UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For

the month of: May 2024 |

|

Commission File Number: 1-14830 |

| GILDAN ACTIVEWEAR INC. |

| (Translation of registrant’s name into English) |

| |

|

600 de Maisonneuve Boulevard West

33rd Floor

Montréal, Québec

Canada H3A 3J2 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form

40-F þ

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GILDAN ACTIVEWEAR INC. |

|

| |

|

|

| Date: May 30, 2024 |

By: |

/s/ Michelle Taylor |

|

| |

|

Name: |

Michelle Taylor |

|

| |

|

Title: |

Vice-President, General Counsel and Corporate Secretary |

|

| |

|

|

|

|

|

EXHIBIT INDEX

EXHIBIT

99.1

Gildan

Activewear Announces Increase of Normal Course Issuer Bid

Montreal,

May 29, 2024 - Gildan Activewear Inc. (GIL: TSX and NYSE) is committed to returning capital to shareholders via share buybacks

and dividends as a key element of its capital allocation program. As previously indicated, the Company planned on resuming share repurchases

following the Annual General Meeting of shareholders which occurred on May 28, 2024. Consequently, Gildan’s newly reconstituted

Board of Directors has now approved the resumption of share repurchases and an amended normal course issuer bid (NCIB).

“Given

our continued execution of the Gildan Sustainable Growth strategy, our expected strong free cash flow and the strength of our balance

sheet, we are eager to resume our share repurchases as we move through 2024,” said Glenn J. Chamandy, President and CEO.

As

such, Gildan today announced that it has received approval from the Toronto Stock Exchange (TSX) to amend its current NCIB, which commenced

on August 9, 2023, in order to increase the maximum number of common shares that may be repurchased from 8,778,638, or 5% of its issued

and outstanding common shares as at July 31, 2023 (the reference date for the NCIB), to 17,124,249 common shares, representing 10% of

the public float as at July 31, 2023. No other terms of the NCIB have been amended.

The

NCIB, which began August 9, 2023, and will end no later than August 8, 2024, is conducted by means of open market transactions on both

the TSX and the New York Stock Exchange (NYSE), or alternative Canadian trading systems, if eligible, or by such other means as may be

permitted by securities regulatory authorities, including pre-arranged crosses, exempt offers, private agreements under an issuer bid

exemption order issued by securities regulatory authorities and block purchases of common shares. Under the NCIB, Gildan may purchase

up to a maximum of 92,611 common shares daily through the facilities of the TSX, which represents 25% of the average daily trading volume

on the TSX for the six months ended July 31, 2023, in addition to purchases made on other exchanges including the NYSE.

The

price to be paid by Gildan for any common shares will be the market price at the time of the acquisition, plus brokerage fees, and purchases

made under an issuer bid exemption order will be at a discount to the prevailing market price in accordance with the terms of the order.

The actual number of common shares purchased under the NCIB and the timing of such purchases will be at Gildan's discretion and shall

be subject to the limitations set out in the TSX Company Manual.

Other

than to reflect the increase in the maximum number of common shares that may be repurchased under the NCIB, the automatic securities

purchase plan (ASPP) entered into with a designated broker in relation to the NCIB on August 9, 2023 also remains unchanged. The ASPP

allows for the purchase of common shares under the NCIB, subject to certain trading parameters, at times when Gildan ordinarily would

not be permitted to purchase its common shares due to applicable regulatory restrictions or self-imposed trading black-out periods. Outside

of the predetermined black-out periods, common shares may be purchased under the NCIB based on the discretion of the Company’s

management, in compliance with TSX rules and applicable securities laws.

During

the period from August 9, 2023 to May 29, 2024, Gildan purchased and cancelled a total of 8,611,018 common shares, representing

4.9% of its issued and outstanding common shares and 5.0% of the public float as at July 31, 2023, for a total cost of US$272.5 million.

All shares purchased pursuant to the NCIB have been canceled.

Gildan’s

management and the Board of Directors believe the repurchase of common shares represents an appropriate use of Gildan’s financial

resources and that share repurchases under the NCIB will not preclude Gildan from continuing to pursue organic growth and complementary

acquisitions.

Caution

Concerning Forward-Looking Statements

Certain

statements included in this press release constitute “forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and Canadian securities legislation and regulations and are subject to important risks, uncertainties,

and assumptions. This forward-looking information includes, amongst others, statements relating to potential future purchases by Gildan

of its common shares pursuant to the NCIB and ASPP. Forward-looking statements generally can be identified by the use of conditional

or forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,”

“project,” “assume,” “anticipate,” “plan,” “foresee,” “believe,”

or “continue,” or the negatives of these terms or variations of them or similar terminology. We refer you to the Company’s

filings with the Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission, as well as the risks described

under the “Financial risk management”, “Critical accounting estimates and judgments,” and “Risks and uncertainties”

sections of the Company’s most recent Management’s Discussion and Analysis for the year ended December 31, 2023 (“FY2023

MD&A”) for a discussion of the various factors that may affect these forward-looking statements. Material factors and assumptions

that were applied in drawing a conclusion or making a forecast or projection are also set out throughout such document.

Forward-looking

information is inherently uncertain and the results or events predicted in such forward-looking information may differ materially from

actual results or events. Material factors, which could cause actual results or events to differ materially from a conclusion or projection

in such forward-looking information, include, but are not limited to changes in general economic, financial or geopolitical conditions

globally or in one or more of the markets we serve, including the pricing and inflationary environment, and our ability to implement

our growth strategies and plans, as well as those factors listed in the FY2023 MD&A under the “Risks and uncertainties”

section and “Caution regarding forward-looking statements” sections. These factors may cause the Company’s actual performance

in future periods to differ materially from any estimates or projections of future performance expressed or implied by the forward-looking

statements included in this press release.

There

can be no assurance that the expectations represented by our forward-looking statements will prove to be correct. The purpose of the

forward-looking statements is to provide the reader with a description of management’s expectations regarding the Company’s

future financial performance and may not be appropriate for other purposes. Furthermore, unless otherwise stated, the forward-looking

statements contained in this press release are made as of the date of this press release, and we do not undertake any obligation to update

publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events, or otherwise

unless required by applicable legislation or regulation. The forward-looking statements contained in this press release are expressly

qualified by this cautionary statement.

About

Gildan

Gildan

is a leading manufacturer of everyday basic apparel. The Company’s product offering includes activewear, underwear and socks, sold

to a broad range of customers, including wholesale distributors, screenprinters or embellishers, as well as to retailers that sell to

consumers through their physical stores and/or e-commerce platforms and to global lifestyle brand companies. The Company markets its

products in North America, Europe, Asia Pacific, and Latin America, under a diversified portfolio of Company-owned brands including Gildan®,

American Apparel®, Comfort Colors®, GOLDTOE®, and Peds®.

Gildan

owns and operates vertically integrated, large-scale manufacturing facilities which are primarily located in Central America, the Caribbean,

North America, and Bangladesh. Gildan operates with a strong commitment to industry-leading labour, environmental, and governance practices

throughout its supply chain in accordance with its comprehensive ESG program embedded in the Company’s long-term business strategy.

More information about the Company and its ESG practices and initiatives can be found at www.gildancorp.com.

Investor

inquiries:

Jessy

Hayem, CFA

Vice-President,

Head of Investor Relations

(514)

744-8511

jhayem@gildan.com |

Media

inquiries:

Genevieve

Gosselin

Director,

Global Communications and Corporate Marketing

(514)

343-8814

communications@gildan.com |

|

|

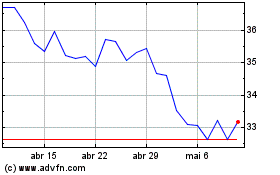

Gildan Activewear (NYSE:GIL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Gildan Activewear (NYSE:GIL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024