0000039911false00000399112024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported)

March 7, 2024

THE GAP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-7562 | | 94-1697231 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| Two Folsom Street | | |

| San Francisco, | California | | 94105 |

| (Address of principal executive offices) | | (Zip Code) |

(415) 427-0100

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.05 par value | GPS | The New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| |

| Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On March 7, 2024, The Gap, Inc. (the “Company”) issued a press release announcing the Company’s earnings for the fourth quarter and fiscal year ended February 3, 2024. A copy of such press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information provided pursuant to this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| | Press Release dated March 7, 2024 announcing the Company’s earnings for the fourth quarter and fiscal year ended February 3, 2024 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| THE GAP, INC. | |

| | | |

| | | |

| Date: March 7, 2024 | By: | /s/ Katrina O’Connell | |

| | Katrina O’Connell | |

| | Executive Vice President and | |

| | Chief Financial Officer | |

Gap Inc. Reports Fourth Quarter and Fiscal 2023 Results; Provides Fiscal 2024 Outlook

Fourth Quarter Net Sales Increased with Market Share Gains

Fourth Quarter Operating Margin Expansion Reflects Continued Financial and Operational Rigor

Full Year Operating Cash Flow of $1.5 Billion; Ended Fiscal Year with Cash Balance of $1.9 Billion

SAN FRANCISCO – March 7, 2024 – Gap Inc. (NYSE: GPS), the largest specialty apparel company in the U.S., with a portfolio of brands including Old Navy, Gap, Banana Republic, and Athleta, today reported financial results for its fourth quarter and fiscal year ended February 3, 2024.

“The fourth quarter exceeded expectations on several key metrics along with market share gains, reflecting improved trends at Old Navy and Gap and strong continued progress on margins and cash flow,” said Gap Inc. President and Chief Executive Officer, Richard Dickson. “The financial and operational rigor we have worked to develop, and will continue to pursue, is enabling us to focus on reinvigorating our brands with the goal of generating profitable growth and value for shareholders. While there is a lot of work to do, I am inspired by the team’s commitment and energized by the opportunities ahead.”

The company noted that fiscal year 2023 had 53 weeks versus 52 weeks in fiscal year 2022. As a result, the company’s results for the fourth quarter and the fiscal year include the additional week, while comparable sales calculations exclude the additional week.

Fourth Quarter Fiscal 2023 - Financial Results

•Net sales of $4.3 billion were up 1% compared to last year, inclusive of an estimated 2 percentage points of negative impact from the sale of Gap China. The addition of the 53rd week contributed approximately 4 percentage points of growth to the fourth quarter.

◦Comparable sales were flat year-over-year.

◦Store sales increased 4% compared to last year.

◦Online sales decreased 2% compared to last year and represented 40% of total net sales.

•Gross margin was 38.9%, an increase of 530 basis points versus last year.

◦Merchandise margin increased 500 basis points versus last year primarily driven by lower commodity costs and improved promotional activity during the quarter.

◦Rent, occupancy, and depreciation (ROD) as a percent of sales leveraged 30 basis points versus last year.

•Operating expense was $1.46 billion.

•Operating income was $214 million; operating margin of 5.0%.

•The effective tax rate of 15.1% benefited from the release of certain tax reserves.

•Net income of $185 million; diluted earnings per share of $0.49.

Full Year Fiscal 2023 - Financial Results

•Net sales of $14.9 billion were down 5% compared to last year, inclusive of an estimated 2 percentage points of negative impact from the sale of Gap China. The addition of the 53rd week contributed about 1 percentage point of growth to the full year.

◦Comparable sales down 2% year-over-year.

◦Store sales decreased 3% compared to last year. The company ended the year with 3,560 store locations in over 40 countries, of which 2,562 were company operated.

◦Online sales decreased 7% compared to last year and represented 37% of total net sales.

•Gross margin was 38.8%, expanding 450 basis points versus last year's reported gross margin and 380 basis points versus last year’s adjusted rate.

◦Merchandise margin increased by 490 basis points versus last year's reported rate; on an adjusted basis, merchandise margin increased 420 basis points driven by lower air freight expense and improved promotional activity.

◦Rent, occupancy, and depreciation (ROD) deleveraged 40 basis points versus last year.

•Reported operating expense was $5.22 billion; adjusted operating expense, excluding $89 million in restructuring costs and a $47 million gain on sale of a building, was $5.17 billion, down 6% from last year primarily driven by savings as a result of strategic actions.

•Reported operating income was $560 million; reported operating margin of 3.8%.

•Adjusted operating income, excluding $93 million in restructuring costs and a $47 million gain on sale, was $606 million; adjusted operating margin of 4.1%.

•The reported effective tax rate was 9.7%. The adjusted effective tax rate was 11.0%.

•Reported net income was $502 million; reported diluted earnings per share of $1.34.

•Adjusted net income, excluding restructuring costs and the gain on sale, was $536 million; adjusted diluted earnings per share of $1.43 includes approximately $0.29 of discrete tax benefits and an estimated $0.05 benefit related to the 53rd week.

Balance Sheet and Cash Flow Highlights

•Ended the year with cash and cash equivalents of $1.9 billion, an increase of 54% from the prior year.

•Fiscal 2023 net cash from operating activities was $1.5 billion. Free cash flow, defined as net cash from operating activities less purchases of property and equipment, was $1.1 billion.

•Ending inventory of $2 billion was down 16% compared to last year.

•Fiscal year 2023 capital expenditures were $420 million.

•Paid a fourth quarter dividend of $0.15 per share, totaling $56 million. Paid dividends totaling $222 million in fiscal year 2023. The Company's Board of Directors approved a first quarter fiscal 2024 dividend of $0.15 per share.

Additional information regarding adjusted gross margin, adjusted operating expense/adjusted SG&A, adjusted operating income, adjusted operating margin, adjusted effective tax rate, adjusted net income, adjusted diluted earnings per share, and free cash flow, all of which are non-GAAP financial measures, is provided at the end of this press release along with a reconciliation of these measures from the most directly comparable GAAP financial measures for the applicable period.

Fourth Quarter and Full Year Fiscal 2023 - Global Brand Results

Comparable Sales

| | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter | | Fiscal Year |

| 2023 | | 2022 | | 2023 | | 2022 |

| Old Navy | 2 | % | | (7) | % | | (1) | % | | (12) | % |

| Gap | 4 | % | | (4) | % | | 1 | % | | (4) | % |

| Banana Republic | (4) | % | | (3) | % | | (7) | % | | 9 | % |

| Athleta | (10) | % | | (5) | % | | (12) | % | | (5) | % |

| Gap Inc. | 0 | % | | (5) | % | | (2) | % | | (7) | % |

Old Navy:

•Fourth quarter net sales of $2.29 billion were up 6% compared to last year. Comparable sales were up 2%. This represents the second consecutive quarter of positive comparable sales at the brand, demonstrating improved consistency in performance and execution.

•Full year net sales of $8.2 billion were flat versus last year. Comparable sales were down 1%.

Gap:

•Fourth quarter net sales of $1.01 billion were down 5% compared to last year. Excluding the estimated negative impact to sales of 8 percentage points related to the sale of Gap China, sales would have been up 3% versus last year. Comparable sales were up 4%. Performance was driven by continued strength in Women's, which gained market share for the fifth quarter in a row.

•Full year net sales of $3.3 billion were down 11% versus last year. Excluding the estimated negative impact to sales of 7 percentage points related to the sale of Gap China, sales would have been down 4% versus last year. Comparable sales were up 1%.

Banana Republic:

•Fourth quarter net sales of $567 million were down 2% compared to last year. Comparable sales were down 4%. While the brand has been making progress elevating its aesthetic, re-establishing Banana Republic will take time and there is work to be done to better execute many of the fundamentals.

•Full year net sales of $1.9 billion were down 8% versus last year. Comparable sales were down 7%.

Athleta:

•Fourth quarter net sales of $419 million were down 4% compared to last year. Comparable sales were down 10%. Athleta's performance improved sequentially versus the prior quarter, but sales continue to be challenged due to tougher comparisons as the brand laps a period of elevated discounting last year.

•Full year net sales of $1.4 billion were down 8% versus last year. Comparable sales were down 12%.

Fiscal 2024 Outlook

The company’s outlook takes into consideration the continued uncertain consumer and macro environment. The company's projected full year fiscal 2024 operating income growth below is provided in comparison to its full year fiscal 2023 adjusted operating income. In addition, the company's expected first quarter fiscal 2024 gross margin expansion below is provided in comparison to its first quarter fiscal 2023 adjusted gross margin.

Full Year Fiscal 2024

| | | | | | | | | | | |

| | Full Year Fiscal 2024 Outlook | | Full Year Fiscal 2023 Results |

| Net sales | Roughly flat on a 52-week basis | | $14.9 billion |

| Gross margin | At least 50 bps expansion | | 38.8% |

| Operating expense | Approximately $5.1 billion | | $5.17 billion (adjusted) |

| Operating income | Low-to-mid teens growth | | $606 million (adjusted) |

| Effective tax rate | Approximately 28% | | 9.7% |

| Capital expenditures | Approximately $500 million | | $420 million |

First Quarter Fiscal 2024

| | | | | | | | | | | |

| First Quarter Fiscal 2024 Outlook | | First Quarter Fiscal 2023 Results |

| Net sales | Roughly flat | | $3.3 billion |

| Gross margin | At least 100 bps expansion | | 37.2% (adjusted) |

| Operating expense | Approximately $1.2 billion | | $1.20 billion (adjusted) |

Webcast and Conference Call Information

Emily Gacka, Director of Investor Relations at Gap Inc., will host a conference call to review the

company’s fourth quarter and fiscal year 2023 results beginning at approximately 2:00 p.m. Pacific Time today. Ms. Gacka will be joined by President and Chief Executive Officer, Richard Dickson and Chief Financial Officer, Katrina O’Connell.

A live webcast of the conference call and accompanying materials will be available online at investors.gapinc.com. A replay of the webcast will be available at the same location.

Non-GAAP Disclosure

This press release and related conference call include financial measures that have not been calculated in accordance with U.S. generally accepted accounting principles (GAAP) and are therefore referred to as non-GAAP financial measures. The non-GAAP measures described below are intended to provide investors with additional useful information about the company’s financial performance, to enhance the overall understanding of its past performance and future prospects, and to allow for greater transparency with respect to important metrics used by management for financial and operating decision-making. The company presents these non-GAAP financial measures to assist investors in seeing its financial performance from management's view and because it believes they provide an additional tool for investors to use in computing the company's core financial performance over multiple periods with other companies in its industry. Additional information regarding the intended use of non-GAAP measures included in this press release and related conference call is provided in the tables to this press release.

The non-GAAP measures included in this press release are adjusted gross margin, adjusted operating expense/adjusted SG&A, adjusted operating income, adjusted operating margin, adjusted effective tax rate, adjusted net income, adjusted diluted earnings per share, and free cash flow. These non-GAAP measures exclude the impact of certain items that are set forth in the tables to this press release. In addition, the company's outlook includes projected full year fiscal 2024 operating income growth compared to its full year fiscal 2023 adjusted operating income as well as expected first quarter fiscal 2024 gross margin expansion compared to its first quarter fiscal 2023 adjusted gross margin.

The non-GAAP measures used by the company should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP and may not be the same as similarly titled measures used by other companies due to possible differences in method and in items or events being adjusted. The company urges investors to review the reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures included in the tables to this press release below, and not to rely on any single financial measure to evaluate its business. The non-GAAP financial measures used by the company have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles.

Forward-Looking Statements

This press release and related conference call contain forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Words such as “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan,” “project,” and similar expressions also identify forward-looking statements. Forward-looking statements include statements regarding the following: our strategic priorities, including maintaining and delivering financial and operational rigor, reinvigorating our brands, strengthening our platform, and energizing our culture; our executive leadership team and their roles and contributions; our financial position heading into fiscal 2024; continuing to elevate our performance, improve execution consistency, and set the foundation for brand reinvigoration; each brand having trend-right product assortments and a clear point of view; our brand reinvigoration playbook; Old Navy accelerating growth in the Active market; building consistency and delivering against

priorities at Old Navy; reigniting Gap brand with big ideas and delivering results; reestablishing Banana Republic to thrive in the premium lifestyle space; Banana Republic getting back to product and execution basics in fiscal 2024; the timeline for reestablishing Banana Republic and unlocking the brand’s potential; the impact in fiscal 2024 of lapping periods of elevated discounting at Athleta; resetting Athleta for success; Athleta’s efforts driving underlying benefits; building and sharpening our operational capabilities to improve effectiveness and efficiency and drive cost leverage and demand generation; elevating our technology tools and capabilities; cultivating a digital-first organization and mindset; using our platform to unlock additional value creation; energizing our culture to fuel creativity and connectivity; our Chief People Officer’s role in building a winning culture; strengthening the fundamentals in 2024; remaining focused on discipline around margin recovery, expense actions, inventory management, and maintaining a strong balance sheet; our dividend policy and expected first quarter fiscal 2024 dividend; expected fiscal 2024 net sales; expected fiscal 2024 operating income growth; the impact of the loss of an additional week in fiscal 2024 and timing shifts associated with the additional week in fiscal 2023; impacts related to geopolitical issues in the Red Sea in fiscal 2024; consumer dynamics and macroeconomic pressures in fiscal 2024; the impact of a CFBP ruling on late fees for credit card holders in fiscal 2024; expected gross margin expansion in fiscal 2024; expected commodity cost tailwinds in fiscal 2024; expected ROD deleverage in fiscal 2024; expected fiscal 2024 SG&A; identifying and pursuing efficiencies as we drive our strategic plan; expected fiscal 2024 net interest expense; expected fiscal 2024 effective tax rate; expected fiscal 2024 capital expenditures; expected first quarter fiscal 2024 net sales; expected first quarter fiscal 2024 gross margin expansion; expected first quarter fiscal 2024 SG&A; and generating sustainable, profitable growth and delivering value for shareholders over the long-term.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, without limitation, the following risks, any of which could have an adverse effect on our financial condition, results of operations, and reputation: the overall global economic and geopolitical environment and consumer spending patterns; the highly competitive nature of our business in the United States and internationally; the risk that we or our franchisees may be unsuccessful in gauging apparel trends and changing consumer preferences or responding with sufficient lead time; the risk that we fail to maintain, enhance and protect our brand image and reputation; the risk that we may be unable to manage our inventory effectively and the resulting impact on our gross margins and sales; the risk of loss or theft of assets, including inventory shortage; the risk that we fail to manage key executive succession and retention and to continue to attract qualified personnel; the risks to our business, including our costs and global supply chain, associated with global sourcing and manufacturing; the risks to our reputation or operations associated with importing merchandise from foreign countries, including failure of our vendors to adhere to our Code of Vendor Conduct; the risk that trade matters could increase the cost or reduce the supply of apparel available to us; the risk that we or our franchisees may be unsuccessful in identifying, negotiating, and securing new store locations and renewing, modifying, or terminating leases for existing store locations effectively; engaging in or seeking to engage in strategic transactions that are subject to various risks and uncertainties; the risk that changes in our business strategy or restructuring our operations may not generate the intended benefits or projected cost savings; the risk that our efforts to expand internationally may not be successful; the risk that

our franchisees and licensees could impair the value of our brands; the risk that our investments in customer, digital, and omni-channel shopping initiatives may not deliver the results we anticipate; the risk of data or other security breaches or vulnerabilities that may result in increased costs, violations of law, significant legal and financial exposure, and a loss of confidence in our security measures; the risk that failures of, or updates or changes to, our IT systems may disrupt our operations; reductions in income and cash flow from our credit card arrangement related to our private label and co-branded credit cards; the risk of foreign currency exchange rate fluctuations; the risk that our comparable sales and margins may experience fluctuations or that we may fail to meet financial market expectations; the risk that our level of indebtedness may impact our ability to operate and expand our business; the risk that we and our subsidiaries may be unable to meet our obligations under our indebtedness agreements; the risk that changes in our credit profile or deterioration in market conditions may limit our access to the capital markets; evolving regulations and expectations with respect to ESG matters; natural disasters, public health crises (such as pandemics and epidemics), political crises (such as the ongoing Russia-Ukraine and Israel-Hamas conflicts), negative global climate patterns, or other catastrophic events; our failure to comply with applicable laws and regulations and changes in the regulatory or administrative landscape; the risk that we will not be successful in defending various proceedings, lawsuits, disputes, and claims; the risk that our estimates regarding consumer demand are inaccurate, or that global economic conditions worsen beyond what we currently estimate; the risk that changes in our business structure, our performance or our industry could result in reductions in our pre-tax income or utilization of existing tax carryforwards in future periods, and require additional deferred tax valuation allowances; the risk that changes in the geographic mix and level of income or losses, the expected or actual outcome of audits, changes in deferred tax valuation allowances, and new legislation could impact our effective tax rate; the risk that the adoption of new accounting pronouncements will impact future results; and the risk that additional information may arise during our close process or as a result of subsequent events that would require us to make adjustments to our financial information.

Additional information regarding factors that could cause results to differ can be found in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 14, 2023, as well as our subsequent filings with the Securities and Exchange Commission.

These forward-looking statements are based on information as of March 7, 2024. We assume no obligation to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

About Gap Inc.

Gap Inc., a house of iconic brands, is the largest specialty apparel company in America. Its Old Navy, Gap, Banana Republic, and Athleta brands offer clothing, accessories, and lifestyle products for men, women and children. Since 1969, Gap Inc. has created products and experiences that shape culture, while doing right by employees, communities and the planet. Gap Inc. products are available worldwide through company-operated stores, franchise stores, and e-commerce sites. Fiscal year 2023 net sales were $14.9 billion. For more information, please visit www.gapinc.com.

Investor Relations Contact:

Nina Bari

Investor_relations@gap.com

Media Relations Contact:

Megan Foote

Press@gap.com

The Gap, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

UNAUDITED

| | | | | | | | | | | | | |

| ($ in millions) | February 3,

2024 | | January 28,

2023 | | |

| ASSETS | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 1,873 | | | $ | 1,215 | | | |

| | | | | |

| Merchandise inventory | 1,995 | | | 2,389 | | | |

| Other current assets | 527 | | | 1,013 | | | |

| Total current assets | 4,395 | | | 4,617 | | | |

Property and equipment, net of accumulated depreciation | 2,566 | | | 2,688 | | | |

| Operating lease assets | 3,115 | | | 3,173 | | | |

| Other long-term assets | 968 | | | 908 | | | |

| Total assets | $ | 11,044 | | | $ | 11,386 | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

| Current liabilities: | | | | | |

| Accounts payable | $ | 1,349 | | | $ | 1,320 | | | |

| Accrued expenses and other current liabilities | 1,108 | | | 1,219 | | | |

Current portion of operating lease liabilities | 600 | | | 667 | | | |

| Income taxes payable | 39 | | | 50 | | | |

| Total current liabilities | 3,096 | | | 3,256 | | | |

| Long-term liabilities: | | | | | |

| Revolving credit facility | — | | | 350 | | | |

| Long-term debt | 1,488 | | | 1,486 | | | |

| Long-term operating lease liabilities | 3,353 | | | 3,517 | | | |

| Other long-term liabilities | 512 | | | 544 | | | |

| Total long-term liabilities | 5,353 | | | 5,897 | | | |

| Total stockholders' equity | 2,595 | | | 2,233 | | | |

| Total liabilities and stockholders' equity | $ | 11,044 | | | $ | 11,386 | | | |

The Gap, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | |

| 14 Weeks Ended (1) | | 13 Weeks Ended | | 53 Weeks Ended (1) | | 52 Weeks Ended |

| ($ and shares in millions except per share amounts) | February 3,

2024 | | January 28,

2023 | | February 3,

2024 | | January 28,

2023 |

| Net sales | $ | 4,298 | | | $ | 4,243 | | | $ | 14,889 | | | $ | 15,616 | |

| Cost of goods sold and occupancy expenses | 2,626 | | | 2,819 | | | 9,114 | | | 10,257 | |

| Gross profit | 1,672 | | | 1,424 | | | 5,775 | | | 5,359 | |

| Operating expenses | 1,458 | | | 1,454 | | | 5,215 | | | 5,428 | |

| Operating income (loss) | 214 | | | (30) | | | 560 | | | (69) | |

| | | | | | | |

| Interest, net | (4) | | | 13 | | | 4 | | | 70 | |

| Income (loss) before income taxes | 218 | | | (43) | | | 556 | | | (139) | |

Income tax expense | 33 | | | 230 | | | 54 | | | 63 | |

| Net income (loss) | $ | 185 | | | $ | (273) | | | $ | 502 | | | $ | (202) | |

| Weighted-average number of shares - basic | 372 | | | 366 | | | 370 | | | 367 | |

| Weighted-average number of shares - diluted | 381 | | | 366 | | | 376 | | | 367 | |

Net earnings (loss) per share - basic | $ | 0.50 | | | $ | (0.75) | | | $ | 1.36 | | | $ | (0.55) | |

Net earnings (loss) per share - diluted | $ | 0.49 | | | $ | (0.75) | | | $ | 1.34 | | | $ | (0.55) | |

__________

(1) Fiscal 2023 includes incremental sales attributable to the 53rd week.

The Gap, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

UNAUDITED

| | | | | | | | | | | |

| 53 Weeks Ended | | 52 Weeks Ended |

| ($ in millions) | February 3,

2024 (a) | | January 28,

2023 (a) |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 502 | | | $ | (202) | |

| Depreciation and amortization | 522 | | | 540 | |

| | | |

| Loss on divestiture activity | — | | | 35 | |

| Gain on sale of building | (47) | | | (83) | |

| Change in merchandise inventory | 383 | | | 554 | |

| Change in accounts payable | 42 | | | (540) | |

| Change in accrued expenses and other current liabilities | 12 | | | (243) | |

| Change in income taxes payable, net of receivables and other tax-related items | 75 | | | 417 | |

| Other, net | 43 | | | 129 | |

| Net cash provided by operating activities | 1,532 | | | 607 | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (420) | | | (685) | |

| Net proceeds from sale of buildings | 76 | | | 458 | |

| | | |

| | | |

| | | |

Proceeds from divestiture activity | 9 | | | — | |

| Other | 1 | | | — | |

| Net cash used for investing activities | (334) | | | (227) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from revolving credit facility | — | | | 350 | |

Repayments of revolving credit facility | (350) | | | — | |

| | | |

| | | |

| Payments for debt issuance costs | — | | | (6) | |

| Proceeds from issuances under share-based compensation plans | 27 | | | 27 | |

| Withholding tax payments related to vesting of stock units | (20) | | | (20) | |

| Repurchases of common stock | — | | | (123) | |

| Cash dividends paid | (222) | | | (220) | |

| Other | (2) | | | (2) | |

Net cash (used for) provided by financing activities | (567) | | | 6 | |

| | | |

| Effect of foreign exchange rate fluctuations on cash, cash equivalents, and restricted cash | (3) | | | (15) | |

Net increase in cash, cash equivalents, and restricted cash | 628 | | | 371 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 1,273 | | | 902 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 1,901 | | | $ | 1,273 | |

__________

(a) For the fifty-three weeks ended February 3, 2024 and the fifty-two weeks ended January 28, 2023, total cash, cash equivalents, and restricted cash includes $28 million and $58 million, respectively, of restricted cash recorded within other current assets and other long-term assets on the Condensed Consolidated Balance Sheets.

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

FREE CASH FLOW

Free cash flow is a non-GAAP financial measure. We believe free cash flow is an important metric because it represents a measure of how much cash a company has available for discretionary and non-discretionary items after the deduction of capital expenditures. We require regular capital expenditures including technology improvements as well as building and maintaining our stores and distribution centers. We use this metric internally, as we believe our sustained ability to generate free cash flow is an important driver of value creation. However, this non-GAAP financial measure is not intended to supersede or replace our GAAP results.

| | | | | | | | | | | | |

| 53 Weeks Ended | | 52 Weeks Ended | |

| ($ in millions) | February 3,

2024 | | January 28,

2023 | |

| Net cash provided by operating activities | $ | 1,532 | | | $ | 607 | | |

| Less: Purchases of property and equipment | (420) | | | (685) | | |

| Free cash flow | $ | 1,112 | | | $ | (78) | | |

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

ADJUSTED STATEMENT OF OPERATIONS METRICS FOR FISCAL YEAR 2023

The following adjusted statement of operations metrics are non-GAAP financial measures. These measures are provided to enhance visibility into the Company's underlying results for the period excluding the impact of restructuring costs and a gain on sale of building. Management believes the adjusted metrics are useful for the assessment of ongoing operations as we believe the adjusted items are not indicative of our ongoing operations, and provide additional information to investors to facilitate the comparison of results against past and future years. However, these non-GAAP financial measures are not intended to supersede or replace the GAAP measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in millions)

53 Weeks Ended February 3, 2024 | | Gross Profit | | Gross Margin | | Operating Expenses | | Operating Expenses as a % of Net Sales | | Operating Income | | Operating Margin | | Income Tax Expense | | Net Income | | Earnings per Share - Diluted |

| GAAP metrics, as reported | | $ | 5,775 | | | 38.8 | % | | $ | 5,215 | | | 35.0 | % | | $ | 560 | | | 3.8 | % | | $ | 54 | | | $ | 502 | | | $ | 1.34 | |

| Adjustments for: | | | | | | | | | | | | | | | | | | |

| Restructuring costs (a) | | 4 | | | — | % | | (89) | | | (0.6) | % | | 93 | | | 0.6 | % | | 23 | | | 70 | | | 0.19 | |

Gain on sale of building | | — | | | — | % | | 47 | | | 0.3 | % | | (47) | | | (0.3) | % | | (11) | | | (36) | | | (0.10) | |

| Non-GAAP metrics | | $ | 5,779 | | | 38.8 | % | | $ | 5,173 | | | 34.7 | % | | $ | 606 | | | 4.1 | % | | $ | 66 | | | $ | 536 | | | $ | 1.43 | |

__________(a) Includes $64 million of employee-related costs and $29 million of consulting and other associated costs related to our previously announced actions to further simplify and optimize our operating model and structure.

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

ADJUSTED STATEMENT OF OPERATIONS METRICS FOR FISCAL YEAR 2022

The following adjusted statement of operations metrics are non-GAAP financial measures. These measures are provided to enhance visibility into the Company's underlying results for the period excluding the impact of impairment of certain inventory, impairment related to the Yeezy Gap business, a loss on divestiture activity, and a gain on sale of building. Management believes the adjusted metrics are useful for the assessment of ongoing operations as we believe the adjusted items are not indicative of our ongoing operations, and provide additional information to investors to facilitate the comparison of results against past and future years. However, these non-GAAP financial measures are not intended to supersede or replace the GAAP measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in millions)

52 Weeks Ended January 28, 2023 | | Gross Profit | | Gross Margin | | Operating Expenses | | Operating Expenses as a % of Net Sales | | Operating Income (Loss) | | Operating Margin | | Income Tax Expense | | Net Income (Loss) | | Earnings per Share - Diluted |

| GAAP metrics, as reported | | $ | 5,359 | | | 34.3 | % | | $ | 5,428 | | | 34.8 | % | | $ | (69) | | | (0.4) | % | | $ | 63 | | | $ | (202) | | | $ | (0.55) | |

| Adjustments for: | | | | | | | | | | | | | | | | | | |

| Inventory impairment charges (a) | | 58 | | | 0.4 | % | | — | | | — | % | | 58 | | | 0.4 | % | | 9 | | | 49 | | | 0.13 | |

| Yeezy Gap impairment charges (b) | | 53 | | | 0.3 | % | | — | | | — | % | | 53 | | | 0.3 | % | | 9 | | | 44 | | | 0.12 | |

Loss on divestiture

activity (c) | | — | | | — | % | | (35) | | | (0.2) | % | | 35 | | | 0.2 | % | | 5 | | | 30 | | | 0.08 | |

Gain on sale of building | | — | | | — | % | | 83 | | | 0.5 | % | | (83) | | | (0.5) | % | | (17) | | | (66) | | | (0.18) | |

| Non-GAAP metrics | | $ | 5,470 | | | 35.0 | % | | $ | 5,476 | | | 35.1 | % | | $ | (6) | | | — | % | | $ | 69 | | | $ | (145) | | | $ | (0.40) | |

__________(a) Represents the inventory impairment charges as a result of delayed seasonal product and extended size product, primarily at Old Navy.

(b) Represents the impairment charges as a result of the decision to discontinue the Yeezy Gap business, primarily related to inventory.

(c) Represents the impact of the loss on divestiture activity related to the transition of the Old Navy Mexico business.

The Gap, Inc.

NET SALES RESULTS

UNAUDITED

The following table details the Company’s fourth quarters and fiscal years 2023 and 2022 net sales (unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | Old Navy Global | | Gap Global | | Banana

Republic Global | | Athleta Global | | Other (3) | | Total |

14 Weeks Ended February 3, 2024 (1) | | | | | |

U.S. (2) | $ | 2,107 | | | $ | 768 | | | $ | 494 | | | $ | 407 | | | $ | 17 | | | $ | 3,793 | |

| Canada | 171 | | | 99 | | | 48 | | | 12 | | | — | | | 330 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other regions | 10 | | | 140 | | | 25 | | | — | | | — | | | 175 | |

| Total | $ | 2,288 | | | $ | 1,007 | | | $ | 567 | | | $ | 419 | | | $ | 17 | | | $ | 4,298 | |

| ($ in millions) | Old Navy Global | | Gap Global | | Banana

Republic Global | | Athleta Global | | Other (3) | | Total |

| 13 Weeks Ended January 28, 2023 | | | | | |

U.S. (2) | $ | 1,982 | | | $ | 709 | | | $ | 505 | | | $ | 423 | | | $ | 2 | | | $ | 3,621 | |

| Canada | 165 | | | 91 | | | 49 | | | 10 | | | — | | | 315 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other regions | 19 | | | 261 | | | 24 | | | 3 | | | — | | | 307 | |

| Total | $ | 2,166 | | | $ | 1,061 | | | $ | 578 | | | $ | 436 | | | $ | 2 | | | $ | 4,243 | |

| ($ in millions) | Old Navy Global | | Gap Global | | Banana

Republic Global | | Athleta Global | | Other (3) | | Total |

53 Weeks Ended February 3, 2024 (1) | | |

U.S. (2) | $ | 7,460 | | | $ | 2,470 | | | $ | 1,681 | | | $ | 1,310 | | | $ | 46 | | | $ | 12,967 | |

| Canada | 674 | | | 332 | | | 170 | | | 45 | | | — | | | 1,221 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other regions | 69 | | | 539 | | | 88 | | | 5 | | | — | | | 701 | |

| Total | $ | 8,203 | | | $ | 3,341 | | | $ | 1,939 | | | $ | 1,360 | | | $ | 46 | | | $ | 14,889 | |

| ($ in millions) | Old Navy Global | | Gap Global | | Banana

Republic Global | | Athleta Global | | Other (3) | | Total |

| 52 Weeks Ended January 28, 2023 | | |

U.S. (2) | $ | 7,471 | | | $ | 2,461 | | | $ | 1,829 | | | $ | 1,428 | | | $ | 12 | | | $ | 13,201 | |

| Canada | 679 | | | 332 | | | 192 | | | 33 | | | — | | | 1,236 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other regions | 84 | | | 981 | | | 95 | | | 19 | | | — | | | 1,179 | |

| Total | $ | 8,234 | | | $ | 3,774 | | | $ | 2,116 | | | $ | 1,480 | | | $ | 12 | | | $ | 15,616 | |

__________

(1) Fiscal 2023 includes incremental sales attributable to the 53rd week.

(2) U.S. includes the United States and Puerto Rico.

(3) Primarily consists of net sales from revenue-generating strategic initiatives.

The Gap, Inc.

REAL ESTATE

Store count, openings, closings, and square footage for our stores are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| January 28, 2023 | | 53 Weeks Ended February 3, 2024 | | February 3, 2024 |

| Number of

Store Locations | | Number of Stores

Opened | | Number of Stores

Closed | | Number of

Store Locations | | Square Footage

(in millions) |

| | | |

Old Navy North America | 1,238 | | | 25 | | | 20 | | | 1,243 | | | 19.8 | |

| Gap North America | 493 | | | 1 | | | 22 | | | 472 | | | 5.0 | |

Gap Asia (1) | 232 | | | 2 | | | 11 | | | 134 | | | 1.2 | |

| | | | | | | | | |

| Banana Republic North America | 419 | | | 2 | | | 21 | | | 400 | | | 3.3 | |

| Banana Republic Asia | 46 | | | 4 | | | 7 | | | 43 | | | 0.2 | |

| Athleta North America | 257 | | | 25 | | | 12 | | | 270 | | | 1.1 | |

| Company-operated stores total | 2,685 | | | 59 | | | 93 | | | 2,562 | | | 30.6 | |

| Franchise (1) | 667 | | | 293 | | | 96 | | | 998 | | | N/A |

| Total | 3,352 | | | 352 | | | 189 | | | 3,560 | | | 30.6 | |

__________

(1) The 89 Gap China stores that were transitioned to Baozun during the period are not included as store closures or openings for Company-operated and Franchise store activity. The ending balance for Gap Asia excludes Gap China stores and the ending balance for Franchise includes Gap China locations transitioned during the period.

v3.24.0.1

Cover Page Cover Page

|

Mar. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 07, 2024

|

| Entity Registrant Name |

THE GAP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-7562

|

| Entity Tax Identification Number |

94-1697231

|

| Entity Address, Address Line One |

Two Folsom Street

|

| Entity Address, City or Town |

San Francisco,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94105

|

| City Area Code |

415

|

| Local Phone Number |

427-0100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.05 par value

|

| Trading Symbol |

GPS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000039911

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

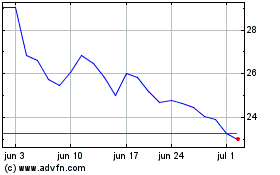

Gap (NYSE:GPS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Gap (NYSE:GPS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024