false

0000897802

0000897802

2023-01-01

2023-12-31

0000897802

spe:CommonSharesMember

2023-12-31

0000897802

spe:PreferredSharesMember

2023-12-31

2023-12-31

0000897802

spe:PreferredSharesMember

2023-12-31

0000897802

spe:CommonSharesMember

2023-12-31

2023-12-31

0000897802

spe:CommonSharesMember

2022-12-31

0000897802

spe:CommonSharesMember

2021-12-31

0000897802

spe:CommonSharesMember

2020-12-31

0000897802

spe:CommonSharesMember

2019-12-31

0000897802

spe:PreferredSharesMember

2022-12-31

0000897802

spe:PreferredSharesMember

2021-12-31

0000897802

spe:PreferredSharesMember

2020-12-31

0000897802

spe:PreferredSharesMember

2019-12-31

0000897802

spe:PreferredSharesMember

2022-12-31

2022-12-31

0000897802

spe:PreferredSharesMember

2021-12-31

2021-12-31

0000897802

spe:PreferredSharesMember

2020-12-31

2020-12-31

0000897802

spe:PreferredSharesMember

2019-12-31

2019-12-31

0000897802

spe:OtherClosedEndInvestmentCompanySecuritiesMember

2023-01-01

2023-12-31

0000897802

spe:SpecialPurposeAcquisitionCompaniesMember

2023-01-01

2023-12-31

0000897802

spe:ShortSalesMember

2023-01-01

2023-12-31

0000897802

spe:CommonStocksMember

2023-01-01

2023-12-31

0000897802

spe:ExchangeTradedFundMember

2023-01-01

2023-12-31

0000897802

spe:FixedIncomeSecuritiesIncludingNonInvestmentGradeSecuritiesMember

2023-01-01

2023-12-31

0000897802

spe:CorporateBondsGovernmentDebtSecuritiesAndOtherDebtSecuritiesMember

2023-01-01

2023-12-31

0000897802

spe:ShortSaleRiskMember

2023-01-01

2023-12-31

0000897802

spe:SmallAndMediumCapCompanyRiskMember

2023-01-01

2023-12-31

0000897802

spe:ForeignSecuritiesMember

2023-01-01

2023-12-31

0000897802

spe:EmergingMarketSecuritiesMember

2023-01-01

2023-12-31

0000897802

spe:PreferredStocksMember

2023-01-01

2023-12-31

0000897802

spe:ConvertibleSecuritiesMember

2023-01-01

2023-12-31

0000897802

spe:RealEstateInvestmentTrustsMember

2023-01-01

2023-12-31

0000897802

spe:IssuerRiskMember

2023-01-01

2023-12-31

0000897802

spe:ForeignCurrencyRiskMember

2023-01-01

2023-12-31

0000897802

spe:DefensivePositionsMember

2023-01-01

2023-12-31

0000897802

spe:RiskCharacteristicsOfOptionsAndFuturesMember

2023-01-01

2023-12-31

0000897802

spe:SecuritiesLendingRiskMember

2023-01-01

2023-12-31

0000897802

spe:DiscountRiskMember

2023-01-01

2023-12-31

0000897802

spe:OtherRisksMember

2023-01-01

2023-12-31

0000897802

spe:InvestmentTransactionsAndInvestmentIncomeMember

2023-01-01

2023-12-31

0000897802

spe:DividendsAndDistributionsMember

2023-01-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07528

Special Opportunities Fund, Inc.

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Andrew Dakos

Bulldog Investors, LLP

Park 80 West

250 Pehle Avenue, Suite 708

Saddle Brook, NJ 07663

(Name and address of agent for service)

Copy to:

Thomas R. Westle, Esq

Blank Rome LLP

1271 Avenue of the Americas

New York, NY 10020

1-877-607-0414

Registrant's telephone number, including area code

Date of fiscal year end: 12/31/2023

Date of reporting period: 12/31/2023

Item 1. Reports to Stockholders.

(a)

Special Opportunities Fund, Inc.

(SPE)

Annual Report

For the year ended

December 31, 2023

Special Opportunities Fund, Inc.

Managed Distribution Plan (unaudited)

On March 4, 2019, the Special Opportunities Fund (the “Fund”) received authorization from the SEC that permits the Fund to distribute long-term capital gains to stockholders more than once per year. Accordingly, on April 1, 2019, the Fund

announced its Board of Directors formally approved the implementation of a Managed Distribution Plan (“MDP”) to make monthly cash distributions to stockholders.

In the year ended December 31, 2023, the Fund made monthly distributions to common stockholders at an annual rate of 8%, based on the NAV of the Fund’s common shares as of the close of business on the last business day of the previous year. You

should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the MDP. The MDP will be subject to regular periodic review by the Fund’s Board of Directors.

With each distribution, the Fund will issue a notice to stockholders which will provide detailed information regarding the amount and composition of the distribution and other information required by the Fund’s exemptive order. The Fund’s Board of

Directors may amend or terminate the MDP at any time without prior notice to stockholders; however, at this time, there are no reasonably foreseeable circumstances that might cause the termination of the MDP. For tax reporting purposes the actual

composition of the total amount of distributions for each year will continue to be provided on a Form 1099-DIV issued after the end of the year.

The conversion price for each share of the Fund’s convertible preferred stock will decrease by the amount of each distribution to common stockholders. The current conversion price, as well as other information about the Fund, is available on the

Fund’s website at www.specialopportunitiesfundinc.com.

Special Opportunities Fund, Inc.

February 29, 2024

Dear Fellow Shareholder:

The stock market continued to advance in the second half of 2023, with the S&P 500 Index gaining 8.04%. After accounting for distributions, the Fund’s net asset value per common share (NAV) rose by 10.05% in the

second half of 2023. For the entire year, the Fund’s NAV return was 18.83% vs. 26.29% for the S&P 500 Index. As of December 31, 2023, the trading discount of the Fund’s common shares was 17.06%. Since then, the discount has narrowed by about

1%. From late April 2023 through the end of 2023, the Fund has repurchased 452,787 of its common shares at discounts of at least 15% and 80,397 preferred shares at a discount to their book value of $25. The details about our repurchases are posted

monthly on the Fund’s website.

The Fund has a managed distribution plan that calls for monthly distributions to common shareholders at an annual rate of at least 8% of the NAV as of the last trading day of the prior year. On December 29, 2023, the NAV

was $14.30. Therefore, the minimum monthly distribution for 2024 is $0.0954 per share.

As a reminder, on January 21, 2022, the Fund completed a rights offering for shares of Convertible Preferred Stock, Series C, at $25 per share which pay quarterly distributions at a rate of 2.75% per annum. The preferred

shares may be converted into common stock initially at a price of $20.50 per share (or a ratio of 1.2195 shares of common stock for each share of Series C Stock) and is adjusted for any distributions to common stockholders. Please refer to the

prospectus, which is available on the SEC’s website, for full details regarding the Series C stock. The current conversion ratio and diluted NAV of the Fund’s common shares (assuming all Series C shares are converted to common shares) are posted

weekly on the Fund’s website.

Investment Update and Commentary

In the second half of 2023, we saw greater value in discounted closed-end funds (CEFs) and business development companies (BDCs). Consequently, we increased the Fund’s exposure to these investments from 67.5% of

investable assets to 71.1%. In addition, with fewer IPOs for special purpose acquisition companies (SPACs) and a substantial number of SPAC maturities, i.e., liquidations or mergers, the percentage of the Fund’s total investable assets in SPACs

fell from 16.5% to 14.7%. We see an investment in a pre-merger SPAC as an alternative to a money market fund with a degree of optionality. As a rule, we almost never hold a SPAC’s common stock after a business combination. As of the end of 2023,

the balance of the Fund’s portfolio consisted of a smattering of shares of undervalued operating companies, notes, and about 5% in cash equivalents.

In our last letter, we predicted that a decision by a judge in the District Court for the Southern District of New York (SDNY) concluding that a bylaw placing so-called

Special Opportunities Fund, Inc.

“control share” limitations on voting by shareholders of CEFs “violates Section 18(i) of the Investment Company Act of 1940” would be upheld on appeal. That turned out to be an accurate prediction. A

Massachusetts state court had previously reached the same conclusion. On June 29, 2023, yet another lawsuit was filed in the SDNY against a number of Maryland-based CEFs to invalidate similar control share prohibitions on stockholder voting. The

judge in that case quickly ruled for the plaintiff and although that decision is being appealed, we foresee little chance of it being successful. In early January 2024, one CEF issued a poison pill that effectively limits the number of shares any

shareholder can acquire. Shortly thereafter, the largest shareholder sued to have the poison pill invalidated. It is disappointing, to say the least, that the SEC, which is authorized to enforce the securities laws, has taken a “hands off” approach

regarding attempts by managements of investment companies to undermine the voting rights of shareholders. As a result, shareholders have had to engage in costly, inefficient, and time-consuming private litigation to protect their voting rights.

We were able to sell all our shares of First Trust Dynamic Europe Equity Income Fund (FDEU) at prices very close to NAV. In late 2022, we asked FDEU’s Board of Trustees to recommend converting FDEU to an

open-end fund, which it was required to propose to stockholders in 2023. The Board refused so we solicited proxies to elect our nominees as Trustees. The Board refused to count our votes, claiming that our nominees were ineligible. Apparently

embarrassed about the prospect of losing the election, a few days before the stockholder meeting, FDEU announced that it would become an exchange-traded fund (“ETF”) by the end of 2023. Despite that welcome result, which effectively eliminated the

discount, we sued the Board and the manager because we believe disenfranchising shareholders should not go unchallenged. After we sued, the Board rescinded FDEU’s illegal control share bylaw. As a result, we have filed a motion for an award of

legal fees for obtaining a “common benefit” for FDEU’s stockholders. Unsurprisingly, management is opposing our motion.

In our last letter, we noted that, after having given notice of our intent to nominate trustees of MFS High Yield Municipal Trust (CMU) and MFS Investment Grade Municipal Trust (CXH), we reached a

settlement agreement with management. At the time, the discount for each of these CEFs was about 14%. The settlement provided for a modest self-tender offer by each fund and a commitment to provide a full liquidity event in two years unless the

discount shrinks to no more than 7.5%. The discount for each fund is still in double-digits, which we think is unjustifiably high. Consequently, the Fund is maxed out in both CMU and CHX and it is hard to envision them not outperforming almost

every open-end municipal bond fund over the next two years.

The Fund has a meaningful stake in shares of Destra Multi-Alternative Fund (DMA). More than half of DMA’s total assets are unquoted private investment

Special Opportunities Fund, Inc.

vehicles. Last spring, after eliminating its monthly dividend, DMA’s shares fell to a discount of more than 50%. We then reached out to management to discuss options to enhance stockholder value. On October 6, 2023, DMA

announced that “unless certain targets are met, [it] will dissolve at the close of business on March 31, 2027.” In addition, a representative of a large shareholder was invited to join DMA’s Board of Trustees. That gives us more confidence that (1)

the valuations of DMA’s private holdings are not reasonable, and (2) management will not be tempted to renege on its commitment to dissolve. As Ronald Reagan used to say, “Trust but verify.” DMA’s stock has risen since the announcement, and the

discount has narrowed significantly, to about 30%. Hopefully, it will continue to narrow. Otherwise, we may push for an earlier windup.

In essence, CMU, CXH, and DMA are now quasi term trusts, i.e., funds with a limited life and that have committed to either wind up or provide a liquidity event at some point if certain conditions are met. There are

currently about fifty closed-end term trusts with terms that expire as early as several months from today to more than ten years. The obvious attraction of these funds is that any discount will eventually be eliminated. We have been increasing our

exposure to some of these funds depending on a number of factors, including the current discount and the time to maturity. For example, Nuveen Preferred & Income Term Fund (JPI) is slated to wind up in just six months and it is trading at a 3

to 4% discount to NAV. Interestingly, JPI has announced that it will ask stockholders to approve eliminating its fixed life and, if approved, will conduct a self-tender offer for 100% of its shares at NAV. Either way, shareholders should be able to

monetize their shares at NAV in about six months. Overall, JPI currently looks like an attractive investment because of the built in “alpha” by elimination of the discount.

This year, we expect to be quite active in enhancing the value of the Fund’s investments. We have already submitted proposals to Principal Real Estate Income Fund (PGZ), Tortoise Energy Independence Fund (NDP), Tortoise

Power and Energy Infrastructure Fund (TPZ), and Virtus Total Return Fund (ZTR). We also anticipate engaging with the management of other companies whose shares we believe are undervalued and that have not taken steps to address the disparity.

A settlement was approved by the court in our class action lawsuit against FAST Acquisition Corp. (FST), a SPAC that was slated to liquidate. We alleged that FST’s remaining assets should have been equitably distributed

to all stockholders. The Fund owned about 555,000 shares of FST, which were cancelled and consequently are not being valued. The settlement provides for a payment of slightly more than fifty cents per share plus $5,000 to be paid to the Fund for

serving as the lead plaintiff. We hope to receive payment in the near future.

Our largest investment in an operating company is shares of Texas Pacific Land (TPL), a profitable asset-rich company that owns land in West Texas, primarily in

Special Opportunities Fund, Inc.

the Permian Basin. Traditionally, TPL has generated revenue through rental and royalty payments by oil and gas producers. We believe that its potential is not being fully realized and that senior management wants to use

TPL’s shares and cash to invest in other businesses with lower margins to justify their extremely high compensation. A settlement agreement with TPL’s largest shareholder required it to vote its shares in accordance with the Board’s recommendation

as long as its representative is on the board. We have reason to believe that the composition of the Board is likely to change in the next year or two. If so, that could be the catalyst for an increased stock price.

As always, please note that instruction forms for voting proxies for certain CEFs held by the Fund are available at http://www.specialopportunitiesfundinc.com/proxy_voting.html. To be notified directly of such instances,

please email us at proxyinstructions@bulldoginvestors.com.

Sincerely yours,

Phillip Goldstein

Chairman

Special Opportunities Fund, Inc.

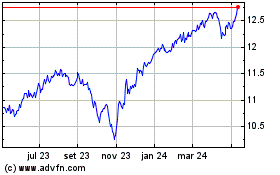

Growth of $10,000 Investment

Performance at a glance (unaudited)

|

Average annual total returns for common stock for the periods ended 12/31/2023

|

|

|

|

|

Net asset value returns

|

1 year

|

5 years

|

10 years

|

|

Special Opportunities Fund, Inc.

|

18.74%

|

9.55%

|

5.63%

|

|

Market price returns

|

|

|

|

|

Special Opportunities Fund, Inc.

|

14.13%

|

9.97%

|

5.42%

|

|

Index returns

|

|

|

|

|

S&P 500® Index

|

26.29%

|

15.69%

|

12.03%

|

|

Share price as of 12/31/2023

|

|

|

|

|

Net asset value

|

|

|

$14.30

|

|

Market price

|

|

|

$11.86

|

Past performance does not predict future performance. The return and value of an investment will fluctuate so that an investor’s share, when sold, may be worth more or less than their original cost. The Fund’s common

stock net asset value (“NAV”) return assumes, for illustration only, that dividends and other distributions, if any, were reinvested at the NAV on the ex-dividend date. The Fund’s common stock market price returns assume that all dividends and other

distributions, if any, were reinvested at the lower of the NAV or the closing market price on the ex-dividend date. NAV and market price returns for the period of less than one year have not been annualized. Returns do not reflect the deduction of

taxes that a shareholder could pay on Fund dividends and other distributions, if any, or the sale of Fund shares.

The S&P 500® Index is a capital weighted, unmanaged index that represents the aggregate market value of the common equity of 500 stocks primarily traded on the

New York Stock Exchange. You cannot invest directly in an index.

Special Opportunities Fund, Inc.

Portfolio composition as of 12/31/2023(1) (Unaudited)

| |

|

Value

|

|

|

Percent

|

|

|

Investment Companies

|

|

$

|

152,393,478

|

|

|

|

71.44

|

%

|

|

Special Purpose Acquisition Vehicles

|

|

|

31,564,441

|

|

|

|

14.80

|

|

|

Money Market Funds

|

|

|

10,255,081

|

|

|

|

4.81

|

|

|

Other Common Stocks

|

|

|

9,243,834

|

|

|

|

4.33

|

|

|

Unsecured Notes

|

|

|

4,792,252

|

|

|

|

2.25

|

|

|

Corporate Obligations

|

|

|

1,598,381

|

|

|

|

0.75

|

|

|

Trusts

|

|

|

1,527,009

|

|

|

|

0.72

|

|

|

Real Estate Investment Trusts

|

|

|

1,414,054

|

|

|

|

0.66

|

|

|

Preferred Stocks

|

|

|

345,678

|

|

|

|

0.16

|

|

|

Warrants

|

|

|

118,787

|

|

|

|

0.06

|

|

|

Rights

|

|

|

49,166

|

|

|

|

0.02

|

|

|

Total Investments

|

|

$

|

213,302,161

|

|

|

|

100.00

|

%

|

|

(1)

|

As a percentage of total investments.

|

The following table represents the Fund’s investments categorized by country as of December 31, 2023:

| |

|

% of Total

|

|

|

|

Country

|

|

Investments

|

|

|

|

United States

|

|

|

96.22

|

%

|

|

|

China

|

|

|

1.16

|

%

|

|

|

Hong Kong

|

|

|

1.01

|

%

|

|

|

Guernsey

|

|

|

0.86

|

%

|

|

|

Ireland

|

|

|

0.75

|

%

|

|

|

Cayman Islands

|

|

|

0.00

|

%

|

|

| |

|

|

100.00

|

%

|

|

Special Opportunities Fund, Inc.

Portfolio of investments—December 31, 2023

| |

|

Shares

|

|

|

Value

|

|

|

INVESTMENT COMPANIES—96.76%

|

|

|

|

|

|

|

|

Closed-End Funds—82.41%

|

|

|

|

|

|

|

|

abrdn Global Dynamic Dividend Fund

|

|

|

49,874

|

|

|

$

|

465,823

|

|

|

Apollo Tactical Income Fund, Inc.

|

|

|

37,375

|

|

|

|

521,755

|

|

|

Bancroft Fund Ltd.

|

|

|

22,345

|

|

|

|

357,073

|

|

|

BlackRock California Municipal Income Trust

|

|

|

229,380

|

|

|

|

2,759,441

|

|

|

BlackRock ESG Capital Allocation Term Trust

|

|

|

73,787

|

|

|

|

1,190,184

|

|

|

Blackstone Strategic Credit 2027 Term Fund

|

|

|

86,455

|

|

|

|

978,671

|

|

|

BNY Mellon Alcentra Global Credit Income 2024 Target Term Fund, Inc.

|

|

|

46,559

|

|

|

|

379,456

|

|

|

BNY Mellon Municipal Income, Inc.

|

|

|

621,787

|

|

|

|

4,041,615

|

|

|

BNY Mellon Strategic Municipal Bond Fund, Inc.

|

|

|

468,928

|

|

|

|

2,677,579

|

|

|

Carlyle Credit Income Fund

|

|

|

153,336

|

|

|

|

1,219,021

|

|

|

Central and Eastern Europe Fund, Inc.

|

|

|

188,883

|

|

|

|

1,841,609

|

|

|

Central Securities Corp.

|

|

|

219,394

|

|

|

|

8,286,511

|

|

|

ClearBridge Energy Midstream Opportunity Fund, Inc. (a)

|

|

|

2,349

|

|

|

|

82,027

|

|

|

ClearBridge MLP & Midstream Fund, Inc.

|

|

|

8,213

|

|

|

|

329,259

|

|

|

ClearBridge MLP & Midstream Total Return Fund, Inc. (a)

|

|

|

186

|

|

|

|

6,739

|

|

|

Destra Multi-Alternative Fund

|

|

|

216,567

|

|

|

|

1,349,212

|

|

|

Dividend and Income Fund

|

|

|

350,673

|

|

|

|

4,267,690

|

|

|

DWS Municipal Income Trust

|

|

|

1,117,608

|

|

|

|

9,935,535

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

256,315

|

|

|

|

2,217,125

|

|

|

Eaton Vance New York Municipal Bond Fund

|

|

|

423,341

|

|

|

|

4,085,241

|

|

|

Ellsworth Growth and Income Fund Ltd.

|

|

|

76,934

|

|

|

|

621,627

|

|

|

Federated Hermes Premier Municipal Income Fund

|

|

|

4,839

|

|

|

|

53,181

|

|

|

First Trust High Yield Opportunities 2027 Term Fund

|

|

|

71,825

|

|

|

|

1,000,522

|

|

|

First Trust MLP and Energy Income Fund

|

|

|

15,392

|

|

|

|

131,909

|

|

|

Gabelli Dividend & Income Trust

|

|

|

123,595

|

|

|

|

2,674,596

|

|

|

General American Investors Co., Inc.

|

|

|

324,541

|

|

|

|

13,939,036

|

|

|

Herzfeld Caribbean Basin Fund, Inc.

|

|

|

1,941

|

|

|

|

5,396

|

|

|

High Income Securities Fund

|

|

|

242,733

|

|

|

|

1,558,346

|

|

|

Highland Opportunities and Income Fund

|

|

|

310,059

|

|

|

|

2,384,354

|

|

|

Invesco High Income 2024 Target Term Fund

|

|

|

201,622

|

|

|

|

1,389,176

|

|

|

Mexico Equity & Income Fund, Inc.

|

|

|

100,100

|

|

|

|

1,121,120

|

|

|

MFS High Yield Municipal Trust

|

|

|

741,292

|

|

|

|

2,453,677

|

|

|

MFS Investment Grade Municipal Trust

|

|

|

213,211

|

|

|

|

1,614,007

|

|

|

Miller/Howard High Dividend Fund

|

|

|

8,331

|

|

|

|

88,392

|

|

|

Morgan Stanley Emerging Markets Debt Fund, Inc.

|

|

|

175,052

|

|

|

|

1,216,611

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Portfolio of investments—December 31, 2023

| |

|

Shares

|

|

|

Value

|

|

|

INVESTMENT COMPANIES—(continued)

|

|

|

|

|

|

|

|

Closed-End Funds—(continued)

|

|

|

|

|

|

|

|

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

|

|

|

162,390

|

|

|

$

|

756,737

|

|

|

Neuberger Berman Municipal Fund, Inc.

|

|

|

30,225

|

|

|

|

312,829

|

|

|

Neuberger Berman Next Generation Connectivity Fund, Inc.

|

|

|

535,671

|

|

|

|

5,854,884

|

|

|

New America High Income Fund, Inc.

|

|

|

91,191

|

|

|

|

641,985

|

|

|

Nuveen Floating Rate Income Fund

|

|

|

242,798

|

|

|

|

1,995,800

|

|

|

Nuveen Multi-Asset Income Fund

|

|

|

12,779

|

|

|

|

157,182

|

|

|

NXG NextGen Infrastructure Income Fund

|

|

|

65,522

|

|

|

|

2,328,652

|

|

|

Pershing Square Holdings Ltd. Fund

|

|

|

30,000

|

|

|

|

1,370,502

|

|

|

Pershing Square Holdings Ltd. Fund

|

|

|

10,000

|

|

|

|

467,000

|

|

|

Principal Real Estate Income Fund

|

|

|

201,915

|

|

|

|

1,908,097

|

|

|

Royce Value Trust, Inc.

|

|

|

83,173

|

|

|

|

1,210,999

|

|

|

Saba Capital Income & Opportunities Fund

|

|

|

249,557

|

|

|

|

1,924,084

|

|

|

SRH Total Return Fund, Inc.

|

|

|

1,116,522

|

|

|

|

15,486,160

|

|

|

Taiwan Fund, Inc.

|

|

|

223,819

|

|

|

|

7,741,899

|

|

|

Templeton Global Income Fund

|

|

|

48,267

|

|

|

|

182,932

|

|

|

The Swiss Helvetia Fund, Inc.

|

|

|

236,992

|

|

|

|

1,943,334

|

|

|

Tortoise Energy Independence Fund, Inc.

|

|

|

49,741

|

|

|

|

1,425,577

|

|

|

Tortoise Power and Energy Infrastructure Fund, Inc.

|

|

|

147,267

|

|

|

|

2,063,859

|

|

|

Virtus Convertible & Income 2024 Target Term Fund

|

|

|

17,054

|

|

|

|

148,711

|

|

|

Virtus Total Return Fund, Inc.

|

|

|

805,935

|

|

|

|

4,440,702

|

|

|

Western Asset Global Corporate Defined Opportunity Fund, Inc.

|

|

|

287

|

|

|

|

3,665

|

|

|

Western Asset Intermediate Muni Fund, Inc.

|

|

|

24,397

|

|

|

|

187,857

|

|

| |

|

|

|

|

|

|

129,796,963

|

|

| |

|

|

|

|

|

|

|

|

|

Business Development Companies—14.35%

|

|

|

|

|

|

|

|

|

|

Barings BDC, Inc.

|

|

|

403,900

|

|

|

|

3,465,462

|

|

|

CION Investment Corp.

|

|

|

899,218

|

|

|

|

10,170,156

|

|

|

FS KKR Capital Corp.

|

|

|

213,874

|

|

|

|

4,271,064

|

|

|

Logan Ridge Finance Corp.

|

|

|

81,161

|

|

|

|

1,835,050

|

|

|

PennantPark Investment Corp.

|

|

|

67,321

|

|

|

|

465,188

|

|

|

Portman Ridge Finance Corp.

|

|

|

98,369

|

|

|

|

1,789,332

|

|

|

SuRo Capital Corp. (a)

|

|

|

152,351

|

|

|

|

600,263

|

|

| |

|

|

|

|

|

|

22,596,515

|

|

|

Total Investment Companies (Cost $136,915,078)

|

|

|

|

|

|

|

152,393,478

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Portfolio of investments—December 31, 2023

| |

|

Shares/Units

|

|

|

Value

|

|

|

SPECIAL PURPOSE ACQUISITION VEHICLES—20.04%

|

|

|

|

|

|

|

|

99 Acquisition Group, Inc. (a)

|

|

|

154,727

|

|

|

$

|

1,576,668

|

|

|

Agriculture & Natural Solutions Acquisition Corp. Units (a)

|

|

|

25,000

|

|

|

|

253,750

|

|

|

Alpha Partners Technology Merger Corp. (a)

|

|

|

37,224

|

|

|

|

398,297

|

|

|

AP Acquisition Corp. (a)

|

|

|

193,647

|

|

|

|

2,155,291

|

|

|

Ares Acquisition Corp. II (a)

|

|

|

161,985

|

|

|

|

1,691,123

|

|

|

Arrowroot Acquisition Corp. (a)

|

|

|

50,000

|

|

|

|

523,500

|

|

|

Churchill Capital Corp. VII (a)

|

|

|

124,920

|

|

|

|

1,311,660

|

|

|

Colombier Acquisition Corp. II Units (a)

|

|

|

61,998

|

|

|

|

624,940

|

|

|

EVe Mobility Acquisition Corp. (a)

|

|

|

34,200

|

|

|

|

369,702

|

|

|

Four Leaf Acquisition Corp. (a)

|

|

|

67,644

|

|

|

|

710,938

|

|

|

Global Lights Acquisition Corp. (a)

|

|

|

246,417

|

|

|

|

2,483,883

|

|

|

Gores Holdings IX, Inc. (a)

|

|

|

104,060

|

|

|

|

1,092,630

|

|

|

Haymaker Acquisition Corp. 4 (a)

|

|

|

179,631

|

|

|

|

1,844,810

|

|

|

Inflection Point Acquisition Corp. II (a)

|

|

|

244,733

|

|

|

|

2,528,092

|

|

|

Investcorp Europe Acquisition Corp. I (a)

|

|

|

154,932

|

|

|

|

1,707,351

|

|

|

Quetta Acquisition Corp. (a)

|

|

|

167,742

|

|

|

|

1,695,872

|

|

|

Screaming Eagle Acquisition Corp. (a)

|

|

|

491,801

|

|

|

|

5,213,091

|

|

|

Spring Valley Acquisition Corp. II (a)

|

|

|

130,332

|

|

|

|

1,408,889

|

|

|

TG Venture Acquisition Corp. (a)

|

|

|

309,207

|

|

|

|

3,351,804

|

|

|

Trailblazer Merger Corp. I (a)

|

|

|

59,479

|

|

|

|

622,150

|

|

|

Total Special Purpose Acquisition Vehicles (Cost $30,976,559)

|

|

|

|

|

|

|

31,564,441

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Shares

|

|

|

|

|

|

|

PREFERRED STOCKS—0.22%

|

|

|

|

|

|

|

|

|

|

Diversified REITs—0.21%

|

|

|

|

|

|

|

|

|

|

NexPoint Diversified Real Estate Trust

|

|

|

22,324

|

|

|

|

337,092

|

|

| |

|

|

|

|

|

|

|

|

|

Office REITs—0.01%

|

|

|

|

|

|

|

|

|

|

Brookfield DTLA Fund Office Trust Investor, Inc.

|

|

|

171,723

|

|

|

|

8,586

|

|

|

Total Preferred Stocks (Cost $4,932,717)

|

|

|

|

|

|

|

345,678

|

|

| |

|

|

|

|

|

|

|

|

|

OTHER COMMON STOCKS—5.87%

|

|

|

|

|

|

|

|

|

|

Biotechnology—0.39%

|

|

|

|

|

|

|

|

|

|

Cyteir Therapeutics, Inc. (a)

|

|

|

200,000

|

|

|

|

608,000

|

|

| |

|

|

|

|

|

|

|

|

|

Financial Services—0.16%

|

|

|

|

|

|

|

|

|

|

Cannae Holdings, Inc. (a)

|

|

|

12,980

|

|

|

|

253,240

|

|

| |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Portfolio of investments—December 31, 2023

| |

|

Shares

|

|

|

Value

|

|

|

Food Products—0.26%

|

|

|

|

|

|

|

|

Limoneira Co.

|

|

|

20,000

|

|

|

$

|

412,600

|

|

| |

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels—4.39%

|

|

|

|

|

|

|

|

|

|

Texas Pacific Land Corp.

|

|

|

4,400

|

|

|

|

6,918,780

|

|

| |

|

|

|

|

|

|

|

|

|

Real Estate Management & Development—0.67%

|

|

|

|

|

|

|

|

|

|

Howard Hughes Holdings, Inc. (a)

|

|

|

12,000

|

|

|

|

1,026,600

|

|

|

Trinity Place Holdings, Inc. (a)

|

|

|

221,748

|

|

|

|

24,614

|

|

| |

|

|

|

|

|

|

1,051,214

|

|

|

Total Other Common Stocks (Cost $7,675,035)

|

|

|

|

|

|

|

9,243,834

|

|

| |

|

|

|

|

|

|

|

|

|

TRUSTS—0.97%

|

|

|

|

|

|

|

|

|

|

Copper Property CTL Pass Through Trust

|

|

|

151,189

|

|

|

|

1,527,009

|

|

|

Lamington Road Grantor Trust (a)(c)

|

|

|

320,690

|

|

|

|

0

|

|

|

Total Trusts (Cost $1,758,153)

|

|

|

|

|

|

|

1,527,009

|

|

| |

|

|

|

|

|

|

|

|

|

REAL ESTATE INVESTMENT TRUSTS—0.90%

|

|

|

|

|

|

|

|

|

|

NexPoint Diversified Real Estate Trust

|

|

|

177,868

|

|

|

|

1,414,054

|

|

|

Total Real Estate Investment Trusts (Cost $2,327,359)

|

|

|

|

|

|

|

1,414,054

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Principal

|

|

|

|

|

|

| |

|

Amount

|

|

|

|

|

|

|

CORPORATE OBLIGATIONS—1.01%

|

|

|

|

|

|

|

|

|

|

Lamington Road DAC (b)(c)

|

|

|

|

|

|

|

|

|

|

8.000%, 04/07/2121

|

|

$

|

17,203,693

|

|

|

|

688,148

|

|

|

9.750%, 04/07/2121

|

|

|

1,753,821

|

|

|

|

910,233

|

|

|

Total Corporate Obligations (Cost $6,256,237)

|

|

|

|

|

|

|

1,598,381

|

|

| |

|

|

|

|

|

|

|

|

|

UNSECURED NOTES—3.04%

|

|

|

|

|

|

|

|

|

|

Legacy IMBDS, Inc. (c)

|

|

|

|

|

|

|

|

|

|

8.500%, 09/30/2026

|

|

|

23,458

|

|

|

|

0

|

|

|

Sachem Capital Corp.

|

|

|

|

|

|

|

|

|

|

7.125%, 06/30/2024

|

|

|

60,000

|

|

|

|

1,500,000

|

|

|

7.750%, 09/30/2025

|

|

|

120,000

|

|

|

|

2,864,652

|

|

|

6.000%, 03/30/2027

|

|

|

20,000

|

|

|

|

427,600

|

|

| |

|

|

|

|

|

|

4,792,252

|

|

|

Total Unsecured Notes (Cost $5,546,450)

|

|

|

|

|

|

|

4,792,252

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Portfolio of investments—December 31, 2023

| |

|

Shares

|

|

|

Value

|

|

|

WARRANTS—0.07%

|

|

|

|

|

|

|

|

Alset Capital Acquisition Corp.

|

|

|

|

|

|

|

|

Expiration: February 2027

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

23,750

|

|

|

$

|

237

|

|

|

Andretti Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: March 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

72,334

|

|

|

|

18,084

|

|

|

Blockchain Coinvestors Acquisition Corp. I

|

|

|

|

|

|

|

|

|

|

Expiration: November 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

32,500

|

|

|

|

1,625

|

|

|

Cactus Acquisition Corp. 1 Ltd.

|

|

|

|

|

|

|

|

|

|

Expiration: October 2026

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

40,700

|

|

|

|

1,221

|

|

|

Cartesian Growth Corp. II

|

|

|

|

|

|

|

|

|

|

Expiration: July 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

21,986

|

|

|

|

2,858

|

|

|

Churchill Capital Corp. VII

|

|

|

|

|

|

|

|

|

|

Expiration: February 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

24,984

|

|

|

|

3,997

|

|

|

Corner Growth Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: December 2027

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

33,333

|

|

|

|

2,067

|

|

|

Corner Growth Acquisition Corp. 2

|

|

|

|

|

|

|

|

|

|

Expiration: June 2026

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

14,366

|

|

|

|

431

|

|

|

Digital Health Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: November 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

116,000

|

|

|

|

3,074

|

|

|

Global Gas Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: October 2027

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

19,300

|

|

|

|

618

|

|

|

HNR Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: July 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

63,000

|

|

|

|

3,622

|

|

|

iCoreConnect, Inc.

|

|

|

|

|

|

|

|

|

|

Expiration: May 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

150,000

|

|

|

|

30

|

|

|

Insight Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: August 2026

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

12,450

|

|

|

|

251

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Portfolio of investments—December 31, 2023

| |

|

Shares

|

|

|

Value

|

|

|

WARRANTS—(continued)

|

|

|

|

|

|

|

|

Investcorp Europe Acquisition Corp. I

|

|

|

|

|

|

|

|

Expiration: November 2028

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

150,000

|

|

|

$

|

34,380

|

|

|

Keyarch Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: July 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

75,000

|

|

|

|

1,313

|

|

|

Lamington Road

|

|

|

|

|

|

|

|

|

|

Expiration: July 2025

|

|

|

|

|

|

|

|

|

|

Exercise Price: $0.20 (a)(c)(e)

|

|

|

640,000

|

|

|

|

0

|

|

|

Landcadia Holdings IV, Inc.

|

|

|

|

|

|

|

|

|

|

Expiration: March 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

25,000

|

|

|

|

1,622

|

|

|

NKGen Biotech, Inc.

|

|

|

|

|

|

|

|

|

|

Expiration: October 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

17,677

|

|

|

|

1,428

|

|

|

Northern Star Investment Corp. III

|

|

|

|

|

|

|

|

|

|

Expiration: February 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

17,833

|

|

|

|

75

|

|

|

Northern Star Investment Corp. IV

|

|

|

|

|

|

|

|

|

|

Expiration: December 2027

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

8,833

|

|

|

|

11

|

|

|

Plutonian Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: October 2027

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

101,969

|

|

|

|

3,049

|

|

|

Quantum FinTech Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: December 2027

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

76,000

|

|

|

|

3,906

|

|

|

Screaming Eagle Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: December 2027

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

75,200

|

|

|

|

33,848

|

|

|

TG Venture Acquisition Corp.

|

|

|

|

|

|

|

|

|

|

Expiration: August 2028

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)

|

|

|

100,000

|

|

|

|

1,040

|

|

|

ZyVersa Therapeutics, Inc.

|

|

|

|

|

|

|

|

|

|

Expiration: December 2027

|

|

|

|

|

|

|

|

|

|

Exercise Price: $11.50 (a)(c)(e)

|

|

|

65,250

|

|

|

|

0

|

|

|

Total Warrants (Cost $418,693)

|

|

|

|

|

|

|

118,787

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Portfolio of investments—December 31, 2023

| |

|

Shares

|

|

|

Value

|

|

|

RIGHTS—0.03%

|

|

|

|

|

|

|

|

Alset Capital Acquisition Corp. (a)

|

|

|

47,500

|

|

|

$

|

9,975

|

|

|

Hudson Acquisition I Corp. (Expiration: April 18, 2024) (a)

|

|

|

25,100

|

|

|

|

3,966

|

|

|

Keyarch Acquisition Corp. (a)

|

|

|

150,000

|

|

|

|

9,405

|

|

|

Nocturne Acquisition Corp. (a)

|

|

|

75,000

|

|

|

|

12,360

|

|

|

Plutonian Acquisition Corp. (Expiration: August 15, 2024) (a)

|

|

|

101,969

|

|

|

|

13,460

|

|

|

Total Rights (Cost $74,774)

|

|

|

|

|

|

|

49,166

|

|

| |

|

|

|

|

|

|

|

|

|

MONEY MARKET FUNDS—6.51%

|

|

|

|

|

|

|

|

|

|

Fidelity Institutional Government Portfolio—Class I, 5.240% (d)

|

|

|

5,127,540

|

|

|

|

5,127,540

|

|

|

Invesco Treasury Portfolio—Institutional Class, 5.262% (d)

|

|

|

5,127,541

|

|

|

|

5,127,541

|

|

|

Total Money Market Funds (Cost $10,255,081)

|

|

|

|

|

|

|

10,255,081

|

|

|

Total Investments (Cost $207,136,136)—135.45%

|

|

|

|

|

|

|

213,302,161

|

|

|

Other Assets in Excess of Liabilities—0.33%

|

|

|

|

|

|

|

562,133

|

|

|

Preferred Stock—(35.78)%

|

|

|

|

|

|

|

(56,363,925

|

)

|

|

TOTAL NET ASSETS—100.00%

|

|

|

|

|

|

$

|

157,500,369

|

|

Percentages are stated as a percent of net assets.

|

(a)

|

Non-income producing security.

|

|

(b)

|

The coupon rate shown represents the rate at December 31, 2023.

|

|

(c)

|

Fair valued securities. The total market value of these securities was $1,598,381, representing 1.01% of net assets. Value determined using significant unobservable inputs.

|

|

(d)

|

The rate shown represents the seven-day yield at December 31, 2023.

|

|

(e)

|

Illiquid securities. The total market value of these securities was $0, representing 0.00% of net assets.

|

The Schedule of Investments incorporates the Global Industry Classification Standard (GICS®). GICS was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poors Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Statement of assets and liabilities—December 31, 2023

|

Assets:

|

|

|

|

|

Investments, at value (Cost $207,136,136)

|

|

$

|

213,302,161

|

|

|

Cash

|

|

|

8,094

|

|

|

Receivables:

|

|

|

|

|

|

Investments sold

|

|

|

738,047

|

|

|

Dividends and interest

|

|

|

1,587,906

|

|

|

Other assets

|

|

|

25,852

|

|

|

Total assets

|

|

|

215,662,060

|

|

| |

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

Payables:

|

|

|

|

|

|

Investments purchased

|

|

|

1,488,810

|

|

|

Advisory

|

|

|

180,257

|

|

|

Administration

|

|

|

33,757

|

|

|

Chief Compliance Officer

|

|

|

6,093

|

|

|

Director

|

|

|

10,459

|

|

|

Fund accounting

|

|

|

711

|

|

|

Custody

|

|

|

5,995

|

|

|

Transfer Agent

|

|

|

2,481

|

|

|

Legal

|

|

|

9,421

|

|

|

Audit

|

|

|

45,000

|

|

|

Reports and notices to shareholders

|

|

|

14,774

|

|

|

Accrued expenses and other liabilities

|

|

|

8

|

|

|

Total liabilities

|

|

|

1,797,766

|

|

| |

|

|

|

|

|

Preferred Stock:

|

|

|

|

|

|

2.75% Convertible Preferred Stock – $0.001 par value, $25 liquidation value per share;

|

|

|

|

|

|

2,254,557 shares outstanding

|

|

|

|

|

|

Total preferred stock

|

|

|

56,363,925

|

|

| |

|

|

|

|

|

Net assets applicable to common shareholders

|

|

$

|

157,500,369

|

|

| |

|

|

|

|

|

Net assets applicable to common shareholders:

|

|

|

|

|

|

Common stock – $0.001 par value per common share; 199,995,800 shares authorized;

|

|

|

|

|

|

11,010,177 shares issued and outstanding, 14,796,650 shares held in treasury

|

|

$

|

397,849,371

|

|

|

Cost of shares held in treasury

|

|

|

(245,208,216

|

)

|

|

Total distributable earnings (deficit)

|

|

|

4,859,214

|

|

|

Net assets applicable to common shareholders

|

|

$

|

157,500,369

|

|

|

Net asset value per common share ($157,500,369 applicable to

|

|

|

|

|

|

11,010,177 common shares outstanding)

|

|

$

|

14.30

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Statement of operations

| |

|

For the year ended

|

|

| |

|

December 31, 2023

|

|

|

Investment income:

|

|

|

|

|

Dividends

|

|

$

|

7,486,235

|

|

|

Interest

|

|

|

2,163,190

|

|

|

Total investment income

|

|

|

9,649,425

|

|

| |

|

|

|

|

|

Expenses:

|

|

|

|

|

|

Investment advisory

|

|

|

2,097,272

|

|

|

Directors’

|

|

|

245,943

|

|

|

Administration

|

|

|

224,336

|

|

|

Compliance

|

|

|

69,580

|

|

|

Reports and notices to shareholders

|

|

|

59,916

|

|

|

Audit

|

|

|

44,995

|

|

|

Transfer agency

|

|

|

43,840

|

|

|

Custody

|

|

|

40,222

|

|

|

Legal

|

|

|

36,828

|

|

|

Stock exchange listing

|

|

|

32,273

|

|

|

Insurance

|

|

|

30,908

|

|

|

Accounting

|

|

|

4,833

|

|

|

Other

|

|

|

38,773

|

|

|

Net expenses

|

|

|

2,969,719

|

|

|

Net investment income

|

|

|

6,679,706

|

|

| |

|

|

|

|

|

Net realized and unrealized gains (losses) from investment activities:

|

|

|

|

|

|

Net realized gain from:

|

|

|

|

|

|

Investments

|

|

|

1,077,661

|

|

|

Foreign currency translations

|

|

|

5,001

|

|

|

Distributions received from investment companies

|

|

|

1,144,856

|

|

|

Net realized gain

|

|

|

2,227,518

|

|

|

Change in net unrealized appreciation (depreciation) on:

|

|

|

|

|

|

Investments

|

|

|

17,743,241

|

|

|

Foreign currency translations

|

|

|

8,730

|

|

|

Net realized and unrealized gains from investment activities

|

|

|

19,979,489

|

|

|

Discount on redemption and repurchase of preferred shares

|

|

|

179,207

|

|

|

Increase in net assets resulting from operations

|

|

|

26,838,402

|

|

|

Distributions to preferred stockholders

|

|

|

(1,587,197

|

)

|

|

Net increase in net assets applicable to common shareholders resulting from operations

|

|

$

|

25,251,205

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Statement of cash flows

| |

|

For the Year Ended

|

|

| |

|

December 31, 2023

|

|

|

Cash flows from operating activities:

|

|

|

|

|

Net increase in net assets

|

|

$

|

26,838,402

|

|

|

Adjustments to reconcile net increase in net assets applicable to common

|

|

|

|

|

|

shareholders resulting from operations to net cash provided by operating activities:

|

|

|

|

|

|

Purchases of investments

|

|

|

(127,141,189

|

)

|

|

Proceeds from sales of investments

|

|

|

138,497,698

|

|

|

Net purchases and sales of short-term investments

|

|

|

(3,171,952

|

)

|

|

Return of capital and capital gain distributions received from underlying investments

|

|

|

3,937,263

|

|

|

Accretion of discount

|

|

|

149

|

|

|

Increase in dividends and interest receivable

|

|

|

(815,874

|

)

|

|

Decrease in receivable for investments sold

|

|

|

379,838

|

|

|

Increase in other assets

|

|

|

(1,045

|

)

|

|

Decrease in payable for investments purchased

|

|

|

(880,148

|

)

|

|

Increase in payable to Adviser

|

|

|

192

|

|

|

Decrease in accrued expenses and other liabilities

|

|

|

(22,501

|

)

|

|

Net distributions received from investment companies

|

|

|

1,144,856

|

|

|

Net realized gain from investments

|

|

|

(2,222,518

|

)

|

|

Litigation and other proceeds

|

|

|

40,372

|

|

Discount on redemption and repurchase of preferrd shares

|

|

|

(179,207

|

)

|

|

Net change in unrealized appreciation of investments

|

|

|

(17,743,241

|

)

|

|

Net cash provided by operating activities

|

|

|

18,661,095

|

|

| |

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

Distributions paid to common shareholders

|

|

|

(11,783,156

|

)

|

|

Distributions paid to preferred shareholders

|

|

|

(1,587,197

|

)

|

|

Repurchase of common stock

|

|

|

(5,077,215

|

)

|

|

Repurchase of preferred stock

|

|

|

(1,830,718

|

)

|

|

Net cash used in financing activities

|

|

|

(20,278,286

|

)

|

|

Net change in cash

|

|

$

|

(1,617,191

|

)

|

| |

|

|

|

|

|

Cash:

|

|

|

|

|

|

Beginning of year

|

|

|

1,625,285

|

|

|

End of year

|

|

$

|

8,094

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Statements of changes in net assets applicable to common shareholders

| |

|

For the

|

|

|

For the

|

|

| |

|

year ended

|

|

|

year ended

|

|

| |

|

December 31, 2023

|

|

|

December 31, 2022

|

|

|

From operations:

|

|

|

|

|

|

|

|

Net investment income

|

|

$

|

6,679,706

|

|

|

$

|

3,478,374

|

|

|

Net realized gain (loss) from:

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

1,077,661

|

|

|

|

(954,692

|

)

|

|

Foreign currency translations

|

|

|

5,001

|

|

|

|

—

|

|

|

Distributions received from investment companies

|

|

|

1,144,856

|

|

|

|

1,828,305

|

|

|

Net change in unrealized appreciation (depreciation) on:

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

17,743,241

|

|

|

|

(29,012,831

|

)

|

|

Foreign currency translations

|

|

|

8,730

|

|

|

|

—

|

|

|

Discount on redemption and repurchases of preferred shares

|

|

|

179,207

|

|

|

|

—

|

|

|

Net increase (decrease) in net assets resulting from operations

|

|

|

26,838,402

|

|

|

|

(24,660,844

|

)

|

| |

|

|

|

|

|

|

|

|

|

Distributions paid to preferred shareholders:

|

|

|

|

|

|

|

|

|

|

Net dividends and distributions

|

|

|

(1,587,197

|

)

|

|

|

(1,467,040

|

)

|

|

Total dividends and distributions paid to preferred shareholders

|

|

|

(1,587,197

|

)

|

|

|

(1,467,040

|

)

|

|

Net increase (decrease) in net assets applicable to common

|

|

|

|

|

|

|

|

|

|

shareholders resulting from operations

|

|

|

25,251,205

|

|

|

|

(26,127,884

|

)

|

| |

|

|

|

|

|

|

|

|

|

Distributions paid to common shareholders:

|

|

|

|

|

|

|

|

|

|

Net dividends and distributions

|

|

|

(6,271,117

|

)

|

|

|

(15,317,585

|

)

|

|

Return of capital

|

|

|

(5,512,039

|

)

|

|

|

(226,028

|

)

|

|

Total dividends and distributions paid to common shareholders

|

|

|

(11,783,156

|

)

|

|

|

(15,543,613

|

)

|

| |

|

|

|

|

|

|

|

|

|

Capital Stock Transactions (Note 4)

|

|

|

|

|

|

|

|

|

|

Repurchase of common stock through tender offer

|

|

|

—

|

|

|

|

(19,612,500

|

)

|

|

Repurchase of common stock

|

|

|

(5,077,215

|

)

|

|

|

—

|

|

|

Total capital stock transactions

|

|

|

(5,077,215

|

)

|

|

|

(19,612,500

|

)

|

|

Net increase (decrease) in net assets

|

|

|

|

|

|

|

|

|

|

applicable to common shareholders

|

|

|

8,390,834

|

|

|

|

(61,283,997

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net assets applicable to common shareholders:

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

149,109,535

|

|

|

|

210,393,532

|

|

|

End of year

|

|

$

|

157,500,369

|

|

|

$

|

149,109,535

|

|

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

(This Page Intentionally Left Blank.)

Special Opportunities Fund, Inc.

Financial highlights

Selected data for a share of common stock outstanding throughout each year is presented below:

Net asset value, beginning of year

Net investment income (loss)(1)

Net realized and unrealized gains (losses) from investment activities

Total from investment operations

Common share equivalent of dividends paid to preferred shareholders from:

Net investment income

Net realized gains from investment activities

Net increase (decrease) in net assets attributable to common stockholders resulting form operations

Dividends and distributions paid to common shareholders from:

Net investment income

Net realized gains from investment activities

Return of capital

Total dividends and distributions paid to common shareholders

Anti-Dilutive effect of Common Share Repurchase

Dilutive effect of conversions of preferred shares to common shares

Anti-Dilutive effect of tender offer

Net asset value, end of year

Market value, end of year

Total net asset value return(2)

Total market price return(3)

Ratio to average net assets attributable to common shares:

Ratio of expenses to average assets(4)

Ratio of net investment income to average net assets(1)

Supplemental data:

Net assets applicable to common shareholders, end of year/period (000’s)

Liquidation value of preferred stock (000’s)

Portfolio turnover

Preferred Stock:

Total Shares Outstanding

Asset coverage per share of preferred shares, end of year

The accompanying notes are an integral part of these financial statements.

Special Opportunities Fund, Inc.

Financial highlights (continued)

|

For the year ended December 31,

|

|

|

2023

|

|

|

2022

|

|

|

2021

|

|

|

2020

|

|

|

2019

|

|

|

$

|

13.01

|

|

|

$

|

16.55

|

|

|

$

|

16.13

|

|

|

$

|

16.06

|

|

|

$

|

13.78

|

|

| |

0.58

|

|

|

|

0.28

|

|

|

|

0.18

|

|

|

|

0.59

|

|

|

|

0.31

|

|

| |

1.80

|

|

|

|

(2.43

|

)

|

|

|

4.06

|

|

|

|

0.84

|

|

|

|

3.13

|

|

| |

2.38

|

|

|

|

(2.15

|

)

|

|

|

4.24

|

|

|

|

1.43

|

|

|

|

3.44

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(0.14