Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

07 Agosto 2024 - 10:10AM

Edgar (US Regulatory)

No.1-7628

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF AUGUST 2024

COMMISSION FILE NUMBER: 1-07628

HONDA GIKEN KOGYO KABUSHIKI KAISHA

(Name of registrant)

HONDA

MOTOR CO., LTD.

(Translation of registrant’s name into English)

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo 107-8556, Japan

(Address of principal

executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| HONDA GIKEN KOGYO KABUSHIKI KAISHA (HONDA MOTOR CO., LTD.) |

|

| /s/ Sumihiro Takahashi |

| Sumihiro Takahashi |

| General Manager |

| Finance Division |

| Honda Motor Co., Ltd. |

Date: August 7, 2024

Consolidated Financial Results for the Fiscal First Quarter Ended

June 30, 2024 (IFRS)

August 7, 2024

|

|

|

| Company name |

|

: Honda Motor Co., Ltd. |

| Listing |

|

: Tokyo Stock Exchange |

| Securities code |

|

: 7267 |

| URL |

|

: https://global.honda/en/investors/ |

| Representative |

|

: Toshihiro Mibe, Director, President and Representative Executive

Officer |

| Inquiries |

|

: Masao Kawaguchi, Head of Accounting and Finance Supervisory Unit

Tel. +81-3-3423-1111 |

| Scheduled date to commence dividend payments |

|

: — |

| Supplemental materials prepared for consolidated financial results |

|

: Yes |

| Holdings of financial results meeting |

|

: Yes |

(Amounts are rounded to the nearest million yen)

1. Consolidated Financial Results for the Three Months Ended June 30, 2024 (from April 1, 2024 to June 30, 2024)

|

|

|

| (1) Consolidated operating results (for the three months ended June 30) |

|

(% of change from the same period of the previous fiscal year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Sales revenue |

|

|

Operating profit |

|

|

Profit before

income taxes |

|

|

Profit for the period |

|

|

Profit for the period

attributable to owners

of the parent |

|

|

Comprehensive

income for the period |

|

| Three months ended |

|

|

Yen (millions) |

|

|

|

% |

|

|

|

Yen (millions) |

|

|

|

% |

|

|

|

Yen (millions) |

|

|

|

% |

|

|

|

Yen (millions) |

|

|

|

% |

|

|

|

Yen (millions) |

|

|

|

% |

|

|

|

Yen (millions) |

|

|

|

% |

|

| June 30, 2024 |

|

|

5,404,858 |

|

|

|

16.9 |

|

|

|

484,705 |

|

|

|

22.9 |

|

|

|

559,474 |

|

|

|

8.7 |

|

|

|

414,327 |

|

|

|

8.2 |

|

|

|

394,660 |

|

|

|

8.7 |

|

|

|

947,527 |

|

|

|

-5.9 |

|

| June 30, 2023 |

|

|

4,624,996 |

|

|

|

20.8 |

|

|

|

394,447 |

|

|

|

77.5 |

|

|

|

514,924 |

|

|

|

116.9 |

|

|

|

382,945 |

|

|

|

134.1 |

|

|

|

363,069 |

|

|

|

143.3 |

|

|

|

1,006,423 |

|

|

|

15.6 |

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable

to owners of the parent -

Basic |

|

|

|

Earnings per share attributable

to owners of the parent -

Diluted |

| Three months ended |

|

Yen |

|

|

|

Yen |

| June 30, 2024 |

|

81.81 |

|

|

|

81.81 |

| June 30, 2023 |

|

73.02 |

|

|

|

73.02 |

Explanatory notes:

| 1. |

Basic and diluted earnings per share are calculated based on the profit for the period attributable to owners of

the parent. |

| 2. |

As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the record date of September 30, 2023. Basic and diluted earnings per share attributable to owners of the parent are calculated based

on the assumption that the stock split had been implemented at the beginning of the previous fiscal year. |

(2) Consolidated financial

position

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total assets |

|

|

Total equity |

|

|

Equity attributable to owners

of the parent |

|

|

Ratio of equity attributable to

owners of the parent to

total assets |

|

| As of |

|

|

Yen (millions) |

|

|

|

Yen (millions) |

|

|

|

Yen (millions) |

|

|

|

% |

|

| June 30, 2024 |

|

|

31,311,972 |

|

|

|

13,697,678 |

|

|

|

13,411,175 |

|

|

|

42.8 |

|

| March 31, 2024 |

|

|

29,774,150 |

|

|

|

13,005,872 |

|

|

|

12,696,995 |

|

|

|

42.6 |

|

2. Dividends

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Annual dividends per share |

|

| |

First

quarter-end |

|

|

Second

quarter-end |

|

|

Third

quarter-end |

|

|

Fiscal

year-end |

|

|

Total |

|

| |

|

Yen |

|

|

Yen |

|

|

Yen |

|

|

Yen |

|

|

Yen |

|

| Fiscal year ended March 31, 2024 |

|

|

— |

|

|

|

87.00 |

|

|

|

— |

|

|

|

39.00 |

|

|

|

— |

|

| Fiscal year ending March 31, 2025 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal year ending March 31, 2025 (forecast) |

|

|

|

|

|

|

34.00 |

|

|

|

— |

|

|

|

34.00 |

|

|

|

68.00 |

|

Explanatory notes:

| 1. |

Revisions to the forecast of dividends most recently announced: None |

| 2. |

As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the record date of September 30, 2023. The year-end dividend per share for the fiscal year

ended March 31, 2024 is based on the number of shares after the stock split and the total annual dividend is disclosed as “ – ”. Based on the number of shares prior to the stock split, the

year-end dividend and the total annual dividend for the fiscal year ended March 31, 2024 are expected to be JPY 117.00 per share and JPY 204.00 per share, respectively. |

3. Forecast of Consolidated Financial Results for the Fiscal Year Ending March 31, 2025 (from April 1, 2024 to March 31, 2025)

(% of change from the previous fiscal year)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Sales revenue |

|

|

Operating profit |

|

|

Profit before

income taxes |

|

|

Profit for the year |

|

|

Profit for the year

attributable to owners

of the parent |

|

|

Earnings per share

attributable to owners

of the parent |

|

| |

|

Yen (millions) |

|

|

% |

|

|

Yen (millions) |

|

|

% |

|

|

Yen (millions) |

|

|

% |

|

|

Yen (millions) |

|

|

% |

|

|

Yen (millions) |

|

|

% |

|

|

Yen |

|

| Full-year |

|

|

20,300,000 |

|

|

|

-0.6 |

|

|

|

1,420,000 |

|

|

|

2.8 |

|

|

|

1,480,000 |

|

|

|

-9.9 |

|

|

|

1,070,000 |

|

|

|

-9.5 |

|

|

|

1,000,000 |

|

|

|

-9.7 |

|

|

|

210.82 |

|

Explanatory note:

Revisions to the forecast of consolidated financial results most recently announced: Yes

*Explanatory notes

(1) Significant changes in the scope of consolidation during the period: None

|

|

|

|

|

| Newly included: |

|

- companies |

|

(Company name: -) |

|

|

|

| Excluded: |

|

- companies |

|

(Company name: -) |

(2) Changes in accounting policies and changes in accounting estimates

|

|

|

|

|

|

|

|

|

| (i) |

|

Changes in accounting policies required by IFRS |

|

|

: |

|

|

None |

| (ii) |

|

Changes in accounting policies due to other reason |

|

|

: |

|

|

None |

| (iii) |

|

Changes in accounting estimates |

|

|

: |

|

|

None |

(3) Number of issued shares (common shares)

| |

(i) |

Number of issued shares at the end of the period (including treasury stock) |

|

|

|

|

|

| As of June 30, 2024 |

|

5,280,000,000 shares |

|

|

| As of March 31, 2024 |

|

5,280,000,000 shares |

|

|

| |

(ii) |

Number of treasury stock at the end of the period |

|

|

|

|

|

| As of June 30, 2024 |

|

457,569,637 shares |

|

|

| As of March 31, 2024 |

|

451,092,624 shares |

|

|

| |

(iii) |

Average number of shares outstanding during the period |

|

|

|

|

|

| Three months ended June 30, 2024 |

|

4,823,906,086 shares |

|

|

| Three months ended June 30, 2023 |

|

4,972,297,953 shares |

|

|

As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the record date of September 30, 2023. Number of issued shares at the end of the period (including

treasury stock), number of treasury stock at the end of the period and average number of shares outstanding during the period are calculated based on the assumption that the stock split had been implemented at the beginning of the previous fiscal

year.

| * |

Review of the Japanese-language originals of the attached consolidated quarterly financial statements by

certified public accountants or an audit firm : None |

| * |

Proper use of earning forecasts, and other special matters |

This announcement contains “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are based on management’s assumptions and beliefs taking into account information currently available to it. Therefore, please be advised that the actual

results of the Company could differ materially from those described in these forward-looking statements as a result of numerous factors, including general economic conditions in the principal markets of the Company, its consolidated subsidiaries and

its affiliates accounted for by the equity-method, and fluctuation of foreign exchange rates, as well as other factors detailed from time to time. The various factors for increases and decreases in profit have been classified in accordance with a

method that Honda considers reasonable.

Honda’s American Depositary Shares are listed and traded on the New York Stock Exchange. One

American Depositary Share represents three common shares.

For supplemental materials prepared for consolidated financial results and

other information, please refer to Honda’s Investor Relations website (URL https://global.honda/en/investors/).

TABLE OF CONTENTS

Consolidated Financial Results for the Fiscal First Quarter Ended June 30, 2024

|

|

|

|

|

| 1. Overview of Consolidated Financial Results |

|

|

2 |

|

| 2. Condensed Consolidated Interim Financial Statements and Notes to Condensed Consolidated

Interim Financial Statements |

|

|

3 |

|

| [1] Condensed Consolidated Statements of Financial Position |

|

|

3 |

|

| [2] Condensed Consolidated Statements of Income and

Condensed Consolidated Statements of

Comprehensive Income |

|

|

4 |

|

| Condensed Consolidated Statements of Income

For the three months ended June 30, 2023 and

2024 |

|

|

4 |

|

| Condensed Consolidated Statements of Comprehensive Income

For the three months ended

June 30, 2023 and 2024 |

|

|

5 |

|

| [3] Condensed Consolidated Statements of Changes in Equity |

|

|

6 |

|

| [4] Condensed Consolidated Statements of Cash Flows |

|

|

7 |

|

| [5] Assumptions for Going Concern |

|

|

8 |

|

| [6] Notes to Condensed Consolidated Interim Financial Statements |

|

|

8 |

|

—1—

1. Overview of Consolidated Financial Results

Consolidated Operating Results

Honda’s

consolidated sales revenue for the three months ended June 30, 2024 increased by 16.9%, to JPY 5,404.8 billion from the same period last year, due mainly to increased sales revenue in Motorcycle business and Automobile business as well as

positive foreign currency translation effects. Operating profit increased by 22.9%, to JPY 484.7 billion from the same period last year, due mainly to increased profit attributable to price and cost impacts, which was partially offset by

increased expenses. Profit before income taxes increased by 8.7%, to JPY 559.4 billion from the same period last year. Profit for the period attributable to owners of the parent increased by 8.7%, to JPY 394.6 billion from the same period

last year.

Consolidated Statements of Financial Position

Total assets as of June 30, 2024 increased by JPY 1,537.8 billion, to JPY 31,311.9 billion from March 31, 2024 due mainly to increased

receivables from financial service as well as positive foreign currency translation effects. Total liabilities increased by JPY 846.0 billion, to JPY 17,614.2 billion from March 31, 2024 due mainly to increased financing liabilities

as well as positive foreign currency translation effects, which was partially offset by decreased trade payables. Total equity increased by JPY 691.8 billion, to JPY 13,697.6 billion from March 31, 2024 due mainly to increased

retained earnings attributable to profit for the period as well as positive foreign currency translation effects.

—2—

2. Condensed Consolidated Interim Financial Statements and Notes to Condensed Consolidated Interim

Financial Statements

[1] Condensed Consolidated Statements of Financial Position

March 31, 2024 and June 30, 2024

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Mar. 31, 2024 |

|

|

Jun. 30, 2024 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

4,954,565 |

|

|

|

4,977,263 |

|

| Trade receivables |

|

|

1,240,090 |

|

|

|

1,143,580 |

|

| Receivables from financial services |

|

|

2,558,594 |

|

|

|

2,776,541 |

|

| Other financial assets |

|

|

229,583 |

|

|

|

192,827 |

|

| Inventories |

|

|

2,442,969 |

|

|

|

2,675,607 |

|

| Other current assets |

|

|

446,763 |

|

|

|

519,421 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

11,872,564 |

|

|

|

12,285,239 |

|

|

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

| Investments accounted for using the equity method |

|

|

1,206,968 |

|

|

|

1,248,365 |

|

| Receivables from financial services |

|

|

5,616,676 |

|

|

|

6,200,507 |

|

| Other financial assets |

|

|

968,142 |

|

|

|

1,020,828 |

|

| Equipment on operating leases |

|

|

5,202,768 |

|

|

|

5,541,058 |

|

| Property, plant and equipment |

|

|

3,234,413 |

|

|

|

3,294,674 |

|

| Intangible assets |

|

|

999,689 |

|

|

|

1,043,662 |

|

| Deferred tax assets |

|

|

170,856 |

|

|

|

152,676 |

|

| Other non-current assets |

|

|

502,074 |

|

|

|

524,963 |

|

|

|

|

|

|

|

|

|

|

| Total non-current assets |

|

|

17,901,586 |

|

|

|

19,026,733 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

29,774,150 |

|

|

|

31,311,972 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Trade payables |

|

|

1,609,836 |

|

|

|

1,474,570 |

|

| Financing liabilities |

|

|

4,105,590 |

|

|

|

4,889,382 |

|

| Accrued expenses |

|

|

638,319 |

|

|

|

595,591 |

|

| Other financial liabilities |

|

|

340,858 |

|

|

|

372,129 |

|

| Income taxes payable |

|

|

157,410 |

|

|

|

138,430 |

|

| Provisions |

|

|

566,722 |

|

|

|

578,689 |

|

| Other current liabilities |

|

|

904,757 |

|

|

|

918,723 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

8,323,492 |

|

|

|

8,967,514 |

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

| Financing liabilities |

|

|

6,057,967 |

|

|

|

6,162,648 |

|

| Other financial liabilities |

|

|

316,919 |

|

|

|

314,803 |

|

| Retirement benefit liabilities |

|

|

284,844 |

|

|

|

304,119 |

|

| Provisions |

|

|

385,001 |

|

|

|

362,558 |

|

| Deferred tax liabilities |

|

|

855,067 |

|

|

|

921,241 |

|

| Other non-current liabilities |

|

|

544,988 |

|

|

|

581,411 |

|

|

|

|

|

|

|

|

|

|

| Total non-current liabilities |

|

|

8,444,786 |

|

|

|

8,646,780 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

16,768,278 |

|

|

|

17,614,294 |

|

|

|

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

86,067 |

|

|

|

86,067 |

|

| Capital surplus |

|

|

205,073 |

|

|

|

204,951 |

|

| Treasury stock |

|

|

(550,808 |

) |

|

|

(562,991 |

) |

| Retained earnings |

|

|

10,644,213 |

|

|

|

10,850,417 |

|

| Other components of equity |

|

|

2,312,450 |

|

|

|

2,832,731 |

|

|

|

|

|

|

|

|

|

|

| Equity attributable to owners of the parent |

|

|

12,696,995 |

|

|

|

13,411,175 |

|

| Non-controlling interests |

|

|

308,877 |

|

|

|

286,503 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

13,005,872 |

|

|

|

13,697,678 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

|

29,774,150 |

|

|

|

31,311,972 |

|

|

|

|

|

|

|

|

|

|

—3—

[2] Condensed Consolidated Statements of Income and Condensed Consolidated Statements of Comprehensive

Income

Condensed Consolidated Statements of Income

For the three months ended June 30, 2023 and 2024

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Three months

ended

Jun. 30, 2023 |

|

|

Three months

ended

Jun. 30, 2024 |

|

| Sales revenue |

|

|

4,624,996 |

|

|

|

5,404,858 |

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

(3,627,891 |

) |

|

|

(4,208,475 |

) |

| Selling, general and administrative |

|

|

(404,703 |

) |

|

|

(495,796 |

) |

| Research and development |

|

|

(197,955 |

) |

|

|

(215,882 |

) |

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

(4,230,549 |

) |

|

|

(4,920,153 |

) |

|

|

|

|

|

|

|

|

|

| Operating profit |

|

|

394,447 |

|

|

|

484,705 |

|

|

|

|

|

|

|

|

|

|

| Share of profit of investments accounted for using the equity method |

|

|

42,853 |

|

|

|

1,434 |

|

| Finance income and finance costs: |

|

|

|

|

|

|

|

|

| Interest income |

|

|

32,855 |

|

|

|

50,089 |

|

| Interest expense |

|

|

(9,042 |

) |

|

|

(12,219 |

) |

| Other, net |

|

|

53,811 |

|

|

|

35,465 |

|

|

|

|

|

|

|

|

|

|

| Total finance income and finance costs |

|

|

77,624 |

|

|

|

73,335 |

|

|

|

|

|

|

|

|

|

|

| Profit before income taxes |

|

|

514,924 |

|

|

|

559,474 |

|

| Income tax expense |

|

|

(131,979 |

) |

|

|

(145,147 |

) |

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

382,945 |

|

|

|

414,327 |

|

|

|

|

|

|

|

|

|

|

| Profit for the period attributable to: |

|

|

|

|

|

|

|

|

| Owners of the parent |

|

|

363,069 |

|

|

|

394,660 |

|

| Non-controlling interests |

|

|

19,876 |

|

|

|

19,667 |

|

|

|

| |

|

Yen |

|

| Earnings per share attributable to owners of the parent |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

73.02 |

|

|

|

81.81 |

|

—4—

Condensed Consolidated Statements of Comprehensive Income

For the three months ended June 30, 2023 and 2024

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Three months

ended

Jun. 30, 2023 |

|

|

Three months

ended

Jun. 30, 2024 |

|

| Profit for the period |

|

|

382,945 |

|

|

|

414,327 |

|

| Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

|

| Items that will not be reclassified to profit or loss |

|

|

|

|

|

|

|

|

| Remeasurements of defined benefit plans |

|

|

6 |

|

|

|

(5 |

) |

| Net changes in revaluation of financial assets measured at fair value through other comprehensive

income |

|

|

15,709 |

|

|

|

(5,332 |

) |

| Share of other comprehensive income of investments accounted for using the equity method |

|

|

2,825 |

|

|

|

(280 |

) |

| Items that may be reclassified subsequently to profit or loss |

|

|

|

|

|

|

|

|

| Net changes in revaluation of financial assets measured at fair value through other comprehensive

income |

|

|

(155 |

) |

|

|

(31 |

) |

| Exchange differences on translating foreign operations |

|

|

581,244 |

|

|

|

489,146 |

|

| Share of other comprehensive income of investments accounted for using the equity method |

|

|

23,849 |

|

|

|

49,702 |

|

|

|

|

|

|

|

|

|

|

| Total other comprehensive income, net of tax |

|

|

623,478 |

|

|

|

533,200 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period |

|

|

1,006,423 |

|

|

|

947,527 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period attributable to: |

|

|

|

|

|

|

|

|

| Owners of the parent |

|

|

972,537 |

|

|

|

914,903 |

|

| Non-controlling interests |

|

|

33,886 |

|

|

|

32,624 |

|

—5—

[3] Condensed Consolidated Statements of Changes in Equity

For the three months ended June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Equity attributable to owners of the parent |

|

|

Non-controlling

interests |

|

|

Total

equity |

|

| |

|

Common

stock |

|

|

Capital

surplus |

|

|

Treasury

stock |

|

|

Retained

earnings |

|

|

Other

components

of equity |

|

|

Total |

|

| Balance as of April 1, 2023 |

|

|

86,067 |

|

|

|

185,589 |

|

|

|

(484,931 |

) |

|

|

9,980,128 |

|

|

|

1,417,397 |

|

|

|

11,184,250 |

|

|

|

318,041 |

|

|

|

11,502,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

363,069 |

|

|

|

|

|

|

|

363,069 |

|

|

|

19,876 |

|

|

|

382,945 |

|

| Other comprehensive income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

609,468 |

|

|

|

609,468 |

|

|

|

14,010 |

|

|

|

623,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

363,069 |

|

|

|

609,468 |

|

|

|

972,537 |

|

|

|

33,886 |

|

|

|

1,006,423 |

|

| Reclassification to retained earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

416 |

|

|

|

(416 |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

| Transactions with owners and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(99,915 |

) |

|

|

|

|

|

|

(99,915 |

) |

|

|

(53,367 |

) |

|

|

(153,282 |

) |

| Purchases of treasury stock |

|

|

|

|

|

|

|

|

|

|

(59,507 |

) |

|

|

|

|

|

|

|

|

|

|

(59,507 |

) |

|

|

|

|

|

|

(59,507 |

) |

| Disposal of treasury stock |

|

|

|

|

|

|

|

|

|

|

394 |

|

|

|

|

|

|

|

|

|

|

|

394 |

|

|

|

|

|

|

|

394 |

|

| Share-based payment transactions |

|

|

|

|

|

|

(232 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(232 |

) |

|

|

|

|

|

|

(232 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total transactions with owners and other |

|

|

|

|

|

|

(232 |

) |

|

|

(59,113 |

) |

|

|

(99,915 |

) |

|

|

|

|

|

|

(159,260 |

) |

|

|

(53,367 |

) |

|

|

(212,627 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of June 30, 2023 |

|

|

86,067 |

|

|

|

185,357 |

|

|

|

(544,044 |

) |

|

|

10,243,698 |

|

|

|

2,026,449 |

|

|

|

11,997,527 |

|

|

|

298,560 |

|

|

|

12,296,087 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Equity attributable to owners of the parent |

|

|

Non-controlling

interests |

|

|

Total

equity |

|

| |

|

Common

stock |

|

|

Capital

surplus |

|

|

Treasury

stock |

|

|

Retained

earnings |

|

|

Other

components

of equity |

|

|

Total |

|

| Balance as of April 1, 2024 |

|

|

86,067 |

|

|

|

205,073 |

|

|

|

(550,808 |

) |

|

|

10,644,213 |

|

|

|

2,312,450 |

|

|

|

12,696,995 |

|

|

|

308,877 |

|

|

|

13,005,872 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

394,660 |

|

|

|

|

|

|

|

394,660 |

|

|

|

19,667 |

|

|

|

414,327 |

|

| Other comprehensive income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

520,243 |

|

|

|

520,243 |

|

|

|

12,957 |

|

|

|

533,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

394,660 |

|

|

|

520,243 |

|

|

|

914,903 |

|

|

|

32,624 |

|

|

|

947,527 |

|

| Reclassification to retained earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(38 |

) |

|

|

38 |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

| Transactions with owners and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(188,418 |

) |

|

|

|

|

|

|

(188,418 |

) |

|

|

(54,998 |

) |

|

|

(243,416 |

) |

| Purchases of treasury stock |

|

|

|

|

|

|

|

|

|

|

(12,502 |

) |

|

|

|

|

|

|

|

|

|

|

(12,502 |

) |

|

|

|

|

|

|

(12,502 |

) |

| Disposal of treasury stock |

|

|

|

|

|

|

|

|

|

|

319 |

|

|

|

|

|

|

|

|

|

|

|

319 |

|

|

|

|

|

|

|

319 |

|

| Share-based payment transactions |

|

|

|

|

|

|

(122 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(122 |

) |

|

|

|

|

|

|

(122 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total transactions with owners and other |

|

|

|

|

|

|

(122 |

) |

|

|

(12,183 |

) |

|

|

(188,418 |

) |

|

|

|

|

|

|

(200,723 |

) |

|

|

(54,998 |

) |

|

|

(255,721 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of June 30, 2024 |

|

|

86,067 |

|

|

|

204,951 |

|

|

|

(562,991 |

) |

|

|

10,850,417 |

|

|

|

2,832,731 |

|

|

|

13,411,175 |

|

|

|

286,503 |

|

|

|

13,697,678 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—6—

[4] Condensed Consolidated Statements of Cash Flows

For the three months ended June 30, 2023 and 2024

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Three months

ended

Jun. 30, 2023 |

|

|

Three months

ended

Jun. 30, 2024 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Profit before income taxes |

|

|

514,924 |

|

|

|

559,474 |

|

| Depreciation, amortization and impairment losses excluding equipment on operating

leases |

|

|

185,697 |

|

|

|

187,926 |

|

| Share of profit of investments accounted for using the equity method |

|

|

(42,853 |

) |

|

|

(1,434 |

) |

| Finance income and finance costs, net |

|

|

(19,992 |

) |

|

|

(41,502 |

) |

| Interest income and interest costs from financial services, net |

|

|

(36,616 |

) |

|

|

(42,969 |

) |

| Changes in assets and liabilities |

|

|

|

|

|

|

|

|

| Trade receivables |

|

|

134,426 |

|

|

|

136,517 |

|

| Inventories |

|

|

29,146 |

|

|

|

(108,546 |

) |

| Trade payables |

|

|

(171,061 |

) |

|

|

(164,570 |

) |

| Accrued expenses |

|

|

(56,526 |

) |

|

|

(87,424 |

) |

| Provisions and retirement benefit liabilities |

|

|

(37,090 |

) |

|

|

(30,876 |

) |

| Receivables from financial services |

|

|

(337,122 |

) |

|

|

(315,249 |

) |

| Equipment on operating leases |

|

|

45,052 |

|

|

|

(76,747 |

) |

| Other assets and liabilities |

|

|

(50,244 |

) |

|

|

(75,349 |

) |

| Other, net |

|

|

(16,099 |

) |

|

|

5,589 |

|

| Dividends received |

|

|

36,332 |

|

|

|

51,024 |

|

| Interest received |

|

|

115,115 |

|

|

|

181,054 |

|

| Interest paid |

|

|

(42,861 |

) |

|

|

(99,206 |

) |

| Income taxes paid, net of refunds |

|

|

(54,106 |

) |

|

|

(158,975 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) operating activities |

|

|

196,122 |

|

|

|

(81,263 |

) |

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Payments for additions to property, plant and equipment |

|

|

(69,208 |

) |

|

|

(138,790 |

) |

| Payments for additions to and internally developed intangible assets |

|

|

(42,127 |

) |

|

|

(68,623 |

) |

| Proceeds from sales of property, plant and equipment and intangible assets |

|

|

1,332 |

|

|

|

40 |

|

| Proceeds from sales of subsidiaries, net of cash and cash equivalents disposed of |

|

|

(2,940 |

) |

|

|

— |

|

| Payments for acquisitions of investments accounted for using the equity method |

|

|

(36,734 |

) |

|

|

(831 |

) |

| Payments for acquisitions of other financial assets |

|

|

(65,233 |

) |

|

|

(50,174 |

) |

| Proceeds from sales and redemptions of other financial assets |

|

|

88,327 |

|

|

|

65,778 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(126,583 |

) |

|

|

(192,600 |

) |

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from short-term financing liabilities |

|

|

3,004,472 |

|

|

|

2,421,185 |

|

| Repayments of short-term financing liabilities |

|

|

(2,858,776 |

) |

|

|

(2,167,488 |

) |

| Proceeds from long-term financing liabilities |

|

|

532,895 |

|

|

|

477,816 |

|

| Repayments of long-term financing liabilities |

|

|

(493,899 |

) |

|

|

(405,841 |

) |

| Dividends paid to owners of the parent |

|

|

(99,915 |

) |

|

|

(188,418 |

) |

| Dividends paid to non-controlling interests |

|

|

(20,691 |

) |

|

|

(23,781 |

) |

| Purchases and sales of treasury stock, net |

|

|

(59,113 |

) |

|

|

(12,183 |

) |

| Repayments of lease liabilities |

|

|

(19,738 |

) |

|

|

(19,342 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

(14,765 |

) |

|

|

81,948 |

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

225,606 |

|

|

|

214,613 |

|

|

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

|

280,380 |

|

|

|

22,698 |

|

| Cash and cash equivalents at beginning of year |

|

|

3,803,014 |

|

|

|

4,954,565 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

|

4,083,394 |

|

|

|

4,977,263 |

|

|

|

|

|

|

|

|

|

|

—7—

[5] Assumptions for Going Concern

None

[6] Notes to Condensed Consolidated Interim Financial

Statements

[A] Segment Information

Based on

Honda’s organizational structure and characteristics of products and services, Honda discloses segment information in four categories: Reportable segments of Motorcycle business, Automobile business and Financial services business, and other

segments that are not reportable. The other segments are combined and disclosed in Power products and other businesses. Segment information is based on the components of Honda for which separate financial information is available that is evaluated

regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance. The accounting policies used for segment information are consistent with the accounting policies used in the Company’s condensed

consolidated interim financial statements.

Principal products and services, and functions of each segment are as follows:

|

|

|

|

|

| Segment |

|

Principal products and services |

|

Functions |

|

|

|

| Motorcycle Business |

|

Motorcycles, all-terrain vehicles (ATVs), side-by-sides (SxS) and relevant parts |

|

Research and development

Manufacturing Sales and related services |

|

|

|

| Automobile Business |

|

Automobiles and relevant parts |

|

Research and development

Manufacturing Sales and related services |

|

|

|

| Financial Services Business |

|

Financial services |

|

Retail loan and lease related to Honda products

Others |

|

|

|

| Power Products and Other Businesses |

|

Power products and relevant parts, and others |

|

Research and development

Manufacturing Sales and related services

Others |

—8—

Segment information based on products and services

As of and for the three months ended June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Motorcycle

Business |

|

|

Automobile

Business |

|

|

Financial

Services

Business |

|

|

Power Products

and Other

Businesses |

|

|

Segment

Total |

|

|

Reconciling

Items |

|

|

Consolidated |

|

| Sales revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External customers |

|

|

756,955 |

|

|

|

2,992,339 |

|

|

|

773,029 |

|

|

|

102,673 |

|

|

|

4,624,996 |

|

|

|

— |

|

|

|

4,624,996 |

|

| Intersegment |

|

|

— |

|

|

|

39,009 |

|

|

|

629 |

|

|

|

6,522 |

|

|

|

46,160 |

|

|

|

(46,160 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

756,955 |

|

|

|

3,031,348 |

|

|

|

773,658 |

|

|

|

109,195 |

|

|

|

4,671,156 |

|

|

|

(46,160 |

) |

|

|

4,624,996 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

|

143,520 |

|

|

|

176,982 |

|

|

|

69,528 |

|

|

|

4,417 |

|

|

|

394,447 |

|

|

|

— |

|

|

|

394,447 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment assets |

|

|

1,793,502 |

|

|

|

10,669,517 |

|

|

|

12,374,016 |

|

|

|

504,694 |

|

|

|

25,341,729 |

|

|

|

1,131,628 |

|

|

|

26,473,357 |

|

| Depreciation and amortization |

|

|

17,699 |

|

|

|

163,159 |

|

|

|

205,004 |

|

|

|

3,661 |

|

|

|

389,523 |

|

|

|

— |

|

|

|

389,523 |

|

| Capital expenditures |

|

|

9,727 |

|

|

|

119,758 |

|

|

|

553,141 |

|

|

|

3,143 |

|

|

|

685,769 |

|

|

|

— |

|

|

|

685,769 |

|

As of and for the three months ended June 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yen (millions) |

|

| |

|

Motorcycle

Business |

|

|

Automobile

Business |

|

|

Financial

Services

Business |

|

|

Power Products

and Other

Businesses |

|

|

Segment

Total |

|

|

Reconciling

Items |

|

|

Consolidated |

|

| Sales revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External customers |

|

|

937,687 |

|

|

|

3,434,612 |

|

|

|

938,075 |

|

|

|

94,484 |

|

|

|

5,404,858 |

|

|

|

— |

|

|

|

5,404,858 |

|

| Intersegment |

|

|

— |

|

|

|

69,914 |

|

|

|

1,324 |

|

|

|

10,402 |

|

|

|

81,640 |

|

|

|

(81,640 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

937,687 |

|

|

|

3,504,526 |

|

|

|

939,399 |

|

|

|

104,886 |

|

|

|

5,486,498 |

|

|

|

(81,640 |

) |

|

|

5,404,858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment profit (loss) |

|

|

177,648 |

|

|

|

222,840 |

|

|

|

84,970 |

|

|

|

(753 |

) |

|

|

484,705 |

|

|

|

— |

|

|

|

484,705 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment assets |

|

|

2,195,414 |

|

|

|

12,201,278 |

|

|

|

15,257,512 |

|

|

|

607,911 |

|

|

|

30,262,115 |

|

|

|

1,049,857 |

|

|

|

31,311,972 |

|

| Depreciation and amortization |

|

|

18,293 |

|

|

|

164,236 |

|

|

|

218,208 |

|

|

|

4,218 |

|

|

|

404,955 |

|

|

|

— |

|

|

|

404,955 |

|

| Capital expenditures |

|

|

12,785 |

|

|

|

146,761 |

|

|

|

776,953 |

|

|

|

2,147 |

|

|

|

938,646 |

|

|

|

— |

|

|

|

938,646 |

|

Explanatory notes:

| 1. |

Intersegment sales revenues are generally made at values that approximate

arm’s-length prices. |

| 2. |

Reconciling items include elimination of intersegment transactions and balances as well as unallocated corporate

assets. Unallocated corporate assets, included in reconciling items as of June 30, 2023 and 2024 amounted to JPY 1,276,238 million and JPY 1,330,698 million, respectively, which consist primarily of the Company’s cash and cash

equivalents and financial assets measured at fair value through other comprehensive income. |

[B] Other

Loss related to airbag inflators

Honda has been

conducting market-based measures in relation to airbag inflators. Honda recognizes a provision for specific warranty costs when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and a

reliable estimate can be made of the amount of the obligation. There is a possibility that Honda will need to recognize additional provisions when new evidence related to the product recalls arise, however, it is not possible for Honda to reasonably

estimate the amount and timing of potential future losses as of the date of this report.

—9—

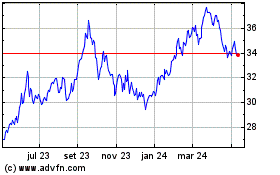

Honda Motor (NYSE:HMC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

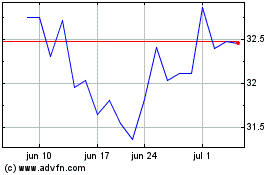

Honda Motor (NYSE:HMC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025