and technology will continue to provide better experiences and prices for our customers. We believe this will ultimately unlock long-term shareholder value.

Q4 2023 Highlights

All figures are compared to Q4 2022 unless otherwise stated.

•Grew policies-in-force 55% to 341,764

•Gross premiums written more than doubled to $279 million

•Gross premiums earned increased 50% to $214 million

•Gross written premium cession rate was 18% versus 55%

•Renewal premium % of gross premiums earned decreased to 42% as a result of new business growth

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

•Recognized a 66% gross accident period loss ratio, an 11-point improvement, driven by pricing and underwriting advancements; Gross LAE ratio improved 4 points to 9%

•Accident period severity was up 6% while frequency decreased 4% (tenure mix adjusted bodily injury, collision, and property damage coverages)

•Gross combined ratio improved 22% points to 110%; net combined ratio improved 68 points to 112%

•Reduced net loss 59% to $24 million, operating loss 74% to $12 million, and adjusted EBITDA 99% to a loss of $0.3 million

Key quarterly metrics

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

FY 2023 highlights

All figures are compared to FY 2022 unless otherwise stated.

•Gross premiums written increased 31% to $783 million

•Gross premiums earned decreased 1% to $636 million

•Gross written premium cession rate was 27% versus 55%

•Renewal premium % of gross premiums earned decreased to 59% as a result of new business growth

•Recognized a 66% gross accident period loss ratio, a 14-point improvement year-over-year, driven by pricing and underwriting advancements; Gross LAE ratio remained consistent at 10%

•Accident period severity increased 7% and frequency decreased 5% (tenure mix adjusted bodily injury, collision, and property damage coverages)

•Gross combined ratio improved 21 points to 116%; net combined ratio improved 62 points to 133%

•Reduced net loss 50% to $147 million, operating loss 61% to $101 million, and adjusted EBITDA 77% to a loss of $43 million

Key annual metrics

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Growth

We experienced strong growth in Q4 2023, with total new writings up almost five-fold and policies-in-force up 55% relative to Q4 2022.

Our distribution strategy remains centered on driving disciplined, profitable growth. With a focus on the best price and ease of use—created by our proprietary technology—there are many ways to distribute our product and grow our customer base. We categorize our distribution strategy into two channels: Direct and Partnership.

The Direct channel was our primary growth driver in 2023, fueled by performance marketing and organic traffic. We have continued to invest in the product to create an easy, transparent, and seamless experience for our customers. We had a record-breaking year in terms of Direct growth with Q4 not only accelerating, but also resulting in our best calendar period gross loss ratio of the year. We credit this success to our technology advantage that has allowed us to create a strong product offering for our customers. Our data science driven machine that systematically deploys targeted marketing spend to optimize unit economics and detect trends in the Direct channel also serves as a strong differentiator.

The Partnership channel is driven by a modern tech stack that can seamlessly integrate into existing platforms, all with a focus on minimal separation between the need for insurance and the purchase of a policy. This includes a wide array of integrations, spanning early-stage marketing partnerships through fully embedded user experiences.

We continue to build partnerships across many verticals, including automotive, financial services, affinity, and agency channels. As we grow this channel, we plan to continue to eliminate friction in the purchase experience by moving partners to fully embedded experiences. This allows a seamless purchase experience on the platforms that our customers know and trust.

Building differentiated access to customers remains a core pillar of our company strategy. We will continue to pursue disciplined and measured growth in the Direct channel as we are able to achieve our target unit economics, while our Partnership channel diversifies our distribution and builds further long-term growth opportunities.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Pricing and Underwriting

Our technology advantage demonstrates our ability to effectively match price to risk as evidenced by our superior loss ratios. Our underwriting results improved significantly throughout 2023, with our performance in Q4 2023 marking one of the strongest since our company’s founding. Our gross accident period loss ratio of 66% was produced on record quarterly gross written premium of $279 million. This resulted in a reduction of our Operating Loss to $12 million in the quarter versus $48 million in the same quarter last year. This is strong evidence that our technology advantage continues to evolve and translate into improved unit economics. Further, these results demonstrate our continued, disciplined approach to underwriting by focusing on profitable growth.

At the core of Root’s strategy is our automated data science platform, which leverages proprietary machine learning across all elements of the insurance value chain, including customer onboarding, underwriting, pricing, telematics, and claims. We plan to continue our expansion of these core assets to enhance our connected car capabilities, shorten the algorithm feedback loop, and further automate pricing and claims.

Our technology platform allows us to see changes in claims costs and quickly respond. With this capability, we were able to identify a rapidly changing inflationary environment and adjust our prices to position us for profitable growth. With this backdrop, Root is looking to expand our geographic reach to even more customers.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Gross accident period loss ratio

*Renewal gross accident period loss ratio for auto only

Financial

We continue to be laser focused on reaching profitability with our existing capital. 2023 results show meaningful progress on this front. We continued our diligent growth trajectory at attractive target unit economics while leveraging our fixed expense base.

In the fourth quarter 2023, net loss improved 59% year-over-year to $24 million and adjusted EBITDA improved 99% year-over-year to a loss of $0.3 million. This meaningful progress is driven by loss ratio improvement and fixed expense management that sets the foundation for scalable growth. Last quarter, we communicated an evolution in our reinsurance strategy, which continues to benefit net results through increased retention and lower reinsurance costs. Consistent with prior guidance, in Q4 2023, our gross earned premium cession rate was 18%, and the gap between gross and net loss and LAE ratios was reduced to single digits.

As we have achieved our target loss ratio and established a scalable expense base, reaching profitability now largely depends on the level of our discretionary marketing investments. As Root grows, our marketing spend may elevate near-term losses as we do not defer the majority of customer acquisition cost over the life of our customers. Acquisition expenses in our Direct channel will vary, and will be deployed at attractive expected returns over the customer lifecycle.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

It’s important to note that we believe we could achieve profitability in the near term if we determined reducing our marketing investments was the best approach to drive shareholder value. However, this would require us to forgo significant amounts of accretive business, reduce our share of market, and ultimately come at the expense of building long-term shareholder value.

We ended the year with $507 million in unencumbered capital, reflecting an annual unencumbered cash consumption of $52 million in 2023, compared to $179 million in 2022, net of proceeds from the issuance of debt. We are energized and committed to future growth as we start 2024 from a position of strength.

*Reconciliation from Net Loss to Adjusted EBITDA disclosed below.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Looking ahead

We started 2023 with three clear objectives: achieve our target unit economics via pricing and underwriting, reduce expenses to control cash burn, and reach scale to cover our costs. We are proud that we have achieved success in all three, as evidenced by our strong results.

However, we are far from satisfied. The challenges that we faced over the past two years have acutely sharpened our discipline and focus, which we will carry into the years ahead.

We have greater conviction in our mission—to unbreak insurance through data science and technology—than ever before. We remain grateful to our employees, who drive this mission every day, to our customers for their trust, and to our shareholders for their support.

Alex Timm

Co-Founder & CEO

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Non-GAAP financial measures

This letter and statements made during our earnings webcast may include information relating to Direct Contribution and Adjusted EBITDA, which are "non-GAAP financial measures" and are defined below. These non-GAAP financial measures have not been calculated in accordance with generally accepted accounting principles in the United States, or GAAP, and should be considered in addition to results prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, GAAP results.

In addition, Direct Contribution and Adjusted EBITDA should not be construed as indicators of our operating performance, liquidity, or cash flows generated by operating, investing and financing activities, as there may be significant factors or trends that they fail to address. We caution investors that non-GAAP financial information, by its nature, departs from traditional accounting conventions. Therefore, its use can make it difficult to compare our current results with our results from other reporting periods and with the results of other companies.

Our management uses these non-GAAP financial measures, in conjunction with GAAP financial measures, as an integral part of managing our business and to, among other things: (1) monitor and evaluate the performance of our business operations and financial performance, (2) facilitate internal comparisons of the historical operating performance of our business operations, (3) facilitate external comparisons of the results of our overall business to the historical operating performance of other companies that may have different capital structures and debt levels, (4) review and assess the operating performance of our management team, (5) analyze and evaluate financial and strategic planning decisions regarding future operating investments, and (6) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments.

For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP financial measures,” Reconciliation of Total Revenue to Direct Contribution” and “Reconciliation of Net Loss to Adjusted EBITDA” in Root’s 2023 Annual Report on Form 10-K at http://ir.joinroot.com or the SEC’s website at www.sec.gov.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Defined Terms & Glossary

We utilize the following definitions for terms used in this letter.

Direct Contribution

We define direct contribution, a non-GAAP financial measure, as gross profit/(loss) excluding net investment income, net realized gains on investments, report costs, commission expenses related to our partnership channel, warrant compensation expense related to progress towards achieving milestones for policies originated under the Carvana commercial agreement, overhead allocated based on headcount, or Overhead, and salaries, health benefits, bonuses, employee retirement plan related expenses and employee share-based compensation expense, or Personnel Costs, licenses, professional fees and other expenses, ceded premiums earned, ceded loss and LAE, and net ceding commission and other. Net ceding commission and other is comprised of ceding commission received in connection with reinsurance ceded, partially offset by amortization of excess ceding commission, and other impacts of reinsurance ceded which are included in other insurance expense (benefit). After these adjustments, the resulting calculation is inclusive of only those gross variable costs of revenue incurred on the successful acquisition of business. We view direct contribution as an important metric because we believe it measures progress towards the profitability of our total policy portfolio prior to the impact of reinsurance.

Adjusted EBITDA

We define adjusted EBITDA, a non-GAAP financial measure, as net loss excluding interest expense, income tax expense, depreciation and amortization, share-based compensation, warrant compensation expense, restructuring charges, write-off of prepaid marketing expenses, legal fees and other items that do not reflect our ongoing operating performance. After these adjustments, the resulting calculation represents expenses directly attributable to our operating performance. We use adjusted EBITDA as an internal performance measure in the management of our operations because we believe it provides management and other users of our financial information useful insight into our results of operations and underlying business performance. Adjusted EBITDA should not be viewed as a substitute for net loss calculated in accordance with GAAP, and other companies may define adjusted EBITDA differently.

Unencumbered Capital

We define unencumbered capital as unrestricted cash and cash equivalents held outside of our regulated insurance entities.

Distribution Channels

•Direct: seamless experiences driven by performance marketing and organic traffic connecting consumers directly to the product.

◦Digital. Our direct digital channel is designed to drive volume by efficiently capturing high-intent customers. We accomplish this by meeting our customers within platforms they use extensively such

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

as Google or select marketplace platforms where consumers are actively shopping for insurance. We deploy dynamic data science models to optimize targeting and bidding strategies across our digital platforms, aligning customer acquisition cost to expected lifetime value of the potential customer.

◦Referral. We encourage our existing customers to spread our value proposition. Our referral channel compensates existing customers who refer new customers who subsequently complete a test drive. This channel facilitates community-based growth to those who value our fair and transparent approach to insurance. This is our lowest cost acquisition channel and an important aspect of our ongoing distribution strategy.

◦Channel Media. We build consideration and drive intent through household-level targeted media channels including direct mail, billboards, and regional TV and radio. We utilize these media channels to drive awareness when launching in new markets and to actively target customers in active states.

•Partnerships: a wide array of integrations, spanning early-stage marketing partnerships through fully embedded user experiences.

◦Embedded. We build upon the mobile and web customer experiences of distribution partners to reach a captive customer base with an embedded solution. With varying levels of connectivity, including our proprietary and fully-integrated application programming interfaces, or APIs, we are able to engage high intent prospective customers in contextually relevant third-party applications. While these partnerships take time to onboard and launch, over the long term, we believe our flexible technology stack offers a seamless bind experience, creating a differentiated customer experience in this channel. We expect increased penetration of this channel over time as we seek to grow embedded relationships with other tech-enabled companies with relevant customer bases.

◦Agency. We continue to invest in a product to bring the speed and ease of our technology to the independent agency channel. This channel provides access to a larger demographic of customers and we believe it has staying power. We developed an efficient quote and bind process through our agent platform that enables simplified distribution from agents to their customers. The technology driven approach makes this an appealing platform for agents and an efficient acquisition channel for us.

About Root, Inc.

Founded in 2015 and based in Columbus, Ohio, Root, Inc. (NASDAQ: ROOT) is the parent company of Root Insurance Company and Root Property & Casualty Insurance Company. Root is revolutionizing insurance through data science and technology to provide consumers a personalized, easy, and fair experience. The Root app has roughly 13 million app downloads and has collected 22 billion miles of driving data to inform their insurance offerings.

For further information on Root, please visit root.com.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Root Insurance Company and Root Property & Casualty Insurance Company are headquartered in Columbus, Ohio, with renters insurance available through Root Insurance Company in Arkansas, Georgia, Kentucky, Missouri, Nevada, New Mexico, Ohio, Tennessee, and Utah. Root, Inc. is active in 34 markets for auto insurance: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, West Virginia, and Wisconsin. Business is underwritten by Root Insurance Company and/or Root Property & Casualty Insurance Company depending on the market. In Texas, we also write business as a Managing General Agent, underwritten by Redpoint County Mutual Insurance Company. Carvana Insurance built with Root is available only in the states where Root writes insurance, excluding California.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Forward-looking statements

This letter contains—and statements made during the above-referenced webcast will contain— forward-looking statements relating to, among other things, the future performance of Root and its consolidated subsidiaries that are based on Root’s current expectations, forecasts, and assumptions, and involve risks and uncertainties.

These include, but are not limited to, statements regarding:

•Our expected financial results for 2024

•Our ability to retain existing customers, acquire new customers, and expand our customer reach

•Our expectations regarding our future financial performance, including total revenue, gross profit/(loss), net income/(loss), direct contribution, adjusted EBITDA, net loss and loss adjustment expense, or LAE, ratio, net expense ratio, net combined ratio, gross loss ratio, gross LAE ratio, gross expense ratio, gross combined ratio, marketing costs and costs of customer acquisition, quota share levels, changes in unencumbered cash balances and expansion of our new and renewal premium base

•Our ability to realize profits, acquire customers, retain customers, contract with additional partners to utilize the products, or achieve other benefits from our embedded insurance offering

•Our ability to expand our distribution channels through additional partnership relationships, digital media, independent agents and referrals

•Our ability to drive a significant long-term competitive advantage through our partnership with Carvana and other partnerships

•Our ability to develop products for embedded insurance and other partners

•The impact of supply chain disruptions, increasing inflation, a recession and/or disruptions to properly functioning financial and capital markets and interest rates on our business and financial condition

•Our ability to reduce operating losses and extend our capital runway

•Our goal to be licensed in all states in the United States and the timing of obtaining additional licenses and launching in new states

•The accuracy and efficiency of our telematics and behavioral data, and our ability to gather and leverage additional data

•Our ability to materially improve retention rates and our ability to realize benefits from retaining customers

•Our ability to underwrite risks accurately and charge profitable rates

•Our ability to maintain our business model and improve our capital and marketing efficiency

•Our ability to drive improved conversion and decrease the cost of customer acquisition

•Our ability to maintain and enhance our brand and reputation

•Our ability to effectively manage the growth of our business

•Our ability to raise additional capital efficiently or at all

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

•Our ability to improve our product offerings, introduce new products and expand into additional insurance lines

•Our ability to cross sell our products and attain greater value from each customer

•Our lack of operating history and ability to attain profitability

•Our ability to compete effectively with existing competitors and new market entrants in our industry

•Future performance of the markets in which we operate

•Our ability to operate a “capital-efficient” business and obtain and maintain desirable levels of reinsurance

•The effect of further reductions in the utilization of reinsurance, which would result in retention of more premium and losses and could cause our capital requirements to increase

•Our ability to realize economies of scale

•Our ability to attract, motivate and retain key personnel, or hire personnel, and to offer competitive compensation and benefits

•Our ability to deliver a vertically integrated customer experience

•Our ability to develop products that utilize telematics to drive better customer satisfaction and retention

•Our ability to protect our intellectual property and any costs associated therewith;

•Our ability to develop an autonomous claims experience

•Our ability to take rate action early and react to changing environments

•Our ability to meet risk-based capital requirements

•Our ability to realize the benefits anticipated from our Texas county mutual fronting arrangement

•Our ability to expand domestically

•Our ability to stay in compliance with laws and regulations that currently apply or become applicable to our business

•The impact of litigation or other losses

•changes in laws or regulations, or changes in the interpretation of laws or regulations by a regulatory authority, specific to the use of artificial intelligence

•Our ability to defend against cybersecurity threats and prevent or recover from a security breach or other significant disruption of our technology systems or those of our partners and third-party service providers

•The effect of interest rates on our available cash and our ability to maintain compliance with our Term Loan

•Our ability to maintain proper and effective internal control over financial reporting and remediate existing deficiencies

•Our ability to continue to meet Nasdaq listing standards

•The growth rates of the markets in which we compete

Root’s actual results could differ materially from those predicted or implied by such forward-looking statements, and reported results should not be considered as an indication of future performance.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Factors that could cause or contribute to such differences also include, but are not limited to, those factors that could affect Root’s business, operating results, and stock price included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Root’s 2023 Annual Report on Form 10-K at http://ir.joinroot.com or the SEC’s website at www.sec.gov.

Undue reliance should not be placed on the forward-looking statements in this letter or the above-referenced webcast, which are based on information available to Root on the date hereof. We assume no obligation to update such statements.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Financial statements | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS - UNAUDITED |

AS OF DECEMBER 31, 2023 AND 2022 |

| As of |

| 2023 | | 2022 |

| (in millions, except par value ) |

| Assets | | | |

| Investments: | | | |

| Fixed maturities available-for-sale, at fair value (amortized cost: $168.4 and $134.2 at December 31, 2023 and December 31, 2022, respectively) | $ | 165.9 | | | $ | 128.4 | |

| Short-term investments (amortized cost: $0.9 and $0.4 at December 31, 2023 and December 31, 2022, respectively) | 0.9 | | | 0.4 | |

| Other investments | 4.4 | | | 4.4 | |

| Total investments | 171.2 | | | 133.2 | |

| Cash and cash equivalents | 678.7 | | | 762.1 | |

| Restricted cash | 1.0 | | | 1.0 | |

| Premiums receivable, net of allowance of $4.0 and $2.8 at December 31, 2023 and December 31, 2022, respectively | 247.1 | | | 111.9 | |

| Reinsurance recoverable and receivable, net of allowance of $1.8 and $0.2 at December 31, 2023 and December 31, 2022, respectively | 125.3 | | | 148.8 | |

| Prepaid reinsurance premiums | 48.2 | | | 74.2 | |

| Other assets | 76.2 | | | 81.7 | |

| Total assets | $ | 1,347.7 | | | $ | 1,312.9 | |

| Liabilities, Redeemable Convertible Preferred Stock and Stockholders’ Equity | | | |

| Liabilities: | | | |

| Loss and loss adjustment expense reserves | $ | 284.2 | | | $ | 287.4 | |

| Unearned premiums | 283.7 | | | 136.5 | |

| Long-term debt and warrants | 299.0 | | | 295.4 | |

| Reinsurance premiums payable | 54.4 | | | 119.8 | |

| Accounts payable and accrued expenses | 65.6 | | | 39.7 | |

| Other liabilities | 83.1 | | | 45.0 | |

| Total liabilities | 1,070.0 | | | 923.8 | |

| Commitments and Contingencies | | | |

Redeemable convertible preferred stock, $0.0001 par value, 14.1 shares issued and outstanding at December 31, 2023 and December 31, 2022 (redemption value of $126.5) | 112.0 | | | 112.0 | |

| Stockholders’ equity: | | | |

Class A common stock, $0.0001 par value, 9.5 and 9.2 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively | — | | | — | |

Class B convertible common stock, $0.0001 par value, 5.0 shares issued and outstanding at December 31, 2023 and December 31, 2022 | — | | | — | |

| | | |

| Additional paid-in capital | 1,883.4 | | | 1,850.7 | |

| Accumulated other comprehensive loss | (2.5) | | | (5.8) | |

| Accumulated loss | (1,715.2) | | | (1,567.8) | |

| Total stockholders’ equity | 165.7 | | | 277.1 | |

| Total liabilities, redeemable convertible preferred stock and stockholders’ equity | $ | 1,347.7 | | | $ | 1,312.9 | |

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS - UNAUDITED |

| | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in millions, except per share data) |

| Revenues: | | | | | | | |

| Net premiums earned | $ | 176.0 | | | $ | 64.3 | | | $ | 399.9 | | | $ | 285.9 | |

| Net investment income | 7.7 | | | 4.0 | | | 30.2 | | | 6.2 | |

| Net realized (losses) gains on investments | — | | | (0.6) | | | — | | | 0.5 | |

| Fee income | 10.2 | | | 3.4 | | | 23.4 | | | 16.5 | |

| Other income | 0.9 | | | 0.2 | | | 1.5 | | | 1.7 | |

| Total revenues | 194.8 | | | 71.3 | | | 455.0 | | | 310.8 | |

| Operating expenses: | | | | | | | |

| Loss and loss adjustment expenses | 122.7 | | | 77.7 | | | 331.3 | | | 351.0 | |

| Sales and marketing | 26.5 | | | 3.2 | | | 49.3 | | | 48.0 | |

| Other insurance expense (benefit) | 25.4 | | | (2.3) | | | 47.6 | | | (8.0) | |

| Technology and development | 12.4 | | | 9.4 | | | 44.8 | | | 55.5 | |

| General and administrative | 20.1 | | | 31.0 | | | 83.3 | | | 127.4 | |

| Total operating expenses | 207.1 | | | 119.0 | | | 556.3 | | | 573.9 | |

| Operating loss | (12.3) | | | (47.7) | | | (101.3) | | | (263.1) | |

| Interest expense | (11.7) | | | (10.6) | | | (46.1) | | | (34.6) | |

| | | | | | | |

| Loss before income tax expense | (24.0) | | | (58.3) | | | (147.4) | | | (297.7) | |

| Income tax expense | — | | | — | | | — | | | — | |

| Net loss | (24.0) | | | (58.3) | | | (147.4) | | | (297.7) | |

| Other comprehensive income (loss): | | | | | | | |

| Changes in net unrealized gains (losses) on investments | 4.1 | | | 1.1 | | | 3.3 | | | (6.2) | |

| Comprehensive loss | $ | (19.9) | | | $ | (57.2) | | | $ | (144.1) | | | $ | (303.9) | |

| Loss per common share: basic and diluted (both Class A and B) | $ | (1.64) | | | $ | (4.13) | | | $ | (10.24) | | | $ | (21.11) | |

| Weighted-average common shares outstanding: basic and diluted (both Class A and B) | 14.6 | | | 14.1 | | | 14.4 | | | 14.1 | |

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

| | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH FLOWS - UNAUDITED |

| Years Ended December 31, |

| 2023 | | 2022 |

| (in millions) |

| Cash flows from operating activities: | | | |

| Net loss | $ | (147.4) | | | $ | (297.7) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Share-based compensation | 17.3 | | | 30.5 | |

| Warrant compensation expense | 17.4 | | | 14.5 | |

| | | |

| Depreciation and amortization | 12.6 | | | 13.8 | |

| Bad debt expense | 14.1 | | | 17.4 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net realized gains on investments | — | | | (0.5) | |

| Gain on lease modification | (0.3) | | | (0.9) | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Premiums receivable | (147.7) | | | 18.8 | |

| Reinsurance recoverable and receivable | 21.9 | | | 6.2 | |

| Prepaid reinsurance premiums | 26.0 | | | 26.6 | |

| Other assets | 4.8 | | | (7.5) | |

| Losses and loss adjustment expenses reserves | (3.2) | | | (32.8) | |

| Unearned premiums | 147.2 | | | (43.6) | |

| Reinsurance premiums payable | (65.4) | | | 18.2 | |

| Accounts payable and accrued expenses | 27.7 | | | 17.9 | |

| Other liabilities | 41.4 | | | 8.5 | |

| Net cash used in operating activities | (33.6) | | | (210.6) | |

| Cash flows from investing activities: | | | |

| Purchases of investments | (76.0) | | | (47.7) | |

| Proceeds from maturities, call and pay downs of investments | 37.5 | | | 34.1 | |

| Sales of investments | 2.2 | | | 7.1 | |

| Purchases of indefinite-lived intangible assets and transaction costs | — | | | (1.3) | |

| Capitalization of internally developed software | (9.2) | | | (8.8) | |

| Purchases of fixed assets | (0.2) | | | — | |

| Net cash (used in) provided by investing activities | (45.7) | | | (16.6) | |

| Cash flows from financing activities: | | | |

| | | |

| Proceeds from exercise of stock options and restricted stock units, net of tax (withholding)/ proceeds | (1.1) | | | 0.3 | |

| | | |

| Payment of preferred stock and related warrants issuance costs | (3.0) | | | (3.0) | |

| Proceeds from issuance of debt and related warrants, net of issuance costs | — | | | 286.0 | |

| | | |

| | | |

| | | |

| Net cash (used in) provided by financing activities | (4.1) | | | 283.3 | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (83.4) | | | 56.1 | |

| Cash, cash equivalents and restricted cash at beginning of year | 763.1 | | | 707.0 | |

| Cash, cash equivalents and restricted cash at end of year | $ | 679.7 | | | $ | 763.1 | |

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

Supplemental financial information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| KEY PERFORMANCE INDICATORS - UNAUDITED | | |

| Three Months Ended |

| December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | December 31, | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 | | 2021 | | | | |

| (dollars in millions, except Premiums per Policy) |

| Policies in force | 341,764 | | | 259,522 | | | 203,840 | | | 199,685 | | | 220,354 | | | 354,371 | | | | | |

| Premiums per policy | $ | 1,423 | | | $ | 1,398 | | | $ | 1,353 | | | $ | 1,292 | | | $ | 1,220 | | | $ | 1,006 | | | | | |

| Premiums in force | $ | 972.7 | | | $ | 725.6 | | | $ | 551.6 | | | $ | 516.0 | | | $ | 537.7 | | | $ | 713.0 | | | | | |

| Gross premiums written | $ | 279.2 | | | $ | 224.2 | | | $ | 145.0 | | | $ | 134.7 | | | $ | 122.0 | | | $ | 158.4 | | | | | |

| Gross premiums earned | $ | 214.4 | | | $ | 159.8 | | | $ | 131.5 | | | $ | 130.1 | | | $ | 142.8 | | | $ | 189.3 | | | | | |

| Gross profit/(loss) | $ | 46.7 | | | $ | 11.2 | | | $ | 12.7 | | | $ | 5.5 | | | $ | (4.1) | | | $ | (23.2) | | | | | |

| Net loss | $ | (24.0) | | | $ | (45.8) | | | $ | (36.7) | | | $ | (40.9) | | | $ | (58.3) | | | $ | (109.9) | | | | | |

| Direct contribution | $ | 65.8 | | | $ | 37.0 | | | $ | 29.3 | | | $ | 18.6 | | | $ | 9.9 | | | $ | (4.2) | | | | | |

| Adjusted EBITDA | $ | (0.3) | | | $ | (19.4) | | | $ | (11.9) | | | $ | (11.3) | | | $ | (24.5) | | | $ | (73.4) | | | | | |

| Net loss and LAE ratio | 69.7 | % | | 85.8 | % | | 93.1 | % | | 105.5 | % | | 120.8 | % | | 127.0 | % | | | | |

| Net expense ratio | 42.2 | % | | 57.3 | % | | 57.4 | % | | 55.7 | % | | 58.9 | % | | 84.9 | % | | | | |

| Net combined ratio | 111.9 | % | | 143.1 | % | | 150.5 | % | | 161.2 | % | | 179.7 | % | | 211.9 | % | | | | |

| Gross loss ratio | 60.9 | % | | 65.6 | % | | 65.5 | % | | 71.5 | % | | 78.1 | % | | 88.5 | % | | | | |

| Gross LAE ratio | 8.6 | % | | 9.6 | % | | 10.0 | % | | 11.2 | % | | 12.2 | % | | 11.0 | % | | | | |

| Gross expense ratio | 40.2 | % | | 43.5 | % | | 42.7 | % | | 40.3 | % | | 41.5 | % | | 44.0 | % | | | | |

| Gross combined ratio | 109.7 | % | | 118.7 | % | | 118.2 | % | | 123.0 | % | | 131.8 | % | | 143.5 | % | | | | |

| Gross accident period loss ratio | 66.1 | % | | 64.8 | % | | 66.0 | % | | 67.1 | % | | 77.4 | % | | 94.1 | % | | | | |

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| KEY PERFORMANCE INDICATORS - UNAUDITED | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | 2023 | | | | | | | | 2022 | | 2021 | | | | | | |

| | | | | (dollars in millions, except Premiums per Policy) | | | | | | |

| Policies in force | | | | | 341,764 | | | | | | | | | 220,354 | | | 354,371 | | | | | | | |

| Premiums per policy | | | | | $ | 1,423 | | | | | | | | | $ | 1,220 | | | $ | 1,006 | | | | | | | |

| Premiums in force | | | | | $ | 972.7 | | | | | | | | | $ | 537.7 | | | $ | 713.0 | | | | | | | |

| Gross premiums written | | | | | $ | 783.1 | | | | | | | | | $ | 600.0 | | | $ | 742.6 | | | | | | | |

| Gross premiums earned | | | | | $ | 635.8 | | | | | | | | | $ | 643.6 | | | $ | 719.6 | | | | | | | |

| Gross profit/(loss) | | | | | $ | 76.1 | | | | | | | | | $ | (32.2) | | | $ | (51.9) | | | | | | | |

| Net loss | | | | | $ | (147.4) | | | | | | | | | $ | (297.7) | | | $ | (521.1) | | | | | | | |

| Direct contribution | | | | | $ | 150.7 | | | | | | | | | $ | 27.6 | | | $ | 8.1 | | | | | | | |

| Adjusted EBITDA | | | | | $ | (42.9) | | | | | | | | | $ | (185.9) | | | $ | (446.1) | | | | | | | |

| Net loss and LAE ratio | | | | | 82.8 | % | | | | | | | | 122.8 | % | | 126.4 | % | | | | | | |

| Net expense ratio | | | | | 50.4 | % | | | | | | | | 72.2 | % | | 134.5 | % | | | | | | |

| Net combined ratio | | | | | 133.2 | % | | | | | | | | 195.0 | % | | 260.9 | % | | | | | | |

| Gross loss ratio | | | | | 65.2 | % | | | | | | | | 82.1 | % | | 86.0 | % | | | | | | |

| Gross LAE ratio | | | | | 9.6 | % | | | | | | | | 10.3 | % | | 10.5 | % | | | | | | |

| Gross expense ratio | | | | | 41.6 | % | | | | | | | | 45.4 | % | | 71.3 | % | | | | | | |

| Gross combined ratio | | | | | 116.4 | % | | | | | | | | 137.8 | % | | 167.8 | % | | | | | | |

| Gross accident period loss ratio | | | | | 66.0 | % | | | | | | | | 80.2 | % | | 88.7 | % | | | | | | |

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| RECONCILIATION OF TOTAL REVENUE TO DIRECT CONTRIBUTION - UNAUDITED | | |

| Three Months Ended |

| December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | December 31, | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 | | 2021 | | | | |

| (dollars in millions) |

| Total revenue | $ | 194.8 | | | $ | 115.3 | | | $ | 74.8 | | | $ | 70.1 | | | $ | 71.3 | | | $ | 93.2 | | | | | |

| Loss and loss adjustment expenses | (122.7) | | | (85.8) | | | (59.5) | | | (63.3) | | | (77.7) | | | (107.8) | | | | | |

Other insurance (expense) benefit | (25.4) | | | (18.3) | | | (2.6) | | | (1.3) | | | 2.3 | | | (8.6) | | | | | |

| Gross profit/(loss) | 46.7 | | | 11.2 | | | 12.7 | | | 5.5 | | | (4.1) | | | (23.2) | | | | | |

| Net investment income | (7.7) | | | (9.0) | | | (6.8) | | | (6.7) | | | (4.0) | | | (2.4) | | | | | |

| Net realized gains on investments | — | | | — | | | — | | | — | | | 0.6 | | | — | | | | | |

Adjustments from other insurance (expense) benefit(1) | 26.7 | | | 21.7 | | | 14.9 | | | 13.0 | | | 11.6 | | | 11.8 | | | | | |

| Ceded premiums earned | 38.4 | | | 59.8 | | | 67.6 | | | 70.1 | | | 78.5 | | | 104.4 | | | | | |

| Ceded loss and loss adjustment expenses | (26.2) | | | (34.4) | | | (39.7) | | | (44.2) | | | (51.3) | | | (80.5) | | | | | |

Net ceding commission and other(2) | (12.1) | | | (12.3) | | | (19.4) | | | (19.1) | | | (21.4) | | | (14.3) | | | | | |

| Direct contribution | $ | 65.8 | | | $ | 37.0 | | | $ | 29.3 | | | $ | 18.6 | | | $ | 9.9 | | | $ | (4.2) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| RECONCILIATION OF TOTAL REVENUE TO DIRECT CONTRIBUTION - UNAUDITED | | |

| Years Ended December 31, | | |

| 2023 | | 2022 | | 2021 | | | | | | |

| (dollars in millions) |

| Total revenue | $ | 455.0 | | | $ | 310.8 | | | $ | 345.4 | | | | | | | |

| Loss and loss adjustment expenses | (331.3) | | | (351.0) | | | (392.3) | | | | | | | |

Other insurance (expense) benefit | (47.6) | | | 8.0 | | | (5.0) | | | | | | | |

| Gross profit/(loss) | 76.1 | | | (32.2) | | | (51.9) | | | | | | | |

| Net investment income | (30.2) | | | (6.2) | | | (5.0) | | | | | | | |

| Net realized gains on investments | — | | | (0.5) | | | (2.4) | | | | | | | |

Adjustments from other insurance (expense) benefit(1) | 76.3 | | | 38.4 | | | 56.0 | | | | | | | |

| Ceded premiums earned | 235.9 | | | 357.7 | | | 409.3 | | | | | | | |

| Ceded loss and loss adjustment expenses | (144.5) | | | (243.7) | | | (302.5) | | | | | | | |

Net ceding commission and other(2) | (62.9) | | | (85.9) | | | (95.4) | | | | | | | |

| Direct contribution | $ | 150.7 | | | $ | 27.6 | | | $ | 8.1 | | | | | | | |

______________

(1) Adjustments from other insurance (expense) benefit includes report costs, commission expenses related to our partnership channel, certain warrant compensation expense related to our embedded channel, Personnel costs, Overhead, licenses, professional fees and other.

(2) Net ceding commission and other is comprised of ceding commissions received in connection with reinsurance ceded, partially offset by amortization of excess ceding commission, and other impacts of reinsurance ceded.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA - UNAUDITED | | |

| Three Months Ended |

| December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | December 31, | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 | | 2021 | | | | |

| | | (dollars in millions) |

| Net loss | $ | (24.0) | | | $ | (45.8) | | | $ | (36.7) | | | $ | (40.9) | | | $ | (58.3) | | | $ | (109.9) | | | | | |

| Adjustments: | | | | | | | | | | | | | | | |

| Interest expense | 11.0 | | | 11.1 | | | 10.7 | | | 10.4 | | | 9.9 | | | 1.6 | | | | | |

| Income tax expense | — | | | — | | | — | | | — | | | — | | | — | | | | | |

| Depreciation and amortization | 4.2 | | | 2.7 | | | 2.7 | | | 2.6 | | | 4.6 | | | 5.6 | | | | | |

| Loss on early extinguishment of debt | — | | | — | | | — | | | — | | | — | | | 15.9 | | | | | |

| Share-based compensation | 4.9 | | | 4.7 | | | 5.2 | | | 2.1 | | | 5.5 | | | 4.6 | | | | | |

| | | | | | | | | | | | | | | |

| Warrant compensation expense | 4.1 | | | 5.0 | | | 3.9 | | | 4.4 | | | 4.2 | | | 8.8 | | | | | |

Restructuring charges(1) | 1.8 | | | 1.9 | | | 1.9 | | | 5.6 | | | 10.2 | | | — | | | | | |

Write-offs and other(2) | (2.3) | | | 1.0 | | | 0.4 | | | 4.5 | | | (0.6) | | | — | | | | | |

| Adjusted EBITDA | $ | (0.3) | | | $ | (19.4) | | | $ | (11.9) | | | $ | (11.3) | | | $ | (24.5) | | | $ | (73.4) | | | | | |

______________

(1) Restructuring costs consist of employee costs, real estate exit costs, and other. This includes $0.4 million and $3.2 million of share-based compensation for Q1 2023 and Q4 2022, respectively. This also includes $0.2 million, $0.1 million, $0.1 million and $0.3 million of depreciation and amortization for Q4 2023, Q2 2023, Q1 2023 and Q4 2022, respectively.

(2) Write-offs and other primarily reflects legal costs, write-off of prepaid marketing expense and other items that do not reflect our ongoing operating performance. This includes $0.1 million in Q4 2022 related to the write-off of prepaid marketing expense. Legal and other fees related to the purported misappropriation of funds by a former senior marketing employee in 2022 of ($0.2) million, $1.0 million, $0.4 million, $2.0 million and $1.2 million in Q4 2023, Q3 2023, Q2 2023, Q1 2023 and Q4 2022, respectively, net of anticipated recovery in Q4 2022 of $1.9 million.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES | | |

| RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA - UNAUDITED | | |

| Years Ended December 31, | | | | | | | | |

| 2023 | | 2022 | | 2021 | | | | | | | | |

| (dollars in millions) |

| Net loss | $ | (147.4) | | | $ | (297.7) | | | $ | (521.1) | | | | | | | | | |

| Adjustments: | | | | | | | | | | | | | |

| Interest expense | 43.2 | | | 31.9 | | | 14.4 | | | | | | | | | |

| Income tax expense | — | | | — | | | — | | | | | | | | | |

| Depreciation and amortization | 12.2 | | | 12.1 | | | 16.6 | | | | | | | | | |

| Share-based compensation | 16.9 | | | 25.2 | | | 19.3 | | | | | | | | | |

| | | | | | | | | | | | | |

| Loss on early extinguishment of debt | — | | | — | | | 15.9 | | | | | | | | | |

| Warrant compensation expense | 17.4 | | | 14.5 | | | 8.8 | | | | | | | | | |

Restructuring charges(1) | 11.2 | | | 18.6 | | | — | | | | | | | | | |

Write-offs and other(2) | 3.6 | | | 9.5 | | | — | | | | | | | | | |

| Adjusted EBITDA | $ | (42.9) | | | $ | (185.9) | | | $ | (446.1) | | | | | | | | | |

______________

(1) Restructuring costs consist of employee costs, real estate exit costs, and other. This includes $0.4 million, $5.3 million and zero of share-based compensation for the years ended December 31, 2023, 2022 and 2021, respectively. This also includes $0.4 million, $1.7 million and zero of depreciation and amortization for the years ended December 31, 2023, 2022 and 2021, respectively

(2) Write-offs and other primarily reflects legal costs, write-off prepaid marketing expense and other items that do not reflect our ongoing operating performance. This includes write-off of prepaid marketing expenses of zero, $10.2 million and zero for the years ended December 31, 2023, 2022 and 2021, respectively. Legal and other fees of related to the purported misappropriation of funds by a former senior marketing employee in 2022 of $3.2 million, $1.2 million, and zero for the years ended December 31, 2023, 2022 and 2021, respectively, partially offset by an insurance recovery of $1.9 million in 2023.

Letter to Shareholders: FY 2023

____________________________________________________________________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | |

| ROOT, INC. AND SUBSIDIARIES |

| WRITTEN AND EARNED PREMIUM - UNAUDITED |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (dollars in millions) |

| Gross premiums written | $ | 279.2 | | | $ | 122.0 | | | $ | 783.1 | | | $ | 600.0 | |

| Ceded premiums written | (50.5) | | | (66.7) | | | (209.9) | | | (331.2) | |

| Net premiums written | 228.7 | | | 55.3 | | | 573.2 | | | 268.8 | |

| | | | | | | |

| | | | | | | |

| Gross premiums earned | 214.4 | | | 142.8 | | | 635.8 | | | 643.6 | |

| Ceded premiums earned | (38.4) | | | (78.5) | | | (235.9) | | | (357.7) | |

| Net premiums earned | $ | 176.0 | | | $ | 64.3 | | | $ | 399.9 | | | $ | 285.9 | |

v3.24.0.1

Cover

|

Feb. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity Registrant Name |

ROOT, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39658

|

| Entity Tax Identification Number |

84-2717903

|

| Entity Address, Address Line One |

80 E. Rich Street

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Columbus

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43215

|

| City Area Code |

866

|

| Local Phone Number |

980-9431

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value

|

| Trading Symbol |

ROOT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001788882

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

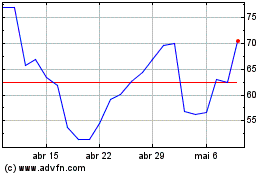

Root (NASDAQ:ROOT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Root (NASDAQ:ROOT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024