false

--12-31

Q2

0001574235

0001574235

2024-01-01

2024-06-30

0001574235

dei:FormerAddressMember

2024-01-01

2024-06-30

0001574235

2024-08-08

0001574235

2024-06-30

0001574235

2023-12-31

0001574235

PULM:SeriesAConvertiblePreferredStockMember

2024-06-30

0001574235

PULM:SeriesAConvertiblePreferredStockMember

2023-12-31

0001574235

2024-04-01

2024-06-30

0001574235

2023-04-01

2023-06-30

0001574235

2023-01-01

2023-06-30

0001574235

us-gaap:PreferredStockMember

2023-12-31

0001574235

us-gaap:CommonStockMember

2023-12-31

0001574235

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001574235

us-gaap:RetainedEarningsMember

2023-12-31

0001574235

us-gaap:PreferredStockMember

2024-03-31

0001574235

us-gaap:CommonStockMember

2024-03-31

0001574235

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001574235

us-gaap:RetainedEarningsMember

2024-03-31

0001574235

2024-03-31

0001574235

us-gaap:PreferredStockMember

2022-12-31

0001574235

us-gaap:CommonStockMember

2022-12-31

0001574235

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001574235

us-gaap:RetainedEarningsMember

2022-12-31

0001574235

2022-12-31

0001574235

us-gaap:PreferredStockMember

2023-03-31

0001574235

us-gaap:CommonStockMember

2023-03-31

0001574235

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001574235

us-gaap:RetainedEarningsMember

2023-03-31

0001574235

2023-03-31

0001574235

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001574235

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001574235

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001574235

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001574235

2024-01-01

2024-03-31

0001574235

us-gaap:PreferredStockMember

2024-04-01

2024-06-30

0001574235

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0001574235

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0001574235

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0001574235

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0001574235

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001574235

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001574235

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001574235

2023-01-01

2023-03-31

0001574235

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001574235

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001574235

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001574235

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001574235

us-gaap:PreferredStockMember

2024-06-30

0001574235

us-gaap:CommonStockMember

2024-06-30

0001574235

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001574235

us-gaap:RetainedEarningsMember

2024-06-30

0001574235

us-gaap:PreferredStockMember

2023-06-30

0001574235

us-gaap:CommonStockMember

2023-06-30

0001574235

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001574235

us-gaap:RetainedEarningsMember

2023-06-30

0001574235

2023-06-30

0001574235

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

PULM:OneCustomerMember

2024-04-01

2024-06-30

0001574235

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

PULM:OneCustomerMember

2024-01-01

2024-06-30

0001574235

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

PULM:OneCustomerMember

2023-04-01

2023-06-30

0001574235

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

PULM:OneCustomerMember

2023-01-01

2023-06-30

0001574235

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

PULM:TwoCustomerMember

2024-01-01

2024-06-30

0001574235

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

PULM:OneCustomerMember

2023-01-01

2023-12-31

0001574235

PULM:LaboratoryEquipmentMember

2024-06-30

0001574235

PULM:LaboratoryEquipmentMember

2023-12-31

0001574235

us-gaap:LeaseholdImprovementsMember

2024-06-30

0001574235

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001574235

PULM:OfficeFurnitureAndEquipmentMember

2024-06-30

0001574235

PULM:OfficeFurnitureAndEquipmentMember

2023-12-31

0001574235

us-gaap:ComputerEquipmentMember

2024-06-30

0001574235

us-gaap:ComputerEquipmentMember

2023-12-31

0001574235

PULM:CapitalInProgressMember

2024-06-30

0001574235

PULM:CapitalInProgressMember

2023-12-31

0001574235

PULM:CiplaAgreementMember

PULM:CiplaTechnologiesLlcMember

2024-01-01

2024-06-30

0001574235

PULM:CiplaAgreementMember

PULM:CiplaTechnologiesLlcMember

PULM:ResearchAndDevelopmentServiceMember

2024-06-30

0001574235

PULM:CiplaTechnologiesLlcMember

PULM:CiplaAgreementMember

PULM:IrrevocableLicenseMember

2024-06-30

0001574235

PULM:CiplaTechnologiesLlcMember

PULM:CiplaAgreementMember

PULM:ResearchAndDevelopmentServiceMember

2024-04-01

2024-06-30

0001574235

PULM:CiplaTechnologiesLlcMember

PULM:CiplaAgreementMember

PULM:ResearchAndDevelopmentServiceMember

2024-01-01

2024-06-30

0001574235

PULM:CiplaTechnologiesLlcMember

PULM:CiplaAgreementMember

PULM:ResearchAndDevelopmentServiceMember

2023-04-01

2023-06-30

0001574235

PULM:CiplaTechnologiesLlcMember

PULM:CiplaAgreementMember

PULM:ResearchAndDevelopmentServiceMember

2023-01-01

2023-06-30

0001574235

PULM:CiplaAgreementMember

PULM:CiplaTechnologiesLlcMember

2024-06-30

0001574235

PULM:LeaseAssignmentAgreementMember

2024-05-28

2024-05-28

0001574235

PULM:HCWainwrightAndCoLLCMember

PULM:SaleAgreementMember

2021-05-01

2021-05-31

0001574235

PULM:HCWainwrightAndCoLLCMember

PULM:SaleAgreementMember

srt:MinimumMember

2021-05-01

2021-05-31

0001574235

PULM:HCWainwrightAndCoLLCMember

PULM:SaleAgreementMember

PULM:ATMOfferingMember

srt:MinimumMember

2021-05-01

2021-05-31

0001574235

PULM:HCWainwrightAndCoLLCMember

PULM:SaleAgreementMember

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001574235

us-gaap:SubsequentEventMember

2024-07-01

0001574235

PULM:WarrantOneMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantOneMember

2024-06-30

0001574235

PULM:WarrantTwoMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantTwoMember

2024-06-30

0001574235

PULM:WarrantThreeMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantThreeMember

2024-06-30

0001574235

PULM:WarrantFourMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantFourMember

2024-06-30

0001574235

PULM:WarrantFiveMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantFiveMember

2024-06-30

0001574235

PULM:WarrantSixMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantSixMember

2024-06-30

0001574235

PULM:WarrantSevenMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantSevenMember

2024-06-30

0001574235

PULM:WarrantEightMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantEightMember

2024-06-30

0001574235

PULM:WarrantNineMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantNineMember

2024-06-30

0001574235

PULM:WarrantTenMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantTenMember

2024-06-30

0001574235

us-gaap:WarrantMember

2024-06-30

0001574235

PULM:IncentivePlanMember

2024-06-30

0001574235

PULM:LegacySharePlanMember

2024-06-30

0001574235

PULM:StockAwardPlanMember

2024-06-30

0001574235

PULM:StockAwardPlanMember

2024-01-01

2024-06-30

0001574235

us-gaap:StockOptionMember

2023-12-31

0001574235

us-gaap:StockOptionMember

2023-01-01

2023-12-31

0001574235

us-gaap:StockOptionMember

2024-01-01

2024-06-30

0001574235

us-gaap:StockOptionMember

2024-06-30

0001574235

us-gaap:ResearchAndDevelopmentExpenseMember

2024-04-01

2024-06-30

0001574235

us-gaap:ResearchAndDevelopmentExpenseMember

2023-04-01

2023-06-30

0001574235

us-gaap:ResearchAndDevelopmentExpenseMember

2024-01-01

2024-06-30

0001574235

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-06-30

0001574235

us-gaap:GeneralAndAdministrativeExpenseMember

2024-04-01

2024-06-30

0001574235

us-gaap:GeneralAndAdministrativeExpenseMember

2023-04-01

2023-06-30

0001574235

us-gaap:GeneralAndAdministrativeExpenseMember

2024-01-01

2024-06-30

0001574235

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0001574235

PULM:LeaseAgreementMember

PULM:CobaltPropcoMember

2022-01-07

0001574235

PULM:LeaseAgreementMember

PULM:CobaltPropcoMember

2022-01-06

2022-01-07

0001574235

PULM:LeaseAgreementMember

PULM:CobaltPropcoMember

2024-03-01

2024-03-31

0001574235

PULM:LeaseAgreementMember

2024-06-30

0001574235

PULM:OptionsToPurchaseCommonStockMember

2024-01-01

2024-06-30

0001574235

PULM:OptionsToPurchaseCommonStockMember

2023-01-01

2023-06-30

0001574235

PULM:WarrantsToPurchaseCommonStockMember

2024-01-01

2024-06-30

0001574235

PULM:WarrantsToPurchaseCommonStockMember

2023-01-01

2023-06-30

0001574235

PULM:RaadSeveranceAgreementMember

us-gaap:SubsequentEventMember

2024-07-15

2024-07-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended June 30, 2024

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ___________ to __________

Commission

file number: 001-36199

PULMATRIX,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

46-1821392 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

945

Concord Street, Suite 1217

Framingham,

MA |

|

01701 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(888)

355-4440

Registrant’s

telephone number, including area code

36

Crosby Drive, Suite 100

Bedford,

MA 01730

Former

name, former address and former fiscal year, if changed since last report

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

PULM |

|

The

NASDAQ Stock Market LLC |

As

of August 8, 2024, the registrant had 3,652,285 shares of common stock outstanding.

PULMATRIX,

INC.

FORM

10-Q

FOR

THE QUARTERLY PERIOD ENDED JUNE 30, 2024

TABLE

OF CONTENTS

PART

I—FINANCIAL INFORMATION

Item

1. Condensed Consolidated Financial Statements.

PULMATRIX,

INC.

Consolidated

Balance Sheets

(in

thousands, except share and per share data)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 12,379 | | |

$ | 19,173 | |

| Restricted cash | |

| 1,421 | | |

| - | |

| Accounts receivable | |

| 635 | | |

| 928 | |

| Prepaid expenses and other current assets | |

| 1,201 | | |

| 742 | |

| Total current assets | |

| 15,636 | | |

| 20,843 | |

| Property and equipment, net | |

| - | | |

| 1,158 | |

| Operating lease right-of-use asset | |

| - | | |

| 10,309 | |

| Long-term restricted cash | |

| 51 | | |

| 1,472 | |

| Other long-term assets | |

| 93 | | |

| 176 | |

| Total assets | |

$ | 15,780 | | |

$ | 33,958 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 393 | | |

$ | 1,915 | |

| Accrued expenses and other current liabilities | |

| 1,783 | | |

| 947 | |

| Operating lease liability | |

| 24 | | |

| 429 | |

| Deferred revenue | |

| 270 | | |

| 618 | |

| Total current liabilities | |

| 2,470 | | |

| 3,909 | |

| Deferred revenue, net of current portion | |

| - | | |

| 3,727 | |

| Operating lease liability, net of current portion | |

| - | | |

| 8,327 | |

| Total liabilities | |

| 2,470 | | |

| 15,963 | |

| Commitments and contingencies (Note 10) | |

| - | | |

| - | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred Stock, $0.0001 par value — 500,000 shares authorized; 6,746 shares designated Series A convertible preferred stock; no shares issued and outstanding at June 30, 2024 and December 31, 2023 | |

| - | | |

| - | |

| Common stock, $0.0001 par value — 200,000,000 shares authorized; 3,652,285 shares issued and outstanding at June 30, 2024 and December 31, 2023 | |

| - | | |

| - | |

| Additional paid-in capital | |

| 305,893 | | |

| 305,592 | |

| Accumulated deficit | |

| (292,583 | ) | |

| (287,597 | ) |

| Total stockholders’ equity | |

| 13,310 | | |

| 17,995 | |

| Total liabilities and stockholders’ equity | |

$ | 15,780 | | |

$ | 33,958 | |

The

accompanying footnotes are an integral part of these condensed consolidated financial statements.

PULMATRIX,

INC.

Consolidated

Statements of Operations

(in

thousands, except share and per share data)

(unaudited)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

$ | 1,552 | | |

$ | 1,844 | | |

$ | 7,437 | | |

$ | 3,343 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,834 | | |

| 4,165 | | |

| 6,346 | | |

| 8,039 | |

| General and administrative | |

| 2,001 | | |

| 1,670 | | |

| 3,627 | | |

| 3,880 | |

| Loss on disposal group held for sale | |

| 2,618 | | |

| - | | |

| 2,618 | | |

| - | |

| Total operating expenses | |

| 7,453 | | |

| 5,835 | | |

| 12,591 | | |

| 11,919 | |

| Loss from operations | |

| (5,901 | ) | |

| (3,991 | ) | |

| (5,154 | ) | |

| (8,576 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 133 | | |

| 236 | | |

| 293 | | |

| 458 | |

| Other expense, net | |

| (43 | ) | |

| (61 | ) | |

| (125 | ) | |

| (146 | ) |

| Total other income, net | |

| 90 | | |

| 175 | | |

| 168 | | |

| 312 | |

| Net loss | |

$ | (5,811 | ) | |

$ | (3,816 | ) | |

$ | (4,986 | ) | |

$ | (8,264 | ) |

| Net loss per share attributable to common stockholders – basic and diluted | |

$ | (1.59 | ) | |

$ | (1.04 | ) | |

$ | (1.37 | ) | |

$ | (2.26 | ) |

| Weighted average common shares outstanding – basic and diluted | |

| 3,652,285 | | |

| 3,652,285 | | |

| 3,652,285 | | |

| 3,651,531 | |

The

accompanying footnotes are an integral part of these condensed consolidated financial statements.

PULMATRIX,

INC.

Consolidated

Statements of Stockholders’ Equity

(in

thousands, except share data)

(unaudited)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| | |

Preferred Stock | | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance — January 1, 2024 | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 305,592 | | |

$ | (287,597 | ) | |

$ | 17,995 | |

| Stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| 198 | | |

| - | | |

| 198 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 825 | | |

| 825 | |

| Balance — March 31, 2024 | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 305,790 | | |

$ | (286,772 | ) | |

$ | 19,018 | |

| Balance | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 305,790 | | |

$ | (286,772 | ) | |

$ | 19,018 | |

| Stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| 103 | | |

| - | | |

| 103 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,811 | ) | |

| (5,811 | ) |

| Balance — June 30, 2024 | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 305,893 | | |

$ | (292,583 | ) | |

$ | 13,310 | |

| Balance | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 305,893 | | |

$ | (292,583 | ) | |

$ | 13,310 | |

| | |

Preferred Stock | | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance — January 1, 2023 | |

| - | | |

$ | - | | |

| 3,639,185 | | |

$ | - | | |

$ | 304,585 | | |

$ | (273,476 | ) | |

$ | 31,109 | |

| Issuance of common stock, net of issuance costs | |

| - | | |

| - | | |

| 13,100 | | |

| - | | |

| 53 | | |

| - | | |

| 53 | |

| Stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| 296 | | |

| - | | |

| 296 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,448 | ) | |

| (4,448 | ) |

| Balance — March 31, 2023 | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 304,934 | | |

$ | (277,924 | ) | |

$ | 27,010 | |

| Balance | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 304,934 | | |

$ | (277,924 | ) | |

$ | 27,010 | |

| Stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| 255 | | |

| - | | |

| 255 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,816 | ) | |

| (3,816 | ) |

| Net income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,816 | ) | |

| (3,816 | ) |

| Balance — June 30, 2023 | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 305,189 | | |

$ | (281,740 | ) | |

$ | 23,449 | |

| Balance | |

| - | | |

$ | - | | |

| 3,652,285 | | |

$ | - | | |

$ | 305,189 | | |

$ | (281,740 | ) | |

$ | 23,449 | |

The

accompanying footnotes are an integral part of these condensed consolidated financial statements.

PULMATRIX,

INC.

Consolidated

Statements of Cash Flows

(in

thousands)

(unaudited)

| | |

2024 | | |

2023 | |

| | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (4,986 | ) | |

$ | (8,264 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 106 | | |

| 64 | |

| Amortization of operating lease right-of-use asset | |

| 329 | | |

| 777 | |

| Stock-based compensation | |

| 301 | | |

| 551 | |

| Loss on disposal group held for sale | |

| 2,618 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 293 | | |

| 880 | |

| Prepaid expenses and other current assets | |

| (459 | ) | |

| 49 | |

| Other long-term assets | |

| 83 | | |

| (1,595 | ) |

| Accounts payable | |

| (1,522 | ) | |

| (309 | ) |

| Accrued expenses and other current liabilities | |

| 1,225 | | |

| (437 | ) |

| Operating lease liability | |

| (309 | ) | |

| (843 | ) |

| Deferred revenue | |

| (4,075 | ) | |

| (705 | ) |

| Net cash used in operating activities | |

| (6,396 | ) | |

| (9,832 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (398 | ) | |

| (58 | ) |

| Net cash used in investing activities | |

| (398 | ) | |

| (58 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from issuance of common stock, net of issuance costs | |

| - | | |

| 53 | |

| Net cash provided by financing activities | |

| - | | |

| 53 | |

| Net decrease in cash, cash equivalents and restricted cash | |

| (6,794 | ) | |

| (9,837 | ) |

| Cash, cash equivalents and restricted cash — beginning of period | |

| 20,645 | | |

| 37,253 | |

| Cash, cash equivalents and restricted cash — end of period | |

$ | 13,851 | | |

$ | 27,416 | |

| | |

| | | |

| | |

| Reconciliation of cash, cash equivalents and restricted cash to the consolidated balance sheets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 12,379 | | |

$ | 25,791 | |

| Restricted cash | |

| 1,421 | | |

| 153 | |

| Long-term restricted cash | |

| 51 | | |

| 1,472 | |

| Total cash, cash equivalents and restricted cash | |

$ | 13,851 | | |

$ | 27,416 | |

| | |

| | | |

| | |

| Supplemental disclosures of non-cash investing and financing information: | |

| | | |

| | |

| Reduction of operating lease right-of-use asset and lease liability upon lease modification | |

$ | 8,423 | | |

$ | - | |

| Purchases of property and equipment not yet paid | |

$ | - | | |

$ | 50 | |

| Operating lease right-of-use asset obtained in exchange for operating lease obligation | |

$ | - | | |

$ | 344 | |

The

accompanying footnotes are an integral part of these condensed consolidated financial statements.

PULMATRIX,

INC.

Notes

to Condensed Consolidated Financial Statements (Unaudited)

(in

thousands, except share and per share data)

1.

Organization

Pulmatrix,

Inc. (the “Company”) was incorporated in 2013 as a Delaware corporation. The Company is a clinical-stage biopharmaceutical

company focused on the development of a novel class of inhaled therapeutic products. The Company’s proprietary dry powder delivery

platform, iSPERSE™, is engineered to deliver small, dense particles with highly efficient dispersibility and

delivery to the airways, which can be used with an array of dry powder inhaler technologies and can be formulated with a variety of drug

substances. The Company has developed a pipeline of iSPERSE™-based therapeutic candidates targeted at prevention

and treatment of a range of central nervous system, respiratory and other diseases with important unmet medical needs.

2.

Summary of Significant Accounting Policies and Recent Accounting Standards

Basis

of Presentation

The

condensed consolidated financial statements of the Company included herein have been prepared pursuant to the rules and regulations of

the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in financial

statements prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”)

have been condensed or omitted from this report, as is permitted by such rules and regulations. Accordingly, these condensed consolidated

financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 28, 2024 (the “Annual Report”).

The

financial information as of June 30, 2024, and for the three and six months ended June 30, 2024 and 2023, is unaudited. In the opinion

of management, all adjustments (including those which are normal and recurring) considered necessary for a fair presentation of the interim

financial information have been included. The balance sheet data as of December 31, 2023 was derived from audited consolidated financial

statements. The results of the Company’s operations for any interim periods are not necessarily indicative of the results that

may be expected for any other interim period or for a full fiscal year.

Based

on its current operating plan, the Company believes that its cash and cash equivalents as of June 30, 2024, will be adequate to fund

its currently anticipated operating expenses for at least twelve months from the date these condensed consolidated financial statements

are issued. The Company will need to secure additional funding in the future, from one or more equity or debt financings, collaborations,

or other sources, in order to carry out all of the Company’s planned research and development activities and regulatory activities;

commercialize product candidates; or conduct any substantial, additional development requirements requested by the FDA. Additional funding

may not be available to the Company on acceptable terms, or at all. If the Company is unable to secure additional capital, it will be

required to significantly decrease the amount of planned expenditures and may be required to cease operations. In addition, any disruption

in the capital markets could make any financing more challenging, and there can be no assurance that Pulmatrix will be able to obtain

such financing on commercially reasonable terms or at all. Curtailment of operations would cause significant delays in the Company’s

efforts to develop and introduce its products to market, which is critical to the realization of its business plan and the future operations

of the Company.

Use

of Estimates

In

preparing the condensed consolidated financial statements in conformity with U.S. GAAP, management is required to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date

of the condensed consolidated financial statements, as well as the reported amounts of expenses during the reporting period. Due to inherent

uncertainty involved in making estimates, actual results may differ from these estimates. On an ongoing basis, the Company evaluates

its estimates and assumptions. The most significant estimates and assumptions in the Company’s condensed consolidated financial

statements include, but are not limited to, estimates of future expected costs in order to derive

and recognize revenue and estimates related to clinical trial accruals and upfront deposits.

Concentrations

of Credit Risk

Cash

is a financial instrument that potentially subjects the Company to concentrations of credit risk. For all periods presented, substantially

all of the Company’s cash was deposited in accounts at a single financial institution that management believes is creditworthy,

and the Company has not incurred any losses to date. The Company is exposed to credit risk in the event of default by this financial

institution for amounts in excess of the Federal Deposit Insurance Corporation insured limits.

For

the three and six months ended June 30, 2024, revenue from one customer accounted for 61% and 89%, respectively, of revenue recognized

in the accompanying condensed consolidated financial statements. For the three and six months ended June 30, 2023, revenue from one customer

accounted for 100% of revenue recognized in the accompanying condensed consolidated financial statements. As of June 30, 2024, two customers

accounted for 100% of accounts receivable. As of December 31, 2023, one customer accounted for 100% of accounts receivable.

Summary

of Significant Accounting Policies

The

Company’s significant accounting policies are described in Note 2, Summary of Significant Accounting Policies and Recent Accounting

Standards, in the Annual Report. During the six months ended June 30, 2024, the Company did not make any changes to its significant

accounting policies.

Recent

Accounting Pronouncements

From

time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard

setting bodies that are adopted by the Company as of the specified effective date. The Company did not adopt any new accounting pronouncements

during the six months ended June 30, 2024 that had a material effect on its condensed consolidated financial statements.

In

December 2023, the FASB issued Accounting Standard Update 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures

(“ASU 2023-09”). The guidance in ASU 2023-09 improves the transparency of income tax disclosures by greater disaggregation

of information in the rate reconciliation and income taxes paid disaggregated by jurisdiction. The standard becomes effective for the

annual period beginning on January 1, 2025, with early adoption permitted. The Company is currently evaluating the impact that the adoption

of ASU 2023-09 may have on its consolidated financial statements.

As

of June 30, 2024, there are no other new, or existing recently issued, accounting pronouncements that are of significance, or potential

significance, that impact the Company’s condensed consolidated financial statements.

3.

Prepaid Expenses and Other Current Assets

Prepaid

expenses and other current assets consisted of the following:

Schedule

of Prepaid Expenses and Other Current Assets

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Clinical and consulting | |

$ | 457 | | |

$ | 30 | |

| Insurance | |

| 438 | | |

| 232 | |

| Software and hosting costs | |

| 86 | | |

| 108 | |

| Other | |

| 220 | | |

| 372 | |

| Total prepaid expenses and other current assets | |

$ | 1,201 | | |

$ | 742 | |

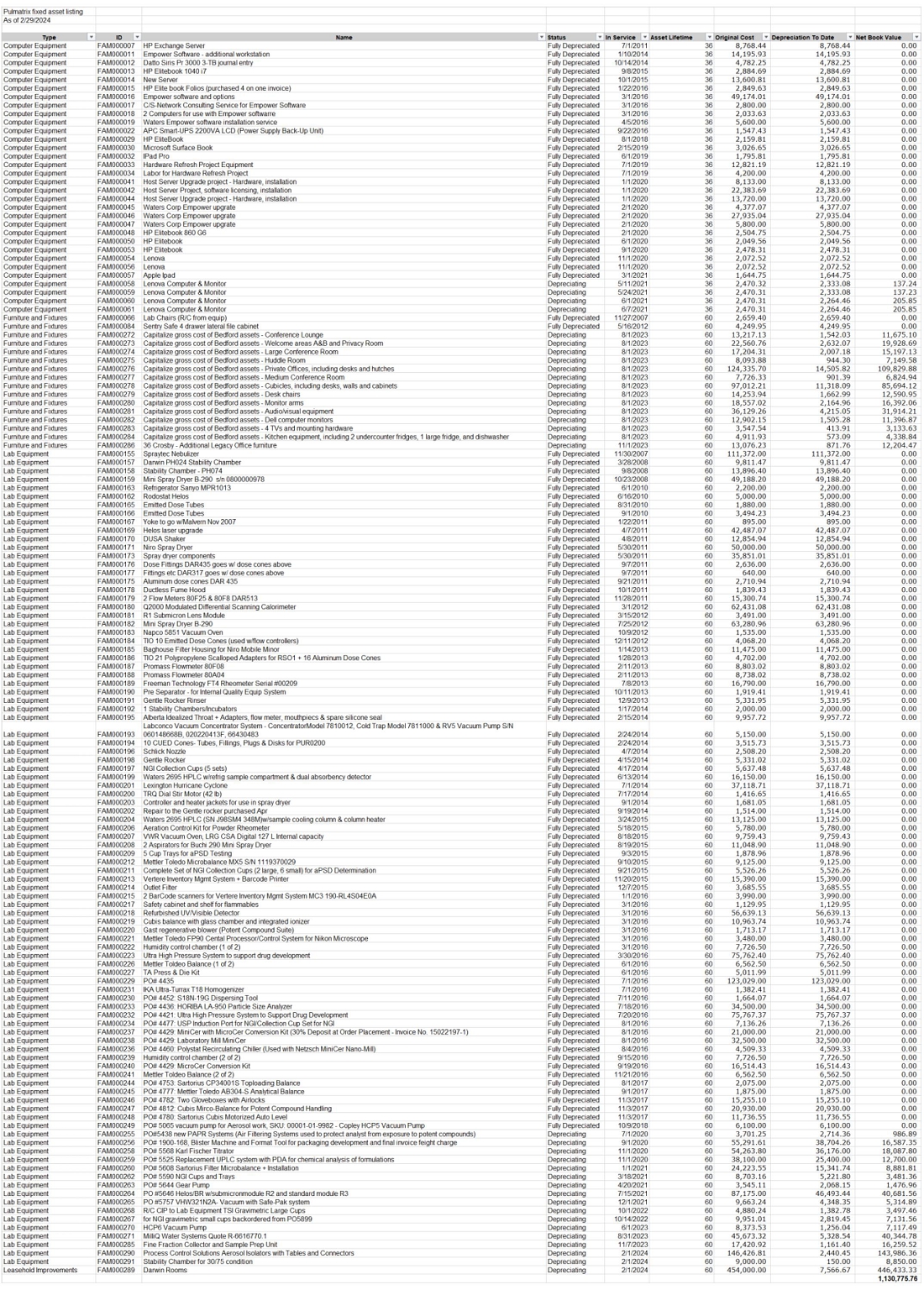

4.

Property and Equipment, Net

The

Company’s Property and equipment, net, were included in the disposal group as part of the MannKind Transaction (as defined in Note

6, Significant Agreements. Refer to that note for further details and accounting discussion). The Company recorded a full write-down

of its net property and equipment balance as of June 30, 2024:

Schedule of Property and Equipment

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Laboratory equipment | |

$ | - | | |

$ | 1,656 | |

| Leasehold improvements | |

| - | | |

| - | |

| Office furniture and equipment | |

| - | | |

| 401 | |

| Computer equipment | |

| - | | |

| 237 | |

| Capital in progress | |

| - | | |

| 600 | |

| Total property and equipment | |

| - | | |

| 2,894 | |

| Less accumulated depreciation and amortization | |

| - | | |

| (1,736 | ) |

| Property and equipment, net | |

$ | - | | |

$ | 1,158 | |

Depreciation

and amortization expense for the six months ended June 30, 2024 and 2023 was $106 and $64, respectively.

5.

Accrued Expenses and Other Current Liabilities

Accrued

expenses and other current liabilities consisted of the following:

Schedule of Accrued Expenses and Other Current Liabilities

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Wages and incentives | |

$ | 1,221 | | |

$ | 70 | |

| Clinical and consulting | |

| 296 | | |

| 347 | |

| Legal and patents | |

| 223 | | |

| 42 | |

| Accrued purchases of property and equipment | |

| - | | |

| 389 | |

| Other | |

| 43 | | |

| 99 | |

| Total accrued expenses and other current liabilities | |

$ | 1,783 | | |

$ | 947 | |

6.

Significant Agreements

Development

and Commercialization Agreement with Cipla Technologies LLC (“Cipla”)

On

April 15, 2019, the Company entered into a Development and Commercialization Agreement (the “Cipla Agreement”) with Cipla

for the co-development and commercialization, on a worldwide exclusive basis, of PUR1900, the Company’s inhaled iSPERSE™

drug delivery system (the “Product”) enabled formulation of the antifungal drug itraconazole, which is only available

as an oral drug, for the treatment of all pulmonary indications, including allergic bronchopulmonary aspergillosis (“ABPA”)

in patients with asthma. The Company entered into an amendment to the Cipla Agreement on November 8, 2021 (the “Second Amendment”)

and a subsequent amendment on January 6, 2024 (the “Third Amendment”). All references to the Cipla Agreement herein refer

to the Cipla Agreement, as amended.

The

Company received a non-refundable upfront payment of $22.0 million (the “Upfront Payment”) under the Cipla Agreement. Upon

receipt of the Upfront Payment, the Company irrevocably assigned to Cipla the following assets, solely to the extent that each covers

the Product in connection with any treatment, prevention, and/or diagnosis of diseases of the pulmonary system (“Pulmonary Indications”):

all existing and future technologies, current and future drug master files, dossiers, third-party contracts, regulatory filings, regulatory

materials and regulatory approvals, patents, and intellectual property rights, as well as any other associated rights and assets directly

related to the Product, specifically in relation to Pulmonary Indications (collectively, the “Assigned Assets”), excluding

most specifically the Company’s iSPERSE™ technology. A portion of the Upfront Payment was deposited by

the Company into a bank account, along with an equal amount from the Company, and was dedicated to the development of the Product (the

“Initial Development Funding”). The Initial Development Funding was depleted during the year ended December 31, 2021, at

which point the Company and Cipla each became responsible for a portion of the development costs actually incurred as described below

(the “Co-Development Phase”).

Pursuant

to the Second Amendment, the Company and Cipla were each responsible for 60% and 40%, respectively, of the Company’s overhead costs

and the time spent by the Company’s employees and consultants on development of the Product (“Direct Costs”). The Company

will share all other development costs with Cipla that are not Direct Costs, such as the cost of clinical research organizations, manufacturing

costs and other third-party costs, on a 50/50 basis.

Pursuant

to the Third Amendment, the Company and Cipla agreed that, during the period commencing on January 6, 2024 and ending July 30, 2024 (the

“Wind Down Period”), the Company will complete all Phase 2b activities, assign or license all patents to Cipla and their

registration with the appropriate authorities in regions other than the United States, complete a physical and demonstrable technology

transfer and secure all data from the Phase 2b study for inclusion in the safety database. The Company will share costs with Cipla during

the Wind Down Period in the same proportions in effect with the Second Amendment discussed above, but subject to a maximum reimbursement

amount by Cipla as approved by the joint steering committee.

Accounting

Treatment

The

Company concluded that because both it and Cipla are active participants in the arrangement and are exposed to the significant risks

and rewards of the collaboration, the Company’s collaboration with Cipla is within the scope of Accounting Standards Codification

(“ASC”) 808, Collaborative Arrangements (“ASC 808”). The Company concluded that Cipla is a customer since

they contracted with the Company to obtain research and development services and a license to the Assigned Assets, each of which is an

output of the Company’s ordinary activities, in exchange for consideration. Therefore, the Company has applied the guidance in

ASC 606, Revenue from Contracts with Customers (“ASC 606”) to account for the research and development services and

a license within the contract. The Company determined that the research and development services and license to the Assigned Assets are

considered highly interdependent and highly interrelated and therefore are considered a single combined performance obligation because

Cipla cannot benefit from the license without the performance by the Company of the research and development services. Such research

and development services are highly specialized and proprietary to the Company and therefore not available to Cipla from any other third

party.

The

Company initially determined the total transaction price to be $22.0 million – comprised of $12.0 million for research and development

services for the Product and $10.0 million for the irrevocable license to the Assigned Assets. Any consideration related to the Co-Development

Phase was not initially included in the transaction price as such amounts are subject to the variable consideration constraint. Additionally,

upon commercialization, Cipla and the Company will share equally, both positive and negative total free cash-flows earned by Cipla in

respect of the Product. However, the Company has not included such free cash-flows in the transaction price as these milestones are constrained.

Revenue

is recognized for the Cipla Agreement as the research and development services are provided using an input method, according to the ratio

of costs incurred to the total costs expected to be incurred in the future to satisfy the Company’s obligations. In management’s

judgment, this input method is the best measure of the transfer of control of the combined performance obligation. The amounts received

that have not yet been recognized as revenue are recorded in deferred revenue on the Company’s consolidated balance sheets, with

amounts expected to be recognized in the next 12 months recorded as current.

The

Company concluded that the Third Amendment is a contract modification that should be accounted for as part of the existing contract.

During the three and six months ended June 30, 2024, the Company recognized $0.9 million and $6.6 million, respectively, in revenue related

to the research and development services and irrevocable license to the Assigned Assets in the Company’s consolidated statements

of operations, as compared to $1.8 million and $3.3 million, respectively, recognized during the three and six months ended June 30,

2023. The revenue recognized during the six months ended June 30, 2024 was primarily associated with the cumulative catch-up recorded

in the three months ended March 31, 2024, from the contract modification, that had been included in deferred revenue at the beginning of the period.

As of June 30, 2024, the aggregate transaction price related to the Company’s unsatisfied obligations was $0.3 million and was

recorded in deferred revenue, all of which was current.

Agreements

with MannKind Corporation (“MannKind”)

On

May 28, 2024, the Company executed certain agreements with MannKind and the Company’s landlord (collectively,

the “MannKind Transaction”), all of which closed during July 2024. The agreements with MannKind included a Bill of Sale and

Assignment Agreement (the “Bill of Sale”) with respect to the assignment of the Company’s rental facility at 36 Crosby

Drive, Bedford, Massachusetts (the “Bedford Facility”) to MannKind along with the transfer of all leasehold improvements,

laboratory equipment and other related personal property. In connection with the assignment of the Bedford Facility, the Company, MannKind

and Cobalt Propco 2020, LLC (the “Landlord”) entered into an Amendment to Lease and Consent to Assignment of Lease (the “Lease

Assignment Agreement”) pursuant to that certain Lease Agreement, dated as of January 7, 2022 (the “Lease Agreement”),

by and between the Company and the Landlord. Pursuant to the Lease Assignment Agreement, MannKind assumed all of the Company’s

obligations under the Lease Agreement, including all rent and other payments.

In

connection with the transactions contemplated by the Bill of Sale and Lease Assignment Agreement, the Company and MannKind entered into

an Intellectual Property Cross License Agreement (the “Cross License Agreement”). Pursuant to the Cross License Agreement,

the Company granted to MannKind (i) an exclusive license to develop, use, manufacture, market, offer and sell iSPERSE formulations of

Clofazimine, (ii) an exclusive license to develop, use, manufacture, market, offer and sell formulations of iSPERSE with one more active

pharmaceutical ingredients for the treatment of nontuberculous mycobacteria lung disease in humans, (iii) an exclusive license to develop,

use, manufacture, market, offer and sell iSPERSE formulations of insulin, (iv) a non-exclusive license to develop, use, manufacture,

market, offer and sell formulations of iSPERSE with one more active pharmaceutical ingredients for the treatment of endocrine disease

in humans, and (v) a non-exclusive license to develop, use, manufacture, market, offer and sell formulations of iSPERSE with one more

active pharmaceutical ingredients for the treatment of interstitial lung diseases (including IPF, PPF and other related lung diseases)

in humans (collectively, the “Out-License”).

Additionally,

pursuant to the Cross License Agreement, MannKind granted to the Company (i) the exclusive right to develop, use, manufacture, market,

offer and sell its single-use disposable dry powder inhaler (including all modifications or improvement thereto made by or on behalf

of the Company, the “Cricket Device”) for the inhaled delivery of dihydroergotamine in any formulation whatsoever, including

the Company’s PUR3100 treatment of acute migraine and (ii) a non-exclusive license to develop, use, manufacture, market, offer

and sell the Cricket Device for the inhaled delivery of one more active pharmaceutical ingredients formulated with iSPERSE for the treatment

of neurological disease in humans (collectively, the “In-License”).

Additionally,

pursuant to the Master Services Agreement, by and between the Company and MannKind, MannKind shall provide certain development services

to the Company, including but not limited to, activities to develop a dry powder formulation of the active pharmaceutical ingredient

that the Company provides to MannKind for oral inhalation using iSPERSE.

To

maintain continuity of iSPERSE platform knowledge, MannKind hired certain members of the Company’s research and development staff

in July 2024.

Accounting

Treatment

The

Company determined that the MannKind Transaction represents a combined agreement for accounting purposes, as the individual components

have the same overall commercial objectives and the consideration under each component is dependent on the other components.

The

consideration due to the Company in the MannKind Transaction consists solely of the non-cash consideration in the form of the In-License.

The fair value of the non-cash consideration received should be allocated to the other components of the MannKind Transaction to determine

the consideration received for the other components. The Company determined that the fair value of the In-License is immaterial given

that adequate alternative inhaler devices are already available on the market (and indeed, the Company has already established use of

another third-party inhalation device in their PUR3100 Phase 1 trial that performed well as a DHE delivery device as reported in a peer-reviewed

publication), and considering optional purchases of Cricket Devices are at market prices. Accordingly, the consideration allocated to

other components of the MannKind Transaction was immaterial.

The

Company accounted for the Lease Assignment Agreement upon execution as a lease modification that reduced the lease term to the assignment

date in July 2024. Accordingly, the Company remeasured its operating lease liability as of the modification date to reflect the decrease

in fixed lease payments, with the amount of the remeasurement, $8.4 million, adjusted by a corresponding reduction to the right-of-use

asset. Refer to Note 11, Leases, for further details.

The

Company concluded that the Out-License component of the MannKind Transaction was within the scope of ASC 606, as the monetization of

its core technology represents an output of the Company’s ordinary activities. The Company transferred control of the combined

licenses of iSPERSE to MannKind at a point in time in July 2024 upon closing of the MannKind Transaction; however, no revenue was recognized

because the consideration allocated to the Out-License component was immaterial.

The

Company determined that its operating lease right-of-use asset and property and equipment subject to the Bill of Sale represented a disposal

group that became held for sale during the second quarter of 2024 and remained classified as held for sale as of June 30, 2024, which

should be measured at the lower of its carrying value or fair value less costs to sell. Since the fair value of the disposal group was

considered immaterial, the Company recorded a full write-down of the disposal group’s carrying value as of June 30, 2024, in the

amount of $2.6 million.

Concurrent

with the closing of the MannKind Transaction, the Company terminated and MannKind hired the majority of the Company’s research

and development employees, representing approximately two-thirds of the Company’s workforce. During the quarter ended June 30,

2024, the Company agreed to provide termination benefits to these employees, which has been included in the balance of accrued expenses

and other current liabilities on the consolidated balance sheet as of June 30, 2024, and was paid to the employees in July 2024.

7.

Common Stock

In

May 2021, the Company entered into an At-The-Market Sales Agreement (the “Sales Agreement”) with H.C. Wainwright and Co.,

LLC (“HCW”) to act as the Company’s sales agent with respect to the issuance and sale of up to $20.0 million of the

Company’s shares of common stock, from time to time in an at-the-market public offering (the “ATM Offering”). Upon

filing of the Annual Report, the Company continued to be subject to General Instruction I.B.6 of Form S-3, pursuant to which in no event

will the Company sell its common stock in a registered primary offering using Form S-3 with a value exceeding more than one-third of

its public float in any 12 calendar month period so long as its public float remains below $75,000,000. Therefore, the amount that may

be able to be raised using the ATM Offering will be significantly less than $20,000,000, until such time as the Company’s public

float held by non-affiliates exceeds $75,000,000.

Sales

of common stock under the Sales Agreement are made pursuant to an effective shelf registration statement on Form S-3, which was filed

with the SEC on May 17, 2024, and subsequently declared effective on May 30, 2024 (File No. 333-279491), and a related prospectus. HCW

acts as the Company’s sales agent on a commercially reasonable efforts basis, consistent with its normal trading and sales practices

and applicable state and federal laws, rules and regulations and the rules of The Nasdaq Capital Market (“Nasdaq”). If expressly

authorized by the Company, HCW may also sell the Company’s common stock in privately negotiated transactions. There is no specific

date on which the ATM Offering will end, there are no minimum sale requirements and there are no arrangements to place any of the proceeds

of the ATM Offering in an escrow, trust or similar account. HCW is entitled to compensation at a fixed commission rate of 3.0% of the

gross proceeds from the sale of the Company’s common stock pursuant to the Sales Agreement.

During

the six months ended June 30, 2024, no shares of the Company’s common stock were sold under the Sales Agreement.

8.

Warrants

There

were no warrants issued or exercised during the six months ended June 30, 2024. During the six months ended June 30, 2024, warrants to

purchase up to 160,445 shares of common stock at a weighted average exercise price of $44.12 per share expired. Subsequent to June 30,

2024, but before the date these condensed consolidated financial statements were issued, warrants to purchase up to 66,675 shares of

common stock at a weighted average exercise price of $26.79 per share expired. The following represents a summary of the warrants outstanding

and exercisable at June 30, 2024, all of which are equity-classified:

Schedule

of Warrants Outstanding

| | |

Adjusted | | |

| |

Number of Shares

Underlying Warrants | |

| Issue Date | |

Exercise Price | | |

Expiration Date | |

Outstanding | | |

Exercisable | |

| December 17, 2021 | |

$ | 14.99 | | |

December 15, 2026 | |

| 36,538 | | |

| 36,538 | |

| December 17, 2021 | |

$ | 13.99 | | |

December 17, 2026 | |

| 281,047 | | |

| 281,047 | |

| February 16, 2021 | |

$ | 49.99 | | |

February 11, 2026 | |

| 65,003 | | |

| 65,003 | |

| August 7, 2020 | |

$ | 35.99 | | |

July 14, 2025 | |

| 90,743 | | |

| 90,743 | |

| August 7, 2020 | |

$ | 44.99 | | |

July 14, 2025 | |

| 10,939 | | |

| 10,939 | |

| July 23, 2020 | |

$ | 35.99 | | |

July 14, 2025 | |

| 77,502 | | |

| 77,502 | |

| July 13, 2020 | |

$ | 44.99 | | |

July 14, 2025 | |

| 21,846 | | |

| 21,846 | |

| July 13, 2020 | |

$ | 35.99 | | |

July 14, 2025 | |

| 334,800 | | |

| 334,800 | |

| February 12, 2019 | |

$ | 26.79 | | |

August 12, 2024 | |

| 66,675 | | |

| 66,675 | |

| June 15, 2015 | |

$ | 1,509.99 | | |

Five years after milestone achievement | |

| 15,955 | | |

| - | |

| Total | |

| | | |

| |

| 1,001,048 | | |

| 985,093 | |

9.

Stock-based Compensation

The

Company sponsors the Pulmatrix, Inc. Amended and Restated 2013 Employee, Director and Consultant Equity Incentive Plan (the “Incentive

Plan”). As of June 30, 2024, the Incentive Plan provided for the grant of up to 818,936 shares of the Company’s common stock,

of which 503,669 shares remained available for future grant. In addition, the Company sponsors two legacy plans under which no additional

awards may be granted. As of June 30, 2024, the two legacy plans have a total of 8 options outstanding, all of which are fully vested

and for which common stock will be issued upon exercise.

The

following table summarizes stock option activity during the six months ended June 30, 2024:

Schedule

of Stock Option Activity

| | |

Number of Options | | |

Weighted- Average Exercise Price | | |

Weighted- Average Remaining Contractual Term (Years) | | |

Aggregate Intrinsic Value | |

| Outstanding — January 1, 2024 | |

| 344,306 | | |

$ | 20.92 | | |

| 7.54 | | |

$ | - | |

| Forfeited or expired | |

| (32,869 | ) | |

$ | 5.18 | | |

| | | |

| | |

| Outstanding — June 30, 2024 | |

| 311,437 | | |

$ | 22.58 | | |

| 6.95 | | |

$ | - | |

| Exercisable — June 30, 2024 | |

| 221,578 | | |

$ | 29.07 | | |

| 6.46 | | |

$ | - | |

No

stock options were granted during the six months ended June 30, 2024. The Company records stock-based compensation expense related to

stock options based on their grant-date fair value. As of June 30, 2024, there was $0.5 million of unrecognized stock-based compensation

expense related to unvested stock options granted under the Company’s stock award plans. This expense is expected to be recognized

over a weighted-average period of approximately 1.6 years.

The

following table presents total stock-based compensation expense for the three and six months ended June 30, 2024 and 2023:

Schedule

of Stock-based Compensation Expenses

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Research and development | |

$ | 29 | | |

$ | 59 | | |

$ | 145 | | |

$ | 131 | |

| General and administrative | |

| 74 | | |

| 196 | | |

| 156 | | |

| 420 | |

| Total stock-based compensation expense | |

$ | 103 | | |

$ | 255 | | |

$ | 301 | | |

$ | 551 | |

10.

Commitments and Contingencies

Research

and Development Activities

The

Company contracts with various other organizations to conduct research and development activities, including clinical trials. The scope

of the services under contracts for research and development activities may be modified and the contracts, subject to certain conditions,

may generally be cancelled by the Company upon written notice. In some instances, the contracts, subject to certain conditions, may be

cancelled by the third party. As of June 30, 2024, the Company had no material noncancellable commitments not expected to be reimbursed

under the Cipla Agreement.

Legal

Proceedings

In

the ordinary course of its business, the Company may be involved in various legal proceedings involving contractual and employment relationships,

patent or other intellectual property rights, and a variety of other matters. The Company is not aware of any pending legal proceedings

that would reasonably be expected to have a material impact on the Company’s financial position or results of operations.

11.

Leases

The

Company has limited leasing activities as a lessee which are primarily related to its corporate headquarters, which were relocated during

the third quarter of 2023 and again during the third quarter of 2024.

On

January 7, 2022, the Company executed the Lease Agreement with the Landlord for its corporate headquarters at 36 Crosby Drive, Bedford,

Massachusetts. The leased premises comprise approximately 20,000 square feet of office and lab space, and the lease provides for base

rent of $0.1 million per month, payment of which began in March 2024. The Company is responsible for real estate taxes, maintenance,

and other operating expenses applicable to the leased premises.

On

May 28, 2024, as part of the MannKind Transaction (see further discussion in Note 6, Significant Agreements), the Company and

the Landlord executed the Lease Assignment Agreement to assign the Lease Agreement to MannKind in July 2024. The Company accounted for

the Lease Assignment Agreement as a lease modification that reduced the lease term to the assignment date in July 2024. Accordingly,

the Company remeasured its lease liability as of the modification date to reflect the decrease in fixed lease payments, with the amount

of the remeasurement, $8.4 million, adjusted by a corresponding reduction to the right-of-use asset.

As of June 30, 2024, the

Company had $1.4 million of restricted cash held in a depository account at a financial institution to collateralize a conditional stand-by

letter of credit related to the Lease Agreement, which was presented within current assets on the consolidated balance sheet. Following the closing of the MannKind Transaction, this collateral was released in August 2024, providing additional cash available for operations.

In

June 2024, the Company entered into a short-term lease agreement for its new headquarters at 945 Concord Street, Framingham, Massachusetts.

No lease liability or right-of-use asset has been recorded for this short-term lease.

The

components of lease expense for the Company for the three and six months ended June 30, 2024 and 2023 were as follows:

Schedule

of Components of Lease Expenses

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Lease cost | |

| | | |

| | | |

| | | |

| | |

| Fixed lease cost | |

$ | 271 | | |

$ | 418 | | |

$ | 678 | | |

$ | 796 | |

| Variable lease cost | |

| 104 | | |

| 168 | | |

| 206 | | |

| 281 | |

| Total lease cost | |

$ | 375 | | |

$ | 586 | | |

$ | 884 | | |

$ | 1,077 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other information | |

| | | |

| | | |

| | | |

| | |

| Cash paid for amounts included in the measurement of lease liabilities | |

$ | 322 | | |

$ | 432 | | |

$ | 657 | | |

$ | 863 | |

| Weighted-average remaining lease term | |

| | | |

| | | |

| 7 days | | |

| 0.2 years | |

| Weighted-average discount rate | |

| | | |

| | | |

| - | | |

| 8.40 | % |

Maturities

of lease liabilities due under these lease agreements as of June 30, 2024 are as follows:

Schedule of Maturities of Lease Liabilities

| | |

Operating Leases | |

| Maturity of lease liabilities | |

| | |

| 2024 (7 days) | |

$ | 24 | |

| Total lease payments | |

| 24 | |

| Less: interest | |

| - | |

| Total lease liabilities | |

$ | 24 | |

| | |

| | |

| Reported as of June 30, 2024 | |

| | |

| Lease liabilities — short term | |

$ | 24 | |

| Lease liabilities — long term | |

| - | |

| Total lease liabilities | |

$ | 24 | |

12.

Income Taxes

The

Company had no income tax expense due to operating losses incurred for the three and six months ended June 30, 2024 and 2023.

Management

of the Company evaluated the positive and negative evidence bearing upon the realizability of its deferred tax assets and determined

that it is more likely than not that the Company will not recognize the benefits of the deferred tax assets. As a result, a full valuation

allowance was recorded as of June 30, 2024 and December 31, 2023.

The

Company applies ASC 740, Income Taxes, for the financial statement recognition, measurement, presentation, and disclosure of uncertain

tax positions taken or expected to be taken in income tax returns. Unrecognized tax benefits represent tax positions for which reserves

have been established. A full valuation allowance has been provided against the Company’s deferred tax assets, so that the effect

of the unrecognized tax benefits is to reduce the gross amount of the deferred tax asset and the corresponding valuation allowance. The

Company has no material uncertain tax positions as of June 30, 2024 and December 31, 2023.

13.

Net Loss Per Share

Basic

net loss per share is calculated by dividing net loss by the weighted-average number of common shares outstanding during the period.

Diluted net loss per share is calculated by dividing the weighted-average number common shares outstanding during the period, after taking

into consideration any potentially dilutive effects from outstanding stock options or warrants.

Basic

and diluted net loss per share were the same for the three and six months ended June 30, 2024 and 2023, as the effect of potentially

dilutive securities would have been anti-dilutive.

The

following potentially dilutive securities outstanding have been excluded from the computation of diluted weighted-average shares outstanding,

because such securities had an anti-dilutive impact:

Schedule

of Computation of Anti-Dilutive Weighted-Average Shares Outstanding

| | |

Three and Six Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| Options to purchase common stock | |

| 311,437 | | |

| 393,254 | |

| Warrants to purchase common stock | |

| 1,001,048 | | |

| 1,161,493 | |

| Total options and warrants to purchase common stock | |

| 1,312,485 | | |

| 1,554,747 | |

14.

Subsequent Events

Departure

of Chief Executive Officer

On

July 15, 2024, the Board of Directors (the “Board”) of the Company approved a General Release and Severance Agreement (the

“Raad Severance Agreement”), by and between the Company and Teofilo Raad, dated as of July 19, 2024, and effective as of

the same date (the “Separation Date”). Effective as of the Separation Date, Mr. Raad’s employment with the Company

ceased and Mr. Raad relinquished all positions, offices, and authority with the Company and any affiliates, including as a member of

the Board and all committees thereto, and the Amended and Restated Employment Agreement by and between the Company and Mr. Raad, dated

as of June 28, 2019, was terminated.

Pursuant

to the terms of the Raad Severance Agreement, the Company will provide to Mr. Raad certain termination-related payments totaling approximately

$1.0 million, less all lawful and authorized withholdings and deductions. Any outstanding equity awards granted to Mr. Raad under the

Company’s equity compensation plans and that would have vested during the 12-month period following the Separation Date became

fully vested as of the Separation Date.

Appointment

of Interim Chief Executive Officer

On

July 15, 2024, the Board approved the appointment of Peter Ludlum as the Interim Chief Executive Officer (the “Interim

CEO”), effective as of July 20, 2024 (“Ludlum Effective Date”), pursuant to an amendment to the consulting

agreement, by and between the Company and Danforth Advisors, LLC, dated as of November 29, 2021, and

amended on April 8, 2022, and October 20, 2022.

The

Company has completed an evaluation of all other subsequent events after the balance sheet date of June 30, 2024 through the date the

condensed consolidated financial statements were issued to ensure that the condensed consolidated financial statements include appropriate

disclosure of events both recognized in the condensed consolidated financial statements as of June 30, 2024, and events which occurred

subsequently but were not recognized in the condensed consolidated financial statements. The Company has concluded that no subsequent

events have occurred that require disclosure, except as disclosed within the condensed consolidated financial statements.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Management’s

Discussion and Analysis of Financial Condition and Results of Operations is intended to provide a reader of our financial statements

with a narrative from the perspective of our management on our financial condition, results of operations, liquidity, and certain other

factors that may affect our future results. The information set forth below should be read in conjunction with the condensed consolidated

financial statements and the notes thereto included elsewhere in this Quarterly Report on Form 10-Q as well as the audited consolidated

financial statements and the notes thereto contained in our Annual Report on Form 10-K filed with the SEC on March 28, 2024. Unless stated

otherwise, references in this Quarterly Report on Form 10-Q to “us,” “we,” “our,” or our “Company”

and similar terms refer to Pulmatrix, Inc., a Delaware corporation and its subsidiaries.

Forward-Looking

Statements

This

Quarterly Report on Form 10-Q contains forward-looking statements. All statements other than statements of historical fact contained

herein, including statements regarding our business plans or strategies, projected or anticipated benefits or other consequences of our

plans or strategies, projected or anticipated benefits from acquisitions to be made by us, or projections involving anticipated revenues,

earnings, or other aspects of our operating results, are forward-looking statements. Words such as “anticipates,” “assumes,”

“believes,” “can,” “could,” “estimates,” “expects,” “forecasts,”

“guides,” “intends,” “is confident that,” “may,” “plans,” “seeks,”

“projects,” “targets,” and “would,” and their opposites and similar expressions, as well as statements

in future tense, are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of

future performance or results and may not be accurate indications of when such performance or results will actually be achieved. Forward-looking

statements are based on information we have when those statements are made or our management’s good faith belief as of that time

with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially

from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include,

but are not limited to:

| |

● |

our

history of recurring losses and negative cash flows from operating activities, significant future commitments and the uncertainty

regarding the adequacy of our liquidity to pursue or complete our business objectives; |

| |

|

|

| |

● |

our

inability to carry out research, development and commercialization plans; |

| |

|

|

| |

● |

our

inability to manufacture our product candidates on a commercial scale on our own or in collaborations with third parties; |

| |

|

|

| |

● |

our

inability to complete preclinical testing and clinical trials as anticipated; |

| |

|

|

| |

● |

our

collaborators’ inability to successfully carry out their contractual duties; |

| |

|

|

| |

● |

termination

of certain license agreements; |

| |

|

|

| |

● |

our

ability to adequately protect and enforce rights to intellectual property, or defend against claims of infringement by others; |

| |

|

|

| |

● |

difficulties

in obtaining financing on commercially reasonable terms, or at all; |

| |

|

|

| |

● |

intense

competition in our industry, with competitors having substantially greater financial, technological, research and development, regulatory

and clinical, manufacturing, marketing and sales, distribution, personnel and resources than we do; |

| |

|

|

| |

● |

entry

of new competitors and products and potential technological obsolescence of our products; |

| |

|

|

| |

● |

adverse

market and economic conditions; |

| |

|

|

| |

● |

our

ability to maintain compliance with Nasdaq’s listing standards; |

| |

|

|

| |

● |

loss

of one or more key executives or scientists; and |

| |

|

|

| |

● |

difficulties

in securing regulatory approval to market our product candidates. |

For

a more detailed discussion of these and other risks that may affect our business and that could cause our actual results to differ from

those projected in these forward-looking statements, see the risk factors and uncertainties described under the heading “Risk Factors”

in Part II, Item 1A of this Quarterly Report on Form 10-Q and in Part I, Item 1A of our Annual Report on Form 10-K. The forward-looking

statements contained in this Quarterly Report on Form 10-Q are expressly qualified in their entirety by this cautionary statement. We

do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which any

such statement is made or to reflect the occurrence of unanticipated events, except as required by law.

“iSPERSE™”

is one of our trademarks used in this Quarterly Report on Form 10-Q. Other trademarks appearing in this report are the property of their

respective holders. Solely for convenience, these and other trademarks, trade names and service marks referred to in this report appear

without the ®, TM and SM symbols, but those references are not intended to indicate, in any way, we or the owners of such

trademarks will not assert, to the fullest extent under applicable law, their rights to these trademarks and trade names.

Overview

Business

We

are a clinical-stage biopharmaceutical company focused on the development of novel inhaled therapeutic products intended to prevent and

treat respiratory and other diseases with important unmet medical needs using our patented iSPERSE™ technology. Our

proprietary product pipeline includes treatments for central nervous system (“CNS”) disorders such as acute migraine and

serious lung diseases such as Chronic Obstructive Pulmonary Disease (“COPD”) and allergic bronchopulmonary aspergillosis

(“ABPA”). Our product candidates are based on our proprietary engineered dry powder delivery platform, iSPERSE™,

which seeks to improve therapeutic delivery to the lungs by optimizing pharmacokinetics and reducing systemic side effects to improve

patient outcomes.

We

design and develop inhaled therapeutic products based on our proprietary dry powder delivery technology, iSPERSE™, which

enables delivery of small or large molecule drugs to the lungs by inhalation for local or systemic applications. The iSPERSE™

powders are engineered to be small, dense particles with highly efficient dispersibility and delivery to airways. iSPERSE™

powders can be used with an array of dry powder inhaler technologies and can be formulated with a broad range of drug substances

including small molecules and biologics. We believe the iSPERSE™ dry powder technology offers enhanced drug loading

and delivery efficiency that outperforms traditional lactose-blend inhaled dry powder therapies.

Our

goal is to develop breakthrough therapeutic products that are safe, convenient, and more effective than the existing therapeutic products