Filed by ConocoPhillips

pursuant to Rule 425 under the Securities

Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Marathon Oil Corporation

Commission File No.: 001-05153

Date: May 29, 2024

[The following FAQs were made available

to employees of ConocoPhillips on May 29, 2024.]

Transaction Details and Rationale

| 1. | Why is ConocoPhillips doing this transaction? |

| • | Marathon Oil has a deep inventory of low cost of supply

resource. |

| • | This transaction aligns with our financial framework and

will provide additional upside from future value creation. |

| • | It will also increase our scale and resiliency with the

addition of low cost of supply resources. |

| • | We also see an opportunity to further unlock value Marathon

Oil’s high-quality Lower 48 assets in the Eagle Ford, Bakken, Permian and Anadarko Basins, along with its international operations

in Equatorial Guinea. |

| 2. | Should we assume we’re becoming a Lower 48 company? |

| • | While this does make us highly competitive in the Lower

48, we have always seen value in being a globally diverse company. |

| • | We believe that our portfolio continues to offer diversity

in product, location and asset type that represents a competitive advantage compared to other E&Ps. |

| • | We’ve been consistent about building our company around

the best resource base in the business. |

| • | The expanded Lower 48 position provides a strong complement

to our existing Lower 48 assets, but also to our other globally diverse, low-capital-intensity legacy positions. |

| • | And as a reminder, we've been actively high grading our

own portfolio over the past several years. Last year we: |

| i. | Opportunistically acquired the remaining 50% of Surmont, a long life, low declining and low capital intensity asset that we know well

and can make better through our full ownership; |

| ii. | Made final investment decision to develop Willow, approving the project and funding construction needed to reach first oil; |

| iii. | Progressed our global LNG business through expansion in Qatar, FID at Port Arthur LNG and several offtake and re-gasification agreements. |

| 3. | What is the timeline to complete the transaction? |

| • | The transaction is expected to close in the fourth quarter

of 2024, subject to customary regulatory approvals. |

| 4. | What approvals are required before closing? |

| • | The transaction requires Hart-Scott-Rodino clearance and

certain other regulatory approvals. |

| 5. | Are we adding any offices? |

| • | The ConocoPhillips Center in Houston will remain the company’s

headquarters. |

| • | GCR will continue to be run out of the ConocoPhillips Center;

Permian will continue to be run out of Midland. |

| 6. | What synergies do we see with the transaction? |

| • | We expect to capture cost and capital savings with this

transaction. |

| • | Part of the savings will come from optimizing field

operations and applying our strong commercial acumen to lower our operating costs. We also plan to leverage our enhanced cross-basin footprint

to improve capital efficiencies. |

| • | The synergies also include approximately $250 million in

annual general and administrative costs savings. These savings are not predicated on reductions in ConocoPhillips personnel. |

| • | We recognize that any transaction puts pressure on the organization,

so it’s important that everyone take care of themselves, look out for each other and prioritize safety in everything you do. |

Integration Process

| 7. | Can I communicate with Marathon Oil’s employees before the transaction closes? |

| • | Until closing, we remain two separate companies. |

| 8. | Will we adopt any of Marathon Oil’s systems? |

| • | Both ConocoPhillips and Marathon Oil are already recognized

leaders in oil and gas technology and operations. |

| • | We fully expect to learn from Marathon Oil’s practices

and incorporate those learnings into our future technical endeavors. |

| 9. | Does this transaction change our plans for the U.S. nxtgenERP implementation? |

| • | No, we do not expect any changes to the project or timeline,

currently scheduled for January 2025. |

| • | As we build our integration plan, we will assess the timeline

to integrate Marathon Oil systems and resources into our nxtgen efforts. |

Workforce Impacts

| 10. | Do we expect any ConocoPhillips workforce reductions? |

| • | Cost savings are not predicated on reductions in ConocoPhillips

personnel. |

| 11. | Will there be an Expression of Interest (EOI)? |

| • | No, there are no plans to offer an EOI. |

| 12. | How many employees does Marathon Oil have, and will they all be transferring to ConocoPhillips? |

| • | Information on Marathon Oil’s workforce can be found

here. |

| • | While it’s too early to predict staffing needs, we

do expect to do a thorough and strategic review of Marathon Oil’s staff to determine opportunities for transition services agreement

staffing and long-term employment. |

| 13. | Will there be any organizational changes? |

| • | No significant changes are expected at this time. |

| • | In the coming months, we will be assessing how we structure

the organization to optimize productivity and engagement as integration plans are developed. |

| • | While details are still being worked, we expect to add Marathon

Oil employees into our current structure. |

| 14. | Will there be relocations? |

| • | We don’t expect material relocations of ConocoPhillips

personnel. |

Culture

| 15. | How compatible are these two cultures? |

| • | The safety of our employees and our communities

remains the number one priority. |

| • | Marathon Oil operates with a high standard of excellence

that complements our SPIRIT Values. We share a focus on operating safely and responsibly, acting with integrity and demonstrating a commitment

to our communities. |

| • | Overall, we think the values of our cultures are very similar. |

| • | SPIRIT Values will remain core. |

Lower 48

| 16. | Does this change our presence in any of our Lower 48 communities? |

| • | ConocoPhillips will continue to support initiatives through

our community investment programs, consistent with our long-standing approach to meeting needs in our operating areas across the globe. |

| 17. | Will Marathon Oil employees be expected to adapt to our safety processes? |

| • | Yes, we will expect all employees to adhere to our safety

standards, processes and systems. |

Forward-Looking Statements

This communication includes “forward-looking statements”

as defined under the federal securities laws. All statements other than statements of historical fact included or incorporated by reference

in this communication, including, among other things, statements regarding the proposed business combination transaction between ConocoPhillips

(“ConocoPhillips”) and Marathon Oil Corporation (“Marathon”), future events, plans and anticipated results of

operations, business strategies, the anticipated benefits of the proposed transaction, the anticipated impact of the proposed transaction

on the combined company’s business and future financial and operating results, the expected amount and timing of synergies from

the proposed transaction, the anticipated closing date for the proposed transaction and other aspects of ConocoPhillips’ or Marathon’s

operations or operating results are forward-looking statements. Words and phrases such as “ambition,” “anticipate,”

“estimate,” “believe,” “budget,” “continue,” “could,” “intend,”

“may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,”

“would,” “expect,” “objective,” “projection,” “forecast,” “goal,”

“guidance,” “outlook,” “effort,” “target” and other similar words can be used to identify

forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. Where, in any

forward-looking statement, ConocoPhillips or Marathon expresses an expectation or belief as to future results, such expectation or belief

is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements

are not guarantees of future performance and involve certain risks, uncertainties and other factors beyond ConocoPhillips’ or Marathon’s

control. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in the forward-looking statements.

The following important factors and uncertainties,

among others, could cause actual results or events to differ materially from those described in forward-looking statements: ConocoPhillips’

ability to successfully integrate Marathon’s businesses and technologies, which may result in the combined company not operating

as effectively and efficiently as expected; the risk that the expected benefits and synergies of the proposed transaction may not be fully

achieved in a timely manner, or at all; the risk that ConocoPhillips or Marathon will be unable to retain and hire key personnel; the

risk associated with Marathon’s ability to obtain the approval of its stockholders required to consummate the proposed transaction

and the timing of the closing of the proposed transaction, including the risk that the conditions to the transaction are not satisfied

on a timely basis or at all or the failure of the transaction to close for any other reason or to close on the anticipated terms, including

the anticipated tax treatment (and with respect to increases in ConocoPhillips’ share repurchase program, such increases are not

intended to exceed shares issued in the transaction); the risk that any regulatory approval, consent or authorization that may be required

for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the occurrence of any event,

change or other circumstance that could give rise to the termination of the proposed transaction; unanticipated difficulties, liabilities

or expenditures relating to the transaction; the effect of the announcement, pendency or completion of the proposed transaction on the

parties’ business relationships and business operations generally; the effect of the announcement or pendency of the proposed transaction

on the parties’ common stock prices and uncertainty as to the long-term value of ConocoPhillips’ or Marathon’s common

stock; risks that the proposed transaction disrupts current plans and operations of ConocoPhillips or Marathon and their respective management

teams and potential difficulties in hiring or retaining employees as a result of the proposed transaction; rating agency actions and ConocoPhillips’

and Marathon’s ability to access short- and long-term debt markets on a timely and affordable basis; changes in commodity prices,

including a prolonged decline in these prices relative to historical or future expected levels; global and regional changes in the demand,

supply, prices, differentials or other market conditions affecting oil and gas, including changes resulting from any ongoing military

conflict, including the conflicts in Ukraine and the Middle East, and the global response to such conflict, security threats on facilities

and infrastructure, or from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that

might be imposed by Organization of Petroleum Exporting Countries and other producing countries and the resulting company or third-party

actions in response to such changes; insufficient liquidity or other factors that could impact ConocoPhillips’ ability to repurchase

shares and declare and pay dividends such that ConocoPhillips suspends its share repurchase program and reduces, suspends or totally eliminates

dividend payments in the future, whether variable or fixed; changes in expected levels of oil and gas reserves or production; potential

failures or delays in achieving expected reserve or production levels from existing and future oil and gas developments, including due

to operating hazards, drilling risks or unsuccessful exploratory activities; unexpected cost increases, inflationary pressures or technical

difficulties in constructing, maintaining or modifying company facilities; legislative and regulatory initiatives addressing global climate

change or other environmental concerns; public health crises, including pandemics (such as COVID-19) and epidemics and any impacts or

related company or government policies or actions; investment in and development of competing or alternative energy sources; potential

failures or delays in delivering on ConocoPhillips’ current or future low-carbon strategy, including ConocoPhillips’ inability

to develop new technologies; disruptions or interruptions impacting the transportation for ConocoPhillips’ or Marathon’s oil

and gas production; international monetary conditions and exchange rate fluctuations; changes in international trade relationships or

governmental policies, including the imposition of price caps, or the imposition of trade restrictions or tariffs on any materials or

products (such as aluminum and steel) used in the operation of ConocoPhillips’ or Marathon’s business, including any sanctions

imposed as a result of any ongoing military conflict, including the conflicts in Ukraine and the Middle East; ConocoPhillips’ ability

to collect payments when due, including ConocoPhillips’ ability to collect payments from the government of Venezuela or PDVSA; ConocoPhillips’

ability to complete any other announced or any other future dispositions or acquisitions on time, if at all; the possibility that regulatory

approvals for any other announced or any future dispositions or any other acquisitions will not be received on a timely basis, if at all,

or that such approvals may require modification to the terms of those transactions or ConocoPhillips’ remaining business; business

disruptions following any announced or future dispositions or other acquisitions, including the diversion of management time and attention;

the ability to deploy net proceeds from ConocoPhillips’ announced or any future dispositions in the manner and timeframe anticipated,

if at all; potential liability for remedial actions under existing or future environmental regulations; potential liability resulting

from pending or future litigation; the impact of competition and consolidation in the oil and gas industry; limited access to capital

or insurance or significantly higher cost of capital or insurance related to illiquidity or uncertainty in the domestic or international

financial markets or investor sentiment; general domestic and international economic and political conditions or developments, including

as a result of any ongoing military conflict, including the conflicts in Ukraine and the Middle East; changes in fiscal regime or tax,

environmental and other laws applicable to ConocoPhillips’ or Marathon’s businesses; disruptions resulting from accidents,

extraordinary weather events, civil unrest, political events, war, terrorism, cybersecurity threats or information technology failures,

constraints or disruptions; and other economic, business, competitive and/or regulatory factors affecting ConocoPhillips’ or Marathon’s

businesses generally as set forth in their filings with the Securities and Exchange Commission (the “SEC”). The registration

statement on Form S-4 and proxy statement/prospectus that will be filed with the SEC will describe additional risks in connection

with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration

statement on Form S-4 and proxy statement/prospectus are considered representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to

differ materially from those described in the forward-looking statements, please refer to ConocoPhillips’ and Marathon’s respective

periodic reports and other filings with the SEC, including the risk factors contained in ConocoPhillips’ and Marathon’s most

recent Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K. Forward-looking statements represent current expectations

and are inherently uncertain and are made only as of the date hereof (or, if applicable, the dates indicated in such statement). Except

as required by law, neither ConocoPhillips nor Marathon undertakes or assumes any obligation to update any forward-looking statements,

whether as a result of new information or to reflect subsequent events or circumstances or otherwise.

No Offer or Solicitation

This communication is not intended to and

shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote

or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except

by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Merger

and Where to Find It

In connection with the proposed transaction,

ConocoPhillips intends to file with the SEC a registration statement on Form S-4, which will include a proxy statement of Marathon

that also constitutes a prospectus of ConocoPhillips common shares to be offered in the proposed transaction. Each of ConocoPhillips and

Marathon may also file other relevant documents with the SEC regarding the proposed transaction. This communication is not a substitute

for the proxy statement/prospectus or registration statement or any other document that ConocoPhillips or Marathon may file with the SEC.

The definitive proxy statement/prospectus (if and when available) will be mailed to stockholders of Marathon. INVESTORS AND SECURITY HOLDERS

ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH

THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able

to obtain free copies of the registration statement and proxy statement/prospectus (if and when available) and other documents containing

important information about ConocoPhillips, Marathon and the proposed transaction, once such documents are filed with the SEC through

the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by ConocoPhillips will be available

free of charge on ConocoPhillips’ website at www.conocophillips.com or by contacting ConocoPhillips’ Investor Relations

Department by email at investor.relations@conocophillips.com or by phone at 281-293-5000. Copies of the documents filed with the SEC by

Marathon will be available free of charge on Marathon’s website at www.ir.marathonoil.com or by contacting Marathon at 713-629-6600.

Participants in the Solicitation

ConocoPhillips, Marathon and certain of their

respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information about the directors and executive officers of ConocoPhillips is set forth in (i) ConocoPhillips’ proxy

statement for its 2024 annual meeting of stockholders under the headings “Executive Compensation”, “Item 1: Election

of Directors and Director Biographies” (including “Related Party Transactions” and “Director Compensation”),

“Compensation Discussion and Analysis”, “Executive Compensation Tables” and “Stock Ownership”, which

was filed with the SEC on April 1, 2024 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1163165/000130817924000384/cop4258041-def14a.htm,

(ii) ConocoPhillips’ Annual Report on Form 10-K for the fiscal year ended December 31, 2023, including under the

headings “Item 10. Directors, Executive Officers and Corporate Governance”, “Item 11. Executive Compensation”,

“Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” and “Item

13. Certain Relationships and Related Transactions, and Director Independence”, which was filed with the SEC on February 15,

2024 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1163165/000116316524000010/cop-20231231.htm and (iii) to

the extent holdings of ConocoPhillips securities by its directors or executive officers have changed since the amounts set forth in ConocoPhillips’

proxy statement for its 2024 annual meeting of stockholders, such changes have been or will be reflected on Initial Statement of Beneficial

Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4 or Annual Statement of Changes in

Beneficial Ownership of Securities on Form 5, filed with the SEC (which are available at EDGAR Search Results https://www.sec.gov/edgar/search/#/category=form-cat2&ciks=0001163165&entityName=CONOCOPHILLIPS%2520(COP)%2520(CIK%25200001163165)).

Information about the directors and executive officers of Marathon is set forth in (i) Marathon’s proxy statement for its 2024

annual meeting of stockholders under the headings “Proposal 1: Election of Directors”, “Director Compensation”,

“Security Ownership of Certain Beneficial Owners and Management”, “Compensation Discussion and Analysis”, “Executive

Compensation” and “Transactions with Related Persons”, which was filed with the SEC on April 10, 2024 and is available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/101778/000010177824000082/mro-20240405.htm, (ii) Marathon’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2023, including under the headings “Item 10. Directors, Executive

Officers and Corporate Governance”, “Item 11. Executive Compensation”, “Item 12. Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder Matters” and “Item 13. Certain Relationships and Related Transactions,

and Director Independence”, which was filed with the SEC on February 22, 2024 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/101778/000010177824000023/mro-20231231.htm

and (iii) to the extent holdings of Marathon securities by its directors or executive officers have changed since the amounts set

forth in Marathon’s proxy statement for its 2024 annual meeting of stockholders, such changes have been or will be reflected on

Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or

Annual Statement of Changes in Beneficial Ownership of Securities on Form 5, filed with the SEC (which are available at EDGAR Search

Results https://www.sec.gov/edgar/search/#/category=form-cat2&ciks=0000101778&entityName=MARATHON%2520OIL%2520CORP%2520(MRO)%2520(CIK%25200000101778)).

Other information regarding the participants

in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained

in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials

become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or

investment decisions. Copies of the documents filed with the SEC by ConocoPhillips and Marathon will be available free of charge through

the website maintained by the SEC at www.sec.gov. Additionally, copies of documents filed with the SEC by ConocoPhillips will be

available free of charge on ConocoPhillips’ website at www.conocophillips.com/ and those filed by Marathon will be available

free of charge on Marathon’s website at www.ir.marathonoil.com/.

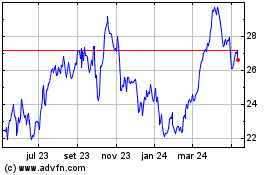

Marathon Oil (NYSE:MRO)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

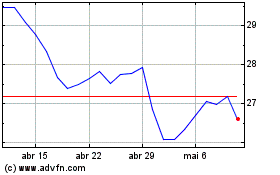

Marathon Oil (NYSE:MRO)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024