1 INVESTOR PRESENTATION Q 1 | M AY 2 0 2 4 | N A S D A Q : M Y R G

2 Various statements in this announcement, including those that express a belief, expectation, or intention, as well as those that are not statements of historical fact, are forward-looking statements. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future production, revenue, income, capital spending, segment improvements and investments. Forward-looking statements are generally accompanied by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “likely,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should,” “unlikely” or other words that convey the uncertainty of future events or outcomes. The forward-looking statements in this announcement speak only as of the date of this announcement. We disclaim any obligation to update these statements (unless required by securities laws), and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. Forward-looking statements in this announcement should be evaluated together with the many uncertainties that affect MYR Group’s business, particularly those mentioned in the risk factors and cautionary statements in Item 1A of MYR Group’s most recent Annual Report on Form 10-K, and in any risk factors or cautionary statements contained in MYR Group’s Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. SAFE HARBOR NOTICE FORWARD-LOOKING STATEMENTS

3 QUALITY SOLUTIONS FOR INCREASED ELECTRIFICATION 65+ OFFICE LOCATIONS MYR Group Inc. is a holding company of subsidiaries that have delivered some of the largest and most notable electrical infrastructure and commercial and industrial projects throughout the United States and Canada, since 1891. MYR GROUP INC. - A MARKET LEADER IN ELECTRICAL CONSTRUCTION CONTINUED GROWTH Healthy organic and acquisitive growth SUPERIOR SAFETY CULTURE Performance that exceeds industry standards; 2023 stats: TCIR – 1.13 LTIR - 0.14 ESSENTIAL CLEAN ENERGY CONTRACTOR Providing superior electrical infrastructure services that support the clean energy transformation STRONG FINANCIALS Growing revenue, strong backlog, and stable balance sheet to support projects of any magnitude EXTENSIVE RESOURCES & EXPERTISE Dedicated workforce of 9,000+ employees and one of the largest centralized, specialized fleet in the industry LONG-STANDING CUSTOMERS Established client relationships and alliance partnerships across the U.S. and Canada, some held for 50+ years EXPERIENCED LEADERSHIP Executive team that averages more than 28 years of industry experience : MYRG SINCE 2008 Reportable Segments: T&D and C&I COMMERCIAL INDUSTRIAL TRANSPORTATION EV CHARGING SOLAR DATA CENTERS COMMERCIAL & INDUSTRIAL (C&I) TRANSMISSION DISTRIBUTION SUBSTATION STREET LIGHTING STORM RESTORATION STORAGE & SOLAR TRANSMISSION & DISTRIBUTION (T&D)

4 Achieved record revenue and EPS in 2023, revenue up 21% from 2022 and EPS up 10% from 2022 $3.65B 03/31/2024 LTM $2.07B 2019 $2.25B 2020 $2.50B 2021 $3.64B 2023 RANKED AMONG TOP 5 U.S. SPECIALTY ELECTRICAL CONTRACTORS 28 YEARS IN A ROW $3.01B 2022 CAGR 14.2%

5 • T&D work activity primarily consists of small to medium-sized projects, with some larger transmission, High Voltage Direct Current (HVDC) and utility-scale solar projects. We continue to execute routine maintenance work under long- term Master Services Agreements (MSAs). Strong, long-term drivers will continue to increase T&D spending. • C&I projects have had slight impacts due to supply chain disruptions though budgeting and bidding activity remains strong, specifically in the core markets we serve. • Infrastructure bills could promote increased spending and both MYR Group business segments are well-positioned to benefit from this. • AI is driving growth in data centers and power demand. Data centers have been an important and growing end market for our C&I segment for a long time, while new interconnections, substations and infrastructure upgrades to data centers create additional opportunities for our T&D segment. • Strong balance sheet with $434M in availability under our $490M credit facility and funded debt to LTM EBITDA leverage of 0.20x, which management believes will enable us to meet our working capital needs, support the organic growth of the business, pursue acquisitions, and opportunistically repurchase shares. WHAT WE SEE OUTLOOK

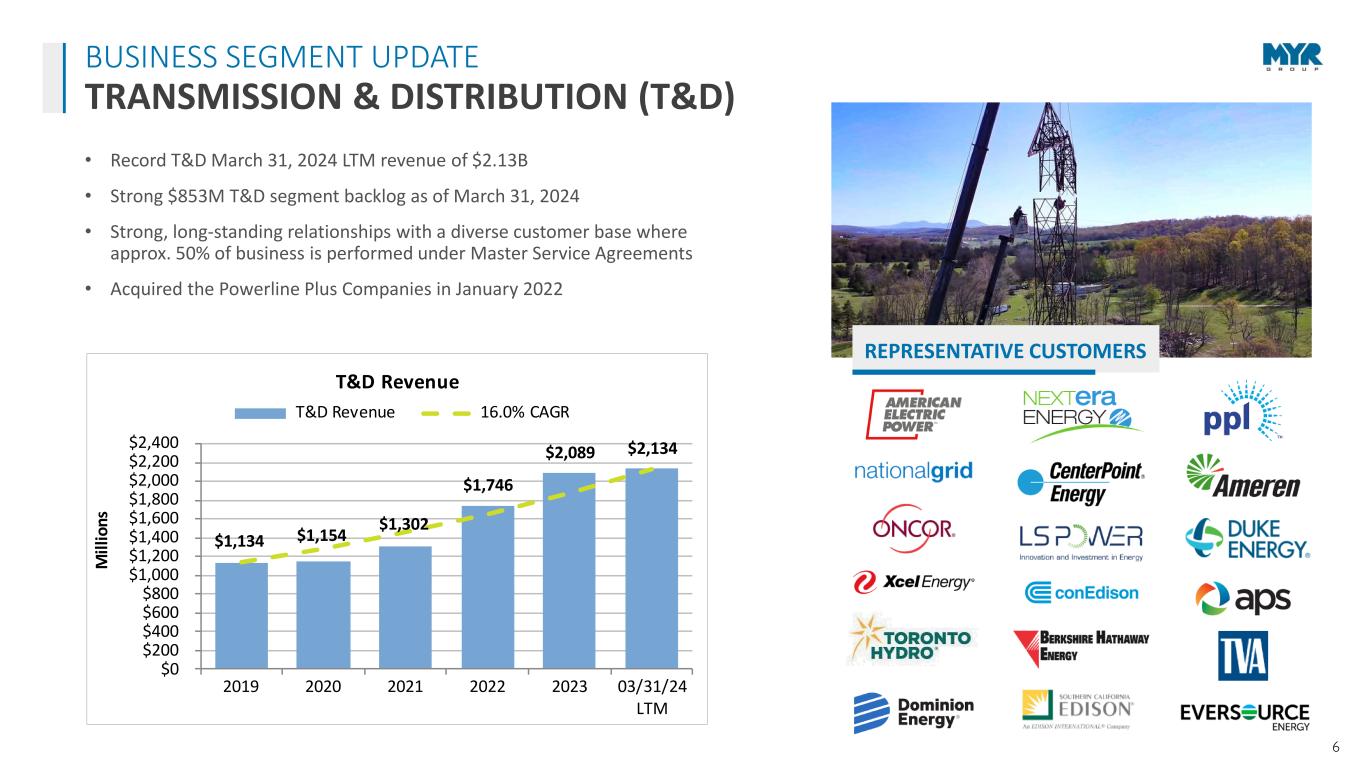

6 • Record T&D March 31, 2024 LTM revenue of $2.13B • Strong $853M T&D segment backlog as of March 31, 2024 • Strong, long-standing relationships with a diverse customer base where approx. 50% of business is performed under Master Service Agreements • Acquired the Powerline Plus Companies in January 2022 BUSINESS SEGMENT UPDATE TRANSMISSION & DISTRIBUTION (T&D) REPRESENTATIVE CUSTOMERS $1,134 $1,154 $1,302 $1,746 $2,089 $2,134 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 $2,400 2019 2020 2021 2022 2023 03/31/24 LTM M ill io n s T&D Revenue T&D Revenue 16.0% CAGR

7Source: The C Three Group, North American Electric Distribution Market Forecast, October 2023 “Overall, distribution spend increased 7% in 2022 over 2021. Investor-owned utility spend increased by 9.1%.” U.S. and Canadian Electric Distribution Actual and Forecasted Capital Expenditures STRONG LONG-TERM DRIVERS T&D MARKET OUTLOOK Source: Edison Electric Institute, updated January 2024 Actual and Projected Transmission Investment of Investor-Owned Electric Companies Investor-owned electric companies spent $26.7 billion on transmission investment in 2022, compared to $25.1 billion in 2021 (in nominal dollars), and are planning to invest approximately $121 billion on transmission construction between 2023 and 2026. System Reliability & Resiliency Programs Aging Electric Grid Connecting Clean Energy Sources Plant Retirements System Hardening Electrification Data Centers Distributed Energy Resources • The $1.2 trillion Infrastructure Investment and Jobs Act (IIJA) will invest significantly in our nation’s infrastructure over the next decade, including $73 billion for the electric grid and energy infrastructure. So far, more than $448 billion of the total funding has been announced. (whitehouse.gov, April 2024) • Between the IIJA and Inflation Reduction Act (IRA), combined federal spending planned for energy over the next 5-10 years is more than $300 billion. (Brookings.edu, Feb. 1, 2023) • The DOE has acknowledged U.S. transmission systems need to grow significantly – by 60% by 2030 and may need to triple by 2050 – to meet clean electricity demands. (energy.gov, May and June 2023) INVESTMENT DRIVERS

8 • C&I March 31, 2024 LTM revenue of $1.51 billion • Strong $1.57B C&I segment backlog as of March 31, 2024 • Growth in our core markets is driven by increasing investments in data centers, transportation, clean energy, and healthcare, as well as reshoring of manufacturing, and we remain well diversified across our core markets • Strong, long-standing customer relationships REPRESENTATIVE CUSTOMERS BUSINESS SEGMENT UPDATE COMMERCIAL & INDUSTRIAL (C&I) $937 $1,093 $1,197 $1,263 $1,555 $1,514 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 2019 2020 2021 2022 2023 03/31/24 LTM M il li o n s C&I Revenue C&I Revenue 11.9% CAGR

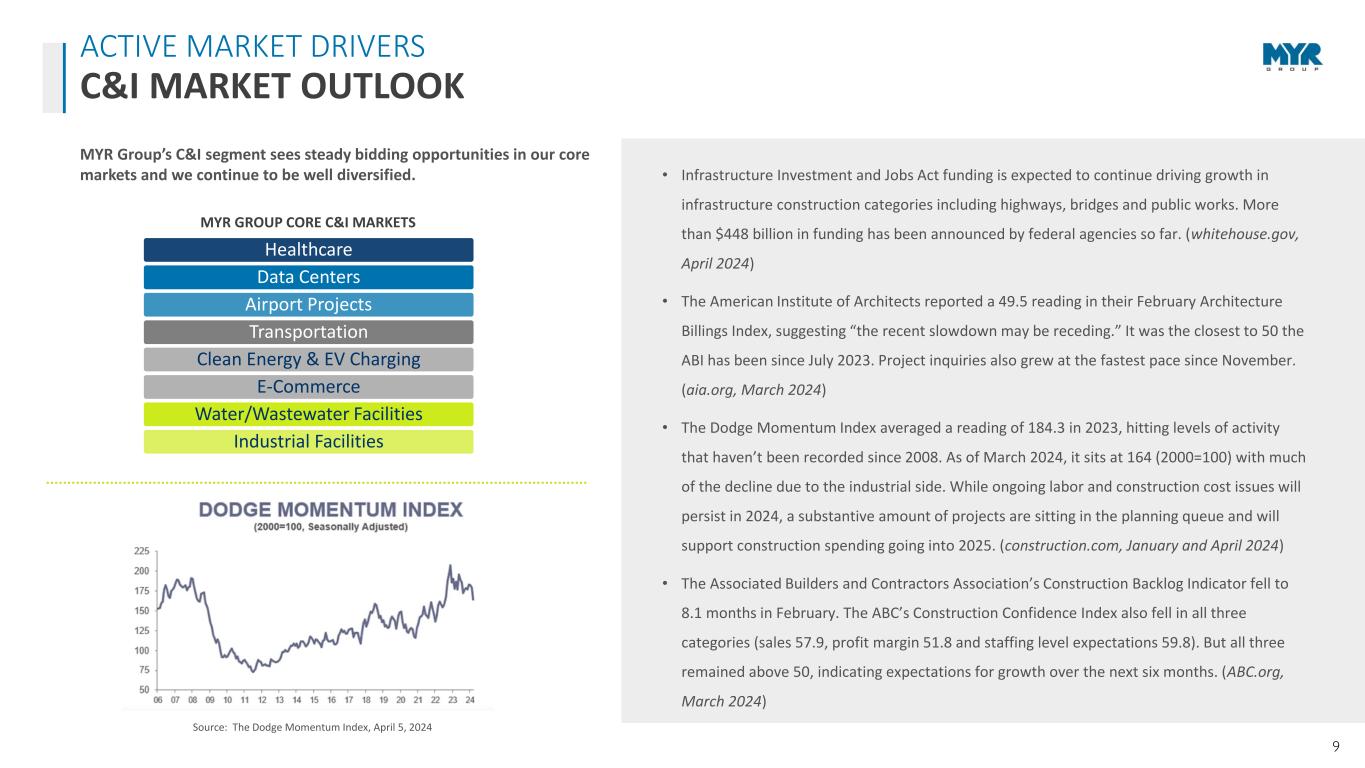

9 Healthcare Data Centers Airport Projects Transportation Clean Energy & EV Charging E-Commerce Water/Wastewater Facilities Industrial Facilities MYR GROUP CORE C&I MARKETS ACTIVE MARKET DRIVERS C&I MARKET OUTLOOK • Infrastructure Investment and Jobs Act funding is expected to continue driving growth in infrastructure construction categories including highways, bridges and public works. More than $448 billion in funding has been announced by federal agencies so far. (whitehouse.gov, April 2024) • The American Institute of Architects reported a 49.5 reading in their February Architecture Billings Index, suggesting “the recent slowdown may be receding.” It was the closest to 50 the ABI has been since July 2023. Project inquiries also grew at the fastest pace since November. (aia.org, March 2024) • The Dodge Momentum Index averaged a reading of 184.3 in 2023, hitting levels of activity that haven’t been recorded since 2008. As of March 2024, it sits at 164 (2000=100) with much of the decline due to the industrial side. While ongoing labor and construction cost issues will persist in 2024, a substantive amount of projects are sitting in the planning queue and will support construction spending going into 2025. (construction.com, January and April 2024) • The Associated Builders and Contractors Association’s Construction Backlog Indicator fell to 8.1 months in February. The ABC’s Construction Confidence Index also fell in all three categories (sales 57.9, profit margin 51.8 and staffing level expectations 59.8). But all three remained above 50, indicating expectations for growth over the next six months. (ABC.org, March 2024) Source: The Dodge Momentum Index, April 5, 2024 MYR Group’s C&I segment sees steady bidding opportunities in our core markets and we continue to be well diversified.

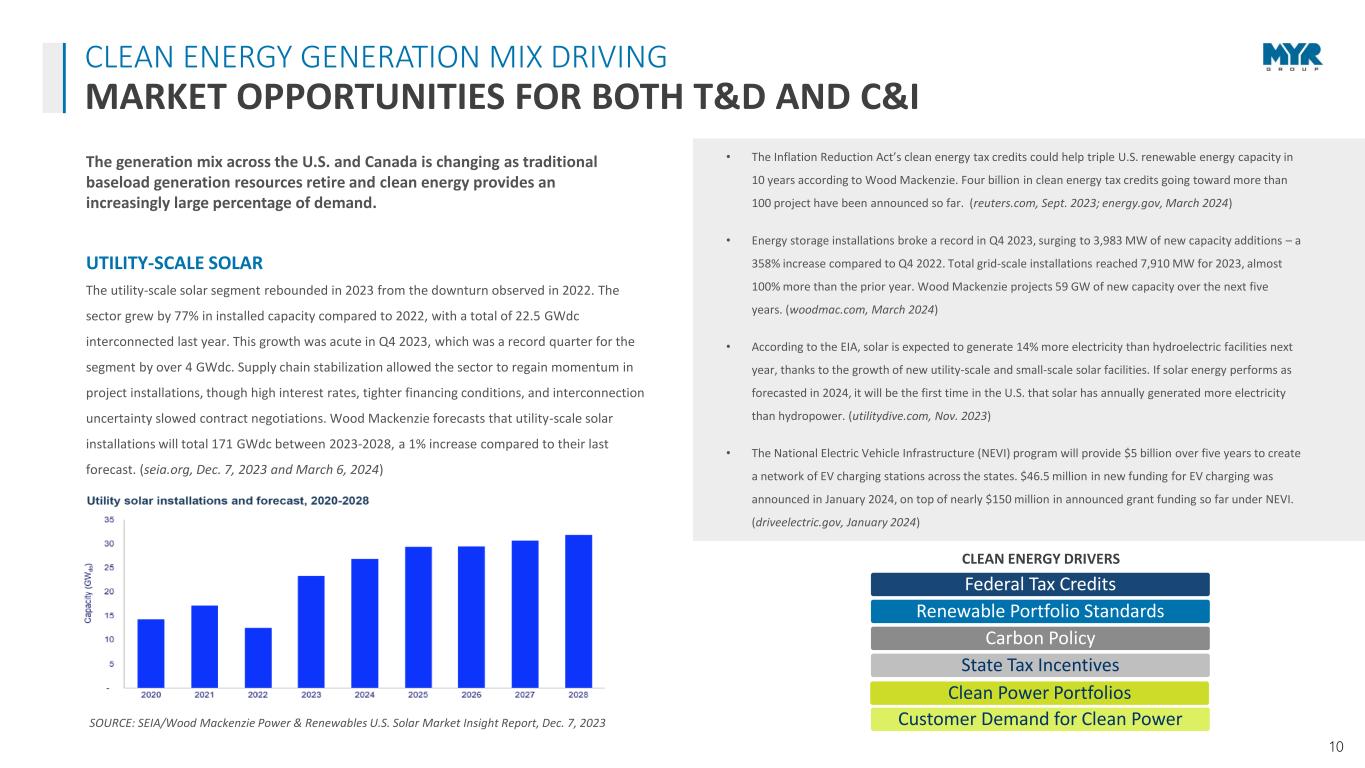

10 CLEAN ENERGY GENERATION MIX DRIVING MARKET OPPORTUNITIES FOR BOTH T&D AND C&I Federal Tax Credits Renewable Portfolio Standards Carbon Policy State Tax Incentives Clean Power Portfolios Customer Demand for Clean Power CLEAN ENERGY DRIVERS UTILITY-SCALE SOLAR SOURCE: SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight Report, Dec. 7, 2023 The utility-scale solar segment rebounded in 2023 from the downturn observed in 2022. The sector grew by 77% in installed capacity compared to 2022, with a total of 22.5 GWdc interconnected last year. This growth was acute in Q4 2023, which was a record quarter for the segment by over 4 GWdc. Supply chain stabilization allowed the sector to regain momentum in project installations, though high interest rates, tighter financing conditions, and interconnection uncertainty slowed contract negotiations. Wood Mackenzie forecasts that utility-scale solar installations will total 171 GWdc between 2023-2028, a 1% increase compared to their last forecast. (seia.org, Dec. 7, 2023 and March 6, 2024) The generation mix across the U.S. and Canada is changing as traditional baseload generation resources retire and clean energy provides an increasingly large percentage of demand. • The Inflation Reduction Act’s clean energy tax credits could help triple U.S. renewable energy capacity in 10 years according to Wood Mackenzie. Four billion in clean energy tax credits going toward more than 100 project have been announced so far. (reuters.com, Sept. 2023; energy.gov, March 2024) • Energy storage installations broke a record in Q4 2023, surging to 3,983 MW of new capacity additions – a 358% increase compared to Q4 2022. Total grid-scale installations reached 7,910 MW for 2023, almost 100% more than the prior year. Wood Mackenzie projects 59 GW of new capacity over the next five years. (woodmac.com, March 2024) • According to the EIA, solar is expected to generate 14% more electricity than hydroelectric facilities next year, thanks to the growth of new utility-scale and small-scale solar facilities. If solar energy performs as forecasted in 2024, it will be the first time in the U.S. that solar has annually generated more electricity than hydropower. (utilitydive.com, Nov. 2023) • The National Electric Vehicle Infrastructure (NEVI) program will provide $5 billion over five years to create a network of EV charging stations across the states. $46.5 million in new funding for EV charging was announced in January 2024, on top of nearly $150 million in announced grant funding so far under NEVI. (driveelectric.gov, January 2024)

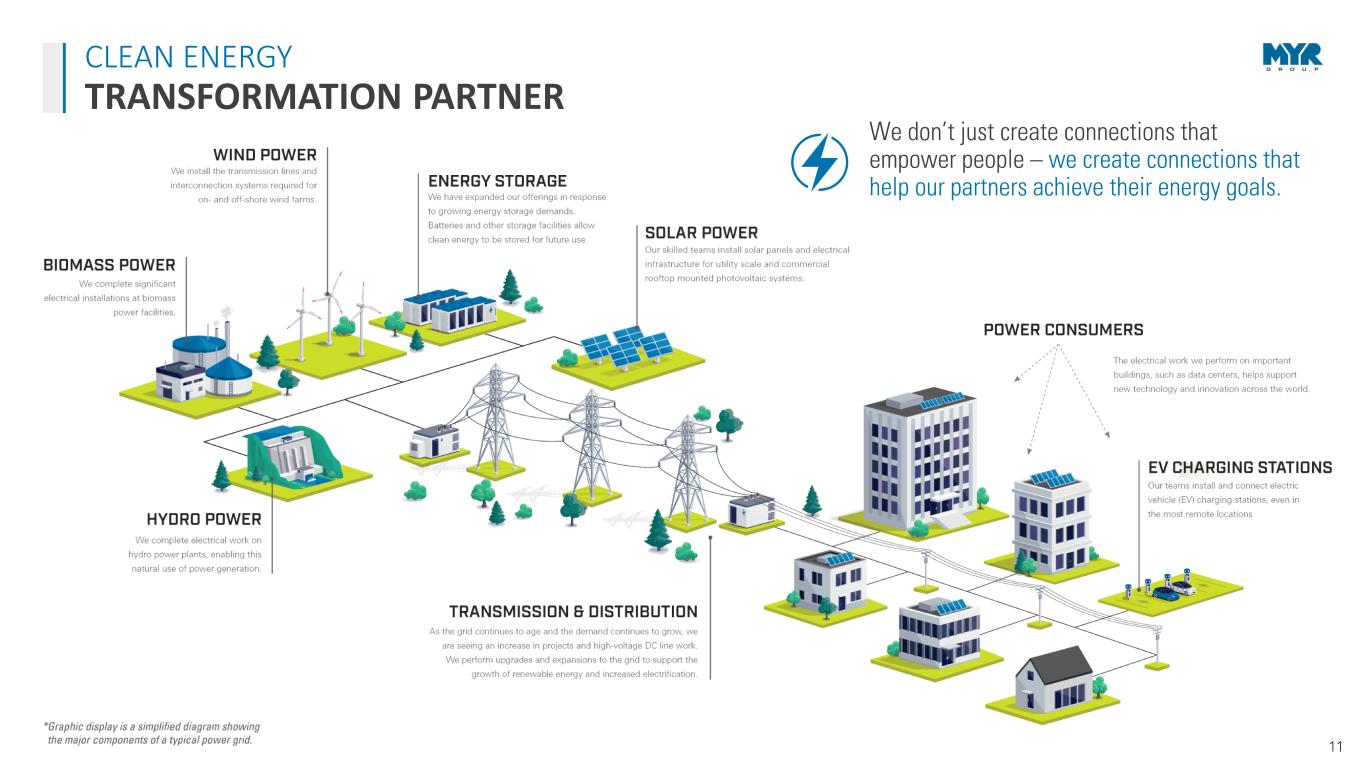

11 We don’t just create connections that empower people – we create connections that help our partners achieve their energy goals. CLEAN ENERGY TRANSFORMATION PARTNER

12 STRONG MARKET COUPLED WITH OUR COMPETITIVE EDGE POSITIONS MYR GROUP FOR CONTINUED GROWTH Healthy organic and acquisitive growth Proven execution of corporate strategy Strong financial position Centralized operations for greater efficiency and cross-collaboration Strong presence in key markets with expanding geographic footprint Future-driven mindset to deploy new systems and technologies Broadening our capabilities to support the development of clean energy infrastructure Experienced leadership team Reputation for excellence with customers, with more than 90% return clients in both segments Diversified customer base with no client or contract representing more that 10% of revenue INVESTMENT HIGHLIGHTS U.S./Canada Long-term growth both organically and via acquisition T&D Transmission market outlook strong next 5+ years C&I Well-diversified C&I sector (Transportation, Healthcare, Data Center, EV Infrastructure) Clean Energy Clean energy initiatives driving increased construction spend MYR GROUP STRATEGIC IMPERATIVES FINANCIAL STRENGTH Deliver positive financial results on a consistent basis while positioning the company for growth ORGANIZATIONAL EXCELLENCE Sustain a culture that aids in attracting, retaining, and developing the best people in the industry OPERATIONAL EXCELLENCE Continue investments in people, equipment, health, safety, the environment, technology, innovative programs, process improvement, and sustainability CUSTOMER SATISFACTION Strive to always be the first choice for our clients and remain one of the most reliable, efficient, and high-value providers STRATEGIC GROWTH

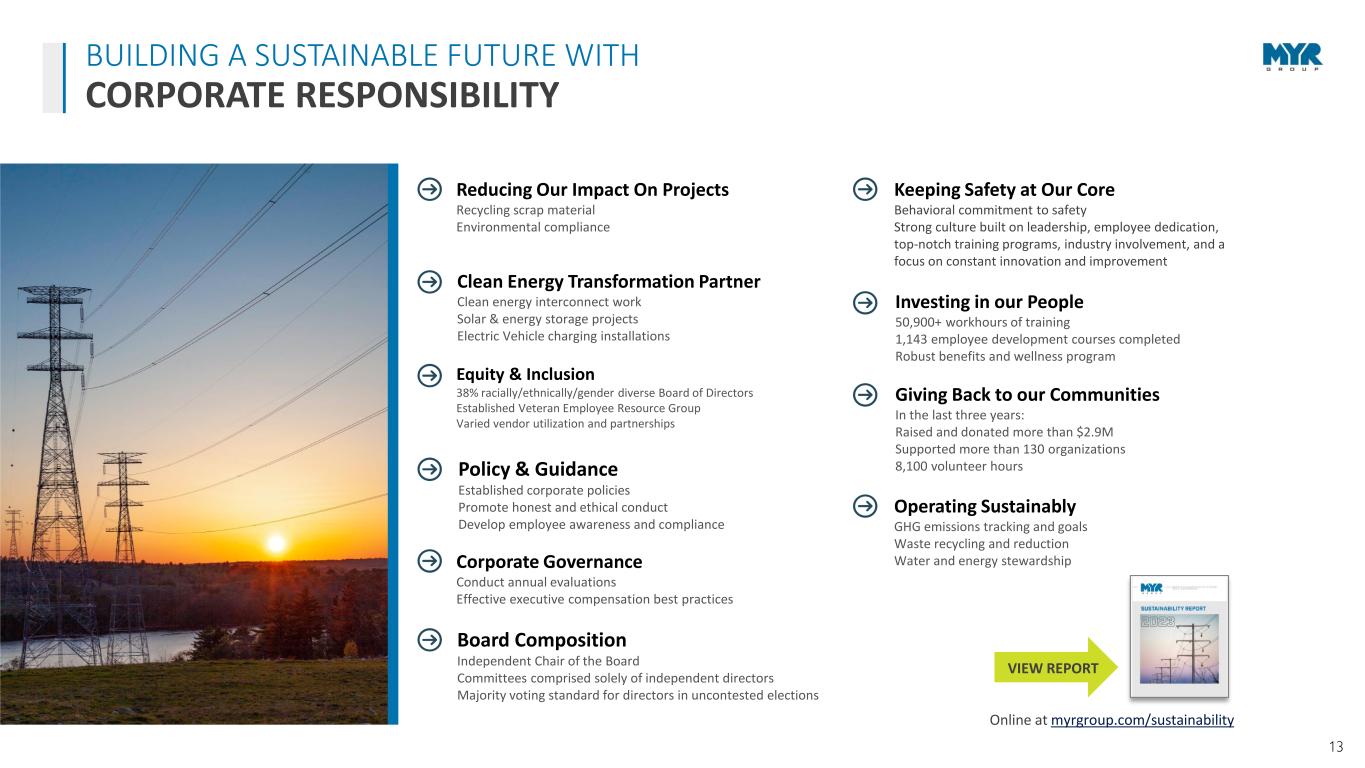

13 BUILDING A SUSTAINABLE FUTURE WITH CORPORATE RESPONSIBILITY VIEW REPORT Policy & Guidance Established corporate policies Promote honest and ethical conduct Develop employee awareness and compliance Equity & Inclusion 38% racially/ethnically/gender diverse Board of Directors Established Veteran Employee Resource Group Varied vendor utilization and partnerships Reducing Our Impact On Projects Recycling scrap material Environmental compliance Clean Energy Transformation Partner Clean energy interconnect work Solar & energy storage projects Electric Vehicle charging installations Giving Back to our Communities In the last three years: Raised and donated more than $2.9M Supported more than 130 organizations 8,100 volunteer hours Operating Sustainably GHG emissions tracking and goals Waste recycling and reduction Water and energy stewardship Investing in our People 50,900+ workhours of training 1,143 employee development courses completed Robust benefits and wellness program Board Composition Independent Chair of the Board Committees comprised solely of independent directors Majority voting standard for directors in uncontested elections Corporate Governance Conduct annual evaluations Effective executive compensation best practices Keeping Safety at Our Core Behavioral commitment to safety Strong culture built on leadership, employee dedication, top-notch training programs, industry involvement, and a focus on constant innovation and improvement Online at myrgroup.com/sustainability

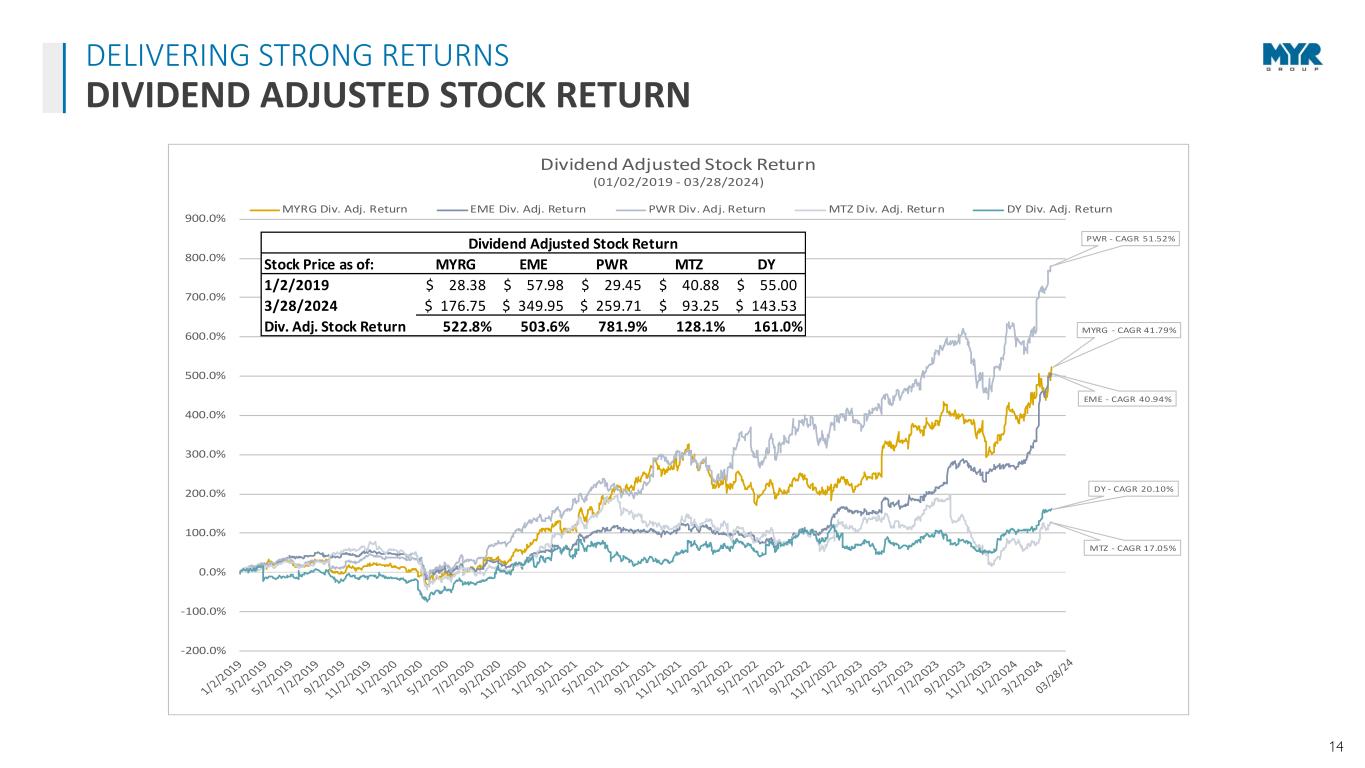

14 DELIVERING STRONG RETURNS DIVIDEND ADJUSTED STOCK RETURN MYRG - CAGR 41.79% EME - CAGR 40.94% PWR - CAGR 51.52% MTZ - CAGR 17.05% DY - CAGR 20.10% -200.0% -100.0% 0.0% 100.0% 200.0% 300.0% 400.0% 500.0% 600.0% 700.0% 800.0% 900.0% Dividend Adjusted Stock Return (01/02/2019 - 03/28/2024) MYRG Div. Adj. Return EME Div. Adj. Return PWR Div. Adj. Return MTZ Div. Adj. Return DY Div. Adj. Return Dividend Adjusted Stock Return Stock Price as of: MYRG EME PWR MTZ DY 1/2/2019 28.38$ 57.98$ 29.45$ 40.88$ 55.00$ 3/28/2024 176.75$ 349.95$ 259.71$ 93.25$ 143.53$ Div. Adj. Stock Return 522.8% 503.6% 781.9% 128.1% 161.0%

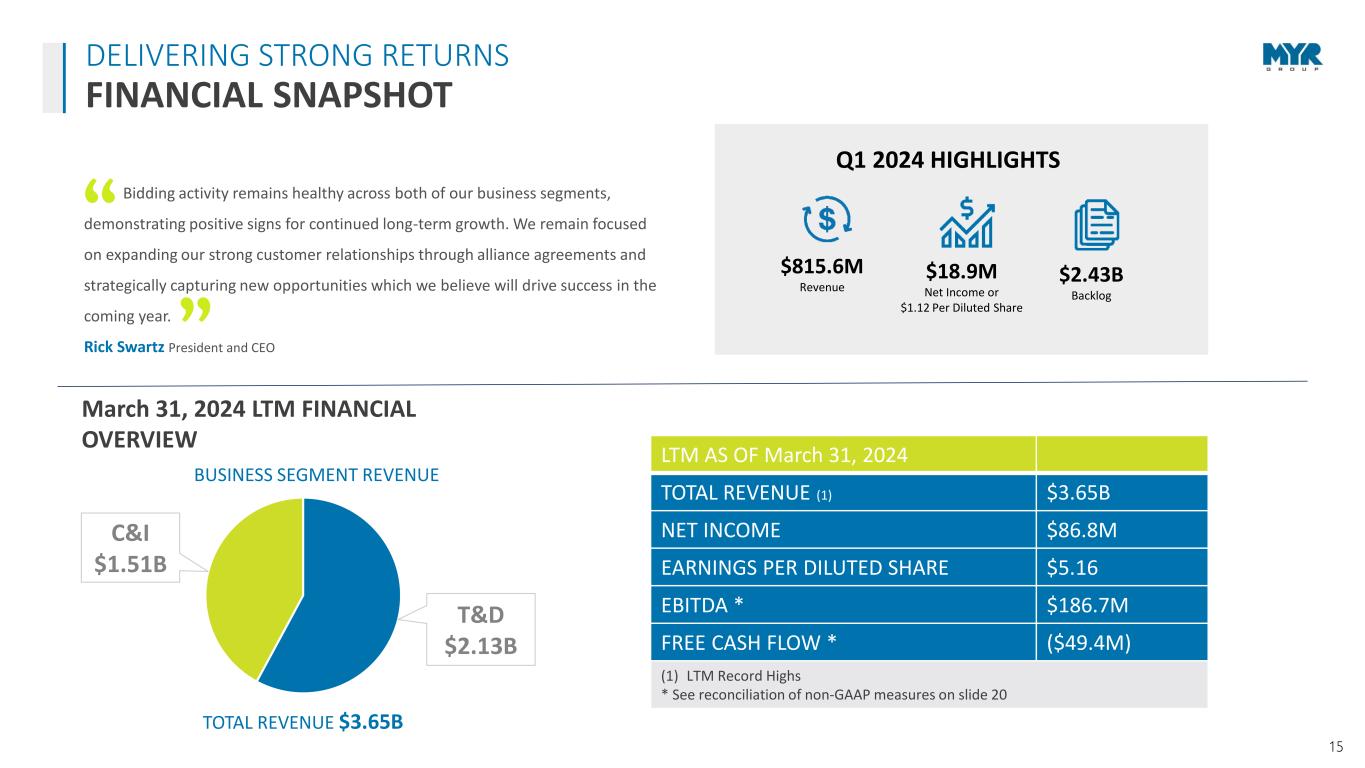

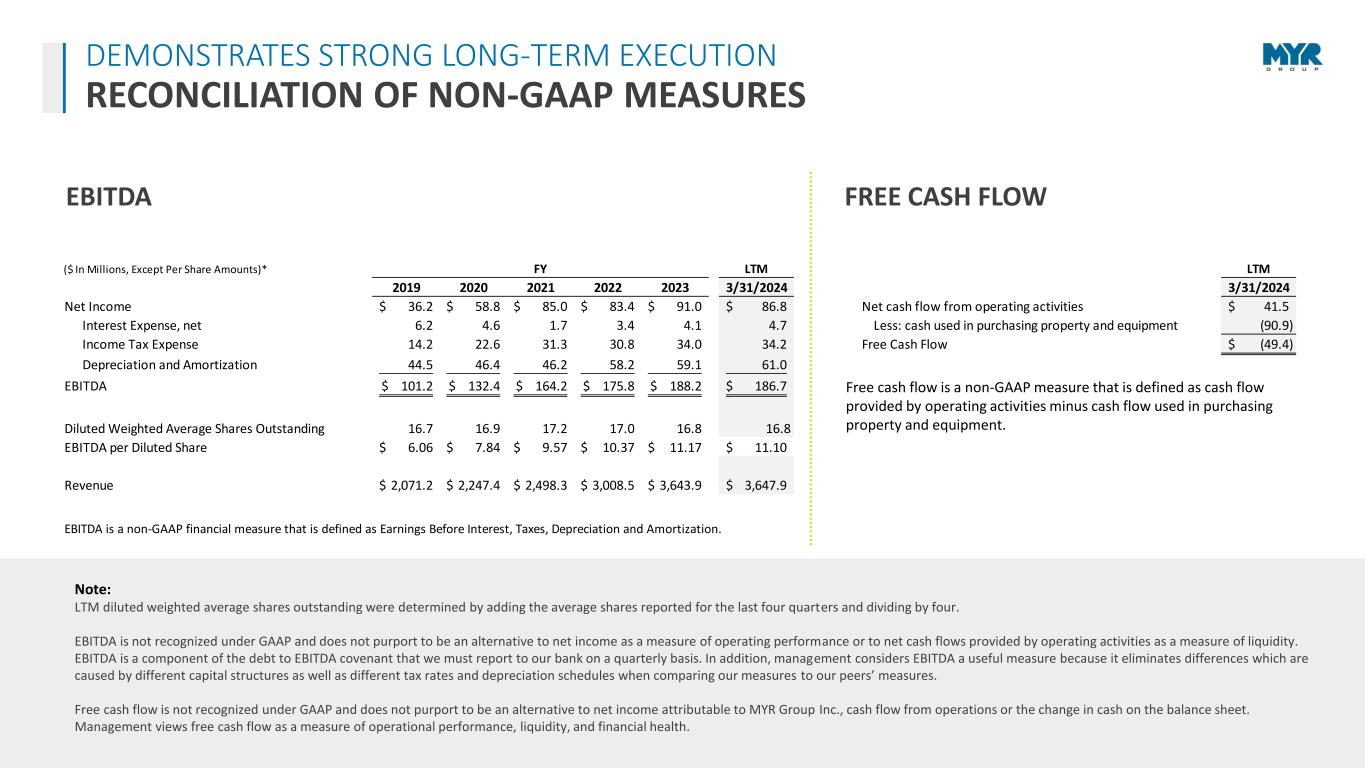

15 Q1 2024 HIGHLIGHTS $18.9M Net Income or $1.12 Per Diluted Share $2.43B Backlog $815.6M Revenue Bidding activity remains healthy across both of our business segments, demonstrating positive signs for continued long-term growth. We remain focused on expanding our strong customer relationships through alliance agreements and strategically capturing new opportunities which we believe will drive success in the coming year. Rick Swartz President and CEO “ ” DELIVERING STRONG RETURNS FINANCIAL SNAPSHOT T&D $2.13B C&I $1.51B BUSINESS SEGMENT REVENUE LTM AS OF March 31, 2024 TOTAL REVENUE (1) $3.65B NET INCOME $86.8M EARNINGS PER DILUTED SHARE $5.16 EBITDA * $186.7M FREE CASH FLOW * ($49.4M) (1) LTM Record Highs * See reconciliation of non-GAAP measures on slide 20 March 31, 2024 LTM FINANCIAL OVERVIEW TOTAL REVENUE $3.65B

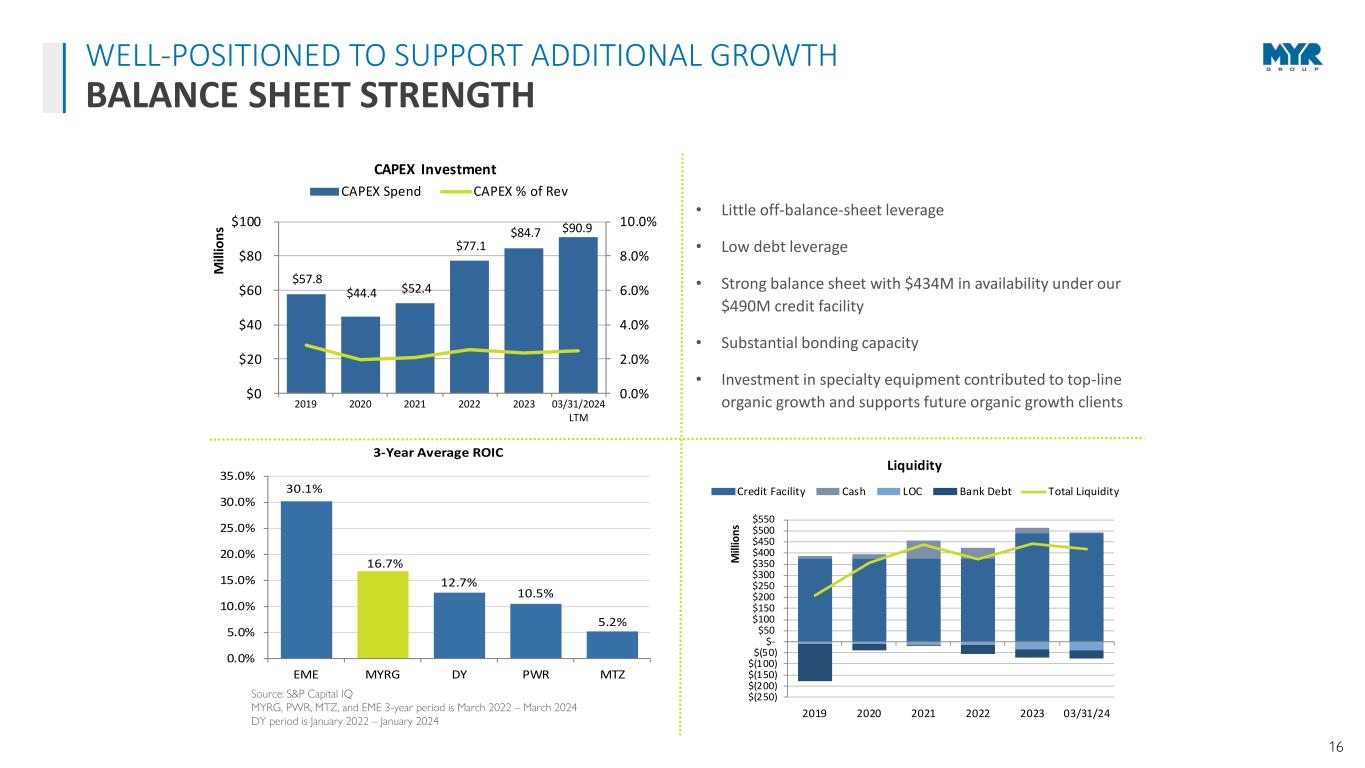

16 $57.8 $44.4 $52.4 $77.1 $84.7 $90.9 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% $0 $20 $40 $60 $80 $100 2019 2020 2021 2022 2023 03/31/2024 LTM M ill io n s CAPEX Investment CAPEX Spend CAPEX % of Rev 30.1% 16.7% 12.7% 10.5% 5.2% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% EME MYRG DY PWR MTZ 3-Year Average ROIC $(250) $(200) $(150) $(100) $(50) $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 2019 2020 2021 2022 2023 03/31/24 M ill io n s Liquidity Credit Facility Cash LOC Bank Debt Total Liquidity Source: S&P Capital IQ MYRG, PWR, MTZ, and EME 3-year period is March 2022 – March 2024 DY period is January 2022 – January 2024 • Little off-balance-sheet leverage • Low debt leverage • Strong balance sheet with $434M in availability under our $490M credit facility • Substantial bonding capacity • Investment in specialty equipment contributed to top-line organic growth and supports future organic growth clients WELL-POSITIONED TO SUPPORT ADDITIONAL GROWTH BALANCE SHEET STRENGTH

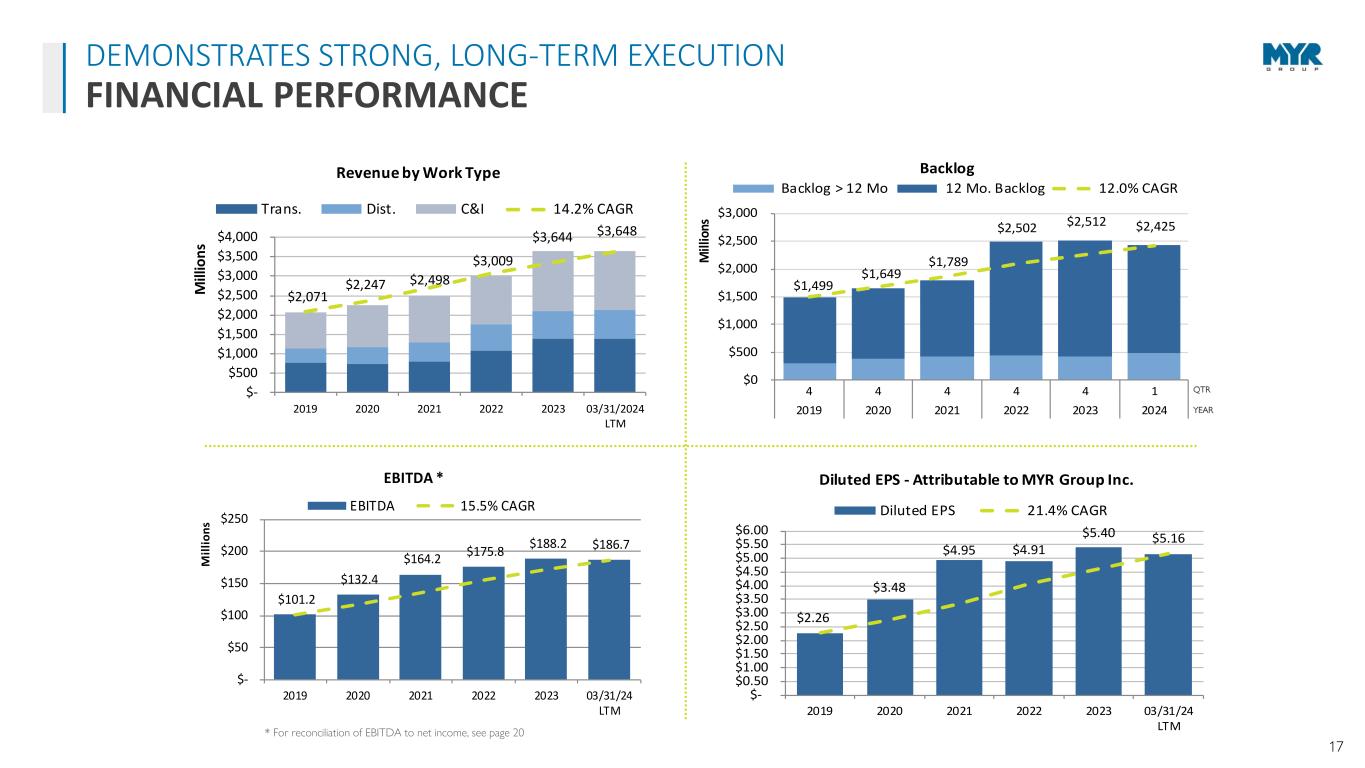

17 $2,071 $2,247 $2,498 $3,009 $3,644 $3,648 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2019 2020 2021 2022 2023 03/31/2024 LTM M ill io n s Revenue by Work Type Trans. Dist. C&I 14.2% CAGR $1,499 $1,649 $1,789 $2,502 $2,512 $2,425 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 4 4 4 4 4 1 2019 2020 2021 2022 2023 2024 M ill io ns Backlog Backlog > 12 Mo 12 Mo. Backlog 12.0% CAGR $101.2 $132.4 $164.2 $175.8 $188.2 $186.7 $- $50 $100 $150 $200 $250 2019 2020 2021 2022 2023 03/31/24 LTM M il li o n s EBITDA * EBITDA 15.5% CAGR $2.26 $3.48 $4.95 $4.91 $5.40 $5.16 $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 2019 2020 2021 2022 2023 03/31/24 LTM Diluted EPS - Attributable to MYR Group Inc. Diluted EPS 21.4% CAGR * For reconciliation of EBITDA to net income, see page 20 QTR YEAR DEMONSTRATES STRONG, LONG-TERM EXECUTION FINANCIAL PERFORMANCE

18 EXECUTIVE LEADERSHIP Rick Swartz, CEO MYRG: 41 years Industry: 41 years 19 YEARS EXECUTIVES AVERAGE: WITH MYR GROUP Effective February 24, 2023 MYR Group Inc. has a strong team of experienced leaders that make up our executive team and Board of Directors. We believe diversity of our leadership is a critical component of creating long-term value for our shareholders. We select individuals that bring extensive experience and unique perspectives to both our Company and our Board. Kelly Huntington, CFO MYRG: 1 year Industry: 21 years Brian Stern, COO - T&D MYRG: 19 years Industry: 23 years Don Egan, COO - C&I MYRG: 32 years Industry: 32 years William Fry, CLO MYRG: 5 years Industry: 26 years 28 YEARS OF INDUSTRY EXPERIENCE 25% Female 88% Majority Independent 38% Racially/Ethnically/ Gender Diverse Directors BOARD OF DIRECTORS STATISTICS 7:1 Varied Tenure 7 of 8 have 0- 9 years 1 of 8 have 10 years EXECUTIVES & BOARD OF DIRECTORS EXPERIENCED LEADERSHIP TEAM

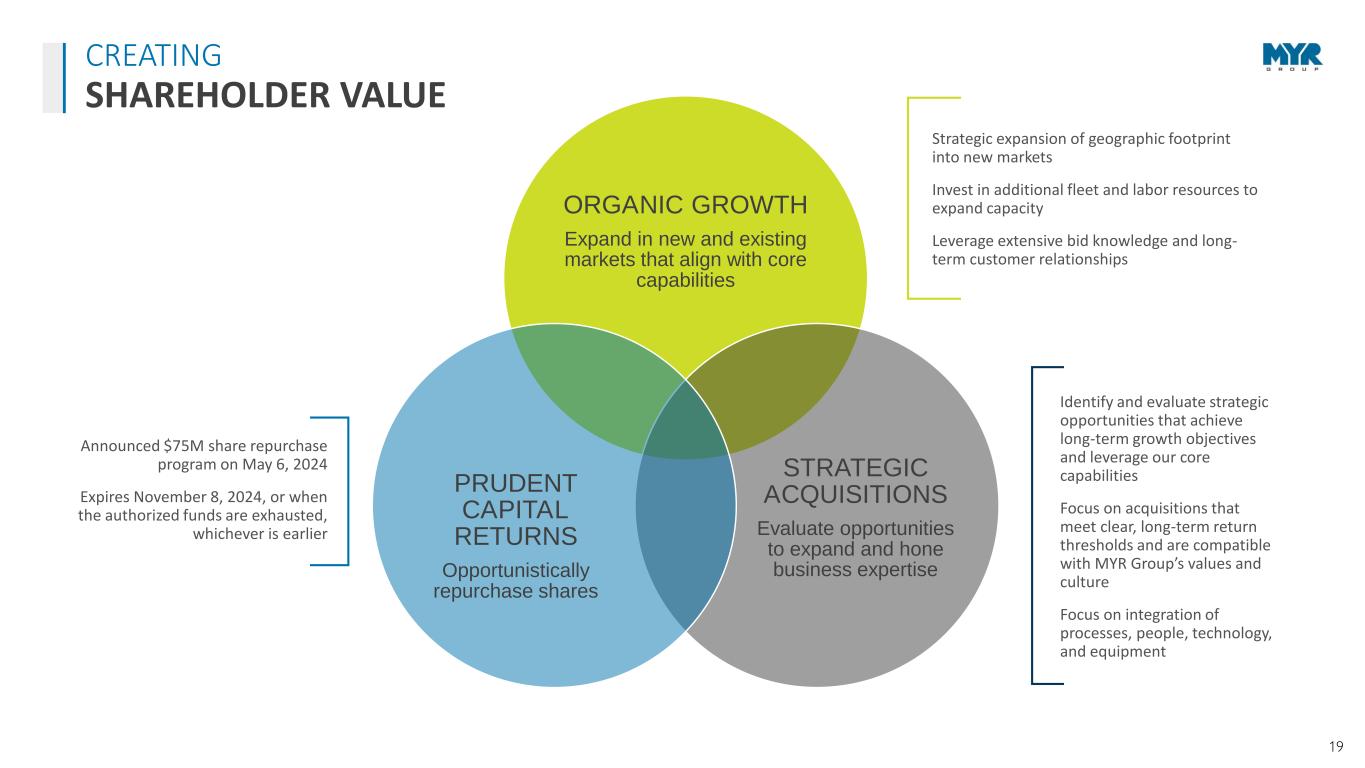

19 ORGANIC GROWTH Expand in new and existing markets that align with core capabilities STRATEGIC ACQUISITIONS Evaluate opportunities to expand and hone business expertise PRUDENT CAPITAL RETURNS Opportunistically repurchase shares Announced $75M share repurchase program on May 6, 2024 Expires November 8, 2024, or when the authorized funds are exhausted, whichever is earlier Identify and evaluate strategic opportunities that achieve long-term growth objectives and leverage our core capabilities Focus on acquisitions that meet clear, long-term return thresholds and are compatible with MYR Group’s values and culture Focus on integration of processes, people, technology, and equipment Strategic expansion of geographic footprint into new markets Invest in additional fleet and labor resources to expand capacity Leverage extensive bid knowledge and long- term customer relationships CREATING SHAREHOLDER VALUE

20 Note: LTM diluted weighted average shares outstanding were determined by adding the average shares reported for the last four quarters and dividing by four. EBITDA is not recognized under GAAP and does not purport to be an alternative to net income as a measure of operating performance or to net cash flows provided by operating activities as a measure of liquidity. EBITDA is a component of the debt to EBITDA covenant that we must report to our bank on a quarterly basis. In addition, management considers EBITDA a useful measure because it eliminates differences which are caused by different capital structures as well as different tax rates and depreciation schedules when comparing our measures to our peers’ measures. Free cash flow is not recognized under GAAP and does not purport to be an alternative to net income attributable to MYR Group Inc., cash flow from operations or the change in cash on the balance sheet. Management views free cash flow as a measure of operational performance, liquidity, and financial health. ($ In Millions, Except Per Share Amounts)* FY LTM LTM 2019 2020 2021 2022 2023 3/31/2024 3/31/2024 Net Income 36.2$ 58.8$ 85.0$ 83.4$ 91.0$ 86.8$ Net cash flow from operating activities 41.5$ Interest Expense, net 6.2 4.6 1.7 3.4 4.1 4.7 Less: cash used in purchasing property and equipment (90.9) Income Tax Expense 14.2 22.6 31.3 30.8 34.0 34.2 Free Cash Flow (49.4)$ Depreciation and Amortization 44.5 46.4 46.2 58.2 59.1 61.0 EBITDA 101.2$ 132.4$ 164.2$ 175.8$ 188.2$ 186.7$ Diluted Weighted Average Shares Outstanding 16.7 16.9 17.2 17.0 16.8 16.8 EBITDA per Diluted Share 6.06$ 7.84$ 9.57$ 10.37$ 11.17$ 11.10$ Revenue 2,071.2$ 2,247.4$ 2,498.3$ 3,008.5$ 3,643.9$ 3,647.9$ EBITDA is a non-GAAP financial measure that is defined as Earnings Before Interest, Taxes, Depreciation and Amortization. Free cash flow is a non-GAAP measure that is defined as cash flow provided by operating activities minus cash flow used in purchasing property and equipment. EBITDA FREE CASH FLOW DEMONSTRATES STRONG LONG-TERM EXECUTION RECONCILIATION OF NON-GAAP MEASURES

21NOTE: Images used throughout this presentation may have been taken before COVID. Net Income (LTM) [A] +[(Net Interest Expense + Amortization of Intangibles)* (1-Effective Tax Rate)] ÷ [Book Value (Total Stockholders' Equity [B]) + Net Funded Debt] @ beginning and ending period average = Return on Invested Capital [A] Net Income excludes noncontrolling interest and discontinued operations [B] Total Stockholders' Equity excludes minority interests and discontinued operations Three year averages are derived from calculating the return metric for each twelve month period and then averaging the three period metrics S&P CAPITAL IQ DISCLAIMER OF LIABILITY NOTICE This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third-party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes and should not be relied on as investment advice. DAVID GUTIERREZ INVESTOR CONTACT Dresner Corporate Services 312.780.7204 dgutierrez@dresnerco.com KELLY HUNTINGTON MYR GROUP CONTACT MYR Group Inc., Chief Financial Officer 847.290.1891 khuntington@myrgroup.com HEADQUARTERS 12121 GRANT STREET, SUITE 610 THORNTON, CO 80241 DEFINITIONS FINANCIAL RATIOS