Filed

by Alerus Financial Corporation

(Commission

File No.: 001-39036)

Pursuant

to Rule 425 of the Securities Act of 1933

and

deemed filed pursuant to Rule 14a-12

of

the Securities Exchange Act of 1934

Subject

Company: HMNF

(Commission

File No.: 0-24100)

Date:

May 15, 2024

The following materials were shared

with employees of HMN Financial Inc. on May 15, 2024.

WELCOME

TO ALERUs

Together,

we’ll soar to new heights

Timeline

| SIGNING |

May 15 |

§ |

Issue press release; post to both Home Federal and Alerus websites |

| § |

Employee announcement |

| § |

Mail letter to Home Federal clients |

| § |

Business as usual for Home Federal |

| May – July |

§ |

Expand project team for closing and conversion planning |

| § |

Communicate long-term staffing needs as decisions are made |

| § |

Communicate pay to stay (retention) bonuses |

| Late summer/early fall |

§ |

Alerus will complete orientation/benefits enrollment with all employees in preparation for closing |

| § |

Home Federal shareholder vote and Alerus shareholder vote |

| CLOSING |

Back half of 2024 |

§ |

Anticipated regulatory approval |

| Back half of 2024 |

§ |

Anticipated legal closing |

| § |

Mail letter to Home Federal clients; update Home Federal and Alerus websites |

| § |

Employees move to Alerus payroll and benefits |

| § |

Employees will begin getting access to Alerus systems and technology platforms |

| § |

Operate as “Alerus, formerly Home Federal”, while maintaining separate banking/accounting systems until conversion |

| § |

Branch signs will be updated between closing and conversion |

|

CONVERSION

|

Back half of year

or early 2025 |

§ |

Client conversion to Alerus platforms – includes multiple client touchpoints to minimize client disruption, including mailed/emailed communications, detailed conversion brochure, reminder and follow ups messages, and information posted to both Home Federal and Alerus websites |

| § |

Employees move to all Alerus systems and platforms |

| § |

Operate as “Alerus” |

| POST |

2025 |

§ |

Ongoing conversion support for clients |

| § |

Ongoing integration support for employees |

| § |

Sunset all Home Federal systems and platforms |

| § |

Measure retention and performance |

Initial

questions

What is changing

for me today?

Nothing. Although this news may be unexpected,

we are committed to making this a smooth transition to Alerus — both for you, and for clients. While there will be changes in joining

a new company, learning new systems, and eventually transitioning clients to Alerus systems and platforms, we will keep you well informed

of these timelines as exact dates are finalized. Our goal is to support you throughout this transition, ensuring our combined success

as a bigger company.

What does this mean

for me and my clients, long term?

We are a stronger

company, together.

Alerus is a growing company —

with continued growth comes additional opportunities. We look forward to getting to know you and further expanding our Midwest market

share together. We are stronger together. Once the merger is complete, we will have the 12th largest in-state deposit market

share in Minnesota and will rank among the Top 3 among community banks.

For your clients, we believe there will

be new opportunities to add more value to their relationships. Alerus is a diversified financial service provider that is large enough

to meet clients’ needs but small enough to provide individualized service. This community banking focus is our sweet spot. Alerus

brings a more robust product offering to your clients, including wealth advisory and retirement services. We believe merging our two

organizations together will allow us to deliver these services to clients, and in turn, add more value.

Additionally, we are very focused on

growth. Our sound balance sheet and capital will allow us to continue to expand existing relationships and build upon new opportunities

together.

Company

Who is Alerus?

Re-established in 1933, with roots tracing

back to 1879, Alerus is one of the most diversified banks in the country. We are a commercial wealth bank and national retirement provider

that provides comprehensive and holistic financial solutions to businesses and consumers through banking, wealth, and retirement segments.

Services are delivered by skilled professionals whose goal is to help clients identify and attain their financial objectives.

We are driven by our purpose and mission

to help clients achieve their financial goals. We do this by providing clients with a primary point of contact, a trusted financial advisor,

who takes the time to truly understand the unique needs and preferences of each client they serve, then draws on the expertise within

the organization to craft the optimal solution for the client. By delivering holistic advice and exceptional serve to our clients, we

continue to create value for our clients, our company, and our shareholders.

Alerus Financial Corporation is a publicly

held company and is traded on Nasdaq as ALRS. Alerus Financial Corporation is the parent and holding company of Alerus Financial, N.A.,

a nationally chartered bank. These names are often used in formal communication. We commonly operate as Alerus.

In September 2019, Alerus completed

an initial public offering (IPO) and became publicly traded on Nasdaq. This move allowed Alerus to further diversify its shareholder

makeup. Today, this makeup includes large institutional investors, Alerus clients, individual investors, and employees. Employees share

in the overall success of Alerus through our employee stock ownership plan (ESOP).

Where can I find

more information about Alerus?

Visit alerus.com, alerusrb.com, or investors.alerus.com.

Alerus is listed on Nasdaq as ALRS. Visit Nasdaq.com and search for ALRS to view public filings and financials.

Why Home Federal?

Merging with Home Federal enables Alerus

to expand its existing footprint into new markets with virtually no overlap and add talented professionals to our team. Combined, the

merger will create a $5 billion diversified financial institution and place Alerus among the Top 3 community banks in Minnesota.

Additionally, Alerus wanted to partner

with Home Federal because of its long-tenured clients, granular deposit and loan portfolio, and sound credit discipline. This aligns

well with our long-term growth strategy to expand our commercial client base.

Since 2000, Alerus has completed 25

acquisitions and has a proven track record of successfully retaining clients and the talented professionals who serve them. Our successful

acquisition strategy is guided by a commitment to align with companies that have similar cultures, talented professionals, and are exceptionally

client centric. We are also committed to a high degree of honesty, professionalism, and transparency throughout each merger and beyond.

Like Home Federal, we are focused on helping clients achieve long-term financial success. We prioritize client service above all and

value relationships over transactional business. This business model presents a tremendous opportunity for our companies as we join to

continue serving clients.

EMPLOYEE

STRUCTURE AND POSITIONS

Will we be keeping

our jobs?

A significant number of our current

750+ Alerus employees have been retained through acquisitions. We anticipate retaining client-facing and client relationship-focused

employees. We will work diligently over the next several weeks to visit one-on-one with every team member to discuss future

staffing plans. We will be as open and up front with everyone as we can possibly be about long-term plans. Unfortunately, we do know

that we will not retain all employees long term but we will work impacted team members on a pay to stay (retention) program through

the conversion, which is expected to be completed later this year. Our Human Resources team and other Alerus leaders will begin

meeting with managers and employees to better understand everyone’s roles, positions, skills, and how they may best fit with

Alerus’ existing team and operations. We will keep you informed as we gain more details and reach decisions.

We are very proud of our workplace-related

awards and high employee satisfaction survey results. Alerus is a high-performing and growing company, which may present new opportunities

for you in other departments. We currently have over 30 open positions; as new positions become available, we will share these opportunities

with you and welcome you to apply as an internal candidate.

When do I become

an Alerus employee?

You will be transferred to the Alerus

payroll system at your current salary or hourly rate as of the closing date, tentatively scheduled to late 2024. At that time, you will

also have the opportunity to sign up for Alerus’ benefits, which are highlighted in the packet. Prior to closing, we will schedule

orientation meetings, at which time we will complete the application process, payroll paperwork, and benefits enrollment.

How will the benefits

package change?

Alerus offers a comprehensive and competitive

benefits package including health, dental, life, and LTD insurance, 401(k) and ESOP programs for retirement savings, and a flexible

time off (FTO) program that promotes and encourages a work-life balance. More information on these programs is provided in the packet

and will be shared at the upcoming orientation sessions. Employees will retain years of service credit with Home Federal for most benefits.

Will our office hours

or work schedules change?

There are currently no plans to change

office hours or employee work schedules, including the remote schedule for certain positions.

What resources will

be in place to support us throughout the transition?

Our goal is to take care of you, so

you can take care of clients. We do this through our “Alerus Ally” program, where employees are paired with fellow Alerus

employees — a co-worker who can be your resource for all questions. We’ve found this program is extremely helpful as employees

are beginning to learn new systems and work with different product sets. Additionally, we will provide a detailed training calendar as

a roadmap to learning new systems and platforms in preparation for the conversion. Following conversion, you’ll have the opportunity

to continue your personal growth and development through Alerus University. Whether it’s professional association accreditation,

external training programs, internal classes, or online training courses, we’re committed to developing your core competencies

and building future leaders for our company.

CONVERSION

DETAILS

What is the timeline

for conversion?

We anticipate transitioning clients

to the Alerus platform and online systems later this year and will inform you of the detailed schedule as dates are finalized.

How will I keep updated

about the conversion and any transition news?

We will send periodic emails with updates

and information as we build out the conversion plan and make decisions. In the meantime, feel free to contact anyone on the attached

contact list with specific questions. We welcome hearing from you.

Will our products

and services change?

Until conversion is completed, current

and new clients will continue to receive Home Federal products and services. Alerus’ broader wealth advisory services, and retirement

and benefits plans and services will be available upon conversion.

Upon conversion,

what systems will we be using?

The following is a list of Alerus’

core systems that you will use upon conversion:

| § | Banking

platform: Fiserv Signature |

| § | Loan

documents: LaserPro |

| § | Teller

platform and deposit account documents: Fiserv Desktop |

| § | Document

imaging: Fiserv Nautilus |

| § | Email:

Microsoft Outlook |

| § | Team

Collaboration: Webex meetings, calling, and messaging |

| § | Other:

Microsoft SharePoint, Word, Power Point, and Excel |

WORKING

WITH CLIENTS

When will we refer

to ourselves as Alerus?

We won’t officially begin integrating

the Alerus brand until the closing is completed later this year. Please continue to use Home Federal in your signature blocks, voicemails, etc.

until you receive future communication regarding this transition plan. After the closing date, you can expect a transitional state while

the conversion takes place, i.e. Home Federal, now part of Alerus. Everyone will have an Alerus email address assigned to them at closing.

However, you may continue to use both your existing work email address and new Alerus email address. It will be set up so that emails

for both addresses flow into your inbox.

As we near the closing date, we will

provide more information on the communication transition plan from Home Federal to Alerus.

How will our clients

be notified about the merger with Alerus?

Letter

Clients will receive a letter from Home

Federal (a copy is included in the packet).

Websites

The Home Federal and Alerus websites

will be updated to notify clients of the announcement.

Social media

The announcement will also be shared

on all Home Federal and Alerus social media channels, including Facebook, X, LinkedIn, and Instagram.

| § | Alerus

encourages all employees to like/share/comment on social media posts, so feel free to share

Home Federal-Alerus posts on your own channels. |

| § | If

you would like to share a post and aren’t sure what to say, here are some suggestions: |

| § | Example1

[with shared post announcing the merger]: Exciting news! Looking forward to the opportunities

ahead. |

| § | Example2

[with shared post announcing the merger or link to news release on Alerus website]: Big announcement:

Home Federal is merging with Alerus to expand offerings and services to clients. |

MEDIA

REQUESTS

Please do not comment on media requests.

Instead, pass all media inquiries or questions to Alerus’ Public Relations Manager, Kris Bevill. If you receive an inquiry and

are not sure how to respond, here is a suggestion.

“Thank you for inquiring about

the recent announcement. Kris Bevill from Alerus works directly with all media and will be able to help you. I can provide you with her

contact information.”

Kris’ contact

information:

701.306.8561 | Cell

701.280.5076 | Office

kris.bevill@alerus.com

Working

With CLIENTS

Home

Federal

Key

Messages

It’s business

as usual.

“Rest assured, it’s business

as usual. Nothing will change with your accounts or how you conduct banking business in the immediate future. Our goal is to make this

transition as seamless as possible. We will give you plenty of notice when the time comes to transition to Alerus.”

| · | Interest

rates will remain the same.

“For now, nothing will change with the interest rates you are currently earning.

We will provide ample communication and competitive offerings when changes do occur.” |

| | | |

| · | Loan

payments should continue to be made the same.

“Please continue to make loan payments as you have done in the past.” |

Our locations will

remain open as usual.

“All offices will remain open

with our current operating hours. Our name will remain Home Federal until the sale is complete later this year.”

We are a stronger

company, together.

Alerus brings new services, allowing

us to further meet our clients’ complex financial needs, while still focusing on providing individualized service. We share a very

similar business model and believe we can have a greater impact in working by holistically with clients through this merger. Clients

will soon have access to a broader product set and greater resources to support our continued growth.

Are my deposits insured

by the FDIC?

“Your deposit accounts will continue

to be insured without interruption. Alerus is a Member FDIC insured bank with the same protection you are receiving with Home Federal.”

Similar to Home Federal, Alerus is also regulated by the Office of the Comptroller of the Currency (OCC), which ensures that it operates

in a safe and sound manner, provides fair access to financial services, treats clients fairly, and complies with applicable laws and

regulations.”

Who is Alerus?

“Alerus is a commercial wealth

bank and national retirement provider specializing in providing personalized service to help clients achieve their financial goals. Originally

headquartered in Grand Forks, North Dakota, the company has expanded significantly in the past few decades. It has banking and wealth

offices in Grand Forks and Fargo, North Dakota, the Minneapolis-St. Paul metro area, and Scottsdale and Phoenix, Arizona. Alerus provides

comprehensive financial solutions to businesses and consumers, including banking, wealth services, and retirement and benefits plans

and services. Alerus provides personalized service and the right products at the right time to clients to help them achieve their immediate

and long-term goals. Alerus has the size and product diversity to provide more services and capabilities than were available to you before,

but they emphasize client service and personal care and being a good corporate citizen in the community. I think you’ll be very

happy with this transition.”

Are you going to

have a job?

“The announcement is still new,

and the sale has not been finalized yet, but Alerus has stated that most everyone who works with clients directly will remain in their

roles.”

CLIENT

Requests to Close Accounts

“First and foremost, please understand

that your funds are immediately available to you. Your relationship is extremely important to us, and we would like the opportunity to

continue serving you. If you have any questions, I’d like to address any concerns you may have?”

| · | I

want to withdraw my money: “I can certainly help you with this transaction, but

before we take that step, I would like to invite you to remain a client. We’re

confident that Alerus will not only be able to continue to perform as you would expect us

to, but we'll be able to add value to your banking relationship through expanded wealth advisory

services and retirement planning. Alerus is a very strong and stable financial institution,

and we are comfortable with the change. Your relationship is very important to us, and we

would like to continue working with you.” |

| · | How

is Alerus different than Home Federal: “Actually, we have very similar values.

We are both focused on taking care of our clients, helping their businesses grow, and helping

them achieve their financial goals. However, Alerus is a larger organization with an extremely

broad array of financial offerings. We look forward to making these available to you and

helping you with all your financial needs. One of the primary reasons Alerus is here today

is because they are committed to growth. They have a very successful business model and are

a growing company. We’re excited about this opportunity and look forward to continuing

to work with you.” |

| · | I

know Home Federal, I don’t know Alerus: “Rest assured, we are committed

to making this a seamless transition for you. Alerus is committed to keeping the same client

contact staff so we will continue to work together. We would like to ask you to continue

placing your trust in us and Alerus, a sound and safe financial institution. One of the primary

reasons Alerus is here today is because they are committed to growing the company. Again,

your relationship is very important to us, and we would like to continue working with you.” |

| · | Does

Alerus know how to handle this situation: “Fortunately, Alerus is well-equipped

to handle this change and has experience successfully acquiring and transferring other banks

to its organization. Alerus has previously acquired a full-service bank with multiple offices

in Minneapolis-St. Paul and several other bank branches in Phoenix, and loans and deposits

from other banks, in addition to retirement and benefits companies. Alerus is committed to

making this a seamless transition for everyone, including you. Again, your relationship is

very important to us, and we’d really like you to stay.” |

| · | I

don’t want to go through the transition to Alerus: “I do realize this change

may be frustrating because it is hard to know what to expect. However, most employees that

previously helped you will continue to help you. And you will be kept well informed of the

transition so that you don’t experience any interruption in your banking. Alerus does

provide products and services that we previously did not offer, as well as additional locations

in Minnesota, and I think that may benefit you.” |

Additional

Products & Services offered by Alerus

| · | Alerus

offers a broad array of services banking, wealth, and retirement services. The expanded wealth

advisory services include financial planning, investment management, and trust and fiduciary

services. |

| · | Please

note these products are not available to clients until everything has been converted to the

Alerus platform. |

Upset

CLients

While we do not anticipate that anyone

will be upset, we do recognize this change may be emotional for both employees and clients. In the event a client is upset, get an additional

employee involved and an Alerus representative. Remain calm, acknowledge the client’s request, and we'll figure out the best way

to handle any situation that comes up. We're all in this together and making sure we're doing our best to take care of clients and alleviate

any potential concerns.

Supporting

Material

Your relationship is most valuable in

working with clients to answer their questions and reassure them about this transaction. If support materials are needed, please refer

to these tools:

| · | Alerus

overview: this fact sheet summarizes who Alerus is, including our mission, portfolio,

and geographic footprint, as well as a detailed company history on the back side. |

| · | Annual

report: the 2023 annual report is Alerus’ most recent tool highlighting our performance

and organizational strength; it can be found on investors.alerus.com. |

| · | Alerus

website: Alerus.com is a great tool to help clients get more information about Alerus. |

Conversion

Details

We anticipate the conversion being completed

later this year. We will review existing product and service offerings to ensure the best fit for retaining clients.

Once a conversion date has been scheduled,

employees and clients will be kept well informed and will not experience any interrupted service in how they conduct their banking. Clients

will be provided with all their new information and tools (checks, debit card, etc.) prior to the change being made.

| 1016

Civic Center Drive

Rochester,

MN 55901 |

507-535-1200

Direct

www.justcallhome.com |

May 15, 2024

Dear Home Federal client,

An exciting new chapter is unfolding at Home Federal Savings Bank.

We are pleased to announce Home Federal has entered into a definitive agreement to merge with Alerus, a commercial wealth bank and national

retirement services provider with headquarters in Grand Forks, North Dakota, and the Twin Cities. Subject to customary approvals, the

merger is expected to be complete later this year.

We carefully selected Alerus as our partner and will work closely

with them to ensure a smooth transition for you. We have been dedicated to serving our clients and our communities for 90 years. Partnering

with Alerus continues that tradition while providing opportunities to better serve our communities, employees, and you.

You may be curious why we are partnering with Alerus. In recent years,

consolidation has been an ongoing trend within the banking industry. It is becoming increasingly common for banks like Home Federal to

join with similar organizations in order to continue growing and providing the best services possible, while maintaining the important

attributes of a community bank.

Alerus is a good match for Home Federal for many reasons. We share

similar values, emphasizing client relationships over transactions and focusing on helping clients grow and thrive for long-term financial

success. Like Home Federal, Alerus is a Member FDIC insured bank. It also offers a full suite of financial services, including consumer

and business banking, mortgage, wealth services, and retirement and benefits, which will expand our capabilities and opportunities available

to you. Finally, Alerus is the right size to meet almost any financial need without sacrificing the personalized service you are accustomed

to receiving. Alerus has grown to become a large organization, but its roots run deep in community banking. They are committed to doing

the right thing for clients, employees, and community.

We are excited for the new opportunities this partnership brings to

our employees and you. For now, it’s business as usual. Loan payments should continue to be made the same as usual, and there will

be no changes with your accounts, interest rates, or how you conduct banking business in the immediate future. Our name, products, and

services will remain unchanged until the merger is complete. We will give you plenty of notice when the time comes to transition to Alerus.

In the meantime, if you have any questions about this change, please contact our team or stop by one of our branches. Your business is

very important to us. We value our relationship and look forward to continuing to serve you.

Sincerely,

Bradley Krehbiel

President and Chief Executive Officer

|

Member

FDIC |

Enhancing

the financial well-being of our clients and community one relationship at a time. |

|

Special Note Concerning Forward-Looking Statements

This report contains “forward-looking statements”

within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements

include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated

future performance of HMNF and Alerus and certain plans, expectations, goals, projections and benefits relating to the Merger, all of

which are subject to numerous assumptions, risks and uncertainties. These statements are often, but not always, identified by words such

as “may,” “might,” “should,” “could,” “predict,” “potential,”

“believe,” “expect,” “continue,” “will,” “anticipate,” “seek,”

“estimate,” “intend,” “plan,” “projection,” “would,” “annualized,”

“target” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking

nature. Examples of forward-looking statements include, among others, statements HMNF makes regarding the ability of HMNF and Alerus

to complete the transactions contemplated by the agreement and plan of merger (the “Merger Agreement”), including the parties’

ability to satisfy the conditions to the consummation of the Merger, statements about the expected timing for completing the merger of

HMNF with and into Alerus (the “Merger”), the potential effects of the proposed Merger on both HMNF and Alerus, the possibility

of any termination of the Merger Agreement, and any potential downward adjustment in the Exchange Ratio.

Forward-looking statements are not historical

facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently

uncertain and outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially,

from the anticipated results or outcomes indicated in these forward-looking statements. In addition to factors disclosed in reports filed

by HMNF and Alerus with the SEC, risks and uncertainties for HMNF, Alerus and the combined company that may cause actual results or outcomes

to differ materially from those anticipated include, but are not limited to: (1) the possibility that any of the anticipated benefits

of the proposed Merger will not be realized or will not be realized within the expected time period; (2) the risk that integration

of HMNF’s operations with those of Alerus will be materially delayed or will be more costly or difficult than expected; (3) the

parties’ inability to meet expectations regarding the timing of the proposed Merger; (4) changes to tax legislation and their

potential effects on the accounting for the Merger; (5) the inability to complete the proposed Merger due to the failure of HMNF’s

or Alerus’ stockholders to adopt the Merger Agreement, or the failure of Alerus’ stockholders to approve the issuance of

Alerus common stock in connection with the Merger; (6) the failure to satisfy other conditions to completion of the proposed Merger,

including receipt of required regulatory and other approvals; (7) the failure of the proposed Merger to close for any other reason;

(8) diversion of management’s attention from ongoing business operations and opportunities due to the proposed Merger; (9) the

challenges of integrating and retaining key employees; (10) the effect of the announcement of the proposed Merger on HMNF’s,

Alerus’ or the combined company’s respective customer and employee relationships and operating results; (11) the possibility

that the proposed Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (12)

the amount HMNF’s stockholders’ equity as of the closing date of the Merger and any potential downward adjustment in the

Exchange Ratio; (13) the dilution caused by Alerus’ issuance of additional shares of Alerus common stock in connection with the

Merger; and (14) changes in the global economy and financial market conditions and the business, results of operations and financial

condition of HMNF, Alerus and the combined company. Please refer to each of HMNF’s and Alerus’ Annual Report on Form 10-K

for the year ended December 31, 2023, as well as both parties’ other filings with the SEC, for a more detailed discussion

of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements.

Any forward-looking statement included in this

report is based only on information currently available to management and speaks only as of the date on which it is made. Neither HMNF

nor Alerus undertakes any obligation to publicly update any forward-looking statement, whether written or oral, that may be made from

time to time, whether as a result of new information, future developments or otherwise.

Additional Information and Where to Find It

Alerus will file a registration statement on Form S-4

with the SEC in connection with the proposed transaction. The registration statement will include a joint proxy statement of HMNF and

Alerus that also constitutes a prospectus of Alerus, which will be sent to the stockholders of HMNF and Alerus. Before making any voting

decision, the stockholders of HMNF and Alerus are advised to read the joint proxy statement/prospectus when it becomes available because

it will contain important information about HMNF, Alerus and the proposed transaction. When filed, this document and other documents

relating to the Merger filed by HMNF can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also

can be obtained free of charge by accessing HMNF’s website at www.justcallhome.com/HMNFinancial under “SEC Filings”

and Alerus’ website at www.alerus.com under the link “Investors Relations” and then under “SEC Filings.”

Alternatively, these documents, when available, can be obtained free of charge from HMNF upon written request to HMN Financial, Inc.,

Corporate Secretary, 1016 Civic Center Drive NW, Rochester, Minnesota 55901 or by calling (507) 535-1200 or from Alerus upon written

request to Alerus Financial Corporation, Corporate Secretary, 401 Demers Avenue, Grand Forks, North Dakota 58201 or by calling (701)

795-3200. The contents of the websites referenced above are not deemed to be incorporated by reference into the registration statement

or the joint proxy statement/prospectus.

Participants in the Solicitation

This report does not constitute a solicitation

of proxy, an offer to purchase or a solicitation of an offer to sell any securities. HMNF, Alerus, and certain of their directors, executive

officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders

of HMNF and Alerus in connection with the proposed Merger under SEC rules. Information about the directors and executive officers of

HMNF and Alerus will be included in the joint proxy statement/prospectus for the proposed transaction filed with the SEC. These documents

(when available) may be obtained free of charge in the manner described above under “Additional Information and Where to Find It.”

Security holders may also obtain information regarding

the names, affiliations and interests of HMNF’s directors and executive officers in the definitive proxy statement of HMNF relating

to its 2024 Annual Meeting of Stockholders filed with the SEC on March 21, 2024 and HMNF’s Annual Report on Form 10-K/A

for the year ended December 31, 2023 filed with the SEC on March 19, 2024. Security holders may obtain information regarding

the names, affiliations and interests of Alerus’ directors and executive officers in the definitive proxy statement of Alerus relating

to its 2024 Annual Meeting of Stockholders filed with the SEC on March 25, 2024 and on Alerus’ Annual Report on Form 10-K

for the year ended December 31, 2023 filed with the SEC on March 8, 2024. To the extent the holdings of HMNF securities by

HMNF’s directors and executive officers or the holdings of Alerus securities by Alerus’ directors and executive officers

have changed since the amounts set forth in HMNF’s or Alerus’ respective proxy statement for its 2024 Annual Meeting of Stockholders,

such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. These documents can

be obtained free of charge in the manner described above under “Additional Information and Where to Find It.”

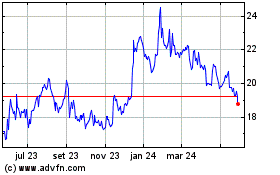

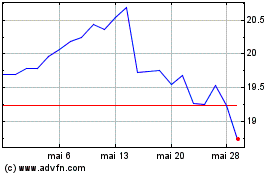

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024