false

0000928465

0000928465

2024-07-18

2024-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Act of 1934

Date

of Report (Date of earliest event reported) July 18, 2024

AMCON DISTRIBUTING COMPANY

(Exact name of registrant as specified in its charter)

| Delaware |

|

1-15589 |

|

47-0702918 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| |

7405 Irvington Road, Omaha NE 68122 |

|

(Address of principal executive offices) (Zip Code)

| Registrant’s telephone number, including area code: 402-331-3727 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFO 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

DIT |

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On July 18, 2024, the Company issued a press

release announcing financial results for its third fiscal quarter ended June 30, 2024. A copy of the press release is attached to

this report as an exhibit.

The information in this report (including the

exhibit) shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liabilities of that Section. The information set forth in this report (including the exhibit) shall not be

incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except

as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL

STATEMENTS AND EXHIBITS

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AMCON DISTRIBUTING COMPANY |

| | (Registrant) |

| | |

| Date: July 18, 2024 | /s/

Charles J. Schmaderer |

| | |

| | Name: |

Charles

J. Schmaderer |

| | Title: |

Vice

President, Chief Financial Officer and Secretary |

Exhibit 99.1

AMCON DISTRIBUTING COMPANY REPORTS RESULTS

FOR THE QUARTER ENDED JUNE 30, 2024

NEWS RELEASE

Omaha, NE, July 18, 2024 - AMCON Distributing

Company (“AMCON” or “the Company”) (NYSE American: DIT), an Omaha, Nebraska based Convenience and Foodservice

Distributor, is pleased to announce fully diluted earnings per share of $2.46 on net income available to common shareholders of $1.5 million

for its third fiscal quarter ended June 30, 2024.

“AMCON’s customer-centric philosophy

is a competitive advantage in this economic environment, as our customers rely on our ability to deliver a timely flow of goods and services.

Foodservice, technology platforms, and associated staffing for these strategic areas are a central focus of our management team. We are

committed to making the investments necessary to compete in the marketplace,” said Christopher H. Atayan, AMCON’s Chairman

and Chief Executive Officer. He further noted, “We welcome our new team members and customers from our recently completed acquisition

of Richmond Master Distributors, Inc. AMCON is committed to pursuing strategic acquisition opportunities in the Convenience

Distributor and Foodservice sectors.”

“Labor shortages, supply chain issues, inflation,

volatility in energy prices, and the impact of rising interest rates continue to present challenges for our business,” said Andrew

C. Plummer, AMCON’s President and Chief Operating Officer. Mr. Plummer added, “Our recent acquisitions have enhanced

our geographic reach to better serve our customers as they grow their store footprints.”

Charles J. Schmaderer, AMCON’s Chief Financial

Officer said, “Sales for the fiscal quarter ended June 30, 2024 were $717.9 million and the Company ended the fiscal period

with total shareholders’ equity of approximately $110.0 million. We continue to maintain a strong liquidity position and recent

amendments to our bank credit facilities provided additional flexibility to pursue our strategic objectives that materialized during the

quarter.” Mr. Schmaderer also added, “We continue to invest in the final completion of our 175,000 square foot distribution

facility in Springfield, Missouri. In addition, we are also deploying capital in enhanced foodservice capabilities in our recently purchased

250,000 square foot distribution facility in Colorado City, Colorado, and we opened a new retail location in Lakewood Ranch, Florida.”

AMCON, and its subsidiaries Team Sledd, LLC

and Henry’s Foods, Inc., is a leading Convenience and Foodservice Distributor of consumer products, including beverages,

candy, tobacco, groceries, foodservice, frozen and refrigerated foods, automotive supplies and health and beauty care products with thirteen

(13) distribution centers in Colorado, Illinois, Indiana, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Tennessee,

and West Virginia. Through its Healthy Edge Retail Group, AMCON operates fifteen (15) health and natural product retail stores

in the Midwest and Florida.

This news release contains forward-looking

statements that are subject to risks and uncertainties and which reflect management's current beliefs and estimates of future economic

circumstances, industry conditions, Company performance and financial results. A number of factors could affect the future results of

the Company and could cause those results to differ materially from those expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to conduct its business and meet its capital expenditures needs and the

other factors described under Item 1.A. of the Company’s Annual Report on Form 10-K. Moreover, past financial performance

should not be considered a reliable indicator of future performance. Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 with respect to all such forward-looking

statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

For Further Information Contact:

Charles J. Schmaderer

AMCON Distributing Company

Ph 402-331-3727

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Balance Sheets

June 30, 2024 and September 30, 2023

| | |

June | | |

September | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

| | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 719,342 | | |

$ | 790,931 | |

| Accounts receivable, less allowance for credit losses of $2.5 million at June 2024 and $2.4 million at September 2023 | |

| 80,469,376 | | |

| 70,878,420 | |

| Inventories, net | |

| 160,778,835 | | |

| 158,582,816 | |

| Income taxes receivable | |

| 330,170 | | |

| 1,854,484 | |

| Prepaid expenses and other current assets | |

| 15,991,451 | | |

| 13,564,056 | |

| Total current assets | |

| 258,289,174 | | |

| 245,670,707 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 103,989,865 | | |

| 80,607,451 | |

| Operating lease right-of-use assets, net | |

| 24,710,670 | | |

| 23,173,287 | |

| Goodwill | |

| 5,778,325 | | |

| 5,778,325 | |

| Other intangible assets, net | |

| 4,881,659 | | |

| 5,284,935 | |

| Other assets | |

| 2,954,262 | | |

| 2,914,495 | |

| Total assets | |

$ | 400,603,955 | | |

$ | 363,429,200 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 46,249,366 | | |

$ | 43,099,326 | |

| Accrued expenses | |

| 16,590,155 | | |

| 14,922,279 | |

| Accrued wages, salaries and bonuses | |

| 8,168,882 | | |

| 8,886,529 | |

| Current operating lease liabilities | |

| 6,662,109 | | |

| 6,063,048 | |

| Current maturities of long-term debt | |

| 5,335,127 | | |

| 1,955,065 | |

| Current mandatorily redeemable non-controlling interest | |

| 1,651,608 | | |

| 1,703,604 | |

| Total current liabilities | |

| 84,657,247 | | |

| 76,629,851 | |

| | |

| | | |

| | |

| Credit facilities | |

| 156,941,944 | | |

| 140,437,989 | |

| Deferred income tax liability, net | |

| 4,594,841 | | |

| 4,917,960 | |

| Long-term operating lease liabilities | |

| 18,358,088 | | |

| 17,408,758 | |

| Long-term debt, less current maturities | |

| 17,917,378 | | |

| 11,675,439 | |

| Mandatorily redeemable non-controlling interest, less current portion | |

| 6,497,523 | | |

| 7,787,227 | |

| Other long-term liabilities | |

| 1,669,817 | | |

| 402,882 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Preferred stock, $.01 par value, 1,000,000 shares authorized | |

| — | | |

| — | |

| Common stock, $.01 par value, 3,000,000 shares authorized, 630,362 shares outstanding at June 2024 and 608,689 shares outstanding at September 2023 | |

| 9,648 | | |

| 9,431 | |

| Additional paid-in capital | |

| 33,800,187 | | |

| 30,585,388 | |

| Retained earnings | |

| 107,429,445 | | |

| 104,846,438 | |

| Treasury stock at cost | |

| (31,272,163 | ) | |

| (31,272,163 | ) |

| Total shareholders’ equity | |

| 109,967,117 | | |

| 104,169,094 | |

| Total liabilities and shareholders’ equity | |

$ | 400,603,955 | | |

$ | 363,429,200 | |

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Unaudited Statements

of Operations

for the three and nine months ended June 30,

2024 and 2023

| | |

For the three months ended June | | |

For the nine months ended June | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Sales (including excise taxes of $150.2 and $153.7 million, and $415.7 and $414.9 million, respectively) | |

$ | 717,852,293 | | |

$ | 696,489,427 | | |

$ | 1,964,688,673 | | |

$ | 1,847,472,782 | |

| Cost of sales | |

| 669,893,539 | | |

| 649,623,651 | | |

| 1,831,118,129 | | |

| 1,724,504,862 | |

| Gross profit | |

| 47,958,754 | | |

| 46,865,776 | | |

| 133,570,544 | | |

| 122,967,920 | |

| Selling, general and administrative expenses | |

| 39,920,976 | | |

| 36,851,520 | | |

| 113,857,467 | | |

| 99,227,695 | |

| Depreciation and amortization | |

| 2,415,158 | | |

| 2,103,429 | | |

| 6,923,716 | | |

| 4,982,068 | |

| | |

| 42,336,134 | | |

| 38,954,949 | | |

| 120,781,183 | | |

| 104,209,763 | |

| Operating income | |

| 5,622,620 | | |

| 7,910,827 | | |

| 12,789,361 | | |

| 18,758,157 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other expense (income): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 2,903,925 | | |

| 2,385,842 | | |

| 7,463,175 | | |

| 6,249,540 | |

| Change in fair value of mandatorily redeemable non-controlling interest | |

| 393,324 | | |

| 698,571 | | |

| 727,457 | | |

| 864,684 | |

| Other (income), net | |

| (78,903 | ) | |

| (931,765 | ) | |

| (833,050 | ) | |

| (1,159,021 | ) |

| | |

| 3,218,346 | | |

| 2,152,648 | | |

| 7,357,582 | | |

| 5,955,203 | |

| Income from operations before income taxes | |

| 2,404,274 | | |

| 5,758,179 | | |

| 5,431,779 | | |

| 12,802,954 | |

| Income tax expense | |

| 914,875 | | |

| 1,813,800 | | |

| 2,331,875 | | |

| 4,164,000 | |

| Net income available to common shareholders | |

$ | 1,489,399 | | |

$ | 3,944,379 | | |

$ | 3,099,904 | | |

$ | 8,638,954 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share available to common shareholders | |

$ | 2.48 | | |

$ | 6.74 | | |

$ | 5.18 | | |

$ | 14.78 | |

| Diluted earnings per share available to common shareholders | |

$ | 2.46 | | |

$ | 6.59 | | |

$ | 5.11 | | |

$ | 14.56 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic weighted average shares outstanding | |

| 600,161 | | |

| 585,625 | | |

| 598,637 | | |

| 584,359 | |

| Diluted weighted average shares outstanding | |

| 606,252 | | |

| 598,590 | | |

| 606,151 | | |

| 593,480 | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividends paid per common share | |

$ | 0.18 | | |

$ | 0.18 | | |

$ | 0.82 | | |

$ | 5.54 | |

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Unaudited Statements

of Shareholders’ Equity

for the three and nine months ended June 30,

2024 and 2023

| | |

| | |

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

Treasury Stock | | |

Paid-in | | |

Retained | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Earnings | | |

Total | |

| THREE MONTHS ENDED JUNE 2023 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, April 1, 2023 | |

| 943,272 | | |

$ | 9,431 | | |

| (332,220 | ) | |

$ | (30,867,287 | ) | |

$ | 29,766,566 | | |

$ | 98,167,058 | | |

$ | 97,075,768 | |

| Dividends

on common stock, $0.18 per share | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (111,219 | ) | |

| (111,219 | ) |

| Compensation

expense related to equity-based awards | |

| — | | |

| — | | |

| — | | |

| — | | |

| 409,411 | | |

| — | | |

| 409,411 | |

| Committed

repurchase of common stock | |

| — | | |

| — | | |

| (2,363 | ) | |

| (404,876 | ) | |

| — | | |

| — | | |

| (404,876 | ) |

| Net

income available to common shareholders | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 3,944,379 | | |

| 3,944,379 | |

| Balance, June 30, 2023 | |

| 943,272 | | |

$ | 9,431 | | |

| (334,583 | ) | |

$ | (31,272,163 | ) | |

$ | 30,175,977 | | |

$ | 102,000,218 | | |

$ | 100,913,463 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| THREE MONTHS ENDED JUNE 2024 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, April 1, 2024 | |

| 964,945 | | |

$ | 9,648 | | |

| (334,583 | ) | |

$ | (31,272,163 | ) | |

$ | 33,160,639 | | |

$ | 106,053,510 | | |

$ | 107,951,634 | |

| Dividends

on common stock, $0.18 per share | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (113,464 | ) | |

| (113,464 | ) |

| Compensation

expense related to equity-based awards | |

| — | | |

| — | | |

| — | | |

| — | | |

| 639,548 | | |

| — | | |

| 639,548 | |

| Net

income available to common shareholders | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,489,399 | | |

| 1,489,399 | |

| Balance, June 30, 2024 | |

| 964,945 | | |

$ | 9,648 | | |

| (334,583 | ) | |

$ | (31,272,163 | ) | |

$ | 33,800,187 | | |

$ | 107,429,445 | | |

$ | 109,967,117 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

Treasury Stock | | |

Paid-in | | |

Retained | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Earnings | | |

Total | |

| NINE MONTHS ENDED JUNE 2023 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, October 1, 2022 | |

| 917,009 | | |

$ | 9,168 | | |

| (332,220 | ) | |

$ | (30,867,287 | ) | |

$ | 26,903,201 | | |

$ | 96,784,353 | | |

$ | 92,829,435 | |

| Dividends

on common stock, $5.54 per share | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (3,423,089 | ) | |

| (3,423,089 | ) |

Compensation

expense and issuance of

stock in connection with equity-based awards | |

| 26,263 | | |

| 263 | | |

| — | | |

| — | | |

| 3,272,776 | | |

| — | | |

| 3,273,039 | |

| Committed

repurchase of common stock | |

| — | | |

| — | | |

| (2,363 | ) | |

| (404,876 | ) | |

| — | | |

| — | | |

| (404,876 | ) |

| Net

income available to common shareholders | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 8,638,954 | | |

| 8,638,954 | |

| Balance, June 30, 2023 | |

| 943,272 | | |

$ | 9,431 | | |

| (334,583 | ) | |

$ | (31,272,163 | ) | |

$ | 30,175,977 | | |

$ | 102,000,218 | | |

$ | 100,913,463 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NINE MONTHS ENDED JUNE 2024 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, October 1, 2023 | |

| 943,272 | | |

$ | 9,431 | | |

| (334,583 | ) | |

$ | (31,272,163 | ) | |

$ | 30,585,388 | | |

$ | 104,846,438 | | |

$ | 104,169,094 | |

| Dividends

on common stock, $0.82 per share | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (516,897 | ) | |

| (516,897 | ) |

Compensation

expense and issuance of

stock in connection with equity-based awards | |

| 21,673 | | |

| 217 | | |

| — | | |

| — | | |

| 3,214,799 | | |

| — | | |

| 3,215,016 | |

| Net

income available to common shareholders | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 3,099,904 | | |

| 3,099,904 | |

| Balance, June 30, 2024 | |

| 964,945 | | |

$ | 9,648 | | |

| (334,583 | ) | |

$ | (31,272,163 | ) | |

$ | 33,800,187 | | |

$ | 107,429,445 | | |

$ | 109,967,117 | |

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Unaudited Statements

of Cash Flows

for the nine months ended June 30, 2024

and 2023

| | |

June | | |

June | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net income available to common shareholders | |

$ | 3,099,904 | | |

$ | 8,638,954 | |

| Adjustments to reconcile net income available to common shareholders to net cash flows from (used in) operating activities: | |

| | | |

| | |

| Depreciation | |

| 6,520,440 | | |

| 4,701,316 | |

| Amortization | |

| 403,276 | | |

| 280,752 | |

| (Gain) loss on sales of property and equipment | |

| (141,522 | ) | |

| (133,159 | ) |

| Equity-based compensation | |

| 1,850,233 | | |

| 1,940,631 | |

| Deferred income taxes | |

| (323,119 | ) | |

| 809,616 | |

| Provision for credit losses | |

| 131.132 | | |

| (7,697 | ) |

| Inventory allowance | |

| 175,706 | | |

| 442,603 | |

| Change in fair value of contingent consideration | |

| 45,362 | | |

| — | |

| Change in fair value of mandatorily redeemable non-controlling interest | |

| 727,457 | | |

| 864,684 | |

| Changes in assets and liabilities, net of effects of business combinations: | |

| | | |

| | |

| Accounts receivable | |

| (4,110,926 | ) | |

| (8,026,950 | ) |

| Inventories | |

| 12,365,936 | | |

| (12,294,118 | ) |

| Prepaid and other current assets | |

| (999,319 | ) | |

| (745,490 | ) |

| Other assets | |

| (39,767 | ) | |

| (569,683 | ) |

| Accounts payable | |

| 4,082,394 | | |

| 10,360,228 | |

| Accrued expenses and accrued wages, salaries and bonuses | |

| 1,112,351 | | |

| 1,487,971 | |

| Other long-term liabilities | |

| 446,831 | | |

| 185,704 | |

| Income taxes payable and receivable | |

| 1,524,314 | | |

| 1,572,253 | |

| Net cash flows from (used in) operating activities | |

| 26,870,683 | | |

| 9,507,615 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| (16,793,486 | ) | |

| (6,759,929 | ) |

| Proceeds from sales of property and equipment | |

| 306,748 | | |

| 151,307 | |

| Acquisition of Burklund | |

| (15,464,397 | ) | |

| — | |

| Acquisition of Richmond Master | |

| (6,631,039 | ) | |

| — | |

| Acquisition of Henry's | |

| — | | |

| (54,865,303 | ) |

| Net cash flows from (used in) investing activities | |

| (38,582,174 | ) | |

| (61,473,925 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Borrowings under revolving credit facilities | |

| 1,845,255,576 | | |

| 1,863,027,754 | |

| Repayments under revolving credit facilities | |

| (1,828,751,621 | ) | |

| (1,810,914,231 | ) |

| Proceeds from borrowings on long-term debt | |

| — | | |

| 7,000,000 | |

| Principal payments on long-term debt | |

| (2,277,999 | ) | |

| (1,011,559 | ) |

| Dividends on common stock | |

| (516,897 | ) | |

| (3,423,089 | ) |

| Redemption and distributions to non-controlling interest | |

| (2,069,157 | ) | |

| (2,405,128 | ) |

| Net cash flows from (used in) financing activities | |

| 11,639,902 | | |

| 52,273,747 | |

| Net change in cash | |

| (71,589 | ) | |

| 307,437 | |

| Cash, beginning of period | |

| 790,931 | | |

| 431,576 | |

| Cash, end of period | |

$ | 719,342 | | |

$ | 739,013 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid during the period for interest, net of amounts capitalized | |

$ | 6,976,501 | | |

$ | 5,824,144 | |

| Cash paid during the period for income taxes, net of refunds | |

| 1,066,105 | | |

| 1,780,000 | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash information: | |

| | | |

| | |

| Equipment acquisitions classified in accounts payable | |

$ | 83,180 | | |

$ | 1,622,224 | |

| Committed repurchase of treasury stock | |

| — | | |

| 404,876 | |

| Purchase of property financed with promissory note | |

| 8,000,000 | | |

| — | |

| Portion of Burklund acquisition financed with promissory note | |

| 3,900,000 | | |

| — | |

| Portion of Burklund acquisition financed with contingent consideration | |

| 1,578,444 | | |

| — | |

Issuance of common stock in connection with the vesting of

equity-based awards | |

| 1,296,372 | | |

| 2,044,805 | |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

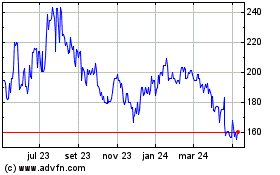

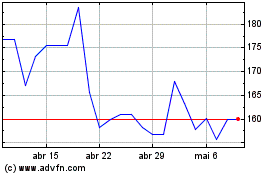

AMCON Distributing (AMEX:DIT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

AMCON Distributing (AMEX:DIT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024