Filed by Alerus Financial

Corporation

(Commission File No.: 001-39036)

Pursuant to Rule 425

of the Securities Act of 1933

and deemed filed pursuant

to Rule 14a-12

of the Securities Exchange

Act of 1934

Subject Company: HMNF

(Commission File No.: 0-24100)

Date: July 26, 2024

The following is a transcript of an investor

call held by Alerus Financial Corporation, which was made available on July 26, 2024, on the investor relations webpage of Alerus

Financial Corporation at www.alerus.com under the link “Investors Relations”.

07 - 25 - 2024

Alerus Financial Corp

Second Quarter 2024

Earnings

TOTAL PAGES: 16

CORPORATE SPEAKERS:

Katie

Lorenson

Alerus

Financial Corp; President, Chief Executive Officer

Alan

Villalon

Alerus

Financial Corp; Chief Financial Officer

Karin

Taylor

Alerus

Financial Corp; Chief Risk and Operating Officer

James

Collins

Alerus

Financial Corp; Chief Banking and Revenue Officer

Forrest

Wilson

Alerus

Financial Corp; Chief Retirement Services Officer

PARTICIPANTS:

Brendan

Nosal

Hovde

Group; Analyst

David

Feaster

Raymond

James; Analyst

Nathan

Race

Piper

Sandler; Analyst

Matthew

Renck

KBW;

Analyst

PRESENTATION:

Operator^ Good afternoon.

Welcome to the Alerus Financial Corporation Earnings Conference Call. (Operator Instructions)

Please note this event is being recorded.

This call may include forward-looking statements.

And the company's actual results may differ materially

from those indicated in any forward-looking statements.

Important factors that could cause actual results

to differ materially from those indicated in the forward-looking statements are listed in the earnings release and the company's SEC filings.

I would now like to turn the conference over to Alerus

Financial Corporation President and CEO, Katie Lorenson.

Please go ahead.

Katie Lorenson^ Thank you. Good morning. And thank

you for joining Alerus' Second Quarter Earnings Conference Call.

Joining me on the call today is CFO, Alan Villalon,

Chief Risk and Operating Officer, Karin Taylor; Chief Banking and Revenue Officer, Jim Collins; and our Chief Retirement Services Officer,

Forrest Wilson.

I will kick off the call today with an overview of

the results for the quarter, a recap of some strategic highlights, some additional color on credit during the quarter and an update on

our pending acquisition of HMN Financial.

For the quarter, we reported net income of USD 6.2

million or USD 0.31 of earnings per share.

Operating results for the quarter generally exceeded

expectations with continued improving trends across our diversified sources of revenue, driving impressive improvement in PPNR or pre-provision

net revenue of 48% on a linked quarter basis.

The team we are building continues to excel in adding

full client relationships across our commercial, wealth and private banking segments.

Notably, we exceeded expectations for deposits at

the end of the quarter with our fifth straight quarter of deposit growth in a very difficult and competitive deposit environment.

A huge shout out to our team members who have done

a fantastic job, again, sourcing new core [client] relationships, retaining inflows and capturing liquidity events opportunities. This

success allowed us to see deposit balances tick up and offset substantial seasonal outflows.

Deposit wins were sourced from all markets and generally

the result of our One Alerus approach to holistic opportunities to serve clients across the suite of commercial and private banking, treasury

management and wealth advisory services.

In addition, we continue to build balances across

our synergistic deposits including our health savings accounts and wealth management and retirement money market portfolio.

Our loan-to-deposit ratio ended the quarter at 88%

and continues to be a high-quality deposit portfolio that is well diversified by size, geography and type.

We saw some growth in our CD base, which notably

has a low level of CD-only clients. And as emphasized in the previous quarters, we continue to operate and fund our loan growth with zero

broker deposits.

For the quarter, we grew loans 4.2%.

We remain highly selective and disciplined in both

pricing and credit, and we continue to build a best-in-class team of bankers and risk management experts who have strong credit acumen

and deep experience in vetting opportunities and working with entrepreneurs, business banking and mid-market commercial clients. Consistent

with our efforts and focus on commercial banking, we added a team of veteran equipment finance professionals in our Arizona market to

complement our strength in C&I and to continue adding to our already well-diversified loan portfolio. All these efforts resulted in

an increase in net interest income of approximately 8% and adjusted net interest margin expansion of 13 basis points during the quarter.

Moving on to fee income, which is the strategic differentiator for Alerus, it contributed to over 53% of total revenues, and we ended

the quarter at USD 43.6 billion of AUA and AUM. All core underlying business lines saw fundamental improvement with total fee income increasing

8.1% during the quarter.

Our retirement leader, Forrest Wilson, who joined

us just a few months ago, has made an immediate impact including assembling a talented retirement leadership team and addressing strategic

opportunities, which we believe will continue to improve client retention, client acquisition and overall profitability of this highly

valuable division. The retirement industry national rankings were recently published with Alerus moving ahead for the first time to a

top 25 or better in all categories measured including assets, plans and participants.

Our growing Wealth Management division delivered

another solid quarter of results with continued momentum driven by strong core business within the mass affluent and the high net worth

client base. New revenue pipelines remain strong and synergistic opportunities are building.

We delivered a solid quarter of managing expenses

with expenses down slightly.

While we continue to invest in talent, we remain

committed to thoughtfully managing these investments through FTE count. These disciplined efforts focused on constant improvement, leveraging

our technology platforms better and seeing higher production and revenue generation with a similar expense base are all part of our path

to continued improvement in efficiency and profitability.

During the quarter, we recorded a USD 4.5 million

provision expense, resulting from expected gradual credit normalization towards more historical levels from the past years of completely

benign credit metrics. After fifteen straight quarters of immaterial charge-offs or net recoveries, we had a charge-off of a nonaccrual

C&I loan that was nearly fully reserved for in previous quarters.

Our allowance to loan losses remained at 1.31%, consistent

with prior quarters as we replenished the balance to account for loan growth and the impairment of a previously identified problem loan,

which was moved to nonaccrual during the quarter.

This previously classified loan is a commercial real

estate construction loan that has had missteps in the construction process. The market data supports the feasibility of the project and

the borrower has injected additional capital into the project. They have additional [levels] to pull to keep this project moving forward

through stabilization.

We continue and remain committed to prompt identification

and movement in credits where there are challenges. And given the additional time needed to execute these options for this particular

credit, we determined that it was prudent to place this credit on nonaccrual.

We have reviewed our commercial real estate construction

deals and all are performing as expected. The broader loan portfolio continues to perform well and overall classified loans trended down

in the second quarter with material upgrades and payoffs.

Our priority and core focus continues to be building

our commercial wealth bank, and our loan mix will continue to trend to higher levels of C&I, which today accounts for approximately

30% of the portfolio, with another 30% in consumer and residential and the remainder in a granular and well diversified CRE portfolio.

Overall, investor CRE levels at 213% remained well

within regulatory thresholds and well under most of our peer group.

In addition to robust reserve levels at 1.31%, we

remain well positioned with healthy capital levels with a CET1 of 11.7% and adjusted TCE of 7.91%.

During the second quarter, we continued our long

history of raising our dividend and raised it by another 5.3%. Lastly, a quick update on the recently announced acquisition of HMN Financial.

As a reminder, this is our 26th acquisition and the

teams are working great together, leveraging the experience and the expertise to seamlessly integrate our two great companies.

We are also progressing on schedule through the regulatory

and shareholder approval process, and we continue to anticipate a closing in the fourth quarter of this year, as indicated previously.

I will now hand it over to Alan Villalon, CFO, for

additional recap and guidance.

Alan Villalon^ Thanks, Katie.

I'll start my commentary on page 13 of our investor

deck that is posted on the Investor Relations part of our website. Let's start on our key revenue drivers.

On a reported basis, both net interest income and

fee income grew over 8% during the quarter. The increase in net interest income was driven primarily by strong organic loan growth, growth

in noninterest-bearing deposits and continued expansion in our core net interest margin.

Growth in fee income was primarily driven by an increase

in overall asset-based and nonmarket-based fees within our wealth and retirement business lines and a seasonal rebound in mortgage.

Fee income continues to be a large component of overall

revenues and a differentiator for Alerus.

I'll go into detail about each of our fee income

segments in later slides. Turning to page 14, net interest income increased to over USD 24 million in the second quarter, primarily driven

by improving loan yields and strong loan growth, coupled with stable deposit levels. The bank term funding program arbitrage was also

accretive to net interest income by USD 459,000.

Within the quarter, we recognized approximately 10

basis points of total accretion from the 2022 Metro Phoenix Bank acquisition. Excluding purchase accounting accretion from the Metro acquisition

and the impact of the BTFP, core net interest margin still expanded 6 basis points to 2.46% from 2.4% in the prior quarter.

In the upcoming quarter, we still expect our net

interest margin on both a core and reported basis to improve a couple of basis points. Excluding the impact of NPV and our swaps, our

AL modeling shows our NII increasing mid-single digits should the Fed cut by 100 basis points. Based on Fed dot lots, we still see a path

for our NIM to exceed 3% in 2026.

Should the Fed cut more aggressively, we anticipate

reaching 3% sooner. Let's turn to page 15 to talk about earning assets.

Since the acquisition of Metro Phoenix Bank, we had

our seventh consecutive quarter of loan growth.

Over those seven quarters, we grew loans at an average

unannualized rate of over 3% per quarter.

We continue to let our investment portfolio run down

as we remix low-yielding securities into higher-yielding loans.

For the remainder of 2024, we continue to grow loans

even with 6% of our loans contractually paying down in the second half of the year. Turning to page 16, on a period-ending basis, our

deposits increased 0.4% from the prior quarter.

While we saw our usual seasonal outflows from our

public funds, we continue to drive organic deposit growth to offset these outflows.

Importantly, noninterest-bearing deposits grew 1.3%

in the quarter and remained stable at 21% of total deposits.

During the quarter, our deposit activity was impressive

as average account size wins were double the size of accounts lost during the quarter, and we continue to experience a net increase in

overall accounts as well.

Given the stable deposit levels, our loan-to-deposit

ratio was well below our target level of 95%.

For the third quarter of 2024, we continue to expect

the seasonal outflow of approximately USD 80 million to USD 100 million.

While these outflows will pressure deposit balances

in the upcoming quarter, we do expect deposit levels to be slightly higher from current levels at the end of the year. Turning to page

17, I'll now talk about our banking segment, which also includes our mortgage business.

I'll focus on the fee income component now since

I already covered interest income.

Overall noninterest income from banking was up USD

1.4 million or 39% from the prior quarter. Most of the increase was attributed to a seasonal rebound in our mortgage business.

During the quarter, we also recognized USD 628,000

in swap fees as we continue to grow our mid-market C&I banking business.

As a reminder, the swap income is client driven,

so it tends to be lumpy and unpredictable.

For the third quarter, we expect the overall level

of noninterest income to decrease slightly from the second quarter levels and would expect mortgage revenues to slow and other noninterest

income to be posted to a normalized level of USD 1.5 million.

On page 18, I will provide some highlights of our

Retirement business. Total revenue from the business increased 2.7% from the prior quarter, driven by both asset-based and nonmarket-based

fees. End of quarter assets under management increased 2.3%, mainly due to improved equity in bond markets. Participants within retirement

grew almost 1% during the quarter.

For the third quarter, we do expect fee income from

Retirement business to be stable.

Turning to page 19, you can see the highlights of

our Wealth Management business.

On a linked quarter basis, revenues increased 4%,

while end-of-quarter assets under management decreased 1.7%, mainly due to an outflow for one custody client in the quarter where we charged

minimal basis points.

For the third quarter, excluding any market impact,

we expect fee income from our Wealth business to be up slightly given the continued improvement in the markets. Page 20 provides an overview

of our noninterest expense.

During the quarter, noninterest expense decreased

0.7%.

During the quarter, we also incurred USD 563,000

in onetime merger-related expenses related to the pending acquisition of HMN Financial. Excluding these merger expenses, core noninterest

expense decreased 2.1%.

We now expect total expenses for 2024 to grow mid-single

digits when compared to 2023 on a reported basis as further merger-related expenses will be incurred. Turning to page 21, you can see

our core credit metrics.

We had net charge-offs to average loans of 36 basis

points in the quarter, primarily related to a nonperforming loan, which already had an individual reserve allocated in the prior quarters.

Our nonperforming assets to total assets percentage

was 63 basis points compared to 17 basis points from the prior quarter. This is still below the industry average for regional banks of

approximately 73 basis points over the past decade.

As Katie mentioned, the increase here was related

to one previously identified construction loan that was moved to nonaccrual status.

I will discuss our capital liquidity on page 22.

We continue to remain very well capitalized as our

common equity Tier one to risk-weighted assets is 11.7%.

We also maintained our status as a dividend aristocrat.

We increased our dividend consistently over the last

20 years.

On the bottom right, you will see the breakdown in

the sources of over USD 2.5 billion of potential liquidity.

Overall, we continue to remain well positioned for

both liquidity and capital standpoint to support future growth or whether any economic uncertainty. To summarize on page 23, we had a

robust second quarter as pre-provision net revenue improved over 48% from the prior quarter.

We continue to see strong organic loan growth and

strong deposit growth that offset any seasonal outflows.

Our net interest margin continues to improve as we

continue to see a path where margins can improve to over 3% even if the Fed remains on pause.

Our fee businesses also drove improved returns, which

continue to differentiate us in the industry.

We remain focused on driving revenue growth and managing

expenses, leading to positive operating leverage improvement during the quarter. Both our reserve and capital levels remain strong to

weather any economic uncertainty.

And with that, I will now open up for Q&A.

QUESTION &

ANSWER:

Operator^ (Operator Instructions) The first question

comes from Brendan Nosal with Hovde Group.

Brendan Nosal^ Just want to start off on the construction

credit that migrated. Just looking for a couple of additional color points here. Just kind of curious what the reserve is against it at

this point, how far through the construction phase is the project and what your evaluation of default risk is at this point?

Karin Taylor^ Brendan, this is Karin.

We have about 25% reserved on that particular credit.

The project is 80% complete. And at this point, we believe that they have very feasible options to deliver the remaining equity needed

to complete the project.

However, we learned about this fairly late in the

quarter, in fact, shortly after quarter ended.

And so we've got some more work to do to assess those

options.

Brendan Nosal^ And then, just turning to the margin

commentary you gave.

I just want to make sure I understood the outlook

properly.

Is it correct that you expect a few basis points

of expansion next quarter off of that [3.57] core number?

Alan Villalon^ Not 357. [257] million of the core

and reported numbers.

Brendan Nosal^ And then how does the $400 million

of swaps rolling off kind of impacting next quarter?

Alan Villalon^ Yes.

So we had $400 million of swaps roll off in July,

and we have another $200 million rolling off in January of 2025.

What we're seeing right now is that you're going

to see us return to slightly liability sensitive from being asset sensitive.

So as rates come down, you'll see us again probably

have our NII improve about mid-single digits should the Fed cut by 100 basis points.

Operator^ The next question comes from David Feaster

with Raymond James.

David Feaster^ Maybe just staying on the margin topic,

I appreciate your commentary about the getting to a 3% margin, even ex cuts because I mean there's obviously a huge repricing power.

I just wanted to maybe get a sense of whether there

was a timeframe that we could talk about getting there? And does that include the HMN deal as well?

Alan Villalon^ So the timeframe we're talking about

is can to 3% in 2026 on an average for the full year 2026.

So if you think about that, we should be in the low

3s for the full year 2026.

So you can get that ramp up between now and then.

And we're looking right now on basically on our ALM modeling on a static balance sheet basically.

So it's just a remixing of what we're doing today

and then putting on the [super] on at the current rates today, so just remixing.

And this does not include HMN. This is just our balance

sheet today.

So with HMN coming on, we'll give guidance to that

later.

But we're probably going to get there -- 3%'s not

going to change our outlook.

David Feaster^ But HMN should be accretive to the

margin?

Alan Villalon^ Yes. That's correct.

David Feaster^ And then I wanted to touch on -- it

was great to see the equipment finance team that you guys added.

I guess, how quickly do you think this team can start

adding to growth? What are some of the cross-sell opportunities that you might see or other synergies? And do you think there's an opportunity

to drive deposit growth potential from that group as well?

James Collins^ Yes, David, this is Jim. The business

strategy for bringing them on is that, that's the key segue product in the mid-market companies that are with other banks.

So we'll use that as a wedge product to get into

those mid-market companies and take over the full relationship. Typically, there would be an ask of 30% of the equipment note in deposits.

That's our goal when we're just doing a straight up equipment piece.

Now obviously we're going for the full relationship.

So this team is building that out the rest of this

year.

We'll have some activity this year, but the full

activity will start next year.

We're integrating them with our existing C&I

sales force, specifically the commercial group that's doing C&I in the mid-market.

So the cross-sell opportunities go along with our

full commercial wealth business model, where we want them to get us into the full C&I relationship for that company, and then we want

to bring in private banking, treasury management and wealth services and then tack on our 401(k) group.

So the business plan is the same. This is just a

better segue into some of the markets where we don't have firm mid-market C&I activity.

David Feaster^ And then just curious, maybe given

the move in rates, has your thoughts on balance sheet optimization changed at all? I mean it seems like it might give you some more flexibility,

especially with the HMN F deal.

I'm curious just gives you some more flexibility.

Has your thoughts on optimization or any strategies in the intermediate term change at all?

Katie Lorenson^ I'll kick this off and then Al, you

can come in after me.

We are constantly assessing balance sheet restructuring

optimization opportunities. And we do believe with the addition of HMN, that is going to give us additional opportunities to evaluate.

Alan Villalon^ The only thing I'd add on there, what

Katie said too, I mean as you could with HMN, that acquisition with the equipment leasing team coming on, with the present deposit growth

we've had, we're constantly looking at ways to optimize our balance sheet. And it's not just for the short term, it's for the long term

because as we want to think about our balance sheet positioning, we aren't right now liability-sensitive, but over the long term, we want

to get to be slightly asset sensitive because we have an inherent liability sensitivity on our fee income set of businesses. When interest

rates go up, typically, that slows the markets down, which will hit AUM in both the Retirement and Wealth businesses and also slows down

mortgage.

So we'd like to see that spread income business for

us to be just a tiny bit asset sensitive again to provide that [see-saw].

So we're constantly evaluating opportunities to optimize

and get our balance sheet to that position.

David Feaster^ And if I could just squeeze one more

in. Great to hear the commentary about the new deposit account growth, that's extremely encouraging.

I guess, where are you having the most success in

kind of just your thoughts on continuing to drive that account growth and ultimately translate into core deposit growth going forward?

James Collins^ Most of our success to this point

is in that mid-market C&I and government non-profit vertical, again, bringing on the talent that we brought on in the last 1.5 years,

having them focused on their long-term relationships and their long-term reputations and segueing those relationships into fuller relationships

over here at Alerus is really where we found most of the success, and it's been broad.

It's been all over in different industries in mid-market

and different segments and government non-profit.

But also, I would say our retail team has done a

fantastic job just sitting down with customers and gravitating more of the cash that they might have at other institutions into our institutions.

So it's really broad-based across all of our revenue

streams, but the focus is and will continue to be in that mid-market C&I deposit, large depositors and verticals that will add a lot

more deposits as supplement our loan growth.

Operator^ The next question is from Nathan Race with

Piper Sandler.

Nathan Race^ I apologize I jumped on a little late,

but was just curious if you could provide additional color on the construction loan that moved to nonaccrual this quarter in terms of

when it was originated, the underlying property type and so forth and any potential loss content expectations associated with this? And

then also just curious to hear some background on the C&I loan as well that seems like it was a reserve for going in for the quarter

in terms of when this loan was originated? And any reasons behind why it deteriorated in the quarter?

Karin Taylor^ We'll start on the construction loan.

It is a multifamily loan.

It was originated in August of 2022. The issues with

it are around construction management. The fundamentals in the market for multifamily remain very strong, and this is a well-positioned

project in terms of location to amenities, public transportation, major employers.

And so the borrower has stepped up and injected equity

at this point to cover the cost overruns. They continue to have those options available, but there's been a delay in terms of when we

expected this next injection, which is why we moved into nonaccrual when we did. That said, they do continue to have feasible options

to bring equity in.

I mentioned in response to an earlier question, our

reserve on it at this point is about 25%.

It happened late in the quarter, in fact, actually

early third quarter just after quarter end.

And so we're still working on assessing the options

being presented by the borrower. With regard to the longer [reach of the] charge-off, it is a C&I credit.

It was originated back in 2020 shortly before the

pandemic. When the loan was originated, it was part of a business repositioning. And unfortunately, it was impacted substantially by Covid.

Nathan Race^ And just curious, as you look out over

the next couple of quarters, what your expectations are just in terms of charge-off levels? I imagine this quarter will prove to be fairly

idiosyncratic but just any thoughts on kind of what you're seeing in terms of the normalized level of charge-offs in the current environment?

Karin Taylor^ Sure. Just generally speaking, in terms

of credit outlook, we've seen normalization.

So this construction deal aside, our migration appears

very typical to what it was prior to Covid. And as Katie mentioned in her comments, we actually had net upgrades, which reduced our overall

level of criticized compared to the first quarter. With regard to charge-offs, the one bit of uncertainty, I would say, for this next

quarter is just as this company that we took the charge-off on this quarter moves into liquidation, we're going to be getting updated

valuations, so we could see some further adjustments there.

Remaining balance on that loan is about USD 2.5 million.

Nathan Race^ Maybe changing gears, I apologize if

you touched on it, but just is the expectation still that the TFP will remain on balance sheet at least through the end of 2024?

Alan Villalon^ Yes. That is correct, Nate.

We expect that to maintain through the end of the

year.

Nathan Race^ Expenses were really well controlled

in the quarter. Any thoughts on how we should think about the run rate in 3Q and 4Q?

Alan Villalon^ Yes.

We do I gave a little bit of guidance saying that

overall 2024 expenses should be up mid-single digits now when you include merger-related expenses, so when you compare on a reported basis

to 2023, we'll have a little seasonal uptick here in terms of some tech spending we have that was it just typically hits us in the second

half of the year. All the two incentive comp as things are going well for us to a pickup there.

But overall, we continue to look at ways to manage

expenses prudently, and we're still looking at somewhere mid-single digits on a reported basis.

Nathan Race^ And that includes HMN F potentially

closing in the fourth quarter or no?

Alan Villalon^ That is including HMS closing in the

fourth quarter, correct.

Nathan Race^ Yes. And on that front, just curious

if you could provide any other update in terms of how that integration is going, what the reception has been in Rochester among both clients

and employees at HMNF and kind of how you're progressing on the approval front and kind of when you guys expect to close the acquisition

in the fourth quarter?

James Collins^ I will jump in real quick on employees

and the customer standpoint. Everything is going, I would say, extremely well. The employees are very engaged in looking forward to rolling

into our balance sheet and our product set. The customer feedback has been, again, very positive, going with a local community bank with

a lot of ties into Minnesota and the Northern Upper Midwest and looking forward to having a little bit better product mix and a little

bit better reach.

So very positive.

Katie Lorenson^ Yes.

I would add just on the customer front, a number

of their clients very familiar with Alerus as they are retirement and benefit clients already. And so that was a positive.

From an integration standpoint, the teams are working

very well together.

Obviously as this is our 26th acquisition, we have

a lot of experience and have learned a lot and are progressing very well in that regard.

We are targeting a close and conversion for the fourth

quarter, and it appears at this point from a regulatory standpoint that things are progressing well in terms of hitting those dates.

Nathan Race^ And then one last one for Katie. Just

any update in terms of with the new Chief Retirement Officer on board, how things are progressing in terms of discussions with potential

partners that you guys can potentially come to an acquisition arrangement within retirements?

Forrest Wilson^ Yes. This is Forrest Wilson. Thanks

for the question. Yes. We've been fairly quickly able to establish a fairly experienced team, myself and a number of others do have quite

a bit of acquisition experience and also contacts within the industry.

So our goal is growth, as you know and we have kind

of used these contacts to put feelers out and so forth.

Our goal is to look at as many acquisitions as we

can.

Experiences taught me and our team that we need to

be very, very selective because they can send you in the wrong direction as quickly as they can help you grow.

So you want to be very selective.

So excited about kind of the start we're off to on

this front.

We're looking at a few right now.

I would say that nothing is imminent, but we are

actively looking and intend to be that way for some time and partnering with Katie and I and others to execute here.

Nathan Race^ That's great color.

I appreciate that, Forrest. And all the other color

can answer my questions. Thank you, everyone.

Operator^ The next question is from the line of Matt

Renck with KBW.

Matthew Renck^ My first question, just a follow-up

to the balance sheet optimization questions. How are you comfortable letting the loan-to-deposit ratio like get to before maybe you pumped

up for Exxon growth a bit? Or is that not necessarily the way you're looking at it?

Alan Villalon^ I mean right now we've told a lot

of what we have a target for us and what I said on the earlier in the call we're looking at a 95% loan-to-deposit ratio. That's kind of

our internal target right now.

But we're seeing really good activity right now so

there's nothing leading us to cause us to think about pumping the brakes at the moment.

Matthew Renck^ And then just one question on deposits.

I know you guys said you were focused on kind of

the middle market commercial deposits.

But with the synergistic deposits up 17% year-over-year.

I was just curious how rate cuts might impact the

growth rate of that deposit line item.

Alan Villalon^ So we don't see a material impact

there because a lot of those clients are synergistic side that come from our wealth and retirement businesses. And those customers, we

did a deposit study, and those are very long tenured clients of ours.

So unless there's a big remixing in the portfolio

mix, and we don't see a big shift in that. And typically, what we've seen over time is that those as people continue to save for more

retirement, we see those balances actually increasing.

So hence, why you've seen that consistency in synergies

for deposit growth over the last several years for us.

Operator^ (Operator Instructions)

This will conclude our question and answer session.

I would like to turn the conference back over to

Katie Lorenson for any closing remarks.

Katie Lorenson^ Thank you. And thank you all for

joining our call today.

We appreciate your questions.

We appreciate your feedback.

Overall, a very solid quarter from a fundamental

operating standpoint.

From a credit and lending standpoint, we will remain

proactive.

We will remain disciplined in our underwriting and

committed to constant review of stress testing and timely identification of issues, utilizing both internal and external resources.

We believe we've turned the corner with NIM expansion

and solid revenue growth across our differentiated business model, and we look forward to continued progress towards the approval and

closing of our HMNS deal.

We are positioned for sustainable growth and increasing

profitability over time, which will lead to book and shareholder value creation.

Thank you to all of our talented team members for

your continuous hard work in making Alerus better every day for our clients, our communities and our shareholders. Thank you, everyone.

Operator^ The conference has now concluded. Thank

you for attending today's presentation.

You may now disconnect.

Special Note Concerning Forward-Looking Statements

This report contains

“forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations,

forecasts and projections with respect to the anticipated future performance of Alerus Financial Corporation (“Alerus”)

and HMN Financial Corporation, Inc. (“HMNF”) and certain plans, expectations, goals, projections and benefits

relating to the merger of HMN with and into Alerus (the “Merger”), all of which are subject to numerous assumptions,

risks and uncertainties. These statements are often, but not always, identified by words such as “may,”

“might,” “should,” “could,” “predict,” “potential,”

“believe,” “expect,” “continue,” “will,” “anticipate,”

“seek,” “estimate,” “intend,” “plan,” “projection,” “would,”

“annualized,” “target” and “outlook,” or the negative version of those words or other comparable

words of a future or forward-looking nature. Examples of forward-looking statements include, among others, statements Alerus makes

regarding the ability of Alerus and HMNF to complete the transactions contemplated by the agreement and plan of merger (the

“Merger Agreement”), including the parties’ ability to satisfy the conditions to the consummation of the Merger,

statements about the expected timing for completing the Merger, the potential effects of the proposed Merger on both Alerus and

HMNF, and the possibility of any termination of the Merger Agreement, and any potential downward adjustment in the exchange

ratio.

Forward-looking statements

are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their

nature, are inherently uncertain and outside of management’s control. It is possible that actual results and outcomes may differ,

possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. In addition to factors disclosed

in reports filed by Alerus and HMNF with the SEC, risks and uncertainties for Alerus, HMNF and the combined company that may cause actual

results or outcomes to differ materially from those anticipated include, but are not limited to: (1) the possibility that any of

the anticipated benefits of the proposed Merger will not be realized or will not be realized within the expected time period; (2) the

risk that integration of HMNF’s operations with those of Alerus will be materially delayed or will be more costly or difficult than

expected; (3) the parties’ inability to meet expectations regarding the timing of the proposed Merger; (4) changes to

tax legislation and their potential effects on the accounting for the Merger; (5) the inability to complete the proposed Merger due

to the failure of the Alerus’ or HMNF’s stockholders to adopt the Merger Agreement, or the failure of Alerus’ stockholders

to approve the issuance of Alerus’ common stock in connection with the Merger; (6) the failure to satisfy other conditions

to completion of the proposed Merger, including receipt of required regulatory and other approvals; (7) the failure of the proposed

Merger to close for any other reason; (8) diversion of management’s attention from ongoing business operations and opportunities

due to the proposed Merger; (9) the challenges of integrating and retaining key employees; (10) the effect of the announcement

of the proposed Merger on Alerus’, HMNF’s or the combined company’s respective customer and employee relationships and

operating results; (11) the possibility that the proposed Merger may be more expensive to complete than anticipated, including as a result

of unexpected factors or events; (12) the amount of HMNF’s stockholders’ equity as of the closing date of the merger and any

potential downward adjustment in the exchange ratio; (13) the dilution caused by Alerus’ issuance of additional shares of Alerus’

common stock in connection with the Merger; and (14) changes in the global economy and financial market conditions and the business, results

of operations and financial condition of Alerus, HMNF and the combined company. Please refer to each of Alerus’ and HMNF’s

Annual Report on Form 10-K for the year ended December 31, 2023, as well as both parties’ other filings with the SEC,

for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the

forward-looking statements.

Any forward-looking

statement included in this report is based only on information currently available to management and speaks only as of the date on

which it is made. Neither Alerus nor HMNF undertakes any obligation to publicly update any forward-looking statement, whether

written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Additional Information and Where to Find It

Alerus has filed a Registration

Statement on Form S-4 (Registration Statement No. 333-280815) with the SEC on July 15, 2024, in connection with a proposed transaction

between Alerus and HMNF. The registration statement includes a joint proxy statement of Alerus and HMNF that also constitutes a prospectus

of Alerus, which will be sent to the stockholders of Alerus and HMNF after the SEC declares the registration statement effective. Before

making any voting decision, the stockholders of Alerus and HMNF are advised to read the joint proxy statement/prospectus, because it contains

important information about Alerus, HMNF and the proposed transaction. This document and other documents relating to the Merger filed

by Alerus can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge

by accessing Alerus’ website at www.alerus.com under the link “Investors Relations” and then under “SEC Filings”

and HMNF’s website at www.justcallhome.com/HMNFinancial under “SEC Filings.” Alternatively, these documents can be obtained

free of charge from Alerus upon written request to Alerus Financial Corporation, Corporate Secretary, 401 Demers Avenue, Grand Forks,

North Dakota 58201 or by calling (701) 795-3200, or from HMNF upon written request to HMN Financial, Inc., Corporate Secretary, 1016

Civic Center Drive NW, Rochester, Minnesota 55901 or by calling (507) 535-1200. The contents of the websites referenced above are

not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus.

Participants in the Solicitation

This report does not constitute

a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Alerus, HMNF, and certain of their

directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies

from the stockholders of Alerus and HMNF in connection with the proposed Merger under SEC rules. Information about the directors and executive

officers of Alerus and HMNF is included in the joint proxy statement/prospectus for the proposed transaction filed with the SEC. These

documents may be obtained free of charge in the manner described above under “Additional Information and Where to Find It.”

Security

holders may obtain information regarding the names, affiliations and interests of Alerus’ directors and executive officers in

the definitive proxy statement of Alerus relating to its 2024 Annual Meeting of Stockholders filed with the SEC on March 25,

2024 and on Alerus’ Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on

March 8, 2024. Security holders may also obtain information regarding the names, affiliations and interests of HMNF’s

directors and executive officers in the definitive proxy statement of HMNF relating to its 2024 Annual Meeting of Stockholders filed

with the SEC on March 21, 2024 and HMNF’s Annual Report on Form 10-K/A for the year ended December 31, 2023

filed with the SEC on March 19, 2024. To the extent the holdings of Alerus’ securities by Alerus’ directors and

executive officers or the holdings of HMNF securities by HMNF’s directors and executive officers have changed since the

amounts set forth in Alerus’ or HMNF’s respective proxy statement for its 2024 Annual Meeting of Stockholders, such

changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. These documents can

be obtained free of charge in the manner described above under “Additional Information and Where to Find It.”

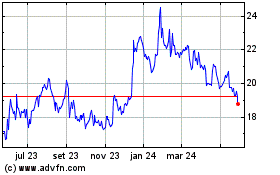

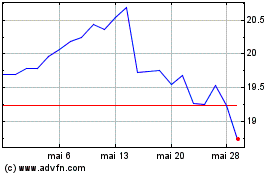

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024