false

Q1

--12-31

0001615063

0001615063

2024-01-01

2024-03-31

0001615063

2024-05-07

0001615063

2024-03-31

0001615063

2023-12-31

0001615063

2023-01-01

2023-03-31

0001615063

us-gaap:ServiceMember

2024-01-01

2024-03-31

0001615063

us-gaap:ServiceMember

2023-01-01

2023-03-31

0001615063

INSE:ProductSalesMember

2024-01-01

2024-03-31

0001615063

INSE:ProductSalesMember

2023-01-01

2023-03-31

0001615063

us-gaap:CommonStockMember

2023-12-31

0001615063

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001615063

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001615063

us-gaap:RetainedEarningsMember

2023-12-31

0001615063

us-gaap:CommonStockMember

2022-12-31

0001615063

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001615063

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001615063

us-gaap:RetainedEarningsMember

2022-12-31

0001615063

2022-12-31

0001615063

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001615063

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001615063

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0001615063

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001615063

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001615063

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001615063

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001615063

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001615063

us-gaap:CommonStockMember

2024-03-31

0001615063

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001615063

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001615063

us-gaap:RetainedEarningsMember

2024-03-31

0001615063

us-gaap:CommonStockMember

2023-03-31

0001615063

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001615063

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001615063

us-gaap:RetainedEarningsMember

2023-03-31

0001615063

2023-03-31

0001615063

2023-01-01

2023-12-31

0001615063

INSE:ThroughDecemberThirtyOneTwentyTwentyFourMember

2024-03-31

0001615063

INSE:ThroughDecemberThirtyOneTwentyTwentySixMember

2024-03-31

0001615063

INSE:ThroughDecemberThirtyOneTwentyTwentyNineMember

2024-03-31

0001615063

INSE:IncentivePlanMember

us-gaap:RestrictedStockUnitsRSUMember

2023-12-31

0001615063

INSE:IncentivePlanMember

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-03-31

0001615063

INSE:IncentivePlanMember

us-gaap:RestrictedStockUnitsRSUMember

2024-03-31

0001615063

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-03-31

0001615063

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2024-01-01

2024-03-31

0001615063

us-gaap:PerformanceSharesMember

2024-01-01

2024-03-31

0001615063

us-gaap:PerformanceSharesMember

srt:MinimumMember

2024-01-01

2024-03-31

0001615063

us-gaap:PerformanceSharesMember

srt:MaximumMember

2024-01-01

2024-03-31

0001615063

us-gaap:RestrictedStockUnitsRSUMember

srt:MaximumMember

2024-01-01

2024-03-31

0001615063

us-gaap:PerformanceSharesMember

srt:ChiefExecutiveOfficerMember

2024-01-01

2024-03-31

0001615063

us-gaap:PerformanceSharesMember

INSE:RSUMember

2024-03-31

0001615063

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2023-12-29

2023-12-29

0001615063

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-03-31

0001615063

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-03-31

0001615063

INSE:MacquarieCorporateHoldingsPtyLimitedMember

2024-03-31

0001615063

INSE:MacquarieCorporateHoldingsPtyLimitedMember

2024-01-01

2024-03-31

0001615063

INSE:MacquarieCorporateHoldingsPtyLimitedMember

2023-01-01

2023-12-31

0001615063

INSE:MacquarieCorporateHoldingsPtyLimitedMember

2023-01-01

2023-03-31

0001615063

INSE:ConsultancyAgreementMember

INSE:RichardWeilMember

2023-01-01

2023-06-30

0001615063

INSE:ConsultancyAgreementMember

INSE:RichardWeilMember

2023-07-01

2023-12-31

0001615063

INSE:ConsultancyAgreementMember

2024-01-01

2024-03-31

0001615063

INSE:ConsultancyAgreementMember

2023-01-01

2023-03-31

0001615063

INSE:GamingMember

us-gaap:ServiceMember

2024-01-01

2024-03-31

0001615063

INSE:VirtualsportsMember

us-gaap:ServiceMember

2024-01-01

2024-03-31

0001615063

INSE:InteractiveMember

us-gaap:ServiceMember

2024-01-01

2024-03-31

0001615063

INSE:LeisureMember

us-gaap:ServiceMember

2024-01-01

2024-03-31

0001615063

INSE:CorporateFunctionsMember

us-gaap:ServiceMember

2024-01-01

2024-03-31

0001615063

INSE:GamingMember

INSE:ProductSalesMember

2024-01-01

2024-03-31

0001615063

INSE:VirtualsportsMember

INSE:ProductSalesMember

2024-01-01

2024-03-31

0001615063

INSE:InteractiveMember

INSE:ProductSalesMember

2024-01-01

2024-03-31

0001615063

INSE:LeisureMember

INSE:ProductSalesMember

2024-01-01

2024-03-31

0001615063

INSE:CorporateFunctionsMember

INSE:ProductSalesMember

2024-01-01

2024-03-31

0001615063

INSE:GamingMember

2024-01-01

2024-03-31

0001615063

INSE:VirtualsportsMember

2024-01-01

2024-03-31

0001615063

INSE:InteractiveMember

2024-01-01

2024-03-31

0001615063

INSE:LeisureMember

2024-01-01

2024-03-31

0001615063

INSE:CorporateFunctionsMember

2024-01-01

2024-03-31

0001615063

INSE:GamingMember

us-gaap:ServiceMember

2023-01-01

2023-03-31

0001615063

INSE:VirtualsportsMember

us-gaap:ServiceMember

2023-01-01

2023-03-31

0001615063

INSE:InteractiveMember

us-gaap:ServiceMember

2023-01-01

2023-03-31

0001615063

INSE:LeisureMember

us-gaap:ServiceMember

2023-01-01

2023-03-31

0001615063

INSE:CorporateFunctionsMember

us-gaap:ServiceMember

2023-01-01

2023-03-31

0001615063

INSE:GamingMember

INSE:ProductSalesMember

2023-01-01

2023-03-31

0001615063

INSE:VirtualsportsMember

INSE:ProductSalesMember

2023-01-01

2023-03-31

0001615063

INSE:InteractiveMember

INSE:ProductSalesMember

2023-01-01

2023-03-31

0001615063

INSE:LeisureMember

INSE:ProductSalesMember

2023-01-01

2023-03-31

0001615063

INSE:CorporateFunctionsMember

INSE:ProductSalesMember

2023-01-01

2023-03-31

0001615063

INSE:GamingMember

2023-01-01

2023-03-31

0001615063

INSE:VirtualsportsMember

2023-01-01

2023-03-31

0001615063

INSE:InteractiveMember

2023-01-01

2023-03-31

0001615063

INSE:LeisureMember

2023-01-01

2023-03-31

0001615063

INSE:CorporateFunctionsMember

2023-01-01

2023-03-31

0001615063

country:GB

2024-01-01

2024-03-31

0001615063

country:GB

2023-01-01

2023-03-31

0001615063

country:GR

2024-01-01

2024-03-31

0001615063

country:GR

2023-01-01

2023-03-31

0001615063

INSE:RestOfWorldMember

2024-01-01

2024-03-31

0001615063

INSE:RestOfWorldMember

2023-01-01

2023-03-31

0001615063

country:GB

2024-03-31

0001615063

country:GB

2023-12-31

0001615063

country:GR

2024-03-31

0001615063

country:GR

2023-12-31

0001615063

INSE:RestOfWorldMember

2024-03-31

0001615063

INSE:RestOfWorldMember

2023-12-31

0001615063

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

INSE:CustomerOneMember

2024-01-01

2024-03-31

0001615063

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

INSE:CustomerOneMember

2023-01-01

2023-03-31

0001615063

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

INSE:CustomerOneMember

2023-01-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

INSE:Instrument

INSE:Integer

iso4217:EUR

iso4217:GBP

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended March 31, 2024

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period _______________

Commission

File Number: 001-36689

INSPIRED

ENTERTAINMENT, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

47-1025534 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

Number) |

| 250

West 57th Street, Suite 415 |

|

|

| New

York, NY |

|

10107 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (646) 565-3861

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☒ |

| Non-accelerated

filer ☐ |

|

Smaller

reporting company ☐ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

INSE |

|

The

NASDAQ Stock Market LLC |

As

of May 7, 2024, there were 26,571,308 shares of the Company’s common stock issued and outstanding.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

References

in this report to “we,” “us,” “our,” the “Company” and “Inspired” refer to

Inspired Entertainment, Inc. and its subsidiaries unless the context suggests otherwise.

Certain

statements and other information set forth in this report, including in Item 2, “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and elsewhere herein, may relate to future events and expectations, and as such

constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Our forward-looking

statements include, but are not limited to, statements regarding our business strategy, plans and objectives and our expected or contemplated

future operations, results, financial condition, beliefs and intentions. In addition, any statements that refer to projections, forecasts

or other characterizations or predictions of future events or circumstances, including any underlying assumptions on which such statements

are expressly or implicitly based, are forward-looking statements. The words “anticipate”, “believe”, “continue”,

“can”, “could”, “estimate”, “expect”, “intend”, “may”, “might”,

“plan”, “possible”, “potential”, “predict”, “project”, “scheduled”,

“seek”, “should”, “would” and similar expressions, among others, and negatives expressions including

such words, may identify forward-looking statements.

Our

forward-looking statements reflect our current expectations about our future results, performance, liquidity, financial condition, prospects

and opportunities, and are based upon information currently available to us, our interpretation of what we believe to be significant

factors affecting our business and many assumptions regarding future events. Actual results, performance, liquidity, financial condition,

prospects and opportunities could differ materially from those expressed in, or implied by, our forward-looking statements. This could

occur as a result of various risks and uncertainties, including the following:

| |

● |

government

regulation of our industries; |

| |

|

|

| |

● |

our

ability to compete effectively in our industries; |

| |

|

|

| |

● |

the

effect of evolving technology on our business; |

| |

|

|

| |

● |

our

ability to renew long-term contracts and retain customers, and secure new contracts and customers; |

| |

|

|

| |

● |

our

ability to maintain relationships with suppliers; |

| |

|

|

| |

● |

our

ability to protect our intellectual property; |

| |

|

|

| |

● |

our

ability to protect our business against cybersecurity threats; |

| |

|

|

| |

● |

our

ability to successfully grow by acquisition as well as organically; |

| |

|

|

| |

● |

fluctuations

due to seasonality; |

| |

|

|

| |

● |

our

ability to attract and retain key members of our management team; |

| |

|

|

| |

● |

our

need for working capital; |

| |

|

|

| |

● |

our

ability to secure capital for growth and expansion; |

| |

|

|

| |

● |

changing

consumer, technology and other trends in our industries; |

| |

|

|

| |

● |

our

ability to successfully operate across multiple jurisdictions and markets around the world; |

| |

|

|

| |

● |

changes

in local, regional and global economic and political conditions; and |

| |

|

|

| |

● |

other

factors described in the reports and documents we file from time to time with the U.S. Securities and Exchange Commission (the “SEC”). |

In

light of these risks and uncertainties, and others discussed in this report, there can be no assurance that any matters covered by our

forward-looking statements will develop as predicted, expected or implied. Readers should not place undue reliance on any forward-looking

statements. Except as expressly required by the federal securities laws, we undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason. We advise

you to carefully review the reports and documents we file from time to time with the SEC.

PART

I - FINANCIAL INFORMATION

ITEM

1. FINANCIAL STATEMENTS

INSPIRED

ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(in

millions, except share data)

| |

|

March

31, 2024 |

|

|

December

31, 2023 |

|

| |

|

(Unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

35.3 |

|

|

$ |

40.0 |

|

| Accounts

receivable, net |

|

|

37.5 |

|

|

|

40.6 |

|

| Inventory,

net |

|

|

31.7 |

|

|

|

32.3 |

|

| Prepaid

expenses and other current assets |

|

|

39.6 |

|

|

|

39.6 |

|

| Total

current assets |

|

|

144.1 |

|

|

|

152.5 |

|

| |

|

|

|

|

|

|

|

|

| Property

and equipment, net |

|

|

63.2 |

|

|

|

62.8 |

|

| Software

development costs, net |

|

|

21.9 |

|

|

|

21.8 |

|

| Other

acquired intangible assets subject to amortization, net |

|

|

12.9 |

|

|

|

13.4 |

|

| Goodwill |

|

|

58.3 |

|

|

|

58.8 |

|

| Operating

lease right of use asset |

|

|

15.2 |

|

|

|

14.2 |

|

| Costs

of obtaining and fulfilling customer contracts, net |

|

|

9.7 |

|

|

|

9.4 |

|

| Other

assets |

|

|

5.8 |

|

|

|

8.0 |

|

| Total

assets |

|

$ |

331.1 |

|

|

$ |

340.9 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities

and Stockholders’ Deficit |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

57.6 |

|

|

$ |

60.8 |

|

| Corporate

tax and other current taxes payable |

|

|

3.2 |

|

|

|

6.3 |

|

| Deferred

revenue, current |

|

|

4.9 |

|

|

|

5.6 |

|

| Operating

lease liabilities |

|

|

5.1 |

|

|

|

4.7 |

|

| Current

portion of long-term debt |

|

|

18.9 |

|

|

|

19.1 |

|

| Other

current liabilities |

|

|

4.4 |

|

|

|

4.2 |

|

| Total

current liabilities |

|

|

94.1 |

|

|

|

100.7 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

debt |

|

|

293.3 |

|

|

|

295.6 |

|

| Finance

lease liabilities, net of current portion |

|

|

2.5 |

|

|

|

1.6 |

|

| Deferred

revenue, net of current portion |

|

|

8.0 |

|

|

|

7.1 |

|

| Operating

lease liabilities |

|

|

10.5 |

|

|

|

9.8 |

|

| Other

long-term liabilities |

|

|

3.9 |

|

|

|

4.1 |

|

| Total

liabilities |

|

|

412.3 |

|

|

|

418.9 |

|

| |

|

|

|

|

|

|

|

|

| Commitments

and contingencies |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

deficit |

|

|

|

|

|

|

|

|

| Preferred

stock; $0.0001 par value; 1,000,000 shares authorized, no shares issued and outstanding at March 31, 2024 and December 31, 2023,

respectively. |

|

|

— |

|

|

|

— |

|

| Common

stock; $0.0001 par value; 49,000,000 shares authorized; 26,559,756 shares and 26,219,021 shares issued and outstanding at March 31,

2024 and December 31, 2023, respectively |

|

|

— |

|

|

|

— |

|

| Additional

paid in capital |

|

|

387.3 |

|

|

|

386.1 |

|

| Accumulated

other comprehensive income |

|

|

45.8 |

|

|

|

44.5 |

|

| Accumulated

deficit |

|

|

(514.3 |

) |

|

|

(508.6 |

) |

| Total

stockholders’ deficit |

|

|

(81.2 |

) |

|

|

(78.0 |

) |

| Total

liabilities and stockholders’ deficit |

|

$ |

331.1 |

|

|

$ |

340.9 |

|

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INSPIRED

ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(in

millions, except share and per share data)

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Revenue: | |

| | |

| |

| Service | |

$ | 57.1 | | |

$ | 57.5 | |

| Product sales | |

| 6.0 | | |

| 7.4 | |

| Total revenue | |

| 63.1 | | |

| 64.9 | |

| | |

| | | |

| | |

| Cost of sales: | |

| | | |

| | |

| Cost of service (1) | |

| (15.9 | ) | |

| (15.0 | ) |

| Cost of product sales | |

| (4.5 | ) | |

| (6.7 | ) |

| Selling, general and administrative expenses | |

| (34.2 | ) | |

| (29.2 | ) |

| Depreciation and amortization | |

| (9.9 | ) | |

| (9.4 | ) |

| Net operating (loss) income | |

| (1.4 | ) | |

| 4.6 | |

| | |

| | | |

| | |

| Other expense | |

| | | |

| | |

| Interest expense, net | |

| (6.6 | ) | |

| (6.3 | ) |

| Other finance income | |

| 0.1 | | |

| 0.1 | |

| | |

| | | |

| | |

| Total other expense, net | |

| (6.5 | ) | |

| (6.2 | ) |

| | |

| | | |

| | |

| Income tax benefit | |

| 2.2 | | |

| 0.2 | |

| Net loss | |

| (5.7 | ) | |

| (1.4 | ) |

| | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | |

| Foreign currency translation gain (loss) | |

| 1.0 | | |

| (2.9 | ) |

| Reclassification of loss on hedging instrument to comprehensive income | |

| — | | |

| 0.2 | |

| Actuarial gains on pension plan | |

| 0.3 | | |

| 0.2 | |

| Other comprehensive income (loss) | |

| 1.3 | | |

| (2.5 | ) |

| | |

| | | |

| | |

| Comprehensive loss | |

$ | (4.4 | ) | |

$ | (3.9 | ) |

| | |

| | | |

| | |

| Net loss per common share – basic and diluted | |

$ | (0.20 | ) | |

$ | (0.05 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding during the period – basic and diluted | |

| 28,603,734 | | |

| 27,974,182 | |

| Supplemental disclosure of stock-based compensation expense | |

| | | |

| | |

| Stock-based compensation included in: | |

| | | |

| | |

| Selling, general and administrative expenses | |

$ | (2.3 | ) | |

$ | (2.9 | ) |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INSPIRED

ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

THREE

MONTHS ENDED MARCH 31, 2024

(in

millions, except share data)

(Unaudited)

| | |

Shares | | |

Amount | | |

capital | | |

income | | |

deficit | | |

deficit | |

| | |

Common stock | | |

Additional paid in | | |

Accumulated other comprehensive | | |

Accumulated | | |

Total stockholders’ | |

| | |

Shares | | |

Amount | | |

capital | | |

income | | |

deficit | | |

deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of December 31, 2023 | |

| 26,219,021 | | |

| — | | |

| 386.1 | | |

| 44.5 | | |

| (508.6 | ) | |

| (78.0 | ) |

| Foreign currency translation adjustments | |

| — | | |

| — | | |

| — | | |

| 1.0 | | |

| — | | |

| 1.0 | |

| Actuarial gains on pension plan | |

| — | | |

| — | | |

| — | | |

| 0.3 | | |

| — | | |

| 0.3 | |

| Issuances under stock plans | |

| 340,735 | | |

| — | | |

| (0.8 | ) | |

| — | | |

| — | | |

| (0.8 | ) |

| Stock-based compensation expense | |

| — | | |

| — | | |

| 2.0 | | |

| — | | |

| — | | |

| 2.0 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (5.7 | ) | |

| (5.7 | ) |

| Balance as of March 31, 2024 | |

| 26,559,756 | | |

$ | — | | |

$ | 387.3 | | |

$ | 45.8 | | |

$ | (514.3 | ) | |

$ | (81.2 | ) |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INSPIRED

ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

THREE

MONTHS ENDED MARCH 31, 2023

(in

millions, except share data)

(Unaudited)

| | |

Common stock | | |

Additional paid in | | |

Accumulated other comprehensive | | |

Accumulated | | |

Total stockholders’ | |

| | |

Shares | | |

Amount | | |

capital | | |

income | | |

deficit | | |

deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of December 31, 2022 | |

| 25,909,516 | | |

| — | | |

| 378.2 | | |

| 50.8 | | |

| (514.6 | ) | |

| (85.6 | ) |

| Balance | |

| 25,909,516 | | |

| — | | |

| 378.2 | | |

| 50.8 | | |

| (514.6 | ) | |

| (85.6 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| — | | |

| — | | |

| — | | |

| (2.9 | ) | |

| — | | |

| (2.9 | ) |

| Actuarial gains on pension plan | |

| — | | |

| — | | |

| — | | |

| 0.2 | | |

| — | | |

| 0.2 | |

| Reclassification of loss on hedging instrument to comprehensive income | |

| — | | |

| — | | |

| — | | |

| 0.2 | | |

| — | | |

| 0.2 | |

| Issuances under stock plans | |

| 353,554 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| 3.0 | | |

| — | | |

| — | | |

| 3.0 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1.4 | ) | |

| (1.4 | ) |

| Balance as of March 31, 2023 | |

| 26,263,070 | | |

$ | — | | |

$ | 381.2 | | |

$ | 48.3 | | |

$ | (516.0 | ) | |

$ | (86.5 | ) |

| Balance | |

| 26,263,070 | | |

$ | — | | |

$ | 381.2 | | |

$ | 48.3 | | |

$ | (516.0 | ) | |

$ | (86.5 | ) |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INSPIRED

ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in

millions)

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (5.7 | ) | |

$ | (1.4 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 9.9 | | |

| 9.4 | |

| Amortization of right of use asset | |

| 1.1 | | |

| 0.8 | |

| Stock-based compensation expense | |

| 2.3 | | |

| 2.9 | |

| Contract cost expense | |

| (2.4 | ) | |

| (2.6 | ) |

| Reclassification of loss on hedging instrument to comprehensive income | |

| — | | |

| 0.2 | |

| Non-cash interest expense relating to senior debt | |

| 0.2 | | |

| 0.3 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 2.7 | | |

| 8.3 | |

| Inventory | |

| 0.4 | | |

| (3.5 | ) |

| Prepaid expenses and other assets | |

| 4.3 | | |

| 1.0 | |

| Corporate tax and other current taxes payable | |

| (6.3 | ) | |

| (6.2 | ) |

| Accounts payable and accrued expenses | |

| (2.6 | ) | |

| 3.5 | |

| Deferred revenues and customer prepayment | |

| 0.6 | | |

| (0.2 | ) |

| Operating lease liabilities | |

| (1.0 | ) | |

| (0.9 | ) |

| Other long-term liabilities | |

| 0.1 | | |

| — | |

| Net cash provided by operating activities | |

| 3.6 | | |

| 11.6 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (4.4 | ) | |

| (5.5 | ) |

| Acquisition of third-party company trade and assets | |

| — | | |

| (0.6 | ) |

| Purchases of capital software | |

| (3.3 | ) | |

| (2.8 | ) |

| Net cash used in investing activities | |

| (7.7 | ) | |

| (8.9 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Repayments of finance leases | |

| (0.2 | ) | |

| (0.5 | ) |

| Net cash used in financing activities | |

| (0.2 | ) | |

| (0.5 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash | |

| (0.4 | ) | |

| 0.6 | |

| Net (decrease) increase in cash | |

| (4.7 | ) | |

| 2.8 | |

| Cash, beginning of period | |

| 40.0 | | |

| 25.0 | |

| Cash, end of period | |

$ | 35.3 | | |

$ | 27.8 | |

| | |

| | | |

| | |

| Supplemental cash flow disclosures | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 0.1 | | |

$ | 0.1 | |

| Cash paid during the period for income taxes | |

$ | — | | |

$ | 0.1 | |

| Cash paid during the period for operating leases | |

$ | 2.1 | | |

$ | 2.1 | |

| | |

| | | |

| | |

| Supplemental disclosure of noncash investing and financing activities | |

| | | |

| | |

| Additional paid in capital from net settlement of RSUs | |

$ | (0.8 | ) | |

$ | — | |

| Lease liabilities arising from obtaining right of use assets | |

$ | (2.2 | ) | |

$ | (0.1 | ) |

| Property and equipment acquired through finance lease | |

$ | 1.3 | | |

$ | — | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

1.

Nature of Operations, Management’s Plans and Summary of Significant Accounting Policies

Company

Description and Nature of Operations

We

are a global gaming technology company, supplying content, platform, gaming terminals and other products and services to online and land-based

regulated lottery, betting and gaming operators worldwide through a broad range of distribution channels, predominantly on a business-to-business

basis. We provide end-to-end digital gaming solutions (i) on our own proprietary and secure network, which accommodates a wide range

of devices, including land-based gaming machine terminals, mobile devices and online computer applications and (ii) through third party

networks. Our content and other products can be found through the consumer-facing portals of our interactive customers and, through our

land-based customers, in licensed betting offices, adult gaming centers, pubs, bingo halls, airports, motorway service areas and leisure

parks.

Liquidity Discussions

As

of March 31, 2024, the Company’s cash on hand was $35.3 million, and the Company had working capital in addition to cash of $14.7

million. The Company recorded a net loss of $5.7 million and $1.4 million for the three months ended March 31, 2024 and 2023, respectively.

Net income/losses include non-cash stock-based compensation of $2.3 million and $2.9 million for the three months ended March 31, 2024

and 2023, respectively. Historically, the Company has generally had positive cash flows from operating activities and has relied on a

combination of cash flows provided by operations and the incurrence of debt and/or the refinancing of existing debt to fund its obligations.

Cash flows provided by operations amounted to $3.6 million and $11.6 million for the three months ended March 31, 2024 and 2023, respectively.

Management

currently believes that the Company’s cash balances on hand, cash flows expected to be generated from operations, ability to control

and defer capital projects and amounts available from the Company’s external borrowings will be sufficient to fund the Company’s

net cash requirements through May 2025.

Basis

of Presentation

The

accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles

generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and pursuant to the applicable rules and regulations of the SEC. Certain information

or footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted,

pursuant to the rules and regulations of the SEC for interim financial reporting. Accordingly, they do not include all the information

and footnotes necessary for a comprehensive presentation of financial position, results of operations, or cash flows. It is management’s

opinion, however, that the accompanying unaudited interim condensed consolidated financial statements include all adjustments, consisting

of a normal recurring nature, which are necessary for a fair presentation of the financial position, operating results and cash flows

for the periods presented.

The

accompanying unaudited interim condensed consolidated financial statements should be read in conjunction with the Company’s

consolidated financial statements and notes thereto for the years ended December 31, 2023 and 2022. The financial information as of

December 31, 2023 is derived from the audited consolidated financial statements presented in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2023 filed with the SEC on April 15, 2024. The financial information for the three months ended March 31, 2023 is

derived from the unaudited consolidated financial statements presented in the Company’s Annual Report on Form 10-Q/A for the three

months ended March 31, 2023 filed with the SEC on February 27, 2024. The interim results for the three months ended

March 31, 2024 are not necessarily indicative of the results to be expected for the year ending December 31, 2024 or for any future

interim periods.

2.

Allowance for Credit Losses

Changes

in the allowance for credit losses are as follows:

Schedule

of Changes in Allowance for Credit Losses

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

(in millions) | |

| Beginning balance | |

$ | (1.1 | ) | |

$ | (1.4 | ) |

| Additional allowance for credit losses | |

| — | | |

| (0.2 | ) |

| Recoveries | |

| — | | |

| 0.2 | |

| Write offs | |

| — | | |

| 0.4 | |

| Foreign currency translation adjustments | |

| — | | |

| (0.1 | ) |

| Ending balance | |

$ | (1.1 | ) | |

$ | (1.1 | ) |

3.

Inventory

Inventory

consists of the following:

Schedule

of Inventory

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

(in millions) | |

| Component parts | |

$ | 22.5 | | |

$ | 23.3 | |

| Work in progress | |

| 1.0 | | |

| 0.4 | |

| Finished goods | |

| 8.2 | | |

| 8.6 | |

| Total inventories | |

$ | 31.7 | | |

$ | 32.3 | |

Component

parts include parts for gaming terminals. Our finished goods inventory primarily consists of gaming terminals which are ready for sale.

4.

Accounts Payable and Accrued Expenses

Accounts

payable and accrued expenses consist of the following:

Schedule

of Accounts

Payable and Accrued Expenses

| | |

March

31, 2024 | | |

December 31, 2023 | |

| | |

(in millions) | |

| Accounts payable | |

$ | 35.2 | | |

$ | 41.9 | |

| Interest payable | |

| 8.4 | | |

| — | |

| Payroll and related costs | |

| 5.1 | | |

| 5.5 | |

| Cost of sales including inventory | |

| 5.0 | | |

| 6.4 | |

| Other creditors | |

| 3.9 | | |

| 7.0 | |

| Total accounts payable and accrued expenses | |

$ | 57.6 | | |

$ | 60.8 | |

5.

Contract Related Disclosures

The

following table summarizes contract related balances:

Schedule of Contract Related Balances

| | |

Accounts Receivable | | |

Unbilled Accounts Receivable | | |

Right to recover asset | | |

Deferred Income | | |

Customer Prepayments and Deposits | |

| | |

(in millions) | |

| At March 31, 2024 | |

$ | 36.7 | | |

$ | 20.5 | | |

$ | 0.6 | | |

$ | (12.9 | ) | |

$ | (3.1 | ) |

| At December 31, 2023 | |

$ | 42.8 | | |

$ | 24.0 | | |

$ | 0.6 | | |

$ | (12.7 | ) | |

$ | (2.9 | ) |

Revenue

recognized that was included in the deferred income balance at the beginning of the period amounted to $1.9 million and $1.2 million

for the three months ended March 31, 2024 and 2023, respectively.

For

the periods ended March 31, 2024 and 2023 respectively, there was

no significant amounts of revenue recognized as a result of changes in contract transaction price

related to performance obligations that were satisfied in the respective prior periods.

Transaction

Price Allocated to Remaining Performance Obligations

At

March 31, 2024, the transaction price allocated to unsatisfied performance obligations for contracts expected to be greater than one

year, or performance obligations for which we do not have a right to consideration from the customer in the amount that corresponds to

the value to the customer for our performance completed to date, variable consideration which is not accounted for in accordance with

the sales-based or usage-based royalties guidance, or contracts which are not wholly unperformed, is approximately $102.6 million. Of

this amount, we expect to recognize as revenue approximately 30% through December 31, 2024, approximately 50% through December 31, 2026,

and the remaining 20% through December 31, 2029.

6.

Stock-Based Compensation

A

summary of the Company’s restricted stock unit (“RSU”) activity during the three months ended March 31, 2024 is as

follows:

Schedule of Restricted Stock Unit Activity

| | |

Number

of Shares | |

| | |

| |

| Unvested Outstanding at January 1, 2024 (1) | |

| 1,242,175 | |

| Granted (2) | |

| 604,709 | |

| Forfeited | |

| (29,599 | ) |

| Vested | |

| (10,166 | ) |

| Unvested Outstanding at March 31, 2024 | |

| 1,807,119 | |

The

Company issued a total of 340,735 shares during the three months ended March 31, 2024, in connection with the Company’s equity-based plans, which included an aggregate of 333,161 shares issued

in connection with the net settlement of RSUs that vested during the prior year (on December 29, 2023).

7.

Accumulated Other Comprehensive Loss (Income)

The

accumulated balances for each classification of comprehensive loss (income) are presented below:

Schedule of Accumulated Other Comprehensive Loss (Income)

| | |

Foreign Currency Translation Adjustments | | |

Change in Fair Value of Hedging Instrument | | |

Unrecognized Pension Benefit Costs | | |

Accumulated Other Comprehensive (Income) | |

| | |

(in millions) | |

| Balance at January 1, 2024 | |

$ | (78.3 | ) | |

$ | — | | |

$ | 33.8 | | |

$ | (44.5 | ) |

| Change during the period | |

| (1.0 | ) | |

| — | | |

| (0.3 | ) | |

| (1.3 | ) |

| Balance at March 31, 2024 | |

$ | (79.3 | ) | |

$ | — | | |

$ | 33.5 | | |

$ | (45.8 | ) |

| | |

Foreign Currency Translation Adjustments | | |

Change in Fair Value of Hedging Instrument | | |

Unrecognized Pension Benefit Costs | | |

Accumulated Other Comprehensive (Income) | |

| | |

(in millions) | |

| Balance at January 1, 2023 | |

$ | (84.2 | ) | |

$ | 0.3 | | |

$ | 33.1 | | |

$ | (50.8 | ) |

| Change during the period | |

| 2.9 | | |

| (0.2 | ) | |

| (0.2 | ) | |

| 2.5 | |

| Balance at March 31, 2023 | |

$ | (81.3 | ) | |

$ | 0.1 | | |

$ | 32.9 | | |

$ | (48.3 | ) |

In

connection with the issuance of Senior Secured Notes and the entry into a Revolving Credit Facility (“RCF”) Agreement

(the “RCF Agreement”), on May 19, 2021, the Company terminated all of its interest rate swaps. Accordingly, hedge accounting is no longer applicable. The

amounts previously recorded in Accumulated Other Comprehensive Income are amortized into Interest expense over the terms of the

hedged forecasted interest payments. Losses reclassified from Accumulated Other Comprehensive Income into Interest expense in the

Consolidated Statements of Operations and Income for the three months ended March 31, 2024 and March 31, 2023 amounted to $0.0

million and $0.2

million, respectively.

8.

Net Earnings (Loss) per Share

Basic

income/loss per share (“EPS”) is computed by dividing net income/loss attributable to common stockholders by the weighted-average number of common shares outstanding during the period, excluding the effects of any potentially dilutive securities. Diluted

EPS gives effect to all dilutive potential shares of common stock outstanding during the period, including stock options and RSUs, unless

the inclusion would be anti-dilutive.

The

computation of diluted EPS excludes the common stock equivalents of the following potentially dilutive securities because they were either

contingently issuable shares or because their inclusion would be anti-dilutive:

Schedule of Anti-dilutive Securities Excluded from Computation of Earnings per Share

| | |

2024 | | |

2023 | |

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| RSUs | |

$ | 1,807,119 | | |

$ | 1,917,231 | |

There

were no reconciling items for the three months ended March 31, 2024 or March 31, 2023.

The

calculation of Basic EPS includes the effects of 1,840,165 and 1,893,136 shares for the three months ended March 31, 2024 and 2023, respectively,

with respect to RSU awards that have vested but have not yet been issued.

9.

Other Finance Income (Expense)

Other

finance income (expense) consisted of the following:

Schedule of Other Finance Income (Expense)

| | |

| | | |

| | |

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

(in millions) | |

| Pension interest cost | |

$ | (0.9 | ) | |

$ | (0.8 | ) |

| Expected return on pension plan assets | |

| 1.0 | | |

| 0.9 | |

| Other finance income (Costs) | |

$ | 0.1 | | |

$ | 0.1 | |

10.

Income Taxes

The

effective income tax rate for the three months ended March 31, 2024 and 2023 was 27.4% and 13.2%, respectively, resulting in a $2.2 million

and $0.2 million income tax benefit, respectively.

The

effective tax rate reported in any given year will continue to be influenced by a variety of factors, including the level of pre-tax income

or loss, the income mix between jurisdictions, and any discrete items that may occur.

The

Company recorded a valuation allowance against all of our deferred tax assets as of both March 31, 2024 and 2023. We intend to continue

maintaining a full valuation allowance on our deferred tax assets until there is sufficient evidence to support the reversal of all or

some portion of these allowances. However, given our current earnings and anticipated future earnings, we believe that there is a reasonable

possibility that within the next 12 months, sufficient positive evidence may become available to allow us to reach a conclusion that

a significant portion of the valuation allowance will no longer be needed. Release of the valuation allowance would result in the recognition

of certain deferred tax assets and a decrease to income tax expense for the period the release is recorded. However, the exact timing

and amount of the valuation allowance release are subject to change on the basis of the level of profitability that we are able to actually

achieve.

11.

Related Parties

Macquarie

Corporate Holdings Pty Limited (UK Branch) (“Macquarie UK”) (an arranger and lending party under our RCF Agreement) is

an affiliate of MIHI LLC, which beneficially owned approximately 11.4%

of our common stock as of March 31, 2024. Macquarie UK held $2.1

million of the total $18.9

million of RCF drawn at March 31, 2024 and December 31, 2023, respectively. Macquarie UK did not hold any of the Company’s

aggregate senior debt at March 31, 2024 or December 31, 2023. Interest expense payable to Macquarie UK for the three months ended

March 31, 2024 and 2023 amounted to $0.1

million and $0.0

million, respectively. MIHI LLC is also a party to a stockholders agreement with the Company and other stockholders, dated December

23, 2016, pursuant to which, subject to certain conditions, MIHI LLC, jointly with Hydra Industries Sponsor LLC, are permitted to

designate two directors to be nominated for election as directors of the Company at any annual or special meeting of stockholders at

which directors are to be elected, until such time as MIHI LLC and Hydra Industries Sponsor LLC in the aggregate hold less than 5%

of the outstanding shares of the Company.

On

December 31, 2021, the Company entered into a consultancy agreement with Richard Weil, the brother of A. Lorne Weil, our Executive

Chairman, under which Richard Weil received a success fee for services provided in connection with our acquisition of Sportech

Lotteries, LLC. The success fee was paid during the year ended December 31, 2022. Under the agreement, as extended in November 2022

and in July 2023 and December 2023, he will provide consulting services to the Company relating to the lottery in the Dominican

Republic through December 31, 2024, for which he was compensated at a rate of $10,000

per month in consulting fees through to June 30, 2023, and at a rate of $12,500

per month for the remainder of the term of the agreement. The aggregate amount incurred by the Company in consulting fees was $37,500

and $30,000

for the three months ended March 31, 2024 and 2023, respectively.

12.

Leases

Certain

of our arrangements include leases for equipment installed at customer locations. As the lessor, we combine lease and non-lease components

for all classes of underlying assets in arrangements that involve operating leases. The single combined component is accounted for under

ASC 606, Revenue from Contracts with Customers based on the consideration that the non-lease components are the predominant items

in the arrangements. If a component cannot be combined, the consideration is allocated between the lease component and the non-lease

component based on relative standalone selling price. The lease component is accounted for under ASC 842, Leases and the non-lease

component is accounted for under ASC 606.

Lease

income from operating leases and from sales type leases is not material for any of the periods presented.

13.

Commitments and Contingencies

Employment

Agreements

We

are party to employment agreements with our executive officers and other employees of the Company and our subsidiaries which contain,

among other terms, provisions relating to severance and notice requirements.

Legal

Matters

From

time to time, the Company may become involved in lawsuits and legal matters arising in the ordinary course of business. While the Company

believes that, currently, it has no such matters that are material, there can be no assurance that existing or new matters arising in

the ordinary course of business will not have a material adverse effect on the Company’s business, financial condition or results

of operations.

14.

Pension Plan

We

operate a defined contribution plan in the US, and both defined benefit and defined contribution pension schemes in the UK. The defined

contribution scheme assets are held separately from those of the Company in independently administered funds.

Defined

Benefit Pension Scheme

The

defined benefit scheme has been closed to new entrants since April 1, 1999 and closed to future accruals for services rendered to the

Company for the entire financial statement periods presented. The Actuarial Valuation of the scheme as at March 31, 2021, determined

that the statutory funding objective was not met, i.e., there were insufficient assets to cover the scheme’s technical provisions

and there was a funding shortfall.

In

June 2022, a recovery plan was put in place to eliminate the funding shortfall. The plan expects the shortfall to be eliminated by October

31, 2026.

The

following table presents the components of our net periodic pension cost:

Schedule of Net Periodic Pension Cost

| | |

| | | |

| | |

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

(in millions) | |

| Components of net periodic pension cost: | |

| | |

| |

| Interest cost | |

$ | 0.9 | | |

$ | 0.8 | |

| Expected return on plan assets | |

| (1.0 | ) | |

| (0.9 | ) |

| Amortization of net loss | |

| 0.3 | | |

| 0.2 | |

| Net periodic cost | |

$ | 0.2 | | |

$ | 0.1 | |

15.

Segment Reporting and Geographic Information

The

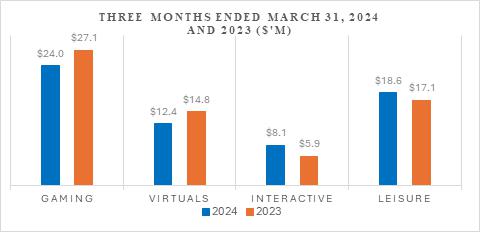

Company operates its business along four operating segments, which are segregated on the basis of revenue stream: Gaming, Virtual Sports,

Interactive and Leisure. The Company believes this method of segment reporting reflects both the way its business segments are managed

and the way the performance of each segment is evaluated.

The

following tables present revenue, cost of sales, excluding depreciation and amortization, selling, general and administrative expenses,

depreciation and amortization, stock-based compensation expense and acquisition related transaction expenses, operating profit/(loss),

and total capital expenditures for the periods ended March 31, 2024 and March 31, 2023, respectively, by business segment. Certain unallocated

corporate function costs have not been allocated to the Company’s reportable operating segments because these costs are not allocable

and to do so would not be practical. Corporate function costs consist primarily of selling, general and administrative expenses, depreciation

and amortization and capital expenditures relating to corporate/shared functions.

Segment

Information

Schedule of Segment Reporting Information by Segment

Three

Months Ended March 31, 2024

| | |

Gaming | | |

Virtual Sports | | |

Interactive | | |

Leisure | | |

Corporate Functions | | |

Total | |

| | |

(in millions) | |

| Revenue: | |

| | |

| | |

| | |

| | |

| | |

| |

| Service | |

$ | 18.6 | | |

$ | 12.4 | | |

$ | 8.1 | | |

$ | 18.0 | | |

$ | — | | |

$ | 57.1 | |

| Product sales | |

| 5.4 | | |

| — | | |

| — | | |

| 0.6 | | |

| — | | |

| 6.0 | |

| Total revenue | |

| 24.0 | | |

| 12.4 | | |

| 8.1 | | |

| 18.6 | | |

| — | | |

| 63.1 | |

| Cost of sales, excluding depreciation and amortization: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of service | |

| (5.8 | ) | |

| (0.4 | ) | |

| (0.6 | ) | |

| (9.1 | ) | |

| — | | |

| (15.9 | ) |

| Cost of product sales | |

| (4.3 | ) | |

| — | | |

| — | | |

| (0.2 | ) | |

| — | | |

| (4.5 | ) |

| Selling, general and administrative expenses | |

| (6.6 | ) | |

| (1.6 | ) | |

| (3.1 | ) | |

| (7.5 | ) | |

| (13.1 | ) | |

| (31.9 | ) |

| Stock-based compensation expense | |

| (0.2 | ) | |

| (0.1 | ) | |

| (0.1 | ) | |

| (0.1 | ) | |

| (1.8 | ) | |

| (2.3 | ) |

| Depreciation and amortization | |

| (4.3 | ) | |

| (0.9 | ) | |

| (1.2 | ) | |

| (3.0 | ) | |

| (0.5 | ) | |

| (9.9 | ) |

| Segment operating income (loss) | |

| 2.8 | | |

| 9.4 | | |

| 3.1 | | |

| (1.3 | ) | |

| (15.4 | ) | |

| (1.4 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net operating loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

$ | (1.4 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total capital expenditures for the three months ended March 31, 2024 | |

$ | 2.0 | | |

$ | 1.2 | | |

$ | 0.5 | | |

$ | 4.9 | | |

$ | 0.5 | | |

$ | 9.1 | |

Three

Months Ended March 31, 2023

| | |

Gaming | | |

Virtual Sports | | |

Interactive | | |

Leisure | | |

Corporate Functions | | |

Total | |

| | |

(in millions) | |

| Revenue: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service | |

$ | 20.2 | | |

$ | 14.8 | | |

$ | 5.9 | | |

$ | 16.6 | | |

$ | — | | |

$ | 57.5 | |

| Product sales | |

| 6.9 | | |

| — | | |

| — | | |

| 0.5 | | |

| — | | |

| 7.4 | |

| Total revenue | |

| 27.1 | | |

| 14.8 | | |

| 5.9 | | |

| 17.1 | | |

| — | | |

| 64.9 | |

| Cost of sales, excluding depreciation and amortization: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of service | |

| (5.9 | ) | |

| (0.4 | ) | |

| (0.3 | ) | |

| (8.4 | ) | |

| — | | |

| (15.0 | ) |

| Cost of product sales | |

| (5.8 | ) | |

| — | | |

| — | | |

| (0.9 | ) | |

| — | | |

| (6.7 | ) |

| Selling, general and administrative expenses | |

| (5.7 | ) | |

| (1.7 | ) | |

| (2.5 | ) | |

| (6.9 | ) | |

| (9.5 | ) | |

| (26.3 | ) |

| Stock-based compensation expense | |

| (0.3 | ) | |

| (0.2 | ) | |

| (0.2 | ) | |

| (0.1 | ) | |

| (2.1 | ) | |

| (2.9 | ) |

| Acquisition and integration related transaction expenses | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Depreciation and amortization | |

| (4.5 | ) | |

| (0.8 | ) | |

| (0.6 | ) | |

| (3.1 | ) | |

| (0.4 | ) | |

| (9.4 | ) |

| Segment operating income (loss) | |

| 4.9 | | |

| 11.7 | | |

| 2.3 | | |

| (2.3 | ) | |

| (12.0 | ) | |

| 4.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net operating income | |

| | | |

| | | |

| | | |

| | | |

| | | |

$ | 4.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total capital expenditures for the three months ended March 31, 2023 | |

$ | 2.4 | | |

$ | 0.4 | | |

$ | 1.1 | | |

$ | 5.2 | | |

$ | 0.5 | | |

$ | 9.6 | |

Geographic

Information

Geographic

information for revenue is set forth below:

Schedule of Geographic Information

| | |

| | | |

| | |

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

(in millions) | |

| Total revenue | |

| | | |

| | |

| UK | |

$ | 47.2 | | |

$ | 49.0 | |

| Greece | |

| 6.1 | | |

| 5.6 | |

| Rest of world | |

| 9.8 | | |

| 10.3 | |

| Total | |

$ | 63.1 | | |

$ | 64.9 | |

| Total revenue | |

$ | 63.1 | | |

$ | 64.9 | |

UK

revenue includes revenue from customers headquartered in the UK, but whose revenue is generated globally.

Geographic

information of our non-current assets excluding goodwill is set forth below:

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

(in millions) | |

| UK | |

$ | 90.0 | | |

$ | 91.9 | |

| Greece | |

| 14.7 | | |

| 15.3 | |

| Rest of world | |

| 24.0 | | |

| 22.4 | |

| Total | |

$ | 128.7 | | |

$ | 129.6 | |

| Total non- current assets excluding goodwill | |

$ | 128.7 | | |

$ | 129.6 | |

Software

development costs are included as attributable to the market in which they are utilized.

16.

Customer Concentration

During

the three months ended March 31, 2024, there was one customer that represented at least 10% of the Company’s revenues,

accounting for approximately 11%

of the Company’s revenues. This customer was served by the Virtual Sports and Interactive segments. During the three months

ended March 31, 2023, there was one customer that represented at least 10% of the Company’s revenues, accounting for

approximately 15%

of the Company’s revenues. This customer was served by the Virtual Sports and Interactive segments.

At

March 31, 2024 no customers represented at least 10% of the Company’s accounts receivable. At December 31, 2023, there was one

customer that represented at least 10% of the Company’s accounts receivable, accounting for approximately 24%

of the Company’s accounts receivable.

17.

Subsequent Events

The

Company evaluates subsequent events and transactions that occur after the balance sheet date up to the date that the financial statements

were issued. The Company did not identify subsequent events that would have required adjustment or disclosure in the consolidated financial

statements.

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion and analysis of our financial condition and results of operations should be read in conjunction with the financial

statements and related notes thereto included elsewhere in this report. This discussion contains forward-looking statements that involve

risks and uncertainties. Our actual future results could differ materially from the historical results discussed below. Factors that

could cause or contribute to such differences include, but are not limited to, those identified below and those referenced in the section

titled “Risk Factors” included elsewhere in this report.

Forward-Looking

Statements

We

make forward-looking statements in this Management’s Discussion and Analysis of Financial Condition and Results of Operations.

For definitions of the term “forward-looking statements”, see the definitions provided in the Cautionary Note Regarding Forward-Looking

Statements at the forepart of this report.

Seasonality

Our

results of operations can fluctuate due to seasonal trends and other factors. Sales of our gaming machines can vary quarter-on-quarter

due to both supply and demand factors. Player activity for our holiday parks is generally higher in the second and third quarters of

the year, particularly during the summer months and slower during the first and fourth quarters of the year.

Revenue

We

generate revenue in four principal ways: (i) on a participation basis, (ii) on a fixed rental fee basis, (iii) through product

sales, (iv) by services provided and (v) through software license fees. Participation revenue generally includes a right to receive a

share of our customers’ gaming revenue, typically as a share of net win but sometimes as a share of the handle or “coin

in” which represents the total amount wagered.

Geographic

Range

Geographically,

the majority of our revenue is derived from, and the majority of our non-current assets are attributable to, our UK operations. The remainder

of our revenue is derived from, and non-current assets attributable to, Greece and the rest of the world (including North America).

For

the three months ended March 31, 2024 we derived approximately 75% of our revenue from the UK (including customers headquartered in the

UK but whose revenue is generated globally), 10% from Greece, and the remaining 15% across the rest of the world. In the three-months

ended March 31, 2023 we derived approximately 76% of our revenue from the UK (including customers headquartered in the UK but whose revenue

is generated globally), 9% from Greece, and the remaining 15% across the rest of the world.

As

of March 31, 2024, our non-current assets (excluding goodwill) were attributable as follows: 70% to the UK, 12% to Greece and 18% across

the rest of the world. As of March 31, 2023 our non-current assets (excluding goodwill) were attributable as follows: 80% to the UK,

5% to Greece and 15% across the rest of the world.

Foreign

Exchange

Our

results are affected by changes in foreign currency exchange rates as a result of the translation of foreign functional currencies

into our reporting currency and the re-measurement of foreign currency transactions and balances. The impact of foreign currency

exchange rate fluctuations represents the difference between current rates and prior-period rates applied to current activity. The

geographic region in which the largest portion of our business is operated is the UK and the British pound sterling

(“GBP”) is considered to be our functional currency. Our reporting currency is the U.S. dollar (“USD”). Our

results are translated from our functional currency of GBP into the reporting currency of USD using average rates for profit and

loss transactions and applicable spot rates for period-end balances. The effect of translating our functional currency into our

reporting currency, as well as translating the results of foreign subsidiaries that have a different functional currency into our

functional currency, is reported separately in Accumulated Other Comprehensive Income.

During

the three months ended March 31, 2024 we derived approximately 25% of our revenue from sales to customers outside the UK. In the thee

months ended March 31, 2023 we derived approximately 24% of our revenue from sales to customers outside the UK.

In

the section “Results of Operations” below, currency impacts shown have been calculated as the current-period average GBP:USD

rate less the equivalent average rate in the prior period, multiplied by the current period amount in our functional currency (GBP).

The remaining difference, referred to as functional currency at constant rate, is calculated as the difference in our functional currency,

multiplied by the prior-period average GBP:USD rate. This is not a U.S. GAAP measure, but is one which management believes gives a clearer

indication of results. In the tables below, variances in particular line items from period to period exclude currency translation movements,

and currency translation impacts are shown independently.

Non-GAAP

Financial Measures

We

use certain financial measures that are not compliant with U.S. GAAP (“Non-GAAP financial measures”), including EBITDA and

Adjusted EBITDA, to analyze our operating performance. In this discussion and analysis, we present certain non-GAAP financial measures,

define and explain these measures and provide reconciliations to the most comparable U.S. GAAP measures. See “Non-GAAP Financial

Measures” below.

Results

of Operations

Our

results are affected by changes in foreign currency exchange rates, primarily between our functional currency (GBP) and our

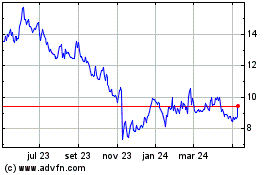

reporting currency (USD). During the three months ended March 31, 2024 and March 31, 2023, the average GBP:USD rates for the periods

1.27 and 1.21, respectively.

The

following discussion and analysis of our results of operations has been organized in the following manner:

| |

● |

a

discussion and analysis of the Company’s results of operations for the three-month period ended March 31, 2024, compared to

the same period in 2023; and |

| |

|

|

| |

● |

a

discussion and analysis of the results of operations for each of the Company’s segments (Gaming, Virtual Sports, Interactive

and Leisure) for the three-month periods ended March 31, 2024, compared to the same period in 2023, including key performance indicator (“KPI”) analysis. |

In

the discussion and analysis below, certain data may vary from the amounts presented in our consolidated financial statements due to rounding.

For

all reported variances, refer to the overall company and segment tables shown below. All variances discussed in the overall company and

segment results are on a functional currency (at constant rate) basis, which excludes the impact of any changes in foreign currency exchange

rates.

Key

Events

During

the three-month period ended March 31, 2024 in the Gaming segment, we completed over 240 B3 / Category C installations of

Inspired’s new Vantage terminal into the Gaming estate.

During

the three-month period ended March 31, 2024 the Interactive segment went live with four new operators including Winmasters, Midnite,

Favbet, and OLG and bet365 in New Jersey.

Key

agreements signed in the three-month period ended March 31, 2024 include a new contract with Kambi Group to integrate Inspired

Virtual Sports products into the Kambi sportsbook platform, a new multi-year contract with Parkdean resorts for the sole supply of

amusement and gaming machines to their holiday park estate of 64 sites nationwide in the UK and a new multi-year contract with Away

Resorts for sole supply to 19 sites nationwide in the UK. We also secured an early contract extension with Hydes in the pubs

business.

Overall

Company Results

Three

Months ended March 31, 2024, compared to Three Months ended March 31, 2023

| | |

For the Three-Month | | |

Variance | |

| (In millions) | |

Period ended | | |

2024 vs 2023 | |

| | |

March 31, 2024 | | |

March 31, 2023 | | |

Variance Attributable to Currency Movement | | |

Variance on a Functional currency basis | | |

Total Functional Currency Variance % | | |

Total Reported Variance % | |

| Revenue: | |

| | |

| | |

| | |

| | |

| | |

| |

| Service | |

$ | 57.1 | | |

$ | 57.5 | | |

$ | 2.4 | | |

$ | (2.8 | ) | |

| (5 | )% | |

| (1 | )% |

| Product | |

| 6.0 | | |

| 7.4 | | |

| 0.2 | | |

| (1.6 | ) | |

| (22 | )% | |

| (19 | )% |

| Total revenue | |

| 63.1 | | |

| 64.9 | | |

| 2.6 | | |

| (4.4 | ) | |

| (7 | )% | |

| (3 | )% |

| Cost of Sales, excluding depreciation and amortization: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of Service | |

| (15.9 | ) | |

| (15.0 | ) | |

| (0.6 | ) | |

| (0.3 | ) | |

| 2 | % | |

| 6 | % |

| Cost of Product | |

| (4.5 | ) | |

| (6.7 | ) | |

| (0.3 | ) | |

| 2.5 | | |

| (37 | )% | |

| (33 | )% |

| Selling, general and administrative expenses | |

| (31.9 | ) | |

| (26.3 | ) | |

| (1.5 | ) | |

| (4.1 | ) | |

| 16 | % | |

| 21 | % |

| Stock-based compensation | |

| (2.3 | ) | |

| (2.9 | ) | |

| (0.1 | ) | |

| 0.7 | | |

| (24 | )% | |

| (21 | )% |

| Depreciation and amortization | |

| (9.9 | ) | |

| (9.4 | ) | |

| (0.4 | ) | |

| (0.1 | ) | |

| 1 | % | |

| 5 | % |

| Net operating (loss) income | |

| (1.4 | ) | |

| 4.6 | | |

| (0.3 | ) | |

| (5.7 | ) | |

| (124 | )% | |

| (130 | )% |

| Other expense | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (6.6 | ) | |

| (6.3 | ) | |

| (0.3 | ) | |

| - | | |

| 0 | % | |

| 5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other finance income | |

| 0.1 | | |

| 0.1 | | |

| (0.0 | ) | |

| - | | |

| 0 | % | |

| 0 | % |

| Total other expense, net | |

| (6.5 | ) | |

| (6.2 | ) | |

| (0.3 | ) | |

| - | | |

| 0 | % | |

| 5 | % |

| Loss before income taxes | |

| (7.9 | ) | |

| (1.6 | ) | |

| (0.6 | ) | |

| (5.7 | ) | |

| 356 | % | |

| 394 | % |

| Income tax expense | |

| 2.2 | | |

| 0.2 | | |

| 0.1 | | |

| 1.9 | | |

| 950 | % | |

| 1000 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (5.7 | ) | |

$ | (1.4 | ) | |

$ | (0.5 | ) | |

$ | (3.8 | ) | |

| 271 | % | |

| 307 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exchange Rate - $ to £ | |

| 1.27 | | |

| 1.21 | | |

| | | |

| | | |

| | | |

| | |

See

“Segments Results” below for a more detailed explanation of the significant changes in our components of revenue within the

individual segment results of operations.

Revenue (for the three months ended March 31, 2024, compared to the three months

ended March 31, 2023)

Consolidated

Reported Revenue by Segment

For

the three months ended March 31, 2024, revenue on a functional currency (at constant rate) basis decreased by $4.4 million, or 7%.

For

the three-month period, Gaming revenue declined by $4.1 million and Gaming service revenue declined by $2.4 million predominantly

due to a decrease in the UK and Greek markets. Gaming Product revenue decreased by $1.7 million predominately due to UK and mainland

Europe product sales. Virtual Sports declined by $3.0 million predominately due to reduced Online revenues. Interactive grew by $1.8

million, driven primarily by revenue growth in the UK, mainland Europe and Latin America. Leisure grew by $0.8 million, driven primarily by the

increase in the revenue generated per machine in the Pubs and increased revenues in Holiday

Parks.

Cost

of sales, excluding depreciation and amortization

Cost

of sales, excluding depreciation and amortization, for the three months ended March 31, 2024, decreased by $2.2 million, or 10% compared to the three-month period ended March 31, 2023.

The decrease was mainly driven by $2.5 million in cost of product related to the reduction in Gaming Product sales.

Selling,

general and administrative expenses

Selling,

general and administrative (“SG&A”) expenses for the three months ended March 31, 2024 increased by $4.1 million, or

16% compared to the three-month period March 31,2024.

The

increase was driven primarily by the cost of restatement work of $5.0 million (excluded from Adjusted EBITDA) as well as an increase