false

0000903419

0000903419

2024-10-29

2024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 29, 2024

Alerus Financial Corporation

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-39036

|

45-0375407

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

401 Demers Avenue

Grand Forks, North Dakota 58201

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (701) 795-3200

N/A

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $1.00 par value per share

|

|

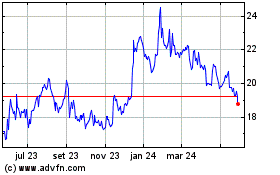

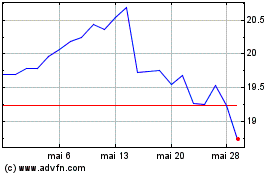

ALRS

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 29, 2024, Alerus Financial Corporation (the “Company”) issued a press release announcing its financial results for the three and nine months ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K, and the related Exhibit 99.1, attached hereto is being “furnished” and will not, except to the extent required by applicable law or regulation, be deemed “filed” by the Company for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor will any of such information or exhibits be deemed incorporated by reference to any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

On October 29, 2024, the Company posted a presentation to the Company’s investor relations website, located at investors.alerus.com. The presentation is also attached hereto as Exhibit 99.2.

The information in Item 7.01 of this Current Report on Form 8-K, and the related Exhibit 99.2, attached hereto is being “furnished” and will not, except to the extent required by applicable law or regulation, be deemed “filed” by the Company for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor will any of such information or exhibits be deemed incorporated by reference to any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

99.2

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 29, 2024

|

Alerus Financial Corporation

|

| |

|

| |

|

| |

By:

|

/s/ Katie A. Lorenson

|

| |

Name:

|

Katie A. Lorenson

|

| |

Title:

|

President and Chief Executive Officer

|

Exhibit 99.1

|

|

Alan A. Villalon, Chief Financial Officer

952.417.3733 (Office)

|

FOR RELEASE (10.29.2024)

ALERUS FINANCIAL CORPORATION REPORTS

Third QUARTER 2024 NET INCOME OF $5.2 MILLION

MINNEAPOLIS, MN (October 29, 2024) – Alerus Financial Corporation (Nasdaq: ALRS), or the Company, reported net income of $5.2 million for the third quarter of 2024, or $0.26 per diluted common share, compared to net income of $6.2 million, or $0.31 per diluted common share, for the second quarter of 2024, and net income of $9.2 million, or $0.45 per diluted common share, for the third quarter of 2023.

CEO Comments

President and Chief Executive Officer Katie Lorenson said, “Earlier this month we closed on our 26th and largest acquisition in company history. In the transaction, we acquired a strong core deposit base and strategically expanded into the vibrant Rochester and Southern Minnesota markets. Throughout the quarter and ahead of this closing, we continued to make long term investments to support and grow our uniquely diversified business model and revenue streams. We continued to demonstrate our position as an employer of choice, with the addition of a specialized equipment leasing team and key hires to drive growth and efficiencies throughout our organization, especially in our retirement and benefit services segment.

We have continued to see market share gains and growth of our client base both in adding new business and deepening relationships with current clients. This year, our retirement and benefits business has grown over 19%, our wealth management business has grown 18%, and we have grown loans nearly 10% and deposits over 7% in a very challenging and competitive environment.

Credit quality remains a key area of focus. Early identification of problem loans coupled with proactive and decisive actions are part of our credit culture. We continue to closely monitor and proactively downgrade loans where we see potential or emerging weaknesses. Normalization of credit continued during the quarter, as two large relationships drove the increase in nonaccrual loans. Charge-offs to average loans for the quarter were 0.04% and reserves to loans was stable at 1.29%.

We are focused on efficient headcount management, and balancing investments in talent, technology and infrastructure, while remaining committed to a strong balance sheet, capital levels, and improving performance as a bigger and better combined entity.

Thank you to the team members both new and long tenured for your hard work, dedication and invaluable contributions supporting our company, our clients and our communities, and helping us on our journey to achieving new milestones and our return to high-performance and top tier financial results.”

Third Quarter Highlights

| |

■

|

Net charge-offs to average loans were 0.04% in the third quarter of 2024, a decrease of 32 basis points from 0.36% in the second quarter of 2024.

|

| |

■

|

Common equity tier 1 capital to risk weighted assets as of September 30, 2024 was 11.12% and continues to be well above the minimum threshold to be “well capitalized” of 6.50%. |

| |

■

|

Repaid Bank Term Funding Program (“BTFP”) borrowings, resulting in risk-free net interest income of $1.2 million earned during the course of the year to date.

|

| |

■ |

$400.0 million of interest rate swaps matured during the third quarter of 2024, which drove increased liability sensitivity as the Federal Reserve began to cut interest rates. Of the remaining $400.0 million of interest rate swaps, $200.0 million will mature in January 2025. |

HMN Financial Acquisition

On October 9, 2024, the Company completed its previously announced acquisition of HMN Financial, Inc. and its subsidiary, Home Federal Savings Bank (together, "HMNF"). The transaction expands the Company's franchise into Rochester, Minnesota and represents the largest bank acquisition in its history. With the addition of HMNF, the Company now has over $5.5 billion in total assets, $3.8 billion in total loans, $4.3 billion in total deposits, and asset under administration and management of approximately $43.6 billion, with 29 locations across the Midwest, as well as Arizona.

Selected Financial Data (unaudited)

| |

|

As of and for the

|

|

| |

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

(dollars and shares in thousands, except per share data)

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Performance Ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average total assets

|

|

|

0.48 |

% |

|

|

0.58 |

% |

|

|

0.95 |

% |

|

|

0.56 |

% |

|

|

0.93 |

% |

|

Adjusted return on average total assets (1)

|

|

|

0.57 |

% |

|

|

0.65 |

% |

|

|

0.75 |

% |

|

|

0.62 |

% |

|

|

0.85 |

% |

|

Return on average common equity

|

|

|

5.52 |

% |

|

|

6.76 |

% |

|

|

10.05 |

% |

|

|

6.43 |

% |

|

|

9.79 |

% |

|

Return on average tangible common equity (1)

|

|

|

7.83 |

% |

|

|

9.40 |

% |

|

|

13.51 |

% |

|

|

8.98 |

% |

|

|

13.27 |

% |

|

Adjusted return on average tangible common equity (1)

|

|

|

9.04 |

% |

|

|

10.30 |

% |

|

|

10.97 |

% |

|

|

9.80 |

% |

|

|

12.27 |

% |

|

Noninterest income as a % of revenue

|

|

|

55.72 |

% |

|

|

53.28 |

% |

|

|

58.21 |

% |

|

|

54.10 |

% |

|

|

54.51 |

% |

|

Net interest margin (tax-equivalent)

|

|

|

2.23 |

% |

|

|

2.39 |

% |

|

|

2.27 |

% |

|

|

2.31 |

% |

|

|

2.50 |

% |

|

Adjusted net interest margin (tax-equivalent) (1)

|

|

|

2.35 |

% |

|

|

2.47 |

% |

|

|

2.24 |

% |

|

|

2.41 |

% |

|

|

2.46 |

% |

|

Efficiency ratio (1)

|

|

|

80.29 |

% |

|

|

72.50 |

% |

|

|

73.37 |

% |

|

|

77.17 |

% |

|

|

73.57 |

% |

|

Adjusted efficiency ratio (1)

|

|

|

77.71 |

% |

|

|

70.80 |

% |

|

|

77.03 |

% |

|

|

75.50 |

% |

|

|

74.58 |

% |

|

Net charge-offs/(recoveries) to average loans

|

|

|

0.04 |

% |

|

|

0.36 |

% |

|

|

(0.09 |

)% |

|

|

0.14 |

% |

|

|

(0.04 |

)% |

|

Dividend payout ratio

|

|

|

76.92 |

% |

|

|

64.52 |

% |

|

|

42.22 |

% |

|

|

66.29 |

% |

|

|

43.08 |

% |

|

Per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share - basic

|

|

$ |

0.26 |

|

|

$ |

0.31 |

|

|

$ |

0.46 |

|

|

$ |

0.90 |

|

|

$ |

1.31 |

|

|

Earnings per common share - diluted

|

|

$ |

0.26 |

|

|

$ |

0.31 |

|

|

$ |

0.45 |

|

|

$ |

0.89 |

|

|

$ |

1.30 |

|

|

Adjusted earnings per common share - diluted (1)

|

|

$ |

0.31 |

|

|

$ |

0.34 |

|

|

$ |

0.36 |

|

|

$ |

0.98 |

|

|

$ |

1.19 |

|

|

Dividends declared per common share

|

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.19 |

|

|

$ |

0.59 |

|

|

$ |

0.56 |

|

|

Book value per common share

|

|

$ |

19.53 |

|

|

$ |

18.87 |

|

|

$ |

17.60 |

|

|

|

|

|

|

|

|

|

|

Tangible book value per common share (1)

|

|

$ |

16.50 |

|

|

$ |

15.77 |

|

|

$ |

14.32 |

|

|

|

|

|

|

|

|

|

|

Average common shares outstanding - basic

|

|

|

19,788 |

|

|

|

19,777 |

|

|

|

19,872 |

|

|

|

19,768 |

|

|

|

19,977 |

|

|

Average common shares outstanding - diluted

|

|

|

20,075 |

|

|

|

20,050 |

|

|

|

20,095 |

|

|

|

20,037 |

|

|

|

20,193 |

|

|

Other Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement and benefit services assets under administration/management

|

|

$ |

41,249,280 |

|

|

$ |

39,389,533 |

|

|

$ |

34,552,569 |

|

|

|

|

|

|

|

|

|

|

Wealth management assets under administration/management

|

|

$ |

4,397,505 |

|

|

$ |

4,172,290 |

|

|

$ |

3,724,091 |

|

|

|

|

|

|

|

|

|

|

Mortgage originations

|

|

$ |

82,388 |

|

|

$ |

109,254 |

|

|

$ |

109,637 |

|

|

$ |

245,743 |

|

|

$ |

298,626 |

|

(1) Represents a non-GAAP financial measure. See “Non-GAAP to GAAP Reconciliations and Calculation of Non-GAAP Financial Measures.”

Results of Operations

Net Interest Income

Net interest income for the third quarter of 2024 was $22.5 million, a $1.5 million, or 6.1%, decrease from the second quarter of 2024. The decrease was primarily due to a decrease in interest income on lower cash balances, lower purchase accounting accretion from the Metro Phoenix Bank acquisition, and increased interest expense on higher deposit balances. These pressures were partially offset by an increase in interest income on higher average loan balances.

Net interest income increased $2.1 million, or 10.5%, from $20.4 million for the third quarter of 2023. Interest income increased $10.2 million, or 24.2%, from the third quarter of 2023, primarily driven by strong organic loan growth at higher yields, in addition to higher cash balances due to the BTFP. The increase in interest income was partially offset by an $8.0 million, or 37.1%, increase in interest expense, due to both an increase in rates paid on interest-bearing deposits and higher deposit and short-term borrowing balances.

Net interest margin (on a tax-equivalent basis) was 2.23% for the third quarter of 2024, a 16 basis point decrease from 2.39% for the second quarter of 2024, and a 4 basis point decrease from 2.27% for the third quarter of 2023. The decrease in net interest margin (on a tax-equivalent basis) was mainly attributable to less purchase accounting accretion, the impact of nonaccrual loans, and higher cost of funds from growth in average interest-bearing deposit balances. This was partially offset by strong loan growth. Adjusted net interest margin (on a tax-equivalent basis) (non-GAAP), which excludes BTFP borrowings and purchase accounting accretion, was 2.35% for the third quarter of 2024, an 11 basis point decrease from 2.47% for the second quarter of 2024, and an 11 basis point increase from 2.24% for the third quarter of 2023.

Noninterest Income

Noninterest income for the third quarter of 2024 was $28.4 million, a $1.0 million increase from the second quarter of 2024. The quarter over quarter increase was primarily driven by improvement across all fee-based businesses. Wealth revenues increased $0.3 million during the third quarter of 2024, a 5.1% increase from the second quarter of 2024. Retirement and benefit services revenue increased $0.1 million for the third quarter of 2024, a 0.4% increase from the second quarter of 2024 results. Combined assets under administration/management in wealth and retirement and benefit services increased 4.8% from June 30, 2024. The increase in wealth, retirement and benefit services revenue, and assets under administration/management was primarily due to improved equity and bond markets. Additionally, other noninterest income increased $0.6 million during the third quarter of 2024, a 28.7% increase from the second quarter of 2024, primarily due to a gain on the sale of fixed assets related to the sale of the Shorewood, Minnesota office in the western suburbs of the Twin Cities.

Noninterest income for the third quarter of 2024 decreased by $44 thousand, or 0.2%, from the third quarter of 2023. Wealth revenues increased $1.4 million, or 26.8%, in the third quarter of 2024, due to an increase in assets under administration/management of 5.4% during that same period. Other noninterest income increased $0.8 million, or 46.1% in the third quarter of 2024 compared to the third quarter of 2023, primarily due to a gain on the sale of fixed assets related to the sale of the Shorewood, Minnesota office and increased client swap fees. Offsetting these increases, retirement and benefit services revenue decreased $2.5 million, or 13.2%, from $18.6 million in the third quarter of 2023, driven by the divestiture of the ESOP trustee business in the third quarter of 2023 which resulted in a one-time recognized gain of $2.8 million.

Noninterest Expense

Noninterest expense for the third quarter of 2024 was $42.4 million, a $3.7 million, or 9.5%, increase from the second quarter of 2024. Professional fees and assessments increased $1.9 million, or 79.8%, from the second quarter of 2024, primarily driven by increased merger-related expenses of $1.1 million in connection with the acquisition of HMNF. Compensation expenses increased $0.8 million, or 3.9%, from the second quarter of 2024, primarily driven by experienced talent acquisitions in commercial lending and increased labor costs. Business services, software and technology expense increased $0.3 million, or 6.1%, from the second quarter of 2024, primarily driven by increased data processing expenses and custodian fees. Occupancy and equipment expense increased $0.3 million, or 14.7%, from the second quarter of 2024, primarily driven by increased rent and depreciation expense driven by the opening of the Shoreview, Minnesota office in the northern suburbs of the Twin Cities in July 2024.

Noninterest expense for the third quarter of 2024 increased $5.2 million, or 13.9%, from $37.3 million in the third quarter of 2023. The increase was primarily driven by professional fees and assessments, compensation and employee taxes and benefits. Professional fees and assessments increased primarily due to increased merger-related expenses of $1.7 million in connection with the acquisition of HMNF and an increase in Federal Deposit Insurance Corporation (“FDIC”) assessments. Compensation expense increased $2.0 million, or 10.4%, in the third quarter of 2024, primarily due to increased labor costs. Employee taxes and benefits expense increased $0.5 million, or 10.3%, primarily due to increased costs related to group insurance.

Financial Condition

Total assets were $4.1 billion as of September 30, 2024, an increase of $176.9 million, or 4.5%, from December 31, 2023. The increase was primarily due to a $272.8 million increase in loans, partially offset by a decrease of $63.9 million in cash and cash equivalents and a decrease of $35.6 million in investment securities.

Loans

Total loans were $3.0 billion as of September 30, 2024, an increase of $272.8 million, or 9.9%, from December 31, 2023. The increase was primarily driven by a $116.7 million increase in non-owner occupied commercial real estate (“CRE”) loans, a $49.6 million increase in construction, land and development CRE loans, a $44.1 million increase in commercial and industrial loans, a $30.3 million increase in multifamily CRE loans and a $24.7 million increase in owner occupied CRE loans, partially offset by $7.4 million and $17.2 million decreases in residential real estate first lien and construction loans, respectively.

The following table presents the composition of our loan portfolio as of the dates indicated:

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 30,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

(dollars in thousands)

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Commercial

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial

|

|

$ |

606,245 |

|

|

$ |

591,779 |

|

|

$ |

575,259 |

|

|

$ |

562,180 |

|

|

$ |

547,644 |

|

|

Commercial real estate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction, land and development

|

|

|

173,629 |

|

|

|

161,751 |

|

|

|

125,966 |

|

|

|

124,034 |

|

|

|

97,742 |

|

|

Multifamily

|

|

|

275,377 |

|

|

|

242,041 |

|

|

|

260,609 |

|

|

|

245,103 |

|

|

|

214,148 |

|

|

Non-owner occupied

|

|

|

686,071 |

|

|

|

647,776 |

|

|

|

565,979 |

|

|

|

569,354 |

|

|

|

504,827 |

|

|

Owner occupied

|

|

|

296,366 |

|

|

|

283,356 |

|

|

|

285,211 |

|

|

|

271,623 |

|

|

|

264,458 |

|

|

Total commercial real estate

|

|

|

1,431,443 |

|

|

|

1,334,924 |

|

|

|

1,237,765 |

|

|

|

1,210,114 |

|

|

|

1,081,175 |

|

|

Agricultural

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land

|

|

|

45,821 |

|

|

|

41,410 |

|

|

|

41,149 |

|

|

|

40,832 |

|

|

|

41,581 |

|

|

Production

|

|

|

39,436 |

|

|

|

40,549 |

|

|

|

36,436 |

|

|

|

36,141 |

|

|

|

34,743 |

|

|

Total agricultural

|

|

|

85,257 |

|

|

|

81,959 |

|

|

|

77,585 |

|

|

|

76,973 |

|

|

|

76,324 |

|

|

Total commercial

|

|

|

2,122,945 |

|

|

|

2,008,662 |

|

|

|

1,890,609 |

|

|

|

1,849,267 |

|

|

|

1,705,143 |

|

|

Consumer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential real estate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First lien

|

|

|

690,451 |

|

|

|

686,286 |

|

|

|

703,726 |

|

|

|

697,900 |

|

|

|

680,634 |

|

|

Construction

|

|

|

11,808 |

|

|

|

22,573 |

|

|

|

18,425 |

|

|

|

28,979 |

|

|

|

37,159 |

|

|

HELOC

|

|

|

134,301 |

|

|

|

126,211 |

|

|

|

120,501 |

|

|

|

118,315 |

|

|

|

116,296 |

|

|

Junior lien

|

|

|

36,445 |

|

|

|

36,323 |

|

|

|

36,381 |

|

|

|

35,819 |

|

|

|

36,381 |

|

|

Total residential real estate

|

|

|

873,005 |

|

|

|

871,393 |

|

|

|

879,033 |

|

|

|

881,013 |

|

|

|

870,470 |

|

|

Other consumer

|

|

|

36,393 |

|

|

|

35,737 |

|

|

|

29,833 |

|

|

|

29,303 |

|

|

|

30,817 |

|

|

Total consumer

|

|

|

909,398 |

|

|

|

907,130 |

|

|

|

908,866 |

|

|

|

910,316 |

|

|

|

901,287 |

|

|

Total loans

|

|

$ |

3,032,343 |

|

|

$ |

2,915,792 |

|

|

$ |

2,799,475 |

|

|

$ |

2,759,583 |

|

|

$ |

2,606,430 |

|

Deposits

Total deposits were $3.3 billion as of September 30, 2024, an increase of $227.9 million, or 7.4%, from December 31, 2023. Interest-bearing deposits increased $298.5 million, while noninterest-bearing deposits decreased $70.5 million, from December 31, 2023. The increase in total deposits was due to both expanded and new commercial deposit relationships and synergistic deposit growth. Synergistic deposits were $920.6 million as of September 30, 2024, an increase of $69.1 million, or 8.1%, from December 31, 2023. The Company continued to have $0 of brokered deposits as of September 30, 2024.

The following table presents the composition of the Company’s deposit portfolio as of the dates indicated:

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 30,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

(dollars in thousands)

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Noninterest-bearing demand

|

|

$ |

657,547 |

|

|

$ |

701,428 |

|

|

$ |

692,500 |

|

|

$ |

728,082 |

|

|

$ |

717,990 |

|

|

Interest-bearing

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand

|

|

|

1,034,694 |

|

|

|

1,003,585 |

|

|

|

938,751 |

|

|

|

840,711 |

|

|

|

759,812 |

|

|

Savings accounts

|

|

|

75,675 |

|

|

|

79,747 |

|

|

|

82,727 |

|

|

|

82,485 |

|

|

|

88,341 |

|

|

Money market savings

|

|

|

1,067,187 |

|

|

|

1,022,470 |

|

|

|

1,114,262 |

|

|

|

1,032,771 |

|

|

|

959,106 |

|

|

Time deposits

|

|

|

488,447 |

|

|

|

491,345 |

|

|

|

456,729 |

|

|

|

411,562 |

|

|

|

346,935 |

|

|

Total interest-bearing

|

|

|

2,666,003 |

|

|

|

2,597,147 |

|

|

|

2,592,469 |

|

|

|

2,367,529 |

|

|

|

2,154,194 |

|

|

Total deposits

|

|

$ |

3,323,550 |

|

|

$ |

3,298,575 |

|

|

$ |

3,284,969 |

|

|

$ |

3,095,611 |

|

|

$ |

2,872,184 |

|

Asset Quality

Total nonperforming assets were $48.0 million as of September 30, 2024, an increase of $39.3 million from December 31, 2023. $25.0 million of the increase was primarily driven by one construction, land and development loan moving to nonaccrual status in the second quarter of 2024. During the third quarter of 2024, management elected to make protective advances in order for construction to continue on that project. Management is actively working with the borrower on strategies to complete construction, preserve value and support repayment of the loan. A large residential real estate relationship and one CRE non-owner occupied loan moving to nonaccrual status also contributed $13.6 million to the increase in nonaccrual loans during the third quarter of 2024.

As of September 30, 2024, the allowance for credit losses on loans was $39.1 million, or 1.29% of total loans, compared to $35.8 million, or 1.30% of total loans, as of December 31, 2023.

The following table presents selected asset quality data as of and for the periods indicated:

| |

|

As of and for the three months ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 30,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

(dollars in thousands)

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Nonaccrual loans

|

|

$ |

48,026 |

|

|

$ |

27,618 |

|

|

$ |

7,345 |

|

|

$ |

8,596 |

|

|

$ |

9,007 |

|

|

Accruing loans 90+ days past due

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

139 |

|

|

|

— |

|

|

Total nonperforming loans

|

|

|

48,026 |

|

|

|

27,618 |

|

|

|

7,345 |

|

|

|

8,735 |

|

|

|

9,007 |

|

|

OREO and repossessed assets

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

32 |

|

|

|

3 |

|

|

Total nonperforming assets

|

|

$ |

48,026 |

|

|

$ |

27,618 |

|

|

$ |

7,348 |

|

|

$ |

8,767 |

|

|

$ |

9,010 |

|

|

Net charge-offs/(recoveries)

|

|

|

316 |

|

|

|

2,522 |

|

|

|

58 |

|

|

|

(238 |

) |

|

|

(594 |

) |

|

Net charge-offs/(recoveries) to average loans

|

|

|

0.04 |

% |

|

|

0.36 |

% |

|

|

0.01 |

% |

|

|

(0.04 |

)% |

|

|

(0.09 |

)% |

|

Nonperforming loans to total loans

|

|

|

1.58 |

% |

|

|

0.95 |

% |

|

|

0.26 |

% |

|

|

0.32 |

% |

|

|

0.35 |

% |

|

Nonperforming assets to total assets

|

|

|

1.18 |

% |

|

|

0.63 |

% |

|

|

0.17 |

% |

|

|

0.22 |

% |

|

|

0.23 |

% |

|

Allowance for credit losses on loans to total loans

|

|

|

1.29 |

% |

|

|

1.31 |

% |

|

|

1.31 |

% |

|

|

1.30 |

% |

|

|

1.39 |

% |

|

Allowance for credit losses on loans to nonperforming loans

|

|

|

82 |

% |

|

|

139 |

% |

|

|

498 |

% |

|

|

410 |

% |

|

|

403 |

% |

For the third quarter of 2024, the Company had net charge-offs of $0.3 million, compared to net charge-offs of $2.5 million for the second quarter of 2024 and net recoveries of $0.6 million for the third quarter of 2023. The quarter-over-quarter decrease in net charge-offs was driven by a $2.6 million charge-off of one commercial and industrial loan in the second quarter of 2024.

The Company recorded a provision for credit losses of $1.7 million for the third quarter of 2024, compared to a provision for credit losses of $4.5 million for the second quarter of 2024 and no provision for credit losses for the third quarter of 2023. The provision for credit losses for the third quarter of 2024 was primarily driven by loan growth and an increase in nonaccrual loans.

The unearned fair value adjustments on the acquired Metro Phoenix Bank loan portfolio were $3.8 million as of September 30, 2024, $5.2 million as of December 31, 2023, and $5.5 million as of September 30, 2023.

Capital

Total stockholders’ equity was $386.5 million as of September 30, 2024, an increase of $17.4 million from December 31, 2023. This change was primarily driven by an improvement in accumulated other comprehensive loss of $10.2 million and an increase in retained earnings of $6.2 million. Tangible book value per common share (non-GAAP) increased to $16.50 as of September 30, 2024, from $15.46 as of December 31, 2023. Tangible common equity to tangible assets (non-GAAP) increased to 8.11% as of September 30, 2024, from 7.94% as of December 31, 2023. Common equity tier 1 capital to risk weighted assets decreased to 11.12% as of September 30, 2024, from 11.82% as of December 31, 2023.

The following table presents our capital ratios as of the dates indicated:

| |

|

September 30,

|

|

|

December 31,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Capital Ratios(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alerus Financial Corporation Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common equity tier 1 capital to risk weighted assets

|

|

|

11.12 |

% |

|

|

11.82 |

% |

|

|

13.01 |

% |

|

Tier 1 capital to risk weighted assets

|

|

|

11.38 |

% |

|

|

12.10 |

% |

|

|

13.30 |

% |

|

Total capital to risk weighted assets

|

|

|

14.04 |

% |

|

|

14.76 |

% |

|

|

16.10 |

% |

|

Tier 1 capital to average assets

|

|

|

9.30 |

% |

|

|

10.57 |

% |

|

|

11.14 |

% |

|

Tangible common equity / tangible assets (2)

|

|

|

8.11 |

% |

|

|

7.94 |

% |

|

|

7.47 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Alerus Financial, N.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common equity tier 1 capital to risk weighted assets

|

|

|

10.73 |

% |

|

|

11.40 |

% |

|

|

12.68 |

% |

|

Tier 1 capital to risk weighted assets

|

|

|

10.73 |

% |

|

|

11.40 |

% |

|

|

12.68 |

% |

|

Total capital to risk weighted assets

|

|

|

11.98 |

% |

|

|

12.51 |

% |

|

|

13.86 |

% |

|

Tier 1 capital to average assets

|

|

|

8.90 |

% |

|

|

9.92 |

% |

|

|

10.72 |

% |

|

(1)

|

Capital ratios for the current quarter are to be considered preliminary until the Call Report for Alerus Financial, N.A. is filed.

|

|

(2)

|

Represents a non-GAAP financial measure. See “Non-GAAP to GAAP Reconciliations and Calculation of Non-GAAP Financial Measures.”

|

Conference Call

The Company will host a conference call at 11:00 a.m. Central Time on Wednesday, to discuss its financial results. Attendees are encouraged to register ahead of time for the call at investors.alerus.com. The call can also be accessed via telephone at +1 A recording of the call and transcript will be available on the Company’s investor relations website at investors.alerus.com following the call.

About Alerus Financial Corporation

Alerus Financial Corporation (Nasdaq: ALRS) is a commercial wealth bank and national retirement services provider with corporate offices in Grand Forks, North Dakota, and the Minneapolis-St. Paul, Minnesota metropolitan area. Through its subsidiary, Alerus Financial, National Association, Alerus provides diversified and comprehensive financial solutions to business and consumer clients, including banking, wealth services, and retirement and benefit plans and services. Alerus provides clients with a primary point of contact to help fully understand the unique needs and delivery channel preferences of each client. Clients are provided with competitive products, valuable insight, and sound advice supported by digital solutions designed to meet the clients’ needs.

Alerus operates 29 banking and commercial wealth offices, with locations in Grand Forks and Fargo, North Dakota; the Minneapolis-St. Paul, Minnesota metropolitan area; Rochester, Minnesota; the southern Minnesota area; Marshalltown, Iowa; Pewaukee, Wisconsin; and Phoenix and Scottsdale, Arizona. Alerus also operates a commercial wealth office in La Crosse, Wisconsin. Alerus Retirement and Benefit serves advisors, brokers, employers, and plan participants across the United States.

Non-GAAP Financial Measures

Some of the financial measures included in this press release are not measures of financial performance recognized by U.S. Generally Accepted Accounting Principles, or GAAP. These non-GAAP financial measures include the ratio of tangible common equity to tangible assets, adjusted tangible common equity to tangible assets, tangible book value per common share, return on average tangible common equity, efficiency ratio, pre-provision net revenue, adjusted noninterest income, adjusted noninterest expense, adjusted pre-provision net revenue, adjusted efficiency ratio, adjusted net income, adjusted return on average assets, adjusted return on average tangible common equity, net interest margin (tax-equivalent), adjusted net interest margin (tax-equivalent), and adjusted earnings per common share - diluted. Management uses these non-GAAP financial measures in its analysis of its performance, and believes financial analysts and investors frequently use these measures, and other similar measures, to evaluate capital adequacy and financial performance. Reconciliations of non-GAAP disclosures used in this press release to the comparable GAAP measures are provided in the accompanying tables. Management, banking regulators, many financial analysts and other investors use these measures in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, which typically stem from the use of the purchase accounting method of accounting for mergers and acquisitions.

These non-GAAP financial measures should not be considered in isolation or as a substitute for total stockholders’ equity, total assets, book value per share, return on average assets, return on average equity, or any other measure calculated in accordance with GAAP. Moreover, the manner in which the Company calculates these non-GAAP financial measures may differ from that of other companies reporting measures with similar names.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of Alerus Financial Corporation. These statements are often, but not always, identified by words such as “may”, “might”, “should”, “could”, “predict”, “potential”, “believe”, “expect”, “continue”, “will”, “anticipate”, “seek”, “estimate”, “intend”, “plan”, “projection”, “would”, “annualized”, “target” and “outlook”, or the negative version of those words or other comparable words of a future or forward-looking nature. Examples of forward-looking statements include, among others, statements the Company makes regarding our projected growth, anticipated future financial performance, financial condition, credit quality, management’s long-term performance goals and the future plans and prospects of Alerus Financial Corporation.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in forward-looking statements include, among others, the following: interest rate risk, including the effects of changes in interest rates; our ability to successfully manage credit risk and maintain an adequate level of allowance for credit losses; new or revised accounting standards; business and economic conditions generally and in the financial services industry, nationally and within our market areas, including the level and impact of inflation and possible recession; the effects of recent developments and events in the financial services industry, including the large-scale deposit withdrawals over a short period of time that resulted in recent bank failures; our ability to raise additional capital to implement our business plan; the overall health of the local and national real estate market; concentrations within our loan portfolio; the concentration of large loans to certain borrowers; our ability to successfully manage credit risk; the level of nonperforming assets on our balance sheet; our ability to implement our organic and acquisition growth strategies, including the integration of HMNF which the Company acquired in the fourth quarter of 2024; the impact of economic or market conditions on our fee-based services; our ability to continue to grow our retirement and benefit services business; our ability to continue to originate a sufficient volume of residential mortgages; the occurrence of fraudulent activity, breaches or failures of our or our third-party vendors’ information security controls or cybersecurity-related incidents, including as a result of sophisticated attacks using artificial intelligence and similar tools; interruptions involving our information technology and telecommunications systems or third-party servicers; potential losses incurred in connection with mortgage loan repurchases; the composition of our executive management team and our ability to attract and retain key personnel; rapid technological change in the financial services industry; increased competition in the financial services industry, including from non-banks such as credit unions, Fintech companies and digital asset service providers; our ability to successfully manage liquidity risk, including our need to access higher cost sources of funds such as fed funds purchased and short-term borrowings; the concentration of large deposits from certain clients, including those who have balances above current FDIC insurance limits; the effectiveness of our risk management framework; the commencement and outcome of litigation and other legal proceedings and regulatory actions against us or to which the Company may become subject; potential impairment to the goodwill the Company recorded in connection with our past acquisitions, including the acquisitions of Metro Phoenix Bank and HMNF; the extensive regulatory framework that applies to us; the impact of recent and future legislative and regulatory changes, including in response to recent bank failures; fluctuations in the values of the securities held in our securities portfolio, including as a result of changes in interest rates; governmental monetary, trade and fiscal policies; risks related to climate change and the negative impact it may have on our customers and their businesses; severe weather, natural disasters, widespread disease or pandemics; acts of war or terrorism, including the ongoing conflict in the Middle East and the Russian invasion of Ukraine, or other adverse external events; any material weaknesses in our internal control over financial reporting; changes to U.S. or state tax laws, regulations and guidance; potential changes in federal policy and at regulatory agencies as a result of the upcoming 2024 presidential election; talent and labor shortages and employee turnover; our success at managing the risks involved in the foregoing items; and any other risks described in the “Risk Factors” sections of the reports filed by Alerus Financial Corporation with the Securities and Exchange Commission.

Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Alerus Financial Corporation and Subsidiaries

Consolidated Balance Sheets

(dollars in thousands, except share and per share data)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Assets

|

|

(Unaudited)

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

65,975 |

|

|

$ |

129,893 |

|

|

Investment securities

|

|

|

|

|

|

|

|

|

|

Trading, at fair value

|

|

|

2,708 |

|

|

|

— |

|

|

Available-for-sale, at fair value

|

|

|

466,003 |

|

|

|

486,736 |

|

|

Held-to-maturity, at amortized cost (with an allowance for credit losses on investments of $137 and $151, respectively)

|

|

|

281,913 |

|

|

|

299,515 |

|

|

Loans held for sale

|

|

|

13,487 |

|

|

|

11,497 |

|

|

Loans

|

|

|

3,032,343 |

|

|

|

2,759,583 |

|

|

Allowance for credit losses on loans

|

|

|

(39,142 |

) |

|

|

(35,843 |

) |

|

Net loans

|

|

|

2,993,201 |

|

|

|

2,723,740 |

|

|

Land, premises and equipment, net

|

|

|

18,790 |

|

|

|

17,940 |

|

|

Operating lease right-of-use assets

|

|

|

9,268 |

|

|

|

5,436 |

|

|

Accrued interest receivable

|

|

|

16,469 |

|

|

|

15,700 |

|

|

Bank-owned life insurance

|

|

|

35,793 |

|

|

|

33,236 |

|

|

Goodwill

|

|

|

46,783 |

|

|

|

46,783 |

|

|

Other intangible assets

|

|

|

13,186 |

|

|

|

17,158 |

|

|

Servicing rights

|

|

|

1,874 |

|

|

|

2,052 |

|

|

Deferred income taxes, net

|

|

|

33,054 |

|

|

|

34,595 |

|

|

Other assets

|

|

|

86,136 |

|

|

|

83,432 |

|

|

Total assets

|

|

$ |

4,084,640 |

|

|

$ |

3,907,713 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing

|

|

$ |

657,547 |

|

|

$ |

728,082 |

|

|

Interest-bearing

|

|

|

2,666,003 |

|

|

|

2,367,529 |

|

|

Total deposits

|

|

|

3,323,550 |

|

|

|

3,095,611 |

|

|

Short-term borrowings

|

|

|

244,700 |

|

|

|

314,170 |

|

|

Long-term debt

|

|

|

59,041 |

|

|

|

58,956 |

|

|

Operating lease liabilities

|

|

|

9,643 |

|

|

|

5,751 |

|

|

Accrued expenses and other liabilities

|

|

|

61,220 |

|

|

|

64,098 |

|

|

Total liabilities

|

|

|

3,698,154 |

|

|

|

3,538,586 |

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Preferred stock, $1 par value, 2,000,000 shares authorized: 0 issued and outstanding

|

|

|

— |

|

|

|

— |

|

|

Common stock, $1 par value, 30,000,000 shares authorized: 19,790,005 and 19,734,077 issued and outstanding

|

|

|

19,790 |

|

|

|

19,734 |

|

|

Additional paid-in capital

|

|

|

151,257 |

|

|

|

150,343 |

|

|

Retained earnings

|

|

|

278,863 |

|

|

|

272,705 |

|

|

Accumulated other comprehensive loss

|

|

|

(63,424 |

) |

|

|

(73,655 |

) |

|

Total stockholders’ equity

|

|

|

386,486 |

|

|

|

369,127 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

4,084,640 |

|

|

$ |

3,907,713 |

|

Alerus Financial Corporation and Subsidiaries

Consolidated Statements of Income

(dollars and shares in thousands, except per share data)

| |

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Interest Income

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

Loans, including fees

|

|

$ |

42,593 |

|

|

$ |

41,663 |

|

|

$ |

34,986 |

|

|

$ |

123,551 |

|

|

$ |

99,187 |

|

|

Investment securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable

|

|

|

4,596 |

|

|

|

4,845 |

|

|

|

6,146 |

|

|

|

14,008 |

|

|

|

18,222 |

|

|

Exempt from federal income taxes

|

|

|

169 |

|

|

|

170 |

|

|

|

182 |

|

|

|

512 |

|

|

|

558 |

|

|

Other

|

|

|

4,854 |

|

|

|

6,344 |

|

|

|

724 |

|

|

|

16,200 |

|

|

|

2,221 |

|

|

Total interest income

|

|

|

52,212 |

|

|

|

53,022 |

|

|

|

42,038 |

|

|

|

154,271 |

|

|

|

120,188 |

|

|

Interest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

|

22,285 |

|

|

|

21,284 |

|

|

|

14,436 |

|

|

|

63,721 |

|

|

|

36,218 |

|

|

Short-term borrowings

|

|

|

6,706 |

|

|

|

7,053 |

|

|

|

6,528 |

|

|

|

19,748 |

|

|

|

15,684 |

|

|

Long-term debt

|

|

|

679 |

|

|

|

684 |

|

|

|

679 |

|

|

|

2,041 |

|

|

|

1,999 |

|

|

Total interest expense

|

|

|

29,670 |

|

|

|

29,021 |

|

|

|

21,643 |

|

|

|

85,510 |

|

|

|

53,901 |

|

|

Net interest income

|

|

|

22,542 |

|

|

|

24,001 |

|

|

|

20,395 |

|

|

|

68,761 |

|

|

|

66,287 |

|

|

Provision for credit losses

|

|

|

1,661 |

|

|

|

4,489 |

|

|

|

— |

|

|

|

6,150 |

|

|

|

550 |

|

|

Net interest income after provision for credit losses

|

|

|

20,881 |

|

|

|

19,512 |

|

|

|

20,395 |

|

|

|

62,611 |

|

|

|

65,737 |

|

|

Noninterest Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement and benefit services

|

|

|

16,144 |

|

|

|

16,078 |

|

|

|

18,605 |

|

|

|

47,876 |

|

|

|

49,977 |

|

|

Wealth management

|

|

|

6,684 |

|

|

|

6,360 |

|

|

|

5,271 |

|

|

|

19,161 |

|

|

|

15,915 |

|

|

Mortgage banking

|

|

|

2,573 |

|

|

|

2,554 |

|

|

|

2,510 |

|

|

|

6,796 |

|

|

|

7,132 |

|

|

Service charges on deposit accounts

|

|

|

488 |

|

|

|

456 |

|

|

|

328 |

|

|

|

1,333 |

|

|

|

940 |

|

|

Other

|

|

|

2,474 |

|

|

|

1,923 |

|

|

|

1,693 |

|

|

|

5,891 |

|

|

|

5,475 |

|

|

Total noninterest income

|

|

|

28,363 |

|

|

|

27,371 |

|

|

|

28,407 |

|

|

|

81,057 |

|

|

|

79,439 |

|

|

Noninterest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation

|

|

|

21,058 |

|

|

|

20,265 |

|

|

|

19,071 |

|

|

|

60,655 |

|

|

|

57,076 |

|

|

Employee taxes and benefits

|

|

|

5,400 |

|

|

|

5,134 |

|

|

|

4,895 |

|

|

|

16,722 |

|

|

|

15,472 |

|

|

Occupancy and equipment expense

|

|

|

2,082 |

|

|

|

1,815 |

|

|

|

1,883 |

|

|

|

5,803 |

|

|

|

5,619 |

|

|

Business services, software and technology expense

|

|

|

4,879 |

|

|

|

4,599 |

|

|

|

4,774 |

|

|

|

14,823 |

|

|

|

15,367 |

|

|

Intangible amortization expense

|

|

|

1,324 |

|

|

|

1,324 |

|

|

|

1,324 |

|

|

|

3,972 |

|

|

|

3,972 |

|

|

Professional fees and assessments

|

|

|

4,267 |

|

|

|

2,373 |

|

|

|

1,716 |

|

|

|

8,633 |

|

|

|

4,397 |

|

|

Marketing and business development

|

|

|

764 |

|

|

|

651 |

|

|

|

750 |

|

|

|

2,200 |

|

|

|

2,139 |

|

|

Supplies and postage

|

|

|

422 |

|

|

|

370 |

|

|

|

410 |

|

|

|

1,321 |

|

|

|

1,275 |

|

|

Travel

|

|

|

330 |

|

|

|

332 |

|

|

|

322 |

|

|

|

954 |

|

|

|

876 |

|

|

Mortgage and lending expenses

|

|

|

684 |

|

|

|

467 |

|

|

|

689 |

|

|

|

1,592 |

|

|

|

1,401 |

|

|

Other

|

|

|

1,237 |

|

|

|

1,422 |

|

|

|

1,426 |

|

|

|

3,543 |

|

|

|

3,909 |

|

|

Total noninterest expense

|

|

|

42,447 |

|

|

|

38,752 |

|

|

|

37,260 |

|

|

|

120,218 |

|

|

|

111,503 |

|

|

Income before income tax expense

|

|

|

6,797 |

|

|

|

8,131 |

|

|

|

11,542 |

|

|

|

23,450 |

|

|

|

33,673 |

|

|

Income tax expense

|

|

|

1,590 |

|

|

|

1,923 |

|

|

|

2,381 |

|

|

|

5,604 |

|

|

|

7,222 |

|

|

Net income

|

|

$ |

5,207 |

|

|

$ |

6,208 |

|

|

$ |

9,161 |

|

|

$ |

17,846 |

|

|

$ |

26,451 |

|

|

Per Common Share Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share

|

|

$ |

0.26 |

|

|

$ |

0.31 |

|

|

$ |

0.46 |

|

|

$ |

0.90 |

|

|

$ |

1.31 |

|

|

Diluted earnings per common share

|

|

$ |

0.26 |

|

|

$ |

0.31 |

|

|

$ |

0.45 |

|

|

$ |

0.89 |

|

|

$ |

1.30 |

|

|

Dividends declared per common share

|

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.19 |

|

|

$ |

0.59 |

|

|

$ |

0.56 |

|

|

Average common shares outstanding

|

|

|

19,788 |

|

|

|

19,777 |

|

|

|

19,872 |

|

|

|

19,768 |

|

|

|

19,977 |

|

|

Diluted average common shares outstanding

|

|

|

20,075 |

|

|

|

20,050 |

|

|

|

20,095 |

|

|

|

20,037 |

|

|

|

20,193 |

|

Alerus Financial Corporation and Subsidiaries

Non-GAAP to GAAP Reconciliations and Calculation of Non-GAAP Financial Measures (unaudited)

(dollars and shares in thousands, except per share data)

| |

|

September 30,

|

|

|

June 30,

|

|

|

December 31,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Tangible Common Equity to Tangible Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total common stockholders’ equity

|

|

$ |

386,486 |

|

|

$ |

373,226 |

|

|

$ |

369,127 |

|

|

$ |

349,402 |

|

|

Less: Goodwill

|

|

|

46,783 |

|

|

|

46,783 |

|

|

|

46,783 |

|

|

|

46,783 |

|

|

Less: Other intangible assets

|

|

|

13,186 |

|

|

|

14,510 |

|

|

|

17,158 |

|

|

|

18,482 |

|

|

Tangible common equity (a)

|

|

|

326,517 |

|

|

|

311,933 |

|

|

|

305,186 |

|

|

|

284,137 |

|

|

Total assets

|

|

|

4,084,640 |

|

|

|

4,358,623 |

|

|

|

3,907,713 |

|

|

|

3,869,138 |

|

|

Less: Goodwill

|

|

|

46,783 |

|

|

|

46,783 |

|

|

|

46,783 |

|

|

|

46,783 |

|

|

Less: Other intangible assets

|

|

|

13,186 |

|

|

|

14,510 |

|

|

|

17,158 |

|

|

|

18,482 |

|

|

Tangible assets (b)

|

|

|

4,024,671 |

|

|

|

4,297,330 |

|

|

|

3,843,772 |

|

|

|

3,803,873 |

|

|

Tangible common equity to tangible assets (a)/(b)

|

|

|

8.11 |

% |

|

|

7.26 |

% |

|

|

7.94 |

% |

|

|

7.47 |

% |

|

Adjusted Tangible Common Equity to Tangible Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible assets (b)

|

|

$ |

4,024,671 |

|

|

$ |

4,297,330 |

|

|

$ |

3,843,772 |

|

|

$ |

3,803,873 |

|

|

Less: Cash proceeds from BTFP

|

|

|

— |

|

|

|

355,000 |

|

|

|

— |

|

|

|

— |

|

|

Adjusted tangible assets (c)

|

|

|

4,024,671 |

|

|

|

3,942,330 |

|

|

|

3,843,772 |

|

|

|

3,803,873 |

|

|

Adjusted tangible common equity to tangible assets (a)/(c)

|

|

|

8.11 |

% |

|

|

7.91 |

% |

|

|

7.94 |

% |

|

|

7.47 |

% |

|

Tangible Book Value Per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total common stockholders’ equity

|

|

$ |

386,486 |

|

|

$ |

373,226 |

|

|

$ |

369,127 |

|

|

$ |

349,402 |

|

|

Less: Goodwill

|

|

|

46,783 |

|

|

|

46,783 |

|

|

|

46,783 |

|

|

|

46,783 |

|

|

Less: Other intangible assets

|

|

|

13,186 |

|

|

|

14,510 |

|

|

|

17,158 |

|

|

|

18,482 |

|

|

Tangible common equity (d)

|

|

|

326,517 |

|

|

|

311,933 |

|

|

|

305,186 |

|

|

|

284,137 |

|

|

Total common shares issued and outstanding (e)

|

|

|

19,790 |

|

|

|

19,778 |

|

|

|

19,734 |

|

|

|

19,848 |

|

|

Tangible book value per common share (d)/(e)

|

|

$ |

16.50 |

|

|

$ |

15.77 |

|

|

$ |

15.46 |

|

|

$ |

14.32 |

|

| |

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Return on Average Tangible Common Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

5,207 |

|

|

$ |

6,208 |

|

|

$ |

9,161 |

|

|

$ |

17,846 |

|

|

$ |

26,451 |

|

|

Add: Intangible amortization expense (net of tax) (1)

|

|

|

1,046 |

|

|

|

1,046 |

|

|

|

1,046 |

|

|

|

3,138 |

|

|

|

3,138 |

|

|

Net income, excluding intangible amortization (f)

|

|

|

6,253 |

|

|

|

7,254 |

|

|

|

10,207 |

|

|

|

20,984 |

|

|

|

29,589 |

|

|

Average total equity

|

|

|

375,229 |

|

|

|

369,217 |

|

|

|

361,735 |

|

|

|

370,758 |

|

|

|

361,260 |

|

|

Less: Average goodwill

|

|

|

46,783 |

|

|

|

46,783 |

|

|

|

46,882 |

|

|

|

46,783 |

|

|

|

47,018 |

|

|

Less: Average other intangible assets (net of tax) (1)

|

|

|

10,933 |

|

|

|

11,969 |

|

|

|

15,109 |

|

|

|

11,969 |

|

|

|

16,149 |

|

|

Average tangible common equity (g)

|

|

|

317,513 |

|

|

|

310,465 |

|

|

|

299,744 |

|

|

|

312,006 |

|

|

|

298,093 |

|

|

Return on average tangible common equity (f)/(g)

|

|

|

7.83 |

% |

|

|

9.40 |

% |

|

|

13.51 |

% |

|

|

8.98 |

% |

|

|

13.27 |

% |

|

Efficiency Ratio

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest expense

|

|

$ |

42,447 |

|

|

$ |

38,752 |

|

|

$ |

37,260 |

|

|

$ |

120,218 |

|

|

$ |

111,503 |

|

|

Less: Intangible amortization expense

|

|

|

1,324 |

|

|

|

1,324 |

|

|

|

1,324 |

|

|

|

3,972 |

|

|

|

3,972 |

|

|

Adjusted noninterest expense (h)

|

|

|

41,123 |

|

|

|