Table of Contents

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 1-A POS

Dated: April 19, 2024

REGULATION A OFFERING CIRCULAR UNDER THE SECURITIES

ACT OF 1933

Viper Networks,

Inc.

(Exact name of issuer as specified in its charter)

Nevada

(State of other jurisdiction of incorporation or organization)

200 E Big Beaver Rd.

Troy, MI 48083

(248) 724-1300

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

JDT Legal

7533 S Center View Ct, #4291

West Jordan, UT 84084

801-810-4465

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

| 7899 |

|

87-0410279 |

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

This Preliminary Offering Circular shall

only be qualified upon order of the Commission, unless a subsequent amendment is filed indicating the intention to become qualified by

operation of the terms of Regulation A.

This Offering Circular is following the Offering

Circular format described in Part II (a)(1)(ii) of Form 1-A POS.

PART II – PRELIMINARY OFFERING CIRCULAR

- FORM 1-A POS: TIER I

An

Offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission.

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor

may offers to buy be accepted before the Offering statement filed with the Securities and Exchange Commission is qualified. This Preliminary

Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities

in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such

state. We may elect to satisfy our obligation to deliver a Final Offering circular by sending you a notice within two business days after

the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering statement in which such Final

Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR

Dated: April 5, 2024

PURSUANT TO REGULATION A OF THE SECURITIES

ACT OF 1933

Viper Networks, Inc.

18851 NE 29th Ave. Suite 700

Troy, MI 48083

13,000,000,000 Shares of Common Stock

at $0.00025 per Share

150,000,000 Shares of Common Stock by the Selling

Shareholders

Minimum Investment: $1,000

Maximum Offering: $3,287,500

See The Offering - Page 9 and Securities Being Offered - Page 28 For Further Details. None of the Securities Offered Are Being Sold By Present Security Holders. This Offering Will

Commence Upon Qualification of this Offering by the Securities and Exchange Commission and Will Terminate 365 days from the date of qualification

by the Securities And Exchange Commission, Unless Extended or Terminated Earlier By The Issuer.

PLEASE REVIEW ALL RISK FACTORS ON PAGES 10

THROUGH PAGE 17 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE IF YOU ARE CAPABLE OF

EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE LOSS OF YOUR INVESTMENT, SHOULD

THAT OCCUR.

THE UNITED STATES SECURITIES AND EXCHANGE

COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT

PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO

AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES

OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Because these securities are being offered on a “best efforts”

basis, the following disclosures are hereby made:

| |

|

Price to Public |

|

Commissions (1) |

|

Proceeds to

Company (2) |

|

Proceeds to

Other Persons (3) |

| Per Share |

|

$.00025 |

|

$0 |

|

$0.00025 |

|

None |

| Minimum Investment |

|

$1,000 |

|

$0 |

|

$1,000 |

|

None |

| Maximum Offering |

|

$3,287,500 |

|

$0 |

|

$3,250,000 |

|

$37,500 |

(1) The Company has not presently engaged

an underwriter for the sale of securities under this Offering.

(2) Does not reflect payment of expenses of this

Offering, which are estimated to not exceed $25,000.00 and which include, among other things, legal fees, accounting costs, reproduction

expenses, due diligence, marketing, consulting, administrative services other costs of blue-sky compliance, and actual out-of-pocket

expenses incurred by the Company selling the Shares. This amount represents the proceeds of the offering to the Company, which will be

used as set out in “USE OF PROCEEDS TO ISSUER.”

(3) There are no finder’s fees or other fees

being paid to third parties from the proceeds. See “PLAN OF DISTRIBUTION.”

(4) $37,500 is being offered by the Selling Shareholders

This Offering (the “Offering”) consists

of Common Stock (the “Shares” or individually, each a “Share”) that is being offered on a “best efforts”

basis, which means that there is no guarantee that any minimum amount will be sold. The Shares are being offered and sold by Viper Networks,

Inc., a Nevada Corporation (the “Company”). We are offering up to 13,000,000,000 Shares plus an additional 150,000,000 shares

for certain selling shareholders (collectively the "Selling Shareholders"). Our offering price is $0.00025 per share. This

Offering has a minimum purchase of $1,000 per investor. We may waive the minimum purchase requirement on a case-by-case basis in our

sole discretion. The Shares are being offered only by the Company on a best-efforts basis to an unlimited number of accredited investors

and to an unlimited number of non-accredited investors subject to the limitations of Regulation A. Under Rule 251(d)(2)(i)(C) of

Regulation A+, non-accredited, non-natural investors are subject to the investment limitation and may only invest funds which do not

exceed 10% of the greater of the purchaser’s revenue or net assets (as of the purchaser’s most recent fiscal year end). A

non-accredited, natural person may only invest funds which do not exceed 10% of the greater of the purchaser’s annual income or

net worth (please see below on how to calculate your net worth). The maximum aggregate amount of the Shares that will be offered is 13,150,000,000

Shares of Common Stock with a Maximum Offering of $3,287,500. There is no minimum number of Shares that needs to be sold in order for

funds to be released to the Company and for this Offering to close. The Company will not receive any proceeds from sales by the Selling

Shareholders.

Our Common Stock is currently quoted on the OTC

Pink tier of the OTC Market Group, Inc. under the symbol “VPER”. On April 18, 2024, the last reported sale price of our common

stock was $0.0003.

The Shares are being offered pursuant to Regulation

A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 1 offerings. The Shares will only be issued to purchasers who satisfy

the requirements set forth in Regulation A. The offering is expected to expire on the first of: (i) all of the Shares offered are sold;

or (ii) the close of business 365 days from the date of qualification by the Commission, unless sooner terminated or extended by the

Company’s CEO. Pending each closing, payments for the Shares will be paid directly to the Company. Funds will be immediately transferred

to the Company where they will be available for use in the operations of the Company’s business in a manner consistent with the “USE OF PROCEEDS TO ISSUER” in this Offering Circular.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE

AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED

TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR, AND

IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE

THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES, AGENTS

OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS

OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES

APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE

THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO

REFER TO WWW.INVESTOR.GOV (WHICH IS NOT INCORPORATED BY REFERENCE INTO THIS OFFERING CIRCULAR).

This Offering is inherently risky. See “Risk Factors”

beginning on page 10.

Sales of these securities will commence upon

qualification at the federal and state levels.

The Company is following the “Offering

Circular” format of disclosure under Regulation A.

AN OFFERING STATEMENT PURSUANT TO REGULATION

A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY

OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE

OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR

THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR

SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION

TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE

TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED

MAY BE OBTAINED.

NASAA UNIFORM LEGEND

FOR RESIDENTS OF ALL STATES: THE PRESENCE

OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED TO MEAN AN OFFER

OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY MADE IN ANY GIVEN

STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE NOT BEEN REGISTERED UNDER

ANY STATE SECURITIES LAWS (COMMONLY CALLED ‘BLUE SKY’ LAWS).

IN MAKING AN INVESTMENT DECISION INVESTORS

MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS

AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY.

FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENSE.

NOTICE TO FOREIGN INVESTORS

IF THE PURCHASER LIVES OUTSIDE THE UNITED

STATES, IT IS THE PURCHASER’S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES

IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER

REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES BY ANY FOREIGN PURCHASER.

PATRIOT ACT RIDER

The Investor hereby represents and warrants that

Investor is not, nor is it acting as an agent, representative, intermediary or nominee for, a person identified on the list of blocked

persons maintained by the Office of Foreign Assets Control, U.S. Department of Treasury. In addition, the Investor has complied with

all applicable U.S. laws, regulations, directives, and executive orders relating to anti-money laundering , including but not limited

to the following laws: (1) the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism

Act of 2001, Public Law 107-56, and (2) Executive Order 13224 (Blocking Property and Prohibiting Transactions with Persons Who Commit,

Threaten to Commit, or Support Terrorism) of September 23, 2001.

NO DISQUALIFICATION EVENT (“BAD ACTOR”

DECLARATION)

NONE

OF THE COMPANY, ANY OF ITS PREDECESSORS, ANY AFFILIATED ISSUER, ANY DIRECTOR, EXECUTIVE OFFICER, OTHER OFFICER OF THE COMPANY PARTICIPATING

IN THE OFFERING CONTEMPLATED HEREBY, ANY BENEFICIAL OWNER OF 20% OR MORE OF THE COMPANY’S OUTSTANDING VOTING EQUITY SECURITIES, CALCULATED

ON THE BASIS OF VOTING POWER, NOR ANY PROMOTER (AS THAT TERM IS DEFINED IN RULE 405 UNDER THE SECURITIES ACT OF 1933) CONNECTED WITH

THE COMPANY IN ANY CAPACITY AT THE TIME OF SALE (EACH, AN “ISSUER COVERED PERSON”)

IS SUBJECT TO ANY OF THE “BAD ACTOR” DISQUALIFICATIONS DESCRIBED IN RULE 506(D)(1)(I) TO (VIII) UNDER THE SECURITIES ACT

OF 1933 (A “DISQUALIFICATION EVENT”), EXCEPT

FOR A DISQUALIFICATION EVENT COVERED BY RULE 506(D)(2) OR (D)(3) UNDER THE SECURITIES ACT. THE COMPANY HAS EXERCISED REASONABLE CARE

TO DETERMINE WHETHER ANY ISSUER COVERED PERSON IS SUBJECT TO A DISQUALIFICATION EVENT.

Continuous Offering

Under Rule 251(d)(3) to Regulation A, the following

types of continuous or delayed Offerings are permitted, among others: (1) securities offered or sold by or on behalf of a person other

than the issuer or its subsidiary or a person of which the issuer is a subsidiary; (2) securities issued upon conversion of other outstanding

securities; or (3) securities that are part of an Offering which commences within two calendar days after the qualification date. These

may be offered on a continuous basis and may continue to be offered for a period in excess of 30 days from the date of initial qualification.

They may be offered in an amount that, at the time the Offering statement is qualified, is reasonably expected to be offered and sold

within one year from the initial qualification date. No securities will be offered or sold “at the market.” The Shares will

be sold at a fixed price to be determined after qualification. We have provided a bona fide estimate of the price range of the Offering,

pursuant to Rule 253(b)(2). The Offering Price will be filed by the Company via an offering circular supplement pursuant to Rule 253(c).

The supplement will not, in the aggregate, represent any change from the maximum aggregate Offering Price calculable using the information

in the qualified Offering statement. This information will be filed no later than two business days following the earlier of the date

of determination of such pricing information or the date of first use of the Offering Circular after qualification.

Subscriptions are irrevocable and the purchase

price is non-refundable as expressly stated in this Offering Circular. The Company, by determination of the Board of Directors, in its

sole discretion, may issue the Securities under this Offering for cash, promissory notes, services, and/or other consideration without

notice to subscribers. All proceeds received by the Company from subscribers for this Offering will be available for use by the Company

upon acceptance of subscriptions for the Securities by the Company.

Forward Looking Statement Disclosure

This Form 1-A POS, Offering Circular, and any

documents incorporated by reference herein or therein contain forward-looking statements and are subject to risks and uncertainties. All

statements other than statements of historical fact or relating to present facts or current conditions included in this Form 1-A POS,

Offering Circular, and any documents incorporated by reference are forward-looking statements. Forward-looking statements give the Company's

current reasonable expectations and projections relating to its financial condition, results of operations, plans, objectives, future

performance, and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current

facts. These statements may include words such as 'anticipate,' 'estimate,' 'expect,' 'project,' 'plan,' 'intend,' 'believe,' 'may,' 'should,'

'can have,' 'likely' and other words and terms of similar meaning in connection with any discussion of the timing or nature of future

operating or financial performance or other events. The forward-looking statements contained in this Form 1-A POS, Offering Circular,

and any documents incorporated by reference herein or therein are based on reasonable assumptions the Company has made in light of its

industry experience, perceptions of historical trends, current conditions, expected future developments and other factors it believes

are appropriate under the circumstances. As you read and consider this Form 1-A POS, Offering Circular, and any documents incorporated

by reference, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties

(many of which are beyond the Company's control) and assumptions. Although the Company believes that these forward-looking statements

are based on reasonable assumptions, you should be aware that many factors could affect its actual operating and financial performance

and cause its performance to differ materially from the performance anticipated in the forward-looking statements. Should one or more

of these risks or uncertainties materialize, or should any of these assumptions prove incorrect or change, the Company's actual operating

and financial performance may vary in material respects from the performance projected in these forward- looking statements. Any forward-looking

statement made by the Company in this Form 1-A POS, Offering Circular or any documents incorporated by reference herein speaks only as

of the date of this Form 1-A POS, Offering Circular or any documents incorporated by reference herein. Factors or events that could cause

our actual operating and financial performance to differ may emerge from time to time, and it is not possible for the Company to predict

all of them. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future

developments or otherwise, except as may be required by law.

About This Form 1-A POS and Offering Circular

In making an investment decision,

you should rely only on the information contained in this Form 1-A POS and Offering Circular. The Company has not authorized anyone to

provide you with information different from that contained in this Form 1-A POS and Offering Circular. We are offering to sell, and seeking

offers to buy the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information contained

in this Form 1-A POS and Offering Circular is accurate only as of the date of this Form 1-A POS and Offering Circular, regardless of the

time of delivery of this Form 1-A POS and Offering Circular. Our business, financial condition, results of operations, and prospects may

have changed since that date. Statements contained herein as to the content of any agreements or other documents are summaries and, therefore,

are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other documents.

TABLE OF CONTENTS

OFFERING CIRCULAR SUMMARY,

PERKS AND RISK FACTORS

OFFERING CIRCULAR SUMMARY

The following summary is qualified in its entirety by the more detailed

information appearing elsewhere in this Offering Circular and/or incorporated by reference in this Offering Circular. For full offering

details, please (1) thoroughly review this Form 1-A POS filed with the Securities and Exchange Commission (2) thoroughly review this Offering

Circular and (3) thoroughly review any attached documents to or documents referenced in, this Form 1-A POS and Offering Circular.

Unless otherwise indicated, the terms “Viper Networks,”

“VPER,” “the Company,” we,” “our,” and “us” are used in this Offering Circular to refer

to Viper Networks, Inc. and its subsidiaries.

Business Overview

Viper Networks, Inc., a Nevada corporation, in partnership with Apollo

Metro, is a manufacturer and distributor of highly efficient LED lighting to provide superior turnkey LED lighting solutions for metropolitan

areas (streets and highways), parking lots and warehousing facilities anywhere. By combining LED Lighting, Wireless MESH, Sensors, Infrared

and Video into a single design; Apollo Metro Solutions’ proprietary line of wireless products can be applied to existing infrastructure

through streamlined system integration for a full selection of intelligent LED lighting solutions worldwide.

Viper Networks also provides telecom engineering services for planning,

network expansion and managed services to telecommunication service providers of various telecom networks in the U.S., Middle East and

Northern Africa with top tier expertise in wireless communications. For a further description of the Company and its plan of operations,

see the section entitled “Description of Business” beginning on Page 22.

| Issuer: |

Viper Networks, Inc. |

| |

|

| Type of Stock Offering: |

Common Stock |

| |

|

| Price Per Share: |

$0.00025 |

| |

|

| Minimum Investment: |

$1,000 per investor. We may waive the minimum purchase requirement on a case-by-case basis in our

sole discretion. |

| |

|

| Maximum Offering: |

$3,287,500. The Company will not accept investments

that would be, in aggregate, greater than the Maximum Offering amount. |

| |

|

| Maximum Shares Offered: |

13,150,000,000 Shares of Common Stock of which 150,000,000 will be sold by Selling Shareholders |

| |

|

| Investment Amount Restrictions: |

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay

is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural

persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review

Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. |

| |

|

| Method of Subscription: |

After the qualification by the SEC of the Offering Statement of which this Offering Circular is

a part, investors can subscribe to purchase the Shares by completing the Subscription Agreement and sending payment by check, wire

transfer, ACH, credit card, or any other payment method accepted by the Company. Upon the approval of any subscription,

the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance

with the Use of Proceeds. Subscriptions are irrevocable and the purchase price is non-refundable. |

| |

|

| Use of Proceeds: |

See the description in the section entitled “USE OF PROCEEDS TO ISSUER” on page 20 herein. |

| |

|

| Voting Rights: |

The Shares have full voting rights. |

| |

|

| Trading Symbols: |

Our common stock is directly quoted on the OTC Pink tier of the OTC Market Group, Inc. under the

symbol “VPER”. |

| |

|

| Transfer Agent and Registrar: |

Pacific Stock Transfer Co. is our transfer agent and registrar in connection with the Offering. |

| |

|

| Length of Offering: |

Shares will be offered on a continuous basis until either (1) the maximum number of Shares are

sold; (2) 365 days from the date of qualification by the Commission; (3) the Company in its sole discretion extends the offering

beyond 365 days from the date of qualification by the Commission, or (4) the Company in its sole discretion withdraws this Offering. |

The Offering

| Common Stock Outstanding (1) |

6,563,597,467 Shares |

| Common Stock in this Offering |

13,000,000,000 Shares |

| Stock to be outstanding after the offering (2) |

19,563,597,467

Shares |

| 1. | As of the date of this Offering Circular. |

| 2. | The total number of Shares of Common

Stock assumes that the maximum number of Shares are sold in this Offering. The Company may

not be able to sell the Maximum Offering Amount. The Company will conduct one or more closings

on a rolling basis as funds are received from investors. Includes 150,000,000 shares being

sold by the Selling Shareholders. For further information, see the section on page 27 entitled

"Selling Securityholders." |

Investment Analysis

There is no assurance the Company will be profitable,

or that management’s opinion of the Company’s future prospects will not be outweighed by the unanticipated losses, adverse regulatory

developments and other risks. Investors should carefully consider the various risk factors below before investing in the Shares.

RISK FACTORS

The purchase of the Company’s Common Stock involves

substantial risks. You should carefully consider the following risk factors in addition to any other risks associated with this investment.

The Shares offered by the Company constitute a highly speculative investment and you should be in an economic position to lose your entire

investment. The risks listed do not necessarily comprise all those associated with an investment in the Shares and are not set out in

any particular order of priority. Additional risks and uncertainties may also have an adverse effect on the Company’s business and your

investment in the Shares. An investment in the Company may not be suitable for all recipients of this Offering Circular. You are advised

to consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to

invest. You should consider carefully whether an investment in the Company is suitable in the light of your personal circumstances and

the financial resources available to you.

The discussions and information in this Offering

Circular may contain both historical and forward- looking statements. To the extent that the Offering Circular contains forward-looking

statements regarding the financial condition, operating results, business prospects, or any other aspect of the Company’s business, please

be advised that the Company’s actual financial condition, operating results, and business performance may differ materially from that

projected or estimated by the Company in forward-looking statements. The Company has attempted to identify, in context, certain of the

factors it currently believes may cause actual future experience and results may differ from the Company’s current expectations.

Before investing, you should carefully read and

carefully consider the following risk factors:

Risks Related to the Company and Its Business

We have a limited operating history.

Our operating history is limited. There can be

no assurance that our proposed plan of business can be realized in the manner contemplated and, if it cannot be, shareholders may lose

all or a substantial part of their investment. There is no guarantee that we will ever realize any significant operating revenues or

that our operations will ever be profitable.

We are dependent upon management, key personnel, and consultants

to execute our business plan.

Our success is heavily dependent upon the continued

active participation of our current management team, especially our current executive officer. Loss of this individual could have a material

adverse effect upon our business, financial condition, or results of operations. Further, our success and the achievement of our growth

plans depends on our ability to recruit, hire, train, and retain other highly qualified technical and managerial personnel. Competition

for qualified employees among companies in our industry, and the loss of any of such persons, or an inability to attract, retain, and

motivate any additional highly skilled employees required for the expansion of our activities, could have a materially adverse effect

on our business. If we are unable to attract and retain the necessary personnel, consultants, and advisors, it could have a material

adverse effect on our business, financial condition, or operations.

Although we are dependent upon certain key personnel, we do

not have any key man life insurance policies on any such people.

We are dependent upon management in order to

conduct our operations and execute our business plan; however, we have not purchased any insurance policies with respect to those individuals

in the event of their death or disability. Therefore, should any of those key personnel, management, or founders die or become disabled,

we will not receive any compensation that would assist with any such person’s absence. The loss of any such person could negatively

affect our business and operations.

We are subject to income taxes as well as non-income-based taxes,

such as payroll, sales, use, value-added, net worth, property, and goods and services taxes.

Significant judgment is required in determining

our provision for income taxes and other tax liabilities. In the ordinary course of our business, there are many transactions and calculations

where the ultimate tax determination is uncertain. Although we believe that our tax estimates will be reasonable: (i) there is no assurance

that the final determination of tax audits or tax disputes will not be different from what is reflected in our income tax provisions,

expense amounts for non-income based taxes and accruals and (ii) any material differences could have an adverse effect on our financial

position and results of operations in the period or periods for which determination is made.

We are not subject to Sarbanes-Oxley regulation and lack the

financial controls and safeguards required of public companies.

We do not have the internal infrastructure necessary,

and are not required to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes-Oxley

Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of our financial

controls. We expect to incur additional expenses and diversion of management’s time if and when it becomes necessary to perform the system

and process evaluation, testing, and remediation required in order to comply with the management certification and auditor attestation

requirements.

We have engaged in certain transactions

with related persons.

Please see the section of this offering circular

entitled “Interest of Management and Others in Certain Transactions”.

Changes in employment laws or regulation

could harm our performance.

Various federal and state labor laws govern the

Company’s relationship with our employees and affect operating costs, including labor laws of non-USA jurisdictions, specifically Canadian

federal and provincial statutes. These laws may include minimum wage requirements, overtime pay, healthcare reform and the implementation

of various federal and state healthcare laws, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership

and sales taxes. A number of factors could adversely affect our operating results, including additional government-imposed increases

in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations

from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

Our bank accounts will not be fully insured.

The Company’s regular bank accounts and the escrow

account for this Offering each have federal insurance that is limited to a certain amount of coverage. It is anticipated that the account

balances in each account may exceed those limits at times. In the event that any of the Company’s banks should fail, we may not be able

to recover all amounts deposited in these bank accounts.

Our business plan is speculative.

Our present business and planned business are

speculative and subject to numerous risks and uncertainties. There is no assurance that the Company will generate significant revenues

or profits.

The Company will likely incur debt.

The Company has incurred debt in the past and

expects to incur future debt in order to fund operations. Complying with obligations under such indebtedness may have a material adverse

effect on the Company and on your investment.

Our expenses could increase without a corresponding

increase in revenues.

Our operating and other expenses could increase

without a corresponding increase in revenues, which could have a material adverse effect on our financial results and on your investment.

Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2)

increases in taxes and other statutory charges, (3) changes in laws, regulations or government policies which increase the costs of compliance

with such laws, regulations or policies, (4) significant increases in insurance premiums, and (5) increases in borrowing costs.

Increased costs could negatively affect

our business.

An increase in the cost of raw materials could

affect the Company’s profitability. Commodity and other price changes may result in unexpected increases in the cost of raw materials.

To date, the sourcing and availability of raw materials has not been problematic and does not pose a significant risk to the Company,

but the Company may be adversely affected by shortages of raw materials and/or an increase in their cost. In addition, energy cost increases

could result in higher transportation, freight and other operating costs. We may not be able to increase our prices to offset these increased

costs without suffering reduced volume, sales and operating profit, and this could have an adverse effect on your investment.

We may be unable to maintain or enhance

our product image.

It is important that we maintain and enhance

the image of our existing and new products. The image and reputation of the Company’s products may be impacted for various reasons, including

litigation. Such concerns, even when unsubstantiated, could be harmful to the Company’s image and the reputation of its products. From

time to time, the Company may receive complaints from customers regarding products purchased from the Company. The Company may in the

future receive correspondence from customers requesting reimbursement. Certain dissatisfied customers may threaten legal action against

the Company if no reimbursement is made. The Company may become subject to product liability lawsuits from customers alleging injury

because of a purported defect in products sold by the Company, claiming substantial damages and demanding payments from the Company.

The Company is in the chain of title when it manufactures, supplies or distributes products, and therefore is subject to the risk of

being held legally responsible for them. These claims may not be covered by the Company’s insurance policies. Any resulting litigation

could be costly for the Company, divert management attention, and could result in increased costs of doing business, or otherwise have

a material adverse effect on the Company’s business, results of operations, and financial condition. Any negative publicity generated

as a result of customer complaints about the Company’s products could damage the Company’s reputation and diminish the value of the Company’s

brand, which could have a material adverse effect on the Company’s business, results of operations, and financial condition, as well

as your investment. Deterioration in the Company’s brand equity (brand image, reputation and product quality) may have a material adverse

effect on its financial results as well as your investment.

If we are unable to protect our Intellectual

Property effectively, we may be unable to operate our business.

Our success will depend on our ability to obtain

and maintain meaningful Intellectual Property Protection for any such Intellectual Property. The names and/or logos of Company brands

(whether owned by the Company or licensed to us) may be challenged by holders of trademarks who file opposition notices, or otherwise

contest trademark applications by the Company for its brands. Similarly, domains owned and used by the Company may be challenged by others

who contest the ability of the Company to use the domain name or URL. Such challenges could have a material adverse effect on the Company’s

financial results as well as your investment.

Computer, website, or information system

breakdown could negatively affect our business.

Computer, website and/or information system breakdowns

as well as cyber security attacks could impair the Company’s ability to service its customers leading to reduced revenue from sales and/or

reputational damage, which could have a material adverse effect on the Company’s financial results as well as your investment.

Changes in the economy could have a detrimental

impact on the Company.

Changes in the general economic climate could

have a detrimental impact on consumer expenditure and therefore on the Company’s revenue. It is possible that recessionary pressures

and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases)

may adversely affect customers’ confidence and willingness to spend. Any of such events or occurrences could have a material adverse

effect on the Company’s financial results and on your investment.

Additional financing may be necessary for

the implementation of our growth strategy.

The Company may require additional debt and/or

equity financing to pursue our growth and business strategies. These include, but are not limited to enhancing our operating infrastructure

and otherwise respond to competitive pressures. Given our limited operating history and existing losses, there can be no assurance that

additional financing will be available, or, if available, that the terms will be acceptable to us. Lack of additional funding could force

us to curtail substantially our growth plans. Furthermore, the issuance by us of any additional securities pursuant to any future fundraising

activities undertaken by us would dilute the ownership of existing shareholders and may reduce the price of our Shares.

Our operating plan relies in large part

upon assumptions and analyses developed by the Company. If these assumptions or analyses prove to be incorrect, the Company’s actual

operating results may be materially different from our forecasted results.

Whether actual operating results and business

developments will be consistent with the Company’s expectations and assumptions as reflected in its forecast depends on a number of factors,

many of which are outside the Company’s control, including, but not limited to:

| • | | whether the Company can obtain sufficient

capital to sustain and grow its business |

| • | | our ability to manage the Company’s growth |

| • | | whether the Company can manage relationships

with key vendors and advertisers |

| • | | demand for the Company’s products and services |

| • | | the timing and costs of new and existing

marketing and promotional efforts and/or competition |

| • | | the Company’s ability to retain existing

key management, to integrate recent hires and to attract, retain and motivate qualified personnel |

| • | | the overall strength and stability of domestic

and international economies |

| • | | consumer spending habits |

Unfavorable changes in any of these or other

factors, most of which are beyond the Company’s control, could materially and adversely affect its business, results of operations and

financial condition.

Our operations may not be profitable.

The Company may not be able to generate significant

revenues in the future. In addition, we expect to incur substantial operating expenses in order to fund the expansion of our business.

As a result, we may experience substantial negative cash flow for at least the foreseeable future and cannot predict when, or even if,

the Company might become profitable.

We may be unable to manage our growth or

implement our expansion strategy.

We may not be able to expand the Company’s product

and service offerings, the Company’s markets, or implement the other features of our business strategy at the rate or to the extent presently

planned. The Company’s projected growth will place a significant strain on our administrative, operational and financial resources. If

we are unable to successfully manage our future growth, establish and continue to upgrade our operating and financial control systems,

recruit and hire necessary personnel or effectively manage unexpected expansion difficulties, our financial condition and results of

operations could be materially and adversely affected.

Our business model is evolving.

Our business model is unproven and is likely

to continue to evolve. Accordingly, our initial business model may not be successful and may need to be changed. Our ability to generate

significant revenues will depend, in large part, on our ability to successfully market our products to potential users who may not be

convinced of the need for our products and services or who may be reluctant to rely upon third parties to develop and provide these products.

We intend to continue to develop our business model as the Company’s market continues to evolve.

The Company Needs To Increase Brand Awareness

Due to a variety of factors, our opportunity

to achieve and maintain a significant market share may be limited. Developing and maintaining awareness of the Company’s brand name,

among other factors, is critical. Further, the importance of brand recognition will increase as competition in the Company’s market increases.

Successfully promoting and positioning our brand, products and services will depend largely on the effectiveness of our marketing efforts.

Therefore, we may need to increase the Company’s financial commitment to create and maintain brand awareness. If we fail to successfully

promote our brand name or if the Company incurs significant expenses promoting and maintaining our brand name, it will have a material

adverse effect on the Company’s results of operations.

Our employees may engage in misconduct

or improper activities.

The Company, like any business, is exposed to

the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with laws or regulations,

provide accurate information to regulators, comply with applicable standards, report financial information or data accurately or disclose

unauthorized activities to the Company. In particular, sales, marketing and business arrangements are subject to extensive laws and regulations

intended to prevent fraud, misconduct, kickbacks, self-dealing and other abusive practices. These laws and regulations may restrict or

prohibit a wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business

arrangements. Employee misconduct could also involve improper or illegal activities which could result in regulatory sanctions and serious

harm to our reputation.

Limitation on director liability.

The Company may provide for the indemnification

of directors to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability

of directors to the Company and its shareholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may

be available for liabilities arising in connection with this Offering.

Risks Related to this Offering and Investment

We may undertake additional equity or debt

financing that would dilute the shares in this offering.

The Company may undertake further equity or debt

financing, which may be dilutive to existing shareholders, including you, or result in an issuance of securities whose rights, preferences

and privileges are senior to those of existing shareholders, including you, and also reducing the value of Shares subscribed for under

this Offering.

An investment in the Shares is speculative

and there can be no assurance of any return on any such investment.

An investment in the Company’s Shares is speculative,

and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved

in an investment in the Company, including the risk of losing their entire investment.

The Shares are offered on a “Best

Efforts” basis and we may not raise the Maximum Amount being offered.

Since we are offering the Shares on a “best

efforts” basis, there is no assurance that we will sell enough Shares to meet our capital needs. If you purchase Shares in this

Offering, you will do so without any assurance that we will raise enough money to satisfy the full Use Of Proceeds To Issuer which we

have outlined in this Offering Circular or to meet our working capital needs.

If the maximum offering is not raised,

it may increase the amount of long-term debt or the amount of additional equity we need to raise.

There is no assurance that the maximum number

of Shares in this Offering will be sold. If the maximum Offering amount is not sold, we may need to incur additional debt or raise additional

equity in order to finance our operations. Increasing the amount of debt will increase our debt service obligations and make less cash

available for distribution to our shareholders. Increasing the amount of additional equity that we will have to seek in the future will

further dilute those investors participating in this Offering.

We have not paid dividends in the past

and do not expect to pay dividends in the future, so any return on investment may be limited to the value of our shares.

We have never paid cash dividends on our Shares

and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our Shares will depend on earnings,

financial condition and other business and economic factors affecting it at such time that management may consider relevant. If we do

not pay dividends, our Shares may be less valuable because a return on your investment will only occur if its stock price appreciates.

We may not be able to obtain additional

financing.

Even if we are successful in selling the maximum

number of Shares in the Offering, we may require additional funds to continue and grow our business. We may not be able to obtain additional

financing as needed, on acceptable terms, or at all, which would force us to delay our plans for growth and implementation of our strategy

which could seriously harm our business, financial condition and results of operations. If we need additional funds, we may seek to obtain

them primarily through additional equity or debt financings. Those additional financings could result in dilution to our current shareholders

and to you if you invest in this Offering.

The offering price has been arbitrarily

determined.

The offering price of the Shares has been arbitrarily

established by us based upon our present and anticipated financing needs and bears no relationship to our present financial condition,

assets, book value, projected earnings, or any other generally accepted valuation criteria. The offering price of the Shares may not

be indicative of the value of the Shares or the Company, now or in the future.

The management of the Company has broad

discretion in application of proceeds.

The management of the Company has broad discretion

to adjust the application and allocation of the net proceeds of this offering in order to address changed circumstances and opportunities.

As a result of the foregoing, our success will be substantially dependent upon the discretion and judgment of the management of the Company

with respect to the application and allocation of the net proceeds hereof.

An investment in our Shares could result

in a loss of your entire investment.

An investment in the Company’s Shares offered

in this Offering involves a high degree of risk and you should not purchase the Shares if you cannot afford the loss of your entire investment.

You may not be able to liquidate your investment for any reason in the near future.

There is no assurance that we will be able

to pay dividends to our Shareholders.

While we may choose to pay dividends at some

point in the future to our shareholders, there can be no assurance that cash flow and profits will allow such distributions to ever be

made.

Sales of a substantial number of shares

of our stock may cause the price of our stock to decline.

If our shareholders sell substantial amounts

of our Shares in the public market, Shares sold may cause the price to decrease below the current offering price. These sales may also

make it more difficult for us to sell equity or equity related securities at a time and price that we deem reasonable or appropriate.

We have made assumptions in our projections

and in Forward-Looking Statements that may not be accurate.

The discussions and information in this Offering

Circular may contain both historical and “forward- looking statements” which can be identified by the use of forward-looking

terminology including the terms “believes,” “anticipates,” “continues,” “expects,” “intends,”

“may,” “will,” “would,” “should,” or, in each case, their negative or other variations or comparable

terminology. You should not place undue reliance on forward-looking statements. These forward-looking statements include matters that

are not historical facts. Forward-looking statements involve risk and uncertainty because they relate to future events and circumstances.

Forward-looking statements contained in this Offering Circular, based on past trends or activities, should not be taken as a representation

that such trends or activities will continue in the future. To the extent that the Offering Circular contains forward-looking statements

regarding the financial condition, operating results, business prospects, or any other aspect of our business, please be advised that

our actual financial condition, operating results, and business performance may differ materially from that projected or estimated by

us. We have attempted to identify, in context, certain of the factors we currently believe may cause actual future experience and results

to differ from our current expectations. The differences may be caused by a variety of factors, including but not limited to adverse

economic conditions, lack of market acceptance, reduction of consumer demand, unexpected costs and operating deficits, lower sales and

revenues than forecast, default on leases or other indebtedness, loss of suppliers, loss of supply, loss of distribution and service

contracts, price increases for capital, supplies and materials, inadequate capital, inability to raise capital or financing, failure

to obtain customers, loss of customers, the risk of litigation and administrative proceedings involving the Company or its employees,

loss of government licenses and permits or failure to obtain them, higher than anticipated labor costs, the possible acquisition of new

businesses or products that result in operating losses or that do not perform as anticipated, resulting in unanticipated losses, the

possible fluctuation and volatility of the Company’s operating results and financial condition, adverse publicity and news coverage,

inability to carry out marketing and sales plans, loss of key executives, changes in interest rates, inflationary factors, and other

specific risks that may be referred to in this Offering Circular or in other reports issued by us or by third-party publishers.

You should be aware of the long-term nature

of this investment.

Because the Shares have not been registered under

the Securities Act or under the securities laws of any state or non-United States jurisdiction, the Shares may have certain transfer

restrictions. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected.

Limitations on the transfer of the Shares may also adversely affect the price that you might be able to obtain for the Shares in a private

sale. You should be aware of the long-term nature of your investment in the Company. You will be required to represent that you are purchasing

the Securities for your own account, for investment purposes and not with a view to resale or distribution thereof.

The Shares in this Offering have no protective

provisions.

The Shares in this Offering have no protective

provisions. As such, you will not be afforded protection by any provision of the Shares or as a Shareholder in the event of a transaction

that may adversely affect you, including a reorganization, restructuring, merger or other similar transaction involving the Company.

If there is a ‘liquidation event’ or ‘change of control’ the Shares being offered do not provide you with any protection. In addition,

there are no provisions attached to the Shares in the Offering that would permit you to require the Company to repurchase the Shares

in the event of a takeover, recapitalization or similar transaction.

You will not have significant influence

on the management of the Company.

Substantially all decisions with respect to the

management of the Company will be made exclusively by the officers, directors, managers or employees of the Company. You will have a

very limited ability, if at all, to vote on issues of Company management and will not have the right or power to take part in the management

of the Company and will not be represented on the board of directors or by managers of the Company. Accordingly, no person should purchase

Shares unless he or she is willing to entrust all aspects of management to the Company.

There is no guarantee of any return on

your investment.

There is no assurance that you will realize a

return on your investment or that you will not lose your entire investment. For this reason, you should read this Offering Circular and

all exhibits and referenced materials carefully and should consult with your own attorney and business advisor prior to making any investment

decision.

Our Subscription Agreement identifies the

state of Nevada for purposes of governing law.

The Company’s Subscription Agreement for

shares issued under this Offering contains a choice of law provision stating, “all questions concerning the construction, validity,

enforcement and interpretation of the Offering Circular, including, without limitation, this [Subscription] Agreement, shall be governed

by and construed and enforced in accordance with the laws of the State of Nevada.” As such, excepting matters arising under federal

securities laws, any disputes arising between the Company and shareholders acquiring shares under this offering shall be determined in

accordance with the laws of the state of Nevada. Furthermore, the Subscription Agreement establishes the state and federal courts located

in Nevada as having jurisdiction over matters arising between the Company and shareholders.

These provisions may discourage shareholder lawsuits

or limit shareholders’ ability to obtain a favorable judicial forum in disputes with the Company and its directors, officers, or

other employees.

IN ADDITION TO THE RISKS LISTED ABOVE,

BUSINESSES ARE OFTEN SUBJECT TO RISKS NOT FORESEEN OR FULLY APPRECIATED BY THE MANAGEMENT. IT IS NOT POSSIBLE TO FORESEE ALL RISKS THAT

MAY AFFECT THE COMPANY. MOREOVER, THE COMPANY CANNOT PREDICT WHETHER THE COMPANY WILL SUCCESSFULLY EFFECTUATE THE COMPANY’S CURRENT BUSINESS

PLAN. EACH PROSPECTIVE PURCHASER IS ENCOURAGED TO CAREFULLY ANALYZE THE RISKS AND MERITS OF AN INVESTMENT IN THE SECURITIES AND SHOULD

TAKE INTO CONSIDERATION WHEN MAKING SUCH ANALYSIS, AMONG OTHER FACTORS, THE RISK FACTORS DISCUSSED ABOVE.

DETERMINATION OF OFFERING PRICE

The Offering Price will be determined after qualification

pursuant to Rule 253(b). The Offering Price will be arbitrarily determined and is not meant to reflect a valuation of the Company.

DILUTION

The term ‘dilution’ refers to the

reduction (as a percentage of the aggregate Shares outstanding) that occurs for any given share of stock when additional Shares are issued.

If all the Shares in this Offering are fully subscribed and sold, the Shares offered herein will constitute approximately 65% of the

total Shares of common stock of the Company. The Company anticipates that, subsequent to this Offering, the Company may require additional

capital and such capital may take the form of Common Stock, other stock or securities or debt convertible into stock. Such future fund

raising will further dilute the percentage ownership of the Shares sold herein in the Company.

If you purchase shares in this Offering, your

ownership interest in our Common Stock will be diluted immediately, to the extent of the difference between the price to the public charged

for each share in this Offering and the net tangible book value per share of our Common Stock after this Offering.

Our historical net tangible book value as of

December 31, 2023 was $(260,273). Historical net tangible book value equals the amount of our total tangible assets, less total liabilities,

divided by the total number of shares of our Common Stock outstanding, all as of the date specified. Net tangible book value per share

is an estimate based on the net tangible book value as of December 31, 2023 and 6,563,597,467 shares of common stock outstanding as of

the date of this Offering Circular.

The following table illustrates the per share

dilution to new investors discussed above, assuming the sale of, respectively, 100%, 75%, 50% and 25% of the Shares offered for sale

in this Offering (before deducting our estimated offering expenses of $25,000 and not including shares sold by Selling Shareholders):

| Funding Level | |

| 100% | | |

| 75% | | |

| 50% | | |

| 25% | |

| Gross Proceeds | |

$ | 3,250,000 | | |

$ | 2,437,500 | | |

$ | 1,625,000 | | |

$ | 812,500 | |

| Offering Price | |

$ | 0.00025 | | |

$ | 0.00025 | | |

$ | 0.00025 | | |

$ | 0.00025 | |

| Net Tangible Book Value per Share of Common Stock before this Offering | |

$ | (0.000398 | ) | |

$ | (0.000398 | ) | |

$ | (0.000398 | ) | |

$ | (0.000398 | ) |

| Increase in Net Tangible Book Value per Share Attributable to New Investors in this Offering | |

$ | 0.000617 | | |

$ | 0.000607 | | |

$ | 0.000589 | | |

$ | 0.000540 | |

| Net Tangible Book Value per Share of Common Stock after this Offering | |

$ | 0.000219 | | |

$ | 0.000209 | | |

$ | 0.000191 | | |

$ | 0.000141 | |

| Dilution per share to Investors in the Offering | |

$ | (0.000031 | ) | |

$ | (0.000041 | ) | |

$ | (0.000059 | ) | |

$ | (0.000109 | ) |

There is no material disparity between the price

of the Shares in this Offering and the effective cash cost to officers, directors, promoters and affiliated persons for shares acquired

by them in a transaction during the past year, or that they have a right to acquire.

PLAN OF DISTRIBUTION

We are offering a Maximum Offering of up to $3,250,000

in Shares of our Common Stock. The offering is being conducted on a best-efforts basis without any minimum number of shares or amount

of proceeds required to be sold. There is no minimum subscription amount required (other than a per investor minimum purchase) to distribute

funds to the Company. The Company will not initially sell the Shares through commissioned broker-dealers, but may do so after the commencement

of the offering. Any such arrangement will add to our expenses in connection with the offering. If we engage one or more commissioned

sales agents or underwriters, we will supplement this Form 1-A POS to describe the arrangement. Subscribers have no right to a return

of their funds. The Company may terminate the offering at any time for any reason at its sole discretion, and may extend the Offering

past the termination date of 365 days from the date of qualification by the Commission in the absolute discretion of the Company and

in accordance with the rules and provisions of Regulation A of the JOBS Act. None of the Shares being sold in this Offering are being

sold by existing securities holders.

After the Offering Statement has been qualified

by the Securities and Exchange Commission (the “SEC”), the Company will accept tenders of funds to purchase the Shares. No

escrow agent is involved and the Company will receive the proceeds directly from any subscription. You will be required to complete a

subscription agreement in order to invest.

All subscription agreements and checks received

by the Company for the purchase of shares are irrevocable until accepted or rejected by the Company and should be delivered to the Company

as provided in the subscription agreement. A subscription agreement executed by a subscriber is not binding on the Company until it is

accepted on our behalf by the Company’s Chief Executive Officer or by specific resolution of our board of directors. Any subscription

not accepted within 30 days will be automatically deemed rejected. Once accepted, the Company will deliver a stock certificate to a purchaser

within five days from request by the purchaser; otherwise, purchasers’ shares will be noted and held on the book records of the

Company.

The Company, by determination of the Board of

Directors, in its sole discretion, may issue the Securities under this Offering for cash, promissory notes, services, and/or other consideration

without notice to subscribers.

At this time no broker-dealer registered with

the SEC and a member of the Financial Industry Regulatory Authority (“FINRA”), is being engaged as an underwriter or for any

other purpose in connection with this Offering. This Offering will commence on the qualification of this Offering Circular, as determined

by the Securities and Exchange Commission and continue for a period of 365 days. The Company may extend the Offering for an additional

time period unless the Offering is completed or otherwise terminated by us, or unless we are required to terminate by application of

Regulation A of the JOBS Act. Funds received from investors will be counted towards the Offering only if the form of payment, such as

a check or wire transfer, clears the banking system and represents immediately available funds held by us prior to the termination of

the subscription period, or prior to the termination of the extended subscription period if extended by the Company.

This is an offering made under “Tier

1” of Regulation A, and the shares will not be listed on a registered national securities exchange upon qualification.

Therefore, the shares will be sold only to a person if the aggregate purchase price paid by such person is no more than 10% of the

greater of such person’s annual income or net worth, not including the value of his primary residence, as calculated under

Rule 501 of Regulation D promulgated under Section 4(a)(2) of the Securities Act of 1933, as amended. In the case of sales to

fiduciary accounts (Keogh Plans, Individual Retirement Accounts (IRAs) and Qualified Pension/Profit Sharing Plans or Trusts), the

above suitability standards must be met by the fiduciary account, the beneficiary of the fiduciary account, or by the donor who

directly or indirectly supplies the funds for the purchase of the shares. Investor suitability standards in certain states may be

higher than those described in this Form 1-A POS and/or Offering Circular. These standards represent minimum suitability

requirements for prospective investors, and the satisfaction of such standards does not necessarily mean that an investment in the

Company is suitable for such persons. Different rules apply to accredited investors.

Each investor must represent in writing that

he/she/it meets the applicable requirements set forth above and in the Subscription Agreement, including, among other things, that (i)

he/she/it is purchasing the shares for his/her/its own account and (ii) he/she/it has such knowledge and experience in financial and

business matters that he/she/it is capable of evaluating without outside assistance the merits and risks of investing in the shares,

or he/she/it and his/her/its purchaser representative together have such knowledge and experience that they are capable of evaluating

the merits and risks of investing in the shares. Broker-dealers and other persons participating in the offering must make a reasonable

inquiry in order to verify an investor’s suitability for an investment in the Company. Transferees of the shares will be required to

meet the above suitability standards.

The shares may not be offered, sold, transferred,

or delivered, directly or indirectly, to any person who (i) is named on the list of “specially designated nationals” or “blocked

persons” maintained by the U.S. Office of Foreign Assets Control (“OFAC”) at www.ustreas.gov/offices/enforcement/ofac/sdn

or as otherwise published from time to time, (ii) an agency of the government of a Sanctioned Country, (iii) an organization controlled

by a Sanctioned Country, or (iv) is a person residing in a Sanctioned Country, to the extent subject to a sanctions program administered

by OFAC. A “Sanctioned Country” means a country subject to a sanctions program identified on the list maintained by OFAC and

available at www.ustreas.gov/offices/enforcement/ofac/sdn or as otherwise published from time to time. Furthermore, the shares may not

be offered, sold, transferred, or delivered, directly or indirectly, to any person who (i) has more than fifteen percent (15%) of its

assets in Sanctioned Countries or (ii) derives more than fifteen percent (15%) of its operating income from investments in, or transactions

with, sanctioned persons or Sanctioned Countries.

OTC Markets Considerations

The OTC Markets is separate and distinct from

the New York Stock Exchange and Nasdaq stock market or other national exchange. Neither the New York Stock Exchange nor Nasdaq has a

business relationship with issuers of securities quoted on the OTC Markets. The SEC’s order handling rules, which apply to New

York Stock Exchange and Nasdaq-listed securities, do not apply to securities quoted on the OTC Markets.

Although other national stock markets have rigorous

listing standards to ensure the high quality of their issuers and can delist issuers for not meeting those standards; the OTC Markets

has no listing standards. Rather, it is the market maker who chooses to quote a security on the system, files the application, and is

obligated to comply with keeping information about the issuer in its files.

Investors may have greater difficulty in getting

orders filled than if we were on Nasdaq or other exchanges. Trading activity in general is not conducted as efficiently and effectively

on OTC Markets as with exchange-listed securities. Also, because OTC Markets stocks are usually not followed by analysts, there may be

lower trading volume than New York Stock Exchange and Nasdaq-listed securities.

USE OF PROCEEDS TO ISSUER

The Use of Proceeds is an estimate based on the

Company’s current business plan. We may find it necessary or advisable to reallocate portions of the net proceeds reserved for one category

to another, or to add additional categories, and we will have broad discretion in doing so.

The maximum gross proceeds from the sale of the

Shares in this Offering are $3,250,000 The net proceeds from the offering payable to the Company, assuming it is fully subscribed, are

expected to be approximately $3,225,000 after the payment of offering costs such as printing, mailing, marketing, legal and accounting

costs, and other compliance and professional fees that may be incurred. The estimate of the budget for offering costs is an estimate only

and the actual offering costs may differ from those expected by management.

Management of the Company has wide latitude and

discretion in the use of proceeds from this Offering. Ultimately, management of the Company intends to use substantially all of the net

proceeds for general working capital and acquisitions. At present, management’s best estimate of the use of proceeds, at various funding

milestones, is set out in the chart below. However, potential investors should note that this chart contains only the best estimates

of the Company’s management based upon information available to them at the present time, and that the actual use of proceeds is likely

to vary from this chart based upon circumstances as they exist in the future, various needs of the Company at different times in the

future, and the discretion of the Company’s management at all times.

A portion of the proceeds from this Offering

may be used to compensate or otherwise make payments to officers or directors of the issuer. The officers and directors of the Company

may be paid salaries and receive benefits that are commensurate with similar companies, and a portion of the proceeds may be used to

pay these ongoing business expenses.

USE OF PROCEEDS

| $0.00025 Offering Price : |

10% |

25% |

50% |

75% |

100% |

| Smart Cities Project |

$200,000 |

$400,000 |

$800,000 |

$1,537,500 |

$2,150,000 |

| Cybergrab Software Launch |

$20,000 |

$50,000 |

$100,000 |

$100,000 |

$100,000 |

| Operations and Marketing |

$105,000 |

$362,500 |

$725,000 |

$800,000 |

$1,000,000 |

| Total |

$325,000 |

$812,500 |

$1,625,000 |

$2,437,500 |

$3,250,000 |

The expected use of net proceeds from this Offering

represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business

conditions evolve and change. The amounts and timing of our actual expenditures, specifically with respect to working capital, may vary

significantly depending on numerous factors. The precise amounts that we will devote to each of the foregoing items, and the timing of

expenditures, will vary depending on numerous factors. As a result, our management will retain broad discretion over the allocation of

the net proceeds from this Offering.

In the event we do not sell all the shares being

offered, we may seek additional financing from other sources in order to support the intended use of proceeds indicated above. If we

secure additional equity funding, investors in this Offering would be diluted. In all events, there can be no assurance that additional

financing would be available to us when wanted or needed and, if available, on terms acceptable to us.

The allocation of the use of proceeds among the

categories of anticipated expenditures represents management’s best estimates based on the current status of the Company’s

proposed operations, plans, investment objectives, capital requirements, and financial conditions. No assurances can be provided that

any milestone represented herein will be achieved. Future events, including changes in economic or competitive conditions of our business

plan or the completion of less than the total Offering amount, may cause the Company to modify the above-described allocation of proceeds.

The Company’s use of proceeds may vary significantly in the event any of the Company’s assumptions prove inaccurate. We reserve

the right to change the allocation of net proceeds from the Offering as unanticipated events or opportunities arise. Additionally, the

Company may from time to time need to raise more capital to address future needs.

The Company reserves the right to change the

use of proceeds set out herein based on the needs of the ongoing business of the Company and the discretion of the Company’s management.

The Company may reallocate the estimated use of proceeds among the various categories or for other uses if management deems such a reallocation

to be appropriate.

DESCRIPTION OF BUSINESS

Corporate History

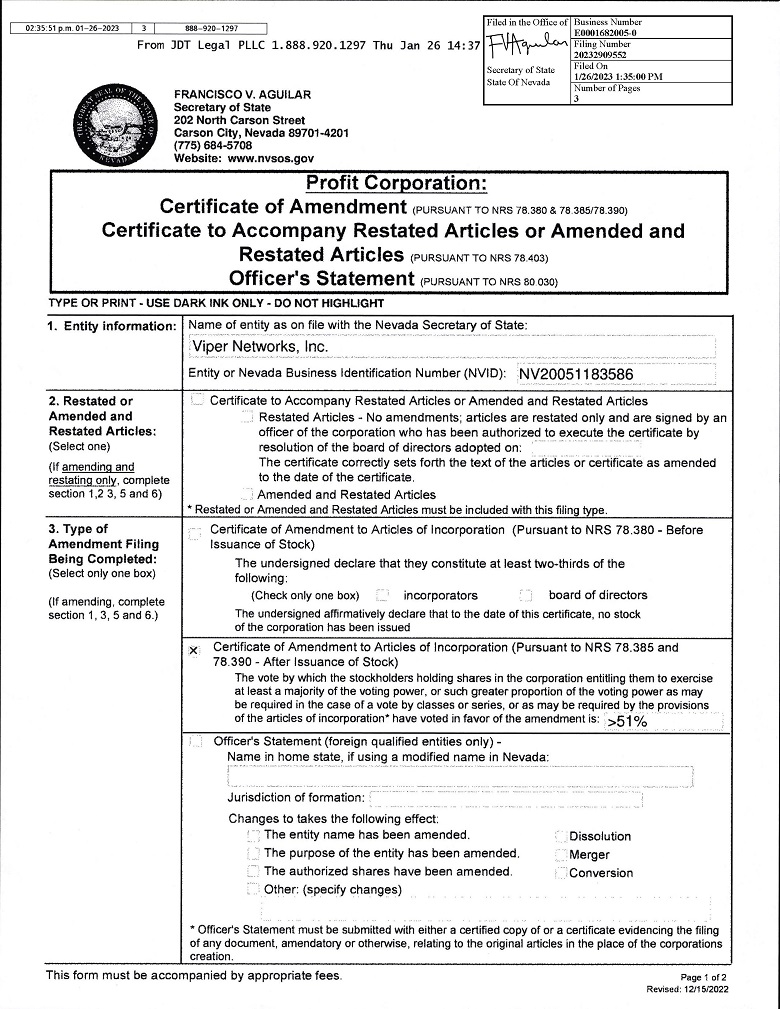

The Company was incorporated under the laws of

the State of Utah on February 28, 1983 as Tinglefoot Mining, Inc. On February 26, 1996, its name was changed to Baja Pacific International,

Inc. On October 7, 1998, its name was changed to Taig Ventures, Inc. On September 14, 2000, its name was changed to Viper Networks, Inc.

In May 2005, the Company redomiciled to the State of Nevada where it maintains an active registration in good standing.

Subsidiaries

None.

Plan of Operations

Viper Networks, Inc., a Nevada corporation, in partnership with Apollo

Metro, is a manufacturer and distributor of highly efficient LED lighting to provide superior turnkey LED lighting solutions for metropolitan

areas (streets and highways), parking lots and warehousing facilities anywhere. By combining LED Lighting, Wireless MESH, Sensors, Infrared

and Video into a single design; Apollo Metro Solutions’ proprietary line of wireless products can be applied to existing infrastructure

through streamlined system integration for a full selection of intelligent LED lighting solutions worldwide.

Viper Networks also provides telecom engineering

services for planning, network expansion and managed services to telecommunication service providers of various telecom networks in the

U.S., Middle East and Northern Africa with top tier expertise in wireless communications.

Our Products

We are a manufacturer and distributor of highly

efficient LED lighting solutions for metropolitan areas. We are launching Smart City Projects with Apollo Smart Lights as an intelligent

lighting solution that offers municipalities the ability to control and adjust street lighting while enabling them to monitor the streets,

enhance security, and manage traffic, all while cutting costs, reducing environmental footprint and unlocking revenue opportunities.

Employees

As of the date of this Offering Circular, the

Company has 25 employees, including its officers, of which 10 are full time. There is no collective agreement between the Company and

its employees. The employment relationship between employees and the Company are individual and standard for the industry.

Property

Our corporate offices are located at 200 E. Big Beaver Rd., Troy,

Michigan, 48083. At this address, Viper Networks occupies an office premises sufficient for its current needs.

MANAGEMENT’S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

Certain statements, other than purely historical