false000168360600016836062024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 22, 2024 |

Cars.com Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37869 |

81-3693660 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

300 S. Riverside Plaza |

|

Chicago, Illinois |

|

60606 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 312 601-5000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

CARS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, Cars.com Inc. (the “Company”) issued a press release announcing its financial results for the year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The information furnished in this report, including Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed to be incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Cars.com Inc. |

|

|

|

|

Date: |

February 22, 2024 |

By: |

/s/ Sonia Jain |

|

|

|

Chief Financial Officer |

Cars.com Reports Fourth Quarter and Full Year 2023 Results

Exceeded Fourth Quarter Guidance, Delivered 7% Year-Over-Year Revenue Growth

Achieved 7% Year-Over-Year ARPD Growth coupled with Strong Fourth Quarter OEM Performance

Generated $137MM of Annual Cash Flows From Operating Activities

CHICAGO, Feb. 22, 2024 -- Cars.com Inc. (NYSE: CARS) (d/b/a “Cars Commerce Inc.” or the “Company”), an audience-driven technology company empowering the automotive industry, today released its financial results for the fourth quarter and year ended December 31, 2023.

Q4 2023 Financial and Key Metric Highlights

•Revenue of $179.6 million, up $11.4 million, or 7% year-over-year

•Net income of $8.3 million, or $0.12 per diluted share, compared to Net Income of $10.3 million, or $0.15 per diluted share, in the prior year

•Adjusted EBITDA of $55.4 million, or 31% of revenue, up $5.9 million year-over-year

•Average Monthly Unique Visitors (“UVs”) of 24.3 million, compared to 24.6 million a year ago

•Traffic (“Visits”) of 142.7 million, up 2% year-over-year

•Monthly Average Revenue Per Dealer (“ARPD”) of $2,523, up 7% year-over-year

•Dealer Customers totaled 19,5041 as of December 31, 2023, up 789 compared to 18,715 as of September 30, 2023

2023 Full-Year Financial and Key Metric Highlights

•Revenue of $689.2 million, up $35.3 million, or 5% year-over-year

•Net income of $118.4 million, or $1.74 per diluted share, compared to Net income of $17.2 million, or $0.25 per diluted share, in the prior year. Current year Net income was primarily related to the release of a significant portion of the Company’s valuation allowance

•Adjusted EBITDA of $194.9 million, or 28.3% of revenue, compared to $186.7 million, or 28.6% of revenue in the prior year

•Cash flows from operating activities of $136.7 million, compared to $128.5 million in the prior year, with Free cash flow of $115.8 million, compared to $108.8 million in the prior year

•UVs of 26.4 million, even compared to the prior year

•Traffic of 614.8 million, up 5% year-over-year, setting an all-time Company record for traffic

Operational Highlights

•AccuTrade was selected by FordDirect as its preferred Vehicle Acquisition and Trade & Appraisal solution for The Shop, a newly launched preferred vendor selection program for its more than 3,000 U.S. Ford and Lincoln retailers

•Closed on the acquisition of D2C Media, a leading provider of website and digital advertising solutions; integration of teams and technology underway supporting the Company’s expanding presence in Canada

•Debuted VIN Performance Media, a new advertising solution that combines three of the Company’s existing media products into a single solution that saves dealers time and money, while maximizing ad performance and operational efficiency

_______________________________

1As of December 31, 2023, this key metric includes the addition of 950 D2C Media only customers.

“2023 marked a year of significant progress. We advanced our platform strategy through the introduction of Cars Commerce, the rollout of our Marketplace Repackaging initiative and our expansion into Canada with the acquisition of D2C Media. Our focus on simplifying everything about buying and selling cars enabled us to continue to deliver value for consumers, dealers, and OEMs, supporting our twelve consecutive quarters of year-over-year profitable revenue growth,” said Alex Vetter, Chief Executive Officer of Cars Commerce. “We begin 2024 well-positioned to continue building on this momentum, unlocking new growth opportunities and driving commerce for the auto industry.”

Q4 2023 Results

Revenue for the fourth quarter, which includes two months of activity related to D2C Media, totaled $179.6 million, an increase of $11.4 million, or up 7%, compared to the prior year period. Excluding D2C Media, the Company’s revenue would have increased 5%, year-over-year.

Dealer revenue grew 8% year-over-year, driven by continued growth in solutions and media products and the 2023 Marketplace Repackaging initiative. OEM and National revenue also grew 8%, year-over-year driven by a 24% increase in OEM customer revenue. Sequentially, OEM and National revenue increased 6%, driven by 11% growth in OEM customer revenue.

Fourth quarter ARPD grew 7%, or $162, year-over-year to $2,523, primarily driven by the 2023 Marketplace Repackaging initiative. As of December 31, 2023, Dealer Customers totaled 19,504, including 950 dealers associated with the Company’s D2C Media acquisition, an increase of 789 compared to 18,715 at the end of the third quarter of 2023.

Total operating expenses for the fourth quarter were $164.7 million, compared to $148.4 million for the prior year period. Adjusted Operating Expenses for the quarter were $150.8 million, a $10.1 million increase compared to the prior year period. The change in Adjusted operating expenses is primarily due to continued investments in people, an increase in depreciation and amortization, and investments in marketing to support the launch of the Company’s Cars Commerce brand.

Net income for the quarter was $8.3 million, or $0.12 per diluted share, compared to Net income of $10.3 million, or $0.15 per diluted share, in the fourth quarter of 2022. The change in Net income is primarily attributable to the changes in the fair value contingent consideration associated with the Company’s prior acquisitions.

Adjusted EBITDA margin expanded sequentially throughout the year, reaching 31% of revenue for the quarter, or $55.4 million, compared to 29% of revenue, or $49.5 million, for the prior year period.

2023 Full-Year Results

Revenue for the year totaled $689.2 million, an increase of $35.3 million, or up 5%, compared to the prior year period. Dealer revenue grew 7% year-over-year, driven by the continued growth in solutions and media and the 2023 Marketplace Repackaging initiative. OEM and National revenue was down 5%, year-over-year; while OEM revenue increased 8% relative to the prior year, revenue from insurance customers was down compared to a year ago. Other Revenue was $4.5 million lower compared to the prior year primarily due to the planned expiration of a non-cash transition services agreement related to AccuTrade in the first quarter of 2023.

For the year, total operating expenses were $635.1 million, compared to $587.8 million in 2022. Adjusted Operating Expenses for the year were $594.1 million, a $38.2 million increase compared to the prior year that was largely driven by increased compensation and employee related expenses, particularly in Marketing and sales and Product and technology. Additionally, as the Company has accelerated product development and technology investments, Depreciation and amortization expense was also up, year-over-year.

Marketing and sales costs increased primarily due to higher compensation and higher investments in Brand Media to support both the Company’s Possibilities advertising campaign and launch of its enterprise brand, Cars Commerce.

2023 Net income totaled $118.4 million, or $1.74 per diluted share, compared to Net income of $17.2 million, or $0.25 per diluted share in the prior year. The increase in Net income is primarily related to the release of a significant portion of the Company’s valuation allowance, given the expectation of projected future income and utilization of the Company’s tax assets.

Adjusted EBITDA for the year totaled $194.9 million, or 28.3% of revenue, compared to $186.7 million, or 28.6% of revenue, in the prior year period.

The Company remained focused on driving high-quality traffic at scale. Organic traffic remained strong at 61% for the year and Average Monthly Unique Visitors for the year were in line with the prior year. In 2023, total Traffic increased 5%, reaching 614.8 million, a new all-time Company record.

Cash Flow and Balance Sheet

Net cash provided by operating activities in 2023 was $136.7 million, compared to $128.5 million in the prior year. Free cash flow in 2023 totaled $115.8 million compared to $108.8 million in 2022. The increase is primarily due to an $8.2 million year-over-year increase in Adjusted EBITDA and favorable working capital, partially offset by a year-over-year increase in cash taxes of $17.1 million.

In 2023, the Company made $36.3 million in debt payments. Total debt outstanding was $490.0 million as of December 31, 2023 and the Company’s net leverage (as defined in the Company’s credit facility) remained within its target net leverage range of 2.0x to 2.5x, improving to 2.3x, compared to 2.4x as of December 31, 2022. Total liquidity as of December 31, 2023 was $234.2 million, which is defined as Cash and cash equivalents of $39.2 million and revolver capacity of $195.0 million.

For the year, the Company repurchased 1.7 million of its common shares, or 2.6% of the 66.3 million shares outstanding at December 31, 2022, for $31.3 million.

“2023 was a year with robust revenue growth and strong Adjusted EBITDA margins, driven by our focus on execution. Our asset light business model consistently generates strong free cash flow conversion that enables us to invest in growth areas that continue to deliver sustained value for consumers, customers, and shareholders,” said Sonia Jain, Chief Financial Officer of Cars Commerce.

2024 Outlook

The Company expects to deliver another year of strong growth. The Company believes market conditions are improving, with increased OEM production, new model launches, and rising dealer inventory, which coupled with a still cautious consumer makes the Company’s in-market solutions more valuable.

First quarter revenue is expected to be between $179 million and $181 million, representing year-over-year growth of 7% to 8%. First quarter revenue outlook reflects continued strong growth in Dealer revenue driven by continued adoption of the Cars Commerce suite of products, the D2C acquisition, and the full period impact of the 2023 Marketplace Repackaging Initiative. OEM and National Advertising spend is also expected to be up year-over-year, but historically has experienced some seasonality from the fourth quarter to the first quarter. For the year, the Company anticipates continued growth across its platform with both dealer and OEM customers which is reflected in its revenue growth guidance of 6% to 8%.

Adjusted EBITDA margin for the first quarter of 2024 is expected to be between 27% and 29%. It’s important to note, the Company has seasonally higher investments in Marketing and sales in the first quarter, due to the timing of in-person industry events. The Company expects margins to improve over the course of the year and deliver a full year Adjusted EBITDA margin between 28% to 30%.

Q4 2023 Earnings Call

As previously announced, management will hold a conference call and webcast today at 8:00 a.m. CT. This webcast may be accessed at the Cars Commerce Investor relations website, investor.cars.com. An archive of the webcast will be available at investor.cars.com following the conclusion of the call.

About Cars Commerce

Cars Commerce is an audience-driven technology company empowering the automotive industry. The Company simplifies everything about car buying and selling with powerful products, solutions and AI-driven technologies that span pretail, retail and post-sale activities – enabling more efficient and profitable retail operations. The Cars Commerce platform is organized around four industry-leading brands: the flagship automotive marketplace and dealer reputation site Cars.com, award-winning technology and digital retail technology and marketing services from Dealer Inspire, essential trade-in and appraisal technology from AccuTrade, and exclusive in-market media solutions from the Cars Commerce Media Network. Learn more at www.carscommerce.inc.

Non-GAAP Financial Measures

This earnings release discusses Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow and Adjusted Operating Expenses. These financial measures are not prepared in accordance with generally accepted accounting principles in the United States ("GAAP"). These financial measures are presented as supplemental measures of operating performance because the Company believes they provide meaningful information regarding the Company’s performance and provide a basis to compare operating results between periods. In addition, the Company uses Adjusted EBITDA as a measure for determining incentive compensation targets. Adjusted EBITDA also is used as a performance measure under the Company’s credit agreement and includes adjustments such as the items defined below and other further adjustments, which are defined in the credit agreement. These non-GAAP financial measures are frequently used by the Company’s lenders, securities analysts, investors and other interested parties to evaluate companies in the Company’s industry. For a reconciliation of the non-GAAP measures presented in this earnings release to their most directly comparable financial measure prepared in accordance with GAAP, see "Non-GAAP Reconciliations" below.

Other companies may define or calculate these measures differently, limiting their usefulness as comparative measures. Because of these limitations, non-GAAP financial measures should not be considered in isolation or as substitutes for performance measures calculated in accordance with GAAP. Definitions of these non-GAAP financial measures and reconciliations to the most directly comparable GAAP financial measures are presented in the tables below.

The Company defines Adjusted EBITDA as net income (loss) before (1) interest expense, net, (2) income tax (benefit) expense, (3) depreciation, (4) amortization of intangible assets, (5) stock-based compensation expense, (6) unrealized mark-to-market adjustments and cash transactions related to derivative instruments, and (7) unrealized foreign currency exchange gains and losses, and (8) certain other items, such as transaction-related items, severance, transformation and other exit costs and write-off and impairments of goodwill, intangible assets and other long-lived assets.

Transaction-related items result from actual or potential transactions such as business combinations, mergers, acquisitions, dispositions, spin-offs, financing transactions, and other strategic transactions, including, without limitation, (1) transaction-related bonuses and (2) expenses for advisors and representatives such as investment bankers, consultants, attorneys and accounting firms. Transaction-related items may also include, without limitation, transition and integration costs such as retention bonuses and acquisition-related milestone payments to acquired employees, consulting, compensation and other incremental costs associated with integration projects, fair value changes to contingent considerations and amortization of deferred revenue related to the Accu-Trade acquisition.

The Company defines Free Cash Flow as net cash provided by operating activities less capital expenditures, including purchases of property and equipment and capitalization of internally developed technology.

The Company defines Adjusted Operating Expenses as total operating expenses adjusted to exclude stock-based compensation, write-off and impairments of goodwill, intangible assets, long-lived assets, severance, transformation and other exit costs and transaction-related items.

Key Metric Definitions

Average Monthly Unique Visitors (“UVs”) and Traffic (“Visits”). The Company defines UVs in a given month as the number of distinct visitors that engage with its platform during that month. Visitors are identified when a user first visits an individual Cars.com property on an individual device/browser combination or installs one of its mobile apps on an individual device. If a visitor accesses more than one of its web properties or apps or uses more than one device or browser, each of those unique property/browser/app/device combinations counts toward the number of UVs. Traffic is defined as the number of visits to Cars.com desktop and mobile properties (responsive sites and mobile apps). The Company measures UVs and Traffic via Adobe Analytics. These metrics do not include traffic to Dealer Inspire or D2C Media websites.

Monthly Average Revenue Per Dealer ("ARPD"). The Company believes that its ability to grow ARPD is an indicator of the value proposition of its platform. The Company defines ARPD as Dealer revenue, excluding digital advertising services, during the period divided by the monthly average number of Dealer Customers during the same period. Beginning with the three months ended June 30, 2022, AccuTrade is included in our ARPD metric. No prior period has been recast as it would be impracticable to do so and the inclusion of AccuTrade would have had an immaterial impact on ARPD for prior periods. Additionally, beginning December 31, 2023, this key operating metric includes D2C Media.

Dealer Customers. Dealer Customers represent dealerships using our products as of the end of each reporting period. Each physical or virtual dealership location is counted separately, whether it is a single-location proprietorship or part of a large, consolidated dealer group. Multi-franchise dealerships at a single location are counted as one dealer. Beginning June 30, 2022, this key operating metric includes AccuTrade; however, no prior period has been recast as it would be impracticable to do so. Additionally, beginning December 31, 2023, this key operating metric includes D2C Media.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the federal securities laws. All statements other than statements of historical facts are forward-looking statements. These statements often use words such as “believe,” “expect,” “project,” “anticipate,” “outlook,” “intend,” “strategy,” “plan,” “estimate,” “target,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecasts,” “mission,” “strive,” “more,” “goal” or similar expressions. Forward-looking statements are based on our current expectations, beliefs, strategies, estimates, projections and assumptions, experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments, and other factors we think are appropriate. Such forward-looking statements are based on estimates and assumptions that, while considered reasonable by Cars Commerce and its management based on their knowledge and understanding of the business and industry, are inherently uncertain. While Cars Commerce and its management make such statements in good faith and believe such judgments are

reasonable, you should understand that these statements are not guarantees of future strategic action, performance or results. Our actual results, performance, achievements, strategic actions or prospects could differ materially from those expressed or implied by these forward-looking statements. Given these uncertainties, you should not rely on forward-looking statements in making investment decisions. When we make comparisons of results between current and prior periods, we do not intend to express any future trends, or indications of future performance, unless expressed as such, and you should view such comparisons as historical data. Whether or not any such forward-looking statement is in fact achieved will depend on future events, some of which are beyond our control.

Forward-looking statements are subject to a number of risks, uncertainties and other important factors, many of which are beyond our control, that could cause our actual results and strategic actions to differ materially from those expressed in the forward-looking statements contained in this press release. For a detailed discussion of many of these and other risks and uncertainties, see “Part I, Item 1A., Risk Factors” and “Part II, Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (“SEC”) on February 22, 2024 and our other filings filed with the SEC and available on our website at investor.cars.com or via EDGAR at www.sec.gov.

You should evaluate all forward-looking statements made in this press release in the context of these risks and uncertainties. The forward-looking statements contained in this press release are based only on information currently available to us and speak only as of the date of this press release. We undertake no obligation, other than as may be required by law, to update or revise any forward-looking or cautionary statements to reflect changes in assumptions, the occurrence of events, unanticipated or otherwise, or changes in future operating results over time or otherwise. The forward-looking statements in this report are intended to be subject to the safe harbor protection provided by the federal securities laws.

Cars Commerce Investor Relations Contact:

Robbin Moore-Randolph

rmr@carscommerce.com

312.601.5929

Cars Commerce Media Contact:

Marita Thomas

mthomas@carscommerce.com

312.601.5692

###

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cars.com Inc. |

|

Consolidated Statements of Income |

|

(In thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Dealer |

|

$ |

161,393 |

|

|

$ |

149,424 |

|

|

$ |

621,661 |

|

|

$ |

579,222 |

|

OEM and National |

|

|

15,410 |

|

|

|

14,330 |

|

|

|

55,904 |

|

|

|

58,557 |

|

Other |

|

|

2,803 |

|

|

|

4,447 |

|

|

|

11,618 |

|

|

|

16,097 |

|

Total revenue |

|

|

179,606 |

|

|

|

168,201 |

|

|

|

689,183 |

|

|

|

653,876 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue and operations |

|

|

30,918 |

|

|

|

28,875 |

|

|

|

122,205 |

|

|

|

114,959 |

|

Product and technology |

|

|

25,230 |

|

|

|

23,166 |

|

|

|

99,584 |

|

|

|

89,015 |

|

Marketing and sales |

|

|

58,835 |

|

|

|

56,515 |

|

|

|

235,471 |

|

|

|

221,879 |

|

General and administrative |

|

|

23,069 |

|

|

|

16,128 |

|

|

|

76,807 |

|

|

|

67,593 |

|

Depreciation and amortization |

|

|

26,619 |

|

|

|

23,706 |

|

|

|

101,000 |

|

|

|

94,394 |

|

Total operating expenses |

|

|

164,671 |

|

|

|

148,390 |

|

|

|

635,067 |

|

|

|

587,840 |

|

Operating income |

|

|

14,935 |

|

|

|

19,811 |

|

|

|

54,116 |

|

|

|

66,036 |

|

Nonoperating expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(8,254 |

) |

|

|

(8,442 |

) |

|

|

(32,425 |

) |

|

|

(35,320 |

) |

Other (expense) income, net |

|

|

(4,790 |

) |

|

|

5,093 |

|

|

|

(3,586 |

) |

|

|

(8,140 |

) |

Total nonoperating expense, net |

|

|

(13,044 |

) |

|

|

(3,349 |

) |

|

|

(36,011 |

) |

|

|

(43,460 |

) |

Income before income taxes |

|

|

1,891 |

|

|

|

16,462 |

|

|

|

18,105 |

|

|

|

22,576 |

|

Income tax (benefit) expense |

|

|

(6,455 |

) |

|

|

6,200 |

|

|

|

(100,337 |

) |

|

|

5,370 |

|

Net income |

|

$ |

8,346 |

|

|

$ |

10,262 |

|

|

$ |

118,442 |

|

|

$ |

17,206 |

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

66,510 |

|

|

|

66,546 |

|

|

|

66,742 |

|

|

|

68,215 |

|

Diluted |

|

|

68,326 |

|

|

|

68,513 |

|

|

|

68,227 |

|

|

|

69,649 |

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.13 |

|

|

$ |

0.15 |

|

|

$ |

1.77 |

|

|

$ |

0.25 |

|

Diluted |

|

|

0.12 |

|

|

|

0.15 |

|

|

|

1.74 |

|

|

|

0.25 |

|

|

|

|

|

|

|

|

|

|

Cars.com Inc. |

|

Consolidated Balance Sheets |

|

(In thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

Assets: |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

39,198 |

|

|

$ |

31,715 |

|

Accounts receivable, net |

|

|

125,373 |

|

|

|

107,930 |

|

Prepaid expenses |

|

|

12,553 |

|

|

|

8,377 |

|

Other current assets |

|

|

1,314 |

|

|

|

605 |

|

Total current assets |

|

|

178,438 |

|

|

|

148,627 |

|

Property and equipment, net |

|

|

43,853 |

|

|

|

45,218 |

|

Goodwill |

|

|

147,058 |

|

|

|

102,856 |

|

Intangible assets, net |

|

|

669,167 |

|

|

|

707,088 |

|

Deferred tax assets, net |

|

|

112,953 |

|

|

|

48 |

|

Investments and other assets, net |

|

|

20,980 |

|

|

|

21,033 |

|

Total assets |

|

$ |

1,172,449 |

|

|

$ |

1,024,870 |

|

Liabilities and stockholders' equity: |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

22,259 |

|

|

$ |

18,230 |

|

Accrued compensation |

|

|

31,669 |

|

|

|

19,316 |

|

Current portion of long-term debt, net |

|

|

23,129 |

|

|

|

14,134 |

|

Other accrued liabilities |

|

|

68,691 |

|

|

|

54,332 |

|

Total current liabilities |

|

|

145,748 |

|

|

|

106,012 |

|

Noncurrent liabilities: |

|

|

|

|

|

|

Long-term debt, net |

|

|

460,119 |

|

|

|

458,249 |

|

Deferred tax liabilities, net |

|

|

8,757 |

|

|

|

1,401 |

|

Other noncurrent liabilities |

|

|

65,717 |

|

|

|

74,778 |

|

Total noncurrent liabilities |

|

|

534,593 |

|

|

|

534,428 |

|

Total liabilities |

|

|

680,341 |

|

|

|

640,440 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred Stock at par, $0.01 par value; 5,000 shares authorized; no

shares issued and outstanding as of December 31, 2023 and 2022,

respectively |

|

|

— |

|

|

|

— |

|

Common Stock at par, $0.01 par value; 300,000 shares authorized;

65,929 and 66,287 shares issued and outstanding as of

December 31, 2023 and 2022, respectively |

|

|

659 |

|

|

|

662 |

|

Additional paid-in capital |

|

|

1,500,232 |

|

|

|

1,511,944 |

|

Accumulated deficit |

|

|

(1,009,734 |

) |

|

|

(1,128,176 |

) |

Accumulated other comprehensive income |

|

|

951 |

|

|

|

— |

|

Total stockholders' equity |

|

|

492,108 |

|

|

|

384,430 |

|

Total liabilities and stockholders' equity |

|

$ |

1,172,449 |

|

|

$ |

1,024,870 |

|

|

|

|

|

|

|

|

|

|

Cars.com Inc. |

|

Consolidated Statements of Cash Flows |

|

(In thousands) |

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

118,442 |

|

|

$ |

17,206 |

|

Adjustments to reconcile Net income to Net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

22,331 |

|

|

|

16,380 |

|

Amortization of intangible assets |

|

|

78,669 |

|

|

|

78,014 |

|

Amortization of Accumulated other comprehensive loss on interest rate swap |

|

|

— |

|

|

|

2,362 |

|

Changes in fair value of contingent consideration |

|

|

5,537 |

|

|

|

8,130 |

|

Stock-based compensation |

|

|

28,491 |

|

|

|

22,342 |

|

Deferred income taxes |

|

|

(114,498 |

) |

|

|

1,283 |

|

Provision for doubtful accounts |

|

|

2,986 |

|

|

|

1,888 |

|

Amortization of debt issuance costs |

|

|

3,042 |

|

|

|

3,235 |

|

Unrealized gain on foreign currency denominated transactions |

|

|

(2,072 |

) |

|

|

— |

|

Amortization of deferred revenue related to AccuTrade Acquisition |

|

|

(883 |

) |

|

|

(4,417 |

) |

Other, net |

|

|

1,026 |

|

|

|

1,202 |

|

Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

|

(15,567 |

) |

|

|

(9,337 |

) |

Prepaid expenses and other assets |

|

|

(5,101 |

) |

|

|

(423 |

) |

Accounts payable |

|

|

3,722 |

|

|

|

2,611 |

|

Accrued compensation |

|

|

11,638 |

|

|

|

(4,296 |

) |

Other liabilities |

|

|

(1,043 |

) |

|

|

(7,669 |

) |

Net cash provided by operating activities |

|

|

136,720 |

|

|

|

128,511 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

Payments for acquisitions, net of cash acquired |

|

|

(76,168 |

) |

|

|

(64,663 |

) |

Capitalization of internally developed technology |

|

|

(19,602 |

) |

|

|

(17,886 |

) |

Purchase of property and equipment |

|

|

(1,280 |

) |

|

|

(1,828 |

) |

Net cash used in investing activities |

|

|

(97,050 |

) |

|

|

(84,377 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from Revolving Loan borrowings |

|

|

45,000 |

|

|

|

45,000 |

|

Payments of Revolving Loan borrowings and long-term debt |

|

|

(36,250 |

) |

|

|

(41,250 |

) |

Payments for stock-based compensation plans, net |

|

|

(9,205 |

) |

|

|

(6,256 |

) |

Repurchases of common stock |

|

|

(31,293 |

) |

|

|

(48,982 |

) |

Payments of debt issuance costs and other fees |

|

|

— |

|

|

|

— |

|

Net cash used in financing activities |

|

|

(31,748 |

) |

|

|

(51,488 |

) |

Impact of foreign currency on Cash and cash equivalents |

|

|

(439 |

) |

|

|

— |

|

Net increase (decrease) in Cash and cash equivalents |

|

|

7,483 |

|

|

|

(7,354 |

) |

Cash and cash equivalents at beginning of period |

|

|

31,715 |

|

|

|

39,069 |

|

Cash and cash equivalents at end of period |

|

$ |

39,198 |

|

|

$ |

31,715 |

|

Supplemental cash flow information: |

|

|

|

|

|

|

Cash paid for income taxes |

|

$ |

17,636 |

|

|

$ |

545 |

|

Cash paid for interest and swap |

|

|

30,416 |

|

|

|

33,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cars.com Inc. |

|

Non-GAAP Reconciliations |

|

(In thousands) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Reconciliation of Net income to Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

8,346 |

|

|

$ |

10,262 |

|

|

$ |

118,442 |

|

|

$ |

17,206 |

|

Interest expense, net |

|

|

8,254 |

|

|

|

8,442 |

|

|

|

32,425 |

|

|

|

35,320 |

|

Income tax (benefit) expense |

|

|

(6,455 |

) |

|

|

6,200 |

|

|

|

(100,337 |

) |

|

|

5,370 |

|

Depreciation and amortization |

|

|

26,619 |

|

|

|

23,706 |

|

|

|

101,000 |

|

|

|

94,394 |

|

Stock-based compensation, including related payroll tax expense |

|

|

7,844 |

|

|

|

5,390 |

|

|

|

30,127 |

|

|

|

22,966 |

|

Non-operating foreign exchange income |

|

|

(2,072 |

) |

|

|

— |

|

|

|

(2,072 |

) |

|

|

— |

|

Write-off of long-lived assets and other |

|

|

389 |

|

|

|

929 |

|

|

|

1,027 |

|

|

|

999 |

|

Severance, transformation and other exit costs |

|

|

1,226 |

|

|

|

960 |

|

|

|

3,574 |

|

|

|

4,329 |

|

Transaction-related items |

|

|

11,253 |

|

|

|

(6,370 |

) |

|

|

10,698 |

|

|

|

6,144 |

|

Adjusted EBITDA |

|

$ |

55,404 |

|

|

$ |

49,519 |

|

|

$ |

194,884 |

|

|

$ |

186,728 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net cash provided by operating activities to Free cash flow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

45,140 |

|

|

$ |

37,220 |

|

|

$ |

136,720 |

|

|

$ |

128,511 |

|

Capitalization of internally developed technology |

|

|

(4,764 |

) |

|

|

(4,739 |

) |

|

|

(19,602 |

) |

|

|

(17,886 |

) |

Purchase of property and equipment |

|

|

(543 |

) |

|

|

(576 |

) |

|

|

(1,280 |

) |

|

|

(1,828 |

) |

Free cash flow |

|

$ |

39,833 |

|

|

$ |

31,905 |

|

|

$ |

115,838 |

|

|

$ |

108,797 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Operating expenses to Adjusted operating expenses for the Three Months Ended December 31, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

Adjustments (1) |

|

|

Stock-Based Compensation |

|

|

As Adjusted |

|

Cost of revenue and operations |

|

$ |

30,918 |

|

|

$ |

— |

|

|

$ |

(396 |

) |

|

$ |

30,522 |

|

Product and technology |

|

|

25,230 |

|

|

|

— |

|

|

|

(2,518 |

) |

|

|

22,712 |

|

Marketing and sales |

|

|

58,835 |

|

|

|

(48 |

) |

|

|

(1,566 |

) |

|

|

57,221 |

|

General and administrative |

|

|

23,069 |

|

|

|

(6,003 |

) |

|

|

(3,364 |

) |

|

|

13,702 |

|

Depreciation and amortization |

|

|

26,619 |

|

|

|

— |

|

|

|

— |

|

|

|

26,619 |

|

Total operating expenses |

|

$ |

164,671 |

|

|

$ |

(6,051 |

) |

|

$ |

(7,844 |

) |

|

$ |

150,776 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonoperating expense, net |

|

$ |

(13,044 |

) |

|

$ |

4,745 |

|

|

$ |

— |

|

|

$ |

(8,299 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes transaction related items, unrealized gain on foreign currency denominated transactions, severance, transformation and other exit costs, and write-off of long-lived assets and other. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Operating expenses to Adjusted operating expenses for the Three Months Ended December 31, 2022: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

Adjustments (1) |

|

|

Stock-Based Compensation |

|

|

As Adjusted |

|

Cost of revenue and operations |

|

$ |

28,875 |

|

|

$ |

— |

|

|

$ |

(224 |

) |

|

$ |

28,651 |

|

Product and technology |

|

|

23,166 |

|

|

|

— |

|

|

|

(1,765 |

) |

|

|

21,401 |

|

Marketing and sales |

|

|

56,515 |

|

|

|

— |

|

|

|

(1,164 |

) |

|

|

55,351 |

|

General and administrative |

|

|

16,128 |

|

|

|

(2,373 |

) |

|

|

(2,237 |

) |

|

|

11,518 |

|

Depreciation and amortization |

|

|

23,706 |

|

|

|

— |

|

|

|

— |

|

|

|

23,706 |

|

Total operating expenses |

|

$ |

148,390 |

|

|

$ |

(2,373 |

) |

|

$ |

(5,390 |

) |

|

$ |

140,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonoperating expense, net |

|

$ |

(3,349 |

) |

|

$ |

(5,229 |

) |

|

$ |

— |

|

|

$ |

(8,578 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes transaction related items, severance, transformation and other exit costs, and write-off of long-lived assets and other. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Operating expenses to Adjusted operating expenses for the Year Ended December 31, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

Adjustments (1) |

|

|

Stock-Based Compensation |

|

|

As Adjusted |

|

Cost of revenue and operations |

|

$ |

122,205 |

|

|

$ |

— |

|

|

$ |

(1,571 |

) |

|

$ |

120,634 |

|

Product and technology |

|

|

99,584 |

|

|

|

— |

|

|

|

(9,360 |

) |

|

|

90,224 |

|

Marketing and sales |

|

|

235,471 |

|

|

|

(48 |

) |

|

|

(6,078 |

) |

|

|

229,345 |

|

General and administrative |

|

|

76,807 |

|

|

|

(10,797 |

) |

|

|

(13,118 |

) |

|

|

52,892 |

|

Depreciation and amortization |

|

|

101,000 |

|

|

|

— |

|

|

|

— |

|

|

|

101,000 |

|

Total operating expenses |

|

$ |

635,067 |

|

|

$ |

(10,845 |

) |

|

$ |

(30,127 |

) |

|

$ |

594,095 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonoperating expense, net |

|

$ |

(36,011 |

) |

|

$ |

3,465 |

|

|

$ |

— |

|

|

$ |

(32,546 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes transaction related items, severance, transformation and other exit costs, unrealized gain on foreign currency denominated transactions, and write-off of long-lived assets and other. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Operating expenses to Adjusted operating expenses for the Year Ended December 31, 2022: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

Adjustments (1) |

|

|

Stock-Based Compensation |

|

|

As Adjusted |

|

Cost of revenue and operations |

|

$ |

114,959 |

|

|

$ |

— |

|

|

$ |

(983 |

) |

|

$ |

113,976 |

|

Product and technology |

|

|

89,015 |

|

|

|

— |

|

|

|

(6,851 |

) |

|

|

82,164 |

|

Marketing and sales |

|

|

221,879 |

|

|

|

— |

|

|

|

(5,068 |

) |

|

|

216,811 |

|

General and administrative |

|

|

67,593 |

|

|

|

(8,943 |

) |

|

|

(10,064 |

) |

|

|

48,586 |

|

Depreciation and amortization |

|

|

94,394 |

|

|

|

— |

|

|

|

— |

|

|

|

94,394 |

|

Total operating expenses |

|

$ |

587,840 |

|

|

$ |

(8,943 |

) |

|

$ |

(22,966 |

) |

|

$ |

555,931 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonoperating expense, net |

|

$ |

(43,460 |

) |

|

$ |

7,946 |

|

|

$ |

— |

|

|

$ |

(35,514 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes transaction related items, severance, transformation and other exit costs, and write-off of long-lived assets and other. |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

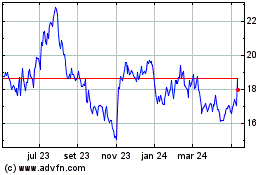

Cars com (NYSE:CARS)

Gráfico Histórico do Ativo

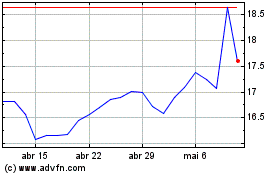

De Mar 2024 até Abr 2024

Cars com (NYSE:CARS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024