Form 8-K - Current report

17 Maio 2024 - 9:03AM

Edgar (US Regulatory)

0000763744FALSE--12-3100007637442024-05-162024-05-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 16, 2024

| | | | | | | | | | | | | | |

| LCI INDUSTRIES |

| | | | |

| | | | |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | 001-13646 | 13-3250533 |

| | | | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | |

| 3501 County Road 6 East, | Elkhart, | Indiana | 46514 |

| | | | |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| Registrant's telephone number, including area code: | (574) | 535-1125 |

| | | | |

| | | | |

| N/A |

| | | | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value | LCII | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year |

As further described below in Item 5.07 of this Current Report on Form 8-K, on May 16, 2024, at the Annual Meeting of Stockholders of LCI Industries (the “Company”), the Company’s stockholders approved an amendment (the “Exculpation Amendment”) to the Company’s Restated Certificate of Incorporation to allow for exculpation of certain of the Company’s officers to the extent permitted by Delaware law. On May 16, 2024, the Company filed with the Secretary of State of the State of Delaware a Certificate of Amendment to the Company’s Restated Certificate of Incorporation that sets forth the Exculpation Amendment (the “Certificate of Amendment”).

A description of the Exculpation Amendment is set forth in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on April 4, 2024, in the section entitled “Proposal 4 – Amendment to the Company’s Restated Certificate of Incorporation to Allow for Exculpation of Officers as Permitted by Delaware Law.” The foregoing description of the Exculpation Amendment is qualified in its entirety by reference to the full text of the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders

The Annual Meeting of Stockholders of the Company was held on May 16, 2024. The total shares outstanding on the record date, March 22, 2024, were 25,448,136. The total shares represented at the meeting in person or by proxy were 24,399,587. The following matters were voted upon:

(1) To elect a Board of ten Directors:

| | | | | | | | | | | | | | |

| For | Against | Abstain | Broker

Non-Votes |

| Tracy D. Graham | 22,874,991 | 207,306 | 4,630 | 1,312,660 |

| Brendan J. Deely | 22,668,399 | 413,501 | 5,027 | 1,312,660 |

| James F. Gero | 22,664,414 | 416,504 | 6,009 | 1,312,660 |

| Virginia L. Henkels | 22,954,973 | 126,903 | 5,051 | 1,312,660 |

| Jason D. Lippert | 22,900,759 | 181,851 | 4,317 | 1,312,660 |

| Stephanie K. Mains | 23,006,774 | 75,526 | 4,627 | 1,312,660 |

| Linda K. Myers | 22,821,862 | 259,239 | 5,826 | 1,312,660 |

| Kieran M. O’ Sullivan | 22,863,085 | 218,691 | 5,151 | 1,312,660 |

| David A. Reed | 22,982,951 | 98,476 | 5,500 | 1,312,660 |

| John A. Sirpilla | 22,959,285 | 122,334 | 5,308 | 1,312,660 |

Each of the persons listed above were elected to serve as Directors until the next Annual Meeting of Stockholders.

(2) To approve, in a non-binding advisory vote, the compensation of the named executive officers:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 19,266,079 | 3,811,895 | 8,953 | 1,312,660 |

(3) To ratify the selection of KPMG LLP as independent auditors for the year ending

December 31, 2024:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 24,157,315 | 238,423 | 3,849 | — |

(4) To approve an amendment to the Company’s Restated Certificate of Incorporation to allow for exculpation of officers as permitted by Delaware law:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 19,559,958 | 3,513,565 | 13,404 | 1,312,660 |

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | | | | | | | | | | |

| | | | | |

| Exhibit No. | Exhibit |

| |

| | | Certificate of Amendment to the Restated Certificate of Incorporation of LCI Industries, dated May 16, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

LCI INDUSTRIES |

(Registrant) |

|

|

By: /s/ Lillian D. Etzkorn Lillian D. Etzkorn Chief Financial Officer |

|

|

| Dated: | May 17, 2024 |

CERTIFICATE OF AMENDMENT TO THE

RESTATED CERTIFICATE OF INCORPORATION OF

LCI INDUSTRIES

LCI Industries, a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify as follows:

1. Article SIXTH of the Restated Certificate of Incorporation of the Corporation, as amended, is hereby amended to read in its entirety as follows:

SIXTH: The Corporation shall, to the full extent permitted by Section 145 of the Delaware General Corporation Law, as amended from time to time, indemnify all persons whom it may indemnify pursuant thereto. If Section 145 shall be repealed, the Corporation shall indemnify any persons, and to the same extent, as it would have been able to do under Section 145 in the form Section 145 existed immediately before its repeal as if it had not been repealed. The by-laws of the Corporation as adopted and amended from time to time by the Board of Directors may make any provision with respect to the indemnification permitted by this Article SIXTH in furtherance of the indemnification provisions of this Article SIXTH, provided such by-law or by-laws are not inconsistent with this Article SIXTH or Section 145, and provided further that no by-law in any way diminishes the scope or extent of the indemnification provided for in this Article SIXTH or in Section 145. No director or officer of the Corporation shall be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or an officer, except for liability (i) for any breach of the director’s or officer’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law, (iv) for any transaction from which the director or officer derived an improper personal benefit, or (v) in the case of an officer, in any action by or in the right of the Corporation. If the Delaware General Corporation Law is amended after approval by the stockholders of this provision to authorize corporate action further eliminating or limiting the personal liability of directors or officers, then the liability of a director or an officer of the Corporation shall be eliminated or limited to the fullest extent permitted by the Delaware General Corporation Law, as so amended.

2. The amendment described herein has been duly adopted in accordance with Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by the authorized officer named below, this 16th day of May, 2024.

| | | | | | | | |

| LCI INDUSTRIES |

| | |

| By: | /s/Andrew J. Namenye |

| | Name: Andrew J. Namenye |

| | Title: Executive Vice President, Chief Legal Officer, and Corporate Secretary |

v3.24.1.1.u2

Cover

|

May 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 16, 2024

|

| Entity Registrant Name |

LCI INDUSTRIES

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13646

|

| Entity Tax Identification Number |

13-3250533

|

| Entity Address, Address Line One |

3501 County Road 6 East,

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46514

|

| City Area Code |

(574)

|

| Local Phone Number |

535-1125

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

LCII

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0000763744

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

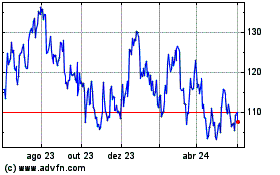

LCI Industries (NYSE:LCII)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

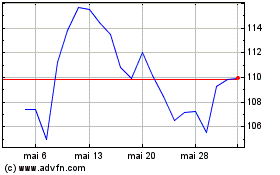

LCI Industries (NYSE:LCII)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024