As filed with the U.S. Securities and Exchange Commission on August 9, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

______________________

Garden Stage Limited

(Exact name of registrant as specified in its charter)

______________________

|

Cayman Islands

|

|

6199

|

|

Not Applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

30th Floor, China Insurance Group Building

141 Des Voeux Road Central

Central, Hong Kong

Tel: +852 2688 6333

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

______________________

c/o Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1 (800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

______________________

With a Copy to:

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

+1 (212) 588-0022

______________________

Approximate date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the Selling Shareholder may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

|

SUBJECT TO COMPLETION, DATED [*], 2024

|

1,750,000 Ordinary Shares to be sold by the Selling Shareholder

GARDEN STAGE LIMITED

This prospectus relates to the resale of up to 1,750,000 ordinary shares with US$0.0001 par value per share (“Ordinary Shares”) of Garden Stage Limited, a Cayman Islands exempted company (“Garden Stage” or the “Company”), that may be sold from time to time by Oriental Moon Tree Limited, a company incorporated under the laws of the British Virgin Islands (the “Selling Shareholder” or “Oriental Moon Tree”). Garden Stage is not selling any Ordinary Shares in this offering, and Garden Stage will not receive any proceeds from the sale of the ordinary shares by the Selling Shareholder.

The Selling Shareholder may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices. No underwriter or other person has been engaged to facilitate the sale of the Ordinary Shares in this offering. The Selling Shareholder may be deemed underwriters of the Ordinary Shares that it is offering. Garden Stage will bear all costs, expenses, and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Shareholder will bear all commissions and discounts, if any, attributable to their sale of Ordinary Shares. See “Plan of Distribution” beginning on page 100.

Our Ordinary Shares trade on the Nasdaq Stock Market under the symbol “GSIW.” On August 6, 2024, the closing price of our Ordinary Shares was US$7.1 per share.

Garden Stage Limited is not a PRC or Hong Kong operating company, but a holding company incorporated in the Cayman Islands. As a holding company with no material operations, Garden Stage Limited conducts all of its operations in Hong Kong through I Win Securities Limited (“I Win Securities”) and I Win Asset Management Limited (“I Win Asset Management”), both incorporated in Hong Kong (I Win Securities and I Win Asset Management are collectively referred as the “Operating Subsidiaries”). The Ordinary Shares offered in this offering are shares of Garden Stage Limited, the Cayman Islands holding company, instead of shares of the Operating Subsidiaries. Investors in this Offering will not directly hold equity interests in the Operating Subsidiaries. This structure involves unique risks to the investors, and the PRC regulatory authorities could disallow this structure, which would likely result in a material change in Garden Stage’s operations and/or a material change in the value of our Ordinary Shares, including that such event could cause the value of such securities to significantly decline or become worthless.

All of our operations are conducted by the Operating Subsidiaries in Hong Kong. We are subject to certain legal and operational risks associated with our Operating Subsidiaries being based in Hong Kong, having all of its operations to date in Hong Kong and having clients who are Mainland China individuals or companies that have shareholders or directors that are Mainland China individuals. We are also subject to the risks of uncertainty about any future actions the PRC government or authorities in Hong Kong may take in this regard. Should the PRC government choose to exercise significant oversight and discretion over the conduct of our business, or in the event that we or the Operating Subsidiaries were to become subject to PRC laws and regulations, we could incur material costs to ensure compliance, and we or the Operating Subsidiaries might be subject to fines, experience devaluation of securities or delisting, no longer be permitted to conduct offerings to foreign investors, and/or no longer be permitted to continue business operations as presently conducted.

The legal and operational risks associated in operating in the PRC also apply to our Operating Subsidiaries’ operations in Hong Kong, and we face the risks and uncertainties associated with the complex and evolving PRC laws and regulations and as to whether and how the recent PRC government statements and regulatory developments, such as those relating to data and cyberspace security, and anti-monopoly concerns, would be applicable to the Operating Subsidiaries and us, given the substantial operations of the Operating Subsidiaries in Hong Kong and the possibilities that Chinese government may exercise significant oversight over the conduct of business in Hong Kong. New regulatory actions related to data security or anti-monopoly concerns in Hong Kong may be taken in the future, and such regulatory actions may also impact our ability to conduct our business, accept foreign investments, or list on a U.S. or foreign stock exchange. In addition, the legal and

Table of Contents

operational risks associated with having operations in mainland China also apply to our presence in Hong Kong. While Hong Kong currently operates under a different set of laws from mainland China, there can be no assurance as to whether the government of Hong Kong will enact laws and regulations similar to mainland China, or whether any laws or regulations of mainland China will become applicable to our operations in Hong Kong in the future, which could be at any time and with no advance notice. If the Operating Subsidiaries or Garden Stage are to become subject to laws and regulations of the PRC, these risks could result in material costs to ensure compliance, fines, material changes in our operations and/or the value of the securities we are registering for sale, and/or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. See “Risk Factors — Risks Related to Doing Business in the Jurisdictions in which the Operating Subsidiaries Operate — All of our operations are in Hong Kong. However, due to the long arm application of the current PRC laws and regulations, the PRC government may exercise significant direct oversight and discretion over the conduct of our business and may intervene or influence our operations, which could result in a material change in our operations and/or the value of our Ordinary Shares. Our Operating Subsidiaries in Hong Kong may be subject to laws and regulations of the PRC, which may impair our ability to operate profitably and result in a material negative impact on our operations and/or the value of our Ordinary Shares. Furthermore, the changes in the policies, regulations, rules, and the enforcement of laws of the PRC may also occur quickly with little advance notice and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain” on page 18; and “Risk Factors — Risks Related to Doing Business in the Jurisdictions in which the Operating Subsidiaries Operate — If the PRC government chooses to extend the oversight and control over offerings that are conducted overseas and/or foreign investment in Mainland China-based issuers to Hong Kong-based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 22.

Our Ordinary Shares may be prohibited from trading on a national exchange or “over-the-counter” markets under the Holding Foreign Companies Accountable Act (the “HFCAA”) if the Public Company Accounting Oversight Board (“PCAOB”) determines that it is unable to inspect or fully investigate our auditor and as a result the exchange where our securities are traded may delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which was signed into law on December 29, 2022, amending the HFCAA and requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchange if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years. Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the PCAOB was unable to inspect or investigate completely certain named registered public accounting firms headquartered in Mainland China and Hong Kong.

Our auditor prior to December 15, 2022, Friedman LLP (“Friedman”), had been inspected by the PCAOB on a regular basis in the audit period. Our auditor from December 15, 2022 to January 26, 2024, Marcum Asia CPAs LLP (“Marcum Asia”) is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Our current auditor, J&S Associate PLT (“J&S”), is headquartered in Malaysia and subject to the inspections by the PCAOB. None of our current or previous auditors are subject to the Determination Report announced by the PCAOB on December 16, 2021 relating to the PCAOB’s inability to inspect or investigate completely registered public accounting firms headquartered in Mainland China or Hong Kong because of a position taken by one or more authorities in the Mainland China or Hong Kong. However, as more stringent criteria have been imposed by the SEC and the PCAOB, recently, we cannot assure you whether Nasdaq or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. In the event it is later determined that the PCAOB is unable to inspect or investigate completely the Company’s auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause trading in the Company’s securities to be prohibited under the HFCAA, and ultimately result in a determination by a securities exchange to delist the Company’s securities. Furthermore, as more stringent criteria have been imposed by the SEC and the PCAOB, recently, which would add uncertainties to our offering, and we cannot assure you whether NASDAQ or regulatory authorities would apply additional and more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures, adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial statements. See “Risk Factors — Risks Related to Our Ordinary Shares and this Offering — Our Ordinary Shares may be prohibited from being traded on a national

Table of Contents

exchange under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors. The delisting of our Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was signed into law on December 29, 2022, amending the HFCAA to require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.” on page 27.

Investing in our Ordinary Shares involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 18 to read about factors you should consider before buying our Ordinary Shares.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and are, therefore, eligible for reduced public company reporting requirements. Please read “Implications of Being an Emerging Growth Company” beginning on page 9 and “Implication of Being a Foreign Private Issuer” beginning on page 10 for more information.

We are a “controlled company” as defined under the Nasdaq Listing Rules, because Oriental Moon Tree Limited, our largest shareholder, will continue to own more than a majority of the voting power of our outstanding Ordinary Shares. As a result, Oriental Moon Tree Limited can control the outcome of matters submitted to the shareholders for approval. Additionally, we may be deemed a “controlled company” within the meaning of the NASDAQ listing rules and follow certain exemptions from certain corporate governance requirements that could adversely affect our public shareholders. For a more detailed discussion of the risk of the Company being a controlled company, see “Risk Factors — Our corporate actions will be substantially controlled by our Controlling Shareholder, Oriental Moon Tree Limited, which has the ability to control or exert significant influence over important corporate matters that require approval of shareholders, which may deprive you of an opportunity to receive a premium for your Ordinary Shares and materially reduce the value of your investment. Additionally, we are deemed to be a “controlled company and may follow certain exemptions from certain corporate governance requirements that could adversely affect our public shareholders.” on page 26 and “Prospectus Summary — Implication of Being a Controlled Company” on page 10 of this prospectus.

For Garden Stage to transfer cash to its subsidiaries, it is permitted under the laws of the Cayman Islands to provide funding to its subsidiaries incorporated in the British Virgin Islands and Hong Kong through loans or capital contributions without restrictions on the amount of the funds. Garden Stage’s subsidiary formed under the laws of the British Virgin Islands are permitted under the laws of the British Virgin Islands to provide funding to their respective subsidiaries through loans or capital contributions without restrictions on the amount of the funds. As a holding company, Garden Stage may rely on dividends and other distributions on equity paid by its subsidiaries for its cash and financing requirements. According to the BVI Business Companies Act 2004 (as amended), a British Virgin Islands company may make dividends distribution to the extent that immediately after the distribution, such company’s assets do not exceed its liabilities and that such company is able to pay its debts as they fall due. According to the Companies Ordinance of Hong Kong, a Hong Kong company may only make a distribution out of profits available for distribution. If any of Garden Stage’s subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to Garden Stage. In the fiscal years ended March 31, 2024, 2023, and 2022 and up to the date of this prospectus, no transfer of cash or other types of assets has been made between our Cayman Islands holding company and subsidiaries. Garden Stage, our Cayman Islands holding company has not declared or made any dividends or other distributions to its shareholders, including U.S. investors, as of the date of the prospectus, nor has any dividends or distributions been made by subsidiaries to our Cayman Islands holding company in the fiscal years ended March 31, 2024, 2023, and 2022 and up to the date of this prospectus. Garden Stage and its subsidiaries do not have any plans to distribute earnings in the foreseeable future. For a more detailed discussion of how cash is transferred among Garden Stage and its subsidiaries, see “Prospectus Summary — Transfers of Cash to and from Our Subsidiaries” beginning on page 5 of this prospectus, and the audited consolidated financial statements and the accompanying footnotes in our annual report on Form 20-F for the fiscal year ended March 31, 2024.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

Table of Contents

TABLE OF CONTENTS

You should rely only on the information provided in this prospectus and any applicable prospectus supplement. Neither we nor the Selling Shareholder have authorized anyone to provide you with different information. Neither we nor the Selling Shareholder are making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus and any applicable prospectus supplement is accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus, our business, financial condition, results of operations, and prospects may have changed.

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 that we file with the SEC using a continuous offering process. Under this continuous offering process, the Selling Shareholder may, from time to time, offer and sell up to an aggregate of 1,750,000 Ordinary Share as described in the section titled “Plan of Distribution.”

You should read this prospectus, exhibits filed as part of the registration statement, and the information and documents incorporated by reference carefully. Such documents contain important information you should consider when making your investment decision. See “Where You Can Find Additional Information” in this prospectus.

You should rely only on the information provided in this prospectus, exhibits filed as part of the registration statement, or documents incorporated by reference into this prospectus. We have not authorized anyone to provide you with different information. This prospectus covers offers and sales of our Ordinary Shares only in jurisdictions in which such offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Ordinary Shares. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

This prospectus may be supplemented from time to time to add, update, or change information in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in a prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus.

Prospectus Conventions

Unless otherwise indicated or the context requires otherwise and for purposes of this prospectus only, references in this prospectus to:

• “17 Uno BVI” refers to 17 Uno Limited, a company incorporated under the laws of British Virgin Islands;

• “AE” refers to an account executive, being licensed representative accredited to I Win Securities to carry out regulated activities, who is self-employed and only entitled to share the brokerage income from the clients referred by him/her;

• “AUM” refers to the amount of assets under management;

• “BSS” refers to the Broker Supplied System, being a front office solution either developed in-house by the Stock Exchange Participant or a third-party software package acquired from commercial vendors, enabling the Stock Exchange Participant to connect its trading facilities to the Open Gateway to conduct trading;

• “CAGR” refers to compounded annual growth rate, the year-on-year growth rate over a specific period of time;

• “China” or the “PRC” refer to the People’s Republic of China, including Hong Kong and Macau;

• “Code of Conduct” refers to the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission of Hong Kong;

• “Controlling Shareholder” refers to Oriental Moon Tree Limited, a company incorporated under the laws of British Virgin Islands;

• “FY 2024” and “FY 2023” are to fiscal year ended March 31, 2024, March 31, 2023, respectively;

• “Garden Stage” or “Company” are to Garden Stage Limited, an exempted company incorporated with limited liability in the Cayman Islands on August 11, 2022;

• “HKD” or “HK$” refer to the legal currency of Hong Kong.

ii

Table of Contents

• “HKSCC” refers to the Hong Kong Securities Clearing Company Limited

• “HKSFC” refers to the Securities and Futures Commission of Hong Kong;

• “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China for the purposes of this prospectus only;

• “I Win Asset Management” refers to I Win Asset Management Limited, a company with limited liability under the laws of Hong Kong;

• “I Win Holdings HK” refers to I Win Holdings Limited, a company with limited liability under the laws of Hong Kong;

• “I Win Securities” refers to I Win Securities Limited, a company with limited liability under the laws of Hong Kong;

• “Licensed Representative(s)” refers to an individual who is granted a license under section 120(1) or 121(1) of the SFO to carry on one or more than one regulated activity;

• “Listing Rules” refers to the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong, as amended, supplemented or otherwise modified from time to time;

• “Mainland China” refers to the mainland of the People’s Republic of China; excluding Taiwan and the special administrative regions of Hong Kong and Macau for the purposes of this prospectus only;

• “Margin financing” refers to the provision of funds by a securities brokerage firm (licensed to provide margin loans as an intermediary) to clients for the purpose of their margin trading, whereby the funds borrowed from a securities brokerage firm to be used for carrying out trading of securities on a leveraged basis, and the relevant securities purchased form the collateral to secure the repayment of the loan granted by the securities brokerage firm;

• “Ordinary Shares” refers to the ordinary shares of the Garden Stage Limited, par value of US$0.0001 per share;

• “Open Gateway” refers to a Windows-based device provided by the Stock Exchange and installed at the Stock Exchange Participants’ office to facilitate electronic interface of the Automatic Order Matching and Execution System of the Stock Exchange with front office systems operated by the Stock Exchange Participant;

• “Operating Subsidiaries” refers to I Win Securities and I Win Asset Management, the indirectly wholly-owned subsidiaries of Garden Stage, unless otherwise specified

• “PRC government” or “Chinse government” are to the government of Mainland China for the purposes of this prospectus only;

• “Responsible Officer(s)” or “RO” refer to a Licensed Representative who is also approved as a responsible officer under section 126 of the SFO to supervise one or more than one regulated activity of the licensed corporation to which he/she is accredited;

• “SEC” refers to the United States Securities and Exchange Commission;

• “Selling Shareholder” refers to Oriental Moon Tree Limited, the largest shareholder of the Company;

• “SFO” refers to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time;

• “Stock Exchange” or “SEHK” refer to the Stock Exchange of Hong Kong Limited;

• “Stock Exchange Trading Right” refers to the right to be eligible to trade on or through the Stock Exchange as a Stock Exchange Participant and entered as such a right in a list, register or roll kept by the Stock Exchange;

iii

Table of Contents

• “Stock Exchange Participant(s)” refers to corporation(s) licensed to carry on Type 1 (dealing in securities) regulated activity under the SFO who, in accordance with the rules of the Stock Exchange, may trade on or through the Stock Exchange and whose name(s) is/are entered in a list, register or roll kept by the Stock Exchange as person(s) who may trade on or through the Stock Exchange;

• “US$” or “U.S. dollars” refer to the legal currency of the United States; and

• “we,” “us,” “our,” “the Company” and “Garden Stage” are to Garden Stage Limited, an exempted company incorporated with limited liability in the Cayman Islands on August 11, 2022, and does not include its subsidiaries, 17 Uno BVI, I Win Holdings HK, I Win Securities, and I Win Asset Management. Where appropriate, we shall refer to the subsidiaries by their legal names, collectively as “our subsidiaries”, or “Operating Subsidiaries” when we refer to our operating entities, as the case may be, and clearly identify the entity in which investors are purchasing an interest;

Garden Stage is a holding company with operations conducted in Hong Kong through its Operating Subsidiaries, using Hong Kong dollars. The reporting currency is U.S. dollars. Assets and liabilities denominated in foreign currencies are translated at year-end exchange rates, income statement accounts are translated at average rates of exchange for the year and equity is translated at historical exchange rates. Any translation gains or losses are recorded in other comprehensive income (loss). Gains or losses resulting from foreign currency transactions are included in net income. The conversion of Hong Kong dollars into U.S. dollars are based on the exchange rates set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. Unless otherwise noted, all translations from Hong Kong dollars to U.S. dollars and from U.S. dollars to Hong Kong dollars in this annual report were made at an average rate of HKD 7.8252 to USD 1.00 and HKD 7.8392 to USD 1.00 for FY 2024 and FY 2023, respectively.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

iv

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain all of the information that may be important to you and your investment decision. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our Ordinary Shares, discussed under “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and the financial statements and related notes and other information that we incorporate by reference herein, including, but not limited to, our 2024 Annual Report and other SEC reports before deciding whether to buy our Ordinary Shares.

Overview

We are a holding company incorporated in Cayman Islands, and all of our operations are carried out by the two wholly-owned Operating Subsidiaries in Hong Kong: a) I Win Securities, which is licensed to conduct Type 1 (dealing in securities) regulated activities under the SFO in Hong Kong, and b) I Win Asset Management, which is licensed to conduct Type 4 (advising on securities) and Type 9 (asset management) regulated activities under the SFO in Hong Kong. Our Operating Subsidiaries are Hong Kong-based financial services providers principally engaged in the provision of (i) placing and underwriting services; (ii) securities dealing and brokerage services; and (iii) asset management services. I Win Securities is the Stock Exchange Participant and holds one Stock Exchange Trading Right. I Win Securities is a participant of the HKSCC.

The table below sets forth the licenses obtained by our Operating Subsidiaries under the jurisdiction of Hong Kong.

|

License type and trading right

|

|

Entity name

|

|

HKSFC Type 1 License – Dealing in securities

|

|

I Win Securities

|

|

HKSFC Type 4 License – Advising on securities

|

|

I Win Asset Management

|

|

HKSFC Type 9 License – Asset management

|

|

I Win Asset Management

|

|

Stock Exchange Participants (Participant ID: 02092)

|

|

I Win Securities

|

|

HKSCC Participants (Participant ID: B02092)

|

|

I Win Securities

|

The service offerings of our Operating Subsidiaries mainly comprise the following:

• Underwriting and Placing Services: I Win Securities acts as (i) book runner, lead manager, or underwriter of listing applicants in IPOs or other fundraising activities; and (ii) placing agent of listed companies in connection with their issuance or sale of securities, in return for underwriting and/or placing commission. I Win Securities also charges investors a brokerage commission when they subscribe for or acquire securities in respect of offerings of listed issuers who engaged I Win Securities to provide placing and underwriting services in respect of the relevant securities. Our revenue derived from our underwriting and placing services accounted for 10.84% and 48.31% of our total revenue for FY 2024 and FY 2023, respectively.

• Securities Dealing and Brokerage Services: I Win Securities provides securities dealing and brokerage services for trading in securities on the Hong Kong Stock Exchange and in other overseas markets. I Win Securities also acts as an intermediary between buyers and sellers of securities listed on the Main Board and GEM of the Hong Kong Stock Exchange and facilitate the clients’ trading of securities listed on selected overseas stock exchanges, including the United States, in return for brokerage commission income. Ancillary to I Win Securities’ securities brokerage and dealing services, I Win Securities also provides nominee services, custodian services, scrip handling services and handling services for corporate actions to our brokerage clients. At the same time, I Win Securities also facilitates the subscriptions to IPOs and secondary placings, either conducted by Hong Kong issuers who engage I Win Securities for placing and underwriting services or conducted by other financial services providers in Hong Kong. For FY 2024 and FY 2023, 56.16% and 47.55% of our total revenue was derived from our securities dealing and brokerage services, respectively.

• Advisory Services: We provide investment advisory services to our clients through I Win Securities, which is licensed with the SFC to carry on type 4 (advising on securities) regulated activity. We act as investment advisors to our clients and provide them with (i) investment advice incidental to our securities trading services; and (ii) investment consultancy and advisory whereby we render investment research and financial and investment related advisory services to our customers in return for a fixed monthly fee. Advisory fees accounted for 29.88% and nil of our total revenues for FY 2024 and FY 2023 respectively.

1

Table of Contents

• Asset Management Services: I Win Asset Management offers discretionary account management and fund management services that cater to different investment objectives of our Operating Subsidiaries’ clients. Our asset management services accounted for 0% and 1.03% of our total revenue for FY 2024 and FY 2023, respectively.

Our revenues were US$1.4 million and US$3.3 million for the years ended March 31, 2024 and 2023, respectively. We recorded net loss of US$4.7 million and US$0.2 million for the years ended March 31, 2024 and 2023, respectively. We plan to keep our business growing by strengthening the securities brokerage, underwriting and placement services and develop our asset management business and margin financing services. Our diversified business portfolio allows our Operating Subsidiaries to create synergies between our business lines, generate new business opportunities for each business segment and provide integrated financial services to clients.

Competitive Strengths

We believe that the following competitive strengths contribute to our success and differentiate us from our competitors:

• A proven and experienced management team consisting of industry veterans;

• Established and strong relationship with our clients and stable client base; and

• Synergies among our different lines of services that generate diversified and stable sources of revenue.

Growth Strategies

Our business model and competitive strengths provide us with multiple avenues for growth. We intend to execute the following key strategies:

• Strengthening our placing and underwriting services;

• Expanding our securities dealing and brokerage market presence in relation to the United States exchanges;

• Developing our securities margin financing services;

• Enhancing and developing our asset management business; and

• Enhancing our IT systems.

Corporate History and Structure

Garden Stage Limited was incorporated on August 11, 2022 under the Cayman Islands law. Prior to the Reorganization as described below, we historically conducted our business through I Win Holdings Limited (“I Win Holdings HK”), a company incorporated under the laws of Hong Kong, and its subsidiaries, namely, I Win Securities Limited (“I Win Securities”) and I Win Asset Management Limited (“I Win Asset Management”), both incorporated under the laws of Hong Kong.

On November 10, 2016, I Win Securities has been established as a company with limited liability under the laws of Hong Kong and commenced our securities brokerage and underwriting and placing business. I Win Securities was licensed by the HKSFC to undertake Type 1 (dealing in securities) regulated activity on July 19, 2017. To expand our services into asset management services, on March 25, 2020, I Win Asset Management has been established as a company with limited liability under the laws of Hong Kong. I Win Asset Management obtained the relevant HKSFC licenses to undertake Type 4 (advising on securities) and Type 9 (asset management) regulated activities on January 25, 2021.

On March 25, 2020, I Win Holdings HK was also incorporated under the laws of Hong Kong as the holding company of I Win Securities and I Win Asset Management.

On June 6, 2022, HKSFC approved I Win Holdings HK to become the holding company of I Win Securities and I Win Asset Management. Subsequently, pursuant to the June 6, 2022 HKSFC approval, on June 24, 2022, I Win Holdings HK acquired 100% of the equity interest of I Win Securities and I Win Asset Management and became their holding company.

2

Table of Contents

Pursuant to the Reorganization in April 2023 as described below, Garden Stage Limited have become the holding company of I Win Holdings HK and its subsidiaries. Upon completion of the Reorganization, our group of companies comprises Garden Stage Limited, 17 Uno Limited (“17 Uno BVI”), I Win Holdings HK, I Win Securities, and I Win Asset Management.

The Reorganization

In this prospectus, we refer to all these following events as the “Reorganization”.

As part of the Reorganization, on August 11, 2022, we formed Garden Stage. Upon the incorporation of Garden Stage Limited on August 11, 2022, Garden Stage Limited issued 1 ordinary shares to Oriental Moon Tree Limited, for a consideration of US$1.00.

On August 17, 2022, the wholly-owned British Virgin Islands subsidiary of Garden Stage, 17 Uno BVI was then incorporated on August 17, 2022, as the proposed intermediate holding of I Win Holdings HK as part of the Reorganization.

On November 21, 2022, Garden Stage Limited executed a shareholder resolution to change the par value of the Ordinary Shares from US$1.00 to $0.0001, a 10,000 for 1 share subdivision (“Share Subdivision”). Upon the Share Subdivision, the one issued and outstanding Ordinary Share held by Oriental Moon Tree Limited was sub-divided into 10,000 Ordinary Shares of par value of US$0.0001 each. Pursuant to such resolution, the authorized share capital of Garden Stage Limited was US$50,000 divided into 500,000,000 Ordinary Shares with a nominal or par value of US$0.0001 each, in accordance with section 13 of the Cayman Islands Companies Act.

Since I Win Securities and I Win Asset Management are HKSFC-licensed corporations, prior approval from the HKSFC is required for any company or individual to become a holding company or the substantial shareholder of an HKSFC-licensed corporation. On September 2, 2022, the New Substantial Shareholder Application was submitted to the HKSFC, in which 17 Uno BVI, Garden Stage, and Oriental Moon Tree are to become the substantial shareholders of I Win Securities and I Win Asset Management. The HKSFC approvals were obtained on January 26, 2023 (the “January 26 HKSFC approval”).

Pursuant to the January 26 HKSFC approval, the Reorganization was completed in April 2023. Pursuant to the Reorganization, on April 3, 2023, Garden Stage acquired, through 17 Uno BVI, all of the issued equity interests of I Win Holdings HK, from the existing shareholders of I Win Holdings HK, namely, Courageous Wealth Limited, Lobster Financial Holdings Limited, Capital Hero Global Limited, Smark Holding Limited, and Gulu Gulu Limited, in cash consideration of HK$1,000 in aggregate. In April 2023, in connection with the Reorganization, Garden Stage Limited allotted and issued:

(a) additional 80,000 Ordinary Shares at the par value of US$0.0001 to Oriental Moon Tree Limited on April 3, 2023; and

(b) additional 11,385,000 Ordinary Shares at the par value of US$0.0001 to Oriental Moon Tree Limited on April 20, 2023.

Upon completion of the Reorganization, I Win Securities and I Win Asset Management, our Operating Subsidiaries, have become the indirect wholly-owned subsidiaries of Garden Stage through 17 Uno BVI and I Win Holding HK.

Pre-IPO Investment

On July 22, 2022, I Win Holdings HK entered into Investment Agreement with State Wisdom Holdings Limited (“State Wisdom Holdings”), as varied by the Supplemental Investment Agreement entered into on November 22, 2022 and a further Supplemental Investment Agreement entered into on April 3, 2023. Pursuant to aforesaid agreements, State Wisdom Holdings to acquire Ordinary Shares representing 5% of the entire issued share capital of Garden Stage Limited upon and at the time of the completion of the Reorganization, at a subscription consideration of HK$3,120,000 (approximately US$397,454), and I Win Holdings HK shall procure Garden Stage Limited to allot and issue the corresponding amount of Ordinary Shares of Garden Stage Limited to State Wisdom Holdings.

On July 22, 2022, I Win Holdings HK entered into Investment Agreement with Bliss Tone Limited (“Bliss Tone”), as varied by the Supplemental Investment Agreement entered into on November 22, 2022 and a further Supplemental Investment Agreement entered into on April 3, 2023. Pursuant to Investment Agreements, Bliss Tone to acquire

3

Table of Contents

Ordinary Shares of representing 5% of the entire issued share capital of Garden Stage Limited upon and at the time of the completion of the Reorganization, at a subscription consideration of HK$3,120,000 (approximately US$397,454), and I Win Holdings HK shall procure Garden Stage Limited to allot and issue the corresponding amount of Ordinary Shares of Garden Stage Limited to Bliss Tone.

According to Investment Agreements and Supplemental Investment Agreements between I Win Holdings HK, Bliss Tone, and State Wisdom Holdings, as part of the Reorganization, Garden Stage allotted and issued:

(a) 5,000 Ordinary Shares to State Wisdom Holdings on April 3, 2023;

(b) 5,000 Ordinary Shares to Bliss Tone on April 3, 2023;

(c) 632,500 Ordinary Shares to State Wisdom Holdings on April 20, 2023; and

(d) 632,500 Ordinary Shares to Bliss Tone on April 20, 2023.

The subscription of Ordinary Shares by State Wisdom Holdings and Bliss Tone were completed on April 20, 2023.

Initial Public Offering

On December 5, 2023, the Company closed its initial public offering of 2,500,000 Ordinary Shares at a public offering price of US$4.00 per Ordinary Share; and the underwriters to the Company’s initial public offering had exercised the Over-Allotment Option in full to purchase an additional 375,000 Ordinary Shares, on December 4, 2023, prior to the closing of the initial public offering.

As of the date of this prospectus, 15,625,000 Ordinary Shares were issued and outstanding.

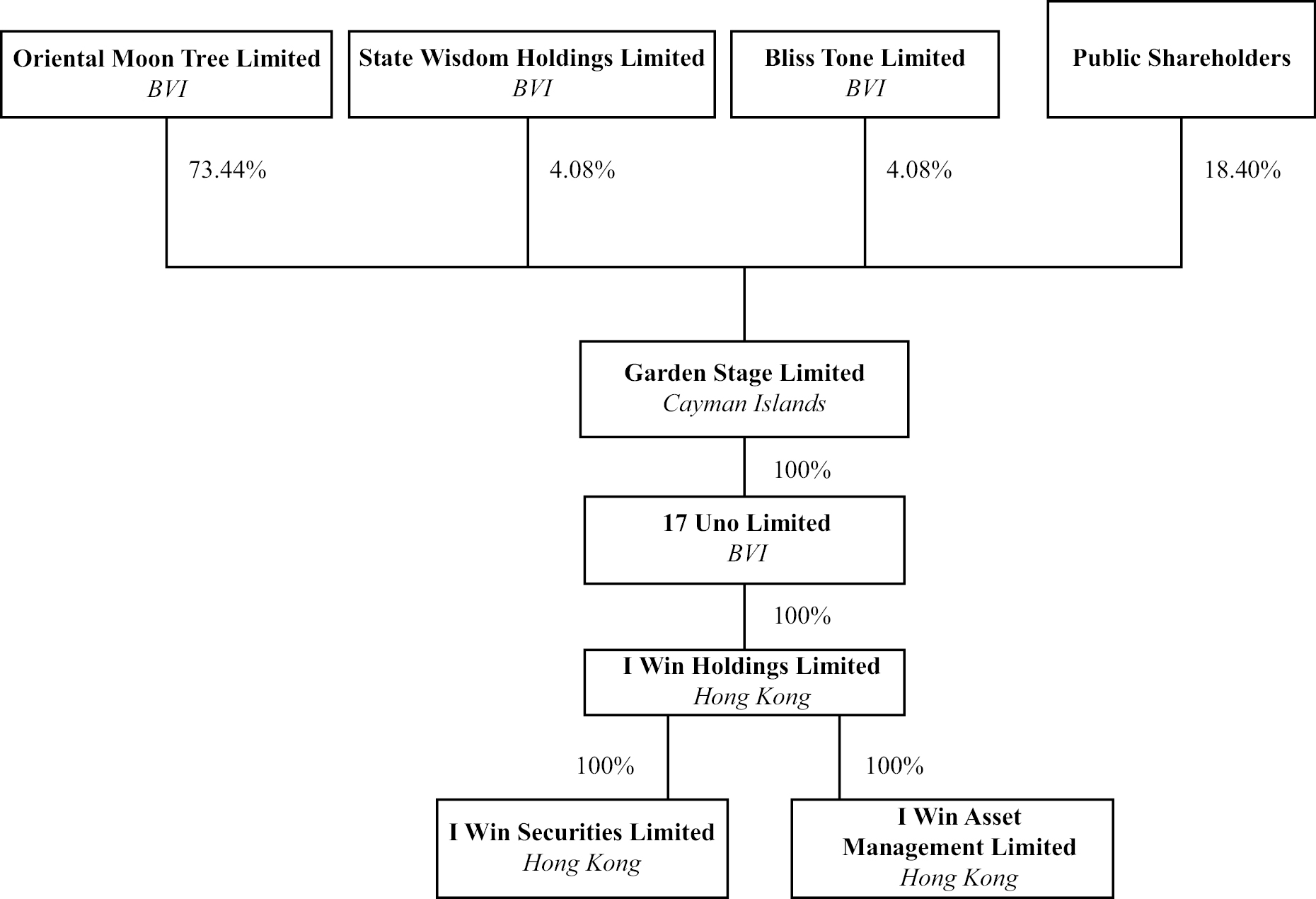

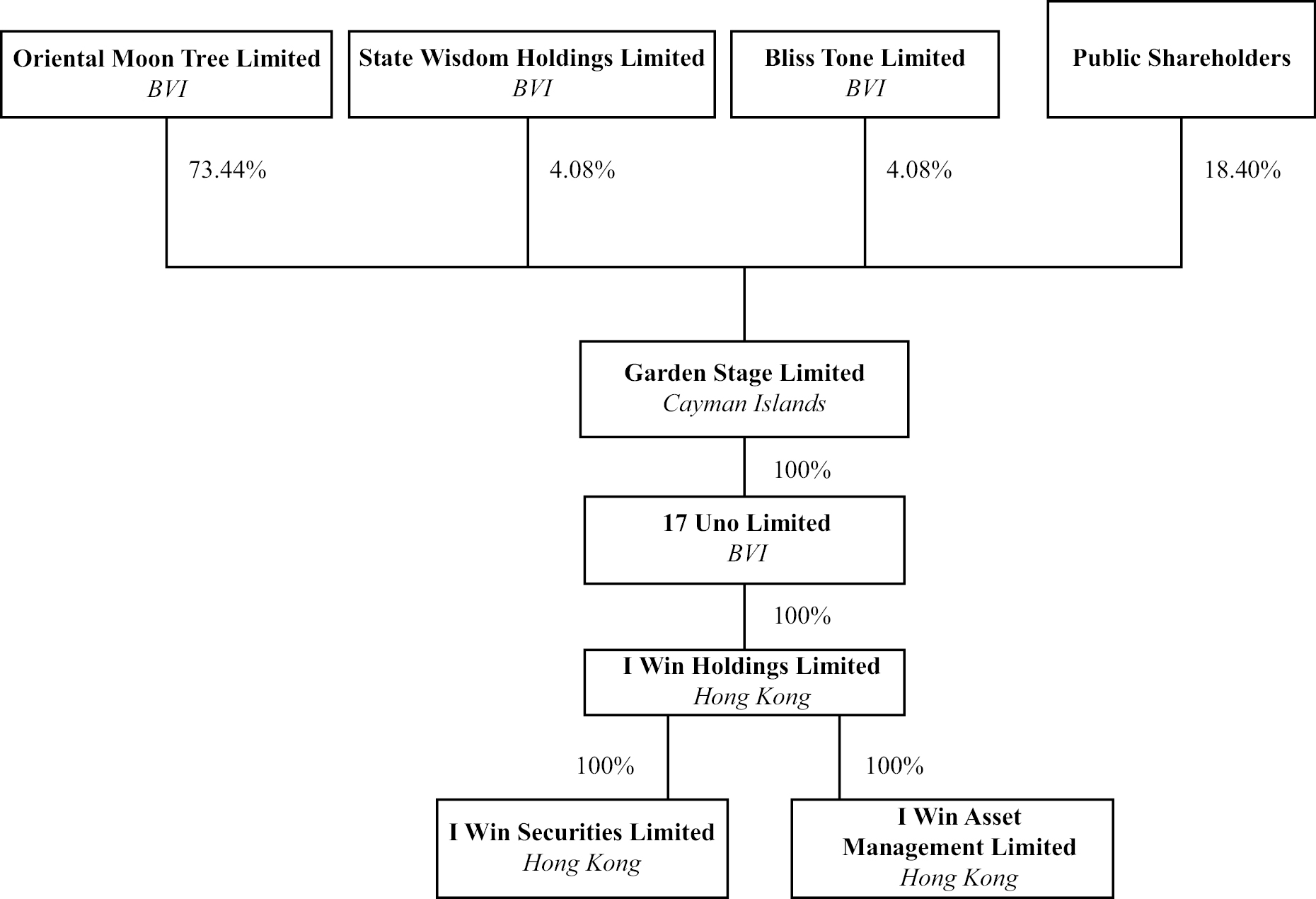

The following diagram illustrates our corporate structure as of the date of this prospectus:

4

Table of Contents

Our Subsidiaries and Business Functions

17 Uno BVI was incorporated under the laws of British Virgin Islands to be the intermediate holding company of I Win Holdings HK on August 17, 2022 as part of the Reorganization. I Win Holdings HK was incorporated under the laws of Hong Kong as the holding company of I Win Asset Management and I Win Securities on March 25, 2020. On June 6, 2022, HKSFC approved I Win Holdings HK to be the substantial shareholder of I Win Securities and I Win Asset Management. On June 24, 2022, I Win Holdings HK acquired 100% of the equity interest of I Win Securities and I Win Asset Management and has become their holding company.

I Win Securities was established in accordance with laws and regulations of Hong Kong on November 10, 2016. With a registered capital of HKD 15,000,000 (approximately US$1.9 million) currently, I Win Securities is a limited liability corporation licensed with HKSFC to undertake Type 1 (dealing in securities) regulated activity.

I Win Asset Management was established in accordance with laws and regulations of Hong Kong on March 25, 2020. With a registered capital of HKD 900,000 (approximately US$0.1 million) currently, I Win Asset Management is a limited liability corporation licensed with the HKSFC to undertake Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

Holding Company Structure

Garden Stage Limited is a holding company incorporated in the Cayman Islands with no material operations of its own. We conduct our operations primarily in Hong Kong through our Operating Subsidiaries in Hong Kong. The Ordinary Shares offered in this offering are shares of the Cayman Islands holding company, instead of shares of our Operating Subsidiaries in Hong Kong. Investors in our Ordinary Shares should be aware that they may never directly hold equity interests in our subsidiaries in Hong Kong.

As a result of our corporate structure, our ability to pay dividends to our shareholders depends upon dividends paid by our Hong Kong subsidiaries through our BVI subsidiary. If our existing Hong Kong subsidiaries or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us.

Transfers of Cash to and from Our Subsidiaries

On December 6, 2023, the wholly owned subsidiary of Garden Stage, I Win Holding Limited, had received the net proceeds from Garden Stage’s initial public offering of US$10.2 million, on behalf of Garden Stage, which is accounted for in our consolidated financial statements as the proceeds to Garden Stage.

For the years ended March 31, 2024, 2023 and 2022, and as of the date of this prospectus, no transfer of cash or other types of assets has been made between our Cayman Islands holding company and subsidiaries. Garden Stage, our Cayman Islands holding company has not declared or made any dividends or other distributions to its shareholders, including U.S. investors, in the past and as date of this prospectus, nor has any dividends or distributions been made by subsidiaries to our Cayman Islands holding company.

Under Cayman Islands law, a Cayman Islands company may pay a dividend either out of profit or share premium account, provided that in no circumstances may a dividend be paid if the dividend payment would result in the company being unable to pay its debts as they fall due in the ordinary course of business. Even if our board of directors decides to pay dividends, the form, frequency, and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions, and other factors that the board of directors may deem relevant. Cash dividends on our Ordinary Shares, if any, will be paid in U.S. dollars.

For Garden Stage Limited to transfer cash to its subsidiaries, Garden Stage is permitted under the laws of the Cayman Islands to provide funding to its subsidiaries incorporated in the British Virgin Islands and Hong Kong through loans or capital contributions without restrictions on the amount of the funds. According to the BVI Business Companies Act 2004 (as revised), a British Virgin Islands company may make dividends distribution to the extent that immediately after the distribution, such company’s assets do not exceed its liabilities and that such company is able to pay its debts as they fall due. According to the Companies Ordinance of Hong Kong, a Hong Kong company may only make a distribution out of profits available for distribution. Other than the above, we did not adopt or maintain any cash management policies and procedures as of the date of this prospectus.

5

Table of Contents

Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. The PRC laws and regulations do not currently have any material impact on the transfer of cash from Garden Stage Limited to our subsidiaries or from our subsidiaries to Garden Stage Limited. There are no restrictions on foreign exchange and there are no limitations on the abilities of Garden Stage Limited to transfer cash to or from our subsidiaries or to investors under Hong Kong Law. There are no restrictions or limitations under the laws of Hong Kong imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong, nor is there any restriction on any foreign exchange to transfer cash between Garden Stage Limited and its subsidiaries, across borders and to U.S. investors, nor there is any restrictions and limitations to distribute earnings from our subsidiaries to Garden Stage Limited and U.S. investors and amounts owed.

For Garden Stage to make dividends to its shareholders, subject to the Companies Act (as revised) of the Cayman Islands, which we refer to as the Companies Act below, and our Amended and Restated Memorandum and Articles of Association, our board of directors may authorize and declare a dividend to shareholders from time to time out of the profits from the Company, realized or unrealized, or out of the share premium account, provided that the Company will remain solvent, meaning the Company is able to pay its debts as they come due in the ordinary course of business.

We do not have any present plan to declare or pay any dividends on our Ordinary Shares in the foreseeable future. We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments, in our Amended and Restated Memorandum and Articles of Association and in the Companies Act. See “Dividend Policy” on page 51 and “Risk Factors — Risks Relating to our Corporate Structure — We rely on dividends and other distributions on equity paid by the Operating Subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of the Operating Subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business” on page 26 for more information.

Permission Required From the Hong Kong Authorities

Due to the licensing requirements of the HKSFC, I Win Securities and I Win Asset Management are required to obtain necessary licenses to conduct their business in Hong Kong and their business and responsible personnel are subject to the relevant laws and regulations and the respective rules of the HKSFC. I Win Securities currently holds a Type 1 license for dealing in securities. I Win Asset Management currently holds a Type 4 license for advising on securities and a Type 9 license for asset management. See “Regulation — Licensing Regime Under the SFO.” These licenses have no expiration date and will remain valid unless they are suspended, revoked, or canceled by the HKSFC. We pay standard governmental annual fees to the HKSFC and are subject to continuing regulatory obligations and requirements, including the maintenance of minimum paid-up share capital and liquid capital, maintenance of segregated accounts, and submission of audited accounts and other required documents, among others. See “Regulation — Licensing Regime Under the SFO.”

Neither we nor any of our subsidiaries are required to obtain any permission or approval from Hong Kong authorities to offer the securities of Garden Stage to foreign investors.

Recent Regulatory Development in the PRC

Hong Kong is a special administrative region of the PRC and the basic policies of the PRC regarding Hong Kong are reflected in the Basic Law of the Hong Kong Special Administrative Region, or the Basic Law, which is a national law of the PRC and the constitutional document for Hong Kong. The Basic Law provides Hong Kong with a high degree of autonomy and executive, legislative and independent judicial powers, including that of final adjudication under the principle of “one country, two systems.” However, there is no assurance that there will not be any changes in the economic, political and legal environment in Hong Kong in the future. If there is a significant change to current political arrangements between Mainland China and Hong Kong, companies operating in Hong Kong may face similar regulatory risks as those operated in the PRC, including their ability to offer securities to investors, list their securities on a U.S. or other foreign exchange, and conduct their business or accept foreign investment. In light of PRC government’s recent expansion of authority in Hong Kong, there are risks and uncertainties which we cannot foresee for the time being, and rules, regulations and the enforcement of laws in the PRC can change quickly with little or no advance notice. The PRC government may intervene or influence the current and future operations in Hong Kong at any time or may exert more oversight and control over offerings conducted overseas and/or foreign investment in issuers like us.

6

Table of Contents

We are aware that, recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in Mainland China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over Mainland China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. For example, on June 10, 2021, the Standing Committee of the National People’s Congress enacted the PRC Data Security Law, which took effect on September 1, 2021. The law requires data collection to be conducted in a legitimate and proper manner, and stipulates that, for the purpose of data protection, data processing activities must be conducted based on data classification and hierarchical protection system for data security. On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly the Opinions on Strictly Cracking Down on Illegal Securities Activities in Accordance with the Law, which, among other things, requires the relevant governmental authorities to accelerate rulemaking related to the overseas issuance and listing of securities, and update the existing laws and regulations related to data security, cross-border data flow, and management of confidential information, and to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over Mainland China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws.

On August 20, 2021, the 30th meeting of the Standing Committee of the 13th National People’s Congress voted and passed the “Personal Information Protection Law of the People’s Republic of China,” or “PRC Personal Information Protection Law,” or “PIPL”, which became effective on November 1, 2021. The PIPL stipulates the rules for cross-border provision of personal information and applies to the processing of personal information of natural persons within the territory of Mainland China that is carried out outside of Mainland China where (1) such processing is for the purpose of providing products or services for natural persons within Mainland China, (2) such processing is to analyze or evaluate the behavior of natural persons within Mainland China, or (3) there are any other circumstances stipulated by related laws and administrative regulations. Prior to the cross-border provision of personal information of the natural persons, personal information processors shall obtain the approval of the corresponding natural persons and advise them of the overseas receiver’s name, contact information, processing purpose and methods, classification of personal information and information reception procedures, etc.

On December 24, 2021, the China Securities Regulatory Commission (“CSRC”), together with other relevant PRC government authorities issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) and the Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (collectively to be referred as the “Draft Overseas Listing Regulations”). The Draft Overseas Listing Regulations require that a Mainland China domestic enterprise seeking to issue and list its shares overseas (“Overseas Issuance and Listing”) shall complete the filing procedures of and submit the relevant information to CSRC. The Overseas Issuance and Listing include direct and indirect issuance and listing. Where an enterprise whose principal business activities are conducted in Mainland China seeks to issue and list its shares in the name of an overseas enterprise (“Overseas Issuer”) on the basis of the equity, assets, income or other similar rights and interests of the relevant Mainland China domestic enterprise, such activities shall be deemed an indirect overseas issuance and listing (“Indirect Overseas Issuance and Listing”) under the Draft Overseas Listing Regulations. On December 28, 2021, the CAC jointly with the relevant authorities formally published the Measures for Cybersecurity Review (2021) which took effect on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020) issued on July 10, 2021. The Measures for Cybersecurity Review (2021) provide that operators of critical information infrastructure purchasing network products and services, and online platform operators (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country.

On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Administrative Measures, and five supporting guidelines, which came into effect on March 31, 2023. The Trial Administrative Measures further stipulate the rules and requirements for overseas offering and listing conducted by PRC domestic companies. The Overseas Listing Regulations require that a PRC domestic enterprise seeking to issue and list its shares overseas shall complete the filing procedures of and submit the relevant information to CSRC, failing which we may be fined between RMB 1 million and RMB 10 million.

7

Table of Contents

Garden Stage is a holding company incorporated in the Cayman Islands with operating entities solely based in Hong Kong, and it does not have any subsidiary or VIE in Mainland China or intend to acquire any equity interest in any domestic companies within Mainland China, nor is it controlled by any companies or individuals of Mainland China. Further, we are headquartered in Hong Kong with our officers and all members of the board of directors based in Hong Kong who are not Mainland China citizens and all of our revenues and profits are generated by our subsidiaries in Hong Kong. Meanwhile, our Operating Subsidiaries may collect and store certain data (including certain personal information) from our customers, some of whom may be individuals in Mainland China, in connection with our business and operations and for “Know Your Customers” purposes (to combat money laundering).

As advised by our PRC counsel, the Measures for Cybersecurity Review (2021), PRC Data Security Law, the PIPL, the Draft Overseas Listing Regulations and the Trial Administrative Measures currently does not have an impact on our business, operations or this offering, nor do we or our Hong Kong subsidiaries are covered by permission requirements from the CAC that is required to approve our Hong Kong subsidiaries’ operations and our Offering, as our Hong Kong subsidiaries will not be deemed to be an “Operator” or a “data processor” that required to file for cybersecurity review before listing in the United States. Because: (i) our Hong Kong subsidiaries were incorporated in Hong Kong and operate only in Hong Kong without any subsidiary or VIE structure in Mainland China and each of the Measures for Cybersecurity Review (2021), the PIPL, the Draft Overseas Listing Regulations and the Trial Administrative Measures do not clearly provide whether it shall be applied to a company based in Hong Kong; (ii) as of date of this prospectus, our Operating Subsidiaries have in aggregate collected and stored personal information of approximately 1,497 Mainland China individuals, far less than one million users; (iii) all of the data our Operating Subsidiaries have collected is stored in servers located in Hong Kong, and we do not place any reliance on collection and processing of any personal information to maintain our business operation; (iv) as of the date of this prospectus, neither of our Operating Subsidiaries has been informed by any PRC governmental authority of any requirement that it files for a CSRC review, nor received any inquiry, notice, warning, or sanction in such respect initiated by the CAC or related governmental regulatory authorities; and (v) data processed in our business should not have a bearing on national security nor affect or may affect national security, and we have not been notified by any authorities of being classified as an Operator. Moreover, as advised by our PRC counsel, pursuant to the Basic Law, PRC laws and regulations shall not be applied in Hong Kong except for those listed in Annex III of the Basic Law (which is confined to laws relating to national defense, foreign affairs and other matters that are not within the scope of autonomy). Therefore, based on the PRC laws and regulations effective as of the date of this prospectus and subject to interpretations of these laws and regulations that may be adopted by PRC government authorities, as advised by our PRC counsel, neither we, nor our Operating Subsidiaries in Hong Kong are currently required to obtain any permission or approval from the PRC government authorities, including the CSRC and CAC, to operate our business, list on the U.S. exchanges, or offer the securities to foreign investors. As of the date of this prospectus, neither we nor our Operating Subsidiaries have ever applied for any such permission or approval.

However, as further advised by our PRC counsel, given the uncertainties arising from the PRC and Hong Kong legal systems, including uncertainties regarding the interpretation and enforcement of the PRC laws and the significant authority of the PRC government to intervene or influence the offshore holding company headquartered in Hong Kong, there remains significant uncertainty in the interpretation and enforcement of relevant PRC cybersecurity laws and other regulations. However, since the Trial Administrative Measures was newly promulgated, its interpretation, application and enforcement remain unclear and there also remains significant uncertainty as to the enactment, interpretation and implementation of other regulatory requirements related to overseas securities offerings and other capital markets activities. If Trial Administrative Measures become applicable to us or our Operating Subsidiaries in Hong Kong, if any of our Operating Subsidiaries is deemed to be an “Operator”, or if the Measures for Cybersecurity Review (2021) or the PRC Personal Information Protection Law become applicable to the Operating Subsidiaries in Hong Kong, the business operation of the Operating Subsidiaries and the listing of our Ordinary Shares in the United States could be subject to the CAC’s cybersecurity review or the CSRC Overseas Issuance and Listing review in the future. While we do not believe we are covered by the permission requirements from CSRC or CAC, investors of our company and our business may face potential uncertainty from actions taken by the PRC government affecting our business. If the applicable laws, regulations, or interpretations change and our Operating Subsidiaries become subject to the CAC or CSRC review, we cannot assure you that our Operating Subsidiaries will be able to comply with the regulatory requirements in all respects and our current practice of collecting and processing personal information may be ordered to be rectified or terminated by regulatory authorities. Moreover, if there is a significant change to the current political arrangements between the PRC and Hong Kong, or the applicable laws, regulations, or interpretations change, and/or if we were required to obtain such permissions or approvals in the future in connection with the listing or continued listing of our securities on a stock

8

Table of Contents

exchange outside of the PRC, it is uncertain how long it will take for us to obtain such approval, and, even if we obtain such approval, the approval could be rescinded. Any failure to obtain or a delay in obtaining the necessary permissions from the PRC authorities to conduct offerings or list outside of the PRC may subject us to sanctions imposed by the CSRC, CAC, or other PRC regulatory authorities. It could include fines and penalties, proceedings against us, and other forms of sanctions, and our ability to conduct our business, invest into the Mainland China as foreign investments or accept foreign investments, ability to offer or continue to offer Ordinary Shares to investors or list on the U.S. or other overseas exchange may be restricted, and the value of our Ordinary Shares may significantly decline or be worthless, our business, reputation, financial condition, and results of operations may be materially and adversely affected. The CSRC, the CAC, or other PRC regulatory agencies also may take actions requiring us, or making it advisable for us, to halt this offering before settlement and delivery of our Ordinary Shares. Consequently, if you engage in market trading or other activities in anticipation of and prior to settlement and delivery, you do so at the risk that settlement and delivery may not occur. In addition, if the CSRC, the CAC, or other regulatory PRC agencies later promulgate new rules requiring that we obtain their approvals for this offering, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding such an approval requirement could have a material adverse effect on the trading price of our securities. See Risk Factors — Risks Relating to Doing Business in the Jurisdictions in which the Operating Subsidiaries Operate — “If the PRC government chooses to extend the oversight and control over offerings that are conducted overseas and/or foreign investment in Mainland China-based issuers to Hong Kong-based issuers, such action may significantly limit or completely hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 22, and “We may become subject to a variety of PRC laws and other obligations regarding data security in relation to offerings that are conducted overseas and/or foreign investment in Mainland China-based issuers, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition and results of operations and may hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless” on page 20.

Implications of Being an “Emerging Growth Company”

As a company with less than US$1.235 billion in revenues during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

• may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or “MD&A”;

• are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”;

• are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

• are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes);

• are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure;

• are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and

• will not be required to conduct an evaluation of our internal control over financial reporting.

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

9

Table of Contents

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year during which we have total annual gross revenues of at least US$1.235 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of our initial public offering; (iii) the date on which we have, during the preceding three-year period, issued more than US$1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our Ordinary Shares that are held by non-affiliates exceeds US$700.0 million as of the last business day of our most recently completed second fiscal quarter. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

Implication of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

• we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company;

• for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies;

• we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

• we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

• we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and

• we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

Implications of Being a Controlled Company

Controlled companies are exempt from the majority of independent director requirements. Controlled companies are subject to an exemption from NASDAQ standards requiring that the board of a listed company consist of a majority of independent directors within one year of the listing date.

Public companies that qualify as a “Controlled Company” with securities listed on the NASDAQ, must comply with the exchange’s continued listing standards to maintain their listings. NASDAQ has adopted qualitative listing standards. Companies that do not comply with these corporate governance requirements may lose their listing status. Under the NASDAQ rules, a “controlled company” is a company with more than 50% of its voting power held by a single person, entity or group. Under NASDAQ rules, a controlled company is exempt from certain corporate governance requirements including:

• the requirement that a majority of the board of directors consist of independent directors;

• the requirement that a listed company have a nominating and governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities;

• the requirement that a listed company have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and

• the requirement for an annual performance evaluation of the nominating and governance committee and compensation committee.

Controlled companies must still comply with the exchange’s other corporate governance standards. These include having an audit committee and the special meetings of independent or non-management directors.

10

Table of Contents

Our Controlling Shareholder, Oriental Moon Tree Limited, which is also the Selling Shareholder, will own a majority of our total issued and outstanding Ordinary Shares following this offering. As a result, we will be a “controlled company” as defined under NASDAQ Listing Rule 5615(c). As a “controlled company,” we are permitted to elect not to comply with certain corporate governance requirements. Although we do not intend to rely on the controlled company exemptions under the NASDAQ listing standards even if we are deemed a controlled company, we could elect to rely on these exemptions in the future, and if so, you would not have the same protection afforded to shareholders of companies that are subject to all of the corporate governance requirements of the NASDAQ Capital Market.

Impact of Russia’s Invasion of Ukraine and Related Supply Chain Issues

Russia launched a large-scale invasion of Ukraine on February 24, 2022. The extent and duration of the military action, resulting sanctions and resulting future market disruptions, including volatilities in stock markets, disruption to global supply chain and worsening of global inflation, are impossible to predict, but could be significant. Any such disruptions caused by Russian military action or other actions (including cyberattacks and espionage) or resulting actual and threatened responses to such activity, including purchasing and financing restrictions, boycotts or changes in consumer or purchaser preferences, sanctions, tariffs or cyberattacks, may have significant collateral impact on global economy and our business model and revenue stream. Nevertheless, as of the date of this document, since (i) we principally operate in Hong Kong and do not have business presence in Russia and Ukraine; and (ii) our industry has been less dependent on oil, natural resources or global supply chain which have been disrupted significantly by Russia’s invasion of Ukraine, there is no material impact on our cash flows, liquidity, capital resources, cash requirements, financial position, or results of operations arising from, related to, or caused by the global disruption from Russia’s invasion of Ukraine.

Corporate Information