Filed by Alerus Financial

Corporation

(Commission File No.: 001-39036)

Pursuant to Rule 425

of the Securities Act of 1933

and deemed filed pursuant

to Rule 14a-12

of the Securities Exchange

Act of 1934

Subject Company: HMNF

(Commission File No.: 0-24100)

Date: May 17, 2024

The following

is a transcript of an investor call held by Alerus Financial Corporation, which was made available on May 17, 2024, on the investor

relations webpage of Alerus Financial Corporation at www.alerus.com under the link “Investors Relations”.

Alerus Financial Corp

Acquisition of HMN Financial

05 - 15 - 2024

Alerus Financial Corp

Acquisition of HMN Financial

TOTAL PAGES: 13

Alerus Financial Corp

Acquisition of HMN Financial

CORPORATE SPEAKERS:

Katie Lorenson

Alerus Financial Corporation; President,

Chief Executive Officer

Alan Villalon

Alerus Financial Corporation; Chief Financial

Officer

James Collins

Alerus Financial Corporation; Chief Banking

and Revenue Officer

Bradley Krehbiel

HMN Financial; Chief Executive Officer

Debbie Lange

Alerus

Financial Corporation; Chief Credit Officer

PARTICIPANTS:

Brendan Nosal

Hovde Group; Analyst

Jeff Rulis

D.A. Davidson; Analyst

David Feaster

Raymond James; Analyst

Nathan Race

Piper Sandler; Analyst

Kevin Roth

Black Maple Capital

Damon Del Monte

KBW; Analyst

PRESENTATION:

Operator^ Good morning. And welcome to the Investor Call Acquisition

of HMN Financial, Inc. (Operator Instructions)

Please note, this event is being recorded.

This call may include forward-looking statements, and the company's

actual results may differ materially from those indicated in any forward-looking statements.

Important factors that could cause actual results to differ materially

from those indicated in the forward-looking statements are listed in the company's SEC filings.

I would now like to turn the conference call over to Alerus Financial

Corporation, President and CEO, Katie Lorenson.

Alerus Financial Corp

Acquisition of HMN Financial

Please go ahead.

Katie Lorenson^ Thank you. And good morning, everyone.

Welcome. And we appreciate you all joining our call today.

Earlier this morning we jointly announced the franchise enhancing strategic

expansion into the Rochester, Minnesota market through the acquisition of HMN Financial.

Joining me here today in the Home Federal Rochester office is Al Villalon,

CFO; Jim Collins, Chief Banking and Revenue Officer; Debbie Lange, Chief Credit Officer; and Brad Krehbiel, CEO of HMN Financial.

I am pleased to be here today to discuss this transaction, which marks

the company's 26th acquisition over the last two decades and creates a premier $5 billion diversified financial institution, positioning

Alerus as the third largest community bank in Minnesota.

This partnership represents the largest in Alerus' history with HMN

having over $1 billion in assets and deposits and 14 locations throughout its footprint.

We have been familiar with HMN and its management team for quite some

time, and through our interactions have been able to diligently assess their business model and cultural fit.

Strategically, Home Federal is a natural extension of our commercial

Wealth Bank into the vibrant and growing Rochester, Minnesota market. Rochester is known nationally for being the home of the Mayo Clinic,

which recently committed to a $5 billion investment in the market. Home Federal locations allow expansion into the Southern Minnesota

market as well as Wisconsin.

These markets represent strong opportunities to grow C&I banking

with a concentration of commercial businesses across the footprint.

Additionally, it provides the opportunity to layer in our diversified

wealth services to new clients and markets, none of which have been modeled in. A key strategic focus for Alerus has been building a strong

core deposit franchise. And over the past several years, we have added additional investments in treasury management professionals and

technology as well as growing our synergistic deposit base. Home Federal maintains an excellent long-tenured core deposit franchise, and

this addition builds upon the foundational balance sheet strength and ability to continue to grow our combined company.

In targeted due diligence and more broadly in understanding the client

base and relationships, we look for consistency in credit culture.

Alerus Financial Corp

Acquisition of HMN Financial

In Home Federal and OCC regulated bank, we found a strong credit discipline,

great asset quality and, importantly, a highly granular and diversified client base and loan portfolio.

From a culture-fit perspective, we believe we have a well-vetted view

of complementary missions in serving our clients, alignment in core values and a strong consistency in credit culture, three critical

areas to execution. Al will get into more details, but overall, the financial metrics of the transaction are quite compelling and are

based on conservative assumptions.

The combined organization is projected to deliver top quartile ROEs

in 2025 and an ROA of almost 1.2%, while maintaining top decile fee income at over 40% of total revenues as well as a fortress balance

sheet of strong capital levels, a well-diversified loan portfolio, robust reserves and a long tenured core deposit base. With the enhanced

benefit of additional scale and operating leverage, we are excited about the future growth prospects of our combined organization. With

that, I will hand it over to Al to discuss the financial metrics of the transaction.

Alan Villalon^ Thanks, Katie.

We have posted slides related to this deal on the Investor Relations

part of our website. Let me go over the financial implications. This transaction is a 100% stock transaction, which is our second in our

company history, which we've issued -- where we have issued stock with the first being our most recent deal with Metro Phoenix. The transaction

value for HMN Financial is over $116 million, which represents a slight premium to tangible book value.

The exchange ratio is fixed, where we are issuing 1.25 shares of Alerus'

stock for each HMNF share.

We expect an increase of shares outstanding by 5.5 million for a total

of approximately 25.3 million of common shares outstanding, which equates to approximately 22% of our pro forma shares outstanding.

On a pro forma basis, the combined entity will have total assets of

$5.5 billion, gross loans of $3.7 billion and deposits of $4.3 billion.

We are targeting 30% of cost saves that will be fully realized in 2025.

This will translate to over a 600 basis point improvement to our efficiency ratio on a fully run rate basis.

We are forecasting for HMN loans to remain stable over the next several

years and a slight decrease in deposit levels as we expect the broker deposits to run off. Even with these conservative growth assumptions,

earnings accretion will exceed 45% on consensus estimates of $1.73 for 2025, and we calculate an earn-back of 2.2 years with an initial

tangible book dilution of approximately 11%.

Without interest rate marks, EPS accretion is still strong at over

20% in 2025, and the deal will be accreted to tangible book value per share. Common Equity Tier one is estimated to

Alerus Financial Corp

Acquisition of HMN Financial

approximately

11% at closing, while tangible equity ratio will be close to 7%, inclusive of all the interest rate marks.

We also expect the following mark-to-market adjustments in this transaction.

On the loan book, a total interest rate discount of $54.2 million will

be amortized over 3.8 years.

Additionally, a credit discount of $14.9 million we recognized, which

is 1.71% of HMN Financial's gross loans. Within that credit mark, $11.2 million will be related to the CECL's double count.

Other marks include a core deposit intangible of $30.7 million that

will be amortized over 10 years on an accelerated basis.

Their existing AOCI will be accreted back over 1.6 years, and we have

a $3.9 million write-up on MSRs, accreted back over five years, $2.8 million write-up on fixed assets, accreted back over 27.5 years and

a $1.5 million write-down on time deposits, accreted back under one year.

We expect our net interest margin for the combined entity to exceed

3% in 2025, with about 10 to 12 basis points of deal accretion affecting the margins each quarter. Based on 30% cost base and no forecasted

revenue synergies, we expect that the buying return on equity being a top quartile performance. You'll see Page 10 in the investor

deck, the combined entity will have a pro forma return on equity in the top quartile, fee income as a percent of revenues will still be

in the top quartile and overall loans of deposits close to top quartile.

We believe this is a great opportunity to combine companies that are

very much culturally aligned and to grow into a new MSA within Minnesota. The deal is financially compelling with the ability to drive

significant earnings accretion and grow value for all shareholders.

We welcome everyone from HMN Financial to Alerus team, and we look

forward to working together in getting this deal completed and to creating industry-leading performance.

I'll now open it up for Q&A.

QUESTION & ANSWER:

Operator^ (Operator Instructions) Our first question comes from Brendan

Nosal from Hovde Group.

Brendan Nosal^ Maybe just to start off here.

It looks like you've identified revenue synergies kind of in the materials,

but are not including them in the modeling kind of as is appropriate. Maybe just talk about what opportunities you see on the synergy

side and how that could factor into getting the fee to revenue mix kind of back up after that initial step down on day one.

Alerus Financial Corp

Acquisition of HMN Financial

James Collins^ This is Jim Collins.

I'll take that one. Brad's team is very experienced and aligns really

well with our existing teams.

So what we see is in the modeling is they just need to concentrate

on keeping the customer base and keeping the employee base. And as we know once you do these announcements all the way through conversion

and past conversion, it's constantly working with the client base just to retain what they have.

So that's why we did not model any additional growth.

I will tell you the cultures are really similar. Credit quality, credit

risk tolerance is very similar.

So we expect that with our balance sheet, we will be able to leverage

that over time.

But for us, the most important thing is to keep the customer and the

employee base together.

Katie Lorenson^ Yes, Brendan, this is Katie Lorenson.

I would add similar to how we approached the Metro Phoenix partnership,

we did not model in revenue synergies there as we know it takes time for the team members to focus on retention, first and foremost and

building relationships and trusted partnerships with the individuals and advisers across wealth management, private banking, mortgage,

et cetera.

But we did and are seeing those synergies come now with time with Metro

Phoenix transaction, and we expect that will be one of the many upsides of this partnership together.

Brendan Nosal^ Yes. That makes sense.

Okay. Perfect. Perhaps one more for me before I step back. Just kind

of curious how the deal and the addition of their balance sheet changes your pro forma interest rate positioning once it closes.

Alan Villalon^ Yes, Brendan.

So initially, it doesn't change as much.

I mean we are looking at this right now and they're liability sensitive

like we are liability sensitive.

So we do expect and hence why we gave the guidance of that 3% net interest

margin to be there in 2025.

Alerus Financial Corp

Acquisition of HMN Financial

So -- but again we dive into a little bit more what I said on our earnings

call though, we'll probably look at just the tail risk out of that interest rate risk management but nothing -- no initial changes.

Operator^ Our next question comes from Jeff Rulis from D.A. Davidson

Company.

Jeff Rulis^ First question maybe for -- maybe Brad could jump in.

But first on just the transaction itself and how the relationship with

HMN has been and Alerus. And then if you could comment on was this a negotiated transaction? Or was -- were other suitors involved?

Bradley Krehbiel^ Thanks for the question. This is Brad. No, other

suitors were not involved.

It was a negotiated transaction.

It's been something that we've been working on for quite some time.

And while we enjoy -- Home Federal enjoyed some great markets that

we're in that are attractive to a lot of banks.

But we understand that execution risk is very, very important and client

retention is important. Katie and I talked about that at length throughout our conversations, and we saw a real good fit there in terms

of, as she put it, our culture and how we do business. And at the end of the day after you put the two companies together, it's what it

looks like a year from now that really makes sense. And so that's what we're confident on that we really feel that our teams will work

well together and be able to make sure we see it true so that customer retention is not an issue.

Jeff Rulis^ Appreciate it, Brad. Maybe one for Katie. Just to check

in on M&A appetite. And do you view kind of the pursuit of the retirement and benefits acquisition kind of a different channel? In

other words, do we -- as you're concentrating on this transaction, does that exclude or negate or to spend the pursuit of maybe acquisitions

on the R&D side?

Katie Lorenson^ Yes. Great question.

It does not.

As you referenced, it is a different channel.

It is different resources.

It is not -- those acquisitions on the fee income side do not require

regulatory approval. And so we intend to continue as we are sourcing and building relationships on the fee income, specifically retirement

and benefit side as we progress in executing and integrating this transaction.

Alerus Financial Corp

Acquisition of HMN Financial

Jeff Rulis^ Al, I'm sorry, I had one other one. The conversion

-- planned conversion, if this closes at Q4, should we just assume early '25?

Katie Lorenson^ Right now we are targeting a close in conversion in

the fourth quarter.

Of course that is dependent on regulatory approval, which we believe

will be as favorable as possible in this environment, but that is both for a close and a conversion in the fourth quarter.

Operator^ Our next question comes from David Feaster from Raymond James.

David Feaster^ Maybe just starting on the credit front. 171 basis points

credit marks, it seems pretty conservative. Just kind of given my quick review of their historical asset quality.

I'm curious, how do you think about their credit profile? What are

you focused on as you did your due diligence and kind of your comfort level coming out of that review?

Debbie Lange^ David, this is Debbie Lange, and I can take that question.

Overall, from a credit alignment standpoint, we were very comfortable

with what we saw during the due diligence review.

We were fortunate to get a high percentage coverage in the portfolio,

looking at not only the C&I portfolio, the CRE portfolio, (inaudible) portfolio, we also sampled some (inaudible), and we've noted

this is an OCC bank. And so we're looking at the review of the credit quality, the credit culture, the underwriting standards very much

in line with what we were expecting to be.

David Feaster^ Okay. That's great. Maybe another one on the balance

sheet, Al. Just obviously look, the deal gives you a lot of financial flexibility, right, since we marked the acquired balance sheet.

I'm curious, how do you think about using that flexibility, whether

-- is there any interest in loan sales or security sales to maybe help accelerate some of the higher cost funding remixing?

I'm just curious how you think about that flexibility and some of the

options that are at your disposal.

Alan Villalon^ David, we're going to be waiving all options here for

sure. None of that was modeled into the forecast for us on that earn-back, none of that was considered in there.

So that's why conservative, but we're going to take a look at the balance

sheet and what I call optimize it.

We'll be looking at where we have opportunity for sure.

Alerus Financial Corp

Acquisition of HMN Financial

David Feaster^ Okay. That's great. And then last one, just -- look,

this gives you some -- you've done a great job on the organic growth side, attracting new talent to the bank. And the deal gives you access

in a small way to some new markets, right, in Wisconsin and Iowa.

I'm curious, how do you think about those markets and potential expansion

opportunities there?

James Collins^ I'll take that one, David.

We have a lot of experience collectively in the state of Wisconsin.

So I'm very bullish in Wisconsin.

I think Wisconsin acts a lot like all the Midwest states.

But certainly like Minnesota, we have an awful lot of contacts in Wisconsin

that can fortify Brad's locations in there and possibly expand through there.

We can also look -- we also enter in Iowa.

We'll take a hard look at what the opportunities are down there as

well.

But I would say for sure, we are very bullish on this concept.

David Feaster

Congrats on the deal.

Operator^ Our next question comes from Nathan Race from Piper Sandler.

Nathan Race^ Al, I just want to clarify on your accretion guidance

for next year.

I think you said 10 to 12 basis point impact from accretable yield,

which gets to like $6 million annually, is that kind of what you're including in the accretion guidance for 2025.

Alan Villalon^ Yes. That sounds about the ballpark. Let me just verify

that for a second here. Do you want to go to your next question?

Nathan Race^ Yes. Sure.

I was also just curious, the pretax deal-related costs come to just

under 20% of the deal value. That seems relatively high compared to other acquisitions that we've seen historically.

So just curious if you can provide any other color around why those

costs are relatively elevated?

Katie Lorenson^ Sure.

Alerus Financial Corp

Acquisition of HMN Financial

I can provide some context around that.

We really, I believe, had a deep level of operational diligence

in addition to credit diligence. And that allowed us to really look into the franchise and look at some things to kind of clean up.

One of the examples of the pension plan, terminate that and kind of

move that stuff off so that when we come together as a combined organization, we really have well-aligned business lines, segments, products

as well as benefits and those types of things.

And so that essentially is what drove the higher onetime deal costs,

which, of course we believe we addressed very well in the purchase price.

Nathan Race^ Okay. Great. And then, Katie, just going back to the previous

question, just in terms of the -- yes, go ahead, Al.

Alan Villalon^ Nate, sorry, on the net accretion here, I just

want to make sure I got the copyright.

I mean we're looking at just around using the 10 to 12 basis points,

it's going to be in that $5 million range per quarter.

Nathan Race^ Okay. Got it. And then just going back to the previous

question, Katie, in terms of the appetite for additional acquisitions on the retirement side of things.

Obviously with TCE up 7% on a pro forma basis with HMNF.

It seems like maybe you're a little bit more constrained in terms of

the size of targets that you could pursue.

So we'd just be curious to hear with this deal pending if that kind

of construct you to some degree in terms of the size of potential partners that you can pursue on that side of the house?

Katie Lorenson^ Well I think first and foremost, the accretion of the

capital is robust with the strong earnings per share accretion that of 40-plus percent.

Secondarily, the retirement benefit side is typically pretty bite-sized.

That's been where we've been at historically. And based on where we are in our journey of conversations, as I kind of forecast out, I

don't think we will miss any opportunities because of our capital levels.

Operator^ Our next question comes from Kevin Roth from Black Maple

Capital.

Kevin Roth^ Congrats on the deal, I like it. A quick question

on the expense saves that you've got.

Alerus Financial Corp

Acquisition of HMN Financial

Can you articulate a little bit more on where -- what the source of

those cost saves will be?

Katie Lorenson^ Sure.

I'll start, and then Al can chime in.

So expected cost saves are 30%. Again those are pretty well balanced

between where you would expect between just like our largest line items on our P&L, it's compensation and benefits and technology.

And so those would be the primary buckets of where the cost saves will come from.

Alan Villalon^ Yes.

So Kevin, when you take a look at HMN's trailing financials there, I

mean you can see the mix of their expense base right there and you can see what the buckets are. And you can expect that we're heavily

weighted, that's where there's going to be some focus on those areas.

Kevin Roth^ Okay. And in terms of the branch network, I mean do

you guys intend to just leaving it as is?

Katie Lorenson^ We do.

We have a long history in our experience at Alerus of optimizing our

branch footprint. And that's just something that we do in practice on a periodic basis, and we'll now do as a larger company in an ongoing

effort to optimize our branch footprint.

Operator^ And our next question comes from Damon DelMonte from KBW.

Damon Del Monte^ Congrats on a nice deal. Just first question for Al

on the margin kind of some of the assumptions that go into that. You guys have done the BTFP kind of arbitrage trade in this last quarter.

Does this kind of maybe change your view on that? Is that something you will unwind prior to the closing?

Alan Villalon^ No. The guidance I gave on the 3% for 2025 that

accounts for the BTFP rolling out as scheduled in the first quarter of next year.

Damon Del Monte^ Got it.

So the 3% is a full year expectation for 25? Or is it you'll reach

that during the course of the year?

Alan Villalon^ That is a full year guidance.

So -- and we're using the base of consensus.

Alerus Financial Corp

Acquisition of HMN Financial

So as we look at consensus out there right now we assume that there's

some Fed cuts baked into that.

So it has to be fair, in terms of looking at it on no rate because

I gave a guidance on the last call in terms of no Fed cuts, we'll probably end the year at 3% and maybe just touch upon it at the end

of the year.

If there's no Fed cuts, (inaudible) staying higher for longer.

Damon Del Monte^ Got it.

Okay. That's helpful. And then do you have a pro forma goodwill amount

that you're expecting to hit the balance sheet?

Alan Villalon^ Yes, hold on for one second there.

Katie Lorenson^ $21 million.

Alan Villalon^ Yes.

Operator^ Our next question comes from Jeff Rulis from D.A. Davidson

Company.

Jeff Rulis^ Just a couple of housekeeping. Al, I just wanted to

confirm a couple of figures. You said the tangible book dilution was 11%.

Alan Villalon^ Yes. That's correct, Jeff.

Jeff Rulis^ Okay. And the CECL double-count, I think you mentioned,

did you say $11 million or so?

Alan Villalon^ $11.2 million.

Operator^ We currently have no further questions.

I will hand back over to Katie Lorenson for final remarks.

Katie Lorenson^ All right. Perfect. Thank you so much. And thank you

for all joining our call today for listening in and answering questions.

We believe we put together a very strong partnership to expand the

Alerus franchise into new markets with robust C&I opportunities, supported by a solid funding base of granular core deposits and clean

credit quality. This strengthens our company to becoming the third-largest community bank in Minnesota.

Alerus Financial Corp

Acquisition of HMN Financial

And although this transaction is sizable, we believe we are very well

positioned to execute and the additional scale will continue to enhance our performance and expedite our return to top-tier returns as

well as value creation for all of our combined shareholders. Thank you, everyone, and have a great day.

Operator^ That does conclude today's conference call.

Have a nice day.

You may now disconnect your lines.

Special Note Concerning Forward-Looking Statements

This report contains “forward-looking statements”

within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements

include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated

future performance of Alerus Financial Corporation (“Alerus”) and HMN Financial Corporation, Inc. (“HMNF”)

and certain plans, expectations, goals, projections and benefits relating to the merger of HMN with and into Alerus (the “Merger”),

all of which are subject to numerous assumptions, risks and uncertainties. These statements are often, but not always, identified by words

such as “may,” “might,” “should,” “could,” “predict,” “potential,”

“believe,” “expect,” “continue,” “will,” “anticipate,” “seek,”

“estimate,” “intend,” “plan,” “projection,” “would,” “annualized,”

“target” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking

nature. Examples of forward-looking statements include, among others, statements Alerus makes regarding the ability of Alerus and HMNF

to complete the transactions contemplated by the agreement and plan of merger (the “Merger Agreement”), including the parties’

ability to satisfy the conditions to the consummation of the Merger, statements about the expected timing for completing the Merger, the

potential effects of the proposed Merger on both Alerus and HMNF, and the possibility of any termination of the Merger Agreement, and

any potential downward adjustment in the exchange ratio.

Forward-looking statements are not historical facts

but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently

uncertain and outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially,

from the anticipated results or outcomes indicated in these forward-looking statements. In addition to factors disclosed in reports filed

by Alerus and HMNF with the SEC, risks and uncertainties for Alerus, HMNF and the combined company that may cause actual results or outcomes

to differ materially from those anticipated include, but are not limited to: (1) the possibility that any of the anticipated benefits

of the proposed Merger will not be realized or will not

Alerus Financial Corp

Acquisition of HMN Financial

be realized within the expected time period; (2) the

risk that integration of HMNF’s operations with those of Alerus will be materially delayed or will be more costly or difficult

than expected; (3) the parties’ inability to meet expectations regarding the timing of the proposed Merger; (4) changes

to tax legislation and their potential effects on the accounting for the Merger; (5) the inability to complete the proposed Merger

due to the failure of the Alerus’ or HMNF’s stockholders to adopt the Merger Agreement, or the failure of Alerus’ stockholders

to approve the issuance of Alerus’ common stock in connection with the Merger; (6) the failure to satisfy other conditions

to completion of the proposed Merger, including receipt of required regulatory and other approvals; (7) the failure of the proposed

Merger to close for any other reason; (8) diversion of management’s attention from ongoing business operations and opportunities

due to the proposed Merger; (9) the challenges of integrating and retaining key employees; (10) the effect of the announcement

of the proposed Merger on Alerus’, HMNF’s or the combined company’s respective customer and employee relationships

and operating results; (11) the possibility that the proposed Merger may be more expensive to complete than anticipated, including as

a result of unexpected factors or events; (12) the amount of HMNF’s stockholders’ equity as of the closing date of the merger

and any potential downward adjustment in the exchange ratio; (13) the dilution caused by Alerus’ issuance of additional shares

of Alerus’ common stock in connection with the Merger; and (14) changes in the global economy and financial market conditions and

the business, results of operations and financial condition of Alerus, HMNF and the combined company. Please refer to each of Alerus’

and HMNF’s Annual Report on Form 10-K for the year ended December 31, 2023, as well as both parties’ other filings

with the SEC, for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those

discussed in the forward-looking statements.

Any forward-looking statement included in this

report is based only on information currently available to management and speaks only as of the date on which it is made. Neither Alerus

nor HMNF undertakes any obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time

to time, whether as a result of new information, future developments or otherwise.

Additional Information and Where to Find It

Alerus will file a registration statement on Form S-4

with the SEC in connection with the proposed transaction. The registration statement will include a joint proxy statement of Alerus and

HMNF that also constitutes a prospectus of Alerus, which will be sent to the stockholders of Alerus and HMNF. Before making any voting

decision, the stockholders of Alerus and HMNF are advised to read the joint proxy statement/prospectus when it becomes available because

it will contain important information about Alerus, HMNF and the proposed transaction. When filed, this document and other documents relating

to the Merger filed by Alerus can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be

obtained free of charge by

Alerus Financial Corp

Acquisition of HMN Financial

accessing Alerus’ website at www.alerus.com

under the link “Investors Relations” and then under “SEC Filings” and HMNF’s website at www.justcallhome.com/HMNFinancial

under “SEC Filings.” Alternatively, these documents, when available, can be obtained free of charge from Alerus upon written

request to Alerus Financial Corporation, Corporate Secretary, 401 Demers Avenue, Grand Forks, North Dakota 58201 or by calling (701)

795-3200, or from HMNF upon written request to HMN Financial, Inc., Corporate Secretary, 1016 Civic Center Drive NW, Rochester,

Minnesota 55901 or by calling (507) 535-1200. The contents of the websites referenced above are not deemed to be incorporated by reference

into the registration statement or the joint proxy statement/prospectus.

Participants in the Solicitation

This report does not constitute a solicitation

of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Alerus, HMNF, and certain of their directors, executive

officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders

of Alerus and HMNF in connection with the proposed Merger under SEC rules. Information about the directors and executive officers of Alerus

and HMNF will be included in the joint proxy statement/prospectus for the proposed transaction filed with the SEC. These documents (when

available) may be obtained free of charge in the manner described above under “Additional Information and Where to Find It.”

Security holders may

obtain information regarding the names, affiliations and interests of Alerus’ directors and executive officers in the definitive

proxy statement of Alerus relating to its 2024 Annual Meeting of Stockholders filed with the SEC on March 25, 2024 and on Alerus’

Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 8, 2024. Security holders may

also obtain information regarding the names, affiliations and interests of HMNF’s directors and executive officers in the definitive

proxy statement of HMNF relating to its 2024 Annual Meeting of Stockholders filed with the SEC on March 21, 2024 and HMNF’s

Annual Report on Form 10-K/A for the year ended December 31, 2023 filed with the SEC on March 19, 2024. To the extent the

holdings of Alerus’ securities by Alerus’ directors and executive officers or the holdings of HMNF securities by HMNF’s

directors and executive officers have changed since the amounts set forth in Alerus’ or HMNF’s respective proxy statement

for its 2024 Annual Meeting of Stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4

filed with the SEC. These documents can be obtained free of charge in the manner described above under “Additional Information and

Where to Find It.”

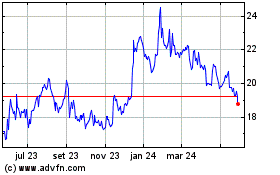

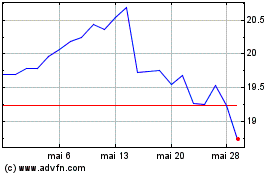

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024