0000031235

EASTMAN KODAK CO

false

--12-31

Q2

2024

7

8

473

470

0

0

100

100

0.01

0.01

63

1

1

0

1

3

6

1

100

0.5

1

10

1

1

1

21.0

21.0

1.2

3.1

1.1

4.1

0

1.0

1.0

3

5

4

0

0

0

false

false

false

false

In the first quarter of 2024, Kodak sold certain assets in the U.S. and recognized a gain of $17 million.

The first quarter of 2023 includes $9 million of interest income associated with a refund received from a governmental authority in a location outside the U.S. that was previously held by the governmental authority to guarantee tax disputes in that jurisdiction.

Reclassified to Total Net Periodic Benefit Cost - refer to Note 12, "Retirement Plans and Other Postretirement Benefits".

There are 60 million shares of no-par value preferred stock authorized, 2.1 million of which are issued and outstanding at December 31, 2022. 2.0 million shares of preferred stock were issued and outstanding at December 31, 2021 and 2020.

Refer to Note 2, “Cash, Cash Equivalents and Restricted Cash” for the components of cash, cash equivalents and restricted cash.

Core includes the Print segment and the Motion Picture and Industrial Film and Chemicals businesses within the Advanced Materials and Chemicals segment, excluding coating and product commercialization services ("Coating Services").

Growth consists of Coating Services and Advanced Materials and Functional Printing within the Advanced Materials and Chemicals segment.

Consulting and other costs are primarily professional services and internal costs associated with certain corporate strategic initiatives, investigations and litigation. Consulting and other costs in the three months ended March 31, 2023 included $10 million of income in representing insurance reimbursement of legal costs previously paid by the Company associated with investigations and litigation matters.

The special termination benefits were incurred as a result of Kodak’s restructuring actions and have been included in Restructuring costs and other in the Consolidated Statement of Operations for that period.

As reported in the Consolidated Statement of Operations.

Other consists of Intellectual Property Licensing ("IP Licensing"), Brand Licensing and Eastman Business Park.

Sales are reported in the geographic area in which they originate.

Variable lease income primarily represents operating costs under real estate leases and incremental variable income based on usage under equipment leases.

There are 60 million shares of no-par value preferred stock authorized, 2.1 million of which are issued and outstanding at December 31, 2023 and 2022. 2.0 million shares of preferred stock were issued and outstanding at December 31, 2021.

00000312352024-01-012024-06-30

xbrli:shares

00000312352024-08-01

iso4217:USD

0000031235us-gaap:ProductMember2024-04-012024-06-30

0000031235us-gaap:ProductMember2023-04-012023-06-30

0000031235us-gaap:ProductMember2024-01-012024-06-30

0000031235us-gaap:ProductMember2023-01-012023-06-30

0000031235us-gaap:ServiceMember2024-04-012024-06-30

0000031235us-gaap:ServiceMember2023-04-012023-06-30

0000031235us-gaap:ServiceMember2024-01-012024-06-30

0000031235us-gaap:ServiceMember2023-01-012023-06-30

00000312352024-04-012024-06-30

00000312352023-04-012023-06-30

00000312352023-01-012023-06-30

iso4217:USDxbrli:shares

00000312352024-06-30

00000312352023-12-31

0000031235us-gaap:RedeemablePreferredStockMember2024-06-30

0000031235us-gaap:RedeemablePreferredStockMember2023-12-31

0000031235kodk:AmendedAndRestatedTermLoanAgreementMember2024-01-012024-06-30

0000031235kodk:AmendedAndRestatedTermLoanAgreementMember2023-01-012023-06-30

00000312352022-12-31

00000312352023-06-30

0000031235us-gaap:CommonStockMember2023-12-31

0000031235us-gaap:AdditionalPaidInCapitalMember2023-12-31

0000031235us-gaap:RetainedEarningsMember2023-12-31

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

0000031235us-gaap:TreasuryStockCommonMember2023-12-31

0000031235us-gaap:PreferredStockMember2023-12-31

0000031235us-gaap:CommonStockMember2024-01-012024-03-31

0000031235us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-31

0000031235us-gaap:RetainedEarningsMember2024-01-012024-03-31

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-31

0000031235us-gaap:TreasuryStockCommonMember2024-01-012024-03-31

00000312352024-01-012024-03-31

0000031235us-gaap:PreferredStockMember2024-01-012024-03-31

0000031235us-gaap:CommonStockMember2024-03-31

0000031235us-gaap:AdditionalPaidInCapitalMember2024-03-31

0000031235us-gaap:RetainedEarningsMember2024-03-31

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-31

0000031235us-gaap:TreasuryStockCommonMember2024-03-31

00000312352024-03-31

0000031235us-gaap:PreferredStockMember2024-03-31

0000031235us-gaap:CommonStockMember2024-04-012024-06-30

0000031235us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-30

0000031235us-gaap:RetainedEarningsMember2024-04-012024-06-30

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-30

0000031235us-gaap:TreasuryStockCommonMember2024-04-012024-06-30

0000031235us-gaap:PreferredStockMember2024-04-012024-06-30

0000031235us-gaap:CommonStockMember2024-06-30

0000031235us-gaap:AdditionalPaidInCapitalMember2024-06-30

0000031235us-gaap:RetainedEarningsMember2024-06-30

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-30

0000031235us-gaap:TreasuryStockCommonMember2024-06-30

0000031235us-gaap:PreferredStockMember2024-06-30

0000031235us-gaap:CommonStockMember2022-12-31

0000031235us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000031235us-gaap:RetainedEarningsMember2022-12-31

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0000031235us-gaap:TreasuryStockCommonMember2022-12-31

0000031235us-gaap:PreferredStockMember2022-12-31

0000031235us-gaap:CommonStockMember2023-01-012023-03-31

0000031235us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000031235us-gaap:RetainedEarningsMember2023-01-012023-03-31

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0000031235us-gaap:TreasuryStockCommonMember2023-01-012023-03-31

00000312352023-01-012023-03-31

0000031235us-gaap:PreferredStockMember2023-01-012023-03-31

0000031235us-gaap:CommonStockMember2023-03-31

0000031235us-gaap:AdditionalPaidInCapitalMember2023-03-31

0000031235us-gaap:RetainedEarningsMember2023-03-31

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

0000031235us-gaap:TreasuryStockCommonMember2023-03-31

00000312352023-03-31

0000031235us-gaap:PreferredStockMember2023-03-31

0000031235us-gaap:CommonStockMember2023-04-012023-06-30

0000031235us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0000031235us-gaap:RetainedEarningsMember2023-04-012023-06-30

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0000031235us-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0000031235us-gaap:PreferredStockMember2023-04-012023-06-30

0000031235us-gaap:CommonStockMember2023-06-30

0000031235us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000031235us-gaap:RetainedEarningsMember2023-06-30

0000031235us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0000031235us-gaap:TreasuryStockCommonMember2023-06-30

0000031235us-gaap:PreferredStockMember2023-06-30

0000031235kodk:LuckyHuaGuangGraphicsCoLtdMembercountry:CN2024-06-30

0000031235kodk:LuckyHuaGuangGraphicsCoLtdMembercountry:CN2023-12-31

0000031235kodk:CashCollateralizedLetterOfCreditFacilityMember2024-06-30

0000031235kodk:CashCollateralizedLetterOfCreditFacilityMember2023-12-31

0000031235kodk:CashCollateralizedForWorkersCompensationObligationsMember2023-12-31

0000031235kodk:CashCollateralizedForWorkersCompensationObligationsMember2024-06-30

0000031235country:BR2024-06-30

0000031235country:BR2023-12-31

0000031235country:GB2023-12-31

0000031235us-gaap:SeriesBPreferredStockMember2024-06-30

0000031235us-gaap:SeriesBPreferredStockMember2023-12-31

0000031235us-gaap:SeriesCPreferredStockMember2024-06-30

0000031235us-gaap:SeriesCPreferredStockMember2023-12-31

0000031235us-gaap:SeriesAPreferredStockMemberkodk:RepurchaseAndExchangeAgreementMember2021-02-262021-02-26

xbrli:pure

0000031235us-gaap:SeriesBPreferredStockMemberkodk:RepurchaseAndExchangeAgreementMember2021-02-262021-02-26

0000031235us-gaap:SeriesBPreferredStockMember2021-02-26

0000031235us-gaap:SeriesBPreferredStockMember2021-02-262021-02-26

0000031235us-gaap:SeriesBPreferredStockMemberkodk:PurchaseAgreementMember2021-02-26

0000031235us-gaap:SeriesBPreferredStockMember2024-01-012024-06-30

utr:D

0000031235srt:MinimumMemberus-gaap:SeriesBPreferredStockMember2024-01-012024-06-30

0000031235srt:MaximumMemberus-gaap:SeriesBPreferredStockMember2024-01-012024-06-30

0000031235us-gaap:SeriesCPreferredStockMemberkodk:PurchaseAgreementMember2021-02-262021-02-26

0000031235us-gaap:SeriesCPreferredStockMemberkodk:PurchaseAgreementMember2021-02-26

0000031235us-gaap:SeriesCPreferredStockMemberkodk:DividendAndOtherRightsMember2021-02-262021-02-26

0000031235kodk:AfterFebruaryTwentySixTwoThousandTwentyFourMemberus-gaap:SeriesCPreferredStockMember2024-02-262024-02-26

0000031235srt:MinimumMemberus-gaap:SeriesCPreferredStockMember2024-01-012024-06-30

0000031235srt:MaximumMemberus-gaap:SeriesCPreferredStockMember2024-01-012024-06-30

0000031235us-gaap:SeriesCPreferredStockMember2021-02-26

0000031235us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:SeriesCPreferredStockMember2023-12-31

0000031235us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:SeriesCPreferredStockMember2024-06-30

0000031235kodk:LCFacilityAgreementMember2024-06-30

0000031235kodk:BankGuaranteesAndLettersOfCreditMember2024-06-30

0000031235us-gaap:SuretyBondMember2024-06-30

0000031235kodk:FederalAndStateValueAddedTaxesLitigationsAndCivilLitigationAndDisputesWithFormerEmployeesMembercountry:BR2024-06-30

0000031235kodk:FederalAndStateValueAddedTaxesLitigationsAndCivilLitigationAndDisputesWithFormerEmployeesMembercountry:BR2024-01-012024-06-30

0000031235us-gaap:ThreatOfExpropriationOfAssetsMembercountry:BR2024-06-30

0000031235kodk:USInternationalDevelopmentFinanceCorporationMember2020-07-28

utr:acre

0000031235srt:MinimumMemberkodk:EastmanBusinessParkRochesterNYMember2024-06-30

0000031235srt:MinimumMember2024-06-30

0000031235srt:MaximumMember2024-06-30

utr:Y

0000031235kodk:WarrantyArrangementPeriodMember2024-01-012024-06-30

utr:M

0000031235srt:MinimumMember2024-01-012024-06-30

0000031235srt:MaximumMember2024-01-012024-06-30

0000031235kodk:ExtendedWarrantyArrangementsMember2023-12-31

0000031235kodk:ExtendedWarrantyArrangementsMember2024-01-012024-06-30

0000031235kodk:ExtendedWarrantyArrangementsMember2024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:PrintMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:BrandMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:AllOtherMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:PrintMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:BrandMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:AllOtherMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:PrintMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:BrandMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:AllOtherMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:PrintMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:BrandMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:AllOtherMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:PrintMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:BrandMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:AllOtherMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:PrintMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:BrandMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:AllOtherMember2024-04-012024-06-30

0000031235us-gaap:CoreMember2024-04-012024-06-30

0000031235kodk:GrowthProductsMemberkodk:PrintMember2024-04-012024-06-30

0000031235kodk:GrowthProductsMemberkodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235kodk:GrowthProductsMemberkodk:BrandMember2024-04-012024-06-30

0000031235kodk:GrowthProductsMemberkodk:AllOtherMember2024-04-012024-06-30

0000031235kodk:GrowthProductsMember2024-04-012024-06-30

0000031235kodk:OtherMemberkodk:PrintMember2024-04-012024-06-30

0000031235kodk:OtherMemberkodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235kodk:OtherMemberkodk:BrandMember2024-04-012024-06-30

0000031235kodk:OtherMemberkodk:AllOtherMember2024-04-012024-06-30

0000031235kodk:OtherMember2024-04-012024-06-30

0000031235kodk:PrintMember2024-04-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMember2024-04-012024-06-30

0000031235kodk:BrandMember2024-04-012024-06-30

0000031235kodk:AllOtherMember2024-04-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:PrintMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:BrandMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:AllOtherMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:PrintMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:BrandMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:AllOtherMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:PrintMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:BrandMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:AllOtherMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:PrintMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:BrandMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:AllOtherMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:PrintMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:BrandMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:AllOtherMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:PrintMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:BrandMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:AllOtherMember2024-01-012024-06-30

0000031235us-gaap:CoreMember2024-01-012024-06-30

0000031235kodk:GrowthProductsMemberkodk:PrintMember2024-01-012024-06-30

0000031235kodk:GrowthProductsMemberkodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235kodk:GrowthProductsMemberkodk:BrandMember2024-01-012024-06-30

0000031235kodk:GrowthProductsMemberkodk:AllOtherMember2024-01-012024-06-30

0000031235kodk:GrowthProductsMember2024-01-012024-06-30

0000031235kodk:OtherMemberkodk:PrintMember2024-01-012024-06-30

0000031235kodk:OtherMemberkodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235kodk:OtherMemberkodk:BrandMember2024-01-012024-06-30

0000031235kodk:OtherMemberkodk:AllOtherMember2024-01-012024-06-30

0000031235kodk:OtherMember2024-01-012024-06-30

0000031235kodk:PrintMember2024-01-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMember2024-01-012024-06-30

0000031235kodk:BrandMember2024-01-012024-06-30

0000031235kodk:AllOtherMember2024-01-012024-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:PrintMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:BrandMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:AllOtherMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:PrintMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:BrandMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:AllOtherMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:PrintMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:BrandMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:AllOtherMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:PrintMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:BrandMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:AllOtherMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:PrintMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:BrandMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:AllOtherMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:PrintMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:BrandMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:AllOtherMember2023-04-012023-06-30

0000031235us-gaap:CoreMember2023-04-012023-06-30

0000031235kodk:GrowthProductsMemberkodk:PrintMember2023-04-012023-06-30

0000031235kodk:GrowthProductsMemberkodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235kodk:GrowthProductsMemberkodk:BrandMember2023-04-012023-06-30

0000031235kodk:GrowthProductsMemberkodk:AllOtherMember2023-04-012023-06-30

0000031235kodk:GrowthProductsMember2023-04-012023-06-30

0000031235kodk:OtherMemberkodk:PrintMember2023-04-012023-06-30

0000031235kodk:OtherMemberkodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235kodk:OtherMemberkodk:BrandMember2023-04-012023-06-30

0000031235kodk:OtherMemberkodk:AllOtherMember2023-04-012023-06-30

0000031235kodk:OtherMember2023-04-012023-06-30

0000031235kodk:PrintMember2023-04-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMember2023-04-012023-06-30

0000031235kodk:BrandMember2023-04-012023-06-30

0000031235kodk:AllOtherMember2023-04-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:PrintMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:BrandMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMemberkodk:AllOtherMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:PlatesInksAndOtherConsumablesMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:PrintMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:BrandMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMemberkodk:AllOtherMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:OngoingServiceArrangementsMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:PrintMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:BrandMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMemberkodk:AllOtherMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:AnnuitiesMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:PrintMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:BrandMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMemberkodk:AllOtherMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:EquipmentAndSoftwareMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:PrintMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:BrandMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMemberkodk:AllOtherMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:FilmAndChemicalsMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:PrintMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:BrandMember2023-01-012023-06-30

0000031235us-gaap:CoreMemberkodk:AllOtherMember2023-01-012023-06-30

0000031235us-gaap:CoreMember2023-01-012023-06-30

0000031235kodk:GrowthProductsMemberkodk:PrintMember2023-01-012023-06-30

0000031235kodk:GrowthProductsMemberkodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235kodk:GrowthProductsMemberkodk:BrandMember2023-01-012023-06-30

0000031235kodk:GrowthProductsMemberkodk:AllOtherMember2023-01-012023-06-30

0000031235kodk:GrowthProductsMember2023-01-012023-06-30

0000031235kodk:OtherMemberkodk:PrintMember2023-01-012023-06-30

0000031235kodk:OtherMemberkodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235kodk:OtherMemberkodk:BrandMember2023-01-012023-06-30

0000031235kodk:OtherMemberkodk:AllOtherMember2023-01-012023-06-30

0000031235kodk:OtherMember2023-01-012023-06-30

0000031235kodk:PrintMember2023-01-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMember2023-01-012023-06-30

0000031235kodk:BrandMember2023-01-012023-06-30

0000031235kodk:AllOtherMember2023-01-012023-06-30

0000031235kodk:PrintMembercountry:US2024-04-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembercountry:US2024-04-012024-06-30

0000031235kodk:BrandMembercountry:US2024-04-012024-06-30

0000031235kodk:AllOtherMembercountry:US2024-04-012024-06-30

0000031235country:US2024-04-012024-06-30

0000031235kodk:PrintMembercountry:CA2024-04-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembercountry:CA2024-04-012024-06-30

0000031235kodk:BrandMembercountry:CA2024-04-012024-06-30

0000031235kodk:AllOtherMembercountry:CA2024-04-012024-06-30

0000031235country:CA2024-04-012024-06-30

0000031235kodk:PrintMembersrt:NorthAmericaMember2024-04-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:NorthAmericaMember2024-04-012024-06-30

0000031235kodk:BrandMembersrt:NorthAmericaMember2024-04-012024-06-30

0000031235kodk:AllOtherMembersrt:NorthAmericaMember2024-04-012024-06-30

0000031235srt:NorthAmericaMember2024-04-012024-06-30

0000031235kodk:PrintMemberus-gaap:EMEAMember2024-04-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMemberus-gaap:EMEAMember2024-04-012024-06-30

0000031235kodk:BrandMemberus-gaap:EMEAMember2024-04-012024-06-30

0000031235kodk:AllOtherMemberus-gaap:EMEAMember2024-04-012024-06-30

0000031235us-gaap:EMEAMember2024-04-012024-06-30

0000031235kodk:PrintMembersrt:AsiaPacificMember2024-04-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:AsiaPacificMember2024-04-012024-06-30

0000031235kodk:BrandMembersrt:AsiaPacificMember2024-04-012024-06-30

0000031235kodk:AllOtherMembersrt:AsiaPacificMember2024-04-012024-06-30

0000031235srt:AsiaPacificMember2024-04-012024-06-30

0000031235kodk:PrintMembersrt:LatinAmericaMember2024-04-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:LatinAmericaMember2024-04-012024-06-30

0000031235kodk:BrandMembersrt:LatinAmericaMember2024-04-012024-06-30

0000031235kodk:AllOtherMembersrt:LatinAmericaMember2024-04-012024-06-30

0000031235srt:LatinAmericaMember2024-04-012024-06-30

0000031235kodk:PrintMembercountry:US2024-01-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembercountry:US2024-01-012024-06-30

0000031235kodk:BrandMembercountry:US2024-01-012024-06-30

0000031235kodk:AllOtherMembercountry:US2024-01-012024-06-30

0000031235country:US2024-01-012024-06-30

0000031235kodk:PrintMembercountry:CA2024-01-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembercountry:CA2024-01-012024-06-30

0000031235kodk:BrandMembercountry:CA2024-01-012024-06-30

0000031235kodk:AllOtherMembercountry:CA2024-01-012024-06-30

0000031235country:CA2024-01-012024-06-30

0000031235kodk:PrintMembersrt:NorthAmericaMember2024-01-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:NorthAmericaMember2024-01-012024-06-30

0000031235kodk:BrandMembersrt:NorthAmericaMember2024-01-012024-06-30

0000031235kodk:AllOtherMembersrt:NorthAmericaMember2024-01-012024-06-30

0000031235srt:NorthAmericaMember2024-01-012024-06-30

0000031235kodk:PrintMemberus-gaap:EMEAMember2024-01-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMemberus-gaap:EMEAMember2024-01-012024-06-30

0000031235kodk:BrandMemberus-gaap:EMEAMember2024-01-012024-06-30

0000031235kodk:AllOtherMemberus-gaap:EMEAMember2024-01-012024-06-30

0000031235us-gaap:EMEAMember2024-01-012024-06-30

0000031235kodk:PrintMembersrt:AsiaPacificMember2024-01-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:AsiaPacificMember2024-01-012024-06-30

0000031235kodk:BrandMembersrt:AsiaPacificMember2024-01-012024-06-30

0000031235kodk:AllOtherMembersrt:AsiaPacificMember2024-01-012024-06-30

0000031235srt:AsiaPacificMember2024-01-012024-06-30

0000031235kodk:PrintMembersrt:LatinAmericaMember2024-01-012024-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:LatinAmericaMember2024-01-012024-06-30

0000031235kodk:BrandMembersrt:LatinAmericaMember2024-01-012024-06-30

0000031235kodk:AllOtherMembersrt:LatinAmericaMember2024-01-012024-06-30

0000031235srt:LatinAmericaMember2024-01-012024-06-30

0000031235kodk:PrintMembercountry:US2023-04-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembercountry:US2023-04-012023-06-30

0000031235kodk:BrandMembercountry:US2023-04-012023-06-30

0000031235kodk:AllOtherMembercountry:US2023-04-012023-06-30

0000031235country:US2023-04-012023-06-30

0000031235kodk:PrintMembercountry:CA2023-04-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembercountry:CA2023-04-012023-06-30

0000031235kodk:BrandMembercountry:CA2023-04-012023-06-30

0000031235kodk:AllOtherMembercountry:CA2023-04-012023-06-30

0000031235country:CA2023-04-012023-06-30

0000031235kodk:PrintMembersrt:NorthAmericaMember2023-04-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:NorthAmericaMember2023-04-012023-06-30

0000031235kodk:BrandMembersrt:NorthAmericaMember2023-04-012023-06-30

0000031235kodk:AllOtherMembersrt:NorthAmericaMember2023-04-012023-06-30

0000031235srt:NorthAmericaMember2023-04-012023-06-30

0000031235kodk:PrintMemberus-gaap:EMEAMember2023-04-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMemberus-gaap:EMEAMember2023-04-012023-06-30

0000031235kodk:BrandMemberus-gaap:EMEAMember2023-04-012023-06-30

0000031235kodk:AllOtherMemberus-gaap:EMEAMember2023-04-012023-06-30

0000031235us-gaap:EMEAMember2023-04-012023-06-30

0000031235kodk:PrintMembersrt:AsiaPacificMember2023-04-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:AsiaPacificMember2023-04-012023-06-30

0000031235kodk:BrandMembersrt:AsiaPacificMember2023-04-012023-06-30

0000031235kodk:AllOtherMembersrt:AsiaPacificMember2023-04-012023-06-30

0000031235srt:AsiaPacificMember2023-04-012023-06-30

0000031235kodk:PrintMembersrt:LatinAmericaMember2023-04-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:LatinAmericaMember2023-04-012023-06-30

0000031235kodk:BrandMembersrt:LatinAmericaMember2023-04-012023-06-30

0000031235kodk:AllOtherMembersrt:LatinAmericaMember2023-04-012023-06-30

0000031235srt:LatinAmericaMember2023-04-012023-06-30

0000031235kodk:PrintMembercountry:US2023-01-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembercountry:US2023-01-012023-06-30

0000031235kodk:BrandMembercountry:US2023-01-012023-06-30

0000031235kodk:AllOtherMembercountry:US2023-01-012023-06-30

0000031235country:US2023-01-012023-06-30

0000031235kodk:PrintMembercountry:CA2023-01-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembercountry:CA2023-01-012023-06-30

0000031235kodk:BrandMembercountry:CA2023-01-012023-06-30

0000031235kodk:AllOtherMembercountry:CA2023-01-012023-06-30

0000031235country:CA2023-01-012023-06-30

0000031235kodk:PrintMembersrt:NorthAmericaMember2023-01-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:NorthAmericaMember2023-01-012023-06-30

0000031235kodk:BrandMembersrt:NorthAmericaMember2023-01-012023-06-30

0000031235kodk:AllOtherMembersrt:NorthAmericaMember2023-01-012023-06-30

0000031235srt:NorthAmericaMember2023-01-012023-06-30

0000031235kodk:PrintMemberus-gaap:EMEAMember2023-01-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMemberus-gaap:EMEAMember2023-01-012023-06-30

0000031235kodk:BrandMemberus-gaap:EMEAMember2023-01-012023-06-30

0000031235kodk:AllOtherMemberus-gaap:EMEAMember2023-01-012023-06-30

0000031235us-gaap:EMEAMember2023-01-012023-06-30

0000031235kodk:PrintMembersrt:AsiaPacificMember2023-01-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:AsiaPacificMember2023-01-012023-06-30

0000031235kodk:BrandMembersrt:AsiaPacificMember2023-01-012023-06-30

0000031235kodk:AllOtherMembersrt:AsiaPacificMember2023-01-012023-06-30

0000031235srt:AsiaPacificMember2023-01-012023-06-30

0000031235kodk:PrintMembersrt:LatinAmericaMember2023-01-012023-06-30

0000031235kodk:AdvancedMaterialsAndChemicalsMembersrt:LatinAmericaMember2023-01-012023-06-30

0000031235kodk:BrandMembersrt:LatinAmericaMember2023-01-012023-06-30

0000031235kodk:AllOtherMembersrt:LatinAmericaMember2023-01-012023-06-30

0000031235srt:LatinAmericaMember2023-01-012023-06-30

0000031235us-gaap:OtherCurrentAssetsMember2024-06-30

0000031235us-gaap:OtherCurrentAssetsMember2023-12-31

0000031235us-gaap:OtherCurrentLiabilitiesMember2024-06-30

0000031235us-gaap:OtherCurrentLiabilitiesMember2023-12-31

0000031235us-gaap:OtherNoncurrentLiabilitiesMember2024-06-30

0000031235us-gaap:OtherNoncurrentLiabilitiesMember2023-12-31

00000312352024-07-012024-06-30

00000312352025-01-012024-06-30

00000312352026-01-012024-06-30

00000312352027-01-012024-06-30

00000312352028-01-012024-06-30

0000031235us-gaap:ForeignCountryMember2023-01-012023-03-31

0000031235us-gaap:SeriesCPreferredStockMember2024-04-012024-06-30

0000031235us-gaap:SeriesCPreferredStockMember2023-04-012023-06-30

0000031235us-gaap:SeriesCPreferredStockMember2024-01-012024-06-30

0000031235us-gaap:SeriesCPreferredStockMember2023-01-012023-06-30

0000031235us-gaap:RestrictedStockUnitsRSUMember2024-04-012024-06-30

0000031235us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-30

0000031235us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-30

0000031235us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-30

0000031235us-gaap:EmployeeStockOptionMember2024-04-012024-06-30

0000031235us-gaap:EmployeeStockOptionMember2023-04-012023-06-30

0000031235us-gaap:EmployeeStockOptionMember2024-01-012024-06-30

0000031235us-gaap:EmployeeStockOptionMember2023-01-012023-06-30

0000031235us-gaap:EmployeeStockOptionMember2024-01-012024-06-30

0000031235us-gaap:EmployeeStockOptionMember2024-04-012024-06-30

0000031235us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-30

0000031235us-gaap:EmployeeStockOptionMember2023-01-012023-06-30

0000031235us-gaap:EmployeeStockOptionMember2023-04-012023-06-30

0000031235us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:AdvancedMaterialsAndChemicalsMemberus-gaap:SegmentContinuingOperationsMember2024-04-012024-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:AdvancedMaterialsAndChemicalsMemberus-gaap:SegmentContinuingOperationsMember2023-04-012023-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:AdvancedMaterialsAndChemicalsMemberus-gaap:SegmentContinuingOperationsMember2024-01-012024-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:AdvancedMaterialsAndChemicalsMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:BrandMemberus-gaap:SegmentContinuingOperationsMember2024-04-012024-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:BrandMemberus-gaap:SegmentContinuingOperationsMember2023-04-012023-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:BrandMemberus-gaap:SegmentContinuingOperationsMember2024-01-012024-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:BrandMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-06-30

0000031235us-gaap:SegmentContinuingOperationsMember2024-04-012024-06-30

0000031235us-gaap:SegmentContinuingOperationsMember2023-04-012023-06-30

0000031235us-gaap:SegmentContinuingOperationsMember2024-01-012024-06-30

0000031235us-gaap:SegmentContinuingOperationsMember2023-01-012023-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:PrintMemberus-gaap:SegmentContinuingOperationsMember2024-04-012024-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:PrintMemberus-gaap:SegmentContinuingOperationsMember2023-04-012023-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:PrintMemberus-gaap:SegmentContinuingOperationsMember2024-01-012024-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:PrintMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:BrandMemberus-gaap:SegmentContinuingOperationsMember2024-04-012024-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:BrandMemberus-gaap:SegmentContinuingOperationsMember2023-04-012023-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:BrandMemberus-gaap:SegmentContinuingOperationsMember2024-01-012024-06-30

0000031235us-gaap:OperatingSegmentsMemberkodk:BrandMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-06-30

0000031235kodk:AllOtherMemberus-gaap:SegmentContinuingOperationsMember2024-04-012024-06-30

0000031235kodk:AllOtherMemberus-gaap:SegmentContinuingOperationsMember2023-04-012023-06-30

0000031235kodk:AllOtherMemberus-gaap:SegmentContinuingOperationsMember2024-01-012024-06-30

0000031235kodk:AllOtherMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-06-30

0000031235kodk:GrossProfitMember2024-01-012024-06-30

0000031235kodk:GrossProfitMember2024-04-012024-06-30

0000031235us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2024-06-30

0000031235us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-12-31

0000031235us-gaap:ForwardContractsMember2024-06-30

0000031235us-gaap:ForwardContractsMember2023-12-31

0000031235us-gaap:FairValueInputsLevel2Member2024-06-30

0000031235us-gaap:FairValueInputsLevel2Member2023-12-31

thunderdome:item

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| For the quarterly period ended: | June 30, 2024 |

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

| Commission File Number |

| 1-00087 |

| EASTMAN KODAK COMPANY |

| (Exact name of registrant as specified in its charter) |

| | |

| New Jersey | 16-0417150 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| | |

| 343 STATE STREET, ROCHESTER, New York | 14650 |

| (Address of principal executive offices) | (Zip Code) |

| (800) 356-3259 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

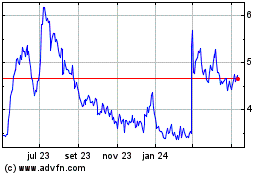

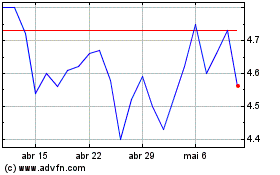

| Title of each class Common | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | KODK | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | ☐ | | Accelerated filer | ☒ | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | ☐ | |

| Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 1, 2024, the registrant had 80.3 million shares of common stock, par value $0.01 per share, outstanding.

EASTMAN KODAK COMPANY

Form 10-Q

June 30, 2024

Table of Contents

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

EASTMAN KODAK COMPANY

CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited)

(in millions, except per share data)

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30, | | | June 30, | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| Revenues | | | | | | | | | | | | | | | | |

| Sales | | $ | 227 | | | $ | 242 | | | $ | 433 | | | $ | 468 | |

| Services | | | 40 | | | | 53 | | | | 83 | | | | 105 | |

| Total revenues | | | 267 | | | | 295 | | | | 516 | | | | 573 | |

| Cost of revenues | | | | | | | | | | | | | | | | |

| Sales | | | 181 | | | | 195 | | | | 349 | | | | 388 | |

| Services | | | 28 | | | | 37 | | | | 60 | | | | 72 | |

| Total cost of revenues | | | 209 | | | | 232 | | | | 409 | | | | 460 | |

| Gross profit | | | 58 | | | | 63 | | | | 107 | | | | 113 | |

| Selling, general and administrative expenses | | | 47 | | | | 40 | | | | 92 | | | | 74 | |

| Research and development costs | | | 8 | | | | 9 | | | | 17 | | | | 18 | |

| Restructuring costs and other | | | — | | | | 5 | | | | 5 | | | | 6 | |

| Other operating expense (income), net | | | 1 | | | | (1 | ) | | | (16 | ) | | | — | |

| Earnings from operations before interest expense, pension income excluding service cost component, other expense (income), net and income taxes | | | 2 | | | | 10 | | | | 9 | | | | 15 | |

| Interest expense | | | 15 | | | | 11 | | | | 30 | | | | 22 | |

| Pension income excluding service cost component | | | (41 | ) | | | (41 | ) | | | (82 | ) | | | (81 | ) |

| Other expense (income), net | | | 1 | | | | 3 | | | | (1 | ) | | | (4 | ) |

| Earnings from operations before income taxes | | | 27 | | | | 37 | | | | 62 | | | | 78 | |

| Provision for income taxes | | | 1 | | | | 2 | | | | 4 | | | | 10 | |

| NET EARNINGS | | $ | 26 | | | $ | 35 | | | $ | 58 | | | $ | 68 | |

| | | | | | | | | | | | | | | | | |

| Basic net earnings per share attributable to Eastman Kodak Company common shareholders | | $ | 0.25 | | | $ | 0.35 | | | $ | 0.56 | | | $ | 0.68 | |

| Diluted net earnings per share attributable to Eastman Kodak Company common shareholders | | $ | 0.23 | | | $ | 0.32 | | | $ | 0.52 | | | $ | 0.63 | |

| | | | | | | | | | | | | | | | | |

| Number of common shares used in basic and diluted net earnings per share | | | | | | | | | | | | | | | | |

| Basic | | | 80.1 | | | | 79.4 | | | | 79.9 | | | | 79.3 | |

| Diluted | | | 92.4 | | | | 93.0 | | | | 91.9 | | | | 92.7 | |

The accompanying notes are an integral part of these consolidated financial statements.

EASTMAN KODAK COMPANY

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

(in millions)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| NET EARNINGS |

|

$ |

26 |

|

|

$ |

35 |

|

|

$ |

58 |

|

|

$ |

68 |

|

| Other comprehensive loss, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Currency translation adjustments |

|

|

(6 |

) |

|

|

(11 |

) |

|

|

(12 |

) |

|

|

(12 |

) |

| Pension and other postretirement benefit plan obligation activity, net of tax |

|

|

(7 |

) |

|

|

(123 |

) |

|

|

(13 |

) |

|

|

(129 |

) |

| Other comprehensive loss, net of tax |

|

|

(13 |

) |

|

|

(134 |

) |

|

|

(25 |

) |

|

|

(141 |

) |

| COMPREHENSIVE INCOME (LOSS), NET OF TAX |

|

$ |

13 |

|

|

$ |

(99 |

) |

|

$ |

33 |

|

|

$ |

(73 |

) |

The accompanying notes are an integral part of these consolidated financial statements.

EASTMAN KODAK COMPANY

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (Unaudited)

| | | June 30, | | | December 31, | |

| (in millions) | | 2024 | | | 2023 | |

| ASSETS | | | | | | | | |

| Cash and cash equivalents | | $ | 251 | | | $ | 255 | |

| Trade receivables, net of allowances of $7 and $8, respectively | | | 139 | | | | 195 | |

| Inventories, net | | | 232 | | | | 217 | |

| Other current assets | | | 38 | | | | 45 | |

| Total current assets | | | 660 | | | | 712 | |

| Property, plant and equipment, net of accumulated depreciation of $473 and $470, respectively | | | 177 | | | | 169 | |

| Goodwill | | | 12 | | | | 12 | |

| Intangible assets, net | | | 22 | | | | 24 | |

| Operating lease right-of-use assets | | | 29 | | | | 30 | |

| Restricted cash | | | 100 | | | | 110 | |

| Pension and other postretirement assets | | | 1,279 | | | | 1,216 | |

| Other long-term assets | | | 80 | | | | 82 | |

| TOTAL ASSETS | | $ | 2,359 | | | $ | 2,355 | |

| | | | | | | | | |

| LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND EQUITY | | | | | | | | |

| Accounts payable, trade | | $ | 128 | | | $ | 125 | |

| Short-term borrowings and current portion of long-term debt | | | 1 | | | | 1 | |

| Current portion of operating leases | | | 10 | | | | 13 | |

| Other current liabilities | | | 139 | | | | 144 | |

| Total current liabilities | | | 278 | | | | 283 | |

| Long-term debt, net of current portion | | | 453 | | | | 457 | |

| Pension and other postretirement liabilities | | | 224 | | | | 237 | |

| Operating leases, net of current portion | | | 25 | | | | 24 | |

| Other long-term liabilities | | | 204 | | | | 213 | |

| Total liabilities | | | 1,184 | | | | 1,214 | |

| | | | | | | | | |

| Commitments and Contingencies (Note 6) | | | | | | | | |

| | | | | | | | | |

| Redeemable, convertible preferred stock, no par value, $100 per share liquidation preference | | | 214 | | | | 210 | |

| | | | | | | | | |

| Equity (Deficit) | | | | | | | | |

| Common stock, $0.01 par value | | | — | | | | — | |

| Additional paid in capital | | | 1,154 | | | | 1,156 | |

| Treasury stock, at cost | | | (12 | ) | | | (11 | ) |

| Accumulated deficit | | | (437 | ) | | | (495 | ) |

| Accumulated other comprehensive income | | | 256 | | | | 281 | |

| Total shareholders’ equity | | | 961 | | | | 931 | |

| TOTAL LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND EQUITY | | $ | 2,359 | | | $ | 2,355 | |

The accompanying notes are an integral part of these consolidated financial statements.

EASTMAN KODAK COMPANY

CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

| |

|

Six Months Ended |

|

| |

|

June 30, |

|

| (in millions) |

|

2024 |

|

|

2023 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

58 |

|

|

$ |

68 |

|

| Adjustments to reconcile to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

13 |

|

|

|

16 |

|

| Pension and postretirement income |

|

|

(73 |

) |

|

|

(72 |

) |

| Change in fair value of the Preferred Stock and Convertible Notes embedded derivatives |

|

|

— |

|

|

|

2 |

|

| Non-cash changes in workers' compensation and employee benefit reserves |

|

|

(1 |

) |

|

|

— |

|

| Stock based compensation |

|

|

4 |

|

|

|

5 |

|

| Net gain from sale of assets |

|

|

(17 |

) |

|

|

(1 |

) |

| (Benefit) provision from deferred income taxes |

|

|

(1 |

) |

|

|

1 |

|

| Decrease in trade receivables |

|

|

51 |

|

|

|

17 |

|

| (Increase) decrease in miscellaneous receivables |

|

|

(1 |

) |

|

|

7 |

|

| Increase in inventories |

|

|

(18 |

) |

|

|

(11 |

) |

| Decrease in trade payables |

|

|

(1 |

) |

|

|

(7 |

) |

| Decrease in liabilities excluding borrowings and trade payables |

|

|

(22 |

) |

|

|

(9 |

) |

| Other items, net |

|

|

18 |

|

|

|

5 |

|

| Total adjustments |

|

|

(48 |

) |

|

|

(47 |

) |

| Net cash provided by operating activities |

|

|

10 |

|

|

|

21 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Additions to properties |

|

|

(19 |

) |

|

|

(11 |

) |

| Proceeds from sale of assets |

|

|

17 |

|

|

|

— |

|

| Net cash used in investing activities |

|

|

(2 |

) |

|

|

(11 |

) |

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Repayment of Amended and Restated Term Loan Agreement |

|

|

(17 |

) |

|

|

— |

|

| Preferred stock cash dividend payments |

|

|

(2 |

) |

|

|

(2 |

) |

| Treasury stock purchases |

|

|

(1 |

) |

|

|

— |

|

| Net cash used in financing activities |

|

|

(20 |

) |

|

|

(2 |

) |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

(5 |

) |

|

|

(2 |

) |

| Net (decrease) increase in cash, cash equivalents and restricted cash |

|

|

(17 |

) |

|

|

6 |

|

| Cash, cash equivalents and restricted cash, beginning of period |

|

|

377 |

|

|

|

286 |

|

| Cash, cash equivalents and restricted cash, end of period |

|

$ |

360 |

|

|

$ |

292 |

|

The accompanying notes are an integral part of these consolidated financial statements.

EASTMAN KODAK COMPANY

CONSOLIDATED STATEMENT OF EQUITY (DEFICIT) (Unaudited)

(in millions)

| | | Six-Month Period Ending June 30, 2024 | |

| | | Eastman Kodak Company Common Shareholders | | | | | |

| | | Common Stock | | | Additional Paid in Capital | | | Accumulated Deficit | | | Accumulated Other Comprehensive Income | | | Treasury Stock | | | Total | | | Redeemable Convertible Preferred Stock | |

| Equity (deficit) as of December 31, 2023 | | $ | — | | | $ | 1,156 | | | $ | (495 | ) | | $ | 281 | | | $ | (11 | ) | | $ | 931 | | | $ | 210 | |

| Net earnings | | | — | | | | — | | | | 32 | | | | — | | | | — | | | | 32 | | | | — | |

| Other comprehensive loss, (net of tax): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Currency translation adjustments | | | — | | | | — | | | | — | | | | (6 | ) | | | — | | | | (6 | ) | | | — | |

| Pension and other postretirement liability adjustments | | | — | | | | — | | | | — | | | | (6 | ) | | | — | | | | (6 | ) | | | — | |

| Preferred stock cash dividends | | | — | | | | (1 | ) | | | — | | | | — | | | | — | | | | (1 | ) | | | — | |

| Preferred stock in-kind dividends | | | — | | | | (1 | ) | | | — | | | | — | | | | — | | | | (1 | ) | | | 1 | |

| Preferred stock deemed dividends | | | — | | | | (1 | ) | | | — | | | | — | | | | — | | | | (1 | ) | | | 1 | |

| Stock-based compensation | | | — | | | | 3 | | | | — | | | | — | | | | — | | | | 3 | | | | — | |

| Equity (deficit) as of March 31, 2024 | | $ | — | | | $ | 1,156 | | | $ | (463 | ) | | $ | 269 | | | $ | (11 | ) | | $ | 951 | | | $ | 212 | |

| Net earnings | | | — | | | | — | | | | 26 | | | | — | | | | — | | | | 26 | | | | — | |

| Other comprehensive loss (net of tax): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Currency translation adjustments | | | — | | | | — | | | | — | | | | (6 | ) | | | — | | | | (6 | ) | | | — | |

| Pension and other postretirement liability adjustments | | | — | | | | — | | | | — | | | | (7 | ) | | | — | | | | (7 | ) | | | — | |

| Preferred stock cash dividends | | | — | | | | (1 | ) | | | — | | | | — | | | | — | | | | (1 | ) | | | — | |

| Preferred stock in-kind dividends | | | — | | | | (2 | ) | | | — | | | | — | | | | — | | | | (2 | ) | | | 2 | |

| Stock-based compensation | | | — | | | | 1 | | | | — | | | | — | | | | — | | | | 1 | | | | — | |

| Purchases of treasury stock (1) | | | — | | | | — | | | | — | | | | — | | | | (1 | ) | | | (1 | ) | | | — | |

| Equity (deficit) as of June 30, 2024 | | $ | — | | | $ | 1,154 | | | $ | (437 | ) | | $ | 256 | | | $ | (12 | ) | | $ | 961 | | | $ | 214 | |

| (1) |

Represents purchases of common stock to satisfy tax withholding obligations. |

EASTMAN KODAK COMPANY

CONSOLIDATED STATEMENT OF EQUITY (DEFICIT) (Unaudited) (cont’d)

(in millions)

| |

|

Six-Month Period Ending June 30, 2023 |

|

| |

|

Eastman Kodak Company Common Shareholders |

|

|

|

|

|

| |

|

Common Stock |

|

|

Additional Paid in Capital |

|

|

Accumulated Deficit |

|

|

Accumulated Other Comprehensive Income |

|

|

Treasury Stock |

|

|

Total |

|

|

Redeemable Convertible Preferred Stock |

|

| Equity (deficit) as of December 31, 2022 |

|

$ |

— |

|

|

$ |

1,160 |

|

|

$ |

(570 |

) |

|

$ |

462 |

|

|

$ |

(11 |

) |

|

$ |

1,041 |

|

|

$ |

203 |

|

| Net earnings |

|

|

— |

|

|

|

— |

|

|

|

33 |

|

|

|

— |

|

|

|

— |

|

|

|

33 |

|

|

|

— |

|

| Other comprehensive loss (net of tax): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Currency translation adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

| Pension and other postretirement liability adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6 |

) |

|

|

|

|

|

|

(6 |

) |

|

|

— |

|

| Preferred stock cash dividends |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

| Preferred stock in-kind dividends |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

1 |

|

| Preferred stock deemed dividends |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

1 |

|

| Stock-based compensation |

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

| Equity (deficit) as of March 31, 2023 |

|

$ |

— |

|

|

$ |

1,161 |

|

|

$ |

(537 |

) |

|

$ |

455 |

|

|

$ |

(11 |

) |

|

$ |

1,068 |

|

|

$ |

205 |

|

| Net earnings |

|

|

— |

|

|

|

— |

|

|

|

35 |

|

|

|

— |

|

|

|

— |

|

|

|

35 |

|

|

|

— |

|

| Other comprehensive loss (net of tax): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Currency translation adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11 |

) |

|

|

— |

|

|

|

(11 |

) |

|

|

— |

|

| Pension and other postretirement liability adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(123 |

) |

|

|

— |

|

|

|

(123 |

) |

|

|

— |

|

| Preferred stock cash dividends |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

| Preferred stock in-kind dividends |

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

2 |

|

| Stock-based compensation |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

| Equity (deficit) as of June 30, 2023 |

|

$ |

— |

|

|

$ |

1,159 |

|

|

$ |

(502 |

) |

|

$ |

321 |

|

|

$ |

(11 |

) |

|

$ |

967 |

|

|

$ |

207 |

|

The accompanying notes are an integral part of these consolidated financial statements.

EASTMAN KODAK COMPANY

NOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1: BASIS OF PRESENTATION AND RECENT ACCOUNTING PRONOUNCEMENTS

BASIS OF PRESENTATION

The consolidated interim financial statements are unaudited, and certain information and footnote disclosures related thereto normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) have been omitted in accordance with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. In the opinion of management, the accompanying unaudited consolidated interim financial statements reflect all adjustments (consisting of normal recurring adjustments) necessary for a fair statement of the results of operations, financial position and cash flows of Eastman Kodak Company and all companies directly or indirectly controlled, either through majority ownership or otherwise (“Kodak” or the “Company”). The results of operations for the interim periods are not necessarily indicative of the results for the entire fiscal year. These consolidated interim statements should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K”).

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

There are no accounting pronouncements recently adopted by Kodak.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In December 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. ASU 2023-09 requires disclosure of additional categories of information about federal, state and foreign income taxes in the rate reconciliation table and more details about the reconciling items in some categories if items meet a quantitative threshold. The ASU requires entities to disclose income taxes paid, net of refunds, disaggregated by federal (national), state and foreign taxes for annual periods and to disaggregate the information by jurisdiction based on a quantitative threshold. The guidance makes several other changes to the disclosure requirements. The ASU is required to be applied prospectively, with the option to apply it retrospectively. The ASU is effective for Kodak for fiscal years beginning after December 15, 2024 ( January 1, 2025 for Kodak).

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. ASU 2023-07 improves reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. In addition, the ASU enhances interim disclosure requirements, clarifies circumstances in which an entity can disclose multiple segment measures of profit or loss, and contains other disclosure requirements. The ASU does not change how an entity identifies its operating segments, aggregates those operating segments, or applies the quantitative thresholds to determine its reportable segments. The ASU is required to be applied retrospectively to all periods presented in the financial statements. The ASU is effective for Kodak for fiscal years beginning after December 15, 2023 ( January 1, 2024 for Kodak) and interim periods within fiscal years beginning after December 15, 2024 ( January 1, 2025 for Kodak).

NOTE 2: CASH, CASH EQUIVALENTS AND RESTRICTED CASH

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the Consolidated Statement of Financial Position that sums to the total of such amounts shown in the Consolidated Statement of Cash Flows:

| | | June 30, | | | December 31, | |

| (in millions) | | 2024 | | | 2023 | |

| Cash and cash equivalents | | $ | 251 | | | $ | 255 | |

| Restricted cash reported in Other current assets | | | 9 | | | | 12 | |

| Restricted cash | | | 100 | | | | 110 | |

| Total cash, cash equivalents and restricted cash shown in the Statement of Cash Flows | | $ | 360 | | | $ | 377 | |

Restricted cash reported in Other current assets on the Consolidated Statement of Financial Position primarily represented amounts that support hedging activities and an escrow of $2 million and $3 million as of June 30, 2024 and December 31, 2023, respectively, in China to secure ongoing obligations under a supply agreement associated with the strategic relationship with Lucky HuaGuang Graphics Co. Ltd. ("HuaGuang"). The agreement with HuaGuang expires in the third quarter of 2024.

Restricted cash included $29 million and $32 million as of June 30, 2024 and December 31, 2023, respectively, representing the cash collateral required to be posted by the Company under the Letter of Credit Facility. In addition, restricted cash as of both June 30, 2024 and December 31, 2023 included $63 million representing cash collateral supporting the Company’s undiscounted actuarial workers’ compensation obligations with the New York State Workers’ Compensation Board ("NYS WCB"). Restricted cash as of June 30, 2024 and December 31, 2023 also included $7 million and $8 million, respectively, of security posted related to Brazilian legal contingencies. In addition, restricted cash as of December 31, 2023 included $5 million of cash collateral posted in the United Kingdom for a letter of credit for aluminum purchases.

NOTE 3: INVENTORIES, NET

| | | June 30, | | | December 31, | |

| (in millions) | | 2024 | | | 2023 | |

| Finished goods | | $ | 93 | | | $ | 85 | |

| Work in process | | | 73 | | | | 68 | |

| Raw materials | | | 66 | | | | 64 | |

| Total | | $ | 232 | | | $ | 217 | |

NOTE 4: REDEEMABLE, CONVERTIBLE PREFERRED STOCK

Redeemable convertible preferred stock was as follows:

| | | June 30, | | | December 31, | |

| (in millions) | | 2024 | | | 2023 | |

| Series B preferred stock | | $ | 97 | | | $ | 96 | |

| Series C preferred stock | | | 117 | | | | 114 | |

| Total | | $ | 214 | | | $ | 210 | |

Series B Preferred Stock

On February 26, 2021 the Company agreed to exchange one million shares of Series A Preferred Stock held by Southeastern Asset Management, Inc. (“Southeastern”) and Longleaf Partners Small-Cap Fund, C2W Partners Master Fund Limited and Deseret Mutual Pension Trust, which are investment funds managed by Southeastern (such investment funds, collectively, the “Purchasers”), for shares of the Company’s newly created 4.0% Series B Convertible Preferred Stock, no par value (the “Series B Preferred Stock”), on a one-for-one basis plus accrued and unpaid dividends. The fair value of the Series B Preferred Stock at the time of issuance approximated $95 million. The Company has classified the Series B Preferred Stock as temporary equity in the Consolidated Statement of Financial Position. If any shares of Series B Preferred Stock have not been converted prior to May 28, 2026 the Company is required to redeem such shares at $100 per share plus the amount of accrued and unpaid dividends.

Dividend and Other Rights

The Series B Preferred Stock has a liquidation preference of $100 per share, and the holders of Series B Preferred Stock are entitled to cumulative dividends payable quarterly in cash at a rate of 4.0% per annum. Dividends owed on the Series B Preferred Stock have been declared and paid when due. If dividends on any Series B Preferred Stock are in arrears for six or more consecutive or non-consecutive dividend periods, the holders of the Series B Preferred Stock will be entitled to nominate one director at the next annual shareholder meeting and all subsequent shareholder meetings until all accumulated dividends on such Series B Preferred Stock have been paid or set aside.

Conversion Features

Each share of Series B Preferred Stock is convertible, at the option of each holder at any time, into shares of Common Stock at the initial conversion rate of 9.5238 shares of Common Stock for each share of Series B Preferred Stock (equivalent to an initial conversion price of $10.50 per share of Common Stock). The initial conversion rate and the corresponding conversion price are subject to certain customary anti-dilution adjustments. If a holder elects to convert any shares of Series B Preferred Stock during a specified period in connection with a fundamental change (as defined in the Series B Certificate of Designations), such holder can elect to have the conversion rate adjusted and can elect to receive a cash payment in lieu of shares for a portion of the shares. Such holder will also be entitled to a payment in respect of accumulated dividends. In addition, the Company will have the right to require holders to convert any shares of Series B Preferred Stock in connection with certain reorganization events in which case the conversion rate will be adjusted, subject to certain limitations.

The Company will have the right to cause the mandatory conversion of the Series B Preferred Stock into shares of Common Stock at any time after the initial issuance of the Series B Preferred Stock if the closing price of the Common Stock has equaled or exceeded $14.50 (subject to adjustment in the same manner as the conversion price) for 45 trading days within a period of 60 consecutive trading days.

Embedded Conversion Features

The Company allocated $1 million to a derivative liability based on the aggregate fair value of the embedded conversion feature of the Series B Preferred Stock on the date of issuance which reduced the original carrying value of the Series B Preferred Stock. The derivative is being accounted for at fair value with subsequent changes in the fair value being reported as part of Other (expense) income, net in the Consolidated Statement of Operations. The fair value of the Series B Preferred Stock embedded derivative as of both June 30, 2024 and December 31, 2023 was a liability of $1 million and is included in Other long-term liabilities in the accompanying Consolidated Statement of Financial Position.

The carrying value of the Series B Preferred Stock is being accreted to the mandatory redemption amount using the effective interest method to Additional paid in capital in the Consolidated Statement of Financial Position as a deemed dividend from the date of issuance through the mandatory redemption date, May 28, 2026.

Series C Preferred Stock

On February 26, 2021, the Company and GO EK Ventures IV, LLC (the “Investor”) entered into a Series C Preferred Stock Purchase Agreement (the “Purchase Agreement”) pursuant to which the Company agreed to sell to the Investor, and the Investor agreed to purchase from the Company, an aggregate of 1,000,000 shares of the Company’s newly created 5.0% Series C Convertible Preferred Stock, no par value per share (the “Series C Preferred Stock”), for a purchase price of $100 per share, representing $100 million of gross proceeds to the Company. The Investor is a fund managed by Grand Oaks Capital. The Company has classified the Series C Preferred Stock as temporary equity in the Consolidated Statement of Financial Position. If any shares of Series C Preferred Stock have not been converted prior to May 28, 2026, the Company is required to redeem such shares at $100 per share plus the amount of accrued and unpaid dividends thereon; provided that the holders of the Series C Preferred Stock have the right to extend such redemption date by up to two years.

Dividend and Other Rights

The Series C Preferred Stock has a liquidation preference of $100 per share, and the holders of Series C Preferred Stock are entitled to cumulative dividends payable quarterly “in‐kind” in the form of additional shares of Series C Preferred Stock at a rate of 5.0% per annum. Dividends owed on the Series C Preferred Stock have been declared and additional Series C shares issued when due. Holders of the Series C Preferred Stock are also entitled to participate in any dividends paid on the Common Stock (other than stock dividends) on an as-converted basis, with such dividends on any shares of the Series C Preferred Stock being payable upon conversion of such shares of Series C Preferred Stock to Common Stock.

Conversion Features

Each share of Series C Preferred Stock is convertible, at the option of each holder at any time, into shares of Common Stock at the initial conversion price of $10 per share of Common Stock. The initial conversion price and the corresponding conversion rate are subject to certain customary anti-dilution adjustments and to proportional increase in the event the liquidation preference of the Series C Preferred Stock is automatically increased. If a holder elects to convert any shares of Series C Preferred Stock during a specified period in connection with a fundamental change (as defined in the Series C Certificate of Designations), such holder can elect to have the conversion rate adjusted and can elect to receive a cash payment in lieu of shares for a portion of the shares of Common Stock. Such holder will also be entitled to a payment in respect of accumulated dividends and a payment based on the present value of all required remaining dividend payments through May 28, 2026, the mandatory redemption date. Such additional payments will be payable at the Company’s option in cash or in additional shares of Common Stock. In addition, the Company will have the right to require holders to convert any shares of Series C Preferred Stock in connection with certain reorganization events in which case the conversion rate will be adjusted, subject to certain limitations.

The Company has the right to cause the mandatory conversion of the Series C Preferred Stock into shares of Common Stock at any time after February 26, 2024 if the closing price of the Common Stock has equaled or exceeded 150% of the then-effective conversion price for 45 trading days within a period of 60 consecutive trading days.

Embedded Conversion Features