Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

22 Julho 2024 - 5:39PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration File No. 333-275130

July 22, 2024

KINDER MORGAN, INC.

Pricing Term Sheet

$500,000,000 5.100% Senior Notes due 2029

$750,000,000 5.950% Senior Notes due 2054

| Issuer: |

Kinder

Morgan, Inc. |

|

| Expected

Ratings (Moody’s / S&P / Fitch)*: |

Baa2/BBB/BBB |

|

| Ratings

Outlooks (Moody’s / S&P / Fitch)*: |

(Stable/Stable/Stable) |

|

| Security

Type: |

Senior

Notes |

|

| Pricing

Date: |

July

22, 2024 |

|

| Settlement

Date (T+7): |

July 31, 2024 |

|

| Interest

Payment Dates: |

February 1

and August 1, commencing February 1, 2025 |

February 1

and August 1, commencing February 1, 2025 |

| Record

Dates: |

January 15

and July 15 |

January 15

and July 15 |

| Maturity

Date: |

August

1, 2029 |

August

1, 2054 |

| Principal

Amount: |

$500,000,000 |

$750,000,000 |

| Benchmark

Treasury: |

4.250%

due June 30, 2029 |

4.250%

due February 15, 2054 |

| Benchmark

Treasury Price / Yield: |

100-09 / 4.186% |

96-06+ / 4.483% |

| Spread

to Benchmark Treasury: |

+95 bps |

+150

bps |

| Yield

to Maturity: |

5.136% |

5.983% |

| Interest

Rate: |

5.100% |

5.950% |

| Price

to the Public: |

99.843% of the aggregate

principal amount |

99.542% of the aggregate

principal amount |

| Optional

Redemption: |

Prior to July 1, 2029 (one month prior to

the maturity date of the notes due 2029), in the case of the notes due 2029, and February 1, 2054 (six months prior to the maturity date

of the notes due 2054), in the case of the notes due 2054 (the applicable date with respect to each such series of notes, the “Applicable

Par Call Date”), we may redeem each series of the notes at our option, in whole or in part, at any time and from time to time,

at a redemption price equal to the greater of: (1) (a) the sum of the present values of the remaining scheduled payments of

principal and interest thereon discounted to the redemption date (assuming such notes matured on the Applicable Par Call Date) on a semi-annual

basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 15 basis points, in the case of the notes

due 2029, and plus 25 basis points, in the case of the notes due 2054, less (b) interest accrued to the date of redemption, and (2) 100%

of the principal amount of the notes being redeemed, plus, in either case, accrued and unpaid interest thereon to, but excluding, the

redemption date. |

| |

|

|

| |

On

or after the Applicable Par Call Date, we may redeem the notes of each series, in whole or in part, at any time and from time to

time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon

to, but excluding, the redemption date. |

| CUSIP

/ ISIN: |

49456B AZ4 / US49456BAZ40 |

49456B BA8 / US49456BBA89 |

Joint Book-Running Managers: |

BofA Securities, Inc.

BMO Capital Markets Corp.

MUFG Securities Americas Inc.

RBC Capital Markets, LLC

Barclays Capital Inc.

Intesa Sanpaolo IMI Securities Corp.

PNC Capital Markets LLC

Regions Securities LLC

Scotia Capital (USA) Inc.

U.S. Bancorp Investments, Inc.

|

|

| |

|

|

* Note: The ratings of a security are not a recommendation to buy,

sell or hold securities and may be subject to revision or withdrawal at any time.

Legend

The issuer has filed a registration statement (including a preliminary

prospectus supplement and a prospectus) with the U.S. Securities and Exchange Commission (the “SEC”) for the offering

to which this communication relates. Before you invest, you should read the preliminary prospectus supplement for this offering, the issuer’s

prospectus in that registration statement and any other documents the issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by searching the SEC online data base (EDGAR) on the SEC web site at

http://www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the

prospectus supplement and prospectus if you request it by contacting BofA Securities, Inc. at 1-800-294-1322, BMO Capital Markets Corp.

at 1-866-864-7760, MUFG Securities Americas Inc. at 1-877-649-6848, or RBC Capital Markets, LLC at 1-212-618-7706.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR

BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED

AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

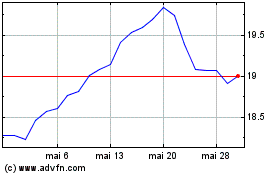

Kinder Morgan (NYSE:KMI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Kinder Morgan (NYSE:KMI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024