UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

SCHEDULE 14A

__________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant

|

|

☒

|

|

Filed by a Party other than the Registrant

|

|

☐

|

Check the appropriate box:

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

|

Proxy Statement/Prospectus

|

|

☒

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material under §240.14a-12

|

A SPAC I ACQUISITION CORP.

(Name of Registrant as Specified In Its Charter)

______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Fee computed on table in exhibits required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

A SPAC I ACQUISITION CORP.

Level 39, Marina Bay Financial Centre

Tower 2, 10 Marina Boulevard

Singapore, 018983

To A SPAC I Acquisition Corp. Shareholders:

As you know, A SPAC I Acquisition Corp. (“ASCA” or the “Company”) initially held a special meeting of the shareholders at 9:00 a.m., Eastern time, on March 1, 2024 (the “Meeting”). At the special meeting, the chairman adjourned the special meeting to be held on March 4, 2024 at the offices of Loeb & Loeb LLP, 345 Park Avenue, New York, NY 10154, and virtually via live webcast at https://loeb.zoom.us/pac/join/6526144748. On or about February 16, 2024, ASCA mailed to you a proxy statement/prospectus (the “Proxy Statement/Prospectus”), asking you to consider and vote upon the following proposals at the Meeting (capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Proxy Statement/Prospectus):

• Proposal 1 — To approve the merger of ASCA with and into A SPAC I Mini Acquisition Corp., a British Virgin Islands business company (“PubCo”), with PubCo remaining as the surviving publicly traded entity (the “Reincorporation Merger”), and the plan of merger for the Reincorporation Merger (the “Reincorporation Plan of Merger”), a copy of which is attached to this proxy statement/prospectus as Annex A, and the transactions contemplated thereunder, which we refer to as the “Reincorporation Merger Proposal” or “Proposal No. 1”;

• Proposal 2 — To approve the business combination and other transactions (and related transaction documents) contemplated by the merger agreement dated February 15, 2023 and amended as of June 12, 2023 and December 6, 2023 (and as may be further amended from time to time, the “Merger Agreement”), by and among NewGenIvf Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands (“NewGenIvf” or “NewGen”), certain shareholders of NewGen, ASCA, PubCo, and A SPAC I Mini Sub Acquisition Corp., a Cayman Islands exempted company and wholly-owned subsidiary of PubCo (“Merger Sub”), a copy of which is attached to this proxy statement/prospectus as Annex B, and the transactions contemplated thereunder including, (i) the Reincorporation Merger, and (ii) immediately following the Reincorporation Merger, the merger of Merger Sub with and into NewGenIvf with NewGenIvf being the surviving entity and a wholly-owned subsidiary of PubCo (the “Acquisition Merger”, together with the Reincorporation Merger, the “Business Combination”), which we refer to as the “Acquisition Merger Proposal” or “Proposal No. 2”;

• Proposal 3 — To approve: (i) for purposes of complying with Nasdaq Listing Rule 5635 (a), (b) and (d), the issuance of more than 20% of the issued and outstanding ASCA Class A ordinary shares and the resulting change in control in connection with the Business Combination upon the consummation of the Business Combination, which we refer to as the “Nasdaq Proposal” or “Proposal No. 3”;

• Proposal 4 — To approve the First Fertility Group Limited 2024 Share Incentive Plan (the “Share Incentive Plan”), a copy of which is attached to this proxy statement/prospectus as Annex C, in connection with the Business Combination upon the consummation of the Business Combination, which we refer to as the “Share Incentive Plan Proposal” or “Proposal No. 4”; and

• Proposal 5 — To approve the adjournment of the Meeting by the chairman thereof to a later date, if necessary, under certain circumstances, including for the purpose of soliciting additional proxies in favor of the foregoing proposals, in the event ASCA does not receive the requisite shareholder vote to approve such proposals, which we refer to as the “Adjournment Proposal” or “Proposal No. 5” and, together with the Reincorporation Merger Proposal, the Acquisition Merger Proposal, the Nasdaq Proposal and the Share Incentive Plan Proposal, the “Proposals”.

ASCA is providing this proxy statement/prospectus supplement to provide information about:

• On February 29, 2024, the Company, A SPAC I Mini Acquisition Corp., a British Virgin Islands business company (“Purchaser”), NewGenIvF Limited, a Cayman Islands exempted company (“NewGen”), A SPAC I Mini Sub Acquisition Corp., a Cayman Islands exempted company and wholly-owned subsidiary of the Company (the “Merger Sub”), and certain buyers named therein led by JAK Opportunities VI LLC (collectively, the “Buyers” or “JAK”) entered into a securities purchase agreement (the “Securities

Purchase Agreement”), pursuant to which the Company has agreed to issue and sell to the Buyers, in a private placement, an aggregate of up to $3,500,000 principal amount of convertible notes (the “Notes”), consisting of two tranches: (x) an initial tranche (the “Initial Tranche”) of an aggregate principal amount of Notes of up to $1,750,000 and including an original issue discount of up to aggregate $122,500, and (2) subsequent tranches of an aggregate principal amount of Notes of up to $1,750,000 and including an original issue discount of up to aggregate $122,500. The Initial Tranche is expected to occur on the date of the closing of the Business Combination, subject to the terms and conditions set forth in the Securities Purchase Agreement. Concurrently with each issuance of the Notes, the Buyers will receive a certain amount of ordinary shares of the Purchaser (the “Commitment Shares”). The Commitment Shares to be issued at the Initial Tranche will be converted from NewGenIvf ordinary shares issued to JAK in February 2024 and will be up to 295,000 ordinary shares of the Purchaser, which will be free from trading restrictions at the closing.

The Notes sold in connection with the Securities Purchase Agreement are convertible into the Purchaser’s ordinary shares at an initial conversion price calculated by dividing $1,000,000,000 (“Valuation Cap”) by the number of Purchaser’s Class A Ordinary Shares on a fully diluted basis (the “Conversion Price”). The Note have an initial maturity date of six (6) months from the issuance date. The Conversion Price is subject to adjustment from time to time for splits, dividends and similar events. The Conversion Price may also be lowered at the Company’s discretion without limitation.

The Notes bear an interest rate of 12.75% per annum, payable on the last day of each quarter, except that upon an event of default, the Notes shall accrue interest at the rate of 17.75% per annum until paid in full. The Notes rank senior to all other existing indebtedness and equity of the Purchaser and are repayable at maturity at 145% of the principal amount. The Notes are prepayable at 175% of the outstanding principal amount, all outstanding and unpaid interest and all other amounts owing under the Notes with at least 30 trading days’ written notice.

The Securities Purchase Agreement contains customary representations, warranties and covenants by, among and for the benefit of the parties, as well as customary indemnification provisions and standstill restrictions for 180 days after each closing of the Notes on the Purchaser’s additional equity or debt capital raising without the consent of the Buyers.

• On March 1, 2024, the Company entered into an acknowledgement agreement (the “Acknowledgement Agreement”) with Chardan Capital Markets, LLC (“Chardan”) and NewGen related to the deferred underwriting commission owed to Chardan in connection with the Company’s initial public offering. Pursuant to the Acknowledgement Agreement, attached as Annex E, the Company will satisfy the deferred underwriting commission at the closing of the Business Combination with NewGen, by (i) paying One Million U.S. Dollars (US $1,000,000) in cash to Chardan, (ii) issuing 1,500,000 PubCo Ordinary Shares (the “Additional Representative Shares”), and (iii) paying Chardan 30% of the gross proceeds from the post-closing financings of the Company, until the deferred underwriting commission is fully paid within 6 months of the closing. The Acknowledgement Agreement also grants Chardan certain registration rights with respect to the ordinary shares and sole right of first refusal for future financings of the Company for a period of 12 months following the closing and other considerations not related to ASCA’s business combination with NewGenIvf.

• On March 1, 2024, ASCA entered into the Third Amendment to Merger Agreement (the “Third Amendment to Merger Agreement”) with NewGen, PubCo, Merger Sub and the Principal Shareholders. As described in the Third Amendment to Merger Agreement, the Company shall issue the Commitment Shares for the Initial Tranche to JAK and the Additional Representative Shares to Chardan.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE BUSINESS COMBINATION OR THE OTHER TRANSACTIONS CONTEMPLATED THEREBY, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This proxy statement/prospectus supplement contains additional information that supplements the Proxy Statement/Prospectus regarding the proposed transactions contemplated by the Merger Agreement. ASCA urges you to read this supplement, together with the Proxy Statement/Prospectus and all accompanying annexes and exhibits regarding the proposed transactions contemplated by the Merger Agreement, carefully and in their entireties.

Your vote is important. Please vote your shares promptly. Whether or not you plan to participate in the Meeting, please submit your proxy card without delay. Shareholders may revoke proxies at any time before they are voted at the Meeting. Voting by proxy will not prevent a shareholder from voting during the Meeting if such shareholder subsequently chooses to participate in the Meeting. If you want to vote at the Meeting, you must submit proof of your legal proxy reflecting the number of your shares along with your name and email address to Advantage Proxy via email to ksmith@advantageproxy.com. Votes will not be accepted over the phone during the Meeting. If you have already submitted your proxy card and do not wish to change your vote, there is no need to submit another proxy card in response to this supplement to the Proxy Statement/Prospectus.

Sincerely,

|

/s/ Claudius Tsang

|

|

|

|

Claudius Tsang

|

|

|

|

Chief Executive Officer and Chief Financial Officer

|

|

|

|

A SPAC I Acquisition Corp.

|

|

|

|

March 1, 2024

|

|

|

SUPPLEMENT DATED MARCH 1, 2024

TO

PROXY STATEMENT/PROSPECTUS

DATED FEBRUARY 14, 2024

Level 39, Marina Bay Financial Centre

Tower 2, 10 Marina Boulevard

Singapore, 018983

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 4, 2024

The following information supplements, and should be read in conjunction with, the Proxy Statement/Prospectus of A SPAC I Acquisition Corp. (“ASCA” or the “Company”) dated February 14, 2024 (the “Proxy Statement/Prospectus”) relating to the proposed transactions contemplated by the Merger Agreement dated as of February 15, 2023 and amended as of June 12, 2023 and December 6, 2023 (and as may be further amended from time to time, the “Merger Agreement”), by and among NewGenIvf Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands (“NewGenIvf” or “NewGen”), certain shareholders of NewGen, ASCA, PubCo, and A SPAC I Mini Sub Acquisition Corp., a Cayman Islands exempted company and wholly-owned subsidiary of PubCo (“Merger Sub”). Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Proxy Statement/Prospectus.

ASCA is providing this proxy statement/prospectus supplement to provide information about:

• On February 29, 2024, the Company, A SPAC I Mini Acquisition Corp., a British Virgin Islands business company (“Purchaser”), NewGenIvF Limited, a Cayman Islands exempted company (“NewGen”), A SPAC I Mini Sub Acquisition Corp., a Cayman Islands exempted company and wholly-owned subsidiary of the Company (the “Merger Sub”), and certain buyers named therein led by JAK Opportunities VI LLC (collectively, the “Buyers” or “JAK”) entered into a securities purchase agreement (the “Securities Purchase Agreement”), pursuant to which the Company has agreed to issue and sell to the Buyers, in a private placement, an aggregate of up to $3,500,000 principal amount of convertible notes (the “Notes”), consisting of two tranches: (x) an initial tranche (the “Initial Tranche”) of an aggregate principal amount of Notes of up to $1,750,000 and including an original issue discount of up to aggregate $122,500, and (2) subsequent tranches of an aggregate principal amount of Notes of up to $1,750,000 and including an original issue discount of up to aggregate $122,500. The Initial Tranche is expected to occur on the date of the closing of the Business Combination, subject to the terms and conditions set forth in the Securities Purchase Agreement. Concurrently with each issuance of the Notes, of the Buyers will receive certain amount of ordinary shares of the Purchaser (the “Commitment Shares”). The Commitment Shares to be issued at the Initial Tranche will be converted from NewGenIvf ordinary shares issued to JAK in February 2024 and will be up to 295,000 ordinary shares of the Purchaser, which will be free from trading restrictions at the closing. The Notes sold in connection with the Securities Purchase Agreement are convertible into the Purchaser’s ordinary shares at an initial conversion price calculated by dividing $1,000,000,000 (“Valuation Cap”) by the number of Purchaser’s Class A Ordinary Shares on a fully diluted basis (the “Conversion Price”). The Notes have an initial maturity date of six (6) months from the issuance date. The Conversion Price is subjected to adjustment from time to time for splits, dividends, and similar events. The Conversion Price may also be lowered at the Company’s discretion without limitation. The Notes bear an interest rate of 12.75% per annum, payable on the last day of each quarter, except that upon an event of default, the Notes shall accrue interest at the rate of 17.75% per annum until paid in full. The Notes rank senior to all other existing indebtedness and equity of the Purchaser and are repayable at maturity at 145% of the principal amount. The Notes are prepayable at 175% of the outstanding principal amount, all outstanding and unpaid interest and all other amounts owing under the Notes with at least 30 trading days’ written notice. The Securities Purchase Agreement contains customary representations, warranties and covenants by, among and for the benefit of the parties, as well as customary indemnification provisions and standstill restrictions for 180 days after each closing of the Notes on the Purchaser’s additional equity or debt capital raising without the consent of the Buyers.

1

• On March 1, 2024, the Company entered into an acknowledgement agreement (the “Acknowledgement Agreement”) with Chardan Capital Markets, LLC (“Chardan”) and NewGen related to the deferred underwriting commission owed to Chardan in connection with the Company’s initial public offering. Pursuant to the Acknowledgement Agreement, attached as Annex E, the Company will satisfy the deferred underwriting commission, at the closing of the Business Combination with NewGen, by (i) paying One Million U.S. Dollars (US $1,000,000) in cash to Chardan, (ii) issuing 1,500,000 PubCo Ordinary Shares (the “Additional Representative Shares”), and (iii) paying Chardan 30% of the gross proceeds from the post-closing financings of the Company, until the deferred underwriting commission is fully paid within 6 months of the closing. The Acknowledgement Agreement also grants Chardan certain registration rights with respect to the ordinary shares and sole right of first refusal for future financings of the Company for a period of 12 months following the closing and other considerations not related to ASCA’s business combination with NewGenIvf.

• On March 1, 2024, ASCA entered into the Third Amendment to Merger Agreement (the “Third Amendment to Merger Agreement”) with NewGen, PubCo, Merger Sub and the Principal Shareholders. As described in the Third Amendment to Merger Agreement, the Company shall issue the Commitment Shares for the Initial Tranche to JAK and the Additional Representative Shares to Chardan.

This supplement contains additional information that supplements the Proxy Statement/Prospectus regarding the proposed transactions contemplated by the Merger Agreement. ASCA urges you to read this supplement, together with the Proxy Statement/Prospectus and all accompanying annexes and exhibits regarding the proposed transactions contemplated by the Merger Agreement, carefully and in their entireties.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE BUSINESS COMBINATION OR THE OTHER TRANSACTIONS CONTEMPLATED THEREBY OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

2

UPDATES TO PROXY STATEMENT/PROSPECTUS COVER PAGE

The Proxy Statement/Prospectus is amended by replacing the third paragraph under the cover page of the Proxy Statement/Prospectus with the following.

ASCA has entered into a merger agreement, dated as of February 15, 2023 and amended as of June 12, 2023 and December 6, 2023 (and as may be further amended from time to time, the “Merger Agreement”), which provides for a Business Combination between ASCA and NewGenIvf Limited, a Cayman Islands exempted company (“NewGenIvf”, “NewGen” or the “Company”). Pursuant to the Merger Agreement, the Business Combination will be effected in two steps: (i) subject to the approval and adoption of the Merger Agreement by the shareholders of ASCA, ASCA will reincorporate to the British Virgin Islands by merging with and into A SPAC I Mini Acquisition Corp., a British Virgin Islands business company (“PubCo”), with PubCo remaining as the surviving publicly traded entity (the “Reincorporation Merger”); and (ii) A SPAC I Mini Sub Acquisition Corp., a Cayman Islands exempted company and wholly-owned subsidiary of PubCo (“Merger Sub”), will be merged with and into NewGenIvf resulting in NewGenIvf being a wholly-owned subsidiary of PubCo (the “Acquisition Merger”). The Merger Agreement is by and among ASCA, PubCo, Merger Sub, NewGenIvf and certain shareholders of NewGenIvf (the “Principal Shareholders”). The aggregate consideration for the Acquisition Merger is $50,000,000, payable in the form of 5,000,000 newly issued PubCo Class A ordinary shares (as defined below) valued at $10.00 per share, plus 800,000 additional PubCo Class A ordinary shares (the “Additional Closing Shares”) and 295,000 commitment shares (the “Commitment Shares”) valued at $10.00 per share in exchange for the NewGenIvf shares issued by NewGenIvf following the original date of the Merger Agreement and certain earnout shares as described in the Merger Agreement. The Additional Closing Shares and the Commitment Share were issued outside of the 5,000,000 merger consideration so that the original shareholders of NewGenIvf would not have the number of shares they received at closing of the Business Combination reduced. Holders of ASCA ordinary shares will be asked to approve, among other things, the Merger Agreement and the other related Proposals. The combined company after the Business Combination is referred to in this proxy statement/prospectus as the “Combined Company.”

The Proxy Statement/Prospectus is amended by replacing the sixth paragraph under the cover page of the Proxy Statement/Prospectus with the following.

It is anticipated that, upon consummation of the Business Combination, assuming maximum redemption by our public shareholders of 1,932,471 of ASCA’s outstanding ordinary shares and no exercise of our warrants, ASCA’s current shareholders would retain an ownership interest of approximately 39.5% of the Combined Company (such that the public shareholders would own approximately 6.9% of the Combined Company), Chardan, the Sponsor, officers, directors and other holders of founder shares would retain an ownership interest of approximately 32.7% in the Combined Company and the NewGenIvf shareholders (including JAK) would own approximately 60.5% of the Combined Company. These relative percentages assume that (i) ASCA’s existing public shareholders exercise their redemption rights with respect to a maximum of 1,932,471 ordinary shares, as discussed herein; and (ii) there is no exercise of ASCA Warrants. If any of ASCA’s existing public shareholders exercise their redemption rights, the anticipated percentage ownership of ASCA’s existing shareholders will be reduced. You should read “Summary of the Proxy Statement/Prospectus — The Business Combination,” “Summary of the Proxy Statement/Prospectus — The Merger Agreement” and “Unaudited Pro Forma Condensed Combined Financial Statements” for further information.

The Proxy Statement/Prospectus is amended by replacing the thirteenth and twentieth paragraph under the cover page of the Proxy Statement/Prospectus with the following.

After the Business Combination, assuming there are no redemptions of shares and there is no exercise of warrants, Mr. Siu, Wing Fung Alfred together with Ms. Fong, Hei Yue Tina will hold 34.2% of the voting power of the PubCo and 40.7% assuming the maximum redemption scenario. Nevertheless, we expect that Mr. Siu, Wing Fung Alfred together with Ms. Fong, Hei Yue Tina will hold a majority of the voting power of the PubCo following the Business Combination, assuming the maximum redemption scenario, the full issuance of earnout shares, and no exercise of our warrants. Accordingly, the Combined Company may be a controlled company under Nasdaq Listing Rule 5615(c). For so long as the Combined Company remains as a controlled company under that definition, it is permitted to elect to rely on certain exemptions from corporate governance rules. As a result, the investors may not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. The Combined Company’s status as a controlled company could cause its securities to look less

3

attractive to certain investors or otherwise harm the trading price. Please see “Risk Factors — If PubCo meets the definition of a “controlled company” under the rules of the Nasdaq Listing Rule, it may choose to exempt from certain corporate governance requirements that could have an adverse effect on the public shareholders.”

The Proxy Statement/Prospectus is amended on page 1 by replacing the term “Combined Company” under “FREQUENTLY USED TERMS” section of the Proxy Statement/Prospectus with the following.

“Combined Company” means ASCA after the consummation of the Business Combination, renamed “NewGenIVF Group Limited”

The Proxy Statement/Prospectus is amended on page 9 and 10 by replacing the answer to the question “What is the consideration being paid to NewGenIvf security holders?” with the following.

A: The aggregate consideration for the Business Combination is $50,000,000, payable in the form of 5,000,000 newly issued PubCo Class A ordinary shares valued at $10.00 per share to NewGenIvf’s shareholders, plus 800,000 additional PubCo Class A ordinary shares (the “Additional Closing Shares”) and 295,000 commitment shares (the “Commitment Shares”) valued at $10.00 per share in exchange for the NewGenIvf shares issued by NewGenIvf following the original date of the Merger Agreement. The Additional Closing Shares and the Commitment Share were issued outside of the 5,000,000 merger consideration so that the original shareholders of NewGenIvf would not have the number of shares they received at closing of the Business Combination reduced. In addition, after the closing of the Business Combination, subject to the terms and conditions set forth in the Merger Agreement, the principal shareholders of NewGenIvf will have the right to receive in the aggregate up to an additional 2,000,000 PubCo Class A Ordinary Shares as follows: (i) in the event that, during the 18-month period after the closing date, the volume-weighted average price of PubCo Class A Ordinary Shares over any 20 trading days within any 30-trading day period is greater than or equal to $15.00, then such principal shareholders will be entitled to receive 1,000,000 earnout shares; and (ii) in the event that the net profit of PubCo and its subsidiaries on a consolidated basis for any four consecutive fiscal quarters, during the six fiscal quarters commencing from the first day of the next fiscal quarter after the closing, is equal to or exceeds $3,825,000, then such principal shareholders will be entitled to receive 1,000,000 earnout shares. 1,350,000 PubCo Ordinary Shares (representing 11.2% of the number of PubCo Ordinary Shares outstanding immediately after the Closing, assuming no redemptions) will be reserved and authorized for issuance under the Share Incentive Award upon closing. After the Closing, the number of PubCo Ordinary Shares reserved and authorized for issuance under the Share Incentive Award may be adjusted to reflect increase or decrease of the number of outstanding PubCo Ordinary Shares. At the closing of the Business Combination, each NewGenIvf ordinary shares then issued and outstanding shall be cancelled and automatically converted into the right to receive PubCo Class A ordinary shares pursuant to the terms of the Merger Agreement.

The Proxy Statement/Prospectus is amended on page 10 by replacing the answer to the question “What equity stake will current shareholders of ASCA and NewGenIvf shareholders hold in the Combined Company after the closing?” with the following.

A: It is anticipated that upon completion of the Business Combination, assuming maximum redemption by our public shareholders of 1,932,471 of ASCA’s outstanding ordinary shares and no exercise of our warrants, ASCA’s current shareholders would retain an ownership interest of approximately 39.5% of the Combined Company (such that the public shareholders would own approximately 6.9% of the Combined Company), Chardan, the Sponsor, officers, directors and other holders of founder shares will retain an ownership interest of approximately 32.7% of the Combined Company and the NewGenIvf shareholders will own approximately 60.5% of the Combined Company.

These ownership percentages with respect to the Combined Company assume the maximum redemption by the ASCA public shareholders of 1,932,471 ordinary shares. If the actual facts are different from these assumptions, the percentage ownership retained by the ASCA shareholders will be different. See “Unaudited Pro Forma Condensed Combined Financial Information.”

4

The Proxy Statement/Prospectus is amended on page 10 by replacing the second sentence of the answer to the question “Do any of ASCA’s directors or officers have interests that may conflict with my interests with respect to the Business Combination?” with the following.

• The Sponsor and its affiliates will benefit from the completion of a business combination and may be incentivized to complete an acquisition of a less favorable target company or on terms less favorable to public shareholders rather than liquidate. The Sponsor and its affiliates will retain 1,725,000 ordinary shares upon consummation of the Business Combination, representing ownership interest of approximately 17.1% in the combined company, which represents a transaction value of approximately $12,064,000, assuming a pre-transaction value of NewGenIvf of $50 million plus the Additional Closing Shares and Commitment Shares valued at $10.95 million and assuming maximum redemption by our public shareholders and no exercise of our warrants. Such ordinary shares had an aggregate market value of approximately $18.8 million, based on the closing price of the ASCA Class A ordinary shares of $10.90 per share on Nasdaq on January 4, 2024.

The Proxy Statement/Prospectus is amended on page 22 by replacing the second paragraph under “Business Combination Consideration” section of the Proxy Statement/Prospectus with the following.

The aggregate consideration for the Business Combination is $50,000,000, payable in the form of 5,000,000 newly issued PubCo Class A ordinary shares valued at $10.00 per share to NewGenIvf’s shareholders, plus 800,000 additional PubCo Class A ordinary shares (the “Additional Closing Shares”) and 295,000 commitment shares (the “Commitment Shares”) valued at $10.00 per share in exchange for the NewGenIvf shares issued by NewGenIvf following the original date of the Merger Agreement. The Additional Closing Shares and the Commitment Shares were issued outside of the 5,000,000 merger consideration so that the original shareholders of NewGenIvf would not have the number of shares they received at closing of the Business Combination reduced. In addition, after the closing of the Business Combination, subject to the terms and conditions set forth in the Merger Agreement, the Principal Shareholders will have the right to receive in the aggregate up to an additional 2,000,000 PubCo Class A Ordinary Shares as follows: (i) in the event that, during the 18-month period after the closing date, the volume-weighted average price of PubCo Class A Ordinary Shares over any 20 trading days within any 30-trading day period is greater than or equal to $15.00, then the Principal Shareholders will be entitled to receive 1,000,000 earnout shares; and (ii) in the event that the net profit of PubCo and its subsidiaries on a consolidated basis for any four consecutive fiscal quarters, during the six fiscal quarters commencing from the first day of the next fiscal quarter after the closing, is equal to or exceeds $3,825,000, then the Principal Shareholders will be entitled to receive 1,000,000 earnout shares.

The Proxy Statement/Prospectus is amended on page 23 by replacing the last paragraph under “Business Combination Consideration” section of the Proxy Statement/Prospectus with the following.

After the Business Combination, assuming there are no redemptions of shares and there is no exercise of warrants, ASCA’s current shareholders will own approximately 49.3% of the issued share capital of PubCo (such that public shareholders will own approximately 21.8% of the Combined Company), Chardan, ASCA’s Sponsor, current directors, officers and affiliates will own approximately 27.4% of the issued share capital of PubCo, and NewGenIvf shareholders (including JAK) will own approximately 50.7% of the issued share capital of PubCo.

Assuming the maximum redemption by public holders of 1,932,471 ASCA’s outstanding ordinary shares, after giving effect to the payments to redeeming shareholders, the public shareholders will own approximately 6.9% of the issued capital of PubCo, Chardan, ASCA’s Sponsor, current directors, officers and affiliates will own approximately 32.7% of the issued share capital of PubCo and NewGenIvf shareholders (including JAK) will own approximately 60.5% of the issued share capital of PubCo.

Assuming the Reincorporation Merger Proposal and the Business Combination Proposal are approved, ASCA expects to close the Business Combination in the first quarter of 2024.

5

The Proxy Statement/Prospectus is amended on page 28 by replacing the first paragraph and the chart under “Ownership of the Post-Business Combination Company After the Closing” with the following.

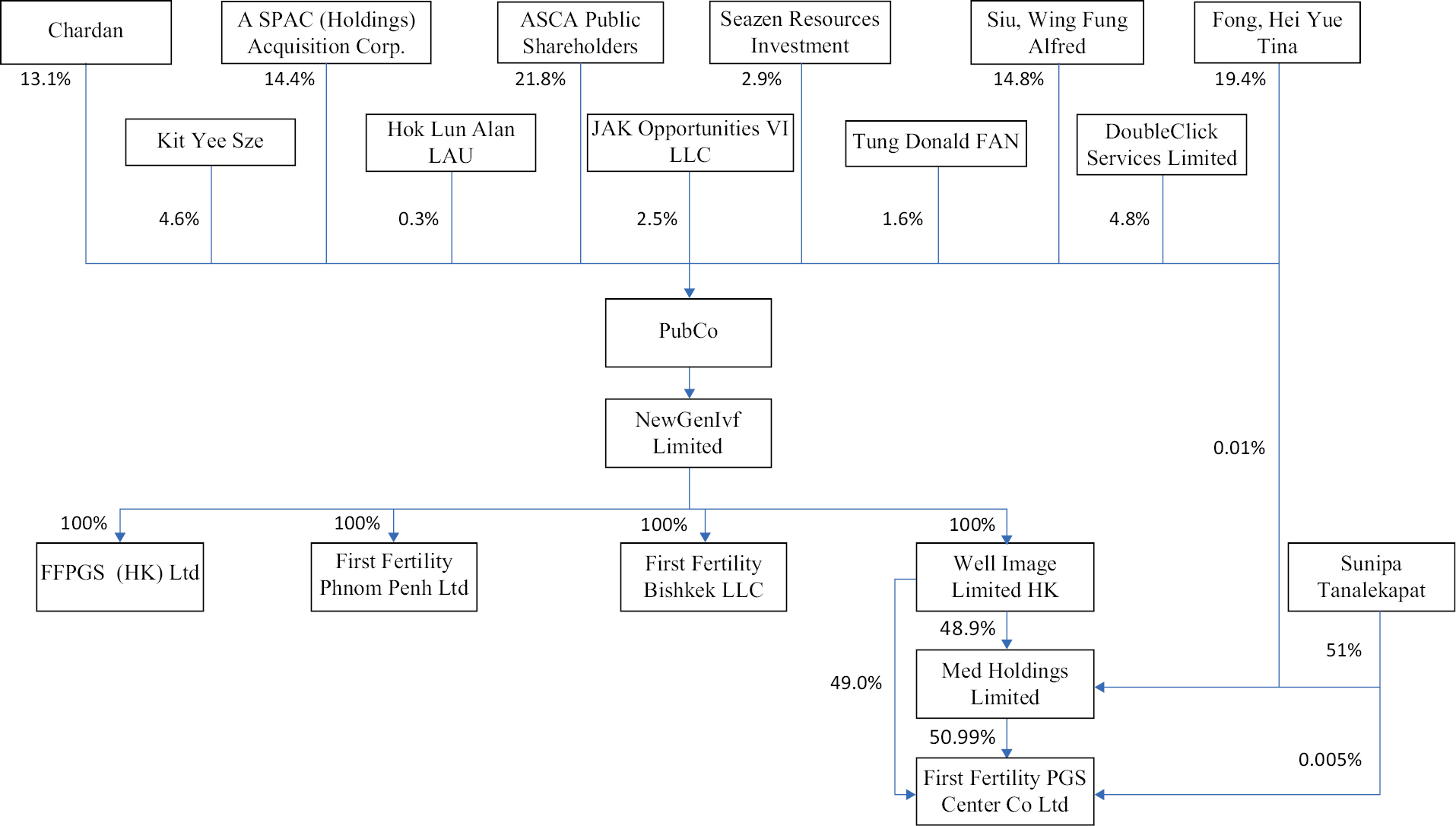

It is anticipated that, upon the closing of the Business Combination, under the “no redemptions” scenario, ASCA’s public shareholders would retain an ownership interest of approximately 21.8% in the Combined Company. The following chart illustrates the ownership structure of PubCo immediately following the Business Combination. The equity interests shown in the diagram below were calculated based on the assumptions that (i) no ASCA’s public shareholders exercises its redemption, (ii) none of the parties in the chart below purchase PubCo Ordinary Shares in the open market, and (iii) there are no other issuances of equity by ASCA prior to or in connection with the consummation of the Business Combination. The ownership percentages set forth below do not take into account (a) the issuance of any additional shares under the Share Incentive Award and (b) the exercise of any PubCo Warrants.

The Proxy Statement/Prospectus is amended on page 30 by replacing the second paragraph under “Interests of Certain Persons in the Business Combination” section of the Proxy Statement/Prospectus with the following.

The Sponsor and its affiliates will benefit from the completion of a business combination and may be incentivized to complete an acquisition of a less favorable target company or on terms less favorable to public shareholders rather than liquidate. The Sponsor and its affiliates will retain 1,725,000 ordinary shares upon consummation of the Business Combination, representing ownership interest of approximately 17.1% in the combined company, which represents a transaction value of approximately $12,064,000, assuming a pre-transaction value of NewGenIvf of $50 million plus the Additional Closing Shares and Commitment Shares valued at $10.95 million and assuming maximum redemption by our public shareholders and no exercise of our warrants. Such ordinary shares had an aggregate market value of approximately $18.8 million, based on the closing price of the ASCA Class A ordinary shares of $10.90 per share on Nasdaq on January 4, 2024.

6

The Proxy Statement/Prospectus is amended on page 77 by replacing the first paragraph of the Risk Factor “ASCA’s shareholders will experience immediate dilution as a consequence of, among other transactions, the issuance of PubCo Class A ordinary shares as consideration in the Business Combination. Having a minority share position may reduce the influence that ASCA’s current shareholders have on the management of PubCo.” under the “Risks Related to the Business Combination” section of the Proxy Statement/Prospectus with the following.

It is anticipated that upon completion of the Business Combination, assuming there are no redemptions of shares and there is no exercise of warrants, ASCA’s current shareholders would retain an ownership interest of approximately 49.3% in the Combined Company (such that the public shareholders would own approximately 21.8% of the Combined Company), Chardan, ASCA’s Sponsor, officers, directors and other holders of founder shares will retain an ownership interest of approximately 27.4% of the Combined Company and the NewGenIvf shareholders (including JAK) will own approximately 50.7% of the Combined Company.

The Proxy Statement/Prospectus is amended on page 83 by replacing the last paragraph under the “Risks Related to Pubco’s Securities following the Business Combination” section of the Proxy Statement/Prospectus with the following.

Your ownership percentage in PubCo Ordinary Shares following the Business Combination will be less than your existing ownership percentage in ASCA as a result of dilution attributable to the relative equity values of the companies involved in the Business Combination. Immediately after the Business Combination, assuming maximum redemption by our public shareholders of 1,932,471 of ASCA’s outstanding ordinary shares and no exercise of our warrants, it is anticipated that (i) the current shareholders of ASCA will hold as a group approximately 39.5% of the PubCo Ordinary Shares and (ii) the current shareholders of NewGenIvf (including JAK) will hold as a group approximately 60.5% of the outstanding capital stock of PubCo. As a result, you may have less influence over matters submitted to a vote of PubCo shareholders.

The Proxy Statement/Prospectus is amended on page 84 by replacing first paragraph of the Risk Factor “If PubCo meets the definition of a “controlled company” under the Nasdaq Listing Rules, it may choose to exempt from certain corporate governance requirements that could have an adverse effect on the public shareholders.” under the “Risks Related to PubCo Operating as a Public Company” section of the Proxy Statement/Prospectus with the following.

After the Business Combination, assuming there are no redemptions of shares and there is no exercise of warrants, Mr. Siu, Wing Fung Alfred together with Ms. Fong, Hei Yue Tina will hold 34.2% of the voting power of the PubCo and 40.7% assuming the maximum redemption scenario. Nevertheless, we expect that Mr. Siu, Wing Fung Alfred together with Ms. Fong, Hei Yue Tina will hold a majority of the voting power of the PubCo following the Business Combination, assuming the maximum redemption scenario, the full issuance of earnout shares, and no exercise of our warrants. Accordingly, the Combined Company may be a controlled company under Nasdaq Listing Rule 5615(c). For so long as the Combined Company remains as a controlled company under that definition, it is permitted to elect to rely on certain exemptions from corporate governance rules. As a result, the investors may not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

The Proxy Statement/Prospectus is amended on page 26 and 110 by adding the following to the end of the “Additional Agreements to be Executed at Closing” section of the Proxy Statement/Prospectus.

Securities Purchase Agreements

On February 29, 2024, the Company, A SPAC I Mini Acquisition Corp., a British Virgin Islands business company (“Purchaser”), NewGenIvF Limited, a Cayman Islands exempted company (“NewGen”), A SPAC I Mini Sub Acquisition Corp., a Cayman Islands exempted company and wholly-owned subsidiary of the Company (the “Merger Sub”), and certain buyers named therein led by JAK Opportunities VI LLC (collectively, the “Buyers” or “JAK”) entered into a securities purchase agreement (the “Securities Purchase Agreement”), pursuant to which the Company has agreed to issue and sell to the Buyers, in a private placement, an aggregate of up to $3,500,000 principal amount of convertible notes (the “Notes”), consisting of two tranches: (x) an initial tranche (the “Initial Tranche”) of an aggregate principal amount of Notes of up to $1,750,000 and including an original issue discount

7

of up to aggregate $122,500, and (2) subsequent tranches of an aggregate principal amount of Notes of up to $1,750,000 and including an original issue discount of up to aggregate $122,500. The Initial Tranche is expected to occur on the date of the closing of the Business Combination, subject to the terms and conditions set forth in the Securities Purchase Agreement. Concurrently with each issuance of the Notes, of the Buyers will receive certain amount of ordinary shares of the Purchaser (the “Commitment Shares”). The Commitment Shares to be issued at the Initial Tranche will be converted from NewGenIvf ordinary shares issued to JAK in February 2024 and will be up to 295,000 ordinary shares of the Purchaser, which will be free from trading restrictions at the closing. The Notes sold in connection with the Securities Purchase Agreement are convertible into the Purchaser’s ordinary shares at an initial conversion price calculated by dividing $1,000,000,000 (“Valuation Cap”) by the number of Purchaser’s Class A Ordinary Shares on a fully diluted basis (the “Conversion Price”). The Notes have an initial maturity date of six (6) months from the issuance date. The Conversion Price is subjected to adjustment from time to time for splits, dividends and similar events. The Conversion Price may also be lowered at the Company’s discretion without limitation. The Notes bear an interest rate of 12.75% per annum, payable on the last day of each quarter, except that upon an event of default, the Notes shall accrue interest at the rate of 17.75% per annum until paid in full. The Notes rank senior to all other existing indebtedness and equity of the Purchaser and are repayable at maturity at 145% of the principal amount. The Notes are prepayable at 175% of the outstanding principal amount, all outstanding and unpaid interest and all other amounts owing under the Notes with at least 30 trading days’ written notice.

The Securities Purchase Agreement contains customary representations, warranties and covenants by, among and for the benefit of the parties, as well as customary indemnification provisions and standstill restrictions for 180 days after each closing of the Notes on the Purchaser’s additional equity or debt capital raising without the consent of the Buyers.

Acknowledgement Agreement

On March 1, 2024, ASCA, entered into a side letter agreement (the “Acknowledgement Agreement”) with NewGen and Chardan Capital Markets, LLC (“Chardan”). As described in the Acknowledgement Agreement, he Company will satisfy the deferred underwriting commission at the closing of the Business Combination with NewGen, by (i) paying One Million U.S. Dollars (US $1,000,000) in cash to Chardan, (ii) issuing 1,500,000 PubCo Ordinary Shares (the “Additional Representative Shares”), and (iii) paying Chardan 30% of the gross proceeds from the post-closing financings of the Company, until the deferred underwriting commission is fully paid within 6 months of the closing. The Acknowledgement Agreement also grants Chardan certain registration rights with respect to the ordinary shares and sole right of first refusal for future financings of the Company for a period of 12 months following the closing and other considerations not related to ASCA’s business combination with NewGenIvf.

Third Amendment to Merger Agreement

On March 1, 2024, ASCA entered into the Third Amendment to Merger Agreement (the “Third Amendment to Merger Agreement”) with NewGen, PubCo, Meger Sub and the Principal Shareholders. As described in the Third Amendment to Merger Agreement, the Company shall issue Commitment Shares to JAK and the Additional Representative Shares to Chardan.

The Proxy Statement/Prospectus is amended on page 106 by replacing the second to seventh paragraph of “General Description of the Acquisition Merger — Business Combination Consideration” section of the Proxy Statement/Prospectus with the following.

The aggregate consideration for the Business Combination is $50,000,000, payable in the form of 5,000,000 newly issued PubCo Class A ordinary shares valued at $10.00 per share to NewGenIvf’s shareholders, plus 800,000 additional PubCo Class A ordinary (the “Additional Closing Shares”) and 295,000 commitment shares (the “Commitment Shares”) valued at $10.00 per share in exchange for the NewGenIvf shares issued by NewGenIvf following the original date of the Merger Agreement. The Additional Closing Shares and the Commitment Shares were issued outside of the 5,000,000 merger consideration so that the original shareholders of NewGenIvf would not have the number of shares they received at closing of the Business Combination reduced. In addition, after the closing of the Business Combination, subject to the terms and conditions set forth in the Merger Agreement, the Principal Shareholders will have the right to receive in the aggregate up to an additional 2,000,000 PubCo

8

Class A Ordinary Shares as follows: (i) in the event that, during the 18-month period after the closing date, the volume-weighted average price of PubCo Class A Ordinary Shares over any 20 trading days within any 30-trading day period is greater than or equal to $15.00, then the Principal Shareholders will be entitled to receive 1,000,000 earnout shares; and (ii) in the event that the net profit of PubCo and its subsidiaries on a consolidated basis for any four consecutive fiscal quarters, during the six fiscal quarters commencing from the first day of the next fiscal quarter after the closing, is equal to or exceeds $3,825,000, then the Principal Shareholders will be entitled to receive 1,000,000 earnout shares.

1,350,000 PubCo Ordinary Shares (representing 11.2% of the number of PubCo Ordinary Shares outstanding immediately after the Closing, assuming no redemptions) will be reserved and authorized for issuance under the Share Incentive Award upon closing. After the Closing, the number of PubCo Ordinary Shares reserved and authorized for issuance under the Share Incentive Award may be adjusted to reflect increase or decrease of the number of outstanding PubCo Ordinary Shares. At the closing of the Business Combination, each NewGenIvf ordinary shares then issued and outstanding shall be cancelled and automatically converted into the right to receive PubCo Class A ordinary shares pursuant to the terms of the Merger Agreement.

Upon the closing of the Business Combination, PubCo board of directors will consist of five (5) directors, three (3) of whom will be designated by NewGenIvf to serve as independent directors in accordance with Nasdaq’s listing standards. See “Directors and Executive Officers of the Combined Company after the Business Combination” for additional information.

After the consummation of the Business Combination, PubCo will be a “foreign private issuer” under the U.S. securities laws and the rules of Nasdaq. For more information about the foreign private issuer, please see “Directors and Executive Officers of the Combined Company after the Business Combination — Foreign Private Issuer Status.”

After the Business Combination, assuming there are no redemptions of shares and there is no exercise of warrants, ASCA’s current shareholders will own approximately 49.3% of the issued share capital of PubCo (such that public shareholders will own approximately 21.8% of the Combined Company), Chardan, ASCA’s Sponsor, current directors, officers and affiliates will own approximately 27.4% of the issued share capital of PubCo, and NewGenIvf shareholders will own approximately 50.7% of the issued share capital of PubCo.

Assuming the maximum redemption by public holders of 1,932,471 ASCA’s outstanding ordinary shares, after giving effect to the payments to redeeming shareholders, the public shareholders will own approximately 6.9% of the issued capital of PubCo, Chardan, ASCA’s Sponsor, current directors, officers and affiliates will own approximately 32.7% of the issued share capital of PubCo and NewGenIvf shareholders will own approximately 60.5% of the issued share capital of PubCo.

The Proxy Statement/Prospectus is amended on page 117 by adding the following to the end of the “Timeline of the Merger” section of the Proxy Statement/Prospectus with the following.

On March 1, 2024, the parties to the Merger Agreement entered into the Third Amendment to Merger Agreement (the “Third Amendment”) that amended and modified the Merger Agreement to, among other things, (i) provide for the issuance of 295,000 additional PubCo Class A ordinary shares in exchange for the commitment shares issued by NewGenIvf following the Securities Purchase Agreement, and (ii) provider for the issuance of 1,500,000 additional PubCo Class A ordinary shares to Chardan at the closing of the Business Combination pursuant to the Acknowledgement Agreement with Chardan. NewGenIvf issued an aggregate of 35,500 remuneration shares at an issue price of HK$0.01 per share pursuant to the Securities Purchase Agreement. Such shares will be exchanged for an aggregate of 295,000 PubCo Class A ordinary shares at the closing of the Business Combination, valued at $10.00 per share consistent with the terms of the value of the shares issued pursuant to the Merger Agreement. No additional shares may be issued under the terms of the Third Amendment.

The Proxy Statement/Prospectus is amended on page 130 by replacing the paragraph before the paragraph “Fairness opinion” with the following.

Continued significant ownership by NewGenIvf. The ASCA Board considered that NewGenIvf’s existing equity holders would be receiving a significant amount of the Combined Company’s shares in the proposed Business Combination and that NewGenIvf’s principal shareholders and key executives are “rolling over” their

9

existing equity interests of NewGenIvf into equity interests in the Combined Company. The current NewGenIvf shareholders, including JAK, are expected to own approximately 50.7% of the outstanding the Combined Company’s shares, constituting approximately 50.7% of the voting power of the Combined Company’s shares, assuming none of ASCA’s public shareholders exercise their redemption rights in connection with the Business Combination.

The Proxy Statement/Prospectus is amended on page 132 and 133 by replacing the seventh paragraph under “Interests of Certain Persons in the Business Combination” section of the Prosy Statement/Prospectus with the following.

The Sponsor and its affiliates will benefit from the completion of a business combination and may be incentivized to complete an acquisition of a less favorable target company or on terms less favorable to public shareholders rather than liquidate. The Sponsor and its affiliates will retain 1,725,000 ordinary shares upon consummation of the Business Combination, representing ownership interest of approximately 17.1% in the combined company, which represents a transaction value of approximately $12,064,000, assuming a pre-transaction value of NewGenIvf of $50 million plus the Additional Closing Shares and Commitment Shares valued at $10.95 million and assuming maximum redemption by our public shareholders and no exercise of our warrants. Such ordinary shares had an aggregate market value of approximately $18.8 million, based on the closing price of the ASCA Class A ordinary shares of $10.90 per share on Nasdaq on January 4, 2024.

The Proxy Statement/Prospectus is amended on page 134 by replacing the entire paragraph and the chart under “Total Class A Ordinary Shares Outstanding Upon Consummation of the Business Combination” section of the Proxy Statement/Prospectus with the following.

It is anticipated that, upon the closing of the Business Combination, under the “no redemptions” scenario, ASCA’s public shareholders would retain an ownership interest of approximately 21.8% in the Combined Company, Chardan, ASCA’s Sponsor, officers, directors and other holders of founder shares would retain an ownership interest of approximately 27.4% in the Combined Company and the NewGenIvf shareholders (including JAK) would own approximately 50.7% of the Combined Company.

Under the “maximum redemptions” scenario, the ASCA’s public shareholders would retain an ownership interest of approximately 6.9% in the Combined Company, Chardan, ASCA’s Sponsor, officers, directors and other holders of founder shares would retain an ownership interest of approximately 32.7% in the Combined Company and the NewGenIvf shareholders (including JAK)_would own approximately 60.5% of the Combined Company.

The following summarizes the pro forma ownership of Class A ordinary shares following the Business Combination under both the “no redemptions” and “maximum redemptions” scenarios:

|

Equity Capitalization Summary

|

|

Scenario 1

Assuming No

Redemptions

|

|

Scenario 2

Assuming Maximum

Redemptions

|

|

Initial Shareholders

|

|

1,725,000

|

|

14.4

|

%

|

|

1,725,000

|

|

17.1

|

%

|

|

Public Shareholders

|

|

2,622,471

|

|

21.8

|

%

|

|

690,000

|

|

6.9

|

%

|

|

NewGenIvf Shareholders

|

|

5,800,000

|

|

48.3

|

%

|

|

5,800,000

|

|

57.5

|

%

|

|

Commitment Shares Shareholders (JAK)

|

|

295,000

|

|

2.5

|

%

|

|

295,000

|

|

2.9

|

%

|

|

Representative Shareholders (Including Additional Representative Shares)

|

|

1,569,000

|

|

13.1

|

%

|

|

1,569,000

|

|

15.6

|

%

|

|

Total Ordinary Shares

|

|

12,011,471

|

|

100.0

|

%

|

|

10,079,000

|

|

100.0

|

%

|

The Proxy Statement/Prospectus is amended on page 136 by replacing the second to fourth paragraph under “Proposal No. 3 — The Nasdaq Proposal” with the following.

Pursuant to the Merger Agreement, we will issue to the NewGenIvf shareholders as consideration in the Business Combination 6,095,000 PubCo Class A ordinary shares in addition to certain earnout shares as described in the Merger Agreement. See “Proposal No. 2 — The Acquisition Merger Proposal — Treatment of NewGenIvf Securities; Merger Consideration.” Because the number of Class A ordinary shares we anticipate issuing as consideration in the Business Combination (1) will constitute more than 20% of our outstanding Class A ordinary

10

shares and more than 20% of outstanding voting power prior to such issuance, and (2) will result in a change of control of ASCA, we are required to obtain shareholder approval of such issuance pursuant to Nasdaq Listing Rules 5635(a) and (b) and potentially Nasdaq Listing Rule 5635(d).

Effect of Proposal on Current Shareholders

If the Nasdaq Proposal is adopted, ASCA would issue shares representing more than 20% of our outstanding Class A ordinary shares in connection with the Business Combination.

The issuance of such shares would result in significant dilution to the ASCA shareholders and would afford such shareholders a smaller percentage interest in the voting power, liquidation value and aggregate book value of ASCA. If the Nasdaq Proposal is adopted, assuming that 6,095,000 PubCo Class A ordinary shares are issued to the shareholders of NewGenIvf as consideration in the Business Combination, we anticipate that the shareholders of NewGenIvf (including JAK) will hold approximately 50.7% of our outstanding ordinary shares, and the current ASCA shareholders will hold approximately 49.3% of our outstanding ordinary shares immediately following completion of the Business Combination. This percentage assumes that no Class A ordinary shares are redeemed in connection with the Business Combination, does not take into account any warrants or options to purchase our Class A ordinary shares that will be outstanding following the Business Combination or any equity awards that may be issued under our proposed Share Incentive Award following the Business Combination.

The Proxy Statement/Prospectus is amended on page 152 by replacing the first paragraph under “Business Combination Activities” with the following.

On February 15, 2023, we entered into the Merger Agreement (as amended on June 12, 2023 and December 6, 2023). As a result of the transactions contemplated in the Merger Agreement, NewGenIvf will become wholly-owned subsidiary of PubCo, and PubCo will change its name to “NewGenIVF Group Limited” In the event that the Business Combination is not consummated by February 17, 2024 (unless further extended monthly up to April 17, 2024 as allowed under ASCA’s Existing Charter), our corporate existence will cease and we will distribute the proceeds held in the Trust Account to our public shareholders.

The Proxy Statement/Prospectus is amended on page 159 by adding to the last paragraph under “Underwriting Agreement” with the following.

On March 1, 2024, the Company entered into an acknowledgement agreement (the “Acknowledgement Agreement”) with Chardan Capital Markets, LLC (“Chardan”) and NewGen related to the deferred underwriting commission owed to Chardan in connection with the Company’s initial public offering. Pursuant to the Acknowledgement Agreement, attached as Annex E, the Company will satisfy the deferred underwriting commission, at the closing of the Business Combination with NewGen, by (i) paying One Million U.S. Dollars (US $1,000,000) in cash to Chardan, (ii) issuing 1,500,000 PubCo Ordinary Shares (the “Additional Representative Shares”), and (iii) paying Chardan 30% of the gross proceeds from the post-closing financings of the Company, until the deferred underwriting commission is fully paid within 6 months of the closing. The Acknowledgement Agreement also grants Chardan certain registration rights with respect to the ordinary shares and sole right of first refusal for future financings of the Company for a period of 12 months following the closing and other considerations not related to ASCA’s business combination with NewGenIvf.

On March 1, 2024, ASCA entered into the Third Amendment to Merger Agreement (the “Third Amendment to Merger Agreement”) with NewGen, PubCo, Merger Sub and the Principal Shareholders. As described in the Third Amendment to Merger Agreement, the Company shall issue the Commitment Shares for the Initial Tranche to JAK and the Additional Representative Shares to Chardan.

11

The Proxy Statement/Prospectus is amended on page 209 and 211 by replacing the table under “UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENTS OF OPERATIONS SIX MONTHS ENDED JUNE 30, 2023” section of the Proxy Statement/Prospectus with the following.

|

|

|

Scenario 1:

Assuming

minimum

redemption

(Shares)

|

|

Scenario 2: Assuming

maximum

redemption

(Shares)

|

|

Class A Ordinary Shares

|

|

|

|

|

|

A SPAC I Public Shares (not including shares underlying the rights)

|

|

1,932,471

|

|

—

|

|

Shares held by Sponsor

|

|

1,725,000

|

|

1,725,000

|

|

A SPAC I Representative Shares (Including Additional Representative Shares)

|

|

1,569,000

|

|

1,569,000

|

|

A SPAC I shares converted from rights

|

|

690,000

|

|

690,000

|

|

A SPAC I shares issued in the Transactions

|

|

6,095,000

|

|

6,095,000

|

|

Pro forma weighted average shares outstanding – basic and diluted

|

|

12,011,471

|

|

10,079,000

|

The Proxy Statement/Prospectus is amended on page 223 by replacing the first paragraph under the “Current Directors and Executive Officers” section of the Proxy Statement/Prospectus with the following.

Mr. Claudius Tsang has served as our Chief Executive Officer since April 2021 and Chairman and Chief Financial Officer since July 2021. Mr. Tsang has over 20 years of experience in capital markets, with a strong track record of success in private equity, M&A transactions, and PIPE investments. Since 2022, Mr. Tsang has been the non-executive director of Unity Group Holdings International Limited (SEHK:1539), a publicly listed investment company engages in the leasing and trading of energy saving products in Hong Kong. During his 15-year career at Templeton from 2005 to 2007 and from 2008 to 2020, Mr. Tsang served in various positions, including Co-head of Private Equity (North Asia) at Templeton Asset Management Limited and a Partner of Templeton Private Equity Partners, Partner, Senior Executive Director, and Vice President. Mr. Tsang was responsible for the overall investment, management, and operations activities of Templeton Private Equity Partners in North Asia. His role encompassed overseeing the analysis and evaluation of opportunities for strategic equity investments in Asia. From July 2007 to June 2008, Mr. Tsang joined Lehman Brothers, where he managed private equity projects in Hong Kong, China, Taiwan and the United States. Mr. Tsang served as the Chief Executive Officer and Chairman of Model Performance Acquisition Corp., from March 2021 and July 2021 respectively, until it closed its business combination with MultiMetaVerse Inc. in January 2023. Since November 2022, he has served as the Chief Executive Officer, Chairman and Director of A Paradigm Acquisition Corp. He previously served as the Chief Executive Officer and, since June 2021, became the Chief Financial Officer and, since January 2024, serves as a director of JVSPAC Acquisition Corp. He has served as the Chief Financial Officer of A SPAC II Acquisition Corp since July 2021 and as the Executive Director and Chief Executive Officer of A SPAC (HK) Acquisition Corp since February 2022 and March 2022, respectively. Since February 2024, Mr. Tsang served as a director of International Media Acquisitions Corp. Mr. Tsang served as a director of the CFA Society of Hong Kong from 2013 to 2019. Mr. Tsang obtained a postgraduate certificate in sustainable business from the University of Cambridge in 2023, a Master of Business Administration from the University of Chicago Booth School of Business in 2017, a bachelor’s degree in law from Tsinghua University in 2005, and a bachelor’s degree in engineering from the Chinese University of Hong Kong in 1998. Mr. Tsang is also a CFA charter holder and a Certified ESG Analyst (CESGA) certification holder.

12

The Proxy Statement/Prospectus is amended on page 238 by replacing the table under the “SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT” section of the Proxy Statement/Prospectus with the following.

|

|

|

Pre-Business

Combination

|

|

Post-Business Combination

|

| |

|

Number of Shares

|

|

Assuming No Redemptions

|

|

Assuming Maximum Redemptions

|

|

Name and Address of

Beneficial Owner(1)

|

|

Number of

Shares

Beneficially

Owned

|

|

% of

Class

|

|

Number of

Shares

|

|

% of

Class

|

|

Number of

Shares

Assuming

Exercise and

Conversion of

All Securities

|

|

% of

Class

|

|

Number of

Shares

|

|

% of

Class

|

|

Number of

Shares

Assuming

Exercise and

Conversion of

All Securities

|

|

% of

Class

|

|

Five Percent Holders of A SPAC I and the Combined Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A SPAC (Holdings) Acquisition Corp.(2)

|

|

1,725,001

|

|

46.3

|

%

|

|

1,725,000

|

|

14.4

|

%

|

|

5,760,000

|

|

27.2

|

%

|

|

1,725,000

|

|

17.1

|

%

|

|

5,760,000

|

|

29.9

|

%

|

|

Siu, Wing Fung Alfred

|

|

—

|

|

—

|

|

|

1,779,500

|

|

14.8

|

%

|

|

1,779,500

|

|

8.4

|

%

|

|

1,779,500

|

|

17.7

|

%

|

|

1,779,500

|

|

9.2

|

%

|

|

Fong, Hei Yue Tina

|

|

—

|

|

—

|

|

|

2,326,000

|

|

19.4

|

%

|

|

2,326,000

|

|

11.0

|

%

|

|

2,326,000

|

|

23.1

|

%

|

|

2,326,000

|

|

12.1

|

%

|

|

DoubleClick Services Limited(3)

|

|

—

|

|

—

|

|

|

573,250

|

|

4.8

|

%

|

|

573,250

|

|

2.7

|

%

|

|

573,250

|

|

5.7

|

%

|

|

573,250

|

|

3.0

|

%

|

|

Kit Yee Sze(4)

|

|

—

|

|

—

|

|

|

546,925

|

|

4.6

|

%

|

|

546,925

|

|

2.6

|

%

|

|

546,925

|

|

5.4

|

%

|

|

546,925

|

|

2.8

|

%

|

|

JAK Opportunities VI LLC

|

|

—

|

|

—

|

|

|

295,000

|

|

2.5

|

%

|

|

295,000

|

|

1.4

|

%

|

|

295,000

|

|

2.9

|

%

|

|

295,000

|

|

1.5

|

%

|

|

Chardan Capital Market, LLC(5)

|

|

69,000

|

|

3.4

|

%

|

|

1,569,000

|

|

13.1

|

%

|

|

1,569,000

|

|

7.4

|

%

|

|

1,569,000

|

|

15.6

|

%

|

|

1,569,000

|

|

8.1

|

%

|

|

Directors and Named Executive Officers of A SPAC I

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Claudius Tsang(2)

|

|

1,725,001

|

|

46.3

|

%

|

|

1,725,000

|

|

14.4

|

%

|

|

5,760,000

|

|

27.2

|

%

|

|

1,725,000

|

|

17.1

|

%

|

|

5,760,000

|

|

29.9

|

%

|

|

Abuzzal Abusaeri

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

Giang Nguyen Hoang

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

John Brebeck

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

All officers and directors as a group (4 individuals)

|

|

1,725,001

|

|

46.3

|

%

|

|

1,725,000

|

|

14.4

|

%

|

|

5,760,000

|

|

27.2

|

%

|

|

1,725,000

|

|

17.1

|

%

|

|

5,760,000

|

|

29.9

|

%

|

|

Directors and Named Executive Officers Post-Business Combination

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Siu, Wing Fung Alfred

|

|

—

|

|

—

|

|

|

1,779,500

|

|

14.8

|

%

|

|

1,779,500

|

|

8.4

|

%

|

|

1,779,500

|

|

17.7

|

%

|

|

1,779,500

|

|

9.2

|

%

|

|

Fong, Hei Yue Tina

|

|

—

|

|

—

|

|

|

2,326,000

|

|

19.4

|

%

|

|

2,326,000

|

|

11.0

|

%

|

|

2,326,000

|

|

23.1

|

%

|

|

2,326,000

|

|

12.1

|

%

|

|

Au, Hok Man Jefferson

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

Richard Li

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

Foo, Yip Eng Jeremy

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

Chiu, Wai Yip Raymond

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

All officers and directors as a group (6 individuals)

|

|

—

|

|

—

|

|

|

4,105,500

|

|

34.2

|

%

|

|

4,105,500

|

|

19.4

|

%

|

|

4,105,500

|

|

40.7

|

%

|

|

4,105,500

|

|

21.3

|

%

|

13

YOUR VOTE IS VERY IMPORTANT. PLEASE VOTE YOUR SHARES PROMPTLY.

Whether or not you plan to participate in the Meeting, please complete, date, sign and return the enclosed proxy card without delay, or submit your proxy through the internet or by telephone as promptly as possible in order to ensure your representation at the Meeting no later than the time appointed for the Meeting or adjourned meeting. Voting by proxy will not prevent you from voting your Ordinary Shares online if you subsequently choose to participate in the Meeting in person or virtually. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the Meeting, you must obtain a proxy issued in your name from that record. Only shareholders of record at the close of business on the record date may vote at the Meeting or any adjournment or postponement thereof. If you fail to return your proxy card or fail to instruct your bank, broker or other nominee how to vote, and do not participate in the Meeting, your shares will not be counted for purposes of determining whether a quorum is present at, and the number of votes voted at, the Meeting.

NO ACTION IN CONNECTION WITH THIS PROXY STATEMENT/PROSPECTUS SUPPLEMENT IS REQUIRED BY ANY SHAREHOLDER WHO HAS PREVIOUSLY DELIVERED A PROXY AND WHO DOES NOT WISH TO REVOKE OR CHANGE THAT PROXY. THE RECORD DATE FOR THE SPECIAL MEETING OF SHAREHOLDERS HAS NOT CHANGED.

You may revoke a proxy at any time before it is voted at the Meeting by executing and returning a proxy card dated later than the previous one, by participating in the Meeting in person or virtually and casting your vote by hand or by ballot (as applicable) or by submitting a written revocation to Advantage Proxy, P.O. Box 13581, Des Moines, WA 98198 Attention: Karen Smith, Telephone: 877-870-8565, that is received by the proxy solicitor before we take the vote at the Meeting. If you hold your shares through a bank or brokerage firm, you should follow the instructions of your bank or brokerage firm regarding revocation of proxies.

14