0000763744FALSE00007637442024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2024

| | | | | | | | | | | | | | |

| LCI INDUSTRIES |

| | | | |

| | | | |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 001-13646 | 13-3250533 |

| | | | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | |

| 3501 County Road 6 East, | Elkhart, | Indiana | 46514 |

| | | | |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| Registrant's telephone number, including area code: | (574) | 535-1125 |

| | | | |

| | | | |

| N/A |

| | | | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value | LCII | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On May 8, 2024, LCI Industries issued a press release setting forth LCI Industries' first quarter 2024 results. A copy of the press release is attached hereto as Exhibit 99.1.

An investor presentation that LCI Industries will refer to during its conference call to discuss the results is attached hereto as Exhibit 99.2 and will be posted on LCI Industries' investor relations website in advance of the call.

The foregoing information is furnished pursuant to Item 2.02, "Results of Operations and Financial Condition." Such information, including the Exhibits attached hereto, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

Exhibit Index:

| | | | | | | | |

| | |

| | Press Release dated May 8, 2024 |

| | |

| | Investor Presentation dated May 8, 2024 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

LCI INDUSTRIES |

(Registrant) |

|

|

By: /s/ Lillian D. Etzkorn Lillian D. Etzkorn Chief Financial Officer |

|

|

| Dated: | May 8, 2024 |

Exhibit 99.1 | | | | | | | | |

FOR IMMEDIATE RELEASE | | |

Contact: Lillian D. Etzkorn, CFO |

Phone: (574) 535-1125 |

E Mail: LCII@lci1.com |

| |

LCI INDUSTRIES REPORTS FIRST QUARTER FINANCIAL RESULTS

Robust margin expansion supported by performance of diversified businesses and consistent operational execution

First Quarter 2024 Highlights

•Net sales of $968 million in the first quarter, down 1% year-over-year

•Net income of $37 million, or $1.44 per diluted share, in the first quarter, up from $7 million, or $0.29 per diluted share, in the first quarter of 2023

•EBITDA of $90 million in the first quarter, up from $53 million in the first quarter of 2023

•Aftermarket Segment operating profit margin of 11.8% in the first quarter, up from 9.7% in the first quarter of 2023

•Inventory reduction of $34 million in the first quarter and down $175 million from the first quarter of 2023

•Quarterly dividend of $1.05 per share paid totaling $27 million in the first quarter

•Acquired furniture business of CWDS, LLC, a subsidiary of Camping World Holdings, Inc. in May 2024, expanding the Company's furniture portfolio to RV and marine OEM and aftermarket customers

Elkhart, Indiana - May 8, 2024 - LCI Industries (NYSE: LCII) which, through its wholly-owned subsidiary, Lippert Components, Inc. ("Lippert"), supplies, domestically and internationally, a broad array of highly engineered components for the leading original equipment manufacturers ("OEMs") in the recreation and transportation markets, and the related aftermarkets of those industries, today reported first quarter 2024 results.

"We delivered solid results in the first quarter, starting the year with healthy EBITDA generation and margin expansion supported by our strong operational focus and improved material costs. As we continue to diversify our business, strength in some of our growing markets like automotive aftermarket, housing, and our transportation businesses has consistently lifted profitability while adding a layer of durable, countercyclical revenue streams. We believe that our diversified markets will remain important drivers of Lippert’s profitable growth into the future,” commented Jason Lippert, LCI Industries’ President and Chief Executive Officer. “We are seeing signs of recovery in North American RV and expect a gradual improvement in production heading further into the year, led by towables where we typically provide the majority of our innovative RV content. Further, introductions of advanced products like our transformational ABS system are embedding us even deeper with key OEMs across our markets, creating opportunities for long-term content growth and serving as the catalyst for approximately $200 million in new business commitments for 2024.”

"We are committed to making continued operational improvements across our footprint, with a focus on creating flexible capacity while reducing costs. We continue to reduce inventory and focus on cash generation as we progress through the year. With our fortified balance sheet, we will continue investing in R&D and innovation while pursuing strategic growth opportunities and returning capital to shareholders,” continued Mr. Lippert. “Looking ahead, we are well-positioned to capture market share gains and advance our competitive position throughout 2024."

“I would like to thank all of the Lippert teams for their incredible dedication to serving our customers and improving our business as we work through lingering headwinds," commented Ryan Smith, LCI Industries' Group

President - North America. "Through our operational expertise, steeped in a culture of product quality and innovation, we will continue to facilitate sustainable growth for Lippert well into the future.”

First Quarter 2024 Results

Consolidated net sales for the first quarter of 2024 were $968.0 million, a decrease of 1% from 2023 first quarter net sales of $973.3 million. Net income in the first quarter of 2024 was $36.5 million, or $1.44 per diluted share, compared to $7.3 million, or $0.29 per diluted share, in the first quarter of 2023. EBITDA in the first quarter of 2024 was $90.3 million, compared to EBITDA of $52.5 million in the first quarter of 2023. Additional information regarding EBITDA, as well as reconciliations of this non-GAAP financial measure to the most directly comparable GAAP financial measure of net income, is provided in the "Supplementary Information - Reconciliation of Non-GAAP Measures" section below.

The decrease in year-over-year net sales for the first quarter of 2024 was primarily driven by lower North American marine production levels and decreased selling prices which are indexed to select commodities, mostly offset by increased North American RV wholesale shipments.

April 2024 Results

April 2024 consolidated net sales were approximately $378 million, up 12% from April 2023, primarily due to an approximate 17% increase in North American RV production, partially offset by an approximate 33% decline in marine sales compared to April 2023.

OEM Segment - First Quarter Performance

OEM net sales for the first quarter of 2024 were $758.3 million, an increase of $0.1 million compared to the same period of 2023. RV OEM net sales for the first quarter of 2024 were $459.6 million, up 15% compared to the same prior year period, driven by a 9% increase in North American RV wholesale shipments, partially offset by decreased selling prices which are indexed to select commodities. Adjacent Industries OEM net sales for the first quarter of 2024 were $298.7 million, down 17% year-over-year, primarily due to lower sales to North American marine OEMs. North American marine OEM net sales in the first quarter of 2024 were $65.4 million, down 45% year-over-year.

Operating profit of the OEM Segment was $32.8 million in the first quarter of 2024, or 4.3% of net sales, compared to an operating loss of $0.7 million, or (0.1)%, in the same period in 2023. The operating profit of the OEM Segment for the quarter was primarily driven by decreased material commodity and freight costs.

Aftermarket Segment - First Quarter Performance

Aftermarket net sales for the first quarter of 2024 were $209.7 million, down 3% year-over-year, primarily driven by lower volumes within marine markets and the impacts of inflation and elevated interest rates on consumers' discretionary spending, partially offset by growth in the automotive aftermarket driven by market share gains. Operating profit of the Aftermarket Segment was $24.8 million in the first quarter of 2024, or 11.8% of net sales, compared to an operating profit of $20.8 million, or 9.7%, in the same period in 2023. The operating profit expansion of the Aftermarket Segment for the quarter was primarily driven by decreased commodity and freight costs as well as pricing changes to targeted products.

“We achieved another quarter of strong profitability in Aftermarket, expanding operating margins by over 200 basis points. Robust demand from the automotive aftermarket, in addition to the growing need for repair, replacement, and upgrades in RV and other adjacencies we serve, are providing a strong tailwind for the business,” Jamie Schnur, LCI Industries’ Group President – Aftermarket commented. “As Jason mentioned, Aftermarket is consistently

supporting Lippert’s overall profitability in a challenging environment. We are excited to continue this progress, providing our customers with best-in-class service and innovative new products, as we head further into 2024.”

Income Taxes

The Company's effective tax rate was 24.3% for the quarter ended March 31, 2024, compared to 24.8% for the quarter ended March 31, 2023. The decrease in the effective tax rate was primarily due to decreases in non-deductible executive compensation costs and effective state tax rates.

Balance Sheet and Other Items

At March 31, 2024, the Company's cash and cash equivalents balance was $22.6 million, compared to $66.2 million at December 31, 2023. The Company used $26.7 million for dividend payments to shareholders and $8.6 million for capital expenditures in the three months ended March 31, 2024.

The Company remained focused on inventory reductions to improve cash generation and optimize working capital in the first quarter. As of March 31, 2024, the Company's net inventory balance was $734.4 million, down from $768.4 million at December 31, 2023 and $909.4 million at March 31, 2023.

The Company's outstanding long-term indebtedness, including current maturities, was $855.3 million at March 31, 2024, and the Company was in compliance with its debt covenants.

Conference Call & Webcast

LCI Industries will host a conference call to discuss its first quarter results on Wednesday, May 8, 2024, at 8:30 a.m. Eastern time, which may be accessed by dialing (833) 470-1428 for participants in the U.S. and (929) 526-1599 for participants outside the U.S. using the required conference ID 327802. Due to the high volume of companies reporting earnings at this time, please be prepared for hold times of up to 15 minutes when dialing in to the call. In addition, an online, real-time webcast, as well as a supplemental earnings presentation, can be accessed on the Company's website, www.investors.lci1.com.

A replay of the conference call will be available for two weeks by dialing (866) 813-9403 for participants in the U.S. and (44) 204-525-0658 for participants outside the U.S. and referencing access code 453124. A replay of the webcast will be available on the Company’s website immediately following the conclusion of the call.

About LCI Industries

LCI Industries, through its wholly-owned subsidiary, Lippert, supplies, domestically and internationally, a broad array of highly engineered components for the leading OEMs in the recreation and transportation markets, consisting primarily of recreational vehicles and adjacent industries, including boats; buses; trailers used to haul boats, livestock, equipment, and other cargo; trucks; trains; manufactured homes; and modular housing. The Company also supplies engineered components to the related aftermarkets of these industries, primarily by selling to retail dealers, wholesale distributors, and service centers, as well as direct to retail customers via the Internet. Lippert's products include steel chassis and related components; axles and suspension solutions; slide-out mechanisms and solutions; thermoformed bath, kitchen, and other products; vinyl, aluminum, and frameless windows; manual, electric, and hydraulic stabilizer and leveling systems; entry, luggage, patio, and ramp doors; furniture and mattresses; electric and manual entry steps; awnings and awning accessories; towing products; truck accessories; electronic components; appliances; air conditioners; televisions and sound systems; tankless water heaters; and other accessories. Additional information about Lippert and its products can be found at www.lippert.com.

Forward-Looking Statements

This press release contains certain "forward-looking statements" with respect to our financial condition, results of operations, profitability, margin growth, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company's

common stock, the impact of legal proceedings, and other matters. Statements in this press release that are not historical facts are "forward-looking statements" for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties.

Forward-looking statements, including, without limitation, those relating to production levels, future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, commodity prices, addressable markets, and industry trends, whenever they occur in this press release are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this press release, the impacts of future pandemics, geopolitical tensions, armed conflicts, or natural disasters on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices, and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company's subsequent filings with the Securities and Exchange Commission. Readers of this press release are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

###

LCI INDUSTRIES

OPERATING RESULTS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | | | Last Twelve |

| | 2024 | | 2023 | | | | | | Months |

| (In thousands, except per share amounts) | | | | | | | | | |

| | | | | | | | | |

| Net sales | $ | 968,029 | | | $ | 973,310 | | | | | | | $ | 3,779,527 | |

| Cost of sales | 744,123 | | | 787,239 | | | | | | | 2,965,502 | |

| Gross profit | 223,906 | | | 186,071 | | | | | | | 814,025 | |

| Selling, general and administrative expenses | 166,295 | | | 166,028 | | | | | | | 653,029 | |

| | | | | | | | | |

| Operating profit | 57,611 | | | 20,043 | | | | | | | 160,996 | |

| Interest expense, net | 9,321 | | | 10,394 | | | | | | | 39,351 | |

| Income before income taxes | 48,290 | | | 9,649 | | | | | | | 121,645 | |

| Provision for income taxes | 11,745 | | | 2,390 | | | | | | | 28,164 | |

| Net income | $ | 36,545 | | | $ | 7,259 | | | | | | | $ | 93,481 | |

| | | | | | | | | |

| Net income per common share: | | | | | | | | | |

| Basic | $ | 1.44 | | | $ | 0.29 | | | | | | | $ | 3.69 | |

| Diluted | $ | 1.44 | | | $ | 0.29 | | | | | | | $ | 3.67 | |

| | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic | 25,374 | | | 25,228 | | | | | | | 25,350 | |

| Diluted | 25,389 | | | 25,293 | | | | | | | 25,468 | |

| | | | | | | | | |

| Depreciation | $ | 18,585 | | | $ | 18,250 | | | | | | | $ | 75,028 | |

| Amortization | $ | 14,104 | | | $ | 14,249 | | | | | | | $ | 56,930 | |

| Capital expenditures | $ | 8,608 | | | $ | 17,159 | | | | | | | $ | 53,658 | |

LCI INDUSTRIES

SEGMENT RESULTS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | | | Last Twelve |

| 2024 | | 2023 | | | | | | Months |

| (In thousands) | | | | | | | | | |

| Net sales: | | | | | | | | | |

| OEM Segment: | | | | | | | | | |

| RV OEMs: | | | | | | | | | |

| Travel trailers and fifth-wheels | $ | 390,763 | | | $ | 330,553 | | | | | | | $ | 1,419,063 | |

| Motorhomes | 68,838 | | | 69,551 | | | | | | | 268,643 | |

| Adjacent Industries OEMs | 298,710 | | | 358,069 | | | | | | | 1,216,174 | |

| Total OEM Segment net sales | 758,311 | | | 758,173 | | | | | | | 2,903,880 | |

| Aftermarket Segment: | | | | | | | | | |

| Total Aftermarket Segment net sales | 209,718 | | | 215,137 | | | | | | | 875,647 | |

| Total net sales | $ | 968,029 | | | $ | 973,310 | | | | | | | $ | 3,779,527 | |

| | | | | | | | | |

| Operating profit (loss): | | | | | | | | | |

| OEM Segment | $ | 32,836 | | | $ | (721) | | | | | | | $ | 50,918 | |

| Aftermarket Segment | 24,775 | | | 20,764 | | | | | | | 110,078 | |

| | | | | | | | | |

| | | | | | | | | |

| Total operating profit | $ | 57,611 | | | $ | 20,043 | | | | | | | $ | 160,996 | |

| | | | | | | | | |

| Depreciation and amortization: | | | | | | | | | |

| OEM Segment depreciation | $ | 14,035 | | | $ | 14,350 | | | | | | | $ | 58,082 | |

| Aftermarket Segment depreciation | 4,550 | | | 3,900 | | | | | | | 16,946 | |

| Total depreciation | $ | 18,585 | | | $ | 18,250 | | | | | | | $ | 75,028 | |

| | | | | | | | | |

| OEM Segment amortization | $ | 10,280 | | | $ | 10,450 | | | | | | | $ | 41,409 | |

| Aftermarket Segment amortization | 3,824 | | | 3,799 | | | | | | | 15,521 | |

| Total amortization | $ | 14,104 | | | $ | 14,249 | | | | | | | $ | 56,930 | |

LCI INDUSTRIES

BALANCE SHEET INFORMATION

(unaudited)

| | | | | | | | | | | | | |

| | March 31, | | | | December 31, |

| | 2024 | | | | 2023 |

| (In thousands) | | | | | |

| | | | | |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 22,625 | | | | | $ | 66,157 | |

| | | | | |

| Accounts receivable, net | 344,406 | | | | | 214,707 | |

| Inventories, net | 734,360 | | | | | 768,407 | |

| Prepaid expenses and other current assets | 68,068 | | | | | 67,599 | |

| Total current assets | 1,169,459 | | | | | 1,116,870 | |

| Fixed assets, net | 454,071 | | | | | 465,781 | |

| Goodwill | 587,791 | | | | | 589,550 | |

| Other intangible assets, net | 432,728 | | | | | 448,759 | |

| Operating lease right-of-use assets | 242,442 | | | | | 245,388 | |

| | | | | |

| Other long-term assets | 94,845 | | | | | 92,971 | |

| Total assets | $ | 2,981,336 | | | | | $ | 2,959,319 | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

| Current liabilities | | | | | |

| Current maturities of long-term indebtedness | $ | 568 | | | | | $ | 589 | |

| Accounts payable, trade | 193,933 | | | | | 183,697 | |

| | | | | |

| Current portion of operating lease obligations | 37,322 | | | | | 36,269 | |

| Accrued expenses and other current liabilities | 177,217 | | | | | 174,437 | |

| Total current liabilities | 409,040 | | | | | 394,992 | |

| Long-term indebtedness | 854,774 | | | | | 846,834 | |

| Operating lease obligations | 218,236 | | | | | 222,680 | |

| Deferred taxes | 31,211 | | | | | 32,345 | |

| Other long-term liabilities | 111,191 | | | | | 107,432 | |

| Total liabilities | 1,624,452 | | | | | 1,604,283 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total stockholders' equity | 1,356,884 | | | | | 1,355,036 | |

| Total liabilities and stockholders' equity | $ | 2,981,336 | | | | | $ | 2,959,319 | |

LCI INDUSTRIES

SUMMARY OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| | Three Months Ended

March 31, |

| | 2024 | | 2023 |

| (In thousands) | | | |

| Cash flows from operating activities: | | | |

| Net income | $ | 36,545 | | | $ | 7,259 | |

| Adjustments to reconcile net income to cash flows (used in) provided by operating activities: | | | |

| Depreciation and amortization | 32,689 | | | 32,499 | |

| Stock-based compensation expense | 4,327 | | | 4,695 | |

| | | |

| Other non-cash items | 1,107 | | | 877 | |

| Changes in assets and liabilities, net of acquisitions of businesses: | | | |

| Accounts receivable, net | (131,059) | | | (123,072) | |

| Inventories, net | 32,892 | | | 131,708 | |

| Prepaid expenses and other assets | (2,392) | | | 5,577 | |

| Accounts payable, trade | 12,038 | | | 25,822 | |

| Accrued expenses and other liabilities | 6,199 | | | (10,689) | |

| Net cash flows (used in) provided by operating activities | (7,654) | | | 74,676 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (8,608) | | | (17,159) | |

| Acquisitions of businesses | — | | | (6,250) | |

| | | |

| | | |

| Other investing activities | 173 | | | 1,960 | |

| Net cash flows used in investing activities | (8,435) | | | (21,449) | |

| Cash flows from financing activities: | | | |

| Vesting of stock-based awards, net of shares tendered for payment of taxes | (9,040) | | | (8,888) | |

| Proceeds from revolving credit facility | 86,248 | | | 165,300 | |

| Repayments under revolving credit facility | (76,927) | | | (201,385) | |

| | | |

| Repayments under term loan and other borrowings | (5) | | | (5,276) | |

| | | |

| | | |

| | | |

| | | |

| Payment of dividends | (26,721) | | | (26,563) | |

| | | |

| | | |

| Other financing activities | (2) | | | (12) | |

| Net cash flows used in financing activities | (26,447) | | | (76,824) | |

| Effect of exchange rate changes on cash and cash equivalents | (996) | | | (437) | |

| Net decrease in cash and cash equivalents | (43,532) | | | (24,034) | |

| Cash and cash equivalents at beginning of period | 66,157 | | | 47,499 | |

| Cash and cash equivalents at end of period | $ | 22,625 | | | $ | 23,465 | |

LCI INDUSTRIES

SUPPLEMENTARY INFORMATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | |

| | | March 31, | | Last Twelve | |

| | | | | 2024 | | 2023 | | Months | |

Industry Data(1) (in thousands of units): | | | | | | | | | | |

| Industry Wholesale Production: | | | | | | | | | | |

| Travel trailer and fifth-wheel RVs | | | | | 73.5 | | | 62.7 | | | 269.9 | | |

| Motorhome RVs | | | | | 10.4 | | | 13.4 | | | 42.9 | | |

| Industry Retail Sales: | | | | | | | | | | |

| Travel trailer and fifth-wheel RVs | | | | | 66.4 | | (2) | 71.8 | | | 321.1 | | (2) |

| Impact on dealer inventories | | | | | 7.1 | | (2) | (9.1) | | | (51.2) | | (2) |

| Motorhome RVs | | | | | 9.9 | | (2) | 11.0 | | | 44.1 | | (2) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | Twelve Months Ended | | | |

| | | | | March 31, | | | |

| | | | | 2024 | | 2023 | | | |

| Lippert Content Per Industry Unit Produced: | | | | | | | |

| Travel trailer and fifth-wheel RV | | | | | $ | 5,097 | | | $ | 5,861 | | | | |

| Motorhome RV | | | | | $ | 3,656 | | | $ | 3,993 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | March 31, | | December 31, | |

| | | | | 2024 | | 2023 | | 2023 | |

Balance Sheet Data (debt availability in millions): | | | | | | | |

Remaining availability under the revolving credit facility (3) | | $ | 153.8 | | | $ | 318.2 | | | $ | 245.3 | | |

| Days sales in accounts receivable, based on last twelve months | | 30.5 | | | 27.9 | | | 30.1 | | |

| Inventory turns, based on last twelve months | | 3.7 | | | 3.3 | | | 3.5 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | 2024 | | | |

| Estimated Full Year Data: | | | | | | | | | | |

| Capital expenditures | | | | | $55 - $75 million | | | |

| Depreciation and amortization | | | | | $130 - $140 million | | | |

| Stock-based compensation expense | | | | | $18 - $23 million | | | |

Annual tax rate | | | | | 24% - 26% | | | |

| | | | | | | | | | |

(1) Industry wholesale production data for travel trailer and fifth-wheel RVs and motorhome RVs provided by the Recreation Vehicle Industry Association. Industry retail sales data provided by Statistical Surveys, Inc.

(2) March 2024 retail sales data for RVs has not been published yet, therefore 2024 retail data for RVs includes an estimate for March 2024 retail units. Retail sales data will likely be revised upwards in future months as various states report.

(3) Remaining availability under the revolving credit facility is subject to covenant restrictions.

LCI INDUSTRIES

SUPPLEMENTARY INFORMATION

RECONCILIATION OF NON-GAAP MEASURES

(unaudited)

The following table reconciles net income to EBITDA.

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| (In thousands) | | | | | | | |

| Net income | $ | 36,545 | | | $ | 7,259 | | | | | |

| Interest expense, net | 9,321 | | | 10,394 | | | | | |

| Provision for income taxes | 11,745 | | | 2,390 | | | | | |

| Depreciation expense | 18,585 | | | 18,250 | | | | | |

| Amortization expense | 14,104 | | | 14,249 | | | | | |

| EBITDA | $ | 90,300 | | | $ | 52,542 | | | | | |

| | | | | | | |

| | | | | | | |

In addition to reporting financial results in accordance with U.S. GAAP, the Company has provided the non-GAAP performance measure of EBITDA to illustrate and improve comparability of its results from period to period. EBITDA is defined as net income before interest expense, net, provision for income taxes, depreciation expense, and amortization expense during the three month periods ended March 31, 2024 and 2023. The Company considers this non-GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. The measure is not in accordance with, nor is it a substitute for, GAAP measures, and it may not be comparable to similarly titled measures used by other companies.

LCI Industries Q1 2024 Earnings Conference Call May 8, 2024 1

FORWARD-LOOKING STATEMENTS This presentation contains certain “forward-looking statements” with respect to our financial condition, results of operations, profitability, margin growth, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company’s common stock, the impact of legal proceedings, and other matters. Statements in this presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties. Forward-looking statements, including, without limitation, those relating to the Company's future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, commodity prices and industry trends, whenever they occur in this presentation are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this presentation, the impacts of future pandemics, geopolitical tensions, armed conflicts, or natural disaster on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company’s subsequent filings with the Securities and Exchange Commission, including the Company's Quarterly Reports on the 10-Q. Readers of this presentation are cautioned not to place undue reliance on these forward- looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law. This presentation includes certain non-GAAP financial measures, such as EBITDA, net debt to EBITDA leverage, and free cash flow. These non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure are included in the presentation. 2

First Quarter 2024 Highlights Financial Performance ■ Net sales of $968 million in the first quarter, down 1% year-over-year ■ Net income of $37 million in the first quarter, up 403% year-over-year ■ EBITDA1 of $90 million in the first quarter, up 72% year-over-year ■ Inventory reductions of $34 million in the first quarter of 2024 Diversification and operational execution supporting enhanced profitability Executing on Diversification ■ Resilience in Aftermarket, international, and other adjacencies are supporting profitability ■ Aftermarket and adjacent industries currently make up 57% of total Company sales Expanding Industry Presence ■ 10+ top towable RV brands using ABS brakes, growing market share into double-digits ■ Acquired furniture business assets of Camping World Holdings Inc. subsidiary in May 2024 in a joint effort to further improve the customer experience and strategically expand Lippert's offerings 3 1 Additional information regarding EBITDA and free cash flow, as well as reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure, is provided in the Appendix 2 For twelve months ended March 31, 2024 Balanced Capital Allocation ■ Returned $27 million of capital to shareholders with quarterly dividend ■ Disciplined spending on capital expenditures with $9 million in the first quarter, compared to $17 million in the first quarter of 2023

Performance and Trends • 73,500 wholesale towable units shipped in Q1 2024, up 17% YOY • Q1 2024 RV OEM sales up 15% YoY • Current 2024 North American forecast of 325 - 350k wholesale units • April 2024 net sales up 12% over April 2023, reflecting gradual industry recovery RV OEM - NET SALES Content per Wholesale Unit • Travel trailer and fifth-wheel RV content of $5,097 for Q1 20241, up 1% sequentially over Q4 2023 • Motorhome content of $3,656 for Q1 20241, up 4% sequentially over Q4 2023 4 Net Sales (in thousands) 1 For twelve months ended March 31, 2024

Performance and Trends • Q1 2024 Adjacent Industries sales down 17% YoY • Decrease primarily driven by declines in the Marine market due to inflation and elevated interest rates impacting retail consumers ◦ Anticipating that pressure on marine sales will start decreasing toward the end of the year • Leveraging innovation to expand Marine content through products like our shallow anchor systems, thrusters, seating, and electric biminis • Resiliency in transit, utility trailer, and building products markets have lessened the impact from NA marine softness ADJACENT INDUSTRIES OEM - NET SALES 5 Net Sales (in thousands)

Performance and Trends • Q1 2024 sales down 3% year over year, driven by softness in the marine market, partially offset by growth in the automotive aftermarket • 220bps YOY margin expansion driven by decreased commodity costs and pricing changes to targeted products • Innovation driving ongoing portfolio expansion through sophisticated products, catering to the new generation of outdoor enthusiasts • Thousands of RV units continue to enter the repair and replacement cycle AFTERMARKET SEGMENT 6 Net Sales (in thousands)

Performance and Trends • Q1 2024 sales up 5% YoY • Maintaining focus on introducing popular European products in North American markets, including window blinds, pop top, and B-vans • International results include RV OEM, Adjacent Industries OEM, and Aftermarket net sales • Continue to see positive results and demand in international adjacent industries such as our Rail business INTERNATIONAL BUSINESS - NET SALES 7 Net Sales (in thousands)

INNOVATION AS A CULTURE Constant innovation continues to drive long-term content expansion Continued focus on innovation has resulted in a record number of product introductions in the last 10 years 8 Independent Suspension Furrion® 18K Chill Cube Air Conditioner Solera® 3000 Off-Grid Series Solar awning Titan Leveling Systems Towable & Motorized CURT® Enhanced Pin Box Solutions OneControl® Auto featuring True Course ABS (Anti-Lock Braking System) SureShade® Forward Facing Power Bimini New Window Designs and Integrated Shades DoubleCOOL Acrylic Cooling Solutions

GROWTH STRATEGY Prioritizing ample liquidity and investments back into the company Balanced Capital Allocation Strategy • Reduce leverage • Investment in the business, with focus on automation projects • Execute strategic acquisitions and divestitures • Return capital to shareholders Continue Execution of our Diversification Strategy • Expanding market share in our Non-RV OEM channel to increase stability • Continue to expand offerings in our various markets through innovations and acquisitions Leveraging Strengths to Win Market Share • Continue to innovate, bringing new and useful offerings to the space • Focusing on long term content per unit growth in all groups • Unlocking cross-selling opportunities through new acquisitions and partnerships 9

Q1 2024 FINANCIAL PERFORMANCE * Additional information regarding EBITDA, as well as reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in the Appendix. 10

As of and for the three months ended March 31 LIQUIDITY AND CASH FLOW 2024 2023 Cash and Cash Equivalents $23M $23M Remaining Availability under Revolving Credit Facility(1) $154M $318M Capital Expenditures $9M $17M Dividends $27M $27M Debt / Net Income (TTM) 9.2x 5.2x Net Debt/EBITDA (TTM)(2)(3) 2.9x 2.4x Cash from Operating Activities $(8)M $75M Free Cash Flow(4) $(16)M $58M (1) Remaining availability under the revolving credit facility is subject to covenant restrictions. (2) 2024 Net Debt/EBITDA ratio is a non-GAAP financial measure and is calculated as follows: Debt of $855M, less Cash of $23M, resulted in Net Debt of $833M at March 31, 2024, divided by Earnings Before Interest, Taxes, Depreciation, and Amortization, "EBITDA" (Net Income of $93M adding back Interest of $39M, Taxes of $28M, and Depreciation and Amortization of $132M), resulting in $292M EBITDA for the twelve months ended March 31, 2024. The GAAP debt / Net income ratio was $855M / $93M or 9.2x. The leverage ratio formula for our debt covenants under our credit agreement contain additional adjustments not included in the non-GAAP measure presented above. (3) 2023 Net Debt/EBITDA ratio is a non-GAAP financial measure and is calculated as follows: Debt of $1,081M, less Cash of $23M, resulted in Net Debt of $1,058M at March 31, 2023, divided by EBITDA (Net Income of $206M, adding back Interest of $32M, Taxes of $66M, and Depreciation and Amortization of $130M), resulting in $434M EBITDA for the twelve months ended March 31, 2023. The GAAP debt / Net income ratio was $1,081M / $206M or 5.2x. (4) Additional information regarding free cash flow, as well as a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in the Appendix. 11

Reconciliation of Non-GAAP Measures APPENDIX EBITDA Three Months Ended March 31, ($ in thousands) 2024 2023 Net income $ 36,545 $ 7,259 Interest expense, net 9,321 10,394 Provision for income taxes 11,745 2,390 Depreciation and amortization 32,689 32,499 EBITDA $ 90,300 $ 52,542 FREE CASH FLOW Three Months Ended March 31, ($ in thousands) 2024 2023 Net cash flows (used in) provided by operating activities $ (7,654) $ 74,676 Capital expenditures (8,608) (17,159) Free cash flow $ (16,262) $ 57,517 12 EBITDA and free cash flow are non-GAAP performance measures included to illustrate and improve comparability of the Company's results from period to period. EBITDA is defined as net income (loss) before interest expense, provision (benefit) for income taxes, depreciation and amortization expense. Free cash flow is defined as net cash flows provided by operating activities minus capital expenditures. The Company considers these non-GAAP measures in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because they provide a useful analysis of ongoing underlying trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies.

13

v3.24.1.u1

Cover

|

May 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 08, 2024

|

| Entity Registrant Name |

LCI INDUSTRIES

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13646

|

| Entity Tax Identification Number |

13-3250533

|

| Entity Address, Address Line One |

3501 County Road 6 East,

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46514

|

| City Area Code |

(574)

|

| Local Phone Number |

535-1125

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

LCII

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0000763744

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

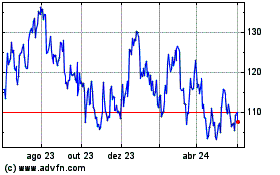

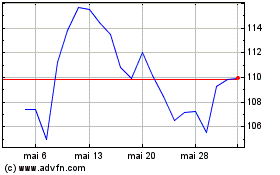

LCI Industries (NYSE:LCII)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

LCI Industries (NYSE:LCII)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024