UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

___________________________

FORM

6-K

___________________________

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of: August 2024

Commission

File Number: 001-40412

___________________________

VICINITY

MOTOR CORP.

(Translation

of registrant’s name into English)

___________________________

3168,

262nd Street

Aldergrove,

British Columbia, Canada V4W 2Z6

Telephone:

(604) 607-4000

(Address

of principal executive office)

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

The

information contained in Exhibit 99.1 of

this Form 6-K is incorporated by reference into, or as an additional exhibit to, as applicable,

the registrant’s Registration Statement on Form F-3 (File No. 333-272964).

DOCUMENTS INCLUDED AS PART OF THIS REPORT

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Vicinity Motor Corp.

(Registrant) |

| |

|

| Date: August 9, 2024 |

By: |

/s/ Tina Stewart |

| |

|

Name: |

Tina Stewart |

| |

|

Title: |

Chief Financial Officer |

EXHIBIT 99.1

Royal Bank of Canada & EDC Issue Demand Letters

and Notice of Enforcement of Security to Vicinity Motor Corp, a North American Supplier of Commercial Electric Vehicles

Vicinity Intends to Pursue All Available Options

Afforded by Law to Resolve These Matters While Continuing to Support its Customer Base

VANCOUVER, BC / ACCESSWIRE / August

9, 2024 / Vicinity Motor Corp. (NASDAQ:VEV) (TSXV:VMC) (“Vicinity” or the “Company”), a North American supplier

of commercial electric vehicles, today announced it has received letters from Royal Bank of Canada (“Royal Bank”) and Export

Development Canada (“EDC”) (the “ Secured Lenders”) which demand full payment of the outstanding debt balances

under their respective credit facilities. Royal Bank has demanded payment by August 19, 2024 and EDC has demanded immediate payment. RBC

indebtedness totals USD$19,202,242 (the Company’s records reflect a lower balance of USD$16,241,641) plus CAD$45,251 and EDC indebtedness

totals USD$8,625,000 plus interest of USD$54,231. Additional interest, costs, fees and expenses under the credit facilities of the respective

Secured Lenders continues to accrue.

In addition, the Secured Lenders have provided

Vicinity with Notices of Intention to Enforce Security pursuant to subsection 244(1) of the Bankruptcy and Insolvency Act (Canada).

The Company will engage in discussions with its creditors to evaluate potential solutions to enable

the Company to carry on in some form in the future; however, there can be no assurances it will be able to successfully do so. The Secured

Lenders may enforce their security and/or a receiver or receiver manager may be appointed. Vicinity intends to pursue all available

options afforded by law to resolve these matters while continuing to support its customer base.

As

disclosed in the Company’s publicly filed interim financial statements for the three months ended March 31, 2024, the credit facilities

were set be renewed on a yearly basis, at the discretion of the Secured Lenders, on July 16, 2024. The Company had actively been working

with Royal Bank and EDC on securing a renewal, but Royal Bank and EDC have exercised their discretion not to renew the credit facilities.

As set out in the interim financial statements, as of March 31, 2024 the Company had drawn USD$17,225,000 under the credit facilities.

Additional details about the credit facilities can be found in Note 5 of the interim financial statements.

The Vicinity Board of Directors remains

committed to navigating these challenges as it turns a corner during a difficult time in the transition to broader electric vehicle adoption,

leveraging the Company’s position as a respected Canadian EV and transit bus OEM providing significant public benefit. Today there

are more than 1,000 Vicinity transit buses in operation across North America and Vicinity recognizes this responsibility to support and

maintain the critical transportation infrastructure that allows North America’s families to fulfill their travel responsibilities.

The Company maintained USD$77.8 million

in assets as of March 31, 2024, including USD$23.5 million of Property, Plant and Equipment, USD$28.2 million of Inventory and USD$4.3

million of cash & cash equivalents. As stated in the Company’s publicly filed Management Discussion & Analysis for the three

months ended March 31, 2024, the Company has been impacted by continued supply chain impacts to its production efficiency, lower than

anticipated demand for the VMC 1200, higher than anticipated working capital requirements to support production backlog and insufficient

support from lenders.

The Company intends for trading of the

Company’s common shares to continue on the NASDAQ and TSX Venture Exchange, subject to compliance with applicable exchange requirements.

About Vicinity Motor Corp.

Vicinity Motor Corp. (NASDAQ:VEV) (TSXV:VMC) (“VMC”)

is a North American supplier of electric vehicles for both public and commercial enterprise use. The Company leverages a dealer network

and close relationships with world-class manufacturing partners to supply its flagship electric, CNG and clean-diesel Vicinity buses,

as well as the VMC 1200 electric truck to the transit and industrial markets. For more information, please visit www.vicinitymotorcorp.com.

Company Contact:

John LaGourgue

VP Corporate Development

604-288-8043

IR@vicinitymotor.com

Investor Relations Contact:

Lucas Zimmerman

MZ Group - MZ North America

949-259-4987

VMC@mzgroup.us

www.mzgroup.us

Neither the TSX-V nor its Regulation Service Provider

(as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain “forward-looking

information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning

of applicable securities laws. All statements, other than statements of historical fact, included herein are forward-looking statements.

Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”,

“believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions,

or statements that events, conditions, or results “will”, “may”, “could”, or “should”

occur or be achieved. In particular, and without limitation, this news release contains forward-looking statements regarding the continuation

of trading of the Company’s common shares on the NASDAQ and TSX Venture Exchange, and the success of the Company’s discussions

with its creditors to evaluate potential solutions to enable the Company to carry on. Forward-looking statements involve various

risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events

could differ materially from those anticipated in such statements.

Important factors that could cause actual results

to differ materially from Vicinity’s expectations include uncertainties relating to the economic conditions in the markets in which

Vicinity operates, vehicle sales volume, anticipated future sales growth, the success of Vicinity’s operational strategies, production

prospects at Vicinity’s assembly facility in the State of Washington, the success of Vicinity’s strategic partnerships, the

ability to continue as a going concern; and other risk and uncertainties disclosed in Vicinity’s reports and documents filed with

applicable securities regulatory authorities from time to time. Vicinity’s forward-looking statements reflect the beliefs, opinions

and projections on the date the statements are made. Vicinity assumes no obligation to update the forward-looking statements or beliefs,

opinions, projections, or other factors, should they change, except as required by law.

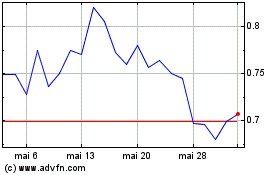

Vicinity Motor (NASDAQ:VEV)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Vicinity Motor (NASDAQ:VEV)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024