Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Maio 2024 - 5:34PM

Edgar (US Regulatory)

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS

As

of March 31, 2024 (Unaudited)

| Principal | | |

| |

| |

| Amount | | |

| |

Value | |

| | | | |

BONDS & DEBENTURES — 31.9% | |

| | |

| | | | |

ASSET-BACKED SECURITIES — 13.6% | |

| | |

| | | | |

COLLATERALIZED LOAN OBLIGATION — 7.7% | |

| | |

| | | | |

ABPCI Direct Lending Fund CLO I LLC | |

| | |

| $ | 2,056,000 | | |

Series 2016-1A, Class E2, 14.309% (3-Month Term SOFR+899.161 basis points), 7/20/2033(a),(b) | |

$ | 2,055,819 | |

| | | | |

ABPCI Direct Lending Fund CLO II LLC | |

| | |

| | 2,942,000 | | |

Series 2017-1A, Class ER, 13.179% (3-Month Term SOFR+786.161 basis points), 4/20/2032(a),(b) | |

| 2,851,198 | |

| | | | |

Barings Middle Market CLO Ltd. | |

| | |

| | 1,040,000 | | |

Series 2021-IA, Class D, 14.229% (3-Month Term SOFR+891.161 basis points), 7/20/2033(a),(b) | |

| 1,039,853 | |

| | | | |

BlackRock Maroon Bells CLO XI LLC | |

| | |

| | 3,287,000 | | |

Series 2022-1A, Class E, 14.814% (3-Month Term SOFR+950 basis points), 10/15/2034(a),(b) | |

| 3,303,422 | |

| | | | |

Fortress Credit Opportunities IX CLO Ltd. | |

| | |

| | 5,186,000 | | |

Series 2017-9A, Class ER, 13.636% (3-Month Term SOFR+832.161 basis points), 10/15/2033(a),(b) | |

| 5,087,886 | |

| | | | |

Ivy Hill Middle Market Credit Fund XII Ltd. | |

| | |

| | 814,000 | | |

Series 12A, Class DR, 13.749% (3-Month Term SOFR+843.161 basis points), 7/20/2033(a),(b) | |

| 802,185 | |

| | | | |

Ivy Hill Middle Market Credit Fund XVIII Ltd. | |

| | |

| | 3,464,000 | | |

Series 18A, Class E, 13.329% (3-Month Term SOFR+801.161 basis points), 4/22/2033(a),(b) | |

| 3,363,069 | |

| | | | |

Ivy Hill Middle Market Credit Fund XX Ltd. | |

| | |

| | 2,380,000 | | |

Series 20A, Class E, 15.318% (3-Month Term SOFR+1,000 basis points), 4/20/2035(a),(b) | |

| 2,408,769 | |

| | | | |

Parliament CLO II Ltd. | |

| | |

| | 1,854,000 | | |

Series 2021-2A, Class D, 9.281% (3-Month Term SOFR+396.161 basis points), 8/20/2032(a),(b) | |

| 1,782,080 | |

| | | | |

TCP Waterman CLO LLC | |

| | |

| | 1,571,000 | | |

Series 2017-1A, Class ER, 13.741% (3-Month Term SOFR+842.161 basis points), 8/20/2033(a),(b) | |

| 1,547,534 | |

| | | | |

VCP CLO II Ltd. | |

| | |

| | 4,421,000 | | |

Series 2021-2A, Class E, 13.986% (3-Month Term SOFR+867.161 basis points), 4/15/2031(a),(b) | |

| 4,421,385 | |

| | | | |

| |

| 28,663,200 | |

| | | | |

EQUIPMENT — 0.8% | |

| | |

| | | | |

Coinstar Funding LLC | |

| | |

| | 2,857,180 | | |

Series 2017-1A, Class A2, 5.216%, 4/25/2047(a) | |

| 2,532,523 | |

| | | | |

Prop 2017-1A | |

| | |

| | 350,900 | | |

5.300%, 3/15/2042(c),(d) | |

| 302,652 | |

| | | | |

| |

| 2,835,175 | |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Principal | | |

| |

| |

| Amount | | |

| |

Value | |

| | | | |

BONDS & DEBENTURES (Continued) | |

| | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | |

| | |

| | | | |

OTHER — 5.1% | |

| | |

| | | | |

ABPCI Direct Lending Fund ABS I Ltd. | |

| | |

| $ | 3,077,121 | | |

Series 2020-1A, Class B, 4.935%, 12/20/2030(a) | |

$ | 2,901,528 | |

| | | | |

ABPCI Direct Lending Fund ABS II LLC | |

| | |

| | 3,387,000 | | |

Series 2022-2A, Class C, 8.236%, 3/1/2032(a) | |

| 3,146,371 | |

| | | | |

ABPCI Direct Lending Fund LP | |

| | |

| | 304,579 | | |

Series 2020-1A, Class A, 3.199%, 12/20/2030(a) | |

| 290,826 | |

| | | | |

Cologix Data Centers US Issuer LLC | |

| | |

| | 1,765,000 | | |

Series 2021-1A, Class C, 5.990%, 12/26/2051(a) | |

| 1,570,849 | |

| | | | |

Diamond Infrastructure Funding LLC | |

| | |

| | 384,000 | | |

Series 2021-1A, Class C, 3.475%, 4/15/2049(a) | |

| 343,668 | |

| | | | |

Diamond Issuer | |

| | |

| | 1,000,000 | | |

Series 2021-1A, Class C, 3.787%, 11/20/2051(a) | |

| 839,877 | |

| | | | |

Elm Trust | |

| | |

| | 44,331 | | |

Series 2020-3A, Class A2, 2.954%, 8/20/2029(a) | |

| 42,396 | |

| | 127,309 | | |

Series 2020-3A, Class B, 4.481%, 8/20/2029(a) | |

| 119,387 | |

| | 721,852 | | |

Series 2020-4A, Class B, 3.866%, 10/20/2029(a) | |

| 672,194 | |

| | | | |

Golub Capital Partners ABS Funding Ltd. | |

| | |

| | 1,002,432 | | |

Series 2020-1A, Class B, 4.496%, 1/22/2029(a) | |

| 945,401 | |

| | 1,401,179 | | |

Series 2021-1A, Class B, 3.816%, 4/20/2029(a) | |

| 1,312,234 | |

| | 3,377,000 | | |

Series 2021-2A, Class B, 3.994%, 10/19/2029(a) | |

| 2,904,169 | |

| | | | |

Hotwire Funding LLC | |

| | |

| | 750,000 | | |

Series 2021-1, Class C, 4.459%, 11/20/2051(a) | |

| 674,134 | |

| | | | |

Monroe Capital ABS Funding Ltd. | |

| | |

| | 851,677 | | |

Series 2021-1A, Class B, 3.908%, 4/22/2031(a) | |

| 830,420 | |

| | | | |

TVEST LLC | |

| | |

| | 13,051 | | |

Series 2020-A, Class A, 4.500%, 7/15/2032(a) | |

| 13,004 | |

| | | | |

VCP RRL ABS I Ltd. | |

| | |

| | 898,752 | | |

Series 2021-1A, Class B, 2.848%, 10/20/2031(a) | |

| 827,603 | |

| | 1,893,186 | | |

Series 2021-1A, Class C, 5.425%, 10/20/2031(a) | |

| 1,703,920 | |

| | | | |

| |

| 19,137,981 | |

| | | | |

TOTAL ASSET-BACKED SECURITIES | |

| | |

| | | | |

(Cost $52,508,649) | |

| 50,636,356 | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 0.4% | |

| | |

| | | | |

AGENCY — 0.1% | |

| | |

| | | | |

Eleven Madison Mortgage Trust | |

| | |

| | 344,000 | | |

Series 2015-11MD, Class A, 3.555%, 9/10/2035(a),(b) | |

| 323,433 | |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Principal | | |

| |

| |

| Amount | | |

| |

Value | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | |

| | |

| | | | |

NON-AGENCY — 0.3% | |

| | |

| | | | |

BX Commercial Mortgage Trust | |

| | |

| $ | 1,311,000 | | |

Series 2021-VOLT, Class F, 7.840% (1-Month Term SOFR+251.448 basis points), 9/15/2036(a),(b) | |

$ | 1,320,011 | |

| | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES | |

| | |

| | | | |

(Cost $1,617,360) | |

| 1,643,444 | |

| | | | |

CONVERTIBLE BONDS — 2.5% | |

| | |

| | | | |

Delivery Hero AG | |

| | |

| | 3,500,000 | | |

1.000%, 4/30/2026 | |

| 3,352,659 | |

| | 500,000 | | |

1.000%, 1/23/2027 | |

| 451,601 | |

| | 100,000 | | |

1.500%, 1/15/2028 | |

| 84,607 | |

| | | | |

Wayfair, Inc. | |

| | |

| | 5,078,000 | | |

0.625%, 10/1/2025 | |

| 4,703,752 | |

| | 122,000 | | |

1.000%, 8/15/2026 | |

| 112,618 | |

| | | | |

Zillow Group, Inc. | |

| | |

| | 48,000 | | |

2.750%, 5/15/2025 | |

| 50,700 | |

| | 350,000 | | |

1.375%, 9/1/2026 | |

| 431,157 | |

| | | | |

TOTAL CONVERTIBLE BONDS | |

| | |

| | | | |

(Cost $8,586,375) | |

| 9,187,094 | |

| | | | |

CORPORATE BANK DEBT — 5.1% | |

| | |

| | | | |

Axiom Global, Inc. | |

| | |

| | 1,713,263 | | |

10.179% (1-Month Term SOFR+485 basis points), 10/1/2026(b),(d),(e) | |

| 1,657,582 | |

| | | | |

Azalea Topco, Inc. | |

| | |

| | 1,141,140 | | |

8.942% (3-Month Term SOFR+361.4 basis points), 7/25/2026(b),(d),(e) | |

| 1,131,874 | |

| | | | |

Capstone Acquisition Holdings, Inc. 2020 Delayed Draw Term Loan | |

| | |

| | 149,058 | | |

10.180% (1-Month Term SOFR+485 basis points), 11/12/2027(b),(c),(d),(e),(f) | |

| 142,693 | |

| | | | |

Capstone Acquisition Holdings, Inc. 2020 Term Loan | |

| | |

| | 2,153,655 | | |

10.180% (1-Month Term SOFR+485 basis points), 11/12/2027(b),(c),(d),(e) | |

| 2,061,690 | |

| | | | |

CB&I STS Delaware LLC | |

| | |

| | 2,135,177 | | |

13.086% (3-Month Term SOFR+776.2 basis points), 12/31/2026(b),(c),(d),(e),(g) | |

| 2,092,473 | |

| | | | |

Cornerstone OnDemand, Inc. | |

| | |

| | 72,884 | | |

9.195% (1-Month Term SOFR+386.4 basis points), 10/16/2028(b),(d),(e) | |

| 71,427 | |

| | | | |

Element Commercial Funding LP | |

| | |

| | 2,360,000 | | |

10.731% (1-Month Term SOFR+575 basis points), 9/15/2024(b),(c),(d),(e),(f) | |

| 2,341,741 | |

| | | | |

Farfetch U.S. Holdings, Inc. | |

| | |

| | 3,199,221 | | |

11.666% (3-Month Term SOFR+625 basis points), 10/20/2027(b),(d),(e) | |

| 2,943,284 | |

| | | | |

Frontier Communications Holdings LLC | |

| | |

| | 1,230,930 | | |

9.195% (1-Month Term SOFR+386.4 basis points), 10/8/2027(b),(d),(e) | |

| 1,222,720 | |

| | | | |

JC Penney Corp., Inc. | |

| | |

| | 462,319 | | |

9.500% (1-Month USD Libor+425 basis points), 6/23/2025*,(b),(d),(e),(h) | |

| 46 | |

| | | | |

Lealand Finance Company B.V. Senior Exit LC | |

| | |

| | 1,698,187 | | |

3.500%, 6/30/2027(b),(c),(d),(e) | |

| (816,751 | ) |

| | 4,666,312 | | |

5.250%, 6/30/2027(b),(c),(d),(e),(f),(i) | |

| (1,679,872 | ) |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Principal | | |

| |

| |

| Amount | | |

| |

Value | |

| | | | |

CORPORATE BANK DEBT (Continued) | |

| | |

| | | | |

Light Commercial Funding LP | |

| | |

| $ | 1,332,000 | | |

11.153% (1-Month Term SOFR+600 basis points), 10/31/2026(b),(c),(d),(e),(f) | |

$ | 1,298,760 | |

| | | | |

McDermott LC | |

| | |

| | 991,164 | | |

9.592%, 6/30/2027(b),(c),(d),(e),(f) | |

| 495,582 | |

| | | | |

McDermott Tanks Escrow LC | |

| | |

| | 228,693 | | |

9.592%, 12/31/2026(b),(c),(d),(e) | |

| 114,346 | |

| | | | |

McDermott Tanks Secured LC | |

| | |

| | 2,513,909 | | |

10.250%, 12/31/2026(b),(c),(d),(e),(f),(i) | |

| (402,225 | ) |

| | | | |

McDermott Technology Americas, Inc. | |

| | |

| | 141,927 | | |

8.442% (1-Month Term SOFR+311.4 basis points), 6/30/2027(b),(d),(e) | |

| 70,963 | |

| | 1,532,125 | | |

6.443% (1-Month Term SOFR+111.4 basis points), 12/31/2027(b),(d),(e),(g) | |

| 597,528 | |

| | | | |

Polaris Newco, LLC Term Loan B | |

| | |

| | 1,136,850 | | |

9.313% (3-Month Term SOFR+400 basis points), 6/5/2028(b),(d),(e) | |

| 1,124,299 | |

| | | | |

Project Myrtle | |

| | |

| | 3,000,000 | | |

7.500% (1-Month Term SOFR+317.9 basis points), 6/15/2025(b),(c),(d),(e),(f),(i) | |

| 1,221,259 | |

| | | | |

QBS Parent, Inc. | |

| | |

| | 1,918,987 | | |

9.709% (3-Month Term SOFR+425 basis points), 9/21/2025(b),(d),(e) | |

| 1,858,213 | |

| | | | |

Vision Solutions, Inc. | |

| | |

| | 73,066 | | |

9.586% (3-Month Term SOFR+426.2 basis points), 5/28/2028(b),(d),(e) | |

| 73,066 | |

| | | | |

WH Borrower LLC, Term Loan B | |

| | |

| | 1,149,495 | | |

10.903% (3-Month Term SOFR+550 basis points), 2/15/2027(b),(d),(e) | |

| 1,145,184 | |

| | | | |

Windstream Services LLC | |

| | |

| | 251,087 | | |

11.680% (1-Month Term SOFR+635 basis points), 9/21/2027(b),(d),(e) | |

| 244,391 | |

| | | | |

TOTAL CORPORATE BANK DEBT | |

| | |

| | | | |

(Cost $22,898,961) | |

| 19,010,273 | |

| | | | |

CORPORATE BONDS — 10.3% | |

| | |

| | | | |

COMMUNICATIONS — 1.0% | |

| | |

| | | | |

Consolidated Communications, Inc. | |

| | |

| | 1,272,000 | | |

6.500%, 10/1/2028(a) | |

| 1,109,820 | |

| | | | |

Frontier Communications Holdings LLC | |

| | |

| | 453,000 | | |

5.875%, 10/15/2027(a) | |

| 437,287 | |

| | | | |

Upwork, Inc. | |

| | |

| | 2,500,000 | | |

0.250%, 8/15/2026 | |

| 2,179,750 | |

| | | | |

| |

| 3,726,857 | |

| | | | |

CONSUMER DISCRETIONARY — 0.7% | |

| | |

| | | | |

Air Canada Pass Through Trust | |

| | |

| | 1,500,000 | | |

Series 2020-1, Class C, 10.500%, 7/15/2026(a) | |

| 1,635,000 | |

| | | | |

Cimpress PLC | |

| | |

| | 381,000 | | |

7.000%, 6/15/2026 | |

| 381,305 | |

| | | | |

VT Topco, Inc. | |

| | |

| | 421,000 | | |

8.500%, 8/15/2030(a) | |

| 443,102 | |

| | | | |

| |

| 2,459,407 | |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Principal | | |

| |

| |

| Amount | | |

| |

Value | |

| | | | |

CORPORATE BONDS (Continued) | |

| | |

| | | | |

ENERGY — 3.5% | |

| | |

| | | | |

Gulfport Energy Corp. | |

| | |

| $ | 11,736 | | |

8.000%, 5/17/2026 | |

$ | 11,912 | |

| | | | |

Tidewater, Inc. | |

| | |

| | 9,600,000 | | |

8.500%, 11/16/2026 | |

| 9,978,000 | |

| | 3,000,000 | | |

10.375%, 7/3/2028(a) | |

| 3,195,000 | |

| | | | |

| |

| 13,184,912 | |

| | | | |

FINANCIALS — 3.6% | |

| | |

| | | | |

Apollo Debt Solutions BDC Senior Notes | |

| | |

| | 2,333,000 | | |

8.620%, 9/28/2028(c),(d) | |

| 2,333,000 | |

| | | | |

Blue Owl Credit Income Corp. | |

| | |

| | 1,167,000 | | |

4.700%, 2/8/2027 | |

| 1,105,786 | |

| | 2,243,000 | | |

7.750%, 9/16/2027 | |

| 2,294,939 | |

| | | | |

Charles Schwab Corp. | |

| | |

| | 549,000 | | |

4.000% (USD 5 Year Tsy+316.8 basis points)(b),(j) | |

| 510,284 | |

| | 75,000 | | |

5.000% (3-Month USD Libor+257.5 basis points)(b),(j) | |

| 67,781 | |

| | | | |

HPS Corporate Lending Fund | |

| | |

| | 520,000 | | |

6.750%, 1/30/2029(a) | |

| 518,480 | |

| | | | |

Midcap Financial Issuer Trust | |

| | |

| | 3,466,000 | | |

6.500%, 5/1/2028(a) | |

| 3,186,536 | |

| | | | |

Oaktree Strategic Credit Fund | |

| | |

| | 1,615,000 | | |

8.400%, 11/14/2028(a) | |

| 1,711,343 | |

| | | | |

OCREDIT BDC Senior Notes | |

| | |

| | 552,000 | | |

7.770%, 3/7/2029(c),(d) | |

| 552,000 | |

| | | | |

Vornado Realty LP | |

| | |

| | 1,000,000 | | |

3.500%, 1/15/2025 | |

| 968,750 | |

| | 250,000 | | |

2.150%, 6/1/2026 | |

| 226,040 | |

| | | | |

| |

| 13,474,939 | |

| | | | |

HEALTH CARE — 0.5% | |

| | |

| | | | |

Heartland Dental LLC/Heartland Dental Finance Corp. | |

| | |

| | 1,796,000 | | |

10.331% (1-Month Term SOFR+500 basis points), 4/30/2028(a),(d) | |

| 1,903,760 | |

| | | | |

TECHNOLOGY — 1.0% | |

| | |

| | | | |

Hlend Senior Notes | |

| | |

| | 3,500,000 | | |

8.170%, 3/15/2028(c),(d) | |

| 3,500,000 | |

| | | | |

TOTAL CORPORATE BONDS | |

| | |

| | | | |

(Cost $37,479,636) | |

| 38,249,875 | |

| | | | |

TOTAL BONDS & DEBENTURES | |

| | |

| | | | |

(Cost $123,090,981) | |

| 118,727,042 | |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Number | | |

| |

| |

| of Shares | | |

| |

Value | |

| | | | |

CLOSED-END FUNDS — 0.1% | |

| | |

| | 142,220 | | |

Altegrity, Inc.(c),(d) | |

$ | 331,372 | |

| | | | |

TOTAL CLOSED-END FUNDS | |

| | |

| | | | |

(Cost $0) | |

| 331,372 | |

| | | | |

COMMON STOCKS — 40.5% | |

| | |

| | | | |

AEROSPACE & DEFENSE — 1.9% | |

| | |

| | 33,600 | | |

Howmet Aerospace, Inc. | |

| 2,299,248 | |

| | 21,785 | | |

Safran SA | |

| 4,936,821 | |

| | | | |

| |

| 7,236,069 | |

| | | | |

APPAREL & TEXTILE PRODUCTS — 0.8% | |

| | |

| | 18,617 | | |

Cie Financiere Richemont SA Class A | |

| 2,838,272 | |

| | | | |

ASSET MANAGEMENT — 0.3% | |

| | |

| | 14,295 | | |

Groupe Bruxelles Lambert NV | |

| 1,080,492 | |

| | 14,610 | | |

Pershing Square Tontine Holdings Ltd.(c),(d) | |

| — | |

| | 3,497 | | |

PowerUp Acquisition Corp* | |

| 38,572 | |

| | | | |

| |

| 1,119,064 | |

| | | | |

BANKING — 3.9% | |

| | |

| | 134,615 | | |

Citigroup, Inc. | |

| 8,513,052 | |

| | 105,255 | | |

Wells Fargo & Co. | |

| 6,100,580 | |

| | | | |

| |

| 14,613,632 | |

| | | | |

BEVERAGES — 2.3% | |

| | |

| | 64,215 | | |

Heineken Holding NV | |

| 5,182,093 | |

| | 130,940 | | |

JDE Peet's NV | |

| 2,749,048 | |

| | 62,216 | | |

Swire Pacific Ltd. Class A | |

| 511,915 | |

| | | | |

| |

| 8,443,056 | |

| | | | |

CABLE & SATELLITE — 3.0% | |

| | |

| | 5,983 | | |

Charter Communications, Inc. Class A* | |

| 1,738,839 | |

| | 215,600 | | |

Comcast Corp. Class A | |

| 9,346,260 | |

| | | | |

| |

| 11,085,099 | |

| | | | |

CHEMICALS — 1.8% | |

| | |

| | 77,685 | | |

International Flavors & Fragrances, Inc. | |

| 6,680,133 | |

| | | | |

CONSTRUCTION MATERIALS — 2.8% | |

| | |

| | 115,552 | | |

Holcim AG* | |

| 10,462,331 | |

| | | | |

E-COMMERCE DISCRETIONARY — 0.8% | |

| | |

| | 28,187 | | |

Alibaba Group Holding Ltd. | |

| 252,991 | |

| | 15,969 | | |

Amazon.com, Inc.* | |

| 2,880,489 | |

| | | | |

| |

| 3,133,480 | |

| | | | |

ELECTRIC UTILITIES — 0.7% | |

| | |

| | 68,180 | | |

FirstEnergy Corp. | |

| 2,633,111 | |

| | 9,047 | | |

PG&E Corp. | |

| 151,628 | |

| | | | |

| |

| 2,784,739 | |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Number | | |

| |

| |

| of Shares | | |

| |

Value | |

| | | | |

COMMON STOCKS (Continued) | |

| | |

| | | | |

ELECTRICAL EQUIPMENT — 2.2% | |

| | |

| | 57,280 | | |

TE Connectivity Ltd. | |

$ | 8,319,347 | |

| | | | |

ENGINEERING & CONSTRUCTION — 0.8% | |

| | |

| | 2,135,146 | | |

McDermott International, Ltd.*,(c),(d) | |

| 427,029 | |

| | 21,370 | | |

Samsung C&T Corp. | |

| 2,541,383 | |

| | | | |

| |

| 2,968,412 | |

| | | | |

ENTERTAINMENT CONTENT — 0.7% | |

| | |

| | 4,347 | | |

Epic Games, Inc.(c),(d) | |

| 1,156,302 | |

| | 81,739 | | |

Nexon Co. Ltd. | |

| 1,355,297 | |

| | | | |

| |

| 2,511,599 | |

| | | | |

HEALTH CARE FACILITIES & SVCS — 0.3% | |

| | |

| | 3,606 | | |

ICON PLC* | |

| 1,211,436 | |

| | | | |

INDUSTRIAL SUPPORT SERVICES — 1.3% | |

| | |

| | 21,507 | | |

Ferguson PLC | |

| 4,697,774 | |

| | | | |

INSURANCE — 1.5% | |

| | |

| | 16,270 | | |

Aon PLC Class A | |

| 5,429,624 | |

| | | | |

INTERNET MEDIA & SERVICES — 4.7% | |

| | |

| | 31,853 | | |

Alphabet, Inc. Class A* | |

| 4,807,573 | |

| | 19,721 | | |

Alphabet, Inc. Class C* | |

| 3,002,720 | |

| | 8,390 | | |

Delivery Hero SE*,(a) | |

| 240,005 | |

| | 9,669 | | |

Just Eat Takeaway.com NV*,(a) | |

| 143,309 | |

| | 10,387 | | |

Meta Platforms, Inc. Class A | |

| 5,043,720 | |

| | 1,004 | | |

Netflix, Inc.* | |

| 609,759 | |

| | 86,481 | | |

Prosus N.V.* | |

| 2,712,736 | |

| | 14,078 | | |

Uber Technologies, Inc.* | |

| 1,083,865 | |

| | | | |

| |

| 17,643,687 | |

| | | | |

LEISURE FACILITIES & SERVICES — 1.0% | |

| | |

| | 48,095 | | |

Entain PLC | |

| 484,046 | |

| | 12,342 | | |

Marriott International, Inc. Class A | |

| 3,114,010 | |

| | | | |

| |

| 3,598,056 | |

| | | | |

METALS & MINING — 1.2% | |

| | |

| | 788,595 | | |

Glencore PLC* | |

| 4,332,644 | |

| | | | |

OIL & GAS PRODUCERS — 1.1% | |

| | |

| | 7,174 | | |

Gulfport Energy Corp.* | |

| 1,148,701 | |

| | 160,090 | | |

Kinder Morgan, Inc. | |

| 2,936,051 | |

| | | | |

| |

| 4,084,752 | |

| | | | |

OTHER COMMON STOCK — 0.0% | |

| | |

| | — | | |

Other Common Stock(k) | |

| 3,251 | |

| | | | |

REAL ESTATE SERVICES — 0.0% | |

| | |

| | 16,058 | | |

Copper Property CTL Pass Through Trust(d) | |

| 158,171 | |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Number | | |

| |

| |

| of Shares | | |

| |

Value | |

| | | | |

COMMON STOCKS (Continued) | |

| | |

| | | | |

RETAIL - DISCRETIONARY — 0.5% | |

| | |

| | 23,348 | | |

CarMax, Inc.* | |

$ | 2,033,844 | |

| | | | |

SEMICONDUCTORS — 4.3% | |

| | |

| | 42,594 | | |

Analog Devices, Inc. | |

| 8,424,667 | |

| | 2,797 | | |

Broadcom, Inc. | |

| 3,707,172 | |

| | 16,423 | | |

NXP Semiconductors NV | |

| 4,069,127 | |

| | | | |

| |

| 16,200,966 | |

| | | | |

SOFTWARE — 0.0% | |

| | |

| | 10,312 | | |

Windstream Holdings, Inc.*,(c) | |

| 97,964 | |

| | | | |

TECHNOLOGY HARDWARE — 0.7% | |

| | |

| | 49,244 | | |

Nintendo Co. Ltd. | |

| 2,686,657 | |

| | | | |

TECHNOLOGY SERVICES — 0.8% | |

| | |

| | 44,825 | | |

LG Corp. | |

| 2,916,747 | |

| | | | |

TRANSPORTATION & LOGISTICS — 0.5% | |

| | |

| | 84,452 | | |

PHI Group, Inc.*,(c),(d) | |

| 1,689,040 | |

| | | | |

TRANSPORTATION EQUIPMENT — 0.6% | |

| | |

| | 14,298 | | |

Westinghouse Air Brake Technologies Corp. | |

| 2,082,933 | |

| | | | |

TOTAL COMMON STOCKS | |

| | |

| | | | |

(Cost $97,718,505) | |

| 151,062,779 | |

| | | | |

LIMITED PARTNERSHIPS — 11.2% | |

| | |

| | 55,000 | | |

Blue Torch Credit Opportunities Fund II LP(d),(l) | |

| 4,135,218 | |

| | 60,000 | | |

Clover Private Credit Opportunities Fund LP(d),(l) | |

| 4,415,103 | |

| | 55,000 | | |

HIG WhiteHorse Direct Lending 2020 LP(d),(l) | |

| 3,786,818 | |

| | 80,000 | | |

Metro Partners Fund VII LP(d),(l) | |

| 8,467,701 | |

| | 80,000 | | |

MSD Private Credit Opportunities Fund II LP(d),(l) | |

| 2,961,594 | |

| | 30,000 | | |

MSD Real Estate Credit Opportunities Fund(d),(l) | |

| 1,392,050 | |

| | 55,000 | | |

Nebari Natural Resources Credit Fund I LP(d),(l) | |

| 5,122,342 | |

| | 30,000 | | |

Piney Lake Opportunities Fund LP(d),(l) | |

| 3,073,967 | |

| | 18,000 | | |

Post Road Special Opportunity Fund II LP(d),(l) | |

| 1,615,708 | |

| | 34,745 | | |

Silverpeak Credit Opportunities LP(d),(l) | |

| 1,735,764 | |

| | 48,500 | | |

Silverpeak Special Situations(d),(l) | |

| 4,868,623 | |

| | | | |

TOTAL LIMITED PARTNERSHIPS | |

| | |

| | | | |

(Cost $36,520,673) | |

| 41,574,888 | |

| | | | |

PREFERRED STOCKS — 0.0% | |

| | |

| | | | |

ENERGY — 0.0% | |

| | |

| | 47 | | |

Gulfport Energy Corp., 10.000%, (c) | |

| 45,659 | |

| | | | |

INDUSTRIALS — 0.0% | |

| | |

| | 908 | | |

McDermott International, Ltd., 8.000%, (c),(d) | |

| 103,239 | |

| | | | |

TOTAL PREFERRED STOCKS | |

| | |

| | | | |

(Cost $83,400) | |

| 148,898 | |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Number | | |

| |

| |

| of Shares | | |

| |

Value | |

| | | | |

WARRANTS (SPAC) — 0.1% | |

| | |

| | 1,374 | | |

American Oncology Network, Inc., Expiration Date: March 31, 2028* | |

$ | 467 | |

| | 11,954 | | |

Atlantic Coastal Acquisition Corp. II, Expiration Date: June 2, 2028* | |

| 643 | |

| | 20,278 | | |

BigBear.ai Holdings, Inc., Expiration Date: December 31, 2028* | |

| 6,797 | |

| | 13,186 | | |

Brand Engagement Network, Inc., Expiration Date: December 31, 2027* | |

| 1,584 | |

| | 94,574 | | |

BurTech Acquisition Corp., Expiration Date: December 18, 2026* | |

| 17,014 | |

| | 9,384 | | |

Churchill Capital Corp. VII, Expiration Date: February 29, 2028* | |

| 3,003 | |

| | 26,146 | | |

Disruptive Acquisition Corp. I A Shares, Expiration Date: March 6, 2026*,(c) | |

| — | |

| | 12,721 | | |

ECARX Holdings, Inc., Expiration Date: December 21, 2027* | |

| 382 | |

| | 31,567 | | |

Electriq Power Holdings, Inc., Expiration Date: January 25, 2028* | |

| 35 | |

| | 4,908 | | |

Global Partner Acquisition Corp. II, Expiration Date: December 30, 2027*,(c) | |

| — | |

| | 26,146 | | |

Golden Arrow Merger Corp., Expiration Date: July 31, 2027* | |

| 4,973 | |

| | 7,538 | | |

Heliogen, Inc., Expiration Date: March 31, 2028* | |

| 75 | |

| | 24,015 | | |

MariaDB PLC, Expiration Date: December 16, 2027* | |

| 2,161 | |

| | 13,756 | | |

Metals Acquisition Ltd., Expiration Date: June 16, 2028* | |

| 28,062 | |

| | 16,476 | | |

NioCorp Developments Ltd., Expiration Date: March 17, 2028* | |

| 6,426 | |

| | 6,999 | | |

Northern Star Investment Corp. III, Expiration Date: February 24, 2028*,(c) | |

| 7 | |

| | 5,407 | | |

Northern Star Investment Corp. IV, Expiration Date: December 31, 2027*,(c) | |

| 1 | |

| | 14,795 | | |

Plum Acquisition Corp. I, Expiration Date: December 31, 2028* | |

| 5,770 | |

| | 1,029 | | |

Plum Acquisition Corp. III, Expiration Date: March 31, 2028* | |

| 139 | |

| | 1,748 | | |

PowerUp Acquisition Corp., Expiration Date: February 18, 2027* | |

| 53 | |

| | 815 | | |

Prenetics Global Ltd., Expiration Date: December 31, 2026* | |

| 8 | |

| | 5,878 | | |

Ross Acquisition Corp. II, Expiration Date: February 12, 2026*,(c) | |

| 530 | |

| | 39,217 | | |

Sable Offshore Corp., Expiration Date: December 31, 2028* | |

| 101,180 | |

| | 13,618 | | |

Slam Corp., Expiration Date: December 31, 2027* | |

| 2,451 | |

| | 2,126 | | |

Swvl Holdings Corp., Expiration Date: March 31, 2027* | |

| 36 | |

| | 25,079 | | |

Twelve Seas Investment Co. II, Expiration Date: March 2, 2028* | |

| 2,357 | |

| | | | |

TOTAL WARRANTS (SPAC) | |

| | |

| | | | |

(Cost $117,788) | |

| 184,154 | |

| | | | |

SHORT-TERM INVESTMENTS — 15.3% | |

| | |

| | | | |

MONEY MARKET INVESTMENTS — 15.3% | |

| | |

| | 57,143,474 | | |

Morgan Stanley Institutional Liquidity Treasury Portfolio - Institutional Class, 5.08%(m) | |

| 57,143,474 | |

| | | | |

TOTAL SHORT-TERM INVESTMENTS | |

| | |

| | | | |

(Cost $57,143,474) | |

| 57,143,474 | |

| | | | |

| |

| | |

| | | | |

TOTAL INVESTMENTS — 99.1% | |

| | |

| | | | |

(Cost $314,674,821) | |

| 369,172,607 | |

| | | | |

Other Assets in Excess of Liabilities — 0.9% | |

| 3,397,991 | |

| | | | |

TOTAL NET ASSETS — 100.0% | |

$ | 372,570,598 | |

BDC

– Business Development Company

LLC

– Limited Liability Company

LP

– Limited Partnership

PLC

– Public Limited Company

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

US

– United States

| * | Non-income

producing security. |

| (a) | Security

exempt from registration under Rule 144A of the Securities Act of 1933. These securities

are restricted and may be resold in transactions exempt from registration normally to

qualified institutional buyers. The total value of these securities is $66,500,790, which

represents 17.85% of Net Assets. |

| (b) | Variable

or floating rate security. |

| (c) | Level

3 securities fair valued under procedures established by the Board of Directors, represents

4.67% of Net Assets. The total value of these securities is $17,408,491. |

| (d) | Restricted

securities. These restricted securities constituted 19.60% of total net assets at March

31, 2024, most of which are considered liquid by the Adviser. These securities are not

registered and may not be sold to the public. There are legal and/or contractual restrictions

on resale. The Fund does not have the right to demand that such securities be registered.

The values of these securities are determined by valuations provided by pricing services,

brokers, dealers, market makers, or in good faith under policies adopted by authority

of the Fund's Board of Directors. |

| (e) | Bank

loans generally pay interest at rates which are periodically determined by reference

to a base lending rate plus a premium. All loans carry a variable rate of interest. These

base lending rates are generally (i) the Prime Rate offered by one or more major United

States banks, (ii) the lending rate offered by one or more European banks such as the

London Interbank Offered Rate (“LIBOR”), (iii) the Certificate of Deposit

rate, or (iv) Secured Overnight Financing Rate (“SOFR”). Bank Loans, while

exempt from registration, under the Securities Act of 1933, contain certain restrictions

on resale and cannot be sold publicly. Floating rate bank loans often require prepayments

from excess cash flow or permit the borrower to repay at its election. The degree to

which borrowers repay, whether as a contractual requirement or at their election, cannot

be predicted with accuracy. |

| (f) | As

of March 31, 2024, the Fund had entered into commitments to fund various delayed draw

debt-related investments. Such commitments are subject to the satisfaction of certain

conditions set forth in the documents governing those investments and there can be no

assurance that such conditions will be satisfied. |

| (g) | Payment-in-kind

interest is generally paid by issuing additional par/shares of the security rather than

paying cash. |

| (h) | Security

is in default. |

| (i) | All

or a portion of the loan is unfunded. |

| (j) | Perpetual

security. Maturity date is not applicable. |

| (k) | As

permitted by U.S. Securities and Exchange Commission regulations, "Other" Common

Stocks include holdings in their first year of acquisition that have not previously been

publicly disclosed. |

| (l) | Investment

valued using net asset value per share (or its equivalent) as a practical expedient. |

| (m) | The

rate is the annualized seven-day yield at period end. |

Source

Capital, Inc.

SCHEDULE

OF INVESTMENTS - Continued

As

of March 31, 2024 (Unaudited)

| Restricted Security | |

Initial Acquisition Date | |

Cost | | |

Fair Value | | |

Fair Value as a

% of

Net

Assets | |

| Altegrity, Inc. | |

9/1/2021 | |

$ | - | | |

$ | 331,372 | | |

| 0.09 | % |

| Apollo Debt Solutions BDC Senior Notes, 8.620%, 9/28/2028 | |

8/10/2023 | |

| 2,333,000 | | |

| 2,333,000 | | |

| 0.63 | % |

| Axiom Global, Inc., 10.179% (1-Month Term SOFR+485basis points), 10/1/2026 | |

11/18/2021 | |

| 1,701,575 | | |

| 1,657,582 | | |

| 0.44 | % |

| Azalea Topco, Inc., 8.942% (3-Month Term SOFR+361.4basis points), 7/25/2026 | |

9/20/2021 | |

| 1,136,139 | | |

| 1,131,874 | | |

| 0.30 | % |

| Blue Torch Credit Opportunities Fund II LP | |

2/16/2021 | |

| 3,816,396 | | |

| 4,135,218 | | |

| 1.11 | % |

| Capstone Acquisition Holdings, Inc. 2020 Delayed Draw Term Loan, 10.180% (1-Month Term SOFR+485basis points), 11/12/2027 | |

11/12/2020 | |

| 148,596 | | |

| 142,693 | | |

| 0.04 | % |

| Capstone Acquisition Holdings, Inc. 2020 Term Loan, 10.180% (1-Month Term SOFR+485basis points), 11/12/2027 | |

11/12/2020 | |

| 2,140,292 | | |

| 2,061,690 | | |

| 0.55 | % |

| CB&I STS Delaware LLC, 13.086% (3-Month Term SOFR+776.2basis points), 12/31/2026 | |

9/5/2023 | |

| 2,135,177 | | |

| 2,092,473 | | |

| 0.56 | % |

| Clover Private Credit Opportunities Fund LP | |

12/13/2021 | |

| 4,056,233 | | |

| 4,415,103 | | |

| 1.19 | % |

| Copper Property CTL Pass Through Trust | |

10/5/2017 | |

| 528,672 | | |

| 158,171 | | |

| 0.04 | % |

| Cornerstone OnDemand, Inc., 9.195% (1-Month Term SOFR+386.4basis points), 10/16/2028 | |

12/7/2022 | |

| 67,573 | | |

| 71,427 | | |

| 0.02 | % |

| Element Commercial Funding LP, 10.731% (1-Month Term SOFR+575basis points), 9/15/2024 | |

4/14/2023 | |

| 2,330,500 | | |

| 2,341,741 | | |

| 0.63 | % |

| Epic Games, Inc. | |

6/25/2020 | |

| 2,499,525 | | |

| 1,156,302 | | |

| 0.31 | % |

| Farfetch U.S. Holdings, Inc., 11.666% (3-Month Term SOFR+625basis points), 10/20/2027 | |

9/28/2022 | |

| 3,022,190 | | |

| 2,943,284 | | |

| 0.79 | % |

| Frontier Communications Holdings LLC, 9.195% (1-Month Term SOFR+386.4basis points), 10/8/2027 | |

4/9/2021 | |

| 1,222,370 | | |

| 1,222,720 | | |

| 0.33 | % |

| Heartland Dental LLC/Heartland Dental Finance Corp., 10.331% (1-Month Term SOFR+500basis points), 4/30/2028 | |

5/5/2023 | |

| 1,779,035 | | |

| 1,903,760 | | |

| 0.51 | % |

| HIG WhiteHorse Direct Lending 2020 LP | |

7/30/2021 | |

| 3,986,799 | | |

| 3,786,818 | | |

| 1.02 | % |

| Hlend Senior Notes, 8.170%, 3/15/2028 | |

2/16/2023 | |

| 3,500,000 | | |

| 3,500,000 | | |

| 0.94 | % |

| JC Penney Corp., Inc., 9.500% (1-Month USD Libor+425basis points), 6/23/2025 | |

2/3/2021 | |

| - | | |

| 46 | | |

| 0.00 | % |

| Lealand Finance Company B.V. Senior Exit LC, 3.500%, 6/30/2027 | |

2/28/2020 | |

| (959,082 | ) | |

| (816,751 | ) | |

| -0.22 | % |

| Lealand Finance Company B.V. Senior Exit LC, 5.250%, 6/30/2027 | |

11/12/2019 | |

| (10,598 | ) | |

| (1,679,872 | ) | |

| -0.45 | % |

| Light Commercial Funding LP, 11.153% (1-Month Term SOFR+600basis points), 10/31/2026 | |

2/28/2023 | |

| 1,295,370 | | |

| 1,298,760 | | |

| 0.35 | % |

| McDermott International, Ltd. | |

7/1/2020 | |

| 2,014,777 | | |

| 427,029 | | |

| 0.11 | % |

| McDermott International, Ltd., 8.000% | |

12/31/2020 | |

| 64,152 | | |

| 103,239 | | |

| 0.03 | % |

| McDermott LC, 9.592%, 6/30/2027 | |

7/1/2020 | |

| 991,165 | | |

| 495,582 | | |

| 0.13 | % |

| McDermott Tanks Escrow LC, 9.592%, 12/31/2026 | |

2/28/2020 | |

| 228,691 | | |

| 114,346 | | |

| 0.03 | % |

| McDermott Tanks Secured LC, 10.250%, 12/31/2026 | |

12/31/2020 | |

| (5,477 | ) | |

| (402,225 | ) | |

| -0.11 | % |

| McDermott Technology Americas, Inc., 8.442% (1-Month Term SOFR+311.4basis points), 6/30/2027 | |

7/1/2020 | |

| 141,925 | | |

| 70,963 | | |

| 0.02 | % |

| McDermott Technology Americas, Inc., 6.443% (1-Month Term SOFR+111.4basis points), 12/31/2027 | |

7/1/2020 | |

| 1,810,791 | | |

| 597,528 | | |

| 0.16 | % |

| Metro Partners Fund VII LP | |

5/13/2021 | |

| 7,180,327 | | |

| 8,467,701 | | |

| 2.27 | % |

| MSD Private Credit Opportunities Fund II LP | |

3/8/2021 | |

| 2,077,336 | | |

| 2,961,594 | | |

| 0.79 | % |

| MSD Real Estate Credit Opportunities Fund | |

6/11/2020 | |

| 897,640 | | |

| 1,392,050 | | |

| 0.37 | % |

| Nebari Natural Resources Credit Fund I LP | |

8/18/2020 | |

| 5,363,250 | | |

| 5,122,342 | | |

| 1.37 | % |

| OCREDIT BDC Senior Notes, 7.770%, 3/7/2029 | |

2/22/2024 | |

| 552,000 | | |

| 552,000 | | |

| 0.15 | % |

| Pershing Square Tontine Holdings Ltd. | |

7/26/2022 | |

| - | | |

| - | | |

| 0.00 | % |

| PHI Group, Inc. | |

8/19/2019 | |

| 690,707 | | |

| 1,689,040 | | |

| 0.45 | % |

| Piney Lake Opportunities Fund LP | |

6/30/2021 | |

| 2,269,972 | | |

| 3,073,967 | | |

| 0.83 | % |

| Polaris Newco, LLC Term Loan B, 9.313% (3-Month Term SOFR+400basis points), 6/5/2028 | |

6/3/2021 | |

| 1,134,222 | | |

| 1,124,299 | | |

| 0.30 | % |

| Post Road Special Opportunity Fund II LP | |

1/26/2021 | |

| 1,403,902 | | |

| 1,615,708 | | |

| 0.43 | % |

| Project Myrtle, 7.500% (1-Month Term SOFR+317.9basis points), 6/15/2025 | |

12/21/2022 | |

| 1,206,553 | | |

| 1,221,259 | | |

| 0.33 | % |

| Prop 2017-1A, 5.300%, 3/15/2042 | |

2/9/2017 | |

| 350,724 | | |

| 302,652 | | |

| 0.08 | % |

| QBS Parent, Inc., 9.709% (3-Month Term SOFR+425basis points), 9/21/2025 | |

4/13/2020 | |

| 1,798,549 | | |

| 1,858,213 | | |

| 0.50 | % |

| Silverpeak Credit Opportunities LP | |

11/18/2019 | |

| 1,164,440 | | |

| 1,735,764 | | |

| 0.47 | % |

| Silverpeak Special Situations | |

9/25/2020 | |

| 4,304,378 | | |

| 4,868,623 | | |

| 1.31 | % |

| Vision Solutions, Inc., 9.586% (3-Month Term SOFR+426.2basis points), 5/28/2028 | |

12/7/2022 | |

| 62,507 | | |

| 73,066 | | |

| 0.02 | % |

| WH Borrower LLC, Term Loan B, 10.903% (3-Month Term SOFR+550basis points), 2/15/2027 | |

2/9/2022 | |

| 1,072,880 | | |

| 1,145,184 | | |

| 0.31 | % |

| Windstream Services LLC, 11.680% (1-Month Term SOFR+635basis points), 9/21/2027 | |

8/11/2020 | |

| 227,053 | | |

| 244,391 | | |

| 0.07 | % |

| | |

| |

$ | 73,732,226 | | |

$ | 73,041,726 | | |

| 19.60 | % |

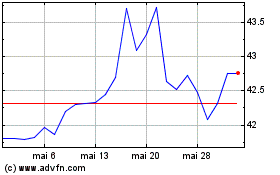

Source Capital (NYSE:SOR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Source Capital (NYSE:SOR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024