Filed Pursuant to Rule 424(b)(7)

Registration No. 333-277294

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 22, 2024)

254,731 Shares

Class A Common Stock

This prospectus supplement relates to the resale of up to 254,731 shares of Class A common stock, par value $0.0001 per share (“Class A Common Stock”), of RingCentral, Inc., a Delaware corporation, by Mitel US Holdings, Inc., which we refer to in this prospectus supplement as Mitel or the selling stockholder, or its permitted transferees.

The shares of Class A Common Stock being offered by the selling stockholder or its permitted transferees were issued pursuant to the Purchase and Sale Agreement, dated November 8, 2021, that we entered into with Mitel and Mitel Networks (International) Limited (as amended, the “Purchase Agreement”), and the Framework Agreement, dated November 8, 2021, that we entered into with Mitel and Mitel Networks, Inc., effective as of November 9, 2021 (as amended, the “Framework Agreement”). We are registering the shares for resale pursuant to the Registration Rights Agreement, dated November 8, 2021, that we entered into with Mitel, effective as of November 9, 2021 (the “Registration Rights Agreement”). See “Selling Stockholder” on page S-16 of this prospectus supplement for a description of these agreements and for additional information regarding the selling stockholder. The prices at which the selling stockholder may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. We are not selling any securities under this prospectus supplement and will not receive any of the proceeds from the sale of shares by the selling stockholder or its permitted transferees.

The selling stockholder may sell the shares of Class A Common Stock described in this prospectus supplement in a number of different ways and at varying prices. See “Plan of Distribution” on page S-18 of this prospectus supplement for more information about how the selling stockholder may sell the shares of Class A Common Stock being registered pursuant to this prospectus supplement. The selling stockholder will pay all brokerage fees and commissions and similar expenses. We will pay certain expenses (except brokerage fees and commissions and similar expenses) incurred in registering the shares, including legal and accounting fees. See “Plan of Distribution” on page S-18 of this prospectus supplement for additional information. Our Class A Common Stock is listed on the New York Stock Exchange (the “NYSE”), under the symbol “RNG.” On February 27, 2024, the last reported sale price of our Class A Common Stock on the NYSE was $32.40 per share.

Investing in our Class A Common Stock involves risks. Please carefully read the information under the headings “Risk Factors” beginning on page S-5 of this prospectus supplement and “Item 1A—Risk Factors” of our most recent report on Form 10-K for the year ended December 31, 2023, or under a similar heading in any other document, that is incorporated by reference in this prospectus supplement before you invest in our securities. Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement and the accompanying prospectus. Any representation to the contrary is a criminal offense.

This prospectus supplement is dated February 28, 2024

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered hereby in any jurisdiction to or from any person whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this Class A Common Stock offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference therein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. We urge you to carefully read this prospectus supplement and the accompanying prospectus, and the documents incorporated herein and therein, before buying any of the securities being offered under this prospectus supplement. To the extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference therein, the statements made in this prospectus supplement will be deemed to modify or supersede those statements made in the accompanying prospectus and documents incorporated by reference therein.

We have not, and the selling stockholder has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus supplement and the accompanying prospectus, which together we sometimes refer to generally as the prospectus, or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We and the selling stockholder take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the selling stockholder are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus or the documents incorporated herein and therein by reference is accurate as of any date other than their respective dates. Our business, financial condition, and results of operations may have changed since those dates. It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, and any related free writing prospectus, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections titled “Where You Can Find More Information” and “Incorporation by Reference” in this prospectus supplement and in the accompanying prospectus.

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying prospectus. It does not contain all of the information that may be important to you and your investment decision. Before investing in our Class A Common Stock, you should carefully read this entire prospectus supplement and the accompanying prospectus, including the matters set forth under the sections of this prospectus supplement and the accompanying prospectus titled “Risk Factors,” the financial statements and related notes and other information that we incorporate by reference herein, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q and the exhibits to the registration statement of which the accompanying prospectus is a part. Unless the context otherwise requires, the terms “RingCentral, Inc.,” “the Company,” “we,” “us” and “our” in this prospectus supplement and the accompanying prospectus refer to the consolidated operations of RingCentral, Inc. and its consolidated subsidiaries as a whole.

Overview

We are a leading provider of AI-driven cloud business communications, contact center, video and hybrid event solutions. We believe that our innovative solutions enable smarter interactions among customers and employees, turning conversations into meaningful insights that drive better business outcomes.

Our cloud-based business solutions are designed to be easy to use, providing a global user identity across multiple locations and devices, including smartphones, tablets, PCs and desk phones. Our solutions can be deployed rapidly and configured and managed easily. Our cloud-based solutions are location and device independent and better suited to address the needs of modern mobile and global enterprise workforces than are legacy on-premises systems. Through our open platform, we enable third-party developers and customers to develop integrations and workflows using our robust set of Application Programming Interfaces and software developers’ kits.

For today’s mobile and highly distributed workforce, RingCentral empowers people to connect from anywhere on any device, across any mode of communication. This gives today’s workforce the ability to communicate more productively and seamlessly in ways that traditional on-premises systems do not support.

RingCentral offers a fully integrated business communications platform, which includes cloud private branch exchanges, cloud contact center, video meetings and webinars, and events. RingCentral is focused on embedding AI into our product portfolio, which we believe is a key product differentiator for the markets and customers we serve.

Our cloud communications and customer engagement solutions are based on our Message Video Phone (MVP) platform. This open platform enables seamless integration with third-party and custom software applications, helping improve business workflows, drive higher employee productivity and enhance better customer service. Our global delivery capabilities support the needs of multi-national enterprises in multiple countries.

Our multi-product portfolio includes:

•RingCentral MVP, an AI-driven Unified Communications as a Service platform, which includes team messaging, video meetings, business SMS and a cloud phone system;

•Contact Center as a Service, a set of cloud-based customer experience solutions that includes RingCentral Contact Center, and RingCX, a native omnichannel contact center with generative AI capabilities and conversation analytics launched in 2023;

•RingCentral Video, our branded video meeting solution with team messaging that enables smart video meetings, rooms solutions, and webinars;

•RingCentral Events, announced in November 2023 following the acquisition of Hopin Events and Session Platforms provides a robust set of features to host virtual, hybrid, and in-person events of all sizes and formats, spanning from single-session events to multi-day & multi-session conferences; and

•RingSense, announced in March 2023, is an AI platform for enhanced business communications and revenue intelligence that helps organizations unlock powerful insights from conversation data. RingSense

for Sales, the first offering in this portfolio, analyzes interactions among salespeople and their prospects to surface key insights and performance measures, helping increase sales efficiency.

We primarily generate revenues from the sale of subscriptions to our offerings. Our subscription plans have monthly, annual, or multi-year contractual terms. We believe that this flexibility in contract duration is important to meet the different needs of our customers. For the years ended December 31, 2023 and 2022, subscriptions revenues accounted for 90% or more of our total revenues. The remainder of our revenues has historically been primarily comprised of product revenues from the sale of pre-configured phones and professional services. We do not develop or manufacture physical phones and offer them as a convenience to our customers. We rely on third-party providers to develop and manufacture these devices and fulfillment partners to successfully serve our customers.

We continue to support our direct inside sales force while also developing indirect sales channels to market our brand and our subscription offerings. Our indirect sales channels who sell our solutions consist of:

•Regional and global network of resellers and distributors;

•Strategic partners who market and sell our MVP or other solutions, including co-branded solutions. Such partnerships include Alcatel-Lucent Enterprise, Amazon Web Services (“Amazon”), Atos SE (“Atos”), Avaya LLC (“Avaya”), and Mitel; and

•Global Service Providers including AT&T, TELUS Communications Company, BT Group plc, Vodafone Group Services Limited (“Vodafone”), Deutsche Telekom (“DT”), Optus Networks Pty Ltd (“Optus”) in Australia, 1&1 Versatel and Ecotel in Germany, MCM in Mexico, Frontier, Charter Communications and others.

Risks Affecting Us

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors.” These risks include, but are not limited to, the following:

•We have incurred significant losses and negative cash flows in the past and anticipate continuing to incur losses for at least the foreseeable future, and we may therefore not be able to achieve or sustain profitability in the future.

•Our quarterly and annual results of operations have fluctuated in the past and may continue to do so in the future. As a result, we may fail to meet or to exceed the expectations of research analysts or investors, which could cause our stock price to fluctuate.

•We rely on third parties, including third parties in countries outside the U.S., primarily in Georgia and the Philippines for a significant portion of our software development, quality assurance, operations, and customer support.

•Global economic conditions may harm our industry, business and results of operations, including the effects of the ongoing war between Russia and Ukraine and related international sanctions against Russia, the ongoing war between Israel and Hamas, and relations between the United States and China.

•Our historically rapid growth and the quickly changing markets in which we operate make it difficult to evaluate our current business and future prospects, which may increase the risk of investing in our stock.

•Our future operating results will rely in part upon the successful execution of our relationships with our strategic partners and global service providers, including Avaya, Amazon, Atos, Alcatel-Lucent Enterprise, Mitel (Unify), Charter Communications, Vodafone, DT, Optus, and other partners and resellers, some or all of which may not be successful.

•We face intense competition in our markets and may lack sufficient financial or other resources to compete successfully.

•We rely and may in the future rely significantly on our strategic partners, agents, brokers, resellers, and global service providers to sell our subscriptions; our failure to effectively develop, manage, and maintain our indirect sales channels could materially and adversely affect our revenues.

•To deliver our subscriptions, we rely on third parties for our network connectivity and for certain of the features in our subscriptions.

•Interruptions or delays in service from our third-party data center hosting facilities, co-location facilities and other third-party providers could impair the delivery of our subscriptions, require us to issue credits or pay penalties and harm our business.

•Failures in Internet infrastructure or interference with broadband access could cause current or potential users to believe that our systems are unreliable, possibly leading our customers to switch to our competitors or to avoid using our subscriptions.

•A security incident, such as a cyber-attack, information security breach or denial of service event could delay or interrupt service to our customers, harm our reputation or business, impact our subscriptions, and subject us to significant liability.

•We depend largely on the continued services of our senior management and other highly-skilled employees, and if we are unable to hire, retain, manage and motivate our employees, we may not be able to grow effectively and our business, results of operations and financial condition could be adversely affected.

•Increased customer turnover, or costs we incur to retain and upsell our customers, could materially and adversely affect our financial performance.

•If we are unable to attract new customers to our subscriptions or upsell to those customers on a cost-effective basis, our business will be materially and adversely affected.

•Our credit agreement imposes operating and financial restrictions on us.

•Servicing our debt, including our notes, may require a significant amount of cash, and we may not have sufficient cash flow from our business to pay all of our indebtedness.

•Our senior notes indenture contains restrictive covenants that may limit our ability to engage in activities that may be in our long-term best interest.

•For as long as the dual class structure of our common stock as contained in our charter documents is in effect, voting control will be concentrated with a limited number of stockholders that held our stock prior to our initial public offering, including primarily our founders and their affiliates, and limiting other stockholders’ ability to influence corporate matters.

•Our Series A Convertible Preferred Stock has rights, preferences and privileges that are not held by, and are preferential to the rights of, our common stockholders, which could adversely affect our liquidity and financial condition.

Corporate Information and History

We were incorporated in California in February 1999, and we reincorporated in Delaware in September 2013. Our principal executive offices are located at 20 Davis Drive, Belmont, California 94002 and the telephone number at that address is (650) 472-4100. Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus supplement or the accompanying prospectus and is not incorporated by reference herein or therein. We have included our website address in this prospectus supplement solely for informational purposes and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus supplement or in deciding whether to purchase shares of our Class A Common Stock. “RingCentral” and other of our trademarks appearing in this prospectus are our property. This prospectus also contains trade names and trademarks of other companies. We do not intend our use or display of other companies’ trade names or trademarks to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies.

THE OFFERING

| | | | | |

| Class A Common Stock registered for sale by the selling stockholder | 254,731 shares of our Class A Common Stock |

| |

| Class A Common Stock to be outstanding after this offering | 83,797,998 shares of our Class A Common Stock |

| |

| Use of proceeds | We will not receive any of the proceeds from the sale of shares of our Class A Common Stock by the selling stockholder. See “Use of Proceeds” for additional information. |

| |

| Selling stockholder | Mitel US Holdings, Inc. |

| |

| NYSE trading symbol | “RNG” |

The number of shares of our Class A Common Stock and Class B common stock, par value $0.0001 per share (“Class B Common Stock”) that will be outstanding after this offering is based on 83,797,998 shares of our Class A Common Stock outstanding and 9,924,538 shares of our Class B Common Stock outstanding as of December 31, 2023 (after giving effect to the issuance of 254,731 shares of Class A Common Stock issued to the selling stockholder on February 28, 2024 in connection with our strategic partnership with Mitel) and excludes:

•8,931,259 shares of Class A Common Stock issuable upon the vesting of restricted stock units outstanding as of December 31, 2023;

•1,344,776 shares of Class A Common Stock issuable upon the vesting of performance stock units outstanding as of December 31, 2023;

•422,192 shares of Class A Common Stock issuable upon the vesting of restricted stock units granted after December 31, 2023;

•742,901 shares of Class A Common Stock reserved for future issuance upon conversion of the Series A Convertible Preferred Stock of the Company outstanding as of December 31, 2023;

•13,579,448 shares of Class A Common Stock reserved for future issuance under our 2013 Equity Incentive Plan as of December 31, 2023; and

•6,293,967 shares of Class A Common Stock reserved for future issuance under our Amended and Restated 2013 Employee Stock Purchase Plan as of December 31, 2023.

Except as otherwise indicated, all information in this prospectus supplement:

•assumes no exercise of outstanding options subsequent to December 31, 2023;

•assumes no vesting of restricted stock unit awards subsequent to December 31, 2023;

•assumes no vesting of performance stock units awards subsequent to December 31, 2023; and

•reflects the issuance of 254,731 shares of Class A Common Stock issued to the selling stockholder on February 28, 2024 in connection with our strategic partnership with Mitel, as described in this prospectus supplement.

RISK FACTORS

Investing in our Class A Common Stock involves a high degree of risk. You should carefully consider the risks described in Part I, Item 1A, Risk Factors in our most recent Annual Report on Form 10-K for the year ended December 31, 2023 together with the other information set forth in this prospectus supplement and the accompanying prospectus, and in the other documents that we include or incorporate by reference into this prospectus supplement, as updated by our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings we make with the SEC, the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement and any risk factors set forth in our other filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), before making a decision about investing in our Class A Common Stock. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. If any risks actually occur, our business, financial condition and results of operations may be materially and adversely affected. In such an event, the trading price of our Class A Common Stock could decline and you could lose part or all of your investment.

For more information about our SEC filings, please see “Where You Can Find More Information” and “Incorporation by Reference.”

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. Forward-looking statements are based upon current expectations that involve risks and uncertainties. Actual results may differ materially from those anticipated in these forward-looking statements. Statements that are not purely historical are forward-looking statements. Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipates”, “believes”, “could”, “seeks”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predicts”, “projects”, “should”, “will”, “would” and similar expressions or variations intended to identify forward-looking statements. Forward-looking statements contained in this prospectus supplement and the accompanying prospectus include, but are not limited to, statements about:

•our progress against short-term and long-term goals;

•our future financial performance;

•our anticipated growth, growth strategies and our ability to effectively manage that growth and effect these strategies;

•our success in all market segments;

•anticipated trends, developments and challenges in our business and in the markets in which we operate, as well as general macroeconomic conditions and geopolitical conflicts;

•our ability to scale to our desired goals, particularly the implementation of new processes and systems and the addition to our workforce;

•the impact of competition in our industry and innovation by our competitors;

•our ability to anticipate and adapt to future changes in our industry;

•our ability to predict subscriptions revenues, formulate accurate financial projections, and make strategic business decisions based on our analysis of market trends;

•our ability to anticipate market needs and develop new and enhanced solutions and subscriptions to meet those needs, and our ability to successfully monetize them;

•our ability to successfully incorporate artificial intelligence (AI) and machine learning powered features into our solutions;

•maintaining and expanding our customer base;

•maintaining, expanding and responding to changes in our relationships with other companies;

•maintaining and expanding our distribution channels, including our network of sales agents and resellers, and our strategic partnerships;

•our success with our strategic partners and global service providers;

•our ability to sell, market, and support our solutions and services;

•our ability to expand our business to larger customers as well as expanding domestically and internationally;

•our ability to realize increased purchasing leverage and economies of scale as we expand;

•the impact of seasonality on our business;

•the impact of any failure of our solutions or solution innovations, including our innovations relating to AI;

•our reliance on our third-party product and service providers;

•the potential effect on our business of litigation to which we may become a party;

•our liquidity and working capital requirements;

•the impact of changes in the regulatory environment including with respect to AI;

•our ability to protect our intellectual property and rely on open source licenses;

•our expectations regarding the growth and reliability of the internet infrastructure;

•the timing of acquisitions of, or making and exiting investments in, other entities, businesses or technologies;

•our ability to successfully and timely execute on, integrate, and realize the benefits of any acquisition, investment, strategic partnership, or other strategic transaction we may make or undertake;

•our capital expenditure projections;

•our capital allocation plans, including expected allocations of cash and timing for any share repurchases and other investments;

•our credit agreement, including both the term loan and the revolving credit facility;

•the estimates and estimate methodologies used in preparing our consolidated financial statements;

•the political environment and stability in the regions in which we or our subcontractors operate;

•the impact of economic downturns on us and our customers;

•our ability to defend our systems and our customer information from fraud and cyber-attack;

•our ability to prevent the use of fraudulent payment methods for our solutions;

•our ability to retain key employees and to attract qualified personnel;

•our ability to successfully implement our plans for reductions in workforce or otherwise achieve the anticipated cost reductions; and

•the impact of foreign currencies on our non-U.S. business as we expand our business internationally.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this prospectus supplement and the accompanying prospectus.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus supplement and the accompanying prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors” and elsewhere in this prospectus supplement and the accompanying prospectus or in the documents incorporated by reference in this prospectus and the accompanying prospectus. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus supplement, the accompanying prospectus and the documents that are incorporated by reference into this prospectus and the accompanying prospectus. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this prospectus supplement and the accompanying prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this prospectus supplement and the accompanying prospectus, and the documents that are incorporated by reference into this prospectus supplement and accompanying prospectus to reflect events or circumstances after the date of this prospectus supplement and the accompanying prospectus or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

See the sections titled “Risk Factors” incorporated from filings we make with the SEC for a more complete discussion of the risks and uncertainties mentioned above and for a discussion of other risks and uncertainties.

USE OF PROCEEDS

All of the shares of Class A Common Stock being offered hereby are being sold by the selling stockholder identified in this prospectus supplement or its permitted transferees. We will not receive any of the proceeds from the sale of shares of Class A Common Stock by the selling stockholder or its permitted transferees. We will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of the shares to be sold by the selling stockholder, including registration, listing fees, printers and accounting fees and fees and disbursements of counsel (collectively, the “Registration Expenses”). Other than Registration Expenses, the selling stockholder will bear any selling discounts, commissions, placement agent fees, fees or expenses of outside counsel of the selling stockholder or other similar expenses payable with respect to sales of shares.

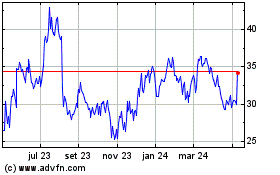

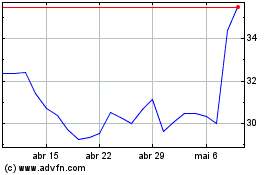

MARKET PRICE OF CLASS A COMMON STOCK

Market Information

Our Class A Common Stock has been traded on the New York Stock Exchange under the symbol “RNG” since September 27, 2013. On February 27, 2024, the last reported sale price for our Class A Common Stock was $32.40 per share.

Holders of Record

As of December 31, 2023, there were 15 stockholders of record. The number of record holders does not include beneficial holders who hold their shares in “street name,” meaning that the shares are held for their accounts by a broker or other nominee. Accordingly, we believe that the total number of beneficial holders is higher than the number of our stockholders of record.

DIVIDEND POLICY

We have never declared or paid, any cash dividends on our Class A Common Stock. We currently intend to retain all of our future earnings, if any, to finance our operations and do not anticipate paying any cash dividends on our Class A Common Stock in the foreseeable future. Any future determination as to the declaration and payment of dividends will be at the discretion of our board of directors and will depend on then-existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business prospects, and other factors our board of directors may deem relevant.

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS OF OUR CLASS A COMMON STOCK

The following is a summary of the material U.S. federal income tax consequences to non-U.S. holders (as defined below) of the ownership and disposition of our Class A Common Stock sold by the selling stockholder or its permitted transferees pursuant to this prospectus supplement but does not purport to be a complete analysis of all the potential tax considerations relating thereto. This summary is based upon the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations promulgated thereunder, administrative rulings and judicial decisions, all in effect as of the date hereof. These authorities may be changed, possibly retroactively, so as to result in U.S. federal income tax consequences different from those set forth below. We have not sought and will not seek any ruling from the Internal Revenue Service (the “IRS”), with respect to the statements made and the conclusions reached in the following summary, and there can be no assurance that the IRS will agree with such statements and conclusions.

This summary applies only to Class A Common Stock sold by the selling stockholder or its permitted transferees pursuant to this prospectus supplement. It does not address the tax consequences arising under the laws of any U.S. state or local jurisdiction or non-U.S. jurisdiction or under U.S. federal gift and estate tax laws, the potential application of the alternative minimum tax, the additional Medicare tax on net investment income or any other tax considerations applicable to an investor’s particular circumstances or to investors that may be subject to special tax rules, including, without limitation:

•banks, insurance companies or other financial institutions;

• tax-exempt organizations or governmental organizations;

•real estate investment trusts, regulated investment companies or grantor trusts;

•qualified foreign pension funds or other tax-qualified retirement plans;

• controlled foreign corporations, passive foreign investment companies and corporations that accumulate earnings to avoid U.S. federal income tax;

• brokers or dealers in securities or currencies;

• traders in securities that elect to use a mark-to-market method of accounting for their securities holdings;

• persons that own, or are deemed to own, more than 5% of our capital stock by vote or by value (except to the extent specifically set forth below);

• U.S. expatriates and former citizens or long-term residents of the United States;

• partnerships (or entities or arrangements classified as such for U.S. federal income tax purposes), other pass-through entities, and investors therein;

• persons who hold our Class A Common Stock as a position in a “hedge,” “straddle,” “conversion transaction” or other risk reduction transaction;

• persons who do not hold our Class A Common Stock as a capital asset within the meaning of Section 1221 of the Code (generally, property held for investment);

• persons deemed to sell our Class A Common Stock under the constructive sale provisions of the Code;

• persons subject to special tax accounting rules as a result of any item of gross income with respect to the Class A Common Stock being taken into account in an “applicable financial statement” (as defined in Section 451(b) of the Code);

• persons who hold or receive our Class A Common Stock pursuant to the exercise of options or otherwise as compensation; or

• persons that own, or are deemed to own, our Class B Common Stock.

In addition, if a partnership (or entity or arrangement classified as such for U.S. federal income tax purposes) holds our Class A Common Stock, the tax treatment of a partner generally will depend on the status of the partner and upon the activities of the partnership. Accordingly, partnerships that hold our Class A Common Stock, and partners in such partnerships, should consult their tax advisors regarding the tax consequences of the purchase, ownership and disposition of our Class A Common Stock.

This discussion is for informational purposes only and is not tax advice. You are urged to consult your tax advisor with respect to the application of the U.S. federal income tax laws to your particular situation, as well as any tax consequences of the purchase, ownership and disposition of our Class A Common Stock arising under the U.S. federal estate or gift tax laws or under the laws of any state, local, non-U.S. or other taxing jurisdiction or under any applicable tax treaty.

Non-U.S. Holder Defined

For purposes of this discussion, you are a non-U.S. holder if you are a beneficial owner of shares of our Class A Common Stock that, for U.S. federal income tax purposes, is not a partnership or:

•an individual who is a citizen or resident of the United States;

•a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created or organized in the United States or under the laws of the United States or any political subdivision thereof, including the District of Columbia;

•an estate whose income is subject to U.S. federal income tax regardless of its source; or

•a trust (x) whose administration is subject to the primary supervision of a U.S. court and which has one or more U.S. persons who have the authority to control all substantial decisions of the trust or (y) which has made a valid election to be treated as a U.S. person for U.S. federal income tax purposes.

Distributions

We have not made any distributions on our Class A Common Stock, and we do not plan to make any distributions on our Class A Common Stock. However, if we do make distributions on our Class A Common Stock, those payments will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. To the extent those distributions exceed both our current and our accumulated earnings and profits, they will constitute a return of capital and will first reduce your basis in our Class A Common Stock, but not below zero, and then will be treated as gain from the sale of stock. Under applicable Treasury Regulations, we may withhold up to 30% of the gross amount of the entire distribution even if the amount constituting a dividend, as described above, is less than the gross amount. You may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS.

Subject to the discussions below on effectively connected income, backup withholding and FATCA, any dividend paid to you generally will be subject to U.S. withholding tax either at a rate of 30% of the gross amount of the dividend or such lower rate as may be specified by an applicable income tax treaty between the United States and your country of residence. In order to receive a reduced treaty rate, you must provide us with an IRS Form W-8BEN, IRS Form W-8BEN-E or other appropriate version of IRS Form W-8 (or the applicable successor form), including a U.S. taxpayer identification number, if required, certifying qualification for the reduced rate. In addition, you will be required to update such forms and certifications from time to time as required by law. If you are eligible for a reduced rate of U.S. withholding tax pursuant to an income tax treaty, you may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS. If you hold our Class A Common Stock through a financial institution or other agent acting on your behalf, you will be required to provide appropriate documentation to the agent, which may then be required to provide certification to the relevant paying agent, either directly or through other intermediaries.

Dividends received by you that are effectively connected with your conduct of a trade or business in the United States (and, if required by an applicable tax treaty, that are attributable to a permanent establishment or a fixed base maintained by you in the United States), are generally exempt from such withholding tax, subject to the discussions below on backup withholding and FATCA. In order to obtain this exemption, you must provide us with an IRS Form W-8ECI properly certifying such exemption. Such effectively connected dividends, although not subject to withholding tax, generally are taxed at the same graduated rates applicable to U.S. persons, net of certain deductions and credits. In addition, if you are a non-U.S. holder treated as a corporation for U.S. federal income tax purposes, dividends you receive that are effectively connected with your conduct of a trade or business in the United States may also be subject to a branch profits tax at a rate of 30% or such lower rate as may be specified by an applicable income tax treaty. You should consult your tax advisor regarding any applicable tax treaties that may provide for different rules.

Gain on Disposition of Our Class A Common Stock

Subject to discussions below regarding backup withholding, you generally will not be required to pay U.S. federal income tax on any gain realized upon the sale or other disposition of our Class A Common Stock unless:

•the gain is effectively connected with your conduct of a trade or business in the United States (and, if required by an applicable income tax treaty, the gain is attributable to a permanent establishment or a fixed base maintained by you in the United States);

•you are an individual who is present in the United States for a period or periods aggregating 183 days or more during the calendar year in which the sale or disposition occurs and certain other conditions are met; or

•our Class A Common Stock constitutes a U.S. real property interest by reason of our status as a “United States real property holding corporation,” or USRPHC, for U.S. federal income tax purposes at any time within the shorter of the five year period preceding your disposition of, or your holding period for, our Class A Common Stock.

In general, a corporation is a USRPHC if the fair market value of its U.S. real property interests equals or exceeds 50% of the sum of the fair market value of its worldwide property interests and its other assets used or held for use in a trade or business (all as determined for U.S. federal income tax purposes). We believe that we are not currently and will not become a USRPHC, and the remainder of this discussion so assumes. However, because the determination of whether we are a USRPHC depends on the fair market value of our U.S. real property relative to the fair market value of our worldwide real property and other business assets, there can be no assurance that we will not become a USRPHC in the future. Even if we become a USRPHC, however, as long as our Class A Common Stock is “regularly traded on an established securities market” (within the meaning of Section 897(c)(3) of the Code), such Class A Common Stock will be treated as U.S. real property interests only if you actually or constructively hold more than 5% of such regularly traded Class A Common Stock at any time during the shorter of the five year period preceding your disposition of, or your holding period for, our Class A Common Stock.

If you are a non-U.S. holder described in the first bullet above, you will be required to pay U.S. federal income tax on the net gain derived from the sale under regular graduated U.S. federal income tax rates, and a corporate non-U.S. holder described in the first bullet above also may be subject to the branch profits tax at a 30% rate, or such lower rate as may be specified by an applicable income tax treaty. If you are an individual non-U.S. holder described in the second bullet above, you will be required to pay a flat 30% U.S. federal income tax (or such lower rate specified by an applicable income tax treaty) on the gain derived from the sale, which gain may be offset by U.S.-source capital losses for the year. You should consult your tax advisor regarding any applicable income tax or other treaties that may provide for different rules.

Backup Withholding and Information Reporting

Generally, we must report annually to the IRS the amount of dividends paid to you, your name and address, and the amount of tax withheld, if any. A similar report will be sent to you. Pursuant to applicable income tax treaties or other agreements, the IRS may make these reports available to tax authorities in your country of residence.

Payments of dividends on or of proceeds from the disposition of our Class A Common Stock made to you may be subject to additional information reporting and backup withholding at a current rate of 24% unless you establish an exemption, for example, by properly certifying your non-U.S. status on an IRS Form W-8BEN, IRS Form W-8BEN-E or another appropriate version of IRS Form W-8 (or an applicable successor form). Notwithstanding the foregoing, backup withholding and information reporting may apply if either we or our paying agent has actual knowledge, or reason to know, that you are a U.S. person.

Backup withholding is not an additional tax; rather, the U.S. federal income tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund or credit may generally be obtained from the IRS, provided that the required information is furnished to the IRS in a timely manner.

Foreign Account Tax Compliance Act (“FATCA”)

Sections 1471 through 1474 of the Code, and the Treasury Regulations and administrative guidance issued thereunder (“FATCA”), generally impose a U.S. federal withholding tax of 30% on dividends on and the gross proceeds from a disposition of our Class A Common Stock paid to a “foreign financial institution” (as defined in the Code) unless such institution enters into an agreement with the U.S. government to, among other things, withhold on certain payments and to collect and provide to the U.S. tax authorities substantial information regarding U.S. account holders of such institution (which includes certain equity and debt holders of such institution, as well as certain account holders that are foreign entities with U.S. owners) or otherwise establishes an exemption. FATCA also generally imposes a U.S. federal withholding tax of 30% on dividends on and the gross proceeds from a disposition of our Class A Common Stock paid to a “non-financial foreign entity” (as specifically defined in the Code) unless such entity provides the withholding agent with either a certification that it does not have any substantial direct or indirect U.S. owners or provides information regarding direct and indirect U.S. owners of the entity or otherwise establishes an exemption.

The withholding provisions described above generally apply to payments of dividends on our Class A Common Stock. The Treasury Secretary has issued proposed regulations providing that the withholding provisions under FATCA do not apply with respect to the gross proceeds from a sale or other disposition of Class A Common Stock, which may be relied upon by taxpayers until final regulations are issued. An intergovernmental agreement between the United States and an applicable foreign country may modify the requirements described in this section. Under certain circumstances, a non-U.S. holder might be eligible for refunds or credits of such taxes. You should consult your tax advisors regarding the potential application of FATCA to your investment in, and ownership and disposition of, our Class A Common Stock.

Each prospective investor should consult its tax advisor regarding the particular U.S. federal, state and local and non-U.S. tax consequences of purchasing, holding and disposing of our Class A Common Stock, including the consequences of any proposed change in applicable laws.

SELLING STOCKHOLDER

The following table details the name of the selling stockholder, the number of shares of our Class A Common Stock beneficially owned by the selling stockholder, and the number of shares of our Class A Common Stock being offered by the selling stockholder for sale under this prospectus supplement. The percentage of shares of our common stock beneficially owned by the selling stockholder both prior to and following the offering of securities pursuant to this prospectus supplement, is based on 83,797,998 shares of our Class A Common Stock outstanding and 9,924,538 shares of our Class B Common Stock outstanding as of December 31, 2023 (after giving effect to the issuance of 254,731 shares of Class A Common Stock issued to the selling stockholder on February 28, 2024 in connection with our strategic partnership with Mitel).

Beneficial ownership for the purposes of the following table is determined in accordance with the rules and regulations of the SEC. Unless otherwise indicated in the footnotes below, each stockholder named in the following table possesses sole voting and investment power over the shares listed. The information does not necessarily indicate beneficial ownership for any other purpose.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares Beneficially Owned

Prior to the Offering | | Shares of Class A Common Stock Being Offered(1) | | Shares Beneficially Owned After the Offering(2) |

| Class A | | Class B | | | Class A | | Class B |

| Name of Selling Stockholder | | Shares | | % | | Shares | | % |

| | Shares | | % | | Shares | | % |

Mitel US Holdings, Inc. (3) | | 254,731 | | * | | — | | — | | 254,731 | | — | | — | | — | | — |

__________________

(*)Represents beneficial ownership of less than 1%.

(1)Represents the number of shares of Class A Common Stock being registered hereby on behalf of the selling stockholder.

(2)Assumes that the selling stockholder disposes of all the shares of Class A Common Stock being registered hereby and does not acquire beneficial ownership of any additional shares. The registration of these shares of Class A Common Stock does not necessarily mean that the selling stockholder will sell all or any portion of the shares of Class A Common Stock covered by this prospectus supplement.

(3)Mitel U.S. Holdings, Inc. is a wholly owned subsidiary of MLN US HoldCo LLC (“MLN HoldCo”). MLN US TopCo Inc. is the sole member of MLN HoldCo and a wholly owned subsidiary of Mitel Networks (International) Limited (“MNIL”). MNIL is a wholly owned subsidiary of MLN TopCo Ltd. (“MLN TopCo”). MLN TopCo is a wholly owned subsidiary of Searchlight II MLN, L.P (“Searchlight II”). Each of MLN HoldCo, MLN US TopCo Inc., MNIL, MLN TopCo and Searchlight II may be deemed to have beneficial ownership of the shares of Class A Common Stock held by Mitel U.S. Holdings, Inc. In addition to the shares being registered hereby on behalf of the selling stockholder, Searchlight II owns 200,000 shares of Series A Convertible Preferred Stock, which are convertible into 742,901 shares of Class A Common Stock at Searchlight II’s option. Searchlight II MLN GP, Ltd. (“MLN GP”) is the general partner of Searchlight II and each of Searchlight Capital II PV, L.P. (“PV LP”) and Searchlight Capital II, L.P. (“Capital II LP”) share voting and economic control over MLN GP. Searchlight Capital Partners II GP, L.P. (“GP LP”) is the general partner of both PV LP and Capital II LP and Searchlight Capital Partners II GP, LLC (“GP LLC”) is the general partner of GP LP. Three managers (the “Managers”) directly or indirectly control the investment and voting decisions of GP LLC by majority vote or consent, and thus, none of the Managers individually control the investment or voting decisions of the GP LLC. Each of PV LP, Capital II LP, GP LP and GP LLC may be deemed to have beneficial ownership of the shares of Class A Common Stock beneficially owned by Searchlight II. Mitel US Holdings, Inc. is a Delaware corporation whose address is 1146 North Alma School Rd., Mesa, Arizona, 85201.

Certain Relationships with Selling Stockholder

Strategic Partnership

On November 8, 2021, we entered into the Purchase and Sale Agreement with Mitel and Mitel Networks (International) Limited (as amended, the “Purchase Agreement”), and the Framework Agreement with Mitel and Mitel Networks, Inc. (as amended, the “Framework Agreement”), each effective as of November 9, 2021. The shares being offered by the selling stockholder were issued by us as additional consideration and commission under the terms and conditions of the Purchase Agreement and the Framework Agreement, respectively. The terms of our strategic partnership with Mitel are described in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference herein.

Registration Rights Agreement

On November 8, 2021, we entered into the Registration Rights Agreement with Mitel, effective as of November 9, 2021 (the “Registration Rights Agreement”), pursuant to which we have agreed to register the sale by Mitel, its affiliates and permitted transferees, of Class A Common Stock issued to Mitel in connection with the

strategic partnership described herein and any securities issued as a dividend, stock split, recapitalization or other distribution with respect to, in exchange for or in replacement of such shares, other than any securities which have previously been disposed of pursuant to an effective registration statement under the Securities Act or may be sold without restriction in compliance with Rule 144. We have agreed to use our reasonable best efforts to cause any such registration statement to become effective within certain time periods following the issuance of shares of Class A Common Stock under the Registration Rights Agreement, as described therein. A copy of the Registration Rights Agreement is filed as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference herein.

PLAN OF DISTRIBUTION

The selling stockholder, which, as used herein, includes donees, pledgees, transferees, assignees, distributees or other successors-in-interest selling shares of our Class A Common Stock received after the date of this prospectus supplement from the selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell any or all of the shares of Class A Common Stock beneficially owned by them and offered hereby. We will not receive any of the proceeds from the sale by the selling stockholder of the shares of our Class A Common Stock.

The selling stockholder and any of its donees, pledgees, transferees, assignees, distributees or other successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the principal trading market for the Class A Common Stock or any other stock exchange, market or trading facility on which the Class A Common Stock is traded or in private transactions. These sales may be at market prices prevailing at the time of sale, at prices related to such market prices, at varying prices determined at the time of sale, at fixed prices or at negotiated prices. A selling stockholder may use any one or more of the following methods when selling securities:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales;

•in transactions through broker-dealers that agree with the selling stockholder to sell a specified number of such common stock at a stipulated price per security;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•a combination of any such methods of sale; or

•any other method permitted pursuant to applicable law.

In addition, the selling stockholder may elect to make a pro rata in-kind distribution of shares of the Class A Common Stock to its stockholders pursuant to the registration statement of which this prospectus supplement forms a part by delivering a prospectus supplement. To the extent that such members, partners or stockholders are not affiliates of ours, such members, partners or stockholders would thereby receive freely tradeable shares of our Class A Common Stock pursuant to the distribution through a registration statement.

The selling stockholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus supplement.

The selling stockholder also may transfer securities in other circumstances, in which case the transferees or other successors in interest will be the selling beneficial owners for purposes of this prospectus supplement.

Broker-dealers engaged by the selling stockholder may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of the Class A Common Stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus supplement, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with Financial Industry Regulatory Authority (“FINRA”) Rule 5110; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the Class A Common Stock or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Class A Common Stock in the course of hedging the positions they assume. The selling stockholder may also sell Class A Common Stock short and deliver these shares to close out its short positions, or loan or pledge the securities to broker-dealers that in turn may sell these shares. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus supplement, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus supplement (as supplemented or amended to reflect such transaction).

The selling stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are required to pay certain fees and expenses incurred by us incident to the registration of the Class A Common Stock. In addition, subject to certain exceptions, we have agreed to indemnify the selling stockholder and certain other persons against certain liabilities in connection with any untrue statement or omission of material fact in filings incident to the registration of the Class A Common Stock pursuant to the Registration Rights Agreement or violations of applicable rules and regulations promulgated under the Securities Act, Exchange Act or state securities laws in connection with such registration, unless such liability arose from untrue statements or omissions furnished by the selling stockholder. The selling stockholder has agreed to indemnify us and certain other persons against any liabilities arising from any untrue statement or omission of material fact in filings incident to the registration of the Class A Common Stock pursuant to the Registration Rights Agreement or violations of applicable rules and regulations promulgated under the Securities Act, Exchange Act or state securities laws in connection with such registration, but only to the extent such untrue statement or omission is made in reliance upon and in conformity with information furnished to the Company by the selling stockholder.

The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the Class A Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Class A Common Stock by the selling stockholder or any other person. We will make copies of this prospectus supplement and the accompanying prospectus available to the selling stockholder and have informed them of the need to deliver a copy of this prospectus supplement and the accompanying prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity of the shares of Class A Common Stock in respect of which this prospectus is being delivered will be passed upon for us by Wilson Sonsini Goodrich & Rosati, Professional Corporation, Palo Alto, California.

EXPERTS

The consolidated financial statements of RingCentral, Inc. as of December 31, 2023 and 2022, and for each of the years in the three-year period ended December 31, 2023, and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2023 have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to this offering. This prospectus supplement, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement, its exhibits and schedules, portions of which have been omitted as permitted by the rules and regulations of the SEC, and the accompanying prospectus. For further information about us, we refer you to the registration statement and to its exhibits and schedules.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.ringcentral.com. Information accessible on or through our website is not a part of this prospectus supplement or the accompanying prospectus.

INCORPORATION BY REFERENCE

The rules of the SEC allow us to incorporate by reference information into this prospectus supplement. The information incorporated by reference is considered to be a part of this prospectus supplement, and information that we file later with the SEC will automatically update and supersede this information. This prospectus supplement incorporates by reference the documents listed below:

•our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 22, 2024; •our Current Report on Form 8-K, filed with the SEC on January 3, 2024; and •the description of our Class A Common Stock contained in our Registration Statement on Form 8-A (File No. 001-36089) filed with the SEC on September 24, 2013, pursuant to Section 12(b) of the Exchange Act, including any amendment or report filed for the purpose of updating such description. All reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this prospectus supplement and prior to the termination of this offering shall be deemed to be incorporated by reference in this prospectus supplement and to be part hereof from the date of filing of such reports and other documents.

Notwithstanding the foregoing, we are not incorporating by reference any documents, portions of documents, exhibits or other information that is deemed to have been furnished to, rather than filed with, the SEC.

Any statement contained in a document incorporated by reference into this prospectus supplement shall be deemed to be modified or superseded for the purposes of this prospectus supplement to the extent that a statement contained herein or in any subsequently filed document that is also incorporated by reference in this prospectus supplement modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

We will provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus supplement is delivered, upon written or oral request of any such person, a copy of any or all of the documents that has been or may be incorporated by reference into this prospectus supplement, including exhibits which are specifically incorporated by reference into such documents, at no cost. Any such request may be made in writing or by telephoning our Investor Relations department at the following address or telephone number:

RingCentral Inc.

20 Davis Drive

Belmont, California 94002

Attn: Investor Relations

(650) 472-4100

PROSPECTUS

RingCentral, Inc.

Class A Common Stock

Preferred Stock

Debt Securities

Depositary Shares

Warrants

Subscription Rights

Purchase Contracts

Units

We may issue securities from time to time in one or more offerings, in amounts, at prices and on terms determined at the time of offering. This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We will provide the specific terms of these securities in supplements to this prospectus, which will also describe the specific manner in which these securities will be offered and may also supplement, update or amend information contained in this prospectus. You should read this prospectus and any applicable prospectus supplement before you invest.

In addition, selling securityholders to be named in a supplement to this prospectus may from time to time offer or sell shares of our Class A Common Stock. To the extent that any selling securityholders resell any of our securities, the selling securityholders may be required to provide you with this prospectus and a prospectus supplement identifying and containing specific information about the selling securityholders and the amount and terms of the securities being offered. Unless the applicable prospectus supplement provides otherwise, we will not receive any proceeds from the sale of our Class A Common Stock by the selling securityholders.

The securities may be sold directly to you, through agents or through underwriters and dealers. If agents, underwriters or dealers are used to sell the securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities and the net proceeds we expect to receive from that sale will also be set forth in a prospectus supplement.

Our Class A Common Stock, par value $0.0001 per share, is listed on the New York Stock Exchange, or the NYSE, under the symbol “RNG.” Each prospectus supplement will indicate whether the securities offered thereby will be listed on any securities exchange.

Investing in our securities involves risks. You should review carefully the risks and uncertainties described under the headings “Risk Factors” beginning on page 5 of this prospectus and “Item 1A – Risk Factors” of our most recent report on Form 10-K or 10-Q or under similar headings in any other document that is incorporated by reference in this prospectus before you invest in our securities. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 22, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC or the Commission, using an automatic “shelf” registration process as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act. Under this automatic shelf registration process, we or the selling securityholders may from time to time sell any combination of the securities described in this prospectus in one or more offerings. There is no limit on the aggregate amount of securities that we or the selling securityholders may offer pursuant to the registration statement of which this prospectus forms a part.

This prospectus provides you with a general description of the securities that may be offered. Each time we or the selling securityholders sell securities, we will provide one or more prospectus supplements that will contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus. Before you invest in our securities, you should read both this prospectus and any applicable prospectus supplement together with the additional information described in the sections titled “Where You Can Find More Information” and “Incorporation by Reference.” This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

We have not authorized anyone to provide you with information that is different from that contained, or incorporated by reference, in this prospectus, any applicable prospectus supplement or in any related free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus and any applicable prospectus supplement or any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in the applicable prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain all of the information that may be important to you and your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including the matters set forth in the section titled “Risk Factors” and the financial statements and related notes and other information that we incorporate by reference herein, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. Unless the context indicates otherwise, references in this prospectus to “RingCentral, Inc.,” “the Company,” “we,” “our” and “us” refer, collectively, to RingCentral, Inc., a Delaware corporation, and its subsidiaries taken as a whole.

Company Overview

We are a leading provider of AI-driven cloud business communications, contact center, video and hybrid event solutions. We believe that our innovative solutions enable smarter interactions among customers and employees, turning conversations into meaningful insights that drive better business outcomes.

Our cloud-based business solutions are designed to be easy to use, providing a global user identity across multiple locations and devices, including smartphones, tablets, PCs and desk phones. Our solutions can be deployed rapidly and configured and managed easily. Our cloud-based solutions are location and device independent and better suited to address the needs of modern mobile and global enterprise workforces than are legacy on-premises systems. Through our open platform, we enable third-party developers and customers to develop integrations and workflows using our robust set of Application Programming Interfaces and software developers’ kits.

For today’s mobile and highly distributed workforce, RingCentral empowers people to connect from anywhere on any device, across any mode of communication. This gives today’s workforce the ability to communicate more productively and seamlessly in ways that traditional on-premises systems do not support.

RingCentral offers a fully integrated business communications platform, which includes cloud private branch exchanges, cloud contact center, video meetings and webinars, and events. RingCentral is focused on embedding AI into our product portfolio, which we believe is a key product differentiator for the markets and customers we serve.

Our cloud communications and customer engagement solutions are based on our Message Video Phone (MVP) platform. This open platform enables seamless integration with third-party and custom software applications, helping improve business workflows, drive higher employee productivity and enhance better customer service. Our global delivery capabilities support the needs of multi-national enterprises in multiple countries.

Our multi-product portfolio includes:

•RingCentral MVP, an AI-driven Unified Communications as a Service platform, which includes team messaging, video meetings, business SMS and a cloud phone system;

•Contact Center as a Service, a set of cloud-based customer experience solutions that includes RingCentral Contact Center, and RingCX, a native omnichannel contact center with generative AI capabilities and conversation analytics launched in 2023;

•RingCentral Video, our branded video meeting solution with team messaging that enables smart video meetings, rooms solutions, and webinars;

•RingCentral Events, announced in November 2023 following the acquisition of Hopin Events and Session Platforms provides a robust set of features to host virtual, hybrid, and in-person events of all sizes and formats, spanning from single-session events to multi-day & multi-session conferences; and

•RingSense, announced in March 2023, is an AI platform for enhanced business communications and revenue intelligence that helps organizations unlock powerful insights from conversation data. RingSense for Sales, the first offering in this portfolio, analyzes interactions among salespeople and their prospects to surface key insights and performance measures, helping increase sales efficiency.

We primarily generate revenues from the sale of subscriptions to our offerings. Our subscription plans have monthly, annual, or multi-year contractual terms. We believe that this flexibility in contract duration is important to meet the different needs of our customers. For the years ended December 31, 2023 and 2022, subscriptions revenues accounted for 90% or more of our total revenues. The remainder of our revenues has historically been primarily comprised of product revenues from the sale of pre-configured phones and professional services. We do not develop or manufacture physical phones and offer them as a convenience to our customers. We rely on third-party providers to develop and manufacture these devices and fulfillment partners to successfully serve our customers.

We continue to support our direct inside sales force while also developing indirect sales channels to market our brand and our subscription offerings. Our indirect sales channels who sell our solutions consist of:

•Regional and global network of resellers and distributors;

•Strategic partners who market and sell our MVP or other solutions, including co-branded solutions. Such partnerships include Alcatel-Lucent Enterprise, Amazon Web Services, Atos SE, Avaya LLC, and Mitel US Holdings, Inc.; and

•Global Service Providers including AT&T, TELUS Communications Company, BT Group plc, Vodafone Group Services Limited, Deutsche Telekom, Optus Networks Pty Ltd in Australia, 1&1 Versatel and Ecotel in Germany, MCM in Mexico, Frontier, Charter Communications and others.

Corporate Information