false

0001137883

0001137883

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 14, 2024

Brainstorm Cell Therapeutics Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36641 |

|

20-7273918 |

(State or other jurisdiction of

incorporation) |

|

(Commission File No.) |

|

(IRS Employer Identification No.) |

| 1325 Avenue of Americas, 28th Floor |

|

| New York, NY |

10019 |

| (Address of principal executive offices) |

(Zip Code) |

(201) 488-0460

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.00005 par value |

BCLI |

NASDAQ Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial

Condition.

On August 14, 2024, Brainstorm Cell Therapeutics

Inc. issued a press release announcing its financial results for the quarter ended June 30, 2024. The full text of the press release

is being furnished as Exhibit 99.1 to this current report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including

Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such

a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

BRAINSTORM CELL THERAPEUTICS INC. |

| |

|

|

| Date: August 14, 2024 |

By: |

/s/ Chaim Lebovits |

| |

|

Chaim Lebovits |

| |

|

President and Co-Chief Executive Officer |

Exhibit 99.1

BrainStorm Cell Therapeutics Announces Second

Quarter 2024 Financial Results and Provides Corporate Update

Company reached alignment with the U.S. FDA on

the Chemistry, Manufacturing, and Controls (CMC) aspects of its planned Phase 3b clinical trial for NurOwn® in ALS

SPA in place for Phase 3b NurOwn®

trial in ALS

Enhanced leadership team with appointment of Hartoun

Hartounian Ph.D. as EVP and Chief Operating Officer, and promotion of Dr. Bob Dagher to

EVP and Chief Medical Officer

Conference call and webcast at 8.30am ET today

NEW YORK, Aug 14, 2024 /PRNewswire/

-- BrainStorm Cell Therapeutics Inc. (NASDAQ: BCLI), a leading developer of adult stem cell therapeutics for neurodegenerative

diseases, today announced financial results for the Second Quarter ended June 30, 2023 and provided a corporate update.

“We continue to make excellent progress

in our preparations for the planned Phase 3b trial of NurOwn in ALS, with important recent developments on regulatory and operational

fronts,” said Chaim Lebovits, President and CEO of BrainStorm. “We believe that the regulatory aspects of the program have

been substantially derisked, having secured agreement with the FDA on a Special Protocol Assessment and also reached alignment on the

CMC aspects. We have selected a leading Clinical Research Organization and are actively working to establish multiple trial sites. If

successful, this trial has the potential to significantly improve the lives of ALS patients by providing a much-needed therapeutic option."

Second Quarter 2024 and Recent Highlights

Clinical and regulatory

| · | In

June 2024, BrainStorm reached alignment with the U.S. Food and Drug Administration (FDA)

on the Chemistry, Manufacturing, and Controls (CMC) aspects of its planned Phase 3b clinical

trial for NurOwn®, its investigational therapy for amyotrophic lateral sclerosis (ALS).

This followed the announcement, in April 2024, that the FDA had granted BrainStorm a

Special Protocol Assessment (SPA) agreement for the Phase 3b trial. The SPA agreement

validates the clinical trial protocol and statistical analysis of the trial, demonstrating

their adequacy for addressing objectives that support a future BLA (Biologics License Application)

in ALS. |

| · | The

Company has selected a leading Clinical Research Organization (CRO) to support the initiation

and execution of the Phase 3b trial. We are actively engaging with over 12 leading ALS centers

of excellence to establish trial sites. Manufacturing processes are well-advanced and on

track to meet production timelines. |

| · | In

May 2024, new biomarker data on NurOwn from the prior Phase 3 study and Expanded Access Program

(EAP) were featured in a presentation at the 3rd Annual ALS Drug Development Summit, which

took place in Boston MA. The data suggested that patients who received extended

treatment with NurOwn continued to see benefits. The summit was attended by advocacy groups,

physicians, research organizations, industry representatives, key thought leaders and decision

makers dedicated to ALS research. |

| · | In

April 2024, Phase 3 biomarker data on NurOwn in ALS were published in Muscle and

Nerve in a paper entitled "Debamestrocel multimodal effects on biomarker pathways

in amyotrophic lateral sclerosis are linked to clinical outcomes". |

Corporate

| · | In

June 2024, BrainStorm completed a successful registered direct offering, with a single institutional

investor, raising gross proceeds of $4.0 million. |

| · | In

June 2024, appointed Hartoun Hartounian Ph.D. as EVP and Chief Operating Officer. Dr.

Hartounian brings a distinguished track record with over 32 years of experience in the biopharmaceutical

industry, with a focus on cell and gene therapy. |

| · | In

April 2024, promoted Dr. Bob Dagher to

Executive Vice President and Chief Medical Officer. Dr. Dagher has over 20 years' of experience

in clinical research and development, with a proven track record of leading successful clinical

trials and fostering innovation in drug development. |

Financial

Results for the Second Quarter Ended June 30, 2024

| · | Cash,

cash equivalents, and restricted cash amounted to approximately $3.65 million, as of June

30, 2024. |

| · | Research

and development expenses, net, in the second quarter ended June 30, 2024 were $0.9 million,

compared to $2.8 million for the quarter ended June 30, 2023. |

| · | General

and administrative expenses for the second quarter ended June 30, 2024 and 2023 were $2.0

million and $2.7 million, respectively. |

| · | Net

loss for the second quarter ended June 30, 2024 was $2.5 million as compared to a net loss

of $5.3 million for the quarter ended June 30, 2023. |

| · | Net

loss per share for the second quarter ended June 30, 2024 and June 30, 2023 was $0.04 and

$0.13, respectively. |

Conference Call and Webcast

BrainStorm

management will discuss the second quarter results and recent progress in a conference call and webcast for the investment community

at 830am ET today. Investors may participate by dialing the following numbers:

| Toll Free: |

877-545-0523 |

| International: |

973-528-0016 |

| Participant Access Code: |

308245 |

| Webcast URL: |

https://www.webcaster4.com/Webcast/Page/2354/51009 |

The

replay of the conference call can be accessed by dialing the numbers below and will be available for 14 days.

Replay

Numbers

| Toll Free: |

877-481-4010 |

| International: |

919-882-2331 |

| Replay Passcode: |

51009 |

About

BrainStorm Cell Therapeutics Inc.

BrainStorm

Cell Therapeutics Inc. is a leading developer of innovative autologous adult stem cell therapeutics for debilitating neurodegenerative

diseases. BrainStorm holds the rights to clinical development and commercialization of the NurOwn® technology platform used to produce

autologous MSC-NTF cells through an exclusive, worldwide licensing agreement. Autologous MSC-NTF cells have received Orphan Drug designation

status from the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for the treatment of amyotrophic lateral

sclerosis (ALS). BrainStorm has completed a Phase 3 trial in ALS (NCT03280056); this trial investigated the safety and efficacy of repeat-administration

of autologous MSC-NTF cells and was supported by a grant from the California Institute for Regenerative Medicine (CIRM CLIN2-0989), and

another grant from the ALS Association and I AM ALS. BrainStorm completed under an investigational new drug application a Phase 2 open-label

multicenter trial (NCT03799718) of autologous MSC-NTF cells in progressive MS and was supported by a grant from the National MS Society

(NMSS).

Notice Regarding

Forward-Looking Statements

This press release contains

"forward-looking statements" that are subject to substantial risks and uncertainties, including statements regarding meetings

with the U.S. Food and Drug Administration (FDA), Special Protocol Assessment (SPA), ADCOM meeting related to NurOwn, the timing

of a PDUFA action date for the BLA for NurOwn, the clinical development of NurOwn as a therapy for the treatment of ALS, the future availability

of NurOwn to patients, and the future success of BrainStorm. All statements, other than statements of historical fact, contained in this

press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use

of words such as "anticipate," "believe," "contemplate," "could," "estimate," "expect,"

"intend," "seek," "may," "might," "plan," "potential," "predict,"

"project," "target," "aim," "should," "will" "would," or the negative of

these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements

are based on BrainStorm's current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to

predict. These potential risks and uncertainties include, without limitation, management's ability to successfully achieve its goals,

BrainStorm's ability to raise additional capital, BrainStorm's ability to continue as a going concern, prospects for future regulatory

approval of NurOwn, whether BrainStorm's future interactions with the FDA will have productive outcomes, and other factors detailed in

BrainStorm's annual report on Form 10-K and quarterly reports on Form 10-Q available at http://www.sec.gov. These factors should

be considered carefully, and readers should not place undue reliance on BrainStorm's forward-looking statements. The forward-looking

statements contained in this press release are based on the beliefs, expectations, and opinions of management as of the date of this

press release. We do not assume any obligation to update forward-looking statements to reflect actual results or assumptions if circumstances

or management's beliefs, expectations or opinions should change, unless otherwise required by law. Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

CONTACTS

Media:

Lisa Guiterman

Phone: +1 202-330-3431

lisa.guiterman@gmail.com

IR:

Michael Wood

Phone: +1 646-597-6983

mwood@lifesciadvisors.com

BRAINSTORM CELL THERAPEUTICS INC. AND

SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands

(Except share data)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| | |

U.S. $ in thousands | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,469 | | |

$ | 1,300 | |

| Other accounts receivable | |

| 33 | | |

| 51 | |

| Prepaid expenses and other current assets (Note 4) | |

| 314 | | |

| 548 | |

| Total current assets | |

$ | 3,816 | | |

$ | 1,899 | |

| Long-Term Assets: | |

| | | |

| | |

| Prepaid expenses and other long-term assets | |

$ | 20 | | |

$ | 22 | |

| Restricted Cash | |

| 179 | | |

| 185 | |

| Operating lease right of use asset (Note 5) | |

| 1,110 | | |

| 1,416 | |

| Property and Equipment, Net | |

| 558 | | |

| 686 | |

| Total Long-Term Assets | |

$ | 1,867 | | |

$ | 2,309 | |

| | |

| | | |

| | |

| Total assets | |

$ | 5,683 | | |

$ | 4,208 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payables | |

$ | 5,340 | | |

$ | 4,954 | |

| Accrued expenses | |

| 718 | | |

| 1,240 | |

| Operating lease liability (Note 5) | |

| 566 | | |

| 603 | |

| Employees related liability | |

| 1,067 | | |

| 1,003 | |

| Total current liabilities | |

$ | 7,691 | | |

$ | 7,800 | |

| | |

| | | |

| | |

| Long-Term Liabilities: | |

| | | |

| | |

| Operating lease liability (Note 5) | |

| 396 | | |

| 672 | |

| Warrants liability (Note 6) | |

| 1,123 | | |

| 594 | |

| Total long-term liabilities | |

$ | 1,519 | | |

$ | 1,266 | |

| | |

| | | |

| | |

| Total liabilities | |

$ | 9,210 | | |

$ | 9,066 | |

| | |

| | | |

| | |

| Stockholders’ Deficit: | |

| | | |

| | |

| Stock capital: (Note 7) | |

| 14 | | |

| 13 | |

| Common Stock of $0.00005 par value - Authorized: 100,000,000 shares at June 30, 2024 and December 31, 2023 respectively; Issued and outstanding: 79,646,942 and 60,489,208 shares at June 30, 2024 and December 31, 2023 respectively. | |

| | | |

| | |

| Additional paid-in-capital | |

| 217,530 | | |

| 210,258 | |

| Treasury stocks | |

| (116 | ) | |

| (116 | ) |

| Accumulated deficit | |

| (220,955 | ) | |

| (215,013 | ) |

| Total stockholders’ deficit | |

$ | (3,527 | ) | |

$ | (4,858 | ) |

| | |

| | | |

| | |

| Total liabilities and stockholders’ deficit | |

$ | 5,683 | | |

$ | 4,208 | |

The accompanying notes are an integral part of the

consolidated financial statements.

BRAINSTORM CELL THERAPEUTICS INC. AND

SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE LOSS (UNAUDITED)

U.S. dollars in thousands

(Except share data)

| | |

Six months ended | | |

Three months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Unaudited | | |

Unaudited | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Research and development, net | |

$ | 1,883 | | |

$ | 5,718 | | |

$ | 922 | | |

$ | 2,794 | |

| General and administrative | |

| 3,573 | | |

| 4,882 | | |

| 2,060 | | |

| 2,655 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (5,456 | ) | |

| (10,600 | ) | |

| (2,982 | ) | |

| (5,449 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Financial income, net | |

| 43 | | |

| 212 | | |

| 30 | | |

| 120 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gain (loss) on change in fair value of Warrants liability (Note 6) | |

| 529 | | |

| - | | |

| (411 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (5,942 | ) | |

$ | (10,388 | ) | |

$ | (2,541 | ) | |

$ | (5,329 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per share from continuing operations | |

$ | (0.09 | ) | |

$ | (0.27 | ) | |

$ | (0.04 | ) | |

$ | (0.13 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding used in computing basic and diluted net loss per share | |

| 67,977,012 | | |

| 38,224,230 | | |

| 71,215,481 | | |

| 39,696,665 | |

The accompanying notes are an integral part of the consolidated financial

statements.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

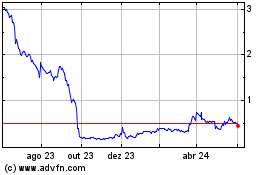

Brainstorm Cell Therapeu... (NASDAQ:BCLI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

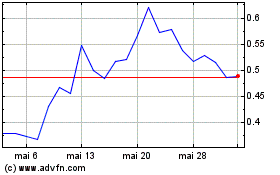

Brainstorm Cell Therapeu... (NASDAQ:BCLI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025