false

0000007332

0000007332

2024-06-07

2024-06-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 7, 2024

SOUTHWESTERN ENERGY COMPANY

(Exact Name of Registrant as Specified in

Charter)

| Delaware |

|

001-08246 |

|

71-0205415 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

10000 Energy Drive

Spring, TX 77389

(Address of principal executive offices) (Zip Code)

(832) 796-1000

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| Common Stock, Par Value of $0.01 |

|

SWN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

As previously

disclosed, on January 10, 2024, Southwestern Energy Company, a Delaware corporation (NYSE: SWN) (“Southwestern”),

entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Chesapeake Energy Corporation, an Oklahoma

corporation (NASDAQ: CHK) (“Chesapeake”), Hulk Merger Sub, Inc., a Delaware corporation and a newly formed, wholly-owned

subsidiary of Chesapeake (“Merger Sub”) and Hulk LLC Sub, LLC, a Delaware limited liability company and a wholly owned

subsidiary of Chesapeake (“LLC Sub” and together with Merger Sub, Southwestern and Chesapeake, the “Parties”).

Subject to the terms and conditions set forth in the Merger Agreement, Merger Sub will be merged with and into Southwestern, with Southwestern

continuing as the surviving entity and a wholly-owned subsidiary of Chesapeake (the “Merger”).

On February 29, 2024, Chesapeake filed a registration

statement on Form S-4 (No. 333-277555) (the “Registration Statement”), which contained a preliminary prospectus

of Chesapeake and a preliminary joint proxy statement of Southwestern and Chesapeake. The Registration Statement was declared effective

by the Securities and Exchange Commission (the “SEC”) on May 17, 2024, which contained Chesapeake’s definitive

prospectus and Southwestern’s and Chesapeake’s definitive joint proxy statement (the “joint proxy statement/prospectus”).

Chesapeake filed the joint proxy statement/prospectus with the SEC on May 17, 2024 and Southwestern commenced mailing copies of the

joint proxy statement/prospectus on or about May 17, 2024.

Since entering into the Merger Agreement, Southwestern

has received, to its knowledge, seven demand letters from purported stockholders of Southwestern and one demand for books and records

under Section 220 of the General Corporation Law of the State of Delaware (the books and records demand together with the demand

letters, the “Demand Letters”). Three complaints have been filed against Southwestern in New York Supreme Court, asserting

claims for negligence, negligent misrepresentation, and breaches of fiduciary duties stemming from allegedly material omissions in the

joint proxy statement/prospectus (the “Complaints”). The Demand Letters assert that purported material information

is omitted from the joint proxy statement/prospectus. It is possible that additional, or similar demand letters may be received by Southwestern,

or that complaints making similar allegations may be filed naming Southwestern as a defendant, regarding the Merger. Absent new or different

allegations that are material or a disclosure obligation under the U.S. federal securities laws, Southwestern will not necessarily disclose

such additional demands or complaints.

Southwestern believes that the disclosures set

forth in the joint proxy statement/prospectus comply fully with applicable law and exchange rules, that no further disclosure beyond that

already contained in the joint proxy statement/prospectus is required under applicable law or exchange rules, and that the allegations

asserted in the Demand Letters are entirely without merit. However, in order to moot these disclosure claims, to avoid nuisance, cost

and distraction, and to preclude any efforts to delay the closing of the Merger, and without admitting any culpability, liability or wrongdoing

and without admitting the relevance or materiality of such disclosures, Southwestern is voluntarily supplementing the joint proxy statement/prospectus

with the supplemental disclosures set forth below (the “Supplemental Disclosures”). Nothing in the Supplemental Disclosures

shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To

the contrary, Southwestern specifically denies all allegations in the Demand Letters or the Complaints that any additional disclosure

was or is required.

SUPPLEMENTAL DISCLOSURES TO JOINT PROXY STATEMENT/PROSPECTUS

The following supplemental information should be read in conjunction

with the joint proxy statement/prospectus, which should be read in its entirety and is available on the SEC’s website at http://www.sec.gov,

along with periodic reports and other information Southwestern files with the SEC. To the extent that the information set forth herein

differs from or updates information contained in the joint proxy statement/prospectus, the information set forth herein shall supersede

or supplement the information in the joint proxy statement/prospectus. All page references are to pages in the joint proxy statement/prospectus,

and terms used below, unless otherwise defined, have the meanings set forth in the joint proxy statement/prospectus. New text within restated

language from the joint proxy statement/prospectus is highlighted with bold, underlined text and removed language within

restated language from the joint proxy statement/prospectus is indicated by strikethrough text.

The disclosure under the heading “The Merger—Background

of the Merger” is hereby supplemented by amending and restating the second full paragraph on page 90 of the joint proxy statement/prospectus

as follows:

At a regularly scheduled meeting of the Southwestern

Board on August 1, 2023, at which all members were present, Mr. Way provided an update regarding the potential business combination

with Chesapeake, noting that there had been no further discussion with Chesapeake since May 2023, and discussed the relative financial

performance of Southwestern and Chesapeake. Mr. Way also discussed a potential strategic transaction with Company B, noting that

Southwestern and Company B had executed a confidentiality agreement. The confidentiality agreement did not contain a standstill

provision limiting Company B from making a topping bid after the Merger was announced and did not include a standstill provision with

a “don’t ask, don’t waive” provision. The Board noted that any potential transaction with Company B would

have to be evaluated in connection with a review of strategic alternatives, including a potential transaction with Chesapeake.

The disclosure under the heading “The Merger—Background

of the Merger” is hereby supplemented by amending and restating the seventh full paragraph on page 91 of the joint proxy statement/prospectus

as follows:

On September 20, 2023, certain members of

the executive management of Southwestern, including Messrs. Way, Carrell, and Giesler, and representatives of Wells Fargo Securities,

LLC (“Wells Fargo”) attended a management presentation regarding a potential strategic transaction with a third potential

counterparty (“Company C”) and received access to certain confidential information regarding Company C and its business. The

confidentiality agreement entered into between Southwestern and Company C did not contain a standstill provision limiting Company C from

making a topping bid after the Merger was announced and did not include a standstill provision with a “don’t ask, don’t

waive” provision.

The disclosure under the heading “The Merger—Background

of the Merger” is hereby supplemented by amending and restating the third full paragraph on page 95 of the joint proxy statement/prospectus

as follows:

On December 1, 2023, Mr. Dell’Osso

called Mr. Way and stated that Chesapeake was not prepared to increase its prior exchange ratio proposal at that time. However, Mr. Dell’Osso

sought to continue the prior discussions regarding value and various other issues. Consistent with the Southwestern Board’s instructions

to continue to progress such negotiations, Mr. Way further discussed with Mr. Dell’Osso such issues, including the construct

for identifying and selecting employees for the combined company, the name of the combined company, and the role of Southwestern’s

corporate office for the combined company. Mr. Dell’Osso and Mr. Way did not discuss specifics related to executive

or director employment or compensation matters as it related to post-closing operations during this phone call or in any subsequent discussion

and only discussed a framework and construct for identifying and selecting employees. The parties agreed to resolve any post-closing employment

and compensation matters in the interim period between signing the Merger Agreement and Closing. No other proposals or indications of

interest from any other parties with which Southwestern had discussions included any details concerning the retention of Southwestern

management in the post-closing company or the purchase of or participation by employees of Southwestern in the equity of the combined

company following the completion of the Proposed Transaction.

The disclosure under the heading “The Merger” is hereby

supplemented by inserting the following disclosure after the second full paragraph on page 101 of the joint proxy statement/prospectus:

Certain Information Relating to BofA Securities

Southwestern has agreed to pay BofA Securities, Inc.

(“BofA Securities”) for its services as a financial advisor to Southwestern in connection with the Merger an aggregate fee

of $3.0 million, payable contingent upon completion of the Merger. Southwestern also has agreed to reimburse BofA Securities for certain

expenses incurred in connection with BofA Securities’ engagement and to indemnify BofA Securities, any controlling person of BofA

Securities and each of their respective directors, officers, employees, agents and affiliates against specified liabilities, including

liabilities under the federal securities laws arising out of BofA Securities’ engagement.

BofA Securities and its affiliates in the

past have provided, currently are providing and in the future may provide investment banking, commercial banking and other financial services

to Southwestern and certain of its affiliates and have received or in the future may receive compensation for the rendering of these services,

including (i) having acted or acting as (i) a book-running manager and/or underwriter for a debt offering of Southwestern, (ii) having

acted or acting as an arranger, bookrunner and syndication agent for, and/or as a lender under, certain letters of credit, term loans,

credit and leasing facilities and other credit arrangements of Southwestern and/or certain of its affiliates, and (iii) having provided

or providing certain commodity, derivatives and other trading services to Southwestern and/or certain of its affiliates. From May 1,

2022 through April 30, 2024, BofA Securities and its affiliates derived aggregate revenues from Southwestern and certain of its affiliates

of approximately $9.0 million for investment and corporate banking services unrelated to the Merger.

In addition, BofA Securities and its affiliates

in the past have provided, currently are providing and in the future may provide investment banking, commercial banking and other financial

services to Chesapeake and/or certain of its affiliates and have received or in the future may receive compensation for the rendering

of these services, including (i) having acted or acting as a book-running manager, bookrunner and/or manager for certain share repurchases

of Chesapeake, (ii) having acted or acting as an arranger, bookrunner and syndication agent for, and/or as a lender under, certain

letters of credit, credit facilities and other credit arrangements of Chesapeake and/or certain of its affiliates, (iii) having provided

or providing certain commodity, derivatives and other trading services to Chesapeake and/or certain of its affiliates, and (iv) having

provided or providing certain treasury management products and services to Chesapeake and/or certain of its affiliates. From May 1,

2022 through April 30, 2024, BofA Securities and/or its affiliates derived aggregate revenues from Chesapeake and certain of its

affiliates of approximately $6.0 million for investment and corporate banking services unrelated to the Merger.

BofA Securities and its affiliates comprise

a full service securities firm and commercial bank engaged in securities, commodities and derivatives trading, foreign exchange and other

brokerage activities, and principal investing as well as providing investment, corporate and private banking, asset and investment management,

financing and financial advisory services and other commercial services and products to a wide range of companies, governments and individuals.

In the ordinary course of their businesses, BofA Securities and its affiliates invest on a principal basis or on behalf of customers or

manage funds that invest, make or hold long or short positions, finance positions or trade or otherwise effect transactions in the equity,

debt or other securities or financial instruments (including derivatives, bank loans or other obligations) of Southwestern, Chesapeake

and certain of their respective affiliates.

Certain Information Relating to RBC Capital Markets

Southwestern has agreed to pay RBC Capital

Markets for its services as a financial advisor to Southwestern in connection with the Merger an aggregate fee of $20 million, payable

contingent upon consummation of the Merger. Southwestern also has agreed to reimburse RBC Capital Markets for certain expenses incurred

in connection with RBC Capital Markets’ services and to indemnify RBC Capital Markets and related persons against certain liabilities,

including liabilities under federal securities laws, arising out of RBC Capital Markets’ engagement.

As the Southwestern Board was aware, RBC

Capital Markets and certain of its affiliates in the past have provided, currently are providing and in the future expect to provide

investment banking, commercial banking and/or other financial services to Southwestern and/or certain of its affiliates unrelated

to the Merger, for which services RBC Capital Markets and its affiliates received and expect to receive compensation, including, during

the approximately two-year period prior to January 3, 2024 (the date of RBC Capital Markets’ most recent material relationships

information provided to the Southwestern Board prior to execution of the Merger Agreement), (i) having acted or acting

as co-syndication agent, joint lead arranger and joint bookrunner for, and as a lender under, certain credit facilities of Southwestern

and (ii) having provided or providing certain commodities, derivatives and/or foreign exchange services. During such approximately

two-year period, RBC Capital Markets and/or its affiliates received for such services described in clauses (i) and (ii) above aggregate

fees of approximately $9.5 million.

As the Southwestern Board also was aware,

RBC Capital Markets and certain of its affiliates in the past have provided, currently are providing and in the future expect to provide

investment banking, commercial banking and/or other financial services to Chesapeake and/or certain of its affiliates, for which

services RBC Capital Markets and its affiliates have received and expect to receive compensation, including, during the approximately

two-year period prior to January 3, 2024, having acted or acting as (i) financial advisor to Chesapeake in connection with certain

acquisition and sale transactions, including Chesapeake’s divestitures of certain Eagle Ford assets, and (ii) joint

lead arranger and joint bookrunner for, and as a lender under, certain credit facilities of Chesapeake. During such approximately two-year

period, RBC Capital Markets and/or its affiliates received for such services described in clauses (i) and (ii) above aggregate

fees of approximately $32 million.

In

the ordinary course of business, RBC Capital Markets and/or certain of its affiliates may act as a market maker and broker in

the publicly traded securities of Southwestern, Chesapeake and/or other entities involved in the Merger or their respective affiliates and

may also actively trade or hold securities or financial instruments (including loans and other obligations) of such entities for RBC Capital

Markets’ or its affiliates’ account or for the account of customers and, accordingly, RBC Capital Markets and its affiliates

may at any time hold long or short positions or otherwise effect transactions in such securities or financial instruments.

Certain Information Relating to Wells Fargo

Southwestern has agreed to pay Wells Fargo

Securities, LLC (“Wells Fargo”) for its services as a financial advisor to Southwestern in connection with the Merger an aggregate

fee of $3.0 million, payable contingent upon consummation of the Merger. Southwestern also has agreed to reimburse Wells Fargo for

certain expenses incurred in connection with Wells Fargo’s services and to indemnify Wells Fargo and related persons against certain

liabilities, including liabilities under federal securities laws arising out of Wells Fargo’s engagement.

As the Southwestern Board was aware, Wells

Fargo and certain of its affiliates in the past have provided, currently are providing and in the future expect to provide investment

banking, commercial banking and/or other financial services to Southwestern and/or certain of its affiliates unrelated to the Merger,

for which services Wells Fargo and its affiliates received and expect to receive compensation. During the two-year period from May 1,

2022 to April 30, 2024, Wells Fargo and/or its affiliates received approximately $70,000 in compensation from Southwestern and its

affiliates for providing investment and commercial banking services unrelated to the Merger, including acting as sole deal manager on

an offering of debt securities by Southwestern in August 2022.

As the Southwestern Board also was aware,

Wells Fargo and certain of its affiliates in the past have provided, currently are providing and in the future expect to provide investment

banking, commercial banking and/or other financial services to Chesapeake and/or certain of its affiliates unrelated to the Merger, for which

services Wells Fargo and its affiliates have received and expect to receive compensation. During the two-year period from May 1,

2022 to April 30, 2024, Wells Fargo and/or its affiliates received approximately $250,000 in compensation from Chesapeake and its

affiliates for providing investment and corporate banking services unrelated to the Merger, including serving as co-lead arranger, syndication

agent and joint bookrunner on an offering of debt securities by Chesapeake in December 2022.

The disclosure on page 110 of the joint proxy statement/prospectus

is hereby supplemented by amending and restating the fourth paragraph set forth under “The Merger—Certain Unaudited Forecasted

Financial Information” as follows:

The Forecasted Financial Information was not prepared

with a view toward compliance with published guidelines of the SEC or the guidelines established by the American Institute of Certified

Public Accountants for preparation or presentation of prospective financial information. The Chesapeake Forecasted Financial Information

included in this joint proxy statement/prospectus has been prepared by, and is the responsibility of, the management of Chesapeake. The

Southwestern Forecasted Financial Information and the Southwestern Pro Forma Forecasted Financial Information included in this joint proxy

statement/prospectus has been prepared by, and is the responsibility of, the management of Southwestern. The Southwestern Forecasted

Financial Information and the Southwestern Pro Forma Forecasted Financial Information included in this joint proxy statement/prospectus

were prepared in a customary manner based on past practice and the best then-available estimates at the time the projections were prepared.

PricewaterhouseCoopers LLP has not audited, reviewed, examined, compiled nor applied agreed-upon procedures with respect to the

accompanying Forecasted Financial Information and, accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form

of assurance with respect thereto. The report of PricewaterhouseCoopers LLP contained in Chesapeake’s Annual Report on Form 10-K

for the year ended December 31, 2023, which is incorporated by reference into this joint proxy statement/prospectus, relates to historical

financial information of Chesapeake, and such report does not extend to the Forecasted Financial Information and should not be read to

do so. In addition, the PricewaterhouseCoopers LLP report contained in Southwestern’s Annual Report on Form 10-K for the year

ended December 31, 2023, which is incorporated by reference in this joint proxy statement/prospectus, relates to Southwestern’s

previously issued financial statements. It does not extend to the Forecasted Financial Information and should not be read to do so.

The disclosure on page 112 of the joint proxy statement/prospectus

is hereby supplemented by amending and restating the table set forth under “The Merger—Certain Unaudited Forecasted Financial

Information— Southwestern Forecasted Financial Information for Southwestern” as follows:

| | |

Southwestern Stand-Alone Basis | |

| | |

| 2024E | | |

| 2025E | | |

| 2026E | | |

| 2027E | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| (in millions, except per unit metrics)(1) | |

| Henry Hub ($/mcf) | |

$ | 2.69 | | |

$ | 3.51 | | |

$ | 3.82 | | |

$ | 3.87 | |

| WTI ($/bbl) | |

$ | 72.26 | | |

$ | 69.66 | | |

$ | 67.03 | | |

$ | 65.28 | |

| Production (mmcfe/d) | |

| 4,283 | | |

| 4,332 | | |

| 4,617 | | |

| 4,724 | |

| EBITDA(2) | |

$ | 2,104 | | |

$ | 2,643 | | |

$ | 3,178 | | |

$ | 3,244 | |

| Cash Flow from Operations | |

$ | 1,868 | | |

$ | 2,397 | | |

$ | 2,815 | | |

$ | 2,920 | |

| Capital Expenditures | |

$ | 1,832 | | |

$ | 2,260 | | |

$ | 2,207 | | |

$ | 2,233 | |

| Free Cash Flow(3) | |

$ | 40 | | |

$ | 133 | | |

$ | 609 | | |

$ | 686 | |

| Unlevered Free Cash Flow(3) | |

$ | 279 | | |

$ | 317 | | |

$ | 795 | | |

$ | 846 | |

| (1) | The Southwestern Forecasted Financial Information for Southwestern set forth in this table does not take into account any circumstances

or events occurring after the date it was prepared. Given that the Chesapeake Special Meeting and Southwestern Special Meeting will be

held several months after the Southwestern Forecasted Financial Information for Southwestern was prepared, as well as the uncertainties

inherent in any forecasted information, Southwestern and Chesapeake shareholders are cautioned not to place undue reliance on such information. |

| (2) | EBITDA is defined as net income adjusted for interest expense, income taxes, depreciation, depletion and amortization and certain

other noncash items. EBITDA is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute

for net income (loss), operating income (loss) or other measures prepared in accordance with GAAP. |

| (3) | Free Cash Flow is defined as cash flow from operations adjusted for capital expenditures and other items. Unlevered Free Cash

Flow is defined as EBITDA, less unlevered cash taxes, stock-based compensation, capex and change in net working capital, plus proceeds

from asset sales, change in investing cash flows and other operating items. Free Cash Flow and Unlevered Free Cash Flow

are is not a measure of financial performance under GAAP. Accordingly, they it

should not be considered as a substitute for net income (loss), operating income (loss) or other measures prepared in accordance with

GAAP. |

The disclosure on page 113 of the joint proxy statement/prospectus

is hereby supplemented by amending and restating the first paragraph set forth under “The Merger—Certain Unaudited Forecasted

Financial Information—Southwestern Management Synergies Estimates” as follows:

For purposes of the Southwestern Management Synergies

Estimates, Southwestern management estimated operating synergies at $86 million in 2024, $173 million in 2025 and $288 million in 2026

and 2027, and estimated capital synergies of $258 million in 2024, $236 million in 2025, $200 million in 2026 and $143 million in 2027.

No value was attributed to net operating loss carryforwards and tax credits for purposes of the Southwestern Management Synergies Estimates

and no value in respect of such net operating loss carryforwards and tax credits was included in the “Projections” as

utilized by Goldman Sachs in connection with its opinion. The Southwestern Management Synergies Estimates were based on certain

assumptions regarding the types of synergies that may be achieved in connection with the Merger, as well as the timing to achieve such

synergies, including the following assumptions:

| · | reduction of general and administrative costs from duplicative public company and other overhead costs; |

| · | reduction in well costs achieved by combined best practice and schedule optimization; |

| · | savings on capital expenditures per well attributable to the use of extended laterals; and |

| · | reduction of operating costs as a result of infrastructure optimization and improved water utilization. |

The disclosure on pages 127-128 of the joint proxy statement/prospectus

are hereby supplemented by amending and restating the first and second full paragraphs set forth under “The Merger—Opinion

of Southwestern’s Financial Advisor—Summary of Financial Analyses—Illustrative Discount Cash Flow Analysis — Southwestern

Standalone” as follows:

Using the Southwestern Projections, Goldman Sachs

performed an illustrative discounted cash flow analysis on Southwestern to derive a range of illustrative present values per share of

Southwestern Common Stock. Using the mid-year convention for discounting cash flows and discount rates ranging from 9.0% to 11.0%, reflecting

estimates of Southwestern’s weighted average cost of capital, Goldman Sachs discounted to present value as of September 30,

2023, (i) estimates of unlevered free cash flow for Southwestern for the period from October 1, 2023, to December 31, 2027,

as reflected in the Southwestern Projections and (ii) a range of illustrative terminal values for Southwestern, which were calculated

by applying terminal year exit EBITDA multiples ranging from 3.25x to 4.25x, to a terminal year estimate of EBITDA to be generated by

Southwestern in calendar year 2027 of approximately $3.244 billion, as reflected in the Southwestern Projections (which

analysis implied perpetuity growth rates ranging from 0.6% to 4.3%). The range of terminal year exit EBITDA multiples was estimated by

Goldman Sachs utilizing its professional judgment and experience, taking into account historical trading multiples of Southwestern. Goldman

Sachs derived such discount rates by application of the Capital Asset Pricing Model (“CAPM”), which requires certain company-specific

inputs, including Southwestern’s target capital structure weightings, the cost of long-term debt, after-tax yield on permanent excess

cash, if any, future applicable marginal cash tax rate and a beta for Southwestern, as well as certain financial metrics for the United

States financial markets generally.

Goldman Sachs derived a range of illustrative enterprise

values for Southwestern by adding the ranges of present values it derived above. Goldman Sachs then subtracted from the range of illustrative

enterprise values it derived for Southwestern the amount of Southwestern’s net debt (including amounts attributable to liability

classified equity awards) of approximately $4.167 billion as of September 30, 2023, as approved for Goldman Sachs’

use by Southwestern, to derive a range of illustrative equity values for Southwestern. Goldman Sachs then divided the range of illustrative

equity values it derived by the number of fully diluted outstanding shares of Southwestern of approximately 1.109 billion

as of September 30, 2023, as provided by and approved for Goldman Sachs’ use by Southwestern, using the treasury stock method,

to derive a range of illustrative present values per share ranging from $4.01 to $6.60.

The disclosure on page 128 of the joint proxy statement/prospectus

is hereby supplemented by amending and restating the first and second full paragraph set forth under “The Merger—Opinion of

Southwestern’s Financial Advisor—Summary of Financial Analyses—Illustrative Present Value of Future Share Price Analysis — Southwestern

Standalone” as follows:

Using the Southwestern Projections,

Goldman Sachs performed an illustrative analysis of the implied present value of an illustrative future value per share of Southwestern

Common Stock. For this analysis, Goldman Sachs first calculated the implied enterprise value for Southwestern of approximately $11.917

billion as of December 31 for the fiscal year 2025, by applying a range of exit multiples of illustrative enterprise value

(“EV”) to next twelve month (“NTM”) EBITDA (“EV/NTM EBITDA”) of 3.25x to 4.25x to estimates of Southwestern’s

NTM EBITDA. This illustrative range of EV/NTM EBITDA exit multiple estimates was derived by Goldman Sachs utilizing its professional judgment

and experience, taking into account current and historical EV/NTM EBITDA exit multiples for Southwestern.

Goldman Sachs then subtracted

the amount of Southwestern’s net debt (including amounts attributable to liability classified equity awards) of approximately

$3.884 billion for fiscal year 2025, as provided by and approved for Goldman Sachs’ use by Southwestern, from the respective

implied enterprise values in order to derive a range of illustrative equity values as of December 31 for Southwestern for the fiscal

year 2025. Goldman Sachs then divided these implied equity values by the projected year-end number of fully diluted outstanding shares

of Southwestern Common Stock of the fiscal year 2025 of approximately 1.119 billion for the fiscal year 2025, calculated

using information provided by and approved for Goldman Sachs’ use by Southwestern, to derive a range of implied future values per

share of Southwestern Common Stock. Goldman Sachs then discounted these implied future equity values per share of Southwestern Common

Stock to September 30, 2023 using an illustrative discount rate of 11.8%, reflecting an estimate of Southwestern’s cost of

equity. Goldman Sachs derived such discount rate by application of the CAPM, which requires certain company-specific inputs, including

a beta for Southwestern, as well as certain financial metrics for the United States financial markets generally. This analysis resulted

in a range of implied present values of $4.48 to $6.69 per share of Southwestern Common Stock.

The disclosure on page 129 of the joint proxy statement/prospectus

is hereby supplemented by amending and restating the table set forth under “The Merger—Opinion of Southwestern’s Financial

Advisor—Summary of Financial Analyses—Selected Precedent Transactions Premia Analysis” as follows:

Announcement

Date | |

Target | |

Acquiror | |

Premium to Last

Undisturbed

Closing Share Price | | |

Transaction

Value

(in billions) | |

| 1/4/2024 | |

Callon Petroleum Company | |

APA Corporation | |

| 13.8 | % | |

$ | 4.5 | |

| 10/23/2023 | |

Hess Corporation | |

Chevron Corporation | |

| 4.9 | % | |

$ | 60.0 | |

| 10/11/2023 | |

Pioneer Natural Resources Company | |

Exxon Mobil Corporation | |

| 19.9 | % | |

$ | 64.5 | |

| 8/21/2023 | |

Earthstone Energy, Inc. | |

Permian Resources Corporation | |

| 14.8 | % | |

$ | 4.5 | |

| 5/22/2023 | |

PDC Energy, Inc. | |

Chevron Corporation | |

| 10.6 | % | |

$ | 7.6 | |

| 3/7/2022 | |

Whiting Petroleum Corporation | |

Oasis Petroleum Inc. | |

| (2.9 | )% | |

$ | 3.9 | |

| 5/24/2021 | |

Cimarex Energy Co. | |

Cabot Oil & Gas Corporation | |

| 0.4 | % | |

$ | 8.8 | |

| 10/20/2020 | |

Parsley Energy, Inc. | |

Pioneer Natural Resources Company | |

| 7.9 | % | |

$ | 7.6 | |

| 10/19/2020 | |

Concho Resources Inc. | |

ConocoPhillips | |

| 11.7 | % | |

$ | 12.9 | |

| 9/28/2020 | |

WPX Energy, Inc. | |

Devon Energy Corporation | |

| 2.6 | % | |

$ | 5.8 | |

| 7/20/2020 | |

Noble Energy, Inc. | |

Chevron Corporation | |

| 7.6 | % | |

$ | 13.0 | |

The disclosure on pages 129-130 of the

joint proxy statement/prospectus is hereby supplemented by amending and restating the first and second full paragraphs set forth under

“The Merger—Opinion of Southwestern’s Financial Advisor—Summary of Financial Analyses—Illustrative Discounted

Cash Flow Analysis — Pro Forma Combined Company” as follows:

Using the Southwestern Projections,

which take into account the Southwestern Projections Synergies, Goldman Sachs performed an illustrative discounted cash flow analysis

of the combined company on a pro forma basis. Using the mid-year convention for discounting cash flows and discount rates ranging from

8.5% to 10.5%, reflecting estimates of the combined company’s weighted average cost of capital, Goldman Sachs discounted to present

value as of September 30, 2023 (i) estimates of unlevered free cash flow for the pro forma combined company for the period from

October 1, 2023, to December 31, 2027, as reflected in the Southwestern Projections and (ii) a range of illustrative terminal

values for the pro forma combined company, which were calculated by applying terminal year exit EBITDA multiples ranging from 4.0x to

5.0x, to a terminal year estimate of the EBITDA to be generated by the pro forma combined company of approximately $6.565 billion,

as reflected in the Southwestern Projections (which analysis implied perpetuity growth rates of (1.0)% to 2.6% and includes run-rate Southwestern

Projections Synergies). The range of terminal year exit EBITDA multiples was estimated by Goldman Sachs utilizing its professional judgment

and experience, taking into account historical trading multiples of Southwestern and Chesapeake over certain prior periods. Goldman Sachs

derived such discount rates by application of the CAPM, which requires certain company-specific inputs, including the pro forma combined

company’s target capital structure weightings, the cost of long-term debt, after-tax yield on permanent excess cash, if any, future

applicable marginal cash tax rate and a beta for the pro forma combined company, as well as certain financial metrics for the United States

financial markets generally.

Goldman Sachs derived ranges

of illustrative pro forma enterprise values for the combined company by adding the ranges of present values it derived above. Goldman

Sachs then subtracted from the range of illustrative pro forma enterprise values the amount of pro forma combined company net debt (including

amounts attributable to liability classified equity awards) of approximately $5.223 billion as of September 30, 2023, as

provided by and approved for Goldman Sachs’ use by Southwestern, to derive a range of implied pro forma equity values for the combined

company. Goldman Sachs then divided the range of implied pro forma equity values it derived by the number of pro forma fully diluted shares

of combined Southwestern common stock (referred to in this section as the “Combined Southwestern Common Stock”) expected to

be outstanding following the consummation of the transaction of approximately 240.9 million, as of September 30, 2023,

as provided by and approved for Goldman Sachs’ use by Southwestern, using the treasury stock method. Lastly, Goldman Sachs multiplied

such amount by the Exchange Ratio of 0.0867x to derive a range of illustrative present values per share of the combined company. This

analysis resulted in a range of implied present values of $6.55 to $8.78 per share of Combined Southwestern Common Stock.

The disclosure on page 130 of the joint

proxy statement/prospectus is hereby supplemented by amending and restating the second and third full paragraphs set forth under “The

Merger—Opinion of Southwestern’s Financial Advisor—Summary of Financial Analyses— Illustrative Present Value of

Future Share Price Analysis — Pro Forma Combined Company” as follows:

Using the Southwestern Projections,

which take into account the Southwestern Projections Synergies, Goldman Sachs performed an illustrative analysis of the implied present

value of a share of Combined Southwestern Common Stock. For this analysis, Goldman Sachs first calculated the illustrative pro forma enterprise

value of approximately $28.578 billion as of December 31 for fiscal year 2025, by applying a range of exit multiples

of EV/NTM EBITDA of 4.0x to 5.0x to estimates of pro forma NTM EBITDA for the fiscal year 2025. This illustrative range of EV/NTM EBITDA

exit multiple estimates was derived by Goldman Sachs utilizing its professional judgment and experience, taking into account current and

historical EV/NTM EBITDA exit multiples for Southwestern and Chesapeake over certain periods.

Goldman Sachs then subtracted

the amount of the combined company’s net debt (including amounts attributable to liability classified equity awards) of approximately

$5.327 billion for the fiscal year 2025, as provided by and approved for Goldman Sachs’ use by Southwestern, from the respective

illustrative pro forma enterprise values in order to derive a range of implied pro forma equity values as of December 31 for the

fiscal year 2025. Goldman Sachs then divided these implied pro forma equity values by the projected year-end number of shares of Combined

Southwestern Common Stock for the fiscal year 2025 of approximately 232 million, calculated using information provided by

and approved for Goldman Sachs’ use by Southwestern, to derive a range of implied pro forma future values per share of Combined

Southwestern Common Stock (excluding dividends). By applying an illustrative pro forma discount rate of 10.9%, reflecting an estimate

of the combined company’s cost of equity, and for the dividends only, using a mid-year convention, Goldman Sachs discounted these

implied pro forma future equity values per share of Combined Southwestern Common Stock to September 30, 2023. Goldman Sachs derived

such discount rate by application of the CAPM, which requires certain company-specific inputs, including a beta for the combined company,

as well as certain financial metrics for the United States financial markets generally. Goldman Sachs then added the cumulative pro forma

dividends per share for the fiscal year 2025 projected to be paid to combined company’s stockholders, discounted to September 30,

2023, to derive a range of implied pro forma future values per share of Combined Southwestern Common Stock (including dividends). Lastly,

Goldman Sachs multiplied such amount by the Exchange Ratio of 0.0867x to derive a range of implied pro forma present values per share

of the combined company. This analysis resulted in a range of implied present values of $6.44 to $8.28 per share of Combined Southwestern

Common Stock.

Cautionary Statement About Forward-Looking

Statements

The information included herein and in any oral

statements made in connection herewith may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All

statements, other than statements of historical fact or present financial information, included herein that address activities, outcomes

and other matters that Southwestern Energy Company (“Southwestern”) or Chesapeake Energy Corporation (“Chesapeake”)

expects, believes or anticipates will or may occur in the future, including without limitation, statements regarding the proposed transaction

between Southwestern and Chesapeake (the “proposed transaction”), the expected closing of the proposed transaction and the

timing thereof and as adjusted descriptions of the post-transaction company and its operations, strategies and plans, integration, debt

levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future

performance, including an expected accretion to earnings and free cash flow and dividend payments are forward-looking statements. Although

we and Chesapeake believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements

are not guarantees of future performance. We and Chesapeake have no obligation and make no undertaking to publicly update or revise any

forward-looking statements, except as may be required by law.

Forward-looking statements include the items identified

in the preceding paragraph, information concerning possible or assumed future results of operations and other statements in this communication

identified by words such as “anticipate,” “intend,” “plan,” “project,” “predict,”

“estimate,” “continue,” “potential,” “should,” “could,” “may,”

“will,” “shall,” “become,” “objective,” “guidance,” “outlook,”

“effort,” “expect,” “believe,” “predict,” “budget,” “projection,”

“goal,” “forecast,” “model,” “target,” or similar words. Statements may be forward-looking

even in the absence of these particular words.

You should not place undue reliance on forward-looking

statements. They are subject to known and unknown risks, uncertainties and other factors that may affect our operations, markets, products,

services and prices and cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements. These forward-looking statements are based on current beliefs

of the management of Southwestern and Chesapeake, based on currently available information, as to the outcome and timing of future events.

In addition to any assumptions and other factors referred to specifically in connection with forward-looking statements, risks, uncertainties

and factors that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are

not limited to: the risk that Southwestern’s and Chesapeake’s businesses will not be integrated successfully; the risk that

cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected;

the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the possibility

that stockholders of Chesapeake may not approve the issuance of new shares of Chesapeake common stock in the proposed transaction or that

stockholders of Chesapeake or stockholders of Southwestern may not approve the proposed transaction; the risk that a condition to closing

of the proposed transaction may not be satisfied, that either Party may terminate the Merger Agreement or that the closing of the proposed

transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including

those resulting from the announcement or completion of the proposed transaction; the risk the Parties do not receive regulatory approval

of the proposed transaction; the occurrence of any other event, change or other circumstances that could give rise to the termination

of the Merger Agreement; the risk that changes in Chesapeake’s capital structure and governance could have adverse effects on the

market value of its securities; the ability of Southwestern and Chesapeake to retain customers and retain and hire key personnel and maintain

relationships with their suppliers and customers and on Southwestern’s and Chesapeake’s operating results and business generally;

the risk the proposed transaction could distract management from ongoing business operations or cause Southwestern and/or Chesapeake to

incur substantial costs; the risk of any litigation relating to the proposed transaction; the risk that Chesapeake may be unable to reduce

expenses or access financing or liquidity; the impact of COVID-19 or other diseases; the impact of adverse changes in interest rates and

inflation; and the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental, health

and safety matters. All such factors are difficult to predict and are beyond our and Chesapeake’s control, including those detailed

in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that

are available on our website at www.swn.com under the “Investors” tab and on the website of the Securities and Exchange Commission

(the “SEC”) at www.sec.gov, and those detailed in Chesapeake’s Annual Reports on Form 10-K, Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K that are available on Chesapeake’s website at investors.chk.com

and on the SEC’s website.

Should one or more of the risks or uncertainties

described above or elsewhere in this communication occur, or should underlying assumptions prove incorrect, actual results and plans could

differ materially from those expressed in any forward-looking statements. We specifically disclaim all responsibility to update publicly

any information contained in a forward-looking statement or any forward-looking statement in its entirety and therefore disclaim any resulting

liability for potentially related damages.

All forward-looking statements attributable to

us are expressly qualified in their entirety by this cautionary statement.

Important Additional Information Regarding

the Transaction Has Been Filed with the SEC and Where to Find It

In connection with the proposed transaction between

Southwestern and Chesapeake, Chesapeake filed a Registration Statement on Form S-4 (the “Registration Statement”) with

the SEC that also constitutes a prospectus of Chesapeake common stock. The Registration Statement was declared effective on May 17,

2024, at which time Chesapeake filed a final prospectus and Southwestern filed a definitive proxy statement. Chesapeake

and Southwestern commenced mailing of the definitive joint proxy statement/prospectus (the “joint proxy statement/prospectus”)

to their respective shareholders on or about May 17, 2024. Each party may also

file other relevant documents regarding the proposed transaction with the SEC. This communication is not a substitute for the joint proxy

statement/prospectus or for any other document that Southwestern or Chesapeake has filed or may file in the future with the SEC in connection

with the proposed transaction. Investors and security holders ARE URGED TO READ THE REGISTRATION

STATEMENT, THE Joint PROXY STATEMENT/PROSPECTUS,

as each may be amended or supplemented from time to time, AND OTHER relevant DOCUMENTS

FILED by Southwestern and Chesapeake WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT Southwestern and CHESAPEAKE, THE PROPOSED transaction, the risks related thereto and related

matters.

Investors will be able to obtain free copies of the joint proxy statement/prospectus,

as each may be amended from time to time, and other relevant documents filed by Southwestern and Chesapeake with the SEC through the website

maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by Southwestern, including the joint proxy statement/prospectus,

will be available free of charge from Southwestern’s website at www.swn.com under the “Investors” tab. Copies of documents

filed with the SEC by Chesapeake, including the joint proxy statement/prospectus, will be available free of charge from Chesapeake’s

website at investors.chk.com.

Participants in the Solicitation

Southwestern and certain of its directors, executive

officers and other members of management and employees, and Chesapeake, and certain of its directors, executive officers and other members

of management and employees may be deemed to be participants in the solicitation of proxies from Southwestern’s stockholders and

the solicitation of proxies from Chesapeake’s stockholders, in each case with respect to the proposed transaction. Information about

Southwestern’s directors and executive officers is available in Southwestern’s Annual Report on Form 10-K for the 2023

fiscal year filed with the SEC on February 22, 2024 and its amendment to its Annual Report on Form 10-K for the 2023 fiscal

year filed with the SEC on April 29, 2024, and in the joint proxy statement/prospectus filed with the SEC. Information about Chesapeake’s

directors and executive officers is available in its Annual Report on Form 10-K for the 2023 fiscal year filed with the SEC on February 21,

2024 and its definitive proxy statement for the 2024 annual meeting of stockholders filed with the SEC on April 26, 2024, and the

joint proxy statement/prospectus. Other information regarding the participants in the solicitations and a description of their direct

and indirect interests, by security holdings or otherwise, will be contained in the Registration Statement, the joint proxy statement/prospectus

and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Stockholders of Southwestern,

stockholders of Chesapeake, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes

available before making any voting or investment decisions.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation

of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

SOUTHWESTERN ENERGY COMPANY |

| |

|

|

| Date: June 7, 2024 |

|

By: |

/s/ CARL F. GIESLER, JR. |

| |

|

Name: |

Carl F. Giesler, Jr. |

| |

|

Title: |

Executive Vice President and Chief Financial Officer |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

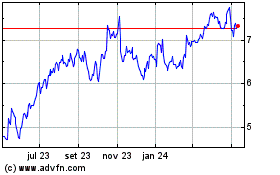

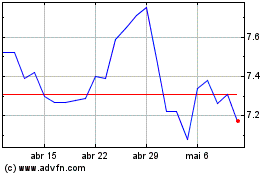

Southwestern Energy (NYSE:SWN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Southwestern Energy (NYSE:SWN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024