SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2024

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

| 4Q23 & 2023 Results |

| | |

São Paulo, March 6, 2024 - Companhia Siderúrgica

Nacional ("CSN") (B3: CSNA3) (NYSE: SID) announces its results for the fourth quarter and full year of 2023 (4Q23 and

2023) in Reais, with its financial statements consolidated in accordance with the accounting practices adopted in Brazil issued by

the Accounting Pronouncements Committee ("CPC"), approved by the Brazilian Securities and Exchange Commission ("CVM")

and the Federal Accounting Council ("CFC") and in accordance with the International Financial Reporting Standards ("IFRS")

issued by the International Accounting Standards Board ("IASB").

The comments address the Company's consolidated results

for the fourth quarter and the full year of 2023 (4Q23 and 2023) and the comparisons are for the third quarter of 2023 (3Q23),

the fourth quarter of 2022 (4Q22) and the year 2022. The dollar exchange rate was R$ 5.22 on 12/30/2022; R$ 5.01 on 09/29/2023 and R$

4.84 on 12/29/2023.

4Q23 and 2023 Operational and

Financial Highlights

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 2 |

| 4Q23 & 2023 Results |

| | |

Consolidated Table - Highlights

¹ Adjusted EBITDA is calculated based on net

income (loss), plus depreciation and amortization, taxes on profit, net financial result, result from participation in investments, result

from other operating revenues/expenses and includes the proportional participation of 37.27% of the EBITDA of the joint subsidiary MRS

Logística.

² Adjusted EBITDA Margin is calculated from Adjusted

EBITDA divided by Managerial Net Revenue.

³ Adjusted Net

Debt and Adjusted Cash/Availability account for 37.27% of MRS, in addition to not considering Forfaiting and Drawn Risk operations.

Consolidated Result

·

Net Revenue totaled R$ 12,005 million in 4Q23, which represents

an increase of 7.9% when compared to 3Q23, mainly as a result of the improvement in price realization in the mining segment amid the rise

of Platts, in addition to the higher volume of steel sold in the period. In 2023, Net Revenue totaled R$ 45,438 million, which corresponds

to an annual increase of 2.4%, reflecting (i) the record iron ore sales registered in the year (up 27.2% compared to 2022) and (ii) the

growth of the cement operation.

·

Cost of Goods Sold (COGS) totaled R$ 8,336 million in 4Q23, practically

stable compared to the previous quarter, with the increase in sales in the steel segment being offset by seasonality in mining. In 2023,

COGS totaled R$ 33 billion, which represents an increase of 7.8% compared to last year, reflecting the strong volume of iron ore traded

in 2023, with higher volume of purchases.

·

In turn, Gross Margin for the quarter reached 30.6%, which corresponds

to an increase of 5.4 p.p. compared to 3Q23 and reflects the operational improvement seen in the Company's main operating segments. In

2023, however, the Gross Margin reached 26.3% and was 3.6 p.p. lower than in 2022, due to the difficulties faced in the steel segment

throughout the year.

·

General and Administrative Selling Expenses totaled R$ 1,213 million

in 4Q23 and were 3.1% higher than in the previous quarter, as a result of the commercial recovery in the steel industry, mainly in the

foreign market. In 2023, expenses totaled R$ 4,490 million, 38% higher than in 2022, reflecting the higher volumes sold in the mining

and cement segments.

·

The Other Operating Income and Expenses group was negative by

R$ 730 million in 4Q23, mainly as a result of cash flow hedge accounting operations, which totaled R$ 459 million in the period. In the

year, the result was negative by R$ 2.7 billion, a practically stable level when compared to 2022.

·

In 4Q23, the Financial Result was negative by R$ 552 million,

which represents a reduction of 55% compared to the previous quarter, as a result of the appreciation of Usiminas' shares, in addition

to a lower cost of debt in the period. In 2023, the financial result was negative by R$ 4.2 billion, 18% higher than in the previous year,

which reflects the impact of the exchange rate variation observed on financial expenses.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 3 |

| 4Q23 & 2023 Results |

| | |

·

The Equity Result was positive by R$ 92 million in 4Q23, a reduction

of 30% compared to the previous quarter as a consequence of the seasonal decrease in MRS's results. In 2023, equity result reached R$

351 million, an annual increase of 47% due to the solid performance achieved by MRS throughout the year.

·

In 4Q23, CSN recorded Net Profit of R$ 851 million, a performance

eight times higher than in the previous quarter, which reflects the operational improvement observed in the period, in addition to the

increase in financial revenues recorded in the quarter. On the other hand, Net Profit for 2023 reached R$ 403 million, which represents

a reduction of 81% compared to the previous year, impacted by the operational challenges seen in the steel segment and the increase in

financial expenses.

Adjusted EBITDA

*The Company discloses its adjusted EBITDA excluding participation in investments

and other operating income (expenses) because it understands that they should not be considered in the calculation of recurring operating

cash generation.

Adjusted EBITDA in 4Q23 was R$

3,626 million, with an Adjusted EBITDA Margin of 29.1% or 4.9 p.p. higher than in the previous quarter. This increase in profitability,

even in a seasonally weaker quarter, is a direct consequence of the operational improvement in the Company's main operating segments,

especially mining, which expanded its EBITDA by 39%, but also the steel industry, which has already managed to show signs of recovery

at the end of the year. In 2023, Adjusted EBITDA reached 11,907 million, a result 14% lower than in 2022, due to operational bottlenecks

in the steel industry in the first half of the year and commercial pressures with the decrease in steel prices that ended up offsetting

the strong performance achieved in mining.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 4 |

| 4Q23 & 2023 Results |

| | |

Adjusted EBITDA (R$ MM) and Adjusted

Margin¹ (%)

¹ The Adjusted EBITDA Margin is calculated by

dividing the Adjusted EBITDA and the Adjusted Net Revenue, which considers the 100% participation in the consolidation of CSN Mineração

and 37.27% in MRS.

Adjusted Cash Flow

Adjusted Cash Flow in 4Q23 was positive by R$ 387

million, with higher investments and financial expenses offsetting the solid operating performance and an efficient working capital management.

Adjusted cash flow¹ in 4Q23

(R$ MM)

¹ The concept of adjusted cash flow is calculated

based on Adjusted EBITDA, subtracting EBITDA of the Joint Subsidiaries, CAPEX, Income Tax, Financial Result and changes in Assets and

Liabilities², excluding the effect of the Glencore advance.

² Adjusted Working Capital is composed of the

change in Net Working Capital, plus the change in long-term assets and liabilities accounts and disregarding the net change in income

tax and CS.

Indebtedness

On 12/31/2023, consolidated net debt reached R$ 30,686

million, with the leverage indicator measured by the LTM Net Debt/EBITDA ratio reaching 2.58x, which represents a reduction of 5 basis

points compared to the previous quarter, highlighting the Company's efforts to reduce its debt level. This was the second consecutive

quarter of deleveraging and the outlook is to continue on this downward trajectory throughout 2024 as CSN advances in the operational

improvement of its segments and in the evolution of its capital structure. In addition, CSN maintained its policy of carrying a high level

of cash, which reached the level of R$ 17 billion in this quarter.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 5 |

| 4Q23 & 2023 Results |

| | |

¹ Net Debt / EBITDA: To calculate debt, the final dollar of each period

is considered, and for net debt and EBITDA, the average dollar of the period.

In addition, the Company remains very active in its

objective of extending the amortization period, focusing on long-term operations and the local capital market. Among the main transactions

in 4Q23, we highlight the issuance of Bonds in CSN's offshore subsidiary, in the total amount of US$ 500 million, maturing in 2030, with

the objective of partially repurchasing the 2026 Bond, in the amount of approximately US$ 120 million.

Amortization Schedule (R$ Bi)

¹ IFRS: does not consider participation in MRS (37.27%).

² Managerial Gross/Net Debt considers a stake in MRS (37.27%), without

accrued interest.

3 Average term after completion of the Liability Management

Plan.

FX Exposure

The net accumulated Foreign

Exchange Exposure in the 2023 balance sheet was US$ 104 million, as shown in the table below, as a result of the increase in the volume

of Hedge Accounting operations and in line with the company's policy of minimizing the impacts of exchange rate volatility on the result.

The Hedge Accounting adopted

by CSN correlates the projected flow of exports in dollars with the future maturities of the debt in the same currency. As a result, the

exchange variation of the dollar debt is temporarily recorded in the shareholders' equity and is taken to the result when the dollar revenues

from such exports occur.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 6 |

| 4Q23 & 2023 Results |

| | |

US$

Investments

A total of R$ 1,595 million were invested in 4Q23,

34% higher than in 3Q23, a movement in line with CSN's history of concentrating its investments at the end of the year. Among the main

projects invested, we highlight the repairs of the coke batteries and modernization of operations at UPV, in addition to the replacement

of the fleet and equipment at the Casa de Pedra mine, and advances in capacity expansion projects, mainly related to P15, recovery of

tailings from the dams and expansion at the port of Itaguaí. In 2023, the amount invested reached R$ 4,523 million and was 33%

higher than in 2022, in line with the evolution of the Company’s strategic project schedule.

Net Working Capital

Net Working Capital applied to the business was negative

by R$ 624 million in 4Q23, a result considerably lower than in the previous quarter, mainly as a result of the 22% increase in

the Suppliers line.

The calculation of Net Working Capital applied to

the business does not take into account Glencore’s advance, as shown in the following table:

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 7 |

| 4Q23 & 2023 Results |

| | |

¹ Other CCL Assets: Considers

employee advances and other accounts receivable.

² Other CCL Liabilities:

Considers other accounts payable, dividends payable, installment taxes and other provisions.

³ Inventories: Does not

consider the effect of the provision for stock/inventory losses. For the calculation of the PME, store stock balances are not taken into

account.

Financial Operations

On November 30, 2023, the Company concluded the pricing

of a new Bond in the amount of US$ 500 million, maturing in 7 years and with the Retap of this issuance taking place on February 8, 2024,

in the additional amount of US$ 200 million. As a result, a total of US$ 700 million was raised in this last issuance, maturing in 2030.

Dividends and Interest on Equity

On November 14, 2023, the Company announced

the distribution of dividends to its shareholders in the amount of R$ 985 million, which corresponds to the amount of R$ 0.74 per share,

as an anticipation of the minimum mandatory dividend for 2023.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 8 |

| 4Q23 & 2023 Results |

| | |

Results by Business Segments

Net Revenue by Segment – 4Q23 (R$ million-before

eliminations)

Adjusted EBITDA by Segment – 4Q23 (R$ million

– before eliminations)

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 9 |

| 4Q23 & 2023 Results |

| | |

| 4Q23 Results (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Rail) |

Energy |

Cement |

Corporate Expenses/

Eliminations |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

5,654 |

5,028 |

67 |

728 |

125 |

1,090 |

(687) |

12,005 |

| Internal Market |

4,072 |

583 |

67 |

728 |

125 |

1,090 |

(1,181) |

5,485 |

| Foreign Market |

1,582 |

4,445 |

- |

- |

- |

- |

494 |

6,520 |

| COGS |

(5,359) |

(2,492) |

(63) |

(434) |

(112) |

(818) |

941 |

(8,336) |

| Gross profit |

295 |

2,536 |

4 |

294 |

13 |

272 |

255 |

3,669 |

| DGA/DVE |

(319) |

(76) |

(3) |

(68) |

(14) |

(194) |

(538) |

(1,213) |

| Depreciation |

356 |

280 |

13 |

110 |

23 |

185 |

(86) |

879 |

| Proportional EBITDA of joint contrl. |

- |

- |

- |

- |

- |

- |

290 |

290 |

| Adjusted EBITDA |

331 |

2,739 |

14 |

336 |

22 |

263 |

(80) |

3,626 |

| |

|

|

|

|

|

|

|

|

| 3Q23 Results (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Rail) |

Energy |

Cement |

Corporate Expenses/

Eliminations |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

5,344 |

4,335 |

75 |

730 |

122 |

1.159 |

(640) |

11,125 |

| Internal Market |

4,130 |

567 |

75 |

730 |

122 |

1.159 |

(1.170) |

5,613 |

| Foreign Market |

1,214 |

3,768 |

- |

- |

- |

- |

530 |

5,512 |

| COGS |

(5,209) |

(2,567) |

(65) |

(367) |

(106) |

(915) |

909 |

(8,320) |

| Gross profit |

135 |

1,768 |

10 |

363 |

16 |

244 |

270 |

2,805 |

| DGA/DVE |

(299) |

(71) |

(3) |

(57) |

(16) |

(145) |

(588) |

(1,175) |

| Depreciation |

346 |

269 |

12 |

100 |

25 |

167 |

(77) |

842 |

| Proportional EBITDA of joint contrl. |

- |

- |

- |

- |

- |

- |

343 |

343 |

| Adjusted EBITDA |

183 |

1,966 |

19 |

406 |

25 |

266 |

(50) |

2,815 |

| |

|

|

|

|

|

|

|

|

| 4Q22 Results (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Rail) |

Energy |

Cement |

Corporate Expenses/

Eliminations |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

6,055 |

3,529 |

86 |

608 |

154 |

1,181 |

(483) |

11,129 |

| Internal Market |

4,501 |

336 |

86 |

608 |

154 |

1,181 |

(949) |

5,917 |

| Foreign Market |

1,554 |

3,193 |

|

|

|

|

466 |

5,212 |

| COGS |

(5,214) |

(1,878) |

(58) |

(382) |

(139) |

(900) |

724 |

(7,847) |

| Gross profit |

840 |

1,651 |

28 |

226 |

15 |

281 |

241 |

3,282 |

| DGA/DVE |

(341) |

(139) |

(9) |

(52) |

(17) |

(148) |

(507) |

(1,213) |

| Depreciation |

326 |

268 |

11 |

96 |

29 |

132 |

(38) |

825 |

| Proportional EBITDA of joint contrl. |

- |

- |

- |

- |

- |

- |

229 |

229 |

| Adjusted EBITDA |

826 |

1,779 |

30 |

270 |

27 |

265 |

(75) |

3,123 |

Results of the Steel Industry

According to the World Steel

Association (WSA), global crude steel production totaled 1,888.2 million tons (Mt) in 2023, a number practically stable compared to 2022.

The high level of activity in the Chinese market, which accounted for 54% of the global volume produced (1,019.1 Mt), ended up offsetting

the lower production in the European Union, whose activity fell by 7.4% in the year. On the other hand, it was possible to observe a sharper

quarterly drop in Chinese production in 4Q23, a somewhat expected movement given the difficulty in maintaining capacity utilization at

the record levels seen throughout the year. In turn, the trend for 2024 is to maintain this strong activity level, with the Chinese government’s

incentives boosting several strategic sectors and helping to offset the weaker dynamics seen in the civil construction market.

Steel Production (thousand tons)

In the case of CSN, Slab Production in 4Q23

totaled 894 thousand tons (kton), a performance 3.1% lower than in the previous quarter, but in line with the seasonality of the

period. Following the same trend, the production of flat-rolled products reached 793 Kton, which represents a reduction of 5.0% compared

to 3Q23, a smaller deceleration than that observed in the same periods of recent years, which reinforces the normalization of the production

process. In 2023, the production of slabs reached 3,296 thousand tons, which represents a reduction of 12.6% compared to 2022, as a result

of the operational bottlenecks verified in the UPV throughout the first half of the year.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 10 |

| 4Q23 & 2023 Results |

| | |

Sales Volume (Kton) – Steel

Total sales reached 1,064 thousand tons in

the fourth quarter of 2023, a volume 4.5% higher than in 3Q23. When analyzing the behavior in the different markets, it can be

seen that the domestic market managed to show growth even with all the pressure faced with imported products, with Zinc Plating

performance as the main highlight. Domestic sales totaled 762 thousand tons of steel products in 4Q23, which represents an increase

of 2.0% compared to 3Q23, still reflecting the normalization of the operation and the Company's resilience in managing to break seasonality

and maintain an assertive commercial strategy even with all the pressure seen in the period. But the main highlight of the quarter came

from the foreign market, whose sales totaled 302 thousand tons in 4Q23 and were 11.4% higher than in 3Q23, showing all the

dynamism presented by the European market at the end of the year. During the quarter, 3,000 tons were exported directly and 299,000 tons

were sold by subsidiaries abroad, of which 81,000 tons were sold by LLC, 147,000 tons by SWT and 71,000 tons by Lusosider.

In 2023, the total volume sold was 4,166 thousand

tons, 5.1% lower than in 2022, with 2,917 thousand tons sold from the domestic market and 1,249 thousand tons abroad. Of this total, the

domestic market was the one that showed the greatest contraction (-5.2% p.a.), explained by production bottlenecks.

Regarding total Sales Volume, the main highlight

in 4Q23 was the distribution segment, with a 24.7% increase compared to the volume sold in the previous quarter. On the other hand, the

sectors of Home Appliances (-19.8%) and Automotive (-12.5%) appear among the main negative highlights as a result of the seasonality of

the period. In the year-over-year comparison, there were important recoveries in General Industry, Steel Packing and Automotive, but with

declines in the other segments.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 11 |

| 4Q23 & 2023 Results |

| | |

| According

to ANFAVEA (National Association of Automotive Vehicle Manufacturers),

vehicle production in 4Q23 registered 574 thousand units, a reduction of 7.2% compared to the previous quarter. In turn, production in

2023 registered 2,325 thousand units, a reduction of 1.9% compared to 2022. For 2024, ANFAVEA projects a growth of 6.2%, with a production

of 2,470 thousand units of vehicles, driven by the growth of heavy vehicles.

When looking at data from the Brazilian Steel

Institute (IABr), Crude Steel production in 4Q23 reached 7.92 Mton, a performance 1.5% lower than in the same period of 2022 and 0.5%

below 3Q23. Apparent Consumption was 5.87 Mton, an increase of 4.4% year-over-year, but a reduction of 7.4% compared to 3Q23, in line

with seasonality. In turn, the Steel Industry Confidence Indicator (ICIA) for the month of December was 37.7 points, which represents

a reduction of 4.9 p.p. compared to December 2022, and reflects all the uncertainty regarding the entry of imported material and price

dynamics in the Brazilian market. In 2023, Crude Steel production reached 31.9 Mton in 2023, a 6.5% lower performance compared to 2022.

In turn, apparent Consumption was 23.9 Mton, up 1.5% year-over-year.

According to IBGE Data, the production

of household appliances for the month of December 2023 registered an increase of 5.5% compared to the previous year, still reflecting

the continuous improvement of the home appliances segment recorded throughout the year after a period of lower demand seen in 2022. In

2023, the production of household appliances registered an annual increase of 4.0%, returning to the production level of the pre-pandemic

period. For 2024, the market is expected to perform even better and achieve a growth of 5%, following the positive trend of economic improvement,

interest rate reduction, and recovery in the civil construction market.

|

|

|

| · | Net Revenue in the Steel Industry reached

R$ 5,654 million in 4Q23, a performance 5.8% higher than in 3Q23, as a result of the better volumes recorded in the period, with

a beginning of recovery in the domestic market (breaking the negative seasonality of the period) and stronger external demand, mainly

in the European market. On the other hand, the Average Price in 4Q23 in the domestic market was 3.5% lower than in 3Q23, also reflecting

the pressure from imported steel and the carryover from the declines seen in the previous months. On the other hand, the price in the

foreign market went in the opposite direction, with an increase of 17.5% compared to the previous quarter, in line with the recovery of

the price in the American market and the volume growth presented in the period. In 2023, net revenue from the steel industry reached R$

22,717 million and was 22.6% lower than in 2022, the result of a very difficult year for the Company, which faced several operational

bottlenecks in production in the first half of the year, in addition to a very strong level of competition from imported material, bringing

down the price of steel in Brazil. |

| · | In turn, the Slab Cost in 4Q23 reached

R$ 3,462/t, a reduction of 2.8% compared to the previous quarter, as a result of the gradual operational normalization. |

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 12 |

| 4Q23 & 2023 Results |

| | |

| · | The steel segment's Adjusted EBITDA reached

R$ 331 million in 4Q23 and was 81.5% higher than in 3Q23, with an Adjusted EBITDA Margin of 5.9% (+2.4 p.p.). This result is a

combination of a stronger foreign market and a domestic performance marked by improved operations with an assertive commercial strategy.

In this sense, it is important to highlight the temporary effect of this lower profitability, since all the necessary adjustments are

being made and it is already possible to observe a recovery of prices in the domestic market. In 2023, the Adjusted EBITDA of the steel

segment reached R$ 1,821 million, with an EBITDA margin of 8.0%, which represents a reduction of 69.7% compared to 2022. |

Mining Results

4Q23 was another quarter marked by strong demand

for iron ore in China, driven by the high utilization capacity of local steel plants and inventory levels that remained below historical

averages. This situation ended up giving even more traction to the price of iron ore, which ended the quarter with a quotation US$ 14.3/ton

above the average seen in the previous quarter. This greater demand has been supported by stimulus packages from the Chinese government

that have helped to boot the consumption, manufacturing and infrastructure segments, thus mitigating the slowdown in the real state and

helping to dissipate greater risks of a drop in demand for iron ore. On the supply side, not even the drier period in Brazil was enough

to reduce the appreciation of the iron ore in the quarter. In this scenario, the price of iron ore ended 4Q23 with an average

of US$ 128.30/dmt (Platts, Fe62%, N. China), 12.5% higher than in 3Q23 (US$ 114.04/dmt) and 29.6% higher than in 4Q22 (US$ 99.00/dmt).

Regarding Sea Freight, the BCI-C3 Route (Tubarão-Qingdao)

averaged US$ 24.9/wmt in 4Q23, which represents an increase of 22.8% compared to the freight cost of the previous quarter,

reflecting the increase in demand in the transoceanic market due to higher bauxite export volumes in Guinea, in addition to a stronger

performance for the period in iron ore volumes from Australia and Brazil.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 13 |

| 4Q23 & 2023 Results |

| | |

| · | Iron Ore Production totaled 10,966 thousand tons in 4Q23, which represents

a decrease of 5.4% compared to the record volume registered in 3Q23, which was already expected due to the entry into the rainy season,

but an increase of 17.5% compared to the same period of the previous year. After two consecutive records, production in the quarter continued

at very high levels, resulting in a performance above the projections expected for 2023, which proves the operational excellence achieved

by the Company throughout the year. In total, 42,650 Kton were produced in 2023, which represents an annual growth of 26.6%. |

| · | Sales Volume, in turn, reached 11,144

thousand tons in 4Q23, only 4.3% below the previous record set last quarter and 14.5% above the same period last year. The Company was

once again able to take advantage of the favorable environment conditions with strong Chinese demand and the period with less rainfall

than usual for this time of the year to deliver a high level of sales in the quarter. In 2023, the volume sold reached 42,662 thousand

tons and was 28% higher than in 2022. |

| · | In 4Q23, Adjusted Net Revenue totaled

R$ 5,028 million, 16% higher than in 3Q23, as a direct result of the better price realization in the period. As a result, Net Unitary

Revenue reached US$ 91.37 per ton, which represents an increase of 21.5% compared to 3Q23, following the upward trajectory

of the Platts price and the stability in the exchange rate, which closed the quarter with an average dollar of R$/US$ 4.93. In 2023, Net

Revenue reached R$ 17,136 million, an increase of 36.8% compared to 2022, as a result of the combination of increased volume recorded

in the period with a higher average price. As a result, the unit net revenue in 2023 was $ 80.30 compared to $ 73.61 a year earlier. |

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 14 |

| 4Q23 & 2023 Results |

| | |

| · | In turn, the Cost

of Goods Sold from mining totaled R$ 2,492 million in 4Q23, a reduction of 2.9% compared to the previous quarter, as

a result of the lower sales volume, in addition to the lower volume of purchases and the non-use of third-party ports. The C1 cost

reached US$ 22.5/t in 4Q23 and was 5.6% higher than in 3Q23, reflecting lower fixed cost dilution. In 2023, COGS reached R$ 9,932

million, an increase of 39.8% compared to last year, mainly due to the higher volume of sales and purchases made in the period. On the

other hand, the C1 for the year ended with an average of US$ 21.8 per ton, below Company’s guidance. |

| · | Adjusted EBITDA reached R$ 2,739

million in 4Q23, with a quarterly Adjusted EBITDA margin of 54.5% or 9.1 p.p. higher than in the previous quarter. This expressive

result is a consequence of the combination of better iron ore prices and high sales volume, resulting in an extraordinary performance

that reflects the operational improvement in the rainy season. In 2023, Adjusted EBITDA reached R$ 7,843 million, an increase of 29.2%

compared to the previous year, reflecting the production and sales records achieved, in addition to the strong price realization seen

in the year. |

Cement Results

According to the National Union of the Cement

Industry (SNIC), cement sales in Brazil from January to December 2023 totaled 62 million tons and were practically stable when compared

to the previous year. This scenario reflects an accommodation of the market after a cycle of high growth, still limited by a very high

interest rate when looking at the year as a whole. On the other hand, even considering all these effects, it can be seen that the market

remains very resilient and shows positive trends for 2024 as it is already possible to observe positive signs coming from incentive federal

programs, such as PAC and Minha Casa Minha Vida, in addition to the effects of a sharper drop in interest rates. The positive sign of

GDP growth should also boost cement sales this year, helping to improve the pricing outlook for this market.

Regarding commercial performance, CSN's sales

in 4Q23 totaled 3,128 Kton, which represents a decrease of 4.1% compared to the previous quarter, in line with seasonality,

but 7.1% above the same period last year. The year 2023 was extremely important for the Company, a period marked by the integration

of the assets of Cimentos Brasil (formerly LafargeHolcim Brasil), the entry into new markets and the consolidation of CSN as a leading

market player in several important regions of the country. As a result, the Company recorded a sales volume of 12,770 Kton in 2023, which

represents a significant increase of 75.8% compared to the previous year, a direct reflection of the assertive commercial strategy adopted

in the period.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 15 |

| 4Q23 & 2023 Results |

| | |

| · | Net Revenue, in turn, reached R$ 1,090

million in 4Q23 and was 6.0% lower than in the previous quarter, reflecting the seasonality at the end of the year and the lower price

levels presented. In 2023, Net Revenue reached R$ 4,511 million, which represents an annual increase of 60% and reflects all the capture

of synergies with the significant increase in volume seen in the period. |

| · | In 4Q23, cement COGS fell 15% compared

to the previous quarter, as a result of the capturing of operational synergies. |

| · | In turn, the segment’s Adjusted EBITDA

was practically stable in the quarter, reaching R$ 263 million in 4Q23, but with an Adjusted EBITDA Margin of 24.1%, or 1.1

p.p. higher than in 3Q23. This gain in profitability, even in a period of low seasonality, reflects all the synergy capture verified in

the operation and shows that the Company continues to advance in increasing efficiency. In 2023, adjusted EBITDA was R$975 million, which

represents an increase of 24.4% compared to 2022, but with an EBITDA margin of 21.6%, or 6.2 p.p. lower. However, it is important to note

that this decrease in the annual EBITDA margin was circumstantial, reflecting weaker price dynamics mainly in the first half of the year,

and it is already possible to observe a more favorable price and volume dynamics for 2024. |

Energy Results

The year 2023 was marked by the integration of

the assets acquired in 2022, both in the operational, administrative and governance spheres.

Regarding results, 4Q23 continued to be

marked by price dynamics below the average of recent years, due to the high level of water in the reservoirs. As a result, the volume

of energy traded in the quarter generated Net Revenue of R$ 125 million, which represents an increase of only 2.9% compared to

the previous quarter. Adjusted EBITDA, however, decreased in the period, reaching R$ 22 million and generating an Adjusted EBITDA

Margin of 17.3%, or a reduction of 3.0 p.p. compared to the previous quarter. In the year, the Company recorded a net revenue of R$

546 million and an adjusted EBITDA of R$ 144 million, with a margin of 26.3%, a performance still limited by the low energy prices seen

in Brazil throughout 2023, a situation that already shows a significant change at the beginning of 2024 with prices reacting strongly

to a lower volume of rainfall.

Logistics Results

Railway Logistics: In 4Q23, Net Revenue

reached R$ 728 million, with an Adjusted EBITDA of R$ 336 million and an Adjusted EBITDA Margin of 46.2%. Compared to 3Q23,

the revenue was practically stable, but with an Adjusted EBITDA 17.3% lower. Year-to-date, net revenue reached R$ 2,645 million in 2023,

which represents a year-over-year increase of 14.4%, while Adjusted EBITDA grew 21.2%, reaching R$ 1,339 million and with an EBITDA margin

of 50.6%.

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 16 |

| 4Q23 & 2023 Results |

| | |

Port Logistics: In 4Q23, 285 thousand

tons of steel products were shipped by Sepetiba Tecon, in addition to 13 thousand containers, 5 thousand tons of general cargo and 166

thousand tons of bulk. Compared to the previous quarter, the Company decreased its shipments due to the seasonality of the period, with

greater decreases in the volume of steel products and in the volume of bulk. As a result, Net Revenue from the port segment was

9.8% lower than in the previous quarter, reaching R$ 67 million in 4Q23, with a negative impact on the Adjusted EBITDA for the

period, which was R$ 14 million, with an Adjusted EBITDA Margin of 20.8%, or 4.4 p.p. lower than in 3Q23. In 2023, the segment

recorded a Net Revenue of R$ 266 million and Adjusted EBITDA of R$ 54 million, with a margin of 20.4%. In 2023, 1,100 thousand tons of

steel products were shipped by TECON, in addition to 58 thousand containers, 35 thousand tons of general cargo and 659 thousand tons of

bulk.

ESG – Environmental, Social & Governance

ESG PERFORMANCE – CSN GROUP

Since the beginning of 2023, CSN has adopted

a new format for disclosing its ESG actions and performance, making its performance in ESG indicators available on an individualized basis.

The new model allows Stakeholders Have quarterly access to the main results and indicators and can monitor them in an effective

and even more agile way. Access can be made through the results center of CSN's IR website: https://ri.csn.com.br/informacoes-financeiras/central-de-resultados/.

The information included in this release has

been selected based on its relevance and materiality to the company. Quantitative indicators are presented in comparison with the period

that best represents the metric for monitoring them. Thus, some are compared with the same quarter of the previous year, and others with

the average of the previous period, ensuring a comparison based on seasonality and periodicity. In addition, it is important to highlight

that the ESG Performance Report also incorporates the performance indicators of CSN Cimentos' new assets, acquired in 2022, so that some

absolute indicators will undergo significant changes when compared to the previous period.

More detailed historical data on CSN's performance

and initiatives can be found in the 2022 Integrated Report, released in April 2023 (https://esg.csn.com.br/nossa-empresa/relatorio-integrado-gri

). The review of ESG indicators occurs annually for the closing of the Integrated Report, so the information contained in the quarterly

releases is subject to adjustments resulting from this process.

It is also possible to monitor CSN's ESG performance

in an agile and transparent manner, in our web site, through the following e-mail address: https://esg.csn.com.br .

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 17 |

| 4Q23 & 2023 Results |

| | |

Capital Markets

In the fourth quarter of 2023, CSN's shares

rose 61.9%, while the Ibovespa index increased 15.1%. In 2023, CSN's shares rose 35.1% while the Ibovespa increased 22.3%. The average

daily volume (CSNA3) traded on B3, in turn, was R$ 119.4 million in 4Q23 and R$ 121.1 million in 2023. On the New York Stock Exchange

(NYSE), the Company’s American Depositary Receipts (ADRs) showed a strong appreciation in dollar terms of 64.4% in 4Q23, while the

Dow Jones index increased 12.5%. In 2023, ADRs are up 42.4% while the Dow Jones is up 13.7%. The average daily trading of ADRs

(SID) on the NYSE in 4Q23 was US$ 6.3 million and R$ 8.0 million in 2023.

| |

4Q23

|

2023 |

| No. of shares in thousands |

1,326,094 |

1,326,094 |

| Market Cap |

|

|

| Closing Price (R$/share) |

19.66 |

19.66 |

| Closing Price (US$/ADR) |

3.93 |

3.93 |

| Market Value (R$ million) |

26,071 |

26,071 |

| Market Cap (US$ million) |

5,212 |

5,212 |

| Change in the period |

|

|

| CSNA3 (R$) |

61.9% |

35.1% |

| SID (US$) |

64.4% |

42.4% |

| Ibovespa (R$) |

15.1% |

22.3% |

| Dow Jones (US$) |

12.5% |

13.7% |

| Volume |

|

|

| Daily average (thousand shares) |

8,183 |

8,493 |

| Daily average (R$ thousands) |

119,438 |

121,139 |

| Daily average (thousand ADRs) |

2,080 |

2,796 |

| Daily Average (US$ thousand) |

6,267 |

8,021 |

|

Source: Bloomberg

|

|

|

| |

|

|

Earnings Conference Call:

| 4Q23 and

2023 Earnings Presentation Webcast |

Investor

Relations Team |

Conference

Call in Portuguese with Simultaneous Translation into English

March 7,

2024

11:30 a.m. (Brasilia time)

09:30 a.m. (New York time)

Webinar:

click here

|

Marcelo Cunha Ribeiro – CFO and IR Executive Director

Pedro Gomes de Souza (pedro.gs@csn.com.br)

Rafael Costa Byrro (rafael.byrro@csn.com.br) |

Some of the statements contained herein are forward-looking

statements that express or imply actual results, performance or events. These perspectives include future results that may be influenced

by historical results and the statements made in 'Prospects'. Current results, performance and events may differ materially from assumptions

and outlooks and involve risks such as: general and economic conditions in Brazil and other countries; interest rate and exchange rate

levels, protectionist measures in the U.S., Brazil, and other countries, changes in laws and regulations, and general competitive factors

(on a global, regional, or national basis).

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 18 |

| 4Q23 & 2023 Results |

| | |

INCOME STATEMENT FOR THE YEAR

CONSOLIDATED – Corporate Law – In Thousands of Reais

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 19 |

| 4Q23 & 2023 Results |

| | |

BALANCE SHEET

CONSOLIDATED – Corporate Law – In Thousands of Reais

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 20 |

| 4Q23 & 2023 Results |

| | |

CASH FLOW

CONSOLIDATED – Corporate Law – In Thousands of Reais

| | | |

| For more information, please visit our website: https://ri.csn.com.br/ | | 21 |

| 4Q23 & 2023 Results |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 6, 2024

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Marcelo Cunha Ribeiro

|

| |

Marcelo Cunha Ribeiro

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

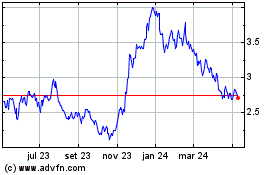

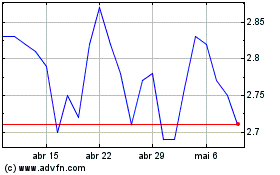

Companhia Siderurgica Na... (NYSE:SID)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Companhia Siderurgica Na... (NYSE:SID)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025